Don't wanna be here? Send us removal request.

Text

Boost Your ROI Using Machine Learning

In today’s hyper-competitive market, businesses are under immense pressure to deliver more value while minimizing costs. This is where machine learning (ML) comes into play. By leveraging vast amounts of data and computational power, companies can identify patterns, optimize processes, and improve decision-making—ultimately leading to a higher return on investment (ROI). This article explores how machine learning transforms ROI across industries and which key business functions are already reaping the benefits.

Smarter Marketing Campaigns

One of the most immediate impacts of ML can be seen in marketing. With intelligent algorithms analyzing customer behavior, engagement patterns, and conversion rates, businesses can hyper-personalize their campaigns in real-time.

Key advantages include:

Predictive customer segmentation

Real-time ad optimization

A/B testing at scale

Reduced customer acquisition costs

ML also enhances customer lifetime value prediction, allowing businesses to invest resources in high-value segments, ensuring a better marketing ROI.

Supply Chain Optimization

Machine learning is revolutionizing supply chain management by enabling proactive decision-making. By integrating ML models into logistics, businesses can forecast demand more accurately, optimize inventory levels, and prevent bottlenecks.

Impact Areas:

Inventory forecasting

Route optimization

Supplier risk analytics

Real-time tracking and anomaly detection

This level of automation reduces overhead, improves delivery timelines, and ensures cost savings, translating directly into ROI uplift.

Enhancing Customer Experience

A seamless customer experience is at the heart of long-term brand loyalty. ML models help businesses anticipate customer needs and personalize experiences across touchpoints. Whether it’s chatbots, recommendation engines, or real-time support prioritization, intelligent systems deliver faster and more relevant interactions.

Examples include:

AI-driven chat support with natural language understanding

Personalized product or content recommendations

Sentiment analysis for feedback and reviews

When experiences feel tailor-made, customer satisfaction increases—along with conversions and retention rates.

Financial Forecasting and Risk Mitigation

For finance and accounting teams, machine learning reduces uncertainty. Sophisticated models evaluate spending behavior, detect anomalies, and forecast trends with precision, offering an edge in strategic planning.

Use cases:

Fraud detection using anomaly detection models

Credit risk scoring

Cash flow predictions

Expense categorization and budgeting

Organizations can now proactively allocate capital, minimize financial risks, and improve the accuracy of investment decisions.

Intelligent Product Development

Machine learning enhances the product development lifecycle by identifying features users love and predicting future needs. Through behavioral analysis and usage data, businesses can reduce development cycles and improve product-market fit.

Strategic advantages:

Feature prioritization based on user behavior

Automated quality assurance using image/text recognition

Usage analytics for iterative product improvements

Shorter development timelines and smarter iteration loops improve cost-efficiency and ensure that product investment delivers maximum value.

Workforce Productivity and Automation

With the integration of ML in enterprise workflows, employee productivity sees a marked improvement. Repetitive and time-consuming tasks are offloaded to intelligent systems, allowing human workers to focus on strategic, high-value initiatives.

Areas impacted:

Automated data entry and document classification

Email sorting and CRM updates

Employee attrition prediction models

The result? Lower operational costs, improved employee satisfaction, and better resource utilization.

Real Results Backed by Data

A 2024 study by McKinsey revealed that companies adopting ML at scale have improved operational efficiency by up to 30%, with a corresponding ROI increase of 10-15% across departments. In industries like retail and finance, the adoption rate for ML-powered tools is expected to grow over 20% year-over-year through 2026.

Choosing the Right Development Partner

To truly unlock the potential of ML, it's critical to collaborate with a reliable technology provider. Whether you're building custom ML algorithms or embedding AI in existing systems, working with a team that understands your business domain can drastically improve ROI outcomes.

Firms offering specialized machine learning development services bring together data scientists, ML engineers, and industry-specific consultants to tailor solutions that align with your goals. Companies looking for robust end-to-end support often collaborate with an AI ML development company to scale their AI journey effectively.

Future Outlook

As competition intensifies, machine learning will shift from being a differentiator to a necessity. Business leaders who leverage this technology today will set the standard for their industries tomorrow. From predictive insights to full-stack automation, ML is not just about staying relevant—it’s about staying ahead.

