#2290 VIN correction

Photo

Hello truckers! If you haven’t e-filed form 2290 HVUT for this tax season yet. E-file form 2290 at Tax2290.com and reduce your penalties today!

0 notes

Text

How to Amend IRS Form 2290 Online

"Step-by-Step Guide to Amending Form 2290 Online with Truck2290.com:

Login & Select Amendment Type: Sign in and choose the amendment type needed.

Enter VIN & Tax Details: Update vehicle identification number (VIN) and tax information.

Review & Submit: Review your entries, make necessary corrections, and submit for IRS approval."

0 notes

Text

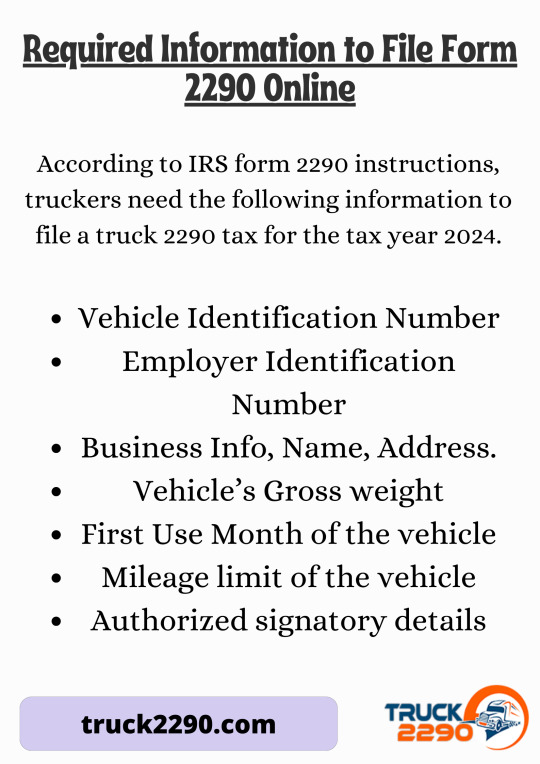

Required Information to File Form 2290 Online

Filing a 2290 tax form for the 2024 tax year is easy with Truck2290. Here, you will get assistance such as accurate tax calculations, free VIN correction, accessibility from anywhere, the ability to upload multiple VINs at once, and you will receive the instant schedule 1 proof in minutes.

0 notes

Text

It is July and Form 2290 is DUE

It is July & #Form2290 is DUE. Electronic filing with @Tax2290 is "The Best". Access our website and eFile 2290 with a discount, apply code "FREEDOM" and avail 10% flat off on your fee. Come and join us in the 4th of July Celebrations!!! #trucking #truckers #tax2290 #2290tax

The Federal Vehicle Use Tax Form 2290, reported by July and August of the Tax Year is now due for the Tax Year 2019 – 2020. E-filing to report and pay the Federal Vehicle Use Tax Return is for all Truckers, irrespective of your business type and size. Owner Operators or Independent Truckers, Small and Medium Size Trucking Companies, Mom & Pop Truckers, Trucking Corporate etc. can use Tax2290.comt…

View On WordPress

#2290 excise tax e-file#2290 tax#2290 tax efile#2290 tax online#2290 VIN correction#e file 2290 tax#e-file for form 2290 excise tax filers#excise tax form 2290#Form 2290#Form 2290 amendments#Form 2290 claims#Form 2290 e file#form 2290 online#heavy duty tax form 2290#Heavy vehicle use tax#How to e-file form 2290?#HVUT online#hvut tax form 2290#IRS form 2290 efile#IRS tax form 2290#tax 2290 e-file#tax e file 2290#tax form 2290 due date#tax form 2290 e file#tax form 2290 instructions#tax form 2290 online#Truck Tax Form 2290#Truck tax online#what is form 2290#when is tax form 2290 due

0 notes

Text

IRS 2290 VIN Correction

If you own a vehicle weighing 55,000 pounds or above on the weight scale, you need to file form 2290

and pay your HVUT return. You can file your IRS 2290 form by logging on to an IRS authorized e-file provider.

When filing form 2290, one of the common errors people make is entering incorrect VIN. So, if you have filed your form with an incorrect VIN, we have got you covered. In this article, we break down the steps you need to take to file for VIN correction.

