Don't wanna be here? Send us removal request.

Text

2025 Budget Pushes Pakistan’s E-Commerce Platforms into the Tax Spotlight

How Pakistan’s 2025 Budget Brings E-Commerce Platforms into the Tax Spotlight

In a pivotal development tied to the 2025 Budget, the National Assembly’s Standing Committee on Finance has advanced a key proposal in the Finance Bill 2025–26 to tax online businesses earning over PKR 5 million annually. The measure aims to expand tax coverage for Pakistan’s rapidly growing e-commerce and digital services sector, aligning with a national revenue target of PKR 14.13 trillion. The clause, introduced during clause-by-clause scrutiny, follows broader ambitions under the new Digital Presence Proceeds Tax Act, which targets foreign digital platforms as well.

2025 Budget Raises Concerns for Women and Micro E-Commerce Sellers

The proposal has sparked concern among legislators and stakeholders over its impact on home-based and small-scale digital sellers, many of whom are women and youth. Committee member Sharmila Faruqi voiced apprehensions, noting that “many women are running online businesses from their homes,” and that taxing them prematurely could hinder financial inclusion. Business leader Mirza Ikhtiar Baig also advocated for leniency, urging regulators to let the grassroots e-commerce economy grow organically before introducing heavier compliance burdens. In response, FBR Chairman Rashid Langrial clarified that income thresholds will protect low-income sellers. Those earning below PKR 5 million or PKR 1.2 million in some categories will remain exempt, even if registered. “If someone earns less than the set threshold, even if registered, they won’t have to pay anything,” he assured.

Industry Pushes Back Against E-Commerce Tax in 2025 Budget

Despite reassurances, the online business community remains uneasy. At a press event in Karachi, representatives from the Chainstore Association and the Pakistan E-Commerce Association warned that the proposed tax structure which includes multiple withholding rates, complex registration rules, and harsh penalties could disrupt over 100,000 small vendors. For many, especially informal sellers and micro-entrepreneurs using platforms like Instagram, WhatsApp, and cash-on-delivery services, the compliance cost could outweigh the benefits. Industry leaders urged the government to adopt a phased implementation strategy and consult with platforms, logistics providers, and payment gateways to build a streamlined, consensus-driven framework. A Balancing Act for Pakistan’s Digital Future While the Senate Finance Committee rejected blanket taxation of individuals earning PKR 1.2 million and recommended zero-rated tax for small sellers, both houses of Parliament appear united in bringing Pakistan’s digital economy into the formal tax net without crushing its most vulnerable players. The road ahead requires balancing two objectives: meeting ambitious revenue targets while ensuring that Pakistan’s booming e-commerce ecosystem led by women, students, and small entrepreneurs isn’t strangled by red tape. Startup.pk Takeaway: As Pakistan formalizes its digital economy, inclusivity and gradual rollout will be key. Startups and online sellers should stay informed, advocate for smart policy, and prepare for an evolving regulatory landscape. FAQ 1. Who will be taxed under the proposed e-commerce tax policy in the Finance Bill 2025–26? Who will be taxed under the proposed e-commerce tax policy in the Finance Bill 2025–26? Online businesses and digital service providers earning over PKR 5 million annually will be subject to taxation. However, individuals earning below this threshold (or PKR 1.2 million for small sellers) will remain exempt, even if registered. 2. Will small, home-based online sellers be affected by this new tax? Will small, home-based online sellers be affected by this new tax? According to FBR officials, sellers earning below the income threshold will not be taxed. However, the requirement for registration and potential compliance obligations may still apply, which has raised concerns among micro-entrepreneurs, especially women. 3. How is the government planning to implement the new tax regime for digital businesses? How is the government planning to implement the new tax regime for digital businesses? The government plans to implement a Sales Tax Withholding regime ranging from 0.25% to 2%, depending on transaction value, and apply income tax on digital earnings. Industry representatives are urging a phased rollout and more stakeholder consultations. Read the full article

#2025Budget#Budget2025–26#digitaleconomyPakistan#DigitalTaxPolicy#E-CommercePlatforms#e-commercesalestaxPakistan#e-commercetaxPakistan#FBRe-commercepolicy#FBRPakistan#FinanceBill2025#FinanceBill2025-26Pakistan#FreelancersandTax#GovernmentPolicyPakistan#microbusinesstaxation#onlinebusinesscompliancePakistan#OnlineBusinessRegulationPakistan#OnlineMarketplaces#PakistanE-Commerce#Pakistane-commercetax2025#PakistanFreelancers#Pakistanistartupregulation#PolicyandRegulation#SmallBusinessTaxation#StartupsinPakistan#TaxCompliance#taxononlinebusinessesPakistan#TaxonOnlineSellers#womenentrepreneurs#womenentrepreneurstax

0 notes

Text

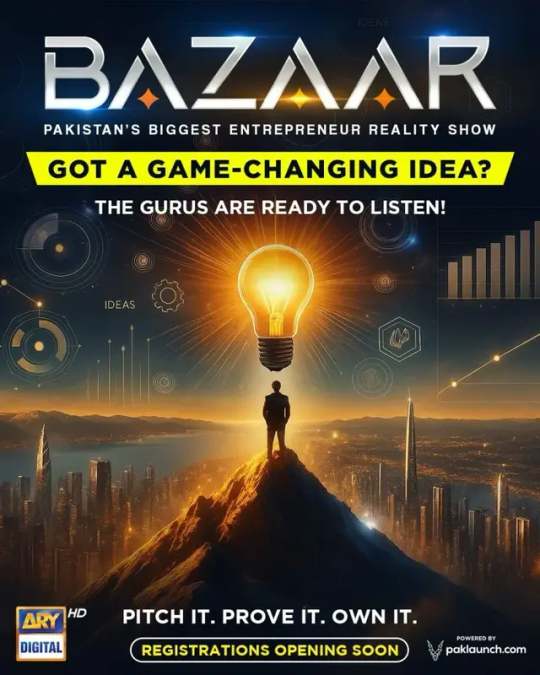

Bazaar: Pakistan’s First Startup Reality Show Set to Launch in 2026

ARY Digital Network, in collaboration with PakLaunch, has announced Bazaar—a next-generation startup reality television series aimed at energizing Pakistan’s entrepreneurial landscape.

