Don't wanna be here? Send us removal request.

Text

How Healthcare Impacts Retirement Savings

Healthcare is generally one of the largest expenses during one’s retirement and costs continue to rise. These costs are rising primarily due to an aging population and longer life expectancy rates. According to Fidelity Investments, an average retired couple age 65 in 2021 may need approximately $300,000 to cover healthcare costs in their retirement years . This estimate also excludes long-term care. Medical costs may significantly impact individuals’ retirement savings and reduce their retirement income if they are not prepared for these expenses.

A common misconception about Medicare is that it is free and will cover all of a retiree’s medical costs in retirement. Medicare pays for some healthcare costs, but it won’t cover everything. There can also be late penalties for those who delay enrolling. Medicare Part B premiums, which provide outpatient coverage, are also increasing by 14.5% in 2022. This is a monthly increase equal to $21.60, which is the largest dollar increase in the program’s history.

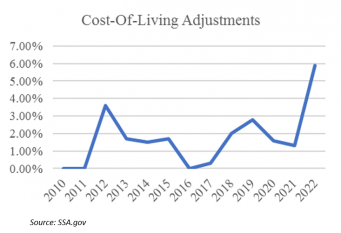

Since 2007, an enrollee’s Medicare Part B premium is based on income, which means the more an individual makes, the more they pay in premiums. (Refer to Income Related Monthly Adjustment Amount (IRMAA) brackets at Medicare.gov for more information.) Another important point to keep in mind is that the majority of those with Medicare will also see a 5.9% cost-of-living adjustment (COLA), which increases an individual’s Social Security benefit. This is the largest increase in 30 years. This COLA increase should cover the increase in the Medicare Part B premiums for most retirees.

1https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

2https://www.aarp.org/health/medicare-insurance/info-2021/part-b-premiums-increase.html

Listed below are a few steps participants can take now to prepare for these rising healthcare costs in retirement:

Utilize A Health Savings Account (HSA)

An HSA is only available in conjunction with a high-deductible health plan. If your company offers an HSA program, now may be a good time to remind employees of this benefit and how to enroll. HSAs can be an effective and tax efficient way to save for healthcare costs in retirement. These accounts are triple tax-free meaning:

Contributions are made on a pre-tax or tax-deductible basis

Savings will grow tax-free

Withdrawals are also tax-free if used to cover qualified medical expenses

There is also a lesser known fourth advantage – Contributions made through a payroll deduction avoid Social Security and Medicare taxes, commonly known as FICA (Federal Insurance Contributions Act) taxes.

Consider Postponing Retirement

Approximately one-third of early retirees who claim Social Security benefits at age 62 are doing so to help pay for medical expenses until they turn age 65 and are eligible for Medicare[1]. It’s important for participants to know their healthcare options prior to retirement. If an individual does not have access to an employer-sponsored healthcare plan or a spouse’s plan, waiting at least until age 65 until they are eligible for Medicare can be beneficial. Alternative options include COBRA and private insurance, but both typically come with a higher cost.

Social Security is always an important topic for participants getting ready for retirement. However, participants often need more than education, they need personalized planning on how to tie Social Security in with their other savings. A retiree can start taking Social Security at age 62 but their benefit will be smaller throughout the duration of their life – monthly benefits may be reduced by up to 30%. The longer someone waits to collect Social Security benefits, the higher the benefit will be. The benefit increases between 7.5% and 8% every year that you wait from full retirement age (which varies depending on when you were born) to age 70.

Where A Retiree Lives Matters

Where an individual lives in retirement can also impact healthcare costs. Although traditional Medicare coverage is the same throughout the country, Medicare Part C, also known as Medicare Advantage, and Part D, which covers prescription drugs, could vary. These plans are sold privately and vary by state. In the case of Medicare Part C, these plans generally have a limited-service area so a retiree could lose coverage if they move.

Income In Retirement

Encouraging participants to start saving early and increase their contribution amount over the course of their career to cover future healthcare costs in retirement is important. Catch-up contributions are another way participants can save more. Catch-up contributions allow those age 50 or older to contribute an extra $6,500 to a 401(k), 403(b) or 457 plan and an extra $1,000 to an individual retirement account (IRA) in 2022.

3https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

Healthcare cost in retirement can have a significant impact on savings. Encourage participants to work with a financial professional to plan ahead.

This material is provided solely for informational purposes and does not constitute investment, tax, legal or accounting advice on the matters addressed. Participants should always consult with a qualified professional to better understand their options.

Source: https://www.pentegra.com/current-thinking/retirement-industry-trends-and-marketplace-expertise/how-healthcare-impacts-retirement-savings/

1 note

·

View note

Text

Making a Good 401(k) Plan Even Better

https://www.slideshare.net/NAFCUServices/making-a-good-401k-plan-even-better-credit-union-conference-presentation

At Pentegra, we believe successful plan outcomes start with effective plan design. Plan features automatic features that better meet the needs of plan participants and plan sponsors can drive successful outcomes for participants and sponsors alike. The Pentegra SmartPath™ is a series of progressive plan design metrics crafted in a way to best ensure successful retirement outcomes by helping participants set a reasonable level of savings, increase their contributions over time, achieve proper investment diversification and best maximize a plan’s investment alternatives.

Source: https://www.pentegra.com/videos/making-a-good-401k-plan-even-better/

1 note

·

View note

Text

The Educated 3(16) Fiduciary

Many financial organizations tout the benefits of their ERISA 3(16) fiduciary services and, frankly, many of these messages can sound irresistibly compelling. But buyer beware; not all 3(16) fiduciary services are created equal. In today’s increasingly litigious environment, it is imperative for plan sponsors to be educated consumers of 3(16) fiduciary services.

