Don't wanna be here? Send us removal request.

Text

Navigating Home Financing: Your Guide to the FintechZoom Mortgage Calculator

In today's rapidly changing world of personal finance, access to reliable tools is key to making informed decisions. When it comes to one of life's most significant investments—homeownership—the FintechZoom Mortgage Calculator stands as an invaluable resource. In this article, we'll explore the features and benefits of this powerful tool and how it can empower you in your home financing journey.

Understanding the FintechZoom Mortgage Calculator

The FintechZoom Mortgage Calculator is an advanced online tool designed to assist you in making well-informed decisions about homeownership. It offers more than just basic calculations; it provides a deep dive into the intricacies of your potential mortgage. Let's delve into its key features and how they can benefit you:

Detailed Inputs

With the FintechZoom Mortgage Calculator, users can input various details, including:

Loan Amount: The total amount you plan to borrow for your mortgage.

Interest Rate: The annual interest rate on your mortgage.

Loan Term: The number of years over which you intend to repay your mortgage.

Property Taxes: If applicable, you can include property taxes in your calculations.

Homeowner's Insurance: The calculator also considers homeowner's insurance costs.

Private Mortgage Insurance (PMI): If your down payment is less than 20%, PMI may apply.

Amortization Schedule

A standout feature of the FintechZoom Mortgage Calculator is its ability to generate an amortization schedule. This schedule provides a month-by-month breakdown of how your payments are allocated toward the principal and interest. It offers invaluable insights into how your loan balance decreases over time, helping you visualize your mortgage's long-term financial impact.

Extra Payments

Many homeowners opt to make additional payments toward their mortgage to expedite the payoff process and reduce interest costs. The FintechZoom Mortgage Calculator allows you to explore the impact of these extra payments, helping you plan your financial strategy effectively.

Affordability Analysis

Prudent financial planning is essential when considering homeownership. The calculator provides an affordability analysis, helping you determine the maximum mortgage amount you can comfortably handle based on your income, expenses, and other financial factors. This feature ensures that you do not overextend yourself financially.

Why Use the FintechZoom Mortgage Calculator?

The FintechZoom Mortgage Calculator is an indispensable tool for several compelling reasons:

Financial Clarity: It offers a comprehensive view of your mortgage, empowering you to make well-informed financial decisions.

Amortization Insights: The amortization schedule helps you visualize how your payments will change over time, allowing for better financial planning.

Customization: You can tailor the calculator to your specific situation by including additional costs like taxes and insurance, ensuring a highly personalized estimate.

In conclusion, the FintechZoom Mortgage Calculator is a user-friendly, feature-rich tool that can greatly assist you in understanding your mortgage options and making wise financial choices. Whether you're a first-time homebuyer or refinancing an existing mortgage, this calculator provides the insights you need to navigate the complex world of home financing with confidence.

For additional financial tools, including the FintechZoom Loan Calculator, be sure to explore the FintechZoom website. These calculators are valuable resources that can help you achieve your homeownership and financial goals.

0 notes

Text

Unlocking Success on the ACT: A Guide to Approved Calculators

Preparing for the ACT can be a challenging journey, and one of the key decisions you'll need to make is selecting the right calculator. The ACT has specific rules about which calculators are allowed, and choosing the appropriate one can make a significant difference in your test performance. In this comprehensive guide, we'll explore the world of ACT-approved calculators, helping you make an informed choice for your test day success.

Why Calculators Are Allowed on the ACT

Before we dive into the details, it's important to understand why calculators are even permitted on the ACT. This standardized test evaluates your knowledge and skills in various subjects, including mathematics. Calculators are allowed to help you efficiently solve complex mathematical problems, allowing you to focus on the concepts being tested rather than getting bogged down in tedious arithmetic.

Types of Calculators Allowed on the ACT

The ACT provides specific guidelines on the types of calculators that are allowed. Let's take a closer look at the three main categories of calculators permitted on the ACT:

1. Basic Calculators

Basic calculators are the simplest and most commonly available. They can perform fundamental arithmetic operations such as addition, subtraction, multiplication, and division. These calculators lack advanced features like graphing capabilities or symbolic manipulation. Basic calculators are perfectly acceptable for the ACT and are often recommended for their straightforwardness and reliability.

2. Scientific Calculators

Scientific calculators are more advanced than basic calculators. They can handle a broader range of mathematical functions, including trigonometry, logarithms, and statistics. While scientific calculators are allowed on the ACT, it's essential to ensure they do not have any prohibited features, such as graphing capabilities. Always refer to the official ACT guidelines to confirm approved scientific calculators.

3. Graphing Calculators

Graphing calculators are the most sophisticated in terms of functionality. They can create graphs, solve equations, and perform complex calculations. However, not all graphing calculators are permitted on the ACT. Only specific models that adhere to the ACT's memory and programmability guidelines are allowed.

Approved Graphing Calculators for the ACT

To help you make an informed decision, here's a list of some popular graphing calculators that are approved for use on the ACT:

TI-83 Plus

TI-84 Plus

TI-84 Plus CE

Casio fx-9750GII

Casio fx-9860GII

Please be aware that this list may change over time, so it's essential to verify the current list of permitted calculators on the official ACT website before your test date. Additionally, ensure that your calculator's memory is cleared before the exam to avoid any potential issues.

The Advantages of Using an Approved Calculator

Using an ACT-approved calculator offers several advantages:

Efficiency: The right calculator can help you solve complex math problems quickly, saving valuable time during the test.

Accuracy: Calculators reduce the risk of making calculation errors, ensuring that your answers are as precise as possible.

In conclusion, choosing the right calculator for the ACT is a vital aspect of your test preparation. Understanding the types of calculators allowed and adhering to the guidelines will help you perform your best on test day. For the most up-to-date information on approved calculators and any rule changes, visit the official ACT website.

1 note

·

View note

Text

Dressing for Your Body Shape

In the realm of fashion, one size does not fit all. Embracing your body shape is the first step towards looking and feeling fabulous. In this comprehensive guide, we'll explore three common body shapes: the Rectangle Body Shape, the Pear Body Shape, and the Triangle Body Shape. Each shape has its unique characteristics and charm, and by tailoring your fashion choices to your silhouette, you can enhance your confidence and style. Let's dive into the world of fashion and discover the perfect outfits for your body shape.

Rectangle Body Shape

The Rectangle Body Shape, characterized by a balanced and straight silhouette, offers a versatile canvas for fashion experimentation. If you identify with this body shape, you have an opportunity to play with various styles that can accentuate your natural assets.

Dressing Tips for Rectangle Body Shape

Define Your Waist: Since the Rectangle Body Shape lacks pronounced curves, opt for dresses and tops with cinched waists or employ belts to create the illusion of a smaller waistline. Unlock Your Style Potential with Rectangle Body Shape

Experiment with Layers: Embrace clothing that adds volume to your upper and lower body. Ruffled tops, layered skirts, and dresses with embellishments can help create a more shapely look. Rectangle Body Shape Fashion Inspiration

Play with Patterns: Choose patterns and colors that draw attention to your shoulders, bust, and hips. Horizontal stripes, V-necks, and bold prints can help in creating the illusion of curves. Rectangle Body Shape Fashion Ideas

Pear Body Shape

The Pear Body Shape, characterized by wider hips and a narrower upper body, is a distinctive and elegant silhouette. To flatter your figure, you can opt for clothing styles that highlight your upper body while balancing your lower body proportions.

