Don't wanna be here? Send us removal request.

Text

India’s Top Valued Quick Commerce Brands: Leaders in Instant Delivery

Most Valued Quick Commerce Brands in India: Who’s Leading the Game?

Quick commerce is rapidly becoming the new normal in India’s grocery shopping landscape. As the demand for ultra-fast delivery services grows, several players have emerged as key contenders in this space. In fact, 31% of urban Indians now use quick commerce for their primary grocery shopping, while 39% rely on it for top-ups. This trend has given rise to intense competition among quick commerce brands, with a few emerging as leaders. Let’s take a closer look at India’s top valued quick commerce brands and how they’ve positioned themselves in this booming market.

The Dominant Players in India’s Quick Commerce Market

When we talk about quick commerce in India, three names come up repeatedly: Blinkit, Swiggy Instamart, and Zepto. These brands have become synonymous with fast, reliable grocery deliveries, and each has carved out a unique position in this competitive market.

Blinkit: The Market Leader

Blinkit, backed by Zomato, with 39% market share, has taken a commanding lead in India’s quick commerce space. Originally known as Grofers, Blinkit rebranded itself and shifted focus to deliver groceries and essentials within minutes. The company’s massive infrastructure, efficient delivery systems, and strong funding from Zomato have given it a significant edge over competitors.

Blinkit’s ability to fulfill customer orders in under 10-15 minutes has become its biggest selling point. As convenience becomes more critical for urban shoppers, Blinkit continues to dominate by improving its delivery speeds and expanding its network of dark stores (localized warehouses for quick delivery). Today, Blinkit is synonymous with quick grocery shopping in major Indian cities.

Swiggy Instamart: Leveraging a Massive Customer Base

Swiggy Instamart, Swiggy’s grocery delivery arm, has emerged as a serious player in the quick commerce market. The main rival of zomato commands a whooping 37% of the market share. What sets Instamart apart is its ability to tap into Swiggy’s massive customer base, built over years of being one of the leading food delivery platforms in India. With its established network, Swiggy Instamart has been able to quickly scale operations, offering a wide variety of grocery items that can be delivered in under 30 minutes.

Instamart has focused heavily on improving distribution, leveraging Swiggy’s expertise in logistics to make rapid deliveries possible. As a result, it has become a preferred option for many urban customers looking for convenience and speed.

Zepto: The Fast-Moving Challenger

Despite entering the market later than its competitors, Zepto has quickly risen to the forefront, leaving behind more established players like Dunzo and BigBasket in the quick commerce space. Zepto with a market share of 20%, has built its reputation on delivering groceries in under 10 minutes, a feat that has resonated strongly with younger, urban customers. This focus on ultra-fast deliveries has allowed Zepto to capture significant market share, even in a crowded space.

One of Zepto’s strategies has been to focus on smaller basket sizes but higher frequency of orders, catering to customers who need quick top-ups rather than bulk grocery orders. This has helped the brand stay nimble and scale rapidly in key metropolitan areas.

Why These Brands Are Thriving

What makes these three brands stand out from the crowd? The answer lies in their ability to scale rapidly, streamline logistics, and meet the growing demand for ultra-fast deliveries. Each brand has its strengths: Blinkit’s market leadership and Zomato backing, Instamart’s access to Swiggy’s user base, and Zepto’s promise of lightning-fast deliveries.

The Indian quick commerce market is still in its early stages, but these brands have already established a strong foothold. Their ability to adapt to customer needs, invest in infrastructure, and innovate in delivery times will likely keep them at the top of the game for years to come.

The Future of Quick Commerce in India

As India’s top valued quick commerce brands continue to evolve, the market shows no signs of slowing down. With more urban Indians relying on quick commerce for both primary grocery shopping and top-ups, the demand for ultra-fast delivery services will only grow. The competition will get fiercer, but Blinkit, Swiggy Instamart, and Zepto have already demonstrated their ability to thrive in this environment.

In the future, we can expect even faster deliveries, broader product offerings, and more localized solutions as these brands look to solidify their positions and expand into new markets. Quick commerce is here to stay, and India’s urban consumers are more than ready for it.

0 notes

Text

India’s Top Valued Quick Commerce Brands: Leaders in Instant Delivery

Most Valued Quick Commerce Brands in India: Who’s Leading the Game?

