Don't wanna be here? Send us removal request.

Text

My Love Pho You: Perfect Competition in the Pho Industry

On a rainy winter day, all you want is something to warm yourself up from the inside out, and what better than a nice, hot, steaming bowl of pho to do just that! Not only is pho warm and delicious, but it is also super affordable and there are plenty of restaurants that sell it! We love driving along Bolsa Ave. in Westminster, California searching for some delicious pho because there are so many options available to us. After searching up “pho” on yelp in the area of Westminster, we zoomed in on a portion of the map that showed ten restaurants selling pho in a one block radius. This screenshot really depicts how there are many sellers present in the pho market.

So you must be wondering, how is this possible? Why are there so many pho restaurants? What kind of market is this???

This is a market of Perfect Competition.

Above are several of the qualities of a perfect competition. In this case, because there are a lot of pho restaurants in just this one area, it shows that there are a lot of sellers. We also know from personal experience, that college students love eating pho. Therefore, there is also a large number of buyers. Concerning the specificity of the product, we (buyers) value all types of pho as generally the same thing. So products here would also be identical.

Menu for Purple Orchid House

$7.95 for a small bowl of beef pho.

Menu for Pho 79 Restaurant

$7.50 for a small bowl of beef pho.

Menu for Pho Quang Trung

$7.95 for a small bowl of beef pho.

Moving on to their ability to control price, one thing we college students loooove is cheaper/very affordable, not fast food, but still yummy meals! So pho is the perfect combination of all of those things! We generally value worthy pho at around $7-8, and (as shown above) it is true that most of these restaurants reflect that same price. And we as consumers would not be willing to spend too much more than that on a bowl of pho, so these sellers have no control on price. Another thing that is seen in the yelp search above is that there are two new sellers entering the market. Restaurant 3 and 4 both opened up just 5 weeks ago! This supports the characteristic that there is indeed an ease of entry into the market.

In conclusion, the pho market is a perfect example of perfect competition. It checks off all of the boxes for what qualifies an industry to be in perfect competition: many buyers/sellers, identical products, price takers, and low barriers of entry. All in all, Econ20A has been a PHO-nominal class because it has pushed us to think about real life applications of economics present in our lives.

by Vienna Wu (24451764) and Zoe Wang (70905733)

#PHOeveryum#itsPHOnomenal#absolutelyPHObulous#wehopethisprojectisunPHOgettable#soPHOsogood#alliwantPHOchristmasisyou

0 notes

Text

Effect of Tobacco Tax in Georgia

Name: Cheng Qu

ID: 79822471

It can be evaluated as a government intervention to negative externality of consumption with the advice of imposing tobacco tax, which Georgia government puts an indirect tax on the consumption of cigarettes. These taxes are paid to the government at each time consumers buy a pack of cigarettes indirectly.

The cigarette can be considered as a demerit good, which is harmful to both consumers’ individual health themselves and society as a whole by pressure on the public medical resource. Thus, cigarette generates a negative effect on the third party. For example, those nonsmoking people’s health will be harmed by those who smoked in a public place and therefore negatively affect the overall health level of the society to cause extra cost in the medical resource.

The better understand the effect of the tobacco tax, I created the graph below:

According to the graph above, Eopt represents the socially optimum outcome, which is the intersection of marginal social cost curve (MSC) and marginal social benefit curve (MSB), which also represents optimum demand Qopt and optimum price Popt . The market is in the best efficiency in this case. Due to the loss of benefits in public health, external cost happens, represented by the difference between marginal private benefit curve (MPB) and the MSB curve. As a result, MSB is smaller than MPB, which moves Eopt to E1 , indicates the market outcome. The overproduction, shown by shifting of Qopt to Q1 , makes the resource overallocated. The resource’s underallocate causes the welfare loss, which is marked as the dark area in the graph.

If the Georgia government puts a $1 of indirect taxes on cigarette, this tax will move MPC=MSC curve leftwards to MPC+tax curve, shifts E1 to E2 , which is close to social optimum outcome. At the same time, consumers should purchase fewer cigarettes because the price of cigarette become more expensive (the increase from P1 to P2 ) to them. As a result, the welfare loss of the society becomes smaller due to the reduction in consumption (smaller dark area compared with the previous graph).

To consumers, they are less sensitive about the change in price in the long run when their income increases because of social development, so the tax policy will not affect them so much. Meanwhile, the cigarette is inelastic, so the responsiveness of quantity demanded to change in price should be small, and consumption changes not much when the price raises. Then consumers have to cost more on the tax compared to producers do. As cigarette has many substitutes, such as alcohol, part of the consumers turn to buy other demerit goods when the price increases, and this will harm the average health of the public even worse.

To producers, an indirect tax will decrease these companies’ revenue because of lower consumption by consumers, and thus less revenue can be applied to pay their workers’ salaries. In order to gain more revenue, producers may decide to dismiss some of their labor force, and this causes unemployment and other economic issues.

To the government, it is necessary to apply taxes to all possible substitutes of cigarettes to avoid consumers to look for substituted products that harm the society. In long run, the government should also provide subsidies to those industries with less pollution, which will reduce pollution and improve people’s health level. Moreover, tax revenue gathered from the indirect tax can be used in health care programs like the medical center, free gym fields, for the improvement of the health level of people.

0 notes

Text

Are Festivals Really Worth It?

