#when is tax form 2290 due

Text

IRS Form 2290 Due Dates: Stay Compliant with eForm2290

Discover essential IRS Form 2290 due dates at eForm2290. Stay updated on deadlines for heavy vehicle owners to file their taxes and ensure compliance with federal regulations. Our comprehensive guide provides clear, concise information on when and how to submit Form 2290, avoiding penalties and ensuring timely tax payments. Whether you're a fleet manager or an owner-operator, our resources simplify the process, helping you stay on track with your tax obligations. Trust eForm2290 for accurate due date information and reliable filing support, ensuring your vehicles remain compliant with IRS requirements throughout the tax year

0 notes

Text

Form 2290 Penalties and Fees: What To Look Forward To

This is very important Form for any person who drives heavy vehicles on public highways as it is related to the Heavy Vehicle Use Tax (HVUT). Nevertheless, incorrect or late filing of these forms can attract severe penalties and fees. One must have a good knowledge of these effects in order to avoid unnecessary expenses and complications

As a result, amounts due from delayed submission could snowball into considerable sums. More often than not, the Internal Revenue Service (IRS) levies fines for not filing the 2290 form by its due date which usually falls on the last day of the month that succeeds the month when you started using your vehicle(s). A penalty of up to 4.5 % per month can accumulate if you fail to meet this deadline up to five months, this also mounts up greatly. Furthermore, $100 is imposed as a minimum fine just in case the tax remains unpaid after it becomes overdue.

Furthermore, interest rates are applied on unpaid taxes besides late filing penalties. The interest rate is equal to federal short term rate plus 3% and starts accruing from the date when return was due until such time as tax is fully paid back. This may significantly increase your liability especially if payment is seriously delayed. For an individual to avoid this kinds of fines including interests there’s need to promptly file his/her Form 2290 and ensure that all taxes have been paid in full. Consistently checking IRS updates while employing digital methods helps simplify everything while minimizing any chances for errors

0 notes

Text

Step-by-Step Interactive Filing Guide for Form 2290

Filing taxes can be daunting, especially when dealing with the Heavy Vehicle Use Tax (HVUT) and Form 2290. This step-by-step guide aims to simplify the process and ensure you file your Form 2290 accurately and on time. Whether you're new to this or need a refresher, this interactive guide will walk you through each step. For a seamless experience, you can always rely on truck2290.com, which offers comprehensive support for your Form 2290 filing needs.

Step 1: Gather Necessary Information

Before you start filling out Form 2290, gather all the necessary information. This will streamline the process and reduce the risk of errors.

Required Information:

Employer Identification Number (EIN): You must have an EIN to file Form 2290. If you don't have one, apply for it well in advance.

Vehicle Identification Number (VIN): Ensure the VIN for each taxable vehicle is accurate.

Taxable Gross Weight: This is the weight of the vehicle fully equipped for service.

Step 2: Determine the Taxable Gross Weight

The taxable gross weight of your vehicle determines the tax you owe. Use the table provided by the IRS to find the correct weight category for your vehicle. This includes the weight of the vehicle when fully loaded with cargo and passengers.

Step 3: Calculate the HVUT

Using the IRS guidelines, calculate the HVUT based on your vehicle’s taxable gross weight. For multiple vehicles, calculate the tax for each one separately. For a quick and accurate calculation, try the interactive tax calculator.

Step 4: Complete Form 2290

With all your information ready, you can now complete Form 2290. Here’s a breakdown of the key sections you need to fill out:

Part I: Vehicle Information

Line 1: Enter your EIN.

Line 2: Enter the taxable period (July 1 of the current year to June 30 of the next year).

Line 3: Enter the date the vehicle was first used in the tax period.

Line 4: List each vehicle's VIN and taxable gross weight.

Part II: Tax Computation

Line 5: Calculate the tax based on the vehicle’s weight.

Line 6: Add any additional taxes for vehicles used in logging.

Line 7: Total the tax due for all vehicles.

Step 5: Choose Your Filing Method

You can file Form 2290 either electronically or by paper. E-filing is recommended for its speed and convenience, especially if you are reporting 25 or more vehicles. Truck2290.com offers an easy-to-use platform for e-filing, ensuring quick and accurate submission.

