I'm Jaskeeran Kour, a Digital marketing enthusiast leveraging cutting-edge strategies to drive brand growth and maximize online presence. Passionate about delivering impactful campaigns and generating measurable results for businesses in the ever-evolving digital landscape.

Don't wanna be here? Send us removal request.

Text

6 Strategies For Paying Down Credit Card Debt Faster

Learn 6 quick and easy ways to pay off your credit card debt faster. These simple one-liner tips can help you save money and become debt-free sooner.

0 notes

Text

Fast and Easy Strategies to Pay Off Credit Card Debt

Paying off credit card debt can feel like a big task, but with a few smart steps, you can reduce it faster and take control of your money. The first thing you should do is make a monthly plan for your money (budget) and write down all your spending. Look at where you're spending extra, and try to cut those costs. Use all this saved money to pay your credit card bills.

Next, try one of these two helpful ways to pay off your debt:

Avalanche Method – Pay the card that has the highest interest rate first. This helps you spend less on extra charges over time.

Snowball Method – Start by paying the card that has the lowest balance. After it's cleared, move to the next one. This way, you see fast progress and stay encouraged.

Also, try to pay more than the lowest amount required each month. Even a small extra payment can help lower your total debt faster.

If you have more than one credit card, you can join all your dues into one loan that has a lower interest rate, or move your balance to another card with less or no interest for some time. This can help you spend less money on interest.

Lastly, stop using your credit cards while you're trying to pay them off. Focus on paying what you already owe. With steady effort and a clear plan, you can clear your credit card debt and feel better about your money in the future.

0 notes

Text

Top 5 Credit Cards for Fashion Lovers

Discover the top 5 credit cards for fashion lovers in India. Enjoy cashback, rewards, and discounts on top fashion brands and online shopping platforms.

0 notes

Text

Top Credit Cards for Fashion Lovers in India

Love fashion and shopping? If you're someone who enjoys keeping up with the latest trends, then the right credit card can make your shopping experience even more exciting. From earning cashback on clothing purchases to getting exclusive discounts on your favorite fashion brands, there are several credit cards in India that are perfect for fashion lovers.

Top credit cards for fashionistas in India include options that offer great rewards on fashion spends, extra benefits during festive sales, and complimentary access to partner brand stores. Some cards also provide milestone benefits and vouchers from popular fashion brands, helping you save more every time you shop.

Popular picks like HDFC Millennia Credit Card, ICICI Amazon Pay Card, SBI SimplyCLICK Card, and AU Bank LIT Card are loved by shoppers for their exclusive offers on fashion and lifestyle. These cards not only reward your fashion choices but also make your purchases more affordable through EMI options and welcome gifts.

Choose a card that matches your shopping habits and let your style shine - smartly and stylishly!

0 notes

Text

Steps to Redeem Credit Card Points

Learn the simple steps to redeem your credit card points easily. Discover how to check your points, explore reward options, and get the most value from your redemptions.

0 notes

Text

Best Ways to Redeem Credit Card Points for Maximum Value

Maximizing the value of your credit card points requires smart redemption strategies. Instead of letting your points expire, consider redeeming them for rewards that offer the best value. Travel rewards are often a great option, as you can use points for flight tickets, hotel stays, or travel upgrades, giving you more bang for your buck. To redeem credit card points for maximum value, choose travel or high-value redemption options.

Another effective way is to convert points into cashback, which can be used to pay your card bill or cover everyday expenses. You can also redeem points for gift vouchers from popular brands, allowing you to shop without spending extra.

To get the most value, keep an eye out for special offers or point conversion deals. Some banks offer higher redemption rates during promotional periods. Lastly, avoid using points for low-value redemptions like merchandise, as they often have lower value per point.

Make sure to regularly check your credit card’s rewards program to stay updated on the best redemption options. This way, you can maximize the benefits and enjoy greater savings.

0 notes

Text

Benefits of Digital Credit Cards and Virtual Payments

Discover the benefits of digital credit cards and virtual payments, including enhanced security, instant access, contactless transactions, and global acceptance. Enjoy seamless, safe, and rewarding payments with advanced technology.

0 notes

Text

Future of Digital Credit Cards & Virtual Payments India

Digital credit cards and virtual payment solutions are shaping the future of transactions in India. With increasing smartphone usage and internet access, more people are shifting towards cashless payments. These solutions offer security, convenience, and faster processing, making transactions seamless for users.

The Future of Digital Credit Cards & Virtual Payments India is driven by innovations like tokenization, biometric authentication, and AI-powered fraud detection. Virtual cards are gaining popularity for online shopping and subscription services, offering enhanced security with unique card numbers.