Angel Delgado Lira

ID#: 17331788

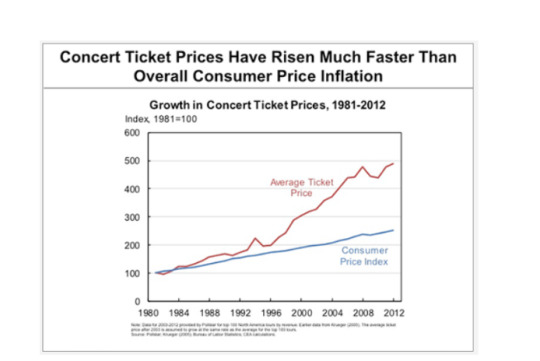

A few years ago, my taste in music started to shift towards more popular artists and genres. Subsequently, getting tickets for an popular artist’s concert became difficult. Either the ticket price was too high, or the tickets would sell out, sometimes even in a matter of seconds. There is already a substantial opportunity cost to going to a concert, but now consumers have to deal with the effects of the digital secondary market on the supply and demand on tickets. Concerts and festivals are supposed to be meaningful experiences, but instead these experiences are costing a consumer large sums of money, effort, and exacerbating the divide between those who don’t have money, and those who are willing to pay an exorbitant amount of money. Festivals are said to be the “biggest bang for your buck” due to the amount of performers in one place, but this isn’t necessarily the case.

Ticket scalping has been an ongoing trend for years, but due to the increase of technology and social media, it is occurring at a much higher rate. The demand for festival tickets is high, which sometimes causes tickets to sell out in a matter of hours. Tickets that are sold through the official festival usually are below the market value, which then causes the secondary market to hike up the price of tickets because they know people are willing to pay a much higher price for these tickets. Last year, Coachella tickets in the secondary market were about $200-300 more expensive.

The supply of tickets is a definite amount that sells out quickly, but the demand is excessively higher than the supply.

However, there is some solace in the secondary market. As the event gets nearer, prices for tickets do come down because of the marginal benefit the scalpers will get from making some profit instead of no profit.

However, that may not be enough solace due to the fact that ticket prices continue to rise higher than what consumers want to pay.

Demand keeps on going up for festivals due to social media influencing people to go to festivals. Digital marketplaces are just going to make festival ticket prices go up. It will be interesting to see what happens in the next few years.

When people are looking to go to a festival, they think at the margin. For many people, festivals are meaningful experiences that they will remember. That is why when a festival goes on sale, tickets can sell for an extremely expensive price. A person’s willingness to pay for the festival is based on the marginal benefit that the show will yield. In Southern California, there are a myriad of festivals that occur each year, but each year there is a new lineup of artists, subsequently a new experience for the concert-goer. Therefore, the marginal benefit of going to a festival is large due to each one being a new experience. Rational people will have to weigh the marginal benefit and marginal cost of going to a festival. However, the marginal cost isn’t just the price of the ticket to attend. This is where concerts go into opportunity costs, and it will be evident that the cost of going to a concert or festival means giving up a lot.

The average concert lasts around 3-4 hours, and in the grand scheme of things this isn’t a lot of time, so the opportunity cost of going to a concert instead of spending those 3-4 hours doing something else isn’t high. The opportunity cost of going to a 3-day festival rises, but even then spending a weekend listening to music you love, spending time with friends and people with mutual interests isn’t high. However, I had a personal experience where I decided to not go to a weekend festival because of its proximity to my midterms. On November 11-12, Camp Flog Gnaw had its yearly festival in Dodger Stadium, and I had tickets. However, I decided to sell the ticket because that weekend would be too valuable to give up. I had to study for midterms, submit 2 essays, and submit an application for a summer research program. The opportunity cost not only takes into account the length of the festival and price of the ticket, it also takes into account the time it spends to get to the venue, parking or Uber costs, sometimes rental or Airbnb costs, food and beverage costs, the time it takes to leave the venue when the show is over, and the earnings you may give up from taking the days off to go to the festival. All in all, the opportunity cost to go to a festival or concert is high, and for many people the benefit of these experiences is not worth the cost. Unfortunately, the opportunity cost is usually only worth it to those who are wealthy, those who have saved up of a long period of time to attend, or those who know people who can get them tickets at a price much lower than the market value.

Festivals are seen as the perfect investment for consumers to see all their favorite artists in one place. However, as ticket prices keep climbing, as well as the demand for every other aspect needed to attend a festival (food, transportation, housing near the venue), is it really worth the investment? For many people it is, but for others these high prices and opportunity costs are turning away consumers who can no longer afford to go to these special experiences.

0 notes

Text

Supply and Demand of Yeezys

Economics 20A made me open my eyes to the fact that supply and demand is happening all around us constantly. A good example for this is when I was trying to buy a new pair of sneakers recently. I looked throughout the adidas, and from being a fan of pop culture I looked into Yeezys.

Originally these shoes would cost about $150 but the price doubled. This is because adidas made the shoes in limited supply while the demand of the shoe was much higher. Making the price of the shoe double in value for third party sellers.

This makes the supply shift to the left and the demand shift to the right, which results in an increase in price of Yeezys shoes.

Moosa Ghias

ID# 37036821

0 notes

Text

Trade Wars: Now on Your Phone

Pauline Truong

SID: 65357285

Trade wars and tariffs have consistently been at the forefront of the current US presidency and at the top of our every shortening news cycle. In this highly charged environment, ECON 20A’s infographic on trade between China and the United States struck me as particularly timely and has led me to pursue a better understanding of the impacts to me and what I can do to offset those impacts in my daily life.

I expected the tariffs to affect my purchasing power particularly in this gift giving holiday season and sought to quantify what that impact is. Since I do much of my shopping online, I did a quick check of pricing history using Amazon price trackers such as Keepa and camelcamelcamel but did not find any appreciable difference in pricing that could be attributed to increased tariffs. In surveying charts of prices for items over time, most of the items I shop for either have prices with variability that mask the effects of tariffs or tend to decrease in price over time. Price depreciation is particularly evident with technology and fashion products that are often gifted but become rapidly outdated. Upon further research, a recent article from The Washington Post indicated that, “ larger retailers such as Walmart, JC Penney and Amazon say they have already locked in low-priced inventory for the holidays” (Bhattarai 2018).

