#bitcoinmining

Explore tagged Tumblr posts

Text

Bitcoin’s Energy Usage: The Most Misunderstood Innovation in Human History

They say Bitcoin is boiling the oceans. That it’s an environmental villain. That its energy use is unjustifiable.

But what if the real crime isn't the energy Bitcoin uses, but the narrative built to demonize it? What if Bitcoin isn’t the problem... but the blueprint for the solution?

Let’s talk truth. Let’s rip apart the lazy headlines and go deeper. Because beneath the noise is a revolution most people still don’t understand.

Bitcoin uses energy. So does everything that matters.

The media loves to compare Bitcoin to Visa or PayPal, painting it as inefficient or unsustainable. But that’s like comparing a flashlight to the sun. Visa runs on the rails of a trusted, centralized system. Bitcoin is the rail. It’s the whole damn thing—a self-contained, decentralized monetary system that operates without permission, politics, or backroom deals.

Its energy use isn’t a bug. It’s the bedrock. Proof-of-Work ties digital value to physical reality. It makes Bitcoin incorruptible. You can’t fake a Bitcoin. You can’t conjure it with a keystroke. You earn it by anchoring to the laws of thermodynamics. It’s not "magic internet money" – it’s physics-backed truth in a world of fiat fiction.

Meanwhile, the traditional financial system gets a free pass. Nobody counts the fuel burned by fleets of armored trucks hauling cash. Or the skyscrapers lit 24/7. Or the servers running endless transactions across thousands of banks, hedge funds, and central banks. No one questions the carbon footprint of the military-industrial complex that keeps the petrodollar on life support.

Bitcoin replaces all that bloat with software. With math. With consensus instead of coercion. It doesn’t require tanks to back it up. It doesn’t need to spy on you to enforce rules. It just runs. Borderless. Permissionless. Unstoppable.

But here’s where things get interesting.

Bitcoin mining isn’t just not bad for the environment. It could be the greatest tool we’ve ever had for energy innovation.

Across the globe, Bitcoin miners are setting up shop where energy is cheap, stranded, or wasted. Remote hydro in the mountains. Natural gas flares in oil fields. Oversupplied wind farms with nowhere to send excess power. Miners turn this lost energy into economic value. They act as a buyer of last resort—a pressure release valve for unstable grids and a reason to build more renewables.

This isn’t hypothetical. It’s happening right now. In Texas, Bitcoin miners are helping stabilize the grid. In parts of Africa, they're jumpstarting economic activity by creating demand where there was none. This is not an energy hog. This is a global infrastructure upgrade wrapped in code.

So why the backlash?

Because Bitcoin exposes the rot. It shines a light on the inefficiency, the fragility, and the waste embedded in the old system. It asks uncomfortable questions. It refuses to play by the rules of fiat gatekeepers. And that scares people.

It forces us to confront the truth: that energy isn’t the problem. Corruption is. Misaligned incentives are. And Bitcoin is the first monetary network in human history that rewards transparency, efficiency, and truth.

We’re witnessing the dawn of a new era—one where money is no longer a tool for control, but a tool for freedom. One where energy isn’t rationed by bureaucracy, but unleashed by innovation.

Bitcoin’s energy use isn’t a moral failing. It’s the cost of freedom. The cost of opting out. The cost of building something better.

We’ve misunderstood the most important innovation of our time.

But the block clock keeps ticking. And history has a way of proving the truth.

Tick tock. Next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#BitcoinEnergy#ProofOfWork#SoundMoney#FixTheMoneyFixTheWorld#Decentralization#DigitalGold#BitcoinIsHope#CryptoRevolution#FinancialFreedom#EnergyInnovation#BitcoinMining#EndTheFUD#MonetaryRevolution#UnpluggedFinancial#TickTockNextBlock#BitcoinFixesThis#SustainableFuture#EconomicTruth#EnergyFUD#financial empowerment#blockchain#finance#globaleconomy#digitalcurrency#financial education#financial experts#unplugged financial#cryptocurrency

5 notes

·

View notes

Text

#PakistanCrypto#ChangpengZhao#BlockchainTechnology#DigitalCurrency#CryptocurrencyRegulation#Web3#BitcoinMining#CryptoInnovation#PCC#Binance#AIDataCenters#DigitalTransformation#CryptoEconomy#PakistanTech#FinTech#BlockchainInfrastructure

2 notes

·

View notes

Text

Peer-to-peer (P2P) lending is a decentralized financial model that connects borrowers directly with individual investors (lenders) through an online platform. This system eliminates traditional intermediaries, such as banks, and allows both borrowers and lenders to benefit from lower fees and higher returns.

