Don't wanna be here? Send us removal request.

Text

Top 5 Personal Loan Apps in India (2025)

Finding a trustworthy loan app in India that is fast, secure, and truly user-friendly can be a challenge. To help you make an informed decision, here’s a quick list of the Top 5 Personal Loan Apps dominating the fintech space in 2025.

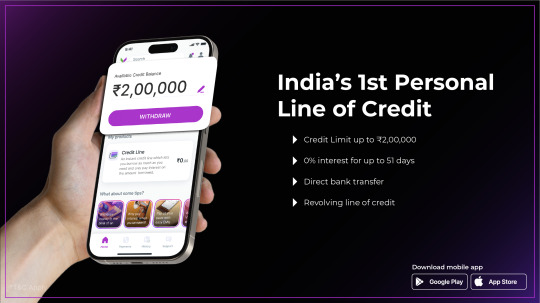

🥇 1. Viva Money – Probably the Best Loan App in India

Viva Money takes the top spot for its seamless process and transparent policies. Whether you're a salaried professional or self-employed, Viva Money lets you apply for a personal loan with minimal documentation and get funds in minutes.

Instant loans up to ₹2,00,000

No hidden charges, 100% paperless

Smart eligibility check

Great customer support

Why Viva? It’s fast, flexible, and built for modern borrowers who don’t want to wait days for approvals.

2. KreditBee

Perfect for young professionals and first-time borrowers. KreditBee offers small-ticket loans with a very simple onboarding process.

Loans from ₹1,000 to ₹2 lakhs

Quick approval

Minimal paperwork

3. MoneyTap

MoneyTap provides a personal line of credit, making it ideal for those who want financial flexibility.

Credit line up to ₹5 lakhs

Interest only on used amount

Fast disbursal

4. Navi

Backed by Sachin Bansal, Navi is a tech-driven app that provides big loans with competitive interest rates.

Loans up to ₹20 lakhs

Interest from 9.9% p.a.

Fully app-based journey

5. PaySense

A solid option for both salaried and self-employed users looking for easy EMIs and instant approvals.

Loans from ₹5,000 to ₹5 lakhs

Pre-approved offers

Flexible tenure options

Final Word

If speed, trust, and simplicity are your top priorities, Viva Money stands out as a top choice. However, all these apps bring something unique to the table—choose the one that fits your needs best!

0 notes

Text

Tips to use EMI calculator for personal loans

Planning a loan — whether it’s for a home, car, or personal needs — can feel overwhelming. That’s where an EMI (Equated Monthly Installment) calculator becomes your best friend. It’s a simple, handy tool that helps you estimate your monthly repayments and plan your finances better. But to get the most out of it, here are a few tips:

1. Know the Basics: Before using an EMI calculator, keep the key inputs ready — loan amount, interest rate, and loan tenure. Accurate details give you reliable results.

2. Compare Multiple Scenarios: Don’t settle on the first set of numbers. Try different interest rates and tenures to understand how they affect your EMI. A longer tenure lowers your EMI but increases total interest paid.

3. Factor in Additional Costs: While calculators give a close estimate, remember they may not include processing fees or other hidden charges. Always cross-check with your lender.

4. Use It for Budget Planning: Use the EMI output to ensure that your monthly loan payment doesn’t strain your finances. Ideally, your total EMIs shouldn’t exceed 40% of your net monthly income.

5. Double-Check with Amortization: Some EMI calculators offer an amortization schedule. It helps you understand how much of your EMI goes toward principal and interest over time — great for long-term financial planning. Conclusion: Using a personal loan EMI calculator wisely can provide you with better financial clarity and confidence. By taking the time to explore different scenarios, you’ll be more prepared to make informed and effective borrowing decisions.

