#tax services

Text

if you are an American,

🙂 are you good?

it’s officially tax season crunch-time folks!

You know what that means: sweaty searches for your W2 and paralyzing fear over whether you owe or not! 🙂

Will it be a return for you this year or will you be looking for a third job to cover that amount due? 🙃

I’m right there with you friends.

Let my humble contribution below, bring you some laughs as you languish to help combat the Sunday Scaries. 🐀❤️

youtube

#taxes#tax services#taxation#tax preparation#tax planning#tax professional#tax policy#tax payers#tax payment#tax filing#tax forms#tax free#tax liability#tax evasion#tax season#tax savings#tax strategies#tax software#mental health#mental illness#mental heath awareness#mental health matters#Youtube

226 notes

·

View notes

Text

KGT Applications offers tailored business solutions. We design custom tools to automate tax processes, streamline operations and enhance efficiency to ensure tax compliance and business growth. With a comprehensive suite of enterprise software, businesses can optimize their processes and reach their maximum potential. Contact KGT Applications today!

#tax services#sap consulting services#business automation#business solutions#process management#Enterprise software

2 notes

·

View notes

Text

#accounting#management#Accounting Firms#Tax Services#accounting companies#bookkeeping#audits#payroll#tax preparation#outsourcing partner#Florida

2 notes

·

View notes

Text

2024-02-26/1445-08-16

May be worth considering mass civil disobediance in the form of delaying paying your taxes (*case by case, if you can, at your own discretion. If you need the return, you do you, no shame, wherever you are.)

Update: I don't know about other countries, but in Canada, the CRA will not harass or stalk you if you do not file your tax returns. [Some scammers will pose as CRA agents to try to intimidate you, don't fall for it]. (You can file in a year or two, again, at your discretion, file retroactively for certain years. Unless you owe an amount, you won't get into serious trouble. I'm not aware of other countries, like America with the IRS, other countries, so do your research first, take care of yourself first. You assume your own risk if you do civil disobedience.)

#taxes#tax season#tax services#death and taxes#gaza#free gaza#free palestine#apartheid#social justice#genocide#ceasefire

4 notes

·

View notes

Text

GST services Singapore

K.M.Ho & Co. offers Business financial audit, GST services Singapore, Public Accounting audit, GST accounting, Tax filing and return services with our top-rated audit firm for handling your business issues in Singapore at reliable prices.

#Business financial audit#Accounting audit#Audit firm singapore#Audit and tax services#Business audit#Tax audit services#Tax audit#Accounting audit services#Accounting audit firms#Tax services#Tax filing services#Tax return services#Public accountant singapore#Public accounting firm singapore#Accounting services singapore#Accounting firm services#GST accounting services#GST filing singapore#GST services singapore#GST return services

2 notes

·

View notes

Text

GST Consultants in Delhi

Conquering the Labyrinth: Navigating GST with Legalntax, Your Expert GST Consultants in Delhi

The Goods and Services Tax (GST) has revolutionized the Indian tax landscape, but its complexities can often leave businesses feeling lost in a labyrinth. Fear not, intrepid entrepreneurs! Legalntax, your trusted GST consultants in Delhi, are here to guide you through every twist and turn.

Why Choose Legalntax as Your GST Guide in Delhi?

With a team of seasoned chartered accountants and tax specialists, Legalntax possesses the expertise and experience to handle all your GST needs. We're not just number crunchers; we're your strategic partners, providing comprehensive GST solutions tailored to your unique business.

Our Services:

GST Registration: We'll ensure smooth and hassle-free registration, helping you navigate the intricacies of online and offline procedures.

GST Return Filing: Leave the complexities of return filing to us. We'll ensure accuracy and timely submission, minimizing the risk of penalties.

GST Compliance: Stay compliant with ever-evolving GST regulations. Our proactive approach keeps you informed and updated, avoiding compliance pitfalls.

GST Audits and Assessments: Face audits with confidence. We'll represent you with expertise and ensure smooth resolution of any discrepancies.

GST Litigation: In case of disputes, our legal team will fight for your rights, protecting your business from unnecessary burdens.

GST Advisory: We're your sounding board. Seek expert advice on optimizing your GST strategy, minimizing tax liabilities, and maximizing profitability.

