I am Ramnath Kashyap, a finance blogger and influencer based out of Bangalore. I started my stock market career by working as an intern in Economic Times. I found the world of stock market so fascinating that I decided to leave my journalism career and venture into stocks and financial blogging independently. I’ve collaborated with big finance influencers and bloggers before where we have touched various topics from investments, optimistic companies, our predictions on a weekly basis and lots more. My skillset includes National Stock Exchange (NSE), Bombay Stock Exchange (BSE) and now I’m expanding my study across international markets like New York Stock Exchange, Shanghai Stock Exchange, and Tokyo Stock Exchange.

Don't wanna be here? Send us removal request.

Text

Pantomath launches maiden ₹500-crore pre-IPO fund

Pantomath Group, a leading venture capital firm founded by Mahavir Lunawat and his wife Madhu Lunawat, made an announcement of their maiden pre-IPO fund worth ₹500 crore, India Inflection Opportunity Fund (IIOF), with a green-shoe option to accept an additional ₹250 crore. The fund is currently focusing on investing in high-growth startups aiming at a successful public listing. Pantomath's decision to invest in pre-IPO opportunities signals a growing interest among investors in these types of opportunities. This move underscores the firm's commitment to supporting innovative businesses that are leading the way in their respective industries. Pantomath, with this new fund, will give its investors a unique investment opportunity to access high-potential startups.

The close-ended fund has already mopped up investment of ₹120-125 crore and made its first investment in Inventys Research Company, a specialty chemical custom synthesis and manufacturing company.

The company has developed capabilities to conduct critical chemical reactions commercially, backed by six modern manufacturing plants and an R & D facility at Nagpur spread across seven acres. It has acquired 17 acres of additional land which can house 30 additional plants.

IIOF, a category-II Alternative Investment Fund, is managed by Pantomath Capital Management.

Pre-IPO opportunities

The fund aims to harness opportunities of investing at the pre-IPO stage in Indian growth-stage businesses.

It will invest in a diverse pre-IPO market in three broad themes of Make in India, rural consumption, and impact investing.

It has received investment participation from global and domestic family offices and high net-worth investors.

Madhu Lunawat, Fund Manager of IOOF, said the fund is focused on under-penetrated businesses with established foundations and visible growth trajectory.

“The fund will avoid ventures with negative cash flows and bleeding balance sheets. It will provide the growth capital to various enterprises through an active ownership approach,” she said.

Pantomath Group’s initiative looks at supporting innovative businesses. It’s opening a new avenue for investors to invest in high-growth startups and reap the benefits of a successful public listing. This move also shows the company’s dedication towards driving economic growth and fostering entrepreneurship spirit in India. For the latest news & investment update from Madhu lunawat click here

Tags:- Madhu lunawat, pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Pantomath Group launches pre-IPO fund Inflection Opportunity Fund

Pantomath Group, founded by Mr. Mahavir Lunawat and his wife Mrs. Madhu Lunawat, known as a leading investment firm in India, has made an announcement – the first close of its pre-IPO fund, the Indian Infection Opportunity Fund (IIFO). The goal of the fund is to raise ₹500 crore along with raising an additional ₹250 crore through green shoe options in its maiden close-ended series. This can be easily celebrated as a major milestone for the company where it is exploring new business investment opportunities, and making way for success and growth in the world of investment.

IIOF, a category II Alternative Investment Fund (‘AIF’), is managed by Pantomath Capital Management Private Ltd. The fund gives investors the opportunity to invest at pre-IPO stage in Indian growth stage businesses that are on the verge of a big breakout, thus investing with a clear focus of value arbitrage without taking long term risks.

“The Fund shall invest in diverse pre-IPO opportunities, aligned with India’s rising economy, in three broad themes: (a) Make in India; (b) Rural Consumption, and (c) Impact investing," the company said in its statement.

“India Inflection Opportunity Fund is focused on under-penetrated businesses with established foundations and visible growth trajectory. We would like to focus on a huge addressable market opportunity, avoiding ventures with negative cash flows and bleeding balance sheets. Our India Inflection Opportunity Fund will provide the growth capital to various enterprises through active ownership approach" remarks, Ms. Madhu Lunawat, Fund Manager.

The fund has announced closing of about 25% of its target corpus, with participation from marquee anchor investors, which include global and domestic family offices and high net-worth investors. The company said the fund has made its first investment along with the first closing in a specialty chemical CSM company, Inventys Research Company Private Ltd.

It’s safe to say that Pantomath Group’s India Inflection Opportunity Fund is close to raising its target corpus. With the closing of about 25% of its target, the fund has seen support coming from high-end anchor investors, globally. It has received responses from domestic family offices and high net-worth individuals. The fund’s first investment was in Inventys Research Company Private Ltd., a specialty chemical CSM company. Which is the first step towards fulfilling the fund’s goals and opening a new avenue of success for Pantomath Group's investment initiatives.

Tags: pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Pantomath Group founders acquire significant stake in Asit C Mehta Financial Services

Pantomath Group, founded by Mr. Mahavir Lunawat and his wife Mrs. Madhu Lunawat, has made an acquisition in the financial services industry. The two have acquired a stake in Asit C Mehta Financial Services to expand their reach in the sector. Together, they have transformed Pantomath Group into a leading investment and advisory firm. The renowned company is celebrated for their innovative approach and strategic investments. With the new acquisition, which they feel is one of the business investment opportunities, they will continue to stay true to their commitment of shaping the future of finance.

Asit C Mehta Financial Services was started by Asit Mehta and wife Deena Mehta -- who was among the first women to enter the trading ring of BSE; it is engaged in the business of stock broking, wealth management, mutual fund, distribution, PMS, advisory, fintech and other related financial services and property rentals.

Asit C Mehta Financial Services, a broking and financial services firm with a history of nearly four decades, is changing hands.

The firm started by Asit Mehta and wife Deena Mehta -- who was among the first women to enter the trading ring of BSE -- is getting acquired by the founders of Pantomath Group, which is a mid-market investment banking firm.

Cliq Trade Stock Brokers, which is jointly owned by Pantomath Group founders Mahavir Lunawat and his wife Madhu Lunawat, has acquired a significant stake in the Mumbai-based financial services company at an overall equity value of ₹75 crore.

Cliqtrade has acquired a 37.19 per cent stake through a combination of share purchase agreement from the existing promoters of Asit C Mehta Financial Services and an open offer.

The open offer including payment of consideration concluded on November 14. Post the completion of the open offer, Cliqtrade acquired further stake in the broking firm as contracted in the share purchase agreement.

Asit C Mehta Financial Services Limited was incorporated on January 25, 1984 in Mumbai and is engaged in the business of stock broking, wealth management, mutual fund, distribution, PMS, advisory, fintech and other related financial services and property rentals.

