#A Self-Made Millionaire's Path To Financial Independence.

Text

The Ultimate Guide to Books on Building Wealth

In the journey towards financial independence and wealth building, knowledge is not just power—it's profit. Understanding the nuances of personal finance, investment strategies, and economic trends can significantly impact your ability to grow and manage your assets. This guide introduces you to the top books on building wealth, each offering unique insights into creating lasting financial success. Whether you're a budding investor, an entrepreneur, or someone looking to revamp their financial health, these books are invaluable resources that promise to guide you every step of the way.

1. "Rich Dad Poor Dad" by Robert Kiyosaki

Robert Kiyosaki's "Rich Dad Poor Dad" is a cornerstone in wealth-building literature, challenging conventional wisdom on personal finance. It contrasts the mindsets of two fathers: one, a highly educated but financially unstable man (the "Poor Dad"), and the other, a savvy investor who understands the value of creating passive income and assets (the "Rich Dad"). This book is essential for anyone looking to shift their perspective on money and investment.

2. "The Intelligent Investor" by Benjamin Graham

Benjamin Graham's "The Intelligent Investor" is heralded as the bible of the stock market. Focused on the principles of value investing—a strategy emphasizing investments in undervalued stocks that offer long-term benefits—this book is a must-read for anyone aiming to navigate the stock market's complexities with grace and profitability.

3. "Think and Grow Rich" by Napoleon Hill

Napoleon Hill's "Think and Grow Rich" goes beyond mere financial advice, delving into the psychological foundation of wealth. Based on Hill's study of over 500 self-made millionaires, the book presents thirteen steps to success that anyone can apply to their lives. It's an invaluable guide for those looking to understand the wealth mindset.

4. "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko

This book reveals that the typical millionaire is not the one flaunting their wealth but the one living right next door who opts for a lifestyle of frugality and disciplined investment. "The Millionaire Next Door" offers insight into the common traits and habits that can lead to accumulating wealth over time.

5. "Your Money or Your Life" by Vicki Robin and Joe Dominguez

"Your Money or Your Life" is a transformative read that encourages readers to look at their relationship with money in a new light. This book provides practical strategies for managing finances in a way that enhances life quality, promoting financial independence and personal fulfillment.

Conclusion

Building wealth is a journey that requires patience, discipline, and, most importantly, knowledge. The books mentioned above offer a solid foundation for anyone looking to understand the principles behind wealth creation and financial success. By applying the lessons learned from these wealth-building manuals, you can set yourself on a path toward financial freedom and security. Remember, the key to building wealth lies not just in making money but in making smart decisions with the money you have. Happy reading, and here's to your financial future!

0 notes

Text

"Rich Dad Poor Dad" is a personal finance book by Robert Kiyosaki that was first published in 1997. The book has become a bestseller and is considered a classic in the financial education genre, with its simple yet powerful message of financial literacy and wealth creation.

The book is structured as a series of lessons that Kiyosaki learned from his two "dads" - his biological father, who was a highly educated but financially insecure government employee, and his best friend's father, who was a self-made millionaire and successful entrepreneur.

Kiyosaki's "rich dad" taught him lessons about money and wealth that were very different from what he learned from his "poor dad." These lessons form the basis of the book's teachings.

One of the key messages of the book is the importance of financial literacy. Kiyosaki argues that schools do not teach children how to manage money effectively, and that financial education is the key to building wealth and achieving financial freedom.

Another important lesson is the difference between assets and liabilities. Kiyosaki defines an asset as something that puts money in your pocket, while a liability is something that takes money out of your pocket. He argues that the key to building wealth is to acquire assets and minimize liabilities.

Kiyosaki also emphasizes the importance of taking control of your financial future. He encourages readers to start their own businesses and invest in real estate as a means of building wealth and achieving financial independence.

Throughout the book, Kiyosaki shares personal anecdotes and examples to illustrate his points. He also includes practical exercises and challenges for readers to implement the book's teachings in their own lives.

The book is divided into ten chapters, each of which covers a different lesson. These lessons include:

1. The Rich Don't Work for Money: In this chapter, Kiyosaki explains the importance of financial literacy and how to develop the mindset of an entrepreneur.

2. Why Teach Financial Literacy?: Kiyosaki argues that schools do not teach children the skills they need to manage their finances effectively, and that parents should take responsibility for teaching their children about money.

3. Mind Your Own Business: Kiyosaki encourages readers to start their own businesses and to focus on building assets rather than accumulating liabilities.

4. The History of Taxes and the Power of Corporations: Kiyosaki discusses the history of taxes and how corporations use tax laws to their advantage.

5. The Rich Invent Money: Kiyosaki explains how the rich use creativity and innovation to create wealth.

6. Work to Learn—Don’t Work for Money: Kiyosaki encourages readers to focus on learning rather than earning, and to seek out opportunities to gain new skills and knowledge.

7. Overcoming Obstacles: Kiyosaki shares strategies for overcoming fear, doubt, and other obstacles that can prevent people from achieving their financial goals.

8. Getting Started: Kiyosaki provides practical advice on how toget started on the path to financial freedom, including setting goals, creating a plan, and taking action.

9. Still Want More? Here Are Some To Do’s: This chapter provides additional tips and strategies for building wealth and achieving financial independence.

10. Inside Out: Kiyosaki concludes the book by emphasizing the importance of changing one's mindset in order to achieve financial success.

Overall, "Rich Dad Poor Dad" is a powerful and inspiring book that challenges readers to rethink their relationship with money and to take control of their financial futures. Its simple yet practical advice has helped millions of people around the world to build wealth and achieve financial freedom.

1 note

·

View note

Text

A Self-Made Millionaire's Path To Financial Independence.

“Money is the most important thing in the world.” It’s a startling and borderline heretical claim. After all, we’re told time and again that you can’t buy happiness.

Well, sure – you can’t spend your way to Earthly bliss. But here’s the flipside: poverty is pretty sure to make you miserable. Far from being the root of all evil, money is the most important tool we have to improve our quality of life.

If you want to look out for the people you love, you’ll need money – the more, the better. Want to spend more time with your kids? Ditto. How about creating time for leisure, reading, going to the theatre and discovering new cultures and countries through travel? You’ll have guessed the answer by now: money.

That’s the philosophy of Kristy Shen, a self-made millionaire who retired at 31. In this post, we’ll be exploring how she did it. Expect plenty of unashamedly contrarian takes, left-field strategies and novel concepts. More to the point, expect to find a roadmap to wealth creation, debt eradication and financial independence.

You’re more likely to make sound decisions if you follow the math rather than your passions.

In 2005, Steve Jobs gave a commencement speech at Stanford University. His advice to the students? “Follow your heart.” That feel-good mantra rippled around the world. Endorsed by the great and good, it soon came to feel commonsensical – why on Earth wouldn’t you follow your passions and do something you love? Here’s one reason: it’s often the wrong choice.

Take the often life-defining decision students make every year about what they’re going to study. That was just what Kristy was mulling over back in 2000. She had a shortlist of three possible majors – creative writing, accounting and computer engineering. Her heart told her to go with writing; math told her to go for engineering. Kristy followed the latter’s advice. It was a good call.

Let’s look at that math. A four-year program in Canada costs about $40,000. Professional writers fall on a spectrum between the unpublished newbie who earns zilch and established pros like Stephen King who earn millions. The average income, however, is $17,000. In 2000, the minimum wage was $6.85 an hour or $14,248 a year. That’s what anyone without a degree could expect to earn, so subtracting that sum from $17,000 told Kristy how much a writing degree was worth: a measly $2,752.

An accounting degree, by contrast, was worth around $24,000 more than the minimum wage. Computer engineering meanwhile netted you a whopping $40,000 more every year.

But hold up. You can’t put a price on happiness – surely dreams are worth pursuing whatever the bottom line says, right? Well, not necessarily. After all, if you don’t know where your next meal is coming from, you’re unlikely to wake up excited about your work, especially if it calls for creativity. Passions also change over time; a 2013 study published in Science found that the dreams of nearly all of the 19,000 participants had changed significantly over the previous decade.

And that’s why it pays to follow the math. Just ask Kristy. Today, she’s a professional writer. The reason she got there is simple: her well-paying engineering job meant she wasn’t reliant on writing to make the rent. Money, in other words, provided her with the foundation which eventually allowed her to pursue her true dream.

