Don't wanna be here? Send us removal request.

Text

Alltick API: Real-Time Data Solutions from Quantitative Trading Primer to Professional Strategies

Why You Need to Eliminate 15-Minute Delayed Market Data?

In fast-paced financial markets, a 15-minute data delay can mean massive opportunity costs. While retail investors rely on outdated prices to formulate strategies, institutional traders have already executed multiple trades using real-time data. This information asymmetry exists not only in stock markets but also in forex, futures, and cryptocurrencies—delayed data essentially provides historical, not actionable insights for live trading.

Alltick API’s Competitive Edge

1. Millisecond-Level Real-Time Global Coverage

Unlike traditional minute-delayed feeds, Alltick API delivers:

Equities: Real-time quotes from 50+ exchanges (NYSE, Nasdaq, HKEX, etc.)

Crypto: Full-coverage pricing from Binance, Coinbase, and other top platforms

Forex & Futures: CME/ICE derivatives market depth data

Unique Tick-Level Streams: Granular order-by-order execution records

2. Quant-Optimized Infrastructure

Architected for algorithmic trading:

99.99% Uptime SLA with 24/7 monitoring

Smart Bandwidth Compression for cost-efficient high-frequency data

Dynamic Load Balancing for scalable request handling

Unified Historical + Real-Time APIs for seamless backtesting

3. Frictionless Developer Experience

Designed for quant newcomers and pros alike:

Multi-Language SDKs (Python/Java/C++)

Plug-and-Play Code Templates

Interactive API Debug Console

Comprehensive English/Chinese Documentation

7×12 Technical Support via Slack & Email

Real-World Use Cases

Case 1: Rapid Strategy Validation

Case 2: Cross-Market Arbitrage Monitoring

Multi-Asset Capabilities Enable:

Stock vs ETF price divergence alerts

Crypto cross-exchange arbitrage detection

Forex spot-futures basis analysis

Case 3: HFT System Deployment

Institutional-Grade Features:

Co-located server hosting

Custom binary protocols

Microsecond-precision timestamps

Order flow analytics toolkit

Choosing Your API Tier

FeatureFree FeedsLegacy VendorsAlltick ProLatency15+ minutes1-5 seconds<100msHistorical DepthEOD Only1 Year10+ YearsConcurrent ConnectionsSingle Thread10-50UnlimitedData FieldsBasic OHLCStandardImplied Volatility, GreeksSupportNoneEmail (Weekdays)Dedicated Engineer

Start Your Quant Journey Today

Whether You Are:

A developer building your first SMA strategy

A quant team stress-testing models

An institution managing multi-strategy portfolios

Alltick offers tailored solutions from free trials to enterprise-grade deployments. Sign Up Now to Get: ✅ 30-Day Full-Feature Trial ✅ Exclusive Quant Strategy Playbook ✅ $500 Cloud Computing Credits

Visit Alltick Official Site to Experience Market Pulse in Real Time. Transform Every Decision with Data That Beats the Speed of Markets.

(CTA: Click "Developer Hub" to configure SDK in 5 mins and claim your API key.)

Technical Highlights

WebSocket/ REST API Hybrid Architecture: Balance speed with flexibility

Regulatory-Compliant Data: FINRA/SEC-reviewed market feeds

Zero Data Gaps: Guaranteed 100% tick reconstruction accuracy

Smart Retry Mechanisms: Auto-reconnect during network instability

Why 2,300+ Hedge Funds Choose Alltick? *"Alltick's unified API eliminated our multi-vendor integration headaches. We achieved 37% faster strategy iteration cycles."* — Head of Quant Trading, Top 50 Crypto Fund

Upgrade Your Edge. Trade at the Speed of Now.

1 note

·

View note

Text

Alltick API: Decoding U.S. Stock Market Rules & Empowering Real-Time Trading Decisions

In the global financial markets, the U.S. stock market remains a cornerstone due to its massive scale, diverse asset classes, and mature trading mechanisms. For both institutional investors and individual traders, the demand for real-time U.S. market data continues to surge. Alltick API, a professional-grade financial market data provider, delivers millisecond-latency global market data while empowering users to seize every trading opportunity with precision. This article explores the U.S. stock ticker system, trading rules, and how Alltick’s real-time API redefines quantitative and high-frequency trading strategies.

1. U.S. Stock Ticker Rules: Precision from Symbol to Market

The U.S. stock ticker system prioritizes simplicity and recognizability, with symbols ranging from 1 to 5 letters that reflect company abbreviations or brand identities. Examples include:

AAPL for Apple Inc.

MSFT for Microsoft

AMZN for Amazon

This coding system not only aids memorization but also reveals industry affiliations. For instance:

Financial firms often use suffixes like "B" or "F" (e.g., JPM for JPMorgan Chase).

Tech companies favor shorter codes (e.g., NVDA for NVIDIA).

Special identifiers like ST (indicating consecutive losses) or DR (post-dividend adjustments) further enhance the informational depth of ticker symbols.

2. U.S. Stock Trading Rules: Efficiency Meets Risk Management

Centered around the NYSE and NASDAQ, U.S. trading mechanisms balance liquidity and fairness:

Trading Hours:

Regular session: 9:30 AM – 4:00 PM ET.

Pre-market (4:00–9:30 AM ET) and after-hours (4:00–8:00 PM ET) trading enable flexibility but with reduced liquidity.

T+2 Settlement: Transactions settle two business days after execution, demanding robust risk management.

Circuit Breakers: Triggered when the S&P 500 drops 7%, 13%, or 20%, halting trading to curb extreme volatility.

In this environment, real-time data latency becomes a critical factor. While standard market data interfaces suffer 15-minute delays, Alltick API’s millisecond-level updates ensure strategies capture micro-movements instantaneously.

3. Alltick API’s Core Advantages: Real-Time Data Revolution

For quantitative and high-frequency strategies, data quality and speed directly determine profitability. Alltick API redefines market data standards through:

A. Zero-Latency Global Coverage

Direct Exchange Feeds: Data sourced directly from NYSE, NASDAQ, and other major exchanges, eliminating intermediaries and ensuring sub-50ms latency.

Multi-Protocol Support: Real-time streaming via WebSocket, REST API for historical data, and compatibility with Python, Java, C++, and more.

B. Comprehensive Data Granularity

Tick-by-Tick Data: Includes price, volume, bid/ask direction, and timestamps to reconstruct market microstructure.

Level 2 Market Depth: Displays top 5 bid/ask tiers, optimizing order execution for high-frequency algorithms.

C. Enterprise-Grade Reliability

Global CDN Network: 99.99% uptime guaranteed through load-balanced servers across regions.

Custom Solutions: Tailor data fields, frequencies, and storage formats to meet institutional needs.

4. Alltick API Use Cases: From Backtesting to Live Trading

High-Frequency Strategy Optimization: Build spread arbitrage or statistical models using real-time ticks to exploit microsecond opportunities.

Risk Monitoring: Detect anomalies (e.g., flash crashes) and dynamically adjust positions via real-time alerts.

Cross-Market Hedging: Synchronize U.S. equities, crypto, and forex data for global portfolio diversification.