Whether you're exploring a new project or scaling an existing one, an experienced machine learning development company can guide your transformation journey with clarity and precision.

0 notes

Text

The Rise of Asset Tokenization: Building the Infrastructure for a Digitized Financial Future

In the evolving digital economy, asset tokenization has emerged as a critical innovation—bridging traditional finance with decentralized ecosystems. As institutions and startups alike explore blockchain-backed ownership models, the demand for reliable asset tokenization development companies continues to rise.

What Is Asset Tokenization?

Asset tokenization is the process of converting real-world assets—like real estate, art, commodities, equity, or debt—into digital tokens on a blockchain. These tokens represent ownership rights, and they can be traded, transferred, or used as collateral just like traditional securities.

What makes tokenization transformative is its potential to:

Increase liquidity for illiquid assets

Reduce transaction costs and intermediaries

Improve transparency and traceability

Enable fractional ownership and global access

Whether it's a luxury villa or a corporate bond, asset tokenization unlocks new investment possibilities by converting tangible value into programmable digital assets.

The Technology Behind Tokenization

Developing a robust asset tokenization platform requires a combination of advanced blockchain infrastructure, smart contract automation, identity management, regulatory compliance, and integration with digital custody and KYC/AML services.

Key tech components include:

Smart Contracts – Automate asset lifecycle and enforce rules for trading, redemption, and ownership.

Token Standards – ERC-20, ERC-721, and ERC-1155 standards define how tokens behave and interact across chains.

Custodial vs Non-Custodial Models – Determine how assets and private keys are secured.

Cross-Chain Compatibility – To enhance interoperability across Ethereum, Polygon, Avalanche, and others.

For enterprises and fintech startups, partnering with a seasoned asset tokenization development company ensures the architecture is secure, scalable, and compliant from day one.

Market Demand and Use Cases

The total addressable market for tokenized assets is expected to exceed $16 trillion by 2030 (Boston Consulting Group). Real-world adoption is being driven across multiple sectors:

Real Estate: Fractional ownership of commercial and residential property

Private Equity: Startup shares tokenized for broader fundraising access

Fine Art and Luxury Goods: NFTs that represent physical collectibles

Green Assets: Carbon credits and renewable energy investments

Treasury Products: Tokenized bonds and T-bills as yield-generating digital assets

A properly designed real world asset tokenization platform development strategy ensures legal, financial, and operational readiness for entering this new paradigm.

Benefits for Enterprises and Investors

Tokenization offers distinct advantages for different stakeholders: StakeholderBenefitsEnterprisesNew funding models, faster settlements, programmable complianceInvestors24/7 access, global liquidity, transparent asset historyRegulatorsReal-time audit trails, programmable identity, AML integration

As asset tokenization services evolve, institutional investors are increasingly exploring these products for yield opportunities and portfolio diversification.

Regulatory Compliance and Security

Any serious asset tokenization company must build with regulation in mind. This includes:

Complying with SEC, FINMA, MAS, or relevant jurisdictional authorities

Integrating KYC/AML protocols

Adopting data protection and GDPR practices

Ensuring cybersecurity standards and smart contract audits

Compliance is no longer optional. It's a foundational layer in any asset tokenization platform development effort.

Choosing the Right Development Partner

While the demand is growing, not all providers offer the same level of technical depth or regulatory awareness. Choosing the right asset tokenization development services partner can make or break the success of your project.

You need a team that understands not just blockchain, but also finance, legal architecture, UX, and post-launch support. From prototype to production, everything must align with the goal of making real-world assets tradable, traceable, and transparent.

Here’s a curated list of top asset tokenization development companies offering tailored blockchain-based infrastructure for asset digitization across real estate, equity, and commodities.

Future Outlook

As tokenization frameworks mature, expect convergence with DeFi, AI, and real-time compliance tools. Institutions are already piloting real world asset tokenization services to modernize internal capital markets. The race is on to build infrastructure that can support trillions of dollars in tokenized value.

