#Equity Ownership Model

Text

Unveiling Our Shared Equity Ownership Model for Real Estate Development in Las Vegas

Welcome to the bustling and ever-evolving Las Vegas real estate market, where a new investment paradigm is taking shape – the Shared Equity Ownership Model. This innovative approach is redefining property investment and development in one of the most dynamic real estate landscapes in the world. Unlike traditional investment models, shared equity offers a unique, collaborative approach to real estate development, aligning the interests of developers, investors, and even residents in a way that benefits all stakeholders.

Shared equity ownership is not just an investment strategy; it’s a transformative approach that is reshaping the very fabric of real estate development in Las Vegas. It bridges the gap between traditional ownership and collaborative investment, offering a balanced mix of flexibility, risk-sharing, and community-focused development. This model is particularly relevant in today’s market, where diversity in investment and inclusivity in development are more important than ever.

While the shared equity model presents numerous advantages, such as increased accessibility to real estate investment and a diversified risk portfolio, it also poses unique challenges. Implementing this model requires navigating complex financial arrangements, legal implications, and ensuring mutual benefits for all parties involved. Understanding these intricacies is crucial for anyone looking to delve into this innovative realm of real estate development.

In Las Vegas, a city known for its rapid growth and diverse property demands, shared equity ownership provides a compelling solution to many development challenges. It offers a way to capitalize on market opportunities while fostering sustainable, community-centric projects. This model's adaptability and potential for inclusive growth make it highly relevant in Las Vegas’s dynamic real estate sector.

Our journey through this article will demystify the shared equity ownership model in the context of Las Vegas’s real estate development. We aim to provide an in-depth exploration of how this model functions, its benefits, the challenges it faces, and strategies for successful implementation. From seasoned investors to new entrants in the real estate market, this article is an insightful guide into the innovative world of shared equity in Las Vegas.

The Mechanics of Shared Equity Ownership

Defining Shared Equity in Real Estate

Shared equity ownership represents a groundbreaking shift in real estate investment. At its core, it is about multiple parties coming together to invest in and develop properties, sharing both the costs and benefits. Unlike traditional models where one entity holds complete ownership, shared equity allows for a more inclusive approach, distributing both risks and rewards among a group of investors. This model can be particularly appealing in markets like Las Vegas, where the high stakes of property development can be daunting for individual investors.

How Shared Equity Works in Property Development

In the realm of property development, shared equity operates on a framework where investors and developers pool resources to finance and build real estate projects. This collaboration goes beyond mere financing; it involves joint decision-making and profit-sharing. Such arrangements often include detailed agreements outlining each party's contribution, responsibilities, and share in the eventual returns. The success of these projects hinges on transparent communication, mutual trust, and aligned objectives among all parties involved.

Implementing Shared Equity in Real Estate Development

Steps to Establishing a Shared Equity Agreement

Embarking on a shared equity venture in Las Vegas’s real estate market begins with a thorough conceptualization of the project. This initial stage involves identifying potential partners who are aligned with the project's vision and objectives. Once you have a team of interested investors, the next critical step is to draft a comprehensive shared equity agreement. This document should meticulously outline each party's contributions, ownership percentages, roles, and the decision-making process. It's crucial to involve legal professionals in this stage to ensure the agreement is comprehensive and legally robust.

Financial structuring forms the backbone of the shared equity model. This step requires developing a detailed financial plan that encompasses the investment from each party, expected returns, and the structure of profit sharing. The plan should be transparent and include strategies for managing financial risks, ensuring the project's economic viability.

An equally important aspect is ensuring regulatory compliance and conducting due diligence. This involves ensuring that the project adheres to all relevant real estate laws, zoning regulations, and other statutory requirements. Due diligence is essential to avoid future legal and financial complications and to ensure the smooth progress of the project.

Another key component of a successful shared equity model is establishing clear protocols for operational management and conflict resolution. Given the nature of shared ownership, it's vital to have mechanisms in place for effective decision-making and resolving disputes. This not only maintains harmony among investors but also ensures the project stays on track.

Financial and legal considerations are paramount in shared equity arrangements. Robust financial planning, including detailed budgeting and contingency planning, is essential. The legal framework must be solid, covering all aspects of property rights, responsibilities, and exit strategies. Engaging legal experts with real estate experience is crucial to navigating the complexities of shared equity and protecting the interests of all parties involved.

Implementing shared equity in real estate development involves several critical steps, from initial conceptualization and partner selection to drafting legal agreements, financial planning, and ensuring regulatory compliance. Each step is integral to the success of the shared equity model, particularly in a dynamic market like Las Vegas. By following these guidelines, developers and investors can collaboratively navigate the path to successful and mutually beneficial real estate projects.

Understanding the 2023 Las Vegas Real Estate Market

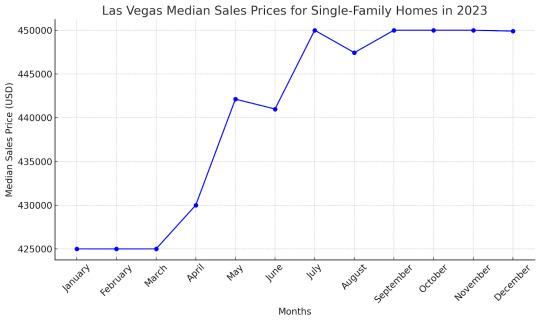

The Las Vegas real estate market in 2023 was characterized by a pattern of stability and gradual growth, with a slight dip towards the year's end. The line graph above illustrates the monthly median sales prices of single-family homes, showing a generally stable market with prices hovering around the $450,000 mark for most of the year, and closing slightly lower at $449,900 in December.

This trend reflects the resilience of the Las Vegas housing market, despite facing challenges such as a surge in mortgage rates and a shortage of inventory. The stable prices throughout the year indicate a sustained demand for housing, underpinned by Las Vegas's robust job market and its appeal as a major tourist destination. The slight decrease in December might be attributed to seasonal fluctuations and broader economic factors, rather than a decline in the market's fundamentals.

Looking ahead into 2024, the Las Vegas real estate market presents both opportunities and challenges. The shared equity ownership model, with its focus on collaboration and community development, is particularly well-suited to this dynamic environment. This model can provide an innovative approach for investors and developers to navigate the market, offering a means to democratize real estate investment and foster sustainable development.

For investors, understanding the trends of 2023 is crucial. The market's overall stability, combined with the potential for growth in shared equity projects, indicates a promising landscape for both traditional and innovative investment strategies. As Las Vegas continues to evolve, these insights can help investors and homeowners alike to make informed decisions in a market that remains one of the most vibrant and diverse in the United States.

Advantages of Shared Equity in Real Estate Development

Accessibility to the Real Estate Market: Shared equity makes real estate investment more accessible. By pooling resources, smaller investors can participate in larger projects, democratizing access to lucrative real estate opportunities.

Risk Mitigation for Investors: One of the key benefits of shared equity is risk distribution. With multiple investors sharing the burden, individual risk is significantly reduced, making it an attractive option for those wary of solo real estate ventures.

Flexibility in Investment: Shared equity arrangements offer flexibility in terms of investment amounts and decision-making. Investors can choose their level of involvement and investment, tailoring it to their financial capabilities and risk appetite.

Potential for Community Development: Shared equity projects often have a community focus, contributing to local development. This aspect can enhance the social value of the investment, aligning financial returns with community benefits.

