Don't wanna be here? Send us removal request.

Video

youtube

Tax Relief Attorney in Salt Lake City? | FAQ & Mistakes To Avoid

0 notes

Video

youtube

Custom Chatbot Services Palm Beach | (561)202-3680

🤖 Want a Chatbot for your website? AI Chatbots are a game-changing tool for businesses, improving customer engagement, response times, sales, and cost savings. We develop AI Chatbots that seamlessly provide answers to customer questions, helping you achieve your goals. Don't miss out on the opportunity to leverage this powerful technology to take your business to the next level! Learn more: 📖 https://localseomarketer.com/chatbot.html (https://youtu.be/xecZlKomWoI) #AIChatbot #SmallBusiness #DevelopmentServices

1 note

·

View note

Video

youtube

🌟 Boost Your Business with Local Video SEO in Delray Beach 🌟

Call To Speak With A Local SEO Expert: Call (561)202-3680

Are you a business owner in Delray Beach looking to take your online presence to the next level? 🚀 Video marketing and search engine optimization (SEO) are the perfect combination to achieve your goals! Here's how a local video SEO company can help you succeed:

🎥 What is a Local Video SEO Company? A local video SEO company specializes in optimizing video content to rank higher in search results, especially for your local audience in Delray Beach. 📍 They use strategic keywords, tags, and SEO techniques to ensure your videos get discovered by potential customers searching for products or services related to your business.

https://localseomarketer.com/video.html

💼 Benefits of Video SEO for Delray Beach Businesses:

Increased Visibility: Videos have a higher chance of appearing on the first page of Google search results, grabbing more attention for your business.

Engaging Content: Captivate your audience with compelling videos that convey your message effectively and drive better engagement.

Local Targeting: Reach potential customers in specific neighborhoods or areas in Delray Beach, boosting foot traffic to your physical location.

Enhanced User Experience: High-quality videos provide valuable information, keeping viewers satisfied and interested in your brand.

Improved Conversion Rates: Engaging videos can influence purchase decisions, leading to higher conversion rates and increased sales.

🎯 Tips for Creating SEO-Optimized Videos:

Relevant Content: Create videos that address the needs and interests of your local Delray Beach audience.

Keyword Research: Identify relevant keywords and include them in video titles, descriptions, and tags.

Local Information: Add location-specific details in your videos to target Delray Beach residents.

Call-to-Action: Encourage viewers to take action, such as visiting your store or subscribing to your channel.

Video Length: Keep your videos concise and engaging to maintain viewer interest.

💡 Is Local Video SEO Worth It? Absolutely! Investing in local video SEO can be a game-changer for your Delray Beach business. With the increasing popularity of video content and the power of SEO, you can outshine your competitors and build a strong online presence.

🔍 Finding the Right Local Video SEO Company in Delray Beach: Look for companies with experience, positive reviews, and a track record of helping businesses in Delray Beach achieve their marketing goals.

So, what are you waiting for? Partner with a reputable local video SEO company in Delray Beach and start reaping the benefits of video marketing and SEO today! 🎬 Your business is about to shine in the online world! ✨

0 notes

Video

youtube

How To Make A Roof Insurance Claim In Rock Hill, SC

Phone: +1 803-244-9996 Address: 206 S Wilson St, Rock Hill, SC 29730 Email: [email protected] Hours: Closes soon ⋅ 5 PM ⋅ Opens 8:30 AM Wed

acing roof damage can be a challenging situation for homeowners in South Carolina. Fortunately, insurance coverage can come to the rescue when unexpected damage occurs. In this guide, we'll walk you through the process of making a roof insurance claim in South Carolina, ensuring you're well-prepared to navigate the claims process successfully.

Step 1: Review Your South Carolina Insurance Policy

The first step in making a roof insurance claim is to thoroughly review your homeowner's insurance policy. Understand what type of roof damage is covered, any exclusions, and the deductible you'll need to pay. Familiarizing yourself with these details will help you understand your coverage limits and set the right expectations for the claims process.