Running a qualified retirement plan for employees is like running a business for clients. Just as with a business, the administrative responsibilities and liabilities of operating a plan are significant. The Department of Labor (DOL) views all business owners who sponsor retirement plans for employees as “3(16)” fiduciaries under federal law [ERISA Section 3(16)]. A 3(16) fiduciary is responsible for ensuring the plan is operated in compliance with the rules of ERISA day in and day out. One can say, the ERISA “buck stops here” on the 3(16) plan administrator’s desk.

As fiduciaries, plan sponsors are held to the highest standard of care and must operate their plans in the best interest of participants. That means their actions with respect to their plans will be judged against the “Prudent Person” rule, which says that all decisions and acts must be carried out “… with the care, skill, prudence, and diligence…” of a knowledgeable person. The DOL assumes plan sponsors know what they are doing when it comes to running a plan and if they don’t they should seek out competent support or be at risk of a fiduciary breach. From an ERISA standpoint, a plan’s “Jack of all trades,” must be master of all not none.

The DOL can hold plan sponsors personally liable for failing to fulfill their fiduciary obligations to their plan participants. Plan fiduciaries who fail in their duties can face costly civil and criminal penalties, too. Perhaps even jail time! All of this makes a strong argument for seeking expert help in running a qualified retirement plan. Thank goodness ERISA allows plan sponsors to outsource some of their 3(16) fiduciary responsibilities by formally appointing another entity to assume some of their plans’ administrative functions.

By engaging a 3(16)-plan administrator, the plan sponsor shifts fiduciary responsibility to the provider for the services specifically contracted (e.g., plan reporting, participant disclosures, distribution authorization, plan testing, etc.). It is important to note that a plan sponsor may never fully eliminate its fiduciary oversight responsibilities for the plan, and remains “on the hook” for the prudent selection and monitoring of the 3(16) plan administrator.

There are lots of organizations out there that offer outsourced 3(16) fiduciary services (e.g., TPAs, trust companies, RIAs, etc.). The process of selecting a 3(16) outsourced solution must be carried out in a prudent manner and solely in the interest of the plan participants. The DOL requires the plan sponsor to engage in an objective process designed to elicit information necessary to evaluate candidates considering, but not limited to, the following:

Qualifications of the service provider,

Whether it has a consistent track record of service,

Its professional “bench-strength” and tenure of staff,

The quality of services provided and

Reasonableness of the provider’s fees in light of the services provided.

In addition, such process should be designed to avoid self-dealing, conflicts of interest or other improper influence.

In the delicate area of plan administration, it’s prudent to go with an experienced professional. Pentegra is a “fiduciary first” and has been for over 75 years. Pentegra’s 3(16) Fiduciary Solutions are comprehensive, proven and flexible. Join us as we celebrate 3(16) Day on March 16th. Learn more about our 3(16) Day at 316fiduciaryday.com

Source: https://www.pentegra.com/current-thinking/retirement-industry-trends-and-marketplace-expertise/9593/

0 notes

Text

A 316 Perspective Putting Clients First

PS: What makes a plan sponsor a good candidate for outsourcing 3(16) services?

As one of America’s oldest independent fiduciaries, we at Pentegra believe every plan sponsor should have a 3(16) administrator.

We were founded nearly 80 years ago as an independent professional fiduciary. Our heritage enables us to support plan sponsors through a variety of retirement plan solutions and a range of service levels, for smaller plans up to some of the largest plans in the country.

As a fiduciary, Pentegra assumes key retirement plan responsibilities for the plan sponsor. This helps reduce legal and administrative burdens, minimize risk and lessen workloads. That’s peace of mind for every plan sponsor and an added layer of protection. Pentegra provides invaluable fiduciary services that give plan sponsors more time to run their business.

PS: What should a plan sponsor evaluate or consider in selecting a 3(16) provider?

The most important thing a plan sponsor can ask is whether the prospective 3(16) provider is an actual independent institutional fiduciary. Consider the provider’s financial stability and longevity. Does it have sufficient fiduciary liability insurance? Read the service agreement carefully to see what responsibilities it is willing to assume. A “true” 3(16) fiduciary administrator not only does the work, but is responsible for making sure that it’s done right. It stands in front of the client and assumes responsibility and liability. Pentegra always puts the clients’ interests first. Consider whether the 3(16) provider will serve as the Employee Retirement Income Security Act (ERISA) named fiduciary in the plan document. Will the provider sign and file the Form 5500? Will it work directly with the plan auditors and respond to IRS and Department of Labor (DOL) inquiries? As a full fiduciary, Pentegra does all of this and more. We offer plan sponsors the security that comes from having an experienced professional on board.

PS: What are the main differentiators between 3(16) providers?

Many providers offer 3(16) services. However, not every provider is an independent fiduciary and not every fiduciary is a full scope, full service fiduciary. Knowing the rules is one component of being a 3(16) fiduciary, but enforcing those rules is another. An independent fiduciary must always act in the best interests of the plan and its participants.

Pentegra builds plan sponsor confidence by knowing the inner workings of client plans, and we are always looking to save plan sponsors time and money. We are skilled at finding and fixing plans with sometimes unforeseen and expensive challenges. We apply a fiduciary perspective to every client and plan we work with, and that includes plans of every type defined contribution (DC) plans, defined benefit (DB) plans, multiple employer plans (MEPs) and pooled employer plans (PEPs).

PS: How does a 3(16) fiduciary help plan sponsors deliver better plan outcomes?

Fiduciary oversight improves plan outcomes and reduces liabilities. Retirement plan administration is complex. It’s subject to legal challenges. Outsourcing fiduciary responsibility by engaging an independent fiduciary helps plan sponsors design a more effective plan that is compliant and easy to administer. That’s peace of mind.

With the increased focus on legal challenges today, can plan sponsors really afford not to have a professional by their side? Often, the real value of a fiduciary is seen when there is a plan issue or problem. As an independent fiduciary, we monitor plans to help ensure they don’t have problems, and, if they arise, we’re the partner to help you fix them.