The Future of Shared Equity in Las Vegas Real Estate

Emerging Trends Influencing Shared Equity Models

The Las Vegas real estate landscape is witnessing significant shifts that are shaping the future of shared equity models. One emerging trend is the growing interest in sustainable and community-focused developments. Shared equity models are well-positioned to capitalize on this by facilitating investments in eco-friendly and socially responsible projects. Another trend is the increasing use of technology in real estate transactions and management, which can streamline shared equity processes and enhance transparency for all stakeholders. Additionally, the diversification of the Las Vegas real estate market, with a rise in mixed-use developments, offers fertile ground for shared equity models to flourish, catering to a wider range of investor interests and community needs.

The Role of Shared Equity in Market Growth

Shared equity has the potential to play a pivotal role in the growth of the Las Vegas real estate market. By democratizing access to property investment, it allows a broader spectrum of investors to participate in and benefit from the city's real estate boom. This model can drive more equitable growth and stimulate diverse development projects, from residential complexes to commercial and mixed-use properties. It also fosters a sense of community ownership and engagement, which can lead to more sustainable and long-lasting developments.

Challenges and Prospects in Shared Equity

While the prospects are bright, shared equity in real estate also faces challenges. Ensuring alignment of interests among diverse investors and managing complex partnership dynamics are some of the key hurdles. Additionally, adapting to regulatory changes and market fluctuations requires agility and innovative thinking. Despite these challenges, the shared equity model holds substantial promise for future growth, offering a more inclusive and collaborative approach to real estate development in Las Vegas.

Some FAQs Answered on The Relevant Topic

How does shared equity in real estate work?

Shared equity involves multiple investors pooling resources to buy or develop a property. Investors share ownership, risks, and returns, which can make real estate investment more accessible and spread out the financial burden.

What are the benefits of investing in shared equity real estate in Las Vegas?

Benefits include access to larger and more diversified real estate projects, shared risk, potential for higher returns due to collective investment power, and contributing to community-focused developments.

Are there any particular risks associated with shared equity investments?

Yes, like any investment, there are risks. These include potential conflicts among investors, market risks, and challenges in aligning investment strategies. Proper legal agreements and clear communication can mitigate these risks.

In conclusion, the shared equity ownership model in Las Vegas real estate development presents a transformative approach to property investment. It offers numerous benefits, from making real estate investment more accessible to fostering community-oriented projects. While there are challenges, the model’s potential to revolutionize the Las Vegas real estate market is substantial. As we look to the future, shared equity ownership stands out as a promising avenue for innovative investment opportunities, contributing significantly to the growth and diversity of the Las Vegas real estate landscape. This model is not just about financial returns; it's about creating sustainable, inclusive, and community-driven developments that resonate with the evolving dynamics of Las Vegas.

1 note

·

View note

Text

In 2021, despite continued struggles during the COVID-19 pandemic, the number of Black-owned businesses grew by 14.3% from the year prior. This growth is a significant achievement in a landscape where Black individuals still own the lowest share of employer firms (firms with more than one employee) compared to every other racial group. The following year, Black median wealth grew, along with a 30% increase in employer firm revenue.

In the face of this progress, a litany of lawsuits combatting programs that intentionally fund Black-owned businesses is moving through the courts, emboldened by two watershed Supreme Court cases that ended affirmative action in higher education last year. The legal backlash against DEI (diversity, equity, and inclusion) initiatives has been swift, leaving a chilling effect across government, nonprofit, and private investment programs. For these investors, the question lingers: Is it still legal to invest in Black-owned businesses?

Responses from experts seem to be “yes,” but with some alternative strategies. Governments, philanthropists, banks, and businesses must use funding methods that pass legal scrutiny—and fortunately, many already exist. This report explains how tools such as special purpose credit programs, community development financial institutions, and placed-based investment—along with innovative funding models such as community ownership and crowdfunding—are all legal strategies funders can use to invest in Black businesses today.

6 notes

·

View notes

Text

is solarpunk compatible with space travel?

I am currently a big fan of solarpunk, but my first love in the world of science and science fiction was related to space travel. I realize that space travel is a very tainted concept. Our understanding of space is greatly impacted by colonialism, imperialism, and capitalism. While solarpunk feels like a response to the infinite growth mindset, space is literally described as another frontier. This may be a massive piece of copium on my part, but I wonder, can there be a solarpunk version of space travel? Is it possible to have a decolonial interest in leaving the earth? Can an understanding of the rest of the universe allow us to be in community with it more successfully? I don’t have super developed answers for this right now, but I think it could be interesting to make gestures in that direction.

One of the ways to solarpunk space could be to transition the industry and to locally scaled, community-based initiatives. Right now, space economics are deeply wedded to money and the nation-state model. Instead of a focus on scale, where there are massive agencies that decide how space technologies are explored, there could be more boutique outfits that are based in specific, human-scaled communities. This would probably not be high on the priority list of a community, but could be a nice to have once other needs are met. Maybe, if space travel needs a degree of centralization, there could be an exploration of using federation to collectively decide how to develop space programs on a regional level.

This program could be developed through an open source model, where communities have their own makerspaces and fabrication labs. People could develop and experiment with space tech, and the open source model would allow breakthroughs to be more quickly proliferated. One of the most important things for a solarpunk space program would be that bottom-up, equity-centered approach.

Due to space programs being couched in hegemonic modes of operation, the process tends to be very wasteful. From all of the debris in the atmosphere, to the motivations of various space movements themselves, there is a lack of critical analysis of domineering systems. For space to get solarpunk’d, the economies of creating spaceships and the like would have to be circular, with making sure that there is minimal impact on our environment, moving us towards a degrowth orientation. Even life support systems and on-mission resource management should have a regenerative focus.

The main thing to focus on is the needs and wants of communities. Governments and corps should not dictate what going to space looks like. The design of spaceships and habitats should be participatory. Everyone who has interest should be able to contribute, and anything developed should have a communal focus. In other words, these projects would not just be the machinations of a single eccentric.

This ain’t to say that it’ll be easy. A community-driven space program is hard to imagine, when space travel lives in a very imperial, statist milieu. Maybe we can look at Earth-bound advancements for inspiration. On Earth, we can see the potential for decentralized production, cooperative ownership, and ecological communities. Looking at space through this lens has a lot of potential in my mind.

We can use solarpunk principles to move towards the future in ways that are truly inspiring and ecologically sound. Collective and individual creativity can be harnessed to great ends. So. Can solarpunks go to space? I, selfishly, hope so! But it would have to be to the ends of connecting more with our universe (expanding our definition of nature), and improving the lives of all. We have to prioritize regeneration, equity, and community, to create a cool space program.

