Mitch Zacks is Principal and Senior Portfolio Manager at Zacks Investment Management

Don't wanna be here? Send us removal request.

Text

Is China Set to Rule the “Internet of Cars?”

Your first question might be: “what the heck is the “Internet of Cars?!” It’s a fair one. The Internet of Vehicles (IoV) just might be the next milestone in the tech zeitgeist, with designs to integrate vehicle-to-vehicle, vehicle-to-roads, vehicle-to-human and vehicle-to-sensor mobile interactions. The internet-based technology is expected to equip vehicle users with better and easier-to-use navigation, road safety and location sharing tools along with other functionalities of their smartphones including entertainment apps, web browsing and (hands free) calls. Sounds like something that should be coming from Silicon Valley, but in actuality it is China that could be emerging as one of the biggest forces at its forefront.

Currently ranking as the largest market for automobiles—with 24.6 million units sold in 2015—along with having the highest number of internet users in the world, China is ripe for securing a hefty slice of the IoV revolution. And it’s already well underway.

Already, several Chinese internet/technology companies have embarked on clinching deals with the biggest automobile firms in the world. Chinese internet behemoth Baidu has managed to get automakers including Hyundai, BMW, Mercedes, Ford, Audi and Volkswagen to install its ‘CarLife’ in their units sold in China. The search engine company also teamed up with an insurer for a usage-based auto insurance project.

In 2014, Alibaba purchased Chinese interactive mapping and navigation firm Autonavi for $1.5 billion, and is looking forward to joining hands with Chinese automaker SAIC. Also, Audi has revealed plans of incorporating Chinese internet company Tencent’s WeChat app into its vehicles to allow location sharing. French automobile maker PSA Peugeot-Citroen will reportedly collaborate with Alibaba for wi-fi features in their cars sold in China, and is also planning to install apps to detect gas usage and vehicle location.

The “connected vehicle” market also spells ample opportunity for mobile service providers. Connectivity features in cars could require more data usage and faster internet speed—meaning more revenue-earning avenues would be available for internet/cellular service providers. To cash-in on this promising market, China Mobile and Deutsche Telecom partnered in October 2014 to provide 4G-based vehicle information services to connected drivers.

China to Take-On U.S. Tech Giants

According to estimates by Statista, the number of connected cars in China would touch more than 44 million by 2020, and would therefore surpass the estimated U.S. levels of around 31.8 million. Revenues in the connected car market are expected to grow at CAGR +44.9% in China over 2016-2020, which is significantly faster than the +27.6% predicted for the U.S. market.

Fuelled by a growing tech-savvy domestic population (around 60% of Chinese customers are willing to change car brands for better connectivity features as revealed by a McKinsey survey) coupled with regulatory curbs on foreign technology (such as those on Google Maps and Apple’s iBooks and iTunes movies), Chinese tech firms can potentially give a tough competition to their foreign counterparts in its domestic market. The ‘Made in China 2025’ government initiative unveiled last year stated goals to boost domestic technology and innovation in China, which included 80 percent of domestic automobile entertainment systems and 100 percent of the nation’s satellite navigation system market, to be owned by Chinese companies by 2030.

Furthermore, with the possible expansion of China-made car exports in emerging regions like Africa and Asia, in addition to an expected development of its own operating system (akin to Ios/Android), China’s footprints in the internet-connected ecosystem could transcend borders in coming years. That could add to the competition among global powers in the tech space.

Bottom Line for Investors

Armed with government support to stem entry of foreign players, China’s domestic technology sector is brimming with potential for the automobile space, exacerbated even more so by a large and growing tech-savvy consumer base. But that’s not to say that the U.S. technology industry is doomed under Chinese competition.

For one, China’s prosperity in the tech-auto sector would likely be more concentrated in its domestic market, potentially leaving the long-standing U.S. technologies to cater to a larger and rapidly growing global market, just as the U.S. successfully did after websites like Google were blocked by China.

Globally, more than 97% of the smartphone market comprises iOS and Android operating systems—something that could likely be translated into consumers’ choice of connectivity systems on their car dashboards. Moreover, in China millions of customers who are long accustomed to using Apple or Android products on their smartphones may not be willing to change so easily.

Something to keep an eye on will be how quickly U.S. tech companies bring innovative and remarkable products to market, and who creates the superior applications. So far, the U.S. has proven time and again to have the best and deepest ability to shape the landscape, and China’s isolationist approach may just be the thing to keep it that way.

FREE Download – Zacks Economic Outlook

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

1 note

·

View note

Text

Bull Markets Don’t Die of Old Age

Pensacola, FL asks…Mitch, the bull market is in its 7th year – is the next bear around the corner? When is it coming and how can I prepare?

Thanks for the question. Know that bull markets don’t have to die of old age. Who’s to say this won’t be the longest bull market in history? It’s possible. Investors should not make defensive portfolio adjustments simply because it ‘feels like’ the bull market is ‘due.’ This is now the 2nd longest bull market in U.S. history (behind the 1987-2000 bull) and fundamentals suggest this current bull won’t end this year.

The decision to lower equity exposure should hinge more on your age, tolerance for risk, and cash flow needs versus a forecast for timing the next bear market. In other words, investors are generally best served by allocating investments in their portfolios based on factors they know— investment objectives and time horizon. Keep it simple.

The other thing we know is that, over time, stocks have trended higher than other asset classes and have delivered consistently positive returns over the long run. You can’t find any 20-year period in history where stocks delivered a negative return. Why try to get cute with the market and risk not generating that positive long-term return? Think of it this way: trying to time the market actually decreases the likelihood you will generate a long-term positive return. In my view, it’s not a risk worth taking.

Tooting our own horn here for a minute…the Zacks Investment Management approach is to build portfolios based on quantitative research and diversify and allocate investments according to one’s risk tolerance and timing for needing those investments in the future. We’re extremely proud of our performance track record, especially given our focus on managing downside risk for our clients. Pensacola, I hope you’ll take a closer look at how we go about ‘taming’ the bears and driving performance—it’s about putting the ‘math’ and subsequent insights to work every day so clients can rest easy every night.

FREE Download – Zacks Stock Market Outlook Report: August, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

2 notes

·

View notes

Text

U.S. Auto Loan Debt - Reason to Worry?

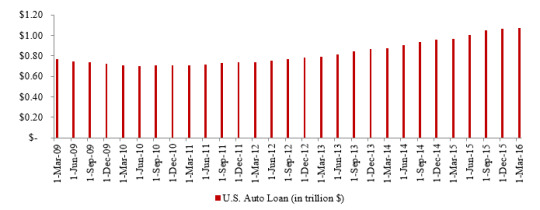

Following the subprime loan crisis that induced the Great Recession, the media has noted at least two other debt crises more recently including those revolving around student debt and, now, car loans. According to Federal Reserve Bank of New York data, U.S. auto loans, in aggregate, have surpassed $1 trillion, up more than 40% from its pre-crisis peak.

