Don't wanna be here? Send us removal request.

Text

California Proposal Paves Way For Six Months' Paid Parental Leave

A new proposal by California governor Gavin Newsom might find new parents with the longest paid parental leave in the country–six months of paid leave that includes mothers and fathers.

As part of the 2019 budge plan Governor Newsom announced, he shared he is requesting six months of paid leave for parents after the birth or adoption of a child.

His proposal states that the administration is committed to expanding the Paid Family Leave program and is wanting to ensure that newborns and newly adopted babies are cared for by a parent or close family member in their first six months. The proposal looks to promote family bonding in an affordable way for all parents.

Related: Washington State To Offer Paid Leave Plan For New Parents

The current California Paid Family Leave plan offers up to six weeks of leave for parents, and mothers may receive an additional six weeks on disability. Same-sex couples and adoptive parents do not receive that, however. Governor Newsom's plan, if approved, will cover the care of a newborn or newly adopted baby for six months, allowing the two parents to split the time if they chose.

Newsom says it is a developmental necessity. He's the father of four himself and says that he wants to support California parents so that they can give kids all the love and care they need in critical early periods where so much development occurs.

Three other states (New York, New Jersey and Rhode Island) offer paid family leave, though Washington, Massachusetts and the District of Columbia have plans rolling out in the next few years that will offer parents anywhere between four and twelve weeks.

Related: D.C. Proposes New Paid Leave Law

Jenya Cassidy is the Director of the California Work & Family Coalition and says she hopes the proposal will be a new precedent for the rest of the United States, particularly as it's the only developed country in the world without guaranteed paid parental leave policies.

Photo: Halfpoint/Shutterstock

The post California Proposal Paves Way For Six Months' Paid Parental Leave appeared first on Mothering.

0 notes

Text

How to Make a Planner Vision Board

Did you know that the second Saturday of January is National Vision Board Day? With two weeks into the New Year, we've gotten our acts together and settled back into our “non-vacay” mode.

As a crafty girl, I take my vision board very seriously! It has to be functional. It has to be accessible…and oh yeah…it has to look good! Now, without throwing any shade, let me say this. I've seen lots of vision boards and many of them look like ransom notes. I'm just keepin' it real! All the chopped up magazine words and images can easily come together to look like crime scene evidence rather than an inspiration. To remedy the epidemic of ransom note vision boards, I'm sharing a few of my own crafty tips for making a vision board that works!

My first tip for vision boarding is to use you planner as the home of your board. Your planner is always within reach and you can reference your vision board whenever you want. By keeping a planner vision board, you'll constantly be reminded and inspired by the goals you set.

To make a planner vision board, you'll need a few crafty items:

12 x 12 patterned paper. Use whatever you love. This will add some color to your vision board and serve as the base of the project.

Stickers!!! Obviously.

Magazines. Even though we're ditching the ransom note look of vision boards, you can still make good use of magazines. Just don't start chopping up too many pictures and words.

Printable journaling cards – YAY! You'll want to have a spot in your vision board for making notes and writing some journal-like entries. We've created an empowering collection of journaling cards that you can download for FREE!!!

A planner. If you're going to make a planner vision board, you'll need a planner. As you probably already know – my go-to planner is my Happy Planner. This super-customizable planner is perfect for adding your own creative elements…like a vision board.

A Planner Punch Board/Word Punch Board from We R Memory Keepers. This punch board let's you punch holes in the edge of your vision board, so you can easily store it in your planner. You're also able to use the Word Punch Board to create custom words for your vision board!

Scrapbooking ephemera. If the word “ephemera” is new to you don't worry! Ephemera are essentially cute decorative pieces of paper that you can use to decorate your planner, scrapbook, journal etc. Most ephemera packs include frames, journaling cards, images, motivational sayings and more. To find your favorite ephemera pack, just head over to Amazon and search “American Crafts Ephemera.” You'll find lots of options!

CLICK HERE TO DOWNLOAD & PRINT YOUR JOURNAL CARDS

STEP ONE:

Use a paper trimmer to cut your patterned paper to 9.25″x12″

STEP TWO:

Use a scoring board to score the paper at 7″

STEP THREE:

Fold the paper as shown

STEP FOUR

Punch the edge of the paper with the Planner Punch Board and insert into your Happy Planner

Now that you've created the base of your vision board, you can get to work adding all the goals and decorative elements that will make this board an inspiration all year long! Here are a few tips for how I but my vision board together!

TIP: Use journaling cards or ephemera frames on the outer fold of your vision board. This can be a place to write down all your main goals for the month, year, season…whatever!

TIP: Use the inner portion of the paper for placing images, inspirational phrases and notes. This can be the place where you dive into each of your goals and create a more traditional vision board.

TIP: Print off a few extra journaling cards to use throughout the year! Vision boards are a great way to jump start your motivation and these journaling cards are quick and easy ways to keep you going.

Happy vision boarding! Be sure to tag #DamaskLove and @DamaskLove on Instagram to show how you're creating your own vision board this year.

And if you're in the mood for even more vision board inspiration, head over to Live Abode where we're sharing some awesome tips for creating your own vision board party!

0 notes

Text

Affordable A-frame house can be built by just two people

Avrame. " src="https://cdn.vox-cdn.com/thumbor/GY-Wu-lmpSBgjlNYywnqRlRgyjI=/142x0:4818x3507/1310x983/cdn.vox-cdn.com/uploads/chorus_image/image/58906557/DUO_exterior_F1_v_3.0.jpg" />

More like A+ frame!

Whether it's a beachside retreat or a cabin in the woods, the A-frame is a special type of building. You might recall the quirky triangle structures from vacations of yore, complete with avocado kitchens and shag carpets. But thanks to Instagram, nostalgia, and the allure of a certain way of life, the A-frame is back and better than ever.

We've seen more A-frames as vacation rentals, tiny A-frame cabins that cost just $700 to build, and even a flatpack version that sets up in six hours. The latest to catch our eye are kit homes from Estonia-based Avrame.

Indrek Kuldkepp, founder and owner of Avrame, first designed his own A-frame as a comfortable, efficient, and affordable home that could be built quickly and easily. After Kuldkepp realized that his A-frame cost about half as much as other homes to build, he decided to start a business selling self-build A-frame kits.

Avrame now sells 11 different models of A-frames, from tiny backyard sheds to larger versions that can comfortably fit a family. All the models feature full-length windows to provide natural light The Duo 100, for example, is on the smaller size at about 613 square feet, with one bedroom and one bathroom on the main level and a sleeping loft up above. The largest model, the Trio 120, has 1,300 square feet of living space with three bedrooms and two bathrooms.