Beyond Technical Expertise:

Legalntax goes beyond just crunching numbers. We understand that GST compliance can be a significant burden on businesses. That's why we focus on simplifying the process, making it transparent and understandable for you. We provide regular updates and guidance on the latest GST developments, empowering you to make informed decisions.

Our Commitment to Your Success:

At Legalntax, your success is our priority. We're invested in your business, working alongside you to minimize tax liabilities, optimize compliance costs, and achieve long-term growth. We offer competitive rates and flexible packages to cater to your specific needs and budget.

Ready to Conquer the GST Labyrinth with Confidence?

Don't let GST compliance become a roadblock to your business success. Choose Legalntax, your trusted GST consultants in Delhi, and navigate the complexities with ease.

Contact us today for a free consultation!

Remember, with Legalntax as your guide, the GST labyrinth transforms into a path to success.

We hope this blog post effectively positions Legalntax as the premier choice for GST consultancy in Delhi. By highlighting your comprehensive services, expert team, and commitment to client success, you can attract businesses seeking reliable and trustworthy guidance through the intricacies of GST.

Here are some additional tips to enhance your blog post:

Include compelling success stories or testimonials from satisfied clients.

Share valuable insights and practical tips on managing GST compliance effectively.

Offer downloadable resources like GST checklists or ebooks.

Optimize your blog post for search engines by including relevant keywords and phrases.

Promote your blog post on social media and other online platforms to reach a wider audience.

By implementing these suggestions, you can create a blog that not only informs and educates potential clients but also positions Legalntax as the go-to GST consultants in Delhi.

2 notes

·

View notes

Text

Unravelling VAT Dynamics: A Comprehensive Handbook on Registration Services in the UAE

Welcome to Goviin VAT Registration Services – a collective of qualified and knowledgeable accountants, auditors, and tax advisors committed to empowering you to take control of your finances and propel your business towards greater heights. Our comprehensive suite of services caters to clients spanning across the UAE. Whether you require seasoned bookkeeping services or proficient tax preparation for your business, rest assured that Goviin VAT Registration Services has the expertise to meet your needs and ensure financial success.

Value Added Tax (VAT) serves as a consumption tax, intricately woven into the economic fabric, impacting the supply of goods and services. This rate applies to a wide array of goods and services, with specific categories enjoying zero-rated or exempt status.

VAT Registration Services:

Engaging professional VAT registration services is a prudent choice for businesses navigating the complexities of compliance. These services streamline the registration process, ensuring accurate submission of required documents and adherence to the Federal Tax Authority (FTA) guidelines.

Key Steps in VAT Registration:

Assessment of Eligibility

Document Preparation

Online Registration Portal

Effectively managing VAT tax registration services in the UAE is pivotal for businesses operating in the region. Professional assistance not only simplifies the registration process but also ensures ongoing compliance with VAT regulations. As the UAE continues to evolve as a global business destination, staying informed and seeking expert guidance becomes paramount for businesses aiming to thrive in this dynamic marketplace.

2 notes

·

View notes

Text

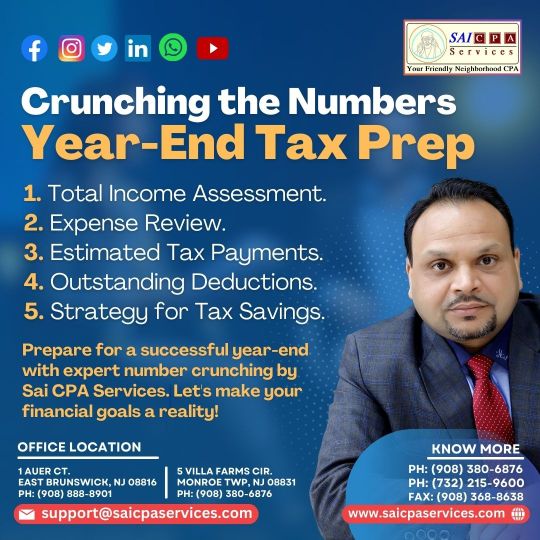

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/

https://www.facebook.com/AjayKCPA

https://www.instagram.com/sai_cpa_services/

https://twitter.com/SaiCPA

https://www.linkedin.com/in/saicpaservices/

(908) 380-6876

1 Auer Ct, East Brunswick,

New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

IRS Tax Preparer

We have a list of IRS-enrolled agents who can provide professional tax preparation for your needs. Find a tax office near you today by searching the IRS enrolled agent list.

