Text

Hidden Costs of Merchant Cash Advance

Are you looking forward to a merchant cash advance loan to relieve your business? In this regard, you won't be facing any related stresses. It is because we will guide you by clearing any doubts which may have popped up in your mind.

If you own a business and intend to maintain a specific capital, then at a particular moment, you may require a certain amount of debt. However, it shall lead to a higher return on equity but can be risky an immense number of times. So, debt can provide liquidity in significant ways, but debt returns are problems for most financial institutions.

Repayment For Merchant Cash

It is necessary to understand the fact that merchant cash doesn't operate as a loan regularly. The main difference is about the interest rates, such that loans involve interest rates upon return, whereas merchant cash involves factor rates.

However, the following solutions are possible in case of merchant cash advance renewal.

Possible Solutions

· The first solution regarding the renewal is the withdrawal by a specific percentage for the sales.

· The second solution involves providing access to your business account. The merchant withdraws a certain amount on a daily/weekly basis.

Both the solutions are feasible until the weekly payments are complete. Upon completion, merchant cash advance renewal can be effective.

Avoidance For Merchant Cash

Due to the presence of merchant cash advance problems, we'd rather say that it is not at all a practical option. Many limitations are assigned to merchant cash.

· If compared with loans, these relatively take more time for repayment. So, these serve as a significant trap for business owners.

· In most cases, scams occur such that annual return percentages are also not revealed by the companies.

· Most companies also take complete control over your rights, thereby making you sign a "confession of judgment."

· Merchant cash advances are irrespective of government regulations. For example, if the government regulations are taken into account, interest rates limit average around ten percent. No such limitations exist in merchant cash service providers, due to which annual percentage rates are high.

Double Dipping And Its Consequences

In the case of merchant cash advance returns, the returns are also known as double dipping. Regardless of the interest rates, the APRs are much higher in such returns. It can also be said that double-dipping serves as returning the borrowed amount with doubled interests, thereby giving up defense rights.

Avoidance For Double Dipping

To avoid double dipping, the business owners should carefully read the terms and conditions to prevent any drastic consequences. Most important of the requirements include the fees, APRs, retaining of legal rights, etc. Any relevant schemes that involve double-dip activities or undisclosed APRs should always be avoided.

Conclusion

Summing it up, the annual APR for the merchant cash advance is not disclosed in most cases. It gives rise to a lot of merchant cash advance problems. Thus, concluding our findings, it is essential to avoid merchant cash advance even if you are in dire need of financial aid.

0 notes

Text

Reverse Consolidation – Challenges, Benefits, And Limitations

Are you looking forward to repaying your merchant cash advance lender? We'll guide you through the best possible options that shall be convenient for you. Some of the best possible options include regular consolidations like SBA Consolidation, Commercial Real Estate Consolidation, Alternative Merchant Cash Advance Consolidation, and Reverse Consolidation.

Out of all the provided options, reverse consolidation serves as the best option for consolidation. It plays a crucial role in reducing the MCA provider payments that are to be made daily or weekly.

Merchant Cash Advance Reverse Consolidation – What is it?

If you don't know about merchant cash advance, it is a financing option in the short term serving as a liquidating means for a business. It is a particular debt borrowed on a short-term basis and doesn't contain any fixed interest rate. MCAs include factor rates that are irrespective of government rules and regulations.

So, merchant cash advance truth in lending violation is such that the financial stability for the short term is ensured. It is because reverse consolidation will play a vital role in that regard. Many people have a misconception regarding reverse consolidation. They consider reverse consolidation as a method of reducing debt, but it's not true.

Merchant cash advance reverse consolidation relates to a financial plan to reduce or fix the payment to be made in advance cash repayment. So, reverse consolidation results in effective management for cash flow.

The following points are essential to consider if you are a business owner and look forward to avail reverse consolidation.

· The reverse consolidation company is affiliated with your business bank account. So, it deposits money every week, due to which the deposited money is withdrawn regularly by the merchant cash advance provider.

· A fraction of the paid debt to the MCA provider on the reverse consolidation company is paid by the business owners. It can be paid on a weekly or monthly basis as agreed upon between both of them.

