Don't wanna be here? Send us removal request.

Text

Universal Life Insurance: Is It Right for You?

Universal life insurance is a popular form of permanent life insurance, but is it right for you? Like any financial tool, it depends on how you want to use it. What are your financial goals? What is your tolerance for risk? How much control do you want to have over your future wealth?

For many people who purchase a universal life insurance policy, the idea of cash value — a built-in savings/investment account within the policy — and its flexible payment options are appealing. But the truth is, most permanent life insurance policies render a cash value. And when it comes to infinite banking — using the cash value of your policy as your own private bank — and retirement planning, universal life insurance often isn’t the best option.

In this article, we’ll explain the 3 types of universal life insurance and the difference between universal life insurance and whole life insurance to help you decide which is best for you and your family.

TYPES OF UNIVERSAL LIFE INSURANCE

Universal life insurance policies fall into 3 categories: guaranteed, indexed and variable.

Guaranteed Universal Life Insurance is the least expensive universal policy. It functions more like term life insurance that doesn’t expire. The majority of guaranteed universal life policies earn little to no cash value.

Indexed Universal Life Insurance earns cash value based on the performance of certain market-based indexes, determined by your insurance provider. Common indexes include the S&P 500 or NASDAQ. Indexed universal life policies are more expensive than guaranteed universal policies because they earn cash value. However, they tend to be less expensive than variable universal policies and whole life policies.

Variable Universal Life Insurance earns cash value based on the performance of a portfolio of stocks and/or bonds, similar to mutual funds. These may be determined by your insurance provider or a broker, or you may have the option to choose your own. Variable universal life insurance tends to be the most expensive type of universal life insurance because policies usually charge brokerage fees for managing investments.

3 IMPORTANT QUESTIONS TO ASK BEFORE YOU PURCHASE UNIVERSAL LIFE INSURANCE

If the insurance company raises my premium, will I be able to afford it?

How would I feel if my cash value declines or reduces to zero?

Am I okay with knowing that my death benefit may also decline or expire?

After evaluating your responses, you might be asking yourself why anyone would purchase a universal life insurance policy.

Premium Payments

One of the appealing features of a universal life insurance policy is that the owner has flexibility when it comes to premium payments. If you have a financial hardship or unexpected expense, it’s possible to pay less on some premiums or use your cash value to cover policy costs. But there are two sides to every coin — your insurance company may choose to raise premiums at their discretion, meaning there is a very real possibility your policy will become more expensive over time.

Whole life insurance, on the other hand, has level premiums. They remain constant for the duration of the policy. It’s easy to budget with whole life insurance because you know the cost of the policy won’t change. And unlike universal life insurance, it’s possible to structure your whole life policy to be paid-up by a certain age, like retirement, so you don’t have to continue paying premiums.

Cash Value

If your universal life insurance policy is an indexed or variable one, the cash value of the policy is tied to market-based equity funds, which fluctuate in value. If market performance is up, you may earn significant gains in a given period. If the market experiences a downturn, you could earn nothing—or even lose cash value. This can be detrimental, particularly if you were counting on the cash value of your policy to help pay premiums, fund other investments, or to provide supplemental retirement income.

What’s more, indexed and variable universal life policies may place a cap on market gains or set a participation rate, which limits your upside potential. Depending on your insurance company, indexes and mutual funds may also set a predetermined performance threshold that must be met before you can tap into gains.

Death Benefit

Because a policy’s cash value is indicative of its death benefit, a universal life insurance policy that risks losing cash value may also have a death benefit that declines or even expires, rendering the policy void. If you need life insurance that is guaranteed not to lapse, universal life insurance may not be the best option.

Whole life insurance works differently, in that it isn’t exposed to the same market risks that can affect cash value. It offers more guarantees, including a no-lapse guarantee, provided premiums are paid.

UNIVERSAL LIFE INSURANCE POLICY RIDERS

When you buy an insurance policy, you often have the option to add policy riders — additional coverage for targeted needs. Policy riders allow you to customize your policy to fit your unique financial needs and goals. Most universal life insurance can be customized with the following riders:

No-lapse guarantee: Your policy is guaranteed not to lapse if your cash value falls below a certain threshold.

Guaranteed insurability: You may increase your death benefit at certain periods over the lifetime of the policy without additional medical exams.

Disability/waiver-of-premium rider: Policy premiums are waived if you become medically disabled

Accelerated death benefit rider: Access your death benefit while you’re still living if you are diagnosed with certain terminal/chronic illnesses.

Accidental death benefit rider: If you die accidentally, the death benefit paid out to your beneficiaries increases.

Child/spouse riders: Add supplemental insurance coverage for your spouse and/or children.

If your primary goal is to increase tax-advantaged wealth, however, you may want to opt for a whole life insurance policy. It’s the only permanent insurance policy that can be customized with a paid-up additions rider. Paid-up additions allow you to “overfund” your insurance policy to supercharge it for growth. By maximizing payments in the early years of the policy, you exponentially increase returns and generate greater cash value over the lifetime of the policy.

GETTING MORE OUT OF YOUR LIFE INSURANCE POLICY

Just like any other financial product available to put your money into, each has a specific purpose. Not all universal life insurance policies are bad, but it’s rare that people get what they expect from them. The best safeguard against hidden traps within an insurance policy is to understand the guarantees the policy can offer. The guarantees are the foundation to building a successful infinite banking strategy and solid retirement plan. A whole life insurance policy is the only permanent insurance vehicle that can:

Guarantee a fixed premium

Guarantee cash value principle and growth

Secure a death benefit for the rest of your life

What’s more, with the right whole life policy you can borrow your cash value and still earn guaranteed returns on it, in spite of outstanding policy loans. Essentially, you can borrow a dollar and invest it at the same time.

If you already have a universal life insurance policy that is underperforming, you may be able to salvage the tax-advantaged cash value via a 1035 Exchange, which allows you to essentially “roll over” your cash value into another insurance product, like a whole life insurance policy.

Request a free virtual consultation

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge #ethoslifehealthadvisors

Credits: PARADIGMLIFE

Date: July 31, 2022

Source: https://paradigmlife.net/blog/universal-life-insurance/

#areteautomation#lifehealthadvisors#bestforhealth#healthtips#livemorechallenge#ethoslifehealthadvisors

0 notes

Text

Does Being Transgender Affect Life Insurance?

Shopping for life insurance requires time and research to ensure you’re getting the best policy to fit your needs. But as a transgender individual, the process can be a bit more complex.

Do transgender people have to get special life insurance? And what is the best life insurance for transgender people? Below, we examine these questions and everything else you need to know about transgender life insurance.

Does Being Transgender Affect Your Ability to Get Life Insurance?

Being transgender in and of itself has no impact on life insurance underwriting, according to Ryan Pinney, president of Pinney Insurance Cente. You shouldn’t be denied a policy or charged a different rate simply because you are transgender. However, some insurance companies still use sex assigned at birth to determine the policy’s rate rather than the person’s gender.

The reason is that they base their risk assessment or underwriting on mortality, Pinney says, which is strongly tied to sex.

“For example, an individual assigned male at birth transitioning to female still has a prostate, which poses an increased risk for prostate cancer later in life, and individuals assigned females at birth still have an increased risk for osteoporosis,” he explains. Further, men generally have a lower life expectancy than women and usually pay higher life insurance rates.

Today, however, many life insurance companies will accept the gender the applicant identifies with, according to Jeremy Hallett, founder and CEO of Quotacy. The exact underwriting requirements vary by insurer. For instance, a few life insurance companies surveyed by Quotacy will use birth gender unless it’s been a minimum of three years since completing gender reassignment surgery, in which case it will consider the applicant’s current gender. Other companies surveyed said they would simply recognize the gender the applicant identifies with.