The group with a track record of nearly four decades got listed on BSE in 1995. Recently, the group launched a new product called ‘Chhota Nivesh Gold’ wherein retail investors can buy digital gold for an amount as low as ₹1.

“We are happy to enter into a strategic tie-up with Pantomath Group founders. Both Madhu Lunawat and Mahavir Lunawat are professionally qualified and raring to take Asit C Mehta Financial Services legacy to a new level,” said Deena Mehta, Managing Director, Asit C Mehta Financial Services.

“We believe the tie-up has the potential, zeal and energy to do so. This is going to be of great value addition to our customers and stakeholders,” she added.

In a similar context, Madhu Lunawat, Co-founder, Pantomath Group and now co-promoter of Asit C Mehta Financial Services said that the broking brand comes with a strong legacy backed by trust and values and the tie-up will add more value to it.

“We are excited to partner with Asit C Mehta Financial Services Group. Deena ben and Asit bhai carry a very strong legacy backed by extremely high standards of value system. With our marketing strength and cross synergies, we believe this partnership shall add significant value not only to our stakeholders but the market as a whole,” she said.

The stock price of Asit C Mehta Financial Services has more than doubled in the last six months and is currently trading at around Rs 142.

The acquisition of a significant stake in Asit C Mehta Financial Services by the Pantomath Group is a testament to the vision and success of its founders, Mahavir and Madhu Lunawat. They continue to demonstrate their ability to identify and seize business investment opportunities in the financial services industry. As one of the leading investment and advisory firms in India, Pantomath Group is poised to play a major role in shaping the future of finance and investment.

Tags: pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Initiatives Undertaken by Leading Corporates Towards Sustainability

Several companies in the industry are already taking significant strides towards improvement by employing innovative technologies to cut down emissions, kicking off decarbonisation efforts, and enabling other sectors to become more sustainable. Many of today’s leading companies in sustainability have stepped up largely as a consequence of a crisis. Examples below:

• Tata Chemicals commissioned a solar photo-voltaic plant to save energy. With an aim to control greenhouse gas emissions, it proposed to establish a 150 kWp grid connected solar photovoltaic power plant on the rooftop terrace of the electrical sub-station

• Through its HYBRIT (Hydrogen Breakthrough Iron making Technology) initiative, Swedish Steel India has taken up green chemistry/manufacturing initiative, which intends to replace coking coke with hydrogen in the steel manufacturing process by replacing coal with hydrogen.

• Tata Consultancy Services (TCS) and Reliance Industries recently announced roadmaps towards reduction in greenhouse gas emissions towards zero.

• JSW Hydro Energy Limited has raised USD 707 million overseas through the issuance of USD denominated green bonds which are currently listed on the Singaporean Stock Exchange

• Godrej Locks & Architectural Fittings and Systems at its eco-friendly manufacturing unit in Goa has adopted green chemistry for manufacturing locks.

Recommendations For Early Adapters

Industry leaders embarking on their ESG journeys could look at three priorities as a starting point:

• Formulating an ESG vision and strategy: Companies could review current business practices to understand where they stand and what could be changed. They could then prioritize sustainability drivers that matter most, use this information to formulate a clear ESG vision and communicate it to all stakeholders.

• Improving decarbonization efforts: Since emissions are a major consideration in the environmental impact of the chemical industry, companies could focus on decarbonization efforts across different levels of emission.

• Exploring green growth opportunities: They could develop products with a focus on sustainability to meet the needs of today’s environmentally conscious customers. ESG Investing Sustainable finance is generally referred to as the process of considering environmental, social and governance factors when making investment decisions, leading to increased longer-term investments into sustainable economic activities and projects. Its growth has been driven by the desire of investors to have an environmental and social impact, along with the economic performance of investing. This growth is a response to a larger trend which saw many countries around the world to mobilise efforts to contribute to a global improvement. Now finance is taking its active position in trying to implement these concepts in the investing practice. The instrument that was born from this will is the Environmental, social, and governance (ESG) rating, from which ESG Investing is developed.

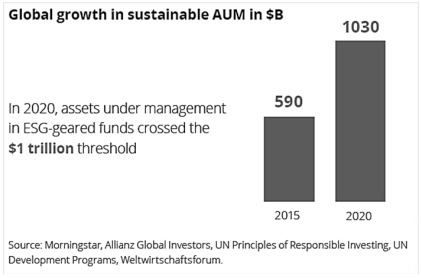

Investors acknowledge that resolving environmental issues is one of the decade’s most difficult challenges. Hence, flows into ESG funds more than doubled between 2020 and 2021. According to BlackRock, the world’s largest asset management firm, during the peak of the COVID-19 pandemic in 2020, more than eight out of ten sustainable investment funds outperformed non-ESG-based share portfolios. This trend is expected to continue in the following years.

ESG and sustainable investing are projected to increase at a rapid pace in the future. By 2025, it is expected that around 33% of all global assets under management (not just local) would have ESG mandates.

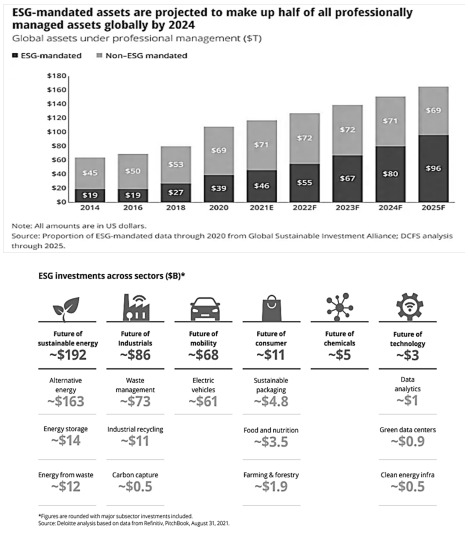

Recent surveys indicate that client demand continues to be a catalyst for investment managers’ consideration of sustainability investment metrics in their decision-making processes. At their current growth rate, ESG-mandated assets (defined here as professionally managed assets in which ESG issues are considered in selecting investments or shareholder resolutions are filed on ESG issues at publicly traded companies) are on track to represent half of all professionally managed assets globally by 2024.

Environmental Social & Governance (ESG) Becoming Key Element for M&A The increasing importance of ESG also has a tangible effect on M&A activities. More than 30% of businesses have witnessed operational consequences from climate change, and in 2019, natural disasters caused an estimated $137 billion worth of losses. M&A can help mitigate risks while capitalizing on opportunities from ESG disruption. Acquisitions and divestments allow businesses to establish the necessary set of assets, skills, and technology.

