Don't wanna be here? Send us removal request.

Link

0 notes

Link

0 notes

Link

0 notes

Link

0 notes

Link

0 notes

Text

Building a Powerful Forex Trading Plan Step by Step

Planning is an essential part of achieving any success. In the case of Forex trading, you need more strategic plans to ensure profitable gain. A Forex trading plan should include backtesting of strategies that go well with changing market conditions. This must define your trading style and goals. You must know the right timing when to exit a trade and when to enter the position. If you lack preparation in defining the right trading methods, your success will delay. Thus you need to document your whole trading process to evaluate what works for you and what doesn't. In this article, we have discussed 7 steps to help you build a successful Forex trading plan.

Some essential components for building a Powerful Forex trading plan:

- Skill Development - Set Goals - Do the trading research - Manage risks - Set your exit & entry rules - Keep trading records - Analyze Performance Skill Development

‘Practice makes it perfect’ is the phrase that applies in any skill-building technique. The more you practice different trading styles and predicting the market conditions, the better you grow to become skillful at the trading craft. Set Goals

Before entering a trade, go for a thorough analysis to set realistic profit targets and risk-to-reward ratios. Go for a trade that is likely to have a potential profit three times greater than the risk. Do the trading research Market fluctuations are never in control and your position can only survive if you can better handle its volatility. Always keep an eye on some important factors like world economy news, political instability, change in market prices, unemployment rate, financial markets, GDP, etc. These factors directly or indirectly affect your trading outcomes. You need to learn to use these details in building your trading strategies. Your forex trading plan may give you the ultimate success you desire but that will depend on how good you are at your research. Manage risk

Identify the risk factors depending on your trading style and tolerance for risk. Monitor the market movements to determine when to invest in a trade. Once you learn the different risk factors that may harm your market position then it will be easy to create your risk management strategies. Set your exit & entry rules Most traders don't know when and where to exit while they only focus more on buying signals. Before you enter a trade, you should know your exits. Determine your stop loss if the trade goes against you. Set your profit target. A basic forex trading plan must include stop loss & take profits. Keep trading records Keeping records is an excellent way to reflect on your trading philosophy. When you keep track of your wins & losses then you can easily plan the next step by calculating out the risks that might be there. Mark your drawdowns and profit targets in your trading journal. If you want your business to be as successful and profitable then learn from your past trading mistakes from your records. Finally analyze performance

Take points after each trade, weekly or monthly performances. Take into account all the pros & cons of your overall trading journey. Learn the key points on where to make necessary changes. With more end evaluations you will become better at analyzing your trading performance. Take note of which strategy worked well and what didn't work at all. The Bottom Line These are all the steps you need to follow to make your trading efficient.A trade cannot guarantee you million dollars profit but can give you multiple choices of profitable trading. Some day the market may fall and some day the market prices may touch the sky. Your strategies can save you from falling into any loss. While there is no guarantee that you will be a millionaire in no time, having a solid forex trading plan is crucial to survive the forex trading game. Read the full article

0 notes

Text

Weekly Market Analysis (Apr 26 - Apr 30): Know How News Impacted Your Currency

April 26

Ifo Business Climate (APR) (Germany) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF Volatility in EURXXX pairs are highly expected. Look for opportunities to enter. In Germany, the IFO Business Climate Index measures entrepreneurs’ sentiment about current business situation and their expectations for the next 6 months. The survey is made by phone and covers 9,000 firms in manufacturing, the service sector, trade and construction. The Business Climate Balance is constructed as the difference between the percentage share of executives that are optimistic and the share that are pessimistic. This balance can take values between -100 (all responding firms assess their situation as poor and expect business to deteriorate) and +100 (all responding firms assessed their situation as good and expect an improvement in their business). For the calculation of the IFO Business Climate Index, the Balance is normalized to the average of a base year (currently 2015). Coincident Index Final (FEB) (Japan) Pair Projection What is this news about? USDJPY, EURJPY, CADJPY, AUDJPY, GBPJPY, CHFJPY, NZDJPY Depending on the outcome of this news, volatility in JPY pairs is highly expected. Traders are to be cautious and look for opportunities. Coincident Index correlates with the business cycle, and is used to identify the current state of the economy. In general, increasing coincident index shows that the economy is in an expansion phase, and decreasing coincident index reflects that the economy is in a contraction phase. The index is calculated using month-over-month percentage changes in 11 leading indicators, 11 coincident indicators, and 6 lagging indicators. Durable Goods Orders MoM (MAR) (USA) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY The forecast says that the USD might get bearish. But, wait for the market confirmation and look for most rewarding setups. Durable Goods Orders refer to new orders placed with manufacturers for delivery of hard goods which meant to last at least three years.

April 27

BoJ Interest Rate Decision (Japan) Pair Projection What is this news about? USDJPY, EURJPY, CADJPY, AUDJPY, GBPJPY, CHFJPY, NZDJPY The prices of JPYXXX can go up or down depending on the decision by BOJ. Market may be volatile, look for opportunities. In Japan, interest rates are set by the Bank of Japan's Policy Board in its Monetary Policy Meetings. The BoJ's official interest rate is the discount rate. Monetary Policy Meetings produce a guideline for money market operations in inter-meeting periods and this guideline is written in terms of a target for the uncollateralized overnight call rate. Consumer Confidence (APR) (Italy) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF EURXXX has the potential to be bullish. Market may be volatile arouns this time. Look for opportunities. In Italy, the Confidence Climate Index covers 2,000 Italian consumers. The survey is done by phone and assesses households’ economic conditions, employment and saving prospects and expected purchases of durable goods. The consumer confidence index is adjusted for seasonal effects and fixed to a base year of 2005. The value 100 indicates no evolution in consumer sentiment, a value over 100 shows increasing confidence and a value under 100 indicates low expectations. CB Consumer Confidence (APR) (USA) Pair Projection USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY Volatility in USD pairs are highly expected. Look for opportunities as market