By 2027, tokenized asset platforms will likely be as mainstream as online trading platforms are today—ushering in a hybrid finance model where digital and real-world assets seamlessly coexist.

0 notes

Text

How Generative AI Development Companies Are Reshaping Industries in 2025

Generative AI is no longer just a buzzword. It’s evolving into a core business capability, driving transformation across industries—from content creation and customer service to pharmaceutical research and software development. Behind this shift are specialized generative AI development companies building advanced solutions tailored to real-world needs.

This blog unpacks how these firms operate, the impact of their services, and why enterprises are investing heavily in generative AI development.

What is Generative AI?

Generative AI refers to algorithms that can generate new content—text, images, code, audio, and more—based on patterns learned from existing data. These models, such as GPT-4, DALL·E, and Stable Diffusion, are trained on massive datasets and can mimic human creativity with astonishing accuracy.

But generative AI isn’t just about mimicking art or language. It's about enhancing productivity, reducing operational bottlenecks, and enabling scalable innovation. From dynamic chatbots to personalized marketing copy, the applications are far-reaching.

Core Capabilities of a Generative AI Development Firm

A generative AI development firm offers services far beyond model training. Their role spans the full AI lifecycle, including:

Data engineering: Aggregating, cleaning, and structuring datasets suitable for model training.

Model selection and fine-tuning: Choosing pre-trained foundational models and customizing them to industry-specific tasks.

Architecture design: Building scalable, secure, and API-ready infrastructure for AI deployment.

Compliance and risk management: Ensuring AI systems adhere to regulatory standards and ethical frameworks.

Their work involves not just code but careful alignment with business objectives.

Industries Being Transformed by Generative AI Services

1. Healthcare

AI-generated diagnostic reports, drug discovery, and patient chatbot systems are transforming clinical operations. Generative models help simulate molecular structures and create synthetic data for rare disease research.

2. Finance

From automated report generation to customer onboarding assistants, banks are leveraging generative AI to save time, cut costs, and stay competitive. AI-powered fraud detection also benefits from dynamic pattern generation and anomaly detection.

3. Retail and eCommerce

Generative AI tailors product descriptions, generates hyper-personalized ad copy, and powers interactive shopping assistants. By customizing content at scale, brands can increase conversion rates while improving customer satisfaction.

4. Education

Educational platforms now deploy generative AI to produce adaptive learning materials, generate quizzes, and provide tutoring support. This enables personalized learning experiences for diverse student needs.

What Makes a Leading Generative AI Development Company Stand Out?

Among the sea of generative AI development companies, only a few demonstrate true technical maturity and domain expertise. The best firms typically:

Invest in R&D to stay ahead of foundational model updates.

Offer custom AI integration tailored to existing business workflows.

Ensure transparency through explainable AI practices.

Embrace a cross-functional team structure, combining AI engineers, data scientists, UI/UX experts, and compliance officers.

These attributes help enterprises avoid the trap of generic AI solutions and instead unlock long-term value.

Key Features to Expect from Generative AI Development Services

Choosing a vendor that offers full-stack Generative AI Development Services ensures scalability, performance, and compliance.

Evaluating the Right Partner: Questions to Ask

Before engaging with a Gen AI Development company, consider these critical questions:

What foundational models do they support (GPT, Claude, DALL·E, etc.)?

Do they offer ongoing support and retraining services?

Can their solution integrate with your CRM, CMS, or proprietary systems?

How do they handle data privacy and security?

What metrics do they use to evaluate AI performance and ROI?

Due diligence is key in selecting a firm that can deliver lasting impact.

Top Global Hubs for Generative AI Development

Countries like the USA, Canada, Germany, and Singapore are emerging as AI innovation powerhouses. Notably, the Generative AI Development Company in USA market has seen a surge due to early adoption, access to talent, and enterprise-level funding.

The U.S. ecosystem offers:

Access to top-tier AI researchers

Venture-backed innovation labs

Regulatory frameworks favorable to experimentation

This makes it a prime location for high-quality AI service providers.