Step 2: Assess the Roof Damage in South Carolina

After reviewing your policy, assess the extent of the roof damage in your South Carolina home. Inspect your roof carefully for any signs of wind, hail, or storm damage. Document the damage with photographs and detailed notes. If necessary, seek the expertise of a professional roofing contractor to provide an estimate of the repair or replacement costs.

Step 3: File Your Roof Insurance Claim Promptly

In South Carolina, it's essential to file your roof insurance claim promptly. Insurance companies often have specific deadlines for filing claims after the damage occurs. Delaying your claim may result in complications and could potentially lead to claim denial.

Step 4: Contact Your Insurance Company in South Carolina

Reach out to your insurance company to initiate the roof insurance claim process. Provide them with accurate and detailed information about the damage, including the date it occurred and any supporting documentation you have collected. An insurance claims adjuster will likely be assigned to your case to further assess the damage.

Step 5: Keep Detailed Records for Your South Carolina Claim

Throughout the roof insurance claims process, maintain thorough records of all communication with your insurance company. Keep a log of phone calls, emails, and any relevant information exchanged. These records will be valuable if you encounter any disputes or issues during the claims process.

Step 6: Cooperate with the Insurance Adjuster in South Carolina

When the insurance adjuster visits your South Carolina property, cooperate fully during the inspection. Provide them with access to the damaged areas and share the evidence you've collected. Their assessment will play a significant role in determining the outcome of your claim.

Step 7: Obtain Repair Estimates for South Carolina

Obtain repair estimates from reputable roofing contractors in South Carolina. These estimates will help ensure that you receive fair compensation for the damage. Submit the estimates to your insurance company to support your claim.

Step 8: Follow the Insurance Company's Decision

After evaluating your claim and assessing the damage in South Carolina, your insurance company will make a decision regarding coverage. If your claim is approved, they will provide the necessary funds to repair or replace your roof. If the claim is denied or you disagree with the decision, you may have options for appeal or reevaluation.

Conclusion

Making a roof insurance claim in South Carolina may seem complex, but by following these steps and being well-prepared, you can navigate the process successfully. Remember to review your policy, document everything, and cooperate with the insurance adjuster to increase the chances of a successful roof insurance claim in South Carolina.

FAQs:

Q: What not to say to a home insurance adjuster in South Carolina?

A: Avoid making statements that might imply fault or downplay the severity of the damage. Stick to providing factual information and evidence to support your claim.

Q: Is a leaking roof covered by insurance in South Carolina?

A: Coverage for a leaking roof in South Carolina depends on your specific insurance policy. Review your policy or contact your insurer to confirm coverage for this type of damage.

#youtube#roofinsurance#roof insurance cliams#how to make a roof insurance cliam#should i make a roof insurance claim

0 notes

Video

youtube

Can I Get Free Solar In North Carolina?

ree solar in NC, solar incentives, tax breaks, solar programs, solar panels installed for free, utility community solar program, cost of enrollment, NC State Energy Program, free solar panel program, $0 out of pocket, save money on electric bills, generate clean energy, NC Solar Rebate Program, one-time rebate, going solar more affordable, North Carolina solar incentives, tax credits, rebates, save money, Southern Energy Management, Federal Solar Investment Tax Credit, residential solar incentives, solar panel pricing, Forbes Home, property tax exemption, solar leasing programs, power purchase agreements (PPAs), Duke Energy Solar Rebate, North Carolina solar companies, Duke Energy solar program, Duke Energy solar rebate application https://energy.solarpanelpowerhq.com

#youtube#FreeSolar SolarIncentives TaxCredits SolarPrograms RenewableEnergy NorthCarolina SolarInstallation SustainableLiving CleanEnergy SolarPower