Dressing Tips for Pear Body Shape

Accentuate Your Upper Body: Attract attention to your shoulders and bust with tops featuring interesting necklines or detailing. Off-shoulder, boat necks, or embellished tops work wonderfully. Pear Body Shape Fashion Advice

A-Line and Flared Bottoms: Balance your proportions by choosing A-line skirts or pants with a slight flare. These styles create a seamless transition from your hips to your ankles. Pear Body Shape Fashion Inspiration

Color Harmony: When selecting color combinations, opt for darker shades for your bottoms and lighter hues for your tops. This draws the eye upward and imparts a slimming effect to your hips. Elevate Your Style with Pear Body Shape Fashion

Triangle Body Shape

The Triangle Body Shape, often known as the "pear-shaped" body, features a narrower upper body and wider hips. To embrace your natural shape while enhancing your assets, strategic fashion choices are key.

Dressing Tips for Triangle Body Shape

Highlight Your Upper Body: Add focus to your shoulders and bust with tops that incorporate embellishments, ruffles, or patterns. A well-fitted blazer can also provide structure to your upper body. Triangle Body Shape Fashion Advice

Opt for A-Line Styles: A-line dresses and skirts with a gentle flare from the waist down create a harmonious look. They emphasize your waist while downplaying your hips. Triangle Body Shape Fashion Inspiration

Dark Colors for Bottoms: Achieve a slimming effect by choosing darker-colored bottoms. This helps divert attention away from your hips, highlighting your upper body for a polished appearance. Discover Your Style with Triangle Body Shape Fashion

Conclusion

Fashion is an art of self-expression, and by understanding your body shape, you can curate a wardrobe that accentuates your beauty. Whether you identify with the Rectangle, Pear, or Triangle Body Shape, there are fashion strategies to enhance your style and boost your confidence. Embrace your unique silhouette, explore diverse styles, and let your fashion choices celebrate your individuality. After all, fashion is about expressing the beautiful you!

2 notes

·

View notes

Text

Maximizing Financial and Health Well-being with Modern Calculators

In today's fast-paced world, modern calculators have become indispensable tools for individuals seeking to achieve financial stability and maintain optimal health. Whether you're planning your finances or managing your fitness goals, the suite of calculators available on ModernCalculators.com offers a range of solutions to help you make informed decisions.

1. Online Loan Calculators

Understanding the financial implications of loans is the first step to making sound borrowing decisions. Online loan calculators provide valuable insights into monthly payments, interest rates, and the overall cost of borrowing, ensuring that you can navigate the lending landscape with confidence.

2. Weight Gain Goal Calculator

For individuals looking to embark on a weight gain journey, this calculator is an invaluable ally. It helps you determine the precise calorie intake needed to reach your desired weight, ensuring that you achieve your goals in a healthy and sustainable manner.

3. Rectangle Body Shape Calculator

Understanding your body shape is key to making informed fashion choices. The rectangle body shape calculator offers personalized style tips and advice, empowering you to accentuate your unique figure.

4. Pear Body Shape Calculator

Just like the rectangle body shape calculator, this tool caters specifically to individuals with a pear-shaped figure, providing fashion recommendations to enhance their appearance.

5. Triangle Body Shape Calculator

For those with a triangular body shape, this calculator offers tailored fashion advice to help you look and feel your best.

6. Car Payment Calculator GA

If you're considering buying a car in Georgia, this calculator assists in estimating your monthly car payments, allowing you to budget effectively for your new vehicle.

7. Mobile Home Mortgage Calculator

Financing a mobile home involves specific considerations, and this calculator helps you understand the financial aspects of mobile home ownership, including mortgage payments.

8. Car Payment Calculator Illinois, Colorado, Virginia

Residents of Illinois, Colorado, and Virginia can benefit from this calculator, which offers region-specific insights into car payments, taxes, and fees.

9. Car Payment Calculator AZ

Planning to purchase a car in Arizona? This calculator helps you estimate your monthly car payments, ensuring you stay within your budget.

10. FintechZoom Mortgage Calculator

Mortgages can be complex, but this calculator simplifies the process by providing estimates for monthly mortgage payments, interest rates, and more.

11. Construction Loan Calculator

For those embarking on construction projects, this calculator assists in managing finances by estimating construction loan payments.

12. Aerobic Capacity Calculator

Fitness enthusiasts can gauge their aerobic capacity with this calculator, gaining insights into cardiovascular health and overall fitness levels.

13. Aircraft Loan Calculator - Airplane Loan Calculator

Aviation enthusiasts can use this tool to calculate loan payments when purchasing aircraft or airplanes.

14. Manufactured Home Loan Calculator

If you're considering financing a manufactured home, this calculator helps you understand the financial aspects of this significant investment.

15. Classic Car Loan Calculator

For vintage car enthusiasts, this calculator aids in estimating loan payments when purchasing classic cars.

16. FintechZoom Loan Calculator

FintechZoom offers a versatile loan calculator for various financial needs, providing insights into repayment schedules and interest rates.

17. ATV Loan Calculator

Planning to buy an ATV? This calculator helps you budget for your new adventure vehicle.

18. Farm Loan Calculator

Farmers and agricultural entrepreneurs can use this calculator to understand the financial implications of farm loans.

19. Pool Loan Calculator

Building a pool? This calculator assists in estimating loan payments for your dream backyard oasis.

20. Solar Loan Calculator

As solar energy becomes more accessible, this calculator helps you determine the financial aspects of financing solar panel installations.

21. Mobile Home Loan Calculator

For individuals considering mobile home ownership, this calculator provides insights into mobile home loan payments.

22. Bridge Loan Calculator - Bridging Loan Calculator

Bridge loans can be complex, but this calculator simplifies the process by estimating bridge loan payments, facilitating informed borrowing decisions.

23. Hard Money Loan Calculator

Investors and real estate professionals can use this calculator to understand the financial aspects of hard money loans.

24. HDFC SIP Calculator

For Indian investors, HDFC offers a systematic investment plan (SIP) calculator to estimate returns on mutual fund investments.

25. Step Up SIP Calculator

This calculator assists Indian investors in planning systematic investment plans with increasing contributions over time.

26. What Calculators Are Allowed on The ACT

Students taking the ACT can use this resource to understand which calculators are permitted during the exam, ensuring they are well-prepared.

27. ALC Calculator

In the realm of beverages, this calculator helps producers determine alcohol content (ALC) in various drinks, ensuring regulatory compliance and quality control.

28. Amortization Loan Calculator

Managing loan repayments is simplified with this calculator, offering a comprehensive schedule of payments over the loan term.

29. ANC Calculator

Healthcare professionals rely on the Absolute Neutrophil Count (ANC) calculator to assess immune system health and make informed treatment decisions.

30. Annual Interest Rate Calculator

This calculator aids in computing the annual interest rate on loans and investments, facilitating financial planning and decision-making.

31. Annualized Percentage Rate Calculator

Understanding the Annualized Percentage Rate (APR) is vital when borrowing money. This calculator simplifies APR calculations for loans and credit cards.

32. Auto Loan Calculator

Whether you're purchasing a new or used car, this calculator helps you estimate monthly auto loan payments, including taxes and fees.

33. Bench Press One Rep Max Calculator

For weightlifters, this calculator determines your one-repetition maximum (1RM) for the bench press, aiding in strength training programs.

34. Refinance Calculator

Refinancing loans can lead to significant savings. This calculator helps you evaluate potential savings when refinancing various types of loans.

35. TDEE Calculator

Your Total Daily Energy Expenditure (TDEE) is crucial for managing your diet and fitness goals. This calculator estimates your daily caloric needs, ensuring you maintain a balanced diet.

36. Body Shape Calculator

Understanding your body shape is the first step in choosing clothing that enhances your appearance. This calculator offers personalized fashion advice based on your body shape.

37. BSA Calculator or Body Surface Area Calculator

Healthcare professionals rely on this calculator to estimate body surface area, a critical factor in medication dosages and treatment planning.