Quick commerce is rapidly becoming the new normal in India’s grocery shopping landscape. As the demand for ultra-fast delivery services grows, several players have emerged as key contenders in this space. In fact, 31% of urban Indians now use quick commerce for their primary grocery shopping, while 39% rely on it for top-ups. This trend has given rise to intense competition among quick commerce brands, with a few emerging as leaders. Let’s take a closer look at India’s top valued quick commerce brands and how they’ve positioned themselves in this booming market.

The Dominant Players in India’s Quick Commerce Market

When we talk about quick commerce in India, three names come up repeatedly: Blinkit, Swiggy Instamart, and Zepto. These brands have become synonymous with fast, reliable grocery deliveries, and each has carved out a unique position in this competitive market.

Blinkit: The Market Leader

Blinkit, backed by Zomato, with 39% market share, has taken a commanding lead in India’s quick commerce space. Originally known as Grofers, Blinkit rebranded itself and shifted focus to deliver groceries and essentials within minutes. The company’s massive infrastructure, efficient delivery systems, and strong funding from Zomato have given it a significant edge over competitors.

Blinkit’s ability to fulfill customer orders in under 10-15 minutes has become its biggest selling point. As convenience becomes more critical for urban shoppers, Blinkit continues to dominate by improving its delivery speeds and expanding its network of dark stores (localized warehouses for quick delivery). Today, Blinkit is synonymous with quick grocery shopping in major Indian cities.

Swiggy Instamart: Leveraging a Massive Customer Base

Swiggy Instamart, Swiggy’s grocery delivery arm, has emerged as a serious player in the quick commerce market. The main rival of zomato commands a whooping 37% of the market share. What sets Instamart apart is its ability to tap into Swiggy’s massive customer base, built over years of being one of the leading food delivery platforms in India. With its established network, Swiggy Instamart has been able to quickly scale operations, offering a wide variety of grocery items that can be delivered in under 30 minutes.

Instamart has focused heavily on improving distribution, leveraging Swiggy’s expertise in logistics to make rapid deliveries possible. As a result, it has become a preferred option for many urban customers looking for convenience and speed.

Zepto: The Fast-Moving Challenger

Despite entering the market later than its competitors, Zepto has quickly risen to the forefront, leaving behind more established players like Dunzo and BigBasket in the quick commerce space. Zepto with a market share of 20%, has built its reputation on delivering groceries in under 10 minutes, a feat that has resonated strongly with younger, urban customers. This focus on ultra-fast deliveries has allowed Zepto to capture significant market share, even in a crowded space.

One of Zepto’s strategies has been to focus on smaller basket sizes but higher frequency of orders, catering to customers who need quick top-ups rather than bulk grocery orders. This has helped the brand stay nimble and scale rapidly in key metropolitan areas.

Why These Brands Are Thriving

What makes these three brands stand out from the crowd? The answer lies in their ability to scale rapidly, streamline logistics, and meet the growing demand for ultra-fast deliveries. Each brand has its strengths: Blinkit’s market leadership and Zomato backing, Instamart’s access to Swiggy’s user base, and Zepto’s promise of lightning-fast deliveries.

The Indian quick commerce market is still in its early stages, but these brands have already established a strong foothold. Their ability to adapt to customer needs, invest in infrastructure, and innovate in delivery times will likely keep them at the top of the game for years to come.

The Future of Quick Commerce in India

As India’s top valued quick commerce brands continue to evolve, the market shows no signs of slowing down. With more urban Indians relying on quick commerce for both primary grocery shopping and top-ups, the demand for ultra-fast delivery services will only grow. The competition will get fiercer, but Blinkit, Swiggy Instamart, and Zepto have already demonstrated their ability to thrive in this environment.

In the future, we can expect even faster deliveries, broader product offerings, and more localized solutions as these brands look to solidify their positions and expand into new markets. Quick commerce is here to stay, and India’s urban consumers are more than ready for it.

0 notes

Text

Key Performance Indicators for SEO Success: What You Need to Track

In the world of digital marketing, knowing how well your SEO efforts are performing is crucial. But how do you measure success? The answer lies in Key Performance Indicators (KPIs). These metrics help you understand what’s working, what isn’t, and where to make improvements. In this article, we’ll break down the top KPIs for SEO success, so you can focus on the metrics that matter most and elevate your strategy to new heights.

