Don't wanna be here? Send us removal request.

Text

Uniswap Price Prediction: 3 Warning Signs Traders Must Watch Now!

Uniswap (UNI) is showing signs of bullish momentum, prompting traders to reassess the token’s next potential move. In a recent analysis shared by Crypto Man MAB, the Uniswap price prediction has turned optimistic as UNI pushed beyond a key resistance zone between $7.50 and $8.00 — a signal of renewed buying pressure.

Support and Resistance Define UNI’s Structure

Currently trading around $8.403 (+1.82%), UNI is testing new levels. The immediate support sits at $7.103, marking the 24-hour low. If this fails, the next key level lies around $6.50 — an area that has previously held as a strong bullish base.

On the resistance side, the price faces a cap near $8.677. A break above this could see UNI targeting the psychological $9.00 mark, which also aligns with bullish short-term projections.

Also Read: Toncoin Price Prediction 2025, 2026 – 2030

Volume Tells a Strong Story

A spike in trading volume has accompanied UNI’s recent surge, indicating strong conviction from buyers. Historically, high volume strengthens upward trends, and if sustained, this could push prices higher — provided there’s no sharp reversal.

Exchange Supply Concerns: On-chain data from Santiment reveals a troubling trend — UNI supply on exchanges has risen to 85.63 million, the highest since February. This jump from 69 million could hint at selling pressure as tokens move to exchange wallets.

Whale Activity: Whale holdings have dropped sharply to 747 million, down from 846 million in October 2023. Despite a price recovery, large players appear to be offloading.

Competitive Threats and Unichain’s Bright Spot

Competition is heating up. PancakeSwap and Hyperliquid are both outpacing Uniswap in recent volume. However, Unichain — Uniswap’s layer-2 solution — now ranks as the 6th largest DEX chain, surpassing platforms like Sui and Avalanche with $9.68B in 30-day volume.

While short-term bullishness exists, rising exchange balances and whale exits pose significant risks to the ongoing rally.

0 notes

Text

AAVE’s $312 Surge: Is This DeFi’s Next Big Price Move?

Aave, one of the pillars of the DeFi world, has captured investor attention once again. Its price recently surged to $312 before slightly retreating to $297.25. For those watching closely, this may be more than a typical rally—it could be a sign of stronger momentum ahead. Let’s explore why AAVE’s fundamentals are aligning for a potential breakout and what that means for its future Aave price prediction.

Strong Network Growth Behind the Surge

AAVE’s network fundamentals are improving rapidly:

Total Value Locked (TVL) jumped to $27.5 billion, up from April’s low of $16 billion.

Total borrowed amount has surged to $17.5 billion, a strong sign of user engagement.

Monthly fees increased from $33M in April to $40M in May, pushing cumulative revenue past $211.7M.

This financial growth suggests rising utility and demand on the platform—an essential driver for price strength.

Investor Confidence on the Rise

Another bullish signal lies in AAVE’s staking and trading metrics:

Staked AAVE coins reached $912M, up from $350M just earlier this month.

Futures open interest hit a record high of $745M, indicating rising speculative interest.

Exchange supply dropped from 3.8M in December to 3.06M now—less sell pressure.

Also Read: Render Price Prediction 2025, 2026 - 2030

Bubble Risk and Technical Indicators

The Short-Term Bubble Risk Indicator stands at 1.37, suggesting bullish energy but also flagging caution. Past data shows that similar levels have led to sharp corrections, so monitoring volatility is key.

Technically, the 50-day SMA sits at $226.26, and the 200-day SMA at $240.00—both still below the current price, supporting upward momentum.

Final Thoughts

AAVE’s price action is backed by real growth and strong fundamentals. While the signs point toward continued upside, investors should watch closely for overheating. The next few weeks could define AAVE’s position in this DeFi cycle.