Now that you're acquainted with the diverse range of calculators available on ModernCalculators.com, you can harness their power to make informed decisions in various aspects of your life. Whether you're planning a major purchase, pursuing fitness goals, or seeking to enhance your overall well-being, these calculators are your trusted companions on the journey to success.

#one rep max calculator or 1rm max calculator#online loan calculators#ovulation calculator#savings calculator#sip calculator or sip return calculator#period due date calculator#personal loan calculator#pregnancy conception date calculator#pregnancy timeline calculator#present value calculator#real estate calculators#rent calculator#rent vs buy calculator#rental property calculator#retirement plan calculator#rmr calculator or resting metabolism calculator#return on investment calculator or ROI Calculator#simple interest Rate calculator#squat one rep max calculator#steps to miles calculator#student loan calculator#vo2 max calculator#waist to hip calculator#weight gain pregnancy calculator#weight gain goal calculator

0 notes

Text

The Power of Modern Calculators: Tools for Financial, Health, and Planning Needs

In today's fast-paced world, access to accurate and efficient calculators is a necessity for making informed decisions in various aspects of life. Whether you're managing your finances, planning for the future, or tracking your health and fitness goals, modern calculators play a pivotal role. In this article, we will explore a range of online calculators provided by Modern Calculators, each designed to address specific needs and assist you in making well-informed choices.

1. Online Loan Calculators

Online Loan Calculators are invaluable tools for individuals seeking loans. These calculators help you estimate monthly payments, interest rates, and repayment schedules, ensuring that you choose the loan that best fits your financial situation.

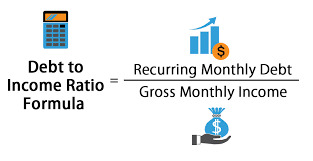

2. Debt to Income Ratio Calculator

Managing your debt is crucial for financial stability. The Debt to Income Ratio Calculator allows you to determine your DTI ratio, aiding in better decision-making when it comes to taking on new debts.

3. Depreciation Calculator

For business owners and individuals with assets, the Depreciation Calculator is a valuable tool. It assists in understanding how assets depreciate over time, aiding in financial planning and tax considerations.

4. Discount Calculators

Whether you're a shopper or a business owner, Discount Calculators help you calculate discounts, savings, and final prices, ensuring you get the best deals.

5. Due Date Calculator

Expecting parents can rely on the Due Date Calculator to estimate their baby's due date based on various factors.

6. EER Calculator or Estimated Energy Requirement Calculator

Maintaining a healthy diet is easier with the EER Calculator. It helps you determine your daily calorie needs based on factors like age, gender, and activity level.

7. Future Value Calculator

Planning for retirement or long-term savings? The Future Value Calculator aids in estimating the future value of your investments, allowing you to set achievable financial goals.

8. Healthy Weight Calculator

Achieving and maintaining a healthy weight is essential for overall well-being. The Healthy Weight Calculator helps you determine a healthy weight range for your height.

9. Height to Waist Ratio Calculator

Assessing your health risks is made easier with the Height to Waist Ratio Calculator, which provides insights into your abdominal obesity risk.

10. Debt Consolidation Calculator

Those looking to simplify their debt repayment strategy can turn to the Debt Consolidation Calculator to explore consolidation options.

11. Home Loan Affordability Calculator

Before purchasing a home, use the Home Loan Affordability Calculator to determine what you can afford and avoid overextending your finances.

12. Home Loan Calculator with Down Payment

When buying a home, calculating the down payment is essential. The Home Loan Calculator with Down Payment simplifies this process.

13. Ideal Body Fat Percentage Calculator

Maintaining a healthy body composition is vital. The Ideal Body Fat Percentage Calculator helps you set realistic fitness goals.

14. Ideal Body Weight Calculator

Determine your healthy weight range with the Ideal Body Weight Calculator, making it easier to manage your weight.

15. Ideal Calorie Intake Calculator

Achieving your fitness goals requires a balanced diet. The Ideal Calorie Intake Calculator assists in determining your daily calorie needs.

16. Inflation Calculator

Planning for future expenses is essential. The Inflation Calculator helps you understand the impact of inflation on your finances.

17. Skipping Rope Calories Burned Calculator

Stay fit with the Skipping Rope Calories Burned Calculator, which estimates calories burned during jump rope workouts.

18. LDL Calculator

Monitor your cardiovascular health with the LDL Calculator, helping you understand your low-density lipoprotein levels.

19. Lean Body Mass Calculator

Fitness enthusiasts can track their progress with the Lean Body Mass Calculator, which calculates lean body mass and body fat percentage.

20. Loan Down Payment Calculator

Planning to buy a car or home? The Loan Down Payment Calculator helps you determine the down payment required for your purchase.

21. Loan Payments Calculator

Manage your loan repayment schedule efficiently using the Loan Payments Calculator.

22. Macronutrient Calculator

Tailor your diet to your nutritional needs with the Macronutrient Calculator.

23. Meal Calories Calculator

Keep track of your calorie intake with the Meal Calories Calculator, aiding in weight management.

24. Mortgage Payoff Calculator

Accelerate your mortgage repayment strategy using the Mortgage Payoff Calculator.

25. Conception Calculator

For those planning to expand their families, the Conception Calculator helps estimate conception dates.

26. One Rep Max Calculator or 1RM Max Calculator

Fitness enthusiasts can gauge their strength using the One Rep Max Calculator.

27. Ovulation Calculator

Couples trying to conceive can benefit from the Ovulation Calculator to determine fertile periods.

28. Savings Calculator

Whether you're saving for a rainy day or a specific goal, the Savings Calculator helps you track your savings progress.

29. SIP Calculator or SIP Return Calculator

Investment planning becomes more accessible with the SIP Calculator, allowing you to estimate returns on Systematic Investment Plans.

30. Period Due Date Calculator

The Period Due Date Calculator aids in tracking menstrual cycles and predicting due dates.

31. Personal Loan Calculator

Evaluate personal loan options efficiently with the Personal Loan Calculator.

32. Pregnancy Conception Date Calculator

Expecting parents can use the Pregnancy Conception Date Calculator to estimate conception dates.

33. Pregnancy Timeline Calculator

Monitor your pregnancy progress with the Pregnancy Timeline Calculator, providing insights into the stages of pregnancy.

34. Present Value Calculator

Financial planning often requires understanding the present value of future cash flows. The Present Value Calculator simplifies this calculation.

35. Real Estate Calculators

For property investors, the Real Estate Calculators offer valuable tools to assess property yield and rental returns.

36. Rent Calculator

Choosing between renting and buying a home is a significant decision. The Rent Calculator helps you analyze the financial aspects of renting.

37. Rent vs Buy Calculator

Make an informed decision about homeownership with the Rent vs Buy Calculator.

38. Rental Property Calculator

Property investors can assess the potential income from rental properties using the Rental Property Calculator.

39. Retirement Plan Calculator

Plan for your retirement with confidence using the Retirement Plan Calculator.

40. RMR Calculator or Resting Metabolism Calculator

Understand your basal metabolic rate with the RMR Calculator to optimize your calorie intake for weight management.

41. Return on Investment Calculator or ROI Calculator

Evaluate investment opportunities using the Return on Investment Calculator, ensuring your investments yield desirable returns.

42. Simple Interest Rate Calculator

Calculate the interest on loans or investments with the Simple Interest Rate Calculator.

43. Squat One Rep Max Calculator

Fitness enthusiasts can track their strength gains with the Squat One Rep Max Calculator.

44. Steps to Miles Calculator

Keep your fitness goals on track by converting your daily steps to miles using the Steps to Miles Calculator.

45. Student Loan Calculator

Plan your student loan repayment strategy with the Student Loan Calculator.

