Don't wanna be here? Send us removal request.

Text

New Income Tax Regime - effective 1st April 2020 u/s Section 115BAC

From FY 2020-21, you can choose to pay income tax under an optional new tax regime. The new tax regime is available for individuals and HUFs with lower tax rates and zero deductions/exemptions. We have discussed the features of the new tax regime and how you can benefit from it.

The choice of whether you should opt for Old Tax Regime or New Tax regime will depend on case to case basis, and is dependent on your taxable salary, whether you have and want to claim tax deductions such as HRA, Housing Loan Interest, have any tax related investments and expenses (us 80C, 80D, etc) or not. You may refer to my other blog article which explains in detail with examples about the new vs old regime and will help you to make an informed choice - https://rahulrjain.tumblr.com/post/190591149120/budget-2020-you-will-end-up-paying-more-income

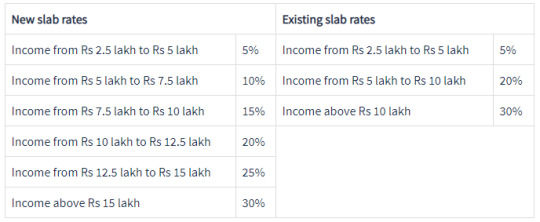

1. Tax rates under the new regime vs old regime

The tax rates under the new tax regime and the existing tax regime are:

2. Exemptions and deductions not claimable under the new tax regime

The new tax regime removes the claim for about 70 deductions and exemptions. The following are the deductions and exemptions you cannot claim under the new tax system:

The standard deduction, professional tax and entertainment allowance on salaries

Leave Travel Allowance (LTA)

House Rent Allowance (HRA)

Minor child income allowance

Helper allowance

Children education allowance

Other special allowances [Section10(14)]

Interest on housing loan on the self-occupied property or vacant property (Section 24)

Chapter VI-A deduction (80C,80D, 80E and so on) (Except Section 80CCD(2) and 80JJAA)

Without exemption or deduction for any other perquisites or allowances

Deduction from family pension income

3. Exemptions and deductions available under the new regime

You can claim tax exemption for:

Transport allowances in case of a specially-abled person.

Conveyance allowance received to meet the conveyance expenditure incurred as part of the employment.

Any compensation received to meet the cost of travel on tour or transfer.

Daily allowance received to meet the ordinary regular charges or expenditure you incur on account of absence from his regular place of duty.

4. Can I choose between the new tax regime and the existing regime?

An employee can choose the new tax regime at the beginning of FY 2020-21 and intimate their employer. The employee cannot change their choice anytime during the financial year. However, the change can be done at the time of filing the income tax return in July 2021. The due date for tax filing for the FY 2020-21 (AY 2021-22) is 31 July 2021. In case an employee does not choose the new tax regime at the beginning of the financial year, the employer will deduct tax (TDS) under the existing tax regime

A salaried taxpayer can opt-in and opt-out every year. That means you can choose the new tax regime in one year and choose the regular tax regime in another year. A non-salaried taxpayer has to choose the new regime at the time of filing the tax return. They need not declare or intimate their choice to anyone at any time during the year. However, a non-salaried taxpayer cannot opt-in and opt-out of the new tax regime every year. Once a non-salaried opts out of the new tax regime, they cannot opt-in again for the new tax regime in the future.

5. How do employees choose the new regime and plan tax?

From a tax planning perspective, it is essential to choose the tax regime at the beginning of the financial year by declaring the same to his/her employee. A taxpayer must make a comparison of the income tax under the new tax regime with the existing regime. Once the taxpayer chooses the tax regime at the beginning of the year, the investments and TDS or advance tax payable calculations are made accordingly.

~For any clarifications, you may reach out to us at [email protected]

1 note

·

View note

Text

GST Rule 86B, 99% ITC restriction and its repercussions wef 1st Jan 2021

The Central Board of Indirect Taxes and Customs (CBIC) has introduced new rule 86B vide notification number 94/2020 dated 22nd December, 2020. Rule 86B is made effective from 1st January 2021.

1. How was ITC utilisation allowed before Rule 86B

Input tax credit plays a very important role in GST by avoiding cascading effect of taxation. The order of utilisation of ITC for different components such as CGST, SGST and IGST has gone through a lot of changes. However, the ITC available in the electronic credit ledger could always be fully utilised for discharging the output tax liability. The new Rule 86B has limited the use of ITC balance for paying its output tax liability.

2. What is the restriction imposed under Rule 86B

Rule 86B limits the use of input tax credit (ITC) available in the electronic credit ledger for discharging the output tax liability. This rule has an overriding impact on all the other CGST Rules.

Applicability: This rule is applicable to registered persons having taxable value of supply (other than exempt supply and zero-rated supply) in a month which is more than Rs.50 lakh. The limit has to be checked every month before filing each return.

Restriction imposed: The applicable registered persons cannot use ITC in excess of 99% of output tax liability. In simple words, more than 99% of the output tax liability cannot be discharged by using input tax credit.

Exceptions to the Rule:

If the persons mentioned below have paid more than Rs.1 lakh as Income Tax under Income Tax Act, 1961:

The registered person

Proprietor, karta or Managing Director of the registered person

Any of the partners or whole time directors or any other person as the case may be.

If the registered person under concern has received a refund of amount greater than Rs.1 lakh in the preceding financial year on account of export under LUT or due to inverted tax structure.