0 notes

Text

With the digital age in full swing, YouTube has cemented itself as a global hub for entertainment, education, and everything in between. Whether it’s music videos, DIY tutorials, or gaming streams, billions of people flock to the platform every month. But which countries boast the most YouTube users? Let’s explore the nations leading the charge in content consumption.

0 notes

Text

Top Countries with the Most YouTube Users : A Global Overview

Countries with the Highest YouTube Users

With the digital age in full swing, YouTube has cemented itself as a global hub for entertainment, education, and everything in between. Whether it’s music videos, DIY tutorials, or gaming streams, billions of people flock to the platform every month. But which countries boast the most YouTube users? Let’s explore the nations leading the charge in content consumption.

0 notes

Text

Top KPIs for SEO Success: Metrics That Matter for Higher Rankings

Key Performance Indicators for SEO Success: What You Need to Track

In the world of digital marketing, knowing how well your SEO efforts are performing is crucial. But how do you measure success? The answer lies in Key Performance Indicators (KPIs). These metrics help you understand what’s working, what isn’t, and where to make improvements. In this article, we’ll break down the top KPIs for SEO success, so you can focus on the metrics that matter most and elevate your strategy to new heights.

0 notes

Text

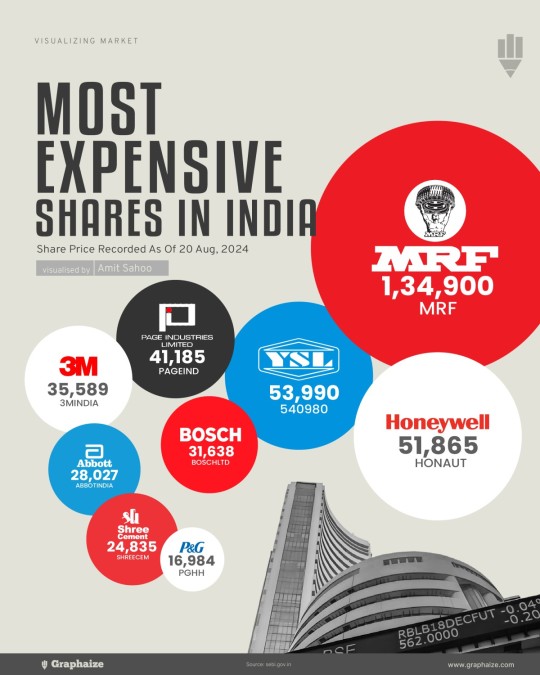

Most Expensive Shares in India 2024: Insights

Investing in high-value shares can be a profitable but often daunting venture, especially in a market like India, where stock prices can soar to unimaginable levels. If you’re curious about the most expensive shares in India for 2024, you’re in the right place! Let’s explore some of the priciest shares in India and understand what makes them so valuable.

When we talk about high-priced stocks, it’s not just about the number of shares you hold, but the quality and profitability of each one. Shares with high prices often reflect a company’s solid market position, strong brand reputation, and consistent performance. Although these shares can’t usually be purchased in bulk, their potential for profit often outweighs their hefty price tags.

0 notes

Text

Entering the Elite: Wealth required for top 1% by country

In a world where the wealth gap continues to widen, many people wonder: how much Wealth required for top 1% by country? Wealth requirements differ drastically across the globe, often depending on factors like population size, cost of living, and economic policies. This article based on Knight Frank Wealth Report 2021 dives into the specific numbers that separate the financial elite from the rest and explores what it takes to be a part of the top 1% in different nations.

Being part of the top 1% isn’t the same everywhere. In some countries, the bar is set extraordinarily high, while others are more accessible to reach, reflecting vast economic differences and sometimes large wealth disparities within their populations. Let’s break down what you’d need to join the elite ranks around the world.

#data visualisation#content marketing#social media#technology#visual analytics#digital infographics#business#ecommerce

0 notes

Text

2024’s Most Popular CMS Platforms by Market Share

In 2024, content management systems (CMS) are still the backbone of modern website creation, with each CMS platform offering unique tools and features to meet a wide range of needs. If you’re in the market for a CMS, understanding which platforms lead by market share can help you make an informed choice. This year’s top contenders highlight industry trends, from WordPress’s enduring dominance to Shopify’s remarkable growth in the e-commerce space.

0 notes

Text

2024’s Most Popular CMS Platforms by Market Share

In 2024, content management systems (CMS) are still the backbone of modern website creation, with each CMS platform offering unique tools and features to meet a wide range of needs. If you’re in the market for a CMS, understanding which platforms lead by market share can help you make an informed choice. This year’s top contenders highlight industry trends, from WordPress’s enduring dominance to Shopify’s remarkable growth in the e-commerce space.