0 notes

Text

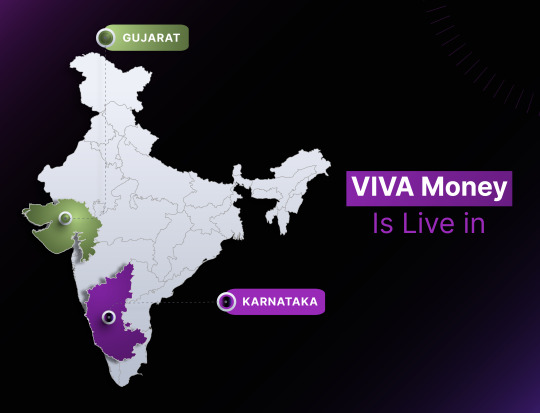

Viva Money Successfully Launched in Maharashtra, After Gujarat & Karnataka

We are delighted to announce the launch of Viva Money in Maharashtra, a pivotal step towards enhancing financial accessibility across the state. Whether you are an entrepreneur striving for growth or a consumer seeking seamless banking solutions, Viva Money is set to redefine your financial journey.

Viva Money is at the forefront of fintech, committed to democratizing financial services for all segments of society. With a comprehensive range of services including microloans, digital wallets, and streamlined payment solutions, Viva Money empowers individuals and businesses traditionally underserved by conventional banking systems.

Maharashtra, as India’s economic powerhouse, presents a strategic entry point for Viva Money’s transformative services. Despite its economic prominence, significant segments of the state still face barriers to financial inclusion. Viva Money’s presence aims to bridge this gap, ensuring that every resident can access essential financial tools with ease and efficiency. Viva is bringing instant personal loans in Maharashtra and in Mumbai.

Key Features Driving Change:

• Microloans for Growth: Designed to fuel entrepreneurial aspirations and alleviate financial constraints, Viva Money offers microloans with flexible terms and swift approvals, empowering local businesses to thrive.

• Efficient Digital Wallets: Simplifying everyday transactions, Viva Money’s digital wallet facilitates secure money storage and seamless payments, ideal for navigating Maharashtra’s dynamic economic landscape.

• Seamless Payment Solutions: From utility payments to peer-to-peer transfers, Viva Money streamlines financial transactions through intuitive interfaces and robust security protocols, ensuring reliability at every step.

• User-Friendly Experience: With a focus on user-centric design, Viva Money’s mobile app is crafted to be intuitive and accessible, making financial management straightforward for individuals across diverse demographics.

By enhancing financial access, Viva Money catalyzes economic growth within Maharashtra. Microloans empower small businesses to expand operations and create employment opportunities, while digital transactions enable efficiency and transparency in financial interactions across the state. It’ll get easier for people to take home loans or personal loans in Maharashtra or its capital, Mumbai.

The launch of Viva Money in Maharashtra marks the beginning of an expansive journey towards nationwide financial inclusion. With a commitment to innovation and customer-centricity, Viva Money is poised to set new benchmarks in India’s fintech landscape, creating sustainable value and fostering economic resilience.

As Maharashtra embraces Viva Money’s transformative solutions, a future of enhanced financial freedom and prosperity beckons. Together, we embark on a journey where technology meets societal impact, empowering individuals and businesses to realize their full potential in a rapidly evolving digital economy. Join us as we redefine financial inclusion, one transaction at a time

0 notes

Text

VIVA Money App Hits 100K+ Downloads in Lightning Speed!

VIVA Money, the revolutionary fintech startup from Bengaluru, has stormed into the digital finance scene with a bang! In just four months since its launch in Gujarat and Karnataka, the VIVA Money app has surpassed a staggering 100,000 downloads, setting a new benchmark for rapid growth and user engagement.

But what's fueling this meteoric rise? Let's dive into the heart of VIVA Money's offerings:

Freedom to Borrow, No Strings Attached: VIVA Money offers an exclusive grace period of up to 51 days, allowing users to borrow without worrying about hefty interest charges.

Revolutionary Revolving Credit: Unlike traditional loans, VIVA Money offers a revolving credit limit, giving you the power to borrow, repay, and borrow again, all with unparalleled ease.

Flexible EMI Plans: Choose from three flexible EMI plans ranging from 5 to 20 months, tailored to fit your unique financial needs and goals.