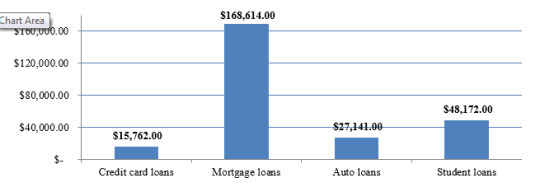

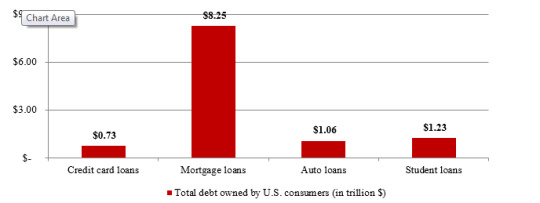

Average Household Debt by Category (U.S.)

Total Debt by Category (U.S.)

Source: NerdWallet

Rising U.S. Auto Loan Debt since March 2009

Source: Federal Reserve Bank of New York

So What Triggered a Rise in U.S. Auto Loans?

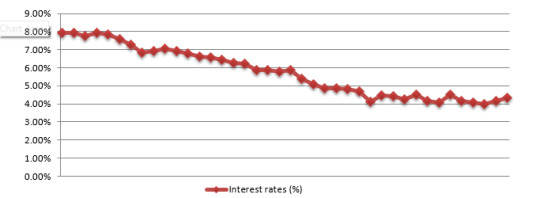

The rise in U.S. auto loans cannot be attributed to one single occurrence, but rather a combination of factors. First, record sales of 17.5 vehicles in 2015 from U.S. automakers, driven by pent up demand for vehicles, spurred auto loan growth. The trend has continued in 2016 as sales of 8.65 million vehicles have been recorded through June 2016, up 1.5% from last year’s record of 8.5 million. Second, lower gasoline prices have added fuel to the sales fire. Third, low interest rates have sparked an increase in auto loans as borrowers with top credit scores can obtain loans with less than 3% interest.

Decreasing Commercial Bank Interest Rates on 48-Month New Car Loan

Source: Federal Reserve Bank of St. Louis

Fourth, cutthroat competition among the banks has led to relaxed underwriting standards for borrowers. Case in point: About 86% of new cars were financed in 2015, up from 80% in 2008 (according to Frontier Group).

Fifth, helpful, but expensive, safety features (like collision-avoidance systems) further stretched the auto loan book given higher prices of new vehicles. In 2015, the average price of a new car, or light truck, reached a record high of $31,831.

Areas of concern

Loans to borrowers with the poorest creditability (i.e. credit scores below 620) has risen by more than 150% from the market bottom attained six years ago, compared to a 98% rise in overall auto lending during the same time.

With the outstanding auto loans hitting more than a trillion dollars, with an average balance of $12,000 per person (or nearly 8 percent of disposable income), it is just behind the dreaded student loan epidemic which stands at $1.3 trillion.

Lax borrowing standards, which fueled the recent boom in auto sales, resulted into a steady rise in the delinquency rate on the subprime auto loans. These security backed subprime car loans reached its highest level since 2009. More than 5% of the subprime auto loans were delinquent by 60 days or more, the highest level since September 2009 (4.97%). Regions like North Dakota (42%), Oklahoma (15.3%), Louisiana (14%) and Texas (14.9%), which are heavily oil dependent economy, experienced an unprecedented rise in the quantum of seriously delinquent (60 days or more) auto loans in the last quarter of 2015. Crash in the oil prices and a flurry of pink slips in the oil industry resulted in this outcome.

Bottom Line for Investors

The recent surge in subprime auto loans has brought back fears reminiscent of the mortgage backed securities crisis of 2008. Still, these subprime auto loans are different in some key ways:

The total auto loans are much smaller relative to the subprime mortgage loans; and recent success of the American Banks in the Fed’s stress tests indicates banks are strong enough to manage potential losses.

As vehicles depreciate, auto loans can’t easily be packaged and sold as an investment product, ideas unlike mortgages during the housing boom.

As average monthly auto loan payments are much smaller, compared to monthly mortgage payments, they are more manageable.

Most economists are of the opinion that, even if the auto-loan market isn't facing a repeat of the 2008 crisis, the development shouldn’t be ignored as deteriorating auto credit dynamics could have a ripple effect and drag on the U.S. economy.

FREE Download – Zacks Economic Outlook: July, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

3 notes

·

View notes

Text

UK Real Estate Funds Suspend Redemptions

Following the Brexit vote, seven asset managers, so far, have suspended redemptions on their UK real estate funds. Accounting for around £18 billion—more than half of the open-ended British property funds market—these funds apparently have limited cash/liquid options to meet the flood of withdrawal requests from investors.

Heightened uncertainty around U.K.’s business prospects, following the referendum, has jittery fund-holders rushing to offload exposures to U.K.’s commercial property. But, given the relatively illiquid nature of the funds’ underlying assets, such as office buildings/parks, warehouses and other commercial properties, asset managers are suspending redemptions to avoid a real estate fire sale.

Standard Life was the first to halt redemptions. Its 13% cash reserves proved insufficient to cushion the overwhelming withdrawal requests, compelling the fund to suspend trading on its £2.9 billion U.K. Real Estate fund on July 4—barely 11 days since the poll results came out. The next day, Aviva Investors froze its £1.8 billion Property Trust.

Citing mounting liquidity pressures, Henderson halted trading on its £3.9 billion U.K. Property PAIF fund along with feeder funds. Columbia Threadneedle and Canada Life temporarily suspended redemptions on £1.39 billion PAIF/feeder funds and four funds totaling £450 million respectively.

Additionally, many money managers ‘devalued’ their funds to discourage investors from selling at prices deemed too low. Aberdeen Fund Managers Ltd. slashed a property fund value by -17% and stopped redemptions. Henderson cut its fund price by -4%.

Many asset managers want to avert a 2007-like real estate bust, when funds contributed to a more than -40% decline in UK property prices from their peak. Temporarily freezing trade on real estate funds is probably viewed by their managers as the only way to stem a potential self-reinforcing cycle of redemptions and free-fall in British property prices. It doesn’t help that foreign investment in UK commercial real estate was already down -50% in the first quarter this year. Plus, demand for the nation’s residential properties plunged to a three-year low in May, mainly due to the anticipation over the forthcoming Brexit referendum at the time.

Also, talks of possible U.K. regulatory measures, such as requiring investors to provide a notice period of at least 30 days to six months to liquidate fund positions, and/or allowing sell-offs only at ultra-low prices, are doing the rounds.