Life Insurance for Transgender People Who Have Already Transitioned

Pinney says that being transgender generally has no additional risk from a life insurance perspective, “but insurance companies will use your personal medical history to make any additional decisions.”

Hallet adds that care is taken when evaluating mental health and the effects of hormone therapies, which can affect insurance pricing. For example, transgender individuals are at a higher risk for depression, anxiety disorders and suicide than cisgender people. So insurance companies will want to review your medical history in detail to determine how any diagnoses and treatment history could impact your life insurance cost.

It’s important to note that a gender dysmorphia diagnosis is not considered a mental illness and shouldn’t impact life insurance rates. That said, each insurance company will evaluate this information on a case-by-case basis and may request a more thorough assessment by medical professionals.

Life Insurance for Transgender People Who Are Transitioning

Acquiring life insurance can be a bit more complicated if you’re in the process of transitioning.

“Most, if not all, insurance companies will postpone offering coverage if any gender-affirming surgeries are pending until after the completion of the surgery and recovery,” Hallet says.

That’s because there’s an inherent risk associated with surgery of any kind. Since life insurance companies are tasked with evaluating mortality risk, they will want to wait until after you’ve recovered from surgery before issuing a policy to ensure there aren’t any complications. So if you have a gender-affirming surgery scheduled for the future, you probably won’t be approved for a policy until surgery is completed.

In some cases, you may be required to provide an attending physician’s statement (APS). This is a letter from a doctor that provides a professional assessment of your health and additional context or details about a medical condition. It’s often needed for life insurance applicants undergoing specialized medical treatments.

If you’re worried about a delay in getting covered, the good news is that you may be able to get temporary life insurance to fill the gap. This covers you during the period between applying for a policy and getting approved. In other cases, the insurance company may backdate your policy.

Dealing With Discrimination When Applying for Life Insurance

Though life insurance companies are supposed to evaluate all applicants equally, discrimination can happen.

There are federal laws that specifically protect transgender individuals from discrimination relative to health insurance, Hallet says. Life insurance, on the other hand, is less clear. And the protections in place vary by state. Some have clear anti-discrimination laws in place, while others institute protections that may or may not include life insurance. Fortunately, more laws are being introduced to ensure transgender life insurance applicants are treated fairly.

For example, Hallet says the state of Delaware has current penalties to protect against unfair discrimination in the value of insurance policies and premiums based on race, color, religion, sexual orientation, gender identity or national origin. “Gender identity” is defined as “a gender-related identity, appearance, expression or behavior of a person, regardless of the person’s assigned sex at birth.”

New Jersey has a bill prepared for the 2022 session to prohibit unfair discrimination in issuing or rating life insurance policies based on transgender status or certain gender identity information.

That means choosing the right insurance company is key.

In a 2022 survey of more than 500 members of the LGBTQ+ community conducted by Bestow, it is clear that the LGBTQ+ community prioritizes end-of-life planning, with 63% of respondents having life insurance, a will or long-term care insurance.

“If you’re transgender, it’s important to work with an agent or broker who has access to many companies and can help transgender individuals navigate the underwriting process most effectively and efficiently,” Pinney says. “The best advisors and brokers will understand the transgender community, be able to provide rates from multiple companies, and advise which companies and products individuals should select.”

#lifehealthadvisors #areteautomation #future #lgbtq #coverage

Credits to: Casey Bond

Date: August 10, 2022

Source: https://www.forbes.com/advisor/life-insurance/transgender-life-insurance/

0 notes

Text

Does the Cost of Life Insurance Rise With Inflation?

Curious what components of life insurance rise with inflation? With a U.S. inflation rate currently more than 9%, many people are wondering what it means for the cost of life insurance. Will your policy premium go up? What does it mean for policies with cash value, like whole life insurance? And what does rising inflation mean for your policy’s death benefit?

In this article, we’ll cover what happens to the cost of insurance policies during inflation and how inflation affects the rate of return on your policy.

LIFE INSURANCE COSTS & RISING INFLATION

Like most consumer goods, when inflation hits, prices on life insurance can go up. This can be bad news if you have a permanent life insurance policy with flexible premiums, like universal life insurance, where your insurer can decide to raise costs. But if you have a whole life insurance policy, your policy has fixed premiums. This means whatever you’re currently paying, you’ll continue to pay for the duration of the policy, regardless of rising inflation.

Term life insurance policies generally have fixed premiums, but check with your provider. If your policy expires before you pass away, you may need to renew your insurance policy at a higher premium.

If you aren’t currently insured and are looking to buy life insurance, whole life policies provide better protection against inflation than other types of life insurance. But if a whole life policy is cost prohibitive right now, don’t wait to get coverage. A convertible term life insurance policy can give you the coverage you need at a low price, and you’ll have the option to convert it to an interest-earning whole life insurance policy at a later date — without the need for a medical exam. This will help you lock in the best premium and insurance rating.

DOES MY RATE OF RETURN ON LIFE INSURANCE RISE WITH INFLATION?

Right now, to combat high inflation, the Fed has rapidly raised interest rates, making it more expensive to borrow money from banks and third-party lenders. Whole life insurance allows you to act as your own bank, and borrow money from the cash value of your life insurance policy. Whole life insurance policies also earn a guaranteed rate of return, historically around 4–5%, that isn’t affected by inflation, but mutual life insurance companies also pay out non-guaranteed dividends on whole life policies that may be affected — in a good way.

For your insurance company, rising interest rates work in their favor by increasing their bond yield and investment income. When your mutual insurance company is profitable, you’re eligible for dividend payments. So, in a scenario of rising inflation and simultaneous rising interest rates, you may benefit. What’s more, when a life insurance company is profitable from their investments, they don’t need to raise premiums to cover costs — purchasing from an A-rated insurance company with good investment standings may provide the best premiums and earnings even in times of inflation.

FINDING THE BEST POLICY TO COMBAT INFLATION

At Paradigm Life, we work with the nations top-rated mutual life insurance companies to find the best policy for your financial goals. We can help you beat inflation by customizing your policy with policy riders, like a paid-up additions rider, which allows you to "overfund" your policy in its early years and supercharge it for growth to keep up with inflation. If you want to use your life insurance policy to generate business capital, send your children to school, or purchase real estate, we can show you how to maximize its potential and take advantage of policy loans to put borrowing power in your hands. If your primary goal is to use life insurance for retirement, we can build a policy that is paid-up by your retirement date, or one you can use to fund an early retirement without penalty. If you want to leave a financial legacy for your heirs, we can show you how to use life insurance as part of an estate plan and take advantage of tax benefits specifically available with life insurance, helping you keep more of your wealth in the family. Don't let the rise of inflation get in the way of your financial freedom.

Request a free virtual consultation with a qualified Wealth Strategist today.

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge #ethoslifehealthadvisors

Credits: PARADIGMLIFE

Date: Aug 6, 2022

Source: https://paradigmlife.net/blog/does-the-cost-of-life-insurance-rise-with-inflation/

#areteautomation#lifehealthadvisors#bestforhealth#healthtips#livemorechallenge#ethoslifehealthadvisors

0 notes

Text

Why Now Is the Time to Replace Your Life Insurance Policy

If you have loved ones that rely on your income, it’s important to always have the right life insurance policy. The only tricky part is that life keeps changing on you.

Maybe you just bought a new house, had a second child or got remarried. Whatever the reason, you realize your coverage needs to last longer than you thought.

While it might seem natural to wait until your current policy is about to expire before replacing it, experts say that’s just about the worst move you can make.

Here’s why, when it comes to matters of life, death and money, there’s no time like the present.