· The merchant cash advance reverse consolidation payment duration is longer than that of merchant cash advance payment.

Reverse Consolidation – Associated Challenges and Benefits

Associated Challenges

There are some challenges associated with reverse consolidation and also should be considered very carefully.

· The duration for the reverse consolidation is comparatively long if compared with the merchant cash advance providing service. It may serve as facilitating needs in the short term but leads to increased debt in the end.

· The burden is reduced for a short time, especially while managing the repayment of the merchant cash advance, but for the long term, the burden of debt increases.

Benefits

· Reverse consolidation plays a crucial role in regulating the business such that it lessens the economic burden on a particular industry.

· The business progress and operations are not disturbed because a fixed percentage is cut off weekly or monthly.

· The financial progress and credit score for the business are not at all disturbed and stays uniform.

Conclusion:

Throughout the article, we've highlighted the reverse consolidation option, which serves as the best repayment method for merchant cash advances. Merchant cash advance truth in lending violation is that the APRs are not often declared in the agreement. We hope that this article helped clear your confusion.

0 notes

Text

How Merchant Cash Advance Effects Your Business

Are you the one who got merchant cash advance and now tired of its repayments? Do you want to stop feeling burdened? We will provide you with practical ways to stop merchant cash advances. Keep reading.

Merchant Cash Advance:

Many people take loans to keep their new businesses alive and to keep them growing. A merchant cash advance is also an option to receive funds from merchant cash advance funders.

Perks of having Merchant Cash Advance:

Merchant cash advance has many benefits over typical bank loans. You can qualify for merchant cash advance even if you have less credit. It is the fastest financing available for small businesses. You don't have to pay fixed installments; instead, funders take a fixed percentage of your future sales. You don't have to put any property or equipment as collateral.

Stings of Merchant Cash Advance:

State laws do not regulate merchant cash advance funders; they charge high interests and other fees. Sometimes it is not a fair deal for borrowers. You have to repay daily, which badly affects your cash flow. It is temporarily a good solution for your business, but it is one of the expensive forms of financing for small businesses in the long run.

Why Is Merchant Cash Advance Not A Loan?

Typical bank loans are tough to secure. They have strict laws associated with them. Still, if we see in the long term, they are more affordable because of the repayment schedule, loan term, interest rates, and other factors. Banks generally make monthly repayments regardless of how well the business is going.

On the other hand, a merchant cash advance is not a loan. Now you might be wondering, why is a merchant cash advance not a loan? Well, it's not borrowing; instead, you sell your future receivables in advance. However, you are obligated to pay a certain percentage of your debit or credit card sales. A merchant cash advance typically takes repayments daily.

A person should choose his financing approach wisely, having clarity about his business goals, cash flow, revenue, and risk tolerance.

How to Stop Merchant Cash Advance?

You never want to have the burden of merchant cash advance. Practical answers are available to how to stop a merchant cash advance, including:

· Term loans have more extended repayment periods, and interest rates are also low.

· You can borrow interest-free money from a family member or a trusted friend or pay cash in advance.

· There are numerous strategies to increase your business profits; you can apply them to decrease your payables.

Consulting an experienced attorney can help you dealing with debt issues and choosing the best option to stop merchant cash advances.

Conclusion

A merchant cash advance is, no doubt, a push towards the growth of your small business. Most people are unaware of why is a merchant cash advance not a loan? The problem is that rules are for loans, as merchant cash advance is not a typical loan, so its high interests are considered legal.

So, you need to have knowledge about how to stop a merchant cash advance before applying for it. Talking about your situation to legal attorneys can help you stop merchant cash advances in the best way.

0 notes

Text

Is Stacking Merchant Cash Advance Bad For Your Business?

Being a business person, you always need an uninterrupted cash flow. At some point, you may need emergency capital at any time. At times like this, your business requires some additional financing apart from your bank loans. We understand that not obtaining the other finances can be devastating for your business.

This article will discuss what options you have for a constant money supply for your business. So, let’s get into the details!

What is Merchant Cash Advance Stacking?

In simpler terms, getting a merchant cash advance is the process when you already have one in your name. Small businesses prefer to stack cash advances because banks are unwilling to provide any additional financing. When a company needs immediate funding and can’t wait for the long bank processes, merchant cash advance stacking seems like the right choice.

