Don't wanna be here? Send us removal request.

Text

Behind the Number: Unveiling the reasons for Startup Failures In India

While lack of funding and valuation struggles can contribute to startup failures in India, they are not the sole factors responsible for the high failure rate. While access to capital is a challenge for many startups, there are several other reasons as well, as mentioned in the previous response.

Funding plays a crucial role in the success of startups, as it provides the necessary resources for growth and expansion. However, startups can fail even with sufficient funding if they are unable to effectively utilize the funds or if there are other underlying issues in their business model.

Valuation struggles can also be a factor in startup failures. Overvaluing or undervaluing a startup can impact its ability to raise capital or attract investors. Unrealistic valuations can lead to difficulties in securing funding, while undervaluing a startup can result in limited resources for growth.

However, it's important to note that startups fail for a variety of reasons, and each case is unique. Factors such as lack of market demand, regulatory challenges, talent acquisition issues, infrastructure limitations, and the absence of mentorship and support can significantly impact the success or failure of a startup.

There are companies that facilitate fundraising specially for startups that will not only help them raise funds but also provide advisory that specializes in Pre-Series A to Series B. One such company is FundTQ

. They have valuation software

to calculate your business value seamlessly and effectively.

Successful startups in India and around the world often address these challenges by conducting thorough market research, building strong teams, adapting to regulatory requirements, and seeking mentorship and guidance from experienced entrepreneurs. It's a combination of factors that contribute to startup success, and overcoming these challenges requires a comprehensive approach.

#pitch deck#business valuation#entrepreneur#entreprenuership#startup india#right valuation#businesswoman#pitch book#entreprenuerlife#fundraising#finance#valuation#trendingnow#viral trends#explorepage

0 notes

Text

The Art and Science of building a Compelling Startup Pitch Deck

Starting a new business venture can be an exciting and overwhelming experience, but one of the most important aspects of launching a successful startup is having a well-crafted pitch deck.

A pitch deck is essentially a visual presentation that provides an overview of your business idea, goals, and potential for growth to potential investors or stakeholders.

Buy Pitch Deck from FundTQ

There are several elements that you must include in your pitch deck to make it effective and stand out from the rest. In this blog, we will discuss the 5 essential elements every startup pitch deck must have.

Clear Value Proposition:

Your pitch deck should clearly communicate your value proposition, which is the unique selling point of your business.

Business Model:

The business model is the backbone of your startup, and it shows how you plan to generate revenue. Your pitch deck should clearly outline your business model, which is the strategy that outlines how your company will generate revenue.

Market Analysis:

In order to demonstrate the potential of your business, it’s important to provide market analysis in your pitch deck. Conduct thorough research on the industry and show the total addressable market (TAM), serviceable available market (SAM).

Financial Projections:

Investors want to know how you plan to use their money and what returns they can expect. Investors want to see that your business has a viable path to profitability, so your pitch deck should include financial projections that demonstrate your growth potential.

Compelling Team Introduction:

Finally, your pitch deck should introduce your team members and their skills and expertise. Investors need to be confident that your team can execute your vision and bring your product or service to market successfully.

In conclusion, With a well-crafted pitch deck, you'll be well on your way to securing the funding you need to turn your startup dreams into a reality. Also pitch deck is essential for any startup looking to attract investment and grow their business.

Buy Pitch Deck now: https://fundtq.com/build-pitchdeck

Desq Worx, Club Patio, Block E, South City I, Sector 41, Gurugram

Email: [email protected]

Call us: +91 87509-56685

#pitch deck#pitch book#startup india#businesswoman#entreprenuerlife#entreprenuership#right valuation#business valuation#entrepreneur#valuation#trending#viral trends#trendingnow

0 notes

Text

THE 10 CHARACTERISTICS OF STARTUP VALUATION

But behind every successful startup there is a careful and strategic allocation of capital that allows the company to grow and flourish. One of the most critical components of this process is startup valuation, which refers to the process of assessing the worth of a startup company.

Stage of development: The stage of development of a startup is a critical factor in determining its valuation. Early-stage startups with little to no revenue are often valued based on their potential and the strength of their team, while later-stage startups with established revenue and customer base are typically valued based on financial performance.