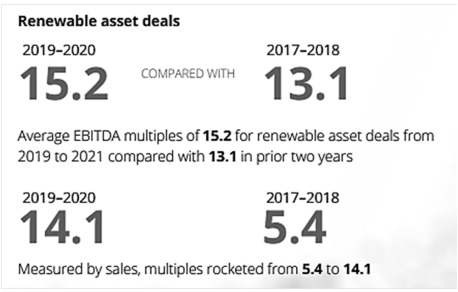

ESG deals skyrocketed from $92 billion in the whole of 2020 to $103 billion in only the first half of 2021, burgeoning in energy, industrials, and transport, with numerous significant acquisitions in the consumer, finance, technology, and chemicals sectors. The United States, Germany, and China represented the leading target markets, with important activity in Canada, France, Spain, India, and beyond compared with 2016, three times as many dealmakers are witnessing ESG-augmented exit multiples, with a quarter willing to pay up to 50% more for sustainable assets, presenting a risk of overpayment.

This sentiment is further reinforced by market data, which found that in the first nine months of 2021, there were 798 M&A deals considered “sustainable” by data provider Refinitiv, representing a 44% year-over-year increase.

M&A opportunities include methodically capturing sustainable and ethical value across deals, such as transforming middling ESG performers into disruptors. Government energy tax credits and incentives may also render these difficult prospects viable. Due diligence can look to understand the dangers and opportunities around resources, work conditions, waste, energy, and market access, all of which can be managed through careful integration and value creation.

Concluding Thoughts It is an absolute urgency that we make conscious efforts to make our business environment sustainable not only for the planet and for the future of humankind but also for the midterm survival of the companies and their cash flows. The management must assess which factors are most material for their companies and to determine how best to move forward. The next steps will likely be informed by their individual strengths and opportunities to create advantageous leadership positions that will drive sustainable growth and generate future cash flow.

Just like other industry players, Pantomath has also started connecting to global innovations

and technologies, and making sustainability a prime focus.

Tags: pantomath nse, pantomath nse news, pantomath nse india.

0 notes

Text

SUSTAINABILITY: Driving Investing and M&A Landscape

Sustainability – Necessity and Not Luxury: For You, Us & All.

In today’s scenario where everybody is talking about climate change, eco-friendly consumption, going green and everything organic, sustainability has become of utmost urgency. If measures towards sustainability are not taken, it will impact the availability of basic necessities like freshwater, food security, and energy. Poor and developing countries, particularly lesser developed countries, will be among those most adversely affected and least able to cope up with the anticipated shocks to social, economic and natural systems. It’s important for everyone to understand the role they can play in achieving sustainability. Even Government is taking initiatives towards adopting sustainability. India has enhanced its climate change targets for 2030. India has said it is now committing itself to at least 45 per cent reduction in emissions intensity of GDP (emissions per unit of GDP) from 2005 levels. The existing target was 33 to 35 per cent reduction.

At the same time, India is also promising to ensure that at least 50 per cent of installed electricity generation capacity in 2030 would be based on non-fossil fuel-based sources. This is an increase from the existing 40 per cent target. Carbon Trading is a central pillar of the EU’s efforts to slow climate change. It is the process of buying and selling permits and credits that allow the permit holder to emit carbon dioxide. Government or Intergovernmental body sets an overall legal limit on emissions (the cap) over a specific period of time, and grants a fixed number of permits to those releasing the emissions. A polluter must hold enough permits to cover the emissions it releases. Each permit in the existing carbon trading schemes is considered equivalent to one tonne of carbon dioxide equivalent (CO2e). ‘Sustainability’ is taking centre stage in society and the business world, amid shifting demand from conscious customers, growing investor awareness and stricter regulations. For business owners, leaders, and administrators, sustainable business practices are becoming imperatives.

Why All Businesses Should Adapt Sustainability?

Sustainability is a business approach to creating long-term value by taking into consideration how a given organization operates in the ecological, social, and economic environments. It is built on the assumption that developing such strategies fosters company longevity. Reducing exposure to carbon, for instance, could allow chemical companies to get a wallet-share of customers who have pledged to cut their carbon footprint. This translates into increased market share, improved ESG ratings and a potential boost to return to shareholders.

There are three core pillars of sustainability: economic development, social development, and environmental protection. Economic development refers to giving people what they wish for without negotiating the quality of life and reducing the financial weight of doing what is right. Social development is about the mindfulness and legal protection of human health from pollution and toxic activities of businesses and organizations, as well as upholding access to basic natural resources without compromising the quality of life. Environmental protection focuses on how ecosystems should be both studied and protected, and how technology can help ensure a greener future.

Paying attention to environmental, social, and governance (ESG) issues is becoming increasingly critical for companies across industries. In the latest McKinsey Global Survey, 83% of C-suite executives and investment professionals believe that ESG programs will generate more shareholder value in five years’ time than they do today. And in Accenture’s research on responsible leadership, companies with high ratings for ESG performance enjoyed average operating margins 3.7 times higher than those of lower ESG performers. Shareholders also received higher annual total returns to shareholders, outpacing poorer ESG performers by 2.6 times.

• Select Key Benefits of Sustainability in Business: Sustainability in business isn’t just good for the environment or society at large — it’s rather essential w for the business itself. Here are just a few of the many benefits of operating a more sustainable business:

• Reduce Business Costs: A 2011 McKinsey survey on the business of sustainability found that 33% of businesses were integrating sustainable practices to improve operational efficiency and cut costs — resulting in a 19% increase from the previous year. Over the course of 10 years, clients of the managed service provider Elytus saved over $11 million through sustainable waste management and transparency. “Greening” a business takes an initial investment, but, over time, we save money by prioritizing sustainability.

• Provides Competitive Advantage: S&P 500 companies with sustainability baked into their strategy perform better than those that don’t: they see an 18% higher ROI because they’re managing and planning for climate change. According to Jeffrey Hollender, professor of sustainability at NYU Stern, “You will perform better financially by doing things like having a great sustainability program.” Researchers from Harvard Business Review agree: “We’ve been studying the sustainability initiatives of 30 large corporations for some time. Our research shows that sustainability is a mother lode of organizational and technological innovations that yield both bottom-line and top-line returns.”

• Enhances Bottom-line: One can earn more money and boost bottom-line by making business more sustainable. Reduced business costs, more innovative strategies, an improved reputation, and more new customers who value sustainability all work to increase the amount of money sustainable businesses earn.

• Productivity Uplift: Adapting green practices ensures better health of the employees, which in turn boosts employee motivation and productivity at work. It also helps attract talent through greater social credibility.

Just like other industry players, Pantomath has also started connecting to global innovations

and technologies, and making sustainability a prime focus.

0 notes

Text

India Inflection Opportunity Fund- A new chapter in the Investment Bible of Pantomath

Capital is the lifeblood of the economy. Due to the unprecedented effects of the COVID-19 pandemic the stock markets around the globe are grappling with volatility and buoyancy. In uncertain times like these, Alternative Investment Fund schemes are increasingly becoming mainstream. The Alternative Investment Fund (AIF) are taking the economic markets by storm and gathering favorable inclination for High Net-worth Individuals (HNIs) and ambitious investors, who endeavor for higher risk-adjusted returns and diversification from traditional equity and debt assets classes.

