Discover Singulardex.com - the world's leading crypto investment platform. Our unique USP provides the security you need to make smart investments with confidence. Start your journey today and experience the power of crypto!

Don't wanna be here? Send us removal request.

Text

Monitor Market Moves and Trade Smart with Precision Crypto Platforms

Digital asset markets thrive on motion. For experienced participants, movement isn’t noise—it’s an invitation. Price shifts, breakout patterns, and momentum swings all represent clues waiting to be decoded. Real-time access to data and a responsive interface can make the difference between catching a wave and missing it entirely. In an environment where latency translates to risk, only platforms built for agility provide the clarity needed to operate with confidence in highly reactive conditions.

Interpreting the Ups and Downs Behind Market Momentum

The conversation around bitcoin’s price is more than speculation—it’s a leading indicator of liquidity, sentiment, and macro pressure across decentralised markets. Sudden moves often ripple across protocols, affecting asset pairings, contract values, and trading behaviours. Sophisticated tools are now used not only to track but to anticipate reactions based on volume, funding rate changes, and liquidation clusters. Understanding how to navigate these signals allows for smarter positioning and calculated risk when entering or exiting on-chain futures.

Infrastructure That Speaks the Language of Speed

Performance is no longer optional. Whether engaging in leveraged trading or managing passive strategies, users require uninterrupted access across chains, contracts, and wallets. The strength of any decentralised system lies in its ability to manage large volumes under pressure without service degradation. Platforms that scale without compromising execution offer more than functionality—they offer reliability. These systems become the backbone of modern crypto interaction, especially when global events or sudden price action stress-test the limits of decentralised protocols.

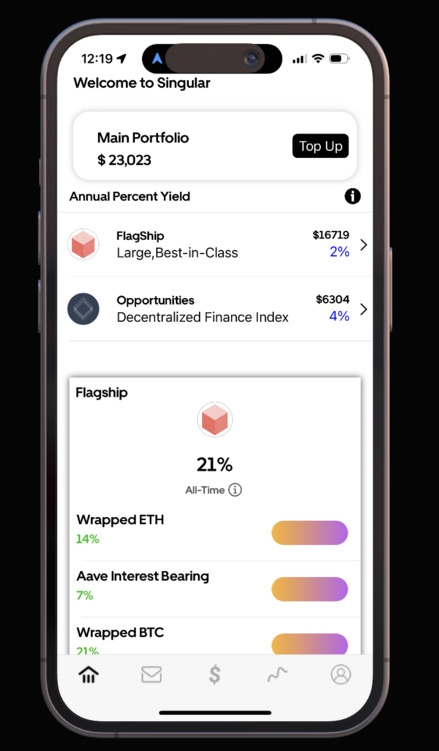

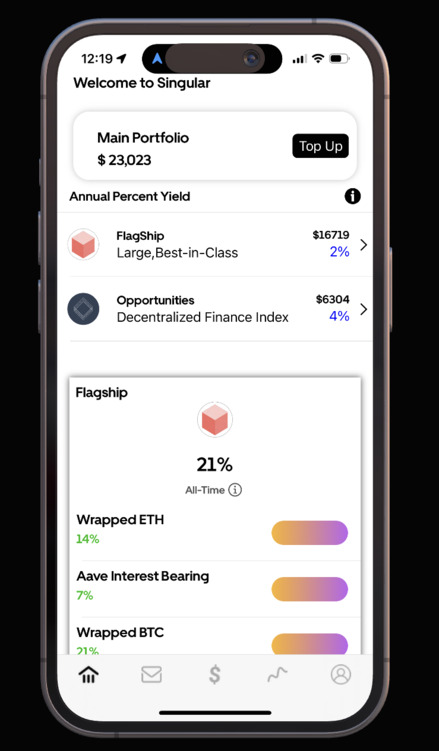

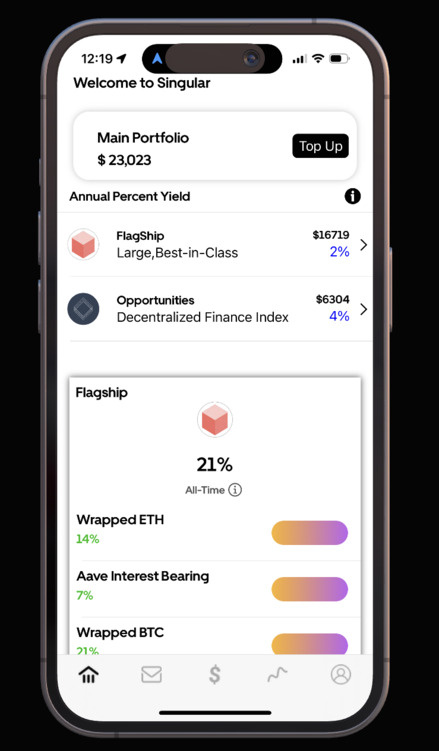

When Asset Management Meets Trading Fluidity

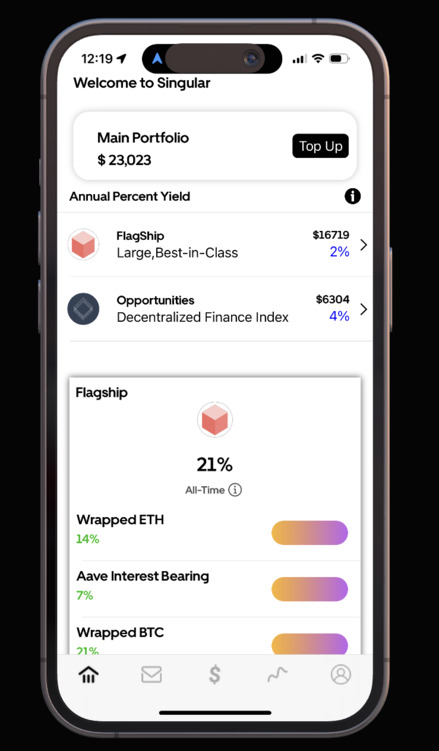

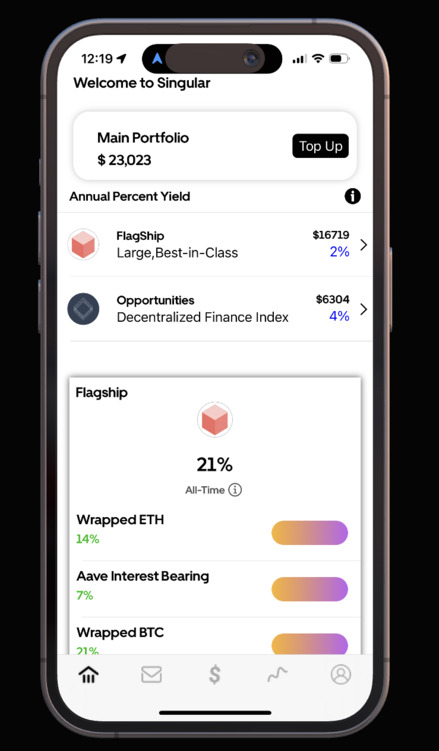

What sets apart a singular crypto experience is its fusion of self-custody, execution speed, and layered data all within a single interface. The user no longer has to juggle dashboards or compromise between asset visibility and order management. Instead, integrated wallets now function as execution terminals—handling margin, liquidity, and analytics in real time. This tight integration enables decisions to be made on the fly, whether reacting to sudden BTC movements or exploring lesser-known token pairs with high momentum potential.

Precision-Focused Tools Built for Decision-Makers

Every market condition demands a different lens. Traders operating across decentralised futures and spot markets now rely on dashboards equipped with detailed charts, live tickers, and risk summaries. Platforms that pair singular crypto environments with predictive analytics unlock new methods for engagement, empowering users to plan around volatility instead of reacting to it: the more seamless the tool, the more intuitive the response. What emerges is not just a trade but a strategy shaped by real-time intelligence that is delivered with speed.

Conclusion

Navigating crypto markets means constantly adapting to change. Platforms that combine flexibility, speed, and smart tools are quickly becoming indispensable for participants seeking control without compromise. In this evolving space, singulardex.com brings together seamless wallet management and responsive trading environments to offer a complete ecosystem for both precision execution and asset control. As interest grows and strategies evolve, only those systems built to handle volatility with grace will continue to thrive. Where others wait, real traders move fast—and smart.