73 notes

·

View notes

Text

This day in history

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

#15yrsago Got a cell-phone? FCC claims the right to search your house https://www.wired.com/2009/05/fcc-raid/

#15yrsago Infinite Typewriters: Goats webcomic collection is transcendantly silly without being forced https://memex.craphound.com/2009/05/20/infinite-typewriters-goats-webcomic-collection-is-transcendantly-silly-without-being-forced/

#15yrsago Fight terrorism by arresting terrorists, not by looking at our genitals at airports https://edition.cnn.com/2009/TRAVEL/05/18/airport.security.body.scans/

#15yrsago Lessig reviews Helprin’s embarrassing infinite copyright, bloggers-are-stupid, Creative Commons is evil book https://www.huffpost.com/entry/the-solipsist-and-the-int_b_206021

#10yrsago Podcast: Firefox’s adoption of closed-source DRM breaks my heart https://ia802206.us.archive.org/30/items/Cory_Doctorow_Podcast_273_fixed/Cory_Doctorow_Podcast_273_Firefoxs_adoption_of_closed-source_DRM_breaks_my_heart.mp3

#10yrsago Interviews with & portraits of sex-machine makers https://web.archive.org/web/20140903013303/http://designyoutrust.com/2011/08/sex-machines-photographs-and-interviews-by-timothy-archibald/

#10yrsago Steve Wozniak explains Net Neutrality to the FCC https://www.theatlantic.com/technology/archive/2010/12/steve-wozniak-to-the-fcc-keep-the-internet-free/68294/

#10yrsago Disneyland’s original prospectus revealed! https://memex.craphound.com/2014/05/20/disneylands-original-prospectus-revealed/

#10yrsago Jo Walton’s “My Real Children”: infinitely wise, sad and uplifting novel https://memex.craphound.com/2014/05/20/jo-waltons-my-real-children-infinitely-wise-sad-and-uplifting-novel/

#5yrsago That billionaire who paid off a graduating class’s student loans also supports the hedge-fundie’s favorite tax loophole https://archive.nytimes.com/dealbook.nytimes.com/2014/04/10/a-private-equity-titan-with-a-narrow-focus-and-broad-aims/

#5yrsago TOSsed out: EFF catalogs the perverse ways that platform moderation policies hurt the people they’re supposed to protect https://www.eff.org/tossedout

#5yrsago How Warner Chappell was able to steal revenues from 25% of a popular Minecraft vlogger’s channels https://www.youtube.com/watch?v=LZplh8rd-I4

#5yrsago Notorious forum for account-thieves hacked, login and messages stolen and dumped https://krebsonsecurity.com/2019/05/account-hijacking-forum-ogusers-hacked/

#5yrsago A look back at the sales training for Radio Shack’s Model 100, a groundbreaking early laptop https://www.fastcompany.com/90349201/heres-how-radioshack-sold-its-breakthrough-laptop-circa-1983

#5yrsago DRM and terms-of-service have ended true ownership, turning us into “tenants of our own devices” https://www.wired.com/story/right-to-repair-tenants-on-our-own-devices/

#5yrsago Research shows that 2FA and other basic measures are incredibly effective at preventing account hijacking https://security.googleblog.com/2019/05/new-research-how-effective-is-basic.html

#5yrsago A deep dive into the internal politics, personalities and social significance of the Googler Uprising https://fortune.com/longform/inside-googles-civil-war/

#1yrago Dumping links like Galileo dumped the orange https://pluralistic.net/2023/05/20/the-missing-links/#plunderphonics

7 notes

·

View notes

Text

The news of Magic Johnson's purchasing of the NFL Washington Commanders football team was a momentous occasion for Black America. Current Owner Dan Synder has agreed to sell the team to Magic and Sixers owner Josh Harris for 6.05 billion, fully financed.

For decades, Black people had been excluded from ownership in major sports leagues, and Magic's acquisition will be a significant step towards equity and representation.

The purchase marked a shift in the power dynamics of professional sports, where Black athletes had long been exploited for their talent without adequate representation in leadership positions.

As a successful businessman and beloved figure in the Black community, Magic is a role model and symbol of Black excellence, proving that Black people could not only compete but excel in any field they chose.

His soon to be purchase, also means that Black people would have a voice in the decision-making process of a major sports franchise in the NFL, and their perspectives and experiences would be taken into account from the top.

Furthermore, Magic's ownership could serve as a catalyst for other Black entrepreneurs to invest in sports and create more opportunities for Black athletes and staff.

The purchase will be a reminder that Black people are not just consumers, but also creators and innovators, who could shape and influence the industries they participated in.

For Black America, Magic Johnson's purchase of the Washington Commanders will be more than just a business deal. It will also be a symbol of progress and a step towards of a more equitable and inclusive society. Brick by brick.

Citing of source: https://www.tmz.com/2023/04/13/dan-snyder-sells-washington-commanders-magic-johnson-josh-harris-6-billion/

38 notes

·

View notes

Text

What Private Equity Firms Are and How They Operate

Private equity firms can raise money from institutional investors like pension funds and insurance companies. Corporations utilize private equity services that guide them in fundraising. Private equity firms hold more than 4 trillion USD in assets. Also, return on investment (ROI) makes this financial instrument remarkably attractive to investors. This post will elaborate on how private equity firms work.

What is a Private Equity Firm?

Private equity (PE) means the company is not publicly held. It allows companies to increase their financial capacity by offering investors partial ownership. Private equity services also help publicly listed companies become private by completely replacing previous owners.

Professional teams hired by private equity firms work on market trend analytics by outsourcing investment research and creating appropriate reports. An investment research report depicts the advantages and risks associated with each portfolio management decision.

Investing in private equity is financially riskier than traditional investment vehicles. Therefore, private equity funds use tried and tested investment strategies to redistribute risks. An experienced fund manager will use investors’ capital for private equity opportunities with an excellent ROI.

How Does Private Equity Work?

Private equity services can charge 2% of assets as management fees. Otherwise, they require 20% of gross profits if company ownership undergoes a thorough structural change.

Passive investors are known as limited partners (LPs) who do not affect the company’s decisions and policies. However, general partners (GPs) can determine managerial and executive strategies, affecting how the company operates.

Investment research outsourcing assists private equity firms in networking with more investors and optimizing their strategies for different industries. Besides, each investor can contribute to financial improvements by mentoring the company owners.

Therefore, private equity benefits the company by enriching its knowledge base with the recommendations made by veteran investors.

Types of Private Equity Investment Strategies

1| Venture Capital

Startups require financial assistance to launch their products and services or expand their production capabilities. Venture capital (VC) helps them secure capital resources and business management intelligence. After all, venture capitalists often have a personal connection with the startup ideas they support.

Venture capitalists use private equity services to evaluate investment decisions and a new company’s growth potential as part of their risk mitigation efforts. They share their knowledge with inexperienced young leaders at startups to increase efficiency and build stronger teams.

VC financing involves investing up to 10 million USD in different startups. So, successful investments in well-performing startups will balance the risks originating from the less stable business models of other firms.

2| Leveraged Buyouts

LBO means leveraged buyout, and private equity services utilize borrowed capital to acquire company ownership through this investment strategy. Additionally, a company’s assets are collateral for the respective debt.

This strategy helps private equity funds leverage their investments without committing financial capital directly. While the borrowed money attracts interest, the ROI of highly efficient companies can easily offset the repayment outflows. Many private equity firms have acquired new companies through multiple rounds of leveraged buyouts.

PE professionals often employ the LBO strategy when privatizing a public enterprise. Privatization results in decreased regulatory obligations and enhanced operational freedoms. Later, new ownership will implement policies to make the public enterprise more efficient and marketable.

You may also notice how LBO-based corporate acquisitions divide the company into segments with a narrower industry focus. Doing so makes selling the company and settling the debt obligations more flexible.

Conclusion

Unlisted companies explore unique outsourcing services to identify fundraising opportunities via extensive investment research. Private equity is a practical financial instrument that helps businesses generate the capital necessary for business expansion.

Simultaneously, general partners acquire decision-making authority and empower startups with business development insights. Therefore, private equity supports the companies on two frontiers: financial assistance and managerial mentorship.

A leader in investment research outsourcing, SG Analytics helps investors and business owners successfully deploy data-driven fundraising activities. Contact us today to obtain analytical support for deal sourcing, target screening, and excellent business modeling.

2 notes

·

View notes

Text

Greetings Bernard Arnault,

Charmed Circle Services

If you refer to a group of people as a charmed circle, you mean that they seem to have special power or influence, and do not allow anyone else to join their group.

