Photo

Crypto-Back: What It Is & Why It’s Popular

Many credit card issuers are now offering crypto-back as an incentive, and merchants that are partnered with Merchant Industry can benefit from this trend.

1 note

·

View note

Text

Credit Card Processing for Small Business

The merchant industry is here to provide cheap and best credit card processing for small businesses. It will make new merchants grow their business popularly.

Best Credit Card Processing for Small Business

Merchant Industry is one of the topmost accepted credit card processing company in New York. Merchant industry is popular among the industries because of its easy setup on credit card processing for small business. If you’re a new merchant looking for credit card processors to grow your business popular then join with us immediately.

Why Small Business Needed Credit Card Processing

When you accept payment from the world’s major financial card brands giants such as Visa, Mastercard, and American Express, you can show the world that your business is legalized. When a payment processing method is set up for your business, you have brought your business into the economic mainstream. This increases trust with potential and regular customers and gives them confidence that your business is official.

For merchants who running a small business and looking to save on costs, the best option is Merchant Industry. The company has a great reputation and a large number of praise from customers – something we don’t often see with other merchant account providers. With all the positive advantages this company is regarded as the best and cheapest credit card processing company for small business.

Cheapest Credit card Processing Company

Credit Card Processing is essential for any scale of business. Nearly Eighty-Five percent of consumers use cards for everyday purchases and spend more than cash-paying shoppers. We determined the cheapest card payment processing solutions for small business in terms of below conditions.

Transaction Fees,

Contract Terms,

Ease of Use, And

Included Point-Of-Sale Features.

How Online Payment Processing for small business works

For small businesses, Merchant Industry using a solution that integrates both the payment gateway and merchant account in one system. Even though tons of providers are there for online credit card payments, but the merchant industry is unique among them.

Best Processing Device for Small Business

We know, how it is hard to choose the best credit card machine for small business. So, to minimize your confusion we provide machines with all features and portable credit card processing machines on the market. Merchant Industry offers you fast, secure and reliable processing device for your business. We offer simplified and affordable pricing plans with our card machines to suit your business needs.

What Makes us Different

Merchant Industry is one of the best merchant services company in the U.S. It provides credit card processing for small business and believes that businesses of all sizes deserve to be successful. Outstanding Customer Service, Latest Technology, and transparency make us the best merchant processing services company across the country.

0 notes

Text

Crypto-Back: What It Is & Why It’s Popular - Merchant Industry

Many credit card issuers are now offering crypto-back as an incentive, and merchants that are partnered with Merchant Industry can benefit from this trend.

Is Crypto-Back Becoming the New Cash-Back?

Cryptocurrencies have been around since 2009, and the two largest cryptos are Bitcoin and Ethereum. Investing in these highly speculative financial instruments entails a lot of risks, but now even risk-averse individuals can participate in the crypto craze, and without ever investing a dollar.

So how is this done? With credit cards that offer crypto as a reward in place of traditional rewards like cash-back, points, and travel miles. But are crypto-back credit cards for everyone? Let’s discuss the pros and cons below.

Pros and Cons of Crypto-Back

Pro: Crypto-Back Is a Lot Like Cash-Back

If you’re a credit card holder who’s familiar with how the cash-back incentive works, then you pretty much know already how crypto-back works. When you make a purchase, instead of getting a certain percentage back in cash, you’ll get 1-3 percent back in the cryptocurrency of your choice.

Card issuers that offer this reward have partnered with leading crypto exchanges. Therefore, when a cardholder gets crypto back on a purchase, their preferred crypto will be sent to a digital wallet of their choosing. And since more and more places are accepting cryptocurrency as a form of payment, you can use your stored crypto to purchase anything from a service online to a cup of coffee.

Pro: Low-Risk Introduction to Crypto

With crypto-back, individuals who wouldn’t invest their own money in cryptocurrencies can instead use their credit card issuer’s money to dabble in crypto. Getting crypto-back as a reward is, in a way, gambling with house money. And if you can tolerate a rewards balance that sometimes fluctuates widely, you may be able to tolerate the fluctuations when investing your own money in some cryptocurrencies.

Con: Volatility

The most notable downside of crypto-back is that your total reward balance fluctuates 24 hours a day. A cash-back reward balance, on the other hand, is much more steady, as the US dollar’s value doesn’t fluctuate extremely like the value of Bitcoin or Ethereum.

