I'm Rayman Singh. Passionate SEO enthusiast dedicated to helping businesses thrive online. Specialized in boosting website visibility, improving search rankings, and generating organic traffic through effective optimization strategies.

Don't wanna be here? Send us removal request.

Text

How to Maximize Credit Card Interest-Free Period

Learn simple and smart ways to make the most of your credit card's interest-free period. Follow these easy tips to avoid interest and manage your payments better.

0 notes

Text

Interest-Free Period on Credit Cards: Simple Guide for Users

Understanding how your credit card’s interest-free period works can help you avoid extra charges and manage your finances better. The interest-free period is the time between your purchase date and the payment due date when no interest is charged—if you pay your full outstanding balance on time.

This benefit can help you save money and make smarter spending decisions on interest-free periods on credit cards. To make the most of it, always know your billing cycle and due date. If you make a purchase at the start of your billing cycle, you get the longest interest-free period.

However, if you carry forward any unpaid balance to the next cycle, you lose this benefit and interest starts applying from the date of purchase. It's important to remember that cash withdrawals are not covered under the interest-free period—they attract interest from day one. So, try to avoid using your credit card for ATM withdrawals.

Paying your total outstanding amount before the due date is key to enjoying the full benefits of the interest-free period. Stay alert, track your expenses, and always pay on time to enjoy a stress-free credit card experience with the Interest-Free Period on Credit Cards.

0 notes

Text

Axis Vistara Infinite Credit Card Top Features

Discover the top features of the Axis Vistara Infinite Credit Card, including free business class tickets, Club Vistara Gold membership, lounge access, and travel rewards.

0 notes

Text

Axis Vistara Infinite Credit Card Features and Benefits

Looking for a premium travel credit card? The Axis Vistara Infinite Credit Card is a great option for frequent flyers who want luxury and rewards. This card offers complimentary Club Vistara membership, business class tickets as welcome and milestone benefits, and exclusive lounge access at airports in India and abroad.

You earn Club Vistara (CV) Points on every spend, which can be redeemed for flights and upgrades. For those who travel often, Axis Vistara Infinite Credit Card provides great value with travel insurance, priority services, and exclusive hotel and dining offers. You also get up to 4 business class tickets annually on reaching spending milestones.

The card comes with Visa Infinite privileges, offering global assistance, concierge services, and more. With its strong mix of luxury and benefits, the Axis Vistara Infinite Credit Card stands out as one of the best choices for premium travelers.

Whether you're a business traveler or someone who loves flying in comfort, this card can elevate your travel experience while rewarding you for every spend.

0 notes

Text

Standard Chartered Credit Card For Family Benefits

Enjoy family benefits with Standard Chartered Credit Cards. Get cashback, rewards, fuel surcharge waivers, and add-on cards for easy expense management.

0 notes

Text

Standard Chartered Credit Card Benefits for Families

Standard Chartered Credit Cards offer excellent benefits for families, making everyday spending more rewarding. With these cards, you can enjoy cashback, reward points, and exclusive discounts on dining, shopping, and travel. They also provide added perks like fuel surcharge waivers, airport lounge access, and EMI options, making them ideal for managing family expenses with Standard Chartered Credit Card Benefits for Families.

The bank offers multiple credit cards tailored to suit different needs. For instance, the Standard Chartered Platinum Rewards Card provides bonus reward points on dining and fuel expenses, while the Super Value Titanium Card offers cashback on utility bill payments and fuel. These features help you save more on regular expenses.

Additionally, Standard Chartered Credit Cards come with family-friendly benefits such as add-on cards. These cards allow family members to enjoy the same perks, making it easier to manage household expenses. With contactless payments and robust security features, these cards ensure safe and convenient transactions.

If you’re looking for a credit card that offers financial convenience and valuable rewards for your family, Standard Chartered Credit Cards are worth considering. Explore their range and choose one that fits your family’s needs.