A protection racket is a type of racket and a scheme of organized crime perpetrated by a potentially hazardous organized crime group that generally guarantees protection outside the sanction of the law to another entity or individual from violence, robbery, ransacking, arson, vandalism, and other such threats, in exchange for payments.

Green Crime is illegal activity that involves the environment, biodiversity, or natural resources. There are generally five types of major environmental crime: illegal logging, fishing, and mining, and crimes that harm wildlife and generate pollution.

State-corporate crime is a concept in criminology for crimes that result from the relationship between the policies of the state and the policies and practices of commercial corporations.

Tax Haven Lobbying

State-corporate crime is a concept in criminology for crimes that result from the relationship between the policies of the state and the policies and practices of commercial corporations.

Organized transnational crime is organized criminal activity that takes place across national jurisdictions, and with advances in transportation and information technology, law enforcement officials and policymakers have needed to respond to this form of crime on a global scale.

Government Joint Venture

Example: Government Part Owned Coal & Diamond Mines

international corporation that specializes in coal & diamond mining, coal & diamond exploitation, coal & diamond retail, diamond trading and industrial coal & diamond manufacturing sectors.

Example: Debswana Diamond Company Limited Influenced

Debswana is a joint venture between the government of Botswana and the South African diamond company De Beers; each party owns 50 percent of the company

Ecological Preservation Company

Farmland Real Estate

Acquisition

Lease

Gross Margin

China Big Four Influence: Industrial and Commercial Banks, Construction Bank, & Agriculture Banks (Ag Banks)

Products

Finance and insurance, consumer banking, corporate banking, investment banking, investment management, global wealth management, private equity, mortgages, credit cards

Gross Margin Loan

In exchange for farmland development or startup give cash for gross margin %

LVMH Digital Wallet

Air Miles Credit Card

Client Card (Gift Card/Social Club)

Drop Shipping

Isolated Investment Platform/Newsletter

Distributors Type

Wholesale distributors provide that liaison, buying large quantities of products from manufacturers, storing them and then supplying them to retailers and other businesses.

Distributors

Distributors have a business relationship with manufactures and have partial ownership of the product they sell. Some distributors buy exclusive rights to buy a company's product to ensure that they are the sole distributor of that product in the area. Distributors often sell to wholesalers and retailers, creating minimal contact with the final buyers.

Indirect selling

Indirect selling is when a company uses an intermediary to distribute and sell its product. Indirect selling marketing channels can use varying amounts of intermediaries. In the most direct distribution route, the manufacturer can sell their product to an intermediary who then sells the product to a consumer. However, they may sometimes involve more than one intermediary in the distribution of a product.

This marketing channel encompasses many of the examples of intermediary channel uses, including shopping malls and chain retailers.

LVMH Distribution & Cash Conversion Cycle

Big Pharma Distribution Model

Wholesalers purchase drugs from manufacturers and distribute to a variety of customers, including independent, chain, or mail-order pharmacies, hospitals, long-term care, and other medical facilities.

Wholesale Distribution Clients

Drop Shipping

Malls

Modeling Agencies

Wedding Directors

Private Schools

Social Club

Art Auctions

Film Production Companies

Car Dealerships/Shows (Collaboration)

Jewelers (Gift Card Distribution for Store Credit)

Political Cabinet

Tennis Clubs (Dress Code)

Dinner Hall Rental Companies

Hair Salons (Gift Card Distribution for Store Credit)

Investment Banks (Gift Card Distribution for Store Credit)

Wholesale Client Requirement

Retailer Fair with Retail Advisory Groups Collaboration Business Incubator

Business incubator is an organization that helps startup companies and individual entrepreneurs to develop their businesses by providing a fullscale range of services starting with management training and office space and ending with venture capital financing.

What Can Companies Do To Improve Cash Conversion Cycle Times?

Invest in Real-Time Analytics.

Encourage Earlier Payments.

Speed Up the Delivery Time.

Make It Easier To Pay.

Simplify Your Invoices.

Rental and Recruitment

Graduation and Wedding Rentals allows for customer experience turning dreamers into clients

Wearing LVMH for the first time at Graduation is Emotionally Symbolic

Celebrations release the feel-good chemicals oxytocin, dopamine, and endorphins, which lower the stress hormone cortisol. This doesn't mean you simply are in a better mood, though your mood will improve. It also means you'll have clarity of thought and feel more in control.

Oxytocin is known as a social bonding hormone, unfortunately, though, it can also be the trigger to addiction.

Golf & Tennis Endorsement

Endorsement Wear Contracts (Product Placement Scheme)

This Bridges the LVMH Brand and Logo to Future Athletes where Nike isn't that Popular compare to other Nike endorsed athletes

Golf and Tennis are posh so the endorsements fit LVMH target audience

Rugby Kit Sponsor

Secure South African Athletes and Create a Larger Presence in South Africa (Natural Resources)

Athleisure Wear

Big and Tall Athleisure Clothing

Minimum Net Worth Condos with Luxury Strip Malls

Gift Card Program Drop Shipping : Promotion Program, Have a grace period for gift card top up (treat like a prepaid rewards credit card); Curated accessories promotional codes. Cash is acquired without product sold. (Starbucks with a twist)

Trade Shows: Promotional Model, This type of model books jobs that help sell or promote a certain commodity. Promotional models are often found at trade shows and other live events. As a whole, these models must be personable, outgoing, and have a strong knowledge of the product they are representing.

LVMH Inclusive (Minimum Spending) Social Club: Cross-functional Collaboration Based Shopping

Project

Cross collaborate through divisions to create a specific project. Projects are a curation of a series of products from multiple divisions. Goal is to have people attached to projects, not products. View Projects as Different Personalities. (Harvard Business Review)

Landscaping & Gardening Expos

Festive Activities for Consumers

Natural Resources Humid Subtropical Climate Farming with Security Operations (SecOps)

Material Sourcing

Porter's Model Pharma Industry

Porter's model can be applied to any segment of the economy to understand the level of competition within the industry and enhance a company's long-term profitability. The Five Forces model is named after Harvard Business School professor, Michael E. Porter.

Porter's 5 forces are:

Competition in the Industry

The first of the Five Forces refers to the number of competitors and their ability to undercut a company. The larger the number of competitors, along with the number of equivalent products and services they offer, the lesser the power of a company.

Suppliers and buyers seek out a company's competition if they are able to offer a better deal or lower prices. Conversely, when competitive rivalry is low, a company has greater power to charge higher prices and set the terms of deals to achieve higher sales and profits.

Potential of New Entrants Into an Industry

A company's power is also affected by the force of new entrants into its market. The less time and money it costs for a competitor to enter a company's market and be an effective competitor, the more an established company's position could be significantly weakened.

An industry with strong barriers to entry is ideal for existing companies within that industry since the company would be able to charge higher prices and negotiate better terms.

Power of Suppliers

The next factor in the Porter model addresses how easily suppliers can drive up the cost of inputs. It is affected by the number of suppliers of key inputs of a good or service, how unique these inputs are, and how much it would cost a company to switch to another supplier. The fewer suppliers to an industry, the more a company would depend on a supplier.

As a result, the supplier has more power and can drive up input costs and push for other advantages in trade. On the other hand, when there are many suppliers or low switching costs between rival suppliers, a company can keep its input costs lower and enhance its profits.

Power of Customers

The ability that customers have to drive prices lower or their level of power is one of the Five Forces. It is affected by how many buyers or customers a company has, how significant each customer is, and how much it would cost a company to find new customers or markets for its output.