When you buy an Avrame, the kit includes timber, the roof, the floor structure, windows and doors, building accessories, and a full set of drawings for building the structure. Avrame doesn't provide the building foundation or the interior finishings, but they do say that two people with reasonable skills can build the kits themselves. The entire process-from choosing a kit to moving in-usually takes four to eight months.

Avrame says their homes are more efficient and maintain heat better than traditional A-frames thanks to durable structural insulated panels. You can also add onto to any model by making the A-frame longer.

Prices range according to the size of the A-frame, with the largest model-the Trio 120-costing about $35,000.

Since we first reported on Avrame, a US outpost has set up shop in Salt Lake City, Utah, with a new US-specific website here. Designed to pass the most common building code requirements in the U.S., Avrame USA works with each client to determine local requirements and makes adjustments as needed. The good news, however, is that this means that Avrame kits are now available in all 50 states. Head over here for more.

Courtesy of Avrame

The interior of the Duo model by Avrame, one of the mid-size kit homes.

Courtesy of Avrame

All of the kit homes can accommodate wood burning or gas fireplaces.

Courtesy of Avrame

The small kitchen area of the Duo feels airy thanks to floor-to-ceiling windows.

Courtesy of Avrame

The exterior of the Trio model.

Courtesy of Avrame

The interior of the Trio, one of the larger models.

Courtesy of Avrame

Large windows bring the outdoors in with the Trio model.

0 notes

Text

Chalk Paint on Plastic Pots – An Amazing Makeover!

Try chalk paint on plastic pots for an easy makeover that you'll love, especially if you match the paint to your home decor! I found my set of plastic plant pots at our local Walmart. Each one is $5 and I love the quality. They are heavy, sturdy, and the fake dirt inside is solid. [...]

The post Chalk Paint on Plastic Pots – An Amazing Makeover! appeared first on Pet Scribbles.

0 notes

Text

The Anatomy Of An Adjustable Rate Mortgage Increase

I'm so excited to share with you something I got in the mail the other day. No, it wasn't a notification that Financial Samurai had won an award for being the best personal finance site. My site is too focused on understanding hard things to make us all rich to appeal to the masses.

Instead, I got something better. It was letter from my bank saying my adjustable rate mortgage interest rate is going up!

This is the first time I've ever received such a letter because, in the past, I would always refinance my 5-year ARM (my preferred ARM term) lower before the fixed period was up.

But with interest rates having moved up since I bought my house in 2014, the logical thing to do was keep holding it until the reset.

The Origins Of Our 5-Year ARM

We bought a San Francisco single family fixer in 1H2014 for $1,250,000. We were tired of living in the north end of San Francisco for the past 9.5 years and wanted a change of scenery.

Originally, we had planned to relocate to Hawaii, but when we found our current house with ocean views, we though this would be a good compromise.

We put down 20% and took out a $992,000 5-year ARM. Originally, I was going to put down 32%, because I had about $430,000 come due from a 4.1% 5-year CD. But with a mortgage rate of only 2.5%, I felt it was worth borrowing more and investing the difference.

The 2.5% mortgage rate was based on the one year LIBOR rate + a 2.25% margin – 0.25% discount for being an excellent customer. Back in 2014, the one year LIBOR rate was at only 0.5%, hence my 2.5% rate.

The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds from other banks in the London market.

LIBOR is the most widely used global “benchmark” or reference rate for short-term interest rates. Check out the historical one-year LIBOR chart below.

As you can tell from the one-year LIBOR chart, I bottom-ticked my mortgage rate in 2014. Some of you might be thinking that instead of getting a 5/1 ARM, I should have gotten a 30-year fixed rate instead.

But given my strong belief that we will be in a permanently low interest rate environment for the rest of our lives, I felt that paying 0.85% – 1.25% more for a 30-year fixed rate was a waste of money. So my actions followed my brain.

Besides, the average homeownership duration in America is only around 8.7 years. At most, one may consider taking out a 10/1 ARM to match durations.

As I planned to either sell my home within 10 years in order to buy a nicer home in Hawaii or pay off the mortgage during this time frame, to me, taking out a 5/1 ARM was worth the “risk.”

Regardless of whether you want to waste your money on a 30-year fixed mortgage or not, mortgage rates have indeed gone up for all of us since 2014.

Based on the current one year LIBOR rate of ~3.1% + my margin of 2.25% – my 0.25% for being an excellent client, my new mortgage rate should be a reasonable 5.1% when it resets in mid-2019.

If I end up paying 5.1% for the next five years, my average mortgage rate over a 10 year period would be 5.1% + 2.5% = 7.6% /2 = 3.8%. 3.8% is pretty much in-line with the rate I would have gotten if I just locked in a 30-year fixed rate mortgage in 2014.

However, with the money saved from not paying a 30-year fixed mortgage and the $100,000+ less in downpayment, I ended up investing the difference and earned a ~7% return on average from 2014 – 2018 because the stock market went up until 2018. Although I did eek out a 0.8% gain in 2018.

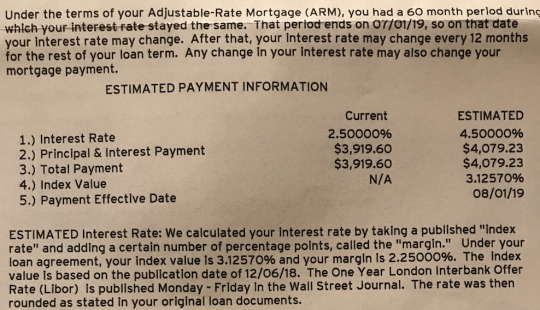

But surprise! I won't be paying an estimated 5.1% mortgage rate in 2019. Instead, my letter says that I'll be paying an estimated 4.5%. Have a look at the portion of the letter below.

The letter clearly states how they calculate my mortgage rate, yet for some reason, they still come up with an estimated rate of 4.5% instead of 5.1%. Perhaps my good customer discount of -0.25% will grow to -0.85% next year? Or perhaps my bank simply made a mistake in their calculation.

No, no. Banks aren't stupid. The reason why my rate only goes up from 2.5% to 4.5% is that under the terms of my mortgage, my ARM can only reset by at most 2% after the initial 5-year fixed rate of 2.5% is up.

This maximum reset amount is pretty standard among ARM loans. But this reset amount is something you must have your bank point out in the document.

The other thing to note is that ARM loans generally have a maximum mortgage interest rate they can charge for the life of your loan. In my case, that maximum is 7.5%, but we're never going to get there in my opinion.

Unfortunately, after one full year at 4.5%, my bank can raise my ARM by another 2%, bringing my mortgage rate up to 6.5% for year seven.

However, I doubt rates will keep on surging higher as the global economy slows. Instead, by the time my ARM reset occurs again in 7/1/2020, we might very well be in a recession with one year LIBOR rates moving back down.

