#Aeps service charges

Text

Aeps service charges

Aadhaar Enabled Payment System (AEPS) is a financial service in India that allows individuals to perform basic banking transactions using their Aadhaar number and fingerprint authentication. It is an initiative by the National Payments Corporation of India (NPCI) to make banking services accessible to all, particularly in rural and remote areas.

URL:-

https://jansevakendr.org/category/aeps/

1 note

·

View note

Text

Intel Processor Plant Energy Use to Equal 500,000 Homes

New Post has been published on https://www.ohenergyratings.com/blog/intel-processor-plant-energy-use-to-equal-500000-homes/

Intel Processor Plant Energy Use to Equal 500,000 Homes

Customer Bills May Pay for Intel Plant Energy

The a new AEP Ohio energy deal with Intel may bring thousands of good paying jobs to the area, but it will include a rate increase lasting 20 years. Learn what the data industry means to future Ohio electricity rates.

Intel is building a new computer chip plant in Licking County. However, this kind of plant will require a lot of electricity. With the increased strain on the Ohio grid, this can cause significant problems for customers. Specifically, AEP Ohio is asking for $95 million in grid improvements and upgrades to combat the increase in power usage. But who will foot the bill? Is it Intel, who will be using over a half-million homes’ worth of energy? Or will it be customers?

Intel Energy Deal Sours Some Customers

Usually, contracts require companies to pay around 40% of the upgrade costs for new infrastructure. However, Intel is working out a special deal. This deal would allow them to only supply the special circuit breakers they’ll need for the plant. Those costs total around $740,000. That leaves $94 million unaccounted for. On top of this, Intel will pay a lower transmission rate along with its other monthly charges and fees.

How Will Intel Affect Your Energy Bills?

On August 13, PUCO staff submitted their recommendation for the Intel and AEP Ohio “Reasonable Arrangement“. The agreement’s term is 20 years.

In order to deliver power to the Intel plant, AEP Ohio has agreed to build a new substation. To pay for it, customers will pay an additional 64 cents as a rider on their AEP Ohio electricity bills. That means consumers can expect to pay an extra $7.20 each year for the next two decades. That’s a total of $144.00.

However, there is an important condition in the Intel contract with AEP Ohio. Intel must pay a $94.5 million exit fee if it fails to invest $20 billion in the new facility. This includes generating over 3,000 jobs at Intel plus another 17,000 construction and support jobs in the Licking County area.

Ohio Tech Energy Use To Rise

This new Intel project isn’t the only data center project that could bring more load to the AEP Ohio grid. Amazon Web Services and Google both have operate data centers in the Columbus area which is served by AEP Ohio. Overall, AEP is now expecting a 20% usage increase across the US, where they usually expect a 1%-2% increase. And all this new demand falls on top of increasing residential consumer demand.

Additional substations and bigger power line capacity are needed to improve grid stability. So, Ohio energy customers can expect more grid improvement projects over the next four years. And yes, that probably means additional rate hike riders will appear on future bills.

More Data Center Costs Coming

Right now, the Ohio grid is struggling with the heat. So, imagine adding an additional 500,000 homes and a couple of data centers to the end of your street. Future grid improvements across Ohio are on the horizon and these should help benefit all of AEP Ohio’s customers in the long run. Of course, rates hikes are not convenient for everyone. But in this case, they are also an investment in job growth. Intel isn’t the only tech company looking at expansion in the next five years. You can expect companies like Meta, Amazon, and Google to construct more data centers and consume more energy. To keep up to date on the grid improvements in your area, check out www.ohenergyratings.com

0 notes

Text

How And When To Apply For Medicare Supplement?

Applying for a Medicare Supplement Plan (Medigap) involves specific timelines and considerations to ensure you have access to the broadest range of coverage options without penalties or limitations. Here’s a detailed guide on how and when to apply for Medicare Supplement:

Timing Your Enrollment

Initial Enrollment Period (IEP)

Timing: The best time to enroll in a Medicare Supplement Plan is during your Medigap Open Enrollment Period (OEP). This period begins when you are both 65 years old or older and enrolled in Medicare Part B.