Since broad product level tracking was not yielding the insights I hoped to gain, I turned my attention to higher level sources from organizations such as Americans for Free Trade and Farmers for Free Trade. Their Tariffs Hurt the Heartland website contains a map of tariff impacts across the US.

While October was the highest tariffed month in US history with $6.2 billion paid by US businesses, I wanted to find out what this means to me. Based on Chinese import data on the ports of Los Angeles and Long Beach, it is clear that Southern California will be disproportionately impacted by the tariffs along with the agricultural sectors that have been targeted in the trade war. Businesses and startups in California are already being hurt (Giordano 2018).

With the arrest of Huawei’s CFO this week in Canada for extradition to the United States, the path to negotiating trade disputes will likely continue to be a difficult one.

Since it appears that it is only a matter of time until the full impacts of the trade war will be widely experienced, I was inspired to develop a trade-based mobile game application that uses principles from ECON 20A that may provide a supplemental source of income. Here is a video of it in action.

References:

Bhattarai, Abha. “'This Could Be Catastrophic': Small Businesses Say New Tariffs Will Make It Even Harder to Compete.” The Washington Post, WP Company, 20 Sept. 2018, www.washingtonpost.com/business/2018/09/20/this-could-be-catastrophic-small-businesses-say-new-tariffs-will-make-it-even-harder-compete/?utm_term=.6503fa23bc73.

Giordano, Chiara. “PC Case Maker CaseLabs Says It Has Been 'Forced into Bankruptcy and Liquidation' by US Tariffs.” The Independent, Independent Digital News and Media, 11 Aug. 2018, www.independent.co.uk/news/world/americas/pc-case-maker-caselabs-latest-news-bankrupt-liquidated-us-tariffs-a8487416.html.

“News & Press Releases.” Tariffs Hurt the Heartland, 7 Dec. 2018, tariffshurt.com/news/.

0 notes

Text

Oil Price affect Gas Prices

Looking back on my everyday life, after taking this course, I can now understand more some of the different choices that the market takes. For example, as a commuter, something that I always have to pay attention to is the gas prices. I always wonder why is it that in different locations prices vary and why gas sometimes rises very high. After learning about the supply and demand curves I was able to see why it is that the prices change. As the school year started, the gas price was starting to go up. The gas price went up to over four dollars, but just to this week, the gas prices went down to 3.29. As I looked up news from surrounding oil price I found an article named “Oil Prices Rise on U.S. Saudi Tensions” by Christopher Alessi, which talked about the tension between US and Saudi which would affect the cost of oil. Looking at the supply and demand curve, with the cost of oil increase it would decrease the supply which would cost the price of gas to go up. In the article “Oil Prices Drop Sharply as OPEC Struggles to Agree on Cuts” by Dan Molinski and Georgi Kantchev because there was still no decision made “on cutting crude output” which ended up affecting oil prices going down.

This would be the supply and demand curve of back when oil price were back to regular normal prices which would leave the gas prices to okay of normal prices.

This would be the supply and demand curve for the gas prices when the oil price went up. Since the oil price went up then the supply would be less and move the supply curve up. As the supply curve went up it made the gas price up.

Alessi, Christopher. “Oil Prices Rise on U.S.-Saudi Tensions.” The Wall Street Journal, Dow Jones & Company, 15 Oct. 2018, www.wsj.com/articles/u-s-saudi-tensions-boost-oil-market-1539600195.

Kantchev, Georgi. “Oil Prices Drop Sharply as OPEC Struggles to Agree on Cuts.” The Wall Street Journal, Dow Jones & Company, 6 Dec. 2018, www.wsj.com/articles/oil-drops-as-opec-agreement-on-output-cuts-remains-elusive-1544092350.

By: Bianca Gomez ID# 12484208

0 notes

Text

MHF Ban Implications on Gasoline in Southern California

ID : 27366061

Name: Dania Alfeerawi

There are two refining companies that utilize Modified Hydrofluoric Acid (MHF) to produce clean gasoline for cars to run on. These companies are located in southern California and are known as Torrance Refining Company and the Valero Wilmington Refinery. This modified hydrofluoric acid, if leaked from these refineries can cause immediate death to humans within a 3 mile radius of the refinery. Since Torrance and Carson are cities overly populated with houses within the outskirts of the refineries, the implementation of this Hydrofluoric Acid causes a negative externality on the residents of those cities who have to face deadly consequences if there was ever a leak, and also face effects of direct pollution from the refinery as a result. As a result, residents of Torrance and Carson have gathered to ban MHF at these refineries for the safety of residents. If MHF is banned, this would mean that these refineries would shut down, and this would lead to a shortage of gasoline in Southern California. Since the market for gasoline will have the supply curve shift to the left due to a outside factor such as MHF ban, the shortage of gasoline will cause gasoline prices to sky rocket (Figure 1). Since Southern California residents are highly dependent on cars are their main mode of transportation, this event would cause California residents to pay at prices much higher than they were originally. It will also result in the quantity demanded decreasing (Figure 1), as some California residents would then have to consider gasoline as a luxury good due to the expensive price, and will have to switch modes of transportation to buses, bicycling, or rideshare programs. This MHF ban will also result in employment losses of thousands of employees. As a result of unemployment, there will be competition among those employees to apply to the only other southern california refinery that will be in operation due to its use of sulfuric acid instead of MHF. Therefore, that single socal refinery, Chevron at El Segundo, will be considered to have market power as a monopoly because it can choose to control the price of gasoline on gases in southern California, and also has a massive amount of options of workers with experiences applying to their company from the two refineries that went of business. In the short-run, Chevron will make a profit as a monopoly since it can set prices at a higher price than the marginal cost. (Figure 2). On the other hand, if the two companies did not shut down and instead had to pay a corrective tax from the government to take into account the external costs of pollution and dangerous implications of MHF, then consumers in southern California would still have to pay more as a result of the social cost, and this would result in switching to other modes of transportation if the tax price is too high for some consumers.