#blockchains#blockchain#cryptocurrency#blockchaintechnology#bitcoin#crypto#blockchainnews#ethereum#bitcoinnews#cryptotrading#bitcoins#blockchainrevolution#bitcoinmining#cryptocurrencies#btc#cryptonews#blockchainwallet#cryptocurrencynews#cryptoinvestor#nft#blockchaintech#litecoin#bitcoincash#binance#decentralized#bitcointrading#web#cryptoworld#eth#blockchainfund

2 notes

·

View notes

Text

From the desert to the bottom of the sea, we stay stacking sats 🏜️🌊🐳

Leave your thoughts below in the comments ⬇️ #bitcoin #crypto #bitcoinmining #btcfi

#bitcoin#crypto#binance#blockchain#ethereum#investing#nft#web3#web3community#web3gaming#bitcoin mining#bitcoinmining#btcfi

2 notes

·

View notes

Text

#Bitcoin#Crypto#DigitalEnergy#BTC#Blockchain#Decentralization#CryptoMining#Web3#FutureOfMoney#BitcoinMining#HODL#Ethereum#FinancialFreedom#EnergyRevolution#BitcoinNetwork#DigitalGold

2 notes

·

View notes

Video

youtube

Welcome to the New Era of Bitcoin Mining!

3 notes

·

View notes

Text

#Bitcoin mining profitability is reaching historic lows, according to recent data.

As the landscape continues to shift, miners are facing unprecedented challenges.

Stay updated with the latest trends

2 notes

·

View notes

Text

Buy virtual card with bitcoin and get #discount

Unlimited transition and Buy virtual credit card with cryptocurrency

#crypto updates#crypto token#crypto mining#crypto bot#crypto airdrop#cashmaster#cashmoney#investmentcard#bitcoinmining#cryptowallet#cryptomarket#cryptochain#cryptonews#cryptomoney

2 notes

·

View notes

Text

The mining process in the world of Bitcoin: understanding the depths of the process and profit opportunities In the world of digital currencies, the mining process is a vital part of the currency system, where miners are involved in processing and verifying transactions across the blockchain network. Miners receive a reward in modern Bitcoin for their efforts in this process. How to mine digital currencies: This process relies on the computers used to integrate new transactions into the Bitcoin blockchain. Although verification is relatively easy for computers, the process becomes more difficult as algorithms become more complex and processing speed increases. Miners try to get bitcoin users around the world to agree to a single copy of a transaction, competing on a peer-to-peer network to win bitcoins. As processing power increases, devices attempt to obtain bitcoins, as well as increased transaction fees. Mining process: Processing power speed refers to the hash rate, and the processing power is called hardware hash power. The miner's winning time is set at around 10 minutes, and the mining difficulty changes automatically to ensure stability. The mining process depends on practical proof, where the prospector provides proof of solving the mathematical problem. The miner is rewarded with the bitcoins generated and transaction fees. Terms like nonce refer to random objects that are used to attempt to complete the verification process. Once proof of work is found, a new block is discovered and verified over the peer-to-peer network. The mining reward is reduced over time and halved every 210,000 blocks. summary: The mining process is considered one of the important aspects in the world of digital currencies, and many digital currencies play an important role in the digital economy, and among these digital currencies Bitcoin stands out. Individuals can start mining and explore profit opportunities by participating in the process.

#تعدين_البيتكوين#BitcoinMining#Blockchain#بيتكوين#عملة_رقمية#CryptoMining#تكنولوجيا_البلوكشين#Cryptocurrency

3 notes

·

View notes

Text

Looks like NFT prices have hit rock bottom.

Get your monkey for nothin' and your chimps for free.

I want my, I want my, I want my NFT.

#NFT#DireStraits#rockbottom#monkeyfornothing#getyourmonkey#forfree#IRONY#cryptocurrency#blockchain#bitcoinmining#wasteofmoney#cryptoscams#humor#artists on tumblr#acrylic#dailyartwork#artoftheday#artwork#painting#kunst#lowbrowart#outsiderart#flomm#flommist#beercoaster#beermat#perspective