Paying Down Principal

In order to make more money, mortgage brokers and banks LOVE to scare the heck out of inexperienced homebuyers by saying their payments will surge higher once an ARM resets.

They don't show them a 35-year historical chart of declining interest rates. By scaring their customers, they have a higher chance of locking them into 30-year fixed rate mortgages for fatter margins.

Don't be fooled.

Historical 30-year Mortgage Interest Rate Chart

You can see from the letter that despite my mortgage rate increasing from 2.5% to 4.5%, an 80% increase, my monthly payment is only expected to increase from $3,919.60 to $4,079.33, a mere 4% rise.

The reason for the slight increase in monthly mortgage payment is because we've paid down 32% of our loan in 4.5 years ($992,000 down to $734,000).

Paying down over $250,000 in our mortgage was partly due to normal monthly principal payments coupled with random extra principal pay downs. Although the 2.5% interest rate is low, paying down mortgage debt has always been part of my long term investment strategy.

Following my FS-DAIR strategy, I would regularly try and use 25% of my free cash flow to pay down debt and use the other 75% to invest. Again, I'm just taking action based on my own advice.

I kept on paying down principal randomly until the 10-year yield breached 2.5% in December 2017. Once the 10-year yield was higher than 2.5%, I stopped because I was now getting an interest-free mortgage since I could simply invest the amount of my mortgage in a 10-year bond yield to cover all my payments.

Living for free is one of the best things ever!

If I had taken out a 30-year fixed mortgage for 3.625%, I wouldn't have been able to experience interest-free living.

Your mileage will vary in terms of how much principal you actually paid down during the initial fixed rate period of your ARM. However, even if you didn't pay down any extra principal during a five year period, you will have still paid down ~10% of your principal balance, depending on your interest rate.

An Appreciation In Your Home's Value

Even if you've got to pay a higher mortgage rate when your ARM resets, you may be pleased to discover that your home has appreciated in value during the fixed rate period.

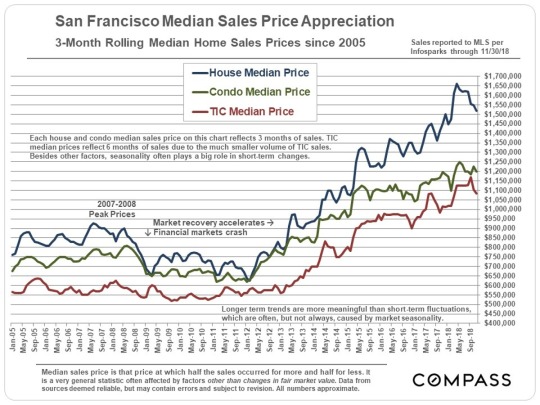

The San Francisco median home price increased from $1,100,000 in 2014 to ~$1,500,000 today, or a 37% increase.

A $420,000 principal increase more than makes up for a measly $159.63 monthly increase in mortgage payment, roughly half of which is going to pay down principal anyway.

Again, your home's appreciation amount will vary. Unless you timed your home purchase completely wrong, such as buying in 4Q2006 – 4Q2008 or maybe 1Q2018 (jury is still out), you'll likely come out OK.

Even if you did purchase at the most recent peak, normal downturns usually last no more than 3-5 years with 10% – 20% corrections.

Make A Mortgage Pay Down Plan

Given I have until 7/1/2019 before my mortgage rate jumps from 2.5% to 4.5%, I plan to keep paying my mortgage as usual and not pay anything extra to principal.

As soon as I exhaust all 60 months at 2.5%, I will pay down $50,000 in principal on month 61. After the initial $50,000 extra principal payment, I will keep paying down between $20,000 – $30,000 a month in extra principal until the mortgage is gone or until I find my Hawaiian dream home.

Based on my extra principal payments, the mortgage should be completely paid off by January 2022, or about 7.5 years after I first took out the loan.

Anything can happen between now and January 2022, which is why it's prudent to continue investing and paying down debt while having a good cash hoard. You can now earn a healthy 2.45% in a money market account with CIT Bank, for example. That's huge, since just several years ago, savings rates were under 0.5%.

Earning a 4.5% rate of return is excellent at this stage in the economic cycle, but so is having enough cash to find a gem of a property in Hawaii at a big discount. And boy, am I seeing discounts everywhere now!

The alternative solution to aggressively paying down principal is to simply refinance my mortgage when it's time to reset to another 5/1 ARM.

After checking online for the latest mortgage rates, I can get a 5/1 ARM jumbo for only 3.25%. This means that after 10 years, my blended interest rate is 2.875%. Not bad at all.

Article Summary

1) Match the duration of your mortgage's fixed duration with the estimated ownership duration or the length of time you estimate it will take to pay off the mortgage.

2) Paying for a 30-year fixed rate mortgage might provide you more peace of mind, but you're likely overpaying for that peace of mind.

3) Read the terms of your ARM loan carefully and figure out what is the maximum interest rate increase during the first reset and what is the lifetime interest rate cap.

4) Try to make extra payments during your ARM's fixed rate period to relieve potential interest rate pressure during the reset.

5) Don't borrow more than you can comfortably afford = no greater than a 80% loan-to-value ratio with a 10% cash buffer after a 20% downpayment. Being overly leveraged is what consistently destroys people's finances.

Readers, why do people take out overpriced 30-year fixed rate mortgages when the average homeownership duration is less than 9 years? Why pay a higher rate when interest rates have gone down for 35+ years in a row?

The post The Anatomy Of An Adjustable Rate Mortgage Increase appeared first on Financial Samurai.

0 notes

Text

This Is The Most Affordable Way To Remove Your Makeup

While I don't usually mind putting on makeup every morning, I used to dread taking it off. My skin has always been on the sensitive side, and it has only gotten more sensitive over time. I used to remove my makeup with store-bought makeup remover wipes, but they often left my skin feeling angry and irritated. I knew there had to be a better way to take my makeup off every night!

But it wasn't just a skin issue either. It felt wasteful to use a new wipe each night to take my makeup off, only to toss it out immediately. But after a bit of research and experimentation, I managed to cook up some simple solutions to both of my makeup removing problems! And I'll be sharing both of them with you today! :-)

First I'll show you how to make my homemade makeup remover solution. The solution not only effectively removed even the most stubborn makeup, but it also left my skin feeling soft and moisturized! No more red and aggravated skin issues. (The moisturizing effect comes from the coconut oil, which is great for both dry and aging skin. For those with oily or acne-prone skin, you may want to cut back on the amount of coconut oil to suit your skin type.)