Is It Easy To Get Second Advance?

The answer is “no.” A company may have a tough time securing stack advances when it already owes one. To get additional finances, they will have to find a lender who can take another“position” on top of Position 1.

That means that the lender agrees on filing for UCC-1 and takes a second position merchant cash advance. That’s normal because some lenders willingly take 2nd, 3rd, 4th, or 5th positions because of the increasing rates.

Cash Advance Repayment Methodology

Merchant cash amount ranges from few thousand dollars to 200,000 dollars and stacking it doubles or triples the amount. For payback, the lender will take 15-20% of the merchant’s daily sales. The lender can directly take out money via the ACH payment method or through a connected bank account.

One more thing that makes advance payments different from bank loans is that payments are made on factor rate instead of interest. The most common factor rate is 1.2 and 1.4. That states, an MCA of 20,000 dollars with a factor rate of 1.25 gives you a total repayment of 25,000 dollars.

Pros and Cons of Stacking

Pros:

· It is the fastest way of getting funds for a business. Even some companies approve and release funds within 24 hours.

· The process is easy, and lenders don’t ask for merchant cash advance credit report.

Cons:

· Stacking advances means increased rates and shorter terms—consequently, more capital stress.

· The merchant finds himself in a debt trap when he takes another advance to pay the previous one.

· Stacking advances increase the debt burden on your business and the possibility of defaulting at the same time.

Do Advances Affect Your Credit Report?

That doesn’t affect merchant cash advance credit report. Even some lenders provide advances with a credit report of less than 500. The only way lenders can target credit reports when your company defaults.

Conclusion

Summing it up, merchant cash advance stacking may seem fascinating and easy game only if not used frequently. It proves to be the only solution in case of emergencies. However, regular cash advances may lead to tight budgeting and the need for more loans. Additionally, with every cash advance, your daily or weekly cashback amount will increase.

0 notes

Photo

Pragmatic and Results-Driven Advice by the Experienced Attorneys

Grant Phillips Law will support you no matter how hard and challenging your situation is. This is a debt resolution law firm with many years of experience in this field. We provide Help With Business Debt and make sure to resolve business debts for all size businesses. We offer custom plans to our customers and offer some of the best strategies to keep your cash flow positive.

0 notes

Photo

Quality Merchant Cash Advance Help for Every Business

Have you faced Merchant Cash Advance Default Lawsuit? Let Grant Phillips Law, PLLC stand beside you and help you pay off your debts and find your peace. Do not worry at all if you are inflated payments that put you out of business because we will certainly cover your needs. We offer various business debt relief options, so you are highly recommended to discuss your case with us as soon as possible.