We put participants and plan sponsors first.

Source: https://www.pentegra.com/wp-content/uploads/2021/01/A-316-Perspective-Putting-Clients-First..FINAL_.pdf

1 note

·

View note

Text

Your Retirement Super Bowl A Strategic Saving Plan is Key

Right now, you might be more focused on which team will win Super Bowl LVI than on figuring out how much you should be saving for retirement. What’s your game plan? The reality is that figuring out how much you need to save is your biggest game your own personal retirement Super Bowl.

Many news reports and surveys suggest that people are not saving nearly enough for retirement. Financial professionals define “enough” as the ability to replace 75–80% of your preretirement income. It’s nice to have a general benchmark like that to start with, but does it apply to you? Understanding the potential variables and how to address them are the key to achieving your retirement goals.

Why you might need a LESS aggressive game plan

Depending on how you envision your life in retirement, your anticipated expenses may be much less than they are today. In addition, you may continue to earn money in retirement to help offset expenses. Here are some reasons you may need to save less than the general benchmark indicates:

You have a mortgage that you plan on paying off before you retire

You plan on downsizing to a smaller home, with a much lower mortgage payment

You plan on relocating to a less expensive city

You plan on working part-time during retirement

You anticipate other sources of income, such as investment/rental properties

You expect Social Security benefits will provide adequate income for your needs

You will no longer need to financially support children or other family members

You anticipate good health, with no unexpected medical or long-term care expenses.

Why you might need a MORE aggressive game plan

On the other hand, with retirement potentially lasting 20 years or more, you may want to be more aggressive with your retirement saving goal. Here are some reasons you may need to save more than the general benchmark indicates:

If you have a mortgage, and you plan on continuing to make payments during retirement

You want to travel extensively or purchase a second home for an occasional getaway

You expect higher healthcare expenses

You anticipate needing long-term care at some point

You plan on starting your own business and will need to provide funding

You will need to financially support children or other family members

You believe that your Social Security benefits will be reduced or inadequate.

Call the plays

There are many variables involved in determining how much you should be saving for retirement. Here are some important things to think about:

How much you have saved so far

Desired lifestyle in retirement

Projected rate of return on your savings

Rate of inflation in the future

Uncertainty about the future of Social Security benefits and Medicare

How long you expect to live

Future cost of healthcare and medications.

Consider a professional retirement quarterback

If you haven’t already, you may want to consider a professional financial advisor to help you with your retirement saving game plan. They can help you keep all your financial goals in perspective, while helping you determine the best investing strategy for achieving them, based on your unique personal situation.

How will your mortgage play into retirement?

Traditionally, homeowners looked forward to paying off their mortgage before retirement and removing the heavy burden of a monthly house payment. But that is becoming less common, according to a recent survey. The 2018 survey, “Retirement and Mortgages,” by national mortgage banker American Financing, found 44% of Americans between the ages of 60 and 70 have a mortgage when they retire, and as many as 17% of those surveyed say they may never pay it off. The survey also found that 32% predict they will be paying their mortgage for at least eight more years.

Source: https://www.pentegra.com/wp-content/uploads/2022/02/Your-Retirement-Super-Bowl%E2%80%94A-Strategic-Saving-Plan-is-Key.pdf

0 notes

Text

Benefits That Attract and Retain Employees As We Emerge From The Pandemic

Although the worst of the pandemic is hopefully behind us, the lifestyle disruption it caused has created a monumental shift in how people work. This disruption has affected nearly every industry and has caused many individuals to take a step back and reevaluate what their career means to them. According to the Bureau of Labor Statistics, a record 4.4 million people quit their jobs in September of 2021 alone. It is no surprise then that many employers are facing the challenge of attracting and retaining talent brought on by the pandemic. This issue is likely to continue through 2022 and beyond. Talented employees enhance productivity and provide leadership and are often a company’s greatest asset. In a recent study of 205 retirement plan sponsors, 81% said they are concerned about the increased competition for talent and 73% are struggling to find qualified employees to fill positions1 . With job candidates scarce, companies will be vying for the same top-tier employees. As a result, many companies are utilizing their retirement and benefit packages and placing an emphasis on improving their employees’ financial wellness and wellbeing to help differentiate themselves as the employer of choice. Below are a few ways employers are now positioning themselves for success:

Offer Employer Retirement Plan Matching Contributions

An employer retirement plan match is an attractive employee benefit that can help an employer set themselves apart. A recent study showed that more than 45% of respondents considered an employer 401(k) match to be a major factor when deciding to accept a job2 . Many employers are now considering increasing their matches and shortening their vesting schedules. Even if employers had to suspend their matches due to the pandemic, reinstating a match is a positive message to communicate to employees. Offering a match also boosts employee enrollment into the plan.

Add A Profit-sharing Arrangement

Some employers are adding a profit-sharing arrangement to their 401(k) plans. This provides employees with a personal interest in a company’s success, which can potentially limit employee turnover through rewarding ongoing service. For employers, a primary benefit is flexibility whereby no contributions are required if there are no profits in a particular year.

Offer Additional Benefits

Some plan sponsors are adding other non-retirement plan related benefits such as emergency savings accounts (ESAs) and/or health savings accounts (HSAs). An ESA can be funded through automatic deposits setup through payroll deductions, similar to how employees fund their 401(k) plans. The money deducted into an ESA is taxed as income and is available to employees who have financial needs that are immediate. HSAs allow employees to set aside money on a pre-tax basis to pay for qualified medical expenses. If your company offers an HSA program, now may be a good time to remind employees of this benefit and how to enroll into the account. HSAs can be an effective and tax efficient way to save for healthcare costs in retirement.

