#$JBHT

Explore tagged Tumblr posts

Text

5 Trade Ideas for Monday: Ally, Bristol-Myers, Comerica, eBay and JB Hunt

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Ally Financial, Ticker: $ALLY

Ally Financial, $ALLY, comes into the week at resistance. The RSI is in the bullish zone with the MACD positive and rising. Look for a push over resistance to participate…..

Bristol-Myers Squibb, Ticker: $BMY

Bristol-Myers Squibb, $BMY, comes into the week at resistance. It has a RSI in the bullish zone with the MACD crossing up and positive. Look for a push over resistance to participate…..

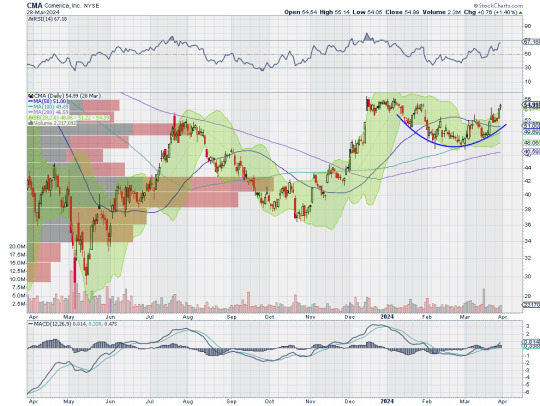

Comerica, Ticker: $CMA

Comerica, $CMA, comes into the week moving higher. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…..

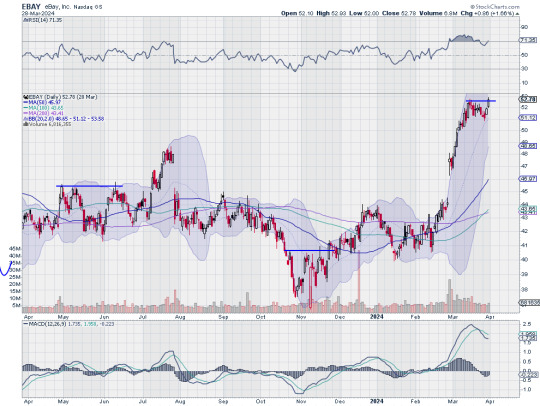

eBay, Ticker: $EBAY

eBay, $EBAY, comes into the week breaking resistance. It has a RSI is the bullish zone with the MACD crossed down but positive. Look for continuation to participate…..

JB Hunt Transport Services, Ticker: $JBHT

JB Hunt Transport Services, $JBHT, comes into the week approaching resistance. It has a RSI at the midline with the MACD negative and crossing up. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the First Quarter of the year in the books, saw equity markets exhibited strength.

Elsewhere look for Gold to continue its uptrend while Crude Oil builds on its move higher. The US Dollar Index continues to drift to the upside in consolidation while US Treasuries consolidate in their downtrend. The Shanghai Composite looks to reverse the short term uptrend while Emerging Markets consolidate in a broad range.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong, especially the SPY on both timeframes. The QQQ is showing some momentum divergence that could lead to more consolidation or a pullback while the IWM looks top step up as it breaks to 2 year highs. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

Explore J.B. Hunt Transport Services stock forecast for 2025–2029, with price targets up to $449.35. Learn about its operations and policy #JBHuntTransport #JBHT #JBHTstockprice #Transportationstocks #Stockpriceforecast #Dividendstocks #Stockbuybacks #Intermodal #logistics #Investmentopportunities #Stockmarketanalysis

#Best logistics stocks to buy 2025#Dividend Stocks#Freight transportation#Intermodal logistics#Investment#Investment Insights#Investment Opportunities#Is JBHT a good stock to buy now#J.B. Hunt dividend yield 2025#J.B. Hunt financial performance 2024#J.B. Hunt share buyback program#J.B. Hunt stock#J.B. Hunt stock price forecast 2025–2029#JB Hunt Transport#JBHT#JBHT stock price#JBHT stock price target 2029#JBHT stock support level $120#stock buybacks#Stock Forecast#Stock Insights#Stock market analysis#Stock Price Forecast#Transportation stock investment tips#Transportation stocks#Why invest in J.B. Hunt stock

