RAJ KISHAN CPA INC., a leading accounting firm in Burlington, Massachusetts, offers expert tax preparation services for individuals and businesses. With over 15 years of experience, we specialize in accurate and efficient tax filing, ensuring compliance while maximizing deductions and credits. Our personalized approach ensures that every client receives tailored solutions to meet their unique financial needs.

Don't wanna be here? Send us removal request.

Text

Expert Tax Planning and Preparation Services

Get expert tax planning and preparation services tailored to your personal and business needs. Our team helps you reduce your tax liability, maximize deductions, stay compliant with the latest IRS regulations, and file accurately and on time. Trusted by individuals, entrepreneurs, and small business owners for reliable, stress-free tax support year-round.

#accounting firm#Tax planning and preparation#accountant burlington#cpa burlington ma#accounting firms burlington

0 notes

Text

5 Tax Prep Tips to Save Time, Stress & Money

Make tax season less overwhelming with these 5 essential tax preparation tips. From organizing your documents and starting early to using the right tools, knowing your deductions, and double-checking your return, these strategies will help you file accurately, avoid costly mistakes, and reduce last-minute stress. Whether you're a first-time filer or a seasoned taxpayer, these tips will save you time, protect your money, and give you peace of mind.

#cpa tax professional#accounting firm#accountant burlington#accounting firm burlington#tax preparation services

0 notes

Text

Trusted Accounting Firm in Burlington for Businesses

As a trusted accounting firm in Burlington, we specialize in supporting small businesses with accurate, timely, and personalized financial services. From bookkeeping and tax preparation to payroll and business advisory, our expert team helps local entrepreneurs stay compliant and make smarter financial decisions. With deep knowledge of local regulations and a commitment to your business success, we provide accounting solutions that grow with you.

#accounting firm#cpa tax professional#cpa burlington ma#accounting firm in burlington#accounting firm burlington#accounting firms burlington