Why would I need to replace my policy?

With a “term” life insurance policy — the much more affordable kind — you only pay for the time you need, whether that’s five, 10, 20 or 30 years.

During that time, you’ll know that your loved ones won’t have to worry about losing the house or struggling with medical bills if something were to happen to you.

“Your biggest asset is yourself; your biggest asset is your income,” says Jeremy Hallett, CEO of life insurance comparison site Quotacy. “If you weren’t here to provide for your family, you’ll want to make sure that money is there.”

For most people, there’s no need to buy a permanent policy that will last until you’re 112. If you figure 20 years is enough time to pay off the house and build up savings for your partner, a 20-year policy will do.

That said, it’s hard to predict what your circumstances will be like 20 years in the future. Maybe you have a kid five years in — and with only 15 years left on the policy, it’ll expire well before your child graduates from high school.

As soon as someone knows they need more coverage, Hallett says, they should act right away.

Why you shouldn’t wait for your policy to expire

The simple math behind life insurance, Hallett says, is that “every year you get older, it gets more expensive.”

Imagine a healthy 30-year-old man was able to find a 20-year policy for about $21 per month. If he waits until age 50, when it expires, buying a new policy of the same length might cost him $85 per month — and that’s assuming he hasn’t developed any health conditions in that time.

“It’s cheaper to fix the problem today than to wait for the future to solve it,” says Hallett.

Cancelling a term policy early doesn’t come with any fees or penalties. Instead, moving swiftly before you get any older can help you lock in a low monthly rate that will pay off for years to come.

What to consider before getting a new policy

While it’s important not to dawdle, you still need to make sure the new policy you’re buying is the best fit for you and your family.

First, look at your life as it stands today and decide how much coverage you need, how long it needs to last and whether you need any additional riders.

Then it’s time to find the right insurer. There’s no need to stick with the same company that provided your original policy; in fact, the Insurance Information Institute recommends comparing at least three quotes before settling on an offer.

Shopping around for rates will ensure you get the best possible deal on your life insurance policy, meaning more coverage to protect your family and more money to spend on something fun in the here and now.

#lifehealthadvisors #lifeinsurance #finance #money #areteautomation

Credits to: Sigrid Forberg

Published on: July 15, 2021

Source:https://moneywise.com/insurance/life/it-will-never-be-cheaper-to-replace-your-term-policy-than-right-now

0 notes

Text

Overfunded Life Insurance: Why It Really Pays Off

Overfunded life insurance can help you quickly grow wealth, especially when utilized with whole life insurance as part of a Wealth Maximization Account™. In this article, we’ll explain what overfunded life insurance is and how it works, why overfunded life insurance is used by the wealthy (and large corporations), and how to use your own overfunded life insurance policy for tax benefits, cash flow, liquidity, asset protection, and more.

WHAT IS OVERFUNDED LIFE INSURANCE?

Often when shopping for life insurance, it becomes all about finding the cheapest quote. Getting the most coverage for the least amount of money seems like the best deal, right? Well, not necessarily. Depending on your financial goals and the type of life insurance you buy, sometimes it makes sense to pay more.

Term life insurance provides coverage for a predetermined time period, or term, and 100% of the cost of your policy goes toward its death benefit and administrative fees. If you pass away within the term, your policy pays out to your beneficiary. If you outlive your term, there is no payout and any money paid in premiums belongs to your insurance company. This is the cheapest type of life insurance and it comes with no living benefits — its sole purpose is to fund a death benefit.

Permanent life insurance policies are more expensive, but they come with several living benefits. These types of policies provide coverage for the lifetime of the insured. A portion of the cost of your policy goes toward its death benefit and administrative fees. The remainder goes into a built-in savings account called cash value. When you pass away, regardless of when that may be, your policy pays out to your beneficiary. But before that day comes, you can utilize the cash value of your permanent life insurance policy for personal loans, business capital, retirement income, or anything else you choose. On top of that, permanent life insurance policies grow your wealth by earning interest and some earn potential dividends.

When you take out a policy loan (borrow from your cash value), any interest or dividends you’ve earned can be borrowed tax-free. Unpaid policy loans are deducted from your death benefit (plus interest) when you pass away. Paying back your policy loans can be done on your own timetable and interest rates charged by your insurance company are typically lower than those found with banks or private lenders. In fact, using policy loans from a permanent life insurance policy essentially allows you to be your own bank.

If you’re interested in private banking with life insurance, it makes sense that you would want to have as much money in your “bank” as possible. After all, the more cash value you have in your insurance policy, the greater interest and dividends you can potentially earn, and the more money you can borrow (or withdraw). This is accomplished by overfunding your life insurance — paying more into your policy and/or structuring it in such a way that it is supercharged to grow wealth faster and accumulate more wealth over your lifetime.

WHOLE LIFE VS. UNIVERSAL LIFE

Perhaps you’ve heard that whole life insurance earns low rates of return or that it takes a very long time to grow wealth inside a policy. It’s true — typical whole life insurance policies aren’t structured for optimal returns or rapid growth. But when you properly structure your whole life policy to be overfunded, you can maximize your earning potential much faster.

Properly structured whole life insurance offers several guarantees and options not commonly found with other types of permanent policies. Plus, whole life insurance policyholders assume less risk than with other types of insurance like indexed universal life or variable universal life.

Here are 5 reasons why whole life insurance is ideal for overfunding:

Whole life insurance earns a guaranteed rate of return.

Whole life insurance from a mutual insurance company earns potential dividends.

Whole life insurance guarantees level policy premiums for life.

Whole life insurance policies aren’t subject to market volatility.

Whole life insurance policies can utilize a paid-up additions rider to optimize growth.

This last benefit, a paid-up additions rider, is a type of supplemental life insurance key to an overfunded life insurance policy. Its primary goal is to allow you to contribute the maximum amount to your policy allowed by the IRS to still receive tax benefits and front load your policy in the first several years for optimum earning potential and lifetime growth.

THE MODIFIED ENDOWMENT CONTRACT

The IRS regulates how much you can contribute into an insurance policy over a certain time period and still retain tax advantages. Overfund your policy by too much, too quickly, and you run the risk of it becoming a modified endowment contract (MEC), which falls under less favorable tax rules.

A paid-up additions rider, in conjunction with a whole life insurance policy, is designed to help prevent a policy from becoming a MEC by increasing your policy’s death benefit as you continue to contribute toward its cash value, maintaining the minimum required ratio of death benefit to cash value required by the IRS over any 7-year period.

This 7-year period can be viewed another way: as a 7-pay test. In fact, since 1983, all life insurance policies have been required to meet the 7-pay test to avoid becoming MECs. Prior to 1983, people were purchasing life insurance with very small death benefits, making substantial up-front payments instead of annual premiums, and enjoying the increased tax benefits applied to their accumulated interest and dividend growth. Realizing the policies were essentially tax shelters, the IRS modified its tax code to measure the amount of premiums paid into a policy over 7 years relative to the amount of the death benefit.

Every policy is different as far as how much cash value is considered “too much” by the IRS, as each policy has a different face value and premium, based on age and health. An ideal whole life policy structured for growth will overfund just under the 7-pay limit, as it pertains to the individual policy. Typically, the cash value should be around 80–90% of the premiums paid within the first 7 years for optimal growth, with very little premium going toward the death benefit.

Should you have temporary insurance needs, like outstanding loans, a mortgage, or business obligations that require additional financial protection, it’s possible to add an inexpensive term policy onto your whole life insurance policy, giving you the temporary coverage (additional death benefit) you need now without any long-term commitments or drain on your cash value accumulation.