How To Make A DIY Makeup Remover Solution

Ingredients:

1 cup distilled water

1 1/2 Tbsp baby shampoo

1 Tbsp coconut oil

1-3 drops lavender essential oil (optional)

Directions:

Melt the coconut oil in your microwave just until liquified. Then pour the melted coconut oil, distilled water, shampoo, and essential oil (if using) into a mason jar.

Place the lid on the jar and shake well to mix. Pour into a squeeze bottle for easy access, and store in a cool, dark place.

Next, I'll show you how I solved my other makeup removing woes-by making my own reusable makeup remover pads! They're so easy to make, are gentle on skin, and can be used again and again.

How To Make Reusable Makeup Remover Pads

You'll need:

Flannel fabric

Scissors

Sewing machine

Directions:

First you'll need some flannel fabric. An old flannel pillowcase or shirt works perfectly! Flannel is both soft and absorbent, making it a great choice to use for removing makeup.

Next, you'll make about one dozen square pads out of the flannel fabric. There are a couple of different ways to do this, and you can choose whichever one you prefer. The first option is to cut out 24 square pieces of flannel, to be sewn together into 12 pads.

The second option (which is what I used) is to cut off the closed end of a flannel pillowcase, then cut that up into square pieces. That will give you two squares of fabric that are already sewn together on one end, which will save you a step!

Once you have your fabric cut out, use your sewing machine to stitch the flannel squares together, leaving one side open.

Trim the corners, then flip each pad inside out so the seams are on the inside.

Fold the edges of the final side under and top-stitch it closed. Then your reusable makeup remover pads are done! If your pads aren't perfectly square or your stitches aren't that even, don't sweat it. They'll still be functional, and that's the important part here! :-)

Cleaning Your Reusable Makeup Remover Pads

One of the best things about these makeup remover pads is that you can toss them right in your washing machine to clean them! I like to keep a small, zippered laundry bag under my bathroom sink, and I toss the pads in the bag when I'm done using them. Once I've used all the pads, I simply zip up the bag and toss it in the washing machine with the rest of my laundry. You can reuse them again and again, and save yourself quite a bit of money over time!

Together, my reusable makeup remover pads and my DIY makeup remover solution solved all of the complaints I used to have about taking off my makeup. This two-pronged approach is not only better for my skin, but it's better for my budget and for the planet too! :-)

What's your preferred method for removing your makeup?

0 notes

Text

Landscaping Stone Borders Around Flower Beds

Stone Border Around Flower Bed

Austin Chopped Stone with a Flagstone Cap

Landscaping Stone Borders

Austin Chopped Stone Borders with Flagstone Cap around Flower Beds Landscaping Project

Stone Wall Borders

Raised flower beds with stone wall borders

Raised Flower Bed Landscaping

Landscaping stone walls border on raised flower beds

Curved Stone Borders

Flower bed island with curved stone border all the way around.

Flower Bed Landscaping

Landscaping stone borders around flower bed

Stone Border Around Pond

Landscaping a Pond with Stone Borders in Back Yard

Mulching Flower Beds with Stone Borders

Adding mulch to flower bed with stone borders

Large Stone Divider

Large stones dividing a garden bed landscaping

Large Rocks Border

Landscaping flower bed with large rocks as border

Flat Brick Stone Borders

Flat stone borders around flower beds

Stone Border Around Tree Bed

Tree and Flower Bed with Stone Border Landscaping

Stone Retaining Wall

Landscaping a Stone Retaining Wall Around Flower Bed

Get Stone Borders Installed

Request Quote

When you feel stressed, and you need a place to have a significant relaxation, your outdoor area will always serve as a perfect spot. So, investing in improving the look of your landscape is a fantastic treat for yourself.

Nature's view has its unique and effective way of providing you a valuable tranquility. It can even make it easier for you to forget all the negative vibes around.

After a busy weekday, it is ideal to put an effort visiting your garden area and recharge yourself. To make this more effective, providing your flower beds with landscape stone border can improve your experience.

Here, you will be able to learn different ideas for your next landscape stone border project. So, how are you going to choose the right stone for your flower beds.

Type of Edging Stones for Borders

There are different types of stone to choose from and each type has its unique characteristics. We can generally install any type of stone you prefer, but what we usually like to recommend is listed below:

Austin Chopped Stone

Oklahoma Chopped Stone

Leauders Chopped Stone

Boulder Moss Stones

Shape and Texture

Natural stones are known for its rounded shape resulted from long exposure to water in the streams, rivers, lakes or ocean. Manufactured stones provide a shape which is intended to imitate the appearance of natural stones. You have no trouble choosing the best stones for your flower bed landscaping because there is already a wide variety of man-made stone that provides organic and attractive look. Thus, it offers a uniform size and shape, with various color options.

With the help of a different type of landscape stone, it is made easier for you to create a more attractive look for your flower bed.

Artistic Medium

When you are deciding for landscape stone border design, you can play with your imagination. You may come up with a rock garden theme where you can use stones with a natural round shape and then choose plants that can enhance the overall look.

Different Rock Features

Landscape stones can be you to different landscape ideas where you can take advantage of different stone features to fulfill your creativity. In building a stone border, you can use either collection of pebbles and smaller stones or larger sizes within the gabion cages. This provides an attractive look while staying functional as a retaining wall.

Learn how to build a stone retaining wall – pdf

Water Feature Accent

Landscape stones are attractive and artistically dry. However, if you combine it with a water feature, its beauty, color, and texture become full of life. For a natural look for your flower bed, you can use paddle stones because of its neutral colors. Thus, they are quite flexible when it comes to creating natural mosaic designs.

There is no way for you not to try a landscape stone border to create an attractive and unique look for your flower bed. The next time that you will visit your garden, you will get more satisfaction with the view.

For help with installing stone borders around your flower beds contact JC's Landscaping for a free estimate.

Facebook Pinterest Twitter Google+ Reddit

The post Landscaping Stone Borders Around Flower Beds appeared first on JC's Landscaping LLC.

0 notes

Text

3 Commercial Property Tax Strategy Considerations for the Next Recession

Is a recession on the way in 2019? If you ask a CFO, there is nearly a coin-flip chance that the answer is yes. Ask a CFO if a recession will start by the end of 2020 and that number skyrockets to 82%, according to the latest Duke University/CFO Global Business Outlook survey.

0 notes

Text

3 Ways To Put Fall Leaves to Work on Your Commercial Property

At times, Klausing Group's goal of leading the landscape industry means returning to an old practice rather than inventing a new one. Fallen leaves are a valuable resource, and the industry's practice of removing them is often not the most practical or economical approach. Instead, we utilize fallen leaves whenever possible to improve results in the landscape.