1 note

·

View note

Video

youtube

Best Mobile Car Detailers Mesa AZ | PH: 480-885-4255

0 notes

Photo

Should I Rent or Buy a House 2022

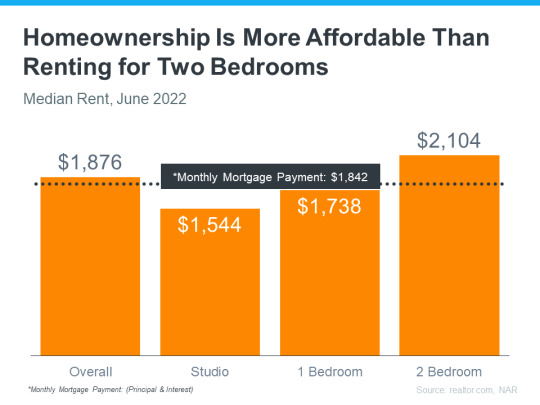

Consider this if increasing house costs leave you questioning if it makes more sense to buy a house or rent in today's real estate market. It's not simply home rates that have increased in recent years-- rental rates have skyrocketed too. As a current article from realtor.com states:

"The average lease across the 50 biggest US cities reached $1,876 in June, a brand-new record level for Realtor.com information for the 16th successive month."

That indicates increasing prices will likely impact your real estate strategies in either case. There are a couple of crucial distinctions that could make purchasing a home a more rewarding alternative for you.

Is It Cheaper To Buy A House Or Rent An Apartment?

Yes, if you need more space. What you might not realize is that, according to the most recent data from realtor.com and the National Association of Realtors (NAR), it may actually be more budget-friendly to purchase than rent depending on how many bed rooms you need. The chart below uses the typical rental payment and mean home mortgage payment across the nation to show why.

Buying a Home May Make More Financial Sense Than Renting One

As the graph communicates, if you need 2 or more bed rooms, it may really be more economical to when asking yourself the question should I buy a home in Boca Raton even as average home prices increase. While this doesn't consider the interest deduction or other financial benefits that include owning a house, it does help paint the picture that it may be more budget friendly to purchase then rent for that system size based on nationwide averages. So, if one of the factors encouraging you to move is a desire for more space, this could be the included support you need to consider homeownership.

Homeownership Also Provides Stability and a Chance To Grow Your Wealth

In addition to being more budget friendly depending on how many bed rooms you need, buying has two other essential benefits: payment stability and equity.

You lock in your month-to-month payment with your fixed-rate home mortgage when you purchase a house. And that's particularly crucial in today's inflationary economy. With inflation, rates increase across the board for things like gas, groceries, and more. Securing your housing payment, which is most likely your biggest month-to-month expense, can supply higher long-term stability and assistance protect you from those rising expenses moving on. Renting doesn't supply that same predictability. A recent article from CNET describes it like this:

“...if you buy a house and secure a fixed-rate mortgage, that means that no matter how much prices or interest rates go up, your fixed payment will stay the same every month. That's an advantage over renting since there's a good chance your landlord will raise your rent to counter inflationary pressures.”

Not to mention, when you buy, you have the chance to develop equity, which in turn grows your net worth. It works like this. As you pay for your mortgage over time and as home worths continue to value, so does your equity. And that equity can make it simpler to sustain a relocation into a future house if you decide you require a bigger home later. Once again, the CNET post discussed above helps describe:

“Homeownership is still considered one of the most reliable ways to build wealth. When you make monthly mortgage payments, you're building equity in your home that you can tap into later on. When you rent, you aren't investing in your financial future the same way you are when you're paying off a mortgage.”

Summary Let's connect to explore your choices if you're trying to decide whether to keep leasing or purchase a house. With house equity and a guard versus inflation on the line, it might make more sense to buy a house if you're able to.

https://youtu.be/Iowx-ukddLg

0 notes

Photo

With all the headings and buzz in the media, some consumers believe the market remains in a real estate bubble. As the housing market shifts, you may be wondering what'll happen next. It's only natural for concerns to creep because it could be a repeat of what occurred in 2008. The bright side is, there's concrete information to reveal why this is nothing like the last time.