HOW OVERFUNDED LIFE INSURANCE IS USED BY THE WEALTHY

While you don’t have to be wealthy to utilize private banking with whole life insurance, the wealthy typically use overfunded insurance policies to accomplish these goals:

Traditional role of death payout. The original purpose of insurance, dating back to the 1800s. If something unexpected happens, there’s a payout.

Liquid assets in case of emergency. Money withdrawn or loaned against the policy can be used for an unexpected event, such as a medical emergency or job loss, and there are no age-related penalties for accessing funds.

Asset protection. As a private contract between you and your insurer, your policy and its cash value are protected from creditors and legal action in most states.

Guaranteed loan provision. You can borrow against the policy to take advantage of any purchase opportunity — including business, investment, or personal — that requires liquidity and fast action.

Retirement savings. Without the contribution caps of 401(k)s or other qualified savings plans, overfunded life insurance is a safe option for retirement savings that is protected from market volatility and is accessible for early retirement before age 59 ½ without penalty.

Tax-advantaged wealth. Life insurance, compared to alternatives, has some of the most lucrative tax benefits, as follows:

Beneficiaries. The payout of life insurance to a beneficiary is income tax-free. It is also estate-tax-free if the overall estate falls under a certain level.

Cash value. The growth of cash value is tax-deferred and can be used tax-free in some instances.

Policy loans. The funds received from a policy loan are not subject to income tax.

Withdrawals. Withdrawals of cash value, called partial surrenders, are tax-free up to the basis (overall amount contributed to the policy).

In fact, overfunded whole life insurance is held as a Tier 1 Asset by nearly every major bank in the USA and has been used by the likes of McDonald’s and Walt Disney as a source of business capital.

SETTING UP YOUR POLICY

Provided you have a steady income, are in reasonably good health, and can commit to your long-term financial goals, overfunded life insurance may be a key part of your financial portfolio. If you’re a business owner, overfunded life insurance is nearly essential to securing the longevity of your company. And if you’re currently maxing out other retirement savings options or are looking for more reliability than Wall Street, a properly structured whole life insurance policy is almost certainly the way to go.

At Paradigm Life we can customize a policy to fit your financial situation. Our expert Wealth Strategists are available to answer your questions and show you customized illustrations, outlining an individual plan of action to help you achieve your goals. Request a free virtual consultation, no strings attached.

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge #ethoslifehealthadvisors

Credits: PARADIGMLIFE

Date: July 5, 2021

Source: https://paradigmlife.net/blog/overfunded-life-insurance-why-it-really-pays-off/

#areteautomation#lifehealthadvisors#bestforhealth#healthtips#livemorechallenge#ethoslifehealthadvisors

0 notes

Text

Build Your Own Bank with Whole Life Insurance

Have you ever wondered how to build your own bank using a whole life insurance policy?

Also known as a 770 Account or Wealth Maximization Account™, properly structured participating whole life insurance policies contain unique features that allow you to use life insurance as though it were your own private bank, while still retaining a death benefit for your heirs.

Banking with whole life insurance is a wealth strategy better suited for some individuals than others. And before you build your own bank, there are a few key factors to understand about how this type of policy differs from typical life insurance. Here’s what you need to know.

BUILD YOUR OWN BANK: WHO IS IT FOR?

Banking with whole life insurance is a wealth building strategy ideal for individuals looking to regain control of their finances — particularly when it comes to paying taxes and interest — and diversify away from Wall Street. This particular strategy works for:

Executives and business owners

Individuals looking to replace a 401(k)

Individuals who have maxed out 401(k) contributions

Individuals who want to retire early

Families with children (especially if saving for college)

Real estate investors

Individuals looking for increased cash flow

It’s not a get-rich-quick strategy, but it is a proven strategy — and it’s a safe one. Participating whole life insurance acts as a volatility buffer against market downturns and it’s been utilized by wealthy families and corporations for over 100 years. In fact, even banks hold billions of dollars in whole life insurance policies as assets. Shouldn’t your financial portfolio utilize the same strategy banks rely on?

BENEFITS OF BANKING WITH WHOLE LIFE INSURANCE

When you build your own bank with a participating whole life insurance policy, the primary purpose of your policy isn’t the death benefit. It is to fund your financing needs, like buying a car or home, paying for a child’s education, investing in real estate, or even funding retirement.

This is possible because whole life insurance features a built-in savings account called cash value, which earns a guaranteed rate of return and can be utilized as collateral, allowing you to borrow from your insurance company instead of a bank.

Why borrow from your insurer instead of your bank? There are several reasons:

You’ll typically receive a lower interest rate

You determine the payback schedule

There are no credit checks required

Payment history doesn’t show up on a credit report

Your loan is private (no UCC-1 filing)

You can access funds quickly

Your loan amount is based on your cash value, not on income or credit score

In addition to earning a guaranteed rate of return (better than most CDs or other bank savings accounts), your whole life insurance policy may also earn non-guaranteed dividends if it’s underwritten by a mutual life insurance company. Any growth in cash value is exempt from income tax, dividend tax, and capital gains tax, provided it’s used properly.

When you factor in growth from your guaranteed rate of return and non-guaranteed dividends, it’s likely you’ll still accumulate wealth with whole life insurance even if you’re paying interest on a policy loan. Your net interest will be positive. But that’s not all…

Most participating whole life insurance policies will pay returns on the full value of your policy, regardless of outstanding loans. For example, if you have $50,000 in cash value and you take out a $25,000 policy loan, you’ll still earn interest on the full $50,000. Every dollar you borrow still earns interest, even as you pay interest on your loan. You don’t have to sacrifice the growth of your savings to finance other opportunities. No other traditional bank or lender offers this benefit.

BUILD YOUR OWN BANK: HOW TO GET STARTED

Before buying a whole life insurance policy, it’s imperative to understand the financial commitment involved with owning one. Whole life insurance premiums remain level for the duration of the policy — in other words, your entire life — so you need to have a steady income. Failure to pay policy premiums will result in a lapsed policy, and you could lose money.

Whole life policies are considerably more expensive than term life insurance. But remember, the primary purpose of your policy isn’t insurance coverage or a death benefit for your family — it’s your bank. Once the death benefit and administrative fees are covered, the rest of your premium payment is reflected in your cash value, where it grows your wealth tax-free and can be borrowed to finance other investments and purchases.

Further, because you’re buying a life insurance policy, you’ll need to be eligible for coverage. Ideally, you want to build your own bank when you’re young and healthy because you’ll receive favorable premiums. However, if you’re approaching retirement, already retired, or have been denied insurance coverage in the past, don’t let it deter you from seeking out a participating whole life insurance policy. At Paradigm Life, we work with the nation’s top mutual insurance companies and have years of experience finding policies for a wide range of clients.

Banking with whole life insurance isn’t a passive wealth strategy, meaning before you build your own bank, you need to be willing to take an active role in your own financial future. You don’t need a finance degree, but you do need a clear outline of your financial goals. What’s your primary reason for wanting to build your own bank? Are you hoping to retire early? Diversify away from market volatility? Gain a source of business capital? Invest in real estate?

Whatever your goal is now, it’s also highly likely that your goals and financial situation will evolve over time. So it’s important to find an insurance agent or Wealth Strategist you can meet with at least annually to discuss your insurance policy and make necessary adjustments for optimal performance.

At Paradigm Life, our Wealth Strategists all own participating whole life insurance policies and are experts at banking with whole life insurance because it’s a wealth strategy they personally utilize. If you’re ready to build your own bank, we offer virtual consultations at your convenience and serve clients in all 50 states and Canada.

Request a free virtual consultation today.