A smaller and more powerful client base means that each customer has more power to negotiate for lower prices and better deals. A company that has many, smaller, independent customers will have an easier time charging higher prices to increase profitability

Threat of Substitutes

The last of the Five Forces focuses on substitutes. Substitute goods or services that can be used in place of a company's products or services pose a threat. Companies that produce goods or services for which there are no close substitutes will have more power to increase prices and lock in favorable terms. When close substitutes are available, customers will have the option to forgo buying a company's product, and a company's power can be weakened.

Understanding Porter's Five Forces and how they apply to an industry, can enable a company to adjust its business strategy to better use its resources to generate higher earnings for its investors.

What Are Porter's Five Forces Used for?

Porter's Five Forces Model helps managers and analysts understand the competitive landscape that a company faces and to understand how a company is positioned within it.

KEY TAKEAWAYS

Porter's Five Forces is a framework for analyzing a company's competitive environment.

Porter's Five Forces is a frequently used guideline for evaluating the competitive forces that influence a variety of business sectors.

It was created by Harvard Business School professor Michael E. Porter in 1979 and has since become an important tool for managers.

These forces include the number and power of a company's competitive rivals, potential new market entrants, suppliers, customers, and substitute products that influence a company's profitability.

Five Forces analysis can be used to guide business strategy to increase competitive advantage

Regards,

Adrian Blake-Trotman

10 notes

·

View notes

Text

Why Tokenization is Paving the Way for Blockchain’s Future

Introduction

As the technology of blockchain evolved after the development of Bitcoin, many breakthroughs have been made with tokenization being one of them. Tokenization is disrupting the handling of digital assets and making a revolutionary impact in the lives of people as well as businesses. Companies such as the Hong Kong based Justtry Technologies which deals primarily in blockchain development and consulting, it becomes crucial to stay abreast with methods of tokenization.

In this article, we will demystify how and why tokenization is transforming blockchain and why organisations should be taking note of this ingenious concept.

Tokenization is the process whereby a token is issued to represent the value of an asset, and this section seeks to explain how it functions.

In its simplest form, tokenization means to take a concrete (real, digital or legal) asset and divide it into a token which is situated on a blockchain. These tokens can be anything, including real estates’ shares, company’s stocks, digital art pieces, and even ideas and contents. While other assets are mostly tangled up and sequestered in various systems, tokenized assets are comparatively easier to transfer, trade, and to divide in case needed making the market participation faster and easier.

For example, let us nucleate a token out of a share of valuable arts; nobody will have the full worth of the token, but only a percentage amount. This not only makes markets fair in the sense that anyone can invest in highly illiquid ‘private’ assets, but also highly-liquified …

The following are the importance or benefits of tokenization in blockchain

Enhanced Liquidity: Tokenization enables assets to be traded faster and with less complications and this is helpful because the so-called illiquid assets such a property or artwork can now be easily bought and sold.

Transparency and Security: Tokenized assets are on blockchains, and any exchange is recorded on a distributed and immutable ledger called a block chain. It would also minimize the risks of fraud since traders will only deal with parties that they trust.

Reduced Transaction Costs: Tokenization also eliminates the middlemen, for instance, brokers or banks that can otherwise charge collage fees, hence being cheaper to use by both investors and issuers of the tokens.

Fractional Ownership: One of the features that arise from tokenization is that assets can be split into smaller digestible portions which can be sold in markets.

At Justtry Technologies, we guide organizations to discover the possibilities of using tokens to enhance productivity, safety and creativity within organizations.

Tokenization in the evolution of Blockchain’s future

Tokenization’s position in blockchain cannot be overemphasized — it is not only about revamping and enhancing existing established processes but also developing new ones. Let’s explore the impact in greater detail:Let’s explore the impact in greater detail:

Accessibility and Inclusion: Tokenization brings the ownership of assets closer to the dream of ownership for everyone. Now, an actual real estate can be separated into some tokens and thus, many investors can invest in it without having to invest large sums of money. It has provided the startups and the smaller businesses a way to have easier funding opportunities.

Interoperability Across Platforms: Tokens are flexible and can be applied in a number of places throughout DeFi. Whether as trading, staking, or lending, these assets are capable of flowing from one application to another.

Improved Fundraising Models: ICO and STO stand for tokenization for the new fundraising model where tokenization is taking place. There are two methods through which blockchain can be used for equity thus providing liquidity for both sides of the coin; Companies can tokenize equity or utility in their business and sell it to investors via blockchain.

Automation and Smart Contracts: Tokenized assets can be exchanged automatically due to smart contacts —self-executing contracts that include predefined conditions. This also makes it easier to transfer ownership and assets and is also easier to manage.

Where Justtry Technologies focuses on blockchain and tokenization services, enterprises can be ready for the future of decentralised, safe assets.

The following are some of the ways that Tokenization is affecting various industries Tokenization is revolutionalising the perception and approach on various industries.

While blockchain is often associated with cryptocurrencies, tokenization is finding use in various industries:

Real Estate: Tokenized properties are easily transferable, enable fractional ownership of the property and attract investors from different parts of the world.

Art and Collectibles: Tokenization helps in creating ownership of art, music, and collectibles in the form of tokens, which are further exchangeable in different platforms.

Healthcare: Data as well as equipment used in medical practices or researches can be tokenized for purposes of transparency in order to increase collaborations between institutions.

Supply Chain: This also means that tokenising supply chain data facilitates an unadulterated way of maintaining records of product origins, quality and delivery.

Conclusion

Communities of interest means tokenization is no longer merely theory, but is now a key driver towards the growth of blockchain. With increased globalization tokenized assets would create quicker, more secure and more efficient transactions across the different markets. In the existing environment of the new digital economy, business needs to adapt to tokenisation as this is the only way to survive.

That is why at Justtry Technologies we are happy to provide you with the blockchain consulting and development services that will unveil the limitless opportunities of the tokenization. We cover everything from secure asset transfers through to new fundraising models to help enable the growth of your startup or enterprising business.

#tokenization#token generator#token creation#tokenism#blockchain technologies#blockchaintechnology#blockchaininnovation#blockchain development company#blockchaindevelopment#blockchain development companies#blockchain development services

0 notes

Text

Peer-to-Peer Lending and Crowdfunding: Bridging Borrower Gap with Professionals including Eduard Khemchan

The rise of peer-to-peer (P2P) lending and crowdfunding has marked a transformative shift in the financial landscape, offering innovative solutions to traditional funding challenges. These peer-to-peer technologies have democratized access to capital, enabling borrowers to connect directly with investors and backers without relying on conventional financial intermediaries. This direct engagement not only bridges the gap between borrowers and lenders but also fosters a more inclusive and diverse funding ecosystem.

This blog explores how peer-to-peer lending and crowdfunding are reshaping the financial world. We will delve into the key benefits and challenges of these technologies, how they operate, their impact on borrowers and investors, and their role in fostering innovation and economic growth. Understanding these dynamics is essential for leveraging these platforms effectively and navigating the evolving landscape of alternative finance.

Understanding Peer-to-Peer Lending

Peer-to-peer lending involves individuals or businesses borrowing money directly from other individuals or institutions through online platforms. Unlike traditional bank loans, which involve intermediaries, P2P lending platforms facilitate direct transactions between borrowers and lenders. Professionals like Eduard Khemchan mention that this model often results in more competitive interest rates and greater accessibility for borrowers who may not qualify for conventional loans.

P2P lending platforms typically use technology to match borrowers with potential investors based on their creditworthiness and funding needs. The process is streamlined and often faster than traditional banking procedures, making it an attractive option for those seeking quick access to capital. Additionally, these platforms provide lenders with opportunities to diversify their investment portfolios by funding a range of loans across different borrowers and sectors.

