Don't wanna be here? Send us removal request.

Text

5 Benefits of automate your accounts receivables process

#cashflow management#ai based accounts receivable#cash application process#ai powered accounts receivable#ar management#ar collection#payment reminder

0 notes

Text

https://www.kapittx.com/accounts-receivable-ai-agents/

#cashflow management#ai in accounts receivable#ar collection#Accounts receivable LLM Agent#Accounts Receivable AI Agents

0 notes

Text

Core Modules of Accounts Receivable LLM Agents

#ar management#ai based accounts receivable#ai in accounts receivable#payment reminder#cash application process#ar collection#accounts receivable AI Agents

0 notes

Text

Transforming Accounts Receivable with AI: A New Era of Efficiency

Introduction

The evolution of technology has dramatically reshaped the way businesses operate. From standalone applications to cloud-based SaaS solutions and now AI-powered platforms, each phase has brought about increased efficiency and scalability. In the realm of finance, particularly Accounts Receivable (AR) management, these advancements have redefined processes that were once manual and time-consuming.

AI is not just an option but a necessity for businesses aiming to optimize their AR processes. By leveraging AI-driven insights, automation, and decision-making capabilities, companies can mitigate the inefficiencies of traditional AR management and improve cash flow predictability.

The Shortcomings of the Manual Accounts Receivable Process

Traditional AR management involves tracking invoices, following up on payments, and reconciling accounts. While these tasks are essential, manual execution poses several challenges:

Human Errors: Manual data entry increases the risk of mistakes, leading to incorrect invoices, missed payments, and reconciliation issues.

Delays in Collections: Dependence on spreadsheets and ERP systems with limited automation capabilities often results in inefficiencies, slowing down the collections process.

Limited Visibility: Without real-time insights, businesses struggle to forecast cash flow accurately, impacting financial planning and decision-making.

The Impact of Traditional AR Processes on Business Performance

Relying solely on ERP systems and spreadsheets for AR management can lead to:

Increased Days Sales Outstanding (DSO), reducing available working capital.

Inefficient cash flow planning due to inaccurate forecasting.

High operational costs due to manual follow-ups and dispute resolution.

Scenarios That Slow Down Collections and Affect AR Performance

Delayed Follow-Ups: A collection specialist manually following up with customers may miss crucial payment deadlines due to workload constraints.

Dispute Resolution Bottlenecks: A company manually reviewing disputes takes weeks to resolve an issue, delaying payments and affecting cash flow.

Lack of Payment Insights: Without AI-driven analytics, businesses fail to anticipate potential late payments, resulting in unplanned cash shortages.

Transitioning to AI-Powered AR Management Systems

AI-driven Accounts Receivable management systems are designed to address inefficiencies through automation, predictive analytics, and real-time decision-making. These intelligent systems improve financial operations by reducing manual tasks, accelerating cash flow, and minimizing risks associated with late payments and bad debt.

Context-Aware AI-Powered Accounts Receivable Systems

These systems use machine learning models to understand customer behavior, payment patterns, and business rules to support finance teams in:

Automating Invoice Processing: AI automates the generation, validation, and tracking of invoices, ensuring timely payments.

Enhancing Payment Predictions: AI models analyze past payment behavior to predict future payment trends, allowing businesses to take preemptive action.

Streamlining Communication with Customers: AI-powered chatbots and automated emails personalize and optimize payment follow-ups, improving response rates.

Providing Proactive Dispute Resolution: AI can identify common dispute patterns, categorize claims, and suggest resolutions before they escalate.

What Are Accounts Receivable AI Agents?

AI agents in Accounts Receivable management act as virtual assistants that can:

Detect potential payment delays and recommend proactive actions to avoid cash flow disruptions.

Automate follow-ups with customers based on payment history and personalized communication strategies.

Categorize and prioritize disputes for faster resolution, reducing operational burden on finance teams.

Accounts Receivable AI agents have emerged as a transformative solution, embedding industry-specific expertise into real-time, adaptable AR systems. By combining the flexibility of context-aware systems with domain-specific knowledge, these AI-driven agents empower organizations to tackle AR challenges with precision and efficiency.

Operational Advantages of Accounts Receivable AI Agents

1. Targeted Domain Expertise

Accounts Receivable AI agents are fine-tuned to handle the complexities of AR processes in an industry ensuring:

Automated contract analysis to verify payment terms and flag discrepancies before invoicing.

Risk assessment for outstanding receivables, using historical payment behavior to predict late payments and suggest proactive actions.

Compliance with financial regulations through AI-driven checks that ensure adherence to accounting standards and policies.

2. Dynamic Adaptability in Real-Time Operations

Unlike rigid legacy systems, AI-driven AR solutions adjust dynamically to payment trends and external factors. This includes:

Real-Time Payment Monitoring: AI agents detect irregular payment patterns, alerting teams to potential fraud or delayed payments.

Automated Payment Prioritization: By analyzing due dates and risk levels, AI recommends collection strategies that optimize recovery rates.

Adaptive Workflows: AI dynamically updates AR processes based on customer interactions, seasonal trends, or macroeconomic conditions.

3. End-to-End Workflow Automation

By automating complex AR workflows, Accounts Receivable AI agents transform raw financial data into actionable insights. Benefits include:

Faster Invoice Processing: AI enables instant invoice validation, reducing processing delays.

Reduced Operational Costs: Automating repetitive tasks such as reconciliation allows finance teams to focus on strategic decisions.

Seamless ERP Integration: AI bridges gaps between structured (e.g., ERP systems) and unstructured data (e.g., emails, contracts), ensuring smooth financial operations

Understanding Accounts Receivable LLM Agents

Large Language Model (LLM) agents are advanced AI models designed to handle complex AR-related interactions. They assist in:

Generating contextual responses for customer queries.

Summarizing past interactions to provide personalized follow-ups.

Enhancing AR workflows by automating decision-making.

LLM Agents vs. LLM Workflows in AR

While both are AI-driven, they serve different purposes:

LLM Agents operate independently, handling real-time customer interactions and decision-making.

LLM Workflows orchestrate multiple AI agents and automation steps to streamline end-to-end AR processes.

Core Modules of Accounts Receivable LLM Agents

1. Memory

The memory module plays a crucial role in maintaining the continuity and personalization of interactions. Key functions include:

Retaining Customer Payment History and Preferences: This module securely stores detailed records of each customer’s payment history, including past due amounts, payment schedules, and preferred payment methods.

Enhancing Personalized Follow-Ups: By leveraging this historical data, the system can provide more personalized follow-up actions, such as reminders tailored to the customer’s payment behavior, thus improving collection efficiency and customer satisfaction.

2. Reasoning Engine

The reasoning engine is the analytical brain of the system, designed to assess and make recommendations based on data insights. Key functions include:

Assessing Payment Patterns and Recommending Actions: It analyzes the payment behavior of customers to identify patterns, such as regular late payments or partial payments. Based on these patterns, it recommends appropriate actions, like sending reminders or offering payment plans.

Prioritizing Collections Efforts: By evaluating the risk and likelihood of payment from different customers, it helps prioritize efforts, focusing on high-risk accounts that need immediate attention while automating routine follow-ups for low-risk accounts.

