Don't wanna be here? Send us removal request.

Text

Can you predict which mutual funds will do better than others?

Can you anticipate which mutual funds will do better than others?

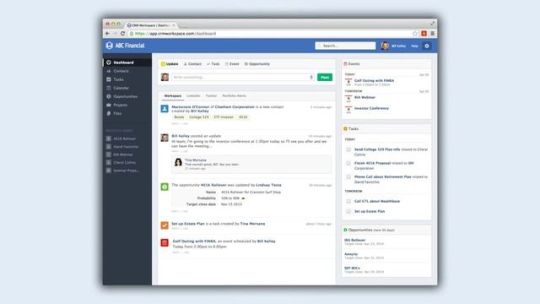

It turns out you can. The number of financial investment items readily available for purchase increases every year. Large item choice might produce issues, both for the client and the consultant. At Junxure, we've decided to construct an algorithm to deal with that concern. What we sought We wanted to supply necessary help for advisors and customers, presuming that some mutual funds can bring organized returns in given market conditions. Depending upon a fund's method, approaches of management and item specifics, it may be a better fit for purchase today, or remain more promising for the conditions of tomorrow-- in a various environment. In this vein, we chose to check whether AI-based algorithm can discover the best mutual funds using affiliations hidden in item costs, macro indications, market indexes, FX rates and commodities. The twist was-- we did not try to translate these reliances however rather put them to work and see the real results in product ranking. How we did that We collected macro indications of significant worldwide economies (US, EU, China, Japan, LatAm, India), commodities prices, FX rates and significant indexes quotes. Then, we used cost history for over 4000 mutual funds traded on NASDAQ. Our goal was to create a ranking of the funds and figure out which ones would score the highest rate of return in the next quarter. To produce optimum environment for the algorithm, we required to prepare the information we had accumulated and run a lot of additional analyses (e.g. return and threat ratios, fund performance signs). The last thing to be done before the training begun was to effectively decrease data dimensions using Principal Part Analysis (PCA). What carried the most guarantee The most appealing results came from the ensemble machine discovering technique. It utilizes several discovering algorithms (lots best performing AI models in our case) to obtain a much better predictive performance. For the results measurement, we created a Top-Bottom Analysis. In the analyzed group, we created a ranking of mutual funds, arranged by the probability of achieving the greatest rate of return in the next quarter. Then, we moved 3 months in the future and examined whether we were right, specifically whether the leading 10% was significantly better than the bottom 10% from our ranking. To produce the most sensible environment, we measured our outcomes utilizing so called test data, which is a dataset which the algorithm has actually never ever "seen" prior to. It ensured that such outcomes can be obtainable in daily operations. In order to assess a mutual fund capability to outperform its peer groups, our design took various specifications into account: fund threat and previous efficiency in different market conditions, return persistence and repeatability, risk-adjusted efficiency ratios as well as methodical risk related to main market elements. The last one, in particular, is somewhat vague: information-driven market movements which are quite unforeseeable, human behavior which is uncertain, adaptive and sometimes repeatable, finally the basic financial laws that should discuss reliances between economic cycles and possession prices in a long term but not constantly do. We anticipated device learning to tell us more where the fact was-- comments Grzegorz Prosowicz, Consulting Director for Capital Markets at Advisor Engine. What the outcomes were The actual results for the test dataset surpassed our expectations. The very best results we have achieved were 78% in Top-Bottom Analysis. It means that in 4 out of 5 cases we can predict which funds would score a greater rate of return. Additionally, the difference in rate of return between bottom and leading funds totaled up to 2,99 percentage points quarterly (12,51 p.p. CAGR). In other words, advisor picking products for their customer from readily available item universe for one-year period, could rely on 12,51 percentage points better returns with the algorithm-- no matter how the markets perform. What's next? Think of having a service of that kind in your institution. Your consultants would lastly get a reliable assistance with choosing the ideal items and become more productive. Is the service going to reach a similar success in every country or scenarios? Is the service all set to launch as cloud API in your organization or get checked by you in kind of proof of concept? --------------------------------------------- Wealth management techniques in the digital age The service digitization procedure which might be observed for more than a dozen (if not more than twenty) years does not skirt the financial sector. Both business and banks providing investment advisory services place significance on innovative software targeted at assisting in the customers' wealth management. What should the wealth management service appear like in the digital improvement age and what strategies can be adopted by the institutions using them? Digital wealth management technique-- challenges Both the banks and business offering the wealth management service deal with a number of difficulties connected with the digital transformation. According to the "Swim or sink: Why Wealth Management Can't Afford to Miss the Digital Wave" report prepared by Advisor Engine, the wealth management service is presently one of the least sophisticated ones in terms of technology. age structure-- a high share of clients classified into HNWI and UHNWI (Ultra High Net Worth People) groups are seniors who do not demand any cutting edge services from banks or advisory companies and who depend on direct contacts with the advisors, aversion to developments-- the wealthiest clients think the validated wealth management methods must be used and it is needless to introduce new options, innovation limitations-- lots of banks keep using older software, the extension of which with brand-new functionalities is made complex and costly. Despite the challenges which need to be overcome by banks and advisory companies, the wealth management digital method might produce quantifiable advantages. The authors of the report by McKinsey advisory company called "Secret Trends in Digital Wealth Management-- and What to Do about Them" observe the clients having access to the software helping with wealth management report the 5 to 10 times higher satisfaction level than customers communicating with the consultants in a conventional way. The costs are not irrelevant