[1] Principal Financial Group, https://www.pionline.com/retirement-plans/firms-beef-retirement-benefits-attract-and-retain-employees

[2] https://www.betterment.com/401k/resources/employer-match Offer Greater Flexibility

Many employees settled into working from home and all the flexibility that went along with that. Some were able to achieve a healthy work/life balance with no longer having to contend with a long commute or set office hours. But workplace flexibility goes beyond just working from home. Some other benefits include providing caregiver leave and rethinking paid time off (PTO) policies. We Can Help

These are just some of the ways employers can help recruit and retain the high-quality employees that their companies depend upon. Pentegra is here to help.

Contact us at 800-872-3473 to learn more about plan redesign and benefit enhancement options.

Source: https://www.pentegra.com/current-thinking/retirement-industry-trends-and-marketplace-expertise/benefits-that-attract-and-retain-employees-as-we-emerge-from-the-pandemic/

0 notes

Text

Improving Your Retirement Plan’s Long-Term Results

The total amount you’ll have in your retirement account by the time you retire will depend on the choices you make and the future of the investment markets. While you can’t control what the markets will do, you can help improve your retirement account’s long-term results. Consider the strategies described below.

Save as Much as Possible

The more you contribute and the earlier you start, the more you’ll have in your account at retirement time, all else being equal. Years of compounded growth can result in a lot more money in your account than you actually put in. Also, you won’t be paying taxes on your contributions or on account earnings until you withdraw money from your account.

Take Some Risk

Invest a significant portion of your retirement money in higher risk investments, such as stocks. You will need to stay ahead of inflation to have real growth in your retirement account. The price you will pay for the “safety” of low-risk investments, such as money market portfolios, will be potentially lower returns that may not keep up with inflation.

Keep Track of Your Investment

It’s important to track your investment results periodically. You need to find out how well your account is doing and whether your returns are high enough to meet your retirement goals. Also, if you experience any major life changes, you may want to reassess your investment strategy. You may need to make changes in your portfolio mix at some point; however, don’t react to every short-term swing of the investment markets. If you have several years before retirement, you probably will be better off waiting out temporary periods of declining prices.

Don’t Give in to Temptation

It may be very tempting to spend some of your retirement plan money before retirement if your plan permits, especially if you experience a hardship. If at all possible, leave the money in your account and don’t give in to temptation. You usually will have to pay a 10% tax penalty plus regular income tax on the withdrawal. But more importantly, you can’t retire on money that you have already spent. If you change jobs, make sure you roll the money over into an individual retirement account or your new employer’s plan.

Keep the Faith

If you contribute as much as possible, invest in higher risk investments, make changes only when necessary, and leave the money in your account until retirement, you will be on track toward a more secure retirement. And, any sacrifices that you have to make now will be worth it when you are enjoying your well-deserved retirement.

Source: https://www.pentegra.com/wp-content/uploads/2019/07/Improving-your-retirement-plans-long-term-results.pdf

1 note

·

View note

Text

The DOL GoP Gap

They are new for 2022 Groups of Plans (GoPs) or as the Department of Labor (DOL) has begun to refer to them for reporting purposes, “Defined Contribution Group Plans.” The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, Pub. L. 116–94, created GoPs, effective for the 2022 plan year. Technically, it is a simplified mechanism for filing a single Form 5500 information return for a collection of defined contribution plans that have the same overall set up.

If you are thinking Multiple Employer Plan (MEP) or Pooled Employer Plan (PEP), think again. Generally, MEPs and PEPs allow more than one employer to participate in a single retirement plan. In contrast, GoPs allow several employers each with their own defined contribution plan to file a single Form 5500 for the collection of plans as long as they have the same trustee, named fiduciary(-ies), administrator, plan year and investment options. In theory, the appeal of GoPs is that a group of employers (unrelated or related) can keep their own plans and combine to gain economies of scale by collectively negotiating better pricing for administration and investment services, plus have simplified reporting.

While the industry received some information on GoPs in the Department of Labor’s (DOL) proposed Form 5500 changes released in September 2021, more was anticipated in the DOL’s final Form 5500 regulations and news release issued December 29, 2021. Disappointingly, no further guidance was included just a promise that the consolidated filing option for certain groups of defined contribution retirement plans would be the subject of one or more later final notices.

Of utmost interest is whether the DOL will or won’t apply the Independent Qualified Public Accountant audit requirement when a GoP collectively includes 100 or more individual participants. If the agency does, much of the glow will be off GoPs.

Source: https://www.pentegra.com/current-thinking/retirement-industry-trends-and-marketplace-expertise/the-dol-gop-gap/

0 notes

Text

A Spending Plan for Retirement

Congratulations, you’re about to retire! Your many years of hard work have paid off, and now it’s time to finally take it easy. So, how do you plan to spend your time? Traveling? Golfing? Visiting your relatives? However you want to enjoy your retirement, you need to think about how you’re going to spend your money.

Don’t Rush In

It’s important not to be impulsive when you first retire. While you may feel you deserve an exotic vacation or a new car, immediately splurging might not be a smart move. You should determine how much retirement money you can afford to withdraw each year.

No False Assumptions

Make sure you carefully calculate how much you will really need to withdraw from your savings. If you just make some general assumptions, you could end up taking out more than you should and risk running out of retirement funds down the road.

Also, don’t assume you won’t need retirement income for very long and, thus, that you might as well spend a lot of your money right off the bat. Depending on your age at retirement and how healthy you are, you could be retired for over 30 years. With many retirees living active lives well into their 80s, you may want to prepare for a long retirement so that you don’t risk outliving your savings.

Keep Track of Expenses

Write down all the expenses you anticipate you will have once you retire. Work-related expenses will likely be reduced. Depending on your anticipated lifestyle, recreational and travel expenses may increase. If you plan to relocate, remember to figure in all the costs associated with moving. And, if you will have to pay for part or all of your health care, make sure you include those expenses, too.