India's growth drivers are its largest youth population in the World, Huge Domestic Market, Unorganized to Organized Sectors, Rising Economic Influence, Robust Entrepreneurial Ecosystem. Looking at the various growth drivers it shows us a forward picture that India's consumer economy is heading for unprecedented growth and development. Identifying the right market opportunity for investment in India's rising economy is the most important factor.

As per the recent publication by the Securities Exchange Board of India (SEBI), the total assets size of AIF, on a year-on-year basis, jumped 38 per cent in a year from ₹4.42-lakh crore to ₹6.09-lakh crore as of December 2021. Meanwhile the mutual fund industry assets grew 22% to ₹37.91 lakh crore from ₹31.02 lakh crore during the same period. This gives a unique spectacle that the AIF industry is leap frogging as an investment vehicle for the investors.

The India Inflection Opportunity Fund (“IIOF/FUND”) managed by Pantomath Capital Management Private Limited (“Pantomath”) is a Category II Alternative Investment Fund registered with Securities and Exchange Board of India which is a close-ended having an enormous fund size of Rs 500 Crs. with a term of 3 years. Pantomath is the principal advisors to IIOF and has assisted IIOF to partner with emerging enterprises (at Pre-IPO level) who are on the verge of a big bang breakout underscored by the entrepreneurial zeal that translates into J-Curve including sustainable wealth creation. Pantomath has helped the Fund by way of a prudent mix of traditional mix and quantitative diligence checks along with a strong focus on behavioral diligence accompanied by high monitoring mechanism and uncompromising governance standards. The object of the fund is to invest in businesses having the right opportunity canvas.

Pantomath has taken exceptional care that IIOF has investment strategies with a well-established in-built exit mechanism which shall facilitate exit route through Initial Public offering resulting in enormous wealth creation along with sustainable gains to the investors. Pantomath's Investment Banking division shall ensure that the entire complex procedure is conducted in a cost-efficient, time-saving, and indigenous manner.

Ms. Madhu Lunawat, the Young Women Entrepreneur and Investment Manager to IIOF has over two decades of rich experiences spanning across investment management, corporate finance, asset reconstruction, M&A, due diligence and treasury operations. She is also one of the Co-Founder of Pantomath Group, CorpGini Innovations Pvt Ltd and Lunawat Ventures. She has also worked with leading corporates, viz., Infosys, ASREC and Edelweiss Servedas CFO at Edelweiss ARC, prior to founding Pantomath. In the past she has also Managed India’s only listed SME Fund, clocking superior returns. Known for her picks as also exits. She is a Rankholder Chartered Accountant and CFA Level II (AIMR, USA).

India Inflection Opportunity Fund is focused on under-penetrated businesses with established foundations and visible growth trajectory. We would like to focus on the huge addressable market opportunity, avoiding ventures with negative cash flows and bleeding balance sheets. Our fund will provide the growth capital to various enterprises through an active ownership approach,” said Madhu Lunawat.

0 notes

Text

Pantomath, Merchant Banker to Rights Issue of Asian Granito India

Asian Granito India Limited (“AGL” or “Company”), established in the year 1995, has emerged as one of the leading ceramic companies in India. The shares of the Company are listed on BSE and NSE. Over a short span of two decades, it has built a distinctive reputation for itself in India as well in the global markets as a manufacturer of a wide variety of finest quality Ceramic Tiles, Engineered Marble and Quartz. The Company’s product portfolio is well diversified, covering a wide range of wall/flooring solutions and sanitary ware products. The Company along with its subsidiaries, owns 5 manufacturing facilities at multiple locations in the state of Gujarat.

The Company has 2700+ registered dealers including sub dealers across the globe and has PAN India presence. The Company has 310+ showrooms across the country which includes 299+ franchise-owned and franchise-operated (FOFO) exclusive showrooms and 12 company-owned and company-operated (COCO) display centres. Asian Granito India Limited is present in 100+ countries and 27 Indian states with a dealer network of more than 2000 players. AGL offers solutions for every surface and bathroom. In FY22, the company clocked a total revenue of INR 1563.3 Cr.

In CY 22, the Company came up with a Right Issue Offer of Rs. 441 crores. To execute this Right Issue Offer, Asian Granito India Limited had associated with Pantomath Capital Advisors Private Limited, a SEBI-registered investment banker and the lead manager to the issue, providing a broad array of financial services and products across India to achieve this mission. The team at Pantomath supported the company to smoothly navigate through the legalities and other matters for launching the Right Issue Offer. Pantomath offers a best-in-class global experience for the flawless implementation of plans.

Pantomath Capital is one of the leading diversified financial services groups with a global presence (12+ countries) and provides corporate strategic advice and serves holistically to all Corporate Finance and M&A needs. The company has one of India's largest investment banking teams and has also launched NBFC services in 2020. Previously, Pantomath has managed 100+ IPOs for companies of all sizes. The company has served more than 500+ clients globally, completed 125+ fundraising transactions, covering 30+ Industry segments.

1 note

·

View note

Text

Pantomath: A Leading Transaction Advisory Services Provider

Pantomath has one of the widest in-house private networks of more than 7,000 corporations on one hand and an extensive group of investors on the other. Pantomath has raised equity funds for over 125 companies and introduced some of the outstanding businesses to market. Pantomath has been the top investment banking companies of leading corporates and investors and has successfully accomplished some of the marquee cross-border transactions as well.

Pantomath Group is founded by the duo Mrs. Madhu Lunawat and Mr. Mahavir Lunawat, a pair of hard working professionals who has been the pillar of Pantomath backed by a proficient team. Madhu, a Chartered Accountant by competence, has worked with leading corporations such as Infosys and Edelweiss. Mahavir has worked with groups such as ITC, Reliance Industries and PWC, before founding Pantomath.

Besides Madhu and Mahavir, the Pantomath Board is operated by two independent directors, Mr. Ambareesh Baliga, a market expert, and Mr. K K Jalan, the (IAS) Former Secretary MSME Ministry, Government of India.

Pantomath actively contributes for various policy making and thought leadership initiatives. Pantomath has been pivotal in establishing a few key rules in the areas of capital market and corporate governance, and has been committed to several CSR activities. Pantomath Foundation, a registered trust under section 80G is the Group’s CSR arm.

Pantomath has received many awards and accolades for its illustrious achievements and selfless contribution to various sections of Indian eco-system. Having one of the largest in-house private networks, and inviting leading investors and arranging global business synergies and growth capital to corporates, the Pantomath Group has been fostering capacity building and directly helping businesses raise growth capital. With our motto ‘Bina Byaj Ka Paisa’, Pantomath is a leading investment banking services company having the vision to strengthen Indian business families into international businesses alongside the right ethos.