Bazaar, Pakistan’s first startup reality TV show, is set to air in early 2026. Designed for early-stage and growth-stage entrepreneurs, the show offers startups the chance to pitch their ideas to a panel of investors (“gurus”) and mentors in front of a national audience. More than just entertainment, Bazaar promises real investment, expert guidance, and massive exposure. Confirmed mentors include prominent names such as Naureen Hyatt (Zood), Dr. Sara Khurram (Sehat Kahani), Omar Askari (NayaPay), and Zohaib Malik (Dastgyr), with others representing companies like Daraz, Bookme, Moveit, and EZBike. Described as more than just a show, Bazaar introduces a live equity exchange model, investors can make on-the-spot offers, while mentors receive a 1% equity stake in startups they support, aligning incentives with founder success. Startups will also benefit from funding via a joint ARY–PakLaunch fund and regulated public crowdfunding. “Bazaar is a great opportunity for startups in Pakistan to connect with investors and mentors on a national platform,” said Syed Azfar Hussain of NIC Karachi, at the launch event. “It brings visibility, funding, and expert support to entrepreneurs who are ready to scale.”

Learning from the Past?

The show comes in the wake of criticism aimed at Pakistan’s version of Shark Tank, where many deals failed to materialise, and founders reported misrepresentation of their companies. With Bazaar, organizers say they’ve learned from the shortcomings of such shows. “Unlike other shows, Bazaar ensures funding for selected startups,” said Hussain. The mentorship bootcamp and detailed due diligence process aim to correct the trust deficit that plagued earlier formats. With its focus on structure, mentorship, and real outcomes, Bazaar may just become the launchpad Pakistan’s startup ecosystem has long needed. FAQ What is Bazaar, the new Pakistani reality show? Bazaar is a startup-focused reality TV show where entrepreneurs pitch their businesses to a panel of investors and mentors for funding and guidance Who is behind the production of Bazaar? The show is a collaboration between ARY Digital Network and PakLaunch, a platform for Pakistani startups and investors. How is Bazaar different from Shark Tank Pakistan? Unlike previous formats, Bazaar includes a mentorship layer, a structured bootcamp, guaranteed funding for selected startups, and a live equity exchange model to ensure real investment. Who are the mentors and investors involved in the show? Mentors include executives from Zood, Sehat Kahani, NayaPay, Dastgyr, Bookme, Moveit, and EZBike. The identities of the four investor “gurus” will be revealed later Read the full article

#ARYBazaar2026#BazaarARYstartupshow#investmentTVshowPakistan#liveequitypitchshow#mentorshipforstartupsPakistan#PakistanientrepreneursTVshow#Pakistanistartupfunding#PakistaniversionofSharkTank#PakLaunchrealityshow#realityshowforbusinessideas#startupbootcampPakistan#startupmentorsARYshow#startuprealityshowPakistan#startupTVpitchPakistan

0 notes

Text

Pakistan IT Potential Shines at US Tech Investment Conference 2025

Pakistan Positions Itself as the Next Big Tech Destination at US Investment Conference

Pakistan IT took center stage at the final leg of the Pakistan-US Tech Investment Conference 2025, which concluded in Washington DC with a strong show of optimism for the country's booming technology sector. Drawing tech executives, investors, and entrepreneurs from across the US, the day-long event marked the culmination of earlier sessions in Dallas and New York — and amplified one message: Pakistan is ready for the global tech stage.

Strategic Collaboration to Showcase Pakistan IT on the Global Stage

Organized by the Embassy of Pakistan in collaboration with PSEB, P@SHA, the Ministry of Commerce, and OPEN Global, the event showcased Pakistan’s IT potential to a global audience eager for growth markets. Ambassador Rizwan Saeed Sheikh set the tone, declaring the tech sector as Pakistan’s “most promising domain” for economic advancement. “With 65% of the population under 30, Pakistan is rich in raw digital talent,” he stated. “It’s time to partner with the US and co-create solutions for the future.”

Youth-Driven Innovation: Fueling the Future of Pakistan IT

The ambassador also unveiled a video series to highlight success stories of Pakistani startups, an initiative aimed at inspiring youth and attracting U.S. mentorship and capital to further fuel the country’s startup momentum. Speakers including Abu Bakar (CEO, PSEB), Sajjad Syed (Chairman, P@SHA), and Tariq Khan (President, OPEN Global), echoed the potential of cross-border partnerships and emphasized the role of diaspora networks in amplifying Pakistan’s global tech footprint. For Pakistan’s startup community, the message was clear: global investors are watching, and the world is opening its doors to Pakistan’s digital transformation. Why This Matters for Pakistan’s Tech Future This conference wasn't just symbolic, it marked a strategic shift. For years, Pakistan's startup ecosystem has grown steadily, fueled by a wave of incubators, accelerators, and VC interest. But with rising global competition, visibility and trust in Pakistan’s tech sector are now key to unlocking the next level of growth. The Pakistan-US Tech Investment Conference did just that: it gave Pakistan a platform in the world's largest tech economy and allowed entrepreneurs, investors, and policymakers to engage directly. Conclusion The Pakistan-US Tech Investment Conference 2025 marked more than the end of a three-city tour it signaled the start of a new chapter in Pakistan’s tech journey. With global attention turning toward South Asia’s emerging markets, Pakistan’s combination of youth, talent, and ambition offers a compelling case for tech investment. Explore more insights and founder stories at Startup.pk. Your platform for navigating Pakistan’s startup landscape. FAQ 1. What was the purpose of the Pakistan-US Tech Investment Conference 2025? What was the purpose of the Pakistan-US Tech Investment Conference 2025? The conference aimed to showcase Pakistan's growing potential in the IT sector, attract foreign investment, and foster collaboration between Pakistani and American tech ecosystems 2. Who organized the conference and where was it held? Who organized the conference and where was it held? The event was hosted by the Embassy of Pakistan in Washington DC, in collaboration with the Pakistan Software Export Board (PSEB), Ministry of Commerce, P@SHA, and OPEN Global. It was the final installment following earlier sessions in Dallas and New York City. 3. Why is Pakistan considered a promising market for tech investment? Why is Pakistan considered a promising market for tech investment? With over 65% of its population under the age of 30, a rapidly expanding IT workforce, and increasing global interest, Pakistan offers a youthful, innovative, and cost-effective market for tech development and investment. Read the full article