If the registered person under concern has discharged his liability towards output tax by electronic cash ledger for an amount in excess of 1% cumulatively of the total output tax liability up to the said month in the current financial year.

If the registered person under concern is any of the following:

Government department

Public sector undertaking

Local authority

Statutory Authority

3. Impact of Rule 86B on businesses & working capital

After going through the above restrictions and exceptions introduced by Rule 86B, it is clear that the above rule is applicable only to the large taxpayers. There will be no impact on micro and small businesses. The motto behind the introduction of this rule is to control the issue of fake invoices to use the fake input tax credit to discharge liability. Further, it restricts fraudsters from showing high turnovers without having any financial credibility.

CBIC has further clarified that 1% is to be calculated on the tax liability in a month and the turnover of the respective month. Let us understand this with the help of an example:

A taxpayer Mr.A has made a sale of Rs. 1 crore of goods on which tax rate is 12%. In this case, he can discharge his liability up to 99% through ITC and must pay Rs. 12,000 in cash, as per this rule.

Though this rule has also brought genuine taxpayers under ambit making it inconvenient for them, the motto of the Government is to avoid fake invoicing and eventually curb tax evasion.

4. CBIC Clarifications

Clearing the air around "misconceptions" about recently amended Goods and Services Tax (GST) rules, the Central Board of Indirect Taxes and Customs (CBIC), in a series of tweets, has said the rule will be applicable to only 0.5 per cent of the total taxpayers base of 1.2 crore. Some had earlier raised objections that this rule will affect a large number of taxpayers.

Traders' body the Confederation of All India Traders (CAIT) also urged Finance Minister Nirmala Sitharaman to defer the implementation of Rule 86B in GST, terming it a "counter-productive" measure that will increase the traders' compliance burden.

"The rule clearly identifies where the risk to revenue is high and imposes deterrence to the fraudsters in a multi-layered fraud of passing fake ITC," the nodal national agency responsible for administering customs and GST said. It added the rule will help control those who issue fake invoices and show high turnovers but have no financial credibility and flee after misusing ITC without payment of any tax liability in cash.

On speculations that it'll lead to a huge burden on small businesses by increasing their working capital requirement, the CBIC said the cash payment of 1 per cent is to be calculated on the tax liability in a month and the turnover of the respective month. "In fact, it amounts to only 0.01 per cent of turnover," the CBIC said.

It clarified that the rule does not apply to micro and small business and composition dealers. "The new provision which restricts the use of ITC for discharging output liability is applicable to the registered person who value of taxable supply other than exempt supply and export in a month exceeds Rs 50 lakh -- that means those annual whose turnover is more than Rs 6 crore," it added.

0 notes

Text

Budget 2020 - You will end up paying more Income Tax under new regime!

Yes, you heard it right. Budget 2020 looks to be a complete eyewash for salaried taxpayers.

If your total deductions/exemptions (including Standard Deduction + Profession Tax of of Rs 52500/-) in a year is going to exceed Rs 2.5 lakhs in a year, for tax payers drawing Salary of more than 10 lakhs, then it will always make sense to choose old regime. Most taxpayers will fall under this category, as they do invest in House Property, but life insurance, PPF, NPS, Health Insurance, etc, as Salary levels increase.

Some bureaucrat in Delhi who thinks that just by increasing tax slabs from 3 to 6 and giving an option to taxpayers to choose between the old and new regime (old one with higher rates and exemptions, and new one with increased slabs, lowers rates but no exemptions), does not simplify the lifes of taxpayers, and infact makes it more miserable and confusing..