0 notes

Photo

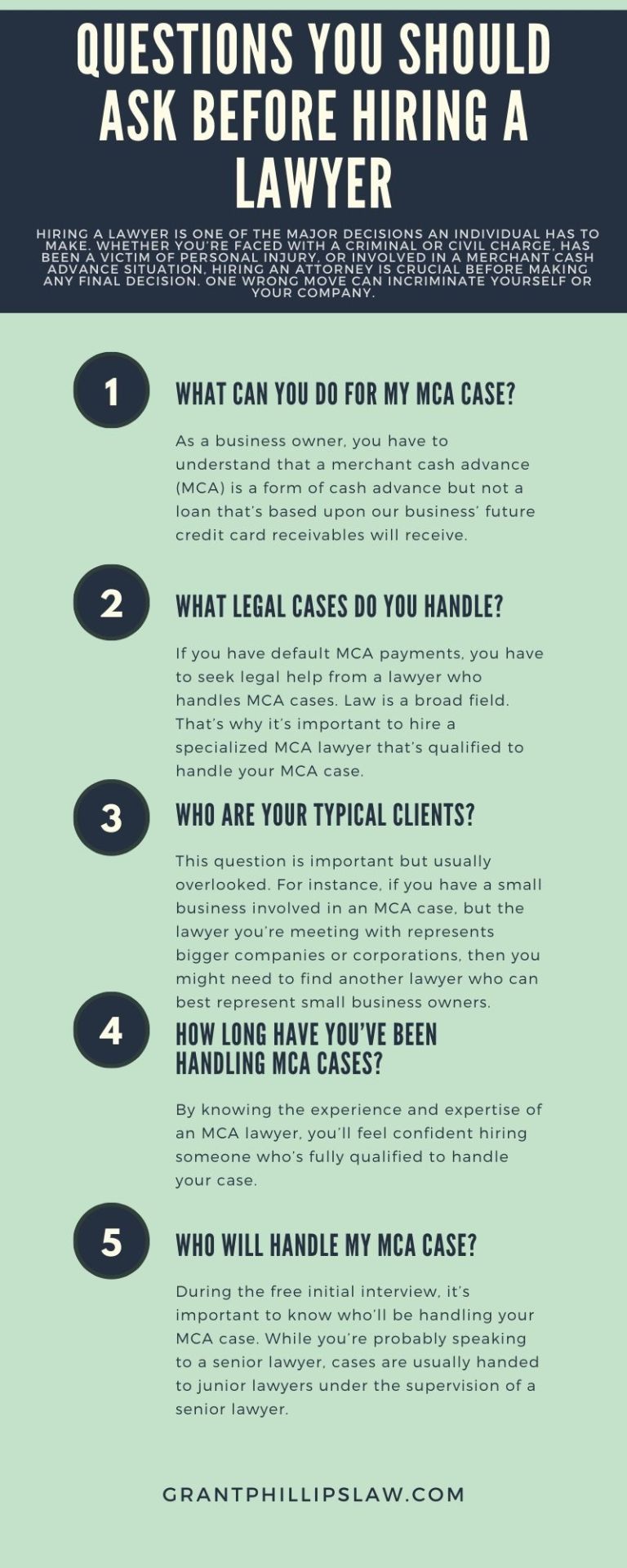

Questions You Should Ask Before Hiring A Lawyer

Do you want some kind of Business Debt help? Then here is the solution for you. You can take help from Attorneys who rely on a combined experience of 35 yrs in Business Debt settlement and apart from this, they have been dealing with Merchant Cash Advance Debt for the last 10 yrs.

0 notes

Photo

How to improve CIBIL™ score after credit card settlement

Do you want some kind of Business Debt help? Then here is the solution for you. Grant Phillips Law, PLLC gives individual and business debt answers to people and little organizations battling with debt.

0 notes

Photo

How to Avoid Filing for Bankruptcy

This Grant Phillips law can also help you with your Merchant Cash Advance Credit Report. It is basic that a credit report is acquired from every one of the 3 main credit agencies, in order to make sure that you are finding all your creditors. So what is recorded on Experian for instance may not be recorded on the Transunion report. Thus, Grant Phillips law gets each of the 3 reports for you.