0 notes

Text

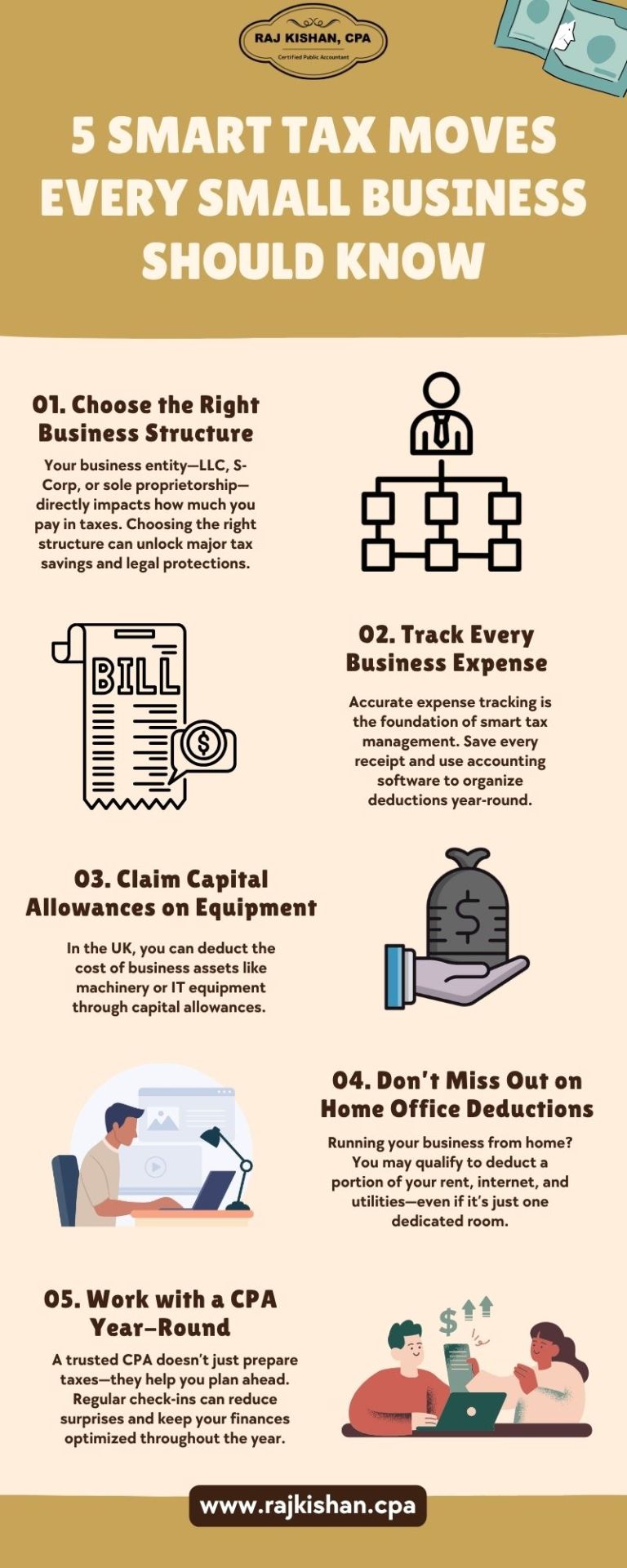

5 Smart Tax Moves Every Small Business Should Know

Learn 5 smart tax strategies every UK small business should know. Discover how working with a CPA for tax preparation can help you reduce your tax bill, claim key deductions, and stay HMRC-compliant all year round.

0 notes

Text

Professional Accounting services Massachusetts

Professional accounting services Massachusetts help individuals and businesses manage their finances with confidence and clarity. From accurate bookkeeping and payroll processing to expert tax planning and business consulting, these services ensure compliance with state and federal laws while supporting long-term financial success.

#accounting firm#accountant burlington#cpa tax professional#accounting firms burlington#accounting firm in burlington

0 notes

Text

4 Major Types of Taxes

There are four main types of taxes that individuals and businesses need to understand to avoid a potential tax problem. Income tax applies to earnings from work or business activities. Sales tax is added at checkout on most goods and services. Property tax is based on the value of owned real estate and supports local services. Payroll tax is deducted from wages to fund retirement and healthcare programs—mistakes in any of these areas can lead to serious tax problems.

0 notes

Text

Professional Payroll Services

Managing payroll can be a time-consuming and complex task for any business, riddled with compliance risks and potential errors. Our Professional payroll services are designed to streamline your operations, ensuring your employees are paid accurately and on time, every time. From precise wage calculations and tax withholdings to timely federal and state tax filings, we handle all the intricate details.

#cpa tax professional#accounting firm in burlington#payroll services#payroll tax services#Professional payroll services

