Don't wanna be here? Send us removal request.

Text

A Comprehensive Handbook for Investing in Real Estate through Private Equity

Real estate has long been a favored asset class for investors seeking stable returns and long-term wealth creation. However, navigating the intricacies of the real estate market is challenging- especially when it comes to accessing investment opportunities and managing risks effectively.

Private equity has emerged as a powerful tool for investors looking to capitalize on the potential of the real estate market.

Are you, too, looking to dive into real estate investing through private equity but need to know how?

Private equity is an investment where individuals or organizations pool their capital to buy private company ownership. The goal is to generate and create large returns through active management and eventual sale or Initial Public Offering (IPO).

In this blog, we're going to delve deeper into investing through private equity and walk you through each step of the process of finding the ideal private equity real estate fund. Let's read on:

What Makes Private Equity Unique?

Illiquid nature: Investments are typically held for several years, providing long-term growth opportunities.

Limited partnership structure: Investors become limited partners, entrusting the management to the general partner, who makes investment decisions.

Active management approach: Private equity firms actively participate in the operational and strategic aspects of real estate investments.

Long-term investment strategy: Private equity involves holding investments for 5-10 years or more.

Types of Private Equity Firms and Structures

Traditional private equity firms - These firms invest in various industries, including real estate, alongside other sectors. They may have dedicated real estate divisions or teams specializing in real estate investments.

Real estate-focused private equity firms - These firms exclusively focus on real estate investments and possess in-depth knowledge and expertise in the sector. They may have different strategies, such as opportunistic, value-add, or core investments.

Real estate investment trusts (REITs) - REITs are publicly traded companies that own and operate income-generating properties. They offer a way for individual investors to participate in real estate through publicly traded securities.

Steps to Invest in Real Estate through Private Equity

1. Unraveling the Fund's Costs and Investment Structure

Private equity real estate funds typically have a two-tiered structure comprising:

A general partner (GP): The GP manages the fund and makes investment decisions,

Limited partners (LPs): The LPs provide the capital.

The costs associated with private equity real estate funds can include management fees, performance fees (carried interest), and various expenses related to acquisitions, asset management, and divestments.

Understanding these costs and evaluating their potential impact on your investment returns is crucial.

2. Exploring Different Private Equity Real Estate Strategies

Now that we've covered the fundamentals let's explore the different strategies employed by private equity real estate funds:

Value-Added Strategy: This strategy involves acquiring properties that have the potential to be improved. Picture it as turning rough diamonds into sparkling gems. These properties may be underperforming assets or properties that need to be renovated and yield long-term results. The fund aims to increase the value of these properties through active management and targeted improvements. Ultimately, the fund hopes to sell the properties at a higher price than it paid for them.

Core Strategy: If you're looking into stability and consistent income, this is your strategy. Core funds invest in stable, income-generating properties that are typically well-established and located in prime locations. These funds offer low risk and steady cash flow, making them a good option for conservative investors looking for long-term stability.

Opportunistic Strategy: Lastly, if you're up for adventure and seeking higher-risk opportunities, this is your way to go! Opportunistic funds invest in assets that offer the potential for high returns but also carry higher risk. These funds typically focus on distressed assets, development projects, or markets with favorable growth prospects. Opportunistic funds require active management and typically have a longer investment horizon.

3. Conduct Investment Analysis

Performing a comprehensive investment analysis is essential when considering real estate investments through private equity. Here's how to approach this process:

Financial modeling and projections involve constructing a detailed financial model that forecasts potential cash flows, expenses, and returns over the investment's lifespan. This allows investors to assess the investment's profitability and determine its viability within their portfolio.

Evaluating investment returns and cash flow potential entails analyzing metrics such as internal rate of return (IRR), cash-on-cash return, and net operating income (NOI). This assessment helps gauge the investment's ability to generate consistent income and achieve target returns.

Assessing the risk-reward profile involves considering the potential risks associated with the investment, such as market volatility, regulatory changes, or property-specific risks. Performing sensitivity analysis enables investors to understand how variations in key assumptions impact the investment's performance.

Comparing the investment opportunity against established criteria involves benchmarking the investment against predetermined metrics and criteria. This ensures alignment with investment goals, risk tolerance, and return expectations, enabling investors to make informed decisions.

By diligently conducting investment analysis, investors can gain valuable insights into the financial viability, risk exposure, and alignment with their investment objectives, allowing them to make well-informed investment decisions in the realm of real estate private equity.

4. Embracing Risks and Considering the Long-Term Outlook

Investing in private equity real estate funds can be a rewarding experience, but it is essential to be aware of the challenges and risks involved. These funds are subject to market volatility, economic cycles, regulatory changes, and liquidity concerns.

However, by carefully assessing these risks and aligning your investment strategy with your long-term goals, you can mitigate potential downsides and increase your chances of success.

5. Decide the Exit Strategy

Crafting a well-defined exit strategy is a crucial aspect of real estate investment through private equity.

Define exit goals and timeline, establish a clear vision for the investment's lifespan and the desired time frame for exiting the property. This helps align the exit strategy with the investor's objectives and overall portfolio strategy.

Evaluate market conditions and potential exit avenues, conduct thorough analysis of the real estate market, including supply and demand dynamics, pricing trends, and investor sentiment. This assessment helps identify the most favorable market conditions and available exit options, such as selling the property, refinancing, or recapitalization.

Executing the exit strategy entails implementing the chosen exit avenue, whether it be listing the property for sale, engaging with potential buyers or real estate investors, negotiating terms, or refinancing the property to extract equity. This step aims to maximize returns and achieve the desired exit outcome.

The Takeaway

To wrap it all up, investing in real estate through private equity can be a lucrative venture. It allows you to diversify your portfolio and capitalize on the ever-growing real estate market.

Of course, no investment comes without risks. Economic cycles can affect property values, and the real estate market can be unpredictable, along with challenges coming from regulatory adjustments and liquidity issues.

However, you can overcome these challenges by carefully evaluating the risks and matching your investment approach with long-term objectives.

Just remember to do your due diligence, consult financial advisors, and stay informed about market trends and developments.

#investing in real estate#invest in private equity real estate#real estate private equity#private equity real estate fund#real estate syndication

0 notes

Text

7 Key Approaches to Reducing Risk in Real Estate Investments

Real estate investments have withstood the test of time, proving their resilience through wars, economic crashes, and global crises. However, like any investment, real estate carries inherent risks. To successfully raise real estate capital, it is essential to grasp and address these risks effectively.

By understanding the potential challenges and incorporating risk management strategies in real estate investment, real estate syndicators can protect their investments and provide security to their investors. Awareness of real estate risks is crucial for navigating the investment landscape and fostering confidence among potential investors.

What can you do when looking to take your real estate investments to the next level?

In the dynamic world of real estate, reducing risk is the key to maximizing your returns and securing long-term success. After all, the stakes are high, and making informed decisions is crucial.

You may have heard the saying, "Knowledge is power." When it comes to real estate investments, knowledge combined with strategic risk-reduction techniques is your secret weapon. By understanding and implementing these proven methods, you can safeguard your assets, optimize your returns, and build a portfolio that stands the test of time.

But first, let's dispel a common misconception.

Reducing risk in real estate investments does not mean avoiding them altogether or settling for mediocre returns. On the contrary, it is about taking calculated steps to minimize potential pitfalls while maximizing your profit potential by using real estate leverage strategies.

So, what are these game-changing approaches?

These seven fundamental approaches are your roadmap to achieving financial prosperity in real estate.