Digitally Driven Convenience: Embrace the future of finance with VIVA Money's 100% digital process, eliminating paperwork and streamlining your borrowing experience.

Seamless Bank Transfers: Say goodbye to traditional credit card limitations! With VIVA Money, your credit line can be seamlessly transferred to your bank account, putting financial freedom at your fingertips.

Lightning-Fast Approval: With VIVA Money, there's no waiting game. Experience lightning-fast approval and disbursal within a mere 15 minutes, ensuring you get the funds you need when you need them.

VIVA Money goes beyond just offering a Credit Line; it's dedicated to transforming how Indians handle their financial matters and boasts extensive experience in the lending sector. As the fintech landscape continues to evolve, VIVA Money remains committed to innovation, customer satisfaction, and financial inclusion.

Looking ahead, VIVA Money has its sights set on Rajasthan and Maharashtra, gearing up to extend its innovative financial solutions to even more eager users across India. With a personalized loan product in the pipeline, offering higher loan amounts and extended repayment periods, VIVA Money is poised to make a lasting impact on the Indian fintech ecosystem.

So, what's next for VIVA Money? With an estimated 40,000 credit lines and a projected loan book value of ₹1400 million by year's end, the journey is just beginning. Join the VIVA Money revolution today and experience the future of finance, redefined.

About VIVA Money:

VIVA Money stands at the forefront of digital financial lending, offering India's premier Line of Credit. Powered by cutting-edge technology and a customer-centric approach, VIVA Money provides seamless access to financial solutions through its mobile application and website.

As a subsidiary of the holding company Tirona Limited, with its headquarters in Cyprus, Viva Money benefits from a global perspective. Tirona Ltd operates across Europe, Asia, and South America, investing in fintech opportunities and established companies in banking and IT. Notable investments within Tirona's portfolio include 4 finance, the world's leading digital consumer finance company, and TBI Bank, a next-generation digital bank operating in multiple countries.

With assets spanning more than 20 projects in 22 countries, Tirona's financial prowess is evident. The group's total assets saw a 30% increase in 2022, reaching 1.44 billion euros, while revenue surpassed 490 million euros. This growth trajectory underscores Tirona's commitment to innovation and excellence in the financial sector, driving progress and prosperity across diverse markets.

0 notes

Text

The Newest Way of Taking Loans: Lowest Interest Possible

In today's fast-paced world, financial needs can arise unexpectedly, and having access to an instant personal loan has become a necessity for many. The emergence of credit line apps in India has revolutionized the way people approach borrowing, offering a convenient and efficient alternative to traditional loans. Read on to explore the concept of a line of credit loan, delve into the benefits of instant personal loan apps, and compare the advantages of a line of credit vs. personal loan. Understanding Credit Line Apps: Credit line apps in India have gained immense popularity due to their user-friendly interfaces and the speed at which they process instant personal loan applications. These apps provide a flexible borrowing option known as a line of credit loan. Unlike traditional loans, where you receive a lump sum amount, a line of credit allows borrowers to access a pre-approved credit limit and withdraw funds as needed. This not only offers financial flexibility but also ensures that you only pay interest on the amount you use. Instant Loan Apps – A Game Changer: One of the key features of credit line apps is their ability to provide instant personal loans. Whether you need funds for a medical emergency, to cover unexpected expenses, or to seize a lucrative investment opportunity, instant personal loan apps have made the borrowing process hassle-free. The approval and disbursal of funds take minutes, eliminating the lengthy approval procedures associated with conventional loans. This quick turnaround time is a significant advantage for those in need of urgent financial assistance. Benefits of a Line of Credit Loan: Flexibility: A line of credit loan provides borrowers with the flexibility to use funds as per their requirements. Unlike an instant personal loan where you receive a fixed amount, a credit line allows you to access funds up to a predetermined limit. Interest Savings: With a line of credit, you only pay interest on the amount you withdraw, not the entire credit limit. This can result in substantial interest savings compared to an instant personal loan where interest is calculated on the entire loan amount from the beginning. Revolving Credit: A line of credit is a revolving credit facility, meaning that as you repay the borrowed amount, it becomes available for you to use again. This revolving nature provides an ongoing source of funds without the need to reapply for a loan. Line of Credit vs. Personal Loan: Interest Cost: The interest cost is generally lower with a line of credit due to the pay-as-you-go structure. Personal loans, on the other hand, charge interest on the entire loan amount from the outset. Usage Flexibility: A line of credit offers greater flexibility as borrowers can use funds as needed, whereas a personal loan provides a lump sum amount. Repayment Structure: Personal loans have fixed monthly repayments, while a line of credit allows for minimum monthly payments with the option to repay the full amount at any time. Wrapping Up: Credit line apps in India have introduced a game-changing approach to borrowing, providing consumers with instant access to funds at the lowest possible interest rates. The innovative concept of a line of credit loan, coupled with the speed and convenience of instant loan apps, has reshaped the lending landscape. When considering a loan, understanding the benefits of a line of credit vs. personal loan can empower borrowers to make informed decisions and secure the financial assistance they need on their terms.