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge #ethoslifehealthadvisors

Credits: PARADIGM LIFE

Date: December 22, 2021

Source: https://paradigmlife.net/blog/build-your-own-bank-with-whole-life-insurance/

#areteautomation#lifehealthadvisors#bestforhealth#healthtips#livemorechallenge#ethoslifehealthadvisors

0 notes

Text

The Newlyweds' Guide to Life Insurance

It’s officially wedding season! As the US continues to open back up, it seems that everywhere you look someone is getting married, with a double whammy of postponed 2020 nuptials and regularly scheduled 2021 events kicking off.

If you’re one of the many couples getting married this year — or perhaps you’ve already tied the knot (congrats!) — chances are there are a few high priority life items on your list to tackle. While life insurance may not be the first thing on your mind post-wedding, it is definitely worth thinking about as you tie your futures together.

Marriage is a partnership

For most people, marriage is a commitment on many levels: emotional, ethical and spiritual just to name a few, but also financial and practical! For one, there are usually beneficial, fiscal implications to tying the knot. There is even a fancy financial term that describes the relationship between spouses (and business partners): you share an insurable interest, that is to say, one of you will suffer hardship if the other passes away. Having a life insurance policy will help to ensure your spouse is taken care of financially, should something happen to you.

Just married? Now’s a good time for life insurance

It can’t be overstated that the best time to buy life insurance is always “yesterday” or, failing that, “right now.” That is because the younger and healthier you are when you purchase your policy, the lower the rate you can get. This is all the more important as you and your spouse likely share great plans for the future: you might be looking to buy a house and raise kids. If you choose to combine your finances, you will also be sharing your debt. All the more reason to plan carefully.

At Ladder, we believe in making life insurance personalized, simple, and flexible. If you want to lower your coverage during the lifetime of your policy, you can decrease your coverage amount with just a few clicks or taps in the app, which decreases your premiums by the same proportion.

A quick look at joint life insurance

The insurable interest defined earlier is a prerequisite for a type of life insurance known as “joint life insurance.” Such policies can be “first to die,” i.e. pay out to the beneficiary when the first spouse dies, or “second to die,” i.e. pay out when both insured parties die. The former can be practical because it involves just one policy that ensures a payout for the other party regardless of circumstances. “Second to die” policies typically don’t involve spouses as beneficiaries, but instead protect extended family members like grandchildren. Most people won’t benefit much from joint life insurance, unless one spouse cannot be insured due to a health condition — in which case the policy is calculated based on the healthy spouse.

The benefits of separate policies

Ideally, we would recommend both spouses get a separate life insurance policy. Going separate, for one, ensures each policy is tailored to each spouse and their financial situation, not just now but also in the future. For instance, if you and your spouse decide to buy a house and get a mortgage together, one of you might take on the mortgage payments while the other covers the expenses of managing your household. You may also choose different life insurance policies that reflect your respective incomes to maintain the same standard of living for your significant other.

#lifehealthadvisors #areteautomation #ethos #couple #insurance

Credits to: Liana Corwin

Date: June 29, 2021

Source: https://finance.yahoo.com/news/newlyweds-guide-life-insurance-142738778.html

0 notes

Text

Modified Endowment Policy vs. Permanent Life Insurance

A modified endowment policy is a life insurance product that can be useful for estate planning or retirement income with less volatility than market-based assets. It’s considered a form of limited pay permanent life insurance because it’s often purchased in one lump sum or over the course of a few annual payments, instead of level annual payments for life.

If you’re thinking about buying permanent life insurance but you don’t want to make annual payments every year in perpetuity, a modified endowment policy may be the right option for you. But before you buy, you should know that certain limited pay life insurance policies offer more benefits and advantages than others, especially when it comes to taxes.

MODIFIED ENDOWMENT POLICY TAX TREATMENT

When you buy a permanent life insurance policy, it typically features a built-in savings account called Cash Value. Your cash value reflects how much your insurance company would pay out if you were to terminate the policy, minus any fees or penalties. You can withdraw your cash value tax-free, up to the amount you’ve paid into your policy in premiums. You can also borrow against your cash value tax-free in the form of a life insurance policy loan. What’s more, permanent life insurance policies grow cash value in addition to what you pay in premiums. Some policies base growth of indexes or mutual funds, while others — namely participating whole life insurance — pay a guaranteed rate of return not tied to markets, plus non-guaranteed dividends.

Through the 1970s, many people purchased this type of whole life insurance specifically with the goal of maximizing tax-advantaged returns and growing cash value. Of course, the quickest way to do that is to pay a large sum upfront, either buying the policy in one single payment or a few payments spread out over the early years of ownership. But in 1988, life insurance laws changed, limiting tax advantages to policies.

Today, if you want to purchase a policy in one lump sum or with few payments to optimize growth, the IRS taxes cash value when you use it, whether you withdraw it or take a policy loan. Essentially, a modified endowment policy works more like a qualified retirement plan, such as a 401(k), than a cash value life insurance policy. The difference is modified endowment policies aren’t exposed to market volatility the way stocks, bonds and mutual funds are.

Here’s an overview of the difference in tax treatment between a whole life policy and a modified endowment policy:

Taxes & Whole Life Insurance

Tax-free growth of interest and dividends

Growth of cash value can be used tax-free

Tax-free policy loans

Tax-free retirement income

Income tax-free death benefit

Estate tax-free death benefit

Taxes & Modified Endowment Policies

Tax-deferred growth of interest and dividends

Growth of cash value is taxed when used

Policy loans are taxed

Retirement income is taxed

Income tax-free death benefit

Estate tax-free death benefit

WHY CHOOSE A MODIFIED ENDOWMENT POLICY?

When would it make sense to choose a modified endowment policy with limited tax advantages over a whole life policy? It depends on what you’re using your policy for. Generally, if your primary goal is to pass down tax-advantaged wealth to your heirs and lower estate taxes, a modified endowment policy fits the bill. It’s a one-time purchase you can essentially set and forget. Modified endowment policies may also be a viable option for retirees looking to protect some of their retirement income from market fluctuations.

A modified endowment policy could be right for you if:

You don’t plan on accessing you cash value until after age 59 1/2

You want guaranteed returns with less volatility than the stock market

You’ve already maxed out other qualified retirement plan contributions

You want to increase the tax-free death benefit your heirs receive

You want to make one lump-sum purchase instead of paying life insurance premiums annually for life

You’re approaching retirement or already retired

On the other hand, a whole life insurance policy is preferred if you’re looking to capitalize on the benefits of your policy during your own lifetime. It’s more hands-on in terms of managing your policy and making regular payments over a number of years, but the ability to take tax-free policy loans increases your liquidity and cash flow, whether it be for real estate, retirement, a child’s education, investment opportunities, business capital, or an emergency fund.

A whole life insurance policy could be right for you if:

You want liquidity and the ability to access your cash value at any time

You want guaranteed returns you can access tax-free

You want tax-free retirement income

You want to increase the tax-free death benefit your heirs receive

You’re committed to long-term financial goals

You’re young and have time to maximize cash value

THE WEALTH MAXIMIZATION ACCOUNT™

What if you don’t want to pay insurance premiums every year until you die, but you want the tax advantages and liquidity offered with whole life insurance? There is a third option: The Wealth Maximization Account from Paradigm Life.

Wealth Maximization Accounts are participating whole life insurance policies that are structured to be paid up in as few as 7 years. They still retain the tax advantages of regular whole-life policies but generate growth quickly similar to a modified endowment policy. What’s more, a Wealth Maximization Account may also include supplemental insurance called Paid-Up Additions that allow you to overfund your account in its early years within the parameters outlined by the IRS for life insurance tax treatment. This supercharges your cash value and delivers exponential growth over the lifetime of the policy.

If you’re deciding between a modified endowment policy or a permanent life insurance policy, schedule a free virtual consultation.