1 note

·

View note

Text

Deterioration in Earnings per Share by -23.67 % at JBHT over the October to December 31 2023 time-frame https://csimarket.com/stocks/news.php?code=JBHT&date=2024-02-24154649&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Earnings Ahead: JPM, BAC, C, GS, TSM, UNH and More (NYSE:BAC)

Jan. 12, 2025 8:01 AM ETBMI, WIT, INFY, BAC, JPM, GS, C, VOXX, KBH, TSM, UNH, FAST, SLB, AEHR, MS, SNV, WFC, USB, IIIN, BK, WABC, MTB, HOMB, PKE, RMCF, RF, WAFD, STT, PNC, INC, JBHT, TCBI, MFA, NVEC, TFC, FULL, EDUC, CVGW, WBS, PNFP, UNTY, CPHC, RFIL, ROIC, JCTC, ANIX, APLD, BSVN, SOTK, NTRP, CFG, BL, FNGR, OZK, VMAR, GATO, BARK, CNXC, CARO, EEIQ, PSNY, TPET, PAPL, HOVER, ROE, BLK, TTANAuthor:…

0 notes

Text

Earnings Ahead: JPM, BAC, C, GS, TSM, UNH and More (NYSE:BAC)

Jan. 12, 2025 8:01 AM ETBMI, WIT, INFY, BAC, JPM, GS, C, VOXX, KBH, TSM, UNH, FAST, SLB, AEHR, MS, SNV, WFC, USB, IIIN, BK, WABC, MTB, HOMB, PKE, RMCF, RF, WAFD, STT, PNC, INC, JBHT, TCBI, MFA, NVEC, TFC, FULL, EDUC, CVGW, WBS, PNFP, UNTY, CPHC, RFIL, ROIC, JCTC, ANIX, APLD, BSVN, SOTK, NTRP, CFG, BL, FNGR, OZK, VMAR, GATO, BARK, CNXC, CARO, EEIQ, PSNY, TPET, PAPL, HOVER, ROE, BLK, TTANAuthor:…

0 notes

Text

$JBHT: J.B. Hunt (JBHT) gets a Positive upgrade with a $200 target, reflecting growing optimism in intermodal recovery.

0 notes

Text

Rebel's Edge April 17 UAL VNDA JBHT ASML

Rebel's Edge 1pm line up: Biden wants to triple China tariffs on steel, aluminum imports Silver hits multi-year highs! $UAL $VNDA $JBHT $ASML Sports @petenajarian Olympic Amateurs should they be paid?

Check out this episode!