Duration: The Medigap Open Enrollment Period lasts for six months from the first day of the month in which you're both 65 or older and enrolled in Part B.

Guaranteed Issue Rights: During this period, you have guaranteed issue rights, meaning that insurance companies cannot deny you coverage or charge you higher premiums based on pre-existing conditions or health status.

Special Enrollment Periods (SEPs)

Qualifications: You may qualify for a Special Enrollment Period (SEP) outside of the initial enrollment period under certain circumstances, such as losing other health coverage or moving out of your plan's service area.

Conditions: SEPs vary based on specific qualifying events and may allow you to enroll in a Medigap plan without facing medical underwriting.

Annual Enrollment Periods (AEPs) and General Enrollment Periods (GEPs)

Scope: Unlike Medicare Advantage Plans (Part C) or Medicare Prescription Drug Plans (Part D), Medicare Supplement Plans do not have annual enrollment periods.

Exceptions: If you miss your Medigap OEP or do not qualify for a SEP, you may apply during the Annual Enrollment Period (October 15 to December 7) or the General Enrollment Period (January 1 to March 31).

Steps to Apply for Medicare Supplement

Research and Compare Plans

Coverage: Review the coverage options and benefits provided by different Medigap plans (e.g., Plan A, Plan B, etc.). Plans are standardized across most states but can vary in cost and additional benefits.

Costs: Compare premiums, deductibles, and other out-of-pocket expenses associated with each plan type.

Insurance Companies: Research and compare insurance companies offering Medigap plans in your area. Consider factors such as customer service ratings, reputation, and financial stability.

Contact Insurance Companies

Inquire About Plans: Contact insurance companies directly or visit their websites to obtain detailed information about their Medigap plans.

Request Quotes: Request quotes for the plans you're interested in to compare costs and coverage.

Enrollment Process

Choose a Plan: Select the Medicare Supplement Plan that best meets your healthcare needs and budget.

Fill Out Application: Complete the application provided by the insurance company. You may need to provide personal information, Medicare information (Part A and Part B enrollment dates), and details about any existing health conditions.

Submit Application: Submit your completed application to the insurance company. Ensure all information is accurate and up-to-date to avoid delays in processing.

Confirmation and Coverage Start Date

Approval: Once your application is approved, the insurance company will send you a policy confirmation and details about your coverage.

Coverage Start Date: Your Medicare Supplement coverage typically begins on the first day of the month following your application approval, assuming you have met all eligibility criteria.

Considerations and Tips

Understand Plan Types: Familiarize yourself with the different standardized Medigap plans and their benefits to choose the most suitable option.

Plan Changes: You can change Medigap plans at any time, but you may be subject to medical underwriting outside of your initial enrollment or special enrollment periods.

Medicare Advantage Plans: If you currently have a Medicare Advantage Plan and want to switch to a Medigap plan, ensure you understand the enrollment timing and any penalties that may apply.

Consultation: Consider consulting with a licensed insurance agent specializing in Medicare or a Medicare counselor to navigate your options and make informed decisions.

Applying for a Medicare Supplement Plan involves understanding enrollment periods, comparing plan options, and completing the application process with careful consideration of timing and eligibility. By planning and researching your options, you can ensure seamless access to additional coverage that complements your Medicare benefits and meets your healthcare needs.

0 notes

Text

Navigating Humana Medicare Supplement Plans: What You Need to Know

Introduction to Medicare Supplement Plans

Medicare Supplement plans, also known as Medigap plans, are private health insurance policies designed to fill the gaps in Original Medicare coverage (Part A and Part B). These plans are standardized across different insurance companies and offer various benefits to help Medicare beneficiaries manage out-of-pocket costs associated with healthcare services.

Understanding Humana Medicare Supplement Plans

Purpose and Benefits of Medigap Plans:

Medigap plans are designed to cover expenses such as copayments, coinsurance, and deductibles that are not fully paid by Medicare Part A and Part B.

Benefits are standardized across plan types labeled A through N, ensuring consistency in coverage options regardless of the insurance provider.