3. Cognitive Skills – Task-Specific Inferences

This module leverages advanced AI to handle specific, complex tasks that require a higher level of cognitive processing. Key functions include:

AI-Driven Dispute Categorization and Risk Assessment: When a payment dispute arises, the system can categorize the dispute type and assess the associated risk. This allows for faster resolution and better risk management.

Predictive Analytics for DSO Reduction: Using predictive analytics, it forecasts the days sales outstanding (DSO) and suggests strategies to reduce it. This might involve identifying potential payment delays before they occur and taking preemptive action.

By integrating these core modules, Accounts Receivable LLM Agents can significantly enhance the efficiency, accuracy, and effectiveness of accounts receivable management, ultimately improving cash flow and customer relations.

Agentic Systems in AR Management

Characteristics of AI Agentic Systems for Accounts Receivable (AR)

Autonomous Decision-Making: AI systems are equipped to evaluate accounts receivable (AR) data and make decisions without human intervention. They can execute predefined actions such as sending payment reminders, initiating follow-ups, and offering payment plans based on the analysis of customer payment behavior.

Context Awareness: These systems understand the historical context of each customer interaction. They adapt communication strategies based on the customer’s payment history, preferences, and prior engagements, leading to more personalized and effective interactions.

Continuous Learning: AI agentic systems continuously learn from historical data and past interactions. They refine their strategies over time, enhancing their accuracy and effectiveness in predicting payment patterns, categorizing disputes, and recommending actions.

Types of AI Agents in Accounts Receivable

1. Task-Specific Agents: These agents are designed to handle specific AR tasks with high efficiency. For example, they can manage invoice tracking, ensuring all invoices are accounted for and followed up promptly. They also handle dispute resolution by categorizing disputes, assessing risks, and suggesting solutions based on historical data.

2. Multi-Agent Systems: In a multi-agent system, several AI agents work together to streamline AR workflows. Each agent may be responsible for a different aspect of the AR process, such as invoicing, payment reminders, dispute management, and risk assessment. By collaborating, these agents can provide a comprehensive AR management solution that enhances overall efficiency and effectiveness.

3. Human-in-the-Loop Agents: These agents assist human collection specialists by providing valuable insights and recommendations while allowing for human oversight and decision-making. They analyze data and suggest actions, but the final decisions are made by human experts, combining the strengths of AI and human intuition.

The Future of AI in Accounts Receivable

AI-Driven Negotiation and Dispute Resolution: As AI technology continues to evolve, AI-powered assistants will become more adept at handling negotiations and resolving disputes. They will facilitate smoother dispute resolution processes, reducing the time required to settle issues and improving overall customer satisfaction.

Intelligent Credit Risk Assessment: Future AI agents will have the capability to analyze real-time financial data, providing more accurate and timely assessments of customer creditworthiness. This will enable businesses to make informed decisions about extending payment terms and managing credit risk more effectively.

Advanced Predictive Analytics: AI-powered dashboards will offer CFOs and finance teams actionable insights for optimizing working capital. These dashboards will leverage predictive analytics to forecast cash flow, identify potential payment delays, and suggest strategies for improving AR management and reducing days sales outstanding (DSO).

By integrating these advanced AI capabilities, AR management systems will become more efficient, accurate, and proactive, ultimately enhancing the financial health of businesses and their relationships with customers.

Conclusion and Future Directions

AI is revolutionizing accounts receivable management by enhancing efficiency, accuracy, and customer experiences. AI Agents and LLM-powered automation platforms like Kapittx are leading this transformation by providing businesses with intelligent, automated solutions that drive faster payments and optimize cash flow.

The transformation of AR management through AI is not just an upgrade—it is a strategic necessity. Businesses that adopt AI-powered AR solutions gain a competitive edge by improving efficiency, reducing DSO, and optimizing cash flow.

Kapittx is at the forefront of this revolution, offering AI-driven solutions tailored to modern financial needs. Now is the time to define your AI roadmap with Kapittx and unlock the true potential of intelligent AR management.

#cashflow management#ar collection#ai based accounts receivable#ai in accounts receivable#accounts receivable LLM Agents#Accounts Receivable AI Agents

0 notes

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

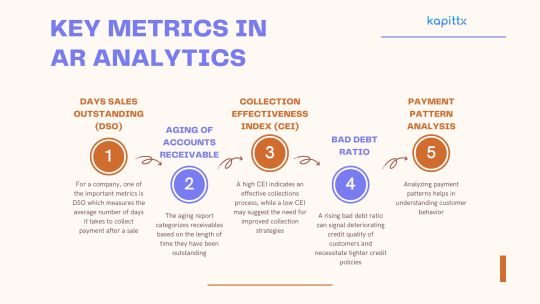

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

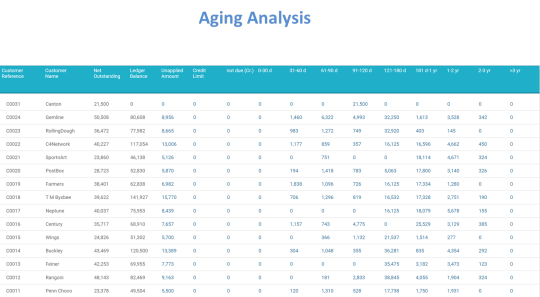

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

Case Study: AR Analytics in Action

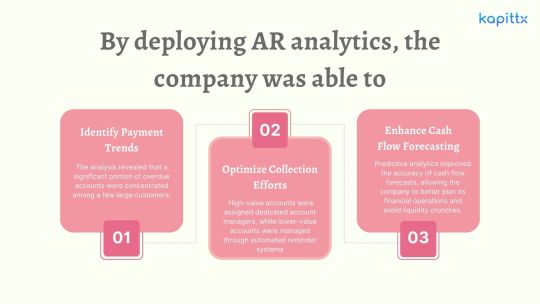

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

Best Practices for Efficient Cash Application: Leveraging AI for Superior Results

Efficient cash application management is a critical process for any business, as it directly impacts financial health, operational productivity, and customer relationships. An effective cash application process, also known as payment processing, ensures accurate allocation of incoming payments, quick reconciliation, and minimal errors. However, traditional methods often lead to inefficiencies, disputes, and even severe cash flow problems. With advancements in technology, AI-powered cash application processes and cash application automation software have transformed how businesses manage payment reconciliation, enabling faster, more accurate outcomes.

What is the Cash Application Process?

The cash application process involves applying incoming payments to the corresponding invoices in the accounts receivable system. Payments can take various forms, including checks, electronic transfers, credit cards, or cash. The primary goals are:

To deposit received funds promptly into the company’s bank account.

To accurately match payments to the corresponding invoices or accounts.

This process is vital for maintaining accurate records, reducing receivables clutter, and ensuring seamless customer interactions. However, mismanagement can cause delays, disputes, and inefficiencies.

The Importance of an Efficient Cash Application Process

Cash application is a critical component of accounts receivable management, directly impacting a company’s cash flow, customer relationships, and overall financial health. An efficient cash application process not only minimizes unapplied payments and reduces errors but also streamlines operations, ensuring smooth financial workflows. Conversely, inefficiency in this process can lead to several significant issues.

Benefits of an Efficient Cash Application Process

1. Minimized Unapplied Payments: An efficient cash application process ensures that incoming payments are promptly and accurately matched with the corresponding invoices. This minimizes unapplied payments, where funds are received but not allocated to specific customer accounts, leading to a clearer financial picture.