Look at Your Investments

While you may focus on the amount of retirement savings you’ve accumulated, also project the investment return your savings will generate. The higher your return, the longer your savings are likely to last. In recent years, you may have shifted more of your portfolio into fixed-income investments to help preserve the value of your principal. However, you may want to keep a portion of your funds in stocks so that your portfolio will have the potential to produce returns that outpace inflation.

Anticipate Inflation

During your saving years, inflation had an impact on the future buying power of your money. Inflation will continue to have an impact once you retire, especially if your retirement lasts a long time. Over a 30-year retirement, even a low inflation rate can erode the value of your savings. So consider the rate of inflation when you determine your savings withdrawal rate.

Talk to Your Financial Professional

When it comes to spending your retirement savings, it’s important to get it right. Your financial professional can help you figure out how much you can withdraw from your savings so that you achieve your retirement goals and have enough to last throughout your retirement.

Monitor Your Plan

Once you retire and have a spending plan in place, you’ll want to review your plan periodically. You may need to make adjustments if your investment returns are lower than anticipated, the rate of inflation increases, or your spending needs change significantly.

Source: https://www.pentegra.com/wp-content/uploads/2020/01/A-Spending-Plan-for-Retirement.pdf

0 notes

Text

Retroactive 2021 Tax Planning; Overlooked Deductions and Credits

With 2021 behind us, many business owners are discovering that, despite COVID-related challenges, they had a good year from a business perspective. That means it would be great to have additional tax deductions and credits to help reduce the business’s overall tax liability.

Fortunately, certain retirement plan-related deductions and credits are still available for 2021 – that’s right after the fact for establishing and funding qualified retirement plans they set up in 2022 for 2021. Let’s explore how business owners can potentially reduce their business’s tax bill with qualified plan deductions and credits.

First, businesses may fully deduct amounts contributed to qualified plans and these contributions may be made up to the due date, plus extensions, of their 2021 tax return filing date. But what if the business hadn’t established a qualified plan by the end of 2021? What options do these business owners have?

Fortunately, the rules for establishing retirement plans have changed as a result of the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019. Under the SECURE Act, for 2020 and later tax years, a business has until its tax filing deadline, plus extensions for a particular tax year, to set up a plan. The plan establishment deadline is tied to the type of business entity and its associated tax filing deadline as illustrated below.

[Note: Simplified employee pension (SEP) plans have historically followed the above schedule; and special set-up rules apply for safe harbor 401(k) plans.]

Establishing a plan retroactively can be particularly appealing if the business owner establishes a defined benefit plan, such as a cash balance plan. Cash balance plans can allow qualifying business owners to contribute and deduct hundreds of thousand dollars to such an arrangement under the right circumstances. As noted previously, this can be done retroactively for the 2021 tax year. With the help of their tax advisor, business owners can determine if a cash balance plan is right for them.[Note: Simplified employee pension (SEP) plans have historically followed the above schedule; and special set-up rules apply for safe harbor 401(k) plans.]

In addition, small businesses (with fewer than 100 employees) may also be eligible for additional tax credits for setting-up retirement plans and/or adding an automatic enrollment feature. Let’s explore some of the incentives and the plan establishment process.

The “Startup Credit” for new plans is $5,000, available for the first three years the plan is in existence and offers real benefits by freeing up tax dollars for other important business purposes. The credit was greatly improved as part of the SECURE Act, effective January 1, 2020 (increasing the maximum credit from $500 to $5,000). It is intended to encourage business owners to establish retirement plans by helping make the plan more affordable during the startup process. In addition, the business receives full tax deductions for all contributions made to the plan.

On top of that, if a business owner elects to add an automatic enrollment feature to the plan, an additional $500 credit (for the first three years) is also available to the company. The automatic enrollment feature calls for newly eligible participants to be enrolled automatically in the plan with a specified default deferral rate. The IRS provides additional details about the startup and auto deferral credits here. Consider the following example.

Retirement plan availability and coverage has become a public policy concern in recent years. More people need to be saving additional amounts for retirement. Employer- sponsored retirement plans are effective in getting individuals to save for retirement. Thus, from a policy perspective, the goal is to help and encourage smaller employers to offer retirement plans to their employees.

Clearly, in addition to benefiting employees, retirement plan deductions and credits can be helpful in controlling overall tax liability and should be given serious consideration. The next step for a business owner who is contemplating starting a retirement plan is to discuss these issues with a certified public accountant (CPA) familiar with retirement plans and their complexities. When dealing with retirement plan issues, there is no “one size fits all” approach, and careful planning and execution is essential. That said, these deductions and credits often play an important role in limiting the tax liability for many business owners—and letting them keep more of what they earn.

Source: https://www.pentegra.com/current-thinking/retirement-industry-trends-and-marketplace-expertise/retroactive-2021-tax-planning-overlooked-deductions-and-credits/

0 notes

Text

Make Saving More Your New Year's Plan

As you begin the new year, what do you see when you look back? Is it the heap of forgotten new year’s resolutions from years past? This year, think about making a resolution that’s easy to keep: increasing your contributions to your retirement plan.

What makes it easy? When you participate in your retirement plan, your contributions are automatically deducted from your paycheck and put into the investments you’ve selected. So even if you never change your original contribution amount, you’re still saving money for your retirement. But consider how much more you could potentially accumulate if you periodically increase the amount you contribute. It’s as simple as changing the percentage of your pay that goes into your plan account.

Where will I find the money? The new year is a good time to review your budget to look for places to trim. Cutting spending is an effective way to come up with money you can use to increase your contribution amount. And adding part of any raise you receive to your retirement account can also give your savings a boost.

Why can’t I wait? The sooner you start saving more for your retirement, the more years your savings will have to potentially grow and compound. Increasing your contribution amount whenever you can may mean a larger account balance at retirement.

Still not convinced? Remember that you’ll probably need to save more for retirement than for any other goal that you have.