0 notes

Text

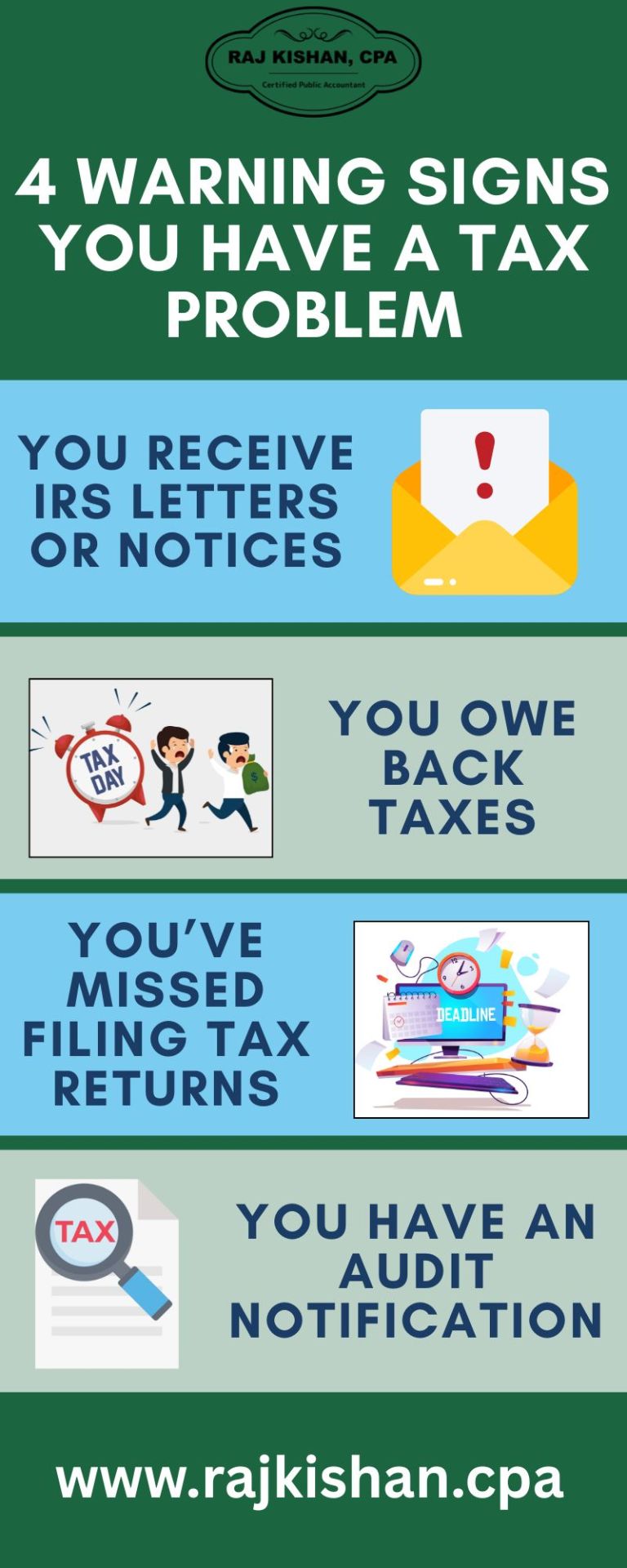

4 Warning Signs You Have a Tax Problem

Worried about your taxes? You're not alone and the warning signs aren't always obvious. Here are 4 key indicators that you may have a tax problem, from missed filings to wage garnishments. Knowing what to watch for can help you take action early, avoid IRS penalties, and protect your financial future. Don’t wait for the IRS to come knocking find out what to do before things get worse.

#taxproblem#irswarningsigns#backtaxes#unfiledtaxreturns#wagegarnishment#taxdebt#taxhelp#taxresolution#taxtrouble

0 notes

Text

Keeping Every Receipt in Check

Bookkeeping services are essential for maintaining accurate financial records and ensuring compliance with tax regulations. Professional bookkeepers help track income, expenses, receipts, and invoices, which supports effective budgeting and financial planning. Small businesses benefit from organized bookkeeping by gaining clarity on their cash flow, identifying financial trends, and preparing for audits or tax filings. Consistent and precise bookkeeping lays the foundation for long-term business stability and informed decision-making.

#small business accounting services#cpa for small business#small business accounting Burlington#small business accounting#Accounting services Massachusetts#accounting services in Burlington#bookkeeping services in Burlington#tax accountant in Burlington#bookkeeping#accounting services#bookkeeping services

0 notes

Text

Why Small Business Accounting Is No Longer Just About Bookkeeping

Modern small business accounting is no longer limited to bookkeeping. This blog explores how today’s accountants offer strategic planning, real-time insights, and cloud-based tools to help businesses make informed decisions. Learn how compliance, tax strategy, and financial advisory services now play a key role in driving business success. Whether you're a growing startup or an established company, understanding these trends can transform how you manage finances and plan for the future. Stay ahead with smarter accounting solutions.

#small business accounting services#cpa for small business#small business accounting Burlington#small business accounting#Accounting services Massachusetts#accounting services in Burlington#bookkeeping services in Burlington#tax accountant in Burlington

1 note

·

View note

Text

Payroll Red Flags | Signs It’s Time to Outsource

Is your payroll system putting your business at risk? This video highlights the most common payroll red flags—frequent errors, missed tax deadlines, and employee dissatisfaction—that signal it’s time to consider professional payroll services. Learn how outsourcing can improve accuracy, reduce stress, and save your business time and money. Don’t wait for an audit to realize there’s a problem. Watch now and take control of your payroll before it’s too late.

