Don't wanna be here? Send us removal request.

Text

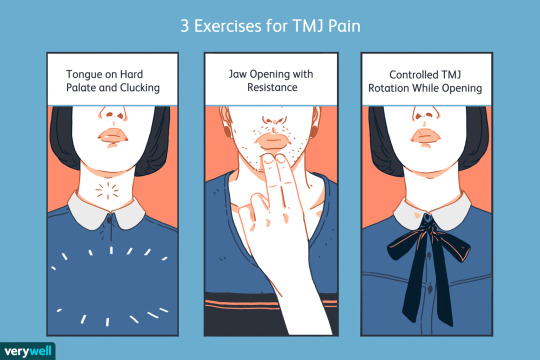

Simple Exercises to Strengthen Your Temporomandibular Joint for Better Jaw Health

The temporomandibular joint (TMJ) is a small but critical joint that connects your jawbone to your skull. It plays an essential role in everyday actions such as chewing, speaking, and even breathing. However, for many individuals, the TMJ can become a source of discomfort due to stress, injury, or conditions like temporomandibular joint disorder (TMD). Luckily, there are simple exercises you can incorporate into your routine to strengthen your TMJ and promote better jaw health.

Understanding the Importance of TMJ Health

Before diving into the exercises, it's important to understand why maintaining TMJ health is crucial. A healthy TMJ ensures smooth jaw movements, reduces the risk of pain, and supports overall oral health. When the joint becomes strained or misaligned, you might experience symptoms like:

Jaw pain or tenderness

Clicking or popping sounds

Difficulty chewing

Headaches or ear pain

Limited jaw movement

By dedicating time to specific exercises, you can alleviate these symptoms and improve joint functionality.

Warm-Up Exercises for the TMJ

Just like with any other joint or muscle, warming up the TMJ is essential before performing strengthening exercises. Here are two simple warm-up techniques:

1. Jaw Relaxation

Sit in a comfortable position with your back straight.

Let your jaw hang loosely, avoiding clenching your teeth.

Place your tongue gently on the roof of your mouth.

Take deep breaths, allowing your jaw muscles to relax.

2. Side-to-Side Movements

Slowly move your jaw from side to side without forcing the motion.

Repeat this movement 5-10 times to prepare your TMJ for the exercises.

Strengthening Exercises for the TMJ

1. Resistance Exercise with Hand Support

This exercise strengthens the muscles surrounding the TMJ and improves stability.

Place your thumb under your chin.

Open your mouth slowly while applying light pressure with your thumb.

Hold the position for a few seconds, then close your mouth slowly.

Repeat this 5-10 times.

2. Controlled Mouth Opening

Place your tongue on the roof of your mouth.

Open your mouth as wide as you comfortably can, ensuring smooth movement.

Close your mouth slowly and repeat the process 10 times.

3. Chin Tucks

This exercise helps improve jaw alignment and reduces strain on the TMJ.

Sit or stand with your back straight.

Gently tuck your chin in as if creating a "double chin."

Hold the position for 5 seconds and repeat 10 times.

4. Tongue-Up Exercise

Rest your tongue on the roof of your mouth.

Slowly open and close your mouth while maintaining the tongue’s position.

Perform this exercise 10 times.

Stretching Exercises for the TMJ

Stretching can help relieve tension in the TMJ and surrounding muscles. Try these simple stretches:

1. Jaw Stretch

Open your mouth as wide as you comfortably can.

Place your fingers on the top of your front teeth and gently apply pressure downward.

Hold for 5-10 seconds and repeat 5 times.

2. Side Jaw Stretch

Move your jaw to the left as far as it comfortably goes.

Hold for a few seconds, then move it to the right.

Repeat this stretch 5-10 times on each side.

Tips for Maintaining TMJ Health

In addition to exercises, consider adopting these habits to keep your temporomandibular joint healthy:

Practice good posture to avoid unnecessary strain on your jaw.

Avoid clenching or grinding your teeth by being mindful of jaw tension.

Eat soft foods if you’re experiencing discomfort, and gradually reintroduce harder foods as the pain subsides.

Manage stress through relaxation techniques such as meditation or yoga.

Seek professional help if symptoms persist or worsen.