2. Reduced Errors: Automation and systematic approaches in cash application significantly reduce the likelihood of errors. By minimizing human intervention, businesses can ensure that payments are applied correctly, reducing the risk of misallocations and financial discrepancies.

3. Streamlined Operations: With an efficient process in place, businesses can streamline their financial operations. This includes faster processing times, improved accuracy, and better coordination between departments, all of which contribute to smoother overall workflows.

4. Improved Cash Flow: Timely and accurate application of cash payments directly impacts a company’s cash flow. Efficient cash application ensures that funds are available for use more quickly, enhancing operational liquidity and financial stability.

5. Enhanced Customer Relationships: Accurate and timely cash application fosters trust and reliability in customer relationships. Customers appreciate prompt acknowledgment of their payments, which reflects positively on the business and strengthens customer loyalty.

Improved Accuracy

AI technologies significantly reduce human errors by automatically matching payments to the correct accounts based on remittance data. Traditional, manual processes are prone to mistakes due to human oversight, such as entering wrong amounts, misplacing payments, or failing to match payments to the right invoices. AI-powered systems, on the other hand, use machine learning and pattern recognition to ensure that every payment is accurately allocated. This precision helps in maintaining accurate financial records and avoids the costly mistakes that manual processes often incur.

Faster Processing Times

One of the most substantial benefits of AI-powered cash application is the ability to handle large volumes of payments swiftly. Automated systems process payments faster than human capabilities, significantly reducing the time it takes to reconcile accounts. This speed ensures minimal backlogs and enables the AR team to focus on more strategic tasks. For businesses handling thousands of transactions daily, the improvement in processing time can be a game-changer, leading to enhanced operational efficiency and productivity.

Enhanced Cash Flow Management

By speeding up the payment processing, AI-powered systems contribute to better cash flow management. Quick and accurate reconciliation means that businesses have a clearer and more immediate picture of their financial standing. This timely insight is crucial for maintaining liquidity, which allows companies to meet their short-term obligations, invest in growth opportunities, and reduce the need for short-term borrowing. Enhanced cash flow management also helps in better financial planning and forecasting, providing a solid foundation for strategic decision-making.

Customer Satisfaction

Accurate and timely postings are essential for maintaining good customer relationships. AI-powered cash application systems reduce the likelihood of misapplied payments and discrepancies, which are common sources of customer disputes. When customers see that their payments are processed correctly and their accounts reflect accurate information, it builds trust and confidence in the business. Satisfied customers are more likely to remain loyal and continue their business relationships, which is beneficial for long-term profitability and growth.

Best Practices for Cash Application Process and Payment Processing

1. Implement Auto-Cash Technology

AI Powered Cash Application software or Auto-cash systems like Kapittx use advanced algorithms to automatically match payments to invoices. This technology offers several benefits:

Increased Accuracy: By reducing human error, auto-cash systems ensure that payments are accurately allocated to the correct invoices.

Reduced Manual Effort: Automation minimizes the need for manual data entry and reconciliation, allowing your AR team to focus on more strategic tasks.

Improved Auto-Cash Hit Rates: With higher matching percentages, auto-cash technology ensures that a larger proportion of payments are accurately applied without manual intervention.

To implement auto-cash technology effectively:

Choose a robust auto-cash system that integrates seamlessly with your existing AR software.

Regularly update and maintain your customer payment data to ensure the system has accurate information.

Train your AR team to understand the system’s functionalities and handle exceptions efficiently.

2. Follow Customer Instructions

Compliance with customer remittance advice is crucial for accurate payment application. Remittance advice provides detailed information about which invoices a payment is intended to cover, ensuring correct allocation.

To follow customer instructions effectively:

Automate Remittance Processing: Use software that can automatically capture and process remittance advice from various formats, such as email, paper, or electronic data interchange (EDI).

Double-Check Allocations: Implement checks and balances to verify that payments are applied according to customer instructions before finalizing transactions.

Communicate Clearly: Maintain open communication with customers to clarify any ambiguities in their remittance advice.

3. Handle Discrepancies Promptly

Prompt handling of payment discrepancies is essential to avoid backlogs and ensure smooth cash flow. Here’s how to manage discrepancies effectively:

Write Off Small Discrepancies: Establish thresholds for writing off minor discrepancies to streamline the reconciliation process. This allows your team to focus on resolving significant issues.

Prioritize Significant Issues: Develop a systematic approach for identifying and resolving larger discrepancies. This includes investigating the root cause and taking corrective actions.

Regular Audits: Conduct regular audits to identify recurring discrepancies and implement measures to prevent them in the future.

4. Leverage Imaging Tools

Digital imaging tools can expedite the resolution of payment discrepancies and improve accessibility. By digitizing payment and remittance documents, businesses can enhance their cash application process.

Speed Up Resolution: Digital images of payments and remittances allow for faster identification and resolution of discrepancies, as they can be quickly accessed and reviewed.

Improve Accessibility: Store digital images in a centralized system that can be accessed by authorized personnel, facilitating better collaboration and transparency.

Automate Data Extraction: Use optical character recognition (OCR) technology to automatically extract data from digital images, reducing manual data entry and errors.

5. Invest in Training and Specialization

Equipping your AR team with the necessary skills and knowledge is crucial for handling unapplied and unidentified cash effectively.

Regular Training: Provide ongoing training programs to keep your team updated on the latest tools, technologies, and best practices in cash application.

Specialized Roles: Assign specialized roles within your AR team to handle specific aspects of the cash application process, such as resolving discrepancies or managing customer communications.

Knowledge Sharing: Foster a culture of knowledge sharing and continuous improvement within your team to leverage collective expertise and experience.

6. Monitor Key Metrics

Tracking key metrics allows businesses to continuously improve their cash application process. Important metrics to monitor include:

Payment Volume: Keep track of the number and value of payments processed to understand workload and performance trends.

Unapplied Cash Value: Measure the value of payments that remain unapplied to identify inefficiencies and areas for improvement.

Auto-Cash Hit Rates: Monitor the percentage of payments automatically matched to invoices to assess the effectiveness of your auto-cash system.

Days Sales Outstanding (DSO): Track DSO to gauge how quickly your business is collecting payments and identify opportunities to accelerate cash flow.

To monitor these metrics effectively:

Implement Dashboards: Use real-time dashboards to visualize key metrics and track performance against predefined targets.

Regular Reviews: Conduct regular reviews of your cash application metrics to identify trends, challenges, and opportunities for improvement.

Benchmarking: Compare your performance with industry benchmarks to understand how your cash application process measures up and identify best practices.

The Role of Cash Application Automation Software

Modern cash application automation software enhances efficiency by incorporating AI and machine learning capabilities. These systems:

Automate repetitive tasks like matching payments to invoices.

Analyze patterns to improve accuracy and hit rates over time.

By integrating with ERP they significantly improve payment reconciliation productivity.

Case Studies examples : How Automation Transformed Cash Application

Case 1: Manufacturing Industry

An equipment manufacturer faced significant challenges with unapplied cash exceeding $2 million. By implementing AI-powered cash application processes, the company achieved:

Increased operational efficiency, saving thousands in labor costs.

Reduction of unapplied cash from $2 million to $400,000 in six months.

