Lawyer interested in blockchain, AI, healthtech, fintech and other technology.

Don't wanna be here? Send us removal request.

Text

THE CAT’S WIFE

When the Cat’s father passed away, the Cat was sad.

The Cat’s wife cried with him, saying that she also missed the Cat’s father, who was called Numb.

Numb had been a great soul, and everyone who knew him, remembered his kindness for them.

As a result of his kindness, Numb was well loved.

Numb was stern but caring.

Numb was a fierce and protective friend, who stood up for others.

The Cat’s wife was happy to learn about Numb’s great character.

Numb had left some land for the Cat.

The Cat’s wife suddenly made a big fuss, remembering the land.

“Sell that land, Cat!” she said.

She had wanted to sell it for a long time.

“I want to own a cat house! I don’t want to rent a dog house anymore!”

The Cat was sad, his wife had asked him to buy another place ten years before.

After the Cat bought her special place, she refused to use it, and she refused to rent it out.

Cat asked, “What about that special place we have, can you allow me to rent it out?”

“My things are there, they are worth a lot!” said Cat’s wife.

“If you give me 10,000 kitty dollars, I will pack the things, and give them away, and you can have the place!” she said.

The Cat knew that Numb had been very sad about Cat’s wife’s attitude back then.

Cat’s wife didn’t want to rent it out because she had a lot of jimble-jumble things inside that place.

Cat’s wife didn’t want to use it because she had many other things to do.

So that special place was left like that for more than 10 years.

The Cat resolved to find the 10,000 kitty dollars and empty out the place.

The Cat’s father, Numb, had become numb, due to Cat’s wife.

The Cat closed his eyes and dreamed about packing all the things and throwing them into a fire.

But first he would have to find the 10,000 kitty dollars.

Then the Cat could pack up all the things his wife had put there, and burn them.

Ashes to ashes. Dust to dust.

Cat remembered Numb and cried terribly.

Then the Cat resolved to be a stronger cat, and face the world with his bravest meow.

0 notes

Text

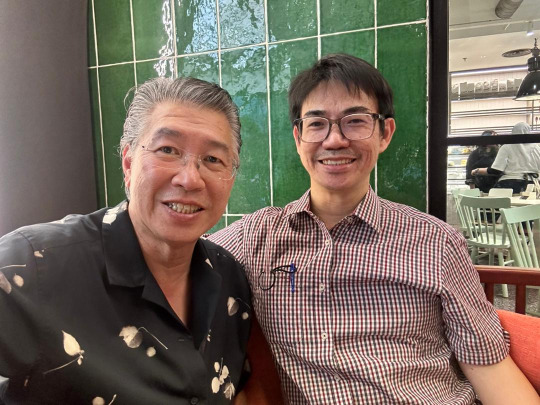

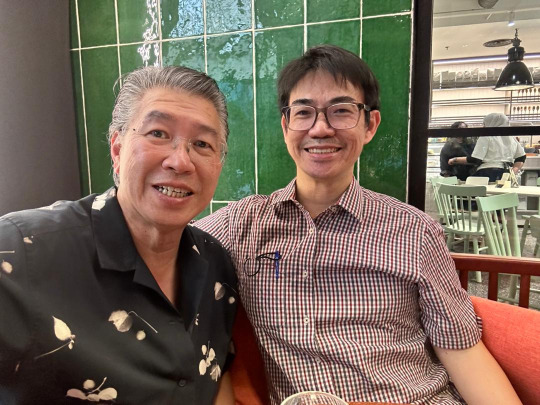

Meeting with a Dato

Today a Dato visited my office. He was opening an office in Vietnam.

I enjoyed speaking with him. I asked him if he had any stock investing tips for me.

He told me to look into banks, and telcos. And some of the retail companies, like grocery shops.

During bad times, food security and finance are so important. (He mention.)

As for airlines, he said that many things are not in their control. Oil prices, flight routes, slots, etc. They are at the mercy of others.

Lesson: It's better to invest into companies which can control their own supply chain.

I guess that it would be good, to try what he suggested.

I'm a newbie when looking at the stocks. Let's see where it goes.

0 notes

Text

Lifetime deals don't work for everyone.

You're really taking a chance on a founder to keep his word and his promise.

And in recent days some founders play the resurrection game - declaring that their platform has become unviable and needs to be shut down .... Only to restart the entire thing under a different name.

Not everyone is like that, some people are sincere.

Those that keep their promises, give delight to their supporters.

There's one thing that founders should insist upon.

That lifetime supporters should not be selling their accounts to others.