Step 6: Make the Payment

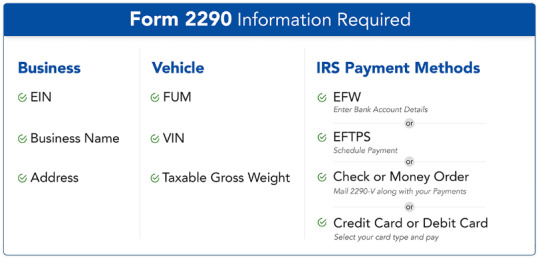

The IRS provides several payment options for the HVUT:

Electronic Funds Withdrawal (EFW): Directly from your bank account.

Electronic Federal Tax Payment System (EFTPS): Requires prior enrollment.

Credit or Debit Card: Convenient and immediate payment.

Check or Money Order: Traditional method, but slower processing.

Step 7: Submit Your Form 2290

If filing electronically, submit your Form 2290 through a trusted e-file provider like truck2290.com. If filing by paper, mail the completed form and payment to the IRS address listed on the form instructions.

Step 8: Receive Your Schedule 1

Once the IRS processes your Form 2290, you will receive a stamped Schedule 1 as proof of payment. This document is crucial for registering your vehicle with your state’s Department of Motor Vehicles (DMV).

Tips for a Smooth Filing Experience

Double-Check Information: Ensure all details, especially the VIN and EIN, are correct.

File Early: Avoid last-minute rush and potential penalties by filing well before the deadline.

Use a Reliable Service: Platforms like [truck2290.com](https://www.truck2290.com) provide support, ensuring you don’t miss any steps and your filing is accurate.

Common Mistakes to Avoid

Incorrect EIN or VIN: Always double-check these numbers for accuracy.

Wrong Weight Category: Ensure you calculate the vehicle’s weight correctly.

Late Filing: Missing the deadline can result in penalties and interest.

Conclusion

Filing Form 2290 doesn’t have to be a stressful experience. By following this step-by-step guide, you can ensure a smooth and accurate filing process. For additional support and to simplify your filing, visit [truck2290.com](https://www.truck2290.com). Their user-friendly platform and expert assistance can help you file your Form 2290 quickly and accurately, ensuring compliance and peace of mind. Happy filing!

#Form2290#Schedule1#IRS#Truck2290#form2290irs#irs#taxform2290#form2290online#2290online#2290instructions

0 notes

Text

When Taxes are Due on Form 2290

Form 2290 is used to report and pay the Heavy Vehicle Use Tax (HVUT) for vehicles operating on public highways with a gross weight of 55,000 pounds or more. The due date for Form 2290 taxes varies based on the tax period and when the vehicle was first used during that period.

Here are the general deadlines:

Annual Filing Deadline: For most vehicles, the tax period begins on July 1st and ends on June 30th of the following year. The annual filing deadline for Form 2290 is typically August 31st of each year. This means that if your vehicle falls within this tax period, you would need to file Form 2290 by August 31st.

First Used Month Deadline: If a heavy vehicle is first used in any month other than July, the HVUT is prorated for that tax year. In this case, the Form 2290 filing deadline is the last day of the month following the month in which the vehicle was first used. For example, if a vehicle is first used in October, the deadline to file Form 2290 for that vehicle would be November 30th.

#truck2290#irs2290#irsform2290#hvut#trucktax#2290duedate#form2290#taxfiling#taxseason#heavyvehicletax

0 notes

Text

All About Form 2290

Form 2290 is an IRS tax levied on the truck owners. This is an annual tax collected by the IRS. Trucks that weigh 55,000 pounds or more and used for 5,000 miles or more are subjected to this tax. The tax money is used for the construction and maintenance of highways in the US.

File Form 2290 From your State

You can file IRS HVUT from anywhere. To make the filling simple and easier, you can file the IRS HVUT with IRS-authorized e-file service providers. eForm2290 is an IRS-authorized e-file service provider with more than a decade experience.

Form 2290 Due Date

The IRS HVUT due date for the first used vehicles is the last day of the month following the first used month. For example, if you have used your vehicle for the first time in the month of October, then 30th November is the last day to file HVUT. To know more about IRS HVUT due date, please visit the official IRS site.

Form 2290 – Reasons for Rejection

There are several reasons for IRS HVUT rejection, like:

Mismatched EIN number

Missing signature

RTN rejection

Duplicate VIN or form 2290

Form 2290 Correction

Committing errors when filing IRS HVUT is common. If there are any errors that occurred during filing of IRS HVUT, you can correct it. Before submitting your form, please review it. This will help you avoid mistakes when filing IRS HVUT tax.