0 notes

Text

Navigating the Urban Landscape: Understanding the Cost of Living in Bangalore

Bangalore, the Silicon Valley of India, is a vibrant metropolis known for its booming IT industry, cultural diversity, and pleasant climate. As professionals flock to this tech hub, understanding the cost of living in Bangalore becomes paramount. In this blog, we will delve into various aspects that contribute to the overall expenses, such as housing, transportation, and the city's dynamic economic landscape. Housing Costs: One of the major components of the cost of living in Bangalore is housing. Whether you are looking for a 1BHK flat or a shared room, the rental market in the city can be competitive. The cost of a 1BHK flat rent in Bangalore varies depending on the locality, amenities, and proximity to key areas. Areas like Koramangala and Indiranagar are popular but come at a higher cost, while neighbourhoods farther from the city centre might offer more affordable options. Room rent in Bangalore, especially in shared accommodations, can be a budget-friendly alternative for many young professionals. Transportation: Navigating Bangalore's bustling streets can be both exciting and challenging. The Bangalore Metro has become a lifeline for many residents, providing a convenient and time-saving mode of transportation. The Bangalore metro network connects various parts of the city, making it easier for commuters to travel to work or explore the city. However, the convenience of public transportation comes at a cost, and factoring in transportation fares is crucial when estimating the overall cost of living in Bangalore. Economic Landscape: Bangalore's economic landscape is dominated by the presence of numerous IT companies and startups. The city has earned its reputation as the hub for fintech startups in Bangalore, attracting professionals from different parts of the country. While the thriving job market contributes to the city's dynamic atmosphere, it also plays a significant role in influencing the cost of living. Salaries in the IT sector are often higher, but it's essential to align your income with the city's expenses. Balancing Act: Living in Bangalore is undoubtedly an exciting experience, but it requires a delicate balance between income and expenses. Understanding the cost of living in Bangalore is the key to managing your budget effectively. It involves making informed choices about housing, transportation, and lifestyle, ensuring that you can enjoy the city's offerings without breaking the bank. Wrapping Up: In the bustling city of Bangalore, where managing expenses can be a delicate task, a reliable financial partner can make all the difference. Enter Viva Money, a standout personal loan app that has been gaining attention for its seamless solutions in the face of the rising cost of living in Bangalore. For those navigating the vibrant IT and fintech startups in Bangalore, unexpected financial challenges are par for the course. Viva Money understands this reality and steps up to offer a user-friendly personal loan app designed with the unique needs of Bangalore's professionals in mind. Whether you're on the hunt for a 1BHK flat in prime localities or looking to manage room rent in Bangalore, Viva Money provides quick, hassle-free financial solutions. Tailored to meet the individual needs of tech professionals in Bangalore, the app ensures that financial hiccups don't hinder your lifestyle. Viva Money's personal loan app boasts a streamlined application process, competitive interest rates, and flexible repayment options, making it a go-to choice for those seeking financial stability in the fast-paced Silicon Valley of India. Whether you're a part of the established IT sector or contributing to the booming fintech startups in Bangalore, Viva Money is your ally in navigating this journey. Download the personal loan app today to experience a world of convenience at your fingertips.