An auto-cash hit rate improvement from 65% to 90%.

Case 2: Medical Equipment Company

A medical devices firm struggled with misapplied payments leading to cash flow disruptions. After adopting cash application automation software:

Cash flow improved, enabling reinvestment in revenue growth.

Open credit memos reduced from 1,200 to 300 within a year.

Customer disputes dropped by 75%, enhancing satisfaction.

Benefits of AI Powered Cash Application Software or Payment Reconciliation Software

AI Powered Cash Application Software or Payment reconciliation software plays a crucial role in automating and streamlining cash application management. Key advantages include:

Reduced Errors: Automated matching eliminates human error.

Real-Time Insights: Provides a clear view of receivables for better decision-making.

Scalability: Supports businesses as they grow, handling higher payment volumes effortlessly.

Step-by-Step Guide to an Efficient Cash Application Process

Collect Payments: Deposit incoming funds promptly to optimize cash flow.

Match Payments: Use remittance advice and auto-cash tools for accurate allocation.

Reconcile Accounts: Regularly check for unapplied or misapplied payments and address them.

Resolve Discrepancies: Communicate with customers to clarify unclear remittance advice.

Analyze and Optimize: Continuously improve processes by tracking metrics and refining automation algorithms.

Learn More:

Conclusion

An efficient cash application process is essential for maintaining healthy cash flow, improving customer satisfaction, and optimizing operational efficiency. By leveraging AI-powered cash application processes, businesses can overcome common challenges, reduce errors, and achieve seamless payment reconciliation. Investing in modern cash application automation software and payment reconciliation software is no longer optional—it’s a necessity in today’s competitive landscape.

Start transforming your cash application management today with Kapittx by integrating advanced technology and best practices to unlock unparalleled efficiency and accuracy.

#cash application process#cashflow management#AR collection#ai in accounts receivable#ar management#payment reminder#ar automation solution#ai based accounts receivable

0 notes

Text

Accounts Receivable Challenges in Distribution Industry and to Address Them

In the distribution industry, companies are navigating a complex landscape that directly impacts their cash flow management, accounts receivable, and bottom-line performance. Distribution channels, whether serving consumer goods or industrial products, play a critical role in bringing products from manufacturers to consumers, which involves warehousing, transportation, inventory management, and other logistical tasks. Industries such as grocery, convenience, and pharmacy rely on these channels for market reach and customer satisfaction.

Despite the steady demand for goods, factors like seasonal fluctuations, intense market competition, and intricate cash flow management processes have emerged as key challenges. Cash flow management is essential, especially as distribution companies often operate with extended credit terms, impacting the cash conversion cycle. Late payments from clients can significantly disrupt cash flow, leading to operational delays and missed growth opportunities. Additionally, seasonal peaks often require companies to carefully balance inventory levels and operational costs.

Achieving Scale and Enhancing Market Share

For distribution companies, achieving scale—first locally, then nationally—is vital for operational efficiency, customer insights, and investment in new capabilities. Reaching scale can also allow for reinforcing market share through key measures such as:

Digital Self-Service Tools: Investing in self-service technology for customers and resellers allows distributors to streamline transactions, enhance the customer experience, and reduce operational costs.

Pricing and Accounts Receivable Management for Distribution: Improved margins through effective pricing strategies and efficient accounts receivable management for distribution can have a positive impact on cash flow management and financial sustainability. Efficient cash application and proactive collection efforts help distributors reduce Days Sales Outstanding (DSO) and strengthen liquidity.

Private-Label Products and Value-Added Services: Offering private-label products and value-added services, such as customized delivery options or specialized product packaging, enables distributors to differentiate themselves in a competitive market and strengthen client relationships.

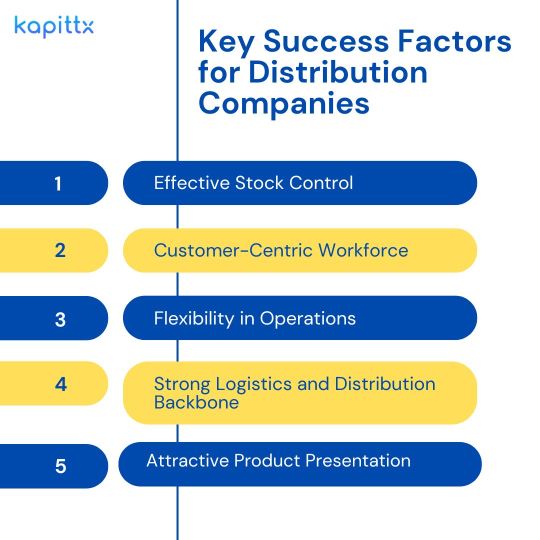

Key Success Factors for Distribution Companies

Effective Stock Control: Seasonal fluctuations mean that most revenue is generated in a few peak months. Accurate forecasting and stock control are essential for optimizing stock levels and maximizing sales.

Customer-Centric Workforce: Distributors who serve retail stores should emphasize customer service, as friendly, knowledgeable sales staff improve client relationships and loyalty.

Flexibility in Operations: Adapting to demand is key. During high-sales periods, distributors should expand their workforce and inventory, while scaling back in slower seasons to minimize costs.

Strong Logistics and Distribution Backbone: Controlling margins is essential in distribution. Investing in efficient logistics and distribution systems helps distributors manage transportation costs, inventory flow, and stock availability across locations.

5. Attractive Product Presentation: The product’s appearance, shelf management, and environment also influence sales. This goes beyond physical retail stores and includes online presentations and prompt service delivery, which can make a substantial difference.

Accounts Receivable Challenges in the Distribution Sector

Cash Flow and Accounts Receivable Management for Distribution companies

Cash flow remains a top priority for distributors who often deal with extended credit terms for B2B clients. This brings the importance of accounts receivable automation for distribution companies. Distributors commonly extend 30- to 60-day payment terms to retailers, impacting the cash conversion cycle. Given that most retail distributors have high expenses tied to warehousing, transportation, and workforce, any delay in payment can have a cascading effect on operations.

Extended Days Sales Outstanding (DSO) increases the risk of cash flow disruptions, creating operational delays and potentially causing missed opportunities. In the U.S., the average DSO for retail distribution companies is approximately 57 days; however, high-performing companies aim to reduce this metric to 40 days or less.

2. Seasonal Goods and Inventory Control

For many distributors, peak sales months from October to December make up a substantial part of their annual revenue. This heavy reliance on a single season places pressure on their inventory management, requiring them to balance stock levels meticulously. A miscalculation in inventory can lead to stockouts, missed sales, or excess stock, all of which affect cash flow. Companies need a firm grip on demand forecasting, especially for seasonal products, to control stock on hand and minimize waste.

Current B2B Payment Modes and Their Benefits

Adopting efficient payment modes can significantly enhance cash flow and streamline the reconciliation process for distributors. As part of the accounts receivable automation for distribution companies, by offering multiple payment options to retailers distributors can not only offer convenient options to pay, one can also improve relationships with the retailers.

Here are several payment modes and their potential benefits:

Automated Clearing House (ACH): ACH transfers reduce payment processing time and lower transaction fees compared to traditional checks. They also minimize manual reconciliation, reducing human error and time spent on cash application.

Electronic Funds Transfer (EFT): EFT enables real-time transfers, which can be crucial for high-turnover distributors who need prompt cash flow. EFTs also simplify record-keeping and reduce the need for physical checks.