5. Why Choose Alltick?

Alltick outperforms traditional vendors through cost efficiency and developer-centric design:

Affordable Pricing: Tiered plans and free trials replace Bloomberg Terminal’s $20k+/year fees.

Seamless Integration: Clear documentation, sample code (Python/CURL), and 5-minute setup.

Conclusion: Turn Data into Your Alpha with Alltick API

In the financial arena, where information equals wealth, Alltick API redefines market data with real-time accuracy, global coverage, and unmatched reliability. Whether refining quant models, managing risk, or optimizing trades, Alltick empowers your strategy at every step.

Visit 【Alltick API】 to start your free trial and unlock the full potential of the U.S. stock market.

Alltick — Real-Time Data, Decisive in Milliseconds.

1 note

·

View note

Text

Unlock Real-Time Forex & Stock Data for Professional-Grade Quantitative Trading

——Free API + High-Frequency Market Feeds to Seize Millisecond-Level Opportunities

I. The Core Challenge of Quantitative Trading: Data Quality Determines Strategy Success

In the competitive world of financial markets, the success of quantitative trading hinges on real-time availability, completeness, and accuracy of data. Traditional data sources often face three critical limitations:

High Latency: Minute-level delayed data fails to capture micro market movements, missing high-frequency arbitrage opportunities.

Limited Coverage: Narrow asset classes or regional restrictions hinder cross-market strategies.

Unreliable Stability: Data outages or duplicate records distort backtesting results and increase execution risks.

Alltick API delivers professional-grade financial data services, offering developers, traders, and institutions a free API key and ultra-low-latency market feeds (avg. 170ms) across 100,000+ instruments including stocks, forex, and cryptocurrencies. It powers quantitative systems as the ultimate "data engine".

II. Core Advantages of Alltick API: Free Tier + High-Frequency Data

1. Zero-Cost Entry: Free API for Rapid Prototyping

Instant Registration: Create an account via our website or GitHub examples in 5 minutes.

Full Basic Features: Free tier includes 10 instrument queries, 1 WebSocket connection, and 1-year historical data for strategy validation.

2. Millisecond-Level Forex Data, Direct from Top Liquidity Sources

100+ Currency Pairs: Covering majors (EUR/USD, USD/JPY) and emerging pairs (AUD/CAD), sourced directly from global banks and exchanges.

Tick-by-Tick Updates: Receive real-time bid/ask prices and volumes via WebSocket for high-frequency decision-making.

3. Global Stock Market Coverage: HK, US, and A-Shares

30,000+ Equities: Full coverage of Hong Kong (3,000+), US (11,000+), and China A-shares (5,000+) with order book and trade-by-trade data.

Multi-Timeframe OHLC: Flexible intervals from 1-minute to monthly charts for diverse strategies.

4. Enterprise-Grade Reliability & Scalability

99.95% SLA Guarantee: Less than 5 hours annual downtime ensures uninterrupted trading.

Multi-Protocol Support: REST API, WebSocket, and FIX protocols for low-latency to high-frequency needs.

III. Four Key Use Cases for Alltick API

1. High-Frequency Trading (HFT)

Example Strategy: Capture forex arbitrage opportunities using tick-level spread analysis.

Implementation: Subscribe to EUR/USD real-time quotes via WebSocket, trigger orders based on order book patterns.

2. Multi-Asset Portfolio Management

Data Integration: Monitor US tech stocks, gold futures, and Bitcoin simultaneously for risk diversification.

3. Machine Learning Model Training

Historical Data: Train models with 5+ years of tick-level data to reduce overfitting risks.

4. Institutional Risk Management

Real-Time Alerts: Track currency fluctuations via API to minimize cross-border settlement slippage.

IV. Three Steps to Integrate Alltick API

1. Register & Get API Key

Visit Alltick Official Site, sign up via email or Gmail, and generate your token instantly.

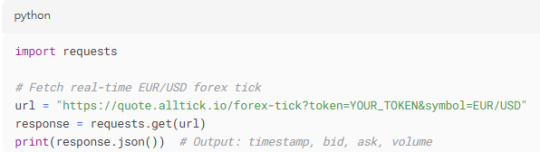

2. Run Sample Code (Python)

3. Scale with Premium Plans

Upgrade for 1,200+ requests/minute, full-market data, and multi-WebSocket connections.

V. Client Success Stories: Data-Driven Profit Growth

Hong Kong Quant Fund: Boosted annual returns by 15% using Alltick’s HK stock tick data.

Cross-Border Payment Platform: Reduced settlement slippage by 70%, saving $50k+ daily.

Act Now!

Whether you’re an individual developer, startup, or financial institution, Alltick API combines zero-barrier free access with institutional-grade data to accelerate your strategy deployment.

Visit [Alltick API] now!!!

1 note

·

View note

Text

Alltick - Turn Tick Data into Your Financial 'Money Machine'

Beneath the ever - changing financial markets lies a treasure trove of information, waiting to be explored. Every instantaneous price tick, every lightning - fast order cancellation and amendment, and every microsecond of liquidity fluctuation共同weave the core logic of market operations. While most investors are still observing the market from the relatively crude “minute - level” perspective, Tick - level data interfaces have become the ultimate weapon for high - precision trading decisions.

I. Tick Data: The Key to Unlocking Market Chaos

Traditional technical analysis, often based on compressed data, may seem reasonable but can be misleading. Tick data, however, takes us back to the authentic micro - state of the market, unveiling the mysteries of price formation:

Liquidity Dissection Atlas

Order Book Entropy Monitoring: By capturing subtle changes in Tick - level order book data, we can precisely calculate market depth elasticity. It’s like giving market liquidity a high - precision “health check” to understand its “resilience.”

Iceberg Order Imaging Technology: Amid the fog of high - frequency order cancellations, it accurately identifies hidden large - order trajectories, allowing investors to see the movements of big money trying to stay under the radar.

Liquidity Migration Prediction: Based on changes in the speed of Tick flow, it predicts trends in cross - market fund transfers, enabling investors to deploy strategies ahead of time.

During the volatile period of CME gold futures in 2024, the liquidity early - warning model based on Alltick Tick data successfully captured a 40% depth decay signal 11 seconds in advance. This helped institutional clients avoid a potential impact cost of $23 million in a single day, setting a prime example of precise market prediction.

Price Discovery Microscope

Transaction - by - Transaction Traceability: It thoroughly analyzes the impact of each block trade on the order book, revealing the gradual market - force interactions like peeling layers of an onion.

Cross - Market Arbitrage Crack Capture: It accurately identifies pricing deviations between ETFs and their component stocks at the Tick level, offering rare micro - arbitrage opportunities.

Volatility Particle Analysis: By studying the distribution of Tick intervals, it predicts potential “black swan” events that could trigger significant market fluctuations, allowing investors to prepare for risks in advance.

A top - tier hedge fund leveraged Alltick’s nanosecond - level timestamp data and discovered a 3 - microsecond statistical arbitrage window between US stock options and the underlying stocks. This led to an extraordinary annual return of over 900%, a perfect example of how precise data can boost trading.