Kristy’s Chinese heritage taught her that debt is a trap to be avoided at all costs.

Did you know that on average Chinese citizens save 38 percent of their income? Americans, by contrast, squirrel away 3.9 percent of what they earn while the Japanese keep just 2.8 percent for a rainy day. So what’s going on – are the Chinese just inherently frugal?

Not really. Even before the communists came to power in 1949, corruption was endemic in China. Combine that with the absence of official credit channels like bank loans and you had the makings of a culture which ran on favors. When folks wanted to buy something big, they had a simple choice: take on an onerous personal debt and put themselves in someone else’s power, or save up until they had enough cash to buy it outright. That’s why, historically, debt in China is understood not so much as an “IOU” but an “I own you.”

If you’re Chinese like Kristy, that history means you’re basically programmed to avoid debt like the plague. But here’s the thing: when you crunch the numbers, it turns out that’s a pretty good attitude to adopt wherever you live.

Take the Rule of 72, an insight first formulated by a fifteenth-century Italian mathematician called Luca Pacioli. Here’s how it works. To work out how long it takes for your investment to double, divide 72 by the return rate of your investment. So let’s say you’re getting six percent on your $1,000 investment. Seventy-two divided by six equals 12. This last number is the number of years you’ll need in order for that grand to compound into $2,000. Over time, the balance increases. The money you make makes more money.

If you’re an investor, the Rule of 72 is your friend; if you’re a debtor, it’s your worst enemy. Say you buy a $1,000 TV on credit. Typically, the interest rate will be around 20 percent. Divide 72 by 20 and you get 3.6 – that’s how long it’ll take your debt to double! After seven years, it will have almost quadrupled.

When you put it like that, the Chinese custom of paying off personal debts during the New Year on pain of being cursed with 12 months of misfortune starts to make a lot of sense. But don’t worry – the idea here isn’t to scare you.

Consumer debt is a financial crisis which needs to be addressed immediately.

Debt is a blood-sucking vampire. It bleeds you dry. Worse, it leaves you terrified of the sunlight, trapping you indoors in an endless cycle of work and repayment. If you want financial independence, you’ll have to put a stake through this bad boy’s heart.

Consumer debt has the highest interest rates, so that’s where you should start. The first thing you’ll need to do is cut your expenses to the bone. It’s painful but essential. As we’ve seen, the Rule of 72 means your debts grow at an ungodly rate. If you’re saddled with a 10 or 20 percent interest rate, there’s no point trying to save or invest your hard-earned cash – there’s no getting in front of debt. Do whatever it takes, whether it’s finding a side hustle, renting out a spare room, or saying “no” to dinners out.

Next, you’ll need to prioritize how you repay your loans by putting them in order based on interest rate, from highest to lowest. When you’re surrounded by hungry vampires, it’s always a good idea to kill the one with the biggest appetite first. That means paying the minimum monthly repayment on all your cards to avoid defaulting and throwing everything that you don’t need for essentials like rent at the nastiest bloodsucker. Paying off your smallest loan might make you feel good, but you’re not trying to massage your ego here – you’re fighting for your freedom.

The final step is refinancing your loans. Lots of credit card companies allow you to transfer balances between different cards and pay zero percent interest for a certain amount of time. That’s usually a year. If you’re sure you can use these so-called “grace periods” to pay off a loan completely, use this option. Bear in mind, however, that these companies are gambling on you failing to do so, which will allow them to jack up the interest rate and screw you.

Remember, trying to gain financial independence while carrying around debt is like running a marathon with a backpack full of bricks – it’ll sap your strength before you’ve even run a mile. If you want to grow your assets, you need to kill that vampire!

If you want to buy happiness, spend your cash on experiences rather than stuff.

What does cocaine have to do with shopping? Surprisingly, quite a lot. Understanding that connection holds the key to getting the most out of the money you decide to spend on luxuries.

But before we get to that, let’s talk about the brain. When something good happens, the “pleasure chemical” dopamine surges through your mesolimbic pathway, essentially your brain’s main highway, to the nucleus accumbens – a kind of dopamine processing plant. A substance like cocaine triggers this surge – but so does splurging on a Gucci handbag. In both cases, the reward is a massive neural high.

Here’s where it gets interesting. As a 2006 article in the journal NeuroImage demonstrated, the nucleus accumbens doesn’t just react to positive stimuli – it also reacts to the expectation of those stimuli. In other words, pleasure isn’t just about absolute dopamine levels but how much dopamine our brains expect is on the way.

Unfortunately for cocaine addicts and shopaholics, the brain keeps ratcheting its expectation levels upwards. That’s why people need ever-larger amounts of cocaine and ever-more expensive handbags – they’re forever chasing that unrepeatable first high.

That means you’re not going to enjoy yourself even if you’re wealthy enough to fund your shopping habits. This might sound like the preamble to an old-fashioned moral lecture about how money can’t buy happiness, but it’s really not. Truth be told, it can. It just boils down to what you’re spending it on.

Not all spending is created equal; some kinds go further than others. When Kristy started her blog and began receiving emails from her readers, she noticed a trend. The more stuff people owned, the unhappier they were. Folks who owned less and used their money to buy experiences, by contrast, were pretty happy with their lot in life.

That’s because possessions give you an initial burst of dopamine which fades as your nucleus accumbens acclimatizes. The pleasure that comes with learning new skills or traveling doesn’t fade nearly as quickly. As long as you practice now and again, you’ll always be able to play the piano, and those holiday snaps from Rome will always take you back to that week you spent in the Eternal City with your husband.

Buying property isn’t the failsafe investment it’s made out to be.

Lots of folks are cautious about borrowing money, but they usually make one big exception: a mortgage. Conventional wisdom says buying a house isn’t just a rite of passage into adulthood but a wise investment in the future. After all, you can always sell at a profit, right?

Well, no. In reality, property comes with all sorts of hidden costs. Let’s talk numbers. According to the US Census Bureau, the average family stays in their home for 9 years. Typically, these families invest in brick and mortar in the expectation that property prices will rise. Historically, that rate rises and falls with inflation, but for simplicity’s sake, let’s assume here that prices increase by a steady 6 percent every year.

Our family – let’s call them the Smiths – buy their house for $500,000. Add 9 times 6 percent – 9 years at 6 percent inflation – to that and you get $844,739. That leaves a tidy profit of $344,739.

Not so fast. To buy the property, the Smiths need a title search from the land registry office. That’s $1,000. The title recording fee costs $150. The lawyer who processes those documents charges another grand.

Then there’s insurance. Rates vary across the US, but 0.5 per cent of the house’s value is pretty common. Paid annually for 9 years, that comes to $22,500. A property tax of 1 percent per annum adds another $45,000 to the bill. Meanwhile, realtors advise setting aside at least one percent of a home’s value every year for maintenance, which is what the Smiths do. That’s another $45,000.

Selling isn’t cheap either. A commission of 6 percent of the final sale price clocks in at $50,684. The land transfer tax is 1.2 percent, so that’s $10,137. Oh and there’s another lawyer, who also bills for $1,000.

That brings us to $175,571 – 51 percent of the Smiths’ profit. But we haven’t talked about interest yet. Like most families, the Smiths paid a ten percent down payment in cash and borrowed the rest from their bank. Over 9 years, they have paid $162,033 in interest.

That’s a whopping 98 percent of the sale price. And remember, we started by assuming that the value of the Smiths’ house would grow by 6 percent every year. That’s well above the actual inflation rate in the US, which is about 2 percent. In the real world, the Smiths would have lost money!

Use the “Rule of 150” to decide whether to buy a house or use your money for something else.

We crunched the numbers and saw that the cost of buying, owning and selling a house outweighed the returns in the case of a fictional American family. The moral of the story, however, isn’t that you should never buy a house – it’s that you need to work out if that’s a good call in your situation.

Ask a realtor and they’ll swear it’s all very simple. If the monthly mortgage payment equals the rent on a similar house or apartment, you’re better off buying rather than giving your money to a landlord. Look more closely, however, and you’ll find it’s a little more complicated.

That’s where the Rule of 150 comes in. This is a tool to help you compare the true cost of owning a home with what you would be saving by not renting. Here’s how it works:

Over the first 9 years of a standard 30-year mortgage, only about 50 percent of your payments go towards the actual loan; paying off interest on that loan accounts for the other 50 percent. Now, additional ownership costs like maintenance and insurance are roughly equal to the interest on a standard mortgage during those first 9 years, so that’s another 50 percent. So to calculate your actual monthly payments, you’ll need to multiply your monthly mortgage payment by 150 percent.

