Text

That little money I put in for SHIBA INU a month or two ago is making me so happy I invested. Gonna go past that next 0 realll soon.🤑🤑🤑

18 notes

·

View notes

Photo

Get your wallets ready because I have a great deal to offer!

45 notes

·

View notes

Photo

Thinking of buying a home?

Here are seven basic steps to take you from thinking the owning! 😁

Are you or someone you know looking for your next home mortgage, refinance or investment property?

I can help!

Contact me with your Real Estate #mortgage and #investing questions and needs. :-) https://www.instagram.com/p/CUDBlLPlROm/?utm_medium=tumblr

957 notes

·

View notes

Photo

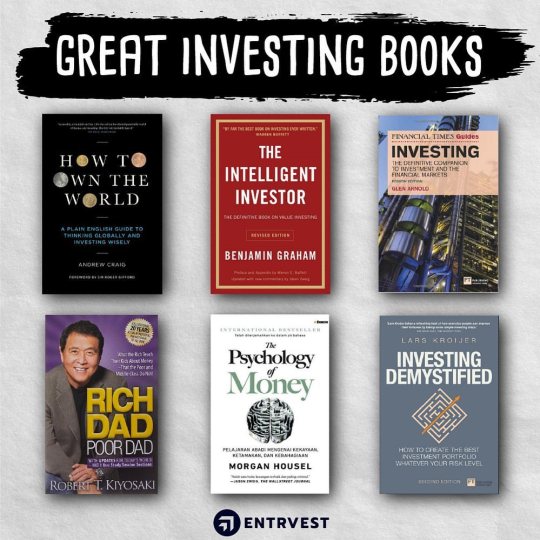

Gaining the right knowledge is one of the most important parts of becoming a successful investor. The following books will provide a great foundation for your investing journey:

1. How to Own the World by Andrew Craig

2. The Intelligent Investor by Benjamin Graham

3. Investing - The Definitive Companion to Investment and the Financial Markets by Glen Arnold

4. Rich Dad Poor Dad by Robert T. Kiyosaki

5. The Psychology of Money by Morgan Housel

6. Investing Demystified by Lars Kroijer

Which investment book has helped you the most, let us know in the comments below.

#investing #investingbooks #money #trading #moneytips #wealth #rich #viral #entrvest #richdadpoordadbook #theintelligentinvestor #finance #financetips https://www.instagram.com/p/CSuvMkSCXe6/?utm_medium=tumblr

830 notes

·

View notes

Note

How did you get started with investing? I've seen you talk about it before and I know that's something I need to do, but I feel so lost in terms of which companies to invest in and how much money I should put in. I have retirement accounts but nothing outside of that. And really, I feel like I can't talk to anyone IRL about this because I'm too embarrassed - I'm literally a CPA and do corporate taxes for a living but still find investing to be so intimidating 😞.

I mean, when people say "you should be investing" often, until you reach a certain wealth level, they are actually referring to your 401K. This is more general advice for the readers, but don't feel bad if you're not investing outside of retirement, especially if you're early in your career or if you're in a job where you don't have much disposable income. Don't feel bad in general, honestly, even if you haven't got a retirement fund at all; life is hard and money is necessary but stupid.

I only really started to invest invest in the last two years and even then I'm pretty conservative about it. On the plus, as a CPA, you will probably have a leg up in terms of knowing a lot of financial terms and kind of...understanding how money works in at least some sense.

I actually got started studying investing with my retirement fund. I was young and broke and mad that a chunk of my paycheck was going into my 401K when I could use that money NOW (see Sam Vimes Boots Theory for more on why ready cash now can often beat more cash later). I didn't know much about finance but I knew that a) I was basically being forced to play the financial markets with that money and b) the fate of our country's economy is tied to the stock market which is a mood ring hooked up to a roulette wheel. Being the Oldest Living Millennial I also understood I might not actually ever get to retire, so I decided to treat my retirement fund like Monopoly money: real but meaningless. And so I thought, well, let's Learn About Investing with it.

When you invest with a 401K or IRA usually you're not buying straight stocks; you're buying some conglomeration of investments bundled together as a fund (this is not a technical term, fund has a specific meaning in the technical sense, but it's easier to just use fund as a shorthand so I'm gonna). These can include stocks, bonds, mutual funds, and other more esoteric vehicles. So I started looking into the funds available to me -- there's the "retire in this year" fund that most people just dump all their money into, but there were also ways to invest in small businesses abroad, in health care or in funds that are "socially responsible", ways to buy into funds that did nothing but attempt to keep up with inflation, and on and on.