4 notes

·

View notes

Text

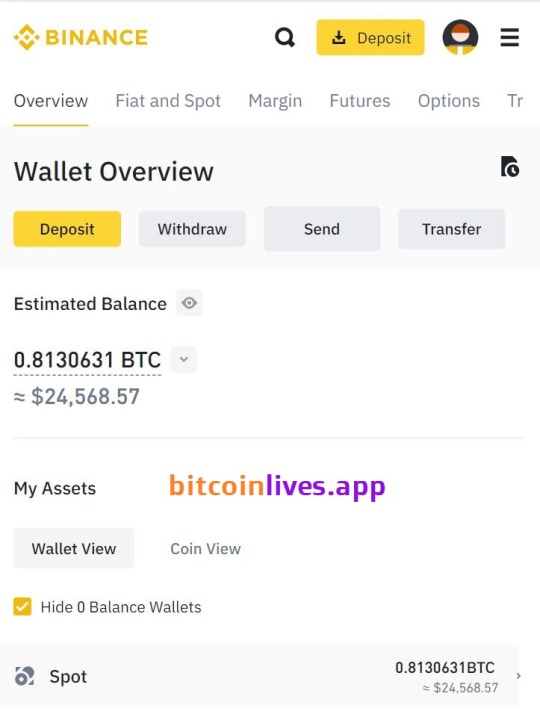

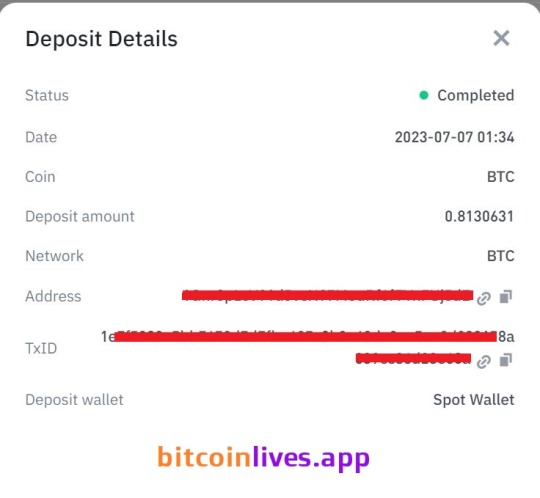

Bitcoin Mining platform

Bitcoin Live App is a crypto mining platform to help you start earning BTC! It contains the most necessary tools for working with digital assets: cloud bitcoin mining equipment with high hash power. It is a meta-universe of crypto investments available to everyone.

How does Bitcoin Mining App work?

Previously, to mine cryptocurrencies, you had to buy equipment and then recoup its cost. Bitcoin Live App allows you to start mining right now with a minimum cost threshold.

We have developed a quantum decryption algorithm to mine Bitcoin at unsurpassed speed. You only have to log in and activate our process with very simple steps, the magic happens in our the magic happens in our mining farms, so you just have to wait for your profits to be generated. No more hassle with buying and maintaining equipment or mining pools.It's easiest and most efficient way to make money from cryptocurrency mining without having to buy and maintain your equipment. Just choose and buy the best Crypto Mining Key for you and start earning today!

Join over 50.000 people with the world’s leading hashpower provider

During this time, We have won the trust of thousands of users. So, join our Platform and start earning bitcoin today by using our mining website. Start mining the quick way, Generate 1 BTC fast and easy with instant withdraw.

138 notes

·

View notes

Text

Understanding the Bitcoin Halving: What It Means for the Future

Introduction

In the ever-evolving world of cryptocurrencies, the term "Bitcoin halving" frequently pops up in discussions, often accompanied by predictions of significant market shifts and opportunities. But what exactly is Bitcoin halving, and why does it hold such importance? In this blog post, we'll explore the mechanics behind Bitcoin halving, its historical impacts, and what it could mean for the future of Bitcoin and the broader financial landscape.

What is Bitcoin Halving?

Bitcoin halving is a predetermined event that occurs approximately every four years, or after every 210,000 blocks are mined. During this event, the reward for mining new blocks is halved, effectively reducing the rate at which new Bitcoins are created. This mechanism is built into Bitcoin's code as a deflationary measure to control the supply of Bitcoin over time.

The Mechanics Behind Bitcoin Halving

To understand the significance of halving, it's essential to grasp how Bitcoin mining works. Bitcoin miners use powerful computers to solve complex mathematical problems, validating transactions and adding them to the blockchain. As a reward for their efforts, miners receive a certain number of Bitcoins. Initially, this reward was set at 50 Bitcoins per block. However, after the first halving in 2012, it dropped to 25 Bitcoins, then to 12.5 in 2016, and most recently to 6.25 in May 2020. The latest halving in 2024 reduced the reward to 3.125 Bitcoins per block.

Historical Impact of Bitcoin Halving

Historically, Bitcoin halving events have been followed by significant price increases. The reduced supply of new Bitcoins tends to create a scarcity effect, driving demand and, consequently, the price. For example, after the 2012 halving, Bitcoin's price rose from around $12 to over $1,000 within a year. Similarly, post-2016 halving, the price surged from approximately $650 to nearly $20,000 by the end of 2017.

However, it's crucial to note that while past performance can provide insights, it doesn't guarantee future results. Various factors, including market sentiment, regulatory developments, and technological advancements, can influence Bitcoin's price.