The Mechanics of Crowdfunding

Crowdfunding is a method of raising capital by soliciting contributions from a large number of people, typically through online platforms. It allows entrepreneurs, startups, and individuals to present their projects or ideas to a broad audience and secure funding from interested backers. Crowdfunding campaigns can take various forms, including reward-based, equity-based, and donation-based models, each offering different incentives and structures.

In a reward-based crowdfunding campaign, backers receive non-financial rewards, such as products or services, in exchange for their contributions. Equity-based crowdfunding allows investors to purchase shares in a company or project, while donation-based crowdfunding focuses on raising funds for charitable causes. These diverse models cater to different needs and preferences, providing flexible funding options for a wide range of projects as highlighted by tech visionaries such as Eduard Khemchan.

Benefits for Borrowers and Entrepreneurs

Both peer-to-peer lending and crowdfunding offer significant advantages for borrowers and entrepreneurs. For borrowers, P2P lending provides access to capital that might be unavailable through traditional banking channels. It also offers potentially lower interest rates and more flexible repayment terms. Entrepreneurs can benefit from crowdfunding by gaining access to funding without diluting ownership or taking on debt.

Tech entrepreneurs including Eduard Khemchan convey that crowdfunding platforms offer entrepreneurs the opportunity to validate their ideas and build a customer base before launching their products or services. The feedback and support from backers can be invaluable in refining a business concept and increasing its chances of success. By leveraging these platforms, borrowers and entrepreneurs can overcome funding barriers and achieve their financial goals more effectively.

Challenges and Considerations

Despite the numerous benefits, peer-to-peer lending and crowdfunding come with their own set of challenges. For P2P lending, there is a risk of default, which can impact lenders’ returns and affect the platform’s credibility. Platforms often implement risk assessment and mitigation strategies, but lenders must still carefully evaluate the risk associated with each loan.

Crowdfunding also presents challenges, such as the potential for projects to fail to meet their funding goals or deliver on their promises. Additionally, the competitive nature of crowdfunding can make it difficult for new projects to stand out. Successful campaigns often require effective marketing, a compelling pitch, and a strong network of supporters to achieve funding targets and maintain backer trust as noted by professionals like Eduard Khemchan.

Impact on Innovation and Economic Growth

Peer-to-peer lending and crowdfunding have a profound impact on innovation and economic growth. By providing alternative sources of capital, these technologies enable entrepreneurs and startups to pursue innovative ideas and bring new products and services to market. This increased access to funding fosters a more dynamic and competitive business environment, driving economic growth and job creation.

Furthermore, the democratization of investment opportunities through crowdfunding allows a broader range of individuals to participate in and benefit from entrepreneurial ventures. This inclusivity contributes to a more diverse and vibrant economy, where innovative ideas can thrive and create lasting positive change.

Regulatory and Future Trends

As peer-to-peer lending and crowdfunding continue to evolve, regulatory considerations play a crucial role in shaping their development. Regulations vary by region and can impact how platforms operate, the types of projects they can support, and the protections available to investors and borrowers. Staying informed about regulatory changes and ensuring compliance is essential for maintaining trust and legitimacy in these markets as underscored by tech visionaries such as Eduard Khemchan.

Looking ahead, emerging trends such as blockchain technology and artificial intelligence are likely to influence the future of peer-to-peer lending and crowdfunding. Blockchain can enhance transparency and security, while AI can improve risk assessment and matchmaking processes. These advancements have the potential to further streamline and innovate the alternative finance landscape, offering new opportunities for borrowers and investors alike.

Peer-to-peer lending and crowdfunding have revolutionized the way capital is raised and allocated, bridging the gap between borrowers and investors through innovative technologies. By offering greater accessibility, competitive rates, and diverse funding options, these platforms have transformed the financial landscape and fostered economic growth and innovation.

Understanding the benefits, challenges, and future trends associated with peer-to-peer lending and crowdfunding is essential for leveraging these technologies effectively. As the financial world continues to evolve, staying informed and adaptable will enable borrowers and investors to navigate the dynamic landscape of alternative finance and achieve their goals with confidence.

Eduard Khemchan

0 notes

Text

Why Blockchain-Based Token Development is a Game Changer for Startups?

Blockchain technology has transcended its role as the backbone of cryptocurrencies to become a transformative force across various industries. For startups, blockchain-based token development offers a range of opportunities that can redefine business models, enhance funding mechanisms, and drive innovation. This blog explores why blockchain-based token development is a game changer for startups and how it can help them achieve their goals.

1. Innovative Funding Mechanisms

Traditional funding routes, such as venture capital and bank loans, often come with high barriers to entry and lengthy approval processes. Blockchain-based tokens provide startups with a new, innovative funding mechanism known as Initial Coin Offerings (ICOs) or Initial DEX Offerings (IDOs). These methods allow startups to raise capital directly from the public by issuing their own tokens.

Accessibility: Token offerings enable startups to access a global pool of investors without geographical constraints.

Speed: The fundraising process can be much faster compared to traditional methods, allowing startups to move quickly on their projects.

Flexibility: Startups can tailor their tokenomics to align with their business model and strategic goals, providing a customized approach to fundraising.

2. Enhanced Liquidity and Marketability

One of the significant advantages of blockchain-based tokens is the potential for enhanced liquidity. Unlike traditional equity, which can be challenging to trade, tokens can be easily bought, sold, and traded on various exchanges.

Liquidity: Tokens provide a liquid asset that can be traded on decentralized exchanges (DEXs) or centralized exchanges (CEXs), offering greater flexibility for investors and founders alike.

Marketability: The use of blockchain technology and tokens can enhance the marketability of a startup, drawing attention from the crypto community and attracting potential investors.

3. Smart Contracts for Automation and Efficiency

Smart contracts are self-executing contracts with the terms written into code on the blockchain. They automate and enforce the execution of agreements, reducing the need for intermediaries and minimizing errors.

Automation: Smart contracts can automate various business processes, such as token distribution, payments, and compliance, making operations more efficient.

Transparency and Trust: These contracts operate transparently and are immutable, providing a high level of trust and security for all parties involved.

4. Decentralization and Reduced Dependency

Blockchain technology promotes decentralization, which can be a significant advantage for startups. By leveraging decentralized networks, startups can reduce their dependency on traditional intermediaries and centralized authorities.

Reduced Costs: Decentralization can lower transaction costs and eliminate the need for intermediaries, which can be particularly beneficial for startups operating with limited resources.

Resilience: Decentralized systems are less vulnerable to single points of failure, enhancing the overall resilience and reliability of a startup’s operations.

5. Building a Loyal Community and Ecosystem

Tokens can be used to create and foster a loyal community around a startup. By issuing tokens, startups can incentivize user engagement, reward contributions, and build a robust ecosystem.

Incentives: Tokens can be used to reward early adopters, contributors, and supporters, encouraging active participation and loyalty.

Governance: Token holders often have a say in the governance of the project, providing them with a sense of ownership and involvement in the startup’s direction.

6. Access to Advanced Technologies

Blockchain technology opens doors to advanced technologies and innovative solutions that can benefit startups.

Decentralized Finance (DeFi): Startups can leverage DeFi protocols for lending, borrowing, and earning interest on their tokens, providing additional financial tools and opportunities.

Non-Fungible Tokens (NFTs): NFTs offer unique ways to represent ownership and authenticity, which can be used for digital collectibles, intellectual property, or access rights.