46. VO2 Max Calculator

Assess your cardiovascular fitness with the VO2 Max Calculator.

47. Waist to Hip Calculator

Monitor your waist-to-hip ratio, a key indicator of cardiovascular health, using the Waist to Hip Calculator.

48. Weight Gain Pregnancy Calculator

Expectant mothers can track their weight gain during pregnancy with the Weight Gain Pregnancy Calculator.

In conclusion, Modern Calculators provides a diverse range of online tools that cater to various financial, health, and planning needs. These calculators empower individuals to make informed decisions, manage their finances, and lead healthier lives. Whether you're a fitness enthusiast, a homeowner, or an investor, these calculators are valuable assets in your quest for success and well-being.

#bmi calculator#bmr calculator or basal metabolism calculator#alc calculator#amortization loan calculator#anc calculator#annual interest rate calculator#annualized percentage rate calculator#auto loan calculator#bench press one rep max calculator#refinance calculator#tdee calculator#body shape calculator#bsa calculator or body surface area calculator#business loan calculator#weight loss calculator#calories burned calculator#carbohydrate calculator or carb intake calculator#cash back or low interest calculator#compound investment calculator#compound Interest rate calculator#credit cards calculator credit cards payoff calculator#daily protein intake calculator#daily water intake calculator#deadlift one rep max calculator#debt consolidation calculator#debt to income ratio calculator#depreciation calculator#discount calculators#due date calculator#eer calculator or estimated energy requirement calculator

1 note

·

View note

Text

Empowering Financial Decisions with Modern Calculators: Your Key to Financial Success

In an era where information is readily available, financial empowerment is key to making informed decisions. Thanks to the digital age, we have access to an impressive array of calculators that can simplify complex financial tasks. Let's explore the world of Modern Calculators and discover how these tools can empower you in various aspects of your financial journey.

1. Rectangle Body Shape Calculator

Your body shape plays a significant role in fashion choices. The Rectangle Body Shape Calculator not only identifies your body shape but also offers tailored fashion advice to help you look and feel your best.

2. Pear Body Shape Calculator

Enhance your style by understanding your body shape. The Pear Body Shape Calculator provides insights and fashion tips specifically designed for pear-shaped individuals.

3. Triangle Body Shape Calculator

Confidence in your wardrobe starts with knowing your body shape. The Triangle Body Shape Calculator identifies your body type and offers fashion recommendations to elevate your style.

4. Car Payment Calculator GA

Planning to buy a car in Georgia? The Car Payment Calculator GA simplifies the process by helping you estimate your monthly car payments, ensuring they fit comfortably within your budget.

5. Mobile Home Mortgage Calculator

Homeownership is a dream for many, and mobile homes provide an affordable path. The Mobile Home Mortgage Calculator assists in estimating your monthly mortgage payments, making homeownership more achievable.

6. Car Payment Calculator Illinois, Colorado, Virginia

If you're relocating to Illinois, Colorado, or Virginia, this calculator helps you estimate car payments in different states, ensuring your budget aligns with your new location.

7. Car Payment Calculator AZ

Considering a vehicle purchase in Arizona? The Car Payment Calculator AZ enables you to calculate potential car payments, allowing you to budget effectively.

8. FintechZoom Mortgage Calculator

Mortgages can be complex, but the FintechZoom Mortgage Calculator simplifies the process. Calculate mortgage payments, explore interest rates, and understand your amortization schedule with ease.

9. Construction Loan Calculator

Building your dream home? The Construction Loan Calculator estimates your construction loan requirements and monthly payments, ensuring a smooth building process.

10. Aerobic Capacity Calculator

Your fitness journey starts with understanding your aerobic capacity. Calculate your fitness level and tailor your workouts for optimal results using this essential tool.

11. Aircraft Loan Calculator - Airplane Loan Calculator

For aviation enthusiasts, owning an aircraft is a dream come true. The Aircraft Loan Calculator simplifies the financial side of aviation, helping you understand loan terms and payments.

12. Manufactured Home Loan Calculator

Thinking about a manufactured home? This calculator provides invaluable insights into potential loan payments, making homeownership in a manufactured home more achievable.

13. Classic Car Loan Calculator

Passionate about classic cars? The Classic Car Loan Calculator helps estimate classic car loan payments, bringing you closer to your dream vehicle.

14. FintechZoom Loan Calculator

Whether you need a personal or business loan, the FintechZoom Loan Calculator equips you to estimate monthly payments and assess the financial impact of borrowing.

15. ATV Loan Calculator

Ready for off-road adventures? The ATV Loan Calculator calculates potential ATV loan payments, ensuring your outdoor escapades are within reach.

16. Farm Loan Calculator

Aspiring farmers can benefit from the Farm Loan Calculator. It simplifies estimating loan payments and planning expenses for a successful agricultural venture.

17. Pool Loan Calculator

Turn your backyard into a paradise with a pool. The Pool Loan Calculator helps you understand the cost of financing your dream pool, making planning easy.

18. Solar Loan Calculator

Considering solar energy? Calculate the financial impact of a solar energy system on your budget and savings with the Solar Loan Calculator, helping you make eco-friendly choices.

19. Mobile Home Loan Calculator

Contemplating a mobile home purchase? Estimate potential mobile home loan payments to make an informed decision about your future home.

20. Bridge Loan Calculator - Bridging Loan Calculator

Real estate investors often use bridge loans for flexibility. The Bridge Loan Calculator simplifies the process of evaluating your bridge loan requirements, facilitating smarter investment decisions.

21. Hard Money Loan Calculator

Hard money lending can be a viable financing option. Use this calculator to assess potential hard money loan terms and payments, ensuring you make sound financial choices.

22. HDFC SIP Calculator

Systematic Investment Plans (SIPs) are an excellent way to grow your wealth. The HDFC SIP Calculator helps plan your investments and understand potential returns on your SIP portfolio.

23. Step Up SIP Calculator

Planning to increase your SIP investments gradually? The Step Up SIP Calculator allows you to calculate the benefits of incremental investment increases on your wealth accumulation.

24. What Calculators Are Allowed on The ACT

For students preparing for the ACT, understanding which calculators are permitted during the exam is crucial. This article provides valuable insights into the types of calculators allowed, ensuring you're well-prepared for test day.

In conclusion, Modern Calculators offers a wide range of calculators that simplify complex tasks and empower you to make informed decisions in various aspects of your life. These calculators are your tools for financial empowerment, helping you achieve your goals and secure your financial future. Explore them today and embark on your journey to financial success!

#Rectangle Body Shape#Pear Body shape#Triangle Body Shape#Car Payment Calculator GA#Mobile Home Mortgage Calculator#Car Payment Calculator Illinois#Colorado#Virginia#Car Payment Calculator AZ#FintechZoom Mortgage Calculator#Construction Loan Calculator#Aerobic Capacity Calculator#Aircraft Loan Calculator - Airplane Loan Calculator#Manufactured Home Loan Calculator#Classic Car Loan Calculator#FintechZoom Loan Calculator#ATV Loan Calculator#Farm Loan Calculator#Pool Loan Calculator#Solar Loan Calculator#Mobile Home Loan Calculator#Bridge Loan Calculator - Bridging Loan Calculator#Hard Money Loan Calculator#HDFC SIP Calculator#Step Up SIP Calculator

2 notes

·

View notes

Text

Future Value Calculator-FV Calculator-FV Formula-FV Annuity Formula

Are you looking to invest money or plan for your future financial goals? In that case, you must have heard about the Future Value (FV) calculation. Future Value is the value of an investment at a specific time in the future, and it helps you understand how much an investment will be worth in the future, taking into account interest or growth.

