Don't wanna be here? Send us removal request.

Text

Navigating the Process of Purchase Invoice Discounting in Delhi

Understanding the procedural aspects of purchase invoice discounting is crucial for businesses intending to utilize this financial tool effectively. The process typically begins with a company submitting its purchase invoices to a financier or a specialized platform offering discounting services.

Upon verification of the invoices and assessment of the buyer's creditworthiness, the financier advances a significant portion of the invoice value to the company. The remaining amount, minus applicable fees and interest, is disbursed once the buyer settles the invoice.

In Delhi, several fintech platforms and financial institutions facilitate purchase invoice discounting, offering user-friendly digital interfaces and swift processing times. Businesses should conduct thorough due diligence to select a service provider that aligns with their operational needs and financial goals.

0 notes

Text

How Purchase Invoice Discounting Enhances Business Efficiency in Delhi

Efficiency in financial operations is a critical determinant of business success, especially in a competitive market like Delhi. Purchase invoice discounting emerges as a strategic solution to streamline cash flow management and operational efficiency.

By converting purchase invoices into immediate cash, businesses can ensure uninterrupted operations, timely procurement of raw materials, and adherence to production schedules. This financial flexibility allows companies to respond swiftly to market demands and customer needs, thereby gaining a competitive edge.

Moreover, purchase invoice discounting reduces the dependency on traditional credit lines, which often involve lengthy approval processes and stringent collateral requirements. The agility offered by this financing method aligns well with the dynamic nature of Delhi's business environment, where quick decision-making and adaptability are essential.

0 notes

Text

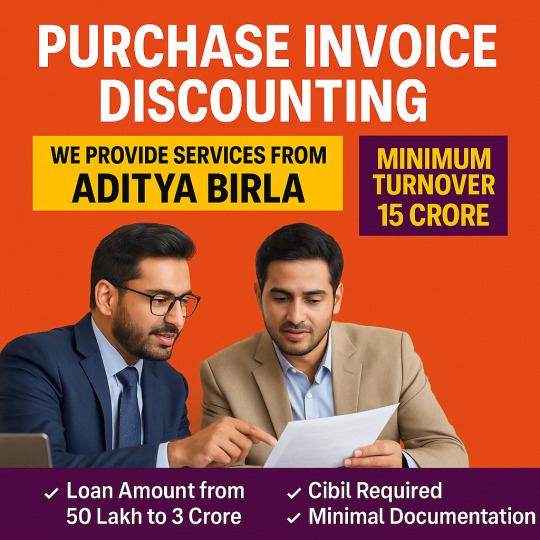

Unlocking Working Capital: An Introduction to Purchase Invoice Discounting in Delhi

In the bustling business landscape of Delhi, maintaining a healthy cash flow is paramount for enterprises of all sizes. One financial tool gaining traction among businesses is purchase invoice discounting. This mechanism allows companies to convert their outstanding purchase invoices into immediate working capital, thereby bridging the gap between payment obligations and cash availability.

Purchase invoice discounting involves a third-party financier advancing funds against the invoices a company has issued to its buyers. This arrangement enables businesses to meet their supplier payments promptly without waiting for the buyers to settle their dues. The process not only ensures timely payments to suppliers but also strengthens the supply chain by fostering trust and reliability.

Delhi's diverse economy, encompassing sectors like manufacturing, retail, and services, presents ample opportunities for businesses to leverage purchase invoice discounting. By adopting this financial strategy, companies can enhance their liquidity, negotiate better terms with suppliers, and seize growth opportunities without the constraints of delayed receivables.

0 notes