0 notes

Photo

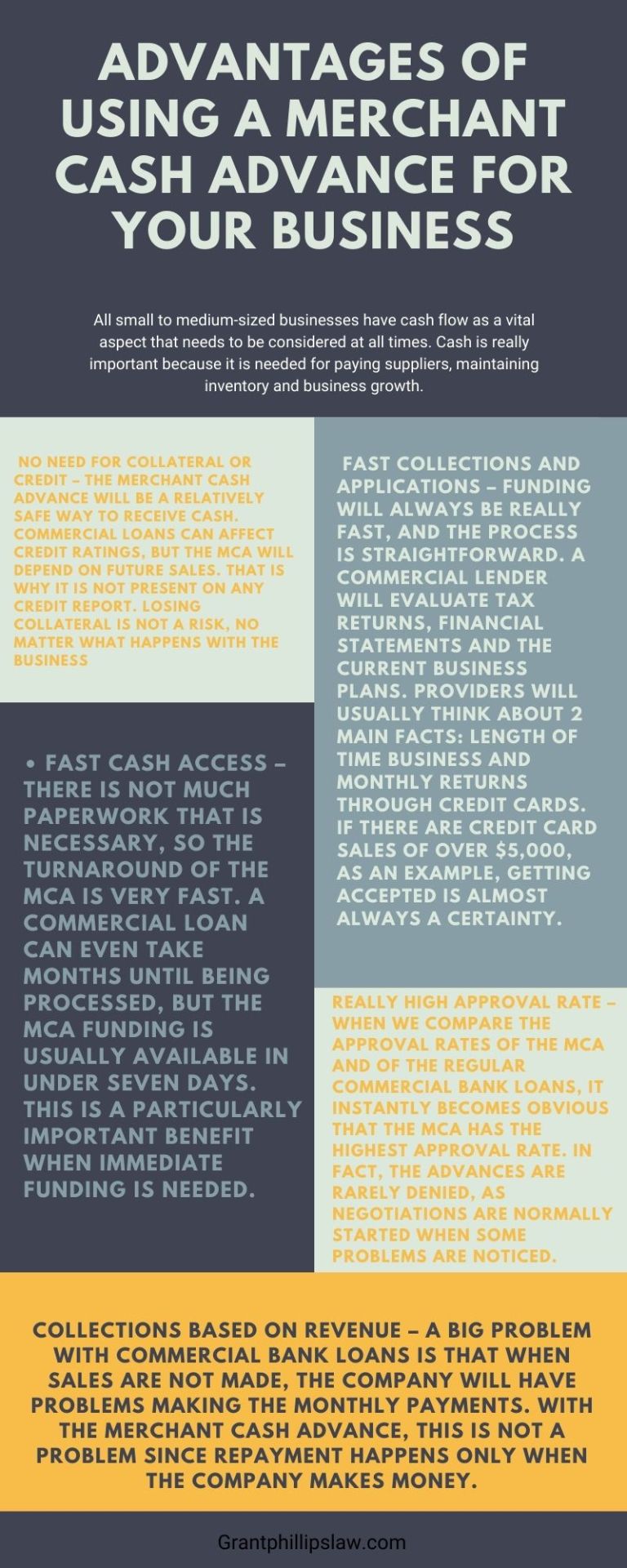

Advantages of Using a Merchant Cash Advance for Your Business

Do you want some kind of Business Debt help? Then here is the solution for you. You can take help from Attorneys who rely on a combined experience of 35 yrs in Business Debt settlement and apart from this, they have been dealing with Merchant Cash Advance Debt for the last 10 yrs.

0 notes

Link

CG Building Solution is a building company in Taupo city (New Zealand). Their goal is to help you improve the landscape design of Taupo They have expertise in renovation, building, and landscaping design Taupo. CG Builder Taupo is a team of skilled professionals with plenty of experience in this field.

0 notes

Text

Protect Your Business with Grant Phillips Law

Have you defaulted On Merchant Cash Advance? Or do you plan to do it? Get help from Grant Phillips Law and discuss everything with this team in order to make an informed decision. As we all know, you need some cash to develop your business and run it accordingly. However, you cannot have enough because at first you need some money to get off the ground, then you will need more because of fluctuations and seasonal changes. All of these things can push you to seek a merchant cash advance.

In fact, an MCA is easy to obtain compared to many other lending companies. As you know, all of these processes are longer and more complex but when you decide to get a merchant cash advance loan, you won’t face such tedious tasks. You will even get your loan within 24 hours. However, a person who defaulted On Merchant Cash Advance can face many issues as it affects businesses severely. Your business will be exposed to a lot of fines and charges. That’s why it’s important that you know what will happen to you default on a merchant cash advance. Note that your lender can sue you. When you fail to pay back the loan, the lender can take your finances. In such a case you need a reliable attorney who can help you in court. Merchant Cash Advance Attorney Nevada is here to provide you the needed legal help and advice. Defaulting in paying your loans is dangerous to your business, so even if you have already done, contact the Merchant Cash Advance Attorney Nevada so you can get the right assistance.

As a full-service law agency, this team also consists of an experienced bankruptcy lawyers. So if there is no solution left, you can file bankruptcy. However, this is not for every person, but if it is right for your situation then it will put you on the road of financial success. Whether you have faced job loss, medical crisis, accidental injury, mortgage crisis, or business failure, the lawyers from Grant Phillips Law will be beside you. Bankruptcy can keep creditors from harassing you and you will be able to keep your assets while allowing your debts to be forgiven. Grant Phillips Law has the most skilled team who can file bankruptcy properly so you won’t be left stuck with unexpected expenses and debts that are not resolved. The experts will do everything so you can obtain your financial freedom. They have a complete understanding of bankruptcy and can find the most suitable solution that works best for you.