Coverage Options:

Each Medigap plan type offers a different combination of basic benefits, although Plans A and B are considered more basic and Plans C through N offer more comprehensive coverage.

Specific benefits may include coverage for Medicare Part A and Part B coinsurance, skilled nursing facility care coinsurance, and foreign travel emergency care.

Benefits of Humana Medicare Supplement Plans

Financial Predictability:

Medigap plans provide beneficiaries with predictable out-of-pocket costs, making it easier to budget for healthcare expenses.

Coverage for Medicare deductibles and coinsurance ensures that beneficiaries are not faced with unexpected medical bills.

Freedom to Choose Providers:

Unlike some Medicare Advantage plans, Medigap plans allow beneficiaries to choose any healthcare provider who accepts Medicare patients.

There are no network restrictions, providing flexibility in accessing specialized care and maintaining relationships with preferred doctors.

Coverage for Medicare Part B Excess Charges:

Some Medigap plans, such as Plan G, cover Medicare Part B excess charges that may occur when doctors charge more than the Medicare-approved amount.

Eligibility and Enrollment

Initial Enrollment Period (IEP):

The best time to enroll in a Medigap plan is during the six-month period that begins when a beneficiary turns 65 and is enrolled in Medicare Part B.

During this period, insurance companies are required to offer coverage without medical underwriting, meaning they cannot deny coverage or charge higher premiums due to pre-existing conditions.

Guaranteed Issue Rights:

Beneficiaries may qualify for a Guaranteed Issue Right (also known as Medigap protections) outside of their IEP, allowing them to enroll in a Medigap plan without medical underwriting.

Qualifying events include losing employer-sponsored coverage, moving out of a Medicare Advantage plan's service area, or other specific circumstances.

Choosing the Right Humana Medicare Supplement Plan

Assessing Healthcare Needs:

Evaluate current healthcare needs, including anticipated medical services, prescription medications, and frequency of doctor visits.

Consider potential future needs, such as planned surgeries or ongoing treatments, to ensure selected coverage meets long-term healthcare requirements.

Comparing Plan Options:

Use resources provided by Humana or consult with licensed insurance agents to compare Medigap plans available in your area.

Review plan details, including coverage benefits, premiums, and additional perks offered by the insurer, to determine which plan best fits your needs and budget.

Cost Considerations:

Compare monthly premiums for different Medigap plans, recognizing that higher premiums may provide more comprehensive coverage but may not always be necessary based on individual healthcare needs.

Factor in potential out-of-pocket costs, such as deductibles and coinsurance, to assess the overall affordability of each plan option.

Tips for Maximizing Benefits

Annual Review:

Regularly review your Medigap coverage during the Annual Enrollment Period (AEP) to ensure it continues to meet your healthcare needs.

Consider changes in health status or medication requirements that may necessitate adjustments to your coverage.

Understanding Plan Changes:

Stay informed about any changes to your Medigap plan's benefits, premiums, or provider networks that may affect your coverage and costs.

Utilize resources provided by Humana or Medicare to stay updated on plan updates and regulatory changes.

Utilizing Additional Benefits:

Take advantage of additional benefits offered by Humana, such as wellness programs, telehealth services, or prescription drug discounts, to enhance your overall healthcare experience.

Conclusion

Navigating Humana Medicare Supplement plans involves understanding the standardized benefits, coverage options, and enrollment considerations associated with Medigap policies. By evaluating individual healthcare needs, comparing plan options, and considering financial factors, beneficiaries can make informed decisions to optimize their Medicare coverage. Humana offers a range of Medigap plans designed to supplement Original Medicare and provide additional financial protection against out-of-pocket healthcare expenses. Regular review and proactive management of Medigap coverage ensure beneficiaries continue to receive comprehensive healthcare benefits that align with their evolving healthcare needs and preferences.

0 notes

Text

Top 10 Tips To Get The Most From Your Medicare Coverage in the USA

Medicare Advantage, also known as Medicare Part C, is a popular alternative to traditional Medicare in the United States. Offering additional benefits and coverage options, Medicare Advantage plans are offered by private insurance companies approved by Medicare.