For example, if you put a $500 purchase on a card that has a base cash-back rate of 2 percent, you’ll get $10 back—and it’ll stay $10 until you use it or until more cash-back is gained. But with crypto-back, you could get $10 worth of crypto-back and then have it only be worth $8 the next day. This is because crypto coins are highly volatile assets. Therefore, one could see their rewards balance cut in half in mere days if it’s in crypto.

How Merchants Can Take Advantage of the Crypto-Back Trend

Merchants that want to take advantage of the crypto credit card trend need to incorporate modern payment processing hardware. Merchant Industry, a leading merchant service, offers the best credit card machines and point-of-sale terminals on the market today. When you open a merchant account with Merchant Industry, all your card processing needs are taken care of, and you can seamlessly accept all kinds of credit and debit cards, even those that are tied to crypto.

About Merchant Industry

In 2007 Merchant Industry was founded by CEO Leo Vartanov on the principle that businesses should be able to purchase credit card machines and merchant accounts at an affordable price while also backed by great service. It was a normal goal at the time, but it helped to change the entire industry. Through Leo Vartanov’s leadership, Merchant Industry pioneered a call center structure to the credit card processing industry Now, 15 years later with well over 20,000+ merchants processing over $5.5 billion per year, Merchant Industry sets the standard for price, customer service, ethics, and integrity.

1 note

·

View note

Text

Visa Moving Payments to the Cloud & What it Means for Merchants

Visa is testing to see if their payment software hub can be moved to the cloud, and such a move would impact merchants who use card processing machines.

Visa Moving Payments to the Cloud & What It Means for Merchants

These days, it’s so easy for consumers to purchase products and services from their favorite merchants. Gone are the days where merchants were hamstrung by lengthy checkout lines that went out the door. Now, merchants can equip their sales associates with mobile/wireless payment terminals, which means transactions can take place all over the store, leading to more sales, revenue, and profit.

Visa wants to take things a step further and revolutionize the digital payments industry by moving their payment software hub to the cloud. If Visa succeeds, processing software would no longer be embedded in individual devices, as it’d be universally accessible via the cloud.

But how feasible is such a move, and how would it impact merchants who rely on card processing hardware already?

Why Visa Wants to Move its Payment Hub to the Cloud

In an exclusive interview with MarketWatch, Visa’s Global Head of Payment and Platform Product explained that Visa intends to move what it calls the “brains” of its payment processing software to the cloud. While payment processing hardware has come a long way over the years, there are some drawbacks that a move to the cloud would rectify. For example, most payment processing hardware requires special components for the software to be utilized, and in many instances the software has to be installed manually, which is complex and often a difficult process that requires a technician.

Moreover, a lot of businesses don’t utilize advanced payment processing technology, specifically because implementing it is too expensive. But a move to the cloud would mean cheaper hardware, automatic updates, and much more. Visa would build off its already successful tap-to-pay tech so transactions stay seamless.

What Moving the Payment Hub Could Mean for Merchants

Visa has deliberately pitched such a move as a boost for merchants, but there are some elements of moving the payment software hub to the cloud that most merchants are expected to dislike. The most glaring one is that cloud security is still not impenetrable, so consumers might worry that paying using cloud-based tech will mean their data is unprotected.

Moreover, a big reason why current payment processing hardware is so expensive is because it’s equipped with the components and software that make payments seamless and more secure. It could be that in order to utilize cloud-based software, devices would have to be stripped of beneficial components and software and doing so could render these devices less secure and less efficient.

What Should Merchants Do Now to Prepare for Such a Move?

Even though there’s talk now about how Visa is working to revolutionize the way merchants take payments, Visa has been experimenting with cloud-based technology since the early 2000s. While they’ve come a long way, there’s still no indication that they’re ready to implement anything on a wide scale.

Therefore, if you’re in the market for credit card processing hardware, you should go through with your plan to purchase some. You can get top-of-the-line credit card machines at Merchant Industry, and these machines can process NFC payments and provide a host of other benefits. Businesses small, medium, and large purchase payment processing hardware through Merchant Industry. There’s always plenty in stock and there are devices for all kinds of industries and enterprises.