To discuss all the options of how you can go through your difficult financial situation, simply contact Grant Phillips Law and rest assured that they are ready to help you find your way forward. Whatever brings you to their door, they will cover your needs and provide personalized services. These expert attorneys have helped many businesses who were just hopeless. Therefore, you can put your trust in their knowledge and skills being sure they will do whatever they can for you!

0 notes

Text

Debt Relief to Your Small Business

Whenever you decide to Consolidate Merchant Cash Advance you will need a reliable help from reliable attorneys. Grant Phillips Law is one-of-a-kind legal agency that has helped many businesses thrive and manage their MCA loans. In general, merchant cash is one of the most common types of business financing available nowadays. In the case of merchant cash advance, a business borrows a certain amount of money and agrees to pay it back on a daily or weekly basis. However, the lender has the right to take some percentage of sales of products. At first sight, this type of loan seems to be useful for small business bur most of all they end up getting no results. Sometimes, business owners even take second or third cash advances to pay off the first cash advance. As a result, they get into a deeper hole and things become more stressful and difficult. This is when businesses need to Consolidate Merchant Cash Advance into one single facility. The experts will allow your business to pay off the debts slowly and reduce the number of those lenders to whom your owe debt.

Small businesses can benefit from this MCA consolidation and the process of repayment will not be so overwhelming. A lot of businesses that take a merchant cash advance loan more than one time, especially when their cash flow slows down, they feel the strain of the daily merchant cash advance payments. So that is why it leads a business owner to secure another MCA. The process continues the same way for a long time until a business owner finds himself paying off 3, 4, 5 or even more MCA loans. It is evident this cycle cannot go on the same way. After all, another cash advance isn’t an option. That is why looking for an MCA consolidation seems to be the most realistic choice.

Having Business Loan Debt Settlement lawyers, Grant Phillips Law guarantees that your will have a great chance to avoid bankruptcy. Once you start working with this team, they will take over everything for you. They will reach out to lenders on your behalf and notify them that from that moment on you’re working with a debt settlement company. So everything will be managed professionally and your lenders will have a reason to trust you. During this time you can focus on your business because Grant Phillips Law will take care of each and every step. So you can be sure you’ll get a successful cash advance settlement. These Business Loan Debt Settlement lawyers have much experience working with lenders nationwide, and they opt for proven methods and strategies help you settle your debt. These experts will do their best to help you reduce your payment by up to 50%, as well as lengthen your payment terms which can lead to saving some cash.

Get in touch with Grant Phillips Law if your small business is struggling to meet its obligation. The professional lawyers look forward to providing you with a debt relief!

0 notes

Text

Personalized Legal Help for Merchant Cash Advance Loan

Getting Merchant Cash Advance Legal help has never been as easy as it is today. If you are drowning in and you don’t find a solution yourself then look no further and hurry up to get in touch with Grant Phillips Law, PLLC. Let this professional team of attorneys help you pay off your debts step by step. It can be very hard to watch how your debt levels rise as you cannot afford to repay them. So never hesitate to get in touch with this expert team of lawyers and you’ll get excellent Merchant Cash Advance Legal. Get a professional assistance and you can rest easy knowing that you will get out of this overwhelming situation. If you have many unsecured debts at high interest rates and you have already taken a Merchant Cash Advance Loan, be sure Grant Phillips Law, PLLC can simplify your payments. At Grant Phillips Law, the expert can advise you the best ever solutions and provide you with various options.

A Merchant Cash Advance Loan is a quick option for many businesses. With an MCA, you can get the needed amount of cash quickly, with an easy application process. A Merchant Cash Advance Loan is easy to get if your business brings in a pretty volume of daily credit and debit card sales because that’s how the money is paid back. Thus, we can claim that if you have a poor personal credit, then many merchant cash advance companies will approve your application. So if you have already taken a MCA loan and you are now unable to pay back the merchant cash advance, opt for a legal help from Grant Phillips Law, PLLC and the specialists will support you every step of the way. Note that there are various MCA companies that require a personal guarantee, in which case they will continue to hold you personally responsible if your business is unable to make the payments. So before signing a document, read it carefully and take into account each detail.

