Don't wanna be here? Send us removal request.

Text

Securing My Dream Home

While growing up I always imagined where I would live and what my house would look like. Of course many of those ideas were influenced by what I experienced living with my family and the lifestyle we were used to maintaining. We lived simply and made the most of what we had. As I haven gotten older and established a steady career, I have become more interested in buying a home, although the thought of it is a bit intimidating for me to conquer on my own.

I had a long-term savings account but had not ever ventured into any other kinds of investment or savings options that could accrue substantial interest. My goal was to purchase a home in five years with a 30% down payment with an estimated $320,000 home purchase price, so my down payment would be $96,000. I know the goal is lofty, but I was convinced of disciplining myself to set such a high down payment to decrease my loan amount. Additionally, I was determined to pay off the mortgage in 15 or less years.

To save for the down payment, I invested some inheritance funds I received ten years ago after the death of a family member. At that time, I decided to invest the entire $40,000 into a 10-year account that offered 8% interest compounded semiannually over the ten years. At the end of those ten year, the $40,000 had translated into nearly $88,000. During those ten years, I continued to also use my regular savings account and also opened numerous CDs of varying terms so I could keep adding to my down payment savings. The CDs lock in the funds at a rate for a specified amount of time, and my local bank had run some special offers that I took advantage of, knowing the time was drawing closer for when I would be purchasing a house. Those CDs yielded additional savings for me to exceed my $96,000 goal by $10,000. After researching several mortgages, I was able to secure a 15-year fixed rate mortgage at 2.375% and was pre-approved up to $400,000.

After deciding where I wanted to live and the type of house I was looking for, my realtor intently pursued finding me many options. Because I had exceeded my down payment goal, I was willing to spend a bit more on the home cost or costs for making an upgrades or changes to the house I purchased. The moment I pulled into the driveway, I had a sense that I had just driven into the driveway of my dream home. Not only did it meet my minimum requirements, the property had numerous additional amenities that I never imagined I would own. My home cost $320,000. I decided to make an even $100,000 down payment and put the remainder of the excess towards closing costs.

I am thankful to God for giving me people in my life who are financially wise and willing to offer sound advice when it comes to investing, credit, savings, and mortgages.

0 notes

Text

Percentage Charts

This week’s blog is a review of various types of ways percentages can be displayed in chart form.

1. Bar Chart

https://www.advsofteng.com/doc/cdpydoc/percentbar.htm

The chart shows an option of looking at weekly sales broken down by percentages of the different products sold. This is a quick way to see color-coded results for each day and item. Although there does not seem to be much information contained on this chart, without even knowing the reasoning this chart was prepared, I can tell you which products sell the most of which day of the week and the ranking of products by sale. If the company was looking to improve customer service, perhaps they would want to staff more service representatives on Wednesdays where service sales earn 51% of the day’s sales.

2. Pie Chart

https://www.ablebits.com/office-addins-blog/2015/11/12/make-pie-chart-excel/

This common pie chart example shows the breakdown of how each food item should by percentage represent a person’s daily total food intake. The chart is easy to read but can become too busy if there are too many categories as the smallest categories tend to become invisible or hard to read.

3. Stacked Bar Chart

https://www.spss-tutorials.com/spss-stacked-bar-charts-percentages/

A slightly different bar chart show horizontal percentages for how specific courses were rated based on the color key. This chart does not have exact percentages noted on the chart (typically within the colored section). I tend to find it more helpful to see the exact number within the cart versus trying to guestimate by lining up the percentage axis with the colored boxes.

4. Donut Pie Chart

https://www.slideteam.net/donut-pie-chart-with-percentage-ppt-summary-example-introduction.html

Here’s a different spin on the pie chart. First, its noticeable likeness to a donut is fun. Section, the look is cleaner and has a more updated look compared to typical pie charts. I also like the ability to color code and provide a more detailed description of what the percentages represent.