About Merchant Industry

In 2007 Merchant Industry was founded by CEO Leo Vartanov on the principle that businesses should be able to purchase credit card machines and merchant accounts at an affordable price while also backed by great service. It was a normal goal at the time, but it helped to change the entire industry. Through Leo Vartanov’s leadership, Merchant Industry pioneered a call center structure to the credit card processing industry Now, 15 years later with well over 20,000+ merchants processing over $5.5 billion per year, Merchant Industry sets the standard for price, customer service, ethics, and integrity.

0 notes

Photo

Best Credit Card Processing Company in NY

Merchant Industry is the Best Credit Card Processing Company NY. It includes innovative technology and expert support with transaction speed and reliability

#best credit card processing company#best credit card processing company in ny#best credit card processing company in new york#credit card processing company

0 notes

Text

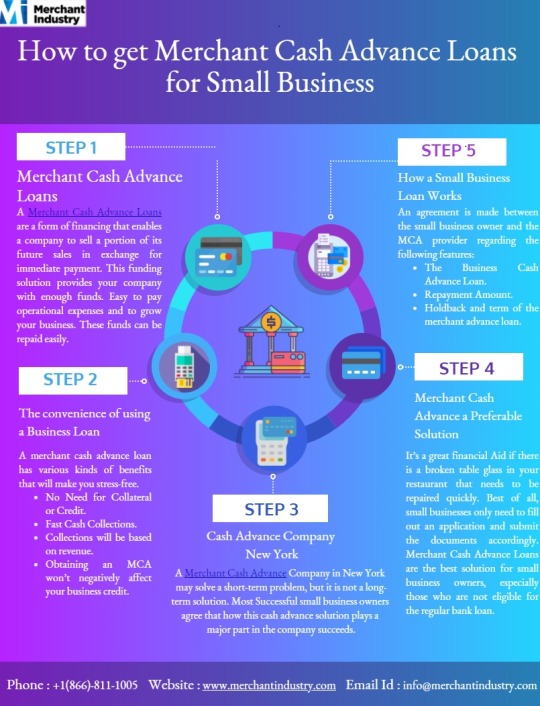

Merchant Cash Advance Loans in New York

Merchant cash advance loans based on credit card sales deposited in a business merchant account. It is a quick way to gain access to funding their business

Merchant Industry offers merchant cash advance (MCA) solution in New York. It is not really a loan, but other than a cash advance based upon the credit card sales deposited in a business merchant account. With an MCA, We advances you cash in exchange for a percentage of your daily credit card and debit card sales, plus a fee. While an MCA is surely one of the faster financing options. This method of financing is one of the most innovative solutions in alternative business finance. In other words if your cash flow situation is positive, a merchant cash advance could be a great way to simple, secure, fast and easy business finance, and get your business on the right track.

Need Cash?

We are prepared to give you up to $150,000 in as little as seven days.

Our Company offers a risk-free alternative method of merchant funding. If you have been looking for a new way to finance business improvements such as…

How It Works?

We provides MCA funds to small business owners. Merchant Cash Advance Loans are just treated as trading transactions. Therefore, our company prepared to offer you an ample portion of that growth in the form of a cash advance solution. Will regain the advance by taking back a small, mutually agreed-upon percentage of your income. This is a great solution for small scale businesses.

How to Become Eligible for MCA?

If you are a restaurant, retail or service business.

Need to process at least $4000/month in credit card sales.

Should have been in business for more than one year and have at least one year left on your lease. Some Internet merchants may qualify – please inquire with our Funding Specialists.

Must not have open judgments or bankruptcies.

The merchant funding process works through your credit-card terminal; therefore, in order to finalize the funding process, you will need the Merchant Industry to provide you with your credit card processing capabilities. The transition to Merchant Industry will be seamless and will not stop your daily business in any way. The Company strongly believes that your business will grow. Merchant Industry considered to be the best among all the Merchant Cash Advance companies across the U.S, as it offers this MCA solution to take our customers business to the next level in the business competitive market.

#merchant cash advance#merchant cash advance in ny#merchant cash advance loans#merchant cash advance loans in ny#merchant cash advance loans in new york

0 notes

Photo

Merchant Cash Advance Loans in New York

Merchant Industry offers merchant cash advance (MCA) solution in New York. It is not really a loan, but other than a cash advance based upon the credit card sales deposited in a business merchant account. With an MCA, We advances you cash in exchange for a percentage of your daily credit card and debit card sales, plus a fee. While an MCA is surely one of the faster financing options. This method of financing is one of the most innovative solutions in alternative business finance. In other words if your cash flow situation is positive, a merchant cash advance could be a great way to simple, secure, fast and easy business finance, and get your business on the right track.