0 notes

Text

Get Instant Personal Loan in Gujarat: All the details you need!

The wealthiest state in India, Gujarat prides itself for its vibrancy, culture and heritage. Currently, the state is witnessing advancements in its industrialisation initiatives. As a tourist-friendly place, Gujarat offers a treat with its beautiful landmarks, palaces and temples. Gujarat is a melting pot of traditions. The state is celebrated through festivals like Navratri, and the International Kite Festival as part of the official celebration of Uttarayan. Its vibrant cities like Ahmedabad, Vadodara and Surat, blend modernity with tradition, making Gujarat as the go-to destination for tourism and business. In the midst of this dynamic environment, an instant personal loan in Gujarat emerges as a financial ally for people navigating the pathways of their dreams & ambitions. Let us explore the latest loan apps in India, as of 2024. Read on to find the best instant loan app in Gujarat that suits your needs. MoneyTap: Provides an app for instant personal loan in gujarat with a credit line. Instant approvals and flexible fund withdrawals. Interest charged only on the utilised amount. IndiaLends: Connects borrowers with multiple lenders for cash loans in Gujarat. Offers instant personal loan in Gujarat based on credit profiles. Simple application, competitive rates, and instant approvals. CASHe: Focuses on short-term cash loans in Gujarat for salaried individuals. Utilises advanced analytics for credit assessment. Offers 'Social Loan Quotient' to build credit profiles. mPokket: Designed for college students and young professionals. Quick cash loans in Gujarat : ₹500 to ₹30,000 with flexible terms. Quick approvals and direct fund disbursal for short-term needs. Credy: Serves salaried individuals and self-employed professionals. Loan range: ₹10,000 to ₹1,00,000 with competitive rates. Simple application, quick approvals, and emphasis on data security. Viva Money: Get Instant Approval in 15 minutes with minimal documentation. Borrow any amount up to your approved credit limit, paying interest only on what you use. Interest is charged solely on the used amount. Choose EMI options for flexible repayments. Easily handle credit, repayments, and fund transfers through a user-friendly mobile app. Why choose VIVA? Viva Money is the latest loan app, revolutionising instant personal loans in Gujarat and Bangalore with its app-based credit line. Due to the no-usage-no-interest feature, users only pay interest on the amount they use. Final Thoughts The availability of an instant personal loan app in Gujarat has provided individuals with greater access to quick and convenient financing options. These latest loan apps have simplified the application process, providing instant approvals and timely disbursal of funds. Each of the mentioned apps offers unique features and benefits to cater to the diverse needs of borrowers. When considering an instant personal loan app in Gujarat, it's essential to evaluate factors such as interest rates, repayment terms, customer reviews, and overall transparency to ensure a seamless and financially sound borrowing experience.

0 notes

Text

Get Instant Personal Loan in Bangalore: All the details you need!