5. Analysis Line Chart

https://academia.stackexchange.com/questions/86240/percent-in-chart-title-and-on-axis-redundant

This chart is an example of two different lines plotted to show percentages over a period of time. You can easily see the percentages trending up or down with one quick glance although specific percentages are not noted.

6. Pictographs

https://support.visme.co/visualizing-data/how-to-create-pictographs-and-icon-arrays-in-visme-global-literacy-statistics/

Being a visual person, I appreciate the use of these people icons that represent the number of people who fall into specific categories. I look at statistics and think of them differently when they are presented in this more personable, less formal way.

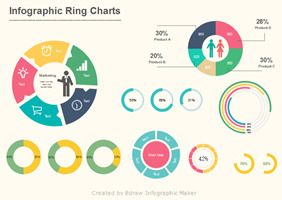

7. Infographic Ring Charts

https://www.edrawsoft.com/infographics/popular-infographic-charts.html

Here is another alternative to a simple circular chart. There is much freedom in being creative with figure presentations to include shapes, colors, and icons. I appreciate the clean, easy look of these charts.

8. Bubble Chart

https://www.edrawsoft.com/infographics/popular-infographic-charts.html

Another more fun, eye-catching presentation is the infographic bubble chart. Though not ideal for all business scenarios, it can add some depth and interest to figures that might not be so interesting or perhaps do not require much explanation. The graphics can add to an otherwise empty-looking screen or simply be a refreshing change to an ordinary chart.

9. 3D Charts

https://www.freepik.com/free-vector/colorful-charts_799117.htmFor a literal different dimension, you can try a 3D chart to explain your data. I like the triangular shape instead of a typical bar chart. As for other newer, viewer-friendly styles, this is eye-catching because of colors, shapes, and being noticeably different from the standard

10. Gradient Infographic

https://www.alamy.com/body-mass-index-obesity-and-overweight-illustration-business-statistics-bar-and-line-charts-percents-pie-charts-steps-options-timeline-people-image262232424.html

When you’re looking to relay different facets of information that together support a main idea, this example is a fantastic option. Of course the color scheme is appealing, but the layout distinctly separates information while still allowing it to flow together. The different shapes represent specific items and are easy to read (in full size print) with plenty of space to add explanations or other necessary details. I would recommend using this for something like a research report or as a way to summarize ideas or conclusions reached via research or perhaps giving an annual report for an organization that has multiple programs running collectively to support a cause.

0 notes

Text

Checking Account Research

As a single woman, managing finances (beyond a checking and savings account) is extremely intimidating to me. Our classwork focusing on checking accounts requiring us to research various options has made me think a bit more about pursuing some other options when it comes to financial planning for my future. I have previously tended to just do something simple versus it being the wisest or most profitable option. I’ll start by sharing some thoughts on checking accounts for those who are new to the checking account scene…

If you are a young adult, maybe a new college grad now collecting a steady paycheck, you have likely already had to select a bank because most employers require direct depositing for paychecks. However, you can have your assets located in more than one bank. This week our class researched checking account options. They range from bare bones accounts with no fees to accounts with varieties of tiers, fees, interest, and other perks. It would be worth your time to do some online searching about what different checking accounts offer. If you want to earn interest, see which banks offer interest but be sure to check other characteristics of the account.

Banks that offer interest may also charge a monthly service fee for the account. However, there are usually one or more ways to avoid those monthly fees. These typically include maintaining a minimum balance or establishing a direct deposit. Additionally, if you have a checking account with a bank, they may offer an incentive to also open a savings account. Ask about promotional offers for new checking and/or savings accounts.