Market potential: Investors look for startups with large market potential. A startup that has the potential to capture a significant share of a growing market will have a higher valuation compared to one with limited market potential.

Intellectual property: Patents, trademarks, and other intellectual property can add value to a startup. Investors will look at the strength and value of a startup’s intellectual property portfolio when determining its valuation.

Financial performance: A startup’s financial performance is a critical factor in determining its valuation. Investors will look at revenue, profitability, and cash flow to assess the startup’s financial health and potential for growth.

Growth prospects: Investors want to see a clear path to growth for startups. Startups with strong growth prospects will have a higher valuation than those with limited potential for growth.

Competition: Investors will look at the competitive landscape of a startup’s industry when determining its valuation. A startup that faces fierce competition may have a lower valuation than one that operates in a less crowded market.

Team: The quality of a startup’s team is crucial in determining its valuation. Investors will assess the experience, expertise, and track record of a startup’s founders and key team members.

Exit strategy: Investors will consider a startup’s exit strategy when determining its valuation. A startup that has a clear plan for an IPO or acquisition will have a higher valuation than one that lacks a clear exit strategy.

Fundraising history: A startup’s fundraising history can impact its valuation. Investors will look at the startup’s previous funding rounds and the valuations at which it raised money.

Risk: Finally, investors will assess the level of risk associated with a startup when determining its valuation. Startups that operate in highly regulated industries or face significant technological or market risks may have a lower valuation compared to those with less risk.

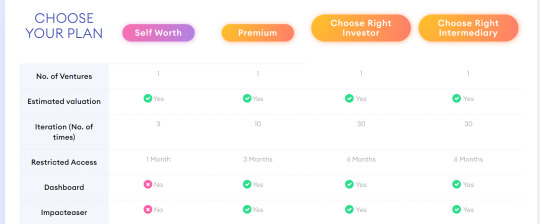

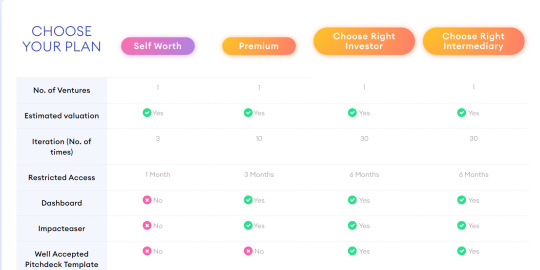

FundTQ is a company that offers a valuation tool subscription to help startups accurately determine their worth. The FundTQ valuation tool is easy to use, with a simple interface that guides you through the valuation process step by step.

Take subscription to know about your business evaluation from India’s first platform where you can know about your business value with FundTQ Valuation process:

Get Valuation for Startups & Business

Email: [email protected] Call us: +91 8750956685

#business#business ideas#businessowner#businesswoman#business valuation#startups#startupideas#startup india#venture capital#angel investor#investment#trending#new ideas#new techniques#new technology#professional valuation reports#startup valuation

0 notes

Text

FundTQ has recently made waves in the investment world by successfully raising $22 million in their Series A round of funding. The company has been able to achieve this impressive feat due to FundTQ innovative ideas and forward-thinking approach.

FundTQ is a company that provides funding to startups and early-stage companies that have the potential to revolutionize industries. They have a team of experienced investors who have a keen eye for identifying companies that have a high likelihood of success.

Overall, FundTQ’s success in raising $22 million in their Series A round of funding is a testament to their innovative ideas and forward-thinking approach. We can expect to see even more exciting things from this company in the future as they continue to support and invest in the next generation of startups and entrepreneurs.

If you have any Queries or you need to Buy Pitch Deck and valuation for your Startups and Business

Click here to Buy Pitch Deck: https://fundtq.com/build-pitchdeck

Click here to get valuated : https://valuation.fundtq.com/subscription

Email: [email protected] Call us: +91 8750956685

#business valuation#right valuation#investment#instagram#clients#pitch deck#pitch book#investingtips#business#businesswoman#startups#smallbusinessowner

0 notes

Text

Take Your Pitch to the Next Level with FundTQ Deck Makers

As an entrepreneur or business owner, you know that one of the most important things you can do is keep track of your company's valuation.