0 notes

Text

Procrastination Algorithm

(For readability purposes, the .md file for this post is available on my GitHub page.)

Introduction

I recently wrote an anecdotal post on my blog about little things that ultimately add spice to your life in ways that you might not always immediately recognize.

In that entry, I mentioned one of my experiences with the universal college student dilemma: the trade-off between sleeping and doing homework.

Here is an excerpt from that blog post:

Should I go lie down in my bed? On one hand, it's cold and lying down is nice. Plus, I'm tired, and I could use a break. On the other hand, I'll probably fall asleep and not get my work done. Well, it's not due until 11 AM, so if I wake up a couple hours before then I'll have time. But will I wake up early? Probably not. But my bed has a blanket, and I like blankets. Then again, it's just physics, so I can probably finish it quickly now and be able to sleep in peace. Then again, it's just physics, so I can probably finish it quickly tomorrow and be able to sleep now. What about lying down with the laptop so I can rest my body but also do the assignment? Nah, I'll probably just fall asleep, so we're back to the first question. I guess sleeping now isn't so bad. But then I won't be able to sleep worry-free. But is there such thing as worry-free? There's always work to be done, and too little time to do it. And aren't all of our fates sealed to the slow decay of our bodies, cell by cell, molecule by molecule, as they succumb to the grips of time until the finality that is the end of our days?

Whoa, that escalated quickly. < / stream_of_consciousness >

After pausing to think about what I had just thought about and concluding that taking an arbitrary philosophical approach probably wasn't the best way to come to a decision, the idea of using an economic approach popped into my head. I'm taking microeconomics right now, and I couldn't help but think of drawing out a production possibility frontier (PPF), so I did. It was bowed out, since this was a case of increasing opportunity cost. Naturally, this meant that I should've sought a middle ground to balance out the benefits of both options while maximizing efficiency, but again, that would lead back to the "lie down and work" option, which didn't seem likely to happen. I proceeded to write down opportunity costs – like time and energy – of each option and eventually had the whole back side of one of my old physics quizzes covered in random econ stuff. I often think about times like this and of how dumb it is that I do extra work I do to avoid doing other work.

Then I remembered I had to do the laundry, so I put my clothes and Tide Pods in the wash and went back upstairs. I finally decided to do my physics homework, since I was already locked in to being awake to finish doing the laundry. While I was doing it, I contemplated whether that was the most efficient decision, constantly worrying that I wouldn't wake up on time and looking up articles on REM sleep and Circadian rhythms to see if I could find a way to determine a time at which to set my alarm guaranteed to wake me up (unfortunately, I found no such method).

Once I was about halfway done with my physics homework, I went back down to throw my stuff in the dryer. I went upstairs to continue doing my homework, and in between problem's I'd look at one of the many PPF curves I'd drawn and mentally mark where on the graph I was. For you econ people out there, I'll just say I was inside the bounds of the curve and Vilfredo Pareto would not be proud.

This is just one of many times that I've had to decide between doing homework and either other homework or some other activity.

Algorithm

Being a computer engineering major, I couldn't help but analyze my behavior from a coding perspective. I realized that when I make these decisions, I essentially follow an algorithm that takes in the data of opportunity costs (such as time and energy, mentioned in the excerpt above) and processes it to determine whether or not I end up doing the task and when.

I decided to write down a rough approximation of the process I follow in Python.

## Reference 1 def file_to_list(file_name): file = open(file_name,"r") return file.readlines() ## Reference 2 class Course(): def __init__(self,name = "UCI Course",importance = 0.0,major_required = False) self.name = name self.importance = importance self.major_required = major_required def set_vals(self,file_name): data_list = file_to_list(file_name) self.name = data_list[0] self.importance = data_list[1] self.major_required = data_list[2] class Homework(): def __init__(self,name = "Homework Assignment",course = Course(),approx_time = 60.0,point_weight = 10.0,mental_exertion = 10.0,do_now = False): self.name = name self.course = course self.approx_time = approx_time self.point_weight = point_weight self.mental_exertion = mental_exertion self.do_now = do_now ## Reference 3 def main(): ## Reference 4 threshold_value_list = file_to_list("threshold.txt") threshold_value = threshold_value_list[0] to_do_list = [] ## Reference 5 course_list = file_to_list("course list.txt") courses = [] homework_list = file_to_list("homework list.txt") homework = [] for i in range(len(course_list)): courses.append(Course(course_list[i])) courses[i].set_vals(courses[i].name) def course(course_name): for i in range(len(courses)): if courses[i].name == course_name: return courses[i] for i in range(len(homework_list)): homework.append(Homework(homework_list[i])) hw_data_list = file_to_list(homework[i].name + ".txt") homework[i].course = course(hw_data_list[1]) homework[i].approx_time = hw_data_list[2] homework[i].point_weight = hw_data_list[3] ## Reference 5 for i in range(len(homework)): ## Reference 6 if (homework[i].point_weight / (homework[i].approx_time ** 2)) * homework[i].course.importance + homework[i].course.major_required > threshold_value: ## Reference 7 homework[i].do_now = True to_do_list.append(homework[i]) ## Reference 8 main()

(If you are viewing this on Tumblr, sorry about the lack of color in the code; it appears Tumblr does not support Markdown syntax highlighting in code blocks. It might help if you view the .md file on my GitHub page.)