#payroll tax services#Professional payroll services#payroll services#payroll services Burlington#accountant burlington#accounting firm#cpa firm#accounting firms burlington#accounting firm burlington#cpa tax professional#certified public accountant#certified public accountant burlington#cpa burlington ma#accounting firm in burlington

1 note

·

View note

Text

What Most People Get Wrong About Tax Preparation Services

Many people misunderstand what professional tax preparation services truly offer. This video breaks down common myths, revealing why DIY tax filing might cost more in the long run. Learn how tax experts do more than just input numbers—they maximize deductions, ensure compliance, and reduce audit risks. Whether you’re an individual, freelancer, or small business owner, understanding these facts can save you time, money, and stress during tax season.

#cpa for tax preparation#tax preparation services#tax preparation services Burlington#accountant burlington#accounting firm#cpa tax professional#accounting firm in burlington#cpa firm#accounting firms burlington#certified public accountant#accounting firm burlington#cpa burlington ma#certified public accountant burlington

1 note

·

View note

Text

What Most People Get Wrong About Tax Preparation Services

Many people misunderstand what professional tax preparation services truly offer. This video breaks down common myths, revealing why DIY tax filing might cost more in the long run. Learn how tax experts do more than just input numbers—they maximize deductions, ensure compliance, and reduce audit risks. Whether you’re an individual, freelancer, or small business owner, understanding these facts can save you time, money, and stress during tax season.

#cpa for tax preparation#tax preparation services#tax preparation services Burlington#accountant burlington#accounting firm#cpa burlington ma#accounting firms burlington#accounting firm burlington#cpa firm#accounting firm in burlington#certified public accountant#cpa tax professional#certified public accountant burlington