#OPENGlobal#P@sha#PakistanITsector#Pakistantechstartups#Pakistan-UStechcollaboration#pakistanientrepreneurs#Pakistaniyouthinnovation#PSEB#startupecosystemPakistan#techinvestmentPakistan#USinvestmentconference

0 notes

Text

How to File Tax Returns in Pakistan (2025): The Complete Guide for Individuals & Startups

Step-by-Step Guide to Filing Tax Returns in Pakistan (2025)

Filing tax returns in Pakistan is more than just a civic duty — it's a legal obligation that directly impacts your financial credibility and access to services. Whether you're a salaried professional, freelancer, or business owner, this step-by-step guide will help you confidently file your income tax return using the FBR’s IRIS portal for the 2025 tax year.

Why File Your Tax Returns?

✔ To stay legally compliant under the Income Tax Ordinance, 2001 ✔ To appear on the Active Taxpayers List (ATL) ✔ To avoid penalties and higher withholding tax rates ✔ To claim refunds or adjust tax credits Staying legally compliant under the Income Tax Ordinance and maintaining ATL status are key. Learn more about

Who Needs to File a Return?

CategoryRequired to File?Salaried individual (above threshold)YesBusiness owner / freelancerYesNTN holder (even with zero income)YesProperty ownersYesOverseas Pakistani (with local income)Yes

Documents You’ll Need

Before logging in, gather these: - CNIC (Computerized National Identity Card) - Salary certificate (for employees) - Profit & Loss Statement (for businesses) - Withholding tax certificates (from bank/telcos) - Rent agreements or property ownership proof - Investment records - Zakat/donation receipts - Bank statements - Utility bills (for property/business) When gathering documents like profit and loss statements or NTN info, check our

Step-by-Step: Filing Tax Returns on IRIS Portal

Step 1: Visit FBR’s IRIS Portal Go to https://iris.fbr.gov.pk/public/txplogin.xhtml Step 2: Log in with CNIC and Password Use the credentials provided during your NTN registration. Forgot your password? Use the "Forgot Password" option on the login screen. Step 3: Start Your Return Go to: → Declaration > Income Tax Return > Select Tax Year (e.g., 2025) Step 4: Complete the Required Tabs Tab NameWho Fills This?What to IncludeEmploymentSalaried IndividualsEmployer's NTN, salary details, tax deductedBusinessFreelancers/BusinessesIncome, expenses, profit/lossPropertyLandlords, property ownersRent income, property value, taxes paidCapital GainsInvestorsCapital gains/losses from shares, real estateOther SourcesEveryoneBank interest, foreign income, etc.Tax CreditsEveryoneZakat, donations, insurance, pension contributionsAssets / LiabilitiesIndividuals & BusinessesCash, gold, vehicles, property, loans Step 5: Validate Withholding Data IRIS automatically pulls data for: - Bank transactions - Telecom usage - Vehicle registration - Property purchases Always cross-check these entries under the “Withholding Data” tab. Step 6: Validate & Submit Once all tabs are filled: - Click “Validate” to check for missing or incorrect fields - Click “Calculate” to see if you owe tax or are due a refund - If everything is accurate, click “Submit” Your return is now officially filed. You will receive an Acknowledgment Receipt (download and save it). What If You Owe Additional Tax? If the system shows you owe tax: - Generate a PSID (Payment Slip ID) from IRIS - Pay through: - 1Link-enabled bank (online or branch) - Mobile banking / Internet banking How to Make e-Payment – FBR Guide How to Check Filing Status You can confirm your filing and ATL status here: https://fbr.gov.pk/categ/active-taxpayer-list-income-tax/51147/30859/71167 Penalties for non-Filers Non-Filing OffensePenalty ImposedNot filing income tax returnRs. 40,000–Rs. 50,000 (minimum)Failure to appear on ATLHigher tax on property, vehicles, bankingFalsifying informationLegal prosecution, heavy fines Tips for Filing Tax Returns in Pakistan Smoothly - File before 30th September to avoid penalties - Save digital & hard copies of your acknowledgment receipt - Consult a certified tax practitioner if needed - Use browser on laptop/PC mobile version can be glitchy FBR Helpline & Complaint Portal Final Thoughts Filing your tax return is more than ticking off a legal requirement; it's about contributing to the country’s financial ecosystem while also securing your economic rights. Whether you’re an employee or entrepreneur, take charge of your tax obligations with confidence and responsibility. Read FAQ Who is required to file a tax return in Pakistan? Every individual or business earning taxable income must file a return—even if no tax is due. What is the deadline for filing tax returns in 2025? For most individuals and companies, the deadline is September 30, 2025, unless extended by FBR. How do I file my return? Returns must be filed electronically via the FBR IRIS portal at https://iris.fbr.gov.pk. What documents do I need? CNIC/NTN, income details, bank statements, withholding certificates, and expense records (for businesses). What happens if I don’t file on time? You may face penalties, lose filer status, and be subject to higher withholding tax rates. Read the full article