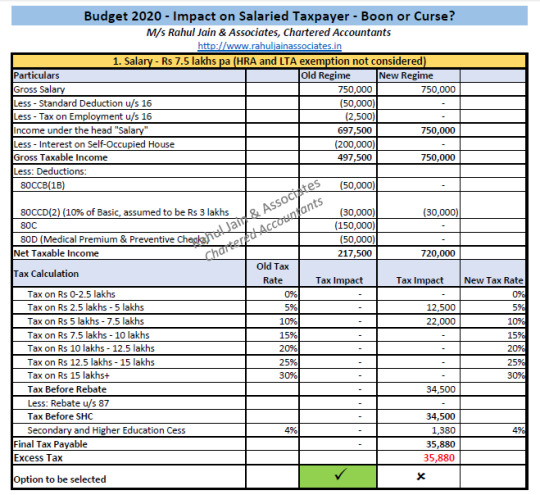

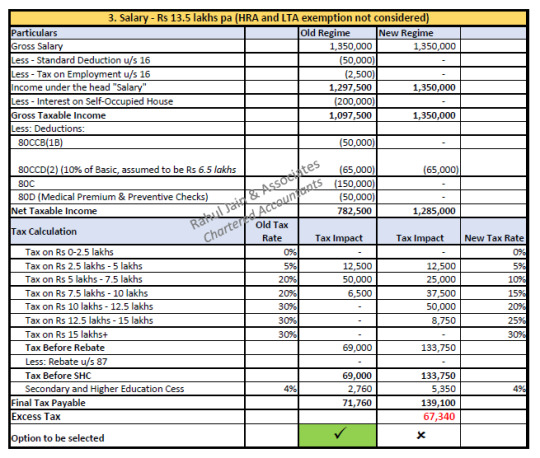

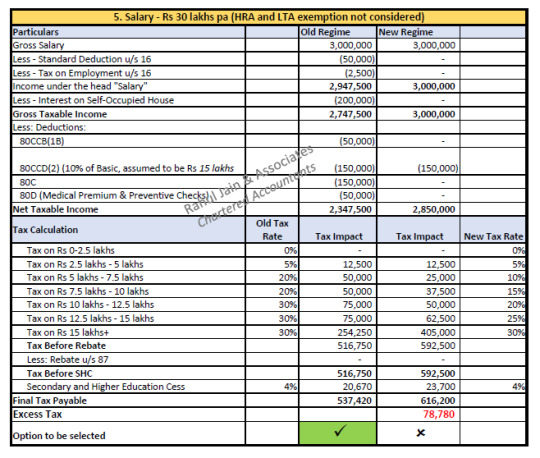

Below is my analysis of impact of Budget 2020 on Salaried Taxpayers, drawing Gross Salary of 7.5 lakhs, 10 lakhs, 13.5 lakhs, 16 lakhs, 30 lakhs and 40 lakhs pa..

In all scenarios it will be beneficial for Salaried Tax Payer to stick to old regime.

0 notes

Text

MCA to issue new SPICe+ Web based forms for Company Formation from Feb 2020

(i) Stakeholders may please note that as part of Government of India’s Ease of Doing Business(EODB) initiatives, the Ministry of Corporate Affairs would be shortly notifying & deploying a new Web Form christened ‘SPICe+’ (pronounced ‘SPICe Plus’) replacing the existing SPICe form. (ii) SPICe+ would be an integrated Web form offering multiple services viz. name reservation, incorporation, DIN allotment, mandatory issue of PAN, TAN, EPFO, ESIC, Profession Tax (Maharashtra) and Opening of Bank Account. It will also facilitate allotment of GSTIN wherever so applied for by the Stakeholders. After deployment of SPICe+ web form, RUN shall be applicable only for change of name of existing companies. (iii) Upon notification & deployment, all new name reservations for new companies as well as new incorporations shall be applied through SPICe+ only (iv) However, incorporation of companies for names reserved through the existing RUN service shall continue to be filed in the existing SPICe eform along with related linked forms as applicable and if marked under resubmission shall be resubmitted in SPICe eform. (v) Resubmission of SPICe forms submitted prior to date of deployment of SPICe+ web form shall also be filed in the existing SPICe eform and related linked forms as applicable.

Due to the proposed changes to the RUN web service (for companies), RESUBMISSION OPTION for name reservation SHALL NOT BE AVAILABLE from 1st Feb 2020 ONWARDS for approximately 15 days. Hence, after 01 Feb 2020, stakeholders are advised to EITHER AWAIT DEPLOYMENT OF SPICe+ AND THEN APPLY FOR NAMES through SPICe+ web form or perform due diligence while submitting any application in existing RUN web service for name reservation. RUN applications (for companies) filed w.e.f 1st February 2020 onwards shall either be approved or rejected based on checks performed by CRC officers. Stakeholders may kindly note and plan accordingly.

#MCA#Ease of doing business#Company registration#Startup India#Startup registration#company formation

0 notes

Text

GST on Real Estate Transactions involving Joint Development Agreements / Transfer of Development Rights wef 1st April 2019 (JDA/TDR)

Construction and Real Estate is a complex business with multiple stakeholders involved in it. It has been a growing sector in India, but ironically has been riddled with litigation owing to multiplicity of taxes and dual administration mechanism; thereby exposing it to the conundrums of both Central and State level complex indirect taxation levy prior to GST regime.

However, with the series of changes that have been made effective from 1st April, 2019 it can be seen as a step in the right direction, although it may not be in line with the GST principles. These changes are enumerated in GST Notification No. 03/2019 – Central Tax (Rate) dt. 29.03.2019 and Notification No. 08/2019-CTR dt. 29.03.2019.

This article is an attempt to summarize the changes made in GST Law effective from 1st April 2019, with respect to its impact on Real Estate Business, involing Joint Development Agreement/Transfer of Development Rights (JDA/TDR) where consideration is in the form of Area Sharing and / or Revenue Sharing. This article does not cover any of the provisions of GST on Real Estate applicable on or before 31st March 2019, nor any transitional provisions for Ongoing Projects as on 31st March 2019.

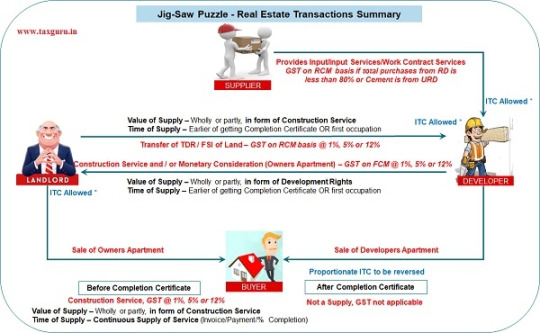

Let us now understand the various parties that could possibly be involved in a typical real estate business end-to-end and the implications of GST on transactions between them.