Conclusion

Caring for your temporomandibular joint is a vital part of maintaining overall oral and jaw health. By incorporating these simple exercises into your daily routine, you can strengthen your TMJ, reduce discomfort, and improve jaw functionality. Remember to be gentle with your movements and consult a healthcare professional if you experience persistent pain or severe symptoms. With consistent effort, you’ll be well on your way to better jaw health.

0 notes

Text

5 Mistakes to Avoid When Hiring a Renovation Contractor in Singapore

Hiring the right renovation contractor in Singapore can make or break your home improvement project. While the right contractor can transform your space beautifully, the wrong choice can lead to costly delays and disappointing results. To help you navigate the process, here are five common mistakes to avoid when hiring a renovation contractor in Singapore.

1. Failing to Verify Credentials and Experience

One of the biggest mistakes homeowners make is not verifying a contractor's credentials and experience. Ensure the contractor:

Is licensed and registered with the relevant authorities, such as the Building and Construction Authority (BCA).

Has experience with similar types of renovation projects.

Provides a portfolio of completed projects.

Neglecting this step can result in hiring someone who lacks the expertise to handle your renovation, potentially leading to poor workmanship or non-compliance with regulations.

2. Not Getting Multiple Quotes

Many homeowners settle for the first contractor they meet without comparing quotes. This can lead to overpaying or missing out on better options. When searching for a renovation contractor in Singapore, request at least three quotes. This will:

Give you an idea of the market rate for your project.

Help you identify unreasonable or hidden costs.

Enable you to assess the contractor’s professionalism during the quoting process.

While affordability is important, don’t let price be the sole deciding factor—consider value for money.

3. Overlooking Written Contracts

A detailed written contract is essential to protect both you and the contractor. Some homeowners rely on verbal agreements, which can lead to misunderstandings and disputes. Ensure the contract includes:

A clear project scope and timeline.

A breakdown of costs, including labor, materials, and any additional charges.

Payment terms and conditions.

Warranties for workmanship and materials.

Without a proper contract, you risk being left in a lurch if things go wrong.

4. Skipping Reference Checks

Even if a contractor seems reliable, failing to check references can lead to unpleasant surprises. Always ask for references from past clients and contact them to inquire about their experiences. Questions to ask include:

Was the project completed on time and within budget?

Was the workmanship up to standard?

Were there any issues, and how were they resolved?

This step helps you gauge the contractor’s reliability and professionalism.

5. Ignoring Red Flags

Trust your instincts and be alert to warning signs when hiring a contractor. Red flags include:

Unusually low quotes that seem too good to be true.

Lack of transparency in providing information or answering questions.

Reluctance to provide a written contract or references.

Poor communication or unprofessional behavior.

If something feels off, it’s better to move on and find a contractor you can trust.

Conclusion

Avoiding these common mistakes can save you time, money, and stress when hiring a renovation contractor in Singapore. Take the time to research and vet potential contractors thoroughly, and don’t rush the process. By doing so, you’ll ensure your renovation project is in good hands, resulting in a beautifully transformed space you can enjoy for years to come.

0 notes

Text

Real Estate Investment Strategies Amidst Global Economic Uncertainty

Investing in real estate has long been a cornerstone of wealth creation, but global economic uncertainty often complicates decision-making. Political upheavals, inflationary pressures, and fluctuating interest rates can make even seasoned investors wary. However, with a well-thought-out strategy, real estate remains one of the most resilient investment avenues, providing long-term growth and diversification.

For investors looking for opportunities in challenging times, focusing on high-growth regions such as Property Investment Singapore is a strategic move. Singapore’s robust economy, transparent regulatory framework, and thriving real estate sector make it a compelling choice. This blog explores effective real estate investment strategies amidst global uncertainties, with a special focus on Singapore’s market.

Understanding Economic Uncertainty and Its Impact on Real Estate

Economic uncertainty stems from various global and local factors, such as geopolitical tensions, supply chain disruptions, rising interest rates, or economic downturns. These uncertainties directly influence the real estate market in the following ways:

Fluctuating Property Prices: During economic turmoil, property prices may stagnate or decline in some regions, presenting buying opportunities.

Tighter Lending Conditions: Higher interest rates may restrict borrowing capacity, affecting affordability.

Shifting Demand Patterns: Economic instability often prompts changes in housing demand, such as increased interest in affordable housing or long-term rental properties.

Successful investors adapt by reassessing their strategies and choosing markets that demonstrate resilience.

Why Consider Property Investment in Singapore?