India's Silicon Valley, Bangalore, is known for its modern lifestyle. Residents of the city, whose expenses are on the rise, can be hit by sudden cash crunches. But you can deal with them conveniently with the help of an instant personal loan in Bangalore. Personal loans can come in handy during any emergency, or big purchases. In contrast to other financing options, personal loans are collateral-free and easy to access. However, failing to provide the right documentation can result in your personal loan application being rejected. To ensure that your loan application goes through smoothly, we have compiled a list of documents required for an instant personal loan in Bangalore. Read on! Why Is There A Eligibility Criteria for Personal Loan? Accurate loan documents and eligibility criteria of the borrowers play a major role in the fast processing of a personal loan. Applicants who do not provide all required documents or do not meet the eligibility criteria may have their personal loan application rejected or delayed. Personal loan eligibility criteria are mandatory because financial institutions don't want to take the risk of delayed payments or fraud. What are the Documents Required for Instant Personal Loan in Bangalore? Documents can differ based on different types of personal loan in Bangalore. For instance, medical or education loans require additional documents, such as medical certificates or university admission letters. However, for basic instant personal loans in Bangalore, the mandatory documents are inclusive of KYC details and income documents to be submitted in a paperless format: KYC documents, inclusive of Aadhaar Card, Mobile Number Linked to Aadhar, Pan Card and Bank Account details. Address proof on driving license/ Passport/Voter’s ID/Utility bills Account holder’s internet banking information Income proof such as salary slips for salaried individuals and financial statements with photographs for self-employed. Employee details or business details such as the name of the company, a position at workplace, work experience and job stability While submitting these documents, ensure your age eligibility should be between 21-58 years for both salaried and self-employed individuals, with a minimum monthly salary of Rs.15,000. Once the required documents are approved, the loan is disbursed instantly into your accepted bank account. Income proof is mandatory to verify the credit score that gives information about a person’s capability to repay the loan regularly in EMIs. The Best Instant Loan App in Bangalore: With a plethora of loan apps flooding the market, identifying the best one can be challenging. However, for those seeking an instant personal loan in Bangalore, one app stands out among the rest –Viva Money with the latest Loan app. This cutting-edge app combines efficiency with user-friendly features, making it the go-to choice for borrowers in the city. Benefits Of Availing Instant Personal Loan From Viva Money: Instant Approval: The process of availing instant cash loans in Bangalore is quite convenient and straightforward with VIVA’s latest loan app. Upon completing a simple application, users can expect approval within minutes, ensuring immediate access to the funds they require. Minimal Documentation: One of the best loan apps in Bangalore. They get rid of cumbersome paperwork associated with traditional loans with VIVA. The entire process is conducted online and by requiring only essential documentation, making the application process swift and stress-free. Flexible Repayment Options: Recognizing the diverse financial circumstances of borrowers, lenders offer flexible repayment plans. Borrowers can choose a tenure that aligns with their financial capabilities, reducing the burden of repayment. Competitive Interest Rates: Affordability is a key consideration, and lenders ensure that borrowers benefit from competitive interest rates. This not only makes the loan more accessible but also alleviates financial strain in the long run.

0 notes

Text

Fintech Startups of Silicon Valley of India that are in the limelight in 2024

India celebrates the spirit of entrepreneurship and innovation throughout its length and breadth. Even though 2023 wasn’t one of the best years for startup culture, 2024 brings new hope, especially in the fintech in Bangalore. With the second-largest base of internet users in the world, this has had a direct impact on the demand for digitised financial services. In fact, India emerged as a global fintech power and ranked third in the world in terms of total fintech companies in bangalore (as of 2024) In this blog, we will list the top startups in Bangalore. According to the reports3, over 3,085 companies are currently (as of August 2023) operating in the fintech in Bangalore. Many of these companies are in the payments sector, followed by lending and wealth tech. As the startup companies in Bangalore expand, many players are focusing on niche sectors. Needless to say, the development has been nothing short of rapid. Today, we aim to bring those fintech startups in bangalore to the limelight they all deserve. Razorpay: One of the major fintech startups in Bangalore, Razorpay is a developer-friendly payment gateway offering a suite of products, including checkout tools and automated vendor payment solutions. The goal is to facilitate quick online payments and provide a fully functional current account, making it a versatile solution for businesses in India. Razorpay supports various payment methods such as credit cards, debit cards, net banking, UPI, and popular wallets. Stripe: Stripe, one of the main fintech startups in bangalore, specializes in enabling online businesses, both big and small, to accept credit and debit card payments securely. Audited as a PCI compliance level 1 service provider, Stripe encrypts and secures credit card information with regular security scans. Used by major brands like Lyft, Amazon, and Shopify, Stripe processes over 90% of personal credit card information. BharatPe: Co-founded in 2018, BharatPe is one of the biggest Indian fintech companies in Bangalore, known for pioneering UPI payments and digital money lending for merchants. A single QR code facilitates payments from multiple UPI applications, and the company has expanded its services to provide loans. BharatPe made $93.33 Mil in revenue in the financial year 2021 and also owns the peer-to-peer lending platform, 12% Club. MoneyTap: Specialising in online personal loans in India, MoneyTap as one of the top fintech startups in Bangalore offers credit lines up to 5 lakhs. Enjoy flexibility with repayment tenures up to 36 months, and pay interest only on the amount used. Tailored loan options cover diverse personal needs, from education to travel and weddings. MoneyTap stands out for its secure, collateral-free model, providing a hassle-free borrowing experience. Viva Money: Viva Money is the latest and emerging as one of the top startups in Bangalore with its financial platform catering to individuals in Karnataka, offering quick cash and instant personal loans during unexpected financial needs. The platform welcomes people from diverse backgrounds, whether salaried employees or business owners. The user-friendly app ensures a seamless, digital lending process. Just upload your documents online, and your loan gets approved within minutes. A standout feature of Viva Money is providing interest-free loans in Karnataka, up to ₹2,00,000, with a repayment window of 51 days from disbursal. Notably, no collateral or securities are required, making Viva Money an accessible option for a broad range of individuals. Wrapping Up There has been a significant revolution in the Fintech industry in the past decade. The inception of various apps has transformed the way people transfer cash, take loans, invest in stocks and gold, and other use other financial services. Fintech companies in Bangalore have made it possible and brought the once unimagined advancement level.