That’s how much your home will actually cost per month once you’ve accounted for all your expenses. So say you’re looking at a monthly mortgage bill of $1,500. When you multiply that by 150 percent, you get your true cost – $2,250. If your Rule of 150 monthly cost is higher than your rent, it makes sense to stick it out in the rental market; if it’s lower, you might want to think about buying.

When Kristy first considered buying a house, she was living in Toronto, Canada’s most expensive city. Prices were out of control and one-person apartments were going for a million dollars apiece. After applying the Rule of 150, she quickly realized that there was no way she was going to be able to buy her own home.

That opened an unexpected can of worms. If she wasn’t going to blow her savings on property, what was she going to do with that nest egg?

Index investing is less risky than betting on individual companies.

The American business guru Robert Kiyosaki once remarked that poor people buy stuff, the middle class buys houses and rich people buy investments. What he meant is that rich people put their money into things that make them more money. But you don’t have to be a multi-millionaire to follow their lead.

Broadly speaking, there are two ways of investing. The first is to do what Wall Street whizzes do – spend a ton of cash on research and fancy algorithms to pick the best companies. The second variant is cheaper, simpler and, most importantly, less risky.

That’s called index investing. Think of it as betting on the casino rather than individual horses. It doesn’t matter who wins the race – the house always makes money. Let’s unpack that.

An index is a list of companies ranked by market capitalization, or the overall value of their public shares. When you invest in an index, you’re effectively betting on every one of those listed firms. Because the index contains the stock of multiple high-performing companies, a single failure won’t wipe you out. The only way you can go bust is if every name on your index simultaneously files for bankruptcy.

That’s highly unlikely. Why? Well, index investing has an elegant built-in barometer. If a company is worth more, the index automatically picks up more shares in that company, and vice versa. If a tech giant releases a world-beating smartphone and its stock soars, the index buys more shares. If a car company runs into trouble and their stock plummets, the index dumps shares. And when a company drops in value from number 500 to number 501, it’s kicked off the index entirely.

This is a highly intuitive way of gauging the stock market as a whole, which is why major indexes like the S&P 500 – a list of the 500 biggest companies – work like this.

Index investing is also good for your wallet. The simplicity of the concept means there’s no need to pay for a hands-on fund manager. In the US, for example, a typical index fund charges fees of just 0.04 percent – 25 times lower than what you’d pay for an actively managed fund. The sales commission? $0. If you ever want to see your bank manager sweat, head to your local branch and ask to have your savings put into index funds!

Early retirement doesn’t depend on how much you make – it’s all about how much you save.

Chances are you’ve idly daydreamed about early retirement. Most folks quickly shelve that idea when they take a look at their bank balance, though. If you’re not raking it in, you just can’t afford to stop working before your mid-sixties, right?

Wrong. Your time to retirement doesn’t depend on how much you earn but how much you save. If you’re making and spending a million bucks a year, you’re entirely dependent on your job and won’t ever be able to retire. If you make $40,000 a year and spend $30,000, on the other hand, you already have a healthy savings rate of 25 percent.

The “normal” retirement age is 65 because most people save between five and ten percent of their salaries and have investment portfolios yielding an average of six to seven percent annually. Plug those numbers into a spreadsheet and you’re looking at 40 to 45 years of work.

The way to reduce that time is to up how much you’re saving. This does two things. Firstly, it cuts your living expenses, which in turn cuts the size of your target portfolio – the amount of cash you’ll need to retire. Secondly, it pumps more money into that portfolio. Think of it as a race: you’re moving the finish closer while also running faster. Even relatively small changes have a big impact. Boosting your savings rate from ten to 15 percent, for example, shaves 5 years off your working life!

Still not convinced? Well, okay, let’s take a look at the case of a fictional couple we’ll call Paul and Jillian. Together, their annual earnings come to $62,175. That’s the median family income in the US. Deduct 15.2 percent for taxes and you’re left with $52,724.40.

Now imagine Paul and Jillian decided to turbocharge their savings rate. They rent a small apartment in an affordable city, cook at home and use car-sharing services like Zipcar. All in all, they pay $40,000 to cover their costs and put $12,724.40 into their portfolio every year.

Let’s lowball the interest rate they’re getting on that and say it’s 6 percent. Even if they never get promotions or better-paying jobs, Paul and Jillian would have a million dollars in 30 years. If they started at 24, they could retire at 54 – 11 years ahead of schedule!

Reducing the size of your target portfolio makes early retirement more manageable.

How much do you need to save to retire early? That’s exactly what researchers asked in a landmark study published in the investment journal AAII in 1998.

They used stock market data to simulate what would happen to a group of fictional retirees who withdrew different percentages of their portfolios every year after retirement. Would “Alan,” for example, make it over the line or run out of cash if he withdrew 10 percent of his $500,000 nest egg every year?

Here’s the answer: Your portfolio is self-sustaining when your annual living expenses are no greater than 4 percent of its total value. Economists call that a safe withdrawal rate. This number allows you to determine the size of your target portfolio – simply multiply your annual expenses by 25. If you need $40,000 a year, you’re looking at a $1,000,000 portfolio.

That’s a lot of cash, right? Sure, but don’t let that put you off – there are also alternative strategies. Take partial financial independence. This gives you the benefits of financial independence, such as flexibility and having more free time, and it’s achievable with a smaller portfolio.

Say you earn the US median family income of $62,175 and need $40,000 a year to cover your living costs. If you shift to part-time work and earn $28,000 after tax, you’ll have an annual shortfall of $12,000 in your budget. Multiply that number by 25 and you have your new target portfolio – $300,000. Save that amount and you can enter semi-retirement!

Then there’s geographic arbitrage. This is the idea that you can earn income in a country with a strong currency like Germany or the US and retire in a country with a weaker currency like Mexico or Thailand. When Kristy and her husband Bryce visited Vietnam, for example, they realized that you can live a luxurious life there for around $1,130 a month.

If you’re earning the local average salary of $150 a month, that’s unaffordable; if you’re earning the average US monthly salary, however, it’s well within your reach. So what does your target portfolio look like now? Multiply $1,130 by 12, which gives you $13,560. Then multiply that by 25 and you have $339,000.

So there you have it – a ton of tricks to help launch your journey to financial independence. All you have to do now is ask yourself a simple question. What’s more important – accumulating expensive things or your freedom? Answer that honestly and your money decisions will become clear.

Getting a handle on your finances comes down to one basic principle: follow the math. That means ignoring feel-good advice like choosing to study a subject you love rather than one that will bring in a salary you can actually live on. It also means bucking social trends if they’re not right for you. Crunch the numbers and you might just discover that you’re better off investing your savings in the stock market rather than buying a house and saddling yourself with a lifetime of debt. Why? Well, if you’re growing your money while avoiding ruinous interest rates, you’re setting yourself up for financial independence. And that means you’re one step closer to the ultimate dream: early retirement.

Action plan: Make invisible waste visible.

Consumerism promises happiness but it’s usually little more than a temporary fix. What it does generate is waste. A lot of waste. Take clothing. According to the Guardian, Americans throw away 11 million tons of clothes every year. So here’s how to eliminate waste in your own wardrobe: make it visible. Simply push all the clothes in your closet to the left, and place an empty hanger with a piece of masking tape in the middle. Everything you wear from now on goes on the right of the marked hanger after it’s been washed. Over time, this reveals how often you use different items. On the right, are the superstars of your wardrobe; in the middle, pieces you do wear but infrequently; and on the left, clothes you never take out at all – the waste.

0 notes

Photo

Lesson 34: "There is no royal flower-strewn path to success. And if there is, I have not found it."

First of her siblings to be free-born (Louisiana, 1867), Sarah Breedlove's earliest days are scant on details. What is known is that she married a young man named Moses McWilliams at the age of 14 and had a daughter, A'Lelia. Unfortunately Moses passed away 2 years later and Breedlove and her daughter moved to St. Louis. Breedlove found work as a washer woman (a fact she would relate years later without shame or apology), and attended night school, ultimately earning her degree and moving to St. Louis. In 1906 she married an advertiser, Charles Joseph Walker, whereupon she took the name C. J. Walker for herself.