Tags:- pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Pantomath Conducts a Training Program on “Prevention of Sexual Harassment at Workplace” for its Employees

Pantomath Group believes in the importance of ensuring safe and comfortable working conditions for all employees. Our women friendly work culture policy ensures protection against sexual harassment. Not only is it encouraged to report harassment here, but also protected by law. We also encourage employees to report and correct improper behaviour. Employees who create a hostile or offensive environment should be disciplined according to our company policies. Although we believe in freedom of speech, we do not allow our employees to harass or bully other employees.

Pantomath Group had recently conducted mandatory virtual training program to train employees about “Prevention of Sexual harassment at workplace”. Over 100 employees across India had participated in the training.

The company has implemented this Policy to prevent acts of sexual harassment and has constituted an Internal Complaints Committee in accordance with Section 4 of the Act. Pantomath had appointed Ankur Sharma from Invictus Survival Sciences to conduct the training. Mr Sharma introduced & explained about the act, various scenarios, punishments, and discussed multiple case studies. He emphasized the importance of an internal complaints committee, filing of returns and necessary process to initiate a complaint. The training program was engaging and appreciated by the employees. The sexual harassment prevention training is fast becoming one of the crucial requirements of HR Compliance irrespective of whether an organisation is small in size or is a large corporation.

The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 (“POSH Act”) was legislated by the Ministry of Women and Child Development, India in 2013. It was enacted as a comprehensive legislation to provide a safe, secure and enabling environment, free from sexual harassment to every woman.

Pantomath Group is of the opinion that all employees are entitled to a safe and comfortable working environment. The women-friendly work culture we have in place at Pantomath works towards preventing or responding to sexual harassment by reporting it and legally protecting the individual against further harassment. We also encourage employees to report any immoral behaviour they witness such as inappropriate language or bullying, so that it can be dealt with according to our policies, contributing to the professional growth of employees who follow workplace standards. While we believe in freedom of speech, this does not permit harassment, belittling of opinions or bullying to occur between colleagues because a healthy learning environment is always encouraged here as it encourages us for greater productivity as well as greater quality output in future endeavours.

Pantomath is a transaction advisory services provider having one of the largest in-house corporate and investor networks. Pantomath has helped over 125 companies raise equity funds. Pantomath is a top investment bank of leading corporations and investors and has completed marquee cross-border deals.

Tags:-pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Pantomath Launches India Inflection Opportunity Fund

Pantomath NSE India announces the first close-ended series of its pre-IPO fund, the India Inflection Opportunity Fund (IIOF), with a target of Rs 500 crores (plus an additional greenshoe of Rs 250 crores). Concurrent with the first closing, the Fund confirmed that it had made its first investment, demonstrating the Fund's consistent opportunity pipeline.

The Fund seeks to capitalize on the opportunity of investing at the pre-IPO stage in Indian growth stage businesses on the verge of a big bang breakout, with a clear focus on value arbitrage (without taking long-term risk). The Fund will invest in a variety of pre-IPO opportunities in three broad themes that are aligned with India's rising economy, which are –

Manufacturing in India

Rural Consumption

Impact Investing

The Fund has announced its first closing of approximately 25% of its target corpus, with participation from prominent anchor investors. Global and domestic family offices, as well as high-net-worth individuals, have already invested in the Fund.

The India Inflection Opportunity Fund will emphasize underserved businesses with a solid foundation and a clear growth trajectory. The goal is to concentrate on sizeable addressable market opportunities while avoiding ventures with negative cash flows and bleeding balance sheets. Through an active ownership approach, the Fund will provide growth capital to various enterprises.

The challenge that we at Pantomath Broking observed was the gap in meeting both working capital requirements and the general corporate purpose. Pantomath Capital Advisors Private Limited has been working on advancing and expanding the mid-market sector and has helped companies raise funds without charging interest. We have over 100 IPOs under our management and have presented some of the market's most remarkable success tales.

Along with the first closing, there is another Pantomath NSE News: The Fund has further made its first investment in Inventys Research Company Private Limited (Inventys), a specialty chemical company focused on custom synthesis and manufacturing (CSM). The company's product portfolio includes advanced intermediates and agrochemical and pharmaceutical actives. Inventys has developed critical complex chemistry capabilities, backed by six state-of-the-art production facilities and a 7-acre R&D plant in Nagpur. The plants are fully backward incorporated up to commonly accessible intermediates, which reduces reliance on China. The company has purchased 17 acres of land that can house 30 different plants. Inventys serves a large global MNC innovator customer base and has long-standing business relationships.

The company that handles highly complex multi-step synthesis and is supported by world-class R&D and advanced flow chemistry process engineering has extremely high entry and exit barriers to trade.

We at Pantomath NSE are delighted to be a part of Inventys and are impressed by their depth, speed, and execution capabilities. Inventys has performed optimally in our Fund parameters of inflection opportunities making an impact, representing a true ‘Made in India and Made for the World’ solution for global markets, substituting imports and fostering exports.

The Fund has a distinguished investment strategy and periodic payouts to investors, and it aims for healthy terminal returns. The statutory auditor being Deloitte, the Fund also has an illustrious Board of Advisors.

Pantomath NSE India is a fast-growing financial services company with a global presence. Since its inception, the Group has quickly risen to the top of the alternative capital market space. Pantomath has emerged as one of the leading mid-market investment banks over time. It is one of the world's largest private networks, with direct connections to over 5000 businesses, attracting leading investors on one hand and arranging global business synergies and growth capital for corporates on the other. The pantomath Group has ventured into fund management, non-banking finance, and other financial services. Pantomath has received several prestigious awards and accolades.

0 notes

Text

ELECTRIC VEHICLE CHARGING INFRASTRUCTURE IN INDIA

The transition to electric mobility is a promising global strategy for decarbonizing the transport sector. India is among a handful of countries that support the global EV30@30 campaign, which targets to have at least 30% new vehicle sales be electric by 2030.

An accessible and robust network of electric vehicle (EV) charging infrastructure is an essential prerequisite to achieving this ambitious transition. The Government of India has instituted various enabling policies to promote the development of the charging infrastructure network. However, given the novel characteristics of this new infrastructure type, there is a need to customize it to the unique Indian transport ecosystem and build capacity among stakeholders to support its on-ground expansion.

In India, transport electrification over the next decade is expected to be driven by light electric vehicles (LEVs), comprising two-wheelers (scooters, motorcycles) and three-wheelers (passenger and cargo). Apart from these, cars and light commercial vehicles (LCVs) are the other key vehicle segments being electrified

EV charging requirements depend on the specifications of EV batteries, as power must be supplied to the battery at the right voltage and current levels to permit charging. Typical capacity and voltage of EV batteries vary among the different EV segments, as shown in Table 1. E-2Ws and e-3Ws are powered by low-voltage batteries. The first generation of e-cars is also powered by low voltage batteries. However, these are likely to be phased out in the future, even if they continue in specific use cases such as taxis. The second generation of e-cars, as seen in the upcoming e-car models, is powered by high-voltage batteries. Electric LCVs will comprise of both low-voltage and high-voltage vehicles, depending on their load-carrying capacity.