VIN Correction: What You Need to Know

If you have entered an incorrect VIN in your previously filed form 2290, you must file an amended return to make the VIN correction. To correct your VIN, you must provide your previously reported VIN and the correct VIN.

You can carry out a VIN correction both online and manually. However, e-filing your VIN correction would be a much faster and easier option. With e-filing, you will receive your new Schedule 1 copy within minutes.

How to Make VIN Correction Online

You can follow the below instructions to make VIN corrections online.

Log in to your e-file service provider.

Click on the box that says ‘make an amendment.'

Provide your business details and fill in any other required information.

Select the tax period for which you want to make a correction and mention if this is your final return.

Select free VIN correction.

Enter the reference number and correct VIN details.

Next, submit the form.

You will receive your new Schedule 1 copy with the corrected VIN.

How to Make VIN Correction Manually

If you want to file for VIN correction manually, follow the instructions:

Obtain form 2290 from your local tax office or download one from the IRS website.

Add details such as name, address, and EIN.

Tick mark the ‘VIN correction’ box.

Mention the corrected VIN on Schedule 1.

Provide a statement with a VIN correction explanation.

Mail the form to

Internal Revenue Service,

P.O. Box 932500,

Louisville, KY 40293-2500.

If you need to get your Schedule 1 copy instantly, it is best to e file 2290 your amended return for VIN correction. Moreover, certain e-file service providers offer free VIN corrections if filed through their platform.

File Form 2290 To Avoid Penalties

Filing your IRS 2290 form is important to stay away from IRS penalties. The IRS monitors the collection of IRS HVUT very carefully. You will receive notifications if you haven’t made the tax payment before the due date.

You should, however, ensure that you have paid all the tax payments before the due date so that you don’t incur any late-filing penalties from the IRS.

Filing your truck tax is your moral responsibility as a trucker. Since the money collected through IRS HVUT is also used for the upkeep of highways, truck operators are the biggest beneficiaries of the service they get alongside the highways.

In Conclusion

If you have entered an incorrect VIN, you can follow the aforementioned instructions to make VIN corrections online or manually. However, to make filing hassle-free, make sure that you double-check the data entered on your form to avoid any errors for future filing.

0 notes

Text

All About Form 2290

Form 2290 is an IRS tax levied on the truck owners. This is an annual tax collected by the IRS. Trucks that weigh 55,000 pounds or more and used for 5,000 miles or more are subjected to this tax. The tax money is used for the construction and maintenance of highways in the US.

File Form 2290 From your State

You can file IRS HVUT from anywhere. To make the filling simple and easier, you can file the IRS HVUT with IRS-authorized e-file service providers. eForm2290 is an IRS-authorized e-file service provider with more than a decade experience.

Form 2290 Due Date

The IRS HVUT due date for the first used vehicles is the last day of the month following the first used month. For example, if you have used your vehicle for the first time in the month of October, then 30th November is the last day to file HVUT. To know more about IRS HVUT due date, please visit the official IRS site.

Form 2290 – Reasons for Rejection

There are several reasons for IRS HVUT rejection, like:

Mismatched EIN number

Missing signature

RTN rejection

Duplicate VIN or form 2290

Form 2290 Correction

Committing errors when filing IRS HVUT is common. If there are any errors that occurred during filing of IRS HVUT, you can correct it. Before submitting your form, please review it. This will help you avoid mistakes when filing IRS HVUT tax.

Most common errors that are made while filling IRS HVUT are:

Entering incorrect VIN

Typo errors

Filling in the wrong taxable gross weight

To correct these errors, you can use the IRS HVUT Amendment. Using this, you can fix any errors on IRS HVUT.

Form 2290 Amendment

For IRS HVUT, amendment implies any change to be made on the already submitted form 2290. You must pay the additional tax for the amended returns electronically.

The change or amends can be:

A change in the taxable gross weight of the vehicle

Exceeded mileage usage of suspended vehicles.

When you file 2290 amendments with eForm2290, we will expedite your form 2290 returns. Once IRS accepts the amendment, you will receive your stamped Schedule 1 copy.