If you're interested in calculating your FV, then you need a Future Value Calculator or FV Calculator. These calculators can help you determine how much your investment will be worth at a particular time in the future, based on different assumptions like interest rate, time, and payment intervals. In this article, we'll discuss the FV Calculator, FV Annuity Formula, and FV Formula, which can help you determine the future value of your investment.

What is a Future Value Calculator?

A Future Value Calculator is an online tool that can help you calculate the future value of an investment. With this calculator, you can input various details such as the present value, interest rate, number of years, and compounding frequency to determine the future value of your investment. It's a convenient way to determine how much your investment will be worth in the future.

There are many Future Value calculators available online, and it's essential to choose one that is easy to use and provides accurate results. You can find Future Value calculators that can calculate the future value of a single investment or a series of investments, such as annuities.

What is an FV Annuity Formula?

An FV Annuity Formula is a mathematical formula that can help you calculate the future value of an annuity. An annuity is a financial product that provides a series of payments at regular intervals, usually monthly or annually. An annuity can be an excellent investment option for individuals who want to receive regular income after retirement or for those who want to save for a specific financial goal.

The FV Annuity Formula considers the present value, interest rate, number of payments, and payment amount to determine the future value of an annuity. It's a handy tool for individuals who want to determine how much their annuity will be worth in the future.

What is an FV Formula?

An FV Formula is a mathematical formula that can help you calculate the future value of a single investment. The FV Formula considers the present value, interest rate, and number of years to determine the future value of an investment. It's a useful tool for individuals who want to determine how much their investment will be worth in the future.

The FV Formula assumes that the investment will earn interest at a fixed rate, and the interest earned will be reinvested at the same rate. It's important to note that the FV Formula doesn't take into account the effects of inflation or taxes, which can impact the real value of an investment.

Conclusion

Calculating the future value of an investment can help you make informed decisions about your financial goals. Future Value calculators, FV Annuity Formula, and FV Formula are essential tools that can help you determine the future value of your investment accurately. These tools consider various factors such as interest rate, time, and payment intervals to calculate the future value of an investment. It's essential to choose a reliable tool and provide accurate information to get precise results. Use these tools to plan for your future financial goals and make informed investment decisions.

0 notes

Text

Discount Calculators - Discount Price Calculator - Discount Calculator Online

If you're a savvy shopper, you know how important it is to calculate discounts accurately. That's where discount calculators come in handy. With just a few inputs, these online tools can quickly tell you the discounted price of an item or the amount you'll save. In this article, we'll explore the various types of discount calculators, how to use them, and the benefits of using them. We'll also provide a review of some of the best discount calculators available online.

Discount Calculators

Discount calculators are tools used to calculate the discounted price of a product. You can use them to find out how much you'll save on a purchase or how much you need to pay after the discount has been applied. These calculators can be found online and are often free to use. They work by taking the original price of an item and applying a discount percentage to it, which gives you the discounted price.

Discount Calculator Online

Online discount calculators are the easiest and most convenient way to calculate discounts. With just a few clicks, you can find out how much you'll save on your next purchase. Online discount calculators are free to use and can be found on many websites. They work by simply inputting the original price of the item and the discount percentage, and then they'll calculate the discounted price for you.

Discount Price Calculator

A discount price calculator is a type of discount calculator that specifically calculates the discounted price of an item. It works by taking the original price of the item and the discount percentage and then calculates the discounted price. This type of calculator is helpful when you want to know exactly how much you'll need to pay after the discount has been applied.

How to Use a Discount Calculator

Using a discount calculator is simple and straightforward. Here are the steps to follow:

Step 1: Enter the original price of the item in the appropriate field.

Step 2: Enter the discount percentage in the appropriate field.

Step 3: Click on the calculate button.

Step 4: The discount calculator will show you the discounted price of the item.

Benefits of Using a Discount Calculator

Using a discount calculator has several benefits, including:

Accuracy: Discount calculators ensure that your calculations are accurate, which helps you avoid making costly mistakes.

Saves time: Manually calculating discounts can be time-consuming, but with a discount calculator, you can quickly find out the discounted price of an item.

Convenience: Discount calculators are easily accessible online and can be used at any time.

Cost-effective: Discount calculators are free to use, which makes them an excellent cost-effective tool.

Best Discount Calculators Online

There are many discount calculators available online, but here are some of the best:

ModernCalculators: This website has a discount calculator that is easy to use and provides accurate results.

Jumi Calculator: This website has a discount calculator that is user-friendly and offers advanced features like tax calculation.

MoneySavingExpert: This website has a discount calculator that calculates discounts and helps you find the best deals.

Conclusion

Discount calculators are essential tools for any savvy shopper. They help you save time, avoid mistakes, and find the best deals. There are many types of discount calculators available online, and they are free to use. By using a discount calculator, you can calculate discounts accurately and quickly, which makes shopping a lot more enjoyable.

0 notes

Text

Depreciation Calculator- Depreciation Formula Calculator – Depreciation Calculation Methods

Depreciation is a critical concept in accounting and finance. It refers to the decline in the value of an asset over time due to wear and tear, obsolescence, or other factors. Depreciation is essential for businesses to track their asset values accurately and calculate their taxable income. If you own a business or are involved in accounting or finance, it is essential to understand depreciation and how it affects your company's finances. Fortunately, there are many tools available to help you calculate depreciation, including a depreciation calculator, a depreciation formula calculator, and various depreciation calculation methods.

Depreciation Calculator

A depreciation calculator is an online tool that allows you to calculate the depreciation of an asset over a specific period. It is a handy tool for businesses to use when determining the depreciation expense for their financial statements or tax returns. To use a depreciation calculator, you need to enter the initial cost of the asset, its useful life, and its salvage value. The calculator will then use this information to calculate the depreciation expense for each year of the asset's useful life.

The main advantage of using a depreciation calculator is that it is a quick and easy way to calculate depreciation accurately. Additionally, it helps to eliminate errors that can occur when performing manual calculations. Many websites offer free online depreciation calculators, making it easy for businesses of all sizes to access this valuable tool.

Depreciation Formula Calculator

If you prefer to calculate depreciation manually, you can use a depreciation formula calculator. The formula for calculating depreciation is relatively simple: (Cost of Asset - Salvage Value) / Useful Life = Depreciation Expense. However, depending on the depreciation method used, the formula can be more complicated. For example, the double-declining balance method uses the formula (2 / Useful Life) * (Cost of Asset - Accumulated Depreciation) = Depreciation Expense.

A depreciation formula calculator can help you calculate depreciation accurately and efficiently. You simply enter the necessary information into the calculator, and it will provide you with the depreciation expense for each year of the asset's useful life.

Depreciation Calculation Methods

There are several depreciation calculation methods that businesses can use. The most common methods include straight-line depreciation, double-declining balance depreciation, and sum-of-the-years' digits depreciation.

Straight-Line Depreciation

The straight-line depreciation method is the simplest and most commonly used depreciation method. It involves dividing the cost of the asset by its useful life and depreciating it by the same amount each year. For example, if an asset costs $10,000 and has a useful life of 5 years, the depreciation expense would be $2,000 per year ($10,000 / 5 years).

Double-Declining Balance Depreciation

The double-declining balance depreciation method is an accelerated depreciation method. It involves applying a depreciation rate that is double the straight-line rate to the asset's beginning-of-year book value. For example, if an asset costs $10,000, has a useful life of 5 years, and a salvage value of $1,000, the double-declining balance rate would be 40% ($2,000 / $10,000). The depreciation expense for the first year would be $4,000 (40% * $10,000), and the book value at the end of the first year would be $6,000 ($10,000 - $4,000). The double-declining balance rate would then be applied to the $6,000 beginning-of-year book value to calculate the depreciation expense for the second year.