After all, your company's value is a key factor in securing funding, attracting investors, and making informed business decisions. But how do you determine your company's true value? That's where FundTQ comes in.

FundTQ is a company that provides valuation services for startups and businesses. With FundTQ, you can rest assured that your company is being accurately assessed for its true value.

Here's why FundTQ is the perfect choice for your valuation needs:

Expertise: FundTQ's team of experienced professionals has a wealth of knowledge in the valuation industry.

Customized Approach: FundTQ understands that every company is unique, and therefore requires a customized approach to valuation.

Transparency: FundTQ is committed to transparency in all aspects of their valuation process.

Fair and Accurate Valuation: FundTQ uses a rigorous valuation process that takes into account all relevant factors, including financial data, market trends, and industry benchmarks.

Overall, FundTQ is the perfect choice for businesses and startups looking for an accurate and reliable valuation. Their expertise, customized approach, transparency, and commitment to fairness and accuracy make them the ideal partner for any company looking to understand their true value.

Don't hesitate to reach out to FundTQ to learn more about their valuation services today!

Email: [email protected] Call us: +91 8750956685

#pitch book#pitch deck#investment#investments#investingtips#venture capital#business valuation#right valuation#valuation in 10 mins#professional valuation reports#funding#valuationsoftware#businesswoman#entrepreneur#entreprenuership#entreprenuerlife#startup india

0 notes

Text

Failures to Avoid: Reasons Why SaaS Startups Crumble!

There are a few reasons why SaaS startups may fail, and understanding these mistakes can be critical for avoiding them and increasing your chances of success.

Poor market research: Many SaaS startups fail because they don't fully understand their target market. Conducting thorough market research is essential to understanding customer needs and behaviors, and will help you identify any gaps or opportunities in the market.

Inadequate user acquisition and retention: Building a product that customers love is only part of the battle. Startups must also develop a comprehensive user acquisition and retention strategy to ensure that they can acquire and retain customers at a reasonable cost. Without a robust strategy in place, startups may struggle to grow their user base and reach profitability.

Poor pricing strategy: Pricing is a critical element of any SaaS startup's success. Many startups make the mistake of pricing their product too low, which can make it difficult to achieve profitability. Conversely, pricing a product too high may deter potential customers and reduce adoption rates. A thorough understanding of your target market and their willingness to pay is crucial when developing a pricing strategy.

Insufficient funding: Finally, many SaaS startups fail because they simply run out of money. Developing a detailed financial plan and raising enough funding to sustain operations is critical for long-term success.

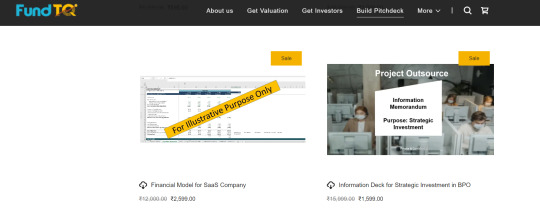

To avoid these common pitfalls, SaaS startups should focus on developing a comprehensive pitch deck that addresses these concerns and showcases the unique value proposition of their product. A strong pitch deck can help startups communicate their vision to potential investors and secure the funding needed to scale and grow their business.

Pitch Deck with FundTQ

Buy your Pitch Deck for your Startup and Business, Click on the link to buy

Additionally, startups should be diligent in their valuation efforts, understanding the financial metrics that are important to investors and developing a sound valuation strategy that accurately reflects the potential of their business.

Valuation with FundTQ in 10 mins

To know the Valuation for your Startup, Click on the link

Email: [email protected] Call us: +91 87509 56685

#pitch deck#startup india#business valuation#entrepreneur#entreprenuership#businesswoman#investors#valuation#entreprenuerlife#pitch book#instagrambusiness

0 notes

Text

From Pitch Deck to Funding: How FundTQ Can Help Early-Stage Startups

As an early-stage startup founder, it can be challenging to get the exposure you need to attract potential investors and secure funding. However, there are several strategies you can use to increase your visibility and get noticed by investors.