Blog Source Url:-

https://singulardex.blogspot.com/2025/06/monitor-market-moves-and-trade-smart.html

0 notes

Text

Trade Smarter and Faster with On-Chain Futures and Secure Wallets

Decentralised trading continues to attract users looking for high-speed performance, secure execution, and tools that go beyond basic swaps. Platforms that integrate these elements into a streamlined experience are no longer just innovation showcases—they’ve become daily utilities. In this space, users expect tools that respond instantly to shifts in volatility while giving access to complex positions in just a few clicks. These changes have not only raised the bar for performance but have also redefined what trust and utility mean in decentralised environments.

The Growing Role of Futures in DeFi Strategy

Modern decentralised exchanges are no longer confined to simple spot trading. The growing popularity of perpetuals has given users more flexibility in building long-term and short-term strategies. Unlike traditional contracts, these positions remain open indefinitely, allowing greater control over market timing and exposure. Funding rate mechanisms balance risk across the network, while built-in leverage provides added firepower for advanced users. What was once considered too complex for DeFi is now embedded in clean, accessible user interfaces that offer both depth and speed without compromising transparency.

The Security Layer Underpinning the Experience

Security in decentralised finance has evolved from an optional feature to an absolute necessity. Users demand more than just encrypted interfaces—they expect systems with smart contracts that have been rigorously audited, along with protection against front-running, slippage, and cross-chain exploits. Effective platforms don’t just focus on on-chain activity but also create invisible safety layers around execution and asset storage. The most trusted environments are those that handle stress, protect liquidity, and remain operational under extreme conditions, without shifting that burden to the user.

Wallet Design That Connects Speed with Simplicity

Functionality in wallets has matured beyond simple send-and-receive operations. A modern singular wallet is expected to operate across chains, integrate with dApps instantly, and display real-time data about assets, staking, and margin. What sets these wallets apart is their ability to work fluidly with high-speed perpetual trading environments, syncing risk data, margin balances, and contract conditions seamlessly. As demand grows for complete self-custody paired with efficiency, wallets now act as both vaults and terminals, capable of executing high-frequency trades while preserving total user control.

Tools that Enhance Decision-Making Under Pressure

Every second matters when trading across volatile markets. That's why today's platforms are optimising not just speed but decision support—combining live order books, funding insights, and risk dashboards into a single hub. The singular wallet becomes even more powerful when paired with perpetuals, allowing seamless toggling between assets, leverage, and exits. These tools are not just helpful—they’re crucial for those who operate across multiple tokens and timeframes. With intuitive layouts and real-time responsiveness, trading transforms from chaotic guesswork into confident execution.

Conclusion

As digital markets grow more sophisticated, decentralised tools must evolve with them. Users want more than speed—they want full control, smart infrastructure, and clarity at every stage of the trade. In the middle of this transformation, singulardex.com offers a complete ecosystem built to connect perpetual contracts with flexible wallet solutions. By bringing execution, custody, and analytics into a single platform, it reshapes how users interact with decentralised finance. In this next chapter of trading, versatility and usability are no longer perks—they are baseline expectations.

Blog Source Url:-

https://singulardex.blogspot.com/2025/06/trade-smarter-and-faster-with-on-chain.html

0 notes

Text

Experience Lightning-Fast DeFi Futures with Advanced Dex Perpetuals

Decentralised trading has rapidly advanced beyond its early limitations, driven by growing demand for transparent, fast-moving, and user-governed protocols. The market no longer tolerates inflexible tools or reliance on intermediaries. Every transaction, whether basic or complex, is now expected to operate with precision. This shift has sparked a new category of DEX platforms designed to reduce delays, cut down slippage, and widen accessibility. In this evolving landscape, adaptability and resilience have become the standard, transforming how users interact with decentralised ecosystems.

What Sets This Ecosystem Apart in a Crowded Field

The current wave of decentralised infrastructure thrives not just on volume but on the details, like protocol design, latency, and flexibility across chains. Platforms that stand out often provide a singular experience, where speed meets strategic execution and users feel empowered, not overwhelmed. By removing unnecessary friction and simplifying access to complex trading options, these systems create an intuitive environment tailored for a diverse group of participants. Whether focused on micro-movements or long-term positions, precision at every level is what keeps these traders returning.

Layers of Security That Run Deep Behind the Interface

Security is the defining factor for staying relevant in any decentralised exchange. Audited smart contracts, non-custodial wallet integrations, and permissionless architecture help maintain integrity even in high-volume conditions. But the foundation is only part of the picture—resilience under stress, rapid protocol updates, and live monitoring are just as crucial. Risk mitigation has shifted from reactive to proactive, with platforms adopting systems that alert users to liquidity shifts or slippage risks. In the DeFi universe, this equilibrium of security and liberty changes the way confidence is acquired.

Precision Trading with Built-In Agility and Control

The new generation of trading products includes features like perpetual contracts, offering strategic depth for traders needing constant exposure without expiry. This is where Dex Perpetuals have gained traction, as they provide leverage and funding rate mechanisms within trustless environments. What makes them effective isn’t just the flexibility—they're engineered for seamless execution across high-speed chains. With real-time updates and adaptive interfaces, these tools are shaping a new expectation: that futures-style trades can be decentralised, on-chain, and still function at the pace of centralised alternatives.

Tooling That Matches the Speed of Decision-Making

Access to high-frequency data, advanced order types, and portfolio analytics is now an essential feature for those trading Dex Perpetuals. These tools cater to individuals who move fast and think in cycles—those who require layered functionality and instant feedback. A dashboard with clarity becomes more than convenience; it’s a requirement. By unifying execution and insight, the modern DEX is no longer just a place to trade—it becomes a strategic command centre. That shift reflects how users are no longer passive participants but active operators in fast-evolving markets.

Conclusion

The evolution of decentralised futures trading has moved far beyond early experiments into a refined, responsive ecosystem. Today’s platforms aim to offer speed, clarity, and versatility without compromising core DeFi principles. In the middle of this transformation, singulardex.com positions itself as a hub where streamlined execution and intelligent tooling meet. As more users embrace this new market standard, success will favour systems that prioritise usability alongside innovation. Whether navigating leverage or exploring perpetual trades, the demand remains the same—smooth, transparent, and effective performance across every step.

Blog Source Url :-https://singulardex.blogspot.com/2025/05/experience-lightning-fast-defi-futures.html

0 notes

Text

The Rise of Decentralized Perpetual Exchanges in the Crypto Market

Decentralized Perpetual Exchanges are revolutionizing the world of cryptocurrency trading by offering traders the ability to enter long or short positions with no expiration dates. Unlike traditional exchanges that involve set expiration for futures contracts, decentralized perpetual exchanges allow for continuous trading without the need to roll over positions or settle at predetermined dates. This gives traders more flexibility and control, creating opportunities for profit regardless of market conditions. By enabling users to trade with leverage, decentralized perpetual exchanges have become a game-changer, offering enhanced risk management tools and opportunities for traders of all experience levels.

Advantages of Using Decentralized Perpetual Exchanges

One of the most significant advantages of decentralized perpetual exchanges is the inherent security and privacy they offer. Since these platforms operate on decentralized blockchain networks, they eliminate the risks associated with centralized platforms that are vulnerable to hacking and data breaches. Users retain full control over their funds and private keys, ensuring that no third party has access to their assets. Additionally, the absence of intermediaries or central authorities in decentralized systems reduces the potential for manipulation, allowing for a more transparent and fair trading environment. This enhanced security and autonomy are key reasons why traders are increasingly flocking to these platforms.

Empowering Traders Through Defi Trading Platforms

DeFi (Decentralized Finance) trading platforms have taken the crypto industry by storm, providing individuals with unprecedented access to a wide range of financial services without the need for traditional banks or intermediaries. By leveraging blockchain technology, these platforms enable peer-to-peer trading, lending, and borrowing in a decentralized manner. One of the most compelling aspects of DeFi trading platforms is their ability to offer users control over their financial transactions and assets, reducing reliance on centralized systems. This shift towards decentralization is empowering traders and investors to operate in a more open, transparent, and secure environment, which is driving the growth of DeFi ecosystems.