Virtual Credit Cards: Virtual credit cards provide secure and quick payment methods, especially useful for repeat transactions with trusted clients. These are particularly advantageous for transactions requiring an extra layer of security.

Credit Card Payments: While these may involve processing fees, they can improve cash flow as distributors receive funds faster. This payment mode is ideal for smaller, high-frequency orders common in retail distribution.

Digital Wallets and Mobile Payments: Although less common in B2B, digital wallets like Apple Pay or Google Wallet are gaining traction. These options are secure and convenient, and as acceptance grows, they may become a more mainstream payment option in the distribution space.

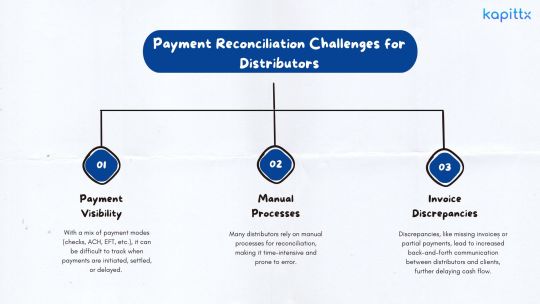

Payment Reconciliation Challenges for Distributors

One of the key components of accounts receivable for distribution companies is the obstacles you face with payment reconciliation, particularly when dealing with high transaction volumes across multiple clients. Major challenges include:

Payment Visibility: With a mix of payment modes (checks, ACH, EFT, etc.), it can be difficult to track when payments are initiated, settled, or delayed. The lack of real-time visibility results in a higher volume of unallocated cash.

Manual Processes: Many distributors rely on manual processes for reconciliation, making it time-intensive and prone to error. Nearly 30% of financial team time in some companies is spent on manual reconciliation, leaving less time for strategic activities.

Invoice Discrepancies: Discrepancies, like missing invoices or partial payments, lead to increased back-and-forth communication between distributors and clients, further delaying cash flow.

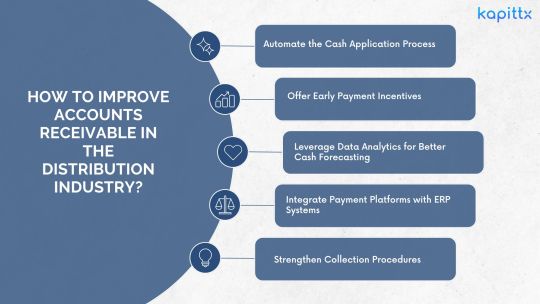

How to Improve Accounts Receivable in the Distribution Industry?

Automate the Cash Application Process: Accounts receivable automation for distribution companies will help in the automation of cash applications and can drastically reduce the time it takes to match payments to invoices, cutting down on manual processing and reducing the risk of errors. Automated systems also improve tracking and enable the finance team to focus on more strategic tasks.

Offer Early Payment Incentives: Providing discounts for early payments encourages clients to pay faster, reducing DSO and enhancing cash flow. The use of digital invoicing and payment reminders can further improve collection efficiency.

Leverage Data Analytics for Better Cash Forecasting: Advanced data analytics can provide insights into client payment patterns and predict cash flow trends. This helps finance teams forecast cash flow accurately, plan for operational expenses, and set credit policies effectively.

Integrate Payment Platforms with ERP Systems: Linking payment processing systems directly with ERP platforms ensures seamless transaction flow and real-time visibility into receivables. This integration minimizes discrepancies and improves reconciliation speed.

Strengthen Collection Procedures: A streamlined collection strategy, including regular follow-ups, automated reminders, and personalized communication, can reduce overdue receivables and maintain steady cash flow.

Conclusion

The distribution space is a dynamic sector with unique accounts receivable challenges in the distribution industry are related to cash flow, payment reconciliation, and accounts receivable management. By adopting modern payment methods, leveraging automation, and optimizing inventory, distributors can navigate these complexities more effectively. Companies that excel at managing inventory, developing a customer-focused workforce, and utilizing efficient logistics will be better positioned to succeed in this competitive market, ultimately achieving better profitability and long-term growth.

Distribution companies that prioritize efficient cash flow management, scale strategically, and invest in technology can gain a competitive advantage in the retail distribution space. By achieving these improvements, they can reduce DSO, optimize operations, and better serve their clients, positioning themselves for sustainable growth in a rapidly evolving industry.

#cashflow management#accounts receivable in distribution#accounts receivable management in distribution#cash application process#payment reconciliation software

0 notes

Text

How to Improve Cash Flow Management in the Construction Industry

Effective cash flow management is essential for the construction industry, where projects are complex, timelines are often long, and payment delays can strain operations. Without a proper cash flow strategy, companies may face financial instability, leading to stalled projects, missed opportunities, and even insolvency. One key to solving this challenge is leveraging AI powered accounts receivable automation to streamline AR processes to reduce DSO and increase cash flow.

In this blog, we will explore strategies and technologies to improve cash flow management, specifically within the construction industry.

Ten Effective Tips for Companies in the Construction Industry to Reduce DSO and Increase Cash Flow.

1. Understand the Unique Challenges of Construction Cash Flow

The construction industry faces cash flow management challenges. Payment cycles are often longer due to factors like project-based billing, delayed approvals, and complex contract terms. Additionally, construction companies frequently manage multiple projects simultaneously, leading to fluctuating cash inflows and outflows. These delays can result in cash shortages, causing project delays or inability to pay suppliers and subcontractors on time.

Accounts receivable automation for construction companies helps tackle these challenges by providing real-time visibility into payment statuses and upcoming cash flow needs. AI powered accounts receivable can further optimize the process, ensuring better predictability and control over project finances.

2. Leverage Accounts Receivable Automation for Faster Payments

One of the main ways to improve cash flow management is to accelerate the payment process. Traditional, manual methods of managing invoices and payments are prone to delays and errors. To overcome this, accounts receivable automation plays a pivotal role. Automation reduces the time between invoicing and payment collection by streamlining the entire process, from generating invoices to sending automated payment reminders.

Through AI-powered accounts receivable software, construction companies can automate routine tasks such as tracking overdue payments, sending reminders to clients, and automatically updating payment statuses. This not only reduces manual effort but also significantly shortens the time it takes to collect payments, thereby improving cash flow.

3. Implement AI in Accounts Receivable to Reduce DSO

Days Sales Outstanding (DSO) is a critical metric in cash flow management. It measures the average number of days it takes for a company to collect payments after a sale has been made. A high DSO can lead to cash flow shortages, which is detrimental in a capital-intensive industry like construction.

Using AI in accounts receivable can dramatically reduce DSO. AI analyses payment histories and patterns, allowing companies to predict when payments are likely to be delayed and take proactive measures. With AI, construction businesses can prioritize which clients to follow up with and when, improving overall payment collection efficiency.

By reducing DSO through AI, construction companies can unlock cash that would otherwise be tied up in unpaid invoices, ensuring smoother cash flow and less reliance on credit or borrowing.

4. Utilize AI and Machine Learning for Predictive Cash Flow Forecasting

AI’s role in cash flow management extends beyond just automating accounts receivable processes. Through generative AI (Gen AI) in finance and accounting, construction firms can leverage machine learning algorithms to predict future cash flow scenarios.