Tap to request your complimentary virtual consultation here.

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge #ethoslifehealthadvisors

Credits: PARADIGM LIFE

Date: January 23,2022

Source: https://paradigmlife.net/blog/modified-endowment-policy-vs-permanent-life-insurance/

#areteautomation#lifehealthadvisors#bestforhealth#healthtips#livemorechallenge#ethoslifehealthadvisors

0 notes

Text

Is Life Insurance an Asset or a Liability?

If you own a life insurance policy or are thinking about purchasing one, where does it fit on your balance sheet? You have to pay a monthly, quarterly or annual premium, so is it a liability? It might seem that way, but the answer is it depends on the type of insurance policy you own. Here’s what you need to know to determine if life insurance is an asset or a liability.

Life Insurance as a Liability

Any type of life insurance that doesn’t earn cash value is considered a liability. The most common type of non-cash value life insurance is term life insurance. With a term policy, you owe regular payments and you’re not guaranteed anything in return. If you outlive the term of your policy, your insurance company pockets the insurance premiums. Term life insurance only pays out a death benefit if you die within the specified term.

Life Insurance as an Asset

Any type of life insurance that earns cash value is considered an asset. Whole life and universal life are two of the most common cash value life insurance policies. With these policies, you owe regular payments but you also build cash value you can access at any time in the form of tax-free policy loans or withdrawals. These types of policies are considered permanent life insurance and pay a guaranteed death benefit, regardless of when you pass away, as long as premiums are paid. What’s more, whole life and universal life generate passive income, either through a guaranteed rate of return or based on market performance of certain indexes or sub-accounts. And whole life policies from mutual insurance companies pay non-guaranteed dividends.

This passive income growth is what sets permanent life insurance apart as an asset, and it can be used for a number of purposes, including funding a tax-free retirement. Whole life insurance in particular is able to grow wealth without the risks associated with market-based investments, shielding retirees against market volatility. And if you plan on retiring early, the cash value in a whole life insurance policy provides liquidity without penalties for withdrawal before 59 ½.

Why Whole Life Insurance is Considered an “AND” Asset

Whole life insurance is a unique asset in that you can both borrow your cash value AND earn money on it at the same time. Say you have $50,000 in cash value and you take out a tax-free policy loan for $25,000 to buy a car. Most savings accounts would only earn interest on the remaining $25,000 in your account. But with cash value in a whole life insurance policy, you’ll continue to earn interest on the full $50,000 — the cash value of your account.

For this reason, not only is whole life insurance an asset, it might be the most valuable asset on your balance sheet.

How Your Policy Protects Other Assets

On top of being a valuable asset, whole life insurance works to protect other assets. Because an insurance policy is a private contract between you and your insurance company, it’s often protected from litigation and claims from creditors. When you need a loan, you can borrow from your insurance company instead of through a bank and use your policy as collateral. You can take out insurance policies on yourself and key employees/business partners to help protect your business and generate business capital. You can hold policies in an irrevocable trust to help protect your estate and avoid or lower estate taxes. These are just a few of the ways whole life insurance helps grow and protect your wealth.

Is life insurance an asset or a liability? It depends on the policy — make sure you choose the right one.

Don’t wait, request your complimentary virtual consultation here.

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge #ethoslifehealthadvisors

Credits: PARADIGM LIFE

Date: February 28, 2022 Source: https://paradigmlife.net/blog/is-life-insurance-an-asset-or-a-liability/

#areteautomation#lifehealthadvisors#bestforhealth#healthtips#livemorechallenge#ethoslifehealthadvisors

0 notes

Text

7 Reasons You Need Life Insurance as an Entrepreneur

Many times entrepreneurs ask themselves these questions: Is purchasing a life insurance policy a good idea for me as an entrepreneur? I am young and in excellent health condition. So, why I would want to invest in an insurance policy?

You are an entrepreneur, and probably you have invested already your money, time, and efforts to ensure that your spark in the form of a business idea becomes a real business.

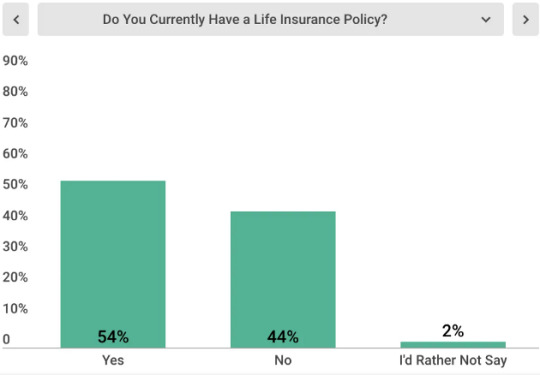

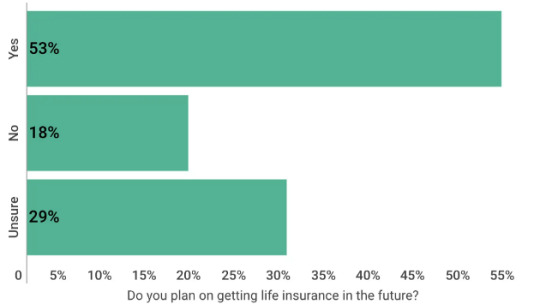

According to the survey about life insurance, 54% of Americans have a life insurance policy, and it is more than half of the people in the US. Something interesting that can be seen from the results is that only 33% do not fully understand their policy.

The survey also found that of just less than half of people without this insurance, more than 50% plan to get insurance in the future, and 44% are not insured because they can’t afford it.

When you understand how important life insurance can be for your life, you will start thinking much more about this topic.

Let’s start with the basics, or what is life insurance and why you need a life insurance policy.

What is Life Insurance?

When it comes to life insurance, in its simplest form, you will pay premiums to your insurance company, and the company will pay money to your estate or your beneficiary after your death.

With life insurance, you are protecting your heirs from this unfortunate possibility. This becomes more important when you are the sole source of income for your family. In this case, if something happens to you, your family will be protected from the financial point of view.

You Are Business Owner, So Why You Need Insurance

In the life of every entrepreneur, the risk is an essential part. You can lose your money. Also, you will have bad days with failed projects.

But all risks can be and will need to be managed somehow. When we talk about financial risks because of uncertainty, we can use some insurance. Regarding health issues, we have health insurance. Because of the risks around us, we decide to buy insurance, and in such a case to protect ourselves from the dangers of the risks that can be an unmanaged risk. For example, with health insurance, if you need to see a doctor without health insurance, even primary care can cost you a fortune.

As we already mentioned, you as an entrepreneur know that you need to expect unexpected things to happen in your work. Also, you know the importance to do things that will prevent some negative consequences, why you do not apply the same things for your own life as well.

Are you making risk assessments for your business? Probably you do something like this. So, you should be doing the risk assessment with your health and well-being. The only thing that will help you in managing such risks is being insured. This is an entrepreneurial way of thinking.

You need to take into consideration that without life insurance protection, the unexpected death or injury of some of the founders could crash the company, starting with layoffs and bankruptcy.

What is the First Thing You Will Need to Do?

The life insurance is not so much popular because it is the insurance we buy not for ourselves but for our beneficiaries and personally we will never benefit from this insurance. But your family will depend in the future on what you will do today.

So, before you decide to take life insurance, it is essential to do several things.

1. Analyze.

Start with the analysis of your needs. What is the situation when it comes to your personal and business finances? What your family will need if you pass away? Look at your personal and business debts, mortgage payments, the income of your family members, and future financial needs related to your kids as college, savings, and so on. When you calculate these things you will be in a better position when you search for life insurance policies.

