Text

Unveiling Our Shared Equity Ownership Model for Real Estate Development in Las Vegas

Welcome to the bustling and ever-evolving Las Vegas real estate market, where a new investment paradigm is taking shape – the Shared Equity Ownership Model. This innovative approach is redefining property investment and development in one of the most dynamic real estate landscapes in the world. Unlike traditional investment models, shared equity offers a unique, collaborative approach to real estate development, aligning the interests of developers, investors, and even residents in a way that benefits all stakeholders.

Shared equity ownership is not just an investment strategy; it’s a transformative approach that is reshaping the very fabric of real estate development in Las Vegas. It bridges the gap between traditional ownership and collaborative investment, offering a balanced mix of flexibility, risk-sharing, and community-focused development. This model is particularly relevant in today’s market, where diversity in investment and inclusivity in development are more important than ever.

While the shared equity model presents numerous advantages, such as increased accessibility to real estate investment and a diversified risk portfolio, it also poses unique challenges. Implementing this model requires navigating complex financial arrangements, legal implications, and ensuring mutual benefits for all parties involved. Understanding these intricacies is crucial for anyone looking to delve into this innovative realm of real estate development.

In Las Vegas, a city known for its rapid growth and diverse property demands, shared equity ownership provides a compelling solution to many development challenges. It offers a way to capitalize on market opportunities while fostering sustainable, community-centric projects. This model's adaptability and potential for inclusive growth make it highly relevant in Las Vegas’s dynamic real estate sector.

Our journey through this article will demystify the shared equity ownership model in the context of Las Vegas’s real estate development. We aim to provide an in-depth exploration of how this model functions, its benefits, the challenges it faces, and strategies for successful implementation. From seasoned investors to new entrants in the real estate market, this article is an insightful guide into the innovative world of shared equity in Las Vegas.

The Mechanics of Shared Equity Ownership

Defining Shared Equity in Real Estate

Shared equity ownership represents a groundbreaking shift in real estate investment. At its core, it is about multiple parties coming together to invest in and develop properties, sharing both the costs and benefits. Unlike traditional models where one entity holds complete ownership, shared equity allows for a more inclusive approach, distributing both risks and rewards among a group of investors. This model can be particularly appealing in markets like Las Vegas, where the high stakes of property development can be daunting for individual investors.

How Shared Equity Works in Property Development

In the realm of property development, shared equity operates on a framework where investors and developers pool resources to finance and build real estate projects. This collaboration goes beyond mere financing; it involves joint decision-making and profit-sharing. Such arrangements often include detailed agreements outlining each party's contribution, responsibilities, and share in the eventual returns. The success of these projects hinges on transparent communication, mutual trust, and aligned objectives among all parties involved.

Implementing Shared Equity in Real Estate Development

Steps to Establishing a Shared Equity Agreement

Embarking on a shared equity venture in Las Vegas’s real estate market begins with a thorough conceptualization of the project. This initial stage involves identifying potential partners who are aligned with the project's vision and objectives. Once you have a team of interested investors, the next critical step is to draft a comprehensive shared equity agreement. This document should meticulously outline each party's contributions, ownership percentages, roles, and the decision-making process. It's crucial to involve legal professionals in this stage to ensure the agreement is comprehensive and legally robust.

Financial structuring forms the backbone of the shared equity model. This step requires developing a detailed financial plan that encompasses the investment from each party, expected returns, and the structure of profit sharing. The plan should be transparent and include strategies for managing financial risks, ensuring the project's economic viability.

An equally important aspect is ensuring regulatory compliance and conducting due diligence. This involves ensuring that the project adheres to all relevant real estate laws, zoning regulations, and other statutory requirements. Due diligence is essential to avoid future legal and financial complications and to ensure the smooth progress of the project.

Another key component of a successful shared equity model is establishing clear protocols for operational management and conflict resolution. Given the nature of shared ownership, it's vital to have mechanisms in place for effective decision-making and resolving disputes. This not only maintains harmony among investors but also ensures the project stays on track.

Financial and legal considerations are paramount in shared equity arrangements. Robust financial planning, including detailed budgeting and contingency planning, is essential. The legal framework must be solid, covering all aspects of property rights, responsibilities, and exit strategies. Engaging legal experts with real estate experience is crucial to navigating the complexities of shared equity and protecting the interests of all parties involved.

Implementing shared equity in real estate development involves several critical steps, from initial conceptualization and partner selection to drafting legal agreements, financial planning, and ensuring regulatory compliance. Each step is integral to the success of the shared equity model, particularly in a dynamic market like Las Vegas. By following these guidelines, developers and investors can collaboratively navigate the path to successful and mutually beneficial real estate projects.