All of these highlight the significant value of Alltick’s futures API, stock API, and real - time data interfaces in providing investors with in - depth market insights.

II. Tick - Level Revolution: Three Key Cognitive Leaps

From “Trend Following” to “Micro - Manipulation”

Tick data empowers trading strategies with a new dimension, freeing traders from traditional trend - based judgments. In the cryptocurrency market, Gas fee bid Tick data can predict Ethereum block - packing priorities. In the foreign exchange market, Tick flow on the EBS platform can reveal subtle central - bank intervention signs. In the commodity futures sector, tick - based warehouse data can reconstruct spot - premium models, enabling deeper market control.

From “Risk Control” to “Risk Pre - Carving”

Alltick’s Tick - level risk engine is like a “quantum - level” precision instrument for risk protection. It accurately evaluates the instantaneous disturbance of a single order on VWAP, predicts liquidity sandstorms by analyzing the hidden Markov relationship between Tick flow speed and market panic index, and monitors cross - asset Tick - correlation mutations in real - time to effectively block the virus - like spread of portfolio risks.

From “Historical Backtesting” to “Digital Twinning”

Equipped with a vast ten - year Tick - level database, Alltick can precisely reconstruct the market ecosystem at any given moment. Whether it’s accurately reproducing the chain reaction of every stop - loss order during a “flash crash,” simulating market - maker quoting - strategy evolution under specific Tick pressure, or training AI traders to adapt to extreme volatility, it provides a comprehensive platform for investors to conduct simulations.

III. Alltick Engine: The Ultimate Architecture for Tick - Level Data Transmission and Processing

Owning Tick data is just the beginning; the key lies in efficiently transforming it into excess returns, which is where the Alltick Engine shines.

Hyperspace Transmission Protocol: The Photon Engine, powered by FPGA - based hardware - accelerated decoding, achieves an ultra - high throughput of 5 million Tick / second. The Smart Routing Matrix dynamically selects the lowest - latency path among 27 global access points. Data quantization encapsulation technology breaks down Tick flow into independent price, volume, and timestamp particle streams, enhancing data - processing efficiency.

Space - Time Folding Computation: Updating the implied volatility matrix of all instruments every 15 seconds to form a Tick - level volatility surface. Real - time calculation of the energy - decay gradient of each - tier order book to build a liquidity - thermodynamics model. Comparing Tick patterns across exchanges to create a microstructure - fingerprint library for rapid identification.

Developer Exoskeleton Interface: The zero - latency sandbox allows investors to seamlessly inject real - time strategies into historical Tick flow for stress testing. The smart data lens enables free switching between observation granularities of Tick, second, and minute. The chaos - engineering module can automatically generate extreme scenarios such as liquidity drought and exchange outages to comprehensively test strategy robustness.

After connecting to the Alltick interface, a quantitative hedge fund in the Asia - Pacific region achieved an impressive eightfold increase in the capacity ceiling of its high - frequency arbitrage strategy. The return - contribution rate during the NASDAQ opening call auction phase soared from 12% to 41%, showcasing the immense power of the Alltick Engine.

Conclusion:

As numerous market participants are still battling for percentage - level returns in the candlestick - chart dimension, Alltick has ushered everyone into a new realm of Tick - level trading. Here, there are no moving - average obscurities or lagging - indicator nuisances. Instead, there’s the intense collision of capital particles in their most primitive state, generating the brilliant sparks of excess returns. Choosing Alltick’s futures API, stock API, and real - time data interfaces is not just upgrading trading tools but undergoing a comprehensive cognitive - species evolution to stand out in financial - market competition.

[Click to penetrate the data veil and enter the Tick - level truth universe opened by Alltick!]

1 note

·

View note

Text

Decoding Tick Data:How Microscopic Market Changes Impact Your Trading Decisions?

In the fast-paced world of financial markets, have you ever missed a golden trading opportunity due to delayed market information? When you see a stock price soaring suddenly, its real price may have started rising 15 minutes earlier. The delay in ordinary market data can silently erode your trading profits.

Tick Data: The “Microscope” for Microscopic Market Changes

Every change in transaction price, volume, and buy/sell orders holds the secrets of the market's true intentions. These Tick data, measured in milliseconds, are crucial for capturing market sentiment and predicting short-term trends. However, most publicly available market data has a delay of over 15 minutes. It's like looking at the market through a “rearview mirror,” and the delayed decision-making timing can greatly reduce the effectiveness of your strategies.

AllTick Futures API/Stocks API/Real-time Data Interface: Breaking the Delay Barrier for Precise Decisions

AllTick API (Application Programming Interface) is the bridge connecting real-time market data with trading strategies. Through standardized data interfaces, developers, trading platforms, and quantitative systems can directly access real-time Tick data from global markets, including stocks, forex, futures, and cryptocurrencies, without the need to maintain complex data sources on their own.

Unlike traditional market data interfaces, the core advantages of AllTick Futures API/Stocks API/Real-time Data Interface are:

Zero-Latency Market Penetration: Say goodbye to 15-minute-old historical data. Synchronize the latest market transaction prices, order book depth, and individual trade details at the millisecond level, enabling your strategies to respond as quickly as institutional investors.

Multi-Dimensional Data Coverage: From high-frequency Tick data to historical market data, from major contracts to cryptocurrencies, it meets the needs of various scenarios such as quantitative backtesting, algorithmic trading, and risk monitoring.

High Stability and Low Threshold: Built on a cloud-based architecture, the API service offers 99.9% availability guarantee. It supports multiple protocols like RESTful and WebSocket, allowing developers to quickly integrate and focus on strategy optimization.

Why APIs Are a Must-Have Tool for Future Traders?

The essence of API is “Data as a Service.” For both individual investors and institutions, AllTick Futures API/Stocks API/Real-time Data Interface acts like an around-the-clock market intelligence officer. It transforms real-time market data into structured data streams to empower trading systems. Whether you're building high-frequency trading strategies, monitoring abnormal market fluctuations, or optimizing investment portfolios, real-time data is the cornerstone of decision-making.

Take Action Now: Seize Millisecond-Level Opportunities with AllTick Futures API/Stocks API/Real-time Data Interface

The market waits for no one. Whether you're an engineer developing intelligent trading systems or an independent trader pursuing precise timing, AllTick Futures API/Stocks API/Real-time Data Interface can provide you with zero-latency, high-precision market data support.

Visit the【AllTick API】 now to apply for a free trial of the interface and experience how real-time data can reshape your trading decision-making logic!

1 note

·

View note

Text

Supercharge Your Trading with Alltick’s Real-Time API!

In the fast-paced world of finance, having access to real-time data is essential. Whether you’re in stocks, forex, futures, or cryptocurrencies, even a slight delay in data can lead to missed opportunities. Alltick API is your solution, providing seamless access to live market data and transforming it into actionable insights.

What is Alltick API? Alltick API is a powerful Application Programming Interface designed for financial applications, enabling instant access to real-time data for trading platforms, algorithmic systems, and analytics tools without the hassle of outdated feeds.