The Rise of Specialized Generative AI Development Companies

The generative AI space is rapidly diversifying. From niche startups building creative tools to enterprise-grade solution providers, companies are carving out focused specializations. Some are dedicated to lawtech, others to fashion, and still others to cybersecurity or genomics.

As this trend grows, directories like Top Generative AI Development Companies help enterprises filter through noise and find experienced partners.

Future Trends in Generative AI Development

Multimodal Systems: The next phase includes models that combine image, text, and audio inputs to produce more context-aware outputs.

Autonomous Agents: Integrated AI agents that can perform multi-step tasks without human prompts.

Synthetic Workforce: AI tools acting as virtual employees for marketing, sales, support, and legal assistance.

On-device AI: Smaller, compressed generative models running locally for privacy-centric applications.

These advancements will drive the next wave of productivity and innovation across sectors.

Final Thoughts

The demand for reliable, high-performing generative AI services is growing exponentially. As companies seek to build smarter, more personalized digital experiences, partnering with the right generative AI development firm becomes critical. Whether you're in healthcare, finance, or retail, investing in AI isn’t just about automation—it's about unlocking human potential at scale.

For businesses ready to take the next step, collaborating with a generative ai development company can lead to transformative outcomes.

0 notes

Text

Sui Wallets: Empowering Web3 Users with Seamless Blockchain Integration

The rise of blockchain technology has paved the way for a decentralized, secure, and transparent future. Among the emerging blockchain platforms, Sui Blockchain stands out for its high-performance capabilities, particularly in decentralized finance (DeFi) applications and non-fungible tokens (NFTs). As Web3 continues to grow, Sui wallets have become essential tools for users, offering a secure way to store, manage, and interact with digital assets.

In this article, we'll explore Sui wallets in detail, discussing their features, functionality, and the crucial role they play in enabling seamless interactions with the Sui blockchain. Whether you're a crypto enthusiast, a developer, or a business looking to integrate blockchain technology, understanding how Sui wallets work is vital.

1. What are Sui Wallets?

A Sui wallet is a digital tool that allows users to securely store their private keys and manage their assets on the Sui blockchain. These wallets are designed to interact with the decentralized applications (dApps) built on the Sui network, offering an intuitive interface to send, receive, and store digital assets such as cryptocurrencies and NFTs.

Sui wallets come in two primary types:

Hot Wallets: These are online wallets that are connected to the internet, providing ease of use for frequent transactions.

Cold Wallets: These are offline wallets, offering enhanced security by storing keys on physical devices, making them less vulnerable to hacking.

Key Features of Sui Wallets:

Private Key Management: Sui wallets provide users with full control over their private keys, ensuring security and ownership of their digital assets.

Multi-Asset Support: Sui wallets support various tokens and assets, including Sui's native cryptocurrency, SUI tokens, and NFTs.

User-Friendly Interface: Designed for both beginners and advanced users, Sui wallets offer an intuitive interface that simplifies blockchain interactions.

2. Role of Sui Wallets in Web3

As Web3 technology continues to evolve, Sui wallets play a crucial role in enabling decentralized applications (dApps) to interact seamlessly with the blockchain. Web3, with its focus on decentralization, aims to give users control over their own data and digital assets. By using Sui wallets, users can:

Engage with DeFi Platforms: Sui wallets allow users to connect with decentralized exchanges (DEXs), lending platforms, and liquidity pools on the Sui blockchain.

Trade and Manage NFTs: With NFTs becoming increasingly popular, Sui wallets offer easy integration with NFT marketplaces, allowing users to buy, sell, and manage their digital collectibles.

Participate in DAO Governance: Many projects on the Sui blockchain use decentralized autonomous organizations (DAOs) for governance. Sui wallets allow users to participate in voting and governance decisions within these organizations.

3. Security Features of Sui Wallets

Security is a top priority when it comes to managing digital assets, and Sui blockchain wallets are designed with robust security features to protect users’ assets. Some of the key security features include:

Two-Factor Authentication (2FA): Many Sui wallets support two-factor authentication, adding an extra layer of security when accessing the wallet.

Encryption: Sui wallets encrypt private keys and sensitive data, ensuring that even if the wallet is compromised, the keys remain secure.