How Decentralized Perpetual Exchanges Enhance Leverage Trading

Leverage trading allows traders to control larger positions in the market with a smaller initial investment, which can significantly amplify both potential profits and risks. Decentralized perpetual exchanges provide an innovative way to engage in leverage trading without the traditional restrictions and complexities of centralized platforms. These exchanges use smart contracts and decentralized protocols to facilitate leveraged positions, giving traders the ability to take on more exposure while mitigating the risk of counterparty default. With leverage available through decentralized perpetual exchanges, traders can maximize their potential returns in volatile markets while managing risk effectively, all within a secure and decentralized ecosystem.

The Role of Liquidity in Decentralized Perpetual Exchanges

Liquidity plays a crucial role in the success and efficiency of decentralized perpetual exchanges. In traditional markets, liquidity is typically provided by centralized market makers or institutional players, but in the decentralized world, liquidity is provided by individual traders and liquidity pools. The decentralized nature of these exchanges allows for greater market depth and a wider variety of assets, as liquidity can be sourced directly from users and liquidity providers. This peer-to-peer liquidity model ensures that trades are executed quickly and efficiently, with minimal slippage. As liquidity continues to grow on decentralized perpetual exchanges, these platforms become even more attractive for high-frequency traders and institutions.

Conclusion:

decentralized perpetual exchanges and DeFi trading platforms are leading a revolution in the way individuals engage with financial markets. These platforms offer a higher level of security, transparency, and autonomy compared to traditional centralized exchanges. By eliminating intermediaries and central authorities, decentralized systems empower traders and investors to take control of their financial assets and make informed decisions. As technology continues to evolve, the future of decentralized trading looks bright, and platforms like singulardex.com are at the forefront of this transformation, offering innovative solutions that cater to the needs of modern traders.

Blog Source Url :- https://singulardex.blogspot.com/2025/05/the-rise-of-decentralized-perpetual.html

0 notes

Text

The Rise of Dex Perpetuals: Revolutionizing Crypto Trading

The world of cryptocurrency trading has undergone a remarkable transformation in recent years, with decentralized exchanges (DEXs) leading the charge. One of the most innovative products to emerge from this movement is Dex Perpetuals. These financial instruments have become increasingly popular among traders for their ability to provide leveraged exposure to a wide array of assets without the need for traditional intermediaries. The essence of perpetual contracts is that they have no expiration date, allowing traders to hold positions as long as they like, making them an attractive option for both short-term and long-term traders.

How Trading Dex is Changing the Landscape

The evolution of Trading Dex platforms has played a key role in this revolution. These platforms allow users to trade a range of financial products, including perpetual contracts, in a decentralized environment. Traditional centralized exchanges often come with high fees, cumbersome registration processes, and a lack of privacy. In contrast, decentralized exchanges offer greater transparency, lower costs, and enhanced privacy. By using smart contracts, Trading Dex platforms facilitate peer-to-peer transactions directly on the blockchain, ensuring security and autonomy for traders. This shift to decentralized trading is democratizing access to financial markets for users across the globe.

Key Benefits of Dex Perpetuals for Traders

Dex Perpetuals offer several advantages over traditional trading methods. First and foremost, these products allow traders to use leverage, which can amplify returns (or losses). This opens up opportunities for those looking to maximize their exposure to price movements with a smaller initial investment. Additionally, the flexibility of perpetual contracts, which have no expiration, enables traders to hold positions longer without worrying about expiry dates. This is particularly beneficial for those engaging in long-term strategies or aiming to hedge against short-term market fluctuations. The transparency and security offered by DEX platforms ensure that traders can execute their strategies with confidence.

Decentralization: A Game Changer in Crypto Trading

One of the standout features of Trading Dex platforms is the shift towards decentralization. Unlike traditional centralized exchanges, which are prone to security breaches, hacking attempts, and regulatory issues, decentralized exchanges operate in a peer-to-peer manner. This eliminates the need for an intermediary, allowing users to maintain full control over their assets at all times. The smart contracts that power these platforms are transparent and immutable, providing an extra layer of security and trust for users. Decentralization also ensures that users have access to a broader range of markets and products without the limitations imposed by centralized exchanges.

The Role of Liquidity in Dex Perpetual

Liquidity is a critical factor in the success of any trading platform, and this holds for Dex Perpetuals as well. In traditional exchanges, market makers provide liquidity to ensure that trades can be executed swiftly and efficiently. However, decentralized exchanges rely on liquidity pools, which are managed by users who contribute their assets to ensure smooth trading. This peer-to-peer liquidity provision helps reduce slippage and ensures that traders can enter and exit positions without significant price changes. The growth of liquidity in decentralized markets has made Trading Dex platforms increasingly efficient and attractive to traders seeking competitive pricing and execution.

Conclusion:

The rise of Dex Perpetuals and Trading Dex platforms marks a significant milestone in the evolution of cryptocurrency markets. The ability to trade decentralized perpetual contracts offers traders unprecedented flexibility, security, and control over their assets. With the decentralization of trading, enhanced risk management tools, and improved liquidity, these platforms are positioning themselves as the future of crypto trading. As the technology continues to evolve and adoption grows, platforms like SingularDex will continue to shape the future of digital finance. By embracing this new wave of decentralized trading, users can access a more open and efficient trading environment.

Blog Source Url :- https://singulardex.blogspot.com/2025/05/the-rise-of-dex-perpetuals.html

0 notes

Text

Understanding the Power of DEX Trades in the Crypto World

In recent years, decentralized exchanges (DEXs) have rapidly evolved, reshaping how cryptocurrency trading operates. Traditional centralized exchanges (CEXs) have long been the dominant platform for trading digital assets, but the rise of DEX trades has introduced a new wave of possibilities. DEXs provide users with greater control over their assets, enabling peer-to-peer transactions without the need for a trusted third party. This decentralized approach minimizes security risks and enhances privacy, making DEX trades more appealing to traders who prioritize autonomy. The shift towards decentralized platforms marks a fundamental change in how cryptocurrencies are exchanged globally.

Exploring the Benefits of Dex Perpetual

One of the most exciting innovations in the decentralized finance (DeFi) space is Dex Perpetuals. Unlike traditional futures contracts, which have set expiration dates, perpetual contracts allow traders to speculate on the price of assets indefinitely. These contracts are a staple of DeFi trading because they enable traders to maintain open positions without worrying about rolling over contracts or managing expirations. Dex Perpetuals offer significant advantages, including high leverage, low fees, and the ability to trade on assets not available in traditional markets. By integrating perpetual contracts into the DEX ecosystem, platforms are offering more sophisticated trading tools that cater to both novice and experienced traders alike.

How DEX Trades Enhance Security and Privacy

One of the biggest draws of decentralized exchanges is their emphasis on security and privacy. Traditional centralized platforms require traders to deposit funds into exchange wallets, exposing assets to potential hacks and breaches. With DEX trades, however, users retain full control over their funds, eliminating the risk of exchange-related hacks. Additionally, because transactions are conducted peer-to-peer on the blockchain, the need for personal data disclosure is reduced, further enhancing privacy. This self-custody model is gaining traction, especially as privacy concerns continue to rise in the digital age. For traders who value anonymity and want to minimize risks, DEX trades provide a safer alternative.

The Growing Popularity of Dex Perpetuals in DeFi

Dex Perpetuals are quickly becoming one of the most sought-after products in the DeFi ecosystem. These contracts allow users to trade on the future price movements of various cryptocurrencies without the need for ownership of the underlying assets. The appeal lies in their ability to provide traders with exposure to multiple assets while minimizing the cost of capital required. This has led to a surge in the adoption of perpetual contracts on decentralized platforms, where users can access a wide variety of trading pairs and leverage their positions for greater returns. As the DeFi landscape grows, Dex Perpetuals are set to become a key component of decentralized trading.

The Future of DEX Trades: A New Era of Trading

Looking to the future, DEX trades are poised to continue disrupting the trading landscape. As blockchain technology evolves, the functionality and accessibility of decentralized exchanges are expected to improve significantly. Innovations in liquidity provision, cross-chain compatibility, and more advanced trading features are on the horizon. DEX platforms are also becoming more user-friendly, allowing individuals with varying levels of experience to engage in complex trading strategies. As the regulatory environment around cryptocurrencies becomes clearer, decentralized platforms will likely be at the forefront of providing open, accessible trading opportunities that remain in line with global standards and regulations.