April 28

CPI q/q (Australia) Pair Projection What is this news about? AUDCAD, AUDUSD, EURAUD, GBPAUD, AUDNZD, AUDJPY, AUDCHF Although this data is extremely late relative to inflation data from other countries, it's the primary gauge of consumer prices and tends to create hefty market impacts; Volatility in AUDXXX is expected Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate; FOMC Statement (USA) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY The FOMC usually changes the statement slightly at each release. It's these changes that traders focus on; USDXXX migth get volatile. It's the primary tool the FOMC uses to communicate with investors about monetary policy. It contains the outcome of their vote on interest rates and other policy measures, along with commentary about the economic conditions that influenced their votes. Most importantly, it discusses the economic outlook and offers clues on the outcome of future votes; Core Retail Sales m/m (Canada) Pair Projection What is this news about? USDCAD, EURCAD, CADJPY, NZDCAD, CADCHF, AUDCAD, GBPCAD Released monthly, about 50 days after the month ends; Change in the total value of sales at the retail level, excluding automobiles; CAD pairs are anticipated to be bullish. Automobile sales account for about 20% of Retail Sales, but they tend to be very volatile and distort the underlying trend. The Core data is therefore thought to be a better gauge of spending trends;

April 29

Advance GDP q/q (USA) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF,GBP/USD, NZD/USD, AUD/USD, USD/JPY ECB usually changes the statement slightly at each release. It's these changes that traders focus on. Volatility is expected from EURXXX pairs. Annualized change in the inflation-adjusted value of all goods and services produced by the economy; Usual Effect 'Actual' greater than 'Forecast' is good for currency; Frequency Released quarterly, about 30 days after the quarter ends; Unemployment Change (APR) (Germany) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF EUR might get weak against other currencies. Look for opportunities cause the prices can get volatile. In German, unemployment change measures the absolut change in the number of unemployed people in the reporting month. Consumer Confidence Final (APR) (Euro Zone) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF This news also indicates EUR getting weaker against other currencies. In Euro Area, the Consumer Economic Sentiment Indicator measures the level of optimism that consumers have about the economy. The survey is made by phone and covers 23 000 households in the Euro Area. The number of households sample varies across the zone. The questions focus on current economic and financial situation, savings intention as well as on expected developments regarding: consumer price indexes, general economic situation and major purchases of durable goods. The Consumer ESI measures consumer confidence on a scale of -100 to 100, where -100 indicate extreme lack of confidence, 0 neutrality and 100 extreme confidence.

April 30

SNB Chairman Jordan Speaks (Switzerland) Pair Projection What is this news about? All CHFXXX AND XXXCHF PAIRS SNB Chairman Apr 2012 - Jun 2021. Volatility is sometimes experienced during his speeches as traders attempt to decipher interest rate clues; CHF might get volatile since the mentioned time. Due to speak at the Swiss National Bank's General Meeting of Shareholders, via satellite; As head of the central bank, which controls short term interest rates, he has more influence over the nation's currency value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy; German Prelim GDP q/q (Germany) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF There are 2 versions of GDP released about 10 days apart - Preliminary and Final. The Preliminary release is the earliest and thus tends to have the most impact; EUR pairs are anticipated to be bearish. Change in the inflation-adjusted value of all goods and services produced by the economy; It's the broadest measure of economic activity and the primary gauge of the economy's health;Derived Via Survey of about 750 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories; GDP m/m (Canada) Pair Projection What is this news about? USDCAD, EURCAD, CADJPY, NZDCAD, CADCHF, AUDCAD, GBPCAD Released monthly, about 60 days after the month ends;, CAD is expected to get weaker around this time around. Change in the inflation-adjusted value of all goods and services produced by the economy It's the broadest measure of economic activity and the primary gauge of the economy's health; Derived Via Survey of about 800 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories; Read the full article

0 notes

Text

Weekly Market Analysis (Apr 19- Apr 23): Know How News Impacted Your Currency

April 19

Balance of Trade (MAR) (Japan) Pair Projection What is this news about? USDJPY, EURJPY, CADJPY, AUDJPY, GBPJPY, CHFJPY, NZDJPY Great volatility expected from JPYXXX currencies starting from this time around. Look for opportunities. Between 1980 and 2010 Japan had been recording trade surpluses every year due to rising exports. However, the trade balance swung to deficit in 2011, as the Fukushima nuclear disaster forced the country to increase its purchases of fossil fuels and gas in the wake of weaker yen. The surplus was back in 2016 and 2017, but in 2018 and 2019 Japan's trade balance shifted back into deficit amid persistent trade tensions between the US and China, and sluggish global growth. In 2019, Japan reported the biggest trade surpluses with the US, Hong Kong, South Korea, Taiwan, Singapore and the Netherlands. The biggest trade deficits were recorded with China, Australia, Saudi Arabia, the UAE and Qatar. Services NZ PSI (MAR) (Newzealand) Pair Projection What is this news about? All NZDXXX & XXXNZD PAIRS. Depending on the outcome the prices of NZDXXX can move either way. Look for opportunities to enter the market. The Business NZ Performance of Services Index (PSI) is a composite index based on the diffusion indexes for sales, new orders, delivered, inventories and employment. A reading above 50 indicates an expansion of the Services sector compared to the previous month; below 50 represents a contraction; while 50 indicates no change. Housing Starts (MAR) (Canada) Pair Projection What is this news about? USDCAD, EURCAD, CADJPY, NZDCAD, CADCHF, AUDCAD, GBPCAD This news might not impact the CADXXX currencies that much, but the possibility still remains. In Canada, a housing start is defined as the beginning of construction work on the building where the dwelling unit will be located. This can be described in 2 ways: usually, the stage when the concrete has been poured for the whole of the footing around the structure; or an equivalent stage where a basement will not be part of the structure.

April 20

CPI q/q (New Zealand) Pair Projection What is this news about? All NZDXXX & XXXNZD PAIRS. This is extremely late relative to inflation data from other countries, but it's the primary gauge of consumer prices and tends to create hefty market impacts; Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate; Average Earnings Index 3m/y (UK) Pair Projection What is this news about? GBPUSD, GBPJPY, GBPCAD, GBPAUD, GBPNZD, GBPCHF, EURGBP, Change in the price businesses and the government pay for labor, including bonuses of UK. GBPXXX pairs are expected to be bearish. It's a leading indicator of consumer inflation - when businesses pay more for labor the higher costs are usually passed on to the consumer; Tertiary Industry Activity m/m (Japan) Pair Projection What is this news about? USDJPY, EURJPY, CADJPY, AUDJPY, GBPJPY, CHFJPY, NZDJPY Change in the total value of services purchased by businesses; JPYXX pairs are also expected to go bearish. It's a leading indicator of economic health - businesses are quickly affected by market conditions, and changes in their spending can be an early signal of future economic activity such as hiring, earnings, and investment;