I didn't know any of that, of course -- I just saw something like "International Explorer Fund" and decided it sounded interesting and I'd learn what it was and what it did, and when I was satisfied that the reward was worth the risk, I'd dump some cash from my 2045-Retirement investment into it. While "past performance is no indication of future success" past performance isn't a bad way to at least pick something to research, and usually there's an earnings graph on the fund's prospectus page. I'd start reading prospectuses and looking up every word I didn't know or felt had a specific context I was missing (mostly on Investopedia, a GREAT resource). I'd take the term, add it to a vocabulary list, and rewrite "what is this and what does it do" in my own words. Eventually I internalized a lot of the terminology but I still check my notes once in a while.

There are financial literacy courses you can take, of course, and I don't think you should be AT ALL ashamed about trying to find a good one (lots of scams out there) or asking colleagues about them. "Hey, I'm not comfortable with my level of literacy about investment vehicles; do you know of any good educational material or class that would fill in the gaps?" is a good way to go about it. Very few people know jack shit about investing and my level of knowledge is just BARELY above jack shit, to be honest, so no shame, my friend. It is also totally fine to find a financial planner or investment advisor outside of your work and have a sit-down with them to get advice, which is what my parents do. Many banks offer that kind of service, so check with wherever you do your banking, and almost any retirement fund administrator (like Vanguard or American Funds) will be happy to send someone to meet with you and advise you. I was never prouder of my financial self-education than the one time I met with a guy from Vanguard who said, "Basically, keep doing what you're doing, this is a model portfolio."

Once I was investing in my retirement funds more confidently, I got the RobinHood app and started studying stocks, which is really just like, "find a stock and do a book report on it". Look at past earnings, who the CEO of the company is, what their board makeup is like, what they're doing in the news. And of course the most important advice: Never, ever invest money in the stock market that you aren't prepared to lose.

Aside from my stock adventures on RobinHood, which is about five hundred dollars that I turned into a thousand dollars over a couple of years, I have money in a few savings accounts. I don't have CDs or money market accounts or any of that, because I still don't have quite enough cash to make it worth it. I just parked some in a credit union that pays 6% interest on the first $1K you put in, and the rest in Betterment, which had a 2% interest rate when I started but now is down to .3% which is a bummer. But I haven't found another vehicle like Betterment which allows you equally easy access to your money while having as intuitive and modular an online interface.

So overall, aside from retirement (which is at $116K, which seems impressive until you remember you're supposed to retire with 25x your yearly salary in your 401K) I have a grand in the stock market, a grand in a 6%-interest savings account with a credit union, a grand in an emergency-only savings account attached to my checking, and roughly five grand with Betterment. It's a fairly conservative setup but I'd like never to be poor ever again, so I'm hedging carefully :D

Some great resources that I've used include:

Investopedia

Planet Money podcast by NPR and its sister podcast, The Indicator

The Financial page of the newspaper (I used to read NYT, now I read Tribune)

Rankandfiled.com, a free stock filings resource site that basically scrapes the SEC for financial data -- this is for if you really want to do a deep dive once you've got more experience

Good luck! It's a slog at first, but eventually it gets kinda fun :)

2K notes

·

View notes

Text

331 notes

·

View notes

Text

personal finance 2021 (adulting 101)

How would I budget or keep on track with my finances as a working student and helping to my family's expenses yet feel fulfilled?

First things first,

I should "reward myself first". So, what are the example of that?

For example:

- the book that I am eyeing for a long time

- travel that I am planning in a budget-friendly way

- stuff and things such as clothes, shoes, supplies, and others

- services that I want to experience such as diode laser, massage, hair improvements.

- household stuff

It should be noted that these are some examples but not limited to them. It also depends on your wants and needs as an individual. Note that rewarding yourself doesn't have to be that costly. If it requires so much money you can change it by what you can afford for now. As for me, those traveling and clothes are not that my priorities so I will modify my "reward myself" program to my school supplies stuff, then next month if my income can afford a diode laser I will purchase it. Rewarding myself might be around 10 % only of my income.

Secondly,

Savings.

Our savings is very dependent on our situation.

