Don't wanna be here? Send us removal request.

Text

https://web.quantsapp.com/quantsapp-classroom/technical-analysis

Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Unlike fundamental analysis, which attempts to evaluate a security's value based on business results such as sales and earnings, technical analysis focuses on the study of price and volume.

0 notes

Text

Option Seller has more advantage when compared to Option buyer in the longer run.

Option Buyer Who bought the put option based on his bearish view in markets, if the markets starts moving upwards, then he would lose money.

0 notes

Text

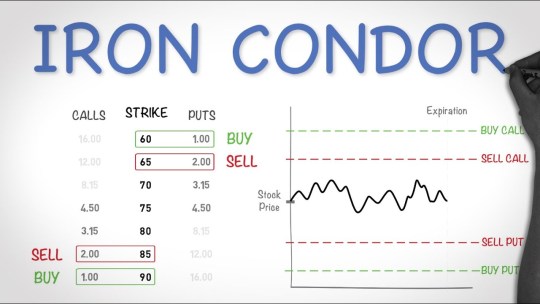

What is iron condor ?, learn with quantsapp classroom.

An iron condor is a choices technique comprising of two puts (one long and one short) and two calls (one long and one short), and four strike costs, all with a similar termination date. The iron condor procures the most extreme benefit when the hidden resource closes between the center strike costs at lapse. All in all, the objective is to benefit from low unpredictability in the fundamental resource.

The iron condor has a comparable result as a normal condor spread, yet utilizes the two calls and puts rather than just calls or just puts. Both the condor and the iron condor are augmentations of the butterfly spread and iron butterfly, separately.

0 notes

Text

Futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set future date for a set price. Futures contracts, or simply "futures," are traded on futures exchanges like the CME Group and require a brokerage account that’s approved to trade futures.

A futures contract involves both a buyer and a seller, similar to an options contract. Unlike options, which can become worthless at expiration, when a futures contract expires, the buyer is obligated to buy and receive the underlying asset and the seller of the futures contract is obligated to provide and deliver the underlying asset.

0 notes

Text

What are Derivatives are securities whose value is dependent on or derived from an underlying asset. For example, an oil futures contract is a type of derivative whose value is based on the market price of oil. Derivatives have become increasingly popular in recent decades, with the total value of derivatives outstanding was estimated.

0 notes

Text

https://web.quantsapp.com/quantsapp-classroom/technical-analysis/what-is-dow-theory

The Dow Theory has always been a very integral part of technical analysis. The Dow Theory was used extensively even before the western world discovered candlesticks. In fact, even today, Dow Theory concepts are being used. In fact, traders blend the best practices from Candlesticks and Dow Theory.

0 notes

Text

Learn more about option seller & option buyer .

Consider an illustration of buyer of a call option, also considered “Long Call”, NIFTY call option of strike 17650, with a premium of about Rs 155 and Lot Size of 50 with expiry date of 1 Sept 2022.

0 notes

Text

What is Sgx Nifty ?, learn in detail about sgx nifty future with Quantsapp classroom .

Singapore Stock Trade SGX is viewed as one of the main stock trade of Asia. SGX Nifty is a subsidiary of NSE Nifty Fates, which is very well known in Singapore Stock Trade. It is an appealing item for unfamiliar financial backers, who need to take a situation in the Indian securities exchange however don't have any desire to enlist with India specialists. SGX Nifty Future is additionally famous among Mutual funds who are uncovered in India market and need to support their openness. So in basic terms, SGX Nifty is only the Indian NIfty exchanged the Singapore Stock Trade.

0 notes

Text

https://web.quantsapp.com/quantsapp-classroom/open-interest/open-interest-defined

0 notes

Text

Learn the derivatives meaning with sgx nifty futures at Quantsapp classroom

A securities with a price that is based on or derived from one or more underlying assets is referred to as a derivative & sgx nifty futures.check the the live derivatives data with Quantsapp classroom .

#derivatives markets#derivative securities#derivatives revenue#derivatives contracts#derivative equity

0 notes

Text

Live Open Interest Chart analysis | Quantsapp

Open interest is the quantity of disrupted or extraordinary agreements of a specific subordinate instrument. It is a measurement or information point that helps check the merchants' cooperation in a fundamental. Rising Open Interest focuses at ascend in the exchanging interest the fundamental. This ascent could be a consequence of ascend in exchanging positions by assortment of exchanging members. The member might be retail or institutional. High open revenue really intends that there are huge number of subsidiary agreements actually open, and that implies market members are dynamic in that resource.

To know More About Open Interest - Nifty Open Interest

0 notes

Text

What is Open Interest ?.

Open interest is the quantity of disrupted or extraordinary agreements of a specific subordinate instrument. It is a measurement or information point that helps check the merchants' cooperation in a fundamental. Rising Open Interest focuses at ascend in the exchanging interest the fundamental. This ascent could be a consequence of ascend in exchanging positions by assortment of exchanging members. The member might be retail or institutional. High open revenue really intends that there are huge number of subsidiary agreements actually open, and that implies market members are dynamic in that resource.

1 note

·

View note