Let's dive in and discover how you can make more intelligent, more secure investment choices.

7 Key Approaches to Reducing Risk in Real Estate Investments

Let’s unveil them one by one, equipping you with the tools and insights you need to make confident investment decisions:

1. Choose a Project Based on its Functional Characteristics

While considering real estate projects, you should evaluate the functional attributes of a real estate project is crucial in determining its desirability and potential for returns. The location of a property plays a vital role in its market value, with convenient access to transportation networks and proximity to schools, hospitals, and shopping centers being highly sought after.

Properties in areas with desirable amenities, such as swimming pools, fitness centers, and communal spaces, tend to attract tenants or buyers more easily. Additionally, properties near public transportation options offer convenience for commuting, enhancing their appeal.

Understanding the rental demand in the area and assessing factors like population growth and employment opportunities can help gauge the property's income potential.

Lastly, properties situated in areas with strong growth potential, driven by infrastructure development and urban revitalization initiatives, offer the prospect of long-term appreciation.

2. Choose an Optimal Development Stage for Real Estate Investment

Timing plays a vital role in real estate investments, and evaluating the stage of development of a project is crucial for informed decision-making.

Projects can be categorized into three main stages

Pre-construction,

Under Construction, and

Ready for Occupancy.

Each stage presents unique risks and potential rewards, and understanding them is essential for selecting the right investment strategy.

Let’s learn more about each stage:

You should conduct proper research at each stage to make informed investment decisions that align with your goals.

3. Choose the Ideal Real Estate Asset Type for Your Investment

Real estate investments encompass various asset types, such as residential properties, commercial buildings, industrial facilities, and mixed-use developments. Each asset type presents unique risks and potential returns, and selecting the right style is essential for a successful investment strategy.

It would be best if you considered the following factors when evaluating the ideal real estate asset type for your investment:

Clarify Your Investment Objectives: Define and Align Your Goals in Real Estate.

Navigate with Market Insights: Analyze the Real Estate Market for Informed Decision-making.

Use Your Expertise: Invest in Real Estate Sectors You Know or Partner with Professionals.

Mitigate Risk through Diversification: Expand Your Real Estate Portfolio Across Multiple Asset Types.

4. Align Your Investment Strategy with Your Financial Time Horizon

When considering a real estate investment, it is essential to assess your financial goals and investment horizon carefully. Align your investment strategy with your financial objectives, whether it's generating short-term income or long-term appreciation. Different real estate projects offer varying timelines for returns, and you can be on top of your game by following these:

Short-Term Income: You should focus on investments with immediate cash flow through commercial real estate tenants.

Long-Term Income: Target real estate opportunities in emerging markets or growth areas for potential appreciation over time.

Have a Balanced Approach: Diversify your real estate portfolio with immediate cash flow and future value appreciation.

5. Expand Your Knowledge and Explore Real Estate Markets in Multiple Cities

Investing in real estate may seem daunting, but don't worry! All it takes is some learning and research. Living in a time where information is just a few keystrokes gives you a significant advantage.

Due to its cyclical nature, conducting thorough research about the current market conditions and trends is essential to reduce risk in real estate investing.

Moreover, you can benefit from extensive marketing research on real estate markets across multiple cities. This will allow for a more diverse portfolio. Diversifying investments across cities with dynamic markets helps d reduce the vulnerability to market-specific how to reduce risk in real estate investing.

Knowledge of multiple real estate markets enables strategic decision-making and risk mitigation and increases your investment opportunities.

In order to have better risk management in real estate development across your real estate portfolio, let's look at the ways to select the correct city for you:

Economic Stability: Dive deep into research to find cities with a stable and diverse economy. Consider points like job growth, unemployment rates, GDP growth, and multiple industries with strong anchors, like schools and hospitals.

Population Growth: Demographics like population play a crucial role when investing. You should invest in cities with a diverse and growing population. This also indicates an increased demand for housing and rental properties, which can contribute to long-term value appreciation.

Location and Neighborhood: No city is known to be the same. It would help if you researched popular neighborhoods extensively while remembering key factors such as schools, transportation hubs, and employment centers.

Infrastructure and Development: The infrastructure of any city can make or break an investment decision. To minimize the risk of investing in real estate, you should assess the city's infrastructure and ongoing development projects. Be on the lookout for investments in essentials like transportation, utilities, and public amenities.

Analyzing micro-markets or specific neighborhoods within a chosen city is essential for assessing the associated risks and making informed investment decisions. Thorough research lets you identify potential risks and take necessary steps to mitigate them effectively.

Furthermore, studying micro-market trends enables you to recognize market cycles and determine the optimal investment timing. Understanding these trends helps you enter the market at the right moment, avoiding periods of oversupply, price declines, or unfavorable conditions.

By delving into micro-market dynamics, you can uncover promising investment opportunities and make well-informed decisions that align with your objectives.

Wrapping Up

To summarize, acquiring knowledge and understanding the critical approaches to reducing risk in real estate investments is paramount when investing in real estate investments. You should take essential steps toward mitigating risks associated with real estate ventures.

However, the work doesn't stop here.

It would help if you did your homework and thoroughly researched these risk-reducing factors. This personalized understanding will enable you to manage and navigate the risks involved effectively.

By doing so, you safeguard your investment track record and establish yourself as a reliable and knowledgeable investor in the eyes of accredited individuals.

So, continue your journey by delving deeper into real estate investing, honing your skills, and staying updated with industry trends.

With a proactive approach and a comprehensive understanding of risk reduction, you can enhance your chances of success and build a resilient and profitable real estate investment portfolio.

#real estate investment portfolio#real estate investing#real estate investments#real estate ventures#Investing in real estate#real estate projects#real estate leverage strategies

0 notes

Photo

Real estate syndication - especially multifamily syndication is among the most preferred investing techniques today. Let's drill down the super-smart ways to save money and make your investment journey smoother and more fruitful: https://bit.ly/3LoZPex

#multifamilysyndicationinvestment#real estate investment#realestatesyndicationdeals#multifamily syndication

0 notes

Photo

When you invest in a new real estate syndication, you are putting your faith in the sponsor team and asset management. When it comes to potential investments, no question is off-limits. Checkout the questions one should ask before investing in real estate syndication deals.

#Invest in a new real estate syndication#Real estate syndication#Real estate syndication deals#Real estate syndication sponsor

0 notes

Text

What is Syndication in the Real Estate Industry - Investors' Guide

Ask yourself, is it possible to diversify your portfolio, get regular cash flow, and enjoy reduced risk of a volatile market without actively managing each separate investment? Sounds too good to be true, doesn't it? Well, it's not! With real estate syndication, all of this is possible and even more.

Real estate syndication is becoming a popular investment choice, especially for passive investors. With attractive preferred returns and tax benefits, real estate investors are becoming more inclined to invest through real estate syndication. If you are here, I am guessing you want to know everything there is to know about real estate syndication and the works. At the end of the article, I aim to have answered all your questions and hopefully given you enough insights to decide whether this is the ideal option for you. Let's begin, shall we?

What is Real Estate Syndication?

Simply put, real estate syndication means grouping a set of investors who collectively pool their money to invest in a commercial or large real estate project. Although this is a traditional practice, syndication allows all types of investors to participate in large-scale real estate projects and raise enough capital that the investors would not be able to come up on their own.

These investors do not actively participate in the real estate project management or exercise any control over the decision-making process. They only provide a certain amount of capital and get returns on their investment, typically annually.