0 notes

Text

Handyman Matters Named One of America's Best Customer Service Companies by Newsweek

Handyman Matters has been recognized as the top Brand in the Home Referral Services and Home Repairs category as part of Newsweek's inaugural list of America's Best Companies for Customer Service. We attribute this honor and recognition to the laser focus our owners have placed on Customer Experience & becoming the Home Ally.

Handyman Matters rated one of America's Best Companies for Customer Service

In collaboration with Statista, Newsweek sanctioned the independent study that was based on several criteria used to measure the customer service experience.

The five evaluation criteria were:

Quality of communication

Technical competence

Range of services offered

Customer focus

Accessibility

The results were published in the 11/30/18 issue of Newsweek and can be seen here. The independent study used data from a vast sample of more than 20,000 US customers and a total of 132,954 customer evaluations collected.

Owner and founder, Andy Bell stated, “What an honor! We cannot be more thrilled for the recognition our Owners earned by being ranked first in our category. It's so gratifying to see the efforts our Owners' focus on our customers day in and day out rewarded by those they are serving.”

“This recognition is validation that our objective to Redefine Home Improvement is gaining the traction it so well deserves!” echoed Chris Bue, CEO of Handyman Matters. “With enhancements like “On My Way” Text Notifications and the ability to Book Online 24/7, we will continue to meet and exceed our customer needs.”

Committed to helping you love your home, we are locally owned and independently operated locations which provide professional and multi-skilled Craftsmen trained to handle a homeowners' to-do list in addition to larger, more critical projects like a bathroom refresh or remodel. At the end of the day, “We Do It All!”

Handyman Matters guarantees our work and offers a “like it's our home” Promise. Check out why Handyman Matters is different here: https://www.youtube.com/watch?v=2DIKDccSp7o

0 notes

Text

5 Garden Resolutions That Are Easy To Keep

Improve Your World With These Garden Resolutions

We can all do a little more to improve the world. Why not start in your own garden with these very easy garden resolutions. Every little bit helps!

Start Composting

Composting is easy, reduces waste, and gives you back great soil to put back in the garden. Why send garden and food waste to a landfill, which would waste fuel, emit pollution, and take up valuable space, when you can keep it cleanly tucked away in a corner of your property and re-use it for good. Composting is easy.

Use Native Plants

There are so many benefits to using native plants. Chief among them is that they are very tough and resilient. They also look good, have less pest problems and are easy to care for. This all makes sense because native plants are adapted to the local environment. Besides all else, native plants provide food and shelter to wildlife. Check out our blog Native Plants For Maryland Gardens for a list of some species you may want to try.

Plant A Pollinator Garden

Want to see more butterflies and birds, not to mention giving them and other pollinators a much needed helping hand? Then plant a pollinator garden. The bottom line is that we need more pollinators in order to produce the food we eat. Planting pollinator plants helps increase this activity. Plus, pollinator plants are beautiful. Some varieties to consider include coneflowers, salvias and sunflowers.

Grow Your Own Vegetables

Now here is something that is both good for the environment and great for your health. Who doesn't love fresh vegetables and fruits? Not only is the fresh food good for you, being out in fresh air and working with soil is good for your health and soul. One other huge benefit, it is a great activity and learning experience for children.

Recycle and Upcycle

We love to recycle, and upcycle! Anything we can keep out of the landfill is a plus. Plastics, cans, bottles, paper, food waste, tires, pallets and on and on and on. Upcycling not only keeps items out of the landfill, it gives them another use. Items that can be donated for someone else to use gives them a new life and can benefit others.

Remember, Allentuck Landscaping Co. is always here to help you design, install, construct and maintain you lawn and landscape. Give us a call!

Allentuck Landscaping Co. is Your Residential Landscape Company

Phone: 301-5-515-1900 Email: [email protected]

At Allentuck Landscaping Company, our mission is to create beautiful environments for people to enjoy. We see landscaping as a way to improve people's lives.

The Allentuck Landscaping Company team has been delighting homeowners in Maryland, Washington DC and Northern Virginia for over 28 years with our turnkey approach to landscape design, installation, construction and maintenance. Most companies try to serve many types of customers at the same time; homeowners, shopping centers, office buildings and the list goes on. At Allentuck Landscaping Co., we focus on one customer, you, the homeowner. We have a singular focus on bringing you the best landscape practices, the best customer service, and the best value for your home.

Services Provide – Master Landscape Plans, Complete Maintenance Programs, Plantings, Patios, Walkways, Retaining Walls, Water Features, Outdoor Lighting, Outdoor Kitchens, Trellises & Pergolas, Irrigation Systems, Drainage Solutions, Grading & Sodding. Fire Pits & Fire Places, Spring Clean Ups, Decks, Fences Areas Served – Chevy Chase, Bethesda, Potomac, Rockville, North Potomac, Darnestown, Gaithersburg, Germantown, Boyds, Clarksburg, Ijamsville, Urbana, Frederick and Washington DC.

The post 5 Garden Resolutions That Are Easy To Keep appeared first on Allentuck Landscapes.

0 notes

Text

2019 Maximum HSA Contribution Limits – How Much Can You Save for Your Medical Expenses?

Health Savings Accounts, or HSAs, are growing in popularity among people who need affordable health insurance and among employers looking to save on health insurance costs.

HSAs have many benefits beyond cost savings. Let's dive in and take a look at what exactly is a health savings account, the HSA contribution limits for each calendar year, how HSAs are one of the most flexible financial accounts you can open, and why it's a good idea to max out your annual HSA contributions.

What is a Health Savings Account?

Health Savings Accounts are a type of tax-advantaged savings account specifically for health care spending. Contributions are tax deductible in the year they are made, and grow tax-free. Withdrawals are tax-free when used for qualified medical expenses.

In essence, a Health Savings Account is very similar to a combination of a Traditional IRA (tax deduction when you make the contribution) and a Roth IRA (no taxes on qualified withdrawals for medical expenses).

This is a huge benefit!

Health Savings Account Eligibility

To be eligible for an HSA, you need to participate in a qualifying High Deductible Health Plan (HDHP) for health insurance.

A plan may qualify as an HDHP if the deductibles are $1,350 per year or higher for individuals, or $2,700 per year or higher for a family plan. These deductibles are typically higher than average, hence the name, High Deductible Health Plan.

High-Deductible Health Plan (HDHP) also limit the deductible amounts and out-of-pocket expenses. For 2019, these limits are $6,750 for self-coverage only, and up to $13,500 for family coverage.

Advantages of HDHPs

Many people choose these health insurance plans because they typically have lower monthly premiums due to the high deductible. Many employers offer these HDHP plans for the same reasons.