Why Real-Time Data Matters Many market data feeds suffer from delays that can jeopardize your trades. Alltick API delivers updates in milliseconds, eliminating lags and ensuring optimal trading performance.

Key Features of Alltick API

Real-Time Data Streaming: Instant access to live prices and volumes across stocks, forex, futures, and cryptocurrencies.

Multi-Asset Coverage: A single API for diverse markets ensures scalability.

High Reliability & Low Latency: Enjoy 99.9% uptime and rapid data delivery.

Easy Integration: User-friendly documentation and SDKs for seamless platform integration.

Who Benefits from Alltick API?

Algorithmic Traders: Execute strategies based on live data.

Brokerage Platforms: Provide clients with real-time charts and order execution.

Financial Analysts: Conduct precise analyses using up-to-the-minute data.

Crypto Exchanges: Enhance liquidity management with instant price updates.

Technical Excellence Alltick API uses advanced caching and distributed networks to ensure accuracy and speed, sourcing data directly from exchanges to reduce latency and costs.

Get Started Today! Don’t let outdated data hold you back. With Alltick API, gain a competitive edge with zero-latency insights and scalable infrastructure.

Visit [Alltick API] to explore documentation, pricing, and free trial options.

Alltick API—Where Speed Meets Precision. Empower your trading with data that moves as fast as the market!

0 notes

Text

Leading the New Era of Trading: The Revolutionary Advantage of Tick-Level Data

In the battlefield of finance, every millisecond of decision delay can lead to a quiet transfer of wealth. While ordinary investors focus on candlestick charts to find trends, top traders have already gained insights into the market's finest pulses through Futures APIs and Stock APIs. This millisecond-level data granularity is the ultimate weapon in modern financial competition.

1. Tick Data: The Atomic-Level Reduction of Market Truth

Traditional minute-level candlesticks are essentially compressed "blurry snapshots," erasing crucial information such as volume distribution and order flow dynamics. In contrast, tick-level data interfaces provide every transaction record (price, volume, timestamp), allowing you to observe the market as if under a microscope:

Capturing Liquidity Black Holes: Identifying hidden traces of large order splits and iceberg orders

Tracking Fund Flows: Analyzing real intentions of major institutions through individual transaction data

Decoding Market Sentiment: Predicting shifts in buying and selling power from changes in quote frequency

Research shows that strategies built on tick data improve the Sharpe ratio by 58% compared to traditional volume-price models, while reducing maximum drawdown by 42%.

2. The Lifeline of High-Frequency Trading: Three Empowering Dimensions of Tick Data

Leap in Strategy Precision

When algorithmic trading needs to predict price fluctuations for the next 15 seconds, minute-level data is like analyzing an F1 racing trajectory in standard definition. The Alltick API offers tick-level data interfaces that support:

Nanosecond-level timestamp synchronization

Depth snapshots of 50 bid/ask levels

Alerts for abnormal volatility

Quantum Leap in Risk Control

In extreme market conditions, tick data serves as a radar to avoid "flash crash traps":

Real-time detection of liquidity drops

Dynamic calculation of instantaneous deviations from VWAP (Volume Weighted Average Price)

Identification of subtle shifts in cross-market arbitrage spreads

Revolution in Backtesting Credibility

Historical backtesting based on tick data can recreate real market frictions:

Precisely calculating slippage

Simulating priority rules of exchange matching engines

3. Alltick API: The Engineered Foundation of the Tick Data Revolution

Accessing tick data is just the starting point; turning it into a trading advantage requires robust data interface infrastructure:

Lightning-Fast Transmission Architecture

27 global edge computing nodes with end-to-end latency < 5 milliseconds

Stream engines processing over 2 million tick events per second

Intelligent Data Services

Machine learning-driven anomaly detection for tick data

Real-time generation of asset correlation heatmaps

Developer Toolkit

Support for multiple access protocols

Multi-language SDKs available

Activate Your Tick Data Privileges Now

The Alltick API is now open for free trial access, allowing you to experience:

Full-range tick-level historical data downloads

Real-time data stream stress testing tools

Exclusive market microstructure analysis reports

In an era where algorithmic trading evolves to microsecond competition, tick data is no longer an "optional accessory" but a vital organ for survival in the market. Choose Alltick's data interfaces to ensure that every strategy is built on the atomic truth of the market—because true trading advantage starts with seeing what others cannot.

0 notes

Text

Say Goodbye to Latency: Alltick API Delivers Real-Time Market Data!

In the fast-paced financial market, what does 15 minutes mean? While traditional market data still shows you "historical prices," Bitcoin may have surged by 10%, futures contracts could have triggered margin calls, and forex rates might have experienced wild fluctuations. This is the decision gap created by delayed data—you only see the market's "past."

Alltick API was created to solve this pain point. As a next-generation standardized data interface solution, Alltick redefines how financial data is accessed through technological innovation. Our API delivers real-time market data streams across all asset classes, including stocks, forex, futures, and cryptocurrencies, with millisecond response times. Say goodbye to the traditional 15-minute delay trap, and make every trading decision based on the "now" of the market.

Why Choose Alltick Data Interfaces?

✅ Zero-Latency Direct Exchange Connection Utilizing a distributed data collection architecture, we connect directly to over 50 top exchanges, including NYSE, NASDAQ, and CME, with data update frequencies precise to the microsecond.

✅ Comprehensive Interface Ecosystem We offer various data interface formats, including RESTful, WebSocket, and FIX protocols, perfectly supporting the diverse needs of high-frequency trading systems, mobile apps, and quantitative analysis platforms, with the capacity for billions of API calls daily.

✅ Intelligent Data Cleansing Engine With built-in mechanisms for anomaly filtering, data completion, and multi-source validation, we ensure that every piece of market data transmitted undergoes strict standardization, allowing direct integration with your trading algorithms without the need for secondary cleansing.

✅ Developer-Friendly Design We provide SDKs in Python, Java, C++, and comprehensive technical documentation, allowing you to complete data interface calls in just 3 lines of code. Whether you’re an independent developer or an enterprise user, the 10-minute onboarding experience will completely change your perception of financial data services.

Innovation Scenarios Driven by Data Interfaces

Quantitative Trading Teams: Build high-frequency arbitrage strategies based on real-time tick data.

Smart Investment Platforms: Create an exceptional user experience with millisecond market updates.

Blockchain Projects: Accurately capture signals of cryptocurrency market fluctuations.

Fintech Companies: Rapidly establish proprietary market analysis systems.

“In the world of algorithmic trading, speed is synonymous with excess returns.” — A CTO of a private equity firm remarked after using Alltick API.

Register now to receive a 7-day full-feature trial and experience how a no-latency data interface can inject "time value" into your trading system. Visit the Alltick website for dedicated technical support, and let us help you turn data interfaces into your core competitive advantage!

【Alltick API—Making Real-Time Data Your Second Nature】 Seize the market opportunity by eliminating every millisecond of delay.

0 notes

Text

Say Goodbye to Data Woes! AllTick API Provides Powerful Support for Your Trading System!