Saving More May Make a Difference

If you increase your contribution by $8 per weekIf you increase your contribution by $16 per weekAfter 40 years you could add:$69,038$138,077After 20 years you could add:$16,017$32,035After 10 years you could add:$5,681$11,362After 5 years you could add:$2,419$4,837

This is a hypothetical example used for illustrative purposes only. It assumes amounts are invested monthly, an average annual total return of 6%, and monthly compounding. It does not represent the result of any particular investment. Your results will be different. Amounts are rounded to the nearest dollar. Tax-deferred amounts accumulated in the plan are taxable on withdrawal, unless they represent qualified Roth distributions. Source: DST Systems, Inc.

Source: https://www.pentegra.com/wp-content/uploads/2018/12/Make-Saving-More-Your-New-Years-Plan.pdf

0 notes

Text

Making A Financial Plan And Checking It Twice

Want to give yourself a really valuable and lasting present? How about a financial plan? Promise yourself that once the holidays are over, you’ll take time to thoroughly review your finances and come up with a strategy for reaching all your goals.

Begin With a Budget

Do you know where your money goes? A spending plan can help you keep track of your income and expenses and set priorities for spending your paycheck. Make sure you put a set amount of money into a savings or investment account every month. If you have trouble coming up with the extra cash, look for ways to cut your spending.

Choose the Right Investments

When it comes to investing, everyone is different — even members of the same family. Spouses may not be willing to take the same amount of risk or feel comfortable with the same kinds of investments. So, it’s important for spouses to talk over their feelings about risk. The investments you choose should reflect your goals, time frame, and risk tolerance. Remember, too, that you want your investments to earn returns that will beat inflation, especially if you’re investing for a long-term goal.

Think About Retirement

It’s generally easier to save money if you set a goal. So you’ll want to estimate how much money you’ll need for retirement. How do you know how much you’ll need? Think about the retirement lifestyle you want. Maybe you want to travel or focus on your hobbies. You may plan to relocate, or just relax at home. You might even decide to work part-time. In any case, compare your anticipated expenses with your current expenses to see how much you’re likely to need.

The next step is to figure out where the money to pay those expenses will come from. Consider how much you can expect from your investments, an employer’s qualified retirement plan, any pensions you have, and Social Security. If your income from these sources will fall short of your goal, find ways to put more money aside while you’re still working to make up the difference.

Plan for the Unexpected

If you were to die or become disabled, would your family be able to maintain its standard of living without your paycheck? Disability and life insurance coverage can replace lost income and allow your loved ones to continue their current lifestyle.

Also think about naming someone to manage your affairs should you become incapacitated. A power of attorney is a legal document that allows the person you name to make financial decisions for you if you’re unable to do so. A living will or durable power of attorney for health care states your wishes with regard to health care decisions.

Create an Estate Plan

You don’t have to be wealthy to have an estate plan. At the very least, everyone should have a will. A will spells out how you want your assets divided, names a guardian for any minor children you have, and appoints an executor or “personal representative” to distribute your assets and pay your final bills. A will also allow you to take advantage of certain planning opportunities that may reduce estate taxes and preserve your assets for your heirs. Plan today to build a solid financial plan for your future.

Source: https://www.pentegra.com/wp-content/uploads/2019/12/Making-a-Financial-Plan-and-Checking-It-Twice.pdf

1 note

·

View note

Text

The Value of an Independent 3(16) Fiduciary

How does one go about assessing a third-party fiduciary for a company’s retirement plan? I thought this might be a good time to revisit the issue, and to remind readers of what they should look for when considering an independent fiduciary.

When it comes to fiduciary duties and their retirement plan, many companies tend to focus on the participants and the investments and rely on outside professionals such as a 3(38) investment fiduciary and a recordkeeper to support their plan, but there’s a missing piece. An independent 3(16) administrative fiduciary can provide an extra set of eyes on your plan. However, there are certain things to bear in mind when it comes to 3(16) fiduciary service providers.

Is the 3(16) provider truly independent, or are they “grading their own test”? Due to the very nature of how retirement plans are constructed, administered – and regulated – it is important that there be no conflicts of interest (real or perceived) as well as an assurance that there is an added level of oversight.

Other items to consider include specifying what the 3(16) provider’s responsibilities encompass – and where they begin and end. While one of the primary reasons to hire a third party is to relieve the time and stress of doing it yourself, that does not mean you are entirely “off the hook” should questions arise. Who might ask such questions? The Internal Revenue Service (IRS) and the U.S. or your state Department of Labor (DOL), to name two. A professional third-party fiduciary will be able to explain where the various responsibilities in administering a retirement plan lie.

Pentegra, as a 3(16) administrative fiduciary, will also provide compliance testing, review and approve plan distributions, ensure required plan notices are delivered, conduct regular due diligence reviews and proactively monitor the plan on an ongoing basis. Further, we will attend to plan audit oversight and we work with the external auditors and your team to resolve plan issues — and deal directly with the IRS and DOL on your behalf, thereby further reducing your burden.

In addition, be sure the fiduciary you are considering does not take a “cookie cutter” approach. This is true in most business sectors, but can be an especially vital consideration when it comes to evaluating fiduciary service providers. Yes, there are certain templates that can be modified depending on such factors as company’s/plan’s size, its aims and goals, and its overall philosophy. But “modified” is the key word there. Everyone appreciates feeling like an individual in practically any service provider/customer relationship. Simply being put into “Box A” or “Box B” and forgetting about it (or being forgotten about) is unlikely to properly address your and your plan’s participants’ needs.

With such flexibility should come interactivity. Does your potential service provider offer a consultative and strategic approach to your retirement plan design? Will they furnish a thorough review of the existing program and provide peer analysis and competitive considerations?