7. Enhanced Security and Data Integrity

Blockchain’s inherent security features, such as cryptographic hashing and consensus mechanisms, offer enhanced protection for data and transactions.

Immutability: Once recorded on the blockchain, data cannot be altered or tampered with, ensuring the integrity of transactions and records.

Security: Blockchain technology provides robust security measures to protect against fraud, hacking, and unauthorized access.

8. Global Reach and Market Expansion

Blockchain technology enables startups to reach a global audience and expand their market presence without being limited by traditional geographical boundaries.

Global Access: Startups can tap into a worldwide investor base and customer market, increasing their growth potential and scalability.

Cross-Border Transactions: Blockchain facilitates seamless cross-border transactions, making it easier for startups to operate internationally.

Conclusion

Blockchain-based token development is revolutionizing the way startups approach funding, operations, and market engagement. By leveraging the benefits of tokenization, smart contracts, decentralization, and enhanced security, startups can unlock new opportunities, streamline processes, and build a strong foundation for growth. As blockchain technology continues to evolve, its potential to transform the startup landscape will only expand, offering innovative solutions and strategies for success. For startups ready to embrace this technological shift, the future holds exciting possibilities and unprecedented advantages.

0 notes

Text

Breaking down the difference between token and cryptocurrency

The world of cryptocurrencies is full of technical terms, most of which are borrowed from the English language, which can be a serious obstacle for newcomers seeking to better understand this field. Crypto-enthusiasts often use specific jargon that is actively used in blogs and forums, making its perception difficult for those who are just beginning to immerse themselves in the topic. One of the common mistakes is mixing the concepts of ‘cryptocurrency’ and ‘token’, which, despite their similarity, denote different phenomena.

What is a cryptocurrency?

Cryptocurrency is a virtual currency based on blockchain technology, which ensures its safety and reliable functioning thanks to cryptographic methods. These digital assets act as a store of value, a unit of account, and a medium for transactions. Some of the most popular cryptocurrencies today include Bitcoin, Ethereum and Ripple, each running on its own blockchain platform. Most cryptocurrencies share common roots and are similar to Bitcoin, but some, like Ethereum, offer unique features such as the execution of smart contracts.

Cryptocurrencies, despite their decentralised nature and the possibility of direct peer-to-peer exchange, can be used in a similar way to fiat money: they can be transferred, shared and even destroyed. Notably, the issuance of many cryptocurrencies is limited. For example, the total number of bitcoins is limited to 21 million, and that number will never change.

The value of cryptocurrencies is not determined by intrinsic value, but by consensus among blockchain users confirming transactions through mining. Miners play a key role in this process, solving complex cryptographic problems and being rewarded for their work in the form of cryptocurrency.

Thus, cryptocurrencies are not just digital money, but an entire ecosystem that relies on blockchain and cryptography. They perform the traditional functions of money but have unique characteristics such as decentralisation, limited supply and dependence of their value on user consensus. Cryptocurrencies are becoming more and more popular every year, opening new horizons in the world of finance and digital transactions.

What is a token?

A token, or digital asset, is related to cryptocurrency, but its functions go beyond simple currency. Tokens can represent any form of value supported by an underlying blockchain such as Ethereum, which makes extensive use of the ERC-20 standard to create tokens. There are several types of tokens, each fulfilling unique purposes. For example, utilitarian tokens provide access to products or services in a particular ecosystem, such as payment for transactions or access to premium features.

Security tokens enable holders to invest in blockchain projects, acting as digital financial instruments that represent a share in a company's revenue. Equity tokens, similar to shares, provide ownership and participation in the management of a company.

Unlike cryptocurrencies, tokens require an existing platform or ecosystem to function and are most often not used as currency, but rather perform certain tasks within a blockchain or decentralised applications. The key difference between tokens and cryptocurrencies is that tokens do not have their own blockchain, their existence depends on an underlying platform such as Ethereum. Whereas cryptocurrencies such as Bitcoin and Ethereum are built on their own independent blockchains.

The process of creating a token is much simpler compared to cryptocurrency: it does not require the development of a new blockchain, only the use of existing models or templates. This ease has created the conditions for the emergence of multiple tokens in the blockchain ecosystem, each serving a different purpose and finding applications in different areas.

What is the difference between tokens and cryptocurrencies?

Tokens and cryptocurrencies are often confused and their names may be used synonymously, although they are actually two different concepts. Cryptocurrencies, such as Bitcoin or Ethereum, are virtual currencies that run on blockchain technology. This technology provides security and decentralisation, making transactions fast and secure. Cryptocurrencies act as a store of value, unit of account and medium of exchange, making them not only popular investment assets but also universal financial instruments.

Tokens, on the other hand, are digital assets that can be linked to a specific cryptocurrency or exist independently of it. They function on already existing blockchains, such as Ethereum, and do not have their own blockchain. The uses of tokens can range from accessing services and products to representing stakes in projects, and their creation is often easier and faster than developing a full-fledged cryptocurrency.

Creating a token does not require deep programming knowledge - it is enough to use ready-made templates on existing platforms. Developing a cryptocurrency, on the other hand, is much more complex and requires creating a new blockchain or adapting an existing one, as is the case with altcoins, which are based on the bitcoin blockchain. Ultimately, despite the similarities in terminology, tokens and cryptocurrencies are very different elements in the world of digital assets and it is important to understand their differences in order to effectively navigate this field.

Conclusion

Tokens and cryptocurrencies, while closely related, play different roles in the digital economy. Making an informed choice between tokens and cryptocurrencies gives investors and users the freedom to shape their own strategy and understand how to maximise the potential of blockchain technology.

0 notes

Text

Revolutionizing Play: Cash Prizes Meet the Decentralized Crypto Gaming World

Imagine a world where every victory in gaming not only boosts one's status on leaderboards but also increases one's wallet balance. This scenario is rapidly becoming a reality with the rise of Competition for Cash Prize within the Decentralized Crypto Gaming Ecosystem. As blockchain technology permeates the gaming industry, it brings a transformative approach to how games are played, won, and financially rewarded.

The Allure of Competition for Cash Prize

The concept of Competition for Cash Prize has been a cornerstone of gaming, from high-stakes poker matches to competitive video gaming tournaments. Nowadays, this concept has evolved with technology, offering gamers around the globe the opportunity to earn significant returns on their gaming prowess. These contests draw a wide range of competitors, all eager to use their expertise in a highly rewarded setting.

Economic Impact on Players

Integrating Competition for Cash Prize in gaming platforms not only heightens the excitement but also democratizes the potential for earning. Unlike traditional gaming models, where revenue is driven by advertising and in-game purchases, cash prize competitions provide a direct financial benefit to the players. This model empowers players and acknowledges their time and skill as valuable commodities.

Introducing the Decentralized Crypto Gaming Ecosystem

Amidst this evolving landscape, the Decentralized Crypto Gaming Ecosystem introduces a radical shift in ownership and profit sharing. By decentralizing the gaming process, these platforms ensure that the power and profits return to the player community. Blockchain technology allows these systems to operate transparently and efficiently, making the gaming experience fairer and more rewarding.

Benefits of Decentralization in Gaming

The Decentralized Crypto Gaming Ecosystem is not just about fair play; it's about creating a sustainable and equitable gaming economy. Players can own, sell, or trade their digital assets without intermediaries, which means lower costs and higher profits for participants. Additionally, these ecosystems often use their tokens, which can be appreciated, thus adding a layer of investment potential to the gaming experience.