For example, AI can analyze historical data, including customer payment behaviors, project timelines, and cost trends, to create accurate forecasts. These forecasts allow finance teams to make informed decisions on budget allocation, project bidding, and financial planning. Knowing when cash shortages might occur allows businesses to prepare in advance, ensuring they have the working capital to cover operational costs.

Gen AI in finance and accounting provides construction firms with a strategic edge in managing finances. By anticipating cash flow fluctuations, companies can maintain liquidity and prevent project delays due to financial constraints.

5. Set Clear Payment Terms and Enforce Them

Many construction companies suffer from poor cash flow because they don’t establish clear payment terms or enforce them consistently. A key part of effective cash flow management is setting precise, favorable payment terms in contracts, such as progress billing, retainage releases, and milestone payments.

Once terms are established, accounts receivable automation for construction can ensure that invoices are sent on time, and reminders are automatically triggered. This reduces the likelihood of late payments and encourages clients to adhere to the agreed-upon terms.

By combining clear payment terms with the efficiency of AI in accounts receivable, construction firms can not only improve their DSO but also enhance their overall cash flow stability.

6. Monitor Accounts Receivable Regularly

Keeping a close eye on accounts receivable is vital for improving cash flow. Relying on outdated methods or waiting until month-end to review outstanding invoices can result in significant cash flow gaps. Instead, construction companies should adopt real-time monitoring tools.

Using AI-based receivable automation tools, construction companies can monitor their cash flow daily. These tools offer insights into unpaid invoices, help detect potential cash flow issues early, and enable businesses to take corrective actions before they escalate.

Additionally, real-time monitoring provides insights into clients’ payment behaviors. Identifying clients who consistently pay late allows businesses to negotiate better payment terms or take measures to reduce financial risks.

7. Streamline Dispute Management

Disputes over project deliverables, change orders, or billing discrepancies can cause severe delays in payments. Dispute management is crucial for cash flow, as prolonged disputes may lead to significant DSO increases.

By incorporating AI in accounts receivable automation, construction companies can streamline dispute management. AI systems can automatically flag invoices that may be prone to disputes based on historical data or identify trends that often lead to delays. Resolving these issues early on can prevent further delays and ensure faster payments.

8. Use Automation to Reduce Administrative Costs

Construction firms typically invest a significant amount of time and resources into manually tracking payments, generating invoices, and following up on late payments. This administrative burden can eat into profits, especially when combined with inefficient cash flow management.

Accounts receivable automation not only speeds up payment collection but also reduces administrative overhead. By automating repetitive tasks, construction companies can reallocate human resources toward more strategic tasks, such as analyzing cash flow patterns and improving project execution.

The combination of AI-powered automation and efficient administrative processes directly contributes to better cash flow management by reducing operational costs.

9. Communicate Clearly with Clients

Clear communication is key to reducing payment delays. Construction projects often involve multiple stakeholders, and any miscommunication can cause significant delays in approval processes, billing, or payment releases.

With AI powered accounts receivable automation, communication becomes more streamlined. Automated systems can send out timely reminders, payment confirmations, and follow-up notices. AI can also help customize communications based on client behavior, making it more likely for clients to respond and comply with payment terms.

Moreover, by keeping clients informed about upcoming payments or project milestones, construction companies can reduce the chances of disputes and delays, ensuring a steady cash flow.

10. Leverage Financing Options Based on Improved Cash Flow Visibility

Having a clear view of your accounts receivable and future cash flow can improve your financing options. Many lenders are more willing to extend favorable credit terms to companies that can demonstrate strong cash flow management practices.

Using AI-powered accounts receivable automation, construction firms can maintain detailed reports that highlight their cash flow health. These insights can make it easier to secure loans or financing for new projects, further supporting business growth.

Conclusion

Effective cash flow management is critical for the construction industry, and adopting technologies like accounts receivable automation software is a game changer. By reducing DSO, streamlining payment collections, and improving forecasting, these technologies provide construction companies with the tools they need to maintain liquidity and grow sustainably.

Incorporating Gen AI in finance and accounting takes it a step further by offering predictive insights that enhance decision-making. By focusing on reducing DSO and improving cash flow, construction firms can not only survive but thrive in a competitive market.

Now is the time for construction businesses to embrace these innovations to secure their financial future and drive long-term success.

#ai in accounts receivable#cashflow management#payment reminder#ai powered accounts receivable#ai based accounts receivable#ar automation solution#ar management

0 notes

Text

What is Cash Application and How AI is Revolutionizing Cash Application Management?

What is Cash Application and How AI is Revolutionizing Cash Application Management?

Managing cash flow efficiently is the lifeblood of any business, especially for companies dealing with high volumes of transactions. Cash application has emerged as one of the most critical functions for businesses, as it directly impacts both cash flow and customer relationships. But what is cash application process, and how is AI transforming this fundamental process to enhance speed, accuracy, and efficiency?

Why Cash Application is Crucial for Companies

Cash application, while often overshadowed by other financial processes, is an essential part of accounts receivable (AR) management. It entails matching incoming customer payments to open invoices, and keeping accounts current and precise. When cash application management is done efficiently, it ensures that businesses maintain healthy cash flow, avoid disruptions, and provide superior customer service. Conversely, poor cash application management can lead to customer dissatisfaction, increased operational costs, and strained cash flow.

In mature as well as fast-growing markets, medium to large-scale businesses operate with complex payment systems, and the stakes are even higher. Delayed or inaccurate cash application management can result in collection inefficiencies, with businesses wasting time chasing already settled invoices. Moreover, mismanagement of the cash application process can tarnish a company’s reputation, as frustrated customers deal with errors like duplicated collection efforts or unapplied payments.

What is Cash Application Process?

Cash application is the process of matching incoming customer payments with the respective invoices. In a typical B2B setup, customers pay their bills or invoices via various payment methods, including checks, ACH (Automated Clearing House) transfers, and online payments. Each payment must be reconciled with the correct invoice to ensure the customer’s account is updated accurately.

Data Collection: Data is pulled from multiple sources like ERPs (Enterprise Resource Planning), billing systems, bank statements, and customer payment advices. Payments may also arrive through various channels such as check payments, wire transfers, and online transactions.

Matching Payments to Invoices: Payments are matched to open invoices based on the remittance advice from customers. This requires close attention to discrepancies like deductions, credit notes, and partial payments.

Reconciliation: Once matched, payments are reconciled against the company’s bank statements to ensure accuracy.

4. Handling Discrepancies: Issues such as short payments, overpayments, deductions, and disputed amounts must be resolved to maintain accurate records.

Common Challenges in Manual Cash Application

“Manual cash application processes are time-consuming and prone to human error. This process can be broken down into two main categories: Payment Reconciliation and Cash Posting.“

Payment Reconciliation

The most time-consuming part of the cash application process is payment reconciliation. This involves matching invoice amounts with remittance information and bank statements. For cash application specialists, visibility into accounts receivable and expected payments is crucial. This information is typically available in the accounts ERP. Keeping track of these payments ensures they are received in a timely manner and properly allocated to the appropriate accounts.

Depending on the payment mode and channel, these formats will vary. For instance, lockbox formats differ from ACH payment reports, and online payment information differs from wire transfers. Additionally, if the payments involve multiple currencies, FX conversion rates can further complicate the process. While bank formats are generally standard, the data still needs to be retrieved for payment reconciliation from either PDFs or Excel sheets.