Real estate syndication is a great way for investors to participate in large-scale projects and get much higher profits from their investment than other real estate investment opportunities. These real estate projects can be anything from multi-family housing complexes to hotels, storage facilities, and office buildings.

This can also be called building a real estate partnership which you can start by investing through a crowdfunding platform or indulge in a separate syndication agreement. You can choose to invest through an online real estate syndication platform on a project that you feel will be most beneficial for your investment needs.

How Does Real Estate Syndication Work?

In a real estate syndication, two primary parties are involved — the sponsor and the investors. The syndication can be called a legal agreement that binds the sponsor and the investors in a real estate deal. The sponsor is the person who organizes the syndication; he is also known as the syndicator. This person is a licensed professional and an experienced real estate investor responsible for all the management and operation work of the real estate project. The investors are simply the ones raising the capital for the project to be functional and aim to get returns once the deal is closed.

The sponsor is responsible for the acquisition of the property, overseeing the development or renovation process, property management, and contingency planning. Furthermore, the sponsor also brings in a certain amount of capital which can be anything between 5-20% of the required equity capital. The investors bring in the rest of the amount.

In exchange for the investor's money, they get a percentage of ownership, like equity units or shares. These units allow the investor to receive a portion of the rental income generated by the property and a share in the profit when the property is sold.

Syndications are typically set up as a Limited Liability Company (LLC) or Limited Partnership (LP). Here, the sponsor is the General Partner and manager, while the investors are limited partners. This legal representation is important because it clearly documents the sponsor's and investors' rights and liabilities.

Typically, investors get an annual return on their investment of 8-12%. The average preferred return is no less than 8%.

Why Participate in Real Estate Syndication?

Trust me when I say that there are a myriad of benefits to real estate syndication. In the opening lines, we barely touched on the most attractive benefits of this type of investment which is why we are going to talk about them (and a few more) in detail here.

If you want to ensure that you aren't entirely relying on just one investment for all your income, it is important to diversify your investment portfolio. This portfolio reflects all the different real estate assets and securities you have invested in, and they can secure you from unpredictable economic downfalls.

Building a diversified portfolio requires time and a lot of management. This hassle is taken care of when you invest through a real estate syndication. Through syndication, you get access to different types of real estate assets spread across various locations. It allows you to diversify your portfolio through a single platform and keep the management to a bare minimum.

With sponsors managing and working hard to utilize every penny of the investors' money for the development of the project, the profits are usually maximized this way. Investors often start receiving returns on their investments as often as a quarterly basis. This generates a steady stream of passive income on a quarterly and annual basis.

Additionally, sponsors keep the investors informed about the progress of the real estate project, occupancy updates, and any changes in plans. This frees up the investor from chasing them on their own or seeking updates single-handedly.

Before 2012, investing in large-scale real estate projects was known to be meant only for distinguished investors or accredited investors. However, thanks to JOBS Act 2012, every investor was given the opportunity to participate in larger commercial projects and crowdfunding. Needless to say, investing in these commercial real estate projects is not easy and requires a lot of knowledge, sometimes to the point that investors give up on it.

With syndication, though, you can easily access bigger investment opportunities, sometimes before they even hit the market. This is because established real estate syndications have insider access. They are usually the first ones to be informed about premium projects and off-market properties to begin the process of capital raising.

With soaring tax inflation rates, especially in the U.S., seeking a tax-advantaged investment option is just as necessary as celebrating the 4th of July. It is a step towards the celebration.

Income through real estate syndication is considered passive income by the IRS and also, and capital gains are typically considered tax-free so you can save tax on your real estate income through these clauses. Furthermore, you can reduce your tax burdens for commercial real estate investment in a number of ways:

Claiming depreciation on the building.

Deductions in operating expenses.

Tax reduction capital gains.

Mortgage interest.

Utilize section 1031 of the U.S. Internal Revenue Code.

It is best to seek a professional tax lawyer's help to make these deductions for you and maximize the chances of justifying them to the IRS.

As real estate syndication allows you to hold your investment for long terms, you will not have to sell your share if the real estate market falls. This is a major problem with private real estate funds. Investors end up taking big losses in such situations because they have to sell when real estate prices decline.

Real estate syndication reduces the risks of a volatile market. When the prices fall, you will not need to sell the property or shares. Instead, you can hold on to them until the prices rise.

Even if you are a beginner investor looking for ways to enter the real estate market, you do not have to be afraid. Investing through a real estate syndication is the easiest and most profitable option, as you do not need any extra expertise to understand the market. You can simply rely on the knowledge and skills of the sponsor and his team, as they are certified real estate professionals.

With syndication, you simply need to give the funds that you want to invest with and let the syndicator take care of management, leases, taxes, renovations, and almost everything else. They also know how to find escape through snags and pitfalls, which a beginner investor might not know.

In private real estate funds, the initial investment amount is sometimes very high, which leaves the investor out of money in the initial stages itself. However, with real estate syndication, the minimum investment amount is usually low, and you can create a positive mark in the real estate market. It allows smaller investment amounts, and this is one of the best ways to attract all types of investors. This is essentially why real estate syndication is gaining more and more popularity.

If you invest in a private real estate project, you will need to keep additional cash reserved for emergency funds or unexpected expenses during the course of the project. This amount needs to be kept aside from your additional investment amount. Yes, it is difficult to do so, especially if you are inexperienced.

Real estate syndication curbs this need as it keeps sufficient capital available at all times for any unexpected expenses or economic downturns. This is because multiple investors pool in their money and raise enough funds to take care of daily operations and contingency plans also.

Identify If Real Estate Syndication is The Right Option For You

Investing through syndication is becoming increasingly popular, and for a good reason. Not only does it take all the management load off your back, but it also allows you to remain actively aware of everything that goes on in the project.

If you have stuck with us till this section, you are probably looking for indications of why you should participate in real estate syndication. So, let's check them out

You are in a position to spare funds and not expect immediate returns from your investment.

You want to be a passive investor rather than actively managing your portfolio in day-to-day trading activities.

You want another source of passive income that can run for the long term.

You are looking for an annual passive income.

You are an accredited investor.

Now, if you fall under any of these categories, then choosing to invest through a real estate syndication is the most profitable option.

Choosing A Real Estate Syndication Structure

As an investor, you will be tasked with choosing a syndication compensation structure that should fulfill your long-term goals and returns. Every syndication is different; hence, their structures will also differ. Some syndications offer higher returns but come with considerably higher risks, while other syndications offer more conservative splits but have low risks. It is important to understand the structure of each syndication you are considering before you choose one. Let's take a look at the two most common syndication structures.

This is the least complicated structure of syndication, where the distribution that is to be split amongst the investors and the sponsors is straightforward and remains uniform across the board for all types of returns and profits.

Whether there is a cash flow generated or profit from the sale of the real estate asset, the straight split structure will provide the same splitting ratio for each distribution. For example, if a syndication follows a 75/25 straight split structure, then 75% of all the cash flow or profit will go to investors (limited partners), and the remaining 25% will go to the sponsor (general manager).

This structure is especially beneficial for passive investors who are seeking high returns and can cope with the increased risks that come with this structure.

The waterfall structure utilizes the 'preferred return' component, which is very popular with investors. In this structure, the cash flow or profits are first paid to investors as a return before they are distributed to the sponsor or anywhere else.

For example, suppose a syndication deal offers an 8% preferred return to its investors. In that case, the investors will receive an 8% return on their investment first when returns are generated, and then the remaining amount will go to the sponsor.