The goal of the higher deductibles is to save costs for everyone, incentivize policyholders to become smarter with their healthcare spending and give you the option of setting aside money pre-tax to pay for healthcare. On the flip side, you need to have sufficient funds to pay your portion of the deductible. So only choose an HDHP if you have some money set aside in an emergency fund or cash savings.

Tax Advantages of Health Savings Accounts

You can set aside pre-tax income in an HSA for use specifically on health spending. HSAs are often compared to and confused with Flexible Spending Accounts (FSAs).

The two are similar in that you set aside pre-tax income for health costs, but FSAs have a serious downside that HSAs do not. With an FSA if you do not spend all of the funds in your account by the end of the year you forfeit the remaining balance of your account to the plan administrator.

With a Health Savings Account you never lose the funds. In fact, you could set aside money this year in an HSA and use it 40 years from now (some people even pay for their health care out of pocket now, and use their HSAs as another way to save for retirement). And as long as the funds are used for healthcare spending, you won't pay any tax on the withdrawals.

2019 HSA Contribution Limits

How much money can you set aside for future healthcare spending with an HSA?

The maximum annual contribution is dependent upon whether you are on an individual or family plan. The maximum HSA contribution limit is $3,500 per year for an individual, while families can contribute $7,000. There is also a catch-up contribution limit of $1,000 for those who are age 55 or older (note: catchup contributions for retirement accounts start at age 50).

Here is a list of contribution limits from recent years, including the HSA contribution limits from 2010 – 2019:

Tax YearIndividualFamily Catch-Up Contributions (age 55 and over) 2019$3,500$7,000$1,000 2018$3,450$6,900$1,000 2017$3,400$6,750$1,000 2016$3,350$6,750$1,000 2015$3,350$6,650$1,000 2014$3,300$6,550$1,000 2013$3,250$6,450$1,000 2012$3,100$6,250$1,000 2011$3,050$6,150$1,000 2010$3,050$6,150$1,000

What Happens If I Contribute Too Much to an HSA?

If you are contributing funds to your HSA automatically through payroll deductions it should be virtually impossible for you to contribute too much to your Health Savings Account. However, it is possible to over-contribute by making deposits outside of the payroll system or simply through error.

If you discover you have contributed too much to your HSA, you must take action to avoid paying penalties to the IRS.

The fix is quite simple: you must remove the excess amount contributed, plus any interest earned on that amount, and pay tax on both before April 15th of the following year. (You can contribute to this year's HSA through April 15 of next year.) You received a tax break by putting the money into your HSA pre-tax, but since you contributed too much you technically should have paid tax on the original income.

Failure to remove the excess contribution by the April 15th deadline and then withdrawing the funds at a later date will result in a 6% excise tax when you do withdraw the funds. Additionally, if you leave the funds in indefinitely, each year you must pay the 6% tax.

However, there is one way to get out of having to remove the contribution and paying tax: leave the contribution in, but avoid the 6% excise tax by lowering the next year's contribution by the amount of the over-contribution.

For example, an individual with an HSA contribution limit of $3,500 per year would have been guilty of contributing $100 too much if they contributed $3,600 this year. They could avoid paying the 6% excise tax by only contributing $3,400 next year (the $3,500 contribution limit minus $100). If they contributed the full $3,500 next year, they would then be forced to pay the 6% tax on the original $100 over-contribution.

Can You Contribute if You Aren't Eligible for the Entire Year? Pro-Rated Contribution Rules Explained

Rarely do you start a new job on January 1st or end it on December 31st. When you gain and lose access to a high deductible health plan will impact your availability to contribute to an HSA. If you are not active in an HDHP for the entire year your situation is a gray area.

Here is what the IRS says in one of its instruction manuals:

Last-month rule allows eligible individuals to make a full contribution for the year even if they were not an eligible individual for the entire year. They can make the full contribution for the year if:

They are eligible individuals on the first day of last month of their taxable year. For most people this would be December 1, and

They remain eligible individuals during the testing period. The testing period runs from December 1 of the current year through December 31 of the following year (for calendar taxpayers).

If the taxpayer does not qualify to contribute the full amount for the year, the contribution is determined by using the sum of the monthly contribution limits rule.

OR

Sum of the monthly contribution limits rule (use Limitation Chart and Worksheet in Form 8889 Instructions). This is the amount determined separately for each month based on eligibility and HDHP coverage on the first day of each month plus catch-up contributions. For this purpose, the monthly limit is 1/12 of the annual contribution limit, as calculated on the Limitation Chart and worksheet.

In other words, you can contribute the full amount if you are eligible as of Dec 1, of the calendar year. However, you may owe back taxes if you do not remain eligible from January 1 – December 31 of the following year.

To avoid tax problems, your HSA contribution can be pro-rated. Simply divide your normal contribution limit by 12 to get your monthly contribution limit.

For individuals, it is $291.66 and for families $583.33 (both numbers represent the 2019 tax year; just apply the current tax year to your situation).

Each month that you had at least 1 day active in an HDHP counts as a full month for your contribution limit. Then simply multiply the number of months you were active in the health plan by your monthly contribution limit.

For example, an individual that started a new job and gained access to an HDHP on March 12th and maintained HDHP coverage through December 31st would have 10 months of pro-rated contribution availability. They could contribute $291.66 x 10 = $2,916.60 for the year. If they contributed the full amount of $3,500 they would need to take the steps listed above to avoid penalties for over-contributing to their HSA.

IRS Publication 969 has more info about HSA qualifications, contribution limits, distribution rules, and more.

Benefits of Maxing Out Your HSA Account Each Year

There are numerous advantages to having an HSA. There is the immediate tax benefit in the year you make your contribution. And since your savings never expire, you can save the funds in your HSA or a linked investment account, and let your savings and investments grow over time. In fact, this can be a brilliant investment strategy:

Using Your HSA as a Super Retirement Account

Health Savings Accounts combine the best of the Traditional IRA and Roth IRA. Contributions are tax-deductible in the year they are made (like a Traditional IRA), and the earnings and withdrawals are tax-free if used for a qualifying medical expense (like a Roth IRA, when used for retirement). There are no age limits when using your HSA funds for a qualifying medical expense. So you can let your money ride until needed. Or just let it grow and pay your medical expenses out of pocket.

What if you want to use your HSA for non-qualifying medical expenses? If used for anything other than a qualifying medical expense, you will pay taxes and a 10% early withdrawal penalty, just as you would with a retirement account. However, the rules change a little bit once you turn age 65. Once you reach age 65, the current tax rules allow you to make non-qualifying withdrawals from your HSA with the same tax rules as a Traditional IRA. So you would pay taxes on the withdrawals, but you would not pay any penalties.

This flexibility makes your HSA one of the most powerful financial tools in your toolbox.