0 notes

Text

[ad_1] Railroad big CSX Corp. on Thursday stated it anticipated the subdued delivery developments it noticed within the third quarter to proceed for the remainder of the yr, as retailers keep cautious on the gadgets they get shipped to their warehouses and shops. Executives made these remarks to debate combined third-quarter outcomes for the corporate, whose rail traces cowl a lot of the jap U.S. They usually comply with what one analyst stated had been “low expectations” for the rail business, as greater costs for important items go away much less room for client spending on different merchandise that will get shipped by rail. “Retailers stay involved concerning the well being of the patron, and although destocking could have slowed, we haven’t seen this flip into sustained will increase so as charges or imports,” Chief Business Officer Kevin Boone stated on CSX’s CSX, -0.42% earnings name. Nevertheless, he stated he noticed the corporate’s home enterprise “progressively strengthening” for the remainder of the yr. The shift in demand final yr towards fundamentals left retailers caught with warehouses and stockrooms filled with issues like clothes, TVs and electronics that they couldn’t promote with out chopping costs. Since then, shops have been extra conservative on what they order and have shipped. Trucking and transport-services supplier J.B. Hunt Transport Inc. JBHT, +0.08% on Tuesday said that while there were signs of positive trends, “we aren't at some extent but to say we’re out of the freight recession.” CSX reported third-quarter web earnings of $846 million, or 42 cents a share, in contrast with $1.11 billion, or 52 cents a share, in the identical quarter final yr. Income fell to $3.57 billion from $3.89 billion within the prior-year quarter. Analysts polled by FactSet anticipated CSX to report adjusted earnings of 43 cents a share on income of $3.55 billion. Gross sales had been hit by less-frequent connections with different types of transportation to haul items to completely different places. These connections, generally known as “intermodal” shipments, remained “challenged,” Chief Govt Joe Hinrichs stated in an announcement. The corporate shipped extra coal, however coal costs fell, it stated. Nevertheless, it additionally reported “strong positive factors in merchandise pricing.” And through the name, it stated it had been “profitable in changing site visitors off the freeway in a market dealing with plentiful truck capability.” Rails and vehicles compete for shipments, with the latter dealing with a downturn in demand and costs, leaving extra trailers ready to be stuffed. Shares of CSX fell 0.9% in after-hours commerce. CSX reported outcomes after its western U.S. counterpart, Union Pacific Corp. UNP, +2.14%, put up a third-quarter profit that topped analysts’ expectations, regardless of a lower in railcar shipments and “continued inflationary pressures.” Citi analyst Christian Wetherbee stated Union Pacific’s outcomes marked a “strong begin to rail earnings towards low expectations.” The outcomes for each rail carriers arrive because the delivery business tries to rebound after supply-chain disruptions through the pandemic, after a surge in on-line shopping for caught the world’s distribution networks off-guard and drove costs and income greater. Issues since have additionally grown over rail security, following Norfolk Southern’s NSC, -1.65% derailment in Ohio earlier this yr, and rail service, after years of chopping prices and guarding income led to longer cargo instances. Main rail operators say they’re making an attempt to employees up and enhance service. However after a rail-worker strike was averted final yr, labor tensions have lingered via this yr as rail operators and unions tried to resolve variations over day off and sick go away, which employees stated was deeply inadequate.

Forward of the earnings, CSX on Thursday introduced the ratification of a paid sick go away settlement with a railroad signalmen union that coated almost 400 workers. BofA analysts final month upgraded CSX shares to a purchase, after the corporate named Mike Cory, an business veteran, as chief working officer. The analysts stated Cory was an operations protégé of Hunter Harrison, a rail government, generally known as an business turnaround artist, together with at CSX. Shares of CSX are up 2% to date this yr. [ad_2]

0 notes

Text

5 Trade Ideas for Monday: Adobe, Graco, JB Hunt, Lennar and Target

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Adobe, Ticker: $ADBE

Adobe, $ADBE, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive and rising. Look for a push over resistance to participate…..

Graco, Ticker: $GGG

Graco, $GGG, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive and rising. Look for a push over resistance to participate…..