Filing with eForm2290

When filing IRS HVUT with eForm2290, you just have to follow a simple process. We have made the process simpler, easier and secure. So that you can rest assured about your tax filings when you are behind the wheels. Use our IRS HVUT coupon to save on our processing fees.

1 note

·

View note

Photo

tax form 2290_efile_usa There is an automatic inspection of errors and the app also assists in averting errors in the #IRS 2023 form by utilizing auto checking. There is an immediate notification for the tax filer regarding the form status and likewise once IRS accepts form 2290. VIN error checking is free and also correction is possible with the app at times of e-filing of #form2023. Check our blog for more information. Link in bio... www.easyform2290.com

#2290form#form2290irs#Irsform2290#form2290instructions#2290formirs#form2290duedate#truckersform2290#2290irsform#efileform2290#Form8849#8849form#Irs8849form#HVUTTax

0 notes

Text

Form 2290 Due date for the tax year 2022-2023

What is Form 2290?

IRS Form 2290 is a Heavy Vehicle Use Tax (HVUT), it should be filed if you run vehicles with a taxable gross weight of 55,000 pounds or more. And also you should file 2290 tax if your vehicle exceeds 5,000 miles or 7,500 miles (for agricultural vehicles) in a tax period.

When is the Form 2290 Due date?

Form 2290 due date for 2022-2023 tax year is August 31.

Failing to file HVUT will result in penalties and interest, which is assessed on a monthly basis.

Late filers not paying HVUT will also face an additional monthly penalty.

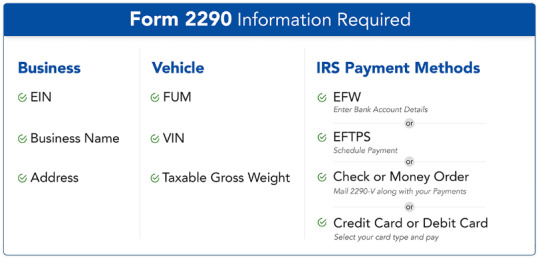

Information required to file Form 2290

Business Name, Address and Employer Identification Number (EIN).

Vehicle Identification Number (VIN), First Used Month (FUM), Taxable Gross Weight, Suspended vehicles (if any).

Review and transmit.

Benefits of filing Form 2290 with ExpressTruckTax

File Form 2290 with ExpressTruckTax, and avail several benefits such as,

Guaranteed Schedule 1 or money back

Free VIN Checker and VIN Correction

Bulk information upload

Copy last year’s return

0 notes

Video

undefined

tumblr

Form 2290 online filing for your heavy vehicle use tax is now more easy and secure with us, Authorized IRS e-file provider with VIN Corrections free. Start your form 2290 eFile for free and get schedule 1 within minutes. Call: (316) 869-0948

0 notes

Text

Step-by-Step Interactive Filing Guide for Form 2290

Filing taxes can be daunting, especially when dealing with the Heavy Vehicle Use Tax (HVUT) and Form 2290. This step-by-step guide aims to simplify the process and ensure you file your Form 2290 accurately and on time. Whether you're new to this or need a refresher, this interactive guide will walk you through each step. For a seamless experience, you can always rely on truck2290.com, which offers comprehensive support for your Form 2290 filing needs.

Step 1: Gather Necessary Information

Before you start filling out Form 2290, gather all the necessary information. This will streamline the process and reduce the risk of errors.

Required Information:

Employer Identification Number (EIN): You must have an EIN to file Form 2290. If you don't have one, apply for it well in advance.

Vehicle Identification Number (VIN): Ensure the VIN for each taxable vehicle is accurate.

Taxable Gross Weight: This is the weight of the vehicle fully equipped for service.

Step 2: Determine the Taxable Gross Weight

The taxable gross weight of your vehicle determines the tax you owe. Use the table provided by the IRS to find the correct weight category for your vehicle. This includes the weight of the vehicle when fully loaded with cargo and passengers.

Step 3: Calculate the HVUT

Using the IRS guidelines, calculate the HVUT based on your vehicle’s taxable gross weight. For multiple vehicles, calculate the tax for each one separately. For a quick and accurate calculation, try the interactive tax calculator.