Explanation

Of course, none of that makes sense to someone who hasn't learned how to code, and even someone who knows how to code doesn't necessarily know the syntax and nuances behind developing in Python, so I'll try to explain it in layman's terms.

The section between ## Reference 1 and ## Reference 2 is purely for coding purposes and has nothing to do with economic principles; it defines a utility used later on to use up less lines and make the code easier to read.

The section between ## Reference 2 and ## Reference 3 defines the properties associated with each course you are taking and the homework assignments associated with each course. These properties include what essentially determine opportunity costs of doing the homework, such as the amount of time it might take to do the assignment (approx_time), the point impact the assignment has on your grade (point_weight), and the effort you'd have to put into the assignment (mental_exertion). These values will be used later for determining whether or not to do the assignment at the time this algorithm/thought process is executed.

Up until this point, the code has only been defining tools to use in the main part of the code, which is what actually "does something." Everything between ## Reference 4 and ## Reference 8refers to this "functional" part of the code.

The way the algorithm works is by adding homework assignments of priority that exceeds a certain arbitrary threshold to a list of assignments that will be done at the time of the decision. The lines between ## Reference 4 and ## Reference 5 define the threshold value (threshold_value), which is determined externally from the program, and the section between ## Reference 6 and ## Reference 8 actually create the "to-do list" of homework assignments (to_do_list).

The single line between ##Reference 6 and ## Reference 7 is a formula that determines the priority value of the homework assignment. This formula could vary depending on the person, the mood they're in, the kind of day they're having, and other situational things that are difficult to quantify. In this particular formula, I made the priority value of the homework assignment proportional to the relative amount of points it's worth (homework[i].point_weight) and the personal importance of the course to the individual (homework[i].course.importance). I also made it inversely proportional to the square of the estimated time taken to do the assignment (homework[i].approx_time ** 2) because time can be considered an increasing opportunity cost with a bowed-out PPF. Finally, I added a small consideration for whether or not the course is required for the major (homework[i].course.major_required).

This algorithm, as previously mentioned, yields a list of assignments to be done, and the actual execution of the algorithm is done in the line after ## Reference 8.

Altogether, this code, saved as a .py file and run correctly through the Python shell, mimics the decisionmaking process that I undergo when deciding what assignments to do at what time.

Conclusion

It goes without saying that procrastination is bad. Ideally, you would never have to run this algorithm for the purpose it is designed for, and you would always have ample time to do your assignments. This code is just for bad planners (like me).

Unfortunately for some, time management isn't exacly a honed skill, leading to situations in which one is backed into a corner faced with a tough decision between undesirable choices. This gets stripped down into an economic decisionmaking problem in its most basic form, built around the fact that people face trade-offs, one of the 10 principles of economics.

I made this code just to illustrate my thought process and how I weigh opportunity costs and trade-offs when it comes to doing my homework. I really hope nobody actually copy/pastes the code into IDLE and uses it to determine how hard they should procrastinate. They'll end up like me, frantically typing an econ assignment up on Tumblr trying to get it in on time for the 5:00 PM due date.

Samuel Bondoc

ID# 35261931

0 notes

Text

Gotta Catch ‘Em All

The wonderful world of Pokémon was unleashed into the world back in 1996. 20 years later, it’s popularity continues to rise, a lifetime not typically seen in a video game’s dynasty. The Company’s success can be largely attributed to its numerous different markets. Pokémon has video games, a trading card game, merchandise, a television series, movies, global events, and by 2016, a mobile game for its consumers to enjoy. Pokémon Go is a mobile app that in the first year of its release alone, was downloaded more than 750 million times. With its global release being two decades after the initial release of the saga, Pokémon fans of nearly all ages flocked to this game, with a heavy concentration in ages 10-13 and 16-20.

With such a massive influence on millions around the world, the game was designed to promote consumers to physically go outside and catch virtual, location based Pokémon. With millions now outside glued to their screens for the primary purpose of catching another Bulbasaur, some unintentional consequences developed quickly. Niantic, the game’s developer, had claimed that the game would encourage people to go outside, and the game’s social functions would promote people to interact with one another, making new friends, and maybe even enemies, on their quest to “catch ‘em all.” These can be seen as positive externalities that the game had produced. However, some negative externalities began to come up, some of which dominating the media. Just three days after its launch, a dead body was found in Wyoming, by a teenager who was outside searching for Pokémon. Reports of trespassing became a consistency, and a rise in child predators, luring children in using this social game was broadcasted globally.

The graph above shows Niantic’s Supply and Demand after considering these externalities. Due to the massive popularity of the game, we can assume that the demand curve is relatively inelastic. That is, for any given price that Niantic offers, the demand will still be just as high. Raising the price wouldn’t decrease the quantity demanded as heavily as it would if the demand curve was relatively elastic. The negative externalities cause the supply curve to shift to the left, because the social cost has now increased because of them. However, because of the positive externalities, the demand curve shifts to the right as society values the good more than before. The combined effect of these, assuming both curves were unit elastic, would have produced the same optimal quantity demanded, now with a price increase. However, due to the demand curve’s relative inelasticity, the optimal quantity produced at market equilibrium has increased, as seen in the graph. The Pokémon Company, with its mass production in a wide array of varying mediums, has become a multi-billion dollar franchise. Their products produce varying success, some more than others, and with each of their products there exist both positive and negative externalities, influencing their market further. With no clear signs of slowing production down, we may see Ash Ketchum and his buddy Pikachu catching Pokémon for another twenty years.