#ActiveTaxpayersList#businesstaxfiling#businesstaxreturnPakistan#documentsneededfortaxreturnPakistan#FBRIRISguide#FBRIRISportal#FBRonlinetaxfiling#FBRportalPakistan#FBRtaxportal#fileincometaxPakistan#filetaxreturnPakistan#freelancetaxrulesPakistan#howtofiletaxreturn#howtofiletaxreturninPakistan2025#incometaxfilingPakistan#incometaxforfreelancersPakistan#incometaxordinancePakistan#incometaxreturnprocessPakistan#IRISFBR#MaiTaxreturnsPakistan#NTNregistrationPakistan#Pakistantaxreturndeadline#PakistaniTaxSystem#salariedtaxfiling#startuptaxcompliance#step-by-steptaxfilingguidePakistan#TaxComplianceforStartups#taxdeductionsPakistan#taxfilingprocessPakistan#taxguide2025

0 notes

Text

How to Register for Provincial Sales Tax in Pakistan: Step-by-Step Guide (2025)

Get Your Sales Tax Number Today: Provincial Tax Registration Process (2025 Edition)

In Pakistan, Provincial Sales Tax on services is administered by provincial authorities, while sales tax on goods falls under the jurisdiction of the Federal Board of Revenue (FBR). Businesses offering services must register with the relevant provincial revenue authority based on their location: - Punjab: Punjab Revenue Authority (PRA) - Sindh: Sindh Revenue Board (SRB) - Khyber Pakhtunkhwa: Khyber Pakhtunkhwa Revenue Authority (KPRA) - Balochistan: Balochistan Revenue Authority (BRA) - Islamabad Capital Territory (ICT): Federal Board of Revenue (FBR)

General Requirements for Provincial Sales Tax Registration

While each authority has its own portal and specific procedures, the core documentation required is generally similar: - CNIC of owner/directors - National Tax Number (NTN) - Business address proof (e.g., utility bill, rent agreement, or ownership document) - Letterhead - Email & mobile number for verification - Bank account maintenance certificate - Business activity description 1. Punjab Revenue Authority (PRA) - Portal: https://e.pra.punjab.gov.pk/ - Process: - Create an account on the PRA portal. - Fill out the online registration form. - Upload the required documents. - CNIC of owner/directors - NTN certificate - Proof of business address (utility bill, rent agreement, or ownership document) - Business letterhead - Bank account maintenance certificate - Email and mobile number (for OTP verification) - Submit the application for approval. - Timeline: The Sales Tax Registration Number (STRN) is typically issued within 2–3 working days. 2. Sindh Revenue Board (SRB) - Portal: https://e.srb.gos.pk - Process: - Sign up on the SRB portal. - Complete the business profile. - Upload necessary documents. - CNIC of proprietor/partners/directors - NTN certificate - Address verification (utility bill, rent deed, or ownership docs) - Bank account certificate - Business activity details - Valid email and phone number - Submit the application for approval. - Note: A physical inspection may occur before activation. - Timeline: Usually 5–7 days if documents are complete. 3. Khyber Pakhtunkhwa Revenue Authority (KPRA) - Portal: https://kpra.kp.gov.pk - Process: - Create a user ID on the KPRA portal. - Submit business information and required documents. - CNIC of applicant - NTN certificate - Business registration/incorporation (if applicable) - Address verification (utility bill or rental agreement) - Bank account certificate - Contact details (email and phone) - Await verification and approval. - Support: KPRA offers in-person assistance if needed. - Timeline: 3–5 working days. 4. Balochistan Revenue Authority (BRA) - Portal: https://bra.gob.pk/ - Process: - Visit the BRA portal and click on "e-Registration". - Fill out the registration form. - Upload the required documents. - CNIC of proprietor/partners - NTN certificate - Business address proof - Bank account maintenance certificate - Nature of services provided - Valid email and phone number - Submit the application for approval. - Timeline: Depends on application volume; typically 5–10 working days. 5. Islamabad Capital Territory (ICT) - Authority: Federal Board of Revenue (FBR) - Process: - Register through the FBR's IRIS portal: https://iris.fbr.gov.pk/ - Fill out the registration form for sales tax on services. - Upload necessary documents. - CNIC - NTN - Proof of business address - Letterhead - Business bank account certificate - Valid email and mobile number - Details of services provided - Submit the application for approval. - Note: The FBR collects sales tax on services in ICT under the Islamabad Capital Territory (Tax on Services) Ordinance, 2001. Provincial AuthorityPortal / WebsiteRegistration Process HighlightsTypical TimelinePunjab Revenue Authority (PRA)https://e.pra.punjab.gov.pk/Create account, fill form, upload documents, submit application2–3 working daysSindh Revenue Board (SRB)https://e.srb.gos.pkSign up, complete profile, upload documents, physical inspection possible5–7 daysKhyber Pakhtunkhwa Revenue Authority (KPRA)https://kpra.kp.gov.pkCreate user ID, submit info & docs, await approval3–5 working daysBalochistan Revenue Authority (BRA)https://bra.gob.pk/Visit portal, fill registration, upload documents, submit5–10 working days (varies)Federal Board of Revenue (FBR)https://iris.fbr.gov.pk/Register on IRIS portal, fill form, upload docs, submitVaries Final Notes on Provincial Sales Tax Compliance - Jurisdiction: Registering in the correct jurisdiction is crucial to avoid penalties and notices. - Multiple Locations: If your service operates across provinces, you may need separate registrations. - Return Filing: File returns monthly through respective portals after registration. Everything You Need to Legally Launch and Run a Business in Pakistan - SECP Registration Guide: Your journey starts with registering your business entity with the Securities and Exchange Commission of Pakistan this is the legal foundation of your company. - NTN Registration Guide: Without an NTN, you can't open a business bank account or file taxes. Learn exactly how to get your National Tax Number via FBR’s IRIS system. - FBR Business Registration Explained: This critical step ensures you're recognized as a tax-paying business and can operate lawfully under FBR regulations. - PSEB Registration Guide: Registering with the Pakistan Software Export Board boosts your IT business’s credibility, unlocks tax incentives, and enhances global visibility and we’ve provided a complete step-by-step guide to make it easy. Skipping any of these steps puts your business at risk of penalties, shutdowns, or lost credibility. Follow this complete path to register, comply, and grow with confidence. FAQ: Provincial Sales Tax Registration in Pakistan (2025) Who needs to register for provincial sales tax? Any service-based business operating in a province—like IT, consultancy, or marketing—must register for sales tax with the relevant provincial authority. How do I apply for registration? You can apply online through the respective authority’s website by submitting your business details, CNIC/NTN, and utility bills. Is sales tax registration the same as income tax registration? No. Sales tax is for services, while income tax covers all income. You must register separately for both. What is the sales tax rate on services? Rates vary by province—typically 16% in Punjab, 13–15% in Sindh, and 15% in Khyber Pakhtunkhwa, Balochistan, and Islamabad subject to category. Read the full article