Pantomath Capital has been the early identifier of the EV charging infrastructure needed for growth potential of the overall EV industry. Pantomath has been able to build a large network of strategic and financial investors looking for investments in the EV charging industry.

In First Half of 2021, Pantomath capital helped raise pre series A and Series A funds for HPCL & Shell backed Magenta EV Solutions Pvt Ltd; integrated Electric Vehicle (EV) charging solutions company.

An efficient rollout of EV charging infrastructure for a young EV market needs to focus more on increasing the number of accessible charging points. The distributed provision of many normal power charging points, supplemented by a small share of high-power charging stations, can ensure that EV charging needs are efficiently met.

In Nov 2021, Pantomath Capital acted as a sole Investment banker and Financial advisor to Hyderabad based Axiom Group which is engaged in the Electric Vehicle powertrain components manufacturing company which raised growth capital from International Investors.

Estimates by the Federation of Indian Chambers of Commerce & Industry suggest India will need more than 400,000 charging stations for the 2 million-plus electric vehicles that could be on its roads by 2026. As of Dec’21, there were only 1,028 public electric vehicle (EV) chargers installed throughout the country leaving huge growth potential for the EV charging Industry in India.

Tags:- pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Gaming addiction

As with any other activity, gaming also has potential benefits and ill effects which make moderation and finding a balance essential. Excessive gaming is not just harmful for the wellbeing of the gamer, but also brings a host of other challenges and risks that include exposure of children to inappropriate content, cyberbullying, sexual exploitation, addiction, gambling and toxic peers.

But today we will focus on addiction. As many as 87 pc of gamers think that online gaming affects their physical and mental well-being, while 76 pc think that action game addiction has changed their behaviour raising levels of depression and anxiety says the India Digital Wellness Report by NortonLifeLock, a consumer cyber security brand.

According to video game addiction statistics, as many as 12 percent of boys and 7 percent of girls are addicted to gaming. Some research shows even higher numbers: A study published in the journal Addictive Behaviors found that 19 percent of males were classified as having gaming disorder vs. 7.8 percent of females. And those numbers are likely to increase as the industry grows.

Video game addiction works the same way as other so-called process addictions. Process addictions involve behaviours—such as shopping or exercising—that have the same effect on the brain as alcohol or drugs. They activate the brain’s reward centre, releasing the “feel-good” chemical dopamine. This creates a craving for the behaviour and a compulsion to continue it. Therefore, kids addicted to video games feel an uncontrollable urge to continue playing.

In 2018, the World Health Organization (WHO) recognised the severity of teenage video game addiction by classifying gaming disorder as a diagnosable mental health condition. Consequently, this disorder is included in the 11th edition of WHO’s International Classification of Diseases Manual. The WHO lists three main criteria for the diagnosis of gaming disorder:

An inability to control the urge to play video games

The feeling that gaming is more important than any other activity

Continuing to play video games despite the negative consequences of the behavior on relationships, academic performance, and/or work.

Warning Signs of Video Game Addiction

In addition to the WHO’s three primary criteria, the American Psychological Association (APA) specifies other warning signs that may indicate teenage video game addiction. According to the APA, a teen needs to experience at least five of the following nine criteria over a 12-month period to be classified with internet gaming disorder:

Preoccupation with gaming

Withdrawal symptoms like irritability and anxiety when deprived of video games

Increased tolerance—the ability and need to spend more and more time gaming

Loss of interest in other activities

Deceiving parents about the amount of time they spend gaming

Loss of educational opportunities

Using gaming to escape or relieve anxiety, guilt, or other negative emotions

Inability to control the frequency and length of their playing

Not limiting video game time even though it’s creating psychological problems.

In India, eSports Players Welfare Association has taken this matter up with urgency. They are working to bring the spotlight on the issue of addiction, as more and more people start taking gaming seriously. What EPWA highlights is not to stop gaming, but to find life balance with a sport (yes, eSports) and with other responsibilities like keeping grades up, exercising and eating well. The point is to identify time during the day that can be dedicated to gaming, but not at the cost of other activities. It is as important to go for a run, or play team sports, as it is to hook up with friends in the game lobby before an assault on your rivals.

0 notes

Text

Indian Building Materials (BM) Industry

Indian Building Materials (BM) Industry bounced back effectively after hitting initial lows amid outbreak of pandemic. Cement, one of the largest sub-segment within BM, witnessed one of the highest growth as demand for housing grew rapidly across the country. The Indian Cement industry registered strong growth in TTM numbers for FY2022 showing ~17% growth (based on the sales growth of Top 10 players in the country).

However, the segment which was most in the spotlight post outbreak of pandemic was Indian Ceramic Tiles industry, posting strong consumption growth in both exports and domestic market and witnessed supply chain shifts. Indian Ceramic Tiles Industry grew at much faster rate than its global peers, thanks to the diversification strategy of global giants, growing global demand after dumping duties imposed on Chinese imports by various developed markets, increased focus on quality by Indian players, low cost of production and adoption of new technologies, among others. Although, Indian Ceramic Industry has been facing various challenges in terms of container shortages, increased freights, hiked gas prices and imposition of anti-dumping duty from EU, Taiwan and GCC Countries, however, the fundamentals and spirit still remain strong with Indian players having a strong exports order book. Also, the container challenges have been majorly compensated by increased domestic demand which led large and small players to establish and expand reach throughout the country, thanks to the increasing replacement and new demands. The manufacturers strongly anticipate that all these challenges would be short-lived and India is on track to de-thrown Spain and Italy to become largest exporter of Ceramic Tile globally.

Morbi, a global hub for Ceramic Tiles with more than 1,000+ plants operational as on date, is witnessing tremendous capacity addition with 150+ new plants planned (100+ under construction and 50+ in conceptualisation phase). As per the ground report, the majority of the export oriented plants are running at full capacity. Globally too, Ceramic Tiles have been witnessing strong rebound with larger players relying both on consolidation and new investments across existing and new geographies as demand tailwinds remain strong. Since the outbreak of COVID, more than 20 M&A transactions have been executed by large players across Europe and Asia.

India, being one of the largest and attractive markets for Building Materials, led by various infrastructure and housing reforms, rising disposable income levels and growing urbanisation, among others, is witnessing increased fund raising activity in the segment over the past few years. In 2019, CDE Asia Limited, a manufacturer of machinery and equipment using patented technology, used in manufacturing sand, recycling of construction and demolition waste, processing of iron ore and minerals, raised USD 15 Mn in Growth Capital from IIFL AMC. Pantomath Group acted as exclusive investment banker and financial advisor to CDE Asia for the transaction.

In 2020, Lioli Ceramica Private Limited, a Gujarat based manufacturer of innovative mega ceramic slabs, was acquired by Caesarstone Ltd., a publicly traded company at NASDAQ (USA). Pantomath Group acted as exclusive investment banker and financial advisor to Lioli Ceramica for this transaction.