April 21

CPI y/y (UK) Pair Projection What is this news about? GBPUSD, GBPJPY, GBPCAD, GBPAUD, GBPNZD, GBPCHF, EURGBP, This is considered the UK's most important inflation data because it's used as the central bank's inflation target; GBPXXX pairs are expected to be bullish. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate; Retail Sales m/m (Australia) Pair Projection What is this news about? AUDCAD, AUDUSD, EURAUD, GBPAUD, AUDNZD, AUDJPY, AUDCHF Change in the total value of sales at the retail level; AUD pairs are expected to be bullish. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity; BOC Monetary Policy Report (Canada) Pair Projection What is this news about? USDCAD, EURCAD, CADJPY, NZDCAD, CADCHF, AUDCAD, GBPCAD The BOC Governor usually holds a press conference to discuss the contents of this report about 75 minutes after release; HIGH volatility in CAD pairs is expected. It provides valuable insight into the bank's view of economic conditions and inflation - the key factors that will shape the future of monetary policy and influence their interest rate decisions;

April 22

Monetary Policy Statement (Euro Zone) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF ECB usually changes the statement slightly at each release. It's these changes that traders focus on. Volatility is expected from EURXXX pairs. It's the primary tool the ECB uses to communicate with investors about monetary policy. It contains the outcome of their decision on interest rates and commentary about the economic conditions that influenced their decision. Most importantly, it discusses the economic outlook and offers clues on the outcome of future decisions; ECB Press Conference (Euro Zone) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF The press conference is about an hour long and has 2 parts - first a prepared statement is read, then the conference is open to press questions.. Heavy volatility expected from EURXXX pairs. t's the primary method the ECB uses to communicate with investors regarding monetary policy. It covers in detail the factors that affected the most recent interest rate and other policy decisions, such as the overall economic outlook and inflation. Most importantly, it provides clues regarding future monetary policy; Unemployment Claims (USA) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY This is the nation's earliest economic data. USDXXX pairs are expected to be bearish. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Unemployment is also a major consideration for those steering the country's monetary policy;

April 23

German Flash Services PMI (Euro Zone) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF Above 50.0 indicates industry expansion, below indicates contraction. There are 2 versions of this report released about a week apart – Flash and Final. EUR is expected to be bullish. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy;Survey of about 800 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories; French Flash Services PMI(Euro Zone) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF EUR is anticipated to be volatile all day long tomorrow. Look for opportunities. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy; Derived Via Survey of about 750 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories; Flash Manufacturing PMI (USA) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry; USD is also expected to be volatile. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy; Derived Via Survey of about 800 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories; Read the full article

0 notes

Text

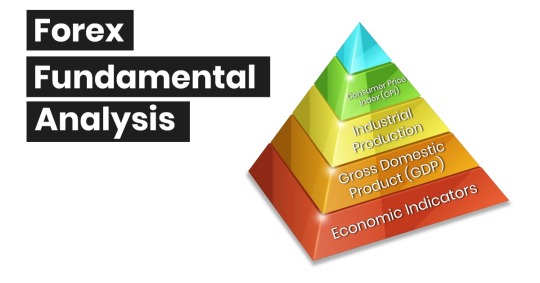

Forex Fundamental Analysis: The Essential Part of Forex Trading

One basic form of analysis that is commonly used in the forex market is called Forex fundamental analysis. This method is applied to determine any changes in currency prices using economic, social, and political factors. Fundamental analysis observes the overall condition of a country that is vital to make a suitable strategy before placing a trade. Indicators such as PMI, PPI, ECI & real estate stats etc. all provide valuable information for traders. Here, take a look at the major factors in the fundamental analysis that are taken into account to identify any market predictions & trading risks. Economic Indicators

Government or private organizations release reports that show a country's overall economic condition. These reports are the economic indicators that reveal any changes in a nation's economy. The reports show any improvement or downfall of a nation’s economy. Each indicator serves a unique purpose. From the economic indicators, we may see how securities & forex markets are being affected. These economic reports also include unemployment rates, financial market news, political updates, bank information etc., required to predict a favorable situation for trading. Gross Domestic Product (GDP)

GDP represents the total amount of all the goods and services produced by a country annually. The GDP figure is another indicator that shows the overall market condition of the nation. Most traders ask for the advance report and the preliminary report before focusing on the GDP figures and then do a final analysis. In this way, they can strategize their trading plans to gain significant profit as an outcome. Industrial Production

This report is used to identify any changes that take place within a country on its production of factories, mines, & utilities. The market fluctuations noticed on these elements can directly impact a nation’s exchange currency rates and that as a result, will affect your trading. Traders use this indicator to understand in which direction the market will shift. The result observed will indicate how you need to strategize your next step in trading. Consumer Price Index (CPI)

The CPI measures any level of change in the prices of total consumer goods. This report is compared to a nation's entire exports done annually. This report will inform you how much money a country has profited or lost on its products and services. This CPI report will analyze a nation’s overall strength or weakness on its currency rates. Importance of Economic Indicators Forex fundamental analysis is so crucial when analyzing the market. The economic indicators serve as a strong base for you to take any trading-related decision. It is vital to follow an economic calendar with lists of indicators and its related statistics that show important changes. Keep observing the market and the manipulation of each indicator. Check the inflation rates as it can cause price and volume movements. The Bottom Line There are many such categories of economic indicators, that can be used to evaluate forex fundamentals. Take time to know how each indicator affects a nation's economy. Without these indicators, Forex fundamental analysis becomes difficult and quite impossible to predict any accurate market movement. These resources define the ultimate decision of any currency trader. Read the full article