Benefits of Long-Term HSA Ownership

I maximized my HSA contributions each year I was eligible to contribute to an HSA. We decided to take advantage of the investment opportunities through the HSA, so we elected to pay our medical costs out of pocket and invest our HSA funds.

My health insurance plan has since changed, and I am no longer eligible to contribute to an HSA plan. However, I am not required to remove those funds until I decide to use them for medical expenses, or I decide I wish to withdraw the funds for other purposes.

Since the funds are invested, I'd like to let them compound as long as possible. If we have a major medical expense, I can elect to pay for them with our HSA savings. And if we are lucky and don't have any expenses we can't pay out of our cash flow or savings, then I will have a large investment account I can tap into when I reach retirement age. I'm hoping for the latter!

Where to Open an HSA Investment Account

The first thing you need to do is qualify for an HSA with a compatible High Deductible Health Care Plan. Check with your employer if you have an employer-sponsored health care plan. If not, then you may be able to purchase a qualifying HDHP on the ACA exchanges or find one through a health insurance company such as eHealthInsurance (this is where I always found our health care plans after I became self-employed).

Once you have a qualifying health care plan, you can shop around for different banks or investment accounts that offer HSAs. I wrote an article about the process of opening an HSA account, which bank I chose, and why.

I decided to open my HSA account with HSA Bank, in part because they have easy access, very low fees (which can be waived if you maintain a certain minimum in your account and because they make it very easy to link your HSA account to a brokerage where you can invest your HSA funds.

HSA Bank offers two investment options. I chose to invest with TD Ameritrade, because of their excellent reputation and access to several hundred fee-free ETFs for trading. So I've never paid anything to make a stock purchase at TD Ameritrade because I invested in ETFs that didn't have any associated trading costs.

You can visit TD Ameritrade to learn more or to open an account.

Health Savings Accounts are one of the most flexible financial accounts you can open. If you are eligible to open an HSA, I recommend maxing out your contributions each year. And if you can swing it, try to pay your medical expenses out of pocket. This will allow your HSA contributions to grow tax-free indefinitely, allowing you to increase your net worth.

The post 2019 Maximum HSA Contribution Limits – How Much Can You Save for Your Medical Expenses? appeared first on Cash Money Life | Personal Finance, Investing, & Career.

0 notes

Text

2 Behavioral Biases That Are Making You Lose Money

One of the most interesting areas of finance is called behavioral finance, which is the study of how our behaviors can influence the outcomes of our portfolios.

According to H. Kent Baker and Victor Ricciardi in The European Financial Review, there are several behavioral biases that can impact your investment portfolio and result in lower returns.

Here are two of those biases:

1. Representativeness

According to Baker and Ricciardi, this bias results when you label an investment “good” or “bad” based on recent performance - rather than looking at the fundamentals.

An investment might be considered “good” if its recent performance has been positive. As a result of this bias, an investor might buy something even if it's overvalued. Representativeness encourages you to buy high. On the other hand, this bias can also cause you to overlook good deals because of a recent poor performance.

As you can see, this bias can lead to you missing out on investments that have solid growth potential, while paying too much for investments that might be at their peak.

Instead of basing investment decisions on recent performance, it's a better idea to look at investment fundamentals to get a better idea of the true value of an investment. Look at “big picture” items such as management, balance sheet, and potential growth. You can also look at figures like P/E ratio to get an idea of whether or not the investment is overvalued or undervalued. If an asset with solid fundamentals is doing poorly in the short-term, it might actually be a good deal.

2. Familiarity

Another bias that Baker and Ricciardi tackle is familiarity, which is the idea that you prefer investments you recognize. You might choose to invest in a company you've heard of over one you don't really know. Familiarity also manifests as a preference for domestic assets over foreign assets.

As a result, familiarity can lead to a lack of diversification in your portfolio. While it's true that you should understand the assets you invest in, it's also true that you need to go beyond a few assets. Familiarity might lead you to invest too heavily in one industry, sector, or geographical location - and you need more diversity than that for a well-balanced portfolio.

The good news is this doesn't need to be all that risky. If you want to diversify, but are wary of foreign investments, consider using index mutual funds and ETFs. It's possible to invest in an all-world ETF that provides you with exposure to foreign assets without as much risk or individual stock picking.

While there's no way to completely eliminate risk from your portfolio, you can invest smarter when you're aware of your behavioral biases. Examine your investing style for these biases, and then make changes to improve your portfolio.

Do you have either of these behavioral biases? How have you controlled them?

This article originally appeared on MoneyNing.com. Let us know what you think (or read what others thought) here.

0 notes

Text

6 New Year Realties for New Real Estate Agents

It's a new year, and of course there will be another flurry of new real estate agents looking for their piece of the pie in the market. Welcome to the new year, and welcome to the real estate industry! Hopefully you didn't think passing your exam ensures you a steady income and fast cars. This career still takes hard work.

0 notes

Text

how we are ditching baseboard heaters

We ripped off the construction band-aid and have been demo-ing our little hearts out over at our #samuelfamilyfixer and sharing loads of progress as we go via Instagram stories. I've put a bunch in my highlights if you've missed anything and I'll be sharing more updates here now that things are really rolling. Along the way I've gotten a ton of questions over what we are doing with the baseboard heaters, if anything, and I tried to answer as best I could in a few short frames but really this is a full blog post kind of answer so here we go!

We love all the modern lines and unique features in the house but what we didn't love was the look of the radiant baseboard heaters. They do the job ok, but boy are they a big bummer to have to design around. No matter how you slice it, they make a space feel dated. So I did a deep dive into researching alternative heating systems and the good news is we got to rip those babies out of there, and will be replacing them with radiant heated floors which will be nicely tucked away under the finished flooring.

Through all my digging I found a company called Warmboard, and their pretty green panels are the answer to our prayers. According to their site… As a whole-home heating system Warmboard is the premier radiant heating solution in the US. Their panels outperform all the competitive systems with faster response times, easier installations, AND lower energy use.

Tubing, that will eventually carry hot water, runs through those grooves in the panels and their patented design spreads the heat from the tubing throughout the surface of the entire floor, so there are no hot/cold spots and the water can run at a lower temperature which means its more efficient. What is really exciting from my point of view is that since these panels have a more even surface temperature than a lot of other radiant systems, the flooring possibilities are wide open. From what I gathered some radiant systems aren't compatible with carpet or hardwood because the heat doesn't make it thought the carpet efficiently and hardwood isn't good with the temperature fluctuation, but with Warmboard you can use thick carpets, laminate, tile, hardwood… all fair game and I am using a mix of almost all of the above. WOOT!