Most common errors that are made while filling IRS HVUT are:

Entering incorrect VIN

Typo errors

Filling in the wrong taxable gross weight

To correct these errors, you can use the IRS HVUT Amendment. Using this, you can fix any errors on IRS HVUT.

Form 2290 Amendment

For IRS HVUT, amendment implies any change to be made on the already submitted form 2290. You must pay the additional tax for the amended returns electronically.

The change or amends can be:

A change in the taxable gross weight of the vehicle

Exceeded mileage usage of suspended vehicles.

When you file 2290 amendments with eForm2290, we will expedite your form 2290 returns. Once IRS accepts the amendment, you will receive your stamped Schedule 1 copy.

Filing with eForm2290

When filing IRS HVUT with eForm2290, you just have to follow a simple process. We have made the process simpler, easier and secure. So that you can rest assured about your tax filings when you are behind the wheels. Use our IRS HVUT coupon to save on our processing fees.

1 note

·

View note

Text

Form 2290 Electronic Filing is Simple and Safe at Tax2290.com

Form 2290 Electronic Filing is Simple and Safe at Tax2290.com

Renew your Truck Tax Form 2290 for 2019 – 20 Tax Year Now at Tax2290.com!

Start Prefiling your 2290 Tax Returns!

Tax2290.com powered by TaxExcise.com is now ready and started accepting (HVUT) Federal Heavy Truck Tax Form 2290 for the new tax year 2019 – 2020. Prefile now and be an early bird in reporting your 2290 taxes before the deadline. Choose electronic filing for faster processing of…

View On WordPress

#excise tax form 2290#heavy duty tax form 2290#hvut tax form 2290#tax form 2290 due date#tax form 2290 e file#tax form 2290 instructions#tax form 2290 online#truck tax form 2290#when is tax form 2290 due

0 notes

Text

How Heavy Highway Use Tax Is Important?

Knowing the fact about is heavy highway vehicle tax is quite crucial. A better understanding will help you to find out its importance. It also encourages you to submit a heavy highway tax. You get to enjoy the benefits of paying this tax when you know where it goes. This is an essential fee that they need to pay. This tax is collected from all of the truckers. This is important for companies to transport their products. This is a essential fee for the truckers. This tax is used for the keeping highways and roads in a fantastic condition. What else if the businesses forget to pay the tax on time? It will cost a huge penalty in their side. Weight distance tax should be calculated on the basis of different states laws, rates of fuel on various states, etc.. Heavy vehicle use taxes are calculated based on its own load.

The Heavy Vehicle Use Tax is filed to the IRS by using Form 2290. The burden of the taxable freight should be calculated here. Truckers need to pay the sum annually. They operate before they have to take collection based on various actions. The initial bill for tax due amount based on the return plus any interest and penalties. At the least, an additional bill ought to be sent by the IRS as a reminder. Interest and penalties will continue to add on until the complete due amount is paid. Ranging from applying for last tax year’s refund to tax because of seizing assets and property, the IRS takes steps. IRS usually takes measures based on the previous year’s tax return because of property seizing or strength seizing. One ought to cover the heavy highway use tax prior than the due date of tax payment without balance keeping. If a trucker failed to pay the complete tax at one time, they need to contact the IRS.

If you don’t admit that maintain a copy of the bill and any tax returns, cancelled checks, other records. It will help the IRS to understand why your bill is wrong. IRS may understand the problem with your tax with such documents. You can visit the local IRS office for a solution. Should you describe or admit your problem previously, IRS will take action on the matter. If you’re facing bankruptcy or other financial problems, notify it previously to the IRS. You can call them or can visit their offices for discussion. You can discuss them to keep it to stop. Making tax report and paying tax on right time is troublesome of lots of the trucking companies. They use the Weight distance tax software to make the job simple. This software can calculate and send the tax report punctually to IRS. With the help of this software, you can save time, money efforts and mistakes as taxes are paid properly and on time.

2 notes

·

View notes

Text

Who Will Need To File The 2290 Tax Form

The Heavy Vehicle Use Tax or HVUT was established by congress in the Surface Transportation Assistance Act of 1982. The act claims that any public highway heavy use trucks have to pay the HVUT to the Internal Revenue Service (IRS), which is described as any vehicle having a gross weight at or more than 55,000 pounds. The Federal government provides money to the states because of this for interstate development and maintenance plans. For the purpose of filing and collecting the excise tax, the IRS will require the use of the most important document related to the HVUT, mostly the 2290 tax form. It affords a built-in calculation formula for determining the tax due on heavy highway use vehicles used throughout the tax period, allows for suspension claims of the tax, and implements claims support for obtaining any eligible tax credits.