Going hand-in-hand with those questions: Be sure you are working with an established, reputable firm. Again, this advice can be applied to nearly any business situation but is imperative when considering 3(16) fiduciaries. Research the prospective fiduciary: Has the company been CEFEX-certified by the Centre for Fiduciary Excellence? CEFEX is the only independent certification process that validates a third-party administrator (TPA) firm is utilizing best practices in conducting plan administration and operational compliance services.

Also, examine the certifications and experience of your prospective fiduciary’s staff. Can they handle the complex range of issues that surround retirement plans? Look for personnel who have earned the American Society of Pension Professionals & Actuaries (ASPPA) designations of Qualified Pension Administrator (QPA); Qualified 401(k) Administrator (QKA); and/or CPC (Certified Plan Consultant).

You should also be sure that you and the third party have regularly scheduled meetings to discuss the plan(s)’ performance, possible changes in strategy, new legal requirements, and so on. Be sure that you set aside the time to fully understand what is going on with your plan.

Finding the right third-party fiduciary for your retirement plan may take some legwork. But that legwork can pay great dividends – not only monetarily, but also in peace of mind.

Source: https://www.pentegra.com/current-thinking/retirement-industry-trends-and-marketplace-expertise/the-value-of-an-independent-316-fiduciary/

0 notes

Text

Give Your Retirement Savings a Lift

Joining your employer’s retirement plan is a great first step on the road to saving for retirement. But that’s just the start of your journey. Along the way, you need to periodically review the amount you’re contributing. Increasing your contribution by even a little bit can make a big difference in your account value over time.

So where do you find those extra dollars to contribute? It isn’t as hard as it may seem. You may be able to come up with additional money by taking advantage of a few of the following opportunities.

When You Receive a Pay Raise

Consider earmarking a portion of any raise you receive as a contribution to your plan account. Since you haven’t been living on that money, you probably won’t miss the amount you contribute to your retirement savings.

When You Pay Off a Loan

When you pay off a loan, such as a student loan, home mortgage, or car loan, you can use the old monthly payment amount to boost your retirement contribution. Paying off a credit card balance can also free up money for your retirement account.

When You Become an Empty Nester

No one said raising a child was cheap. A middle-income family with a child born in 2015 can expect to spend about $233,610 for child-rearing expenses up to age 18.* Once your kids move out, you can use some of the money you were spending on their expenses to increase your plan contribution.

When You Reach Age 50

If you’re age 50 or older, and your plan permits, you may be able to increase your retirement funds by making catch-up contributions in addition to your regular plan contributions.

When a New Year Starts

Another idea is to increase the percentage of pay you contribute to your plan by 1% each year. That little boost can make a difference in the amount of money you’re able to accumulate for retirement.

Reap the Benefits

The sooner you start saving more for retirement, the better. Adding those few extra dollars to your retirement savings plan could make a big difference in your account value over time.

* Expenditures on Children by Families, 2015, U.S. Department of Agriculture, January 2017

Watch Your Savings Grow

An extra $200 a month contribution could grow to:

This is a hypothetical example used for illustrative purposes only and is not representative of any particular investment vehicle. It assumes a 6% average annual total return compounded monthly. Your investment performance will differ. Tax- deferred amounts accumulated in the plan are taxable on withdrawal, unless they represent qualified Roth distributions.

Source: DST

More for Retirement, Less for Taxes

And your federal income-tax rate is

10% 15% 25% 28% 33% 35% 39.6%

If your annual

pretax contribution is Your actual cost in equivalent take-home pay is only*

* Amounts are rounded to the nearest dollar. State income taxes are not considered. Source: DST

Source: https://www.pentegra.com/wp-content/uploads/2018/03/Give-Your-Retirement-Savings-a-Lift.pdf

0 notes

Text

Survey Says: Disconcerting Number of Americans Believe They’ll Run Out of Money and/or Time to Retire Comfortably

A recent survey from TIAA shows that nearly half of Americans are worried about running out of money in retirement – while the remainder say they are more concerned about running out of the time they deem necessary to do what they would like to do in their golden years.

Released on Oct. 27, TIAA’s 2021 Lifetime Income Survey found 45 percent of the 1,001 working American Millennials, Gen Xers, and Baby Boomers who participated in the study saying that exhausting their financial resources is their chief concern – certainly a very real and understandable worry in today’s climate. To help alleviate that concern, 51 percent said that making savings last in retirement is their top priority – commendable, but hardly inspiring confidence.

The survey found that many of the tried-and-true obstacles to saving adequately for retirement remain in play: 44 percent cited debt that needs to be paid off; 42 percent estimated that they cannot afford to put more money away; 22 percent said they want to make sure they can access funds in case of an emergency, while another 22 percent said that they “have other savings priorities.” (Multiple answers were allowed.)

On the time side of the equation, 45 percent said that retiring earlier was their top priority – the survey did not define what “earlier” means in this circumstance. Drilling further down, 42 percent of this group said they were “highly confident” that their savings will last them 20 years in retirement; that figure drops to 32 percent when considering a 30+ year retirement.

The picture is different, however, for those with a lifetime income annuity or pension: 69 percent are highly confident about the 20-year period, and 64 percent are highly confident about 30+ years.

None of these findings are particularly surprising at a glance, though the actual numbers can be troubling. And the lack of detail can be further exasperating: How do the respondents expect to “make their savings last” in retirement? What is their plan when it comes to retiring “earlier” in order to travel or otherwise spend their retirement years?

Fortunately, the survey also found 45 percent of workers saying they believe they can save more if they have help creating and managing a budget, with 66 percent of Millennials thinking that budgeting would allow them to save more.

And that, of course, is almost always the main takeaway from such reports: Seeking professional advice to discuss how to go about creating a reasonably prudent retirement savings strategy – one customized to each person’s needs and desires – can be a tremendous aid.

And — as the Millennials would have it – the earlier the better.

With the Covid-19 pandemic hopefully (finally) receding, it is time to reconsider putting away (more) money for retirement. Consulting a trusted industry professional is, as it always has been, a highly effective method of doing so.