0 notes

Text

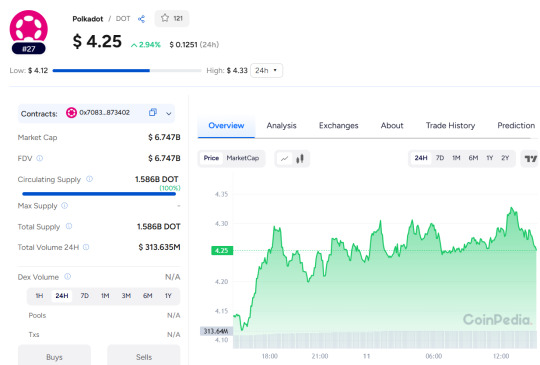

Polkadot Price Prediction: Bullish Reversal Signals as Community Backs Crypto Card

Polkadot (DOT) is showing signs of a potential trend reversal, catching the attention of seasoned crypto traders. With a bullish “inverse head and shoulders” formation on the daily chart and upward indicators from both the Relative Strength Index (RSI) and Stochastic Oscillator, DOT’s price prediction has turned optimistic in the short term.

Bullish Chart Patterns Signal Strength

DOT has broken out of a falling wedge pattern—a bullish setup—and has since been climbing steadily. The key bullish reversal pattern, the inverse head and shoulders, reinforces this upward movement. Currently, bulls are aiming for the next resistance level at $5.37, which marks the highest point from May 11. However, a drop below $3.60 would invalidate this outlook.

Read Polkadot Price Prediction for 2025 - 2030

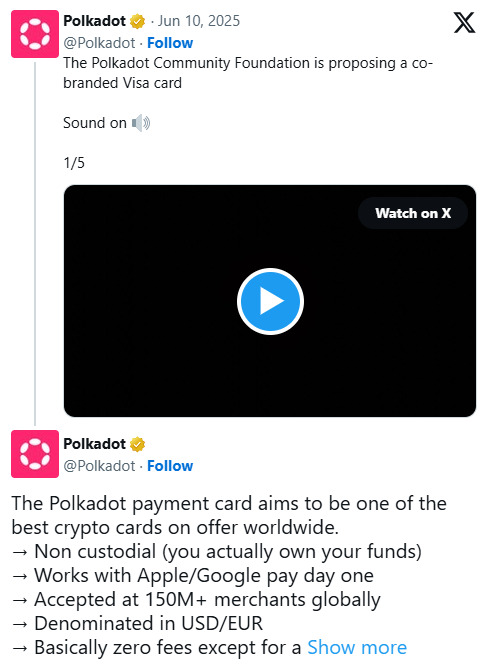

Polkadot's Community-Driven Growth

A major driver behind DOT’s current momentum is the ongoing community vote on launching a Polkadot crypto payment card. Here’s why this matters:

The card will be non-custodial, fee-minimized, and offer cashback.

It will support daily spending globally, with EUR and USD integration.

Over 136,900 DOT tokens (valued at over $570,000) have already been cast in favor, with the vote open for another 27 days. If the initiative passes and gains adoption, it could enhance DOT's real-world utility—bringing more attention and potentially increasing demand.

Also Read: Toncoin Price Prediction 2025, 2026 – 2030

Scaling Up With Elastic Core Integration

Beyond the card, Elastic Scaling is another major development. This upgrade allows parachains to dynamically add multiple cores, improving throughput and reducing congestion.

Asynchronous backing has already halved block times (from 12s to 6s).

Agile coretime has ended the need for parachain auctions, making onboarding easier.

With technical indicators, ecosystem upgrades, and strong community backing, Polkadot is setting the stage for a bullish rally—pending user adoption and vote outcomes.

0 notes

Text

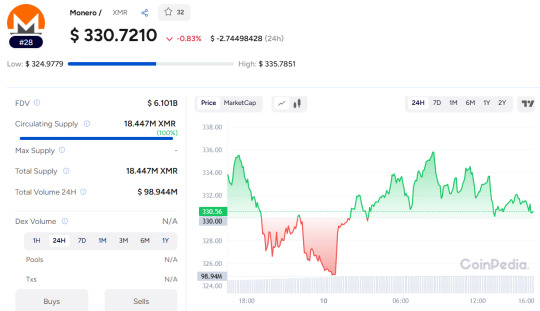

Monero (XMR) Rallies 86% in 2025: What’s Fueling the Surge?

Monero (XMR) has emerged as one of 2025’s top-performing cryptocurrencies, showing a sharp 86% price increase since the start of the year. With the current price sitting at $330.56 and a 24-hour trading volume of over $98 million, Monero is gaining significant momentum. This performance has sparked new interest in XMR’s future and raised fresh questions around its Monero price prediction.