Conclusion:

The evolution of decentralized exchanges and trades is an exciting development that continues to change the way people engage with cryptocurrency markets. As more traders embrace the security, autonomy, and transparency that these platforms offer, decentralized exchanges are becoming increasingly popular. Similarly, Dex Perpetuals are revolutionizing how traders can gain exposure to various assets, offering a more flexible and cost-effective alternative to traditional futures contracts. As the space grows, platforms like SingularDex.com will continue to lead the charge, providing innovative solutions that empower traders to take full control of their digital assets and future-proof their investment strategies.

Blog Source Url :- https://singulardex.blogspot.com/2025/05/understanding-power-of-dex-trades-in.html

0 notes

Text

The Rise of DeFi Trading Platforms: A New Era of Financial Freedom

DeFi trading platforms have revolutionized the financial world by enabling decentralized exchanges and offering users more control over their assets. Unlike traditional platforms, which rely on centralized entities, DeFi platforms leverage blockchain technology to facilitate peer-to-peer transactions. This allows users to trade directly with one another without needing an intermediary. The key advantage of DeFi is that it provides a higher level of transparency, security, and efficiency. Users are no longer dependent on banks or brokers, allowing them to execute trades at any time, from anywhere in the world. This decentralization is fostering greater financial inclusion and innovation.

Exploring the World of DEX Perpetuals and Their Potential

One of the exciting advancements in DeFi trading platforms is the emergence of Dex Perpetuals. These innovative financial instruments allow traders to enter positions with no expiration date, unlike traditional futures contracts that have set expiry times. The perpetual nature of these contracts offers significant flexibility for traders, as they can hold positions for as long as they desire. Perpetuals offer users exposure to a range of assets, from cryptocurrencies to commodities, enabling them to hedge risk or speculate on price movements. With features such as leverage, these instruments enhance trading opportunities while maintaining decentralization, ensuring that all transactions are transparent and secure.

How DeFi Trading Platforms Are Shaping the Future of Trading

DeFi trading platforms are reshaping how people approach trading and investing. These platforms create an open, permissionless environment where anyone can participate without needing approval from a central authority. This is especially advantageous for those in regions with limited access to traditional financial systems. DeFi platforms also enable the use of smart contracts, which automatically execute transactions when predefined conditions are met. This eliminates human error and ensures that trades are executed efficiently and fairly. As the DeFi ecosystem continues to grow, we are witnessing an increase in liquidity, a broader range of assets, and enhanced user experience.

The Benefits of Trading with Dex Perpetuals in the DeFi Ecosystem

With Perpetuals, traders can access a wide range of benefits that make them an attractive option within the DeFi space. The most notable advantage is the ability to trade with leverage, which means users can control larger positions with a smaller initial investment. This amplifies the potential for profit, although it comes with increased risk. Another benefit is the ability to trade 24/7, with no market closures. This gives traders unparalleled flexibility to manage their portfolios at any time. Furthermore, Perpetuals typically have lower fees compared to traditional exchanges, making them cost-effective options for frequent traders looking to maximize their gains.

The Future of DeFi and Dex Perpetuals: A Seamless Experience

As DeFi continues to evolve, so do its trading platforms and the instruments available to users. Dex Perpetuals are expected to grow in popularity, with more sophisticated features being introduced to enhance user experience and streamline trading. One key area of focus is improving user interfaces, ensuring that even those who are new to cryptocurrency trading can navigate the platforms with ease. Moreover, the integration of layer-2 solutions, such as zk-rollups, promises to improve scalability and reduce transaction fees, which will attract even more users to DeFi. As the technology matures, the DeFi ecosystem will become more robust, accessible, and efficient.

Conclusion:

DeFi trading platforms and Perpetuals are at the forefront of a financial revolution that prioritizes decentralization, transparency, and user empowerment. As these platforms continue to evolve, they will provide increasingly sophisticated tools for traders and investors, making the world of finance more accessible to everyone. The ability to trade without intermediaries, coupled with the flexibility of Dex Perpetuals, creates an exciting future for DeFi enthusiasts. For those looking to explore this new financial landscape, singularDex.com offers a cutting-edge platform that combines ease of use with advanced trading features, helping users navigate this fast-paced, decentralized world with confidence.

Blog Source Url:-

https://singulardex.blogspot.com/2025/04/the-rise-of-defi-trading-platforms-new.html

1 note

·

View note

Text

The Rise of Trading DEXs: Revolutionizing the Crypto Space

The landscape of cryptocurrency trading has undergone significant changes in recent years, largely due to the rise of decentralized platforms. One of the most notable advancements has been the emergence of Trading DEX (decentralized exchanges), which allow users to trade digital assets directly with one another without the need for intermediaries. By using blockchain technology, these platforms provide more security, transparency, and control over user funds compared to traditional centralized exchanges. As a result, Trading DEXs have rapidly gained traction in the crypto community, offering a new and more efficient way for traders to engage in the digital market.

Decentralized Perpetual Exchanges: The Future of Crypto Derivatives

Decentralized Perpetual Exchanges are gaining attention as a next-level innovation in the world of decentralized finance (DeFi). These exchanges allow users to trade perpetual contracts—derivative instruments that allow traders to speculate on the price of an asset without an expiration date. Unlike traditional futures contracts, which have an expiration period, decentralized perpetual exchanges allow users to hold their positions indefinitely. This unique feature provides more flexibility for traders, especially in volatile market conditions. With the growing interest in Decentralized Perpetual Exchanges, they are becoming a key element in how modern crypto traders manage risks and make profits.

Key Benefits of Trading DEXs for Crypto Traders

The benefits of using a Trading DEX extend beyond just privacy and security. One of the most compelling reasons for traders to flock to these platforms is the reduction in fees. Traditional centralized exchanges often impose high trading fees and withdrawal charges, while decentralized exchanges typically offer lower fees, making them more attractive to frequent traders. Additionally, Trading DEXs are open 24/7, giving traders the freedom to execute transactions whenever they choose without being constrained by traditional market hours. The decentralized nature of these platforms also eliminates the risk of hacking or centralization of funds, offering users greater peace of mind.

How Decentralized Perpetual Exchanges Benefit Risk Management

Risk management is a crucial aspect of any trading strategy, and Decentralized Perpetual Exchanges have emerged as powerful tools to mitigate potential losses. These exchanges allow users to utilize leverage, enabling them to control larger positions with a smaller amount of capital. This means that even in volatile markets, traders can make significant profits without needing to invest large sums upfront. However, the flip side is that leverage can also amplify losses, which is why risk management features, such as stop-loss and take-profit orders, are essential. With decentralized perpetual exchanges, traders can access these tools in a decentralized environment without sacrificing security or transparency.

The Role of Smart Contracts in Trading DEXs and Perpetual Exchanges

At the core of both Trading DEXs and Decentralized Perpetual Exchanges are smart contracts. These self-executing contracts automatically enforce the terms of the agreement between buyers and sellers. By removing intermediaries, smart contracts significantly reduce the risk of fraud, errors, or delays in the transaction process. In decentralized exchanges, smart contracts ensure that users retain full control of their funds while facilitating peer-to-peer transactions. In perpetual exchanges, smart contracts govern the leverage mechanics and margin calls, making sure the process remains secure, transparent, and efficient. This decentralized approach empowers users and contributes to the trustless nature of the crypto ecosystem.

Conclusion:

Trading DEXs and Decentralized Perpetual Exchanges are set to transform the way traders interact with the crypto market. These decentralized platforms not only offer enhanced security and transparency but also provide users with greater flexibility and control over their trades. As the DeFi ecosystem evolves, we can expect continued improvements in the functionality, usability, and scalability of these platforms. For traders seeking to explore new opportunities and leverage the benefits of decentralized finance, platforms like SingularDex.com are leading the charge in providing secure, innovative, and user-friendly solutions to meet the needs of the modern crypto trader.