In this case, the investor gets 8% of the returns generated, which may or may not be an actual 8% return on the investor's original investment amount. For example, if an investor has invested $50,000 and the preferred return is stated to be 8% on the cash flow or profit, then the investor will not receive $4000 (8% of 50,000), but he will receive 8% of the cash flow or profit.

Furthermore, once the 8% threshold is reached, the real estate syndication deal will change to another split distribution which was placed in case the returns go over 8%. This split can be a 50/50 split or a 70/30 split, wherein the remaining amount is split amongst the investors and the sponsor for either a 70/30 or 50/50 split, whichever ratio was put in place at the time of agreement.

How to Profit From Real Estate Syndication

Apart from the stable returns and lowered market volatility risk, investors have more opportunities to profit from a real estate syndication. Here are some of the other ways that real estate syndication profits the investor:

It allows the investor to diversify his assets through syndication and avoid being overexposed to any one investment.

Investors can build relationships with other investors and this can be fruitful in the future when the investor decides to go solo on his venture.

It also allows investors to reap benefits from other investments while maintaining a stake in the underlying asset of the real estate syndication.

When investors spread their investment across a wide number of properties through real estate syndication, they will see higher profits across the whole real estate cycle.

Final Thoughts

Real estate syndication has allowed all types of investors to reap the benefits of investing in commercial real estate projects. It has also helped sponsors to seek more investors and higher capital for a particular project. The majority of the work is handled by the sponsor and his team; hence, the investors can easily sit back and wait for the returns to come in.

Having said that, it is important for investors to go with a syndication that fulfills all the investor's goals. The investor must meet the prerequisites of the deal and maintain transparency from his end too.

#Real estate syndication#investing in commercial real estate#real estate investors#real estate business

0 notes

Photo

Real estate syndication is among the lucrative businesses in the modern era. It is crucial to understand the structure and investor earning distribution in real estate syndication. Checkout figure out the investment distribution in real estate syndication.

#Real estate investor#Real estate syndication#Investor earning distribution#Real estate investment management#Real estate syndication software#Real estate investment distribution

0 notes

Photo

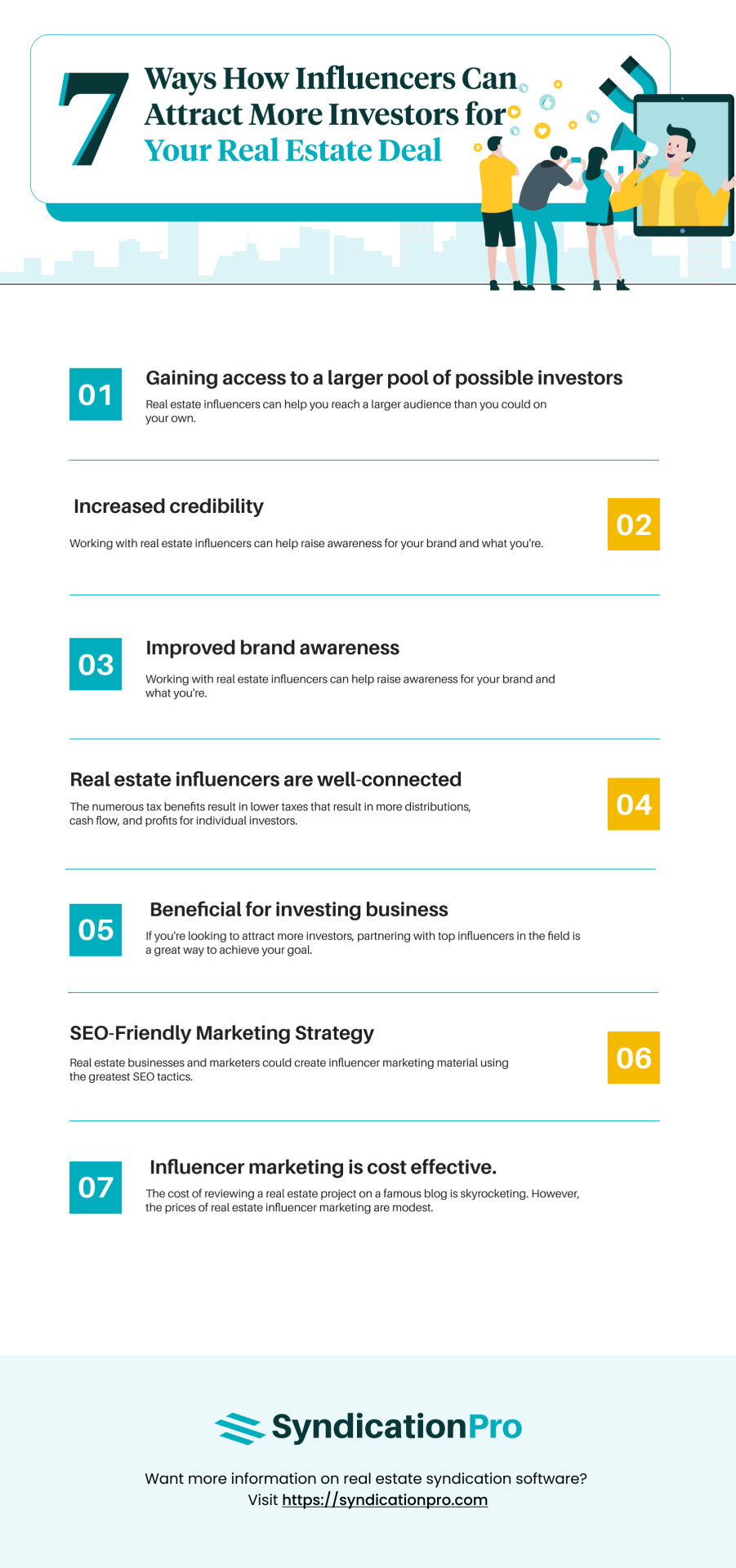

Influencer marketing is an excellent method for reaching out to a certain population when your brand has little awareness. It raises brand recognition and contributes significantly to the value of a marketing effort. Checkout the ways to attract more investors for real estate deal.

0 notes

Photo

Real estate investors don't need to be a master in math while investing in a property or a real estate syndication. The real estate market has been promising and stable for years. Let's take you through the top 10 well-designed real estate calculators every investor should have.

0 notes

Photo

Real estate investing can be a challenging pursuit. Investing in real estate requires time, patience, knowledge, and, most importantly, a large chunk of cash to start with. Real estate syndication helps to diversify your real estate portfolio, boost its liquidity, and generate regular cash flow. Let's check out the key six benefits of investing in real estate syndication.

#real estate investment#investing in real estate#Private Real Estate Funds#Investing in Real Estate Syndication#real estate syndication

0 notes

Photo

Real estate syndication management is an instrumental way to get more capital to fund your deals and grow your business faster. It benefits both buyer and seller, as it typically leads to both parties achieving their desired result. In this infographic, we have encased & discussed five key ways you can manage real estate syndication deals and make money.

0 notes

Text

How To Raise Capital For Real Estate Investing? 8 Things You Must Know

If you are here, you must have looked for the best way to raise capital for real estate investment. While there are many options available nowadays, choosing one is tricky. Yes, you can raise capital with your own money; however, nobody has a tremendous amount at hand to invest it outright. And we know that the higher the amount of capital you bring in, the higher your returns and share will be. Sounds tempting, right?

Now, let’s address the elephant in the room, how to raise capital for real estate investing?

If you do not want to use your money or your entire savings in one go, multiple options are available to borrow and return money according to the agreement. To make this an informed decision, we have listed eight popular options investors resort to for raising capital.