In this Post, we'll delve into the details of Medicare Advantage, exploring how it works, its benefits, enrollment process, and considerations for beneficiaries.

What is Medicare Advantage?

Medicare Advantage is a type of health insurance plan that combines the coverage of Medicare Parts A (hospital insurance) and B (medical insurance) into a single plan offered by private insurance companies. These plans may also include additional benefits not covered by traditional Medicare, such as prescription drug coverage (Part D), dental, vision, hearing, and wellness programs.

How Does Medicare Advantage Work?

When you enroll in a Medicare Advantage plan, you receive your Medicare benefits through the private insurance company administering the plan. The insurance company receives payments from Medicare to cover your healthcare costs and may charge premiums, deductibles, copayments, and coinsurance for covered services. Medicare Advantage plans must provide at least the same level of coverage as traditional Medicare but may offer additional benefits and services. Medicare Leads

Benefits of Medicare Advantage

There are several benefits to choosing a Medicare Advantage plan:

Additional Benefits:

Medicare Advantage plans often include coverage for services not covered by traditional Medicare, such as dental, vision, hearing, and prescription drugs. These additional benefits can help beneficiaries save money on out-of-pocket healthcare expenses.

2. Cost Savings:

Medicare Advantage plans may offer lower premiums, deductibles, and copayments compared to traditional Medicare. Some plans also have out-of-pocket maximums, providing financial protection against high medical expenses.

Care Coordination:

Many Medicare Advantage plans offer care coordination services to help beneficiaries manage their healthcare needs more effectively. This may include case management, disease management, and access to nurse hotlines for medical advice and support.

Provider Networks:

Medicare Advantage plans often have provider networks, which can help beneficiaries access a wide range of healthcare providers, including doctors, hospitals, and specialists. Some plans may also offer out-of-network coverage for additional flexibility.

Enrollment Process

To enroll in a Medicare Advantage plan, you must be eligible for Medicare Part A and Part B and live in the plan's service area. You can typically enroll in a Medicare Advantage plan during specific enrollment periods, including:

Initial Enrollment Period (IEP): When you first become eligible for Medicare, you have an IEP lasting seven months, beginning three months before your 65th birthday month and ending three months after.

Annual Enrollment Period (AEP): Occurs annually from October 15 to December 7, during which you can enroll in or switch Medicare Advantage plans.

Special Enrollment Period (SEP): You may qualify for a SEP if you experience certain life events, such as moving, losing other coverage, or becoming eligible for Medicaid. Medicare Leads

Considerations for Beneficiaries

Before enrolling in a Medicare Advantage plan, consider the following factors:

Coverage and Benefits:

Review the coverage and benefits offered by each Medicare Advantage plan to ensure it meets your healthcare needs and preferences. Consider factors such as premiums, deductibles, copayments, coinsurance, provider networks, and additional benefits.

2. Prescription Drug Coverage:

If you require prescription medications, make sure the Medicare Advantage plan you choose includes Part D prescription drug coverage. Compare formularies, copayments, and preferred pharmacies to find the most cost-effective option for your medications.

3. Provider Network:

Check the provider network of each Medicare Advantage plan to ensure your preferred doctors, hospitals, and specialists are included. If you have established relationships with healthcare providers, make sure they accept the plan before enrolling.

Plan Ratings:

Review the quality ratings of Medicare Advantage plans using resources such as the Medicare Plan Finder or the Medicare Star Ratings. Plan ratings provide insights into factors such as customer satisfaction, quality of care, and member experience.

Cost:

Consider the total cost of each Medicare Advantage plan, including premiums, deductibles, copayments, and coinsurance. Compare costs across different plans to find the most affordable option that meets your healthcare needs.

Conclusion

Medicare Advantage offers beneficiaries an alternative way to receive their Medicare benefits through private insurance companies. With additional benefits, cost-saving opportunities, and care coordination services, Medicare Advantage plans provide comprehensive coverage and flexibility for individuals seeking more than traditional Medicare alone.