The Madam C. J. Walker Manufacturing Company arose out of a moment in Walker's life when she experienced some hair loss and other scalp afflictions. At the time there was a minimal market for hair care products specifically for black customers, though there were some nascent companies from which Walker took her cues. She moved to Denver, CO and created an independent hairdresser and cosmetics company which quickly grew to meet an overwhelming demand, ultimately leading to a national network, dedicated training schools, and an R&D department. Word of "The Walker System" of multi-level marketing spread, and at the company's nadir its employees numbered in the thousands (many of them women of color in management and leadership roles), and listed Booker T. Washington among its investors.

"Now I realize that in the so-called higher walks of life, many were prone to look down upon 'hairdressers' as they called us; they didn’t have a very high opinion of our calling, so I had to go down and dignify this work, so much so that many of the best women of our race are now engaged in this line of business, and many of them are now in my employ."

Today the The Madam C. J. Walker Manufacturing Company is regarded as one of the most widely known and financially successful African-American owned businesses of the early twentieth century, and Walker herself holds the distinction of being one of the first-ever American women to become a self-made millionaire.

Walker is freshly re-energized in the American consciousness this year (2020) due to the Netflix series Self-Made that bowed in March. Accordingly, your recommended reading for this lesson is the biography On Her Own Ground by Walker's great-great-granddaughter A'Lelia Perry Bundles.

2 notes

·

View notes

Text

Best Investing and Finance Books

Best Investing Books

1. The Intelligent Investor by benjamin graham

The greatest investment advisor of the twentieth century, Benjamin Graham taught and inspired people worldwide. Graham's philosophy of “value investing”—which shields investors from substantial error and teaches them to develop long-term strategies—has made The Intelligent Investor the stock market bible ever since its original publication in 1949.

Over the years, market developments have proven the wisdom of Graham’s strategies. While preserving the integrity of Graham’s original text, this revised edition includes updated commentary by noted financial journalist Jason Zweig, whose perspective incorporates the realities of today’s market, draws parallels between Graham’s examples and today’s financial headlines, and gives readers a more thorough understanding of how to apply Graham’s principles.

Vital and indispensable, The Intelligent Investor is the most important book you will ever read on how to reach your financial goals.

2. How to Avoid Loss and Earn Consistently in the Stock Market: An Easy-To-Understand and Practical Guide for Every Investor

Hundreds of books are there about ""How to make money from stocks?"" Still 80% small investors suffer loss in the stock market. Why?

Plenty of free trading tips are available across Television and Internet; still maximum small investors are unable to earn significant return consistently from trading. Why?

Why maximum individuals still consider the stock market as a place for gambling?

Investing in high-quality business (stock) at the right price and holding them for a reasonable period is the only way for wealth creation.Written in an easy-to-understand and simple language, this book will guide you on how to select fundamentally strong business, when to buy and sell stocks and above all how to minimize or avoid loss in the stock market.

Chapters-

1. How to avoid loss in the stock market?

2. Stock Market is NOT risky at all

3. First step of picking winning stocks

4. How to evaluate management?

5. Valuation - It matters much

6. When to buy and when to sell

7. Do's and don'ts to avoid loss in the stock market

8. How to construct your portfolio?

9. Is it required to follow an equity advisor?

10. Quick formula for picking winning stocks

11. Little bit of myself - Important Lessons to be learnt

The book ends with a small note on "Life is not all about the stock market and money"

3. One Up On Wall Street: How to Use What You Already Know to Make Money in the Market

Penned by the famous mutual-fund manager, Peter Lynch, this book elaborates the many advantages that an average investor has over professionals and how they can help them reach financial triumph.

How To Use What You Already Know To Make Money in The Market explains how your knowledge alone can assist you beat the pros of investing. From the viewpoint of America's most triumphant money manager, investment chances are extensively accessible. Whether supermarket or work place, you can find goods and services everywhere. You have to select these organizations in which to invest, before they are found by skilled analysts. You will find more interesting knowledge on investment. Thus the book has become one of the best seller and treasure among readers. Moreover, this book provides time less recommendation on money business. This book has discussed the tips, ebb and flows on building it big in the investment market.

4. How to Make Money in Stocks: A Winning System in Good Times and Bad

Written by the acclaimed entrepreneur, William J O'Neil, How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition is a handy guide that that deals with the stock market and its intricacies. The author of this book has written down the hard-earned knowledge he gained from his own experiences as an investor.

The price charts of winning stocks from the past century have been listed out in the beginning of this book. These charts are supplemented with notes throughout in order to make them more comprehensible to readers. In this book, the author discusses his trademark CAN SLIM method of investing.

The CAN SLIM method put together by the author consists of 7 steps which are aimed at maximising profits. This book imparts valuable information about the times when one needs to cut a loss and the times when one needs to invest and make a profit.

Mutual funds and exchange-traded funds are discussed as well by the author and he provides important tips on the ways to properly approach them while investing. The CAN SLIM method highlighted in this book was formulated by the author after analysing stock market patterns over the last 100 years.

How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition runs its readers through important investment-related aspects such as an organisation's growth rate, demand and supply, mutual funds, etc

5. Irrational Exuberance by Robert J.Shiller

As Robert Shiller’s new 2009 preface to his prescient classic on behavioral economics and market volatility asserts, the irrational exuberance of the stock and housing markets “has been ended by an economic crisis of a magnitude not seen since the Great Depression of the 1930s.” As we all, ordinary Americans and professional investors alike, crawl from the wreckage of our heedless bubble economy, the shrewd insights and sober warnings, and hard facts that Shiller marshals in this book are more invaluable than ever.

The original and bestselling 2000 edition of Irrational Exuberance evoked Alan Greenspan’s infamous 1996 use of that phrase to explain the alternately soaring and declining stock market. It predicted the collapse of the tech stock bubble through an analysis of the structural, cultural, and psychological factors behind levels of price growth not reflected in any other sector of the economy. In the second edition (2005), Shiller folded real estate into his analysis of market volatility, marshalling evidence that housing prices were dangerously inflated as well, a bubble that could soon burst, leading to a “string of bankruptcies” and a “worldwide recession.” That indeed came to pass, with consequences that the 2009 preface to this edition deals with.

Irrational Exuberance is more than ever a cogent, chilling, and astonishingly far-seeing analytical work that no one with any money in any market anywhere can afford not to read–and heed.

Best Finance Books

1. The Millionaire Next Door: The Surprising Secrets of America's Wealthy

The bestselling The Millionaire Next Door identifies seven common traits that show up again and again among those who have accumulated wealth. Most of the truly wealthy in this country don't live in Beverly Hills or on Park Avenue-they live next door. This new edition, the first since 1998, includes a new foreword for the twenty-first century by Dr. Thomas J. Stanley.

2. Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications

John J. Murphy has now updated his landmark bestseller Technical Analysis of the Futures Markets, to include all of the financial markets.

This outstanding reference has already taught thousands of traders the concepts of technical analysis and their application in the futures and stock markets. Covering the latest developments in computer technology, technical tools, and indicators, the second edition features new material on candlestick charting, intermarket relationships, stocks and stock rotation, plus state-of-the-art examples and figures. From how to read charts to understanding indicators and the crucial role technical analysis plays in investing, readers gain a thorough and accessible overview of the field of technical analysis, with a special emphasis on futures markets. Revised and expanded for the demands of today's financial world, this book is essential reading for anyone interested in tracking and analyzing market behavior.

3. The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life

“In the dark, bewildering, trap-infested jungle of misinformation and opaque riddles that is the world of investment, JL Collins is the fatherly wizard on the side of the path, offering a simple map, warm words of encouragement and the tools to forge your way through with confidence. You'll never find a wiser advisor with a bigger heart.” -- Malachi Rempen: Filmmaker, cartoonist, author and self-described ruffian

This book grew out of a series of letters to my daughter concerning various things—mostly about money and investing—she was not yet quite ready to hear.

Since money is the single most powerful tool we have for navigating this complex world we’ve created, understanding it is critical.

“But Dad,” she once said, “I know money is important. I just don’t want to spend my life thinking about it.” This was eye-opening. I love this stuff. But most people have better things to do with their precious time. Bridges to build, diseases to cure, treaties to negotiate, mountains to climb, technologies to create, children to teach, businesses to run.