0 notes

Text

Top 5 Line of Credit Apps in Karnataka | Quick Solution for all your Urgent Financial Needs

India is changing, and with it, the mindsets, practices, norms, and habits of the citizens are also rapidly shifting. For instance, taking a loan is no longer considered taboo today. People take out loans for a wide variety of purposes, such as higher education, financing a vacation, renovating their homes, buying a car, and even getting married. Many financial institutions have started offering funds to help achieve the dreams of today’s striving population. Money lending apps in India have become popular over the years owing to the many benefits compared to banks – customised loans, low-interest rates, quick disbursal, the simple application process, no collaterals. Multiple apps in India offer a quick, digital, and hassle-free way of getting immediate access to funds to fulfil your dreams or help you during an unforeseen situation. Read on more about some of the best loan apps that have taken the market by storm and are changing the way Indians borrow! MoneyTap MoneyTap has a feature called “no-usage-no-interest,” which means that you are charged interest only on the amount of money used. Once you upload your documents and get the approval, you are given credit line apps in Bangalore that you can use according to your needs. They offer a personal line of credit apps in Karnataka of Rs. 3000 to Rs. 5 lakhs. A loan tenure may range from 2 months to 3 years. In major Indian cities, salaried employees who earn at least Rs. 30,000 per month can apply. KreditBee With KreditBee, you can borrow an amount as little as ₹1000 and as much as ₹2 lakh. An individual over 18 years old who earns at least $10k a month can apply for a loan on their app. The entire process takes place on the app, and no physical verification is required. Once you upload the necessary documents, you must wait for verification and approval. Upon approval, the loan amount is deposited into your bank account. Kissht Kissht is a money loan app developed by ONEMi Technology Solutions. They work with Si Creva Capital Services for their financial lending needs. For their instant personal loans in Karanataka, they offer a 100% online application process. Other payments include late payment fees for EMIs paid after the deadline. NIRA Founded by Rohit Sen and Nupur Gupta, Nira is a fintech startup. Their lending partners include Muthoot Finance, Ujjivan Small Finance Bank, Liquiloans, Pincap, DFL, OML, and Kudos Finance. The fintech firm provides salaried workers with an instant line of credit in Karnataka. You will be offered a personal loan in the form of a line of credit apps in Karnataka along with a credit limit ranging from 3,000 to 1 lakh. CASHe CASHe is a fintech company founded in 2016 by V. Raman Kumar. With CASHe instant credit lines, you can borrow up to a maximum limit of Rs. 4 lakhs. You can repay the amount over a year. A minimal interest of 2.5% per month and a processing fee of Rs. 500 or 1% of the loan amount is charged. There are no hidden charges. They offer a 100% online application process, quick approvals, and 7 days interest-free grace period for each instalment. Our app is praised for being user-friendly and bug-free. Plus, they also offer features where you can send money to your friends with ease. Viva Money Viva Money is an excellent financial platform for individuals seeking quick cash or instant personal loans in Karnataka, especially during unexpected money needs or tight financial situations. Unlike many other loan services, Viva Money welcomes people from various backgrounds, whether you're a salaried employee or a business owner.

