Don't wanna be here? Send us removal request.

Text

FM-Radio | March 6, 2023

Market hopes for a cautious Fed rate hike have risen, with speculation that the Fed's rate peak will not exceed market pricing expectations.

The three major U.S. stock indexes hit two-week highs, with the S&P Dow Jones Industrial average Posting its biggest daily gain in nearly two months and its biggest weekly gain in a month.

The Dow Jones Industrial Average ended a four-week losing streak, while the Nasdaq rose nearly 2 percent for the first time in a month. Pan-european stock indexes hit a near two-week high, with Volkswagen up more than 10% and the mining sector up 7% for its biggest weekly gain in nearly two years. The yield on the two-year Treasury note fell below 4.90 percent, breaking a five-day streak of highs since 2007, while the yield on the 10-year Treasury note fell below a key 4.0 percent, breaking a six-day streak of more than three-month highs. The dollar index retreated, falling for the first time in five weeks. Crude oil hit a near three-week high in an intraday V-shaped rally triggered by news that the United Arab Emirates was considering leaving OPEC; U.S. natural gas rose nearly 9% to a near six-week high, up 18% for the week; European natural gas hit a 1-1/2-year low for the third day of the week, down 11% for the week. Gold bounced back to its highest level in more than two weeks, rising more than 2% for the week to mark its biggest gain in seven weeks.

0 notes

Text

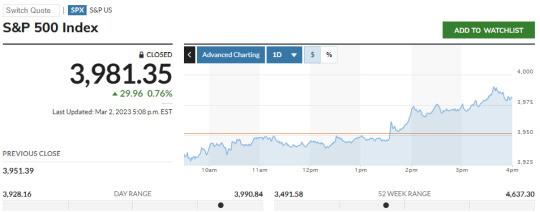

The S&P rebounded, Salesforce backed the Dow, Tesla fell nearly 6% and Treasury yields retreated higher

U.S. unemployment and labor cost data underscored the resilience of the labor market, fueling inflationary pressures and prompting the Federal Reserve to keep raising interest rates. Of the three major U.S. stock indexes, only the Dow Jones Industrial Average rose in early trading. After Fed official Raphael Bostic said he still supported a quarter-point rate hike and could pause it this summer, the S&P index turned higher from its lowest level in more than a month and 2-year Treasury yields, which hit their highest since 2007 for five consecutive days, gave up most of their gains. The dollar index, which nears a seven-week high, trimmed gains. The Dow Jones Industrial Average rose to its highest level in a week for the second time in a row, while Salesforce, a component that beat estimates, rose more than 11%. Tesla fell more than 8% at one point, its biggest intraday drop this year. Overall, China Concept outperformed the market for several days, with station B up nearly 10% and XPeng Motor up more than 7%. Crude oil rose to a two-week high for the third time in a row, while U.S. natural gas snapped a six-game winning streak and fell to a four-week high. Gold stopped three straight gains, bid farewell to more than a week high. Lentin fell 3 percent, while Lentin and nickel both hit more than three-month lows.

0 notes

Text

With inflation in France and Spain beating expectations, markets are fully pricing in ECB rates peaking at 4%. U.S. stocks ended the day in the red, with the S&P 500 down 4.2 percent for February and the Nasdaq down 1.5 percent for the year, while the S&P and Nasdaq were down 2.6 percent and 1.1 percent for February and 3.4 percent and 9.4 percent for the year, respectively. Meta joined the "ChatGPT concept," up more than 3 percent on Tuesday to lead the tech sector, as the Nasdaq Golden Dragon China Index fell nearly 11 percent in February. The 10-year U.S. Treasury yield hit a four-month high before turning lower, rising nearly 40 basis points in February, while the two-year yield neared its highest in 15 1/2 years and rose 60 basis points in February. German bond yields hit their highest in more than a decade, and U.S. and European bond yields deepened inversely. Oil prices rose more than 2 percent to a one-week high in intraday trading, but U.S. crude oil fell more than 2 percent in February and is down for a fourth straight month, while European natural gas fell about 20 percent in February to a 1-1/2-year low. The dollar rose for the first time in five months, the yen hovered at a more than two-month low, bitcoin gained about 1 percent in February, Ethereum gained 3 percent, and both gained more than 30 percent in January. Spot gold fell more than 5 percent in February, its worst in nearly two years, while copper halted its three-month winning streak, aluminum, zinc, nickel and tin fell more than 10 percent and Chicago wheat fell five months in a row to a 17-month low.