By understanding how Medicare Advantage works, exploring plan options, and considering your healthcare needs and preferences, you can make an informed decision about enrollment and get the most from your Medicare coverage in the USA. Medicare Leads

0 notes

Text

AEPS: India's Superhero of Digital Payments

Aadhaar Enabled Payment System (AEPS) is a superhero that came out of the shadows to change the game amid India's digital payment revolution. It's an innovative solution shaking hands with financial transactions across the country, not simply a mouthful of acronyms. Enter the exciting world of AEPS, where you may even flaunt your superhero costume with your Aadhaar card.

AEPS Origin: Creating a Digital Dynamo

On January 10, 2014, the AEPS narrative formally commenced, owing to the brilliant minds at the National Payments Corporation of India (NPCI). They determined it was time to harness the might of Aadhaar, the superhero identity system of India, and presto! When AEPS was founded, financial transactions would be simple.

Important Features: Not Just a Digital Wallet

AEPS is here to satisfy all your financial needs; it refuses to accept mediocrity. It is a one-stop shop for financial adventures, offering everything from cash withdrawals to balance inquiries. What's the hidden component? Your digital adventure becomes a safe and easy adventure when your Aadhaar card is integrated.

Benefits of AEPS: The All-Inclusive Festival

Imagine this: you feel excluded from the digital festivities since you don't have a standard bank account. Do not be alarmed! With its inclusion cape, AEPS swoops in and lets everyone enjoy the celebration. It's free to register, and it's as simple as ordering your favorite snack online! The AEPS service providers ensure that the fiesta is dependable and efficient in addition to being inclusive.

Transaction Charges and Limits: Unlocking the Mystery

Let's speak about numbers now. As with any superhero, AEPS has its limitations. The daily transaction limits dance to various music, and the fees follow suit. Don't worry, though; openness is the key in this situation. Similar to a financial superhero in action, understanding the norms of interaction fosters continued growth in trust.

AEPS: Digital Banking's Marvel

To put it briefly, AEPS blasted onto the Indian digital payment scene in 2014, making an impact akin to a superhero coming to the rescue. It's the most welcoming place in the financial district, not just the easiest to use. AEPS is not simply a milestone; it's the cornerstone forming India's financial future, with a dash of superhero magic, security, and inclusivity. As we advance, the ongoing development and uptake of AEPS hold the potential to be the superpower that completely transforms the world of digital banking.

0 notes

Text

Top Benefits of Using AEPS for Financial Transactions

In a time of technological advances and digital revolutions the financial industry has witnessed a shift to ease of use and accessibility. One of the most recent innovations that have changed the way that financial transactions are conducted, particularly in India and the country of its origin, can be described as an innovation called the Aadhaar Enabled Payment System (AEPS). AEPS is a safe and user-friendly system that makes use of the Aadhaar network to allow many financial transactions. Let's take a look at the main advantages of using AEPS for financial transactions.

Accessible banking: AEPS has played an important role in the promotion of financial inclusion. It allows people living who live in areas that are remote and unserved to gain access to banking services without having to visit physical branches of banks. With only their Aadhaar number and fingerprint even those who do not have traditional bank accounts can make transactions like cash withdrawals inquiring about balances, cash withdrawals, and transfer of funds.

Security Security is essential in the realm of finance. AEPS employs biometric authentication, which ensures that transactions are safe and almost impossible to fake. Biometric authentication provides an additional layer of protection in comparison to conventional PIN-based systems, reducing the possibility of fraud as well as identity theft.

Convenience AEPS removes the requirement for traditional debit card or passbook or even access to the internet. This is extremely practical for people, particularly in rural areas that might not have access to these facilities. All they require is an Aadhaar number and fingerprints for financial transactions, which makes it easy.

Cost-effective Traditional banking can be expensive, and there are charges to ATM withdraws as well as balance inquiry. AEPS transactions are usually cheaper both for the customer and banks as it lowers the costs related to maintaining physical infrastructure.