Step 4: Complete Form 2290

With all your information ready, you can now complete Form 2290. Here’s a breakdown of the key sections you need to fill out:

Part I: Vehicle Information

Line 1: Enter your EIN.

Line 2: Enter the taxable period (July 1 of the current year to June 30 of the next year).

Line 3: Enter the date the vehicle was first used in the tax period.

Line 4: List each vehicle's VIN and taxable gross weight.

Part II: Tax Computation

Line 5: Calculate the tax based on the vehicle’s weight.

Line 6: Add any additional taxes for vehicles used in logging.

Line 7: Total the tax due for all vehicles.

Step 5: Choose Your Filing Method

You can file Form 2290 either electronically or by paper. E-filing is recommended for its speed and convenience, especially if you are reporting 25 or more vehicles. Truck2290.com offers an easy-to-use platform for e-filing, ensuring quick and accurate submission.

Step 6: Make the Payment

The IRS provides several payment options for the HVUT:

Electronic Funds Withdrawal (EFW): Directly from your bank account.

Electronic Federal Tax Payment System (EFTPS): Requires prior enrollment.

Credit or Debit Card: Convenient and immediate payment.

Check or Money Order: Traditional method, but slower processing.

Step 7: Submit Your Form 2290

If filing electronically, submit your Form 2290 through a trusted e-file provider like truck2290.com. If filing by paper, mail the completed form and payment to the IRS address listed on the form instructions.

Step 8: Receive Your Schedule 1

Once the IRS processes your Form 2290, you will receive a stamped Schedule 1 as proof of payment. This document is crucial for registering your vehicle with your state’s Department of Motor Vehicles (DMV).

Tips for a Smooth Filing Experience

Double-Check Information: Ensure all details, especially the VIN and EIN, are correct.

File Early: Avoid last-minute rush and potential penalties by filing well before the deadline.

Use a Reliable Service: Platforms like [truck2290.com](https://www.truck2290.com) provide support, ensuring you don’t miss any steps and your filing is accurate.

Common Mistakes to Avoid

Incorrect EIN or VIN: Always double-check these numbers for accuracy.

Wrong Weight Category: Ensure you calculate the vehicle’s weight correctly.

Late Filing: Missing the deadline can result in penalties and interest.

Conclusion

Filing Form 2290 doesn’t have to be a stressful experience. By following this step-by-step guide, you can ensure a smooth and accurate filing process. For additional support and to simplify your filing, visit [truck2290.com](https://www.truck2290.com). Their user-friendly platform and expert assistance can help you file your Form 2290 quickly and accurately, ensuring compliance and peace of mind. Happy filing!

#Form2290#Schedule1#IRS#Truck2290#form2290irs#irs#taxform2290#form2290online#2290online#2290instructions

0 notes

Text

How To Correct a VIN Error After the Deadline: Form 2290 Amendments

Correcting a VIN error post-deadline? Discover the step-by-step guide to rectify your Vehicle Identification Number mistakes efficiently. From navigating online platforms to submitting revised forms, ensure a seamless correction process for accurate records.

0 notes

Photo

Make sure your #HVUT reporting needs are met by your #Form2290 service provider. At @tax2290, you get #2290efile, Amendment, Claims, VIN Correction, Records keeping, Super fast efile, economic and affordable service. All inclusive with a real time phone, email & chat 2290 support

#Heavy Truck Tax Form 2290 efile#Heavy Truck Tax Form 2290 online#Heavy Truck Tax Form 2290 electronic filing#Heavy Truck Tax for 2021#Heavy Truck Tax eFiling for 2021#Heavy truck tax#heavy truck tax form 2290

0 notes

Photo

Benefits of Filing Form 2290 Online with eForm2290

Let me tell you some of the top advantages of e-filing your IRS Form 2290 with eform2290.