Understanding the 2023 Las Vegas Real Estate Market

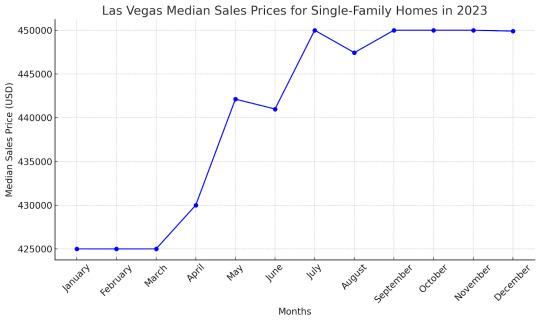

The Las Vegas real estate market in 2023 was characterized by a pattern of stability and gradual growth, with a slight dip towards the year's end. The line graph above illustrates the monthly median sales prices of single-family homes, showing a generally stable market with prices hovering around the $450,000 mark for most of the year, and closing slightly lower at $449,900 in December.

This trend reflects the resilience of the Las Vegas housing market, despite facing challenges such as a surge in mortgage rates and a shortage of inventory. The stable prices throughout the year indicate a sustained demand for housing, underpinned by Las Vegas's robust job market and its appeal as a major tourist destination. The slight decrease in December might be attributed to seasonal fluctuations and broader economic factors, rather than a decline in the market's fundamentals.

Looking ahead into 2024, the Las Vegas real estate market presents both opportunities and challenges. The shared equity ownership model, with its focus on collaboration and community development, is particularly well-suited to this dynamic environment. This model can provide an innovative approach for investors and developers to navigate the market, offering a means to democratize real estate investment and foster sustainable development.

For investors, understanding the trends of 2023 is crucial. The market's overall stability, combined with the potential for growth in shared equity projects, indicates a promising landscape for both traditional and innovative investment strategies. As Las Vegas continues to evolve, these insights can help investors and homeowners alike to make informed decisions in a market that remains one of the most vibrant and diverse in the United States.

Advantages of Shared Equity in Real Estate Development

Accessibility to the Real Estate Market: Shared equity makes real estate investment more accessible. By pooling resources, smaller investors can participate in larger projects, democratizing access to lucrative real estate opportunities.

Risk Mitigation for Investors: One of the key benefits of shared equity is risk distribution. With multiple investors sharing the burden, individual risk is significantly reduced, making it an attractive option for those wary of solo real estate ventures.

Flexibility in Investment: Shared equity arrangements offer flexibility in terms of investment amounts and decision-making. Investors can choose their level of involvement and investment, tailoring it to their financial capabilities and risk appetite.

Potential for Community Development: Shared equity projects often have a community focus, contributing to local development. This aspect can enhance the social value of the investment, aligning financial returns with community benefits.

The Future of Shared Equity in Las Vegas Real Estate

Emerging Trends Influencing Shared Equity Models

The Las Vegas real estate landscape is witnessing significant shifts that are shaping the future of shared equity models. One emerging trend is the growing interest in sustainable and community-focused developments. Shared equity models are well-positioned to capitalize on this by facilitating investments in eco-friendly and socially responsible projects. Another trend is the increasing use of technology in real estate transactions and management, which can streamline shared equity processes and enhance transparency for all stakeholders. Additionally, the diversification of the Las Vegas real estate market, with a rise in mixed-use developments, offers fertile ground for shared equity models to flourish, catering to a wider range of investor interests and community needs.

The Role of Shared Equity in Market Growth

Shared equity has the potential to play a pivotal role in the growth of the Las Vegas real estate market. By democratizing access to property investment, it allows a broader spectrum of investors to participate in and benefit from the city's real estate boom. This model can drive more equitable growth and stimulate diverse development projects, from residential complexes to commercial and mixed-use properties. It also fosters a sense of community ownership and engagement, which can lead to more sustainable and long-lasting developments.

Challenges and Prospects in Shared Equity

While the prospects are bright, shared equity in real estate also faces challenges. Ensuring alignment of interests among diverse investors and managing complex partnership dynamics are some of the key hurdles. Additionally, adapting to regulatory changes and market fluctuations requires agility and innovative thinking. Despite these challenges, the shared equity model holds substantial promise for future growth, offering a more inclusive and collaborative approach to real estate development in Las Vegas.

Some FAQs Answered on The Relevant Topic

How does shared equity in real estate work?

Shared equity involves multiple investors pooling resources to buy or develop a property. Investors share ownership, risks, and returns, which can make real estate investment more accessible and spread out the financial burden.

What are the benefits of investing in shared equity real estate in Las Vegas?

Benefits include access to larger and more diversified real estate projects, shared risk, potential for higher returns due to collective investment power, and contributing to community-focused developments.

Are there any particular risks associated with shared equity investments?

Yes, like any investment, there are risks. These include potential conflicts among investors, market risks, and challenges in aligning investment strategies. Proper legal agreements and clear communication can mitigate these risks.

In conclusion, the shared equity ownership model in Las Vegas real estate development presents a transformative approach to property investment. It offers numerous benefits, from making real estate investment more accessible to fostering community-oriented projects. While there are challenges, the model’s potential to revolutionize the Las Vegas real estate market is substantial. As we look to the future, shared equity ownership stands out as a promising avenue for innovative investment opportunities, contributing significantly to the growth and diversity of the Las Vegas real estate landscape. This model is not just about financial returns; it's about creating sustainable, inclusive, and community-driven developments that resonate with the evolving dynamics of Las Vegas.

1 note

·

View note