The Tax Form 2290 will be used so taxpayers can compute and pay the tax due in the term of the vehicle that equals or exceeds the specific gross weight. Additionally, it figures the total amount due for a vehicle previously filed as suspended, but which subsequently exceeded the mileage use limit. Plus, if during the term, the assessable total weight rises causing it to fall into another category, the electronic version will compute the amount owed. Actually, the IRS will even provide ways for owners with a larger fleet of vehicles for entering the info into the form. Also, the schedule that come with it allows the owner to list all included heavy use vehicles Vehicle Identification Numbers (VINs). Furthermore, the electronic filing will help make the process easier by permitting the upload of an Excel document that has all of the necessary information.

Nevertheless, the IRS requires every single state in the United States to keep evidence of payment or exclusion from the Federal HVUT before registration occurs. Specifically, a validated Schedule 1 copy received as a result of e-filing the 2290 tax form furnishes acceptable proof. Throughout the filing timeframe, on the other hand, will establish the eligibility that's needed for claiming suspension from the tax for anticipated use of equal to or lower than 5,000 miles or equal to or less than, 7,500 miles for agricultural vehicles. Basically, listing those with suspended tax status tax on Schedule 1 indicates suspension before exceeding the mileage use limit, eliminating the excise tax.

Furthermore, it grants guidance in claiming credit for tax paid on destroyed, sold or stolen vehicles, or on those meeting the low mileage limit. Even so, selling while under suspension requires attaching a statement to Form 2290 showing confirmation of sale to avoid liability for mileage exceeding the use limit by the new owner. Plus, during filing, you will need to provide documentation of destroyed or stolen vehicles that will have to be linked to the application.

A specific cycle is applied to the 2290 tax form, normally July 1st through June 30th of the following year. More importantly, whether filing electronically or on paper, the submission together with the payment that's due must be in position before the end of August of the corresponding year. The IRS will require electronic filing, in any case, for businesses that have 25 vehicles or more.

Heavy vehicles cause the bulk of the damages on the highways all over the country. Because of this, they make use of the revenue to offer a way to get the necessary repairs and maintenance work. In the end, the funds collected from the HVUT cure and heal roads across the nation, ensuring safety for all drivers.

Quickly complete your FORM 2290 FILING online when an e-file provider is used. Take a peek at Tax2290.com by going to their site which is http://www.tax2290.com/.

1 note

·

View note

Text

Form 2290 Due date for the tax year 2022-2023

What is Form 2290?

IRS Form 2290 is a Heavy Vehicle Use Tax (HVUT), it should be filed if you run vehicles with a taxable gross weight of 55,000 pounds or more. And also you should file 2290 tax if your vehicle exceeds 5,000 miles or 7,500 miles (for agricultural vehicles) in a tax period.

When is the Form 2290 Due date?

Form 2290 due date for 2022-2023 tax year is August 31.

Failing to file HVUT will result in penalties and interest, which is assessed on a monthly basis.

Late filers not paying HVUT will also face an additional monthly penalty.

Information required to file Form 2290

Business Name, Address and Employer Identification Number (EIN).

Vehicle Identification Number (VIN), First Used Month (FUM), Taxable Gross Weight, Suspended vehicles (if any).

Review and transmit.

Benefits of filing Form 2290 with ExpressTruckTax

File Form 2290 with ExpressTruckTax, and avail several benefits such as,

Guaranteed Schedule 1 or money back

Free VIN Checker and VIN Correction

Bulk information upload

Copy last year’s return

0 notes

Text

5 Ways to Grow Your Trucking Business

Step 1: Control Fuel Costs

If you are an owner-operator, fuel cost is a major part of your expense. Managing your fuel cost will help you save more money and increase your profit margin. Reducing your driving speed, limiting vehicle idling time, managing route and choosing low-fuel-tax states are some of the best ways to bring down fuel costs.

Apart from these measures, keeping your vehicle well-maintained, planning out your route, constant tire checks will also contribute to improved vehicle performance and in turn contributes to less fuel consumption and better savings.