The 2024 Halving and Its Impact

The 2024 halving has already made its mark on the Bitcoin market. Here are a few notable outcomes and their implications:

Increased Scarcity and Higher Prices: As anticipated, the reduction in new Bitcoin supply created a scarcity effect, driving prices higher. This attracted more investors, further fueling the price surge.

Greater Miner Efficiency: With reduced rewards, miners sought more efficient ways to operate, leading to advancements in mining technology and energy use. This has also driven a shift towards sustainable energy sources in mining operations.

Market Maturity: Bitcoin continues to mature as a store of value and medium of exchange. The halving event reinforced Bitcoin's deflationary nature, appealing to those seeking a hedge against inflation.

Potential Market Corrections: While prices have generally increased, the market has also experienced corrections. High volatility remains a hallmark of the crypto market, and investors should be prepared for potential price swings.

What the Future Holds

As we move forward, the crypto community remains abuzz with speculation. Here are a few potential outcomes and their implications:

Continued Price Growth: Following the trend of previous halvings, Bitcoin may continue to see price growth as demand outstrips supply.

Innovations in Mining: The push for more efficient and sustainable mining practices could lead to significant technological advancements.

Increased Adoption: As Bitcoin's deflationary nature becomes more apparent, we may see increased adoption as a store of value and medium of exchange.

Regulatory Developments: Ongoing regulatory developments could play a crucial role in shaping the future of Bitcoin and the broader cryptocurrency market.

Conclusion

Bitcoin halving is a critical event that underscores the unique economic model of Bitcoin. By systematically reducing the supply of new Bitcoins, halving events contribute to Bitcoin's scarcity and deflationary characteristics. As we look to the future, the 2024 halving has already shown significant market developments, impacting miners, investors, and the broader financial ecosystem. Whether you're a seasoned investor or a newcomer, understanding Bitcoin halving is essential to navigating the ever-changing landscape of cryptocurrencies.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Let’s learn about the Bitcoin Revolution together. Your financial freedom starts now!

#Bitcoin#Cryptocurrency#BitcoinHalving#Blockchain#Crypto#DigitalCurrency#BitcoinMining#CryptoInvesting#FinancialRevolution#EconomicFreedom#InflationHedge#CryptoCommunity#CryptoMarket#BTC#CryptoEducation#FutureOfMoney#DeflationaryCurrency#DigitalAssets#Bitcoin2024#CryptoInsights#financial education#unplugged financial#globaleconomy#financial experts#financial empowerment#finance

7 notes

·

View notes

Text

العملات الرقمية :تحليل أفضل العملات الرقمية للاستثمار لعام 2024

Digital currencies: analysis of the best digital currencies for investment for 2024

In the era of expanding the digital economy, digital currencies remain one of the most prominent engines of the modern financial revolution . Investing in them may be an important step to achieve profit, success and sustainable . In this article ,we will give a detailed look at the best digital currencies to invest in 2024.

Since its inception at the beginning of the Twenty-First Century, digital currencies represent a unique economic phenomenon that has expanded very rapidly to form an integral part of the global financial system . With the advancement of time, these currencies have become not just means of electronic payments .They have become valuable investment tools with unlimited potential to achieve high returns

In recent years, we have witnessed a significant increase in interest in digital currencies, as they have become the focus of attention of large and small investors alike, but with this boom, the market remains full of volatility and risks that investors should be aware of .

#Cryptocurrency#Blockchain#Bitcoin#Ethereum#CryptoTrading#CryptoInvestment#BitcoinMining#DecentralizedFinance#DeFi#NFT (Non-Fungible Tokens)#Altcoins#CryptoNews#DigitalAssets#CryptocurrencyMarket#CryptoCommunity

3 notes

·

View notes

Link

0 notes

Text

0 notes

Text

"Mastering Bitcoin" by Andreas M. Antonopoulos is a comprehensive guide for anyone looking to understand the technical underpinnings of Bitcoin and blockchain technology. Whether you're a developer, investor, or simply a tech enthusiast, this book provides a deep dive into how Bitcoin works, its security model, and its potential applications. Below is a step-by-step breakdown of the outcomes you can expect after reading this book, presented in a user-friendly manner:

#Bitcoin#Cryptocurrency#Blockchain#BitcoinDevelopment#Crypto#BlockchainTechnology#BitcoinSecurity#MasteringBitcoin#CryptoWallet#BlockchainDevelopment#CryptoAssets#BitcoinMining#BitcoinTransactions#Decentralization#BitcoinTechnology#Cryptography#CryptocurrencyTrading#BitcoinNetwork#CryptoEducation#DigitalCurrency#BitcoinInvesting#CryptoCommunity#BitcoinTips#CryptocurrencyMining#BitcoinProtocols

1 note

·

View note