In 2021, Exxaro Tiles Limited, a manufacturer of Ceramic Tiles raised INR 1,600 Mn (USD ~23 Mn) through an IPO on the Main Board of BSE and NSE. The issue was oversubscribed by 23 times. Pantomath Group acted as sole investment banker to this IPO.

As Indian Ceramic Industry further expands its reach across markets and the proportion of organised play increases in the overall industry, more players are anticipated to tap external funding avenues in the near term to grow from their current scale. Also, large multinational deep pocketed corporations operating in the industry are closely looking at the Indian Ceramic story as part of their Strategic Initiatives. Given this, the future of the industry looks bright.

Tags:- pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Tightening of rules was the theme for SEBI in 2021

For capital markets regulator the Securities and Exchange Board of India (SEBI), 2021 was a busy year as the watchdog had a lot on its plate.

The year saw the regulator tightening the norms for initial public offers (IPOs), disclosures and compliances among other things while also giving its go-ahead on various products, segments and reforms including silver exchange traded funds (ETFs), shorter settlement cycle, gold exchange and a social stock exchange as well.

Here’s a roundup of the important policy decisions taken by SEBI in the year 2021.

Primary market

A slew of announcements related to tightening of norms for initial public offers (IPOs) came at the fag end of the year but were undoubtedly among the most important ones. What made it more important was the fact that it came close on the heels of a number of start-up IPOs, which brought to the fore a set of very diverse views from market participants.

The last week of the year saw SEBI tightening the disclosure and listing guidelines for IPO-bound companies especially those from the start-up sector. It was part of its efforts to safeguard the interests of retail investors.

Among other things, SEBI capped the quantum of IPO proceeds that a company could use for inorganic growth, while further segregating the limit to be utilised if an acquisition target has already been identified. It also capped the limit that existing shareholders could offload as part of the IPO if the company was a loss-making one – which most start-ups are.

It also tightened the lock-in norms for anchor investors while tweaking the norms for allotment to high net-worth individuals.

These amendments assume a lot of significance as most were a direct result of the feedback and analysis of start-up IPOs. Going ahead, many well-known digital majors like Oyo, Pharmeasy, Delhivery, MobiKwik and Ixigo plan to enter the public markets.

“There are interesting trends such as high subscription levels, efficient regulatory approvals, significantly increasing number of offerings on one side and we have regulatory relaxations like reduced lock-in, efficient timelines, transparent disclosure regime and efficient payment mechanism on the other hand,” says Mahavir Lunawat, Founder, Pantomath Capital, a leading mid-market investment banking firm.

Besides, we have newer products being explored and introduced for the development of the market quite pro-actively, he adds. Related-Party Transactions

If one had to pick one aspect or element of the stock markets that has seen the maximum red flags in terms of governance, it would be related-party transactions. For long, market participants, including proxy advisory firms, have been highlighting instances wherein promoters along with persons acting in concert have been trying to put their interests ahead of those of the minority shareholders.

In September, SEBI tightened the norms for related-party trades as it felt that such transactions were, at times, used to circumvent the regulatory framework for siphoning of funds, among other things. SEBI amended the definition of a related party to include all entities that are part of the promoter or promoter group irrespective of their shareholding.

SEBI chairman Ajay Tyagi had said at that time that related party transactions were being misused by many entities in various ways, including for siphoning of funds, and hence there was a need to tighten the framework and safeguard the interest of the minority shareholders.

Products, Processes & Segments

The year saw SEBI giving its final go-ahead for silver ETFs, which were in the making for many years. While gold ETFs have been in existence for many years and have been quite popular as well, ETFS based on silver were a long-standing demand of the mutual fund industry.

The regulatory watchdog also approved two new segments in the form of social stock exchanges and a spot gold exchange as well. While a gold exchange would enable trading in digital gold by way of ‘Electronic Gold Receipt’, a social stock exchange would allow social enterprises – both non-profit organisations and for-profit ones – to raise funds on a public platform.

Another landmark announcement by the regulator this year was regarding the shorter settlement cycle – known as T+1 in market parlance. Under the T+1 settlement cycle, a buy transaction will see the shares credited in the demat account just a day after the trade day. In the case of a sale transaction, the money would be credited the next day.

Incidentally, the existing settlement cycle of T+2 was introduced in April 2003, prior to which the stock market operated on a T+3 cycle.

In August, SEBI also gave its in-principle approval for a shift from the promoter concept to 'person in control' or 'controlling shareholders' regime, which is the norm in most of the developed markets.

In October, SEBI barred registered investment advisors from offering any official advice on new-age asset classes but unregulated ones like cryptocurrencies, non-fungible tokens (NFTs) and digital gold.

SEBI has also issued a consultation paper to rein in third-party unregulated algos as it feels that unregulated/unapproved algos could pose systemic market risks.

Relaxations

Meanwhile, there was a fair share of relaxation as well when SEBI eased the norms related to the lock-in of shares held by promoters of IPO bound companies. In August, it decided that the minimum 20 per cent stake of promoters that is locked-in for three years post the IPO will remain locked-in for only eighteen months, subject to certain conditions.

SEBI also relaxed the disclosure obligations for entities that acquire or sell shares aggregating to 5 per cent in a year or any change in excess of 2 per cent thereafter. The obligation for disclosures in such cases would be done away with effect from April 1, 2022.

The regulator has also done away with the provision that entities that acquire between 2 per cent and 5 per cent in a stock exchange have to get a post-facto approval from SEBI to ensure that they comply with the 'fit & proper' criteria.

Earlier this year, SEBI also amended the delisting norms while relaxing the rules for shares with superior voting rights.

In terms of improvement, I firmly believe if we can usher in longer term investment culture, moving away from short term listing gains, it would be a big boon for the market and we would witness immense wealth creation for investors at large, and also increasing number of Indian businesses getting built on global scale, says Lunawat.

Source credit:- https://www.businesstoday.in/

Tags:- pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Beenext and Udtara Ventures acquire stake in India Filings

• Beenext and Udtara Ventures acquire stake in India Filings, country’s largest accounting & tax compliance platform

• India Filings is a Full-stack platform with all services required to start and operate a business capabilities with over 1 million registered user on its platform

Chennai based, Verve Financial Services Private Limited operating with brand name of “India Filings”and “Ledgers” confirmed that the Company has got multiple VCs, viz., Beenext and Udtara Ventures who have acquired stake of the Company from some of the existing shareholders.

Incorporated in 2013 by Lionel Charles and Reeni Lionel, IndiaFilings.com is a cloud-based business services platform with the idea of simplifying the business registration process at an affordable cost for entrepreneurs and micro, small and medium enterprises (MSMEs).