Unfortunately, benign neglect of things financial leaves you open to the charlatans of the financial world. The people who make investing endlessly complex, because if it can be made complex it becomes more profitable for them, more expensive for us, and we are forced into their waiting arms.

Here’s an important truth: Complex investments exist only to profit those who create and sell them. Not only are they more costly to the investor, they are less effective.

The simple approach I created for her and present now to you, is not only easy to understand and implement, it is more powerful than any other.

Together we’ll explore:

Debt: Why you must avoid it and what to do if you have it.

The importance of having F-you Money.

How to think about money, and the unique way understanding this is key to building your wealth.

Where traditional investing advice goes wrong and what actually works.

What the stock market really is and how it really works.

Why the stock market always goes up and why most people still lose money investing in it.

How to invest in a raging bull, or bear, market.

Specific investments to implement these strategies.

The Wealth Building and Wealth Preservation phases of your investing life and why they are not always tied to your age.

How your asset allocation is tied to those phases and how to choose it.

How to simplify the sometimes confusing world of 401(k), 403(b), TSP, IRA and Roth accounts.

TRFs (Target Retirement Funds), HSAs (Health Savings Accounts) and RMDs (Required Minimum Distributions).

What investment firm to use and why the one I recommend is so far superior to the competition.

Why you should be very cautious when engaging an investment advisor and whether you need to at all.

Why and how you can be conned, and how to avoid becoming prey.

Why I don’t recommend dollar cost averaging.

What financial independence looks like and how to have your money support you.

What the 4% rule is and how to use it to safely spend your wealth.

The truth behind Social Security.

A Case Study on how this all can be implemented in real life.

Don’t let any of this intimidate you. Those that have gone before you say:

“….in his patented no-frills and often humorous style, JL makes it both approachable and simple. And powerful.”

“…effective message told in a visual, funny style.”

“…a refreshingly unique and approachable take on investing.”

“JL Collins has the gift of making boring financial concepts funny and interesting.”

“Instead of esoteric equations about measuring a stock's alpha and comparing it to its beta, he lights up the campfire and starts telling stories.”

Enjoy the read, and the journey!

4. The Essays of Warren Buffett: Lessons for Corporate America

The fifth edition of The Essays of Warren Buffett: Lessons for Corporate Americacontinues a 25-year tradition of collating Warren Buffett's philosophy in a historic collaboration between Mr. Buffett and Prof. Lawrence Cunningham. As the book Buffett autographs most, its popularity and longevity attest to the widespread appetite for this unique compilation of Mr. Buffett’s thoughts that is at once comprehensive, non-repetitive, and digestible. New and experienced readers alike will gain an invaluable informal education by perusing this classic arrangement of Mr. Buffett's best writings.

“Larry Cunningham has done a great job at collating our philosophy.”—Warren Buffett

"Larry Cunningham takes Buffett's brilliant letters to a still-higher level by organizing them into single-subject chapters. The book begins, moreover, with an excellent introduction by Larry.”—Carol Loomis

“The book on Buffett—a superb job.”—Forbes

“Extraordinary—full of wisdom, humor, and common sense.”—Money

“A classic on value investing and the definitive source on Buffett.”—Financial Times

5. Too Big to Fail: Inside the Battle to Save Wall Street

They were masters of the financial universe, flying in private jets and raking in billions. They thought they were too big to fail. Yet they would bring the world to its knees.

Andrew Ross Sorkin, the news-breaking New York Times journalist, delivers the first true in-the-room account of the most powerful men and women at the eye of the financial storm - from reviled Lehman Brothers CEO Dick 'the gorilla' Fuld, to banking whiz Jamie Dimon, from bullish Treasury Secretary Hank Paulson to AIG's Joseph Cassano, dubbed 'The Man Who Crashed the World'.

Through unprecedented access to the key players, Sorkin meticulously re-creates frantic phone calls, foul-mouthed rows and white-knuckle panic, as Wall Street fought to save itself.

2 notes

·

View notes

Text

The Best Movies on Netflix in India [February 2020]

In its efforts to win Oscars and please its 167 million members, Netflix has been pouring billions into movies recently, including projects from or featuring the likes of Dwayne Johnson, Martin Scorsese, and Michael Bay. One of those — The Irishman — racked up 10 nominations for the streaming service at the 2020 Oscars, though it failed to come away with a single prize. Netflix has also expanded its film efforts in India in the past year, announcing projects from the likes of Shah Rukh Khan and Karan Johar. For now though, the strength of its catalogue is still the acquisitions. With over 3,500 movies, Netflix offers more choices than any other platform in India. To pick the best movies on Netflix, we relied on Rotten Tomatoes, Metacritic, and IMDb ratings to create a shortlist. The last of them was preferred for Indian films given the shortfalls of reviews aggregators in that department. Additionally, we used our own editorial judgement to add or remove a few. This list will be updated once every few months if there are any worthy additions or if some movies are removed from the service, so bookmark this page and keep checking in. Here are the best films currently available on Netflix in India, sorted alphabetically. 12 Monkeys (1995)

Inspired by the 1962 French short La Jetée, a prisoner (Bruce Willis) is sent back in time to learn more about the virus that wiped out nearly all of humanity. Terry Gilliam directs. 12 Years A Slave (2013)

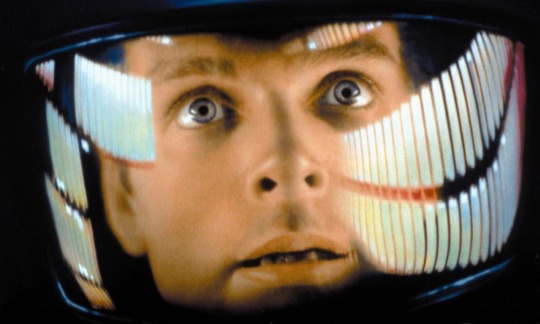

Duped into slavery on the account of a job, Steve McQueen's adaptation of a free New York black man's (Chiwetel Ejiofor) 19th-century memoir is an incredible true story, and an important watch. 2001: A Space Odyssey (1968)

In Stanley Kubrick's highly-influential sci-fi film, humanity charts a course for Jupiter with the sentient computer HAL 9000, to understand the discovery of a black monolith affecting human evolution. It's less plot, and more a visual and aural experience.

3 Idiots (2009)

In this satire of the Indian education system's social pressures, two friends recount their college days and how their third long-lost musketeer (Aamir Khan) inspired them to think creatively and independently in a heavily-conformist world. Co-written and directed by Rajkumar Hirani, who stands accused in the #MeToo movement. 50/50 (2011)

Inspired by a true story, a 27-year-old radio journalist (Joseph Gordon-Levitt) is diagnosed with spinal cancer and learns the value of friendship and love as he battles the rare disease. Aamir (2008)

Adapted from the 2006 Filipino film Cavite, a young Muslim NRI doctor (Rajeev Khandelwal) returning from the UK to India is forced to comply with terrorists' demands to carry out a bombing in Mumbai after they threaten his family. American History X (1998)

In a film that's more relevant today than when it was made, a neo-Nazi white supremacist (Edward Norton), who served three years in prison for voluntary manslaughter, tries to prevent his younger brother from going down the same path. American Hustle (2013)

In the late 1970s, two con artists (Christian Bale and Amy Adams) are forced to work for an FBI agent (Bradley Cooper) and set up a sting operation that plans to bring down several corrupt politicians and members of the Mafia. Jennifer Lawrence, Jeremy Renner star alongside. Andaz Apna Apna (1994)

Two slackers (Aamir Khan and Salman Khan) who belong to middle-class families vie for the affections of an heiress, and inadvertently become her protectors from a local gangster in Rajkumar Santoshi's cult comedy favourite. Andhadhun (2018)

Inspired by the French short film L'Accordeur, this black comedy thriller is the story of a piano player (Ayushman Khurrana) who pretends to be visually-impaired and is caught in a web of twists and lies after he walks into a murder scene. Tabu, Radhika Apte star alongside. Apollo 13 (1995)

Ron Howard dramatises the aborted Apollo 13 mission that put the astronauts in jeopardy after an on-board explosion ate up all the oxygen and forced NASA to abort and get the men home safely. Argo (2012)

Ben Affleck directs and stars in this film about a CIA agent posing as a Hollywood producer scouting for location in Iran, in order to rescue six Americans during the US hostage crisis of 1979. Article 15 (2019)

Ayushmann Khurrana plays a cop in this exploration of casteism, religious discrimination, and the current socio-political situation in India, which tracks a missing persons' case involving three teenage girls of a small village. A hard-hitting, well-made movie, though ironically, it was criticised for being casteist itself, and providing an outsider's perspective. The Avengers (2012)

Earth's mightiest heroes — including Iron Man, Captain America, Thor, and the Hulk — come together in this groundbreaking Marvel team-up from writer-director Joss Whedon to stop Thor's adopted brother Loki (Tom Hiddleston) and his alien army from subjugating mankind.

