#real estate private equity

Text

Real Estate Private Equity | Strataprop

Real Estate Private Equity: Unlocking Opportunities in the Property Market

Real estate private equity has emerged as a powerful investment vehicle, offering investors an attractive opportunity to capitalize on the potential of the property market. With its focus on acquiring, managing, and developing real estate assets, private equity firms bring a unique blend of financial expertise and industry knowledge to create value for their investors. Through this specialized approach, real estate private equity firms can unlock hidden opportunities that traditional investment vehicles may overlook.

Investing in real estate through private equity offers several key advantages. Firstly, it allows investors to diversify their portfolios beyond stocks and bonds, providing exposure to an alternative asset class that tends to have lower correlation with other investments. Additionally, real estate private equity offers potential for higher returns compared to more conventional investment options due to its active management style and ability to identify undervalued properties.

https://strataprop.com/contact-us

Address - Pune - 6th Floor, The Kode, Baner-Pashan Link Road, Pune, Maharashtra 411021

Bengaluru - 6/1-1, Museum Rd, Shanthala Nagar, Ashok Nagar, Bengaluru, Karnataka 560001

Mumbai - Parinee Crescenzo 10th Floor - B Wing, Bandra Kurla Complex, Mumbai, Maharashtra 400051

1 note

·

View note

Text

A Comprehensive Handbook for Investing in Real Estate through Private Equity

Real estate has long been a favored asset class for investors seeking stable returns and long-term wealth creation. However, navigating the intricacies of the real estate market is challenging- especially when it comes to accessing investment opportunities and managing risks effectively.

Private equity has emerged as a powerful tool for investors looking to capitalize on the potential of the real estate market.

Are you, too, looking to dive into real estate investing through private equity but need to know how?

Private equity is an investment where individuals or organizations pool their capital to buy private company ownership. The goal is to generate and create large returns through active management and eventual sale or Initial Public Offering (IPO).

In this blog, we're going to delve deeper into investing through private equity and walk you through each step of the process of finding the ideal private equity real estate fund. Let's read on:

What Makes Private Equity Unique?

Illiquid nature: Investments are typically held for several years, providing long-term growth opportunities.

Limited partnership structure: Investors become limited partners, entrusting the management to the general partner, who makes investment decisions.

Active management approach: Private equity firms actively participate in the operational and strategic aspects of real estate investments.

Long-term investment strategy: Private equity involves holding investments for 5-10 years or more.

Types of Private Equity Firms and Structures

Traditional private equity firms - These firms invest in various industries, including real estate, alongside other sectors. They may have dedicated real estate divisions or teams specializing in real estate investments.

Real estate-focused private equity firms - These firms exclusively focus on real estate investments and possess in-depth knowledge and expertise in the sector. They may have different strategies, such as opportunistic, value-add, or core investments.

Real estate investment trusts (REITs) - REITs are publicly traded companies that own and operate income-generating properties. They offer a way for individual investors to participate in real estate through publicly traded securities.

Steps to Invest in Real Estate through Private Equity

1. Unraveling the Fund's Costs and Investment Structure

Private equity real estate funds typically have a two-tiered structure comprising:

A general partner (GP): The GP manages the fund and makes investment decisions,

Limited partners (LPs): The LPs provide the capital.

The costs associated with private equity real estate funds can include management fees, performance fees (carried interest), and various expenses related to acquisitions, asset management, and divestments.

Understanding these costs and evaluating their potential impact on your investment returns is crucial.

2. Exploring Different Private Equity Real Estate Strategies

Now that we've covered the fundamentals let's explore the different strategies employed by private equity real estate funds:

Value-Added Strategy: This strategy involves acquiring properties that have the potential to be improved. Picture it as turning rough diamonds into sparkling gems. These properties may be underperforming assets or properties that need to be renovated and yield long-term results. The fund aims to increase the value of these properties through active management and targeted improvements. Ultimately, the fund hopes to sell the properties at a higher price than it paid for them.