Monero Beats Bitcoin and Climbs the Rankings

So far in 2025, Bitcoin has gained around 12%. In contrast, Monero’s 86% surge has pushed it into the list of the top 25 cryptocurrencies by market cap—now over $7.5 billion. It has overtaken established tokens like Litecoin and Toncoin.

Here’s a snapshot of the key stats:

Circulating Supply: 18.4 million XMR

24-hour change: -0.99%

1-hour change: -0.35%

Despite slight intraday losses, Monero continues to perform well over the long term.

Privacy Strength Amid Regulatory Pressure

Monero remains a privacy-focused favorite, and that appeal hasn’t faded—even with ongoing regulatory scrutiny. Its price has jumped 150% year-over-year, coming closer to its 2021 all-time high of $517.

Also Read: Bitget Price Prediction 2025, 2026 – 2030

Market Sentiment Remains Bullish

Several influential voices on social media have noted XMR’s strength:

@MoneroMavrick observed that holding above $330 after reaching $417 signals a stronger correction than in past cycles.

@xmrstreet pointed to Monero’s growing appeal among new investors due to its privacy features.

@AltCryptoGems stressed the importance of holding a key support level for another breakout.

Monero is showing strength in both technical and market sentiment aspects. If it maintains current levels, XMR may be poised to retest or surpass its previous highs—making its price prediction a topic worth watching closely.

0 notes

Text

Ethereum Price Prediction: Whales Are Buying ETH: Is $3,000 Next?

Ethereum is once again in the spotlight as institutional activity intensifies. The current market price stands at $2,487.63, with a 24-hour trading volume of $13.31 billion. Despite short-term bearish sentiment, large-scale buying by institutions is reshaping the Ethereum narrative and influencing the broader Ethereum price prediction landscape.

Institutional Interest Gains Momentum

On June 2, BlackRock and Fidelity made strategic shifts in their digital-asset portfolios. They sold $180 million worth of Bitcoin and purchased $78 million of Ethereum. BlackRock now holds over 214,000 ETH—valued at around $560 million—acquired since May, including a single 5,000 ETH transaction executed via Coinbase Prime.

This move signals growing institutional confidence in Ethereum’s long-term utility and value.

Price Movement Remains Limited

Ethereum has been range-bound between $2,323 and $2,738, reflecting consolidation:

The 20-day EMA is close to $2,515, indicating short-term pressure.

RSI is trending lower, signaling weakening momentum.

If the price surpasses $2,738, analysts expect a possible rise toward $3,000 and $3,153. However, a drop below $2,323 could bring the next support level at $2,111 into focus.

Also Read: Coinpedia's Exact Ethereum Classic Price Prediction 2025, 2026 – 2030

ETFs Continue to Attract Capital

Spot Ethereum ETFs have seen consistent inflows for 14 consecutive trading days, totaling more than $800 million. BlackRock’s iShares Ethereum Trust (ETHA) leads the market, with:

$3.7 billion in assets under management.

Over 1.5 million ETH held.

Nine straight days of inflows and a 40% monthly gain in share value.

This trend reflects growing institutional demand, despite Ethereum’s recent 6% price decline.

Market Stability Amid Volatility

Ethereum faced $24 million in short liquidations, the highest since February 2025. On-chain data also recorded over $40 million in combined long and short losses in a single day. Despite this, Ethereum’s market dominance has risen to 9.3%, highlighting its resilience during volatile conditions.

#investing#bitcoinnews#blockchain#btc#bitcoinmining#binance#bitcoincash#cryptocurrency#bitcoin#crypto

0 notes

Text

Is Toncoin Price Ready to Surge? Key Signals Suggest a Breakout

Toncoin (TON) is quietly building momentum beneath the surface. As the crypto market slows, smart money is watching TON’s subtle signals. With the live price at $3.1152 and 24-hour volume at over $331 million, the stage may be set for a significant move. Many traders are turning their attention to Toncoin price prediction as metrics signal rising bullish interest.

Strong Support and Healthy Holder Data

IntoTheBlock data shows that 71.28% of TON holders are currently “in the money,” suggesting a majority of investors are holding at a profit. Just 11.52% remain underwater, limiting the chance of heavy sell-offs.