Because those others, i.e. buyers, might well be buying over an account to maximise its usage.

Those accounts will quickly overwhelm the platform.

AI credits will be quickly drained.

API quotas will be quickly maxed out.

Don't allow reselling and you'll be fine.

#appsumo #lifetimedeal

0 notes

Text

Is It Your Rezeki?

Today I was the speaker for a class of office workers.

A picture of today.

"What if the bank puts RM1 million ringgit into our account by mistake?" somebody asked. "Is it my rezeki?"

So I told them about the case of the mistaken refund. A lady in Australia bought some crypto, and then asked for a refund.

Somebody at the bank made a fat finger mistake and gave her the refund with a few extra zeroes. She was a millionaire!

Instead of returning the money, she went on a shopping spree.

Eight months later, her dishonesty was discovered.

The company sued. The case is still going on today.

But then I came back and I checked the hadiths.

I found one which spoke to me.

In Sunan Abi Dawud 3583:

Umm Salamah reported the Messenger of Allah (ﷺ) as saying: "I am only a human being, and you bring your disputes to me, some perhaps being more eloquent in their plea than others, so that I give judgement on their behalf according to what I hear from them. Therefore, whatever I decide for anyone which by right belongs to his brother, he must not take anything, for I am granting him only a portion of Hell."

In a way, this hadith says that those who take what is not theirs, will get a part of hell.

Or like I sometimes say, "You want the Vellfire, but in the end you get the Hellfire. Is it worth it?"

Thanks to Dr Grace who arranged for me to speak today.

0 notes

Text

Avoid the Loan Sharks

Introduction

Someone I know tried to commit suicide recently. He slashed his arm violently, in a fit of depression and anger, and hoped to bleed out and die. He was found in a pool of blood, and rushed to the hospital. His life is in a precarious state; but the worst has passed.

I was informed that he had run up a huge debt with a loan shark; and his family has just found out about it, and they are trying their best to pull together the cash to pay it off. At the same time, they are trying to negotiate with the loan shark, and ask for a reduction of the interest.

I heard from his family member, the loan shark had played this person for a fool. This person had spoken greatly about his father's wealth; about how his father had made it with blood, sweat, and tears. And his boastful talking had irked some people, so much that they decided to set him up.

How it starts with these loan sharks

A small borrowing, started a small debt, which then snowballed into a huge debt. Once you borrow from a loan shark, they feel legitimized to come after you for everything that you've got. They are notorious for using violence and dabble in vice, and if you come to them, it means that you've accepted those conditions.

But the loan shark is often friendly, when they're trying to get a person to borrow from them. "Don't worry, we are people too," they say. It's like fishing: the ones doing the fishing wait patiently for the fish to bite on the hook. And when the fish gets hooked, they reel it in and never let it go.

A fisherman pulls a fish in from the river or the sea, and plops it on the grass, or a basin. They don't want the fish to flip and land back into the water. Some fishermen whack the fish on the head, to stun it and prevent the fish from moving further.

Loan sharks do that too. Once they have their debtor, they let the debt balloon, and wait for the time to come. At first they'll collect partially, so that the debt continues to increase. The interest rates are far higher than anything the bank offers. Even credit card interest rates cannot compare. I heard that it can start as low as 30% for 3 months, and go as high as 50% a month.

Why not borrow from a conventional bank? (And not a loan shark)

If you borrow money from a bank, at least you know your interest rates are more reasonable. A debt of RM100,000 will not turn into a debt of RM1,000,000. Despite whatever you may say about the traditional banking industry, it plays a much needed role of offering loans to those who need it.

But conventional banks assess risks as well. They see the profile of the borrower, and rate his ability to repay. They offer him a loan within the ambit of his ability to repay. And then they monitor the loan, and send notices whenever there is a default. Repayment is made in monthly instalments, so if there is a hiccup, they will know about it. Best of all, they ask for collateral, to fall back on if the borrower is unable to repay.

So it is ironic that a loan from an unlicensed moneylender, i.e. the loan sharks, is now being repaid with a loan from a conventional financial institution.

But if the loan from the loan shark had been reasonable and followed the operation of the financial institution, that person would not have come to his moment of desperation. He would not have run up his huge debt. And he might still be well.

No, it's unreasonable because it is unlicensed. The loan sharks know that if a borrower comes to them, it's because he does not qualify for a loan from a conventional financial institution. They are the lender of last resort, and they take their chunk of flesh, because they are predators. It's a business that they cannot scale legally; so they operate from the shadows, and claim their victims whenever they find one.