0 notes

Text

The U.S. will struggle to match fourth-quarter performance in the first three months of 2023, even with such a lackluster fourth quarter. According to early economic data, the U.S. economy will expand at a much slower pace or even contract. Rising interest rates and high inflation have forced consumers and businesses to cut back on spending and investment, especially in rate-sensitive areas such as housing and construction.

0 notes

Text

Bill Gates has another move! More than $900m for a stake in the world's second-largest brewer

Bill Gates has bought a 3.8% stake in Heineken Holding NV, the controlling shareholder of the world's second-largest brewer, for about $902 million. Heineken is Europe's biggest brewer and the world's second-largest, behind InBev.

0 notes

Text

Us job cuts continue McKinsey has begun one of the biggest job cuts in its history, cutting 2,000 jobs

Under a plan called Project Magnolia, McKinsey's management team hopes the move will help preserve the pay pool of its senior partners, according to people familiar with the matter. The company, which has grown headcount rapidly over the past decade, is looking to restructure the way its back-office teams are organised to improve efficiency. Specific plans are expected to be finalised in the coming weeks, and the final number of positions to be cut from its existing global workforce of 45,000 is still subject to change. The company had 28,000 employees five years ago, up from 17,000 in 2012.

0 notes

Text

British stocks hit a record high! Pan-european stock index near one-year high!

Pan-european stock indexes, which snapped a four-day winning streak on Friday, rebounded slightly, led by a more than 2% gain in the mining sector and a nearly 0.6% drop in the technology sector. Many European stock indexes closed in the red, with British stocks performing well. Yields on two-year German bonds rose back to near their highest levels since 2008. The dollar index failed to hold above 104 near a six-week high. Oil rose more than 1 percent from a near 2-week low, while European natural gas emerged from a 1-1/2-year low. London nickel and lead rose more than 4% to one-week and three-week highs respectively, while London copper rebounded to its highest this month.

1 note

·

View note

Text

ChatGPT hot out of the circle, this week American stock AI plate surge

The recent Internet popularity of OpenAI's ChatGPT has sparked a frenzy of speculation among U.S. stock investors, and companies with a presence on the circuit are all in demand. At one point, Baidu's US share price jumped more than 10%, BuzzFeed's US headline rose 300% in two days, and C3.ai's share price more than doubled......

With UBS estimating that ChatGPT had more than 100 million monthly active users in January, and the entire market for generative AI applications could be as high as $1 trillion, the potential growth is attracting investors.

0 notes

Text

U.S. price index growth slowed

On Friday, January 27, the latest data from the U.S. Commerce Department showed that the U.S. personal consumption expenditures (PCE) price index rose 5% in December from a year earlier, in line with expectations and weaker than the previous reading of 5.5%, slowing for the sixth straight month and marking the smallest increase since October 2021. Month-on-month growth was 0.1%, unchanged from the previous reading and slightly ahead of market expectations for zero growth.

0 notes

Text

Us stocks were the biggest beneficiaries of a further slowdown in US inflation indices

Consumers' inflation expectations fell at an unexpectedly fast pace, passing on the good news that inflation is slowing further. After the release of the data, the US stock market continued to decline narrowed, the three major indexes have turned higher. On the back of this week's CPI and other data, which reinforced expectations that the Fed would further slow rate hikes to 25 basis points at its next meeting, U.S. stocks accelerated upward, maintaining gains through the first two weeks of 2023.

0 notes

Text

U.S. stocks continued to rise and the dollar hit new lows after the December CPI data

After the CPI announcement, US stock futures rebounded, US Treasury prices rose further, yields accelerated downward, the dollar index plunged intraday, back below 103.00, breaking Monday's low since June 2022. But major U.S. stocks had turned negative during the session, with U.S. Treasury yields paring early declines and the dollar index pared most of its losses. In midday trading, U.S. stocks maintained gains, Treasury yields briefly widened to more than 10 basis points lower, and the dollar continued to hit seven-month lows against a basket of currencies.

0 notes

Text

A strong U.S. rebound?