Dakota Tomas 59087985

0 notes

Text

Demand for Luxury Convertibles Not Looking Very Good

The micro economic concept of supply and demand is a key essential and basis to understanding other more specific economic concepts, such as elasticity, taxes, etc It makes possible the explanation of general economic phenomenon. in this case, how the demand of high-end luxury convertibles has changed in the last decade.

The Mercedes-Benz SL will be used as an example to show the behavior of demand for luxury convertibles. Based on statistical data of sales of the Mercedes-Benz SL in the US of this past decade, the sales for high-end convertibles go on a downward trend on two occasions and increasing on only one. Also, the number of Mercedes-Benz SL’s imported to the US from Germany is mostly constant. Demand does change according to the number of sales of that particular car.

This chart shows the scale of physical sales of all Mercedes-Benz SL in the United States in a 12 year span. The direction of the number of sales has dropped between 2005 to 2011. There is a significant notice of sales increasing between 2012 to 2013, only for sales of the Mercedes-Benz SL to fall from 2013 to 2017.

WHY DEMAND FALLS?

Income of Consumers: The Mercedes-Benz SL is an expensive car, as its starting price is 90,000$ with no additional features. The average American does not have enough funds to afford this particular car.

Tastes of Consumers: Convertibles in general are the least popular form of automobile in the US; sedans and crossover SUV’s are the most common form of vehicle sold in the US. Those are this car’s substitutes, and those demands have been increasing when the SL’s demand decreases. Practicality of a vehicle is very important for when Americans are looking for a new car, and convertibles aren’t as practical as other vehicles. They have fewer seats than other cars and small trunk space especially due to the folding roof that takes up the space of the trunk when the roof opens.

WHY DEMAND ALSO ROSE?

Expectations of Consumers: Between 2011 and 2013 is the only area where demand rose for the SL. This is due to the fact that around 2011 is when the Mercedes-Benz SL was newly updated, meaning that a newer and improved model of that car was released. Because of the new model update of 2011 leading to 2012, people’s willingness to pay becomes higher, and especially higher than the price of the Mercedes-Benz SL itself.

DEMAND CURVE

The car’s demand increasing from 2011-2013 can be interpreted as D0 shifting to DR, and the car’s demand decreasing from 2005-2011 and 2013-2017. P is the price of the vehicle and Qd is quantity demanded of the vehicle.

ELASTICITY

This car can be classified in such a niche category of the car market. It is a convertible, and moreover it is a convertible from a luxury brand. Thus, the elasticity for this good is quite high, with income elasticity of demand greater than +1. Elasticity can also be accountable for the Mercedes’ Benz SL’s declining sales by year. Every year, the car’s base price does increase, although not a significant amount, by around 200-300$. This change in price has influence enough to change the demand of the car every year.

by Ryoma Ashitani #36671345

2 notes

·

View notes

Photo

In the table, column 1 represents the number of lipsticks produced ranging from 0 to 10 lipsticks. Column 2 represents my total cost of producing the lipstick.

I graphed the Average Fixed Cost, Average Variable Cost, and Average Total Cost. As the table shows, the marginal cost increases as the quantity of output increases; therefore the marginal cost will have an upward slope. The marginal-cost curve will also cross the average-total-cost curve at the minimum of average total cost.

The Average fixed cost always declines as output rises because the fixed cost is getting spread over a larger number of units. The Average variable cost usually rises as output increases because of diminishing marginal product. Because of this, the average total cost is U-shaped: it is the sum of these two.

By: Elizabeth Alvarado (46314674)

0 notes

Text

The Rise and Fall (and Rise and Fall and Rise again) of Bitcoin and Its Effect on Other Markets

Earlier this year, I decided to upgrade my desktop computer to the latest hardware. At the time my computer was an amalgamation of parts that were added as older parts had failed. Eventually it got to the point that replacing a single part required replacing two or three other parts, so I decided to replace the lot. That is when I found out that a scarcity in graphics cards caused by the recent boom in bitcoin mining (the process of creating new bitcoins) resulted in the price of graphics cards to dramatically increase. Bitcoin and cryptocurrencies in general became famous a few years ago due to their rapid economic growth and now, years later, they remain as volatile as ever and affect all markets that they are apart of.

https://99bitcoins.com/price-chart-history/

Bitcoin had its first boom in 2013 as a decentralized currency. In March of 2013, the Cyprus government announced a bailout for banks, resulting in a loss for shareholders and customers. Many of these groups began to move their money from the government regulated banking system to the, then new, decentralized digital currency Bitcoin. This resulted in an increase in the demand of Bitcoin as more buyers entered the market. Simultaneously, the supply of Bitcoins is relatively inelastic due nature of the bitcoin mining process. The increase in demand for a product with an inelastic supply resulted in the massive increase in price for Bitcoin, which in turn brought a lot of attention to the cryptocurrency. This attention acted as a form of free advertising and demand only continued to increase. The value for a single bitcoin rose from about $10 in March to nearly $1000 in December of 2013.