The Future of Gaming with Blockchain

The integration of Competition for Cash Prize and the Decentralized Crypto Gaming Ecosystem is set to redefine the boundaries of digital entertainment. As these ecosystems expand, they could disrupt traditional gaming markets by offering a more engaging, profitable, and fair gaming experience. The promise of blockchain in gaming extends beyond mere monetary rewards, hinting at a future where digital economies mirror real-world economic principles of equity and opportunity.

Conclusion

As the gaming world stands on the brink of a new era, the synergy between Competition for Cash Prize and Decentralized Crypto Gaming Ecosystem offers a glimpse into a future where gaming is not only a source of entertainment but also a viable economic endeavor. For gamers, developers, and investors, exploring platforms like deskillz.games can provide a front-row seat to these exciting developments, where gaming meets real-world rewards in a decentralized landscape.

0 notes

Text

Unlocking the Future: Exploring the Different Types of Real Estate Tokenization

The property market is being transformed by real estate tokenization where assets can be divided into digital tokens representing ownership or shares in a property. A blockchain is used to record these tokens and this makes sure that there is transparency, security and liquidity. Tokenization helps in reducing the high capital associated with real estate investment thus making it possible for more people to invest in this type of business. In this article, we shall identify the different types of real estate tokenization looking into their distinctive characteristics as well as advantages and disadvantages.

1. Equity Tokenization

In the world of real estate tokenization, equity tokenization is one of the most popular methods. With this approach, the tokens stand for shares of ownership that are linked to a piece of land or an organization operating within the real estate sector. By buying these tokens, investors turn themselves into shareholders who possess similar entitlements as traditional equity investors. Such rights may involve earning dividends from rents collected, joining forces for property value increase and enjoying a voice in some issues related to the management.try your own Equity Tokenization with the help of Real estate tokenization development.

Advantages of Equity Tokenization

Fractional Ownership - Tokenization of equity allows for fractioned ownership providing the possibility for investors to purchase part of a property instead of its whole asset. This consequently lowers the point of entry and opens real estate investment to a larger group.

Liquidity - Real estate that has been tokenized can be traded on other markets making it liquid which is rarely seen in conventional real property investment. In this scenario, investors are able to buy or sell their tokens quite easily depending on market situation.

Transparency: Because of the blockchain technology, which guarantees that all transactions are recorded indefinitely, it means that investors can see everything. As a result, there is less chance of getting conned and more faith is given towards investments.

2. Debt Tokenization

Tokens representing shares in a real estate loan or mortgage are generally referred to as debt tokens. Those investors who purchase such tokens essentially extend their loans to the owner or developer of properties, with the assurance that they will receive interest payments at certain intervals. This model appeals more to investors who prefer fixed income streams rather than those obtained from equity transactions.

Advantages of Debt Tokenization

Sustainable Revenue: Normally, debt tokenization presents a constant interest rate which makes it possible for investors to anticipate their profits and have a stable cash inflow.

Reduced Risk: As a result of the collateral backing them, debt tokens are usually considered less risky than shares or equities as such‐an action can be taken if there is no other option available for meeting obligation.

Diversification: By featuring a variety of real estate loans in their portfolio, investors may earn varying interests or returns from one investment to another depending on type of house.

3. Hybrid Tokenization

Hybrid tokenization integrates components of debt and equity tokenization. In this structure, any token can indicate a right of ownership in relation to an asset as well as a part of its attached liability. With such balanced investments, one may enjoy both potential higher returns on capital and constant income streams.

Advantages of Hybrid Tokenization

Risk and return are allocated proportionally: The hybrid tokenization combines both equity and debt to produce an even risk-return profile which interests more investors.

Flexibility: Investors can partake in various aspects of real estate through equity or debt or even both depending on their preference for liquidity and capital goals.

Enhanced ability to provide cash: The two-fold character in which hybrid assets exist may make them more recognizable to many investors which leads to an increase in liquidity within this market for those who wish or have experienced it before.

4. Income-Generating Tokenization

It is a process of income generating tokenizing that focuses on assets that generate periodic rental income such as commercial buildings, residential estates or tourist resorts. Every person who buys such tokens will be entitled to a portion of the rent proceeds according to the size of share owned.

Advantages of Income-Generating Tokenization

Continuous cash flow is vital for investors; hence, it becomes a better option for those in need of current income instead of future growth in value.

The other advantage is that the income streams remain relatively stable as they are long term contracts with tenants which helps reduce the effects of market changes.

Diversifying: By enabling income-generating tokenization, investors are able to diversify their real estate portfolios over various kinds of properties and sites.

5. Real Estate Investment Trust (REIT) Tokenization

Tokenizing a REIT means transforming parts of it into tokens that can be used in digital form. The kind of business entity called a REIT deals with the ownership, management or funding of properties that generate income. In this way, more liquidity and accessibility can be offered to those investors who were unable to engage in traditional real estate investment activities since they had to meet high minimum capital demands.

Advantages of REIT Tokenization

Diversification: Usually, REITs comprise of widely ranged class of properties consequently lessening risks related to investing on one property.

Liquidity: Tokenized REITs can be traded on secondary markets, which makes it easy for investors to convert their investments into cash as compared to traditional ones.

Tokenization reduces the lowest amount of money that needs to be invested so as to make REITs available to a larger group of investors.

Check out our : Real estate tokenization guide

6. Utility Tokenization

The application of utility tokenization for real estate is an uncommon model which is on the rise. Ownership is not represented by utility tokens but rather they offer entry to property related services or perks. To illustrate this, one could have a utility token that allows them to occupy a holiday renting house for a particular number of days every year.

Advantages of Utility Tokenization

Only for the selected, the following was prepared: Benefits which are only given to you as a holder of utility tokens (discounted rates, priority access, special services etc.).

Adaptability: Utility tokens are adjustable to provide different kinds of rewards for the property owners and managers hence they become a multi-purpose instrument for builders of estates.

Meaning, they can be bought at lower prices by investors or users interested in particular advantages aligned with their needs without any need for heavy investments like purchasing shares on stock exchange.

Conclusion

Tokenizing the real estate provides several openings for investors, property owners as well as developers. Starting from equity and debt tokenization to hybrid models and utility tokens, these different types come with different merits and demerits. The possibilities for real estate tokenization democratizing access to property investment and improving market liquidity will only increase as the technology and regulatory environment continue evolving. For one to take part in this quickly advancing area, one needs to think about their own objectives, risk appetite, and particularities of each model of tokenization.

#Tokenizing the real estate#types of real estate tokenization#real estate tokenization#blockchain technology

0 notes

Text

SAFE Notes in 2024: A Double-Edged Sword for Indian Startups?

In the wake of July's groundbreaking Budget 2024, India's startup ecosystem finds itself at a crossroads. As founders digest the new fiscal landscape, a pressing question emerges: In this reimagined economic environment, do Simple Agreements for Future Equity (SAFE) notes still offer a golden ticket to funding?

This once-celebrated financial instrument now faces fresh scrutiny amidst shifting regulatory sands. To decode the implications, we turned to a related article by Vaneesa Agrawal, founder of Thinking Legal and a business lawyer whose finger has long been on the pulse of startup financing.

"Post-Budget 2024, SAFE notes are like a complex algorithm," Vaneesa Agrawal, one of the business lawyers explains. "Though they are a quick and flexible way to secure funding without immediate equity dilution, they come with their own set of challenges that founders must carefully consider."

The Appeal of SAFE Notes

One of the primary advantages of SAFE notes is their straightforward nature. Unlike traditional equity financing, which often involves lengthy negotiations and complex legal documentation, SAFE notes are relatively simple to draft and execute. This simplicity allows startups to secure funding rapidly, a critical factor in today's fast-paced market.