Typically, any real estate transaction starts with Developer acquiring land for constructing a building (Residential/Commercial) upon it. Land is either purchased outright from the Landowner, or the Developer enters in to “Joint Development Agreement” (JDA) with the Landowner, whereby

The Developer Acquires the Development Rights from Landowner with respect to the Land

The Development rights entitles the Developer to obtain various types of licenses and approvals from the Government authorities and construct a complex, building, civil structure on the land, either by himself, by acqiring material and labour from Suppliers or getting work done through Works Contractors

In return for the transfer of development rights by landowner, the Developer gives the Landowner consideration in the form of Cash (Revenue Sharing) or Construction Service for certain agreed number of apartments/offices/shops (Area Sharing) allotted to Landwoer (hereinafter referred to as “Owners Apartment”) or both

The remaining apartments/Offices/Shops (hereinafter referred to as “Developers Apartment”) are retained by Developer and sold to other Buyers

Landowner may also sell Owners Apartment independently to Buyers or decide to retain it for own use

So in a nutshell, there are 5 parties typically involved in a Real Estate transaction, which has an impact of GST – Landowner, Developer, Supplier, Works Contractor and Buyer.

Various Transactions in a JDA type of agreement and its GST Impact: Flowchart 1

For ease of reading, we have divided this article into 2 sections as below:

1. Definitions

2. Type of transactions and its taxability

1. Definitions and Terms used in this article

Supply – As per para 5(b) of Schedule II of CGST Act, the following is ‘supply of service“:

..(b) Construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier

As per para 6(a) of Schedule II of CGST Act, the following composite supplies shall be treated as a supply of services, namely:

..(a) works contract as defined in clause (119) of section 2

RREP – Residential Real Estate Project (RREP) means a Real Estate Project in which the carpet area of the commercial apartments is not more than 15 % of the total carpet area of all the apartments in the project.

REP – Real Estate Project (REP) means any project other than RREP.

RCM – Reverse charge (RCM) means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or sub-section (4) of section 5 of the Integrated Goods and Services Tax Act

FCM – Forward Charge (FCM) means the liability to pay tax by the supplier of such goods or services

ITC – Input Tax Credit (ITC) means credit of Input Tax

2. Type of transactions and its taxability

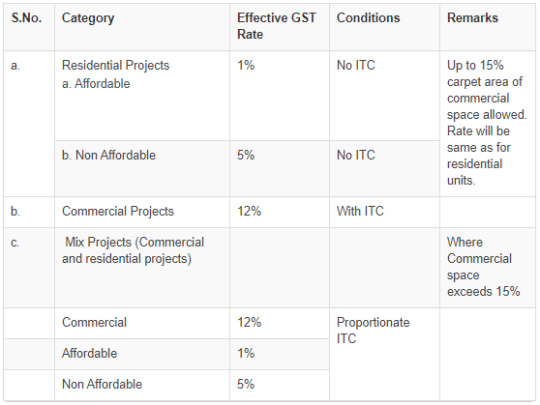

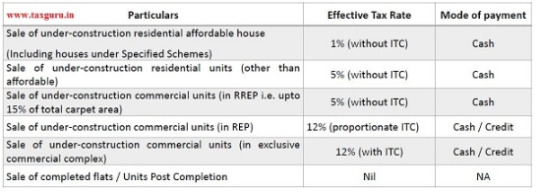

2.1 Sale of units by Developer/Landowner to Buyer – Outward Supply for Ongoing Projects (option not exercised for old rates) and New Projects (01.04.2019 onwards)

In this transaction, either the Developer and/or Landowner sells apartments/shops/offices to the Buyer. This is a simple transaction with the Buyer and GST would be leviable as below, if unit is sold before receipt of Completion Certificate or before its first occupation:

Table 1:

If the entire consideration for the property is received after receipt of Completion Certificate or after its first occupation, whichever is earlier, then it is not considered as a Supply and hence GST is not applicable in such transaction. ITC proportionate to the unsold units as on the date of Completion of the project should be reversed upon completion of the project.

Time of Supply – Continuous supply as per %Completion/Invoicing/Payments received

Input Tax Credit:

Landowner

Entitled to ITC of GST levied by developer on construction of owner’s apartment (refer Flowchart 1) subject to cap of output tax payable on residential apartments sold under construction. For e.g. If the developer charges GST of Rs. 1 lakh to the Landowner, the Landowner should pay at least Rs. 1 lakh as output GST on supply of such apartment to his buyer.

However, if developer pays tax on Construction service for apartments allotted to Landlord (on FCM basis), only on completion of the project, Landowner will not be in a position to avail or utilise ITC, since Landowner cannot charge output GST on further sale of Owners apartment to buyers after completion of project in terms of Schedule III to the Act. Thereby, it seems that even though the landowner is eligible for the credit, its utilisation is doubtful. Whether developer can raise invoice earlier and pay GST before the date of completion of project or first occupation, so that the Landowber can claim ITC, is a question which needs to be considered and clarified by CBIC.

Developer

Not entitled to any ITC in respect of sale of under construction/completed residential units (in any project) and under construction/completed commercial units (in RREP).

ITC can be claimed only on inputs and input services used (see Flowchart 1 above):

for sale of under-construction commercial units (in exclusive commercial complex), or

for sale of under-construction commercial units (in REP), where proportionate ITC can be availed only for the commercial units based on ratio of carpet area of commercial units sold to total carpet area of residential and commercial units

Computation & Reporting of ineligible ITC

ITC not availed should be reported every month by reporting the same as ineligible credit in Form GSTR-3B.