U.S. stocks hit four-week highs, with the Nasdaq rising for a fourth straight day and copper rising above $9,100 for the first time in seven months

On the eve of the release of CPI inflation in December, the president of the Boston Fed spoke dovish in favor of only a 25 basis point rate hike in February. European and American stocks rose across the board, with the Nasdaq notching its longest winning streak since September last year and the Dow Jones Industrial Average up nearly 270 points. Amazon rose nearly 6 percent to its biggest gain in two months, 3B Home, a retail group that warned of bankruptcy, rose nearly 69 percent to its highest level since going public, doubling in three days, and Alibaba rose seven days in a row to its highest in six months. Yields on 10-year European bonds generally fell more than 10 basis points as the inflation outlook improved. The dollar hovered at a seven-month low, facing its first technical "dead cross" in two and a half years, and the offshore yuan was at its highest in five months. Gold turned higher in late trading to hit another eight-month high. Oil prices rose more than 3 percent to a one-week high, while European natural gas fell more than 5 percent to a near one-year low. U.S. gas hit its lowest intraday level in a year and a half and is down nearly 19 percent this year.

Us financial markets will undoubtedly have the most important trading day to start the New Year on Thursday, January 12: The US Labor Department will release the December consumer price index at 21:30 Beijing time tonight, the last CPI indicator to be released before the Federal Reserve's next rate-setting meeting.

With last week's cooler-than-expected payroll data fueling speculation that the Fed might end its rate-hike cycle earlier than expected, tonight's inflation report has come into focus early: investors in stocks and bonds will be looking for more evidence to support a further rally this year; And Fed officials have widely said the inflation report is likely to be the key to deciding whether to raise rates by a quarter-point or a half-point next month.

Consumer prices are expected to rise 6.5% in December from a year earlier, down from the previous month's 7.1% year-over-year increase, according to the median forecast of economists polled by media. In June last year, the CPI rose 9.1 per cent from a year earlier, the biggest increase in more than 40 years.

In one sense, the 6.5% median forecast is even relatively high, since the average of media surveys is already much closer to 6.4%.

From a series of market indicators before the CPI data release, the overall inflation cooling momentum is also extremely obvious.

The median survey at the end of last week had originally predicted a 0 per cent month-on-month change in CPI tonight, but the figure has started to move closer to minus 0.1 per cent. Well-known Wall Street institutions, including Goldman Sachs, Bank of America and Morgan Stanley, now expect the CPI to fall 0.1% month on month in December, while Wells Fargo even expects it to fall 0.2% month on month.

Economists now widely expect the core CPI, which strips out food and energy prices, to rise 0.3 per cent in December from a month earlier, up from 0.2 per cent the previous month. Year-on-year, it would rise 5.7 percent, compared with 6.0 percent last month, which would be the highest December core inflation rate since 1981.

According to a chart from the derivatives team at Barclays, "never in the past 10 years has the S&P 500 reacted as negatively to economic indicators as it did to CPI in 2022."

And it is the CPI data that is now so influential that almost all market participants can no longer ignore it. With the December CPI data out tonight, traders expect the S&P 500 to move at least 2% in either direction on Thursday, up or down, according to the latest pricing in the options market.

0 notes

Text

Legendary value investor Bill Miller is shorting Tesla's stock. Why?

Bill Miller, the legendary value investor who beat the S&P for 15 years in a row, said he is shorting Tesla shares because of growing competition in the new-energy vehicle sector.

For a long time, the industry has been controversial about the positioning of Tesla -- is Tesla a technology company or a car company? Mr. Miller believes Tesla falls into the latter category.

Mr. Miller said Tesla's valuation now looks too high for an auto company. He highlighted that Tesla is now valued at seven times GM's $50bn market capitalisation.

I think Tesla is too expensive. Tesla is more profitable than any car company today. It has plenty of free cash flow. If you think of it as a tech stock, it makes sense that its P/E ratio should be about the same as it was when it dominated the EV sector.