Contactless payments, UPI integration, and digital wallets are further transforming the payment landscape. Banks and fintech companies are continuously introducing new features, ensuring smoother and safer transactions. As RBI and government policies support digital adoption, the future of credit and virtual payments in India looks promising.

Users can expect more rewards, better security, and wider acceptance of digital payment methods. Stay updated on the latest trends and make the most of digital credit cards and virtual payment solutions for a hassle-free and secure transaction experience.

0 notes

Text

Explore the best co-branded credit cards from Indian banks that offer exclusive rewards, discounts, and benefits. Whether you’re into travel, shopping, or fuel, these cards provide tailored perks to maximize your spending. Find the perfect card to unlock brand-specific privileges and enhance your experience today!

0 notes

Text

Best Co-branded Credit Cards from Indian Bank

Co-branded credit cards from Indian banks offer exclusive benefits by partnering with top brands. These cards provide rewards, discounts, and privileges tailored to shopping, travel, fuel, dining, and more. If you frequently spend in specific categories, a co-branded credit card can help you save more while enjoying extra perks.

Some of the best co-branded credit cards in India include the HDFC Bank IRCTC Credit Card, ideal for railway travelers, the SBI Card PRIME - Club Vistara, offering premium travel benefits, and the ICICI Bank Amazon Pay Credit Card, perfect for online shoppers. Other options include the Axis Bank Vistara Credit Card for flight rewards and the IndianOil Kotak Credit Card for fuel savings.

With these cards, you can maximize your spending with cashback, reward points, and brand-specific privileges. Compare different options and choose the one that fits your lifestyle. A co-branded credit card can be a great addition to your wallet if used wisely!

0 notes

Text

Learn how to avoid credit card overpayment with simple tips. Follow these steps for better control over your credit card usage and avoid financial strain.

0 notes

Text

Tips to Avoid Credit Card Overpayment and Manage Balance

Avoiding credit card overpayment is essential to managing your finances wisely. Overpaying your credit card can tie up your money unnecessarily and create complications in refunds or adjustments. Here are some simple tips to avoid credit card overpayment and manage your balance effectively.

Track Your Spending: Regularly monitor your credit card transactions to stay updated on your spending. This helps in making accurate payments without exceeding the due amount.

Set Up Auto Payments Carefully: If you use auto payments, ensure they are set to pay only the outstanding balance and not more. This prevents accidental overpayments.

Verify Your Due Amount: Always check your billing statement before making a payment to avoid paying extra. Cross-check with your transaction history to ensure accuracy.

Use Mobile Banking Alerts: Enable notifications for due dates and payment confirmations. This helps in making timely payments without paying extra.

Keep an Emergency Fund: Instead of overpaying your card, keep extra funds in a savings account for emergencies. This keeps your money accessible when needed.

Following these simple steps can help you avoid overpayment and maintain better control over your credit card balance.

0 notes

Text

Learn how to cancel a credit card payment with this simple guide. Whether it’s a mistake or a change of mind, follow the easy steps to stop a payment and avoid unwanted charges. Understand the process and ensure your transactions are under control.

0 notes

Text

How to Cancel a Credit Card Payment: A Simple Guide

Mistakes can happen, and sometimes you may need to cancel a credit card payment. Whether it's a duplicate transaction, an incorrect amount, or a charge you didn’t authorize, knowing how to act quickly is essential. Here’s a simple guide to help you manage such situations.

First, contact the merchant or service provider as soon as possible. Most merchants can reverse the transaction if you notify them before the payment is processed. If the merchant cannot help, reach out to your credit card issuer. Many banks and financial institutions offer a dispute process to investigate and resolve unauthorized or incorrect charges.

To cancel a credit card payment, ensure you provide all necessary details, including the transaction date, amount, and merchant name. It's also important to monitor your credit card statements for any discrepancies and report them promptly.

Remember, time is crucial when handling payment cancellations. Acting quickly increases the chances of resolving the issue efficiently. By staying informed and proactive, you can avoid unnecessary stress and maintain better control over your credit card transactions.