On the final computation done for the financial year, the final adjustment (excess/short) needs to be carried out in Form GSTR-3B or through Form GST DRC-03 in the month not later than the month of September following the end of financial year in which the cut-off date occurs (ie Project is completed), as follows

Excess ITC availed: Such excess need to be reversed along with interest @18% from 1st of April of such financial year till the date of reversal.

Short ITC availed: Same can be claimed as credit in the return filed not later than September following the financial year in which the cut-off date occurs (ie Project is completed).

Mode of Payment of Output Tax:

80% Condition:

The new lower GST rates on construction of residential housing or commercial units in RREP is subject to procurement of 80% of inputs and input services (other than capital goods, TDR/ JDA, FSI, long term lease premiums)) from registered persons.

However, the value of the following services used in the construction of residential apartments are excluded for this calculation:

Grant of developmental rights

Long term lease of land

Floor space index

Value of electricity

Value of high-speed diesel

Motor spirit and natural gas

Salary to employees (neither a good nor a service as per clause 1 of the Schedule III of CGST Act, 2017)

Land value (as per Schedule III, Entry No 5, of CGST Act, sale of land is not a supply)

On shortfall of purchases from the 80 percent from registered dealers, builder shall be required to pay tax under reverse charge (RCM) at 18 percent, provided that on procurement of cement from unregistered dealers the rate shall be 28 percent rate and procurement of capital goods from unregistered dealers shall be liable to the applicable rate of tax. The tax liability on the shortfall of inward supplies from unregistered person would be added to his output tax liability in the month not later than the month of June following the end of the financial year in which inputs/input services were purchased.

2.2 Transfer of DR/TDR/FSI for Construction of Residential apartments / Residential part of Mixed Project (having both Residential and Commercial Apartments)

Transfer of development rights by Landowner to Developer is treated as Supply in which Development Rights are transferred in return for consideration in kind, by way of wholly or partly, in the form of Construction Service of Complex, Building or Civil Structure (Owners apartment) and/or monetary Consideration from the Developer to the Landowner (refer Flowchart 1 above)

Taxability:

Transfer of DR/ TDR/ FSI used for sale of under construction residential units is exempt

Taxable to the extent of unsold residential apartments on the date of issuance of completion certificate or first occupation, whichever is earlier

Person liable to pay Tax: Promoter – Developer (to be paid under RCM)

Input Tax Credit of tax paid under RCM by Developer – ITC not eligible

Time of Supply / Payment of Tax (In area sharing, revenue sharing or outright purchase of DR/TDR/FSI):

Earlier of

Issuance of Completion certificate; or

First occupation of project

Value of Supply (Value of DR/TDR/FSI):

Area sharing: value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI;

Revenue sharing: monetary consideration paid to the Landowner as revenue share;

Outright purchase: value of monetary consideration paid for outright purchase

GST Tax to be Paid:

Lower of

18% on Value of DR/TDR/FSI in proportion to carpet area of such unsold residential apartments & all commercial apartments to total carpet area of residential apartments & commercial apartments; or

1% / 5% of Value of such unsold apartments & all commercial apartments. Value of unsold apartments is deemed to be equal to value of similar apartments charged by the promoter nearest to the date of completion certificate or first occupation, whichever is earlier

2.3 Transfer of DR/TDR/FSI for Construction of Commercial apartments

Transfer of development rights by Landowner to Developer is treated as Supply in which Development Rights are transferred in return for consideration in kind, by way of wholly or partly, in the form of Construction Service of Complex, Building or Civil Structure (Owners apartment) and/or monetary Consideration from the Developer to the Landowner (refer Flowchart 1 above)

Taxability: Fully taxable

Person liable to pay Tax: Promoter – Developer (to be paid under RCM)

Input Tax Credit of tax paid under RCM by Developer:

For RREP (with Commercial portion less than 15%) – ITC not eligible For REP – ITC attributable to Commercial portion can be claimed For Commercial projects – ITC is eligible

Time of Supply / Payment of Tax (In area sharing, revenue sharing or outright purchase of DR/TDR/FSI):

Area Sharing:

Earlier of:

Issuance of Completion certificate; or

First occupation of project

Revenue Sharing:

SRA Projects (continuous supply of service) – Periodical release of FSI;

JDA projects – Date of transfer of DR/FSI irrevocably

Outright purchase – Date of transfer of DR/TDR/FSISRA Projects (continuous supply of service) – Periodical release of FSI;JDA projects – Date of transfer of DR/FSI irrevocably

Value of Supply (Value of DR/TDR/FSI):

Area sharing: value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI;

Revenue sharing: monetary consideration paid to the Landowner as revenue share;

Outright purchase: value of monetary consideration paid for outright purchase

GST Tax to be Paid:

18% on Value of DR/TDR/FSI

2.4 Construction Service for Owner’s Apartment (aplicable only in case of Area Sharing agreement)

Developer provides Construction service to Landowner over a period. The Developer hands over the ownership rights of certain percentage of the developed area ie. Super Structures like complex, building or civil structure or apartments to the landowner (in Area Sharing JDA), referred to as Owner’s Apartment in Flowchart 1 above.

Taxability: Fully taxable

Person liable to pay Tax: Promoter – Developer (to be paid under FCM)

Input Tax Credit to Landowner (for tax paid under FCM by Developer):

Landowner would be eligible to take credit of taxes paid by him to the developer and can be availed for paying the taxes on sale of the owners apartment to his buyers before issuance of completion certificate or first occupation, whichever is earlier, sold by the Landowner independently.