0 notes

Text

Technical Analysis: Your Staircase to Profitable Forex Trading

Technical analysis is one of the forex trading methods used to determine market predictions. Price charts and technical indicators are the two most common types of technical analysis. This method helps to predict future price movements and helps you figure out the entry and exit points to gain trading advantage. The technical analysts would usually observe and collect information from the market prices, volume, past market details, economical updates & quantitative analysis. They use all these informative factors to analyze profitable trading opportunities for traders. In this article, we will get into more details of this trading tool and know why it is important in forex trading. The effective characteristics of Technical Analysis - It uses multiple strategies to provide accurate market interpretation. - It is capable of predicting how the current market trend will change. - Chart patterns show the price movements. - Technical indicators use mathematical calculations to predict prices and volumes. - Almost all online traders use multiple technical analysis tools for effective trading. - It gives solid information about trading risks & advantages to inform us when to enter or exit a position. - Technical analysis provides early signals for a profitable trading opportunity before any change in market prices. - It does ensure a higher winning rate in trading. Types of technical indicators Most trading systems use varieties of functional indicators to determine most accurate market predictions. These are technologically updated instruments that have so far helped in successful trading for many traders. 10 most powerful technical indicators to Build a Trading Toolkit - Moving average - Moving average convergence divergence (MACD) - Tools of the Trade. - On-Balance Volume. - Accumulation/Distribution Line. - Average Directional Index. - Aroon Indicator. - MACD. - Relative Strength Index. - Stochastic Oscillator. Limitation of Technical Analysis The misinterpretation of chart patterns can cause trading errors to occur. This common mistake can occur in trading. So, one needs to be very careful about misreading the facts & figures of any technical analysis tool. Final thoughts Technical analysis is very important in trading as it knows how the market trend is repeating itself to affect your trading style. There ain’t any magical strategy to bring you the exact formula to be successful in forex trading. It is about using the right tools to determine your risk-to-reward ratio and then plan your trading technique to be most profitable. Technical analysis is such a great analytical tool that actually helps you understand the ins & outs of every market prediction. When you know how to evaluate the trading patterns using technical indicators, you eventually become effective in trading. It is indeed one such great method that is vital for you to survive in the forex market. Read the full article

0 notes

Text

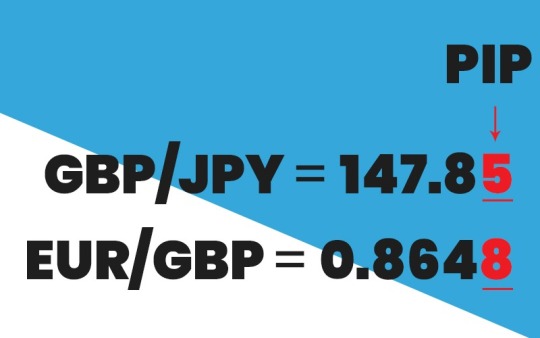

Pip in Forex Trading: The Defining Factor of Your Trading Situation

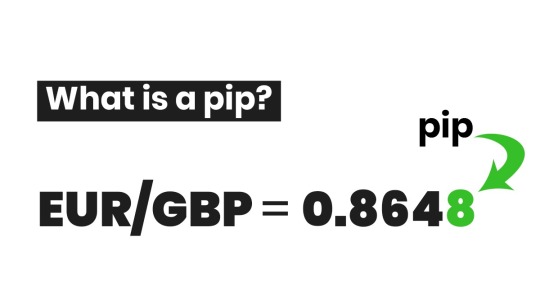

The word ‘pip’ is such a tiny word but carries so much weight when it comes to measuring your overall profit or losses in trading. Pip in forex trading is the most essential thing just as saving your investment from loss is very crucial. Without pips, it is hard to find how exchange rates are changing that can affect your trade. And also, it will alert you to manage your risk factors better. However, many such traders are still in confusion as to how pip works in forex trading. In this article, we discussed what pip means and how you can find your pip value to determine your market position. Know your pip in forex trading

pip in forex trading A pip is the most common term in forex trading that represents the basic unit of measure used for trading currencies. The full form of pip is "percentage in point". A USD/EUR quote of 0.7737 means that you can buy 0.7737 euros for US$1. A one pip increase in this quote will change this value to 0.7738. It shows that US dollar value would shift according to any value change in euros. A pip value is shown in the fourth decimal place of this currency pair that defines the overall change in the currency quote of an exchange rate. This will direct you to either buying or selling stocks in trading. Here, a change of 1 pip is noticed when the value rises from 0.7737 to 0.7738. The 2 keys to determine pip value The pip value is very important when it comes to identifying the total profit or loss factors in your forex trade. The position size or change in the exchange rate can influence the pip value. So, knowing your pips is necessary to find in which direction your trade is moving. You can easily find your market condition in trading by calculating the pip value using the two formulas: - Total profit/loss = Value of pip x Amount of pips - Value of pip = (0.0001 / Exchange rate) * Position size These formulas are the basic way to calculate pip in forex trading. Pips can affect your leverage Your borrowed leverage amount that you are using in your trade is often at risk. More leverage involved in your trading makes you vulnerable to risk your position. Measuring pip in forex trading will cut many such risks that may hinder your progress. Losing a few pips from your account can entirely end your full trading balance. If you use your full cash to trade, then any sudden decrease in forex prices can make you go penniless instantly. On the positive side, when you gain in more pips then you would quickly profit with 100% return of the invested amount. It is recommended that you should risk a minimum amount of leverage to control any damage that may take place. A little change in pip value can impact your trading either negatively or positively. Thus, some good strategies must be followed before placing your trade. Following up on pips is one common technique to know where you are heading. Final overview You must have a clear idea by now about the importance of pip in forex trading. Without having any knowledge about pip, you will quickly drown in the river of your loss and may never come back. It is a must for all beginners to be well-informed about pips. The forex market has more technical concepts that every trader may not know yet. Pips are the starting point from where you should begin your research into the forex world. Read the full article