Bottom Line for Investors

The Brexit referendum has sparked a drastic change in sentiment, from the post-financial crisis period of skyrocketing London property prices. The fund redemption requests are a sign of increasing apprehensions about the U.K.’s consistency as a business center after its vote to leave the EU—meaning, British commercial properties could experience some price decline in the future, even if temporary withholding of funds’ redemptions prevents it from ballooning into a catastrophic downward spiral. Nevertheless, if prices do manage to fall enough, long-term investors could spot some bargain hunting opportunities for high-end properties in London, especially with an already cheap pound.

On the other hand, the rush to unload British real estate exposure could also shift investor capital towards real estate in the U.S. in the coming months, especially as the latter’s economy is showing signs of resilience.

FREE Download – Zacks Stock Market Outlook Report: July/August, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

0 notes

Text

Is Online Lending Creating Another Bubble?

Peer-to-peer (P2P) lending, also known as online lending or marketplace lending, has seen skyrocketing popularity in various countries over the last decade. According to Bloomberg Markets estimates, global online loans have soared from about $5 billion in 2012 to more than $60 billion in 2015[s2] , and Morgan Stanley predicts the volume could jump to some $290 billion by 2020. This is huge growth, but could it be too much growth too fast?

Peer-to-peer lending companies bypass banks’ intermediary role, and their operational cost savings incentivize them to absorb greater risks. This translates into accepting a wider (and riskier) pool of borrowers who get access to credit lines at more favorable terms, as compared to traditional banking institutions. According to California-based Lending Club, a 2016 survey revealed that refinancing debt from high interest credit cards (through Lending Club’s personal loans) helped borrowers reduce interest cost by 32% on average. On the other side of the equation, lenders on these platforms are rewarded for assuming higher risks with yields greater than interest rates on bank deposits.

Online Lending Catches Big Players’ Attention

These high-yield investments have also caught Wall Street’s eye. Hedge funds, asset managers and even banks, including Citigroup Inc. and Jefferies Group LLC, are buying P2P loans and bundling them into bonds to sell to other investors. Such securitizations appeal to funds/banks looking for quick gains, while also serving as a diversified, potentially high-yielding asset pool for investors.

Furthermore, some financial behemoths are partnering with marketplace lenders while others are even introducing their own in-house online lending platforms. Wells Fargo will begin operating its ‘FastFlex’ program this year to provide online loans with maturities as short as one day mainly to small businesses. JPMorgan had announced in December its plans to extend loans to New York-based online lender On Deck’s 4 million small business customers.

Is this Burgeoning Online Lending Revolution About to Collapse?

High yield P2P loans and their securitizations should emerge as potentially lucrative investments for buyers and lenders—as long as the loans are repaid. It would be foolish to overlook the vulnerabilities inherent in these loans’ characteristics—short-term maturities requiring monthly/weekly interest payments from borrowers who have probably been denied credit lines by traditional banks. Recent data suggests some cracks are starting to form.

In February, Moody’s expressed a possible downgrade of three bonds backed by Prosper Marketplace P2P loans and sold by Citigroup, owing to unexpected delays in repayments and rising charge-offs. In another instance, a $126 million deal involving the securitization of CircleBack Lending Inc.’s loans by Jefferies Group LLC has unraveled driving cumulative losses edging past trigger value.

Additionally, Lending Club, the world’s biggest online lending platform, is under the ‘microscope’ for apparent improprieties related to sale of some of its loans, followed by the resignation of its CEO, Renaud Laplanche, in May 2016.

Given these events, it’s reasonable, if not wise, to start drawing parallels to the 2008 subprime crisis. Some of the same factors are at play: the securitization frenzy, risky loans, the shadow banking chain and quick riches. The irony here is that the enhanced regulatory framework on brick-and-mortar banks in the aftermath of the financial meltdown (designed to curb their excessive/indiscriminate risk taking) could actually play a major role in fueling the growth of the online lending market. Return-hungry and risk loving lenders are targeting subprime borrowers once again.

Although the losses, so far, in marketplace lending may not have reached the lows of a crisis, they have served as warnings for regulators to take a closer look into the industry’s books and practices. Earlier this month, the Treasury stated its plan to gain greater transparency, including a public database of loans made from marketplace lenders. It also expressed the need to subject firms lending to small businesses to Federal Consumer Protection Laws.

Bottom Line for Investors

The online lending market has prospered by offering lucrative returns to investors, but at what risk? Recent reports of losses and anomalies on these ‘new’ online lending platforms bring to the fore a rather default-prone image of the industry.

However, broadly speaking, the key for investors is almost always to think about the impact on a relative basis. Given the relatively small size of the online lending market, a crisis here is not likely to impact the broader economy and/or stock market. This is provided that the “too big to fail” institutions do not divert too large a share of their investments into the online lending marketplace in the future, which does not seem likely.

FREE Download – Zacks Economic Outlook: July, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

4 notes

·

View notes

Text

What to Look Out for as Fed Considers Rate Hike

Perhaps not surprisingly, the Federal Reserve left the fed funds rate unchanged in their June meeting, almost certainly on the back of a weak May jobs report (+11,000 m/m). It is yet another example of the Fed’s hypersensitivity to single data points or events, much like their choice to delay a hike in the beginning of the year because of global market volatility (which ended up short-lived).

The Fed’s newfound tendency to backpedal on rate hikes and seemingly “wimp out” on normalizing interest rates is nothing new. If you take a look at the Fed’s record of guidance on interest rates, you’ll find a healthy history of flip-flopping. In December 2015, policymakers expected the benchmark fed funds rate to be around 1.375% by the end of 2016, with a median forecast of 2.375% by the end of 2017. That “dot plot” was actually a reduced version of what they said in June 2015, when they gave guidance of a 1.625% rate by the end of 2016 and 2.875% by 2017. Neither of these outcomes seem even remotely likely now as we’re midway through 2016 and the fed funds rate is still sitting at 0.25%–0.50%.

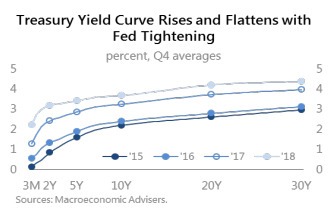

If it sounds like I’m telling you not to trust Fed guidance, then I’ve made my point. Interest rates are low enough (and should remain so) that investors need not get wound up in “Fed watching” and/or base an investment strategy around the FOMC minutes. To me, it’s a feckless exercise. What we should be looking out for is the relationship between short-term interest rates and long-term interest rates, known of course as the yield curve. More on that in a moment.