However, as discussed before, if developer pays tax on Construction service for apartments allotted to Landlord (on FCM basis), only on completion of the project, Landowner will not be in a position to avail or utilise ITC, since Landowner cannot charge output GST on further sale of Owners apartment to buyers after completion of project in terms of Schedule III to the Act. Thereby, it seems that even though the landowner is eligible for the credit, its utilisation is doubtful. Whether developer can raise invoice earlier and pay GST before the date of completion of project or first occupation, so that the Landowber can claim ITC, is a question which needs to be considered and clarified by CBIC.

Time of Supply / Payment of Tax:

Earlier of:

Issuance of Completion certificate; or

First occupation of project

Value of Supply (Value of Construction service for Owners Apartments):

Value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI;

GST Tax to be Paid:

Developer shall pay tax on owner’s area at the time of completion certificate or first occupation, whichever is earlier. Rate of tax will be either 1%, 5% or 12% depending on whether the owners apartment is affordable Residential, Residential or Commercial unit (see Table 1 above)

Conclusion

Time will tell whether the reduced GST rates for under-construction properties will give the necessary fillip to the real estate sector which is currently witnessing adversities. The concern regarding the reduced rate of 5% and 1% is that it is offered without the ability for developers to take input tax credit, which could actually lead to an escalation of costs.

In addition, more clarity from CBIC needs to be provided on how the Landowner can avail input tax credit in respect of the GST on construction service for Owners apartment charged by the Developer, as discussed in earlier sections, as this could also have a significant impact on price point of the apartment sold to ultimate buyers.

Disclaimer: The views, opinions and arguments presented in this article are those of the author and may not necessarily reflect legal standing. While every effort has been taken to provide correct information, the author will not be liable for any loss, expense, liability, detriment or deprivation suffered arising out of any action based on the information provided above. The readers are expected to cross-check the facts and information with government circulars and notification.

Author: CA Rahul Jain can be reached at [email protected]. More details on http://rahuljainassociates.in

0 notes

Text

Mandatory Filing of Income Tax Returns - Who is supposed to file ITR for AY 2020-21?

There are some legal consequences for late filing and evasion, which this article will explore. Let’s understand whether you are required to file an income tax return in India for FY 2019-20

Mandatory Filing:

In any of the following situations (as per the Income Tax Act), it is mandatory for you to file an Income Tax Return in India.

Your gross total income (before allowing any deductions under section 80C to 80U) exceeds Rs 2.5 lakhs in FY 2018-19. This limit is Rs 3 lakh for senior citizens (aged above 60 but less than 80) or Rs 5 lakhs for super senior citizens (aged above 80).

You are a company or a firm irrespective of whether you have income or loss during the financial year

You want to claim an income tax refund

You want to carry forward a loss under a head of income

Return filing is mandatory if you are a Resident individual and have an asset or financial interest in an entity located outside of India. (Not applicable to NRIs or RNORs)

If you are a Resident and a signing authority in a foreign account. (Not applicable to NRIs or RNORs)

You are required to file an income tax return when you are in receipt of income derived from property held under a trust for charitable or religious purposes or a political party or a research association, news agency, educational or medical institution, trade union, a not for profit university or educational institution, a hospital, infrastructure debt fund, any authority, body or trust

If you are a foreign company taking treaty benefit on a transaction in India

A proof of return filing may also be required at the time of applying for a loan or a visa

From Assessment Year 2020-21 (ie Financial Year 2019-20), following additional categories of people are also required to file Income Tax Returns if the threshold is crossed in FY 2019-20, even if they have NIL income or income of less than Rs 2.5 lakhs, 3 lakhs or 5 lakhs, as the case may be:

Those who have deposited more than Rs 1 crore in one or more of their bank accounts

Person who has bought foreign exchange of over Rs 2 lakh

Person who has paid an electricity bill of more than Rs 1 lakh

Penalty for Late Filing of Returns:

From FY 2017-18 onwards, penalties for non-filing an income tax return are as follows:

a. A penalty of Rs 5,000 is applicable if the return is filed after the due date (31st Jul of respective AY for cases not covered by Tax Audit or Audit) but by 31 December.

b. A penalty of Rs 10,000 is applicable if the return is filed after 31 December of respective AY but by 31 March.

Note: Penalty is limited to Rs 1,000 for those with income up to Rs 5 lakhs. These provisions are covered under a new Section 234F.

0 notes

Text

Not filing GST return could cost businesses their tax registration, assets

Not filing Goods and Services Tax (GST) returns on time could cost businesses their assets as well as their tax registration, according to a set of instructions the government has issued to field officers, aimed at forcing compliance.

The standard operating procedures issued by the finance ministry instructs field officers to provisionally attach the assets of registered GST assesses, including bank accounts, in cases they think it is needed to protect revenue interests of central and state authorities. Such attachment will be resorted to in cases where businesses do not file returns even after they receive a notice asking them to do so in 15 days. Officers will also proceed to assess tax liability of the business on their best judgement based on available information. The instructions issued on Tuesday also authorise field officers to cancel the GST registrations as allowed in the indirect tax law. Central GST Act allows cancellation of GST registration if businesses do not file returns for specified periods.