Backup and Recovery Options: Users are provided with recovery phrases or seed phrases, allowing them to restore access to their wallet in case of device failure or loss.

4. Sui Wallet Integration with dApps

One of the most powerful features of Sui wallets is their ability to interact directly with decentralized applications (dApps). This integration allows users to:

Connect with DeFi Protocols: Users can connect their Sui wallet to various DeFi applications, such as decentralized exchanges (DEXs), lending platforms, and yield farming protocols.

NFT Marketplaces: With the rise of NFTs, Sui wallets provide seamless integration with NFT marketplaces, allowing users to mint, buy, and sell NFTs effortlessly.

Smart Contracts: Sui wallets can be used to sign and execute smart contracts directly from the wallet, making it easier for users to engage with Web3 projects.

5. How to Set Up and Use a Sui Wallet

Setting up a Sui wallet is a straightforward process. Here’s a step-by-step guide:

Choose Your Wallet: Start by selecting a wallet that supports the Sui blockchain. Popular options include software wallets and hardware wallets.

Create a New Wallet: Once you��ve selected your wallet, you’ll need to create a new wallet. During this process, you’ll be given a seed phrase (backup phrase). Be sure to store it in a secure location.

Fund Your Wallet: To interact with the Sui blockchain, you’ll need to deposit some SUI tokens or other assets into your wallet. This can be done through exchanges or from other wallets.

Connect to dApps: Once your wallet is set up and funded, you can connect it to any supported dApp on the Sui network. This allows you to interact with DeFi platforms, NFTs, and more.

6. Sui Wallets and Developer Support

For developers looking to build and integrate Sui wallets into their applications, the Sui blockchain provides extensive support through APIs and SDKs. As a Sui blockchain development company, we offer Sui blockchain development services that include wallet integration and dApp development, ensuring that businesses can easily incorporate blockchain solutions into their Web3 applications.

By using Sui blockchain solutions, developers can create customized wallets and decentralized applications that interact seamlessly with the Sui network, benefiting from its high scalability and low transaction fees.

Conclusion

Sui wallets play an essential role in the Web3 ecosystem, offering users a secure, efficient way to interact with the Sui blockchain. Whether you are a cryptocurrency user, an NFT enthusiast, or a developer building decentralized applications, understanding how Sui wallets function is key to navigating the Web3 landscape effectively.

For businesses and developers looking to explore Sui blockchain solutions, partnering with a Sui technology solutions provider can ensure that your project is built with the latest tools and best practices for blockchain integration.

For more information, check out our detailed guide on Sui wallets for Web3 users here.

0 notes

Text

Introduction: Understanding AI-Integrated Smart Crypto Wallets

In recent years, the cryptocurrency landscape has seen immense innovation, and one of the most exciting developments is the introduction of AI-integrated smart crypto wallets. These wallets combine the convenience and security of traditional crypto wallets with the enhanced functionalities provided by Artificial Intelligence (AI). AI integration allows these wallets to provide a personalized, secure, and efficient user experience.

AI-integrated smart wallets are not just about storing and managing digital assets. They offer features that automate transactions, optimize security protocols, and even provide predictive insights into the user’s crypto behavior. By leveraging machine learning algorithms, these wallets adapt to the user’s behavior over time, enhancing the overall experience.

Key Features of AI-Integrated Smart Crypto Wallets

When discussing AI-integrated smart crypto wallets, it is crucial to understand the powerful capabilities that AI brings to the table. Below are some essential features that differentiate these wallets from traditional ones:

Automated Transaction Management AI algorithms in these wallets are capable of monitoring market trends, ensuring transactions are made at optimal moments. For example, they can schedule transfers when certain conditions (like a price drop or market volatility) are met, thereby increasing profitability and reducing risk for users.

Enhanced Security AI algorithms help in identifying and mitigating fraud by analyzing transaction patterns and detecting suspicious activities in real-time. This is particularly important in the crypto space, where scams and hacking attempts are prevalent.

Predictive Analytics for Investment AI-powered wallets can offer predictive insights by analyzing the performance of various cryptocurrencies. By evaluating historical data, market trends, and patterns, these wallets can suggest potential investments to users, making them smarter traders.