0 notes

Text

Emerging Loan Apps in Gujarat for Urgent Financial Needs 2024: All You Need to Know!

Emerging Loan Apps in Gujarat for Urgent Financial Needs 2024: All You Need to Know! When life throws unexpected expenses your way, a personal loan can be your financial saviour. Gujarat, a vibrant state where opportunities abound, has become more accessible than ever before when it comes to securing a personal loan. Whether you’re planning a wedding, pursuing higher education, or need to cover unforeseen medical bills, a personal loan app in Gujarat can provide the financial flexibility you need. Key Players In The Loan Market: We’ll provide a list and highlight the prominent and emerging loan apps in Gujarat that offer a wide range of loan services. Using this guide, readers will be able to find out where to start their loan search and which institutions are known for providing excellent customer service and competitive rates. PaySense PaySense is an instant loan app in Gujarat that offers instant cash loans online, founded by Sayali Karanjkar and Prashanth Ranganathan. You may check your loan eligibility, submit your KYC credentials, apply for a loan using your devices, and get approval in a few hours. India Lends IndiaLends is a personal loan app in Gujarat that offers low interest personal loans in Gujarat, credit cards, and free credit reports in India. They provide quick personal loans online at the lowest possible interest rates, with loans disbursed within 48 hours. NIRA NIRA is one of the emerging loan apps in Gujarat in India that provides salaried workers with a line of credit. You will be offered a personal loan in the form of a line of credit with a credit limit ranging from 3,000 to 1 lakh. Dhani Dhani, also marketed as the “phone se loan” app, disburses the loan amount to your bank account immediately. Personal loans can be applied for from anywhere, anytime. You can acquire a low interest personal loans in Gujarat for up to ₹15 lakh at an interest rate as low as 12%. KreditBee KreditBee provides an instant loan app in Gujarat to young professionals. You may be eligible for a loan of up to ₹one lakh. The entire loan application and approval process is conducted online. Upon completion of the distribution, the funds are deposited into your bank account immediately. CASHe CASHe is a digital lending company that offers short-term low interest personal loans in Gujarat to salaried individuals for a variety of financial requirements. When applying for a loan, you must offer documents such as salary slips, bank statement, address proof, and your PAN card, which can all be uploaded through their personal loan app in Gujarat. Viva Money Viva Money is revolutionising personal loans in India with its app-based credit line. Due to the no-usage-no-interest feature, users only pay interest on the amount they use. They have deployed their services to emerging fintech states in India, starting with Bengaluru and Gujarat. Why choose VIVA? 1. Instant Approval: Get online approval in 15 minutes with minimal documentation. 2. Borrow in Parts: Borrow any amount up to your approved credit limit, paying interest only on what you use. 3. Save on Interest: Interest is charged solely on the used amount. 4. Flexible Repayments: Choose EMI options for convenient repayments. 5. One-stop Solution: Easily handle credit, repayments, and fund transfers through a user-friendly mobile app. Wrapping Up Emerging loan apps in Gujarat are life saviours during an emergency. No matter what your needs are, you can find a loan application that fits them online. Whether it is for your wedding, dream vacation, home makeover, buying the latest gadget, or a medical emergency, you can use an instant loan app in Gujarat to fund your expenses and repay them at your convenience over the prescribed tenure. Life has surely become easier for a lot of people after the emergence of so many interest free personal loans in Gujarat that make borrowing simple and hassle-free.

1 note

·

View note