0 notes

Text

Weekly Market Analysis (Apr 12-Apr 16): Know How News Impacted Your Currency

April 12

Bank Lending YoY (MAR) (Japan) Pair Projection What is this news about? USDJPY, EURJPY, CADJPY, AUDJPY, GBPJPY, CHFJPY, NZDJPY Depending on the outcome of the news JPYXXX pairs might move accordingly. In Japan, bank lending refers to the year-on-year change of all outstanding loans and discounts with banks and shinkin banks. Lending increases with increased business confidence and investment and it is an important indicator for the Japanese economy because of the weakness that has plagued the Japanese banking sector. Retail Sales YoY (FEB) (Euro Zone) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF The overall EURXXX pairs might go down on a bearish trendline id the forecasted outcome turns out correct. But, if there is inconsistency between the forecast and actual outcome in that case the pairs can gegt volatile. In the Euro Area, retail sales show the evolution of the total amount of goods sold. Among them, food drinks and tobacco account for the highest share (39.3 percent); followed by electrical goods and furniture (12.0 percent share); computer equipment books and other (11.4 percent share); pharmaceutical and medical goods (9.9 percent share); textiles, clothing, footwear (9.2 percent share); auto fuel (9.1 percent share); other non-food products (6.0 percent share) and mail orders and internet (2.9 percent share). Among countries, Germany has the highest weight (25.9 percent), followed by France (21.7 percent), Italy (16.1 percent) and Spain (11.4 percent). Others are Netherlands (5.2 percent); Belgium (4.3 percent); Greece (3.0 percent); Austria (2.8 percent); Portugal (2.4 percent); Finland (1.8 percent); Ireland (1.7 percent); Luxembourg and Slovakia (0.8 percent each); Slovenia (0.6 percent); Lithuania (0.4 percent); Latvia and Cyprus (0.3 percent); Estonia (0.2 percent) and Malta (0.1 percent). Business Outlook Survey Indicator (Q1) (Canada) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY We saw a huge uplift in this index in last quarter, it move from -68 to almost +3, we hope that the index will recover and CADXXX to move accordingly. The Business Outlook Survey summarizes interviews conducted by the Bank’s regional offices with the senior management of about 100 firms selected in accordance with the composition of the gross domestic product of Canada’s business sector. The balance of opinion can vary between +100 and -100.

April 13

NAB Business Confidence (Australia) Pair Projection What is this news about? AUDCAD, AUDUSD, EURAUD, GBPAUD, AUDNZD, AUDJPY, AUDCHF AUDXXX pairs have chances to be volatile. Look for opportunities. It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment; CPI m/m (USD) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY USD pairs are anticipated to be volatile and break structure from the mentioned time or prior. Look for opportunities. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate; GDP 3-Month Avg (FEB) (UK) Pair Projection What is this news about? GBPUSD, GBPJPY, GBPCAD, GBPAUD, GBPNZD, GBPCHF, EURGBP, GBP has slighter chances to be bearish or depending on the outcome of the news it can go either way.` GDP measures the value of goods and services produced in the UK. The reading refers to a three-month growth rate, which is a better indicator of the underlying growth in GDP as the monthly figure is likely to be more volatile. In this sense, the monthly release can be thought of as a monthly update on three months’ worth of data on the economy, rather than a figure representing the economy in just one month. Rolling three-month data is calculated by comparing growth in a three-month period with growth in the previous three-month period, for example growth in March to May compared with the previous December to February.

April 14

Westpac Consumer Confidence Index (APR) (Australia) Pair Projection What is this news about? AUDCAD, AUDUSD, EURAUD, GBPAUD, AUDNZD, AUDJPY, AUDCHF Consume index causes a lot of impact on the economy. Depending on the outcome, prices can go up or down. The Consumer Sentiment Index is based on a survey of over 1,200 Australian households. The Index is an average of five component indexes which reflect consumers' evaluations of their household financial situation over the past year and the coming year, anticipated economic conditions over the coming year and the next five years, and buying conditions for major household items. The index scores above 100 indicate that optimists outweigh pessimists. Interest Rate Decision (Newzealand) Pair Projection What is this news about? All NZDXXX & XXXNZD PAIRS. The forcasted number is the same as the last session's. Better look for opportunities as prices of NZD pairs may get very volatile In New Zealand, interest rates decisions are taken by the Reserve Bank of New Zealand. The official interest rate is the Official Cash Rate (OCR). The OCR was introduced in March 1999 and is reviewed eight times a year by the Bank. The OCR influences the price of borrowing money in New Zealand and provides the Reserve Bank with a means of influencing the level of economic activity and inflation. MBA Mortgage Applications (09/APR) (USA) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY USDXXX pairs can go on a bearish trendline or the other way around as there are multiple newses possibly impacting US economy. In the US, the MBA Weekly Mortgage Application Survey is a comprehensive overview of the nationwide mortgage market and covers all types of mortgage originators, including commercial banks, thrift institutions and mortgage banking companies. The entire market is represented by the Market Index which covers all mortgage applications during the week, whether for a purchase or to refinance.

April 16

Core Inflation Rate YoY Final (MAR) (Eur Zone) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF Volatility can be seen with EURXXX pairs. Look for opportunities. There is a high possibility of EURO to remain volatile all day. In Euro Area, the core inflation rate is calculated using the weighted average of the Harmonised Index of Consumer Price (HICP) aggregates, excluding energy, food, alcohol & tobacco that face volatile price movements. BoE Cunliffe Speech (UK) Pair Projection What is this news about? GBPUSD, GBPJPY, GBPCAD, GBPAUD, GBPNZD, GBPCHF, EURGBP, Depending on the outcome of the speech GBPXXX pairs might move accordingly. In the United Kingdom, benchmark interest rate is set by the Monetary Policy Committee (MPC). The Bank of England official interest rate is the repo rate. This repo rate applies to open market operations of the Bank of England with a group of counterparties (banks, building societies, securities firms). Michigan Consumer Sentiment Prel (APR) (US) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY USD/CAD, EUR/USD, USD/CHF,GBP/USD, NZD/USD, AUD/USD, USD/JPY The Index of Consumer Expectations focuses on three areas: how consumers view prospects for their own financial situation, how they view prospects for the general economy over the near term, and their view of prospects for the economy over the long term. Each monthly survey contains approximately 50 core questions, each of which tracks a different aspect of consumer attitudes and expectations. The samples for the Surveys of Consumers are statistically designed to be representative of all American households, excluding those in Alaska and Hawaii. Each month, a minimum of 500 interviews are conducted by telephone. Read the full article

0 notes

Text

Metatrader 4: Most Reliable Trading Platform

MetaTrader 4 (MT4) is one of the best online trading platforms we have today. It is well appreciated by thousands of traders globally. It carries an excellent reputation in the forex market due to its versatile features. MT4 is accessible on Mac, Windows, other mobile apps & also on a web browser. Most brokers would recommend using it as it is a good quality platform. MetaTrader has other versions available as well and those are equally helpful in effective trading. Hence, it is considered as the first preference to many traders and brokers even in 2021. Since 2002, it has been doing great on the forex market, serving traders with quality trading. In this article, we’ll get to know what the MetaTrader 4 system has for the traders and how we can trade using it. This also includes demo accounts, tutorials, automated trading solutions, support & others. Brokers suggesting MetaTrader 4 The brokers of established forex markets mostly from the UK, USA & Europe all offer MetaTrader 4. Their names include: - Admiral Markets - Trading 212 - IC Markets - ZuluTrade - AvaTrade - 24option - Oanda - FXCM - FxPro - XTB - XM - IG MetaTrader 4 Account Access MetaTrader 4 can be easily downloaded from the MetaQuotes website, completely free. You can also get it on an online broker after registering with their service for a real or demo account.