WordPress: The Undisputed Leader

WordPress continues to reign as the world’s most popular CMS, boasting an impressive 63.5% market share in 2024. Known for its flexibility, WordPress is a powerful tool for everything from blogging to complex websites. The platform’s growth rate of 1.23% shows that it’s still expanding, albeit slower than some of the newer platforms. With an extensive library of plugins, themes, and a highly active community, WordPress remains the go-to choice for millions.

For users who need versatility and customization, WordPress is unmatched. It’s an open-source platform, meaning anyone can contribute, so the ecosystem continually grows and improves. Whether you’re a beginner building a blog or a developer working on a complex e-commerce site, WordPress’s flexibility makes it the top choice in 2024.

Shopify: Dominating the E-Commerce Sector

When it comes to e-commerce, Shopify is a force to be reckoned with. Ranking second in popularity among CMS platforms, Shopify holds a 5.5% market share and impressively boasts the highest growth rate at 17.43%. The platform’s appeal lies in its ease of use, scalability, and robust e-commerce tools. Shopify enables business owners to set up online stores quickly, with a range of templates and integrated payment options that make it simple to launch and scale.

Shopify is especially popular among small and medium-sized businesses looking to expand their online sales without worrying about the technical side of website management. The platform offers various integrations with social media and sales channels, further enhancing its appeal for e-commerce. If you’re looking to start an online store, Shopify’s user-friendly interface and feature-rich environment make it a top choice in 2024.

Wix: A Beginner-Friendly Option

Coming in third, Wix is designed for those who want to create websites without coding or design experience. Holding a 3.7% market shar with a solid 11.66% growth rate Wix appeals to beginners who need a quick, intuitive way to launch a website. The platform offers drag-and-drop functionality, which is perfect for non-technical users wanting a simple, visually appealing website.

Wix provides an array of pre-built templates, customizable designs, and a host of apps to enhance functionality, making it a flexible choice for small businesses, personal portfolios, and blogs. Its growth rate shows that Wix is becoming increasingly popular, especially with users who want a hands-off approach to web design and maintenance.

Squarespace: Elegant Designs

Squarespace ranks fourth with a 3.0% market share and a growth rate of 10.43%, reflecting its steady appeal, particularly among designers and small businesses. Known for its sleek, professional-looking templates, Squarespace is often the preferred platform for creatives looking to showcase portfolios or build attractive business sites.

With an easy-to-use interface and built-in tools for SEO, analytics, and e-commerce, Squarespace appeals to users who prioritise aesthetics and professionalism in their websites. The platform’s growth reflects a consistent demand among users who want beautiful websites without a complicated setup process.

Joomla and Drupal: Once Popular, Now Declining

While platforms like WordPress and Shopify are growing, Joomla and Drupal have seen a decline in their market share. These community-driven, open-source platforms once held a collective 17% market share but now represent less than 5%. A decade ago, Joomla and Drupal were considered powerhouses due to their customizable features and flexibility. However, with the rise of more user-friendly platforms, their appeal has waned.

The strength of Joomla and Drupal has always relied on their communities. However, as fewer users and developers support these platforms, resources and innovations have dwindled. Without a solid stream of new updates and community contributions, both Joomla and Drupal struggle to compete in the modern CMS landscape.

Conclusion

Each platform has carved out its niche in 2024, catering to different types of users. While WordPress dominates the overall market, Shopify’s rise highlights the growing demand for e-commerce solutions. Platforms like Wix and Squarespace continue to attract users looking for ease of use and aesthetic appeal.

Whether you’re building a personal blog or an online store, these top CMS platforms of 2024 offer a variety of options tailored to your needs. Choosing the right one can set the foundation for a successful online presence in today’s digital world.

0 notes

Text

Most Expensive Shares in India 2024: Insights

Investing in high-value shares can be a profitable but often daunting venture, especially in a market like India, where stock prices can soar to unimaginable levels. If you’re curious about the most expensive shares in India for 2024, you’re in the right place! Let’s explore some of the priciest shares in India and understand what makes them so valuable.

When we talk about high-priced stocks, it’s not just about the number of shares you hold, but the quality and profitability of each one. Shares with high prices often reflect a company’s solid market position, strong brand reputation, and consistent performance. Although these shares can’t usually be purchased in bulk, their potential for profit often outweighs their hefty price tags.