Eco-friendly and paperless AEPS encourages an environment that is paper-free by eliminating the requirement for paper-based transactions and documents. This helps create a more sustainable banking system, while reducing the environmental impact that comes with traditional banking procedures.

government initiatives This includes: Indian government has been actively promoting using AEPS as a part the efforts it has made to improve financial inclusion and decrease cash transactions. Different welfare schemes and subsidy programs are currently directly credited to beneficiaries' accounts in the form of AEPS which ensures that the money is able to reach recipients in a timely manner.

Real-time transactions The transactions processed in AEPS happen in real time meaning that users have access to their funds and process transactions in a matter of minutes. This is particularly useful in times of emergency or when immediate access to funds are essential.

Simple Account Linking Linking Aadhaar to the bank account is an easy process and is accessible to many people. Once linked, users are able to complete AEPS transactions without difficulty.

Interoperability AEPS can be interoperable with a variety of financial institutions and banks and allows users to access their accounts and make transactions in various business correspondents of banks (BC) branches. This means that customers aren't restricted to one specific branch of the bank.

In the end it is clear that it is clear that the Aadhaar Enabled Payment System (AEPS) is an important game changer for the Indian financial sector. Its ability to offer a wide range of affordable, safe, and easy banking is a popular option for millions of customers particularly those living in rural regions. As the world is continuing to embrace digital innovation, AEPS stands as a shining example of how technology can help bridge the gap between conventional banking services and the financial sector, enhancing the lives of millions of people across India.

1 note

·

View note

Text

How To Do AEPS Transaction?

To perform an AEPS transaction, follow these steps:

Visit a bank or a business correspondent (BC) that offers AEPS services.

Provide your Aadhaar number and bank account details to the BC.

The BC will use a biometric device or micro-ATM to capture your fingerprint or iris scan for authentication.

Once your identity is verified, select the type of transaction (e.g., cash withdrawal, balance inquiry, fund transfer).

Enter the amount and any additional information required for the specific transaction.

Confirm the details and proceed with the transaction.

The BC will process the request and complete the transaction using the NPCI (National Payments Corporation of India) platform.

You will receive a transaction receipt as proof of the successful AEPS transaction.

1 note

·

View note

Text

AEPS API provider in mumbai-Paytrav

Paytrav is a widely successful AEPS API Provider Company in India. Paytrav AePS API enables Business Correspondent to conduct banking transactions using only the customer’s Aadhaar Number and Biometric Identification.

Some prerequisites are, KYC (Know Your Customer) details to open a new account, and Aadhaar number should be linked with the respective bank account. This AePS API Provider activates the service 1-2 minutes post Aadhaar seeding.

The elements required for transactions are Micro ATM, Aadhaar number, Bank name, Biometrics (Fingerprint and/or IRIS), and assisted mode. The transaction cost will be Nil for the customer while Business Correspondent may get charged or paid based on the bank’s discretion.

AePS service allows performing transactions like Balance Enquiry, Cash Withdrawal, Cash Deposits, Aadhaar to Aadhaar Funds Transfer, Payment Transactions (C2B, C2G Transactions). Only the Best AePS API Provider Company can deliver such benefits.

अच्च्छी आमदनी की तलाश करें पूरी। Edupoint- mATM & AEPS ,Recharge की बेहतरीन सर्विस और ज़बरदस्त कमीशन के साथ बढ़ाएं अपनी पहचान भी और इनकम भी!

"Retailer, Distributor, Master Distributor-ID k liye contact kre !

📞 Contact @ 089-763-15-910

Click Now-https://paytrav.in/

1 note

·

View note

Text

Get a Franchise and Join the Entrepreneurial Revolution

We, at VOSO store, offer most profitable franchise business in India. We support the establishment of enterprises with the highest profit margins. We are a retail technology business. A brand-new method for turning your physical store into a digital store is VOSO Store. Through a unique portal, we link retailers and brands to serve end-user offerings. With the VOSO business opportunity start business in India, our store partners are exponentially growing their commercial enterprise. To connect them with a wide range of services and goods through our store partners and to offer our store partners one-of-a-kind support through our facilitator model, VOSO is on a mission to reach an untapped region of the country.