Bank Loans are The Standard Way to Go

The real estate market is rich with opportunities, and banks are now offering loans at lower interest rates. It is one of the safest ways of raising capital, as everything is documented under a statutory financial institution.

To get a loan sanctioned from a bank, you must undergo preliminary checks such as background verification, credit report, debt-to-income ratio, and assets you own. Having cleared all these checks, you will be granted the loan amount and can pay it off on the agreed terms.

Self Directed IRA Real Estate Investing Can Be Explored

You can invest in real estate assets with a self-directed individual retirement account. This option is especially viable for people looking for returns by investing in the real estate market using their retirement savings. Pros of self-directed IRA real estate investing:

Complete control over your investments.

Control how your money will be invested.

With few restrictions, the IRS allows you to invest in real estate without early withdrawal penalties.

It also allows better diversification.

Your assets are more secure in your retirement account than the privately owed ones.

Private & Hard Money Lenders Are a Popular Choice

Both Private and Hard Money lenders provide almost similar services. Hard money lenders are professional institutions with licenses to offer loans on their terms. On the other hand, a private money lender is simply an individual who lends money to you for investment, but again, on their terms.

Why should you go for this option?

These lenders offer the investment amount regardless of your credit score. If you have a low credit score or have other debts, you could still get the money from these lenders.

They disburse the loan amount much faster than banks.

Raising the capital with this option is a good deal if you are willing to pay higher interest rates.

These lenders are more flexible in discussing the terms and signing off on a deal that benefits both parties.

Peer-to-Peer Loan is Helpful

Getting a peer-to-peer loan is now more accessible and has become more convenient. In this type of loan, you can look at multiple investors willing to lend you the money on different terms and conditions. As a borrower, you can choose a lender as per your ability to pay back and the agreed interest rates. There is a peer-to-peer lending platform that you can access online and apply for a loan.

Why choose this option?

Multiple options with carried interest rates.

Easier to access, apply and get the amount disbursed.

Lesser checks and formalities are conducted than in a bank.

All information is registered on the online portal.

Crowdfunding the Project

As you may have understood from the name, crowdfunding means that multiple investors (crowd) will fund your investment project. In this, the total amount of capital needed to be raised is foretold, and then, through a central platform, multiple investors fund the project with any amount they want. The crowdfunding is kept open until the goal is reached. These investors will then get returns based on the amount they put in, making them the owner of a portion of your real estate project.

Consider a Home Equity Loan

Simply put, a home equity loan is a type of loan where you get a fixed amount of money against the equity you have in your existing home as collateral. In this, the amount you receive is supposed to be paid back within a fixed amount of time and at a fixed interest rate.

This type of loan is beneficial for people who have a good credit history, a stable income source, and know that they can pay off the amount on the agreed terms. You can then use this money to fund other real estate projects.

While this is a viable option, you must remember that failing to pay off the loan may result in you losing your home.

FHA Investment Loan is a Smart Choice

FHA or Federal Housing Administration loans are loans that FHA backs. These loans were specifically designed to cater to the housing loan needs of low-income and middle-income borrowers.

Since it is intended for this category specifically, the qualification requirements are comparatively less stringent. People with low credit scores can quickly get an FHA loan with minimum down-payment requirements. FHA loans are also a popular choice for people buying a house for the first time.

Go for Investment Partnership

If you know someone also looking for a similar investment opportunity or might be interested in investing in real estate, then you can form a partnership with them and raise capital.

In this type of partnership, you can openly discuss the capital they will bring and agree upon a share in the profits you get from the investment.

They will then become a valuable second party who can help you with other formalities. You will also gain insights from a different perspective and share the risks too.

Conclusion

When raising capital for real estate investment, you should be careful with your option, as you will be responsible for the deal for the foreseeable future. Whether you are a first-time investor or looking to improve your portfolio, we have listed options that help both types of investors.

#real estate fundraising#real estate investment#investing in real estate#real estate syndication#raising capital for real estate investment

0 notes

Text

Investing in Real Estate: How to Calculate Return on Investment?

From quaint fixer-uppers to sprawling commercial buildings, real estate has long been a favorite investment choice for those seeking long-term financial stability and growth. However, with so many factors to consider when evaluating a potential investment, it can be challenging to determine which properties are worth the risk. That's where the return on investment (ROI) calculation comes in – it's the secret weapon in every savvy investor's arsenal, allowing you to assess the profitability of a potential investment confidently.

Navigating the world of real estate investing requires a robust understanding of the various metrics and calculations involved in determining the profitability of a potential investment. Among these crucial metrics is the return on investment (ROI), a performance measure that provides insight into the effectiveness of a given investment.

In this article, we'll delve into the world of real estate investing and explore the various factors that go into calculating ROI, giving you the knowledge and tools you need to make informed investment decisions that will take your financial future to new heights.

How Do Real Estate Investors Determine A Good Return on Investment?

While the potential for high returns is enticing, it's crucial to determine whether a particular real estate investment will yield a good return on investment (ROI) before committing any funds. Let's explore the ways how real estate investors determine an excellent ROI.

1. Understand the Property's Potential Income Stream

The first step to determining a good ROI on a real estate investment is understanding the potential income stream the property can generate. It includes factors such as the property's location, size, and rental rates. Real estate investors typically consider two primary sources of income from a property: rental income and appreciation.

Rental income is the money generated by renting a property to tenants. This can be calculated by looking at the current market rents for homogenous properties in the area and estimating the amount of rent that can be charged for the property. On the other hand, appreciation refers to the property's value increasing over time due to factors such as inflation and market conditions.

2. Calculate the Cap Rate

The cap rate is widely used for determining the potential ROI of a real estate investment. It is calculated by dividing the property's net operating income by its current market value. The NOI is the income generated by the property after deducting expenses such as taxes, insurance, and maintenance.

A higher cap rate indicates a higher potential ROI, but investors should also consider other factors, such as the property's location, market conditions, and potential for appreciation.

3. Determine the Cash-on-Cash Return

The cash-on-cash return is another important metric for evaluating the ROI of a real estate investment. It is measured by dividing the cash flow generated by the property by the amount of cash invested in the property.

The cash flow includes the rental income generated by the property after deducting expenses such as mortgage payments, taxes, and maintenance.

A higher cash-on-cash return indicates a higher potential ROI, but investors should also consider other factors, such as the property's appreciation potential and the risks associated with the investment.

4. Assess the Risks and Potential Costs

Real estate investments come with risks, such as changes in market conditions, unexpected expenses, and tenant turnover. It's essential to consider these risks and potential costs when evaluating the potential ROI of a real estate investment. For instance, investors should factor in the cost of repairs and maintenance and the potential for rental vacancies.

How to Cut Down on your ROI by making cost reductions

Making cost reductions is a key strategy for cutting down on expenses and boosting your ROI. Following are a few practical ways to cut costs and improve your real estate investment ROI.

1. Reduce Vacancy Rates

Vacancies constitute a high cost for real estate investors, as empty properties generate no rental income. To reduce vacancy rates, keeping your property well-maintained, attractive, and priced competitively is essential. You can also consider offering incentives such as rent discounts or free utilities to attract tenants and encourage them to renew their leases.

2. Lower Operating Expenses

Operating expenses like property taxes, insurance, and maintenance costs, can eat into your ROI. To cut down on these costs, consider negotiating with service providers for better rates or shopping around for more affordable options. You can also take steps to reduce energy costs, such as installing energy-efficient appliances and lighting.

3. Avoid Over-Improvements

While keeping your property in good condition is essential, it's also vital to avoid over-improvements that don't add value or generate a return on investment. Before making any upgrades, evaluate the potential return on investment and prioritize improvements that are likely to yield the highest ROI.