0 notes

Text

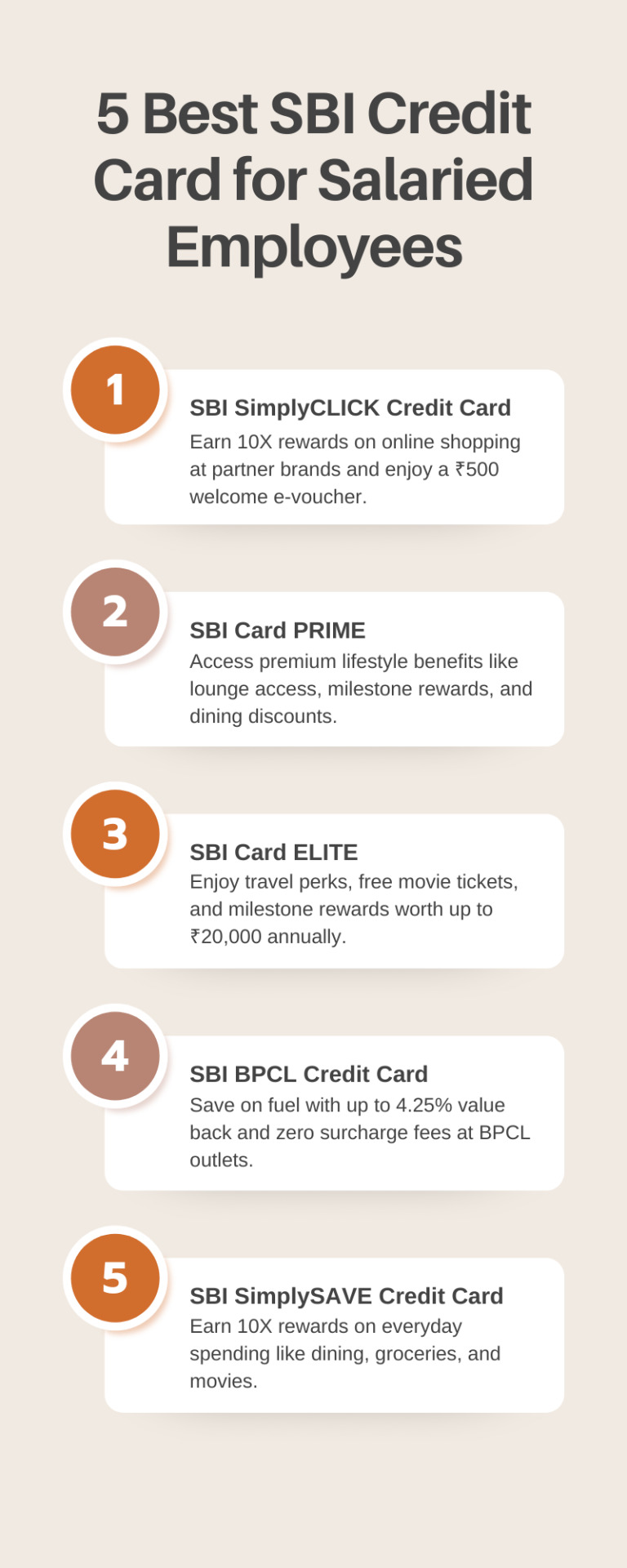

Discover the best SBI credit card for salaried employees, offering amazing rewards, cashback, and exclusive benefits. Choose a card that suits your lifestyle, with perks like fuel surcharge waivers, dining discounts, and travel benefits. Simplify your financial journey with an SBI credit card tailored to your needs. Find the perfect card for your salary account today!

0 notes

Text

Guide On Best SBI Credit Card for Salaried Employees

Looking for the best SBI credit card for salaried employees? SBI offers a wide range of credit cards designed to match the needs of working professionals. These cards provide exciting benefits such as cashback, reward points, travel privileges, dining discounts, and much more, making them ideal for your everyday expenses.

One of the top SBI credit cards for salaried employees is the SBI SimplyCLICK Credit Card, perfect for those who shop online frequently. It offers accelerated rewards on online shopping at partner brands and exclusive e-voucher benefits. Another great choice is the SBI Card PRIME, which provides premium lifestyle privileges such as complimentary airport lounge access, milestone rewards, and discounts on dining.

For individuals who love traveling, the SBI Card ELITE stands out with its travel benefits, including complimentary international and domestic lounge access, movie tickets, and exclusive gift vouchers. Additionally, SBI credit cards offer convenient payment options and attractive reward redemption programs to suit salaried employees' financial needs.

Choose an SBI credit card that complements your spending habits and enjoy benefits that enhance your lifestyle. Explore the features and apply for the best SBI credit card today to make your financial journey rewarding!

0 notes

Text

Learn practical tips to manage credit card interest and APR effectively. Pay balances in full, choose low APR cards, avoid minimum payments, use grace periods, and track spending to save money and stay financially secure.

0 notes