Singapore’s real estate market is renowned for its stability, making it a prime destination for investors seeking safe havens during economic turbulence. Here's why:

1. Strong Economic Fundamentals

Despite global uncertainty, Singapore’s economy remains one of the most competitive globally, thanks to prudent governance, robust infrastructure, and a business-friendly environment. These factors sustain demand for both residential and commercial properties.

2. Strategic Location and Global Connectivity

As a gateway to Asia, Singapore attracts multinational companies and expatriates, boosting demand for office spaces, retail outlets, and rental homes.

3. Transparent Regulatory Framework

Singapore’s regulatory landscape is designed to protect investors. Measures such as the Additional Buyer’s Stamp Duty (ABSD) and Loan-to-Value (LTV) limits ensure market stability and prevent speculative bubbles.

4. Resilient Property Market

Singapore’s property market has shown resilience even during global crises, such as the COVID-19 pandemic. Properties in prime locations like Orchard, Marina Bay, and Sentosa Cove maintain high value due to consistent demand.

Strategies for Real Estate Investment Amidst Uncertainty

Whether you're investing locally or in Singapore, these strategies can help navigate uncertain times:

1. Focus on Diversification

Diversifying your portfolio across asset classes and geographies reduces risk. Consider spreading investments across residential, commercial, and industrial properties in stable markets like Singapore.

2. Prioritize Cash Flow

Invest in income-generating properties that ensure steady rental returns. In Singapore, rental yields for well-located properties often remain stable due to high demand from expatriates and professionals.

3. Leverage Technology

Use real estate technology platforms to analyze market trends, evaluate property values, and identify investment opportunities. Proptech is especially useful in a competitive market like Singapore.

4. Invest in Prime Locations

Focus on properties in central business districts or areas with strong connectivity and infrastructure development. In Singapore, locations like District 9, District 10, and District 11 are always in high demand.

5. Be Cautious with Leverage

During economic uncertainty, avoid over-leveraging. Rising interest rates can increase repayment costs, so it's wise to maintain a conservative debt-to-equity ratio.

6. Hedge Against Inflation

Real estate is an excellent hedge against inflation. Properties in regions with strong economic fundamentals, like Singapore, are less susceptible to value erosion due to inflationary pressures.

7. Monitor Government Policies

Stay updated on government regulations, as policy changes can significantly impact the market. In Singapore, initiatives like cooling measures influence property prices and demand.

Opportunities in Singapore’s Real Estate Market

Residential Properties

High-quality residential projects, especially in prime districts, continue to attract investors. Condominiums near MRT stations, reputable schools, and commercial hubs are particularly popular.

Commercial Real Estate

Office spaces in Singapore’s central business district remain a lucrative investment due to consistent demand from multinational corporations.

Industrial Properties

The rise of e-commerce and logistics has boosted demand for industrial spaces. Singapore’s strategic location in Southeast Asia makes it a key hub for global trade.

Conclusion

Global economic uncertainty may pose challenges, but it also opens up opportunities for strategic real estate investors. By focusing on stable markets like Singapore, adopting a diversified approach, and leveraging local expertise, investors can safeguard their wealth and achieve long-term growth.

Property Investment Singapore offers a reliable and dynamic landscape for navigating uncertain times, making it an essential consideration for any real estate investor. As always, thorough research, sound financial planning, and a clear investment strategy are key to success.

0 notes

Text

The Impact of Urbanization on Real Estate Markets in Southeast Asia: A Focus on Property Investment Singapore

Southeast Asia has emerged as one of the fastest-growing regions in the world, fueled by rapid urbanization and a booming population. This transformation has had a profound impact on real estate markets across the region, reshaping urban landscapes and creating unique opportunities for property investors. Among the most attractive destinations, Property Investment Singapore stands out as a case study of how urbanization influences real estate markets.

In this blog, we’ll explore the dynamics of urbanization in Southeast Asia and analyze its effects on property markets, with a particular focus on Singapore, a global city-state that exemplifies how urban planning and property investment intersect in a rapidly evolving environment.

Urbanization in Southeast Asia: A Snapshot

Urbanization in Southeast Asia has accelerated over the last two decades, with millions moving from rural areas to cities in search of better opportunities. By 2030, the region's urban population is expected to reach 400 million, creating significant demand for housing, infrastructure, and commercial spaces. Major cities such as Jakarta, Bangkok, Kuala Lumpur, and Singapore have become hubs for economic activity, driving the growth of real estate markets.