1 note

·

View note

Text

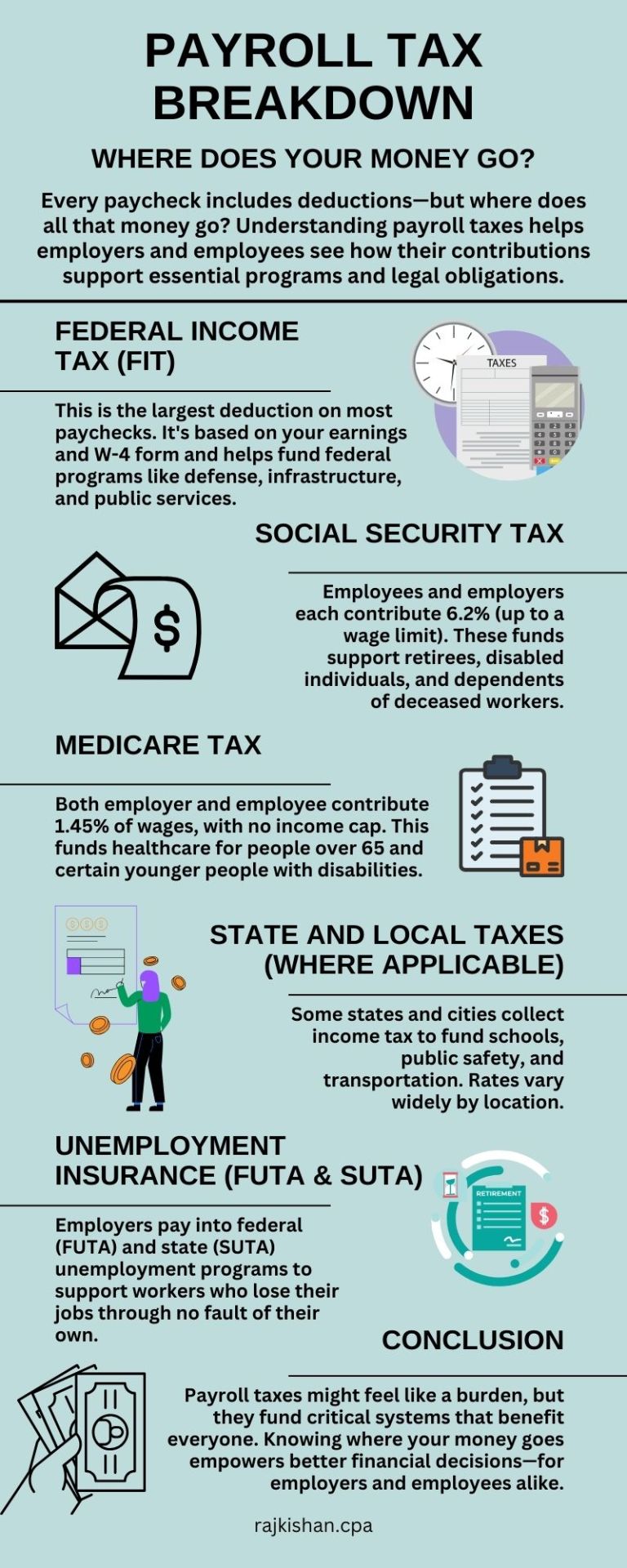

Payroll Tax Breakdown | Where Does Your Money Go?

Expose the secret narrative behind your paycheck with our infographic. Discover how your wages are allocated to support essential programs such as Social Security, Medicare, and unemployment benefits. This visual aid demystifies complex tax elements so employees and employers can better comprehend their financial obligations. Ideal for anyone who wishes to be wiser about payroll and taxation.

#payroll tax services#Professional payroll services#payroll services#payroll services Burlington#accountant burlington#accounting firm#cpa burlington ma#cpa firm#cpa tax professional#accounting firm burlington#accounting firm in burlington#accounting firms burlington#certified public accountant#certified public accountant burlington

1 note

·

View note

Text

Effective Solutions for Your Tax Problem | How to Resolve It with Confidence

Struggling with a tax problem? Whether it's unpaid taxes, IRS notices, or penalties, understanding your options is crucial. Resolving tax issues efficiently involves exploring solutions like negotiation strategies, payment plans, and seeking professional assistance. Don’t let tax stress hold you back—tackle your tax problem head-on and get back on track with the right approach.

#tax problem#tax problem resolution#tax problem resolution Burlington#accountant burlington#accounting firm#cpa burlington ma#cpa firm#cpa tax professional#accounting firm burlington#accounting firm in burlington#accounting firms burlington#certified public accountant#certified public accountant burlington

1 note

·

View note

Text

In-House vs. Outsourced Payroll | Pros, Cons & Cost Comparison

In today’s fast-moving business environment, payroll is no longer a back-office function you can overlook. It directly affects employee satisfaction, compliance, and even your bottom line. With regulatory demands increasing and remote teams becoming the norm, more companies are reconsidering how they handle payroll—should it be managed internally or outsourced to professionals?

This blog breaks down the key differences between in-house and outsourced payroll, the benefits and drawbacks of each, and the real costs businesses should consider before deciding.

What’s the Difference Between In-House and Outsourced Payroll?

In-house payroll refers to managing all payroll-related tasks internally, typically by your HR or finance team. This includes calculating wages, processing payments, filing taxes, handling benefits, and maintaining compliance with labor laws. Outsourced payroll, on the other hand, involves hiring a third-party provider—such as a payroll service firm or CPA—who takes over these responsibilities on your behalf. These providers often bring advanced tools, automated systems, and compliance expertise.

The Pros of In-House Payroll

Keeping payroll in-house appeals to businesses that want full control over sensitive data and processes.

Benefits include:

Greater control over payroll schedules and edits

Immediate access to data and employee records

Customization of pay structures and reporting formats

No third-party involvement, which can ease privacy concerns

Potential cost savings for very small teams or sole proprietors

Ideal for: Startups or very small businesses with simple payroll needs and a knowledgeable internal team.

The Cons of In-House Payroll

While control is appealing, the trade-offs can include risk, time, and a lack of up-to-date compliance.

Challenges include:

Time-consuming manual processes

Risk of errors, missed deadlines, or incorrect filings.