Most of TON’s long-term holders entered the market below $3.05, which now forms a strong support zone.

On the flip side, resistance could emerge near the $5–$6 range, where many holders may look to break even.

Also Read: Tron Price Prediction 2025, 2026 - 2030

Transaction Volumes Signal Investor Confidence

TON’s network activity is growing rapidly, with significant participation from both retail and institutional investors:

Transactions between $1M and $10M jumped 80%

Transfers over $10M surged 50%

Even $10K–$100K transfers are on the rise

This growing diversity suggests broader interest and market strength.

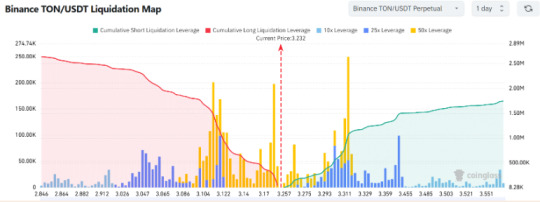

Derivatives Data Hints at Volatility Ahead

Open Interest has risen by 4.28% to $230.72M, while derivatives volume increased 14.95% to $174.86M. These metrics point to renewed speculative activity—often a precursor to price swings.

Key Levels to Watch

The Binance liquidation heatmap shows heavy short positions clustered at $3.31 and $3.50. A price move beyond these levels could trigger a short squeeze, accelerating the rally.

If bulls defend the $3.05–$3.10 range and break above $3.31, Toncoin’s price could rapidly target $4.27—and possibly higher, fulfilling the optimistic forecasts for TON’s next leg up.

0 notes

Text

Whales Are Back: Is Uniswap About to Explode?

Uniswap (UNI) is currently trading at $6.3020, down by 0.53% in the past hour and 5.64% over the last 24 hours. Despite this short-term dip, growing whale activity and new ecosystem developments suggest bullish undercurrents, supporting a positive Uniswap price prediction in the near term.Aa

UNI’s price sits above the 50-day Simple Moving Average (SMA) of $5.9265, but still well below the 200-day SMA at $9.3644—signaling a market in transition. The current circulating supply of UNI stands at 628.7 million tokens, and trading volume over the past 24 hours exceeds $372 million, reflecting strong market participation.

A major catalyst is the launch of Spark on Unichain, Uniswap's Layer-2 network built using Optimism’s OP Stack. This new feature introduces native stablecoin yields on USDC, offering Uniswap users the ability to earn passive income directly on the platform.

Spark Finance is also now live on Optimism, extending yield opportunities through sUSDS—another stablecoin issued by Sky. These yields can be utilized across DEXs and DeFi lending platforms, deepening Uniswap’s integration within the broader DeFi ecosystem.

Also Read: Bittensor Price Prediction 2025, 2026 – 2030

Moreover, recent data from IntoTheBlock reveals a sharp uptick in large UNI transactions (over $100,000). This spike points to renewed whale interest. Such activity during a consolidation phase is often interpreted as accumulation, a pattern that historically precedes bullish breakouts.

While UNI faces near-term selling pressure, the combination of protocol innovations and institutional-sized transactions offers a promising outlook. Investors should monitor both price trends and on-chain activity, as these developments may be signaling the early stages of a trend reversal.

With yield opportunities increasing and whale interest rising, Uniswap may be positioning itself for a stronger performance in the weeks ahead.

0 notes

Text

BNB Eyes $800 as Technicals and On-Chain Metrics Align Bullishly

Binance Coin (BNB) has caught the market’s attention with a bullish breakout from a symmetrical triangle pattern on May 8. Formed between January and early May, the pattern signaled potential strength, and BNB followed through with a 10% rally. Since then, the price has been consolidating between $638 and $696 for over three weeks. At the time of writing, BNB trades around $668, with many traders closely watching this range for the next move in the ongoing BNB price prediction narrative.

A daily close above the $696 resistance could signal the next leg up toward the pattern’s theoretical target of $839.14. Intermediate resistance zones lie at $709.29 (weekly level) and $732 (February 13 high), where some profit-taking may occur. Supporting this bullish bias, the Relative Strength Index (RSI) is at 55, trending upward after a bounce from the neutral 50 level.