Key factors fueling urbanization in Southeast Asia include:

Economic Growth: The region's GDP growth, supported by manufacturing, technology, and services, has led to increased urban migration.

Rising Middle Class: An expanding middle class with higher disposable incomes has boosted demand for quality housing and retail spaces.

Infrastructure Development: Governments have invested heavily in transportation, utilities, and connectivity, making urban areas more accessible and livable.

Singapore: A Global Real Estate Powerhouse

Singapore is a shining example of how urbanization can transform a city into a global real estate hub. Despite its limited land area, the city-state has strategically managed its resources to accommodate a growing population while maintaining high standards of living.

Why Property Investment Singapore is a Prime Opportunity:

Strategic Location Singapore’s position as a global financial center and its connectivity to other major cities in Southeast Asia make it a magnet for international investors. Its stable political climate and pro-business policies further enhance its appeal.

High Demand for Urban Housing Urbanization has led to a surge in demand for housing, particularly in key areas like the Central Business District (CBD), Marina Bay, and Orchard Road. Luxury apartments, condominiums, and integrated developments are particularly popular among both locals and expatriates.

Robust Infrastructure Singapore’s world-class infrastructure, from its efficient public transport system to its state-of-the-art utilities, supports urban living and boosts property values. The city’s focus on sustainability, through initiatives like the Green Plan 2030, adds further value to real estate investments.

Regulated Market The Singapore government actively regulates its real estate market to maintain stability. Measures such as Additional Buyer’s Stamp Duty (ABSD) and Loan-to-Value (LTV) limits ensure a balanced market and minimize speculative risks.

Urbanization and Real Estate Trends in Southeast Asia

Urbanization has brought about significant changes in the real estate landscape across Southeast Asia, including:

1. Increased Demand for Mixed-Use Developments

Mixed-use developments, which combine residential, commercial, and recreational spaces, have gained popularity. These integrated projects cater to urban dwellers' desire for convenience and accessibility.

2. Rising Property Prices

As cities expand and populations grow, property prices have surged, particularly in prime urban areas. For example, Singapore’s high-end real estate market has consistently attracted wealthy investors due to its strong capital appreciation potential.

3. Shift Towards Smart Cities

Urbanization has spurred the adoption of smart technologies in urban planning. Cities like Singapore and Kuala Lumpur are implementing smart city initiatives that integrate technology into infrastructure, transport, and public services.

4. Focus on Affordable Housing

While luxury developments dominate the spotlight, there’s also growing demand for affordable housing to cater to middle- and lower-income groups. Governments across the region are partnering with private developers to address this need.

Challenges of Urbanization in Real Estate

While urbanization creates opportunities, it also brings challenges, including:

Housing Affordability: Rising property prices make housing unaffordable for many, leading to inequality and social tension.

Urban Sprawl: Rapid urbanization often results in poorly planned urban sprawl, straining infrastructure and resources.

Environmental Impact: Real estate development can lead to deforestation, loss of biodiversity, and increased carbon emissions.

Conclusion: Why Property Investment Singapore is a Safe Bet

Urbanization will continue to shape Southeast Asia’s real estate markets for years to come. For investors, understanding these trends is key to making informed decisions. Singapore’s well-regulated market, strong economic fundamentals, and commitment to sustainable urban growth make it a standout destination for property investment.

Whether you’re considering luxury condominiums, mixed-use developments, or commercial spaces, Property Investment Singapore offers a unique opportunity to capitalize on the region’s rapid urbanization while mitigating risks. By investing in Singapore, you’re not just buying property; you’re securing a stake in one of the world’s most dynamic and forward-looking cities.

0 notes

Text

How to Finance Your Property Investment Plans in 2025

Property Investment Singapore is one of the most popular ways to build wealth and achieve financial security. However, financing property investments can be challenging, especially with evolving market conditions and stricter regulations. Whether you’re a first-time investor or a seasoned professional, having a solid plan for funding your property purchase in 2025 is essential. This blog will guide you through various financing options, tips, and strategies to ensure a successful investment journey.

1. Assess Your Financial Readiness

Before diving into property investment, it’s crucial to evaluate your financial health. Ask yourself the following questions:

Do I have a stable income to manage monthly mortgage payments?