Sum-of-the-Years' Digits Depreciation

The sum-of-the-years' digits depreciation method is another accelerated depreciation method.

In conclusion, calculating depreciation is essential for businesses to determine the value of their assets over time. It is important to choose the right depreciation method based on the asset's expected lifespan, expected residual value, and other relevant factors.

Using a depreciation calculator can help businesses streamline the calculation process and ensure accuracy in their financial statements. A depreciation formula calculator is also a useful tool for those who want to understand how depreciation is calculated.

By understanding the different depreciation calculation methods and using the appropriate tools, businesses can make informed decisions about their assets and ensure their financial statements are accurate and compliant with accounting standards.

Overall, the proper calculation of depreciation can help businesses make informed decisions about asset management and financial planning. It is an important aspect of accounting that should not be overlooked.

0 notes

Text

Debt to Income Ratio Calculator - DTI Ratio Calculator - DTI Calculator

Managing your finances can be a daunting task, especially when it comes to managing your debts. One important factor in managing your debts is understanding your debt-to-income ratio (DTI). DTI is the percentage of your monthly income that goes towards paying off your debts. It's a key metric used by lenders to determine your creditworthiness and your ability to manage your debts. In this article, we'll take a closer look at what DTI is and how to use a DTI Ratio Calculator to help you better manage your debts.

What is DTI?

Your DTI is a measure of your ability to manage your debts. It's a ratio that compares your monthly debt payments to your monthly income. To calculate your DTI, you need to add up all your monthly debt payments and divide that number by your gross monthly income. Your DTI is expressed as a percentage, and it indicates how much of your income is going towards paying off your debts.

For example, if your total monthly debt payments are $1,500, and your gross monthly income is $5,000, your DTI would be 30% (1,500 / 5,000 = 0.3, or 30%).

What is a Good DTI Ratio?

A good DTI ratio is generally considered to be 36% or lower. This means that your monthly debt payments should not exceed 36% of your gross monthly income. Lenders use this ratio to assess your ability to repay a loan and to determine your creditworthiness.

However, this ratio is not set in stone, and lenders may have different requirements depending on the type of loan you're applying for. For example, if you're applying for a mortgage, your lender may require a DTI of 43% or lower.

Why is DTI Important?

Your DTI is an important factor in determining your creditworthiness. Lenders use your DTI to assess your ability to repay a loan. If you have a high DTI, it may be difficult to get approved for a loan, as lenders may see you as a high-risk borrower.

Additionally, your DTI can help you understand your own financial situation better. If your DTI is high, it may be an indication that you need to re-evaluate your budget and find ways to reduce your monthly debt payments.

How to Use a DTI Ratio Calculator

Calculating your DTI can be a bit tricky, as it involves several steps and calculations. Fortunately, there are many online DTI Ratio Calculators that can do the math for you. To use a DTI Ratio Calculator, simply follow these steps:

Gather your financial information: To calculate your DTI, you'll need to know your monthly income and your monthly debt payments. Make sure you have all the necessary financial information before you begin.

Find a DTI Ratio Calculator: There are many free DTI Ratio Calculators available online. Find one that you like and open it up.

Enter your income: Enter your gross monthly income into the calculator.

Enter your debt payments: Enter your monthly debt payments into the calculator. This includes any mortgage payments, car loans, credit card payments, or other debts you may have.

Calculate your DTI: Once you've entered all your financial information, the DTI Ratio Calculator will do the math for you and calculate your DTI.

Interpret the results: The DTI Ratio Calculator will give you your DTI as a percentage. If your DTI is below 36%, you're in good shape. If your DTI is higher, you may need to re-evaluate your budget and find ways to reduce your monthly debt payments.

In conclusion, your DTI ratio is an important factor in determining your financial health and eligibility for credit. Calculating your DTI ratio using a reliable and accurate DTI ratio calculator can give you a better understanding of where you stand financially and help you make informed decisions about managing your debt. Whether you need to pay down debt, increase your income, or explore other options like debt consolidation, monitoring and improving your DTI ratio can go a long way in securing your financial future. With the help of a DTI calculator, you can take control of your debt and work towards achieving your financial goals.

0 notes

Text

Debt Consolidation Calculator – Debt Consolidation Loan Calculator

Debt consolidation is a popular financial strategy that allows individuals to simplify their debt and reduce the amount of interest they're paying each month. It involves taking out a new loan to pay off all of your existing debts, leaving you with a single monthly payment to make. However, before you decide to consolidate your debts, it's important to use a debt consolidation calculator or a debt consolidation loan calculator to determine whether it's the right choice for you.

A debt consolidation calculator is a tool that can help you estimate the cost of consolidating your debts. It takes into account factors such as the total amount you owe, the interest rates on each debt, and the term and interest rate of the new loan. By inputting this information, the calculator can generate a report that shows you how much your monthly payment will be, how long it will take to pay off your debts, and how much you'll pay in interest over the life of the loan.

Similarly, a debt consolidation loan calculator is a tool that can help you determine the cost of taking out a debt consolidation loan. It takes into account factors such as the loan amount, interest rate, and term. By inputting this information, the calculator can generate a report that shows you how much your monthly payment will be, how long it will take to pay off the loan, and how much you'll pay in interest over the life of the loan.

One of the benefits of using a debt consolidation calculator or a debt consolidation loan calculator is that it can help you compare different loan options. For example, you can input the terms of two different loans into the calculator to see which one will save you more money in the long run. This can help you make an informed decision about which loan to choose.

Another benefit of using a debt consolidation calculator or a debt consolidation loan calculator is that it can help you create a realistic budget. By seeing how much your monthly payment will be, you can adjust your budget accordingly to make sure you can afford the payment each month. This can help you avoid defaulting on the loan and damaging your credit score.

When using a debt consolidation calculator or a debt consolidation loan calculator, it's important to keep in mind that the estimates provided are just that - estimates. The actual interest rate and terms of the loan may be different than what's shown in the calculator, and your actual monthly payment may vary based on factors such as your credit score and income.

If you're considering using a debt consolidation calculator or a debt consolidation loan calculator, here are a few tips to help you get the most out of the tool:

Gather all of your debt information: Before you start using the calculator, make sure you have all of your debt information handy. This includes the total amount you owe, the interest rates on each debt, and the minimum monthly payment.

Decide on the terms of the new loan: You'll need to know the interest rate and term of the new loan you're considering in order to use the calculator. This information is usually provided by the lender.

Use accurate information: To get the most accurate estimate from the calculator, make sure you're inputting accurate information. This includes the interest rates on your current debts and the interest rate and term of the new loan.

Consider all of the costs: When using the calculator, make sure you're considering all of the costs associated with the new loan, including any fees or charges.

Don't forget about other factors: While a debt consolidation calculator or a debt consolidation loan calculator can be a helpful tool, it's important to remember that there are other factors to consider when deciding whether to consolidate your debts. For example, you'll want to think about the impact on your credit score and whether the new loan will offer any additional benefits, such as lower monthly payments or a shorter payoff period.

In conclusion, using a debt consolidation calculator or a debt consolidation loan calculator can be a useful tool in determining whether debt consolidation is the right choice for you. By providing estimates of your monthly payment, payoff time, and total interest paid, these calculators can help you make an informed decision about your financial future. However, it's important to remember that the estimates provided are just that - estimates. It's always a good idea to do your own research, shop around for the best loan terms, and consult with a financial advisor before making any major financial decisions.

0 notes

Text

Credit Cards Calculator – Credit Cards Payment Calculator – Credit Cards Payoff Calculator

When it comes to managing your credit cards, it's important to have a clear understanding of how much you owe, how much interest you're paying, and how long it will take to pay off your balance. That's where credit card calculators come in handy. In this article, we'll discuss three types of credit card calculators: credit cards calculator, credit cards payment calculator, and credit cards payoff calculator.