During the payment reconciliation process, it’s key to segregate mismatched transactions from matched transactions by taking inputs from ERP data, customer remittance information, and bank statements.

Common types of mismatches are due to following:

1. Deductions: Deductions occur when customers reduce the payment amount due to various reasons like returns, discounts, or allowances. Reconciling these requires matching the deduction details with the corresponding invoice and ensuring the justification for the deduction is valid.

2. Short Payments: Short payments happen when customers pay less than the invoiced amount. These discrepancies need to be investigated to understand the cause—whether it’s an error, a dispute, or an approved discount.

3. FX Differences: When dealing with international transactions, FX (foreign exchange) differences arise due to fluctuations in currency exchange rates. Accurate reconciliation involves converting payments to the base currency and accounting for any exchange rate discrepancies.

4. Tax Holds: Tax holds can occur if there’s an issue with the tax calculations on an invoice. These need to be reviewed to ensure compliance with tax regulations and to adjust the accounts accordingly.

5. Refunds & Chargebacks: Refunds and chargebacks require meticulous tracking. Refunds are payments returned to the customer, while chargebacks are transactions disputed by the customer and reversed by the bank. Proper documentation and validation are essential for reconciling these entries.

6. Payment Processing Charges: When using payment gateways or ACH processing services, fees are often deducted from the payment amount before it reaches the company’s account. Reconciling these charges involves matching the net payment with the gross amount and the associated fees.

Once these mismatches are identified and addressed, the transaction-level payment reconciliation provides a clear picture, enabling accurate cash posting entries into the ERP system. This clarity ensures that all payments are correctly allocated, improving cash flow management and financial reporting accuracy.

What is Cash Posting :

Cash posting is a critical step in the cash application process where payments are recorded in the ERP system to reflect accurate account balances.

What are Cash Posting Challenges

Some of the main challenges businesses face include:

Unapplied Payments: Payments that remain unapplied for days or weeks after receipt cause significant delays. These unapplied payments can create redundancy in collection efforts, as the finance team might continue to contact customers for payments that have already been made but not yet matched and applied.

Misapplied Payments: Incorrectly posting payments to the wrong account or invoice can lead to extensive rework. This mistake requires manual corrections, consumes valuable time, and frustrates customers, potentially leading to disputes and delayed future payments.

Payment Without Remittance Advice: When customers do not provide clear instructions on how their payments should be applied, businesses may struggle to identify the correct account or invoice. This often results in unapplied or misapplied payments, further complicating the reconciliation process.

Multiple Payment Channels: Companies dealing with various payment gateways (e.g., Stripe, PayPal, and Dwolla) or handling both online and traditional check payments face the challenge of reconciling payments in different formats. The diverse formats increase the risk of mismatched data and complicate the reconciliation process.

These challenges create inefficiencies, directly affecting cash flow and customer satisfaction. Research shows that companies with poor cash application processes can experience a 20-30% delay in receiving payments due to manual errors and system inefficiencies. Streamlining and automating the cash posting process can significantly improve the accuracy and speed of payment reconciliation, leading to better financial management and enhanced customer relationships.

The Role of AI in Cash Application Process

Enter AI: artificial intelligence is now revolutionizing cash application process by automating much of the manual work and improving accuracy. Let’s understand how AI powered cash application process will create an impact on your cash flow management:

Automated Matching: AI powered cash application process can process vast amounts of payment data from multiple sources and automatically match payments to open invoices, eliminating the need for human intervention. This drastically reduces the time it takes to apply cash and ensures accuracy.

Error Reduction: AI powered cash application automation software reduces the risk of human error, particularly with misapplied or unapplied payments. By leveraging machine learning, AI systems can learn from past applications and improve their matching algorithms over time.

Handling Payment Discrepancies: AI powered cash application process can flag discrepancies such as short payments, overpayments, or missing remittance advices, and automatically suggest resolutions. For instance, if a payment doesn’t match the invoice amount, the system can identify potential deductions or adjustments based on past transactions.

4. Faster Reconciliation: AI powered cash application automation software accelerates the reconciliation process by matching payments with bank statements in real-time, minimizing delays and ensuring accurate financial records.

5. Handling Complex Payment Structures: AI powered cash application process systems can manage various payment types (check payments, ACH, online payments) and integrate with multiple payment gateways (like PayPal, Stripe, and Aydan), providing a seamless cash application process regardless of the payment method used.

Benefits of AI-Powered Cash Application Process

The introduction of AI into cash application automation software offers numerous benefits:

Speed: What once took days or even weeks can now be accomplished in minutes. AI significantly reduces processing times by automating the matching and reconciliation process.

Accuracy: AI systems are highly accurate, meaning fewer errors, less rework, and improved cash flow.

Scalability: AI can easily scale to accommodate growing transaction volumes, making it ideal for large businesses with high payment frequencies.

Cost Reduction: By automating processes, AI reduces the need for large accounts receivable teams, saving on labor costs.

Should Cash Application Be Outsourced?

While outsourcing cash application to third-party providers is an option, businesses must weigh the pros and cons. Outsourcing can reduce the need for in-house expertise and can be a more affordable option in the short term. However, it may introduce delays and limit control over sensitive financial processes.

On the other hand, AI-driven cash application solutions can offer a middle ground by automating processes while keeping them in-house. This provides greater control and ensures that the company maintains direct oversight of payment processing, while still reaping the benefits of automation.

Conclusion

The adoption of AI powered cash application automation software is transforming how businesses handle one of their most critical functions. By eliminating manual errors, speeding up payment processing, and ensuring accurate application of payments, AI offers a robust solution that allows businesses to streamline their operations and improve cash flow. As AI continues to evolve, it is poised to become an indispensable tool for finance departments looking to stay competitive in the fast-paced world of business.

Investing in AI powered cash application automation software can lead to improved customer relationships, faster cash cycles, and enhanced operational efficiency, positioning companies for long-term success in an increasingly digital economy.

#ai based accounts receivable#cashflow management#payment reminder#Cash application process#accounts receivable automation software#ai in accounts receivable#payment reconciliation#ar management

0 notes

Text

Accounts Receivable and Cash Flow Challenges in Technology and IT Services Companies

The technology and IT services industry is a dynamic and rapidly evolving sector that encompasses a wide range of services and products aimed at managing and optimizing information and business processes.

The Technology and IT Services industry is driven by several key factors that are shaping its growth and evolution. While AI is going to bring in a paradigm shift in the industry and its offering, some of the primary drivers of this industry are Digital Transformation, Cloud Computing, Big Data and Analytics, Internet of Things, Technology innovations like 5G, Blockchain, SaaS etc.

Technology and IT Industry Segments :

1. Software Companies

Independent Software Vendors (ISVs): These companies develop and sell custom made software solutions that can be used by different industries.

Software as a Service (SaaS): These companies provide software applications over the internet and have high dependence on subscription management.

2. IT Services Companies

System Integrators or Value Added Resellers: These firms are solution providers and play the role of an aggregator by incorporating various hardware and software offerings from OEMs as part of their solution.

Managed Service Providers (MSPs): These companies manage a customer’s IT infrastructure and end-user systems on a proactive basis.