#BRAregistration#BusinessRegistrationPakistan#FBRICTsalestax#FBRIRISportal#ICTSalesTax#KPRAregistration#NTNFBRregistration#PRAregistration#ProvincialRevenueAuthorities#ProvincialSalesTax#ProvincialSalesTaxregistrationPakistan2025#PSEBregistrationguide#RegisterforSalesTax2025#SalesTaxforStartups#salestaxonservicesPakistan#salestaxregistrationPakistan#SECPbusinessregistration#SRBregistration#startabusinessinPakistan#TaxCompliancePakistan#TaxFilingGuidePakistan#taxregistrationPakistan

0 notes

Text

How to Register for Sales Tax in Pakistan (2025): Provincial Step-by-Step Guide for Businesses

Introduction to Sales Tax in Pakistan

Sales tax in Pakistan is a value-added tax (VAT) imposed on the sale and purchase of goods and certain services. It is governed by the Sales Tax Act, 1990 and administered by the Federal Board of Revenue (FBR). Businesses that make taxable supplies are required to register for sales tax and comply with monthly filing and payment obligations. Registration brings a business into the formal economy and allows it to claim input tax adjustments.

Who Needs to Register for Sales Tax?

Mandatory Registration Under Section 14 of the Sales Tax Act, registration is mandatory for: - Manufacturers - Wholesalers, dealers, and distributors - Retailers (meeting certain turnover thresholds) - Importers - Service providers (in specific sectors or provinces under respective laws) - Exporters (to obtain zero-rating) Additionally, any person whose taxable turnover exceeds Rs. 10 million per annum or who maintains a business premises is legally bound to register. Voluntary Registration Businesses not falling under the above categories can voluntarily register to avail benefits like input tax credit and to build credibility.

Sales Tax Registration Procedure (FBR Portal)

Sales tax registration is done online via the FBR’s IRIS portal. Here's a step-by-step breakdown: Step 1: NTN Registration Before registering for sales tax, the business must obtain a National Tax Number (NTN): - Visit: https://iris.fbr.gov.pk - Create a user account - Provide details: CNIC, business type, address, contact info, etc. - Upload documents (e.g., CNIC, electricity bill, rent agreement/ownership docs) Click here to read our step by step NTN registration guide Step 2: Access IRIS for Sales Tax Registration Once the NTN is issued: - Login to the IRIS portal - Select “Form 14” – Application for Registration - Choose “Sales Tax” as the registration type Step 3: Provide Business Details Enter: - Business name - Legal structure (sole proprietorship, partnership, company, etc.) - Type of business (manufacturer, importer, retailer, etc.) - Premises information (address, proof of premises ownership/rental) - Bank account information (with IBAN and letter from bank) - Utility bill of premises (not older than 3 months) - Email and mobile number (both must be verified) Step 4: Biometric Verification - Sole proprietors and individuals must complete biometric verification at a NADRA e-Sahulat center Step 5: Verification and Issuance - FBR will verify the application through: - Physical site verification - Utility bills - Geo-tagging of premises (sometimes) - If approved, a Sales Tax Registration Number (STRN) is issued