For best information please visit our website - https://www.enrolledagent.com/

Address - 100 Church Street, 8th floor, New York, NY, United States, 10007

Phone - +1 8552224368

Email - [email protected]

#Enrolled Agent#Enrolled Agent Near Me#Tax Services#EA Tax Preparer#EA Tax Preparer Near Me#IRS Free Filing Program#Enrolled Agent Lookup#List of Enrolled Agents#find enrolled agent

2 notes

·

View notes

Text

youtube

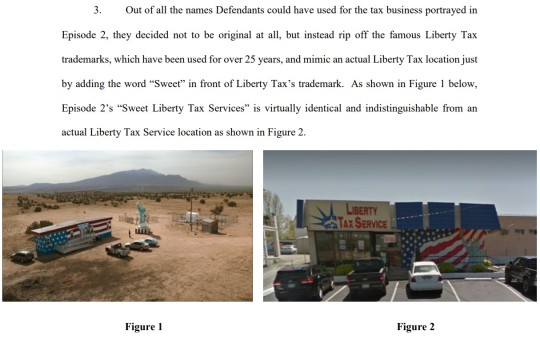

Better Call Saul was SUED IN REAL LIFE by an actual tax company! 👨🏻⚖️

#better call saul#bcs#breaking bad#brba#tv#tv show#tv shows#tv series#did you know#trivia#tv trivia#fun fact#fun facts#sued#lawsuit#liberty tax#taxes#tax preparation#tax services#true story#Youtube

3 notes

·

View notes

Text

Bookkeeping for Startups: Basics and Tips

Starting a new business is an exciting time, but it can also be overwhelming. There are so many things to think about, from marketing and sales to product development and customer service. In the midst of all of this, it's easy to overlook the importance of bookkeeping.

However, bookkeeping is essential for any business, regardless of its size. It's the foundation for managing your finances, making informed decisions, and complying with tax laws.

If you're a startup, you may be wondering where to start with bookkeeping. Here are some basic tips:

Understand the importance of bookkeeping. Bookkeeping is more than just keeping track of your income and expenses. It's also about providing you with insights into your business's financial health. By keeping accurate records, you can track your cash flow, identify areas where you can save money, and make informed decisions about your business's future.

Set up a system for organizing your financial documents. This will make it easier for you to track your transactions and prepare your financial statements. You can use a simple spreadsheet or a more sophisticated accounting software program.

Choose a bookkeeping method. There are two main types of bookkeeping methods: cash basis and accrual basis. Cash basis accounting records transactions when cash is received or paid. Accrual basis accounting records transactions when they occur, regardless of when cash is received or paid. The method you choose will depend on your business's needs.

Track your income and expenses. This is the most important aspect of bookkeeping. You need to track all of your income and expenses, no matter how small. This will help you to stay on top of your finances and identify areas where you can save money.

Reconcile your bank statements. This is the process of comparing your bank statements to your bookkeeping records to make sure they match. It's an important step in ensuring the accuracy of your financial records.

Prepare financial statements. Financial statements are a summary of your business's financial performance. They include the balance sheet, income statement, and cash flow statement. You need to prepare financial statements on a regular basis to track your business's progress and make informed decisions.

Bookkeeping can seem daunting at first, but it's essential for any business. By following these tips, you can set yourself up for success with bookkeeping from the start.

Anchor text: Bookkeeping

Here are some additional tips for bookkeeping for startups:

Use cloud-based accounting software. This can make it easier to track your finances and collaborate with others.

Hire a bookkeeper or accountant. If you don't have the time or expertise to do your own bookkeeping, you can hire a professional to help you.

Stay up-to-date on tax laws. The tax laws can change frequently, so it's important to stay up-to-date so you can file your taxes correctly.

Bookkeeping is an essential part of running any business. By following these tips, you can set yourself up for success with bookkeeping from the start.

If you're a startup, don't neglect bookkeeping. It's an essential part of managing your finances and making informed decisions. By following these tips, you can set yourself up for success with bookkeeping from the start.