It also depends on our monthly expenses because if you're helping your family and independently providing yourself it's surely hard to save and budget it. In my situation right now, I will try to at least save 30 % of my income for this season of my life. Due to my ongoing schooling, I think it will be hard for me to save because I am also paying my tuition fee and other expenses for my university. So, the goal is to find a scholarship (praying for it!!). Save slowly but surely.

Right now, I will set my savings in two categories such as general savings and emergency funds.

Thirdly,

Expenses. Under expenses, there are also sub-categories for it.

Debt - Paying debts. If it cannot be paid in full, make sure to pay little by little ( snowball method). It shouldn't be disregarded as an expense because the money we borrowed is also important to them. Paying for our debts projects us a credible person and builds integrity when a person sees that you're sincere to pay for that debts. Also, for us to have peace of mind. As much as possible if we can be free from bad debts, do it!

Fixed monthly expenses - these are the house rent, internet, gas, insurances, tuition fee, and any expenses that have a fixed amount to pay monthly.

Variable monthly expenses - such as electricity, water, dental, groceries, personal care items and others that amount varies but need for monthly expenses and not wants.

Other expenses - such as tithes or donations, tips, entertainment, eating out, fare, body and hair care/services, other hobbies, clothes, and any other that are included in our wants.

In my situation, I will add School Expenses such as books, uniforms, fees that the school requires, organization membership fees, and many others expenses that involve my education.

With this, I will set my expenses to 60 % of my income.

Self - programming

Be reminded also to become a realistic, discipline, and have objective views in spending our finances.

Be realistic because, in my experience, I set my savings to 40 - 50% of my income wherein it's very hard to impose because at that time I am the one who paid for all of our family expenses (when COVID-19 strikes). With that, it makes me frustrated because from time to time, I withdraw some money from my savings because I need to pay for certain expenses.

Be disciplined as much as possible because it will be our only accountability to achieve our goals in the aspect of finances.

Have objective views because sometimes with the influence of our emotions we tend to be confused that our wants are considered needs. It's okay to purchase our wants but be also reminded of our responsibilities, priorities, and goals. When we are in the situation of being tempted to add to cart on our online shopping, just let those things be on the cart for 7 days and go back with it. If you feel the same way as you add to cart it then buy it if you still have a budget for it.

Disclaimer:

This is based on my situation and my personal experience. Please be also guided that budgeting our finances are greatly dependent on our situation and priorities. We should do what works for us. Also, in the future, this kind of handling of my finances may vary depends on my situation in the future. That's why most of my statement includes "for now" or "right now".

Lord, guide me to properly and wisely budget my finances. Remind me to glorify you with the blessings I received and will receive from you. I pray for a full mastery of handling my finances and my emotions towards my spending habits. I know you are the best provider and please make me reminded of that. I trust that you will provide and you already know what we need. I believe that if it's Your will, it's Your bill. Amen.

93 notes

·

View notes

Text

Difference between "Doing what you love" and "Make money"

We all remember Steve Job famous speech "Do what you love". Although It's a great career advice, It may not be the best financial advice.

You see Steve Jobs was selling personall computer at that time. "Selling" is the word. If you have to make a living you would have to learn how to sell yourself better. Those are really normal skills like communication skills, networking skills, building relationships over time and how to Ask for help. But a lot of people lack them.

There is also, a video of Steve Jobs where he says that " Most people who are kind will love to help. And you can ask them about the things they are doing and how they are doing it."

Try to be authentic in the things you do. Put that little creative effort and make things interesting. It's about making something which the market can value.

You are going to die doing what you love that's for sure. But if you don't really learn how to sell it, you would have a hard time being financially independent.

If you read this long, Thank you!

Some of the best financial advices are :-

1. If it make you happy, buy it. Happiness over money

2. It is always good to save and invest for long term gain.

3. You Don't really need a house. Houses were invented by banks, so that people can buy home loan.

4. Always sell your work over time.

5. Try to write book, make video, or teachs other what you have learnt.

6. Invest on the skills, tools that you need to earn more money.

34 notes

·

View notes

Photo

Habits of millionaires. #money #MondayMotivation #wealth #rich #invest #power #beautiful #life #lifestyle #dailyhabits https://www.instagram.com/p/CLlH5T7n2_K/?igshid=11dvvohx9pu1u

27 notes

·

View notes