The Aviator (2004)

With Leonardo DiCaprio as Howard Hughes and Cate Blanchett as Katharine Hepburn, Martin Scorsese dives into the life of the aviation pioneer and film producer, who grapples with severe OCD while his fame grows. Awakenings (1990)

Robin Williams and Robert De Niro lead the cast of this drama based on a 1973 memoir of the same name, about a doctor (Williams) who discovers the beneficial effects of a drug on catatonic patients, thereby gifting them a new lease on life. Barfi! (2012)

Set in the 1970s amidst the hills of Darjeeling, writer-director Anurag Basu tells the tale of three people (Ranbir Kapoor, Priyanka Chopra, and Ileana D'Cruz) as they learn to love while battling the notions held by society. Beasts of No Nation (2015)

With civil war raging across a fictional African nation, this Netflix Original focuses on a young boy who's trained as a child soldier by a fierce warlord (Idris Elba), and the effects it has on him. Before Sunrise (1995)

In the first chapter of Richard Linklater's long-drawn-out trilogy, two idealistic twentysomethings, an American man (Ethan Hawke) and a French woman (Julie Delpy), spend the night together walking around in the Austrian capital of Vienna. The Big Lebowski (1998)

A guy known as The Dude (Jeff Bridges) seeks payback for his ruined carpet after he's mistaken for a millionaire with the same name in this crime comedy from the Coen brothers. Less about the plot and more about a way of living. The Big Short (2015)

Starring Christian Bale, Steve Carell, Ryan Gosling and Brad Pitt, a look at Wall Street's penchant for self-profit in a vicious loop that caused the 2007–08 global financial meltdown. Birdman (2014)

Alejandro G. Iñárritu won three Oscars including Best Picture for this tale of a washed-up superhero actor (Michael Keaton) who struggles to revive his career with a Broadway play. Known for appearing as if it was shot in a single take, it also starred Edward Norton, Zach Galifianakis, and Emma Stone. Blade Runner (1982)

One of the most influential cyberpunk films ever made is about a burnt-out cop (Harrison Ford) who reluctantly agrees to hunt down a group of fugitive “replicants”, synthetic humans with a limited life-span who aren't allowed to live on Earth. Blue Valentine (2010)

Ryan Gosling and Michelle Williams lead this drama that shifts between time periods to depict a couple's courtship and how their marriage fell apart. Das Boot (1981)

One of the most authentic war movies ever made chronicles the life of a German submarine crew during World War II, as they go through long stretches of boredom and periods of intense conflict, while trying to maintain morale in a capsule 10 feet by 150 feet hundreds of metres under the surface. The Bourne trilogy (2002-07)

Technically not a trilogy, but the first three chapters — Identity, Supremacy, and Ultimatum — starring Matt Damon in the lead as the titular CIA assassin suffering from amnesia were so good that they changed the longest-running spy franchise of all-time: James Bond.

The Breadwinner (2017)

This animated film follows a 11-year-old girl living under Taliban rule in Afghanistan, who disguises herself as a boy to provide for her family after the father is taken away without reason. Uses wonderfully-drawn vignettes to stress on the importance of storytelling. Bulbul Can Sing (2019)

Three teenagers battle patriarchy and the moral police as they explore their sexual identities in Rima Das's National Award-winning drama — and pay for it dearly. Das writes, directs, shoots, edits, and handles costumes. C/o Kancharapalem (2018)

Set in the eponymous Andhra Pradesh town, this Telugu film spans four love stories across religion, caste, and age — from a schoolboy to a middle-aged unmarried man. A debut for writer-director Venkatesh Maha, featuing a cast mostly made up of non-professional actors. Capernaum (2018)

In the award-winning, highest-grossing Arabic film of all time, a 12-year-old from the slums of Beirut recounts his life leading up to a five-year sentence he's handed for stabbing someone, and in turn, his decision to sue his parents for child neglect. Captain Phillips (2013)

The true story of a Somali pirate hijacking of a US cargo ship and its captain (Tom Hanks) being taken hostage, which spawns a rescue effort from the US Navy. The Bourne Ultimatum's Paul Greengrass directs. Cast Away (2000)

After his plane crash-lands in the Pacific, a FedEx employee (Tom Hanks) wakes up on a deserted island and must use everything at his disposal and transform himself physically to survive living alone. Castle in the Sky (1986)

In the first film officially under the Studio Ghibli banner, a young boy and a girl protect a magic crystal from pirates and military agents, while on the search for a legendary floating castle. Hayao Miyazaki writes and directs. Chupke Chupke (1975)

Hrishikesh Mukherjee's remake of the Bengali film Chhadmabeshi, in which a newly-wedded husband (Dharmendra) decides to play pranks on his wife's (Sharmila Tagore) supposedly smart brother-in-law. Amitabh and Jaya Bachchan also star. A Clockwork Orange (1971)

Set in a near-future dystopian Britain, writer-director Stanley Kubrick adapts Anthony Burgess' novel of the same name, commenting on juvenile delinquency through the eyes of a small gang leader who enjoys "a bit of the old ultra-violence". Close Encounters of the Third Kind (1977)

Steven Spielberg's slow-paced sci-fi pic — which spent several years in development, being rewritten over and over — is about an everyday blue-collar guy (Richard Dreyfuss) whose humdrum life turns upside down after an encounter with an unidentified flying object (UFO).

Cold War (2018)

Jumping either side of the Iron Curtain through the late 1940s to the 1960s, Oscar-winner Paweł Pawlikowski depicts the story of two star-crossed lovers, as they deal with Stalinism, rejection, jealousy, change, time — and their own temperaments. Company (2002)

Inspired the real-life relationship between Dawood Ibrahim and Chhota Rajan, director Ram Gopal Varma offers a look at how a henchman (Vivek Oberoi) climbs up the mobster ladder and befriends the boss (Ajay Devgn), before they fall out. Dallas Buyers Club (2013)

Refusing to accept a death sentence from his doctor after being diagnosed with AIDS in the 1980s, the true story of an electrician and hustler (Matthew McConaughey) who smuggles banned medications from abroad. Dangal (2016)

The extraordinary true story of amateur wrestler Mahavir Singh Phogat (Aamir Khan) who trains his two daughters to become India's first world-class female wrestlers, who went on to win gold medals at the Commonwealth Games. The Dark Knight (2008)

In the second part of Christopher Nolan's Dark Knight trilogy, regarded as the greatest comic book movie ever, Batman (Christian Bale) faces a villain, the Joker (Heath Ledger), he doesn't understand, and must go through hell to save Gotham and its people. Dev.D (2009)

Anurag Kashyap offers a modern-day reimagining of Sarat Chandra Chattopadhyay's Bengali romance classic Devdas, in which a man (Abhay Deol), having broken up with his childhood sweetheart, finds refuge in alcohol and drugs, before falling for a prostitute (Kalki Koechlin). Dheepan (2015)

Winner of Cannes' top prize, three Sri Lankan refugees — including a Tamil Tiger soldier — pretend to be a family to gain asylum in France, where they soon realise that life isn't very different in the rough neighbourhoods. Dil Chahta Hai (2001)

Farhan Akhtar's directorial debut about three inseparable childhood friends whose wildly different approach to relationships creates a strain on their friendship remains a cult favourite. Aamir Khan, Saif Ali Khan, and Preity Zinta star. Django Unchained (2012)

Written and directed by Quentin Tarantino, a German bounty hunter (Christoph Waltz) helps a freed slave (Jamie Foxx) rescue his wife from a charming but cruel plantation owner (Leonardo DiCaprio). Drive (2011)

A stuntman moonlighting as a getaway driver (Ryan Gosling) grows fond of his neighbour and her young son, and then takes part in a botched heist to protect them from the debt-ridden husband.