For those looking to diversify their portfolio with quality over quantity, these expensive shares are worth a closer look. Let’s dive into the top high-value shares in India and what makes them stand out.

Top High-Value Shares in India for 2024

MRF Ltd (Madras Rubber Factory)

MRF Ltd, known as India’s largest tyre manufacturer, holds the title for the most expensive shares in India. With a stock price of Rs. 1,34,900, MRF dominates the market, thanks to its robust market share, brand reputation, and commitment to quality.

The company doesn’t just produce tyres; it also specializes in treads, tubes, and conveyor belts and has expanded into motorsports and rubber manufacturing. MRF’s high share price is driven by its leadership in the tyre industry, consistent financial performance, and a limited number of outstanding shares, which maintains high demand among investors.

Honeywell Automation India Ltd

Honeywell Automation India Ltd, a subsidiary of Honeywell International Inc., provides automation and control solutions across various sectors like industrial, building, and home automation. With a share price of Rs. 51,865, Honeywell Automation stands out for its advanced technological solutions and steady growth in the automation industry.

The company’s high market value is a result of its association with the globally recognized Honeywell brand and its consistent growth, which attracts both domestic and international investors.

Yamuna Syndicate Ltd

Engaged in commodities trading, Yamuna Syndicate Ltd deals in petroleum, lubricants, and industrial gases. The company also distributes automotive products, batteries, and other industrial commodities. With a share price of Rs. 53,990, Yamuna Syndicate Ltd enjoys high investor interest due to its strong performance in the commodities market and the scarcity of its shares.

The high demand and limited availability of Yamuna Syndicate shares contribute significantly to its soaring stock price, making it one of the most valuable investments in India’s market.

Page Industries Ltd

Page Industries Ltd, the exclusive licensee of Jockey and Speedo brands in India, manufactures, distributes, and markets innerwear, leisurewear, and sportswear under the Jockey label. Page Industries’ shares are priced at Rs. 41,185, supported by a loyal customer base, premium product offerings, and steady demand in the apparel sector.

Page Industries has created a niche in the Indian apparel market, making it one of the most expensive shares and a valuable asset for investors seeking steady returns from a reliable brand.

The most expensive shares in India represent some of the most successful and stable companies in the market today. From MRF’s tyre empire to Page Industries’ popular Jockey brand, these stocks reflect the best of India’s corporate sector. While their high prices may seem intimidating, their potential for steady returns makes them attractive to many investors.

0 notes

Text

Most Expensive Shares in India 2024: Insights

Investing in high-value shares can be a profitable but often daunting venture, especially in a market like India, where stock prices can soar to unimaginable levels. If you’re curious about the most expensive shares in India for 2024, you’re in the right place! Let’s explore some of the priciest shares in India and understand what makes them so valuable.

When we talk about high-priced stocks, it’s not just about the number of shares you hold, but the quality and profitability of each one. Shares with high prices often reflect a company’s solid market position, strong brand reputation, and consistent performance. Although these shares can’t usually be purchased in bulk, their potential for profit often outweighs their hefty price tags.

For those looking to diversify their portfolio with quality over quantity, these expensive shares are worth a closer look. Let’s dive into the top high-value shares in India and what makes them stand out.

Top High-Value Shares in India for 2024

MRF Ltd (Madras Rubber Factory)

MRF Ltd, known as India’s largest tyre manufacturer, holds the title for the most expensive shares in India. With a stock price of Rs. 1,34,900, MRF dominates the market, thanks to its robust market share, brand reputation, and commitment to quality.

The company doesn’t just produce tyres; it also specializes in treads, tubes, and conveyor belts and has expanded into motorsports and rubber manufacturing. MRF’s high share price is driven by its leadership in the tyre industry, consistent financial performance, and a limited number of outstanding shares, which maintains high demand among investors.

Honeywell Automation India Ltd

Honeywell Automation India Ltd, a subsidiary of Honeywell International Inc., provides automation and control solutions across various sectors like industrial, building, and home automation. With a share price of Rs. 51,865, Honeywell Automation stands out for its advanced technological solutions and steady growth in the automation industry.

The company’s high market value is a result of its association with the globally recognized Honeywell brand and its consistent growth, which attracts both domestic and international investors.