1. E-filing is fast, easy and takes only a few minutes to complete.

2. You can file from anywhere at any time and avoid long queues at the IRS office

3. You will receive your schedule 1 in a matter of minutes

4. You can reach out for support if you have doubts at any point during your filing process

5. You don’t have to worry about making filling errors as we only ask for the necessary details during e-filing

6. You can pay your HVUT tax in four different ways: EFTPS/EFW/Debit or credit card/Check or money order

7. You can file for multiple trucks and use 2290 tax calculator tool to calculate the tax amount

8. You will not miss the filing deadline as we will send you alerts when the filing deadline approaches

9. You can find out the status of your form as we provide updates via email, SMS and fax

10. If you made VIN errors, we offer free VIN correction so you can refile for no cost!

11. All your details are safe and secure as we use advanced encrypted systems to facilitate payment

12. You get the option to pre-file your form 2290 to save time and effort

13. If you’ve made errors while filing your form, you can always file an amended return with the correct information free of charge

14. You can also claim your form 2290 refund through eform2290 in a simple and hassle-free manner

15. The chat support option lets you get the best support and help if you do not wish to speak to our customer support team

2 notes

·

View notes

Link

Filing of 2290form has become simple with eform2290, You will receive Schedule1 in minutes, free VIN corrections, free mail & chat Options 24/7, Use Code ROAD20 to claim 20 % off with eform2290

0 notes

Text

Online 2290 Filing and IFTA Reporting on iTrucker

Those in the trucking business know the burden of filing 2290 form each year. There are serpentine queues to stand in and lots of paperwork to fill out. This can be super annoying, especially when you have big rigs that need to be driver, offices that have to be managed, and employees who require constant supervision.

Time is a precious element in a trucker’s life. It is because if you cannot meet delivery schedules, then you will have to deal with irate customers as soon as you reach the destination. With iTrucker’s 2290 software, it is now easy to fulfill your yearly obligation as a truck driver.

iTrucker 2290 is online software that makes 2290 tax filings simpler and easier for the clients. It is the most convenient and affordable E-filing tax 2290 services on the web. It charges a minimal amount as the service fee. However, you need to make the necessary payment before filing the process to transmit the prepared return to the IRS. You can view the complete 2290 PRICING on our official website.

2290 Key Services Offered at iTrucker

IRS 2290 Schedule 1

IRS 2290 Amendments

Form 8849 Schedule 6

IRS 2290 VIN Corrections

The IFTA Reporting is equally necessary and important as well. If your business employs the use of commercial motor vehicles, you need to file quarterly fuel tax reports that include the total of mileage traveled and the amount of fuel purchased in each state.

Earlier, this required endless paperwork. But today, with the iTrucker’s online IFTA software, it has become very convenient to generate reports and submit them to base jurisdiction. Not only is this software convenient but also affordable. Visit our official website and choose the most appropriate pricing model for yourself. Hurry!! What are you waiting for?

#IFTA Reporting#IFTA PRICING#ifta fuel tax report#ifta tax rates#2290 PRICING#2290 Online Filings#2290 Key Services#AOBRD#HVUT#fmcsa services#trucking industry#Trucking tech news

0 notes

Text

IRS Form 2290 Due date for 2022 - 2023 is August 31

Form 2290 - An Overview

IRS Form 2290 should be filed if you run a vehicle with a combined gross weight of 55,000 pounds or more. Also you should file tax, If your vehicle exceeds 5,000 miles or 7,500 miles for agricultural purposes in a given tax period.

Due date for Form 2290

The due date to file Form 2290 for the year 2022 - 2023 is August 31, 2022.

Due date should be filed based on the First Used Month (FUM) of the vehicle.

If your FUM is July 1, then your due date is August 31.

If you fail to file Form 2290, you are liable for penalties and interest.

Steps to file Form 2290

Step 1:

Enter your Business Name, Address and Employer Identification Number (EIN)

Step 2:

Fill your Form 2290 by submitting your Vehicle Identification Number (VIN), Taxable Gross Weight, First Used Month (FUM), Suspended Vehicle (if any), Third party Designee detail, etc.

Review and Transmit your IRS Form 2290

Benefits of filing Form 2290 with ExpressTruckTax

Filing Form 2290 with ExpressTruckTax is Easy. Benefits include

Receive stamped Schedule 1 in minutes

Guaranteed Schedule 1 or your money back

Instant Error Check

Free VIN Checking and VIN Correction

Bulk Information Upload

Multi User Access

1 note

·

View note