Credit Cards Calculator

The first tool we'll discuss is the credit cards calculator. This calculator helps you determine the true cost of your credit card balance over time. It takes into account your interest rate, the balance on your card, and your monthly payment to calculate the total interest you'll pay over the life of your debt. This information is valuable because it can help you decide whether to pay more than the minimum payment, transfer your balance to a lower interest rate card, or make other changes to your payment plan.

Credit Cards Payment Calculator

The second tool is the credit cards payment calculator. This calculator helps you determine how long it will take to pay off your credit card balance if you only make the minimum payment each month. It takes into account your interest rate, the balance on your card, and your minimum payment to calculate the number of months it will take to pay off your debt. This information is valuable because it can help you decide whether to increase your payment or seek out other strategies to pay off your balance more quickly.

Credit Cards Payoff Calculator

The third tool is the credit cards payoff calculator. This calculator helps you determine how much you need to pay each month to pay off your credit card balance by a specific date. It takes into account your interest rate, the balance on your card, and the number of months you have to pay off your debt to calculate your monthly payment. This information is valuable because it can help you set a goal for paying off your debt and make a plan to achieve that goal.

Using these credit card calculators can help you gain a clearer understanding of your credit card debt and make informed decisions about how to manage it. When using these tools, it's important to remember that they are only estimates, and your actual interest rate and payment amounts may vary. Additionally, these calculators don't take into account other factors that may affect your credit score, such as missed payments or new credit applications.

In conclusion, credit card calculators are valuable tools for managing your credit card debt. By using a credit cards calculator, a credit cards payment calculator, or a credit cards payoff calculator, you can gain insight into the true cost of your debt, how long it will take to pay off, and how much you need to pay each month to reach your goal. Remember to use these tools as a guide and to consider other factors that may affect your credit score when making decisions about managing your credit cards.

0 notes

Text

Annualized Percentage Rate Calculator – Calculating aprs – Annual Percentage Rate Formula

Annual Percentage Rate (APR) is a critical financial concept that consumers and businesses alike need to understand. APR is the total cost of credit to the borrower, including the interest rate and any fees that lenders charge. The APR is typically expressed as a percentage, and the higher the APR, the more expensive it is to borrow money. In this article, we will discuss how to calculate the APR using an Annualized Percentage Rate Calculator and the Annual Percentage Rate Formula, and we will also explore why it is essential to understand APRs.

Annualized Percentage Rate Calculator

The Annualized Percentage Rate Calculator is a simple tool that helps you calculate the APR of a loan. To use the calculator, you need to know the interest rate, loan term, and any fees associated with the loan.

Let's say you borrow $10,000 at an interest rate of 5% per year for five years. You also need to pay a fee of $100 upfront. The first step in calculating the APR is to calculate the total amount of interest you will pay over the life of the loan. In this case, the total interest paid is:

Interest = Principal x Interest Rate x Loan Term Interest = $10,000 x 5% x 5 Interest = $2,500

Next, you need to add any fees associated with the loan. In this case, the fee is $100. The total cost of the loan is:

Total Cost = Principal + Interest + Fees Total Cost = $10,000 + $2,500 + $100 Total Cost = $12,600

Finally, you need to calculate the APR using the following formula:

APR = (Total Cost / Principal) x (365 / Loan Term) x 100% APR = ($12,600 / $10,000) x (365 / 5) x 100% APR = 12.73%

So, the APR on this loan is 12.73%.

Annual Percentage Rate Formula

The Annual Percentage Rate Formula is a mathematical equation used to calculate the APR of a loan. The formula is:

APR = (2 x Number of Payments x Interest Rate / (Number of Payments + 1)) x 12 x 100%

Let's say you borrow $10,000 for one year at an interest rate of 6% per year, with monthly payments. The first step is to calculate the number of payments. In this case, there are 12 monthly payments:

Number of Payments = Loan Term x Payments per Year Number of Payments = 1 x 12 Number of Payments = 12

Next, you need to plug the numbers into the formula:

APR = (2 x 12 x 6% / (12 + 1)) x 12 x 100% APR = 12.68%

So, the APR on this loan is 12.68%.

Why is it important to understand APRs?

APRs are an essential concept to understand because they allow you to compare the costs of borrowing money across different lenders and loan products. For example, if you are looking to borrow $10,000, and you receive two loan offers, one with an APR of 10% and another with an APR of 15%, you can easily see that the second loan will cost you more in the long run.

Additionally, understanding APRs can help you make informed financial decisions. For example, if you are considering a credit card with a high APR, you may want to think twice about carrying a balance on the card, as the interest charges can quickly add up.

Conclusion

In conclusion, the APR is a crucial factor to consider when applying for loans or credit cards. It represents the cost of borrowing and allows you to compare different loan options. The annualized percentage rate calculator and annual percentage rate formula are helpful tools to calculate the APR. By understanding how to calculate APRs, you can make informed financial decisions that align with your goals and needs. Remember to take into account all fees and charges associated with the loan to get an accurate representation of the APR.

0 notes

Text

Simple Interest Loan Payment Calculator – Simple Interest Only Loan Calculator

If you're considering taking out a loan, it's important to understand the basics of simple interest loans and how to calculate your payments. One of the most useful tools for doing so is a simple interest loan payment calculator. Additionally, if you're considering a simple interest only loan, a simple interest only loan calculator can help you determine your payments and the total amount you'll pay over the life of the loan.

In this article, we'll take a closer look at what simple interest loans are, how to use simple interest loan payment calculators and simple interest only loan calculators, and some important things to consider before taking out a loan.

What is a Simple Interest Loan?

A simple interest loan is a type of loan in which interest is calculated only on the principal amount borrowed, and not on any accumulated interest. This means that your interest charges will be lower over time, as your balance decreases.

For example, let's say you borrow $10,000 at a simple annual interest rate of 5%. If you pay off the loan in one year, you'll owe $10,500 - $10,000 for the principal, plus $500 in interest. However, if you pay off the loan over a longer period of time, your interest charges will be lower, as you'll be paying down the principal over time.

Simple interest loans are commonly used for car loans, personal loans, and other types of consumer loans.

What is a Simple Interest Loan Payment Calculator?

A simple interest loan payment calculator is a tool that helps you calculate your monthly loan payments based on the loan amount, interest rate, and loan term. Simply enter these variables into the calculator, and it will provide you with an estimate of your monthly payment.

To use a simple interest loan payment calculator, follow these steps:

Enter the loan amount. This is the total amount you plan to borrow.

Enter the interest rate. This is the annual interest rate you will be charged on the loan.

Enter the loan term. This is the length of time you will have to repay the loan.

Click "Calculate" to see your estimated monthly payment.

Simple interest loan payment calculators are widely available online, and many banks and financial institutions offer them on their websites. They are typically easy to use and can help you estimate your monthly payments and total interest charges over the life of the loan.

What is a Simple Interest Only Loan?

A simple interest only loan is a type of loan in which the borrower pays only the interest charges for a certain period of time, typically the first few years of the loan. After this period, the borrower begins paying down the principal balance of the loan as well.

Simple interest only loans can be appealing to borrowers who want to keep their monthly payments low during the initial years of the loan. However, it's important to note that interest only loans can be riskier than other types of loans, as the borrower is not paying down the principal balance and may face higher payments in the future.

What is a Simple Interest Only Loan Calculator?

A simple interest only loan calculator is a tool that helps you estimate your monthly payments and total interest charges for a simple interest only loan. To use a simple interest only loan calculator, follow these steps:

Enter the loan amount. This is the total amount you plan to borrow.

Enter the interest rate. This is the annual interest rate you will be charged on the loan.