2. Compare insurance companies.

When you have the figures from the previous step, and you know how much your family will need, now you need to compare different insurance companies and quotes. You will need to meet and talk with insurance agents to get information about what they offer. So, get the information and make a benchmark analysis to see what are the best options for your need.

3. Make a decision.

Now you know what you need, you know what are the best options when it comes to life insurance for you and you can make a decision to buy the most proper policy for you. Additionally, you want to be sure that the insurance company will still be there in the future when your beneficiaries need a payout.

Two Types of Life Insurance

There are two types of life insurance. The first is term life insurance, and the second is permanent life insurance.

The term life insurance policies as its name state cover a specified timeframe, usually from one to 30 years. In the worst case, if you pass away during the term’s coverage, the insurance company will pay out a specified benefit to the person or organization, also known as beneficiaries. So, you pay monthly amounts for a specific, and if you pass away while the policy is outstanding, then your beneficiaries receive a predetermined sum of money.

Permanent life insurance from the other side is not related to the specific timeframe (term), but it provides lifelong protection. Many policies offer guaranteed minimums for your cash value growth. As you continue to pay the amount of agreed premium every month, your beneficiaries will receive the full amount guaranteed by your policy.

Many wealthy individuals are using their life insurance policy as a savings account to assist their families.

Specific Reasons Why You Need Life Insurance

Here I want to cover some specific reasons you can take into consideration when you want to decide about life insurance. You need to understand that the life insurance policy should be a good fit for you and your business, reflecting the scope and scale of your business. So, when you decide about purchasing life insurance, as we mentioned earlier, you need to evaluate your individual insurance needs based several factors such as current and possible future debts, income replacement and current and future obligations.

1. You and your co-founders will need life insurance to ensure business survival.

If your cofounders, co-owners or some key employee is suddenly gone or get sick, the business can decline very quickly. With the right life insurance, the surviving partners will have sufficient capital to keep the business operations while looking for a replacement for the deceased partner.

Sometimes you can have persons as a part of your team crucial for your business, and you want to keep them permanently without retirement, the permanent life insurance should probably be most appropriate. On the other side, term life insurance can be more relevant in the case of team members who generate most of the income for the company, and the insurance will be related to the expected retirement date. Also, term life insurance policy is more appropriate if some of the partners personally guaranteed leases or loans for the business.

2. Save your company from bankruptcy after you

As an entrepreneur, probably you want your company to continue on the path of success after you are no longer in charge. Without having the required finances, bankruptcy is possible in such a case.

If you succeed to customize your life insurance policy according to your specific situation, the closing the doors of your company doesn’t have to happen. Your company will be saved even if something happens to you.

3. Brand protection

After you are retiring from making decisions in your company, the business may start to lose the money until there is an appropriate replacement for you. Your insurance policy can ensure the protection of your brand. There will be enough finances to keep things going on until the company finds a competent individual who will take your role.

4. Debts payment

You already know that every business need and will always need financing. If something happens to you, your company can not pay the debts you have taken for normal operations. With life insurance, all your debts can be paid if your policy covers your repayments to be paid by the insurer.

5. Employee protection

Because you are an entrepreneur who owns and manage the company, your small business team members are also dependent on you. Having insurance means that you will protect your employees. The finances from your life insurance policy can be used to keep the business going on and keep the employee’s payment.

6. Cash when you need it

When you need a short-term loan to cover some business expenses the life insurance can become helpful because you can use your savings as collateral security for borrowing money. If you have an appropriate life insurance policy, you can get finances when you need it.

7. Family protection

As we already mentioned here, your family will entirely depend on your income, so if something happens to you, your family might be left unprotected. To ensure that your family will continue with the lifestyle you have secured for them, and life insurance is something you will need to consider. The fact is that your family members will have to go on with life without you, but the life insurance policy will make that easier for them.

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #knowledge

Credits: Entrepreneurship in a Box

Date: 2022

Source: https://www.entrepreneurshipinabox.com/18232/7-crucial-reasons-why-you-need-life-insurance-as-an-entrepreneur/#:~:text=The%20only%20thing%20that%20will,starting%20with%20layoffs%20and%20bankruptcy.

0 notes

Text

What Are the 3 Primary Types of Life Insurance?

You know you need life insurance, but which type of policy is best for your family? There are 3 primary types of life insurance, and each comes with its own advantages (and disadvantages). The type of life insurance that’s right for you depends on your needs, your financial goals and your budget.

In this article, we’ll break down the 3 primary types of life insurance: whole life insurance, universal life insurance, and term life insurance. Keep in mind that whichever policy you ultimately choose, there are a number of ways you can customize your policy to better fit your unique situation. And if you’ve already purchased a policy, it’s not too late to change course. In fact, as your family grows and your financial situation evolves, it’s common for your insurance needs to evolve too.

TYPES OF LIFE INSURANCE

WHOLE LIFE INSURANCE

Whole life insurance is a type of permanent life insurance. This means that you have coverage for life, as long as your insurance premiums are paid. Premiums remain level for the duration of the policy — whatever rate you get when you purchase the policy is the same for life; it will never go up.

In addition to life insurance coverage, a whole life policy also comes with a built-in savings account called cash value. When you pay your premium, it increases your cash value. You also earn a guaranteed rate of return from your insurance company, which further grows your cash value. On top of that, if you purchase a policy from a mutual insurance company, you’re eligible to receive non-guaranteed dividends. The top-rated mutual insurance companies we do business with at Paradigm Life have historically paid out dividends for over 100 years.

So, what’s the big deal with cash value? It’s considered a living benefit, which means you can use it during your lifetime. You can borrow it tax-free at any time, or you can withdraw it. People who own whole life insurance often use their cash value for real estate purchases, college tuition for their children, business capital, or even to fund retirement.

Request a free virtual consultation

UNIVERSAL LIFE INSURANCE

Universal life insurance is another type of permanent life insurance that provides coverage for life, as long as your insurance premiums are paid. Universal life insurance premiums are flexible. You may have the option to pay less if you have a financially difficult year. However, the insurance company can also raise your premium if they choose.

In addition to life insurance coverage, universal life policies also earn cash value. It increases when you pay your premium and you may be able to “over pay” some premiums to grow cash value faster. Insurance companies don’t pay a guaranteed rate of return on universal policies. Instead, growth is based on the performance of the insurance company and its investments, often tied to indexes like the S&P 500 or NASDAQ. Universal life insurance policies typically don’t earn dividends.

Like whole life insurance, your cash value is yours to use during your lifetime. It can be borrowed tax-free or you can withdraw it. But because universal policies don’t earn a guaranteed rate of return (if the insurance company doesn’t perform well in a fiscal year, you may not earn anything at all), it can be hard to plan ahead for financial goals like retirement with universal life insurance.

If you currently own a universal life policy but want the certainty a whole life policy provides, it’s possible to transfer cash value from one policy to another with a 1035 exchange. This allows you to retain certain tax advantages from any earned cash value in your universal policy.

TERM LIFE INSURANCE

Term life insurance only provides coverage for a specified number of years, not for the duration of your life. That means that if you don’t pass away during the term for which you’re insured, your beneficiary won’t receive a death benefit payout. Term life insurance premiums are usually level — they remain the same for the duration of your policy, and they’re the least expensive of any type of life insurance.

The reason term life insurance is so inexpensive is because it doesn’t have a cash value component. There is no living benefit to owning a policy.

If you can’t afford a cash value life insurance policy now but want the living benefits it offers, the best option may be to purchase convertible term life insurance. Convertible term policies allow you to lock in a good health rating now and essentially roll it over to a whole life insurance policy at a later date without an additional medical exam. This means you’ll receive an optimal premium when you’re ready to upgrade your policy.