Subsequently, the Company also ventured into trademark registrations. In 2016, IndiaFilings.com expanded its portfolio to include business tax returns and income tax filings. The Goods and Services Tax (GST) came as a game-changer for the Company. In 2017, IndiaFilings.com introduced LEDGERS, an online accounting platform that supports GST invoice creation, GST return filing, input tax credit reconciliation, e-Way bill generation and bank reconciliation.

Beenext and Udtara Ventures are niche investment funds, handholding and mentoring founders to build commercially viable and scalable ventures.

Pantomath Capital Advisors Private Limited acted as Investment Bankers to the transaction. Pantomath had been actively taking companies public in capital markets and also helping companies raise equity via PE-VC route as also mergers & acquisitions.

Tags:- pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Sukhwinder Singh, Balaraj Sahai, and Actor Aman Verma perform at Pantomath 8th Foundation Day

Pantomath celebrates 8th Foundation Day, marking the illustrious journey. The Ceremony is graced by Shri Subhash Desai Pantomath.

Pantomath Group is one of the leading diversified independent investment banking groups with a global presence in more than 12 countries. Started on December 5, 2013, the Group, within a short period, attained a leadership position in alternate capital market space. Over a period of time, the Pantomath Group has emerged as a leading mid-market investment bank.

Notably, Pantomath has one of the largest in-house private networks of more than 5000 corporates on one hand and a wide base of investors on the other.

Pantomath has managed more than 100 IPOs : maximum number of IPOs in this period and introduced some of the outstanding businesses to market.

Pantomath has been the choicest investment banker of leading corporates and investors and has successfully completed some of the marquee cross-border transactions.

Pantomath Group is founded by the duo Ms Madhu Lunawat and Mr. Mahavir Lunawat. One of the most passionately hard working couple who has been the pillar of Pantomath backed by a strong professional team. Madhu, a Chartered Accountant by qualification, has worked with leading corporates such as Infosys and Edelweiss. Mahavir has worked with conglomerates such as ITC, Reliance Industries and PWC, before founding Pantomath.

Besides Madhu & Mahavir, Pantomath Board is manned by two of the independent directors, Mr. Ambareesh Baliga, market expert and Mr. K K Jalan, (IAS) Former Secretary MSME Ministry, Government of India.

Pantomath zestfully contributes for various policy making and thought leadership initiatives. Pantomath has been pivotal in some of the rule makings in the areas of capital market and corporate governance.

Pantomath has been engaged in several CSR activities. Pantomath Foundation, a section 80G registered trust, is the Group’s CSR arm. Pantomath has received several awards and accolades for its illustrious achievements and selfless contribution to various sections of the Indian eco-system.

Pantomath celebrates 8th Foundation Day. A gala thanks giving ceremony was organized at Black Boxx, Grand Hyatt, Mumbai. Legendary player Sukhwinder Singh along with Comedian actor Balaraj Sahai and Actor Aman Verma performs at the Ceremony. The Ceremony was graced by Shri Subhash Desai, Hon’ble Minister for Industries & Mining, Government of Maharashtra and other distinguished guests.

Tags:- pantomath nse, pantomath nse news, pantomath nse india

0 notes

Text

Florida based Indian-American philanthropist, billionaire and serial entrepreneur, acquires significant stake in Axiom Energy Conversion Limited

9th November 2021, Hyderabad : Hyderabad based, Electric Vehicle (EV) powertrain components manufacturing company, Axiom Energy Conversion Limited. “Axiom” confirmed that a significant stake of close to 50% in the Company has been acquired by eminent Indian-American cardiologist, philanthropist billionaire and business serial entrepreneur, Dr. Kiran Patel.

Incorporated in 1997, Axiom was founded by Mr. Mohanlal Jesai Purohit. Mr. Purohit has experience of over 4 decades in electronics manufacturing. Over the last few years, Axiom has established itself as a key player in the EV powertrain components market. The Company is known for its quality products across the EV value chain from in-house designed battery chargers, DC convertors, and motor controllers.

Currently Axiom customers include multiple leading EV OEM’s and retailers and it continues to rapidly expand its customer base with acquisition of many new customers.

The Company recently launched a new EV charger for two wheelers, alongside chargers for three wheelers. Axiom has plans to introduce world class 4 wheelers EV powertrain solutions over the next 3 years.

With Dr. Kiran Patel coming aboard, Axiom would be exposed to global markets, backed by financial and strategic management bandwidth. Dr. Patel has been investing and supporting start-ups and early- stage businesses in India and across the globe and mentor them through their scale-up journey. Most recently, Dr. Patel was instrumental in taking public the India-based chemical manufacturer, Anupam Rasayan, of which Dr. Patel is Chairman. Anupam Rasayan went public in March of this year at a valuation of over $750 million, fueled by a total capital infusion of $100 million from Dr. Patel which began in 2018. Other recent investments include a $ 60 million dollar investment in 2018 into the medical device company, Concept Medical. This year, Concept Medical became the first India-based company to file for an Investigational Device Exemption (IDE) with the USFDA.

The support to Axiom reflects Dr. Patel’s long-standing initiative of supporting a brighter, cleaner future. In 2005, Dr. Kiran Patel’s lead gift resulted in the construction of the Kiran C Patel Center for Global Solutions. The University of South Florida also created The Kiran C Patel College of Global Sustainability (PCGS). PCGS, now a degree earning college, also produces research and innovations to help cities around the world reduce their ecological footprint while supporting a healthier, more livable and resilient environment. Earlier in May, 2021, Dr. Patel invested in Series A round of leading charging infrastructure and technology company, Magenta.

Speaking about his investments in Axiom, Dr. Kiran Patel said, “My wife and I have always believed in building a legacy by partnering with companies who are passionate in making this planet better for the next generation. I came across the Axiom team recently and we were impressed by the indigenous Make-in-India manufacturing of EV powertrain components, which I believe is essential if India has to be self-sufficient in electric mobility.”

“This is just the beginning of my investments into Axiom and we have carved out a larger investment chest from our international family office. I have a vision for Axiom which goes beyond the Indian sub-continent and with this energetic team with me, we are bound to make Axiom a leading platform for EV powertrains in our portfolio”, added Dr. Patel.

Mr. M. J. Purohit, MD of Axiom said on one occasion, “Axiom is committed to solving EV powertrain/ charging challenges with made in India custom tailored made solutions. These products which we have developed not only for the Indian market, but will have opportunities for the international market as well.

Over the last few years Axiom has built a strong business in the EV powertrain segment in which we operate and with mentor and Investor like Dr. Kiran Patel participating in Axiom, we stand immensely confident we will be able to reach our goals and will be one of the leading EV powertrain solution provider in India”

Pantomath Capital Advisors Private Limited is the sole Investment Banker to the transaction. Recently, Pantomath managed equity fund raise rounds for EV charging player, Magenta as well.

Tags:- pantomath nse, pantomath nse news, pantomath nse india

0 notes