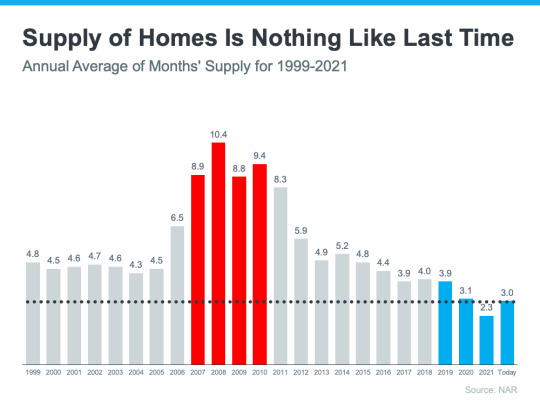

There's a Shortage of Homes on the marketplace Today, Not a Surplus The supply of inventory required to sustain a regular real estate market is around 6 months. Anything more than that is an overabundance and will causes costs to diminish. Anything less than that is a shortage and will result in continued price gratitude.

For historic context, there were too many homes for sale throughout the housing crisis (many of which were short sales and foreclosures), which caused rates to topple. Today, supply is growing, but there's still a shortage of inventory readily available.

The chart below uses data from the National Association of Realtors (NAR) to show how this time compares to the crash. Today, unsold stock sits at just a 3.0-months' supply at the current sales rate.

Due to the fact that of continual underbuilding, one of the factors inventory is still low is. When you combine that with continuous buyer need as millennials age into their peak homebuying years, it continues to put upward pressure on house rates. That limited supply compared to buyer demand is why specialists forecast house rates won't fall this time.

Mortgage Standards Were Much More Relaxed During the Crash

Throughout the lead-up to the housing crisis, it was much easier to get a home mortgage than it is today. The chart below showcases data on the Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers Association (MBA). The greater the number, the much easier it is to get a mortgage.

Running up to 2006, banks were creating synthetic demand by lowering loaning standards and making it simple for just about anybody to receive a home mortgage or refinance their present home. Back then, lending institutions handled much greater risk in both the individual and the home mortgage items used. That resulted in mass defaults, foreclosures Delray Beach, and falling prices.

Today, things are various, and buyers face much greater requirements from home loan business. Mark Fleming, Chief Economist initially American, states:

" Credit requirements tightened in recent months due to increasing financial unpredictability and monetary policy tightening up."

Stricter standards, like there are today, aid avoid a threat of a rash of foreclosures like there was last time.

The Foreclosure Volume Is Nothing Like It Was During the Crash

The most obvious distinction is the number of house owners that were dealing with foreclosure after the real estate bubble burst. Foreclosed properties for sale in Boca Raton activity has been on the way down since the crash due to the fact that purchasers today are more certified and less likely to default on their loans. The graph listed below usages data from ATTOM Data Solutions to help tell the story:

In addition, property owners today are equity abundant, not tapped out. In the run-up to the housing bubble, some house owners were using their houses as personal ATMs. Lots of immediately withdrew their equity once it built up. When house worths began to fall, some property owners found themselves in a negative equity scenario where the quantity they owed on their home loan was greater than the value of their house. A few of those families chose to walk away from their houses, and that led to a wave of distressed residential or commercial property listings (foreclosures and brief sales), which sold at significant discounts that decreased the value of other homes in the location.

Today, costs have actually risen perfectly over the last couple of years, which's given homeowners an equity boost. According to Black Knight:

" In total, mortgage holders acquired $2.8 trillion in tappable equity over the past 12 months-- a 34% increase that equates to more than $207,000 in equity readily available per borrower ...".

With the typical house equity now standing at $207,000, property owners remain in a completely various position this time.

Bottom Line. If you're fretted we're making the very same errors that caused the housing crash, the charts above must help ease your issues. Expert insights and concrete information plainly reveal why this is nothing like the last time foreclosure properties for sale.