One item I discovered while researching banks is the need to be aware of locations of your bank’s fee-free network ATMs. Online banks do not have physical branch locations but will partner with ATM companies. Be sure to search online for ATM locations so you know if there are any conveniently located where you live. Otherwise, you’ll be incurring fees for each use depending on whether or not your bank reimburses you fees for non-network ATMs. Along with ATMs, be sure you have a free Debit card that does not charge you to get cashback at a store. That is a rare occurrence now, but those types of fees can add up if you use your card often. On the other hand, there are banks who offer small financial perks if you use your Debit card to pay for purchases.

Check out the bank’s website, too. A website that is complicated to navigate ranks among my biggest pet peeves as a consumer. This is increased when it comes to a bank’s website as the security measures and information detail are key and personally important. I nearly switched banks once because I felt my bank’s website was archaic. They have since upgraded, but I am not completely thrilled with the new format.

Take your time to compare banks and weigh what is most important to you. Do a positive/negative list of mark a comparison chart. As you accrue more income, you may wish to relocate some funds for investing, but starting basic is a good way to practice money management as you enter the workforce and have a steady income. Happy checking!

0 notes

Text

Back to School

2020. What a year! Nothing is really normal, or is there a new normal? Will there ever be a regular normal? With the effects of COVID in full force on my life, I found myself with a tremendous amount of empty time on my hands. Although I had earned an Associate’s Degree in Business back in 2001, in the years since then, I often thought and talked about completing my Bachelor’s Degree. The idea of how much time it would take was always a deterrent, and despite being single, I maintain a full social schedule of church, friends, family, sports, and volunteering efforts. Where would I fit in school?

Enter COVID. I am currently an executive assistant for a health system. I’m grateful for my job and am proud of where I work--mostly because of the heroes who provide care to our community--my family included! Being a patient myself, I have increasingly thought of moving onto a position within the healthcare system where I could have a positive impact on a patient’s healthcare experience without being a healthcare provider. Since March I have been working either full-time at home or rotating between the office and home on a weekly basis. In June I was researching online education opportunities and discovered LBC’s adult accelerated program. I was nearly instantaneously sold. After applying and figuring out a major and course schedule, I truly felt a complete peace from God about my decision. I began classes in August 2020 and am in the process of taking my fifth and sixth classes—one of which is Business Mathematics. I’m writing this blog as a requirement for this course…so come along with me on this numbers journey…

The first week of Business Math has been a stretching experience and an opportunity to clear out mental cobwebs. Math was always a favorite subject of mine, but what was once simple math for me is now taking me slightly longer to complete. However, I appreciate the learning opportunity more than I did when I first learned the material in high school. I had a frustrating experience of remembering how to write out the steps of how I solved an equation. I could easily figure out the answer, but writing the steps to show how I arrived at my answer? Forget it! I told my friends that I needed a big, fat eraser for math class! (This week I bought stick erasers that function like pens because I will definitely need them!!) Other review concepts for me were equations with parentheses, ratios and proportions (those held me up for some time), and general math vocabulary and concepts.

My slightly nerdy factor includes that I enjoy balancing a checkbook, but my most favorite flashback from this week’s assignments? Story problems! Yes, it’s true. I LOVE story problems! Even though they were slightly painful due to writing out the steps (as referenced earlier in this paragraph), those story problems took me back to my elementary and high school days where I first learned story problems. Reminiscing to classrooms, teachers, classmates, and even my plaid school jumper dress was nostalgic. Thankfully, I did successfully and accurately (hopefully!) complete the Week 1 assignment. So, in spite of the brain cobwebs, eraser drama, showing my work, and random memories from Mr. Coldren’s fifth grade classroom, I truly enjoyed my assignments this week. After all, no pain, no gain. Right?!

I cannot end this post without mentioning my instructor. Her eagerness and encouragement is so very appreciated. She responded very quickly and kindly when I emailed her a question, and I just noticed that she posted an announcement stating she was going to eliminate some of the weekly work due to hearing how many of us struggle with time management and knowing everyone is also suffering from the whole COVID effect thing, too! What a gracious, thoughtful instructor!! A God-given blessing indeed!

1 note

·

View note