What ‘Lower for Longer’ Interest Rates Mean for Investors

The expectation of ‘lower for longer’ interest rates should have several favorable outcomes for the economy and the equities markets. At a glance, this is what I see:

The yield on risk assets, like stocks, is better than what an investor can currently get out of the 10 year U.S. Treasury (~1.6%). Yield chasers will increasingly favor stocks (particularly the dividend payers) and bid-up prices

Corporations will continue using cheap capital for M&A and share buybacks, and I would expect corporate debt levels to rise in the medium term (not a bad thing since debt is so cheap)

The housing market should continue to feel the tailwind of favorable mortgage terms.

The factor to watch right now is the yield curve. In the wake of pronounced volatility in the beginning of the year (driven by China fears) and the ‘Brexit,’ U.S. Treasuries have been bid as a safe haven in a “risk-off” environment, which has kept downward pressure on the long end of the curve. Even with the Fed’s inaction, the yield curve is flattening. It follows that, when the Fed raises interest rates eventually, the yield curve is likely to flatten even further. A flat or inverted yield curve creates a higher probability of recession.

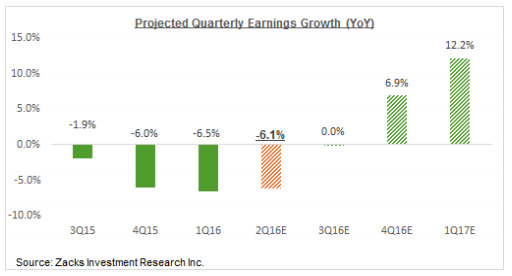

Bottom Line for Investors

Zacks continues to expect that an acceleration of corporate earnings in the back half of 2016, and a stable jobs market, should support two rate hikes this year. The 10-year note yield is also expected to gradually trend higher, as ‘Brexit’ hype recedes and demand pressures ease. Much will be made of the Fed raising rates the next time they decide to do so, but just remember that it’s really nothing more than the fed funds rate going from “extremely low” to “very low” (not much economic difference there). What investors will need to watch closely in the next 12 months is the yield curve, and whether it flattens more than expected due to continued pressure on the long end of the curve. This could mean bad news for the economy and it would probably go unnoticed by most— so keep your eye on it.

FREE Download – Zacks Stock Market Outlook report: July/August, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

1 note

·

View note

Text

How Smartphone Apps Are Revolutionizing Savings

“A penny saved is a penny earned.” - Benjamin Franklin

Americans, in particular, have long been challenged when it comes to saving money. And, psychologists and economists are still striving to pinpoint concrete root causes for why this is the case. Some blame the housing bubble, others the ill-framed 401(k) clause and then there are those who think it’s ‘frugal fatigue’—so long as there are different pundits there will be differing opinions.

But, fear not as help is here…and, we’re not talking about swear jars or piggy banks. For those who struggle to save money the ‘normal’ way, new applications like Digit, Dyme, Acorns and Qapital have arrived to assist.

The timing couldn’t be better. Just consider the numbers: 60% of the Americans who are in their twenties save 5% or less of what they earn monthly while the rest don’t even have a piggy bank to bank on (according to Money Under 30). According to a survey by Bankrate, 76% of the Americans live pay-check to pay-check while 50% of Americans have less than a 3-month cushion in their savings account and 27% have no savings at all.

Granted, it’s hard to save when most people have to deal with a number of loans along with bill payments. Millennials, in particular, face an uphill battle with a tough job market often coupled with crushing student loans. And, when you’re living pay-check to pay-check, spreadsheets aren’t always the first thing on your mind. Unless, of course, you let technology do the hard work for you.

Breaking news: smartphone apps can help you save money! Taking a cue from the old advice to ‘save small but daily,’ these apps attempt to eliminate the human factor to make savings more effortless. Although these apps have yet to gain wide adoption, those who are using them are reported to be seeing some success.

Case in point: Digit is one savings app which uses an ‘out of sight, out of mind’ approach. It uses an algorithm to analyse how much one might save in a month by reviewing your income and expenses. Since the app’s launch in February 2015, it has reportedly been successful helping users save more than $125 million. Then there’s’ Qapital, which helps users set up savings triggers to automatically put money toward a savings goals each time they buy from Starbucks or walk another mile. Qapital hopes this new feature gets more millennials saving toward their goals—and maybe paying more attention to how they’re spending money. While most of the apps give savings advice for free, some, like Acorns, go a step further and transfer funds into an investment account for a small fee.

Bottom Line for Investors

As the majority of Americans are challenged when it comes to saving, these free apps provide unique ways of overcoming these challenges. Additionally, these apps can work both for the not-so-good savers and the flagrantly extravagant and can provide inexpensive and low-risk ways to save. Best of all, you won’t have to go all Ebenezer Scrooge on your friends and loved ones—just a smartphone and the right app for you will work.

FREE Download – Zacks Stock Market Outlook report: July/August, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

0 notes

Text

Investing Opportunity in the “New China” Economy

At a quick glance, China’s economic growth is decelerating. However, this may just be a temporary “side-effect” of the nation’s re-making itself as a services-oriented economy from that of a manufacturing behemoth.

Looking back at U.S. history, this evolution in China’s economy is not unlike that of the U.S. which started as an agricultural based economy, morphed into a giant of industry and is now an envied service and consumption based economy. As these changes proved successful in the U.S., could this be China’s roadmap to prosperity as well?

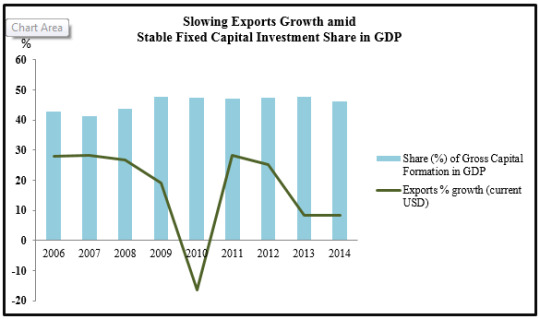

The Chinese manufacturing industry’s epic success—contributing to an average +10% GDP growth in the nation over the last couple of decades—was primarily the result of demand from advanced economies, fueled by China’s low-cost exports. But, that market can’t be expected to continue growing at the same pace forever, especially with overcapacity creeping up in various sectors.

Data source: World Bank

Data source: World Bank

With all the capacity generated by China’s investments in fixed assets, the nation would need a market for an additional output ranging between $5 trillion and $7 trillion (in constant 2009 prices) every year through 2020—as suggested by a 2010 study. That’s something which already saturated foreign demand alone is not likely to accomplish.