Core Strategy: If you're looking into stability and consistent income, this is your strategy. Core funds invest in stable, income-generating properties that are typically well-established and located in prime locations. These funds offer low risk and steady cash flow, making them a good option for conservative investors looking for long-term stability.

Opportunistic Strategy: Lastly, if you're up for adventure and seeking higher-risk opportunities, this is your way to go! Opportunistic funds invest in assets that offer the potential for high returns but also carry higher risk. These funds typically focus on distressed assets, development projects, or markets with favorable growth prospects. Opportunistic funds require active management and typically have a longer investment horizon.

3. Conduct Investment Analysis

Performing a comprehensive investment analysis is essential when considering real estate investments through private equity. Here's how to approach this process:

Financial modeling and projections involve constructing a detailed financial model that forecasts potential cash flows, expenses, and returns over the investment's lifespan. This allows investors to assess the investment's profitability and determine its viability within their portfolio.

Evaluating investment returns and cash flow potential entails analyzing metrics such as internal rate of return (IRR), cash-on-cash return, and net operating income (NOI). This assessment helps gauge the investment's ability to generate consistent income and achieve target returns.

Assessing the risk-reward profile involves considering the potential risks associated with the investment, such as market volatility, regulatory changes, or property-specific risks. Performing sensitivity analysis enables investors to understand how variations in key assumptions impact the investment's performance.

Comparing the investment opportunity against established criteria involves benchmarking the investment against predetermined metrics and criteria. This ensures alignment with investment goals, risk tolerance, and return expectations, enabling investors to make informed decisions.

By diligently conducting investment analysis, investors can gain valuable insights into the financial viability, risk exposure, and alignment with their investment objectives, allowing them to make well-informed investment decisions in the realm of real estate private equity.

4. Embracing Risks and Considering the Long-Term Outlook

Investing in private equity real estate funds can be a rewarding experience, but it is essential to be aware of the challenges and risks involved. These funds are subject to market volatility, economic cycles, regulatory changes, and liquidity concerns.

However, by carefully assessing these risks and aligning your investment strategy with your long-term goals, you can mitigate potential downsides and increase your chances of success.

5. Decide the Exit Strategy

Crafting a well-defined exit strategy is a crucial aspect of real estate investment through private equity.

Define exit goals and timeline, establish a clear vision for the investment's lifespan and the desired time frame for exiting the property. This helps align the exit strategy with the investor's objectives and overall portfolio strategy.

Evaluate market conditions and potential exit avenues, conduct thorough analysis of the real estate market, including supply and demand dynamics, pricing trends, and investor sentiment. This assessment helps identify the most favorable market conditions and available exit options, such as selling the property, refinancing, or recapitalization.

Executing the exit strategy entails implementing the chosen exit avenue, whether it be listing the property for sale, engaging with potential buyers or real estate investors, negotiating terms, or refinancing the property to extract equity. This step aims to maximize returns and achieve the desired exit outcome.

The Takeaway

To wrap it all up, investing in real estate through private equity can be a lucrative venture. It allows you to diversify your portfolio and capitalize on the ever-growing real estate market.

Of course, no investment comes without risks. Economic cycles can affect property values, and the real estate market can be unpredictable, along with challenges coming from regulatory adjustments and liquidity issues.

However, you can overcome these challenges by carefully evaluating the risks and matching your investment approach with long-term objectives.

Just remember to do your due diligence, consult financial advisors, and stay informed about market trends and developments.

#investing in real estate#invest in private equity real estate#real estate private equity#private equity real estate fund#real estate syndication

0 notes

Text

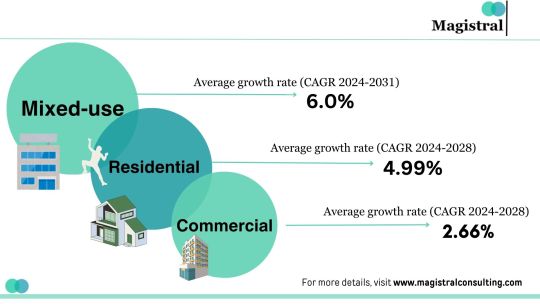

However, before you dive deep into commercial real estate investments and start investing, you need to understand the kind of real estate investments that are there and what makes the perfect fit for you. Taking interest in Real Estate Private Equity funds can be a game changer for you.