0 notes

Text

Market action recommendation on January 9

2023.1.9 Gold Fundamentals: In recent weeks the market for the Federal Reserve to maintain high interest rates, determined to curb inflation expectations continue to "reinforce". Data released by the U.S. Department of Labor on January 6 showed that the U.S. unemployment rate fell to 3.5% in December 2022 from a year earlier, with 223,000 new jobs in the non-agricultural sector, better than the market's general expectations. Last December, the number of new U.S. nonfarm payrolls slowed, but still better than market expectations, indicating that the Fed's aggressive interest rate hikes to curb inflation did not produce significant effects in the labor market. The minutes of the Federal Reserve meeting released not long ago also released "hawkish" signals. The minutes of the Federal Reserve's December 2022 monetary policy meeting showed that it will not cut interest rates in the short term. Fed officials reiterated their determination to reduce inflation and warned the market not to underestimate its willingness to maintain high interest rates for some time. The Fed is willing to risk rising unemployment and slowing economic growth to bring inflation back to its long-term target of 2%. Technical: Gold's effective breakout above the resistance area of $1805-1814 has certainly opened up the room for the bulls to move upwards. At present, the support of gold prices moved up to 1845-1855 region, important support 1800-1820 region; resistance is located in 1870-1900 region. If the breakthrough is expected to attack the 1920-1950 resistance area.

20230109 Gold long Buy range: 1852 near Stop loss: 1840 near Target: near 1864

0 notes

Text

TODAY’S HOT NEWS EXPRESS(FOREING EXCHANGE)

1. The People's Bank of China carried out 57 billion yuan of seven-day reverse repos this week. A total of 1.658 billion yuan of reverse repos matured this week, resulting in a net withdrawal of 1.601 billion yuan in the week, a record high.

2. George Fed: I'm in favor of rates above 5% and keeping them there for a while. Fed's Bostic: US inflation is too high.

3. The US trade account recorded $-61.5 billion in November, the smallest deficit since September 2020; U.S. initial jobless claims for the week ended Dec. 31 came in at 204,000, the lowest since the week ended Sept. 24, 2022.

4. Fed-funds rate swaps are priced to peak the Fed's policy rate above 5% in 2023.

5. Citibank strategists cut U.S. stocks to underweight and raised Europe to overweight.

6. Bank of England: Expectations for UK inflation are largely unchanged.

7. The yield on Japan's 10-year government bond rose to 0.50%, hitting the Bank of Japan's policy ceiling.

8. The BOJ is said to be assessing the impact of the December bond yield adjustment and sees no need to rush into another major bond yield adjustment at the moment.

9. Turkish stock index triggered a secondary circuit breaker, falling 7%.

0 notes

Text

TODAY’S HOT NEWS EXPRESS(STOCK)

1.France's CAC40 index opened up 11.44 points, or 0.17%, at 6772.94 on Friday, January 6th;

2.Spain's IBEX35 index opened up 7.46 points or 0.09% at 8,615.06 on Friday, January 6th.

3.Italy's FTSE MIB index opened 93.30 points or 0.38% higher at 24926.00 on Friday, January 6th;

4.The FTSE 100 index opened 29.85 points or 0.39% higher at 7663.3 on Friday, January 6th.

5.Germany's DAX30 index opened 44.21 points or 0.31% higher at 14,480.52 on Friday, January 6th.

6.The Stoxx Europe 50 index opened up 12.37 points, or 0.31%, at 3971.85 on Friday, January 6.

1 note

·

View note

Text

A number of sectors rebounded strongly after Thursday's unemployment report.

Thursday's month-on-month rise in U.S. jobless claims was in line with expectations, rather than the smaller-than-expected rise in weekly jobless claims reported last week. Continuing claims also topped 1.7 million, the highest since early February. The jobless data showed resilience in the U.S. labor market, but did little to reinforce expectations the Fed will keep tightening for longer after last week's data.

The intraday decline in the yield on the benchmark 10-year Treasury note widened after the unemployment data; The dollar index accelerated its retreat, while U.S. stocks broke a one-week intraday low set on Wednesday. U.S. stocks opened higher. The S&P and the PHLX semiconductor index hit seven-week lows since Nov. 9.

Technology stocks, such as chip stocks, rallied strongly, supporting the market. Not only were the S&P and Nasdaq off their seven-week and more than two-year lows set on Wednesday, respectively, but they also had their best day since late November, when Federal Reserve Chairman Jerome Powell signaled a slower pace of rate hikes by the end of the year. Tesla's rally accelerated Wednesday after a bullish note from Morgan Stanley's star analyst, but it's still on track for its biggest annual loss on record.

0 notes