For the next several years, the Bitcoin market stayed in equilibrium as supply and demand remained somewhat stable, but in Spring of 2017, the price exploded again. Two things occurred: Japan (among a growing number of countries) declares Bitcoin a legal tender, and Bitcoin underwent a “hard fork”. New countries allowing Bitcoin as a legal tender has the obvious impact of adding new buyers to the market, reflecting the events of 2013. However, the effect of a hard fork is more complex. Each coin in a cryptocurrency has a unique ID that is associated with a user’s digital wallet. The algorithm used to “mine” Bitcoins is actually related to the processing and verification of Bitcoin transactions using their IDs. As more Bitcoins are created, the complexity of the algorithm to mine Bitcoins also increases. The length of the ID and the complexity of the mining algorithm means that there can only be a finite number of Bitcoins at any one time. Bitcoins in this sense are a common resource, and as such, they experience the Tragedy of Commons which cannot be solved with government regulation as Bitcoin is a decentralized currency and is not associated with any one government. Bitcoins were being mined to depletion. A “hard fork” is a temporary solution to this problem by splitting Bitcoin into multiple sub currencies that are all associated with Bitcoin (in 2017, this was ‘Bitcoin’ and ‘Bitcoin Cash’), effectively increasing the total number of coins and decreasing the complexity of the mining algorithm. Later in the year, another hard fork occurred called “Bitcoin Gold”. In the hours following each fork, the price fell a huge amount (upwards of %60 according to Forbes) in responds to the massive increase in supply. However, the average total cost of producing Bitcoins fell significantly more leading to an influx of Bitcoin miners. Demand exploded and the price by the end of 2017 was nearly $20,000 per coin.

https://en.wikipedia.org/wiki/Legality_of_bitcoin_by_country_or_territory

Of course, this does not all happen in a bubble. The most efficient method to mine Bitcoins (the method that reduces the average fixed cost for producing bitcoins, thereby maximizing profits) is to use high end graphics cards. The huge increase in demand for Bitcoin caused the demand for such graphics cards to also increase.

https://www.techspot.com/article/1626-gpu-pricing-q2-2018/

The short run response to this increase in demand caused a rise in graphics card prices, leading to profits for companies (like Nvidea and AMD) who produces high end graphics cards. These profits lead to higher production and more distributors to enter the market and sell graphics cards. The increase in supply causes a decrease in price. The graphics card market in early 2018 perfectly demonstrates the effect of an increase in demand in the short run and long run.

Thomas Arrizza (14203593)

0 notes

Text

Sleep vs Makeup

A daily problem I go through is contemplating if I want to wake up half an hour early to do my make up or to sleep for half an hour more.

If I was to do my makeup, I would have to give up 30 minutes or sleep and often, more than 30 minutes (close to an hour). In the process of doing my makeup, there is a possibility where I can lose an eye. I do a very light makeup look where I only do eye makeup when I have classes. For my light, every day, eye makeup, I only put on falsies (false lashes), eyeliner, and fill in my eyebrows. When I mean eyeliner, I literally line my eyes on my waterline and there is a plausible chance that I can get an eye infection if my eyeliner were dirty or way over the expiration date. Furthermore, for my falsies, I apply them with fairly sharp tweezers that I also use to tweeze my eyebrows. If I am not fully awake, there is an even higher chance than the eyeliner that I stab myself in the eye or hurt myself somehow with the tweezers near my eye area.

In comparison with doing my makeup, if I was to sleep for another half an hour and skip over the makeup part, I will get to hit the snooze button and sleep in for more. And yet, I can save myself from losing an eye. However, I do want to be able to look presentable when going to class, but at the same time, the thought of not having to impress anyone also passes through my head. Decisions, decisions, what should I do? Should I sleep in or do my makeup?

Now, in this point in life, I choose to sleep an extra half an hour rather than doing my makeup. When I sleep the extra half an hour, I lose less than doing my makeup and my eye being a huge part of it.

By Athena Situ (53914219)

0 notes

Audio

Opportunity costs and Trade-offs are a part of our everyday life. For example deciding to wake up 5 minutes later after the alarm; you get 5 more minutes of sleep but now the trade-off is arriving to work 5 minutes late. Going to a party vs staying in and studying. What you do not choose and what you could have done with what you gave up is your opportunity cost. On the other hand, what was given up to get what was wanted is the trade off. Every aspect of our life has a trade off and an opportunity cost. My song surrounds a young zot who decided to read memes and nap instead of doing homework and studying for his finals.

In the class i heard him talk

about econ and the impacts

somewhere far along this road we figured out opportunity cost

How could you trade off homework?

Oh how could you procrastinate

the opportunity cost of doing your hw should’ve been your #1 goal

remember about the trade offs that you had to do

you need to watch the opportunity cost yo

I mean after all the time you spent looking at memes

I mean after all the things you’ve avoided

hey yo i know you haven’t been doing your hw

hey yo the oc is too high for you to be slackin’

and now you wanna get an A and no hw done

so you could’ve spent that time studying

you got time, well you got homework

but in the end you still didn’t do it

in the class i heard him talk

about econ and the impacts

somewhere far along this road we figured out opportunity cost

How could you trade off homework?

Oh how could you procrastinate?

how could this trade off bring these grades to a point that I don’t know

you decided to take a nap so

now you up at 3 am doing hw

now you’re tired with an upcoming final

homie i dont know, were those memes worth it?

you wont stop, at the study center at 3 am though

cause i already know how this thing go

you run and tell your friends you’re going to study

they say thats what you said last time you don’t study

you trade off that studying time and you gon’ see

showing up last week asking for extra credit

in the class I heard him talk

about econ and the impacts

somewhere far along this road we figured out oc

Oh how could you trade off homework

Oh how could you procrastinate

napping napping napping nap

yo just knock it off

showing up for extra credit

they know you dont deserve it

now you crying about your grade

and you just goin keep procrastinating

and we just goin be pitying you

i know you cant believe

that youre grades are failing

and you cant make it right

all because you wanted to see memes

the trade off wasnt worth it huh?

in the class i heard him talk

about econ and its impacts

somewhere far along this road we figured out oc

Oh how could you trade off homework

Oh how could you procrastinate

Brandon Rivera(33981560)

0 notes

Text

My several (not) economic shopping experiences

Since my arrival in Irvine to study at UCI I have had to deal with considerable amounts of money and I was confronted with the need to make economic decisions prior to knowing much about economics. Now, having learned much more, I can see what instinctively guided me during decisions in these stories from my year at UCI.