With the aid of our retail partners, we are making improvements to streamline the online service process for every citizen. Retailers and merchants are increasingly using VOSO as their preferred platform for accepting online payments for a variety of services. Our team is always working to improve the functionality and seamlessness of the online portal and payment system. We make it possible for our partners to use all current and upcoming services by offering VOSO Store partnership. VOSO has stores in more than 700 cities and 6000 pin codes. Our store numbers are constantly increasing. The core value of VOSO is to provide a practical platform for all utility

services to all segments of society, particularly in rural and suburban areas, to increase their level of digital literacy.

Through a range of VOSO services like travel booking, utility bill payment, domestic money transfer, PAN card, recharges, and insurance. VOSO enable its store partners to establish strong

connections with their potential customers in this rapidly evolving age, enabling them to obtain services at competitive rates and earn more money than they did previously. VOSO's B2B portal also saves time, energy, and money by connecting you with all the top services at a single touch before they are even built.

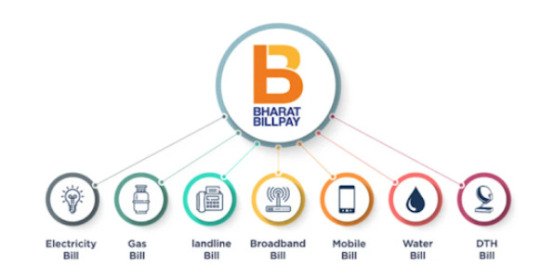

Bills payment

With the Baharat bill payment system, VOSO store works with the portion of bills and upgrades the security and speed of bill payments. BBPS services are available at our stores. You can pay a charge for utility bill payments i.e. (Fastag, Gas Bills, Water Bills, Electricity bill payments, DTH and Mobile recharges, etc.)

VOSO mATM services (micro ATM service)

Voso mATM services now allow you to provide mATM services to your customers and earn the highest commission per transaction. mATMs are devices that allow users to withdraw cash and check balances from any Kirana shop, local store, or e-service portal without having to go to banks and wait in long lines. Merchants can use mATM devices to provide cash withdrawals, cash deposits, and money transfers from one bank account to another, as well as balance checks while earning commissions on each successful mATM transaction.

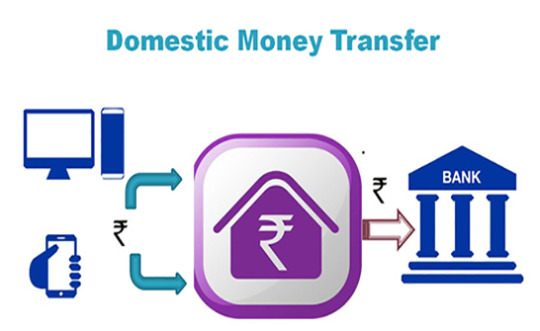

Domestic Money Transfer (DMT)

Our store partners can send money across India using the VOSO portal. These transactions are completed in a matter of seconds, and money is securely transferred to the receiver's account via VOSO's secure payment method. Additionally, VOSO offers expert assistance for any issues that may arise during the transaction. With the help of this crucial service, we guarantee low transaction costs and high earning potential for our partners.

AePS

Paying with an aadhar card is possible with the AEPS or aadhar enabled bill payment system. The NCPI created the AePS payment model, which enables customers to make basic payment

transactions with their aadhar cards, including cash deposits, bank-to-bank transfer balance inquiries, mini statements, aadhar to aadhar funds transfer authentication, BHIM aadhar pay, and many more. By utilizing AePS, merchants can also provide extra services to their clients and users, such as eKYC, best finger detection, demo auth, tokenization, and Aadhar seeding status.

Booking services

Our partners can book buses, flights, or train tickets for any location in the country. We offer expert training and one-on-one support. The VOSO portal and mobile app now make it simple to book bus tickets. You can now compare ticket plans and amenities and select the best one for your clients from any location in India. With the assistance of VOSO partner stores, we take the initiative to provide the best facility with the lowest costs and the best service so that everyone can enjoy a hassle-free journey. We have the highest commission rates.

Conclusion

VOSO store provide most profitable franchise business in India which lead to high profit margin business for store partners. VOSO considers its partners to be its greatest asset. We are committed to the overall growth of our store partners and provide the best services with the highest earning potential. Join VOSO store to earn high profit.