Yamuna Syndicate Ltd

Engaged in commodities trading, Yamuna Syndicate Ltd deals in petroleum, lubricants, and industrial gases. The company also distributes automotive products, batteries, and other industrial commodities. With a share price of Rs. 53,990, Yamuna Syndicate Ltd enjoys high investor interest due to its strong performance in the commodities market and the scarcity of its shares.

The high demand and limited availability of Yamuna Syndicate shares contribute significantly to its soaring stock price, making it one of the most valuable investments in India’s market.

Page Industries Ltd

Page Industries Ltd, the exclusive licensee of Jockey and Speedo brands in India, manufactures, distributes, and markets innerwear, leisurewear, and sportswear under the Jockey label. Page Industries’ shares are priced at Rs. 41,185, supported by a loyal customer base, premium product offerings, and steady demand in the apparel sector.

Page Industries has created a niche in the Indian apparel market, making it one of the most expensive shares and a valuable asset for investors seeking steady returns from a reliable brand.

The most expensive shares in India represent some of the most successful and stable companies in the market today. From MRF’s tyre empire to Page Industries’ popular Jockey brand, these stocks reflect the best of India’s corporate sector. While their high prices may seem intimidating, their potential for steady returns makes them attractive to many investors.

0 notes

Text

Most Expensive Shares in India 2024: Insights

Investing in high-value shares can be a profitable but often daunting venture, especially in a market like India, where stock prices can soar to unimaginable levels. If you’re curious about the most expensive shares in India for 2024, you’re in the right place! Let’s explore some of the priciest shares in India and understand what makes them so valuable.

When we talk about high-priced stocks, it’s not just about the number of shares you hold, but the quality and profitability of each one. Shares with high prices often reflect a company’s solid market position, strong brand reputation, and consistent performance. Although these shares can’t usually be purchased in bulk, their potential for profit often outweighs their hefty price tags.

0 notes

Text

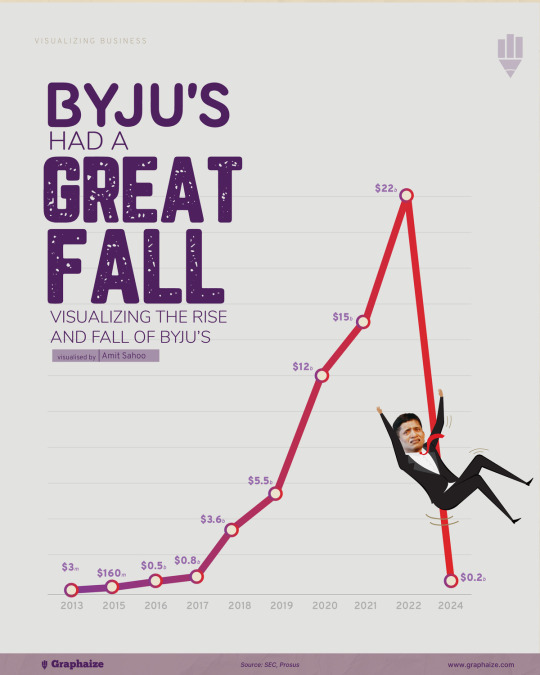

Visualising the Rise and Fall of Byju’s

Byju’s journey, from being one of India’s most valued startups to its dramatic decline, offers a compelling study of rapid growth met with significant challenges. As one of the pioneers of EdTech in India, Byju’s once held a valuation of over $22 billion in 2022. However, due to a series of setbacks including alleged accounting irregularities and mismanagement issues, the company’s valuation has now plummeted by a striking 95%, with the latest valuation estimated at just $0.2 billion after notable investors like BlackRock reduced their stakes.

0 notes

Text

Byju’s journey, from being one of India’s most valued startups to its dramatic decline, offers a compelling study of rapid growth met with significant challenges. As one of the pioneers of EdTech in India, Byju’s once held a valuation of over $22 billion in 2022. However, due to a series of setbacks including alleged accounting irregularities and mismanagement issues, the company’s valuation has now plummeted by a striking 95%, with the latest valuation estimated at just $0.2 billion after notable investors like BlackRock reduced their stakes.

0 notes

Text

In a world where the wealth gap continues to widen, many people wonder: how much Wealth required for top 1% by country? Wealth requirements differ drastically across the globe, often depending on factors like population size, cost of living, and economic policies. This article based on Knight Frank Wealth Report 2021 dives into the specific numbers that separate the financial elite from the rest and explores what it takes to be a part of the top 1% in different nations.