4. Consider Property Management

Hiring a property management company is a smart investment for real estate investors. A property management company can handle tasks such as rent collection, maintenance, and tenant screening, freeing up your time and helping you avoid costly mistakes.

5. Utilize Technology

Technology can be a powerful tool for real estate investors looking to cut costs and improve their ROI. There are many software solutions available that can help streamline property management tasks, such as rent collection, lease renewals, and maintenance requests. These tools can save time and reduce administrative costs, freeing up your resources to focus on more strategic initiatives.

How Is Investment Real Estate Taxed When Selling the Property?

Real estate investments are subject to capital gains tax, which is based on the difference between the purchase price and the sale price of the property:

1. Capital Gains Tax

Any profit you make is subject to capital gains tax when you sell investment real estate. The tax you owe is based on the difference between the sale price of the property and its adjusted basis, which is the purchase price plus any improvements or deductions you've made over time. If the property has appreciated in value, you'll owe capital gains tax on the difference.

The capital gains tax rate depends on how long you've owned the property. If a property is owned for more than a year, long-term capital gains tax is to be paid, which is generally lower than short-term capital gains tax. Long-term capital gains tax rates usually range from 0% to 20%, depending on your income level.

2. Depreciation Recapture Tax

In addition to capital gains tax, you may also owe depreciation recapture tax when you sell investment real estate. Depreciation allows you to deduct the property's cost over time. When you sell the property, you'll need to recapture any depreciation you've taken as income, which is subject to a maximum tax rate of 25%.

3. 1031 Exchange

One way to defer capital gains tax and depreciation recapture tax is to use a 1031 exchange. A 1031 exchange allows one to sell one investment property and reinvest the proceeds in another similar property without paying taxes on the sale. This can be a smart strategy for investors who want to continue building their real estate portfolio without taking a tax hit.

4. State and Local Taxes

Investment real estate may also be subject to state and local taxes when you sell the property. These taxes can vary widely depending on where you live and the specific tax laws in your state or municipality. It's essential to consult with a tax professional to understand the full scope of taxes you may owe when selling investment real estate.

How Is Income From the Real Estate Investment Trust (REIT) Taxed?

REITs need to distribute a minimum of 90% of the taxable income to shareholders as dividends. The income received by shareholders from a REIT is generally taxable at the individual's marginal tax rate. The dividends are reported on the investor's tax return as ordinary income.

Some dividends from REITs may be classified as qualified dividends, which are subject to lower tax rates than ordinary income. The dividend must meet specific criteria set by the IRS to qualify as a qualified dividend. Specifically, the dividend must be paid by a U.S. company or a qualified foreign corporation.

In addition to federal taxes, investors may also owe state and local taxes on REIT dividends. These taxes can vary widely depending on where the investor lives and the specific tax laws in their state or municipality. It's essential to consult with a tax professional to understand the full scope of taxes you may owe on REIT income.

In addition to dividend income, investors may also realize capital gains from the sale of REIT shares. Capital gains from the sale of REIT shares are subject to long-term or short-term capital gains tax rates, depending on how long the investor has held the shares.

How Is Rental Income Taxed?

Rental income is a common source of income for many real estate investors, but it's important to understand the tax implications of earning rental income. In this blog post, we'll explain how rental income is taxed.

The Internal Revenue Service (IRS) considers rental income as ordinary income, which means it is taxed at the individual's marginal tax rate. This can include federal income tax as well as state and local income tax. Rental income should be reported on the investor's tax return as part of their gross income.

One advantage of earning rental income is that it allows for various deductions that can help to lower an investor's tax bill. Deductions can include expenses related to the property, such as mortgage interest, property taxes, maintenance and repairs, insurance, and property management fees. Additionally, rental property owners can claim depreciation on the property itself over a period of 27.5 years.

Furthermore, rental income is generally considered passive income, which means it's subject to passive activity loss rules. If a rental property generates a net loss for the year, the loss can be used to offset other passive income. However, if the net loss exceeds passive income, the excess can be carried forward to near future years or used to offset capital gains.

If real estate investors are actively involved in managing their rental properties, they may be subject to self-employment tax. This tax is a combination of Social Security and Medicare taxes and is paid by self-employed individuals. Real estate investors should consult with a tax professional to determine if they are subject to self-employment tax and how it impacts their tax liabilities.

Rental income is generally taxed at the individual's marginal tax rate. Investors can take advantage of various deductions and depreciation to lower their tax bills. Passive activity loss rules apply to rental income, and investors who actively manage their properties may be subject to self-employment tax. Understanding the tax implications of rental income is an important part of being a successful real estate investor. It's recommended to consult with a tax professional to ascertain you are taking advantage of all available real estate tax benefits and minimizing your tax liabilities.

Conclusion

Investing in real estate requires careful evaluation of potential properties and calculating your return on investment before making any investment decisions. Understanding the various factors impacting your ROI, such as rental income, expenses, financing, and taxes, is essential for making informed investment decisions.

When calculating your ROI, take a comprehensive approach that includes both cash flow and potential appreciation. Using tools like cap rate, cash-on-cash return, and internal rate of return can help you evaluate potential investment opportunities and determine which properties are likely to provide the best return on your investment.

Remember that real estate investing is a long-term game. Building a successful real estate portfolio takes time, effort, and patience. You can build a successful and profitable real estate investment portfolio by carefully evaluating potential properties, using sound investment strategies, and staying up-to-date on market trends and regulations.

#investing in real estate#real estate investment#real estate investors#real estate syndication#best ROI in real estate

0 notes

Text

Pay Attention! Top 10 Market Place to Invest in Real Estate 2023

Real estate investing can be a lucrative venture as long as you know where to put your money. But given the current state of the real estate market, it can be hard to know which places are best to invest in. That's why we're here to help.

In this blog, we've explored the top 10 marketplaces for investing in real estate in 2023. We'll take a look at historical trends, industry projections, and other factors to give you an idea of where to invest your money for the highest returns. So if you're ready to get into real estate and make some serious cash, read on.

How to Choose the A Suitable Location to Invest in Real Estate?

The first step to take when considering investing in real estate is to choose the right location. This can be a difficult task, as there are different things to consider when it comes to finding the perfect location for your investment.

One of the crucial aspects to consider when choosing a location for your real estate investment is the potential return on investment (ROI). The ROI is the amount of money you can expect to make from your investment, and it will vary depending on the location you choose.

Another critical factor to consider when choosing a location for your real estate investment is the level of risk involved. Some areas are riskier than others, and you will need to carefully consider the risks before making your decision. Once you have considered these factors, you will be able to narrow down your options and choose the best location for your real estate investment.

Top 10 Markets Place to Invest in Real Estate 2023

If you're seeking to invest in real estate, there are a number of marketplaces to consider. Here are the top 10 marketplaces to invest in real estate in 2023:

1. Boise, Idaho

For investing in real estate, Boise, Idaho, is a great option. The city has a strong economy and is proliferating, making it an excellent place to invest in both commercial and residential property.

The market for both buying and selling property is very active in Boise, so you should be able to find a good deal on the type of property you're interested in. And, because the city is snowballing, there is a good chance that your investment will appreciate in value over time.

So, if you're thinking about investing in real estate, Boise is definitely worth considering. With its strong economy and population growth, it's a market that offers both buyers and sellers plenty of opportunity.

2. Orlando, Florida

Orlando, Florida, is one of the top marketplaces to invest in real estate. The city offers a great climate, a strong job market, and a high quality of life- all of which make it an attractive destination for both home buyers and renters.