The lesson for you (about loan sharks, and kings)

What is the lesson here? I was blessed to hear my church pastor speak about Hezekaiah, a good king in Israel from the line of King David. His final days offer a lesson that is relevant to this topic.

Hezekaiah was approached by an emissary from the Babylonian king. This emissary was presumably visiting so that Babylon could form an alliance with Israel against the world's superpower at the time: The Assyrians.

To this emissary, Hezekaiah showed everything he had: his stores of gold, silver, and spices. He probably led him around the kingdom and showed his great treasures that his predecessors had accumulated. The Bible says that there was nothing that he did not show the Babylonian emissary. Maybe he was trying to show how secure and how rich he was, in a bid to impress the emissary.

A prophet then asked king Hezekaiah what he had shown the emissary. "Everything", he said. "I showed him all my treasures, all my gold, all my silver." (Something along those lines, which I paraphrase.)

"OK," said the prophet. (Again, I'm paraphrasing.) "Because you showed all your treasures, etc. your children will become slaves and eunuchs in the Babylonian empire, and your kingdom will fall."

King Hezekaiah did not think much of it, because he thought that it would happen after his lifetime. "At least," he thought, "I will escape this ugly fate, right?"

But that was foolish thinking for a king! As a king, the rest of the world would know his sovereignty. He did not need to show them his treasures; indeed, they were not visiting him to audit him.

The lesson is not to show off your wealth, even to friends; because if you do that, eventually, greed will come, and with it, comes your destruction.

People always think that it is OK to shortchange a rich man. I know first hand how many many imagine that a lawyer should be rich, and nonchalantly say, "But you're a lawyer, surely you're rich, and you can afford to _____, right?"

Once they have their justification, they come with their demands and requests. Even if some of them are undeniably rich, they will do so.

Don't be a victim

Coming back to the topic at hand, when that person boasted that his father was rich, he drew the envy and (perhaps) disgust of his friends. They set him up, and plotted how to bring about his financial ruin, with the knowledge that his father would come to his rescue.

In other words, they wanted to take away the wealth that his father had accumulated, just like the Babylonians would one day, take away the wealth that King Hezekaiah's predecessors had accumulated.

The Chinese have a saying, that wealth lasts for three generations: The first generation works hard for it; the second generation, knowing how hard it was, maintains it; and the third generation squanders it all away.

In this case, the person that I know was of the second generation. His father had worked hard to accumulate wealth; and should now be enjoying his retirement. But now, comes a huge debt, and his father's properties will be charged to the bank simply to unlock the liquidity therein. From here on out, the family will work hard to bear the monthly instalments.

Loan sharks are usurious; and so, it is always, always best to avoid them.

In your life, even if you're short on cash, and have nowhere to turn, never go to a loan shark.

If someone offers to help you refinance your debts, think carefully, and never deal with offers on the phone if you can.

After all, banks have branches, and branches have workers who earn a commission. If the deal you get over the telephone is genuine, you should be able to avail it over the counter at a nearby bank.

I don't know how some of these people get my number and call me up to offer a loan, but I always say no, I will see you at the bank if you're real. Not on the phone, please.

Conclusion

Avoid the loan sharks. Even if they're nicely dressed and speak nicely with you. You'll be happier.

Thanks for reading.

Disclaimer: This article is published for information sharing purposes; and should not be regarded as legal advice. Nor should it be considered financial advice, because I am not a financial planner or a financial professional.

This article was first published at Linkedin.

0 notes

Text

Increasing Bumiputra Hiring at Public Listed Companies

At today's Bumiputra Economic Congress, Tan Sri Abdul Wahid Omar, the Bursa Malaysia chairman, suggested that public listed companies should be required to report the diversity of their workforce.

This diversity would encompass the gender, ethnicity and generation of each company's workforce.

This would address the DEI factors of diversity, equity and inclusivity - thus increasing the chances of Bumiputra workers to get hired.

An "Equal Opportunity" policy should also be implemented, he said, to ensure that Bumiputra job applicants have a better chance at getting hired.

He lamented that only one Bumiputra company was listed in the past three years, out of the 97 companies which were listed.

He lamented that the median Bumiputra household incomes were 29 percent lower compared to Chinese household incomes.

And that the median Bumiputra worker earns 45 percent less than a Chinese worker.

All of the above statements are a translation from the Berita Harian newspaper article, "Syarikat senarai awam wajar dedah jantina, etnik sebagai sebahagian daripada pelaporan kemampanan", which was published today, 1st March 2024.

I think it is a good idea.