How much savings or capital do I have for a down payment?

Can I handle unexpected costs like maintenance, taxes, or vacancies?

In Singapore, the Total Debt Servicing Ratio (TDSR) is a key regulation to consider. TDSR limits the amount of your gross income that can go toward debt repayments, ensuring you borrow responsibly. As of 2025, ensure you meet these criteria to secure financing.

2. Explore Financing Options

There are several ways to finance your property investment in Singapore. Let’s explore the most common options:

a) Bank Loans

Banks are the primary source of financing for property purchases in Singapore. Compare different banks to find one offering competitive interest rates, favorable terms, and flexible repayment options. Fixed-rate and floating-rate loans are available, so choose the one that aligns with your financial goals.

b) HDB Loans (For HDB Flats)

If you’re purchasing an HDB property, you may qualify for an HDB loan. These loans typically offer a lower interest rate (2.6% as of recent years) and require a smaller down payment (10% of the property’s purchase price).

c) Private Equity or Syndicate Funding

For investors purchasing multiple properties or entering commercial real estate, private equity or syndicate funding may be a viable option. Pooling resources with other investors can reduce financial strain while diversifying your portfolio.

d) Personal Savings and CPF

The Central Provident Fund (CPF) plays a significant role in property investment in Singapore. You can use your CPF Ordinary Account (OA) savings for your down payment, monthly mortgage repayments, and other related costs.

3. Plan for the Down Payment

Property investments in Singapore require a significant upfront capital outlay. As of 2025, the following down payment rules generally apply:

For HDB loans: A minimum of 10% of the purchase price.

For bank loans: At least 25% of the purchase price, of which 5% must be paid in cash.

If you’re short on funds for the down payment, consider strategies like:

Selling underperforming assets.

Taking up side hustles or freelance work to boost income.

Partnering with co-investors to share the cost.

4. Understand Additional Costs

Apart from the purchase price, property investment in Singapore comes with additional expenses such as:

Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD): ABSD is particularly significant for foreign buyers and individuals purchasing their second or subsequent property.

Legal fees and valuation costs.

Maintenance fees for condominiums or strata-titled properties.

Renovation and furnishing costs.

By factoring in these expenses early, you can avoid unexpected financial strain.

5. Utilize Property Investment Tools and Platforms

Technology has transformed how property investments are managed. In 2025, you can leverage:

Real Estate Investment Trusts (REITs): If you prefer indirect property investments, REITs are an excellent option. They provide exposure to the real estate market without the need for full ownership.

Investment Platforms: Digital tools like PropertyGuru, 99.co, and iCompareLoan help investors compare properties, loans, and financing options in Singapore.

AI-powered Market Insights: Use AI-driven analytics platforms to assess property trends, rental yields, and market performance.

6. Leverage Tax Benefits and Government Schemes

The Singapore government offers various schemes and tax benefits to support property investors. Some examples include:

Rental Income Tax Relief: Deductible expenses like property tax, maintenance, and mortgage interest help reduce taxable income from rental properties.

Proximity Housing Grant (PHG): For families or individuals purchasing resale flats near their parents or children.

Stay updated on policy changes that could affect your investments, as regulations often evolve.

7. Partner with Experts

Navigating the complexities of property investment in Singapore can be overwhelming. Enlist the help of:

Property Agents: Professionals who understand market trends and can guide you to the best investment options.

Mortgage Brokers: Experts who compare loan packages and secure the best financing deal for your needs.

Legal Advisors: Ensure all documentation and agreements comply with Singapore’s strict property laws.

8. Develop a Long-term Strategy

Property investment is a long-term commitment. To maximize your returns:

Focus on high-demand areas like the Central Business District (CBD) or upcoming growth zones.

Opt for properties with strong rental yield potential.

Diversify your portfolio to reduce risks associated with a single asset class.

Final Thoughts

Financing your property investment in Singapore in 2025 requires careful planning, market knowledge, and access to the right resources. By assessing your financial readiness, exploring various financing options, and staying informed about market trends and regulations, you can make informed decisions and build a successful investment portfolio.

Take the time to strategize, seek professional advice when needed, and commit to a disciplined approach to your investments. With the right preparation, your property investment journey in Singapore can be a stepping stone to financial freedom.