“In deserving cases, based on the facts of the case, the Commissioner may resort to provisional attachment to protect revenue…," said the instructions. The move comes at a time when revenue collections and tax return filings remain way below expected levels. Against the total GST registrations of 12.2 million as of June 2019, only 7.8 million filed their returns for October, as per official data. The efforts to improve compliance comes after the authorities remained lenient towards lapses in the initial two years of GST roll out to help businesses and traders migrate to the new indirect tax system. Central and state governments last week decided not to go ahead with any tax rate increase in spite of revenue shortfall and flaws in the GST structure caused by tax cuts in the past as a rate increase could discourage consumption when the economy is going through a slowdown.

0 notes

Text

Taxation of Derivatives Income - Futures & Options (F&O)

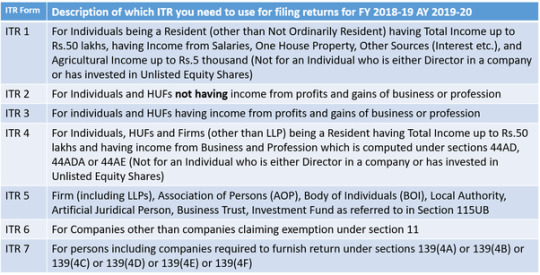

Income from derivative transactions are taxed as business income irrespective of the volume or turnover. If you’ve traded in derivatives, ITR 3 (the form for reporting business income) needs to be filled. Even if you’re a salaried person, you’ll still need to fill ITR-3 if you’ve engaged in any F&O trades in the last FY.

Under Section 43(5), a business is categorized as speculative or non-speculative.

Speculative business income: Income from intraday equity trading is considered as speculative.

Non-speculative business income: Income from trading F&O (both intraday and carryforward) on is considered as non-speculative business. F&O is also considered as non-speculative as these instruments are used for hedging and also for taking/giving delivery of underlying contract.

Maintenance of Books of accounts

All the transaction carried out need to be recorded. This includes buy/sell transactions, expenses like electricity bills, demat charges, phone bills, advisory fee etc. In case a trader is involved in multiple forms of trading in shares like intraday trading, F&O, making investments in MFs, holding shares for more than twelve months from the date of purchase, the business income from each of these must be declared separately since the tax treatment differs based on the type of dealing. The common expenses can be bifurcated depending on the proportion of time spent on the various types of trades.

How do you calculate your trading turnover?

For every trade, contract notes are issued which show the value of assets bought or sold. While for the recording purpose only the difference between is used. Take this example:

Anurag bought one lot of Maruti ports at 2.0 lakhs and sold it for 2.8 lakhs (Profit = Rs 80,000)

Anurag bought one lot of SBI at 3.5 lakhs and sold it for 3.00 lakhs (Loss= Rs 50,000)

The turnover shall be calculated as Rs 80,000 + Rs 50,000 = Rs. 1.30 lakhs. [3]Also, any premium received when you’re writing a option must be added to the turnover value.

When is an audit mandatory?

When the turnover from F&O trading exceeds Rs 2 crore (Section 44AD) or if profits are less than 8% of the trading turnover (and your other income is above taxable limit), the accounts need to be audited by a practicing Chartered Accountant.

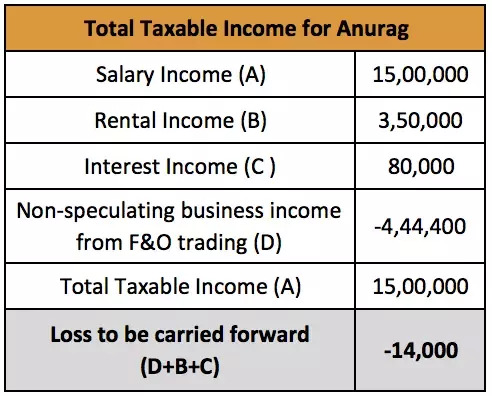

Tax Computation for Anurag

Let’s say Anurag works for Minance and has earned a salary of Rs 15 lakhs in FY 2018-19 (yeah, I wish!)

Anurag opened a trading account with a brokerage firm by paying Rs 5,000 as account opening charges. He has to pay 0.02% as brokerage charges for each F&O trade and paid a total of Rs 98,000 as brokerage charges during the year. He also attended a workshop for F&O beginners and paid the organizers Rs 7,000 for it.

Anurag has mobile expenses of Rs 36,000 (because he talks a lot) for the whole year and a review of his past bills indicates about 50% of his bill is towards his F&O trade. His monthly internet bill is Rs 1,200. He met a consultant who specializes in F&O and had a dinner worth Rs 2,000 with him.

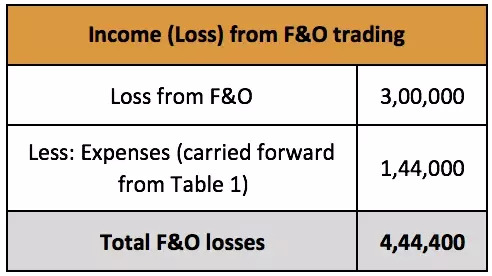

His total turnover is Rs. 1.2 crores and since he’s a horrible trader, his losses are Rs 3 lakhs. Here’s what happened next:

His F&O trades is treated as a business. He will have to file ITR-3 instead of ITR-1 (form for income from salaries, house property, interest and other sources) that he files normally

Anurag can claim expenses of F&O from his income (or loss), which are directly related to F&O his trading

Losses have tax benefits (they can be offset with certain other incomes and can be carry forwarded for 8 succeeding years)

Since Anurag’s turnover is less than Rs 1 crore, but he has losses from FnO business (ie Profit is less than 8% of FnO Turnover) he must get an audit done from his CA. He also has to maintain books of accounts for his trading activity.