0 notes

Text

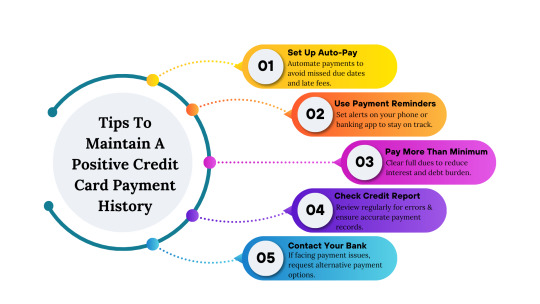

Tips to Maintain a Positive Credit Card Payment History

Learn effective tips to maintain a positive credit card payment history. Set up auto-pay, use reminders, pay more than the minimum, check your credit report, and contact your bank if needed. Timely payments improve your credit score and financial stability, making it easier to get loans and better credit offers.

0 notes

Text

How Credit Card Payment History Affects Your Credit Report

Your credit card payment history plays a crucial role in shaping your credit report. Lenders assess your payment behavior to determine your creditworthiness. The Impact of Credit Card Payment History on Your Credit Report is significant, as timely payments can improve your credit score, while missed or late payments may lower it.

Credit bureaus track your payment history and reflect it on your credit report. A consistent record of on-time payments builds a positive credit profile, making it easier to get loans and credit approvals. On the other hand, even a single missed payment can stay on your report for years, affecting your financial future.

To maintain a good credit score, always pay your credit card bills on time and in full. Setting up automatic payments or reminders can help you avoid delays. If you ever miss a payment, try to clear the dues as soon as possible to minimize the damage.

Building and maintaining a strong payment history ensures better financial opportunities, lower interest rates, and higher credit limits, helping you achieve long-term financial stability.

0 notes

Text

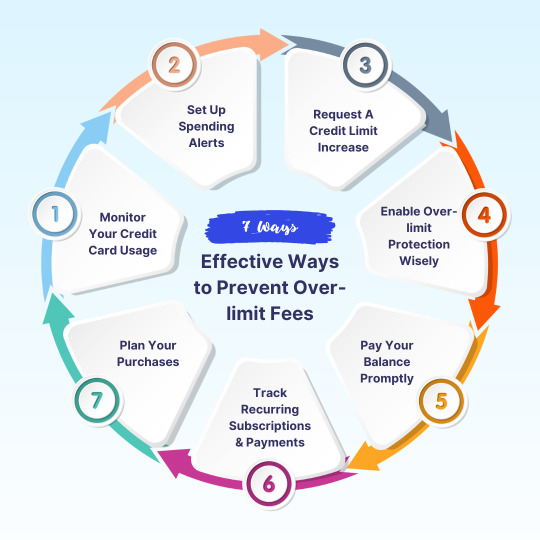

Effective Ways to Prevent Over-limit Fees

Discover effective ways to prevent over-limit fees on your credit card. Learn simple tips like monitoring spending, setting alerts, paying on time, and managing recurring payments to avoid extra charges and maintain healthy finances.

0 notes

Text

How to Avoid Credit Card Over-limit Fees Easily

Exceeding your credit limit can lead to costly over-limit fees, but you can avoid them with simple steps. Always monitor your credit card usage to ensure you stay within the limit. Most banks offer SMS or app alerts to notify you when you’re close to your limit, helping you avoid credit card over-limit fees easily.

Another effective way is to set up automatic payments to cover your dues on time. This prevents unexpected over-limit charges. If you frequently reach your credit limit, consider requesting a credit limit increase from your card issuer. This gives you more spending room without worrying about fees.

Additionally, keep track of subscriptions and recurring payments that might push you over the limit. Cancel or adjust unnecessary ones to stay within your budget. Using your card responsibly not only avoids fees but also improves your credit score.

By following these simple tips, you can manage your credit card better, avoid over-limit fees, and maintain a healthy financial lifestyle.

0 notes

Text

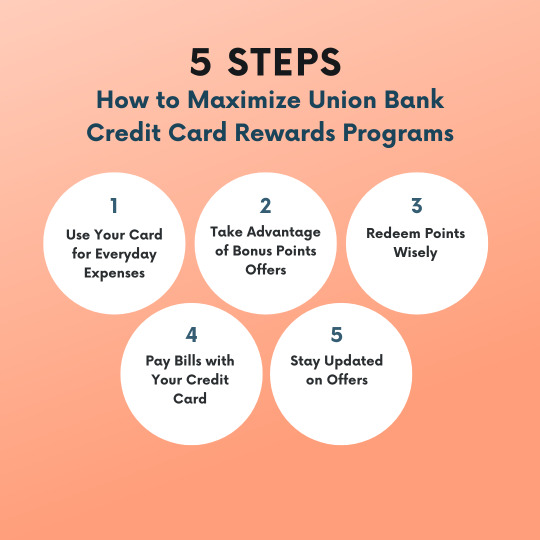

Learn how to maximize your Union Bank credit card rewards with simple tips. Earn more points on everyday spending, enjoy bonus offers, and redeem rewards for shopping, travel, and more.