Market analyst Master Kenobi has added fuel to the fire, suggesting that BNB could surpass the $800 mark. This outlook is underpinned by favorable Ichimoku Cloud signals, where BNB is trading well above the cloud. A bullish Tenkan-sen/Kijun-sen crossover and a Chikou Span breakout above historical price levels confirm growing bullish momentum.

Also Read: Toncoin Price Prediction 2025, 2026 – 2030

Backing the technical signals is strong on-chain activity. According to Token Terminal, BNB’s ecosystem trading volume hit a yearly high of $11.35 billion on Sunday. Similarly, Atermis data shows that stablecoin supply on BNB reached $10.2 billion last week—also a YTD high. This surge in liquidity and user engagement, driven by DeFi and meme coins, highlights growing confidence in the BNB chain.

While a downside test of $638 remains possible in case of a correction, the convergence of technical strength and improving fundamentals makes BNB one of the altcoins to watch closely in the coming weeks.

1 note

·

View note

Text

Ethereum Price Prediction: Bullish Signs Face Bearish Pressure

Ethereum (ETH) has nearly doubled since its April low of $1,385, trading close to $2,500. However, despite the price recovery, both technical charts and on-chain data suggest potential downside risks that could impact short-term Ethereum price prediction.

Daily Chart Hints at a Breakout, but Momentum Lags

Ethereum has formed an inverse head-and-shoulders pattern on the daily chart, often seen as a bullish indicator. A breakout above the neckline at $2,700 could push ETH toward $4,150. A recent golden cross between the 50- and 200-day moving averages also supports the bullish outlook.

However, weak trading volume and a cooling Relative Strength Index (now at 56) indicate fading momentum. Unless ETH closes decisively above $2,700, the setup risks invalidation, possibly pulling prices down to $2,300 or lower.

Key Resistance Holding Back Weekly Gains

The weekly chart shows strong resistance between $2,530 and $2,575, marked by:

A flipped multi-year trendline and 0.382 Fibonacci level

The 50-week EMA, which ETH has failed to break

If Ethereum gets rejected at this zone, it could drop toward $1,975, with extended losses down to $1,075 if bearish conditions worsen.

On-Chain Signals Point to Distribution

Recent spikes in the taker buy/sell ratio suggest aggressive buying, but with no significant price movement, indicating whales may be selling into the rally. Rising exchange reserves further confirm potential distribution.

Also Read: Filecoin Price Prediction 2025, 2026 – 2030

Layer-2 Growth Offers Support

Despite price struggles, Ethereum’s Layer-2 networks are thriving, processing over 15x more transactions than the base layer. This shows strong network utility, which could cushion downside risks.

Meanwhile, futures market sentiment remains neutral, even after heavy liquidations, with the annualized premium steady at 6%.

Ethereum now stands at a critical level. A move above $2,700 may reignite bullish momentum, but failure could lead to a deeper correction.

1 note

·

View note

Text

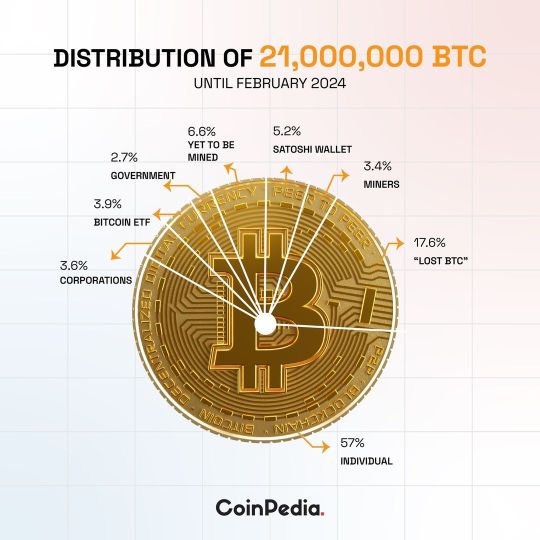

Unlocking the Secrets of Bitcoin:

With 57% held by individuals and 17.6% 'lost', the crypto landscape reveals its mysteries.

As 6.6% awaits mining, the saga of Satoshi Nakamoto's creation continues.