#merchant cash advance#merchant cash advance loans in new york#merchant cash advance in ny#merchant cash advance loans in ny#merchant cash advance in new york

0 notes

Photo

Simple Payment Processing Is Making Credit & Debit Cards More Attractive

Consumers want credit and debit card payments to be quick, safe, and convenient. With Merchant Industry’s Simple Payment Processing tech, they get all that and more!

0 notes

Text

Simple Payment Processing Is Making Credit & Debit Cards More Attractive

Consumers want credit and debit card payments to be quick, safe, and convenient. With Merchant Industry’s Simple Payment Processing tech, they get all that and more!

Simple Payment Processing Is Making Credit & Debit Cards More Attractive

When Covid-19 first hit the US in 2020, there was a lot of concern about how consumers were going to pay for things amidst a pandemic. Cash was immediately viewed as undesirable, as it changes hands so many times spreading germs in the process. Cards were viewed more favorably, but using them in the traditional way—i.e. having to swipe and touch a keypad—was not a great option either.

However, businesses that incorporated modern payment processing hardware—like systems that can process NFC payments—thrived during the pandemic. That’s because customers knew they could do contactless payment at these businesses and avoid putting their health at risk.’

What Are the Benefits of Using Modern Payment Processing Hardware?

Increased Sales and Revenues

With NFC payments, customers can check out faster, which means more customers can be served in an hour as compared to traditional card payment methods. Faster checkout also means that lines won’t be long. If customers can pay fast and avoid standing around waiting to pay, they’re more likely to be satisfied and shop with the merchant again.

If an outdated grocery store payment processing system can check out 30 customers in an hour, and an NFC payment system can check out 50 in an hour, it’s clear that incorporating NFC payments can increase sales and revenue. If a business also utilizes multiple mobile point-of-sale (POS) systems that are NFC-enabled, even more sales and revenue can be generated.

Easy Integration

Integrating NFC payments is simple. Especially if a business uses modern credit card processing hardware, as most of these devices are already programmed with NFC capabilities. If a business partners with a reliable and helpful payment processing company, installation can be handled entirely by an experienced technician. Merchant Industry, the leading merchant service and card processor, sets up both contactless card and mobile wallet payments for their clients, and they’ll have things ready to go on installation day.

Newer Model Terminals Are Compact and Easy to Use

Gone are the days when businesses needed bulky POS systems to process payments. Now there are so many compact and easy-to-use terminals out there, and sales associates can even carry specific terminals around with them so customers can pay in the aisles or at the table while dining in a restaurant. With more places to pay, more customers can be served. And best of all: paying at a small terminal is quick, convenient, safe, and easy.

What Card Holders Want When They Pay

Card holders love using their cards, but some become so fond of them that they want to completely avoid scratching or dirtying their cards. These card holders love NFC-enabled POS systems, as these systems can process a card without ever altering its appearance. As well, if a customer has their card on their phone, the card never has to leave their wallet.

If a card holder is guaranteed a smooth, safe, and effortless transaction, using cash looks obsolete in comparison. Using contactless payment with a card takes mere seconds, whereas a customer can spend over a minute waiting for a cashier to get change when paying with cash.

Merchant Industry’s Payment Processing Tech Is Taking Merchants Everywhere to the Next Level!

If you’re looking to incorporate the best credit card machines on the market into your business, get in touch with Merchant Industry. They can bring NFC payments to your business, set up a duo mid merchant account and the associated hardware, and make payment processing easier and more affordable in a variety of other ways.

0 notes

Text

Best Credit Card Processing Company NY | Merchant Industry

Merchant Industry is the Best Credit Card Processing Company NY. It includes innovative technology and expert support with transaction speed and reliability.

The Premier Credit Card Processing Company

Merchant Industry is the leading Credit Card Processing Company in New York. We are an all-in-one payment processing provider, with a complete lineup of easy, efficient and secure processing solutions. With Merchant Industry, you can access a wide selection of payment products including B2B Processing, Virtual Terminals, Software Integration, Mobile Credit Card Processing, eCommerce Solutions, seamless point of sale compatibility, surcharging, and much more! Also, We provide customized payment solutions for thousands of companies all across the country.