#real estate private equity#tenant improvement contractors#renovation companies near me#residential remodeling contractors near me

0 notes

Link

#banking#resurgentindia#corporate finance#Financial Advisory#Financial Services#real estate#real estate private equity#business valuation#due diligence report#Debt Syndication#TEV & LIE REPORT#investment banking firm#private equity#Private equity firm#startup valuation#pitch deck#intellectual property valuation#property valuation

0 notes

Text

2 notes

·

View notes

Text

Thebrief’s key findings are:

In FY 2022, public pension plans experienced negative asset returns, and some say it could have been even worse without alternative investments.

But the real question is have alternatives (private equity, hedge funds, real estate, and commodities) helped or hurt over the long term?

The results suggest that, from 2001-2022, alternatives have not helped overall returns – although they may have reduced volatility.

7 notes

·

View notes

Text

Banking Law Experts

Saraf and Partners, a distinguished banking & finance law firm, comprises experts in banking law who provide tailored solutions to clients' financial needs. Their in-depth knowledge and experience establish them as the foremost banking and finance lawyers.

#Top law firm in Delhi#Top law firm in India#Banking and finance lawyers#M&A law firm#Private equity law firm#Real Estate Law Firm#Real estate lawyers#legal services#Top law firm in Mumbai#Top lawyers in Mumbai

0 notes

Text

Elite Private Equity Firms with Proven Real Estate Investment Strategies

#outsourcing#real estate management#private equity#maximizereturns#longterminvesting#industry analysis#risk management

0 notes

Text

Sortis.com is the official website of Sortis Capital, offering exclusive access to private, diversified real estate investment opportunities. The site details their investment funds, including the Sortis Income Fund, Sortis REIT, and others, focusing on providing stable, high-yielding fixed-income returns, and diversified asset portfolios for investors. It emphasizes Sortis' expertise in real estate, private equity, lending, and advisory services, aiming to generate excellent risk-adjusted yields and support economic growth through strategic investments. The website underlines the company's commitment to integrity, service, and achieving results for its clients.

#Investment#Real Estate#Private Equity#Income Fund#REIT#Fixed-Income Returns#Diversified Portfolio#Advisory Services#Financial Growth#Integrity