Still struggling with data sources for your quantitative trading system? Tired of high latency, instability, and incomplete data? This article will guide you step-by-step in building an efficient and reliable quantitative trading system, highlighting how to leverage the powerful features of AllTick API to solve your data challenges and seize trading opportunities!

Why Do You Need a Quantitative Trading System?

A quantitative trading system is a powerful tool that utilizes computer technology and mathematical models for automated trading. It can overcome human weaknesses, strictly execute predefined strategies, and enhance trading efficiency and profitability. An excellent quantitative trading system can:

Monitor the market 24/7: Never miss a trading opportunity.

Execute strategies quickly: Millisecond response to market changes.

Automate risk management: Avoid losses from emotional trading.

Backtest historical data: Validate strategy effectiveness and optimize parameters.

Core Aspects of Developing a Quantitative Trading System

Building a quantitative trading system involves multiple critical steps:

Data Acquisition and Cleaning: Obtain high-quality, low-latency market data, and perform cleaning and organization.

Tools: AllTick API provides real-time market data for forex, commodities, stocks, and more, covering over 100,000 products globally, with a reliability of 99.95% and extremely low latency, plus high-frequency data updates!

AllTick API: The Powerful Engine of Your Quantitative Trading System

In the data acquisition and cleaning phase, AllTick API is the key to resolving these challenges, offering comprehensive real-time data interfaces to ensure you grasp market dynamics instantly.

Why Choose AllTick API?

Comprehensive Data: Covers various assets including forex, commodities, and stocks to meet diverse trading needs.

High Real-Time Performance: Low-latency interfaces provide real-time updates, ensuring you capture market dynamics immediately.

Strong Reliability: With an SLA of 99.95%, it guarantees stable data supply, avoiding losses from data interruptions.

Easy Integration: Supports popular programming languages like Python and Go, with example code for quick onboarding.

Conclusion

Building a quantitative trading system is complex, but with the right methods and tools, AllTick API’s comprehensive, real-time, and reliable data becomes an indispensable engine for your trading system.

Visit【 AllTick API 】website now to learn more about our products and embark on your quantitative trading journey!

0 notes

Text

Navigating Hong Kong Market Data: Exploring BMP, Level-0, Level-1.5, and Level-2 Services

1. Exploring the Diversity of Hong Kong Market Data Services

In the Hong Kong stock market, investors frequently encounter three primary types of market data services: BMP, Level-0, Level-1.5, and Level-2. Each service has its unique features and caters to different types of investors.

2. Hong Kong BMP Data (Basic Market Prices)

Hong Kong BMP data is provided by the Hong Kong Stock Exchange and offers basic market quotes. Users can access real-time price data for free, although the data volume is limited compared to more advanced services. Key features of BMP data include:

Real-Time Data: Users can refresh the data manually to get real-time updates.

Data Content: Includes bid prices, last transaction prices, closing prices, daily highs/lows, trading volume, and transaction value.

Suitable Products: Stocks, derivatives, warrants, exchange-traded funds, etc.

Usage Limitations: Requires manual refreshing, with updates dependent on user actions.

BMP data is ideal for casual investors who do not require frequent updates or who prefer not to pay for additional data services. Typically, this service is available for mobile users and allows display of up to 20 stocks simultaneously.

3. Hong Kong Level-0 Data

Hong Kong Level-0 data is a delayed 15-minute service that provides richer data than BMP but comes with a time lag. Its primary features include:

Delayed Data: Updates are 15 minutes behind actual market transactions.

Real-Time Refresh: Despite the delay, data refreshes in real time, providing the latest market conditions.

Data Content: Offers more detailed bid/ask information but does not provide tick-by-tick transaction data.

Level-0 data suits investors who need more detailed information but can tolerate some delay. It is beneficial for observing overall market performance.

4. Hong Kong Level-1.5 Data

Hong Kong Level-1.5 data is a specialized advanced service offered by AllTick API, positioned between Level-1 and Level-2. Key features include:

Real-Time Prices: Provides real-time price updates without the need for manual refreshing.

Tick Data: Displays detailed information for each transaction, including time, price, and volume.

Level-1.5 data is particularly suitable for quantitative traders and institutional platforms that require fast, stable market data for decision-making.

5. Hong Kong Level-2 Data

Hong Kong Level-2 data, provided by the Hong Kong Stock Exchange, is an advanced service offering the most detailed and real-time market data. Its main features include:

Real-Time Prices: Offers real-time price updates without manual refreshing.

Tick Data: Displays detailed information for each transaction, including time, price, and volume.

Ten-Level Depth Data: Shows ten levels of bid and ask prices, providing deeper market insights.

Broker Information: Displays information about the brokers behind the buy/sell orders, aiding in market participant analysis.

Level-2 data is suitable for professional investors and short-term traders requiring rapid and comprehensive market data for their trading decisions.

6. Conclusion

In summary, BMP data is suitable for casual investors, Level-0 data is for those who can tolerate some delay, while Level-1.5 and Level-2 data cater to professional investors needing in-depth market insights. Each service serves a specific purpose and user base. Investors can choose the appropriate data service based on their needs and enhance their trading strategies using AllTick’s stock API, futures API, stock real-time data interface, and forex API.

Visit the 【AllTick API 】and utilize our API to enhance your trading efficiency and seize every investment opportunity!

0 notes

Text

Must-Know Insights: A Detailed Look at U.S. Stock Ticker Codes and Trading Regulations

Overview of the U.S. Stock Market

The U.S. is home to multiple stock exchanges, providing investors with platforms to trade a variety of financial instruments, including stocks, bonds, and options. The major exchanges include:

New York Stock Exchange (NYSE) The largest stock exchange globally, focusing on large-cap stocks like Apple and Microsoft.

NASDAQ The second-largest exchange, primarily trading technology companies, known for its electronic trading system suited for high-frequency trading.

NYSE American Formerly the American Stock Exchange, it caters to small and mid-sized enterprises and exchange-traded funds (ETFs).

Cboe Global Markets A leading options exchange that also offers trading in stocks and futures.

IEX Known for its commitment to fair trading, IEX aims to mitigate the impact of high-frequency trading on retail investors.

Over-the-Counter Markets (OTC Markets) Not a traditional exchange, it allows trading of stocks not listed on major exchanges, categorized into OTCQX, OTCQB, and Pink levels.

Ticker Symbol Encoding Rules

A U.S. stock ticker symbol is a short letter combination used to identify and differentiate publicly traded companies. Here are the key rules:

Basic Structure

NYSE: Typically 1 to 3 letters (e.g., F for Ford Motor Company).

NASDAQ: Usually 4 letters (e.g., AAPL for Apple Inc.).

OTC Markets: Generally 5 letters, with codes ending in “Q” indicating financial distress (e.g., AAPQ).

Special Ticker Codes

Different classes of stock may have suffixes (e.g., BRK.A and BRK.B for Berkshire Hathaway).

Exchange code suffixes indicate the trading venue (e.g., AAPL.O indicates NASDAQ).

Trading Rules Associated with Ticker Symbols

Ticker symbols are not just identifiers; they are closely linked to trading rules:

Trading Hours

Regular trading hours: 9:30 AM to 4:00 PM ET.