Being part of the top 1% isn’t the same everywhere. In some countries, the bar is set extraordinarily high, while others are more accessible to reach, reflecting vast economic differences and sometimes large wealth disparities within their populations. Let’s break down what you’d need to join the elite ranks around the world.

#infographic#social media#data marketing#content marketing#data visualisation#visual analytics#technology

0 notes

Text

AI Patent Trends Infographics from 2014 to 2023

This AI Patent Trends Infographics shows that the world of artificial intelligence (AI) is advancing at a breakneck pace, with Generative AI (GenAI) leading the charge. Between 2014 and 2023, we’ve witnessed a massive surge in AI patents, especially in the field of GenAI, which has emerged as one of the most transformative technologies of the modern age. From industries like life sciences and manufacturing to telecommunications and transportation, GenAI is spreading its influence far and wide. So, which countries are pioneering this technological revolution? Let’s dive into the numbers and see who’s driving innovation in AI in this infographics on AI patents by country.

China’s Dominance in GenAI Patents It’s no surprise that China is leading the race when it comes to GenAI inventions. Between 2014 and 2023, more than 38,000 GenAI inventions came from China alone. To put that in perspective, this figure is six times more than that of the second-place country, the United States. China’s dominance can be attributed to its aggressive investment in AI research and development, along with supportive government policies that encourage innovation.

What makes this even more impressive is how China has managed to expand its AI footprint across multiple industries. From life sciences to telecommunications, China is laying the groundwork for the future of AI-driven technologies, giving it a competitive edge on the global stage.

The United States: The Runner-Up While China may have surged ahead, the United States is still a strong contender in the AI patent race. Known for its robust tech industry and home to many of the world’s top AI companies, the US continues to push the boundaries of GenAI. Though the number of patents is lower compared to China, American companies have been instrumental in the development of foundational technologies, especially around neural networks and machine learning algorithms. Many of the most transformative AI advancements still come from Silicon Valley and top American research institutions.

India: Fastest Growing Player One of the most intriguing stories in AI patent growth comes from India, which has emerged as the fifth-largest hub for GenAI inventions. But what really sets India apart is its remarkable average annual growth rate of 56%—the highest among the top five global leaders in AI innovation. This rapid growth can be attributed to the country’s growing tech talent pool and its increasing focus on AI development, spurred by both private investments and government-backed AI initiatives.

India’s rise in the GenAI field is also significant because it signals a shift in the global AI landscape. With its fast-growing economy and vast resources, India could potentially become a future leader in AI, competing with the likes of China and the US in the coming years.

A Rapid Expansion Across Multiple Sectors What’s interesting is how quickly GenAI is spreading across various industries.

For example, 5,346 GenAI inventions have been registered in the life sciences sector, which highlights the role AI is playing in everything from drug discovery to genetic research. The document management and publishing industry has seen a similar boom, with 4,976 inventions registered in this domain. The fact that GenAI is impacting such a wide range of sectors showcases its versatility and its potential to revolutionize how businesses operate across the board.

GenAI Patents: A Small but Growing Slice of the AI Pie Despite the explosive growth, it’s worth noting that GenAI patents still only make up about 6% of all AI patents globally. This means that while GenAI is becoming increasingly important, the broader AI field continues to encompass a vast array of technologies beyond just generative models. However, given the rapid rise in GenAI patents (an eightfold increase since 2017), this percentage is likely to grow significantly in the coming years.

The 2017 introduction of the deep neural network architecture behind Large Language Models (LLMs), which are now synonymous with GenAI, was a turning point. Since then, the number of patents related to these models has skyrocketed. And as companies race to develop their own versions of these groundbreaking technologies, we can expect to see even more growth in this area.

What Does the Future Hold for GenAI? The world of GenAI is only just beginning to take shape, and the next decade promises even more dramatic advancements. With countries like China, the US, and India leading the way, we are poised to see breakthroughs in industries we can’t yet fully imagine. Whether it’s in autonomous vehicles, personalized medicine, or even advanced telecommunications, the possibilities are endless.

But with rapid growth comes challenges, especially around ethics and regulation. As GenAI becomes more integrated into everyday life, global leaders will need to work together to create frameworks that ensure responsible AI development. This is especially important in sensitive areas like data privacy, security, and employment, where AI could have far-reaching effects.

0 notes