#bookkeeping#bookkeeper#taxpreparation#financial#income#companies#bookkeeping el paso tx#tax services

2 notes

·

View notes

Text

Get Offshore Accounting And Tax Services For Accounting Firms

Are you looking for offshore services for your accounting firm? Visit Credfino.com. Their aim is to assist accounting firms, tax firms in attaining stable and reliable revenue growth, enhancing profitability, and optimizing operations via staffing solutions and business consulting. Visit their website to learn more.

#Accounting Firms#Offshore Staffing#Business Consulting#Tax firms#staffing solutions#Tax Services#Accounting Services#CPA firm#Offshore services

6 notes

·

View notes

Text

How to Report Missed Income or Hidden Assets in Canada, Come Clean?

Want to come clean about your missed income or hidden assets in Canada? Is it possible? How exactly can you do it? In this article, we will be discussing the method to report your missed assets to the CRA. Read on to learn more about the process.

What is CRA's Voluntary Disclosure Program (VDP)?

When it comes to taxes, many people make mistakes or intentionally omit or misreport information. If you are one of these people, you may be able to get on the right side of the Canadian tax system. A Canadian taxpayer can apply to the Voluntary Disclosure Program to reduce late filing penalties (VDP). This program allows taxpayers to correct unintentional errors or omissions on their income tax returns a second time.

What are the conditions to apply for VDP?

You can submit a Voluntary Disclosure Program to:

• Correct any missing or incorrect information in your tax returns.

• Include information or income that you did not disclose in previous tax returns.

• Rectify previously claimed ineligible expenses; remit tax deductions at source in the case of employees.

• Returns for missing information, such as T-1135, must be filed.

• Include foreign income that is taxable in Canada but is not reported.

• Rectify any underreported business or other income.

• VDP can be used to correct or include any information that may result in penalties or legal action.

• Any income or expense that affects your taxation for the tax year is included in the information.

How to Apply for VDP?

First, conduct extensive research to gather all the necessary information and begin assembling your application. Prepare all of the information that must be included with the amended or omitted income tax returns for the applicable periods.

After, fill out Form RC199. Make sure to include all required documentation, and mail it to CRA. If you need to make changes to previous years' income tax returns, you may need to consult with a licensed tax accountant. Your tax accountant can also electronically submit the forms.

Keep in mind that if there are large amounts at stake, it is better to consult with a tax accountant or a lawyer. However, if the error or omission is minor and the monetary amounts are small, you can submit the VDP application independently.

#Accounting and Finance#Accounting Firm#CPA firm#Tax Planning#Tax services#Voluntary Disclosure Program

2 notes

·

View notes

Photo

Crypto Currency Tax Accountant

We are Australia's most trusted tax specialists. Our taxation experts have many years of experience. We also provide Crypto Currency Tax Accountant service. Our Cryptocurrency Tax and shares services are customized to the needs of investors. Get in touch with us if you have questions regarding your investments in shares or crypto Currency. Call at 02 8091 4054 or visit our website.

#Crypto Tax Services in Sydney#Crypto Currency Tax Accountant#crypto#Taxation Services in Sydney#Tax services#Cryptocurrency#bitcoin

2 notes

·

View notes

Text

How Much Should I Pay For Tax Preparation?

Paying and preparing taxes is burdensome for many of us. Of course, we need more time to prepare tax paying fees. To guide you, tax preparation services in Calgaryare there to help you in possible ways. Doing taxes with nominal fees is a must. It may be convenient for you to get someone else to prepare taxes.

A professional paying service in Calgary is delivering timely tax preparation service. They will help you find out the best thing, and tax season must be assigned with a professional, convenient approach. Thus, it stands as the best one and has peace of mind in tax preparation service.

How much does it cost to get your taxes done?

On the other hand, the tax preparation cost actually depends on the basis of moderate evaluation. It stands as the best one and includes standard returns with itemized deductions. The reason is to handle tax preparation with cost anywhere and consider complications.

The tax situation must be handled well with tax pro charges for services. Now, it completely depends on tax preparation services in Calgary.Hourly fees are usually ranging from nearly $100–200 per hour. But, depending on what kind of tax forms you wish to file, the cost will vary accordingly.

It includes standard results and mainly applicable for deductions and notice the tax preparation. There will be no return with basic tax from preparation and covers with standard results. Tax preparation service is a must one to handle anywhere in the basic pay to advanced one.