Pre-market and after-hours trading are also available.

Order Types Investors can use various order types, including market orders, limit orders, and stop orders.

Liquidity and Market Depth Large-cap stocks (like AAPL) generally have high liquidity, while small-cap or OTC stocks tend to have lower liquidity and higher risk.

Trading Fees Stocks on major exchanges typically have lower fees compared to OTC stocks.

Regulatory Compliance Stocks on NYSE and NASDAQ must meet stringent listing standards, while OTC stocks have fewer requirements.

Specific Examples

Apple Inc.

Ticker Symbol: AAPL

Exchange: NASDAQ

Features: High liquidity and transparent information.

Berkshire Hathaway Inc.

Ticker Symbols: BRK.A and BRK.B

Exchange: NYSE

Features: Different classes of stock offer varied investment opportunities.

Ford Motor Company

Ticker Symbol: F

Exchange: NYSE

Features: A blue-chip stock that is easy to recognize.

GameStop Corp.

Ticker Symbol: GME

Exchange: NYSE

Features: Highly volatile, suitable for short-term traders.

OTC Trading Example

Suppose a company named “XYZ Corp.” is trading under XYZQ, investors should approach with caution due to high risk.

Conclusion

Understanding ticker symbols and their associated trading rules is crucial for investors. By leveraging stock APIs, futures APIs, and real-time market data interfaces, investors can efficiently access U.S. market data and make informed trading decisions. For more insights on U.S. stock trading and market characteristics,

visit the 【AllTick API】 website.

0 notes

Text

Alltick API: Unlock the Power of Tick-Level Data, Build a Millisecond Competitive Edge

Introduction: Time is Money—Every Tick Counts

In the battlefield of financial trading, a 0.1-second delay could mean losing millions. While traditional market data lags by 15 minutes, Alltick API delivers **zero-latency tick-level data streams**, offering quant traders and institutions a direct, high-speed gateway to the pulse of global markets.

I. The Pitfalls of Traditional Data: The Cost of 15-Minute Delays

Delayed market data acts like a "frosted glass," forcing traders to rely on blurry historical snapshots. This lag results in:

Ineffective Strategies: High-frequency arbitrage opportunities vanish before execution.

Unmanaged Risks: Stop-loss orders trigger at prices far from intended levels.

Reduced Profits: Backtest results diverge sharply from real-world performance.

Tick-level data, with **millisecond granularity**, records every transaction’s exact time, price, and volume—unlocking the solution to latency-driven challenges.

II. Alltick API: A "Superconductive Network" for Real-Time Data

Designed for financial ecosystems, Alltick API redefines data access through three innovations:

Zero-Latency Direct Connectivity

Direct integration with global exchange core systems, eliminating intermediaries for **nanosecond-level data delivery**.

Cross-Asset Coverage

Unified access to equities, forex, futures, and cryptocurrencies via a single API.

High-Concurrency Architecture

Processes millions of data points per second, ensuring stability during extreme volatility.

III. How Tick Data Revolutionizes Trading Strategies

Scenario 1: A "Microscope" for High-Frequency Strategies

Capture microsecond spreads: Reconstruct order books to identify cross-exchange arbitrage windows.

Optimize execution algorithms: Adjust order timing dynamically based on real-time tick flows.

Scenario 2: "Premium Fuel" for Quant Models

Extract alpha signals: Mine tick sequences for microstructure patterns (e.g., order flow imbalance, block trade anomalies).

Enhance backtesting accuracy: Replace smoothed candlestick assumptions with true transactional timelines.

Scenario 3: A "Radar" for Risk Management

Monitor liquidity shifts in real time to preempt flash crashes.

Calculate dynamic VaR using tick-level volatility for adaptive position sizing.

IV. Built for Developers, Loved by Traders

Alltick API prioritizes seamless integration:

Effortless Setup: REST/WebSocket support—fetch live data in 5 lines of code.

Smart Toolkits: Python/Java SDKs with tick cleaning, resampling, and replay functions.

Sandbox Environment: Free historical tick data for strategy validation.

24/7 Reliability: 99.99% SLA uptime with dedicated technical support.

V. Proven Results: Alltick Users’ Success Stories

A crypto market maker boosted arbitrage returns by 217% post-integration.

A U.S. day-trading team reduced slippage losses by 68% using tick-level backtesting.

A futures CTA strategy saw its Sharpe ratio surge 130% after incorporating microstructure factors.

Conclusion: Seize the Millisecond Future—Start Now

In an era where algorithms and computing power converge, data quality is the ultimate differentiator. Alltick API isn’t just a data feed—it’s **the engine propelling strategies into the tick-level era**.

Sign Up Now for a 7-Day Free Trial and transform every trade into a precision-driven opportunity.

Alltick API: Synchronize Your Strategies with the Market’s Heartbeat

0 notes

Text

Why Your Trading Strategy Needs a Tick-Level Upgrade: A New Era with Alltick API

In the blink of an eye, markets shift. Prices fluctuate. Opportunities vanish. For traders, speed is survival, and outdated data feeds are a silent killer. If your strategy relies on delayed or aggregated market data, you’re already behind. Discover how Alltick API redefines real-time trading with tick-level precision—and why it’s time to level up.

The Problem: Why 15-Minute Delays Are Costing You Millions

Most trading platforms and APIs serve data that’s 15 minutes old. Imagine driving a race car while watching a GPS map from the last lap—you’d crash. Similarly, delayed data forces you to:

Miss microtrends (e.g., sudden crypto price spikes).

Execute trades based on stale order book snapshots.

Lose profits to slippage and missed arbitrage windows.

Tick-level data solves this by capturing every market movement in real time. But building a reliable data pipeline is complex, costly, and time-consuming—until now.

The Solution: Alltick API—Your Gateway to Zero-Latency Trading

Alltick API isn’t just another data feed. It’s a mission-critical infrastructure for traders, quants, and developers who refuse to compromise. Here’s how it transforms your workflow:

Real-TimeEdge, Delivered Instantly

Forget waiting. Alltick API streams live tick data via WebSocket and REST endpoints, syncing with global exchanges like NYSE, Binance, and CME in milliseconds.

Monitor bid-ask spreads, trade volumes, and liquidity shifts as they happen.

Trigger lightning-fast orders using programmable alerts (e.g., "Buy when BTC hits $X").

Eliminate guesswork with raw, unfiltered market depth.

Build Smarter Strategies with Historical Precision

Tick data isn’t just for live trading. Alltick’s 10+ years of archived data lets you:

Backtest algorithms against extreme volatility (think 2020’s COVID crash or Bitcoin’s 2021 surge).

Uncover hidden patterns in order flow and execution timing.

Optimize HFT strategies down to the millisecond.

One API, Every Market

Trade stocks at 9:30 AM EST? Hedge with forex at midnight? Alltick API covers stocks, forex, crypto, futures, and options across 100+ global exchanges. No more juggling multiple data sources—consolidate your tools and focus on profits.