Step 2: Pay Your Taxes on Time

File your taxes well ahead of the due date and ensure that you are compliant. If you’ve incurred a penalty, ensure that you clear your dues and have all the documents ready during audits. When you e-file your 2290 form with eForm2290, you will receive a copy of Schedule 1 within minutes.

Keep printed copies of your Schedule 1 in your vehicle as well as in your records so you can present it as a proof if you get pulled over or during audits. The penalty for not filing your form 2290 on time is 4.5% of the unpaid taxes for each month; or part of a month that a tax return is late. Penalty will start accruing a day after the tax filing due date.

The failure-to-file penalty is 5% of your balance due for every month (or part of a month) in which your taxes go unpaid.

Step 3: Keep Proper Records

Although your primary focus is to improve your business and profit margins, it is equally important to maintain proper records of all your important business documents.

As an owner-operator it might be difficult to keep track of all your documents, and if you find yourself struggling, hire bookkeeping and accounting professionals to do it for you. Keeping a tab on your expenses, routing and fuel costs and invoices will help you optimize your business, analyze costs and stay on top of your tax payments and other dues.

Step 4: Stabilize Your Cash Flow

Keep a healthy cash flow to cover operating expenses like routine maintenance, insurance, and fuel costs as well as keep enough cash reserve for unforeseen circumstances like road accidents or unexpected breakdowns.

As freight bills are paid after the delivery, you need to make sure that you have enough cash in hand to cover your expenses and keep things rolling. Stick to a routine fleet maintenance schedule to keep your vehicle tuned up and avoid unpleasant surprises on the road. Assess your expenses and identify areas where you could save costs.

For instance, you can rely on an equipment leasing company to rent equipment rather than buying an equipment that needs to be upgraded every few years. There are fuel programs that will let you track and manage your fuel spending.

When you manage your cash flow and get faster access to your working capital, you will be able to grow your trucking business much faster.

Step 5. Deploy Efficient Tools and Technologies

As an owner-operator, you may not be able to manage or control each and every aspect of your business. That’s why you must invest in tools and technologies that will make it easier for you to optimize operations and boost productivity.

From accounting and routing to dispatching and invoice management, there is plenty of software in the market that will help you streamline your business by automating operations and streamlining processes.

Read our blog on Best Trucking Management Software to learn more about the best tools that will help you manage your business efficiently.

Final Thoughts

While there are many factors that will contribute to your business growth, the above five steps will definitely give you a head start in growing your business. Thanks to online e-filing providers like eform2290, staying on top of your tax payments is now easier than ever amidst the global pandemic.

0 notes

Text

What to do when truck exceeds the exemption limits?

There is one question that has been quite frequently asked about the filing of Form 2290. If the trucker assumed that his vehicle would not exceed 5000 miles in a tax year (7500 miles foe agricultural vehicles) and has filed a 2290 under suspender or exempt from taxes, but then you realize it is going to exceed the 5,000 miles. You don’t know what to do?

In this article we will dive into the details of what is required to be done if your truck exceeds the exemption limits.

The IRS has drafted specific guidelines differentiating vehicle categories by their total gross weight, the number of miles for which the desired vehicle is used over the public highway in a prescribed tax period.

The Federal law states, a vehicle that needs to be reported over a Form 2290 must complete these criteria, minimum taxable gross weight of 55,000 lbs (including weight of the tractor + weight of the loaded trailer) and when this vehicle is used for over 5000 (for commercial units) and 7500 miles (for agricultural units) within the tax period, then it is called taxable vehicle. When the subjected vehicle is less than 5000 miles (for commercial based unit) and less than 7500 miles (for agricultural units) within a tax period, is declared to be exempt from paying HVUT regardless of the taxable gross weight. These vehicles are also known as “Suspended Vehicles” in the terms of Form 2290.

When the trucker is filing for their HVUT, they are supposed to have an honest statement about whether you heavy highway motor vehicle will be used under or over the desired miles limit. In many cases the HVUT payers face situation where the truck has reported as an exempt vehicle but later the truck outrun the desired miles due to excessive work load or any other reasons.

So now the HVUT payer is required to immediately file an amended Form 2290 to report the unexpected change arisen over the vehicle category. Suspended vehicles exceed mileage to convert an exempt unit to a taxable vehicle and pay annual tax. You won’t be able to make a pro-rated tax due to payment based on the time when the trucks exceed the mileage. IRS would expect the tax due to be paid in full.