How qualified do you need to prepare taxes?

Of course, an average tax preparer will charge less than a high-quality one. It includes loads of experience, and changes would be playing with tax paying. It is completely the best one and gives peace of mind in buying a tax preparation service. When it comes to hiring tax preparation services, you must notice the accurate and thorough considerations as well.

On the other hand, tax preparation is a must and handles cutting-edge solutions. They can find out how to spend more cash and enable expert ideas. It is completely the best one and tackles the results in saving money as well. Thus, tax preparation service is a must to know the qualification of tax preparation.

How organized are your taxes

Tax preparation should be responsible for handling more work and being able to go ahead with pockets and fingertips. It should be maintained well and fulfill the goals accordingly. The tax preparation service took a good idea and had a potential outcome in showing potential benefits.

You have to be organized in arranging tax preparation services to fulfill the budget constraints and tally the amount paid. Organized tax preparation is a must to handle requirements, and I look forward to higher fees.

How do tax advisors set their prices?

Of course, the tax preparation service is a must, and advisors will check the payment and fees accordingly. It should be valid enough and have peace of mind in sitting with them. You have to provide everything to them and guide them accordingly. Thus, it includes preparing methods described by the taxpayers.

At first, the tax preparation service took a good motive and initially paid with each tax from a schedule. It is completely worth wondering about the average costs of filling common forms. They should be vital and have peace of mind in noticing the fee of each tax for average costs. Hence, it is mainly ready to focus on matching rates and fees to find tax preparation services.

On the other hand, tax preparation with the same tax advisor has to bring a matching rate with the advisor’s help. It will guide you to charge with the case and notice the changes with more complexity. They arrange with a chance that the price could increase for some reason. You will often deliver a matching rate and fee to match with paid off with the same tax advisor.

A professional tax preparation service must handle your taxes with a minimum fee, and a more complicated process will be handled. It will effectively undergo charging with more compensation options to handle beyond the flat rate. It will think about flat fees and make them think about the complications in tax preparation.

Furthermore, the charges are value one and completely based on the pricing. It will cost according to the value-based fees and lead to disputes. Of course, tax preparation is a must, with day and day-out quoting needs. It will result in focusing on job access with tax to pay with value-based fees as well.

If you are a tax advisor, charge per hour, spend how much you want to consult for tax advisors. So, it is always best to spend by charging an hourly rate and discussing the tax value and payment. Hourly fees must be easily set out with tax forms and able to expect spending with much time.

Where can you find a trustworthy advisor for tax preparation?

You cannot sit alone to prepare taxes. However, it is always best to hire tax preparation services in Calgary to maintain steady outcomes. However, you have to evaluate the job done and assign a proper tax consultation without any hassles.

The same goes with tax advisors, and notice the changes in paying at the right time. So, a trustworthy tax advisor and tax preparation service is a must-have to hire or consult.

Likewise, the tax advisor should notice the changes in the situation and do it based on the requirements. Thus, it stands best one and ensures focus on the tax bill and maintains as low as possible with more values.

Conclusion

Finally, the tax preparation services Calgaryis a must to guide you to file and pay for tax. Of course, they will guide you professionally and pay tax on time without penalties. Thus, you can get quotes from them and literally get the charges based on the preparation.

The credentials and levels of expertise should be noticed professionally without any hassles. So, it is always the best thing to consult the best company that provides tax preparation services professionally.

0 notes

Text

Benefits of Outsourcing audit support services

Outsourcing audit support services offers numerous benefits for businesses, including streamlined operations, improved compliance, and optimized finances. Our services include financial statements, internal audits, compliance reviews, and risk assessments. Outsourcing provides access to a network of skilled individuals with a deep understanding of auditing standards, regulations, and best practices, enhancing audit accuracy and dependability. Companies can scale resources to their needs, ensuring flexibility and cost-effectiveness. Outsourcing also allows businesses to focus on core competencies, reducing costs and allowing them to focus on other key functions. Outsourcing also offers scalability and flexibility, allowing businesses to adjust their audit needs based on changing markets. Professional audit support services also provide enhanced reporting, security, and improved stakeholder confidence. Trusted providers like Lotus Touch in Dubai, UAE, offer a global network and industry insights, ensuring a commitment to transparency, compliance, and sound financial management.

0 notes