Don't wanna be here? Send us removal request.

Text

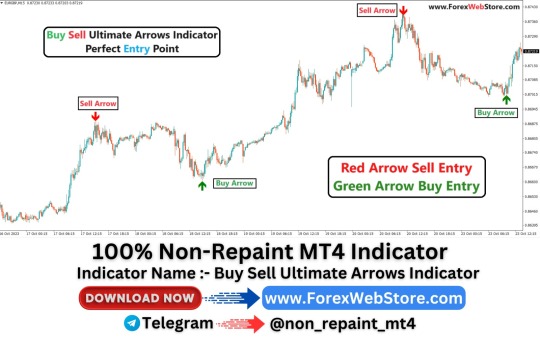

Non-Repaint Indicators in Forex Trading

Understanding Non-Repaint Indicators

The key advantage of non-repaint indicators lies in their ability to offer more accurate signals, thereby reducing false signals and minimizing the risk of whipsaws. By providing a clearer picture of market trends and price movements, these indicators empower traders to make more informed decisions and execute trades with greater confidence.

Benefits of Non-Repaint Indicators

Enhanced Accuracy: Non-repaint indicators deliver signals that accurately reflect market conditions, helping traders to pinpoint high-probability trading opportunities with greater precision.

Reduced Noise: By filtering out false signals and noise, non-repaint indicators enable traders to focus on relevant price movements and trends, leading to more effective trading strategies.

Improved Risk Management: With reliable signals at their disposal, traders can implement more robust risk management strategies, including setting appropriate stop-loss and take-profit levels based on the signals provided by non-repaint indicators.

Versatility: Non-repaint indicators can be used across various timeframes and currency pairs, making them suitable for traders with different trading styles and preferences.

Considerations for Using Non-Repaint Indicators

While non-repaint indicators offer several advantages, it's essential for traders to approach their usage with careful consideration. Here are some key factors to keep in mind:

Backtesting: Before integrating non-repaint indicators into live trading, it's crucial to conduct thorough backtesting to evaluate their performance under different market conditions. This helps traders understand the strengths and limitations of the indicators and fine-tune their trading strategies accordingly.

Confirmation: While non-repaint indicators can provide valuable signals, it's advisable to use them in conjunction with other technical analysis tools for confirmation. This can help validate signals and reduce the risk of false positives.

Adaptability: Market conditions can change rapidly, and no indicator is foolproof. Traders should remain adaptable and be prepared to adjust their strategies based on evolving market dynamics, even when using non-repaint indicators.

Risk Management: Despite the reliability of non-repaint indicators, no trading strategy is without risk. It's essential for traders to implement effective risk management practices and avoid over-reliance on any single indicator or signal.

Conclusion

Non-repaint indicators represent a valuable addition to the toolkit of forex traders, offering enhanced accuracy and reliability in signal generation. By leveraging these indicators effectively, traders can gain a competitive edge in the market and improve their trading performance over time. However, it's essential to approach their usage with caution, conducting thorough testing and integrating them into a comprehensive trading strategy that prioritizes risk management and adaptability. With the right approach, non-repaint indicators can be a powerful ally in navigating the complexities of the forex market and achieving trading success.

Top of Form

0 notes

Text

Best Non Repaint Indicator

1 note

·

View note