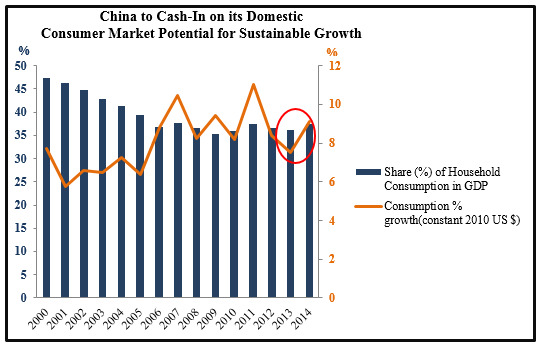

China to Turn ‘Inward’

Notwithstanding China’s citizen headcount exceeding 1 billion, its consumption expenditure share in GDP stood at only 35.9% in 2010 (versus America’s nearly 309 million population’s consumption contributing around 70% of its GDP). That, in addition to a sated foreign market, could have guided Chinese policymakers to turn ‘inward’—as evident from China’s 12th (2011-2015) and 13th (2016-2020) five-year plans—and focus more on capturing their own domestic market to set the wheels in motion for longer-lasting growth.

With a goal to strengthen household purchasing power and improve quality of life, Chinese authorities have planned to improve service industries including health, education, finance, technological innovation, logistics/transport and tourism. Additionally, focus will be put on equitable income and resource distribution as well as creating environmentally-friendly technologies.

It appears the restructuring is already gaining traction. In 2015, slowing industrial growth was accompanied by a strengthening services sector, with the latter growing at +8.3% (up from 2014’s +7.8%). Services sector share rose to 50.5% from the preceding year’s 48.1%, contributing to more than half of China’s GDP for the first time (while Manufacturing share slid more than two percentage points to 40.5%).

Additionally, in 2014, China’s domestic consumption growth accelerated to more than +9%, from the preceding year’s +7.5%. The share of consumer spending increased 1.2 percentage points to reach 37.4% the same year.

Data source: World Bank

Furthermore, the People’s Bank of China’s accommodative policies, such as a record-low lending rate of 4.35% since October and reserve-requirement reductions, have facilitated new loans of 1.38 trillion Yuan this June, beating estimates. Bank deposits and currency in circulation collectively soared +24.6% in June from a year ago, registering the biggest jump in six years.

China’s Restructuring Reminiscent of America’s Transition

China’s restructuring is reminiscent of America’s economic history, although the two are separated by somewhat different sets of driving forces.

The industrial revolution in the U.S., whose first phase spanned the period of 1790 through the 1830s, marked the economy’s transition from agricultural to industry. While China is teetering on overcapacity in manufacturing/heavy industry at present, America was experiencing an abundance of land, far outstripping labor availability, which probably galvanized the nation to switch to machines from manual work for higher productivity. The revolution set the stage for the “factory system” characterized by mass output production from centralized locations, akin to China’s manufacturing success story.

In the post-World War II period, industrial output growth in the U.S. was fast outpacing demand. On the other hand, the higher productivity had already translated into higher wage rates and profits, meaning American consumers had more purchasing power for services. So, to adjust to the situation, employment shifted from the industrial sector to services. Later on, in the late-1970s and ‘80s, Japan and, subsequently, China emerged as strong global competitors to American manufacturing, driving the U.S. further toward a services and consumption-oriented economy. China’s restructuring, however, has less to do with foreign competition than saturated foreign demand for its manufactured products; a largely untapped domestic market only adds to the impetus behind the changeover.

Bottom Line for Investors

China’s reshuffling of economic objectives constitutes a paradigm shift from its decades-old growth engine. And, therefore, it could face some temporary hiccups, such as slackening growth in the initial years of the restructuring process. Nevertheless, these steps are necessary to rein in the Chinese economy’s ‘over-dependence’ on external markets and to become more self-sufficient to mitigate vulnerabilities from external shocks.

Should the nation successfully achieve the restructuring objectives, China could emerge as the next economic superpower, capitalizing on its burgeoning urban populace.

Download – Zacks Economic Outlook: July, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

3 notes

·

View notes

Text

Getting to Know the New Prime Minister—Theresa May

Theresa May is a highly experienced politician who has already made history by becoming the second longest serving home secretary in the past 100 years, serving six years in one of Government’s toughest jobs. Now, May takes on the role of Prime Minister of Britain. As she takes the reigns, she brings with her a new hope of leadership at a dramatic and tumultuous time for the nation. May is a seasoned career politician and an anti-BREXIT campaigner who is admired for her liberal stances on a number of social issues and strong work ethic.

Who is Theresa May?

Born in the seaside town of Eastbourne (Sussex) on October 1st, 1956, to a vicar (Reverend Hubert Brasier) and his wife (Zaidee), May had a humble upbringing which influenced her political career and imbued her with a sense of public service. She attended a state primary (an independent convent school) and then a grammar school in the village of Wheatley, which later became the Wheatley Park Comprehensive School during her time there. She later attended Oxford University (St Hugh's College) for higher studies where she was introduced to the world of politics.

After graduating with a degree in Geography, she initially started working at the Bank of England and later rose to become head of the European Affairs Unit of the Association for Payment Clearing Services. It was during her 3rd year in college, in 1976, that she met her husband Philip, who was president of the Oxford Union, a well-known breeding ground for future political leaders.

Her Political Journey

It was during her college years that she conveyed to her close friends her ambition to pursue politics as her career. She began her political career by stuffing envelopes at her local Conservative Association before becoming a councillor in the London Borough of Merton from 1986 to 1994. Later, she moved to Westminster where she made her entry into parliament as the MP for Maidenhead in 1997, after previously failing to win seats in Durham and Barking.

After becoming MP, she was quickly appointed to William Hague’s shadow cabinet and became the first female chairman of the Conservative Party in 2002. Under Prime Minister David Cameron, she became the Home Secretary.

Key Dates

1986-94: Councillor, London Borough of Merton

1992: Parliamentary candidate, NW Durham

1994: Parliamentary candidate in the Barking by-election

1997 to present: MP of Maidenhead

1999-01: Shadow Education Secretary

2001-03: Shadow Transport

2002-03: Conservative Party Chairman

2003-04: Shadow Transport

2004-05: Shadow Culture Media & Sport

2005-09: Shadow Leader of the House of Commons

2009-10: Shadow Work & Pensions

2010-2016: Home Secretary

2016-present: British Prime Minister

Career Highlights

1. Holding a variety of key shadow cabinet posts from 1999–2010

2. The first female chairman of the Conservatives in 2002

3. Becoming the Minister for Women & Equalities and Home Secretary in 2010

4. Blocking British computer hacker Gary McKinnon’s extradition in 2012

5. Becoming the longest-serving Home Secretary (Britain) in the last century in 2015

6. Becoming the second female Prime Minister in 2016 (following Margaret Thatcher)

Political Thinking

1. Move forward with Brexit referendum toward a ‘win-win’ for both UK and EU

2. Unite UK by values of One Nation Toryism

3. Create a strong, new, positive vision for the future of the nation, a vision of a country that works not for the privileged few, but for every individual

4. Revamp boardroom ethics with workers guaranteed representation on company boards while shareholders vote on executive pay (which will be made binding every year)

5. Promote social mobility and reform

6. Create opportunity for the more disadvantaged in society

Final Thoughts

The Brexit referendum has thrown the UK into one of its worst political crises since 1940. As a result, Theresa May and the government face a daunting task in defining the nation’s new relationship with EU members while uniting the UK as a nation. While the early years of May's time in Downing Street may be dominated by the process of divorcing the UK from the EU, her tenure will surely shape the course of British and European history for the foreseeable future.