You can personalize your MetaTrader 4 new account and start exploring what it holds for trading. Information like trading costs, commissions and spreads are all there for you to start trading. Its new version MetaTrader 5 has more upgrading features. However, both 4 & 5 editions are really good at managing multiple trading accounts using MultiTerminal. Basics steps to trade Know the components and start trading on the MT4 platform. The elements are explained to make it easy for you. Symbol – Here you can find the materials for trading such as forex, gold, or stock indices Volume – Choose lots or CFDs according to your trade size (1 lot is equal to 100,000) Type – Select ‘instant execution’ to place a trade for buying or selling currency pairs. Stop-loss – This tool is great for risk management. It will warn you of any loss that may occur and show you the gained pips. Take-profit – This tool is in auto mode that will automatically stop after you profited a certain level. Comment – Leaving a comment based on your experience is helpful for your trading journal too. Slippage – You can limit slippage to avoid any risk Trade positions Select ‘view’ to enter the MetaTrader 4 terminal and then click ‘trade’. The right side of the profit column will guide you to enter or exit a position. In this way, you can modify stops and limits as well. Trading indicators MetaTrader 4 already has 30 built-in technical indicators and you can also go for additional chart indicators that are easily available on MetaTrader’s Code Base and Market. The Elliott Wave indicator, Bollinger Bands, & pivot points are some indicators you may try as per your trading style. Third-party trading elements like Stealth Orders and Alarm Manager are popular too. Stealth Orders keep your trade anonymous to others while Alarm Manager efficiently handles all your trading alerts, trading time-frames and notifications through a window setup. Java API can be applied to build extensions onto the MetaTrader 4 platform. Automated Trading Solution (Expert Advisors) The best attraction on MetaTrader 4 platform is its automated trading component. Expert Advisor (EA) or technically you may say a robot software, gives excellent automated trading signals. It also does analysis of FX price quotes. You can download trading bots with instructions from Code Base, absolutely free. Or, you can simply rent it out or buy from the market, or freelance developers. Virtual hosting can run trading bots 24/7 through MetaTrader 4 VPS. Traders can also build software robots on the MetaTrader 4 platform if they want, using Raspberry Pi 3 and Python. Mobile App Applications

The MetaTrader 4 mobile app is also great for trading from your phone. This mobile app is also compatible with iPhones, iPads, and some Windows devices. The android users can download the MT4 APK file directly from the Google Play Store. Mobile traders will have access to 3 types of charts, few timeframes, 30 technical indicators, market prediction data,& a chat box to communicate with other traders. Demo Accounts

The MetaTrader 4 demo account has everything to experience real trading without any real money involved. Simply select ‘demo’ from the account options and open a new MetaTrader 4 demo account. You can have access to historical data, indicators, copy trading through Signals and also Expert Advisors can be used on its demo account. Support Team You can find customer support easily available on MetaTrader 4 platform. The ‘Help’ button is there to provide you any basic level support like showing keyboard shortcuts. ‘Contact Us’ page is there to help you with any questions. The technical support team is also there to solve any account-related problems you may face. The MetaTrader 4 online community is very dynamic and informative. You can find training courses, trading advice, tips and many other useful resources to improve your trading skills. Final Evaluation MetaTrader 4 is the most popular & efficient online trading platform, as rated by many brokers & traders. It has efficient software that is very convenient to use with advanced multifunctioning features. It readily provides complete assistance via technical analysis and automated trading service. Other platforms also have some unique qualities to offer. However, MetaTrader 4 has achieved a significant place among its users due to its quality. The reviews show that it is worth choosing this platform to maintain effective long-term trading. Read the full article

0 notes

Text

Non-Farm Payroll (NFP) in Forex | NFP Report, Affect & Trading Strategy

What is the NFP?

The non-farm payroll (NFP) figure is a prominent economic indicator for the United States economy. It represents the number of jobs added, excluding farm employees, government employees, private household employees, and employees of nonprofit organizations. How Does the NFP Affect Forex? NFP data is important because it is released monthly, making it a very good indicator of the current state of the economy. The data is released by the Bureau of Labor Statistics and the next release can be found on an economic calendar. Employment is a very important indicator to the Federal Reserve Bank. When unemployment is high, policymakers tend to have an expansionary monetary policy (stimulatory, with low-interest rates). The goal of an expansionary monetary policy is to increase economic output and increase employment. So, if the unemployment rate is higher than usual, the economy is thought to be running below its potential and policymakers will try to stimulate it. A stimulatory monetary policy entails lower interest rates and reduces demand for the Dollar (money flows out of a low-yielding currency). To learn exactly how this works, see our article on how interest rates affect forex. Which Currency Pairs Are Most Affected by NFP The NFP data is an indicator of American employment, so your currency pairs that include the US Dollar (EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, and others) are most affected by the data release. Other currency pairs also display an increase in volatility when the NFP releases and traders must be aware of this as well, because they may get stopped out. Analyzing the Non-Farm Report Numbers

Like any other piece of economic data, there are three ways to analyze the U.S. non-farm payroll number: - A higher payroll figure is good for the U.S. economy. This is because more job additions help to contribute to healthier and more robust economic growth. Consumers who have both money and a job tend to spend more, leading to growth. As a result, foreign exchange traders and investors look for a positive addition of at least 100,000 jobs per month. Any release above—let's say 200,000—will help to fuel U.S. dollar gains. An above-consensus estimate release will have the same effect. - An expected change in payroll figure causes a mixed reaction in the currency markets. Forex investors witnessing an expected change in the NFP report will turn to other sub-components and items to gain some sort of direction or insight. This includes the unemployment rate and manufacturing payroll sub-component. So, if the unemployment rate drops or manufacturing payrolls rise, currency traders will side with a stronger dollar, a positive for the U.S. economy. But, should the unemployment rate increase, manufacturing jobs decline, investors will drop the U.S. dollar for other currencies. - A lower payroll figure is detrimental for the U.S. economy. Like any other economic report, a lower employment picture is negative for the world's largest economy and the greenback. Should the NFP report show a decline below 100,000 jobs (or a less-than-estimated print), it's a good sign the U.S. economy isn't growing. As a result, Forex traders will favor higher-yielding currencies against the U.S. dollar. The NFP Trading Strategy The NFP report generally affects all major currency pairs, but one of the favorites among traders is the GBP/USD. Because the forex market is open 24 hours a day, all traders have the ability to trade the news event. The logic behind the strategy is to wait for the market to digest the information's significance. After the initial swings have occurred, and aftermarket participants have had a bit of time to reflect on what the number means, they will enter a trade in the direction of the dominating momentum. They wait for a signal indicating the market may have chosen a direction to take rates. This avoids getting in too early and decreases the probability of being whipsawed out of the market before it has chosen a direction. The Bottom Line The logic behind this strategy of trading the NFP report is based on waiting for a small consolidation, the inside bar after the initial volatility of the report has subsided and the market is choosing which direction it will go. By controlling risk with a moderate stop, we are poised to make a potentially large profit from a huge move that almost always occurs each time the NFP is released. - Reference Taken From “DailyFX and Investopedia” Read the full article