0 notes

Text

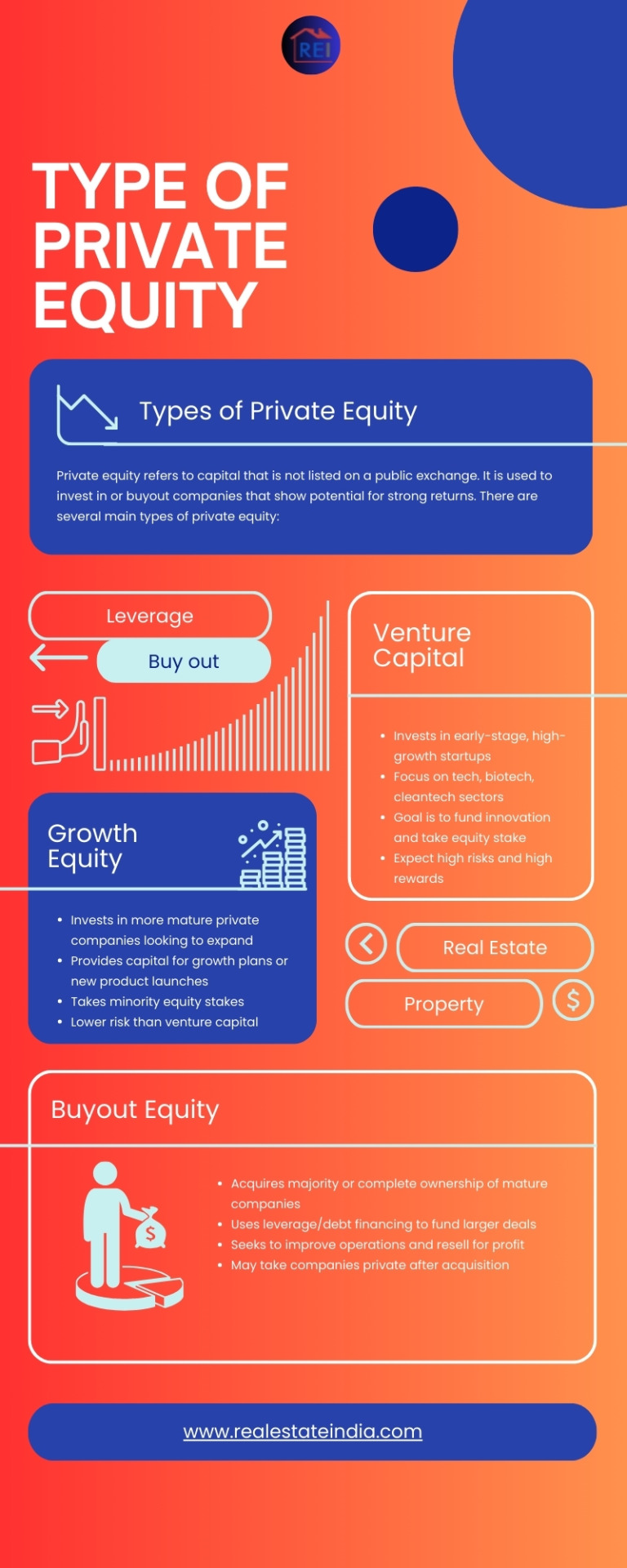

Private equity provides financing to companies not listed on public exchanges, but not all PE is the same. This infographic outlines the four main types of private equity—venture capital, growth equity, buyouts, and distressed PE—to understand their key differences.

source - https://www.realestateindia.com/

0 notes

Text

https://tridentwealthadvisors.com/new-trends-in-commercial-real-estate-private-equity-2024/

Beyond Towers and Tenants: Unveiling New Trends in Commercial Real Estate Private Equity (2024)

Introduction: 2024 Commercial Real Estate Private Equity (CRE PE)

Forget dusty spreadsheets and predictable office leases! The commercial real estate game is changing faster than a barista whips up a latte. We’re talking AI-powered warehouses, co-working havens for nomads, and logistics empires built on drones. Buckle up, investors, because this post dives into the hottest trends reshaping the landscape of Commercial Real Estate Private Equity (CRE PE) in 2024.

0 notes

Text

The real estate market has been booming in recent years. The concept of Real Estate Private Equity funds has become popular among investors as they have great potential for returns. To begin with, real estate private equity investments involve a firm pooling capital from investors on the outside, and then the same capital is used for acquiring and developing properties for a short span before selling them.

0 notes

Text

#commercial real estate investment#alternative investments platform#VC investors#private equity investors#industrial investing

0 notes

Text

#preferred return real estate#preferred return guaranteed payments#Private Real Estate Investing#what is a preferred return#preferred rate of return#preferred return private equity#preferred returns in real estate

0 notes

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

5K notes

·

View notes

Text

How Real Estate Equity Investors Are Driving Innovation And Growth In The Industry?

Investing in Real Estate Equity: Real estate equity investors are individuals or entities who allocate capital into real estate assets, such as residential or commercial properties, with the goal of generating returns through property appreciation and rental income.

Diverse Investment Strategies: Real estate equity investors employ various strategies, including direct property ownership, real estate investment trusts (REITs), or participation in real estate partnerships. Each strategy offers unique advantages and risk profiles.

Risk and Reward: Real estate equity investing can offer potential for long-term wealth accumulation, but it also carries inherent risks, such as market fluctuations, property management challenges, and economic downturns. Diversification and due diligence are essential for mitigating these risks.

Building Wealth and Income: For many investors, real estate equity serves as a way to build wealth over time and create a source of passive income through rental properties or dividend payments from REITs, making it a popular choice within the broader investment landscape.

#the owl house#succession#entrepreneurial firm#Equity Capital Raise Business#Real Estate and Private Equity deals

0 notes