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge #ethoslifehealthadvisors

Credits: PARADIGMLIFE

Date: March 12, 2022

Source: https://paradigmlife.net/blog/what-are-the-3-primary-types-of-life-insurance/

#areteautomation#lifehealthadvisors#bestforhealth#healthtips#livemorechallenge#ethoslifehealthadvisors

0 notes

Text

Does Life Insurance Cover Accidental Drug Overdose?

Both life insurance and accidental death insurance can cover accidental drug overdose in some scenarios. While life insurance covers most causes of death, accidental death coverage pays only for accidents. People buying accidental death coverage often think that this type of insurance covers any accident as long as the person did not die of natural causes. But this is not always the case. Almost all ADD policies have several exclusions in them. Exclusions are provisions in a contract that work to exclude certain deaths from coverage and, if applied, will result in an ADD claim denial.

One of such exclusions is drug exclusion.

A drug exclusion usually says that the policy does not cover any loss resulting from an injury sustained while voluntarily taking drugs which federal law prohibits dispensing without a prescription unless the drug is taken as prescribed or administered by a licensed physician. Often this exclusion is interpreted to mean that if a deceased insured had drugs in the system at the time of death, the death would be excluded from coverage. Such interpretation does not always work in the beneficiaries’ favor and results in many ADD claims being denied due to drug exclusions. However, not every death that involves drugs should be excluded. There are many other factors that should be considered before deciding whether the death falls under the accidental death exclusion.

This article will help you understand if and when a life insurance policy covers drug overdose and what to do if your claim was denied due to drug abuse.

Drug Overdose and Life Insurance Exclusions

First, there is a distinction between life insurance and accidental death coverage. Life insurance normally covers all deaths unless there are provisions for non-payment due to suicide or there are material misrepresentations on the life insurance application and the death occurred within the first two years of the policy issue date. Accidental death policies, on the other hand, do not have such broad coverage and usually pay only if the death is due to an accident and none of the exclusions apply. Accidental death policies can provide coverage for drug overdose only in certain scenarios. One of the most important factors to consider is the wording/language of the exclusion itself. Other important factors in deciding whether the exclusion applies are:

Was the overdose intentional or accidental?

What type of drug was used by the insured?

Was the drug prescribed? If yes, was it taken according to the prescription?

Could the insured foresee that death would result after taking the drug?

What are the laws of the state where the death occurred?

Life insurance companies can deny coverage if they can prove that the drug overdose was deliberate (suicide) or the insured used illegal drugs or abused prescription medications. Insurers can also deny ADD claims where exclusions are written to exclude from coverage any death where a drug is a contributing factor (for example, an insured died in a car crash but the toxicology revealed illegal drugs in his/her system that impacted driving). If your life insurance claim is denied due to any of these scenarios, it is still prudent to consult with a life insurance lawyer experienced in drug-related cases.

Accidental Drug Overdose

Both life insurance policies and state laws have different definitions for “accidental death”. According to the National Institute on Drug Abuse, a death is accidental when:

the drug was taken accidentally

too much of a drug was taken accidentally

the wrong drug was taken or given in error

an accident occurred in the use of a drug in medical or surgical procedures.

Otherwise, drug overdose is considered a suicide by overdose and not an accidental death. Frequently, overdoses result from improperly prescribed drugs, an accidental double dose of narcotic painkiller or other sedative-type of medications, or interactions of various drugs taken together. In such cases, the death is likely to be ruled as accidental, especially if the insured was under medical supervision at the time of the overdose.

Overdose on Illegal vs. Prescription Drugs

Another factor that helps determine whether the drug overdose was accidental, is the type of drug the insured used.

If the overdose occurred as a result of using illicit drugs such as meth, cocaine, or heroin, the insurer may argue that the insured knew or should have known the risks of using such drugs, and deem the overdose as intentional, thus refusing to pay the claim. On the other hand, if prescription drugs prescribed by licensed physicians are involved, the death is likely to be considered accidental if the medications were taken according to the doctor’s advice and not abused. An overdose on prescription drugs is not straightforward. In some cases, life insurance companies may still refuse to pay using the drug exclusion as a reason to deny paying the death benefits.

When a beneficiary files an ADD claim, the insurance company will request a toxicology report. The toxicology report usually shows the substances that were found in the insured’s body at the time of death.

Let us suppose the insured was taking Oxycodone and it was reflected in the toxicology report. The insurance company will analyze the toxicology report to see whether the level of Oxycodone in the insured’s system was within a therapeutic range.

The insurance company will hire a medical expert to analyze the report. In some cases, the insurance company will send the report to a registered nurse or a physician who will review it and render an opinion as to whether Oxycodone was taken according to a physician’s advice.

The problem with this is that medical experts rarely agree on what constitutes a therapeutic range for a drug without considering other factors. For example:

How old was the insured?

What was the insured’s tolerance to the drug?

How long after death was the postmortem exam done?

Did the insured have a liver failure? What are the liver function test results? What other medications was the insured taking?

Did he have any other illness at the time of death that could have slowed his metabolism?

Was the medication administered to the insured while he was unconscious?

When insurance companies’ consultants evaluate toxicology reports, they do not take into consideration all these factors and wrongfully deny many ADD claims. In many cases, they simply put the drug concentration number in Dr. Winek’s Scale or another drug concentration table to see in which range it falls and will deny a claim if the drug concentration is not within a therapeutic range.

Life Insurance Claims and Marijuana Use

At the time this article is written, medical cannabis is legal in about half the states of the country and some states allow recreational use. Even so, many life insurance policies have explicit regulations and exclusions when it comes to marijuana use and it is not uncommon for them to deny claims due to drug exclusion if the insured used marijuana before death. Accidental death policies may not cover deaths where cannabis use contributed to the death.

Contestable life insurance claims may be problematic if the deceased did not disclose using marijuana for medical reasons or recreationally. Non-disclosure of marijuana use on a life insurance application could be considered misrepresentation and lead to a denied life insurance claim if the insured died within the first two years of the policy issue date.

If your claim has been denied due to marijuana use, call us for a free consultation. Our lawyers have extensive experience with marijuana-related cases and can help file an appeal for you. See how they helped recover ADD benefits for a claim denied due to the use of cannabis.

If you want to read more about cannabis laws, check our guide where we explain how they work and how denied claims based on marijuana use are handled.

What to Do if Your Claim Was Denied Due to Drug Use

Accidental death claim denials based on a drug exclusion can be complex and very confusing. They require medical experts and experienced life insurance attorneys.

A life insurance attorney who has handled many ADD claim denials in the past will know exactly what to do to get your ADD claim paid. Our law firm has successfully handled many denied accidental death claims. We have worked with reputable medical experts who provide reliable service. Our ADD attorneys know how to deal with claim denials to get claims paid fast.

#areteautomation #lifehealthadvisors #bestforhealth #healthtips #livemorechallenge #ethoslifehealthadvisors

Credits: Tatiana Kadetskaya

Published: January 18, 2021

Source: https://life-insurance-lawyer.com/accidental-death-claim-denied-due-to-drug-exclusion/

#areteautomation#lifehealthadvisors#bestforhealth#healthtips#livemorechallenge#ethoslifehealthadvisors

0 notes

Text

Business Owned Life Insurance: Who Can Buy a Policy?

If you’re an entrepreneur, you might be wondering, “Can a business own a life insurance policy?” The short answer is yes. But before you buy, find out why business owned life insurance is so important and which type of policy offers the most benefits for your company.

5 REASONS WHY BUSINESS OWNED LIFE INSURANCE MAKES SENSE

Business owners can use life insurance for a variety of reasons. Here are a few you might consider for your company:

It can help generate business capital.