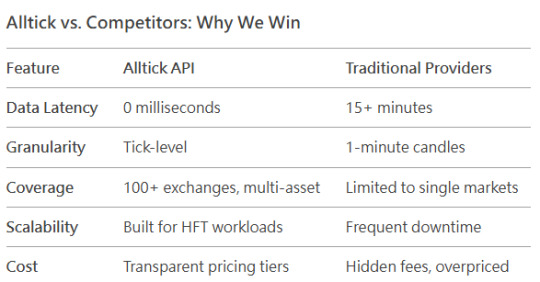

Alltick vs. Competitors: Why We Win

Real Traders, Real Results

Quant Fund AlphaEdge: “Alltick’s crypto tick data helped us spot a 0.3-second arbitrage window between exchanges—netting $2M monthly.”

Retail Trader Jane L.: “I reduced slippage by 40% after switching to Alltick’s real-time forex feeds.”

FintechStartup ChainTrade: “Their API integration took 8 minutes. Now our app users get live data—no delays.”

Stop Trading Blind. Start Trading Ahead. With Alltick API, you’re not just accessing data—you’re gaining a strategic weapon. Whether you’re a solo trader or a hedge fund, the future of trading is tick-level.

Ready to upgrade? Claim Your Free Trial Now →

0 notes

Text

Decoding the Market’s DNA: How Alltick API Delivers Unrivaled Edge with Tick-Level Mastery

Introduction: The Milliseconds That Move Markets In an era where microseconds determine profit margins, relying on stale data is akin to navigating a storm with a broken compass. Traditional market feeds, shackled by 15-minute delays, force traders to operate in the dark. Alltick API shatters this paradigm, offering unfiltered, real-time access to tick-level data across global asset classes—empowering algorithms, analysts, and institutions to act at the speed of opportunity.

The Hidden Cost of Lagging Data

Outdated insights: Delayed feeds distort price discovery, turning precise strategies into guessing games.

Arbitrage erosion: Spreads vanish faster than delayed data refreshes, leaving cross-exchange traders empty-handed.

Risk blind spots: Volatility surges and black swan events unfold in seconds—not minutes. Legacy systems fail to trigger timely safeguards.

Alltick API neutralizes these risks by streaming raw, unadulterated ticks as they occur, ensuring your decisions align with market reality.

Beyond Real-Time: The Alltick Advantage

What Sets Alltick Apart

Nanosecond timestamps: Capture exact market timing for forensic analysis and compliance.

Depth-of-Book granularity: Track liquidity layers and hidden order flow across equities, crypto, and derivatives.

Global synchronization: Co-located servers in NY, London, Tokyo, and Singapore minimize latency for cross-border strategies.

Architecture Built for Demanding Workloads

Adaptive protocols: Seamlessly switch between WebSocket streams for live data and REST APIs for historical granularity.

Data enrichment: Merge raw ticks with corporate actions, splits, and symbology mappings for context-aware analysis.

Scalability first: Handle terabyte-scale data ingestion without compromising speed, whether you’re a startup or a tier-1 bank.

From Theory to Profit: Tick Data in Action

HFT optimization: Detect micro-patterns in order flow to front-run market-moving events.

Smart order routing: Leverage real-time bid-ask spreads to minimize slippage in volatile crypto markets.

AI/ML training: Feed tick-level datasets into neural networks to predict price discontinuities.

Regulatory compliance: Reconstruct trades to the millisecond for audit trails and MiFID II reporting.

Client Spotlight: A hedge fund using Alltick’s forex tick data identified a 0.3-second latency arbitrage window between EUR/USD futures and spot markets, unlocking $2.8M in annualized alpha.

Empowering Developers, Accelerating Innovation

Alltick’s API ecosystem is designed for frictionless adoption:

Low-code connectors: Integrate with TradingView, MetaTrader, or custom platforms via pre-built modules.

Dynamic sandbox: Simulate strategies against historical tick databases before deploying live capital.

Transparent pricing: Pay-per-use models with volume discounts, free tiers for prototyping, and no vendor lock-in.

The New Frontier: Data as a Competitive Weapon

Markets no longer reward reactivity—they reward prescience. With Alltick API, every tick becomes a actionable signal, every latency gap a potential edge. As decentralized finance and AI-driven trading reshape finance, the winners will be those who harness data at its atomic level.

Call to Action

Don’t let milliseconds dictate your margins. Join the institutions and quants already leveraging Alltick’s tick-level supremacy.

0 notes

Text

Real-Time Tick Data and Algorithmic Trading: Powering Smarter Decisions with Alltick API

In today’s hypercompetitive financial markets, speed and precision are not just advantages—they are necessities. Algorithmic trading, which relies on complex models to execute orders at lightning speed, now dominates over 70% of global equity trading volume. However, even the most sophisticated algorithms are only as good as the data fueling them. This is where Alltick API bridges the gap between raw market signals and actionable intelligence.

The Problem: Why 15-Minute Delays Kill Opportunities

Most retail trading platforms and data providers deliver delayed market data—often lagging by 15 minutes or more. While this might suffice for casual investors, algorithmic traders face a critical disadvantage: outdated prices, missed arbitrage windows, and strategies built on stale information. Imagine executing a high-frequency trading (HFT) strategy based on data from 15 minutes ago. The result? Slippage, reduced alpha, and eroded profits.

The Solution: Alltick API Delivers Real-Time Tick Data

Alltick API eliminates latency by providing real-time tick-level data across equities, forex, futures, and cryptocurrencies. Unlike aggregated or delayed feeds, Alltick streams every bid, ask, and trade execution as they occur, empowering algorithms to react to market microstructure in microseconds.

Key Features of Alltick API:

Zero-Latency Data Feeds

Access millisecond-level updates for order books, trades, and historical ticks.

Ideal for HFT, statistical arbitrage, and volatility-sensitive strategies.

Multi-Asset Coverage

Unified API endpoints for global markets: NYSE, NASDAQ, CME, Binance, Coinbase, and 50+ exchanges.

Developer-First Design

RESTful API and WebSocket integration with SDKs in Python, Java, C#, and R.

Granular documentation, code samples, and sandbox environments for rapid testing.

Enterprise-Grade Reliability

99.99% uptime SLA with redundant data centers.

Built-in failover mechanisms for uninterrupted trading.

How Alltick API Transforms Algorithmic Trading

Capture Micro-Price Movements Tick data reveals hidden liquidity patterns and order flow dynamics. For example, a sudden surge in bid size for a Nasdaq-listed stock could signal an impending breakout—detectable only with real-time ticks.

Optimize Execution Timing Smart order routers (SORs) using Alltick’s live data minimize slippage by routing orders to venues with the tightest spreads.

Backtest with Precision Historical tick databases allow traders to simulate strategies against exact market conditions, avoiding survivorship bias.

Case Study: Quant Fund Boosts Alpha by 22%

A mid-sized quant fund switched from delayed data to Alltick API for its crypto arbitrage bots. By leveraging real-time order book snapshots, the fund reduced latency from 800ms to 3ms and increased annualized returns by 22%.

Why Choose Alltick API?

Cost-Efficiency: No need to build or maintain proprietary data infrastructure.

Scalability: Handle 100,000+ requests per second with dynamic load balancing.