Download – Zacks Economic Outlook: July, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

0 notes

Text

What’s Brewing in the Java Market?

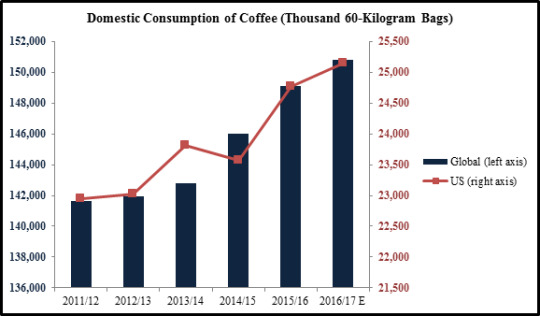

It will come as no shock to you that coffee is one of the most popular hot beverages among consumers. The result—coffee is expected to garner record high global consumption at 150.8 million bags (each weighing 60 kg) in the 12 months starting October 1, a +1.2% increase from the preceding period, as indicated by the U.S. Department of Agriculture (USDA) estimates. However, production levels may be finding it hard to keep up. The global deficit could widen to 2.2 million of 60-kg bags for the 2016-17 season, from 800,000, as suggested by Rabobank International.

Surging global demand is expected to shoot coffee prices up, with inventories predicted to hit a 4-year low in 2016-17 amid heavy rains in Colombia, dry spells in Vietnam and Indonesia, and coffee rust in Central American/Mexico plantations predicted to dampen production (according to USDA reports).

U.S., the biggest consumer of java after the whole of the European Union, is estimated to increase its consumption by +1.5% in 2016-17, to record highs. Also predicted to reach their peaks are demand from China and India at expected +5.3% and +3.7% growth rates respectively (USDA forecasts).

Data source: U.S. Department of Agriculture (June 2016 estimates)

A Brief History of Joe

With the current explosion of java chains serving gourmet/exotic preparations and cold brews, coffee drinking has come a long way. Although apocryphal, legend has it that the stimulant powers of coffee beans were first discovered in Ethiopia by a goat herder who noticed his goats becoming more energized after eating the coffee beans. It’s said to have spread to other parts of the world including Arabia by the 15th century, and to Persia, Egypt, Syria and Turkey by the 16th century. The beverage made its way into Europe by the 17th century. In Europe, coffee quickly began to replace the common breakfast drinks of the time (beer and wine) as those who drank it found themselves more alert and their work greatly improved.

Reaching America around mid-1600s, a major turning point for coffee’s proliferation in the U.S. mainstream was the Boston Tea Party (1773). Colonists decried an exorbitant tea tax, following which people’s growing preference for java even led to taverns increasingly being used as makeshift coffee houses.

Further, as U.S. soldiers took to drinking the stimulating beverage, thanks to military rations during the Civil War and WWI, their habit sustained even after, spurring a +450% influx of coffee houses during 1920-1930s.

One of the earliest shops offering specialty coffee was Peet’s Coffee & Tea founded in Berkeley, California in 1966. In fact, two regulars at the café were Gordon Bowker and Jerry Baldwin, who would later go on to found the coffee retailer which practically revolutionized the way America has its coffee—Starbucks Coffee.

Bowker and Baldwin, along with Zev Siegl, opened the first Starbucks in 1971 in Seattle, Washington. Initially it sold only coffee beans and coffee-making equipment. Starbucks expanded into a full-fledged coffee house chain brewing specialty java, mainly under the initiative of Howard Schultz (who was previously the Director of retail at Starbucks) who bought the company in 1987. Its novel delicacies of Frappuccino and Latte, with emphasis on personalized servings, rapidly got imbibed into the urban population’s daily fare. The chain now has over 23,000 stores across the globe.

Trendsetting coffee house chains with origins in other parts of the world include India’s Café Coffee Day and China’s Momi café.

Bottom Line for Investors

Coffee houses’ evolving roasting/brewing methods have had a big role in whetting people’s appetite for caffeine across the globe. The beverage’s energizing properties coupled with café’s exotic/innovative preparations have made the drink an indispensable staple in our daily lives. Also, the laid-back cozy ambiance of coffee shops has added to their popularity among the socializing youth.

The burgeoning demand for coffee is already being reflected in prices/price expectations: Arabica coffee futures traded in New York soared +20% in June, the biggest monthly increase since February 2014. Robusta, used in instant coffee, experienced around +4.2% rise last month in London. As coffee’s popularity continues to expand, this is a market to keep an eye on.

Download – Zacks Economic Outlook: July, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

0 notes

Text

Free Trade vs. Protectionism – Where I Stand

The aftermath of the “Brexit” vote is sure to create plenty of winners and losers, but perhaps most-watched will be those affected in the realm of trade. At this stage, there’s no sense in speculating how the trade relationship between Britain and the EU will ultimately look— there are far too many unknowns. But, what is worth a closer look is how the Brexit vote has seemingly stirred a movement—one that is bringing into question the benefits of globalization and trade.

Is Free Trade on the Chopping Block?

Something we learned from those leading the “Leave” campaign in Britain was how effective it was to appeal to isolationism. Boris Johnson and Nigel Farage focused their messages on how Britain could do it all on their own—no need for Brussels bureaucracy, no need for a trade deal they felt benefited the EU more than Britain, no need for labor coming from other countries.

Readers may have a strong opinion on the topic of ‘trade’ one way or the other, some even more so who have been directly affected by it with a job loss. The economic benefits of trade are very difficult to measure directly, but the costs are quite tangible (job losses, immigration) and it is easier to see trade hurting more than it helps. In this sense, the emotional argument often trumps the analytical one.

As a career asset manager, I’m hard-wired to put my weight behind the analytical when it comes to cost/benefit analysis, and for trade I’m convinced that freer is almost always better. There is a relatively new data set available that supports this case. The Organization for Economic Development (OECD) and the World Trade Organization (WTO) have created a joint initiative to better measure how countries, in their trade relationships, benefit from and contribute to total output.