The median home value in Orlando is $253,000, which is a bit higher than the national average. However, the cost of living in the city is also relatively high. The average rent for a single-bedroom apartment is $1,200 per month.

Despite the higher costs, Orlando is still a very desirable place to live. The city has a strong job market with plenty of opportunities for career growth. Additionally, Orlando is home to some of the best schools in the state of Florida.

If you wish to invest in a property in a growing city with plenty of amenities, then Orlando is a good choice to include in your list.

3. Charlotte, North Carolina

You also can for Charlotte, North Carolina! This city is consistently ranked as one of the best places to live in the United States, and its strong economy and population growth make it a great place to invest in real estate.

There are many different types of properties available in Charlotte, from luxury homes to more affordable options, so there's something for everyone. The city is the abode of a number of major corporations, which can provide stable rental income for investors.

If you're thinking about investing in Charlotte, then be sure to do your research and work with a knowledgeable local agent. With the right property, Charlotte can be a very lucrative market for investors!

4. Houston, Texas

Houston is one of the most populous cities in the United States, and it is also the largest city in Texas. The Houston real estate market has been booming in recent years as the city has attracted new businesses and residents. The median home price in Houston is $205,000, which is much lower than other major metropolitan areas such as New York City or Los Angeles.

The city of Houston has a strong economy, and it is home to many Fortune 500 companies. The unemployment rate in Houston is below the national average, and job growth has been strong in recent years. The population of Houston is expected to continue to grow in the coming years, which will likely lead to further increases in home prices.

For real estate investment Houston is an excellent choice. The city offers affordable housing, a strong economy, and plenty of opportunities for growth.

5. Dallas, Texas

Dallas, Texas, is a great place to invest in real estate. The market is strong, and there are plenty of opportunities for growth. The city is also very livable, with a lower cost of living & a high quality of life.

It has a growing economy, with many new businesses and industries moving into the area. This provides lots of job opportunities, which helps to attract new residents to the city. The housing market in Dallas is very affordable, especially when compared to other major metropolitan areas. There are many different types of homes available, so you can find a building that fits your budget and needs.

The Dallas real estate market is expected to continue growing in the coming years, so now is a great time to invest. If you're looking for a profitable market to invest in, Dallas should definitely be at the top of your list.

6. Las Vegas, Nevada

The desert oasis of Las Vegas is among the popular places to invest in real estate. The city is constantly growing, with new construction and development happening all the time. There are many different types of properties available for investment, from single-family homes to high-rise condominiums.

The Las Vegas housing market has been very stable in recent years, making it a safe place to invest. Prices have been slowly rising, giving investors good potential for a return on their investment. The city is also very popular with renters, so there is always a high demand for rental properties. If you're looking for a market with good potential for growth and income, Las Vegas is an exciting place to invest in real estate.

7. Atlanta, Georgia

Atlanta, Georgia, is a bustling city full of opportunity, and there's always something new and exciting happening. From the ever-growing downtown area to the many suburban neighborhoods, there's something for everyone in Atlanta. And with the recent influx of young professionals and families moving to the city, the demand for housing is only going to continue to rise.

Whether you're looking to buy a fixer-upper and flip it for a profit or you're interested in long-term rental properties, Atlanta is a great place to invest. The median home price is still relatively affordable compared to other major cities, and there are plenty of neighborhoods that offer good potential for appreciation. With a bit of research & patience, you can find some great deals on investment properties in Atlanta.

8. Tampa, Florida

Tampa, Florida, is a great place to invest in real estate. The city has a population of over three million people and is multiplying. The median home price in Tampa is $235,000, which is affordable for many people. The job market in Tampa is strong, and the housing market is predicted to continue to grow.

There are many different neighborhoods to choose from when investing in Tampa real estate. Some of the most popular neighborhoods include Downtown Tampa, Hyde Park, and Ybor City. Each neighborhood has its own unique character, and there are plenty of properties available for sale. Whether you're seeking a fixer-upper or a brand-new home, you can find it in Tampa.

9. Spokane, Washington

Spokane, Washington, is a top market for real estate investing. The city has a strong economy, a growing population, and a low unemployment rate. Spokane is also home to many colleges and universities, which creates a demand for rental properties.

Spokane has a lot to offer investors, including a strong economy, a growing population, and a low unemployment rate. Additionally, there are many colleges and universities in the area, which creates a demand for rental properties.

10. Phoenix, Arizona

If you are searching for a sunny place to invest in real estate, Phoenix, Arizona, is the place for you! With an average of 300 sunny days per year, it is no wonder that this city is a top choice for retirees and vacationers alike.

Not only is the weather great, but the job market is vital as well. In fact, Phoenix was recently ranked among the top 10 cities for job growth by Forbes Magazine. With a growing population and a stable economy, Phoenix is a great place to invest in real estate.

The median home price in Phoenix is $215,000, which is much cheaper than other major metropolitan areas such as New York City or Los Angeles. And with interest rates still at historic lows, now is a great time to buy a home in Phoenix.

Whether you want a retirement home, a vacation property, or an investment property, Phoenix should be at the top of your list.

Conclusion:

The real estate market is constantly changing, so it's essential to be aware of the trends in order to make the best investment decisions. Doing your research and speaking with experts can help you make informed choices about where to invest. The bottom line is that there are many great opportunities for investing in real estate, whether you're looking for long-term growth or short-term profits. With careful planning and execution, you can achieve success in this dynamic market.

#real estate investment#real estate syndication#real estate investors#real estate investment software

0 notes

Text

7 Real Estate Tools That Business Owners Need to Know

Are you passionate about real estate investing? Are you looking for ways to get started or grow your business? If you answered positively to either of these questions, you should know real estate investing is an exciting way to make money and invest in the future. But it's also challenging and complicated. That's why we've listed some of the best tech resources for new and experienced real estate investors.

In this article, we have covered 7 tools for the real estate business that can help you to grow your company as an entrepreneur.

1. DealMachine

DealMachine aids investors in accomplishing it by assisting in driving leads off the market. It is a fact that not every property is listed for sale, and DealMachine helps you to receive informed prospects and convert them to investments.

DealMachine works best for BRRRR method investors, wholesalers, or investors who are looking for off–market deals. It automates the process of driving for dollars and makes it smooth to get in touch with property owners with on-demand data. Further, its list builder feature helps to build a list of motivated sellers.

2. Carrot

Real estate is a relationship-based business, and with the advent of digitalization, it is crucial growing your online presence is just as significant as your capability to personally connect. Carrot is a growing provider of websites for real estate investors with a minimum monthly fee. Carrot also allows you to customize the Logo, tagline, header image, color scheme of the website, font of the text, and text on each page.

It also allows you to choose between a few different templates and change the background image of each. Also, Carrot, you can rearrange the navigation menu. An important thing that needs to be addressed on your site is relatively simple to tweak.

3. Syndication Pro

SyndicationPro is another essential tool for real estate investors. The real estate syndication platform helps you raise capital faster and also offers robust CRM, Investment Management & Investor Portal.

The comprehensive real estate syndication software that helps manage assets via a unified investment management platform. It ascites the users to nurture leads, automate fundraising and centralize investor relations with robust and easy-to-use Investor CRM.

SyndicationPro also allows sponsors to distribute their investor earnings directly from the platform via ACH transfers and checks. It makes the investment management process much more organized and precise. Integrating ACH payments into SyndicationPro offers benefits such as saving time and reducing errors. It further provides better transparency to investors and a specialized workflow.