Compliance: GDPR-ready and SOC 2-certified for data security.

Get Started Today

Whether you’re building a market-making engine, a momentum trader, or a risk management tool, Alltick API provides the real-time data edge your algorithms need.

📈 Free Trial: Test Alltick API with 14 days of full-access data. 💻 Documentation: Explore our developer portal at Alltick API.

Speed isn’t just about being fast—it’s about being first. Power your algorithms with Alltick API and trade ahead of the curve.

0 notes

Text

Outpace the Market: Instant Access to Global Tick Data via Alltick API

Introduction: The Power of Real-Time Data in Modern Trading

In today’s fast-paced financial markets, milliseconds can mean the difference between profit and loss. Whether you’re trading stocks, forex, futures, or cryptocurrencies, access to real-time tick data is critical for identifying trends, executing strategies, and staying ahead of the competition. Yet, many traders still rely on delayed data feeds—often lagging by 15 minutes or more—leaving them blind to immediate opportunities.

This is where Alltick API comes into play.

The Problem: Why Delayed Data Costs You Money

Most retail trading platforms and free data feeds display prices with a 15-minute delay. By the time you see a "live" price, the market may have already moved significantly. For high-frequency traders, arbitrageurs, or algorithmic systems, this latency is unacceptable.

Imagine trying to catch a wave with a surfboard tied to an anchor—delayed data holds you back from riding the market’s momentum.

The Solution: Alltick API Delivers Real-Time Market Data

Alltick API is a robust, low-latency interface designed to empower traders, developers, and institutions with real-time tick-level data across global markets. Unlike traditional feeds, Alltick eliminates delays, providing:

Zero-latency updates: Prices, order book depth, and trade executions streamed instantly.

Multi-asset coverage: Stocks, forex, futures, cryptocurrencies—all in one unified API.

High-frequency readiness: Process thousands of ticks per second with millisecond precision.

With Alltick, you’re not just observing the market—you’re reacting to it in real time.

Key Features of Alltick API

Real-Time Tick Data Capture every bid, ask, and trade execution as they happen. Analyze micro-trends and liquidity shifts that delayed feeds miss.

Global Market Coverage Access data from NASDAQ, NYSE, CME, Binance, Coinbase, and 50+ other exchanges worldwide.

Customizable Data Streams Filter data by asset class, exchange, or tick frequency. Reduce noise and focus on what matters for your strategy.

Enterprise-Grade Reliability 99.99% uptime, SSL encryption, and scalable infrastructure to handle peak trading hours.

Technical Advantages: Built for Speed and Precision

Low Latency: Data delivery in <10ms, optimized for algorithmic trading systems.

High Throughput: Handle 100,000+ ticks per second without bottlenecks.

WebSocket & REST Support: Choose the protocol that fits your architecture.

Historical Data Integration: Backtest strategies with synchronized real-time and historical datasets.

Who Benefits from Alltick API?

Quantitative Funds: Build alpha-generating models with granular tick data.

Retail Trading Platforms: Offer clients a competitive edge with live pricing.

Cryptocurrency Exchanges: Monitor cross-exchange arbitrage opportunities in real time.

Individual Traders: Execute precision trades using institutional-grade tools.

How to Get Started

Sign Up: Register for an Alltick API key.

Integrate: Use our developer-friendly documentation and SDKs to connect in minutes.

Scale: Upgrade to premium plans for advanced features like custom data pipelines and dedicated support.

Conclusion: Don’t Trade Blind—Trade with Alltick

In a world where markets move at the speed of light, delayed data is a relic of the past. Alltick API equips you with the tools to seize every opportunity, whether you’re scalping Bitcoin, hedging forex exposure, or optimizing a portfolio.

Ready to transform your trading? → Start your free trial today: Explore Alltick API

0 notes

Text

Every Microsecond Matters: Unlock Real-Time Trading via Alltick API

In the fast-paced world of trading, every millisecond counts. Whether you’re trading stocks, forex, futures, or cryptocurrencies, access to real-time market data isn’t just an advantage—it’s a necessity. This is where tick-level data becomes a game-changer, and Alltick API stands as your ultimate gateway to precision and speed.

Why Tick-Level Data Matters

Tick-level data represents the most granular form of market information, capturing every single price movement and transaction in real time. Unlike delayed data feeds—which often lag by 15 minutes or more—tick data reveals the exact price, volume, and timing of trades as they happen. For traders, this means:

Precision Timing: Execute strategies based on live market dynamics, not outdated snapshots.

Enhanced Strategy Development: Backtest models using historical tick data to simulate real-world conditions.

Competitive Edge: Stay ahead of algorithms and institutional players who rely on split-second decisions.

Traditional platforms leave traders in the dark with delayed data. By the time a 15-minute-old price appears on your screen, opportunities have already been seized—or lost.

Alltick API: Real-Time Data, Zero Delays

Alltick API eliminates the limitations of conventional data feeds by delivering real-time tick-level data across multiple asset classes:

Stocks: Track every bid, ask, and trade on global exchanges.

Forex: Monitor currency pairs with microsecond precision.

Futures: Access minute-by-minute shifts in commodities and indices.

Cryptocurrencies: Capture volatile price swings in BTC, ETH, and more.

Built for developers and traders alike, Alltick API integrates seamlessly into trading platforms, quant systems, and custom algorithms. No more scraping unreliable sources or managing costly infrastructure—our API handles the heavy lifting.

Key Features of Alltick API

Ultra-Low Latency: Receive data streams in real time via WebSocket or REST APIs, ensuring no lag between market movements and your strategy execution.

Multi-Asset Coverage: Aggregate data from global markets into a single, unified feed—ideal for diversified portfolios.

Historical Tick Archives: Access years of historical tick data to refine backtesting and uncover hidden patterns.

High Reliability: Built on enterprise-grade infrastructure with 99.9% uptime, Alltick ensures uninterrupted data flow during critical trading hours.

Developer-Friendly: Clear documentation, code samples, and 24/7 support accelerate integration, whether you’re a solo trader or a fintech team.

Who Benefits from Alltick API?

Algorithmic Traders: Optimize high-frequency strategies with live tick data.

Quant Funds: Build models using the most accurate market signals.

Retail Traders: Compete on par with institutional tools.

Fintech Platforms: Enhance user experience with real-time charts and alerts.

Case Study: Transforming Trading Outcomes

A hedge fund leveraging Alltick API reduced slippage by 32% by executing orders aligned with live tick data. A crypto arbitrage bot user reported 20% higher profitability after switching from delayed feeds.

Get Started Today

In trading, success hinges on the quality of your data. With Alltick API, you’re not just accessing numbers—you’re harnessing the pulse of the markets.

Why Wait? 📈 Free Trial: Test Alltick API with 7 days of real-time data. 💻 Easy Integration: Start in minutes with our SDKs and guides. 📞 Expert Support: Our team is ready to help you optimize every trade.

Visit Alltick API to unlock the power of tick-level data—because in trading, the future belongs to those who act now.

Alltick API—Where Data Meets Opportunity.

No delays. No compromises. Just the edge you need.

0 notes