But I also wonder if the leading GLCs (government-linked companies) in Malaysia will take the lead to balance out their workforce, and set an example for other companies.

For example, if a GLC is hiring a majority of employees from a particular community, will it make a conscious effort to increase hiring from another community, even though that second community is seen as more wealthy than the first community?

Will people who are from minority groups be given opportunities? Or will they be passed over for promotion, due to their perceived affluence?

In terms of advancement, will all employees receive the same opportunities to advance, in GLCs, regardless of which community they come from?

Will GLCs appoint directors according to the composition of the racial groups in the country?

I think those questions would not be easy to discuss, but they are necessary to be discussed anyway, if you are really serious about "DEI".

Sometimes, despite a company's stated commitment to hire according to its policy for diversity and inclusion, its workforce does not reflect that commitment.

These can be explained, as follows.

First, a company may be hiring based on a certain skillset, and there are not enough people from a certain community that have that skillset.

Second, the job being advertised may perhaps not require the candidate to be from a certain community.

Third, the hiring process could be carried out blindly, and the hiring team perhaps was not aware of who was applying for the job.

Perhaps the call for an "Equal Opportunity" policy should be clarified, in what way is the equality being evaluated.

If it is an opportunity for the best candidate to be hired, thus giving everyone an equal opportunity, I believe that it would be universally accepted by all parties.

In such scenario, race-based hiring may perhaps be made redundant, and employees could be hired without regard to the color of their skin.

But then I'm reminded of an old story which I read before.

Once upon a time, the animals of the forest decided to compete among themselves to find out who was best.

The bird said that the contest should evaluate who flew best.

The fish said that the contest should be based on who swam best.

The monkey said that the contest should consider who climbed the trees best.

Along came the lion and bared his fangs, and roared.

Many animals became afraid of the lion's wrath and acknowledged him as the winner.

And all of that was only possible because each of them could not agree on what was a good way - an objective way - to judge between each of them.

So perhaps it's better that the listed companies come up with a guideline among themselves, and present it to the Bursa chairman, as their united stand.

But hold on, perhaps there's something else that needs to be mentioned.

You see, many people today are worried about losing their jobs to automation and artificial intelligence.

When simple jobs can be automated, those jobs can be performed at a fraction of the cost by a machine, than the person previously performing it.

When jobs with some complexity can be performed by artificial intelligence, those jobs can be performed with less people, than before.

Artificial intelligence will help people multiply their productivity and act as a second brain.

Sure, you could say that there is a risk of company's confidential data being revealed to outsiders, and that would be a good reason to not use one of those artificial intelligence softwares.

But as our computers grow ever more powerful, it's more and more likely that you would have a locally hosted instance of an artificial intelligence that you could put to use, without ever worrying of your data leaving your computer.

So if you're talking about an "Equal Opportunity", and that equality is measured in terms of who can get things done most efficiently, would automation and artificial intelligence qualify as candidates in the job hunt?

Since Linkedin is a career-focused website, I guess this question is relevant.

I hope that the listed companies in my country look past the racial lens, and accept that automation and artificial intelligence are the new rivals for jobs.

After all, listed companies need to ensure shareholder value maximization.

Every dollar deployed should be deployed to best earn another dollar for the company.

But if keeping everybody employed was the goal, perhaps these listed companies should become social enterprises instead.

Thanks for reading.

Disclaimer: This article was not written as legal advice, so please don't regard it as such.

0 notes

Text

A Tale of Two Hungs

Recently, I went to Vietnam for a holiday. My trip was to a place called Da Lat, which was up in the hills, where it is cooling.

During my trip, I had the opportunity to use Grab, the Malaysian ride hailing app which somehow made it big all over South East Asia.

So, on the second day that I arrived, I got into the car of a Grab driver who had a rotating picture of Mother Mary on his dashboard.

My wife got excited upon seeing that picture. "He must be Christian," she said. "Let's ask him if he can drive us around."

And so I asked, and he said yes.

"For 1.2 million Vietnamese Dong a day, I will be happy to serve you," he said to me, through Google Translate.

And that's how we wound up hiring him.

He drove us around Da Lat, even bringing us to some far flung places and speaking to the locals there to ferry us up the hill when his car couldn't enter.

Like the time when he brought us up the mountain to a small blue lake that my wife wanted to visit. The car went up an unpaved road, which was wide enough, but was clearly for a jeep.

He pushed his car to bring us up anyway.

But at the start of a trail which led up to the lake, it was clear that the trail was just too narrow and wouldn't allow a car to go up.

That's when he spoke with the locals, and got two young men to bring us up on their motorbikes.