Dunkirk (2017)

Christopher Nolan's first historical war movie chronicles the evacuation of Allied soldiers from the French beaches of Dunkirk in World War II, using his love for non-linear storytelling by depicting three fronts — land, sea, and air — in time-shifted ways. The Edge of Seventeen (2016)

In this coming-of-age comedy, the life of an awkward young woman (Hailee Steinfeld) gets more complex after her older brother starts dating her best friend, though she finds solace in an unexpected friendship and a teacher-slash-mentor (Woody Harrelson). End of Watch (2012)

Before he made a terrible sci-fi remake of his own film, writer-director David Ayer took a near-documentarian lens to the day-to-day police work of two partners (Jake Gyllenhaal and Michael Peña) in South Los Angeles, involving their friendship and dealings with criminal elements. Eternal Sunshine of the Spotless Mind (2004)

An estranged couple (Jim Carrey and Kate Winslet) begin a new relationship unaware they dated previously, having erased each other from their memories, in what stands as writer Charlie Kaufman's defining work. The Exorcist (1973)

One of the greatest horror films of all time, that has left a lasting influence on the genre and beyond, is about the demonic possession of a 12-year-old girl and her mother's attempts to save her with the help of two priests who perform exorcisms. The Florida Project (2017)

Set in the shadow of Disney World, a precocious six-year-old girl (Brooklynn Prince) makes the most of her summer with her ragtag playmates, while her rebellious mother tries to make ends meet with the spectre of homelessness always hanging over them. Willem Dafoe stars alongside. Ferris Bueller's Day Off (1986)

In John Hughes' now-classic teen picture, a high schooler fakes being sick to spend the day with his girlfriend and his best friend, while his principal is determined to spy on him. Fruitvale Station (2013)

Black Panther writer-director Ryan Coogler's first feature offered a look at the real-life events of a young California man's (Michael B. Jordan) death in a police shooting in 2008. Winner of two awards at Sundance Film Festival. Full Metal Jacket (1987)

Stanley Kubrick follows a US marine nicknamed Joker from his days as a new recruit under the command of a ruthless sergeant, to his posting as a war correspondent in South Vietnam, while observing the effects of the war on his fellow soldiers.

Ghostbusters (1984)

A bunch of eccentric paranormal enthusiasts start a ghost-catching business in New York, and then stumble upon a plot to wreak havoc by summoning ghosts. Gave birth to one of the most iconic song lyrics in history. Gol Maal (1979)

A chartered accountant (Amol Palekar), with a knack for singing and acting, falls deep down the rabbit hole after lying to his boss that he has a twin, in this Hrishikesh Mukherjee comedy. Gone Girl (2014)

Based on Gillian Flynn's best-selling novel and directed by David Fincher, a confounded husband (Ben Affleck) becomes the primary suspect in the sudden mystery disappearance of his wife (Rosamund Pike). GoodFellas (1990)

Considered as one of the best gangster films of all time, it brought Martin Scorsese and Robert De Niro together for the sixth time. Based on Nicholas Pilegg's 1985 non-fiction book Wiseguy, it tells the rise and fall story of mob associate Henry Hill, his friends and family between 1955 and 1980. Gravity (2013)

Two US astronauts, a first-timer (Sandra Bullock) and another on his final mission (George Clooney), are stranded in space after their shuttle is destroyed, and then must battle debris and challenging conditions to return home. Guardians of the Galaxy (2014)

A bunch of intergalactic misfits, which includes a talking racoon and tree, come together to form a ragtag team in this Marvel adventure that needs no prior knowledge. Guru (2007)

Mani Ratnam wrote and directed this rags-to-riches story of a ruthless and ambitious businessman (Abhishek Bachchan) who doesn't let anything stand in his way as he turns into India's biggest tycoon. Loosely inspired by the life of Dhirubhai Ambani. Haider (2014)

Vishal Bhardwaj's Shakespearean trilogy concluded with this modern-day adaptation of Hamlet, that is also based on Basharat Peer's 1990s-Kashmir memoir Curfewed Night. Follows a young man (Shahid Kapoor) who returns home to investigate his father's disappearance and finds himself embroiled in the ongoing violent insurgency. Her (2013)

A lonely man (Joaquin Phoenix) falls in love with an intelligent computer operating system (Scarlett Johansson), who enriches his life and learns from him, in Spike Jonze's masterpiece. Hot Fuzz (2007)

A top London cop (Simon Pegg, also co-writer) is transferred to a sleepy English village for being the lone overachiever in a squad of slackers. A blend of relationship comedy and a genre cop movie. Edgar Wright directs. Hugo (2011)

In 1930s Paris, a boy who lives alone in the walls of a train station tries to figure out the mystery involving his late father and his most treasured possession, an automaton, that needs a key to function. Martin Scorsese directs.

The Hunger Games: Catching Fire (2013)

In the best of four movies, Jennifer Lawrence's Katniss Everdeen is forced to participate in a special edition of the Hunger Games, a competition where individuals fight to the death, featuring the winners of all previous competitions. I, Daniel Blake (2016)

After a heart attack that leaves him unable to work, a widowed carpenter is forced to fight an obtuse British welfare system, while developing a strong bond with a single mother who has two children. Winner of the Palme d'Or. I Lost My Body (2019)

In this animated Cannes winner, a severed hand escapes from a lab and scrambles through Paris to get back to his body, while recounting its past life that involved moving to France after an accident and falling in love. In This Corner of the World (2016)

Set in Hiroshima during World War II, an 18-year-old woman agrees to marry a man she barely knows in this animated Japanese film, and then must learn to cope with life's daily struggles and find a way to push through as the war rages on around her. Indiana Jones and the Raiders of the Lost Ark (1981)

Directed by Steven Spielberg off a story by George Lucas, an eponymous archaeologist (Harrison Ford) travels the world and battles a group of Nazis while looking for a mysterious artefact, in what is now often considered as one of the greatest films of all-time. Infernal Affairs (2002)

Martin Scorsese's Oscar-winning The Departed is a remake of this original Hong Kongian film, in which a police officer is working undercover in a Triad, while a Triad member is secretly working for the police. Both have the same objective: find the mole. Into the Wild (2007)

Based on Jon Krakauer's nonfiction book, Sean Penn goes behind the camera to direct the story of a top student and athlete who gives up all possessions and savings to charity, and hitchhikes across America to live in the Alaskan wilderness. Iqbal (2005)

In writer-director Nagesh Kukunoor's National Award-winning film, a hearing- and speech-impaired farm boy (Shreyas Talpade) pursues his passion for becoming a cricketer for the national squad, with the help of a washed-up ex-coach (Naseeruddin Shah). The Irishman (2019)

Based on Charles Brandt's 2004 book “I Heard You Paint Houses”, Martin Scorsese offers an indulgent, overlong look at the life of a truck driver (Robert De Niro) who becomes a hitman working for the Bufalino crime family and labour union leader Jimmy Hoffa (Al Pacino).

John Wick (2014)

In the first part of what is now a series, a former hitman (Keanu Reeves) exits retirement to find and kill those that stole his car and killed his dog. Less story, more action, with the filmmakers drawing on anime, Hong Kong action cinema, Spaghetti Westerns, and French crime dramas. Jurassic Park (1993)

It might be over 25 years old at this point but watching the very first Jurassic film from Steven Spielberg — based on Michael Crichton's novel, which he co-adapted — is a great way to remind yourself why the new series, Jurassic World, has no idea why it's doing. Kahaani (2012)

A pregnant woman (Vidya Balan) travels from London to Kolkata to search for her missing husband in writer-director Sujoy Ghosh's National Award-winning mystery thriller, battling sexism and a cover-up along the way. Khosla Ka Ghosla! (2006)

After a powerful property dealer (Boman Irani) holds a middle-class, middle-aged man's (Anupam Kher) newly-purchased property to ransom, his son and his son's friends devise a plot to dupe the swindling squatter and pay him back with his own money. Dibakar Banerjee's directorial debut. Kiki's Delivery Service (1989)

A coming-of-age story of the young titular witch, who opens an air delivery business, helps a bakery's pregnant owner in exchange for accommodation, and befriends a geeky boy during her year of self-discovery. Hayao Miyazaki writes and directs. Lady Bird (2017)

Greta Gerwig's directorial debut is a coming-of-age story of a high school senior (Saoirse Ronan) and her turbulent relationship with her mother (Laurie Metcalf), all while she figures out who she wants to be through friendships and short relationships. Lagaan (2001)

Set in Victorian India, a village farmer (Aamir Khan) stakes everyone's future on a game of cricket with the well-equipped British, in exchange for a tax reprieve for three years. The Little Prince (2015)

Antoine de Saint-Exupery's 1943 novella is given the animation treatment, in which an elderly pilot (Jeff Bridges) recounts his encounters with a young boy who claimed to be an extra-terrestrial prince to his neighbour, a young girl. Rachel McAdams, James Franco, and Marion Cotillard also voice. A Little Princess (1995)

Alfonso Cuarón directs this tale of a young girl who is forced to become a servant by the headmistress at her New York boarding school, after her wealthy aristocratic father is presumed dead in World War I. The Lord of the Rings trilogy (2001-2003)

Peter Jackson brought J.R.R. Tolkien's expansive Middle-Earth to life in these three three-hour epics, which charts the journey of a meek hobbit (Elijah Wood) and his various companions, as they try to stop the Dark Lord Sauron by destroying the source of his power, the One Ring.