For further assistance contact Hopes 2290, an IRS approved online tax filing service provider. Hope we were at help and this article cleared all your doubts and gave you a clear idea on when and how to file an amendment for a exempted vehicle exceeding the mileage limits. Reach us through Phone Support: 1-510-474-1376, Spanish Support: 1-224-215-5888 Support Timings: Mon - Fri 7:00 am CST to 08:00 pm CST. You can also mail us at [email protected]. For a hassle free Tax 2290 e-filing contact Hopes2290.

0 notes

Photo

Heavy Truck Tax Form 2290 online for 2021 is now Due and August 31, 2021 is the deadline. Use Tax2290.com to renew it online in just minutes.

eFile 2290tax returns today, when you owe the IRS, you can ask the IRS to electronically withdraw the money you owe directly from your bank account or Schedule a #EFTPS payment or Pay using your Credit or Debit Cards. #2290eFiling is Fast, Secured and Easy at @tax2290

0 notes

Text

Due Date for IRS Form 2290 for 2023–2024

My form 2290 is due when? The IRS form 2290 must be submitted by August 31 each year for heavy vehicles with a taxable gross weight of 55,000 pounds or more. Form 2290 for newly acquired vehicles must be submitted by the last day of the month after the month of first use.

Pay by October 31, 2023, if September 2023 is the first month used.

How soon must I submit my form 2290?

Pro Tip: Asking yourself when is 2290 payment is due shouldn't be left until the very last minute. To avoid late costs, prepare to file before the 2290 deadline. For instance, if your truck was used for the first time on a public road in July, you must file Form 2290 between July 1 and August 31.

For instance, Mark must register the truck in his name and submit a separate form 2290 reporting this new vehicle on or by December 31, 2023, for the tax year 2023–2024, if he buys a new taxable vehicle on November 3, 2023, and drives it home from the dealership on a public roadway. To prevent late fines, make sure you submit by the deadline of 2290.

Plan ahead and set notifications to e-file your taxes. When is 2290 Due? This should not be a question you leave until the last minute.

0 notes

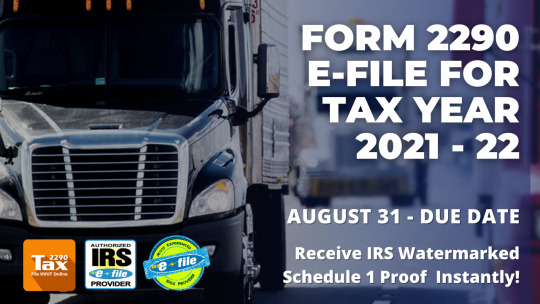

Photo

Form 2290 - HVUT Returns - Due Date - Tax Year 2021 - 22

When is Form 2290 Due? The Form 2290 #HVUT returns are due in July 2021 through June 2022, has to be reported and paid between July 1 and August 31. 2290eFiling is the best way to report and pay, to receive the IRS stamped Schedule 1 instantly.

#Pay 2290 online for 2021#pay 2290 taxes for 2021#pay 2290 electronically for 2021#pay 2290 taxes#pay 2290 tax due#pay 2290 truck tax for 2021

0 notes

Photo

IRS Tax Form 2290 - Due for 2021 - August 31 Deadline

When is Form 2290 Due? The Form 2290 #HVUT returns are due in July 2021 through June 2022, has to be reported and paid between July 1 and August 31. 2290eFiling is the best way to report and pay, to receive the IRS stamped Schedule 1 instantly.

#Truck tax form 2290 for 2021#hvut tax 2290 for 2021#tax 2290 electronic filing#form 2290 due date for 2021#August 31 due date for Tax 2290

0 notes

Text

Nov. 1 is new tax deadline for some storm-struck Michiganders

One of the severe storms that hit Michigan on June 26. In the wake of a major disaster declaration, the IRS is giving some of the state's taxpayers until Nov. 1 to take care of tax tasks. (Photo by Ben Kessler via the National Weather Service)

The 2021 Atlantic hurricane season got off to an early start. Since then, though, it's been a slow tropical season. Thank you, Saharan dust (and Deb Fox)!

However, other major natural disasters have made up for it.

So far in 21, there have been 14 instances of tax relief provided by the Internal Revenue Service due to federal disaster declarations. That's a bit ahead of last year, which by the end of July 2020 had recorded 10 such devastating circumstances.