0 notes

Text

Union Bank of India Credit Card Rewards Program Guide

Looking to make the most of your Union Bank of India credit card? The Union Bank of India Credit Card Rewards Program offers exciting benefits every time you spend. With every eligible transaction, you can earn reward points that can be redeemed for a variety of options like shopping vouchers, travel bookings, merchandise, and more.

The program is designed to suit different spending habits. Whether you use your card for groceries, fuel, dining, or online shopping, you can earn points effortlessly. Plus, with exclusive deals and seasonal offers, you can maximize your rewards even further.

To redeem your points, simply log in to the Union Bank of India credit card portal, browse the rewards catalogue, and choose your preferred reward. The process is easy and user-friendly, ensuring you enjoy your rewards without any hassle.

Start using your Union Bank of India credit card smartly and make every purchase rewarding. Why miss out on benefits when you can earn rewards on your daily expenses? Explore the rewards program today and get more value from your spending!

0 notes

Text

Find the best credit cards for hotel bookings and enjoy maximum rewards, discounts, and exclusive perks. Earn cashback, free stays, and loyalty points on your travel expenses.

0 notes

Text

Best Credit Cards for Hotel Bookings & Maximum Rewards

Looking for the best credit cards to save on hotel bookings and earn maximum rewards? The right card can give you exclusive discounts, free stays, and valuable reward points every time you book a hotel. Here are some of the best credit cards for hotel bookings and maximum rewards:

Best credit cards for hotel bookings & maximum rewards:

HDFC Bank Diners Club Black Credit Card – Enjoy complimentary hotel memberships and exclusive travel perks.

American Express Platinum Travel Credit Card – Earn high travel rewards and get complimentary hotel stays.

SBI Elite Credit Card – Benefit from hotel discounts, travel vouchers, and lounge access.

Axis Bank Magnus Credit Card – Get luxury hotel benefits, cashback, and reward points.

ICICI Bank Sapphiro Credit Card – Avail discounts on hotel bookings and travel privileges.

With these credit cards, you can maximize your savings, enjoy premium hospitality, and make every trip more rewarding. Choose a card that best fits your travel needs and start earning great rewards on hotel stays today!

0 notes

Text

Learn how to generate your HDFC credit card PIN online easily and securely. With just a few simple steps, you can activate your PIN and start using your card for secure transactions. Enjoy convenience and peace of mind with HDFC's quick and safe online PIN generation process.

0 notes

Text

Easy Online Credit Card PIN Generation with HDFC

Generating your HDFC credit card PIN online is quick, simple, and secure. It ensures you can access your credit card and use it safely for online and in-store transactions. Here’s how you can easily generate your PIN online with HDFC:

Login to HDFC NetBanking: Visit the official HDFC NetBanking portal or the mobile banking app.

Select Credit Cards: Once logged in, navigate to the "Credit Cards" section.

Generate PIN: Look for the option to generate or reset your credit card PIN.

Confirm Identity: Verify your identity by entering the required details, such as OTP sent to your registered mobile number.

Create Your PIN: Choose a secure PIN of your preference. Ensure it’s easy to remember but hard for others to guess.

Once your PIN is set, you can start using your card for secure purchases and ATM withdrawals. This online process eliminates the need to visit a branch, offering a fast, efficient, and hassle-free experience.

HDFC's online credit card PIN generation feature adds an extra layer of security and convenience. Whether you're using your card for shopping, dining, or travel, you'll feel confident knowing that your PIN is just a few clicks away.

0 notes

Text

Learn how credit card foreign currency transactions work, including currency conversion, fees, and exchange rate markups. Get tips on managing costs, avoiding Dynamic Currency Conversion (DCC), and maximizing benefits like rewards and security while using your credit card abroad or for international purchases.

0 notes