Enter the interest-only period. This is the length of time during which you will only be required to pay the interest charges.

Enter the loan term. This is the total length of time you will have to repay the loan.

Click "Calculate" to see your estimated monthly payment and total interest charges.

Conclusion

When it comes to taking out a loan, it's important to have all the information you need to make an informed decision. Using loan calculators can help you estimate your monthly payments, the total interest paid, and how long it will take to pay off your loan.

The Simple Interest Loan Payment Calculator and the Simple Interest Only Loan Calculator are both valuable tools for borrowers. The former helps borrowers estimate their monthly payments and the total interest paid on a simple interest loan, while the latter is helpful for borrowers who are considering a simple interest only loan.

Using these calculators can help borrowers make a more informed decision about their borrowing options and choose the loan that best suits their needs and financial situation.

0 notes

Text

Compound Investment Calculator – Investment Calculator Monthly – Money Compounding Calculator

If you're looking to invest your money, it's essential to have a clear understanding of the potential returns and risks of different investment options. One way to gain insight into these factors is by using investment calculators. In this article, we will discuss three essential investment calculators - Compound Investment Calculator, Investment Calculator Monthly, and Money Compounding Calculator - and how they can help you make informed investment decisions.

Compound Investment Calculator

A Compound Investment Calculator is a tool that helps you calculate the future value of an investment that compounds interest over time. Compound interest is the interest calculated on both the principal amount and accumulated interest, which allows your investment to grow more quickly than simple interest.

Using a Compound Investment Calculator is straightforward. You input the initial investment amount, interest rate, the number of years you plan to invest, and how often the interest compounds. The calculator then provides you with the future value of your investment.

For instance, let's say you invest $10,000 in a fund with an annual interest rate of 6% that compounds annually for ten years. The Compound Investment Calculator will show that your investment will be worth $17,908.89 at the end of the ten-year period.

Investment Calculator Monthly

An Investment Calculator Monthly is a tool that helps you calculate the monthly amount you need to invest to reach a specific financial goal. This calculator takes into account the length of time you plan to invest, the interest rate, and the initial investment amount.

Using an Investment Calculator Monthly can help you determine how much you need to save each month to reach your investment goals. For example, let's say you want to save $50,000 in ten years and have an initial investment of $5,000. With an annual interest rate of 8%, the Investment Calculator Monthly will tell you that you need to invest $365.11 each month to reach your goal.

Money Compounding Calculator

A Money Compounding Calculator is a tool that helps you calculate the impact of compounding interest on your savings over time. This calculator takes into account the initial investment amount, interest rate, the length of time you plan to invest, and how often the interest compounds.

Using a Money Compounding Calculator can help you understand how much your savings can grow over time. For example, if you deposit $5,000 into a savings account with an annual interest rate of 4% that compounds monthly, the Money Compounding Calculator will show you that your investment will be worth $7,025.18 after ten years.

How to Use These Calculators

Using these calculators is simple. You can find several online calculators that are free to use. Just input the required information, and the calculator will do the rest. However, it's important to remember that the results provided by the calculators are only estimates and should not be taken as guarantees.

When using these calculators, it's essential to consider other factors that may affect your investment returns. For example, taxes, inflation, and market volatility can all have an impact on the performance of your investments.

The Bottom Line

Investing your money can be a powerful way to build wealth over time, but it's essential to have a clear understanding of the potential returns and risks involved. By using investment calculators like the Compound Investment Calculator, Investment Calculator Monthly, and Money Compounding Calculator, you can make informed decisions about your investments.

Keep in mind that these calculators are just tools to help you estimate potential returns and are not guarantees of actual investment performance. It's also crucial to research your investment options carefully and consult with a financial advisor to make the best decisions for your unique financial situation.

In conclusion, using an investment calculator can be incredibly helpful when planning for your financial future. Whether you're looking to invest in stocks, real estate, or other ventures, understanding the power of compound interest and the potential returns on your investment is critical. By using a compound investment calculator, investment calculator monthly, or money compounding calculator, you can accurately estimate the growth of your investment over time and make informed decisions about how to allocate your funds.

Remember to consider all factors that can affect your investment, including fees, taxes, and market fluctuations. It's also important to regularly monitor your investments and adjust your strategy as needed. By taking a thoughtful and informed approach, you can make the most of your investment and achieve your financial goals.

0 notes

Text

Cash Back or Low Interest Calculator – Lowest Interest Rates on Car Loan

Are you in the market for a new car and looking for ways to save money on your car loan? You're not alone. Many car buyers today are seeking ways to minimize the financial burden of buying a new vehicle. Luckily, there are two tools that can help: the Cash Back or Low Interest Calculator and finding the Lowest Interest Rates on Car Loan. In this article, we'll explore these tools in more detail, helping you to make informed decisions about your car loan and save money in the process.

Cash Back or Low Interest Calculator

One of the most significant decisions you'll make when buying a new car is how to finance it. There are typically two types of incentives offered by car dealerships: cashback or low-interest rates. Cashback incentives offer buyers a lump sum of money after purchasing a car, while low-interest rates provide a discount on the interest paid over the life of the loan. But which one is better for you?

The answer will depend on your unique financial situation, including factors like your credit score, the price of the car, the amount of the loan, and the length of the loan. The Cash Back or Low Interest Calculator can help you determine which option is best suited for your needs.

The Cash Back or Low Interest Calculator takes into account all the factors mentioned above and calculates the amount of money you'll save with each incentive. For instance, if you're looking at a car priced at $30,000 and have been offered either $2,000 cashback or a low-interest rate of 2.5% over a five-year loan, the calculator can show you which option is more cost-effective.

Let's say, for instance, that the calculator tells you that the cashback incentive would save you $2,400 over the life of the loan, while the low-interest rate would save you $1,655. In this scenario, the cashback incentive would be the better option for you. You can use the Cash Back or Low Interest Calculator to play around with different numbers and find the best financing options for your needs.

Lowest Interest Rates on Car Loan

The interest rate on your car loan is another critical factor that can impact how much you pay over the life of the loan. As such, it's important to find the lowest interest rates on a car loan, and there are several ways to do so.

One of the most straightforward ways to find low-interest rates is to shop around and compare rates from different lenders. Banks and credit unions are a good place to start, and there are also online comparison tools you can use to compare rates quickly and easily.

Another way to get a lower interest rate is to improve your credit score. Lenders use credit scores to determine the risk of lending to you. The higher your credit score, the lower the interest rate you'll be offered. There are several ways to improve your credit score, including paying your bills on time, keeping your credit card balances low, and disputing any errors on your credit report.

Finally, you can also negotiate with the car dealer or lender to get a lower interest rate. If you have a good credit score and a solid financial history, you may be able to negotiate a lower rate.

Conclusion

Buying a car is a significant investment, and finding ways to save money on your car loan can make a big difference in your finances. The Cash Back or Low Interest Calculator and finding the Lowest Interest Rates on Car Loan are two tools that can help you achieve that goal.

By using these tools, you can make informed decisions about your car loan, whether it's determining whether a cashback or low-interest rate incentive is better for you or finding the lowest interest rates available. Be sure to shop around, compare rates, and work on improving your credit score to get the best financing deals possible.

0 notes

Text

Home Loan Calculator With Down Payment – HL EMI Calculator – House Down Payment Calculator

If you're considering buying a home, you're probably aware that it can be a complicated and overwhelming process. One of the most important aspects of purchasing a home is financing, and understanding the costs involved can help you plan and budget appropriately. That's where home loan calculators come in. In this article, we will discuss three different types of home loan calculators: the home loan calculator with down payment, the HL EMI calculator, and the house down payment calculator. By understanding how each of these calculators works, you can make more informed decisions about your home buying journey.