They are a CRM for real estate syndication that allows adding follow-up tasks and reminders for you and your team members, improving operational efficiency and better task management.

4. DealCheck

DealCheck helps to estimate repair costs and quickly forecast profits on a particular deal. It aids in quickly analyzing rentals and commercial buildings, loan terms, purchase price, and rental income and helps you observe your ROI or monthly cash flow quickly.

With DealCheck, investors can perform due diligence on BRRRR, flip, rehab projects, any rental property, multi-family, or commercial building. Also, importing property data from public records is easy.

You can check the recent sales and rental comps and create and share detailed reports. You also can compare properties against your purchase criteria and perform reverse valuation analysis to determine your highest offer to the seller.

5. HouseCanary

HouseCanary adds data pertinent to buying a property as an investment. It helps you to save time and money and aids you in making an intelligent investment right at your fingertips. It also offers an off-market search function, and with the feature, you can track what areas of your city have the most profitable rentals.

With House Canary, you can accelerate your business, and the technologies combine AI and image recognition to extract actionable insights from a pool of real estate information.

It has assembled the most comprehensive dataset of sophisticated machine learning models, understanding the relationships between property value drivers that can determine residential properties' current and future valuations.

6. REIPro

REIPro is a built-in platform designed to help real estate investors with lead generation and marketing endeavors. The software has become a game-changer for several real estate investors. It enables you to search for diverse types of properties, including vacant properties, bank-owned, and pre-foreclosures; also, investors can utilize this platform to create direct mailing campaigns.

With REIPRo, you can efficiently find the leads that match your needs and process your real estate transactions without switching the platform. Finding and managing leads became easier with REIPro.In addition, REI Pro helps to scrutinize your transactions with the deal analyzer feature, offering you a one-stop shop lead-generating and CRM platform dedicated to investors.

7. Call Porter

Call Porter aimed to serve investors and set up appointments. It recognizes the caller and helps offer your leads a personalized experience. Call Porter is designed to feature live answering services and offers inbound call management features for real estate investors. Its live call-answering feature offers a team of professional call center agents on standby, ready to answer all inbound calls from leads in real time.

Call Porter ensures a satisfactory experience, and the agents are familiar with real estate investing techniques like professional real estate agents would. These agents are also trained to identify a qualified lead based on the caller's tone and inquiries.

Conclusion:

Real estate is one of the most challenging commercial ventures to master. Operating a successful real estate company takes a lot of time, money, and effort. However, the right real estate state tools will not only make your real estate ventures a success, but they'll also make your work manageable. Real estate investors are lucrative at times, but having the efficient tools at your disposal is crucial to excelling in it.

#real estate syndication software#Real estate investors#real estate investments#ACH payments#real estate syndication#real estate investor software#free real estate software for investors

0 notes

Text

What Will Be the Top 3 Real Estate Fundraising Software in 2023?

Real estate deals are usually long-term and require patience and perseverance to succeed. Regarding real estate investing, capital is critical, and raising capital is often tedious. Apart from the usual challenges faced by investors, real estate financing also has its unique challenges. Here is the real estate fundraising software that comes into the scene, making the entire process of raising funds streamlined. But which are the best software programs? And what's on the horizon? With this in mind, the article has explored what we can expect from the top three real estate software solutions in 2023.

What is Real Estate Fundraising Software?

Real estate fundraising software is the platform or application that allows real estate investors to showcase their properties to potential buyers and donors to raise funds. The properties are shown as available for purchase or rental with various costs and options.

The software helps real estate investors to raise funds by:

Attracting potential buyers and donors by showcasing their properties;

Utilizing online marketing and advertising;

Re-marketing and optimizing all ads to maximize results;

Tracking results throughout the process.

Real Estate Fundraising Software is specifically designed for real estate investors to manage their fundraising campaigns. It automates the process of creating and managing fundraising campaigns so that investors don't have to do anything but let the software do the work. Real Estate Fundraising Software can be used to:

Automate the creation and management of fundraising campaigns.

Manage all aspects of a fundraising campaign, from emailing leads to follow-up calls.

Track and manage all fundraising campaign metrics, including conversion and open and close rates.

Integrate with Stripe, Paypal, and your bank account to collect payments.

Integrate with multiple CRM solutions to transfer leads into sales systems.

Features of Real Estate Fundraising Software

Real estate fundraising software is an online tool used by real estate companies to raise funds from potential investors. This software helps real estate companies with the process of managing and tracking investment funds. Some of the features of real estate fundraising software include:

Flexibility: Real estate fundraising software is flexible and customizable to suit your company's needs. You can change the layout and design of your website or create a custom template to fit your brand.

Automation: Real estate fundraising software allows you to collect pre-approved real estate funds in India through a digital route. It reduces the paperwork, hassle, and delays associated with traditional routes. They also provide a faster payment process by automating funds transfers.

Simplified Investment Process: Real estate fundraising software streamlines the collection of investment funds from potential investors. It allows you to set up an investor database, collect investment paperwork, and follow up with investors after they've made their contributions.

Reporting: Real estate fundraising software provides detailed reports on your fundraising efforts, including statistics on how much has been collected and how many investors have been contacted. You can use these reports to learn how effective your marketing campaign has been and make adjustments if necessary.

Real estate fundraising software can make your fundraising efforts effective and efficient. They can help you engage prospective donors and solicit contributions from them. There are several features that real estate fundraising software can offer you, including:

Generate leads and contacts: These software platforms provide a range of tools that can help you generate leads, capture email addresses, and create contact lists. You can use these to build your donor database and potential target contributors.

Manage donation processing: These software platforms can help you manage the donation processing process, including collecting donor information, processing payments, and following up with contributors. This can ensure that your fundraising efforts are running as smoothly as possible.

Collect campaign data: These software platforms can provide data collection tools enabling you to track the progress of your fundraiser throughout the campaign cycle. This data can inform future fundraising efforts and improve your campaign strategy.

Stay in touch with donors: These software platforms provide tools that allow you to stay in touch with your donors after the campaign ends. You can use this to follow up on donations, thank contributors for their contributions, and solicit additional contributions if necessary

Top 3 Real Estate Fundraising Software in 2023

There are a number of real estate fundraising software that are available in the market. We have explored more affordable, robust, and user-friendly over the next few years among the pool of software. These platforms expand their features and become more integrated with other fundraising tools. Furthermore, these platforms offer advanced reporting and analytics and offer the fundraisers an understanding of where their money is going and what outcome they are getting for their investment. Now let's check out the features and benefits that the top 3 real estate software offers:

SyndicationPro

SyndicationPro offers fundraising automation, and the best bet, you can collaborate with co-sponsors. The software offers co-sponsor a free account and deals that make collaboration streamlined and smooth. All sync helps save time and resources, enabling you to raise capital and find qualified investors, and automating the entire fundraising process. Leveraging the software, anonymity is maintained, the date is centralized, and it makes communication easier and helps you to stay organized.

Besides, Syndication pro due diligence is easy as the software allows you investor accreditation. The accreditation process is simpler and faster than ever before, and the entire verification process is typically done within two business days.

With the easy-to-follow fundraising workflow, you can identify serious investors. The eSign functionality allows you to add multi-parties on each side of the deal and add a countersign option.

SyndicationPro, the automated workflows free up your schedule to focus on the business core. It reduces anywhere between manual work and raising capital. It is an efficient real estate fundraising software that delivers the tools needed to raise capital faster in one unified platform; you also can leverage the ACH payment features.

Juniper Square