But the road up was rocky, and unpaved as well.

The motorcylists' services were separately payable, but our driver asked us to pay directly as he did not want to profit from it.

So on the way back, we asked him to bring us to a place near the scenic lake.

He brought us to a place where there were boats, and a small wooden restaurant where chickens ran around without any cage.

Around the restaurant there were wooden tables with wooden benches, which had hammocks hanging from the sides.

There was no menu and you could only order food if you spoke with the restaurant owners.

I joked that I should pick a good chicken for the restaurant owners to slaughter. Our driver laughed.

Then the restaurant owner brought out the chopped chicken and chopped pork which had been marinated, and our driver cooked them.

And the fee for the lunch was more than 1 million Vietnamese Dong, but it was OK because we enjoyed his sincerity and the uniqueness of the experience.

During the lunch, we spoke about his children and his wife and how he came from another place called Pleiku, and he got married to a lady from Da Lat and forgot to go home.

And that his name is "Ah Hung".

After two days with him, we decided that we couldn't afford to hire drivers for the whole day, and we used the Grab app to call for drivers as and when they were needed.

But one of those drivers turned out to be a young man called "Ah Hung", who seemed fluent in English (at least, from his messages) and he was keen to drive us around.

"I will drive you around, prices follow the app," he said. "No waiting time."

My wife was intrigued. We agreed to hire him the next day , our last day in Da Lat.

But then he dropped us off at our first destination, a park, and he went to the counter with us.

Right after we bought our entrance tickets, he claimed some kind of commissions from the park operators. Right in front of our face.

Obviously, it was his right, but that was also a sign that he was a sly guy.

We didn't think too much of it, and walked around that park.

Then we came out, and called for another Grab driver.

Someone was assigned to us, but the Grab app showed that he was not moving.

I took multiple photographs and sent it over. "Are you coming?" I texted this new driver.

"I am your driver from this morning," he replied. "I am coming."

Only then I realised that it was the same guy.

So we waited and waited, and waited some more.

And he finally came to pick us up.

This time he said something unsettling: "Can you please cancel the booking, and pay me with cash? I will still charge you with Grab rates."

Since we were already in his car, a rather fast moving car, I decided to comply with his request.

"Noooo!" said the Grab app. "Don't cancel, otherwise you might get less cabs in the future!"

But I was also aware that he asked us to cancel the booking because, we were already in his car, and by dealing directly with us, he could earn the full fare, and not share it with Grab.

(I heard that Grab takes a quarter of the fare made by drivers.)

So we told him that we were going to fly the next day, away from Da Lat. Would he like to drive us?

He said yes. "All charges follow the Grab app, but you pay me directly."

I didn't say anything.

Later that night, I asked my wife where she wanted to go the next morning, since our flight was in the late morning.

"Ask him if he can send us to a nearby park, and then to the airport, for 400,000 Vietnamese Dong? We set out around 7.30am and reach airport before 11 am"

And so I asked him, and he sent me a sour reply. (We used Telegram.)

"Someone else paid me 800,000 Vietnamese Dong," he said, obviously miffed at our request. But he didn't indicate his charges.

So I continued to appeal to him. "I'm short on cash, and my debit and credit cards aren't accepted in your country," I said.

"No," he said. "I need to pay for airport charges and tolls."

So I apologised that I was unable to hire him the next morning, and wished him well.

Even though his reply was a simple "Thank you," I could sense his anger.

The next morning, the hotel arranged for a driver to send us to the airport.

We paid this new driver 300,000 Vietnamese Dong, plus a 100,000 fee to cover his petrol, toll, etc.

The first Hung was sincere, a little bit pudgy, and a low key fella. But he was good, and I wouldn't mind engaging him again.

The second Hung seemed like a clever guy, and brave enough to lock in and take his advantage as soon as the opportunity presented itself.

That was the story of two guys called "Hung" (pronounced as "Herng").

One Hung was better than the other.

One Hung would be remembered fondly, while the other Hung would soon be forgotten.

What lessons did you learn from this story?

Thank you for reading.

0 notes

Text

I've been paralyzed by perfectionist tendencies. Work which is not "perfect" gets reworked.

It's time to adopt a new mindset. Now, if it's "good enough", I'll ship it.

Then I'll fix it.

Just get it out.

A job is a job is a job and it doesn't demand perfection.

However, you have to make sure that it fulfills the criteria.

And if it does, it's good enough.

0 notes

Text

A lot of things happening right now.

I can only deal with one thing at a time.

I wish that things were better.

But I'll accept whatever comes my way and make the best of it.

0 notes