Blog Source URL:-

https://singulardex.blogspot.com/2025/04/the-rise-of-trading-dexs.html

0 notes

Text

Exploring the Future of Trading with Decentralized Perpetual Exchanges

In the world of cryptocurrency, trading platforms have evolved significantly to meet the demands of modern traders. One of the most exciting developments is the rise of Decentralized Perpetual Exchanges. Unlike traditional exchanges, decentralized platforms operate without a central authority, giving traders more control over their assets. These exchanges allow users to trade perpetual contracts, which are derivatives that do not have an expiration date, making them a popular choice for traders who want to speculate on the future price of assets without worrying about contracts expiring. The elimination of intermediaries results in lower fees and better transparency, marking a shift toward a more democratized financial landscape.

How Decentralized Perpetual Exchanges Empower Traders

Decentralized exchanges (DEXs) have long been known for their enhanced security and privacy features. With Dex Perpetuals, traders can engage in leveraged trading without exposing themselves to the risks associated with centralized exchanges. Since these platforms operate on blockchain technology, they eliminate the need for an intermediary, reducing the possibility of hacking or fraud. Furthermore, DEX perpetual is available 24/7, enabling global access and providing traders with the freedom to trade at their convenience. The absence of centralized control also means that traders' funds remain in their wallets, giving them complete ownership and control over their assets.

The Rise of Perpetual Contracts in Crypto Trading

Perpetual contracts have gained immense popularity in the cryptocurrency market due to their flexibility and ease of use. These contracts allow traders to bet on the price movements of an asset without worrying about expiration dates, unlike traditional futures contracts. This feature is particularly appealing for those involved in Decentralized Perpetual Exchanges, as they can take advantage of price fluctuations without the need to roll over contracts constantly. Perpetuals also offer leverage, which can amplify potential profits. However, this comes with increased risk, making it crucial for traders to understand the mechanics of the contracts and manage their risk appropriately.

The Mechanics Behind Dex Perpetual

At the core of Dex Perpetuals lies the concept of decentralized liquidity provision. Unlike traditional centralized exchanges, which rely on market makers and order books, decentralized perpetual exchanges use automated market makers (AMMs) to facilitate trading. This ensures that liquidity is always available, and traders can enter or exit positions at any time. Additionally, DEX perpetuals use smart contracts to enforce the rules of trading, ensuring transparency and reducing the likelihood of human error. These smart contracts also allow for the automation of liquidation processes, which adds an extra layer of safety for traders who use leverage.

The Growing Popularity of Decentralized Trading

As the decentralized finance (DeFi) ecosystem continues to expand, the popularity of Dex Perpetuals is growing at a rapid pace. Traders are flocking to these platforms not only because of the security and transparency they offer but also because they provide greater access to financial markets. With the power of blockchain technology, anyone with an internet connection can participate in the global trading arena. This inclusivity is helping to bridge the gap between traditional financial systems and the world of cryptocurrency. As a result, decentralized perpetual exchanges are becoming a central component of the DeFi ecosystem and are poised to reshape the future of trading.

Conclusion

The advent of Decentralized Perpetual Exchanges has undoubtedly revolutionized the way people trade cryptocurrencies. With enhanced security, greater control over funds, and the flexibility of perpetual contracts, these platforms are paving the way for a new era in digital asset trading. The decentralized nature of these exchanges offers unparalleled transparency and privacy while also providing traders with access to a global marketplace. As decentralized finance continues to evolve, platforms like Singulardex.com are leading the charge in providing cutting-edge, user-centric solutions that are transforming the trading landscape. Decentralized perpetual exchanges are here to stay, offering an exciting future for traders worldwide.

Blog Source Url :- https://singulardex.blogspot.com/2025/04/exploring-future-of-trading-with.html

0 notes

Text

Understanding DEX Perpetual: The Future of Decentralized Trading

The rise of decentralized finance has introduced innovative tools for trading digital assets, and one of the most notable developments is DEX perpetual. These contracts have created a way for traders to participate in leveraged trading without relying on a centralized authority. Unlike traditional futures, perpetual allows for indefinite positions, making them a popular choice in the world of cryptocurrency trading. This article explores how DEX perpetual works, their advantages, and why they are transforming the trading landscape.

What Are Perpetual Contracts?

Perpetuals are a type of derivative that allows traders to speculate on the price of an asset without actually owning it. Unlike conventional futures contracts, perpetuals have no expiration date. Hence, traders may keep their holdings as long as they have adequate margin to support them. This flexibility is one reason perpetuals have become popular in the crypto market, where traders can bet on price movements over extended periods without worrying about contract expiry. The price of perpetual is typically linked to the spot price of the asset through a mechanism known as the funding rate. This rate is a fee exchanged between long and short positions, helping to keep the contract price close to the actual market price. If perpetual is trading above the spot price, long holders pay a funding rate to short holders, incentivizing the market to stabilize. This design enables perpetual to remain close to the spot price of the asset, allowing traders to take advantage of price trends in real time.

The Role of DEX Perpetuals in DeFi

DEX perpetuals take perpetual contracts to the next level by bringing them to decentralized exchanges (DEXs). Unlike centralized exchanges, DEXs operate on blockchain technology and allow peer-to-peer trading without a central authority. With DEX perpetuals, users can leverage their trades on a decentralized platform, ensuring greater control and security over their assets. This setup provides an alternative to traditional perpetual contracts offered on centralized platforms, with added benefits such as transparency, self-custody, and resistance to censorship. DEX perpetuals are a vital part of the growing decentralized finance (DeFi) ecosystem, enabling users to access leveraged trading without giving up control of their funds. With DEX perpetual, all trading activities are recorded on the blockchain, making transactions secure and transparent. The decentralized structure removes the risks associated with centralized platforms, such as hacks or restricted access to funds. Additionally, DEX perpetual gives traders access to a broader range of assets and allows them to take long or short positions based on their market predictions.

Benefits and Risks of Trading DEX Perpetual

The benefits of trading DEX perpetuals include access to leverage, security, and transparency. Leverage allows traders to open more prominent positions with less capital, amplifying potential gains. This can be especially appealing for experienced traders who want to maximize their capital efficiency. Furthermore, the decentralized nature of DEX perpetuals means users retain control over their assets, reducing the risk of fund mismanagement and offering greater transparency through blockchain technology. However, trading perpetual with leverage carries inherent risks. While leverage can amplify profits, it can also magnify losses if the market moves against the trader’s position. Given the somewhat erratic nature of the Bitcoin market, this is especially crucial. To trade DEX perpetually effectively, traders need to apply risk management techniques, maintain adequate margins, and understand how the funding rate affects their positions over time.

Conclusion

DEX perpetuals provide a unique opportunity for traders to engage in leveraged trading in a decentralized and secure environment. The benefits of transparency, control, and leverage make DEX perpetual an attractive choice for those looking to expand their trading strategies. For more information on decentralized perpetual exchanges and their advantages, visit singulardex.com. As DeFi continues to evolve, DEX perpetuals represent a significant shift in the way traders interact with the market, empowering them with flexibility and control over their trading experience.

Blog Source Url :- https://singulardex.blogspot.com/2025/02/understanding-dex-perpetual-future-of.html

0 notes

Text

Singular Crypto: A New Frontier in Digital Asset Innovation

Cryptocurrencies have transformed the way people think about finance, providing new tools for investment, transactions, and wealth-building. Singular Crypto is one promising digital asset that aims to enhance how users interact with decentralized financial platforms. With its robust security, user-friendly features, and advanced technology, Singular offers a unique position in the expanding world of cryptocurrency. This article dives into what Singular Crypto is, its core features, and how it stands out in the digital asset landscape.

What is Singular Crypto?

Singular Crypto represents a modern approach to digital assets, developed to streamline transactions, enhance security, and simplify digital asset management. Unlike many other cryptocurrencies, Singular Crypto focuses on creating an intuitive experience for users, making it an ideal choice for both new investors and seasoned traders. Built on secure blockchain technology, Singular Crypto ensures transparency, privacy, and high-speed transactions while keeping fees to a minimum. The goal of Singular Crypto is not only to provide a secure medium for financial transactions but also to create a flexible asset that can integrate seamlessly with a variety of decentralized applications. This capability allows users to maximize the potential of their holdings, whether through trading, staking, or using Singular Crypto for decentralized finance (DeFi) activities. Its versatile design empowers users to manage and grow their digital assets more effectively, making it a valuable addition to the cryptocurrency market.