Staying current with federal, state, and local payroll regulations

Limited backup or support if the payroll person leaves

Higher tech and security costs to ensure data protection

Bottom line: Unless you have a dedicated payroll expert in-house, this can quickly become a liability.

Why Outsourced Payroll Is Gaining Popularity in 2025

Outsourcing payroll is becoming increasingly popular for good reason. Third-party providers offer end-to-end payroll management, from calculating wages to filing taxes and managing year-end forms like W-2s and 1099s. These services reduce your administrative burden and lower your compliance risks. Outsourced payroll is typically more accurate due to automation, and it’s often more secure thanks to advanced encryption and secure cloud-based systems. Modern payroll firms also offer easy integration with accounting or HR platforms, along with mobile access and real-time reporting.

Perhaps most importantly, outsourcing allows you to focus on growing your business rather than getting bogged down in administrative tasks. For companies with remote, hybrid, or multi-state teams, outsourcing is often the only scalable option that ensures compliance across jurisdictions.

Potential Downsides of Outsourcing Payroll

Of course, outsourcing isn’t without its drawbacks. You give up some control over your payroll processes and must rely on external support when issues arise. The onboarding process can take time, and some businesses may feel uneasy about sharing sensitive employee data with a third party. Cost is another consideration. While outsourced payroll can be cost-effective in the long run, there is an ongoing monthly or per-employee fee that needs to be budgeted for.

Cost Comparison: What Are You Really Paying For?

Let’s compare in-house vs. outsourced payroll in terms of cost, time, and risk:

Average Outsourcing Cost:

Small teams (under 10 employees): ~$100–$300/month

Larger businesses: Per-employee pricing (~$20–$30/employee)

Don’t forget to factor in hidden in-house costs like IRS penalties, staff turnover, or security breaches.

How to Decide | Which Payroll Option Is Right for You?

To make the right decision, consider your business size, payroll complexity, available internal resources, and long-term goals. If your payroll is simple, you have a reliable and knowledgeable team, and you prefer maintaining control, in-house may be a good fit. However, if payroll is becoming a distraction, if your team lacks compliance expertise, or if you're scaling quickly and want to reduce risk, outsourcing might be the smarter move.

Ask yourself questions like:

Do we have the internal capacity to manage compliance?

Are we spending too much time processing payroll each month?

Are we prepared for tax audits or multi-state payroll complexities?

If the answer to any of these is no, outsourcing could save you both time and stress.

Final Thoughts | It’s About Control vs. Confidence

Choosing between in-house and outsourced payroll comes down to what your business needs more—control or confidence. With in-house payroll, you control the process but take on the risks and responsibilities that come with it. With outsourced payroll, you gain confidence in compliance and efficiency but must be comfortable relying on a trusted partner.

The good news is that payroll isn't a one-time decision. Some businesses start in-house and outsource later as they grow. Others outsource first and eventually bring it back in-house once they have a dedicated HR team in place. The best choice is the one that aligns with your operational priorities and future growth strategy.

#payroll tax services#Professional payroll services#payroll services#payroll services Burlington#accountant burlington#accounting firm#cpa burlington ma#cpa firm#cpa tax professional#accounting firm burlington#accounting firm in burlington#accounting firms burlington#certified public accountant#certified public accountant burlington

1 note

·

View note

Text

youtube

How to Resolve Tax Debt Without Stress 😮💨

Struggling with tax debt? Don’t stress — there are effective solutions that can help you get back on track. In this short video, learn practical steps to resolve your tax problems, from setting up IRS payment plans to negotiating settlements. Whether you're dealing with personal or business taxes, this guide offers expert-backed tips to ease your burden and regain control of your finances. Watch now and take the first step toward resolution!

#tax problem#tax problem resolution#tax problem resolution Burlington#accountant burlington#accounting firm#cpa burlington ma#cpa firm#accounting firm burlington#cpa tax professional#accounting firm in burlington#accounting firms burlington#certified public accountant#certified public accountant burlington#Youtube

2 notes

·

View notes