for the banks and advisory companies. Utilizing the robo-advisory channel allows to lessen them. Thanks to the algorithms, it is possible to use prompt help to the consumers when making investment choices without significant expenses-- such advisory services are more affordable than the support supplied by a human, experienced advisor and work even in negative market conditions. Junxure Wealth Management software Wealth management digital methods The banks and advisory companies alike know that they can just get using the digital technology potential. Entities with a long market existence buy the innovative options more and more frequently. There are many examples: Perpetual is a company using the wealth management service with a more than 140 years' existence on the Australian market. It decided to make instantaneous insight into financial investment portfolios and reports delivered by means of the chosen social media offered to its consumers, Swiss UBS bank opened a robo-advisory channel for consumers with the wealth listed below 2 million pounds required to open a personal banking account, a Singapore branch of Citi offered their customers the chance to utilize a bank chatbot via Facebook. It offers details e.g. about balances and transactions on the savings account. Carrying out brand-new options suggests advantages not just for consumers (who may acquire a quick insight into their investment portfolio), but likewise for financial institutions. The strategic wealth management might be mostly automated. Some activities may be performed without the consultant's participation. What is more, the specialized software application makes it possible for to gather information which can be examined then to change the embraced wealth management strategies. Advisors having access to the tools assisting in some daily tasks gotten in touch with wealth management gain also more time for discovering clients' needs. According to the research study performed by the advisory business Ernst & Young, one of wealth management parts of particular value for wealthy customers is comprehending their financial objectives and offering a broad access to investment products and tools to them. Strategic wealth management-- how to get ahead of rivals? Lots of financial institutions and banks think about the wealth management digital technique to be the key to obtain competitive advantage and customers who do not wish to base exclusively on their instinct and knowledge when it comes to wealth management. To ensure the provided services correspond to the requirements of their recipients, the business and banks using the wealth management service must: 1. Look at CRM for financial advisors implemented software application from the clients' perspective It is of specific significance the client's frontend operation is user-friendly, allows to set investment goals, is geared up with a monetary preparation application and makes it possible for to interact with specialists and consultants. Multi-modular Junxure Wealth Management software provides a multi-channel client's frontend. Individuals using this service have access to info on various gadgets, consisting of tablets, pcs and smart devices. Customers might use both the assistance of consultants and location orders themselves by means of the robo-advisory channels. 2. Define the target group of clients Strategic wealth management is various for the affluent ones and for HNWI customers. The software ought to be adjusted to the needs of the target client group. The picked option needs to support building the relationship in between the advisor and the consumer. Those Junxure Wealth Management system allows to offer both full and simplified advisory services. What is more, the customers might transfer the orders to the advisors quickly or perform them themselves. Junxure Wealth Management provides likewise monetary and investment advisory services. Customers can be profiled and the consultant might carry out customized tactical wealth management for each of them. 3. Improve (expand) their offering The wealth management digital method is viewed from the perspective of benefits as it e.g. enables to focus on the consumer and their requirements more than in the past. Automating some activities helps with the whole advisory procedure. This, in turn, makes it possible for to expand the offer with brand-new financial investment items which may be of interest for a wider group of consumers. Utilizing Junxure Wealth Management, banks and advisory companies may perform different analyses, including the efficiency and danger ones, for their consumers. Thanks to the control and systematic reporting, the consumer may rely on comprehensive support and likewise execute the most profitable wealth management methods. What are the identifying functions of Junxure Wealth Management? Junxure Wealth Management option was designed to cater for the requirements of the wealth management clients and their consultants. This is a multi-modular wealth management system created for the private banking consumers. It supports the work of all staff members having contacts with the capital transferred by the clients and establishing wealth management strategies, i.e.: consultants-- they might generate a risk profile for every single client and make additional advisory choices based upon it, consisting of offering strategic wealth management, managers-- they take part in the investment process, managing the clients' financial investment portfolios, analysts-- they are responsible for preparing analyses based on the collected information and obtained financial outcomes. The system likewise supports the aftersales services of tremendous importance for more cooperation of the bank (or the advisory business) and the consumer. The customer may count on e.g. consistent insight into their financial investment portfolio and receive reports. They enable the investor to learn the results on various levels, including the classes of assets or currencies. The software application developed by Junxure is adapted likewise to the regulative requirements, consisting of e.g. MiFID II (Markets in Financial Instruments Instruction) which imposes info responsibilities on banks and business using investment items. Thanks to that, the consumers get info about the danger connected with investing in chosen financial instruments and expenses they will incur in relation to utilizing the advisor's assistance.

#Wealth Management Software#wealth manager software#financial advisor software#robo advisor#CRM for financial advisors#Financial CRM#wealth management crm software#advisor technology#RIA CRM

1 note

·

View note