#BitcoinInsights #CryptoJourney 🚀

0 notes

Text

Dive into the Crypto Evolution: From Bitcoin and Ethereum to the Rise of Tether, Binance Coin, and Solana 🚀 Discover the dynamic changes shaping the digital currency landscape from 2019 to 2024! #CryptoEvolution #Bitcoin #Ethereum #Tether #BinanceCoin #Solana

0 notes

Text

Bitcoin enters a new chapter as the 2024 halving slashes mining rewards to 3.125 BTC.

The stage is set for excitement and speculation as the cryptocurrency world braces for the impact. 🚀

0 notes

Text

🌟 Unlocking Bitcoin's Potential: Halving Explained 🌟

Ever wondered why Bitcoin halving matters? Here's a glimpse into its significance and impact:

🔒 Controlled Supply: Ensures sustainability by reducing mining rewards and emphasizing transaction fees.

💰 Inflation Control: Slows down the rate of new Bitcoin creation, curbing inflation and preserving value.

💡 Increasing Scarcity: With each halving, Bitcoin becomes scarcer, potentially driving its value higher over time.

💼 Encouraging Investment: Investors anticipate halving events, seeing them as a signal for potential price appreciation.

Curious to dive deeper? Let's explore the fascinating world of Bitcoin halving together! 🚀 #Bitcoin #HalvingExplained #CryptoInsights

#investing#bitcoinnews#blockchain#btc#cryptocurrency#bitcoincash#bitcoinmining#binance#bitcoin#crypto

1 note

·

View note

Text

Dive into the week's top losers in the #cryptomarket #wormhole leads with a -17.95% drop, followed by #Uniswap at -14.98% and Maker at -13.44%. Stay informed as we navigate the ups and downs of crypto! And Read Our Research Report

#crypto#bitcoinnews#btc#blockchain#investing#binance#cryptocurrency#bitcoin#bitcoincash#bitcoinmining

0 notes

Text

Exciting news from Hong Kong! 🚀 HashKey Capital Limited and Bosera Capital have received approval from the Securities and Futures Commission to launch exchange-traded funds (ETFs) linked to the spot prices of Bitcoin and Ethereum. 🎉 This marks a major milestone in bringing cryptocurrencies into the traditional financial fold, offering investors exciting new opportunities to dive into the world of digital assets. 🌟

#CryptoETFs#HongKongCrypto#Bitcoin#Ethereum#InvestmentOpportunity#bitcoinnews#investing#blockchain#btc#binance#cryptocurrency#crypto#bitcoinmining

0 notes

Text

🌍💰 From the USA to El Salvador, guess which countries are stocking up on #Bitcoin?

With over 566,277 BTC in reserves, these nations are making a big move in the crypto space!

#HODL #GovernmentPower #CryptoReserves #Coinpedia

0 notes

Text

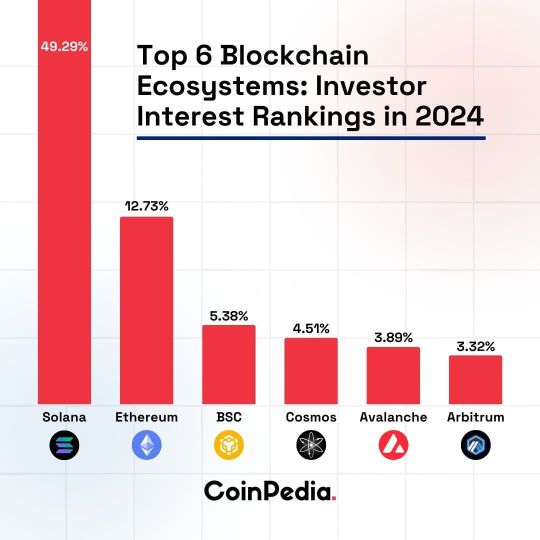

Diving into the Blockchain Ecosystem: Solana Leads the Pack with 49.3% Investor Interest in 2024! 🚀

@cryptocurrency @cryptotheism @cryptonature @cryptocism @crypticsim Solana price prediction

#BlockchainEcosystem#InvestorInterest#Solana#Ethereum#BNB#CryptoMarket#DigitalAssets#BlockchainTrends#CryptoInvesting#MarketAnalysis#bitcoin#crypto#btc#investing#blockchain#bitcoinnews#binance#cryptocurrency

0 notes