Personalized Experience An AI-powered wallet learns from user behavior and offers a tailored experience, such as automated portfolio rebalancing, alerts for favorable trades, and custom notifications. Over time, the wallet evolves to become more in tune with the user's preferences.

Seamless Integration with DeFi and NFTs These wallets can be seamlessly integrated with decentralized finance (DeFi) platforms and non-fungible token (NFT) marketplaces, providing users with easy access to the rapidly growing DeFi ecosystem and facilitating NFT transactions in a secure and efficient manner.

How AI Enhances the User Experience in Crypto Wallets

AI's role goes beyond improving security and transaction automation. It fundamentally enhances the user experience in crypto wallets in the following ways:

Smart Transaction Assistance By analyzing the current crypto market, AI Integration Services can recommend optimal transactions, helping users buy or sell at the most favorable times.

Fraud Prevention and Detection With AI’s ability to learn from patterns, these wallets can automatically flag suspicious activities, ensuring a higher level of protection. This reduces the risk of unauthorized access, a critical feature for crypto users.

Portfolio Management and Insights AI can help users track their investments, making adjustments based on market trends and personal goals. It can also forecast potential risks and offer actionable insights for portfolio optimization.

Real-Time Alerts and Notifications Smart crypto wallets powered by AI can send users alerts in real-time, informing them about price changes, security risks, or opportunities to make profitable transactions.

Why AI Integration in Crypto Wallets Matters for Businesses

Integrating AI into crypto wallets isn’t just about improving user experience. For businesses, it’s an opportunity to gain deeper insights into customer behavior and streamline operations. AI-powered wallets can help businesses:

Enhance customer engagement through personalized services.

Increase security and trust by using advanced fraud prevention measures.

Offer real-time analytics, enabling businesses to make data-driven decisions in their crypto dealings.

In addition, by leveraging AI Integration Solutions For Business, crypto companies can stay ahead of the curve, offering customers advanced tools that traditional wallets cannot. This differentiation is crucial in a rapidly evolving market.

The Future of AI in Crypto Wallets

As the technology advances, AI Integration Solutions will continue to play a key role in revolutionizing crypto wallets. Here are some future trends to look out for:

AI-Powered Cross-Chain Transactions Future AI wallets will support seamless transactions across multiple blockchain networks, improving liquidity and simplifying the trading process for users.

Enhanced AI-driven Security AI’s potential in fraud detection will evolve with more advanced algorithms, potentially using biometric data or advanced machine learning models to offer near-impenetrable security.

Full Integration with Digital Ecosystems The future will see a rise in AI wallets fully integrated with not just crypto exchanges but with the entire digital ecosystem, enabling users to manage their digital assets across various platforms, from DeFi to NFTs, in one place.

Conclusion: The Need for AI Integration in Smart Crypto Wallets

The integration of AI into crypto wallets is not just a trend but a step toward a smarter, more secure, and user-centric financial system. By automating transactions, enhancing security, and offering personalized experiences, AI-integrated smart crypto wallets are poised to transform the way individuals and businesses interact with the cryptocurrency world.

As the demand for AI Integration Solutions increases, adopting AI-powered wallets will be a crucial part of staying competitive in the rapidly evolving digital finance space.

0 notes

Text

How Smart Contract Development Is Reshaping Digital Agreements

In a world where digital transformation is accelerating every industry, trust and transparency have become critical assets. Smart contracts—self-executing contracts with the terms of agreement written into code—are redefining how agreements are created, verified, and enforced. Whether you're building decentralized finance (DeFi) apps, automating business workflows, or launching NFT platforms, smart contract development has become a cornerstone of Web3 and blockchain ecosystems.

This article explores what smart contracts are, how they work, and why they are transforming industries, with real-world use cases, challenges, and how to get started.

What Is a Smart Contract?

A smart contract is a program stored on a blockchain that executes automatically when predefined conditions are met. These contracts eliminate the need for intermediaries and rely on blockchain’s transparency and immutability to ensure trust.

Key Characteristics:

Self-executing: Once deployed, they run without manual intervention.