0 notes

Text

Property Investment for Millennials: Key Considerations in 2025

The concept of property investment has evolved significantly in recent years, especially for millennials. With rising property prices, changing financial priorities, and the advent of digital tools, the real estate market in 2025 offers unique opportunities and challenges. For millennials looking to secure their financial future, Property Investment Singapore stands out as a strategic and potentially rewarding option. In this blog, we’ll explore key considerations for millennials diving into the property market this year.

Why Millennials Are Drawn to Property Investment in 2025

Millennials, born between 1981 and 1996, have matured in an era of technological advancement and economic shifts. Unlike previous generations, they tend to focus on investments that offer stability and long-term growth. Real estate, particularly in booming markets like Singapore, meets these criteria.

Key Drivers:

Financial Independence: Property is seen as a long-term investment to build wealth and hedge against inflation.

Rent vs. Buy Dilemma: Rising rental costs in urban areas make property ownership more appealing.

Passive Income Streams: Rental properties can provide millennials with an additional income source.

Why Choose Property Investment in Singapore?

Singapore’s real estate market is known for its resilience, strategic location, and government policies that foster growth. Here’s why Property Investment Singapore is a compelling option:

Stable Economy and Political Climate

Singapore’s strong economic fundamentals and transparent regulatory framework make it a safe haven for investors. Millennials are particularly drawn to this stability in an uncertain global economy.

Growing Demand for Housing

As the population grows and urbanization continues, the demand for quality housing remains high. This offers opportunities for capital appreciation and rental yields.

Government Schemes and Initiatives

Singapore’s government actively supports first-time buyers and young investors through initiatives like the CPF Housing Grant and Enhanced Proximity Housing Grant. These programs reduce the financial burden and make property ownership more accessible.

Key Considerations for Millennials in 2025

Understanding Your Financial Position

Before investing, it’s essential to evaluate your financial health. Key steps include:

Assessing Debt: Clear high-interest debts before committing to a mortgage.

Saving for a Down Payment: Aim to save at least 25% of the property value for a comfortable down payment.

Building a Safety Net: Keep an emergency fund for unforeseen expenses.

Location, Location, Location

In real estate, location is everything. When considering Property Investment Singapore, focus on:

Proximity to Public Transport: Properties near MRT stations or bus hubs tend to have higher demand.

Amenities and Facilities: Look for areas with good schools, shopping malls, and recreational spaces.

Upcoming Developments: Invest in regions with planned infrastructure projects to maximize appreciation potential.

Type of Property

Millennials should carefully consider the type of property to invest in:

HDB Flats: Affordable housing options with government subsidies.

Condominiums: Offer lifestyle amenities and higher potential for rental yields.

Landed Properties: Require higher capital but offer exclusivity and appreciation over time.

Leverage Technology

In 2025, digital tools play a pivotal role in property investment:

Property Portals: Websites like PropertyGuru and 99.co help you compare listings and market trends.

Virtual Tours: Save time with immersive virtual tours of potential properties.

Data Analytics: Leverage tools that analyze rental yields, market performance, and property values.

Potential Risks and How to Mitigate Them

While property investment is lucrative, it comes with its share of risks. Millennials must be aware of these risks and take proactive steps to mitigate them.

Market Volatility

Risk: Property prices can fluctuate based on market conditions.

Solution: Invest in areas with consistent demand and stable growth trends.

Overleveraging

Risk: Taking on too much debt can strain your finances.

Solution: Stick to properties within your budget and opt for sustainable financing options.

Hidden Costs

Risk: Additional costs like property taxes, maintenance fees, and insurance can add up.

Solution: Budget for all associated costs before committing to a purchase.

Tips for Millennials Considering Property Investment

Start Early: The earlier you invest, the more time your property has to appreciate.

Educate Yourself: Attend workshops, read market reports, and consult property experts.

Work with Professionals: Engage real estate agents, financial advisors, and legal consultants to ensure a smooth investment process.

Think Long-Term: Property investment is not a get-rich-quick scheme. Be prepared to hold your property for several years to reap maximum benefits.

Conclusion

For millennials, property investment is more than just owning a home—it’s about securing financial stability and creating wealth for the future. With strategic planning, informed decision-making, and a focus on growth markets like Property Investment Singapore, millennials in 2025 can confidently step into the real estate world and reap the rewards.

Are you ready to take the plunge into property investment? Start by assessing your financial readiness and exploring the vibrant opportunities in Singapore’s real estate market today!

1 note

·

View note