One option is to use a platform like FundTQ, which provides startup founders with pitch decks and valuations for their startups.

This can be a valuable resource for founders who may not have experience creating these materials or who want to ensure they are presenting their company in the best possible light.

FundTQ helps you generate various reports to build your strong Pitchdeck for your startup or business and you can reach out to multiple investors to get funding.

Pitch Deck with FundTQ

Build Pitch deck for your startup, click the link

FundTQ is a company that also offers a valuation tool subscription to help startups accurately determine their worth. The FundTQ valuation tool is easy to use, with a simple interface that guides you through the valuation process step by step.

Take subscription to know about your business Valuation from India’s first platform where you can know about your business value with FundTQ Valuation process.

To know the valuation of your startup, click on the link to start

For any Queries and question and Buy Premium Pitch Deck at

Email: [email protected]

Call us: +91 62844 82775

#pitch deck#pitch book#startup india#entrepreneur#instagrambusiness#facebookbusiness#startupideas#entrepreneurship#businesswoman#business valuation#earnings

0 notes

Text

Buy your Pitch Deck Today with FundTQ to boost your Confidence and Meet Your Investor Today.

#entreprenuership#entreprenuerlife#entrepreneur#startup india#venture capital#investors#socialmedia marketing#business ideas#businesswoman

0 notes

Text

Turn your startup dreams into a reality with our winning pitch deck – buy now!

The Best Startup Pitch Decks Can Help You Prove the Value of Your Business.

Pitch Deck with FundTQ

Pitching your startup idea to potential investors is a daunting task, especially if you're new to the game.

You may have a fantastic product or service, but if you can't prove the value of your business, it's unlikely that anyone will invest. That's where a great startup pitch deck comes in.

A pitch deck is a presentation that outlines your business plan, vision, and goals. It typically includes slides that highlight your market opportunity, competitive landscape, team, product or service, and financial projections.

A well-crafted pitch deck can help you articulate the value of your business to potential investors, and convince them to back your venture.

So, what makes a great startup pitch deck?

First and foremost, it should be clear and concise. You only have a few minutes to make a good impression, so make sure your pitch is easy to understand and gets straight to the point. Use visuals and graphics to illustrate your points and keep the audience engaged.

Secondly, it should tell a compelling story. Your pitch should not only explain what your business does, but why it matters. What problem are you solving? What unique value do you offer? How will your business make a difference in the world?

Thirdly, it should showcase your team's expertise and experience. Investors want to know that you have the right people on board to execute your vision. Highlight the qualifications and accomplishments of your team members, and explain how their skills will contribute to the success of your business.

Lastly, it should include financial projections that demonstrate the potential return on investment. This is where you prove the value of your business. Show investors how your revenue model works, what your growth strategy is, and what your financial projections look like for the next 3-5 years.

For any Queries and question and Buy Premium Pitch Deck at https://fundtq.com/build-pitchdeck

Email: [email protected]

Call us: +91 8750956685

#pitch book#pitch deck#entreprenuership#entreprenuerlife#funding#startup india#valuation#businessowner

0 notes

Text

The pitch deck should be designed in a way that captures the investor's attention, outlines the problem you are trying to solve, and presents your unique solution. A great pitch deck provided by FundTQ to help attract the right investors to your startup or organization.

Buy Your Pitch Deck now with us : https://fundtq.com/build-pitchdeck

0 notes

Text

Crafting Powerful Pitchdecks and Pitchbooks for Startups

In today’s world, where technological advancements are changing the way businesses operate, it has become imperative for startups and organizations to create a strong and compelling pitch deck.

One of the most important things to consider when creating a pitch deck is to make it clear, concise, and easy to understand. The pitch deck should be designed in a way that captures the investor’s attention, outlines the problem you are trying to solve, and presents your unique solution.

For other organizations, the pitch deck should focus on the unique value proposition of your product or service. Include a clear and concise explanation of the problem you are solving and how your solution is different from others in the market. It is important to show your projected financials, including revenue, profit margins, and market size.

Use FundTQ to demonstrate your knowledge of the investment landscape and show the investor that you are confident in your ability to use the funds wisely.