IT Consulting Services: These firms offer expert advice to help organizations assess and implement advanced IT solutions.

3. Cloud Solutions Providers

Infrastructure as a Service (IaaS): These companies provide virtualized computing resources over the internet.

Platform as a Service (PaaS): For application development, hardware and software tools over the internet are the primary focus of PaaS providers

4. Tech Product Companies

Hardware Manufacturers: These companies produce physical devices such as computers, smartphones, and networking equipment.

Semiconductor Companies: These firms design and manufacture semiconductor chips used in electronic devices.

5. Cybersecurity Providers

These companies offer products and services to protect systems, networks, and data from cyber attacks.

6. Data Center Providers

These companies offer facilities and services for housing and managing data storage systems.

7. Telecommunication Companies

These firms provide communication services such as internet, phone, and television.

8. E-commerce Companies

These companies operate online platforms for buying and selling goods and services.

9. Tech Infrastructure Companies

These companies provide the systems and facilities that enable web-based communications and commerce.

10. Tech Service Companies

These companies offer experienced and technical personnel to help businesses leverage technology.

Irrespective of the segment you operate, in the dynamic landscape of Technology and IT services sector, accounts receivable management and ensuring smooth cash flow are critical for sustaining growth and operational efficiency. However, these companies often face significant challenges that can impede their financial health. This blog post delves into the primary reasons behind accounts receivable challenges and offers insights into how they can be addressed to reduce DSO and increase cash flow.

1. High Days Sales Outstanding (DSO)

One of the most pressing issues is the high Days Sales Outstanding (DSO), which measures the average number of days it takes for a company to collect payment after a sale. A high DSO means the time taken by customers to pay the invoices is longer and exceeding the credit perion offered. This can severely impact cash flow and several factors contribute to this:

Complex Billing Cycles: Technology and IT services often involve complex billing structures, including milestone-based payments, subscription management models, and time-and-materials contracts. These complexities can contribute to the delays in invoicing and collections.

Client Negotiations: Clients, especially large enterprises, may negotiate extended payment terms, further elongating the DSO.

2. Inefficient Accounts Receivable Processes

Inefficient accounts receivable processes can lead to delays and errors in invoicing and payment collection. Common inefficiencies include:

Manual Processes: Reliance on manual processes for invoicing and payment tracking can result in errors and delays.

Lack of Automation: Without automation, accounts receivable teams spend excessive time on routine tasks, leaving less time for strategic activities like follow-ups and dispute resolution.

3. Disorganized Ledger Management

Disorganized ledger management can cause significant issues in tracking and reconciling payments. This disorganization can stem from:

Inconsistent Record-Keeping: Inconsistent or inaccurate record-keeping can lead to discrepancies between the amounts billed and the amounts received.

Poor Communication: Lack of communication between departments can result in incomplete or incorrect information being recorded in the ledger.

4. Customer Disputes and Payment Delays

Customer disputes over invoices can lead to payment delays and strained relationships. Common causes of disputes include:

Billing Errors: Errors in invoices, such as incorrect amounts or missing details, can contribute to payment delays and disputes.

Service Issues: Disputes may also arise from perceived issues with the services provided, leading customers to withhold payment until the issues are resolved.

5. Economic Uncertainty

Economic uncertainty can exacerbate AR and cash flow challenges. Factors contributing to this include:

Market Volatility: Economic downturns or market volatility can lead to reduced spending by clients, resulting in delayed or missed payments.

Budget Constraints: Clients facing their own financial challenges may delay payments to manage their cash flow, impacting the AR of technology and IT services companies.

6. Regulatory Compliance

Compliance with various regulations can add complexity to the AR process. For example:

Data Privacy Regulations: Ensuring compliance with data privacy regulations like GDPR and CCPA can require additional resources and processes, potentially slowing down AR activities.

Financial Reporting Standards: Adhering to financial reporting standards can necessitate detailed documentation and verification, adding to the administrative burden.

7. Supply Chain Disruptions

Supply chain disruptions can impact the delivery of products and services, leading to delays in invoicing and payment collection. These disruptions can be caused by:

Geopolitical Tensions: Geopolitical tensions can disrupt supply chains, leading to delays in project completion and invoicing.

Raw Material Shortages: Shortages of essential raw materials can delay production and delivery, impacting the timing of invoicing and payment collection.

8. Technological Challenges

While technology is a key enabler for IT services companies, it can also pose challenges:

Integration Issues: Integrating new technologies with existing systems can be complex and time-consuming, potentially leading to delays in AR processes.

Cybersecurity Threats: Cybersecurity threats can disrupt operations and lead to delays in invoicing and payment collection.

Addressing the Challenges

1. Implement AI Powered Accounts Receivable Automation

Automating accounts receivable processes can significantly improve efficiency and accuracy. Automation tools can handle routine tasks like invoicing, payment tracking, and reminders, freeing up AR teams to focus on strategic activities. Automation can also reduce errors and speed up the payment collection process.

2. Enhance Communication and Collaboration

Improving communication and collaboration between departments can help ensure accurate and consistent record-keeping. Regular meetings and updates can help identify and resolve issues quickly, reducing the risk of disputes and delays.

3. Adopt Advanced Analytics

Leveraging advanced analytics can provide valuable insights into payment behaviors, customer creditworthiness, and collection effectiveness. Predictive analytics can help forecast cash inflows and identify high-risk accounts, enabling proactive management of AR.

4. Strengthen Customer Relationships

Building strong relationships with customers can help reduce disputes and payment delays. Regular communication and prompt resolution of issues can enhance customer satisfaction and encourage timely payments.

5. Optimize Billing Processes

Streamlining billing processes can help reduce errors and delays. This can include adopting standardized billing templates, conducting regular audits, and ensuring timely and accurate invoicing.

6. Monitor Economic Trends

Keeping a close eye on economic trends can help companies anticipate and prepare for potential challenges. This can include diversifying the customer base, offering flexible payment terms, and maintaining a healthy cash reserve.

7. Invest in Technology

Investing in technology can help address integration and cybersecurity challenges. This can include adopting cloud-based solutions, implementing robust cybersecurity measures, and ensuring seamless integration of new technologies with existing systems.

Conclusion

Accounts receivable and cash flow challenges are significant hurdles for technology and IT services companies. However, by adopting strategic measures such as AI powered accounts receivable automation, advanced analytics, and improved communication, these companies can overcome these challenges and ensure sustained growth and financial stability. At Kapittx, we are committed to helping businesses streamline their AR processes and optimize cash flow through innovative AI-powered accounts receivable solutions. By addressing these challenges head-on, companies can focus on what they do best – delivering cutting-edge technology and IT services to their clients.

#ar management#ai in accounts receivable#ai powered accounts receivable#payment reminder#cashflow management#ai based accounts receivable#Accounts receivable challenges in IT services#ar automation solution#accounts receivable automation software

0 notes

Text

Accounts Receivables Portfolio Strategy: The Modern Approach To Accounts Receivable Management

For B2B companies, accounts receivable continues to be among the top three tangible assets on the balance sheet. Despite this, accounts receivable as an asset is often under- managed, leading to significant cash being unnecessarily locked within your financials. The undermanagement or at times mismanagement of this critical asset not only hinders cash flow but can also strain overall business operations and growth potential.

Understanding the Impact of Internal Processes on Collections