For over a decade, Merchant Industry has provided thousands of businesses with technology-driven payment processing services coupled with added-value services. Apart from this, We also design a unique client-centered business model that ensures competitive pricing and best in class services.

Our Mission

The core values of our company inspire us to strive for excellence in everything that we do. Our credit card processing company stands apart from other companies by delivering unparalleled payment processing services to enable business like yours to succeed. As a Merchant Industry valued client, you will receive a robust suite of payment processing solutions designed to deliver unsurpassed value. Your success is our success!

Partner With Merchant Industry

Did you know joining with Merchant Industry to give a high-quality payment processing solution could help to develop your customer base?

WHY PARTNER WITH MERCHANT INDUSTRY:

Income Growth

Award Winning Support

Exclusive CRM

Services Offered By Us

Merchant Industry ISO Access

We adopt an alternate strategy to work with industry partners. If you have merchants that require the best credit card processing solution. We would like to work with your company…Contact us to schedule a demo today.

Swipe4Free Processing

SWIPE4FREE is one of the best credit card processing company in New York. It provides our customers with a proven solution that allows businesses to increase profits by reducing overhead…

Merchant Cash Advance

Merchant Industry offers a risk-free alternative method of merchant funding. If you have been looking for a new way to finance business improvements, contact one of our MCA funding specialists today.

0 notes

Video

Best Credit Card Processing Company NY | Merchant Industry

Merchant Industry is the Best Credit Card Processing Company NY. It includes innovative technology and expert support with transaction speed and reliability

#best credit card processing company in new york#best credit card processing company#best credit card processing company ny

0 notes

Photo

Best Credit Card Processing Company NY | Merchant Industry

Merchant Industry is the Best Credit Card Processing Company NY. It includes innovative technology and expert support with transaction speed and reliability

#best credit card processing company in new york#best credit card processing company#best credit card processing company in ny

0 notes

Text

What Is a Duo MID Merchant Account? How Can Merchants Benefit

Duo MID merchants are merchants that can offer both cash discounting and traditional card processing through a single device. To know more, read on

Duo MID Merchant Account: Everything You Need to Know

These days, the majority of consumers prefer paying with cards, either debit or credit, in large part because they are simpler and more secure than cash. But in order for a business to be able to accept cards, what’s known as a merchant account needs to be established.

A merchant account is where a business safely stores its non-cash payments. To create such an account, a business needs to form a relationship with a merchant services provider like Merchant Industry.

A specific example of a kind of merchant account is the duo MID merchant account. This type of merchant account is unique because it can be used for both cash discounting and traditional card processing. Duo MID merchant accounts are utilized for a variety of reasons these days and these benefits are discussed below.

Why Duo MID Merchant Accounts Are Beneficial

The main benefit of a duo MID merchant account is that it allows a merchant to offer both cash discounting and traditional credit card processing through a single device under a single identification number. Cash discounting is a program that incentivizes customers to pay with cash, and it’s ideal for merchants who don’t want their profits reduced by burdensome transaction fees.

But there are still customers who prefer paying with cards, regardless of what additional fees are associated with this convenience. This means that merchants need traditional card processing software to serve these customers.

To ensure both groups of customers are satisfied, a merchant can utilize a duo MID merchant account, and usually at no additional cost. The merchant will still be able to avoid hefty card transaction fees, as the merchant services provider will only charge a flat rate for all card processing.

Who Can Implement Duo MID Technology?

A duo MID merchant account is ideal for businesses that want to take advantage of cash discounting without alienating customers who are used to paying with a card. With duo-MID-enabled payment processing technology, a merchant can seamlessly offer cash discounting as well as traditional processing at the checkout counter. The key for the merchant is getting a merchant service provider that delivers best-in-class processing technology along with a processing service that never fails.

Merchant Industry & Duo MID Technology

Merchant industry is the leading merchant services provider offering duo MID merchant accounts. These accounts are backed by some of the best card-processing technology on the market right now. Merchant Industry duo MID merchant accounts are utilized by grocery stores, retail stores, quick service restaurants, e-commerce sites, and many more businesses both small and large.

With a Merchant Industry duo MID merchant account, a merchant can take advantage of all the benefits of cash discounting while still delivering seamless, traditional credit card processing.

Best of all, there’s no additional cost for this convenience. The merchant can still expect to pay a flat rate for all their credit card processing. Moreover, with Merchant Industry a merchant can accept nearly any currency and preferred payment method, all while avoiding the traditional transaction fees that do nothing but eat into hard-earned profits.