0 notes

Text

<p>A Property Expert Helps You Differentiate Reality from Fiction</p> <p>If you're following the news, then I am sure you have seen or heard some headlines about the real estate market that don't offer the full picture. The property market is moving, and when that occurs, it can be hard to separate truth from fiction. That's where a relied on realty expert can can give you valuable <a href="https://askrealtypros.com/a-real-estate-professional-helps-you-separate-fact-from-fiction/">home buying tips in Boca Raton.</a> They can help debunk the headlines so you can really understand today's market and what it indicates for you.</p> <p>Here are three typical real estate market myths you may be hearing, together with the professional analysis that offers better context so you know <a href="https://askrealtypros.com/want-to-buy-a-home-now-may-be-the-time/">when to buy a home in Delray Beach.</a></p> <p>Misconception 1: Home Prices Are Going To Fall</p> <p>One piece of fiction numerous would be purchasers might have seen or heard is that home costs are going to instantly crash so they had better know <a href="https://askrealtypros.com">how to sell your home fast in Boca Raton</a>. That's because headings typically utilize similar, however different, terms to explain what's happening with rates. A couple of you may be seeing right now consist of:</p> <p>-Appreciation, or an increase in home prices.</p> <p>-Depreciation, or a decrease in home prices</p> <p>-And deceleration, which is an increase in home prices, but at a slower pace. (does not mean you will increase the cost of selling your home or loose money.)</p> <p>The fact is, specialists aren't predicting a decline in overall values. Instead, they anticipate appreciation will continue, simply at a decreased speed. That indicates home costs will continue rising and won't fall. Selma Hepp, Deputy Chief Economist at CoreLogic, discusses:</p> <p>" ... higher home loan rates combined with more inventory will cause slower home price growth however not likely decreases in home prices."</p> <p>Misconception 2: The Housing Market Is in a Correction</p> <p>Another typical myth is that the housing market is in a correction. Again, that's not the case. Here's why. According to Forbes:</p> <p>"A correction is a continual decline in the value of a market index or the rate of an individual asset. A correction is typically consented to be a 10% to 20% drop in value from a recent peak."</p> <p>As pointed out above, home costs are still valuing, and professionals task that will continue, simply at a slower speed. That means the housing market isn't in a correction due to the fact that prices aren't falling. It's just moderating compared to the last 2 years, which were record-breaking in almost every method.</p> <p>Misconception 3: The Housing Market Is Going To Crash</p> <p>Some headlines are generating concern that the housing market is a bubble ready to burst. However specialists state today is absolutely nothing like 2008. Among the reasons why is since financing standards are extremely various today. Logan Mohtashami, Lead Analyst for HousingWire, discusses:</p> <p>"As recession talk becomes more prevalent, some people are concerned that mortgage credit lending will get much tighter. This typically happens in a recession, however, the notion that credit lending in America will collapse as it did from 2005 to 2008 couldn't be more incorrect, as we haven't had a credit boom in the period between 2008-2022."</p> <p>During the last real estate bubble, it was much easier to get a home mortgage than it is today. Since then, lending requirements have actually tightened up substantially, and purchasers who acquired a home mortgage over the last decade are a lot more qualified than they were in the years leading up to the crash.</p> <p>Here Is The Bottom Line </p> <p>Get house selling tips from a professional!</p> <p>No matter what you're becoming aware of in the media concerning the housing market, let's connect. That way, you'll have an experienced authority on your side that knows the ins and outs of the market, including existing patterns, and historic context. Furthermore when we represent you we can find you discounted properties undervalued because of financial distress and you will have the ability to purchase much more home for the same amount as everyone else in a higher priced house.</p>

0 notes

Photo

Want To Buy a Home? Now May Be The Best Time To Buy A Home.

There are more homes for sale today than at any time in 2015. So, if you tried to buy a home in 2015 and were outbid or out priced, now might be your opportunity. The number of homes for sale in the U.S. has actually been growing over the past 4 months as increasing mortgage rates help slow the craze the housing market saw throughout the pandemic. Stop waiting for the best time of year to buy a house and get started today.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), discusses why the moving market creates a window of chance for you:

"This is an opportunity for people with a secure job to jump into the market, when other people are a little hesitant because of a possible recession.. . They'll have fewer buyers to compete with."

2 Reasons There Are More Homes for Sale

The first reason the market is seeing more homes offered for sale is the number of sales happening monthly has reduced. This downturn has actually been caused by rising mortgage rates and rising home prices, leading lots of to postpone or put off buying. The chart listed below uses information from realtor.com to demonstrate how active real estate listings have actually increased over the past four months as a result.

Want To Buy a Home? Now May Be the Time.