Now you may ask “Why Is a Merchant Cash Advance Not a Loan?” it is not a loan because you are not borrowing money but you are just selling a part of your future sales. So the repayment is structured through your daily credit and debit card sales. Rates on a merchant cash advance are usually higher than other types of small business loan options. If you have poor credit then you may not probably qualify for an MCA loan. You are highly advised to make an informed decision so that you will be satisfied with the results. Now you don’t have to ask “Why Is a Merchant Cash Advance Not a Loan?” and in order to know more details, simply contact Grant Phillips Law, PLLC.This team will give you the best ever attention you need to resolve all your debts. The consultations this team handles do not have a time limit. You will discuss all the pros and cons of each option and your free consultation will last as long as necessary.

0 notes

Text

Negotiating With Merchant Cash Advance Company

Businesses that have an immediate need for cash, look for a merchant cash advance loan as it is a short-term financing solution.Merchant cash advances can be costly as they come at high interest. Unfortunately, some business owners find themselves trapped in a merchant cash debt because of these high borrowing costs and the big impact on future cash flow. Just because future cash flow is used to pay off the debt, businesses face cash shortages and they start looking for more cash again. This results in taking a second MCA. This process repeats more than once or twice, until they can’t pay off the debt and thus, they are denied further cash advances. So people start wondering how to get out of this issue and finally get rid of merchant cash advance. That’s where Grant Phillips Law comes to help businesses!

If you are also in such a situation, you will certainly need an expert lawyer. By identifying and resolving your cash flow issues, the experts from Grant Phillips Law will certainly help you in the fastest possible time. Have much knowledge about Merchant Cash Advance Block Ach Debits so you can rest assured that you are in safe hands. The lawyer will first review your financial situation, discuss every aspect of your debt with you and explain you everything about Merchant Cash Advance Block Ach Debits. Having offices in New York, New Jersey and Florida, this company prides itself on representing clients across the USA for many years. Being a Full Service Debt Relief and Debt Settlement Law Firm, Grant Phillips Law will never leave you disappointed or alone in such a stressful situation. Never hesitate to contact this law firm and the experts will assist you to get out of debt legally. The lawyer from Grant Phillips Law is fully equipped to handle the whole process. This team can also represent Small Business Owners across the United States in getting their business out from debt. Just deal with these dedicated lawyers and enjoy the most compassionate service you deserve.

Having much experience in this field, the lawyers from Grant Phillips Law know How To Negotiate With Merchant Cash Advance Company. It is alsopossible to have a merchant cash advance repayment period extended so you will not face a lot of burden. As this team knows How To Negotiate With Merchant Cash Advance Company, you will be able to manage and pay off your debts without any hassle. If you are also interested in How To Stop Paying Merchant Cash Advance just schedule a consultation today and see what options are available. Never panic while figuring out how to get out of a merchant cash advance. The professionals are dedicated to solve your debt problems while keeping your business alive. So whenever you want to know How To Stop Paying Merchant Cash Advance but you are still confused, simply contact Grant Phillips Law and let the professionals help you! There are many solutions, so for more information just get back to this team!

0 notes

Text

How Merchant Cash Ruins Businesses and How Grant Phillips Law Can Help You

Does a Merchant Cash Advance (MCA) ruin your business cash flow? Are you searching for a method of refinancing an MCA? Are you being denied every time? Do you want to reduce your payments with one of the cash advance repayment options? Do you need help with a Merchant Cash Advance lawsuit or legal issues? If these questions are common to you and the answer to these questions is “Yes”, then you should look no further and get help from Grant Phillips Law, PLLC. Through effective negotiations, the professionals can restructure your advance to make it more affordable. Simply have a consultation with this team and let the experienced MCA lawyer from Grant Phillips Law review your specific situation and offer suitable services. If you are looking for workable solutions, simply trust this law firm and enjoy the free consultation. The lawyer assigned to your case is here to listen to your needs with respect and address all your concerns about your debts. The MCA attorney will review your current financial situation, including your income, real estate and other assets. Then the lawyer will analyze your budget to understand what you can afford yourself to pay.