About Merchant Industry

In 2007 Merchant Industry was founded by CEO Leo Vartanov on the principle that businesses should be able to purchase credit card machines and merchant accounts at an affordable price while also backed by great service. It was a normal goal at the time, but it helped to change the entire industry. Through Leo Vartanov’s leadership, Merchant Industry pioneered a call center structure to the credit card processing industry Now, 15 years later with well over 20,000+ merchants processing over $5.5 billion per year, Merchant Industry sets the standard for price, customer service, ethics, and integrity.

#mid merchant account in new york#mid merchant account in us#Cash discounting#Duo mid merchants#duo mids#mid merchant account

0 notes

Link

Credit card merchant services offers to accept non-cash modes of payment processing in new york. That allows a business to accept credit card transactions.

#credit card merchant service#Credit Card Merchant Services Company NY#Credit Card Merchant Services Company#Credit Card Merchant Services in newyork

0 notes

Photo

A merchant cash advance loan is an effective funding solution. It will help you to get the best credit card payment processing to grow your business.

#small business loans#merchant loans#Merchant Cash Advance Loans#Merchant Cash Advance in ny#merchant cash advance companies#Merchant Cash Advance#business cash advance

0 notes

Photo

It is important to know how to choose the best e-commerce merchant account provider for your online business. we provide you clear details about that.

#online merchant account providers#merchant account providers in new york#merchant account providers for small business#merchant account providers#e-commerce merchant account providers

0 notes

Photo

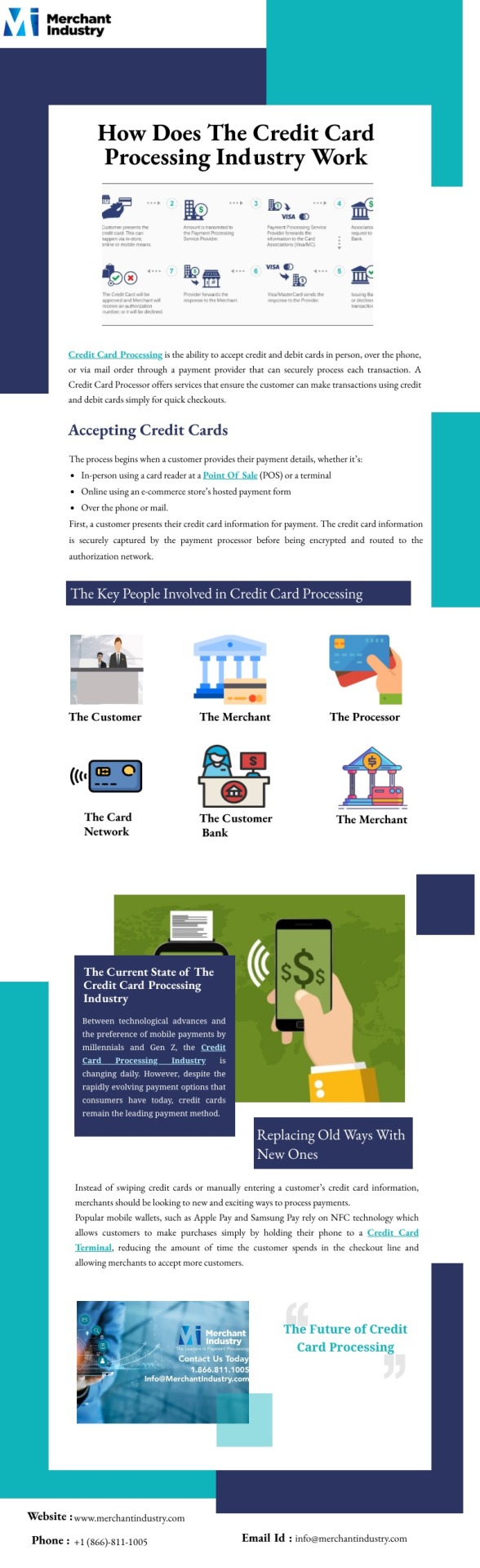

How does the credit card processing industry work in new york and also ensure the customer can make transactions using credit and debit cards.

#mobile credit card processing in new york#how credit card processing works#credit card processing services in NY#credit card processing industry in New York#best credit card processing company in New York

0 notes