Once I locked in on the Warmboard system it opened up my design choices for the flooring. Tile in the sitting room, tile in the kitchen, bathrooms and even tile in the bedroom! I'm doing it. Without the radiant heated floors there would be no way I would install tile in the bedroom in this cold climate, but I was set on keeping the wood ceilings as is and I didn't want wood on both the ceilings and the floors, so with the Warmboard to keep the tile from feeling too cold and giving me the look I wanted, it was a win, win. We are doing carpet in the kids bedrooms and the large fireplace living room to keep those spaces extra cozy, laminate in the dining room, pantries and closets (I was originally planning on tiling those rooms too but when we got the labor estimates back for tile install we had to make some cut backs), and tile everywhere else. A peek at some of the finishes we've narrowed in on above!

Another way we are saving some pennies (like $5000 worth of pennies, because we are covering A LOT of square footage) is by installing all the panels ourselves. This whole renovation is a mix of DIY and hired out work through our contractor, to get the most out of our budget (and so I can splurge on certain things like terrazzo floors in the main living space) and the Warmboard installation is a perfect illustration of that. We install the panels and then licensed heating & cooling professionals come in to run all the tubing, install a new boiler (ours is on its last leg) and does all the plumbing and mechanical portion of the install.

We just started installation and Rupe got a new power tool… so he's happy. It's an auto-feed drill that allows you to stay standing while screwing in all 16 screws per panel. We did the math based on how many panels we have to install and needed 5,000 screws! Rupe's knees are very thankful for the screw-loading stand up drill. Pop Pop and Rupe are on panels, me mostly on the sidelines this time, with the kids but jumping in and throwing my 2 cents in whether or not it is appreciated, and Mimi is sweeping up the floors as they go to make sure there's no princess and the pea situation under the panels. Warmboard supplies an install kit and a detailed custom design plan to follow which makes it a little like a putting together a giant scale, but fairly simple, puzzle. There was a bit of a learning curve at the beginning but once we got into a groove (pun intended) things started to move. I'll let you know how we do on the rest of the house! Wish us luck. x

Oh and p.s. I got the question a lot on IG if this will be our only heat source and the answer is yes! I've heard that some radiant systems may require supplemental heating, but not Warmboard! It is supposed to heat better than forced air, especially when it comes to heating rooms like ours, that are very large and have tall ceilings (ours are 20 feet tall at the peak!). But don't worry, this girl has been in California for way too long… so it better do the job, I will be the true test and report back.

The post how we are ditching baseboard heaters appeared first on Sarah Sherman Samuel.

0 notes

Text

Marie Kondo in the Garden, and Life

I couldn't agree more with what this Washington Post reviewer wrote about Marie Kondo's approach to “tidying up” in her new show on Netflix.

Unlike her TV predecessors, Kondo brings a calming influence to the surroundings - even asking the owners if she may take a moment to kneel in a particular spot and silently greet their homes.

This is a noble and overdue concept for the home makeover and real estate genre - a chance to express gratitude for any home, rather than the perfect home. Years of HGTV's programming have placed homeowners and home-seekers on a narcissistic pedestal of entitled complaint (our house is too small, too ugly, too outdated) and criticisms.

That got me thinking about my attitude toward the gardens I create and then care for. Am I one of those “entitled” complainers on HGTV?

It took mere seconds of reflection for me to conclude that no, I'm not. Real gardeners like me just don't see their gardens that way. Sure, I notice the tasks that need to be done but overall, I love being in my garden and appreciate the hell out of it, whatever condition it's in.

But what about when my garden gets crowded, when plants start encroaching on pathways, when maybe something has to go? Here's where a super-declutterer like Marie has useful advice for me.

The WaPo review continues, “She saves sentimental objects for last, and it's here where the owners must really buckle down and assess whether they are keeping something out of a sense of duty or true joy.”

So the next time I'm making one of those yank-or-keep decisions about an unhappy or overgrown plant, I'll try asking myself if the plant is “sparking joy” for me. That's her favorite phrase and a really great one, I think.

Marie demonstrates thanking a sweather

I'll also try following her advice and “thank” each plant before sending it to the compost (or to a plant swap or whatever). The sight of Marie holding a small piece of clothing reverently in her grasp and then quietly thanking it inspires me to give that a try.

Beyond the Garden

All this makes me wonder – is there anything else in my life that I need to thank and discard because it's not sparking joy for me? Certainly my constant checking for emails and Facebook responses comes to mind.

And how about this: Do all my relationships spark joy or are some of them more joy-draining?

Tidying Up on Netflix Back to the show for a quick reaction. The very notion of this tiny nonEnglish-speaking woman having her own show on American television (or whatever Netflix is) seems crazy! And in a good way. But then so is the astonishing success of her book.

Naturally I'm all for decluttering and to Marie's fans I say “Go for it!” But I'm more of a minimalist than a clutterer, so I'll leave to others a real review of her advice. I also don't watch reality TV, so the super-scripted artificiality and the constant promoting of Marie and her method honestly drove me nuts.

But on a final note, I love that two of the seven homes featured in the show are inhabited by gay couples. I try to notice and enjoy examples like that of things getting better in this country, because, you know.

For our Feedblitz subscribers, the author is Susan Harris

youtube

Marie Kondo in the Garden, and Life originally appeared on GardenRant on January 4, 2019.

0 notes

Text

Indoor Plants & Greenery for the Holidays

This time of year, it's wonderful to bring holiday lights and greenery into the house to remind us of our gardens and add sparkle and cheer to our homes.

Green is the color of renewal and regeneration, and for centuries evergreen trees and greenery have been used in winter celebrations as a symbol of everlasting life. From swags of evergreen to miniature table-top gardens, here are some ideas we love for decorating your home with live plants and fresh-cut greens and flowers.

Forcing bulbs is one of the easiest ways to brighten up the darkest weeks of the year. Image: Pistils Nursery.

Honor winter with a garland, anywhere in your home. This mix of fir, pine and arborvitae branches is accented with dried citrus, but you could decorate with anything that cheers your soul, from ribbons to seashells to toy animals. Image: One Kings Lane.

Fiddle-leaf figs are wildly popular for many reasons, including the fact that they bring a huge, bright pop of green indoors. Apartment Therapy has some good tips for keeping your fiddle-leaf fig happy and healthy. Image: Making It Lovely.

Norfolk Island Pines are wonderful evergreen houseplants-an excellent low-maintenance, small-footprint substitute for a Christmas tree. Image: White Flower Farm.

Decorate a centerpiece or add adorable details to a gift presentation with rosemary and holly berries. Image: Monrovia.

Make the most of winter sunlight by moving your houseplants to your brightest windows, and add even more beauty with pots of forced bulbs. Image: A Garden for the House | Delicious Living.

The post Indoor Plants & Greenery for the Holidays appeared first on Home Outside.

0 notes