In conclusion, a pitch deck is a crucial tool for startups, Edtech, fintech, and various other organizations looking to secure funding from investors and FundTQ provides you a platform where you can Build your Pitchdeck or Pitchbook according to your business and business needs or startups.

For More details Checkout the Page : https://fundtq.com/build-pitchdeck/ols/products?page=1

Still, If you have any question or queries you can contact our team.

#valuation#startup india#pitch deck#pitch book#investors#cashflow#business valuation#FundTQ valuation

0 notes

Text

Pitching for Startups: Crafting the Perfect Pitchdeck

A pitch deck, also known as a slide deck or start-up deck, is a presentation that provides a brief but informative overview of your business.

Pitching your startup to potential investors can be a daunting task, but creating a well-crafted pitch deck can be a game-changer. A pitch deck is essentially a visual representation of your business plan that outlines your startup's value proposition, market opportunity, team, and financial projections.

Creating a pitch deck wih FundTQ before seeking out angel investors can be incredibly beneficial for startups.

For more information you can go through the link to generate the strong Pitchdeck before going to your dream Investor.

#valuation#valuation in 10 mins#startup india#professional valuation reports#right valuation#venture capital#pitch deck

0 notes

Text

Take your company to the next level and Grow your business. Grab investors' attention with our pitch deck.

#pitchdeck #investment #Fundraising #Business #businessideas #investors #startupindia #valuation #startupvaluation #funding

0 notes

Text

News Updates #wakefitinnovation #wakefit #businesstobusiness #ankitgarg #chaitanyaramalingegowda #investors #startup #startupindia #investment #Funding #businesstips #startupbusiness #fundraising #fundraisingideas

0 notes

Text

News Update

#news#NewsUpdate#FintechStartupChallenge#newsfeed#fintech#fintechnews#fintechstartup#creditbee#startup#investors#intrepreneur

0 notes

Text

Follow For Trending

startup #investors #investor #business #businessideas #sharktankindia #mamaearth #skincare #mamaearthproducts #goodnessinside #beauty #ghazalalagh #sharktankindiaseasion2 #amang#vineetasingh #namitathapar Gupta #albinderdhindsa #sourabhkumar #deepindergoyal #pankajchanddah

0 notes

Text

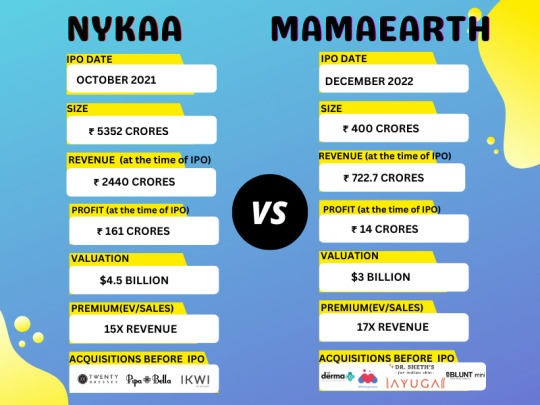

The IPO launched by Mamaearth is grabbing everyone's attention. The valuation that Mamaearth is aiming for is unexpectedly high and has got everyone asking:

Nykaa launched its IPO on October 2021 at a valuation of $4.5 Billion with a revenue of ₹2440 crores. The EV/Revenue of Nykaa stood at 15x at the time of IPO.

Meanwhile, Mamaearth's aiming at a 17x at valuation of $3 Billion when its revenue stands at annualized ₹1,444 crores.

What the learning here:

- Timing of IPO now is good for consumer brands

- Mamaearth's creating favoritism by influencer marketing vs Brand marketing by Nykaa

-Mamaearth is a brand story Vs Nykaa is a marketplace story

Waiting to see how the IPO unfolds and who wins the race.

#mamaearth#skincare#mamaearthproducts#goodnessinside#beauty#ghazalalagh#sharktankindiaseasion2#SharkTankIndia

#SonyLiv#SonyEntertainmentTelevision#peyushbansal#ashneergrover#annupammittal#vineetasingh#namitathapar#AmanGupta

2 notes

·

View notes