A merchant cash advance is a fast solution and it allows a small business to get cash within 24 hours. When a small business decides to take out Merchant Cash Advance loan, they get a sum of cash which should be paid off via a percentage of their daily credit and debit card sales. You can also get Merchant Cash Advance Settlement Terms but it includes a fixed daily payment depending on an estimate of your monthly revenue. In general, merchant cash advance companies typically partner with credit card processors.

Grant Phillips Law, PLLC is here to help you in the most difficult time of your life. The experts will also help you with your MCA Loan Default. In fact, the consequences of defaulting on your merchant cash advance agreement can be severe. There are many small business lenders who almost always include a provision known as a Confession of Judgment in these agreements and may also require you to sign a personal guarantee. So what does this mean? It means that all your personal assets and property will be at high risk. That is why consulting MCA lawyer is the smartest decision. MCA Loan Default is a serious thing and if you are at risk of defaulting on a cash advance, simply get help from Grant Phillips Law, PLLC.

These professional attorneys work with businesses struggling under the weight of an MCA. The main aim of this team is to help your business avoid Merchant Cash Advance Default and restructure your merchant cash advance payments. Juts deal with this legal team and they will certainly help you protect your business and avoid Merchant Cash Advance Default. The experts represent small business owners from all over the country. Some of them are truckers, contractors, roofers, gym owners, retailers, manufacturers and more. Simply call them now and discuss your needs with them.

0 notes

Text

A Unique Legal Help for Merchant Cash Advance Payoff

Merchant Cash Advance Payoff is a long term solution to develop your business, but it can also a great solution when you are not able to keep up with the repayment schedule. Anytime you feel you might default and you are not finding a solution yourself, simply contact Grant Phillips Law, PLLC!Here you can get high-quality legal services and enjoy a personalized approach. If you have a merchant cash advance you are struggling to pay then you can be sure that Grant Phillips Law, PLLC will cover your demands. Don’t feel overwhelmed with your financial crisis because these experts are a reliable helping hand to keep your head above water. This team of lawyers is capable of providing excellent solutions and fight against aggressive debt collectors. Just contact them for Merchant Cash Advance Payoff and you will get your peace of mind back.

Grant Phillips Law, PLLC can help you Adjust Merchant Cash Advance and pay off your debts in a more manageable way. A MCA is also known as a business cash advance. It is a quick and easy source of cash that effectively uses your future card sales for the repayment. Your repayment terms are worked out according to a pre-agreed percentage of your monthly card transactions, and the total repayable amount is fixed. So you don’t need to hurry in order to pay it back as you only repay when you trade - so when business is slow, you’ll pay less, and vice versa. However, sometimes it is not so and many businesses cannot keep up paying the needed amount when their sales are slow. That is why they turn to an MCA lawyer to Adjust Merchant Cash Advance.

In general, a Merchant Cash Advance Loan may seem to be a reasonable or viable option. It helps businesses to operate better and more effectively. Unfortunately, many small business owners get into contractual agreements with more than one MCA lenders. As a result, the payments and interest become too high and it becomes really difficult and even impossible to handle them on their own. So if you are also in this same situation then lose no time and discuss your MCA loan with this team.

If you’ve taken an advance from a merchant cash advance lender and now you have faced a lot of issues, you need an experienced attorney who knows the industry inside out. Hiring a merchant cash advance attorney before your debt problems grow worse will surely help you avoid a potential future bankruptcy. So whenever you need legal assistance or relief, simply trust Grant Phillips Law and your attorney will help you take back control of your cash flow and your business! Grant Phillips Law, PLLC is proud of offering personalized solutions and a unique approach to each person. So what are you waiting for? Merchant cash advances are particularly helpful to businesses that need seasonal trade, such as those in the sectors of retail, hospitality and leisure industries. However, even if this is a good option, merchant cash advance can feel overwhelming as well. Choose Grant Phillips Law, PLLC and you will go through these difficult repayment processes without any stress.

0 notes