The second factor the marketplace is seeing more homes available for sale is due to the fact that the variety of people selling their homes is likewise increasing. The chart below outlines brand-new regular monthly listings coming onto the market compared to last year. As the chart shows, for the past three months, more people have actually put their homes on the marketplace than the previous year.

Wish to Buy a Home? Now May Be the Time.

Bottom Line

The number of homes for sale throughout the country is growing, and that implies more options for those thinking about buying a house. This is the chance lots of have actually been awaiting who were outbid or out priced last year.

0 notes

Photo

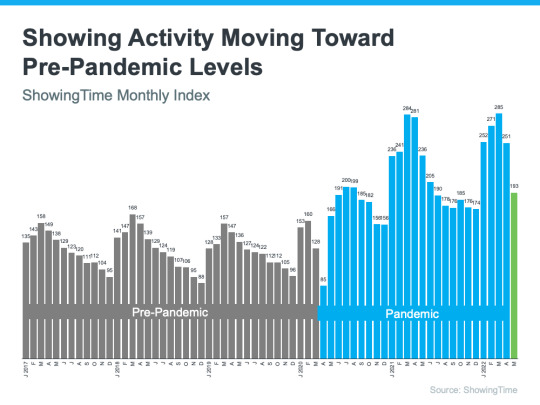

You may have heard in the news that mortgage rates are alot higher today than they were at the start of the year, and that’s has had a strong impact on the affordability in the housing market. As a result of this, the real estate market is showing a shift back to the normal home sale and buyer demand levels or range prior to the pandemic.

Best Time To Buy A House In Boca Raton

But the obvious transition back to the pre-pandemic levels should not be seen as a bad thing. The facts show that, the years leading up to the pandemic were many of the best the housing market years on record. That’s why, as the market is now undergoing a shift, it’s important to appropriately compare what is happening as of today, but not to the abnormal last few pandemic years, but to the current most recent normal years to understand how the current housing market is still very much as strong as ever.

Higher Mortgage Rates Are Moderating the Housing Market

The ShowingTime Showing Index tracks the traffic of home showings according to agents and brokers. It’s also a good indication of buyer wanting to know how to buy a home and what they are doing over time. Here’s a deeper look at their data going all the way back 5 years to 2017 (see graph):

Here’s a breakdown of the story this data tells:

The 2017 through early 2020 numbers (shown in gray) give a good baseline of pre-pandemic demand. The steady up and down trends seen in each of these years show typical seasonality in the market.

The blue on the graph represents the pandemic years. The height of those blue bars indicates home showings skyrocketed during the pandemic. The most recent data (shown in green), indicates buyer demand is moderating back toward more pre-pandemic levels.

This shows that buyer demand is coming down from levels seen over the past two years, and the frenzy in real estate is easing because of higher mortgage rates. For you, that means buying your next home should be less challenging than it would’ve been during the pandemic because there is more inventory available.

Higher Mortgage Rates Slow the Once Frenzied Pace of Home Sales

As mortgage rates started to rise this year, other shifts began to occur too. One additional example is the slowing pace of home sales. Using data from the National Association of Realtors (NAR), here’s a look at existing home sales going all the way back to 2017. Much like the previous graph, a similar trend emerges (see graph):

Again, the data paints a picture of the shift:

The pre-pandemic years (shown in gray) establish a baseline of the number of existing home sales in more typical years.

The pandemic years (shown in blue) exceeded the level of sales seen in previous years. That’s largely because low mortgage rates during that time spurred buyer demand and home sales to new heights.

This year (shown in green), the market is feeling the impact of higher mortgage rates and that’s moderating buyer demand (and by extension home sales). That’s why the expectation for home sales this year is closer to what the market saw in 2018-2019.

Why Is All of This Good News for You?

Both of those factors have opened up a window of opportunity for homeowners looking to move and for first time home buyer in Boca Raton looking to purchase a home. As demand moderates and the pace of home sales slows, housing inventory is able to grow – and that gives you more options for your home search.

So don’t let the headlines about the market cooling or moderating scare you. The housing market is still strong; it’s just easing off from the unsustainable frenzy it saw during the height of the pandemic – and that’s a good thing. It opens up new opportunities for you to find a home that meets your needs.