Post-Registration Compliance

After registration, a business must: a. Issue Sales Tax Invoices - Maintain computerized or manual invoice books with STRN mentioned - Each invoice must show: - Serial number - Date - Buyer and seller name & STRNs - Description, quantity, and value of goods - Rate and amount of sales tax b. File Monthly Sales Tax Returns - Form STR-1 must be submitted monthly - Due date: By the 18th of every month - Include: - Output tax collected - Input tax paid - Adjustments and refunds (if any) - Net tax liability c. Pay Sales Tax - Payable amount must be deposited via online banking or designated bank branches - PRAL or 1 Link systems are typically used d. Maintain Records Businesses are required to maintain complete records of: - Sales and purchases - Inventory - Invoices and credit/debit notes - Bank statements and ledgers - Record retention: 6 years Sales Tax Audit and Compliance Checks Registered businesses may be subject to: - Desk audits - Field audits by FBR officials - Penalties for: - Late filing - Underreporting - Fake/flying invoices - Non-payment of tax Deregistration or Suspension A business can apply for deregistration if: - It ceases taxable supplies - Its turnover drops below the threshold - There’s a change in legal structure or ownership FBR can also suspend STRN in case of: - Non-filing of returns - Failure to respond to notices - Use of fraudulent invoices Benefits of Sales Tax Registration - Legitimacy and enhanced market reputation - Eligibility to claim input tax credit - Participation in government tenders - Facilitation in exports (zero-rated sales) - Avoidance of penalties Provincial Sales Tax (For Services) If your business provides services, registration may also be required with provincial revenue authorities, such as: - Punjab Revenue Authority (PRA) - Sindh Revenue Board (SRB) - Khyber Pakhtunkhwa Revenue Authority (KPRA) - Balochistan Revenue Authority (BRA) Each province has its own portal and rules for sales tax on services. Click here to read the full step by step guide to sales tax registration for provincial authorities. Sales tax registration in Pakistan is a legal and strategic necessity for businesses engaged in taxable activities. While the process is digitalized and relatively straightforward, compliance demands timely filings, accurate invoicing, and proper recordkeeping. For businesses aiming to scale, export, or work with government departments, sales tax registration enhances credibility, eligibility, and operational transparency. Everything You Need to Legally Launch and Run a Business in Pakistan - SECP Registration Guide: Your journey starts with registering your business entity with the Securities and Exchange Commission of Pakistan—this is the legal foundation of your company. - NTN Registration Guide: Without an NTN, you can't open a business bank account or file taxes. Learn exactly how to get your National Tax Number via FBR’s IRIS system. - FBR Business Registration Explained: This critical step ensures you're recognized as a tax-paying business and can operate lawfully under FBR regulations. - PSEB Registration Guide: Registering with the Pakistan Software Export Board boosts your IT business’s credibility, unlocks tax incentives, and enhances global visibility and we’ve provided a complete step-by-step guide to make it easy. Skipping any of these steps puts your business at risk of penalties, shutdowns, or lost credibility. Follow this complete path to register, comply, and grow with confidence. FAQ 1). Is sales tax registration mandatory for all businesses? Yes, all service providers earning taxable revenue must register with their respective provincial authority. 2). What documents are required for registration? Basic requirements include: - CNIC & NTN - Business address & utility bill Business details (name, type, services 3). What is the difference between sales tax and income tax registration? all businesses? Sales tax applies to services rendered; income tax covers all taxable income. Both require separate registrations. 4). What are the current sales tax rates for services? - Punjab: 16% - Sindh: 15% (8% for digital payments in restaurants) - KPK, Balochistan, Islamabad: 15% Note: Rates may vary by sector or service category: 5). Can I register online? Yes. Each authority offers an online registration portal where you can apply and track your application status. Read the full article

#businesstaxregistrationPakistan#FBRregistrationprocess#FBRsalestaxguide#howtoregisterforsalestax#inputtaxcreditPakistan#monthlytaxfilingPakistan#NTNandSTRNregistration#Pakistantaxlaws#salestaxbenefitsforbusinesses#salestaxcompliance#SalestaxregistrationinPakistan#salestaxrules2025#serviceprovidertaxPakistan#taxforstartupsinPakistan#taxguideforexportersPakistan

0 notes

Text

How to Handle Taxes in Pakistan as a Startup and Freelancer (2025)

Struggling with Taxes in Pakistan? Here’s What Startups & Freelancers Need to Know

Handling taxes in Pakistan as a startup or freelancer isn’t just about compliance—it’s about unlocking business credibility, funding eligibility, and lower tax deductions. Whether you're earning from Upwork or building a SaaS product, this guide will walk you through how to manage taxes in Pakistan efficiently, from FBR registration to annual return filing.

1. Understand Your Tax Status

For Freelancers: Freelancers are considered individual taxpayers under Pakistani law. Your income is taxable under the head of "Income from Business or Profession". You must register with the FBR and file an income tax return annually, even if your income is below the taxable threshold. Filing helps you remain an Active Taxpayer, which comes with benefits (like lower withholding tax rates). For Startups: Startups registered as companies (Private Limited, LLP, etc.) are corporate entities. They need: - NTN (National Tax Number) - Sales tax registration (if selling goods/services subject to sales tax) - To file annual corporate income tax returns under the Income Tax Ordinance, 2001. 2. FBR Registration: Start Managing Taxes in Pakistan Legally Whether you’re freelancing solo or running a tech startup: - Register for NTN via the IRIS portal of FBR. - Use your CNIC (for freelancers) or company documents (for startups). - If offering taxable services, register for Sales Tax as well—especially for digital services, consultancy, software development, etc. Documents needed: - CNIC or incorporation documents - Business address & utility bills - Bank account maintenance certificate - Letterhead and contact info 3. Maintain Financial Records All Year Round Don’t wait until tax season. Instead: - Track income and expenses monthly - Maintain receipts, invoices, bank statements - Use accounting software like QuickBooks, Xero, or local tools like Befiler For startups: - Maintain proper books of accounts - Reconcile your sales tax, income tax, and payroll (if any) monthly 4. Know Which Taxes Apply to You Tax TypeFreelancersStartupsIncome TaxYes (as individuals)Yes (corporate rate applies)Sales Tax (Services)Yes (if providing taxable services)Yes (usually mandatory)Advance TaxYes (e.g., on payments via banks)Yes (withheld by clients/vendors)Super TaxNo (unless exceptionally high income)Yes (if taxable income > threshold)Withholding TaxYes (deducted by clients/banks)Yes (deduct and deposit for vendors) 5. File Tax Returns on Time Freelancers: - Annual Income Tax Return: Due by Sept 30 (unless extended). - Use the IRIS portal to submit. Startups: - Income Tax Return + Financial Statements (Audited) - Sales Tax Returns (Monthly by the 18th) - Payroll-related statements (if employees exist) 6. Manage Tax Deductions & Credits Startups and freelancers can reduce taxable income by deducting: - Business expenses (software, rent, equipment, marketing) - Utility bills, internet expenses - Travel and transport (if business-related) - Depreciation on fixed assets - Salaries paid to employees Pro Tip: Keep all proof in case of audit. 7. Why ATL Matters When Filing Taxes in Pakistan Filing your return ensures your name stays on FBR’s Active Taxpayer List (ATL). Benefits include: - Lower tax on bank transactions - Eligibility for government contracts - Trust & credibility in business Check ATL status here: https://www.fbr.gov.pk/ATL