Loveless (2017)

A Cannes winner about the social ills of life in modern Russia, told through the eyes of two separated parents who are drawn back together after their 12-year-old child goes missing. From award-winning director Andrey Zvyagintsev. The Lunchbox (2013)

An unlikely mistake by Mumbai's famously efficient lunchbox carrier system results in an unusual friendship between a young housewife (Nimrat Kaur) and an older widower (Irrfan Khan) about to retire from his job. Lupin the Third: Castle of Cagliostro (1979)

In legendary Japanese director Hayao Miyazaki's feature debut, a dashing master thief enlists the help of a long-time nemesis in the police and a fellow thief to rescue a princess from an evil count, and put an end to his counterfeit money operation. Marriage Story (2019)

Scarlett Johansson and Adam Driver play an entertainment industry couple going through a divorce, which pulls them — and their young son — from New York to Los Angeles, the two different hometowns of the protagonists. Mary Poppins (1964)

Based on P.L. Travers' book series of the same name, a disciplined father hires a loving woman (Julie Andrews) — who he doesn't know is capable of magic — to be the nanny for his two mischievous children. Won five Oscars, including best actress for the debutant Andrews. Masaan (2015)

Neeraj Ghaywan ventures into the heartland of India to explore the life of four people in his directorial debut, all of whom must battle issues of caste, culture and norms. Winner of a National Award and the FIPRESCI Prize at Cannes. Million Dollar Baby (2004)

An overlooked, veteran boxing trainer (Clint Eastwood, who also directs) reluctantly agrees to train a former waitress (Hilary Swank) to help achieve her dreams, which leads to a close father-daughter bond that will forever change their lives. Mission: Impossible – Rogue Nation (2015)

With the organisation he works for disbanded and his country after him, Ethan Hunt (Tom Cruise) races against time to prove the existence of the schemers pulling the strings in this fifth chapter. Introduced Rebecca Ferguson to the franchise. Monty Python and the Holy Grail (1975)

The legendary British comedy troupe mix their talents with the tale of King Arthur and his knights, as they look for the Holy Grail and encounter a series of horrors. A contender for the best comedy of all-time.

Monty Python's Life of Brian (1979)

Satire so cutting that it was banned for years in the UK and elsewhere, Life of Brian saw Monty Python turning their eyes on more long-form storytelling. The Life of Brian is the story of a young Jewish man born on the same day and next door to Jesus Christ, who gets mistaken for the messiah. Mudbound (2017)

A Netflix Original, this World War II drama is set in rural Mississippi, and follows two veterans – one white and one black – who return home, and must deal with problems of racism in addition to PTSD. Munna Bhai M.B.B.S. (2003)

After his parents find out he has been pretending to be a doctor, a good-natured Mumbai underworld don (Sanjay Dutt) tries to redeem himself by enrolling in a medical college, where his compassion brushes up against the authoritarian dean (Boman Irani). Co-written and directed by Rajkumar Hirani, who stands accused in the #MeToo movement. My Neighbor Totoro (1988)

Set in post-war rural Japan, a heart-warming tale of a professor's two young daughters who have adventures with friendly forest sprits. Hayao Miyazaki writes and directs. Mystic River (2003)

Three childhood friends reunite after a brutal murder, in which the victim is one's (Sean Penn) daughter, another (Kevin Bacon) is the case detective, and the third (Tim Robbins) is suspected by both. Clint Eastwood directs. Nightcrawler (2014)

Jake Gyllenhaal plays a freelance video journalist with no ethics or morals who will do anything to get the best footage of violent crimes that local news stations love. A feature directorial debut for screenwriter Dan Gilroy. Ocean's Eleven (2001)

In this first of Steven Soderbergh's trilogy, which features an ensemble cast including George Clooney, Brad Pitt, and Matt Damon, Danny Ocean (Clooney) and his eleven associates plan to rob three Las Vegas casinos at the same time. Okja (2017)

Part environment parable and part skewer of corporatisation, this underappreciated Netflix Original by Bong Joon-ho tells its story of a young Korean girl and her best friend – a giant pet pig – while effortlessly crossing genres. On Body and Soul (2017)

A shy, introverted man and a woman who work at a Hungarian slaughterhouse discover they share the same dreams after an incident, and then try to make them come true.

Only Yesterday (1991)

A Studio Ghibli production about a 27-year-old career-driven Tokyo woman who reminisces about her childhood on her way to the countryside to see her sister's family. Isao Takahata writes and directs. Paan Singh Tomar (2012)

A true story of the eponymous soldier and athlete (Irrfan Khan) who won gold at the National Games, and later turned into a dacoit to resolve a land dispute. Won top honours for film and actor (Khan) at National Awards. Pan's Labyrinth (2006)

In Guillermo del Toro's fantastical version of Spain five years after the civil war, Ofelia – a young stepdaughter of a cruel army officer – is told she is the reincarnated version of an underworld princess but must complete three tasks to prove herself. The Perks of Being a Wallflower (2012)

Emma Watson stars in this coming-of-age comedy based on the novel of the same name by Stephen Chbosky, who also wrote and directed the film. Watson plays one of two seniors who guide a nervous freshman. Phantom Thread (2017)

Set in the glamourous couture world of 1950s post-war London, the life of a renowned dressmaker (Daniel Day-Lewis), who is used to women coming and going through his tailored life, unravels after he falls in love with a young, strong-willed waitress. Pink (2016)

A lawyer (Amitabh Bachchan) comes out of retirement to help three women (Taapsee Pannu, Kirti Kulhari, and Andrea Tariang) clear their names in a crime involving a politician's nephew (Angad Bedi). Won a National Award. PK (2014)

A satirical comedy-drama that probes religious dogmas and superstitions, through the lens of an alien (Aamir Khan) who is stranded on Earth after he loses his personal communicator and befriends a TV journalist (Anushka Sharma) as he attempts to retrieve it. Porco Rosso (1992)

Transformed into an anthropomorphic pig by an unusual curse, an Italian World War I ace fighter veteran now works as a freelance bounty hunter in 1930s Adriatic Sea in the Mediterranean. Hayao Miyazaki writes and directs. Queen (2013)

A 24-year-old shy woman (Kangana Ranaut) sets off on her honeymoon alone to Europe after her fiancé calls off the wedding a day prior. There, freed from the traditional trappings and with the help of new friends, she gains a newfound perspective on life. Director Vikas Bahl stands accused in the #MeToo movement.

Rang De Basanti (2006)

Aamir Khan leads the ensemble cast of this award-winning film that focuses on four young New Delhi men who turn into revolutionary heroes themselves while playacting as five Indian freedom fighters from the 1920s for a docudrama. Ratatouille (2007)

An anthropomorphic rat (Patton Oswalt) who longs to be a chef tries to achieve his dream by making an alliance with a young garbage boy at a Parisian restaurant. From Pixar. Rebecca (1940)

Alfred Hitchcock's first American film is based on Daphne du Maurier's 1938 novel of the same name, about a naïve, young woman who marries an aristocratic widower and then struggles under the intimidating reputation of his first wife, who died under mysterious circumstances. The Remains of the Day (1993)

Made by the duo of Ismail Merchant and James Ivory, this based-on-a-book film is about a dedicated and loyal butler (Anthony Hopkins), who gave much of his life — and missed out on a lot — serving a British lord who turns out to be a Nazi sympathiser. Reservoir Dogs (1992)