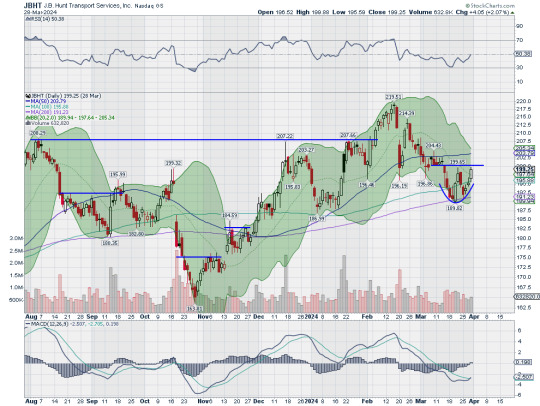

JB Hunt Transport, Ticker: $JBHT

JB Hunt Transport, $JBHT, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

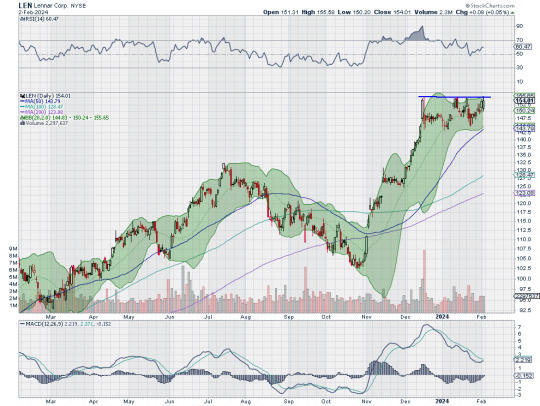

Lennar, Ticker: $LEN

Lennar, $LEN, comes into the week at resistance. It has a RSI in the bullish zone with a MACD positive. Look for a push over resistance to participate…..

Target, Ticker: $TGT

Target, $TGT, comes into the week breaking resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into February, sees Punxsutawney Phil is calling for the weather to get warmer and equity markets are looking downright hot.

Elsewhere look for Gold to continue the short term consolidation while Crude Oil falls back into consolidation. The US Dollar Index continues to drift to the upside in consolidation while US Treasuries consolidate after a pullback. The Shanghai Composite looks to continue the downtrend while Emerging Markets consolidate over support.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY have reset on momentum measures are now also better to the upside. The IWM continues to blaze its own trail, remaining in the 22 month channel. Use this information as you prepare for the coming week and trad’em well.

1 note

·

View note

Link

4 notes

·

View notes

Text

Subdued'Revenue'Performance'for'J'B''Hunt'Transport'Services'Inc''During'Q'''''''Earnings'Season $JBHT #Transport and Logistics #Nasdaq

A Closer Examination of Q2 Results Reveals Challenges in Meeting Growth Expectations J.B. Hunt Transport Services Inc.: Analyzing Q2 2024 Financial Performance and Market Position In the recent quarterly report covering the period from April to June 30, 2024, J.B. Hunt Transport Services Inc. (NASDAQ: JBHT) showcased a mixed financial performance, with notable declines in earnings per share (EPS) and revenue, while also exhibiting resilience in certain operational metrics. This article delves into the key

0 notes

Text

J.B. Hunt: Economic Contraction And A Buying Opportunity

J.B. Hunt (NASDAQ: JBHT) didn’t have a horrible quarter, but it did miss the consensus estimates on a combination of factors, which is terrible news for the broad economy. The combination of higher prices and rising interest rates produced a larger-than-expected decline in demand that impacted pricing and leverage. This is a dual headwind for the company and the economy, suggesting a broad…

View On WordPress

0 notes

Text

$JBHT: J.B. Hunt (JBHT) sees brighter days ahead with an upgrade to Positive, anticipating profit recovery by 2026.

0 notes

Text

JB Hunt Transport Services Inc. (JBHT) Q1 2023 Earnings Call Transcript

JB Hunt Transport Services Inc. (NASDAQ: JBHT) Q1 2023 earnings call dated Apr. 17, 2023 Corporate Participants: Brad Delco — Senior Vice President, Finance John N. Roberts, III — President, Chief Executive Officer Shelley Simpson — Chief Commercial Officer Executive Vice President, People and Human Resources John Kuhlow — Chief Financial Officer Executive Vice President Darren Field — President,…

View On WordPress

0 notes

Text

Continua la temporada de resultados

Continua la temporada de resultados

Continua la temporada de resultados. #earningsseason $TSLA $AAPL $AMD $FB $BAC $NFLX $MSFT $AMZN $PYPL $HAL $CLF $SCHW $XOM $GOOGL $JNJ $AAL $CL $SNAP $BK $T $SOFI $TWTR $UPS $LMT $F $INTC $NUE $UPST $BA $IBM $PG $AA $VZ $SQ $SHOP $JBHT $CVX $ASML $UAL $ROKU $QCOM $DIS $PFE $SYF $KO $SI Recuerden, ¡La mejor inversión es aquella que se realiza en formación! Equipo de MM CAPITAL Por favor…

View On WordPress

0 notes