Bottom Line

The housing market is undergoing a shift because of higher mortgage rates, but the market is still strong. If you’ve been looking to buy a home over the last couple of years and it felt impossible to do, now may be your opportunity. Buying a home right now isn’t easy, but there is more opportunity for those who are looking.

To Start Your Home Buying Process in Boca Raton Contact Us Today (561) 556-3004

0 notes

Photo

What’s Causing Ongoing Home Price Appreciation?

What’s Causing Ongoing Home Price Appreciation in Boca Raton? If you’re thinking about making a move, you probably want to know what’s going to happen to home prices for the rest of the year. While experts say price growth will moderate due to the shifting market, ongoing appreciation is expected. That means home prices won’t fall. Here’s a look at two key reasons experts forecast continued price growth: supply and demand.

While Growing, Housing Supply Is Still Low

Even though inventory is increasing this year as the market moderates, supply is still low. The graph below helps tell the story of why there still aren’t enough homes on the market today. It uses data from the Census to show the number of single-family homes that were built in this country going all the way back to the 1970s.

In the photo you can see the blue bars represent the years leading up to the housing crisis in 2008. As the graph shows, right before the crash, homebuilding increased significantly. That’s because buyer demand was so high due to loose lending standards that enabled more people to qualify for a home loan.

The resulting oversupply of homes for sale led to prices dropping during the crash and some builders leaving the industry or closing their businesses – and that led to a long period of underbuilding of new homes Boca Raton. And even as more new homes are constructed this year and in the years ahead, this isn’t something that can be resolved overnight. It’ll take time to build enough homes to meet the deficit of underbuilding that took place over the past 14 years.

Millennials Will Create Sustained Buyer Demand Moving Forward

The frenzy the market saw during the pandemic is because there was more demand than homes for sale. That drove home prices up as buyers competed with one another for available homes. And while buyer demand has moderated today in response to higher mortgage rates, data tells us demand will continue to be driven by the large generation of millennials aging into their peak homebuying years (see graph by U.S. Population by Generation photo):

What’s Causing Ongoing Home Price Appreciation Boca Raton? If you’re thinking about making a move, you probably want to know what’s going to happen to home prices for the rest of the year. While experts say price growth will moderate due to the shifting market, ongoing appreciation is expected. That means home prices won’t fall. Here’s a look at two key reasons experts forecast continued price growth: supply and demand.

While Growing, Housing Supply Is Still Low

Even though inventory is increasing this year as the market moderates, supply is still low. The graph below helps tell the story of why there still aren’t enough homes on the market today. It uses data from the Census to show the number of single-family homes that were built in this country going all the way back to the 1970s.

The blue bars represent the years leading up to the housing crisis in 2008. As the graph shows, right before the crash, homebuilding increased significantly. That’s because buyer demand was so high due to loose lending standards that enabled more people to qualify for a home loan.

The resulting oversupply of homes for sale Delray Beach led to prices dropping during the crash and some builders leaving the industry or closing their businesses – and that led to a long period of underbuilding of new homes. And even as more new homes are constructed this year and in the years ahead, this isn’t something that can be resolved overnight. It’ll take time to build enough homes to meet the deficit of underbuilding that took place over the past 14 years.

Millennials Will Create Sustained Buyer Demand Moving Forward The frenzy the market saw during the pandemic is because there was more demand than homes for sale. That drove home prices up as buyers competed with one another for available homes. And while buyer demand has moderated today in response to higher mortgage rates, data tells us demand will continue to be driven by the large generation of millennials aging into their peak homebuying years (see graph below):

Odeta Kushi, Deputy Chief Economist at First American, explains:

“. . . millennials continue to transition to their prime home-buying age and will remain the driving force in potential homeownership demand in the years ahead.” That combination of millennial demand and low housing supply continues to put upward pressure on home prices. As Bankrate says:

“After all, supplies of homes for sale remain near record lows. And while a jump in mortgage rates has dampened demand somewhat, demand still outpaces supply, thanks to a combination of little new construction and strong household formation by large numbers of millennials.”