0 notes

Text

Building a Powerful Forex Trading Plan Step by Step

Planning is an essential part of achieving any success. In the case of Forex trading, you need more strategic plans to ensure profitable gain. A Forex trading plan should include backtesting of strategies that go well with changing market conditions. This must define your trading style and goals. You must know the right timing when to exit a trade and when to enter the position. If you lack preparation in defining the right trading methods, your success will delay. Thus you need to document your whole trading process to evaluate what works for you and what doesn't. In this article, we have discussed 7 steps to help you build a successful Forex trading plan.

Some essential components for building a Powerful Forex trading plan:

- Skill Development - Set Goals - Do the trading research - Manage risks - Set your exit & entry rules - Keep trading records - Analyze Performance Skill Development

‘Practice makes it perfect’ is the phrase that applies in any skill-building technique. The more you practice different trading styles and predicting the market conditions, the better you grow to become skillful at the trading craft. Set Goals

Before entering a trade, go for a thorough analysis to set realistic profit targets and risk-to-reward ratios. Go for a trade that is likely to have a potential profit three times greater than the risk. Do the trading research Market fluctuations are never in control and your position can only survive if you can better handle its volatility. Always keep an eye on some important factors like world economy news, political instability, change in market prices, unemployment rate, financial markets, GDP, etc. These factors directly or indirectly affect your trading outcomes. You need to learn to use these details in building your trading strategies. Your forex trading plan may give you the ultimate success you desire but that will depend on how good you are at your research. Manage risk

Identify the risk factors depending on your trading style and tolerance for risk. Monitor the market movements to determine when to invest in a trade. Once you learn the different risk factors that may harm your market position then it will be easy to create your risk management strategies. Set your exit & entry rules Most traders don't know when and where to exit while they only focus more on buying signals. Before you enter a trade, you should know your exits. Determine your stop loss if the trade goes against you. Set your profit target. A basic forex trading plan must include stop loss & take profits. Keep trading records Keeping records is an excellent way to reflect on your trading philosophy. When you keep track of your wins & losses then you can easily plan the next step by calculating out the risks that might be there. Mark your drawdowns and profit targets in your trading journal. If you want your business to be as successful and profitable then learn from your past trading mistakes from your records. Finally analyze performance

Take points after each trade, weekly or monthly performances. Take into account all the pros & cons of your overall trading journey. Learn the key points on where to make necessary changes. With more end evaluations you will become better at analyzing your trading performance. Take note of which strategy worked well and what didn't work at all. The Bottom Line These are all the steps you need to follow to make your trading efficient.A trade cannot guarantee you million dollars profit but can give you multiple choices of profitable trading. Some day the market may fall and some day the market prices may touch the sky. Your strategies can save you from falling into any loss. While there is no guarantee that you will be a millionaire in no time, having a solid forex trading plan is crucial to survive the forex trading game. Read the full article

0 notes

Text

Weekly Market Analysis (Apr 06 - Apr 09): Know How News Impacted Your Currency

April 06

RBA Interest Rate Decision (Australia) Pair Projection What is this news about? AUDCAD, AUDUSD, EURAUD, GBPAUD, AUDNZD, AUDJPY, AUDCHF Depending on the outcome of the news AUDXXX pairs can move bullish or bearish. In Australia, interest rates decisions are taken by the Reserve Bank of Australia's Board. The official interest rate is the cash rate. The cash rate is the rate charged on overnight loans between financial intermediaries, is determined in the money market as a result of the interaction of demand for and supply of overnight funds. Unemployment Rate (FEB) (Italy) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF There is a higer chance that Italy's Unemployed Rate will increase but, depending on the outcome of the new EURXXX can go either way. In Italy, the unemployment rate measures the number of people actively looking for a job as a percentage of the labour force. Unemployment Rate (FEB) (Euro Zone) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF As the COVID situation hasn't improved in the Euro area. EURXXX currencies are very likely to follow a bearish trendline. In Euro Area, the unemployment rate measures the number of people actively looking for a job as a percentage of the labour force.

April 07

Markit Services PMI Final (MAR) (AUS) Pair Projection What is this news about? AUDCAD, AUDUSD, EURAUD, GBPAUD, AUDNZD, AUDJPY, AUDCHF Little volatility is expected from AUDXXX and XXXAUD pairs. Look for opportunities. The IHS Markit Services PMI is based on data compiled from monthly replies to questionnaires sent to a representative panel of purchasing executives in over 400 private sector services firms in Australia. The panel is stratified by GDP and company workforce size. The services sector is divided into the following five broad categories: Transport & Storage, Consumer Services, Information & Communication, Finance & Insurance and Real Estate & Business Services. A reading above 50 indicates an expansion of the manufacturing sector compared to the previous month; below 50 represents a contraction; while 50 indicates no change. Markit Composite PMI Final (MAR) (EURO ZONE) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF EURXXX pairs are anticipated to start moving in any possible direction and high volatility starting from the mentioned time as there are many Euro Courtiers Releasing MRKIT PMI. Markit/ADACI European Services PMI (Purchasing Managers' Index) is based on data collected from a representative panel of around 400 companies based in the European service sector. The index tracks variables such as sales, employment, inventories and prices. A reading above 50 indicates that the services sector is generally expanding; below 50 indicates that it is generally declining. Balance of Trade (FEB) (Canada) Pair Projection What is this news about? USDCAD, EURCAD, CADJPY, NZDCAD, CADCHF, AUDCAD, GBPCAD AAs this is a very high impact news and had affected CAD and USD along with other Exotic Currencies previously, we are anticipating the same move. Between 1970 and 2008 Canada had been recording trade surpluses every year. From 2009 the trade balance shifted to deficit, with an exception of 2011 and 2014. In 2018, the largest trade deficits were recorded with China, Germany and Mexico, while the biggest trade surpluses were recorded with the US, the UK and Norway.