The latest IRS decision to provide taxpayer relief because of a major Mother Nature snit affects some Michigan taxpayers.

The IRS has announced that Great Lakes State individual and business taxpayers who suffered through severe storms, flooding, and tornadoes that began on June 25 now have until Nov. 1 to file various returns and make payments.

The affected counties, per the Federal Emergency Management Agency (FEMA), are Washtenaw and Wayne Counties in the southeastern part of the state.

Here's a quick look at this storm-related relief for these Michigan filers.

Returns, payments and estimated taxes: The extension means that Michigan individuals who had a valid extension until Oct. 15 to file their 2020 tax returns now have until Nov. 1 to finish that document.

However, since any tax payments associated with the extended 2020 returns were due on May 17, the COVID-delayed 2021 deadline, any additional tax due with the final, extended filing will have penalty and interest charges tacked on.

The new Nov. 1 deadline also applies to the quarterly estimated tax payment due on Sept. 15.

As for businesses, the delay applies to quarterly payroll and excise tax returns normally due on Aug. 2. The IRS says that penalties on deposits due on or after June 25, 2021, and before July 12, 2021, will be abated as long as the tax deposits were made by July 12.

And for businesses that face the Aug. 31 deadline to file their Tax Year 2021 Form 2290, Heavy Highway Vehicle Use Tax Return, for vehicles also now have until Nov. 1 to do that.

Contact IRS about penalty notices: Because, well, IRS and taxes, it's possible that taxpayers who live or own a company in Washtenaw or Wayne Counties could get a late filing or late payment penalty notice from the IRS even though they now have added time to take care of tax tasks.

In these cases, if the notice is for a tax obligation that has an original or extended filing, payment or deposit due date that falls within the postponement period, then call the telephone number on the notice to have the IRS abate the penalty.

You can get additional information on services currently available at the IRS operations and services page at IRS.gov/coronavirus.

IRS automatically applies new deadline: Also, Michiganders who live or have a business in the storm-relief counties don't need to do anything to get the November deadline. The IRS automatically identifies taxpayers located in the covered disaster area and applies filing and payment relief.

However, if you reside or have a business outside the covered disaster area and believe you, too, should get more tax time, call the IRS' toll-free disaster hotline at (866) 562-5227 to discuss your circumstances and request the same relief.

Claiming losses this tax year or next: Finally, the disaster relief also includes the option to decide when to claim any uninsured losses on your taxes.

You can do so for the prior year. In this case, that would be the 2020 returns from filers who got extensions and now don't have to get the paperwork to the IRS until Nov. 1. Some Michigan storm victims could find that claiming this year's damages on their 2020 taxes could produce a quicker and larger refund that could help with repairs and other recovery efforts.

Or you can wait to claim any allowable losses when you file your 2021 tax return next year.

Run the numbers for both tax years and choose the filing date that gives you the best result. Remember, too, that you must itemize to claim the personal property losses from a major disaster that aren't covered by insurance or other reimbursements.

That means filing Form 1040 Schedule A, along with Form 4684, Casualties and Thefts. You can read more about this process in my post on considerations in making a major disaster tax claim.

The IRS asks taxpayers making the loss claims on their 2020 return to note that at the top of their Form 1040. Add the phrase "Michigan Severe Storms, Flooding, and Tornadoes" in bold letters at the top of the form.

If you need to get prior tax info to complete your disaster-related filing, the IRS will waive its usual fees for such copies. To get the fee break, use the same Michigan disaster phrase on the Form 4506, Request for Copy of Tax Return, or Form 4506-T, Request for Transcript of Tax Return, that you submit to the IRS for the data.

And whatever tax year you choose to claim your disaster losses, the IRS also requests you include the FEMA disaster declaration number on your return. For the Michigan situation, that's FEMA 4607-DR.

You also might find these items of interest:

Atlantic hurricane season starts early for 7th straight year

State disaster declarations could trigger quicker IRS tax relief under House bill

Storm Warnings: A multi-page collection of blog posts on preparing for, recovering from, and helping those dealing with natural disasters

Advertisements

// <br><br> </center> <center><!-- put the below code in Body --> <!-- ~ Copyright (C) 2014 Media.net Advertising FZ-LLC All Rights Reserved --> <script language="javascript"> medianet_width = "600"; medianet_height = "250"; medianet_crid = "257625731"; medianet_versionId = "3111299";

0 notes