The metric is known as the Trade in Value-Added (TiVA) and, in the WTO and OECD’s words, it’s “the value added by each country in the production of goods and services that are consumed worldwide.” A look at some of the findings reveal quite a few highlights:

The United States adds more value to China’s exports than China does to ours

Foreign countries add about 15% of value to our total exports, with the rest coming from domestic production

While most people see China as “making everything,” they actually source over 30% of the value of their production from other countries

Even Mexico relies on foreign value adds more than the U.S. does

The OECD-WTO joint initiative examines 61 countries and 34 unique industrial sectors, so one could study the findings all day and night. But, the consistent discovery you’ll make is that very few mass produced goods are made in just one country—the global supply chain is vast and interconnected. To make an iPhone, about a dozen countries are involved, and if that supply chain breaks down or a link goes missing (or is legislated away via tariffs) then the cost effectiveness of the iPhone goes out the window. Just ask any Brazilian (with whom the U.S. does not have a free trade agreement) how difficult it is to acquire an Apple computer at a reasonable price. Citizens in Brazil pay at least double what we do.

Raising tariffs or nixing free trade agreements can easily result in a backlash to protectionism, which could mean the ultimate costs of goods sold rises significantly. Roughly two-thirds of GDP in this country is comprised of consumer spending, and the last thing anyone really wants is the costs of goods skyrocketing. Trade is by no means perfect all of the time, but it’s also one of those things that ‘you don’t really know how much it hurts until it’s gone.’

Bottom Line for Investors

Again, I’m not arguing that freer trade is a perfect economic solution and that globalization is the end-all solution for creating the most wealth possible. But, I’d argue that they help more than they hurt. The reason sentiment against trade and globalization is easy to ignite is because the effects are felt by some acutely (those who lose jobs), and that is certainly a problem governments need to work to figure out. Ultimately, the benefits of globalization and trade are distributed throughout society via the lower cost of goods—an iPhone costs $600 instead of the $1,200 it costs in Brazil. If folks were able to see a menu of goods before tariffs and after tariffs, my guess is that free trade wouldn’t get such a bad rap.

FREE Download – Zacks Economic Outlook: July/August, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

3 notes

·

View notes

Text

Theresa May Assumes Key Role as Britain Prime Minister

Theresa May Assumes Key Role as Britain PM – Theresa May became the second woman to lead Britain since Margaret Thatcher (1979-1990), and the world is watching as she assumes the extraordinarily tricky task of guiding Britain through their separation from the European Union (EU). May is a career politician and actually campaigned against the Brexit, but she appears committed to seeing it through based on the referendum result. Germany’s leader, Angela Merkel, has already stated that Britain should not expect an easy path forward in their relationship with the EU, and May finds herself in a difficult position.

June Jobs Report Surprises to the Upside – after a dismal May jobs report that arguably sent the Fed back into the bomb shelter, U.S. job growth surged in June as manufacturing employment increased. June saw nonfarm payrolls increase by +287,000 m/m, the largest gain since last October, which followed the bleak +11,000 m/m added in May. Meanwhile, the unemployment rate held at 4.9%. One would normally assume that a stronger jobs report might encourage the Fed to revisit their projected course for raising rates, but at this stage Fed forecasting feels like a feckless exercise. Even though the Fed’s dual mandate is employment and inflation, they also seem greatly influenced by global events, like the Brexit.

Maintaining Close Ties with Wall Street – Chancellor of the Exchequer, George Osborne, met with some of Wall Street's biggest investors in New York this week to try and encourage them to keep close ties with the U.K. despite the Brexit. It seems extremely unlikely that Wall Street will want to alter its relationship with London following the Brexit, as neither party has any incentive to close-off ties in any way. In fact, once the Brexit has fully taken its course, there could be even more advantageous aspects to the relationship between New York and London, since London will no longer have to abide by regulations set forth in Brussels. Osborne will also visit Singapore and China later this month for the same end.

Bank of England Holds Key Rate at 0.5% - the market has seemingly been wrong in forecasting Britain policy moves lately—first the Brexit, and then this week in setting the expectation that the Bank of England would cut the benchmark rate by 25 basis points and perhaps also boost other stimulus measures, like bond buying programs. Neither outcome happened, perhaps as the central bank elected to hold off on using its stimulus measures until it is deemed essential. With the FTSE trading higher since the Brexit vote, the read is that the markets are perfectly content with the referendum outcome—so why should the central bank act? A 25 basis point cut would be the Bank of England’s first cut in seven years, and would represent an unprecedented low in the central bank's 322-year history.

FREE Download – Zacks Economic Outlook: July, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

1 note

·

View note

Text

Foreign Direct Investment Hits Record Highs

Amidst all the gloom surrounding global economic woes this year, many people overlooked some silver linings—one of them being 2015’s record high global foreign direct investment (FDI) flows.

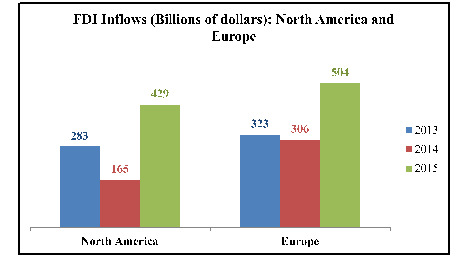

Swelling +38%, global FDI flows (i.e., aggregate investments made by companies/entities directly into overseas businesses versus buying shares on public stock exchanges) peaked to $1.76 trillion in 2015—the highest level since the global financial crisis of 2007-08. And, a quarter of the flows went to North America, outshining the region’s 2000 FDI levels.

The region also registered the sharpest rise at +160% last year from 2014 inflows, driven mainly by more than +250% jump in FDI to the U.S.

Notwithstanding debt woes, the European Union registered a +50% surge and Switzerland received a +886% rise to $69 billion.

Reversing a nearly five-year-old trend, developed economies collectively received the greater share (55%) of global FDI flows in 2015 versus the preceding year’s 41%. The spurt of FDI into advanced economies was largely due to cross-border mergers and acquisitions, particularly in the U.S.

Data Source: UNCTAD

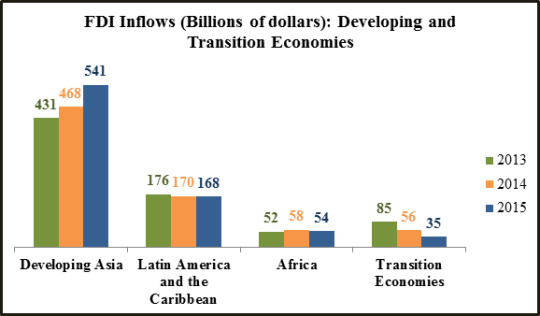

On the other hand, developing economies (excluding Caribbean financial centers) experienced a +9% increase, but flows to transition economies plunged -38% from 2014 levels.

FDI flows to Developing Asia rose around +16%. On the other hand, commodities and energy price routs discouraged foreign investments in Africa (~ -7%), Latin America and the Caribbean (~ -2%).