Table 1: List of expenses incurred for F&O trading by Anurag.

Table 2: Net income from Anurag’s F&O trading business. Remember I made a loss of Rs 3 lakhs because I’m a horrible trader? That’s the first item. The second team is the net expenses brought forward from the grand total of Table 1.

Table 3: F&O trading is considered as a non-speculative business, can be set off with other incomes such as rental income, interest income. Any loss which is unadjusted here (the Rs 14,000 portion) can be carried forward to 8 succeeding years. In these 8 years it can only be set off against non-speculative business income.

Treatment of losses from the F&O trading business and how it affects tax liability?

Reporting losses can help you bring down the tax liability. Since F&O trading is counted as a non-speculative business, loss from F&O trading is allowed to be adjusted against income from any other source (except salary income).

Note: Losses from a speculative business such as day trading cannot be set off against any income other than income from a speculative business.

If the loss is not fully adjusted it can be set off against income under any other source like Income from House Property, Income from Capital Gains etc, except under the head Salaries. If the loss still couldn't be adjusted fully in the year in which it was incurred, the unadjusted loss can be carried forward for next eight years immediately succeeding the year in which it was incurred and be set off only against the head Profit and gains of business and profession for non-speculative business.

Consequences of non-compliance

Penalty of amount upto Rs. 25,000 for not maintaining proper books of accounts.

Penalty of 1.5 % of the turnover or maximum penalty of Rs. 1.5 lakhs for not auditing accounts before the specified date (Relevant date was 31st Oct 2019 for the FY 2018-19).

0 notes

Text

Budget 2019 - Highlights

- Govt Will provide Rs 6,000 per annum to farmers holding land of up to 2 hectres. The amount will be transferred in three installments of Rs 2,000 directly to the farmers. Around 12 crore farmers will directly benefit from this scheme. The initiative will benefit crores of small and marginal farmers, at an estimated cost of Rs. 75,000 crore. It will enable farmers to earn a respectable living (12.5 cr farmers)

- In place of rescheduling of crop loans, all farmers severely affected by severe natural calamities will get 2% interest subvention and additional 3% interest subvention upon timely repayment

- Government proposes to launch a mega pension yojna. The scheme, called Pradhan Mantri Shram Yogi Mandhan, will provide assured monthly pension of 3,000 with contribution of 100 rupees per month for workers in unorganized sector after 60 years of age

- Gratuity limit increased from Rs 20 lakh to Rs 30 lakh

- Individual taxpayers with annual income of up to Rs 5 lakh will get full tax rebate u/s 87A. This is only for “resident” taxpayers

- Standard deduction has been increased to Rs 50,000 from Rs 40,000

- TDS threshold on rental income raised from Rs 1,80,000 to Rs 2,40,000

- TDS limit hiked from Rs 10,000 to Rs 40,000 on Interest paid by Banks (FD), Cooperative Society and Post-Office savings

- No tax on notional rent on second self-occupied house. Section 24 of the Income-tax Act to be amended to provide that the monetary limit of deduction on account of interest payable on borrowed capital (Rs 2 lakhs pa) shall continue to apply to the aggregate of the amounts of deduction in case of more than one self-occupied houses.

- Benefit of rollover of capital tax gains to be increased from investment in one residential house to that in two residential houses, for a taxpayer having capital gains up to Rs 2 crore; can be exercised once in a lifetime

- Notional rent on unsold real estate inventory - Tax to be levied after 2 years from date of completion of project. Previously, it was 1 year

20 views ·

0 notes

Text

Do you file ITR-1 (Sahaj) each year? Check conditions for FY 2018-19 for filing ITR-1..

Check if you are eligible to file ITR 1 Sahaj Form for FY 2018-19 (AY 2019-20):

For the Financial Year 2018-19 and Assessment Year 2019-20, following conditions should be satisfied in order to file ITR-1, else ITR2/3 may be applicable:

1) Individual should not hold any equity shares in an unlisted company – Public or Private

2) Individual should not be director in any company

3) Individual should have total income of not more than 50 Lakh Rupees

4) Individual should have only one house property earning rental income

5) Individual cannot file if any part of income on which tax has been deducted in hands of a person other than individual who is filing returns

6) Agricultural Income should not be more than Rs 5000/-

7) There should be no brought forward loss or loss to be carried forward

8) There should be No income from lottery, race horses, or unexplained income

9) No clubbing the income of another person—spouse or minor child—with her own income

10)Individual should not have assets (including financial interest in any entity) located outside India;

11) Individual should not have signing authority in any account located outside India;

12) Individual should not have income to be apportioned in accordance with provisions of section 5A;

Further, additional details to be provided:

for claiming deduction in Chapter VIA like 80C

for exempt allowances under salary

from income from Bank interest - whether from Fixed Deposit or from Savings Account.

23 views

0 notes

Text

Income Tax Return (ITR) form applicable for FY 2018-19 (AY 2019-20) for Income Tax Assessees

1 note

·

View note