8. Common Tax Filing Mistakes in Pakistan You Must Avoid

- Missing deadlines - Not registering for sales tax - Ignoring advance tax deductions on banking transactions - Underreporting income from foreign platforms (Upwork, Fiverr, Payoneer) - Not claiming allowable expenses 9. Consider Using a Tax Filing Platform or Consultant If you're unsure or overwhelmed: - Use platforms like Befiler, TaxDost, or hire a tax consultant. - A good consultant helps you optimize tax savings, file on time, and avoid penalties. 10. Stay Informed on Tax Laws in Pakistan as a Freelancer or Founder Tax laws evolve. As a founder or freelancer: - Subscribe to FBR updates - Join tax awareness sessions - Follow credible tax consultants or platforms Conclusion: Handling taxes may seem daunting, but with proper planning, registration, and timely filing, freelancers and startups in Pakistan can manage taxes efficiently and focus on growing their business. Being tax compliant isn’t just a legal requirement it’s a badge of credibility that builds trust with clients, investors, and regulators. Everything You Need to Legally Launch and Run a Business in Pakistan - SECP Registration Guide: Your journey starts with registering your business entity with the Securities and Exchange Commission of Pakistan this is the legal foundation of your company. - NTN Registration Guide: Without an NTN, you can’t open a business bank account or file taxes. Learn exactly how to get your National Tax Number via FBR’s IRIS system. - FBR Business Registration Explained: This critical step ensures you’re recognized as a tax-paying business and can operate lawfully under FBR regulations. - PSEB Registration Guide: Registering with the Pakistan Software Export Board boosts your IT business’s credibility, unlocks tax incentives, and enhances global visibility and we’ve provided a complete step-by-step guide to make it easy. Skipping any of these steps puts your business at risk of penalties, shutdowns, or lost credibility. Follow this complete path to register, comply, and grow with confidence. FAQ 1). Do freelancers and startups need to pay taxes in Pakistan? Yes. Both freelancers and startups are legally required to register with the FBR, file tax returns, and pay applicable taxes if their income exceeds the taxable threshold. 2). What taxes apply to freelancers? Freelancers may be subject to income tax and, in some cases, sales tax on services depending on the nature of their work and province. 3). What’s the tax rate for freelancers? Tax rates for individuals (including freelancers) are progressive, ranging from 0% to 35%, depending on annual income. Export of IT services may qualify for tax concessions. 4). What taxes apply to startups? Startups typically pay corporate income tax (standard rate is 29%), unless registered as a small company or availing startup exemptions under Section 100F of the Income Tax Ordinance. 5). How can I register with the FBR? Create an account on the IRIS portal, get your NTN, and register for income tax (and sales tax if applicable). Freelancers can register as individuals; startups register as companies or AOPs 6). Do I need a tax consultant? It’s recommended, especially for startups to hire a tax advisor for compliance, filing, and maximizing deductions, but freelancers can also file independently via the FBR IRIS portal. 7). What happens if I don’t file taxes? Non-filing can lead to penalties, loss of filer status, and higher withholding taxes on payments, contracts, and bank transactions. Read the full article

#advancetaxPakistan#ATLPakistan#FBRregistration#FBRTaxGuide#FreelancerTaxGuidePakistan#freelancertaxPakistan#HowtoFileTaxinPakistan#howtoregisterfortaxinPakistan#IncomeTaxPakistan#IRISportalguide#IRISPortalPakistan#NTNregistrationPakistan#PakistanTaxationSystem#Pakistanitaxsystemforfreelancers#salestaxonservicesPakistan#SalesTaxRegistration#Startuptaxguide#StartupTaxesPakistan#TaxCompliancePakistan#TaxFiling2025#Taxfilingforstartups#taxesforfreelancers2025#TaxesinPakistan#withholdingtaxPakistan

0 notes

Text

The End of Jobless IT Graduates? HEC & MoITT Launches New Skills Initiative

Unemployed Computer Graduates in Pakistan? Not Anymore HEC & MoITT Push for Industry-Ready Skills

At the recent ‘Zero-Day Employability of Computing Graduates’ conference, Pakistan took a decisive step toward solving a persistent challenge: the growing number of unemployed IT graduates. Organized by the Higher Education Commission (HEC) in collaboration with the Ministry of IT & Telecommunication (MoIT&T) and the Pakistan Software Export Board (PSEB), the event brought together top policymakers, academics, and industry experts to redesign the future of computing education in the country.

Redefining Education to Empower Pakistan’s IT Graduates

Ms. Shaza Fatima Khawaja, Minister of IT & Telecommunication, called for urgent reforms to align academia with market realities. With an ambitious $15 billion IT export target by 2029, she emphasized performance-based accountability for institutions and hands-on, industry-linked education that directly boosts graduate employability. Skills Over Syllabus: A New Path Forward for IT Graduates in Pakistan HEC Chairman Dr. Mukhtar Ahmed revealed the development of a new computing curriculum that is 80% hands-on, aiming to close the skill gap and elevate Pakistan's global tech reputation. He pointed to the success of Pakistani youth in global tech competitions as proof of the country’s potential. Building a Smarter Roadmap MoIT&T Secretary Mr. Zarrar Hasham Khan presented a detailed National IT Roadmap targeting systemic barriers like weak academia-industry linkages, inconsistent curricula, and lack of practical training. Key proposals include: - A centralized national competency test - Industry-integrated certification programs - Mandatory final-year projects aligned with real-world tech needs What Comes Next? The conference concluded with action-oriented recommendations, including curriculum standardization, final-year project reform, and nationwide testing models all aimed at transforming fresh computing graduates into job-ready professionals from day one. In a fast-evolving digital economy, this initiative could be the turning point Pakistan’s IT talent pool has long awaited. FAQ 1). What is the Zero-Day Employability Conference about? It’s a national event aimed at addressing the skill gaps that prevent IT graduates in Pakistan from securing employment immediately after graduation. 2). What changes are being made to IT education in Pakistan? HEC is introducing a new computing curriculum that is 80% hands-on and skills-based, while MoITT is pushing for centralized testing and industry-aligned final year projects. 3). How will these changes improve graduate employability? By aligning education with industry needs, introducing standardized competency testing, and linking final year projects with real-world applications, graduates will be better prepared for jobs on day one. Read the full article