Immutable: Code cannot be changed once uploaded on-chain.

Transparent: All participants can view the logic and terms.

By embedding logic into a decentralized environment, smart contracts allow two or more parties to transact securely without relying on third-party verification.

Why Businesses Are Adopting Smart Contract Solutions

The business potential of smart contracts goes far beyond cryptocurrencies. They’re enabling enterprises to:

Reduce operational costs by automating transactions

Eliminate paperwork and manual reconciliation

Ensure tamper-proof record-keeping

Accelerate settlement and reduce disputes

From real estate to healthcare, industries are realizing that smart contract solutions can increase efficiency, security, and accuracy while minimizing human error.

Real-World Use Cases of Smart Contract Development

1. DeFi Platforms

Decentralized finance platforms use smart contracts to automate lending, borrowing, and yield farming without intermediaries.

2. Supply Chain Management

Every checkpoint—from origin to delivery—is verifiable on-chain using smart contracts, improving transparency and reducing fraud.

3. Insurance Automation

Policies are triggered automatically based on predefined conditions, such as weather data for crop insurance.

4. NFT Marketplaces

Smart contracts handle minting, royalties, and transfers, ensuring creators are paid automatically on secondary sales.

5. Real Estate Tokenization

Ownership deeds and fractional investments are managed via tokenized smart contracts, simplifying property transactions.

Challenges in Smart Contract Development

While smart contracts bring immense benefits, they are not without risks. Some key challenges include:

Security vulnerabilities: Bugs in contract logic can lead to fund loss.

High gas fees: Complex contract interactions can incur significant costs.

Scalability issues: Public blockchains may limit throughput and speed.

Lack of regulation: Legal enforceability of smart contracts is still evolving in many jurisdictions.

To overcome these hurdles, partnering with experienced smart contract development service providers ensures robust and secure implementation.

Best Practices for Secure and Scalable Smart Contract Development

Audit Before Deploying: Always perform third-party security audits.

Use Established Frameworks: Tools like OpenZeppelin offer pre-audited libraries for standard functions.

Modular Architecture: Design contracts that are upgradeable and scalable.

Test Rigorously: Simulate contract behavior across all edge cases.

The development lifecycle should include continuous testing, code review, and post-deployment monitoring to reduce risk.

Choosing the Right Smart Contract Development Partner

When evaluating a smart contract development company, look for these traits:

Proven portfolio of blockchain projects

Transparent development process

Ability to integrate with your existing tech stack

In-house auditing or collaboration with reputed auditors

Deep understanding of tokenomics and blockchain ecosystems

A reliable partner not only writes code but helps shape your blockchain product strategy.

Explore a top-tier partner for Smart Contract Development Services here:

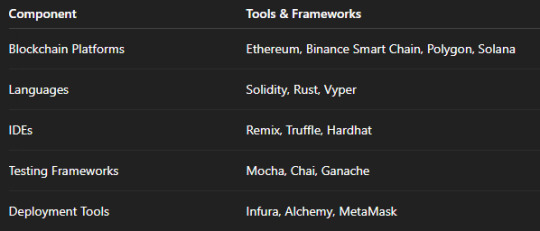

Tech Stack Commonly Used in Smart Contract Development

Each tech stack is chosen based on the target chain, performance requirements, and the project’s business logic.

How SoluLab Delivers End-to-End Smart Contract Development Solutions

SoluLab is a leading blockchain solutions provider offering full-cycle smart contract development solutions tailored to DeFi, NFT, and enterprise use cases. From conceptualization to deployment and audit, our team delivers smart contracts that are robust, gas-efficient, and secure.

With a proven track record across over 150 blockchain projects and an agile development model, SoluLab helps startups and enterprises build with confidence. Learn more about our offerings here:

Final Thoughts

Smart contracts are more than just lines of code—they are the engines powering the decentralized future. Whether you’re building a decentralized application, automating business workflows, or tokenizing real-world assets, investing in reliable smart contract development services is essential for long-term success.

With the right partner and strategy, smart contracts can drastically reduce costs, improve trust, and unlock entirely new business models.

1 note

·

View note