Levi’s leather jacket.

I was walking around Irvine Spectrum Center and looking into stores. At Levi’s, This particular item caught my eye, and additionally, I was looking to buy a leather jacket for a long time.

Because I knew that genuine leather jackets are expensive, but didn’t have a brand preference, I placed a large value on a jacket and had a willingness to pay up to $500. The item I found that day fitted well and satisfied all my preferences, and it cost $398. So, on an impulse, I bought size medium, satisfying my long-time desire and receiving a consumer surplus of a whole $102.

I have been happily wearing my jacket— … —until this year’s Black Friday sales hit the stores… It qualified for a 40% off discount, selling for $239. It would have been such a great opportunity to save $159! Who knows what else I could have bought with that money... I still had a positive consumer surplus, but I was too sad to think about it—after all, my possible consumer surplus shrunk by almost 2.5 times! So, those $159 were a sunk cost.

I mourned it, but it was unrecoverable. Surprisingly, only a few days later, I was wearing my leather jacket without any remorse. I was happy I got it when I did—I gained a lot of satisfaction wearing it over the summer—something that isn’t measurable in economic terms.

The moral is to watch opportunities in the market for buying something expensive that you need for cheaper and not to diminish the value of your purchase because it was possible to save more.

Graphics card

My another experience is about selling something, or, rather, not selling something.

Last year, because of a dramatic rise in cryptocurrency mining, the prices of computer graphics cards (GPUs) were inflated dramatically, up to threefold! Because a powerful GPU is necessary for the process, it can be seen as a factor in production, or a complement good, and the demand curve for it will shift to the right as will the demand for the cryptocurrency.

I have happened to own a GPU that I acquired for $180, but at its peak demand, it would easily sell for $700. However, I didn’t sell it. My profits would have been $520. And, when the prices deflated, I could have bought a much better GPU for $ 700, and my consumer surplus would be enormous.

But, my opportunity costs were too high. It meant to live a year without a GPU—a necessary computer component. I have empirically evaluated my combined value of owning a good GPU during that time and it had exceeded the possible profit of $520. The moral is that even if there is an economic incentive in the form of a lot of money, it could be tempting to take it, but without considering possible opportunity costs, you might end up with less welfare.

An airplane seat.

Here’s another example of weighing opportunity costs from my life:

Flying from Los Angeles to Zurich, Switzerland this summer, the flight was overbooked. So Swiss Airlines offered me $800 to fly two days later. But that meant being a day late to my internship program, which could earn me a negative reputation, and, in the long run, cost me more than $800. Additionally, I would make it home on time to have a tasty dinner that my family prepared for me.

Conclusion

A student’s everyday economic decisions aren’t very hard, they concern mainly opportunity costs and variable supply and demand curves—such as in the cases of sales or inflations. There are more stories that illustrate the necessity to think rationally in economic decisions. I can see the potential of evaluating economic situations “on-the-go,” without the need to reference textbook examples or graphs. Over my year as a student and over this course in economics I have learned to see everyday life from an economic perspective and analyze my past and future decisions about purchasing or selling.

Fyodor Svirschevski 92423786

0 notes

Photo

UCI Housing Options

*on campus, ACC housing, and Park West

Housing is a key factor for all students at UCI; one can choose to commute from home if they live close enough but for the majority of students, their only option is to live away from home in an apartment/dorm. For those that choose to live away from home, some housing options they have include dorming at Middle Earth or Mesa Court/ Mesa Court Towers, ACC apartments (Puerta del Sol, Camino del Sol, Vista del Campo, and Vista del Campo Norte) Park West. There are many other housing options available to students but for this project, I choose to focus on places that I am familiar with. When it comes to living away from home, the factors that students have to also consider are the cost of rent, food, transportation, number of people, amenities and furniture. The comparison of all the factors is here (the image is too big so instead I attatched a link to a googles sheets that anyone can access).

The bar chart above demonstrates the cost per square foot by each housing location. Housing that costs less per square foot is more desirable to the consumer over the higher priced option. For example, a student will be more likely to chose Park West over Middle Earth or Mesa Court if they only consider price per square foot per month; therefore the demand for Park West, in theory, should be greater than that of Middle Earth and Mesa Court. When they start to consider other factors, the demand can start to drastically change so, therefore, the demand for some housing locations can be inelastic. For example, Middle Earth and Mesa Court, and Mesa Court tower are all Freshmen only so the demand will decrease (leftward shift) for other UCI students but the included meal plan could also increase (rightward shift) the demand for Freshmen students. However, their demand may decrease once they learn that the food is not that appetizing.

Another factor that students will need to take into consideration is the distance that they will have to travel to get to campus and the available modes of transportation. In the link to the first figure, I listed the provided transportation options. For locations with several free transportation options, students are more likely to gravitate towards, which leads to a greater demand of said housing locations. As an example, Park West is not as desirable to students since it is almost 3 miles away compared to Puerta del Sol at 1.1 miles away. The same concept applies to the number of amenities, furniture, and utilities.

When I was an incoming freshman, UCI had over-enrolled students which led to an increase in demand for housing. The image below demonstrates how the demand curve in the UCI housing market will shift due to this situation. As the demand increases, the equilibrium quantity will increase while the price of housing will increase.

Next year in Fall of 2019, two new housing locations, Middle Earth Towers and Plaza Verde, will open up for students which causes a shift in the supply curve. This is demonstrated in the image below. As the supply increases the equilibrium price and quantity will both increase.

Adia Hong #46516673

0 notes