April 08

ECB Monetary Policy Meeting Accounts (EUR ZONE) Pair Projection What is this news about? EURUSD, EURJPY, EURGBP, EURCAD, EURAUD, EURNZD, EURCHF Up-surge in EURXXX pairs is anticipated from our end. In the Euro Area, benchmark interest rate is set by the Governing Council of the European Central Bank. The primary objective of the ECB’s monetary policy is to maintain price stability which is to keep inflation below, but close to 2 percent over the medium term. In times of prolonged low inflation and low interest rates, ECB may also adopt non-standard monetary policy measures, such as asset purchase programmes. The official interest rate is the Main refinancing operations rate. . Fed Chair Powell Speaks (USA) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY Minor volatility can be expected from USDXXX pairs. Due to participate in a panel discussion about the global economy at a virtual International Monetary Fund Seminar. Audience questions expected; Foreign Bond Investment (Japan) Pair Projection What is this news about? USDJPY, EURJPY, CADJPY, AUDJPY, GBPJPY, CHFJPY, NZDJPY Prices of JPY can get volatile, we suggest to trade with caution. The net data shows the difference between acquisition and disposition of long-term debt securities: a plus sign indicates net purchases of foreign securities by Japanese investors; a minus sign indicates net selling and inflows of funds into Japan. It excludes Bank of Japan.

April 09

Employment Change (MAR) (CAD) Pair Projection What is this news about? USDCAD, EURCAD, CADJPY, NZDCAD, CADCHF, AUDCAD, GBPCAD Unpredictable movements might occur with CADXXX pairs. Look for opportunities. In Canada, employment change refers to the change in the number of persons who work for pay or profit, or perform unpaid family work. Estimates include both full-time and part-time employment. Building Permits MoM Final (FEB) (AUD) Pair Projection What is this news about? AUDCAD, AUDUSD, EURAUD, GBPAUD, AUDNZD, AUDJPY, AUDCHF We are expecting heavy bullish movement or the reverse wit AUDXXX pairs. In Australia, Building Permits show the monthly change in the number of total dwelling units approved, including building activity carried out on existing buildings. Wholesale Inventories MoM (FEB) (USD) Pair Projection What is this news about? USD/CAD, EUR/USD, USD/CHF, GBP/USD, NZD/USD, AUD/USD, USD/JPY This news sometimes causes some impact in USDXXX pairs. Better be careful around this time. The Wholesale Inventories are the stock of unsold goods held by wholesalers. Inventories are a key component of gross domestic product changes. A high inventory points to economic slowdown in the US, while a low reading points to a stronger growth. Read the full article

0 notes

Text

Get Educated on How to Avoid Forex Trading Scams

The forex market is huge, generating $5 trillion on average from large volumes of trading on a daily basis. Forex trading scams have also increased nowadays, which that became a potential threat for every trader. The importance of learning how to avoid forex trading scams is a must for every trader to keep your investment safe. Still, we keep hearing scam stories from newbies and even the experienced ones fail to notice the fake ones. These are unfortunately creating a bad influence on the non-traders who might consider us as a fraud. We need to raise our voice against such manipulations to keep our forex industry safe from any defamation and abuse. Today, we will get into the details on how to avoid forex trading scams once and for all. Look for scamming signs Take all your time to decide which is the authentic trading service you should invest in. Going through multiple trading communities is another way you can find out about a particular service provider.

Identify all the pros and cons while searching for a reliable forex broker to avoid any investment scams. Customer reviews on reputable forex websites are also very important for your research. The scam reviews on signal services work best as a warning sign. Give your all to find everything on how to avoid forex trading scams for life. You must do your thorough research and proper background check to avoid getting cheated by a scammer. No exact proof of any trading systems Scammers cannot provide you with any proof of their trading system for verification. They would best try to show false evidence to hide their reality in disguise. Many traders would offer trading services without a trading room. These types of scammers are known as "snake oil merchants". The name "Snake oil" is used for false traders. They usually don't have any solid proof of trading of their trading history. Also, they may provide false customer reviews, fake trading results and modified transaction history to manipulate you. Cross-check each and everything they provide Email Spamming

Scammers may also ask for your personal details for misuse - Your full name - Phone number - Home address - E-mail Never give away your sensitive details to someone. You should feel doubtful when your brokers don't provide you with a written risk disclosure statement. Verify every little detail of any official documents your broker provides you with. More precautions to protect yourself from scams

It has become hard to differentiate between the fake and the real service providers, as most fake ones look more realistic. We have summarized a few points for showing you how to avoid forex trading scams. - Find online guidance or professionals to discover any forex scam artists - Take advice from a licensed financial advisor - Ask for business registration proof of a broker you want to work with - Go through all the fine print before opening an account. - While trading lives, always trade for a short period of time initially and then withdraw the money. If it's safe then deposit more funds. - The availability of demo trading offers - Background Affiliation Status Information Center (BASIC) website created by the National Futures Association (NFA) for complete guidance on choosing a reputable broker and avoiding scams. - Register with the Commodity Futures Trading Commission (CFTC), it is the government agency that deals with futures and options trading. - Do some research to find if there are any legal actions against any broker you wish to join - Visit all forex forums to see any complaints about any services and contact the user who complained to investigate more. - Check the company's registration, business background and see if the company is legitimate or not. - Never put your full trust in any big claims you hear. Summary You can prevent yourself from being a victim of a scam using all the above suggestions we made so far. Once you learn to escape from such scamming tactics then you can guide others on how to avoid forex trading scams. Never forget to use a well-established regulated broker, that has a great reputation and positive reviews written by the majority. Make sure your service provider is 100% transparent about its fees and compliance policies. If you can manage the risks of getting cheated then you can finally see how forex trading is beneficial in every way. When you see the business for real then you will know that forex trading is not a scam. Staying alert about scams is equally important as it is to review against any false allegations about forex trading. When you know how real this forex thing is, you can then realize how important it is to spread the true message of its reality to the general public. Read the full article

0 notes