What This Means for Home Prices If you’re worried home values will fall, rest assured that experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand. That means home prices won’t decline.

Bottom Line Based on today’s factors driving supply and demand, experts project home price appreciation will continue. It’ll just happen at a more moderate pace as the housing market continues its shift back toward pre-pandemic levels.

0 notes

Photo

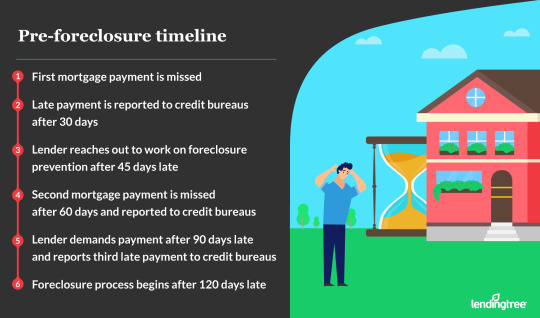

Are you looking for information about stop foreclosure?

Is it important for you to get the right details about foreclosure attorney?

Do you want to get info about ways to 10 Ways to Avoid Foreclosure

Foreclosure Avoidance Options Foreclosure is a devastating financial challenge that faces many families and one that can be avoided. The options available to homeowners in foreclosure are many, including doing a short sale. Following is a brief overview of these different alternatives:

Reinstatement

A reinstatement is the easiest most straight forward solution for a foreclosure, however it is often the most difficult because of the circumstances that put you there in the first place, lack of money. The property owner simply asks for the total amount past due and owing to the mortgage company up to date and pays it. Otherwise known as a payoff reqest. The down fall is that this solution is that if our to far past due you will require the lender's approval for a 'reinstatement' of the mortgage. You can do this up to the day before the final foreclosure sale auction is held.

Forbearance or Repayment Plan

A forbearance or repayment plan involves the homeowner negotiating with the mortgage company to allow them to repay back payments over a period of time. The homeowner typically makes their current mortgage payment in addition to a portion of the back payments they owe.

Mortgage Modification

A mortgage modification involves the reduction of one of the following: the interest rate on the loan, the principal balance of the loan, the term of the loan, or any combination of these. These typically result in a lower payment to the homeowner and a more affordable mortgage.

Rent the Property

A homeowner who has a mortgage payment low enough that market rent will allow it to be paid, can convert their property to a rental and use the rental income to pay the mortgage.

Deed-in-Lieu of Foreclosure

Also known as a "friendly foreclosure," a deed-in-lieu allows the homeowner to return the property to the lender rather than go through the foreclosure process. Lender approval is required for this option, and the homeowner must also vacate the property.

Bankruptcy

Many have considered and marketed bankruptcy as a "foreclosure solution," but this is only true in some states and situations. If the homeowner has non-mortgage debts that cause a shortfall of paying their mortgage payments and a personal bankruptcy will eliminate these debts, this may be a viable solution.

Refinance

If a homeowner has sufficient equity in their property and their credit is still in good standing, they may be able to refinance their mortgage.

Servicemembers Civil Relief Act (military personnel only)

If a member of the military is experiencing financial distress due to deployment, and that person can show that their debt was entered into prior to deployment, they may qualify for relief under the Servicemembers Civil Relief Act. The American Bar Association has a network of attorneys that will work with servicemembers in relation to qualifying for this relief.

Sell the Property

Homeowners with sufficient equity can list their property with a qualified agent that understands the foreclosure process in their area.

Short Sale

If a homeowner owes more on their property than it is currently worth, then they can hire a qualified real estate agent to market and sell their property through the negotiation of a short sale with their lender. This typically requires the property to be on the market and the homeowner must have a financial hardship to qualify. Hardship can be simply defined as a material change in the financial stability of the homeowner between the date of the home purchase and the date of the short sale negotiation. Acceptable hardships include but are not limited to: mortgage payment increase, job loss, divorce, excessive debt, forced or unplanned relocation, and more.

Common Questions About How To Stop Foreclosure

The Delray Beach Foreclosure Attorneys and How To Stop Foreclosure

1 note

·

View note