The Unique Features of Singular

The development of Singular has focused on creating an ecosystem that prioritizes ease of use and security without sacrificing functionality. Singular’s blockchain is optimized to handle a high volume of transactions, making it suitable for individuals who need a reliable, quick, and affordable way to manage digital assets. This high level of efficiency not only speeds up transactions but also makes Singular an appealing option for traders who need fast transaction confirmations. Additionally, Singular’s compatibility with decentralized applications provides users with access to a broad spectrum of DeFi services. This makes Singular an adaptable asset, capable of facilitating activities like lending, borrowing, and earning through decentralized exchanges. The adaptability of Singular within the DeFi space underscores its focus on enhancing financial freedom and flexibility. With these unique features, Singular stands out as a well-rounded digital asset that meets the needs of a dynamic financial market.

Why Singular Crypto is a Smart Choice for Investors

For those seeking an investment that combines growth potential with robust utility, Singular Crypto offers numerous benefits. Its compatibility with DeFi platforms provides an array of earning options, making it an attractive choice for investors interested in using their assets beyond simple transactions. Furthermore, its integration with a secure blockchain and low transaction costs make it a practical choice for those who prioritize security and cost-efficiency in digital finance. Singular also appeals to investors who value transparency and control over their assets. With its blockchain structure, all transactions are recorded transparently, allowing users to track their investments and ensure that they are secure. This transparency, paired with a decentralized setup, allows users to hold and manage assets without third-party involvement, giving them complete ownership of their funds.

Conclusion

In summary, Singular Crypto provides a robust, secure, and versatile option for anyone looking to dive into digital assets or expand their portfolio. With its focus on flexibility, security, and user accessibility, Singular stands out as a valuable tool for both transactions and investment. For more information on how to get started with Singular Crypto and explore its capabilities, visit singulardex.com. Singular Crypto offers a gateway to innovative financial opportunities, empowering users with a dynamic asset for the modern world of digital finance.

Blog Source Url :- https://singulardex.blogspot.com/2025/02/singular-crypto-new-frontier-in-digital.html

0 notes

Text

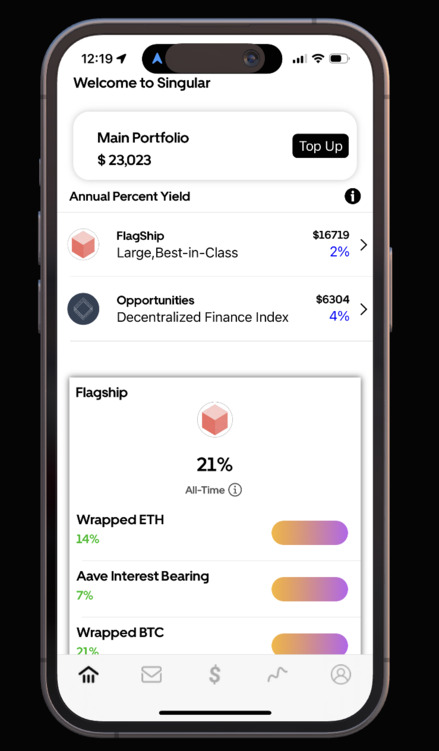

Singular Coin and Singular Wallet: A New Era in Digital Assets

As the cryptocurrency market expands, new digital assets and storage solutions are transforming how users interact with their funds. Singular Coin has emerged as a promising asset in this evolving landscape, accompanied by Singular Wallet, a secure and user-friendly storage solution. This article explores what makes Singular Coin unique, the benefits of Singular Wallet, and how these tools provide users with a streamlined experience in digital asset management.

Understanding Singular Coin

Singular Coin is a digital asset designed for seamless transactions within the cryptocurrency ecosystem. Built on blockchain technology, Singular Coin allows for secure, fast, and low-cost transactions, making it ideal for a range of uses, from peer-to-peer payments to trading on exchanges. Its design is focused on efficiency and scalability, ensuring that it can handle a high volume of transactions without compromising speed or security. The versatility of Singular Coin makes it appealing to a broad audience, including investors and users who are interested in decentralized finance (DeFi) and peer-to-peer interactions. Singular Coin’s value proposition lies in its combination of solid security protocols, minimal transaction fees, and a decentralized framework that empowers users with control over their assets. Its functionality within the digital economy is further enhanced by Singular Wallet, which provides an integrated solution for storing and managing this asset.

Introducing a Singular Wallet for Secure Storage

Singular Wallet is a secure digital wallet specifically designed to store Singular Coin and other compatible cryptocurrencies. This Wallet prioritizes user security and ease of use, providing features such as encryption, multi-factor authentication, and a simple, intuitive interface. Singular Wallet allows users to safely store, send, and receive Singular Coin without needing a third party to oversee transactions. The Wallet’s user-centric design makes it easy for individuals to manage their assets, even if they are new to cryptocurrency. Singular Wallet is equipped with real-time transaction tracking and balance updates, allowing users to monitor their portfolios in an organized and convenient manner. Additionally, it offers advanced security features to ensure that user funds remain safe, which is especially important given the increasing number of cyber threats in the crypto space. By providing a secure and accessible way to store digital assets, Singular Wallet complements Singular Coin’s mission to enhance the digital asset experience.

Benefits of Using Singular Coin and Singular Wallet Together

The combination of Singular Coin and Singular Wallet creates a cohesive ecosystem that supports efficient digital transactions and asset management. When used together, Singular Coin and Singular Wallet streamline the process of managing digital funds, enabling users to send, receive, and monitor their assets with ease. This integrated approach removes the need for multiple wallets or platforms, making Singular Wallet the ideal companion for anyone invested in Singular Coin. Using Singular Wallet also provides users with access to a broader ecosystem of tools and services, including options for staking or participating in DeFi activities. This flexibility enhances the value of Singular Coin, as users can maximize their asset’s potential through various earning opportunities. The seamless interaction between Singular Coin and Singular Wallet enables users to leverage their assets more effectively, whether they’re investing, trading, or using their coins for daily transactions.

Conclusion

In summary, Singular Coin and Singular Wallet offer a powerful combination for anyone interested in secure and efficient digital asset management. With its focus on scalability, security, and user accessibility, Singular Coin presents a valuable opportunity for investors and users alike. For more information on how to get started with Singular Coin and Singular Wallet, visit singulardex.com. This integrated approach to digital assets represents a new era in crypto, providing users with control, convenience, and enhanced financial flexibility.

Blog Source Url: - https://singulardex.blogspot.com/2025/02/singular-coin-and-singular-wallet-new.html

0 notes

Text

The Rise of DeFi Trading Platforms and Perpetual Exchanges

Decentralized Finance (DeFi) has revolutionized the cryptocurrency landscape, allowing users to trade, borrow, and lend assets without a central authority. One of the most exciting developments in DeFi is the emergence of DeFi trading platforms and decentralized perpetual exchanges, which provide users with innovative tools for leveraging digital assets. This article examines the benefits and features of these platforms, their impact on the cryptocurrency market, and why they’re gaining popularity among traders.

Understanding DeFi Trading Platforms

DeFi trading platforms are decentralized exchanges (DEXs) that enable users to trade cryptocurrencies directly with each other through smart contracts. Unlike centralized exchanges, DeFi platforms do not require intermediaries or custodial control, allowing users to retain full ownership of their assets. The use of smart contracts provides an extra layer of security by automating trades and making the process transparent and verifiable on the blockchain. One of the critical advantages of DeFi trading platforms is accessibility. They are open to anyone with an internet connection, providing global access to financial services and eliminating traditional barriers like geographic restrictions or identity verification. Additionally, DeFi platforms often support a wider variety of tokens, including newly launched assets and niche cryptocurrencies that may not be listed on centralized exchanges. For traders, this means a broader range of investment opportunities and an inclusive environment where all participants have equal access to the market.