#academia-industrylinkagePakistan#centralizedcompetencytestIT#finalyearprojectindustrylink#future-readyITworkforce#HECcomputingcurriculum#ITgraduateunemploymentPakistan#MoITTITeducationreform#PakistanITexports2029#PSEBITpolicy#skill-basedITeducation#Zero-DayEmployabilityConference

0 notes

Text

How Startups Can Win Big Under Pakistan’s 2025 AI Vision

Pakistan is making a decisive leap into the global AI race through its National Artificial Intelligence Policy—part of its broader AI Vision targeted for full implementation by 2025. With an expected economic impact of over $13 trillion globally by 2030 (PwC), the AI sector is being prioritized as a key driver of national development. According to the Ministry of IT and Telecom (MoITT), Pakistan aims to integrate AI across governance, healthcare, agriculture, and education. The policy not only promotes responsible AI usage but also focuses on training 1 million youth in digital and emerging technologies through its Digital Pakistan initiative. For startups, this vision is a timely call to build AI-driven solutions that are locally relevant and globally scalable. Explore how Pakistan's tech ecosystem is evolving to support innovation.

Core Pillars of Pakistan’s AI Vision 2025

The policy is structured around five foundational pillars: - Market Enablement: Facilitating the commercialization of AI research and promoting digital transformation across industries. - Awareness & Readiness: Investing in AI education, skill development, and funding for AI-centric projects. - Building a Trusted Environment: Establishing ethical AI principles, legal frameworks, and governance structures to ensure responsible AI deployment. - Transformation & Evolution: Creating an AI adoption roadmap, fostering public-private partnerships, and promoting AI-driven industries. - International Collaboration: Engaging in bilateral AI agreements and aligning with global AI standards to foster international cooperation.

Startup Opportunities in Emerging Sectors

1. Revolutionizing Healthcare with AI Artificial Intelligence (AI) is revolutionizing healthcare in Pakistan by enhancing diagnostics, treatment planning, and patient care. Startups can develop AI-powered tools for early disease detection, telemedicine platforms, and personalized treatment plans. For instance, Sehat Kahani, a telemedicine company, connects patients in rural areas with qualified female doctors through digital consultations, improving access to healthcare services. Additionally, the Digital Human project by the National Center of Artificial Intelligence (NCAI) offers AI-powered diagnostic tools that enable quicker and more accurate diagnoses through sophisticated algorithms and interactive 3D models. 2. Smart Agriculture and Precision Tools Agriculture, a cornerstone of Pakistan's economy, is benefiting from AI through precision farming techniques, predictive analytics, and resource optimization. Startups can explore solutions to assist farmers in monitoring crop health, predicting yields, and managing supply chains efficiently. Platforms like Pak Agri Market and government initiatives such as PARC's smart farming project highlight the growing focus on AI-powered agriculture in Pakistan. 3. Educational Transformation The integration of AI in education is enabling personalized learning and better academic outcomes. Startups have the opportunity to build adaptive platforms, intelligent tutoring systems, and tools that address diverse learning needs. With the HEC approving AI in university curricula, the focus on AI literacy is growing as seen with Queno, an EdTech startup revolutionizing education in Pakistan, by blending AI and localized learning experiences. 4. Public Sector Collaboration The government's push towards e-governance and smart city initiatives opens exciting opportunities for startups to collaborate on projects that enhance public service delivery. Developing AI solutions for traffic management, public safety, and citizen engagement especially through platforms like Pakistan Citizen's Portal can position startups as vital contributors to Pakistan’s national tech-driven development.

Startup Challenges Within Pakistan’s AI Vision Framework

While the opportunities are vast, startups must be cognizant of existing challenges: - Infrastructure Limitations: The lack of dedicated AI funding mechanisms and infrastructure can hinder rapid development. - Skill Gaps: There's a pressing need for AI-trained professionals, necessitating investment in education and training programs. - Regulatory Frameworks: The absence of comprehensive AI regulations and data protection laws requires startups to adopt best practices proactively.

Navigating Challenges

While the opportunities are vast, startups must be cognizant of existing challenges: - Infrastructure Limitations: The lack of dedicated AI funding mechanisms and infrastructure can hinder rapid development. - Skill Gaps: There's a pressing need for AI-trained professionals, necessitating investment in education and training programs. - Regulatory Frameworks: The absence of comprehensive AI regulations and data protection laws requires startups to adopt best practices proactively.

How Startups Can Align with Pakistan’s AI Vision

- Engage in Skill Development: Collaborate with educational institutions to foster AI literacy and training programs. - Adopt Ethical Practices: Implement transparent data policies and adhere to global AI ethical standards to build trust. - Seek Public-Private Partnerships: Align with government initiatives to access funding, resources, and collaborative opportunities. - Focus on Localization: Develop AI solutions tailored to Pakistan's unique socio-economic context, ensuring relevance and impact.

The Future of Startups Under Pakistan’s AI Vision 2025

Pakistan's AI Vision 2025 presents a transformative agenda that, if effectively implemented, can catalyze innovation and economic growth. For startups, this is a pivotal moment to align with national objectives, address pressing challenges, and contribute to a future where AI drives inclusive and sustainable development. Read the full article

#AIinagriculture#AIineducation#AIinhealthcare#AIopportunitiesforentrepreneurs#AIstartupsinPakistan#ArtificialIntelligenceinPakistan#DigitalPakistanAIroadmap#EmergingtechinPakistan#MoITTAIinitiatives#NationalAIpolicyPakistan#PakistanAIstrategy2025#Public-privatepartnershipsinAIPakistan

1 note

·

View note