Source: https://www.pentegra.com/current-thinking/retirement-industry-trends-and-marketplace-expertise/survey-says-disconcerting-number-of-americans-believe-theyll-run-out-of-money-and-or-time-to-retire-comfortably/

0 notes

Text

Retirement Goals: Are You and Your Spouse Talking the Talk?

Do you and your spouse share the same vision of your future retirement lifestyle? For that matter, have you even discussed your retirement expectations? If you haven’t, you’re probably not alone. But being on the same page with your spouse about retirement is a goal worth pursuing. Now may be as good a time as any to start the conversation.

The age factor You and your spouse may each have a retirement age in mind, but have you shared that information with each other? Many of the decisions you’ll have to make may hinge on your age and whether one of you is still working. Health insurance coverage, Social Security benefits, and the amount of income you have may all be affected. Spouses often retire at different times, and that’s okay as long as you plan ahead, agree on the timing, and cover your bases in terms of having sufficient income and insurance coverage.

Work or no work? Would you or your spouse be surprised to find out that the other wants to work during retirement? Many retirees become consultants in their fields or turn a hobby into a business after they leave the work force. Talk to your spouse if you’re considering a part-time or full-time job after retirement, and get his or her reaction before you make a decision.

Your income Maybe you can live on love when you’re 20, but when you’re retired, you need actual money. Plan to sit down with your spouse and your financial professional and determine how much income you can expect to have in retirement (based on current savings rates, projected investment growth, etc.). If you and your spouse have separate retirement plan accounts or investments, make sure you know the amounts in each and come up with a tax-smart strategy for making withdrawals during retirement. You’ll also want to consider the most advantageous age for each of you to begin receiving Social Security benefits.

Your financial life Who handles the finances in your household? If only one spouse manages financial matters, would the other spouse be prepared to assume that responsibility in an emergency? Both spouses should have the skills and knowledge to manage finances. Consider sharing all financial information with your spouse so that either one of you could make important financial decisions.

Location, location Both of you should know where to find copies of your wills, life insurance policies, bank and brokerage account information (including ID and password information for online accounts), and other important documents. Talking with your spouse about retirement can make the transition easier for both of you.

Source: https://www.pentegra.com/wp-content/uploads/2018/03/Retirement-Goals-Are-You-and-Your-Spouse-Talking-the-Talk.pdf

0 notes

Text

Survey Finding How Covid Has Impacted Americans’ Retirement Plans Packs a Few Surprises

Newly released research has uncovered an unsurprising trend: The Covid-19 pandemic has affected many Americans’ approach to their retirement plans.

What is perhaps surprising, however, is how many people expect to retire earlier than they had originally planned.

According to a survey conducted by Northwestern Mutual, the pandemic has resulted in 35% of Americans deciding to change the age when they anticipate retiring, with 24% saying they expect to retire later than originally planned, and 11% saying they hope to retire earlier.

The survey found that the two youngest generations of adults expect to retire before the age of 60 – Generation Z (born between 1997-2012) at 59.4 and Millennials (born between 1981-1996) at 59.5. Overall, the average age people expect to retire is 62.6, down slightly from 63.4 last year.

“The economic environment created by the Covid-19 pandemic has caused a lot of people to re-examine their financial lives,” commented Christian Mitchell, executive vice president & chief customer officer at Northwestern Mutual. “For some, the prospect of an early retirement appears more achievable, while others are adjusting for delays. In either case, having a holistic plan is critical to navigating the uncertainty and reaching your goals.”

For those planning to delay retirement due to the economic impacts of the pandemic, 39% say they’ll push out retirement three to five years, while 35% say their timeline for retirement has shifted back more than 10 years.

The top reasons cited for why people are delaying retirement include:

Wanting to work and save money given additional flexibility with their workplace: 55%

Concerns about rising costs like healthcare and/or unexpected medical costs: 50%

Having to dip into retirement savings: 24%

Taking care of a relative/friend; responsible for additional dependents: 14%

For those planning to retire earlier than expected, 48% say they are moving up their timeline by three to five years.

The top reasons cited for moving up their target retirement age include:

Wanting to spend more time with their loved ones: 42%

Focusing on hobbies/priorities outside of work: 33%

Realizing their personal mission is more important than saving more: 29%

Work situation has changed (laid off, etc.): 28%

On average, the survey found, people have $98,800 saved for retirement, up from $87,500 last year. At the same time, people’s expectations for how much they will need to retire comfortably is also up, from $950,800 in 2020 to $1,047,200 in 2021.

While overall retirement savings are up, more than four in ten (43%) believe they may outlive their savings, up slightly from 41% last year.

However, in an encouraging sign, the data also show that people are proactively taking steps to address this concern, including:

Increasing savings: 29%

Putting together a financial plan: 22%

Discussing options with their family: 18%

Purchasing investments: 18%

Seeking advice from a financial advisor: 18%

When it comes to funding retirement, people plan to lean most heavily on their 401(k) (26.5%), Social Security (26.5%) and personal savings or investments (23.8%). However, 19% said they believe that it is not likely that Social Security will be available to them when they retire, and 43% say they can imagine a time when Social Security no longer exists.

For all of that, it should be clear to us all as never before that unexpected events can alter one’s plans, sometimes significantly. In turn, that proves what we have long maintained: That it is critical to develop a prudent retirement savings plan that should be reviewed regularly.

That is especially true of younger people, who have traditionally been those who tend to think about their retirement the least and, therefore, save for retirement the least.

We hope that they can indeed retire earlier than they had anticipated, but without taking smart action now, we wonder how that can be realistically achieved.

Source: https://www.pentegra.com/current-thinking/retirement-industry-trends-and-marketplace-expertise/survey-finding-how-covid-has-impacted-americans-retirement-plans-packs-a-few-surprises/

0 notes