The Role of Decentralized Perpetual Exchanges in DeFi

Decentralized perpetual exchanges take DeFi trading a step further by offering perpetual contracts—derivatives that allow traders to speculate on asset prices without owning the asset itself. Unlike traditional futures contracts, which have expiration dates, perpetual agreements allow traders to hold positions indefinitely as long as they maintain sufficient margin. Decentralized perpetual exchanges offer the unique advantage of providing leverage, enabling traders to amplify their positions and potentially increase profits. Decentralized perpetual exchanges operate through liquidity pools, where users contribute funds to facilitate trades. This model eliminates the need for traditional order books and provides a smoother trading experience by ensuring there is always liquidity available for users. The peer-to-peer structure of these exchanges adds a level of transparency and trust, as all transactions are recorded on the blockchain and governed by smart contracts. For users looking to trade with leverage while maintaining control over their assets, decentralized perpetual exchanges offer an ideal solution.

Benefits of Using DeFi Platforms and Perpetual Exchanges

Using DeFi trading platforms and decentralized perpetual exchanges provides several advantages for both novice and experienced traders. The ability to trade directly with other users offers greater transparency and security, as assets are stored in users’ wallets rather than on the exchange. This approach minimizes the risks associated with centralized exchanges, such as hacking and mismanagement of funds, providing peace of mind for users. Additionally, the leverage offered by perpetual exchanges allows traders to maximize their capital efficiency, enabling them to take more prominent positions with less upfront capital. However, while leverage can increase profits, it also comes with added risk, especially in volatile markets. Traders need to use risk management strategies and be cautious with leverage to avoid significant losses. The transparency and security of these exchanges, combined with the potential for profit through leveraged trading, make them an appealing choice for traders seeking flexibility and control over their investments.

Conclusion

In summary, DeFi trading platforms and decentralized perpetual exchanges provide valuable options for traders looking to engage with digital assets in a secure, decentralized environment. By offering features like peer-to-peer trading, leverage, and global accessibility, these platforms are reshaping the future of cryptocurrency trading. For more information about decentralized exchanges and the benefits of DeFi trading, visit singulardex.com. With DeFi’s ongoing innovation, these platforms continue to open up new opportunities for traders worldwide, establishing a more inclusive and flexible financial ecosystem.

Blog Source Url:- https://singulardex.blogspot.com/2025/01/the-rise-of-defi-trading-platforms-and.html

0 notes

Text

Exploring the World of DEX Trades and Decentralized Trading

Decentralized exchanges (DEXs) have transformed the cryptocurrency market, offering a secure and flexible way to trade digital assets directly between users. DEX trades are now a popular choice for those who want to maintain control over their funds without relying on a centralized authority. In this article, we’ll explore the advantages and processes of trading DEX, discussing how it works, its unique benefits, and the appeal it holds for today’s crypto traders.

What is a DEX, and How Does it Enable Direct Trading?

A decentralized exchange, or DEX, is a platform that enables users to trade cryptocurrencies directly with one another without the need for an intermediary. Traditional exchanges hold custody of users’ funds and facilitate transactions, but a DEX operates on blockchain technology, relying on smart contracts to enable secure, peer-to-peer transactions. This structure allows users to have complete control over their assets, as their funds are not stored on the platform, thereby reducing the risks associated with centralization, such as hacking or fund mismanagement. The appeal of DEX trades is the transparency, security, and autonomy it provides to users. Intelligent contracts handle transaction execution, and all activities are recorded on a public blockchain, allowing anyone to verify transactions. This approach ensures that trading activity is open and auditable, creating trust among users. For those seeking privacy and autonomy, DEX trades offer a way to access global markets while retaining control of their funds.

Benefits of Trading on a DEX

Trading DEX platforms comes with a number of advantages that make them attractive to cryptocurrency enthusiasts. One significant benefit is security, as users hold their funds in their wallets rather than leaving them in an exchange’s custody. This model minimizes the risk of large-scale hacking incidents, a common threat in centralized exchanges where funds are pooled together. Another significant benefit of DEX trading is privacy. DEXs generally do not require identity verification or personal information, which is appealing to users who prioritize anonymity.

Additionally, trading fees on DEXs tend to be lower than on centralized exchanges, which makes them ideal for frequent traders looking to maximize their profits by minimizing trading costs. The ability to trade a wide range of tokens, including many that may not be available on traditional exchanges, adds further appeal. For those interested in decentralized finance (DeFi), DEXs are often the preferred choice. DeFi platforms frequently operate on or in conjunction with DEXs, giving users access to various financial services such as lending, borrowing, and staking. This integration enhances the versatility of DEXs, enabling them to serve as more than just a trading platform and unlocking new investment opportunities.

How DEX Trades Work in Practice

To engage in DEX trades, users simply connect their crypto wallets to the DEX platform. Once connected, they can select from a variety of trading pairs, often including popular cryptocurrencies and lesser-known tokens. Smart contracts automatically match buy and sell orders and execute trades when conditions are met. This process is secure and transparent, ensuring all transactions are completed on-chain without third-party involvement. The use of liquidity pools is another unique feature of trading DEX platforms. Rather than relying on traditional order books, many DEXs use liquidity pools where users can contribute their assets to earn transaction fees. This setup provides liquidity for other traders and creates a decentralized, community-driven ecosystem that supports smooth trading even in volatile markets.

Conclusion

In summary, DEX trades provide users with a secure, private, and autonomous trading experience that aligns with the principles of decentralization. Trading DEX platforms empower users to control their funds, trade a wide range of assets, and explore new opportunities within the DeFi space. For those interested in learning more about decentralized exchanges, visit singulardex.com. By choosing DEXs, traders can experience the freedom and security that come with decentralized finance, making it a strong option for the modern crypto investor.

Blog Source Url:- https://singulardex.blogspot.com/2025/01/exploring-world-of-dex-trades-and.html

0 notes

Text

Exploring DEX Trades and the Potential of Singular Crypto

As cryptocurrency continues to reshape the financial landscape, decentralized exchanges (DEXs) and innovative digital assets are gaining traction. DEX trades and Singular Crypto are particularly noteworthy, offering both flexibility and security for those venturing into digital finance. This article examines how DEX trades work, the significance of Singular Crypto, and the advantages of using these tools to enhance the trading experience.

Understanding DEX Trades and Their Benefits

DEX trades are transactions that take place on decentralized exchanges, which allow users to trade cryptocurrencies directly with one another through a peer-to-peer (P2P) system. Unlike centralized exchanges, where the exchange itself holds assets, DEXs empower users to maintain control over their assets. Smart contracts, which automatically match buy and sell orders without involving a middleman to execute deals, help transactions on DEXs. One of the critical benefits of DEX trades is security. Since funds remain in the user’s wallet until the trade is executed, there is minimal risk of theft due to a centralized hack, a common concern with traditional exchanges. Additionally, DEXs provide a high level of privacy, often requiring no personal information or identity verification, which appeals to users who value anonymity in their financial transactions. DEXs also typically offer a wider variety of tokens, enabling access to new and niche cryptocurrencies that may not yet be listed on centralized exchanges.

What is Singular Crypto?

Singular Crypto is a versatile digital asset designed for the modern DeFi ecosystem. It provides users with a reliable, secure, and efficient way to participate in digital finance, making it suitable for a variety of applications within decentralized finance (DeFi) platforms. Built to be highly adaptable, Singular Crypto facilitates seamless interactions across multiple DeFi services, from trading to staking and beyond. Singular Crypto’s decentralized nature allows it to integrate well with DEXs, supporting P2P transactions and ensuring that users retain control over their assets. By offering a secure way to store, transfer, and invest digital assets, Singular Crypto aligns with the values of decentralization and financial autonomy. As the DeFi space grows, Singular Crypto is positioned to become an essential tool for traders and investors looking to diversify and manage their portfolios effectively.

Using Singular Crypto for DEX Trades

Combining DEX trades with Singular Crypto creates a powerful synergy for users who seek efficiency and security in their trading activities. Singular Crypto’s compatibility with various DEX platforms enables users to manage their trades easily, while its decentralized framework ensures that transactions remain transparent and secure. Traders can execute trades without relying on centralized exchanges, making Singular Cryptoan an ideal asset for those who prioritize self-custody and control. In addition to trading, Singular Crypto also provides staking opportunities, allowing users to earn rewards while holding the asset. This feature adds further value for users who prefer to invest for the long term. With the flexibility to trade, store, and earn on decentralized platforms, Singular Crypto is well-suited to meet the diverse needs of modern crypto users, making it a robust option for anyone involved in the digital finance space.