Data Source: UNCTAD

Harbingers of Future Growth

Usually a long-term investment, FDI occurs in the following alternative ways—a foreign company acquiring shares of, and/or expanding operations of a domestic entity; the overseas company setting up its subsidiary in the target country; or, a cross-border merger. In the process, technologies and skills exchanged between the two entities can potentially lead to efficiency gains, more employment opportunities and improved profitability—benefits which may not just be restricted to the recipient firm/subsidiary alone.

FDI contributed to around 12 million U.S. jobs in 2013—consisting of 6.1 million directly employed by foreign-owned entities plus 5.9 million jobs indirectly attributable to foreign investments via by-products, like productivity gains and supply chains.

Majority-owned U.S. affiliates of foreign entities accounted for $53 billion investment in R&D in 2013, which is 16.4% of total American R&D expense by businesses that year, underscoring FDI’s importance in sustained economic growth.

Also, emerging countries are fast capturing global investors’ attention owing to their growing market and rapid urbanization. The Indian aviation sector, for example, has reaped substantial gains, with FDI leading to the launch of two airlines, Vistara and Air Asia India, and to Etihad’s purchase of a 24% stake in Jet Airways. The developments have facilitated expansion of international air traffic from the country and operations from several new cities.

Bottom Line for Investors

Even though current global weakness is predicted to slow foreign capital flows globally in 2016, last year’s record foreign investments, particularly in developed economies including the U.S., should potentially provide adequate support for companies’ long-term prospects. Furthermore, by 2018, global FDI flows are predicted to exceed $1.8 trillion on the back of an expected global economic recovery.

As for Corporate America in particular, recent regulatory challenges may have restricted certain cross-border deals this year, but prospects of real growth offered by firming domestic fundamentals and an expected rebound in corporate earnings by end of the fourth quarter augurs well for returns on existing FDIs and add to U.S. companies’ appeal to global investors looking forward.

FREE Download – Zacks Economic Outlook: July, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

0 notes

Text

Banks (Mostly) Ace Fed Stress Tests

Nearly all the largest U.S. banks have passed the Fed’s annual stress tests unconditionally this year—meaning, these banks are deemed fit to ward off financial stresses or crises and are eligible to raise payouts to their shareholders given their present capital stock and risk control practices.

As part of the Dodd-Frank Act, stress tests conducted by the Fed present hypothetical scenarios for banks to run through to test their mettle. According to The Wall Street Journal, this year’s testing scenario was reportedly more severe assuming the following—U.S. unemployment rate soaring to 10% with a plunging stock market reduced to half of its value and Treasury yields turning negative. Although banks are estimated to collectively lose $385 billion on loans in this worst case scenario, most of them have been evaluated to have sufficient capital cushion and risk management tools to combat the crises. Other, less harsh, scenarios included a minor U.S. recession with mild deflation, and a benchmark reflecting average projections of economists.

Passing the test with flying colors, institutions like Bank of America and Citigroup could heave a sigh of relief, having received unconditional approvals in 2015 and 2014 respectively. Following the test results, Citigroup announced a notable hike in quarterly dividends from 5 cents to 16 cents along with a share repurchase of around $8.6 billion. Bank of America plans to raise payouts to 7.5 cents from 5 cents and buy back $5 billion equity. JPMorgan Chase & Co. has decided to repurchase $10.6 billion of shares, up from last year’s announced $6.4 billion.

Of the 33 banks reviewed, the only ones not to fully pass the tests were Morgan Stanley and the U.S. subsidiaries of Deutsche Bank AG and Banco Santander; the latter two failed while Morgan Stanley received a conditional nod from the Fed to raise shareholder dividends. The Fed’s main gripes with these three banks were inadequate capital planning and risk management processes. Nevertheless, the banks’ capital ratios were still well above the required minimum.

Even as it prepares to meet the conditions laid down by the Fed to improve its capital management and internal control practices, Morgan Stanley is set to pay dividends of 20 cents (up from 15 cents) and ramp up share buybacks to $3.5 billion for the coming four quarters (from the preceding period’s $2.5 billion).

Bottom Line for Investors

With more than 90% of the large U.S. banks passing the stress tests, this could create a boost for U.S. banking stocks, bolstered by dividend raises and share repurchases already announced by some of the largest financial firms.

The test results couldn’t have come at a better time. Even as markets grapple with global risks, the tests reaffirm the U.S. banking system’s resilience (even under the most extreme test scenarios)—perhaps this is the most comforting proof of the U.S. economy’s sturdy fundamentals.

Download – Zacks Economic Outlook: July, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

2 notes

·

View notes

Text

Are ‘White-Collar’ Jobs at Risk as Technology Advances?

Technology has evolved to become what it is today—an integral part of human existence. And, while technology benefits society in many ways, its increasing sophistication will likely put a broad set of jobs at risk.

Case in point

Automated systems have begun to replace humans, or help reduce the work load, in many industries. These automated systems or robots have long been an area that many tech giants have been exploring. Below are two examples:

1. For years, e-discovery software has helped lawyers manage the electronic records that need to be produced at the beginning of an investigation or law suit—a job originally done by clerical assistants.

2. Fast-food giant Wendy’s announced that it would replace cashiers with automated kiosks for taking customers’ orders at its restaurants.

Recent developments in the fields of artificial intelligence (AI) and robotics have led many experts to believe that they could help solve productivity gap issues, where they exist. At the same time, this could mean more white-collar jobs could be lost to AI enabled robots. According to Forrester market research, the number of job cuts attributed to robotic automation in the U.S. could grow to 12 million by 2025. White collar jobs most likely to be affected are in customer service and office administration; areas where fresh graduates are most likely to apply for entry-level positions.

Bottom Line for Investors

For centuries, new technology has resulted in swaths of jobs becoming obsolete. However, new and evolving technology has also created jobs as well. Case in point: after analyzing 140 years of data, a study by economists at Deloitte reported that technology has created more jobs than it has displaced since 1871.

Still, a major concern is the pace at which technology is advancing. In some economies, like the U.S., the recovery phase may be slower than is ideal. This begs the question, will new jobs be created fast enough to replace those displaced by technological advancement? We shall see. Regardless, investors are encouraged to remain aware of the balance between technology innovation and employment trends as the state of both can impact investments.

FREE Download – Zacks Economic Outlook: July, 2016

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

0 notes

Text

Investing Opportunity in US Natural Gas?

Electricity is a lifeline of the modern world and its evolution is toward being produced ‘clean.’ Thanks to its clean burning, predictable and flexible nature coupled with a production boom and lower prices, natural gas has become an increasingly attractive fuel for the electricity generation. Evolving technologies will continue to enable natural gas to play an ever increasing role in the clean generation of electricity.