Conclusion

In conclusion, DEX trades and Singular Crypto together offer a comprehensive solution for secure and flexible digital asset management. By leveraging DEXs, traders can benefit from privacy and control, while Singular Crypto enhances the trading experience through its adaptability and security. For those looking to explore more about DEX trades and Singular Crypto, visit singulardex.com. Together, these tools pave the way for a more open, transparent, and efficient approach to cryptocurrency trading and investing.

Blog Source Url:- https://www.blogger.com/blog/post/edit/239481229355769880/6311570658467347643

0 notes

Text

Exploring Bitcoin's Price Movement with Perpetual Contracts

Bitcoin has captured global attention due to its price volatility and potential as a digital asset. With this rise, new financial tools have emerged to allow investors to capitalize on Bitcoin's price movements. One such tool, known as perpetual, offers a way to participate in Bitcoin trading without owning the actual asset. This article examines how perpetual contracts work, their impact on Bitcoin's price, and how traders can use them to their advantage.

Understanding Perpetual Contracts

Perpetuals, or perpetual contracts, are a type of derivative that allows traders to speculate on the price of an asset, like bitcoin, without actually owning it. Unlike traditional futures contracts, which have a set expiration date, perpetual contracts continue indefinitely as long as the trader maintains enough margin to support the position. This feature makes perpetual contracts particularly attractive to those who want to take advantage of bitcoin's price fluctuations without committing to the asset long-term. Perpetual contracts are closely tied to the spot price of bitcoin through a mechanism called the funding rate. This rate is periodically applied between long and short position holders, encouraging the contract's price to stay near Bitcoin's actual market price. Those with long positions pay a funding rate to short position holders if the perpetual contract's price exceeds the spot price and vice versa. This system helps perpetual contracts track bitcoin's price closely, enabling traders to gain exposure to bitcoin's market movement without directly buying or selling the cryptocurrency.

How Perpetual Contracts Impact Bitcoin's Price

The popularity of perpetual contracts has a significant influence on bitcoin's price in the open market. Since perpetual contracts are leveraged products, they allow traders to control a prominent position with a relatively small amount of capital. This leverage can amplify both gains and losses, leading to rapid shifts in market sentiment and potentially driving Bitcoin's price up or down. For instance, during periods of high demand for perpetual, leveraged long positions can push the price upward as traders pile into the market. However, this leverage also increases the risk of liquidations, particularly during high volatility. If bitcoin's price moves significantly against a trader's position, they may be forced to close their position due to insufficient margin, resulting in a cascade effect. Such liquidations can lead to sharp price drops as positions are automatically sold, contributing to Bitcoin's notorious price volatility. Understanding how perpetual affects market dynamics can help traders better anticipate potential price movements and develop strategies to navigate Bitcoin's fast-paced market.

Benefits and Risks of Trading Perpetual Contracts

Trading perpetual offers several benefits for traders who want to engage with Bitcoin's price without the commitment of directly holding the cryptocurrency. Permanent contracts provide liquidity, flexibility, and access to leverage, allowing traders to open prominent positions with less capital. For those looking to capitalize on both rising and falling prices, perpetual offers a straightforward way to take long or short positions, making them popular for day traders and those with a high-risk tolerance. However, perpetuals come with inherent risks due to their leveraged nature. The potential for large profits is accompanied by the possibility of significant losses, especially if Bitcoin's price moves quickly against the trader's position. Traders need to be mindful of market volatility, funding rates, and the potential for forced liquidations. Managing these risks requires knowledge of the market, disciplined risk management, and an understanding of how leverage impacts one's financial exposure.

Conclusion

For traders looking to capitalize on Bitcoin's price fluctuations, perpetual offers an effective way to participate in the market without holding the underlying asset. While these contracts provide flexibility and the potential for high returns, they also come with increased risk, making it essential for traders to be cautious and strategic. For more information on trading perpetual contracts and understanding the dynamics of bitcoin's market, visit singulardex.com. By balancing knowledge and strategy, traders can use perpetual contracts to navigate bitcoin's price movement with greater confidence.

Blog Source Url:

https://singulardex.blogspot.com/2025/01/exploring-bitcoins-price-movement-with.html

0 notes

Text

Exploring the Benefits of Trading on a Decentralized Exchange

The rise of decentralized finance has transformed how people trade and manage digital assets. Decentralized exchanges, or DEX platforms, have gained popularity for their secure, peer-to-peer trading options. A Trading DEX enables users to trade cryptocurrencies without relying on a centralized authority, allowing for more freedom, control, and privacy. This article will discuss how a DEX works, the benefits of trading on one, and why many investors are drawn to this new model of digital asset exchange.

What is a DEX and How Does It Work?

A DEX, short for decentralized exchange, is a platform that facilitates direct transactions between cryptocurrency users without the need for a central intermediary. Unlike traditional exchanges, where a company holds users' funds and oversees all trades, a DEX operates on blockchain technology, allowing users to trade directly with each other. The core of a DEX's functionality is in its use of smart contracts, which automatically execute trades based on pre-set terms, removing the need for a third party to oversee the exchange. Because DEX platforms are decentralized, they provide users with complete control over their assets. This design eliminates the security risks associated with centralized exchanges, such as hacking or mismanagement of funds by a central authority. For traders who prioritize privacy and security, a DEX is an attractive choice, as it keeps all trading activity on-chain, and there is no requirement to share personal information. With smart contracts handling transactions, users can trade with confidence, knowing that transactions are verified and secure.

Benefits of Using a Trading DEX

A Trading DEX offers multiple benefits that set it apart from traditional exchanges. First and foremost, decentralized exchanges provide a high level of security. Since assets are held in users' wallets rather than on the exchange itself, there is significantly less risk of large-scale hacks, which have historically plagued centralized exchanges. Users retain control over their funds and private keys, making a DEX a safer choice for many cryptocurrency investors. In addition to enhanced security, trading on a DEX offers greater privacy. Most decentralized exchanges do not require identity verification, which is standard on centralized exchanges. For individuals who value privacy, this feature is a significant advantage, as it allows them to trade without disclosing personal information. Trading on a DEX is also open to anyone with a compatible wallet, creating a more inclusive environment where participants can trade without restrictions. Another benefit of a Trading DEX is the diversity of trading pairs it often offers. Unlike traditional exchanges that may limit which tokens can be traded, DEX platforms generally support a wide range of cryptocurrencies and tokens. This inclusivity allows users to access a broader array of assets and new token projects that may not yet be available on centralized exchanges. Moreover, trading fees on DEX platforms are often lower, making it an affordable choice for active traders looking to minimize costs.

Why More Traders are Turning to Decentralized Exchanges

As decentralized exchanges continue to evolve, more traders are drawn to the benefits that a DEX provides. For those who prefer transparency, DEX platforms give a clear view of transactions on the blockchain, allowing users to verify each step in the trading process. This transparency builds trust among users, especially as they have more control over their assets and transactions. Additionally, as blockchain technology advances, DEX platforms are becoming faster and more user-friendly, making it easier than ever to participate in decentralized trading. With the global adoption of cryptocurrencies on the rise, decentralized exchanges are likely to play a central role in the future of trading. Investors appreciate the ability to participate in a secure, private, and unrestricted trading environment, which aligns with the core values of cryptocurrency itself. A Trading DEX provides users with a way to experience these benefits, empowering them to manage their assets on their terms.

Conclusion

A DEX offers a secure, transparent, and private way to engage in cryptocurrency trading, allowing users to maintain control over their assets. The benefits of trading on a decentralized exchange, such as enhanced security, lower fees, and access to a wide range of assets, make it a valuable option for today's crypto-savvy users. For those interested in exploring the features and advantages of trading on a DEX, singulardex.com provides a comprehensive platform for decentralized asset management. Decentralized exchanges are redefining digital trading, giving users the tools they need to trade confidently in a decentralized world.

Blog Source Url :-

https://singulardex.blogspot.com/2025/01/exploring-benefits-of-trading-on.html

0 notes