0 notes

Text

Idaho Medicare Advantage Plan: A All-in-One Coverage | Chris Antrim CLTC

Medicare Advantage Plan Insurance | An All-In-One Coverage For Your Medical Needs

Humana Medicare Advantage plans

Medicare Part A & B premiums are not included with the plan but can be added at any time during the year. You will pay a monthly premium to cover this part of your health care costs. The amount that you pay depends on which plan you choose.

The Humana Medicare Advantage Plan offers many benefits including:

No deductible or coinsurance required until you reach $1,350 per person

How do Medicare Advantage Plans work?

Medicare Advantage Plans, sometime s called "Part C" or "MA Plans," are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have Medicare. The page includes information about covered services, rules, and costs for Medicare Advantage Plans.

It also includes information about drug coverage in Medicare Advantage Plans and how Medigap Plans work with Medicare Advantage Plans. Covered services in Medicare Advantage Plans

The following is an overview of the types of health care services that may be included as part of your plan benefits:

Hospitalization - You can stay at most hospitals if they meet certain requirements. Your doctor must approve hospital stays longer than three days. Some plans cover outpatient surgery, but not all.

Physician Services - Doctors who accept assignments from your plan will provide medical treatment to you when needed. They usually charge lower fees than doctors outside your network.

Rules for Medicare Advantage Plans

Medicare Advantage plans are a type of healthcare coverage that provides an alternative to traditional Medicare. These plans are offered by private insurance companies that are approved by Medicare, and they provide the same benefits as traditional Medicare, along with additional benefits that are not covered by traditional Medicare.

If you are enrolled in a Medicare Advantage plan, it is important to understand the rules that govern these plans. Here are some of the most important rules that you should be aware of:

Enrollment Periods: You can enroll in a Medicare Advantage plan during the Annual Enrollment Period (AEP) which runs from October 15 to December 7 every year. You can also enroll during the Initial Enrollment Period (IEP) when you turn 65 or when you become eligible for Medicare. Additionally, there are Special Enrollment Periods (SEPs) that may be available to you if you experience certain life events, such as moving or losing your existing coverage.

Network Restrictions: Most Medicare Advantage plans have network restrictions, which means that you will need to see healthcare providers that are in your plan's network in order to receive the full benefits of your coverage. If you receive care from a provider that is outside of your plan's network, you may be responsible for paying all or part of the cost of your care.

Cost Sharing: Medicare Advantage plans typically require you to pay certain out-of-pocket costs, such as deductibles, copayments, and coinsurance. These costs can vary depending on the plan that you choose, so it is important to review the plan's Summary of Benefits and Coverage to understand your costs.

Prior Authorization: Some Medicare Advantage plans require you to obtain prior authorization before you can receive certain medical services or treatments. This means that you will need to get approval from your plan before you can receive care, and failure to obtain prior authorization could result in your plan denying coverage for the service or treatment.

Coverage Rules: Medicare Advantage plans must provide coverage that is at least as good as traditional Medicare, but they may have different rules for coverage. For example, some plans may require a referral from your primary care physician before you can see a specialist, while others may not have this requirement. It is important to review the plan's Summary of Benefits and Coverage to understand the rules for coverage.

Prescription Drug Coverage: Many Medicare Advantage plans include prescription drug coverage, but the rules for this coverage can vary depending on the plan. Some plans may require you to use specific pharmacies or may have a different formulary of covered drugs than traditional Medicare. It is important to review the plan's Summary of Benefits and Coverage to understand the rules for prescription drug coverage.

Costs for Medicare Advantage Plans

If you live in Idaho and are eligible for Medicare, you may be considering a Medicare Advantage plan as a way to receive your healthcare coverage. Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies that are approved by Medicare, and they provide the same benefits as traditional Medicare, along with additional benefits that are not covered by traditional Medicare. However, the cost of Medicare Advantage plans in Idaho can vary depending on a number of factors.

Premiums

One of the most important costs to consider when choosing a Medicare Advantage plan is the monthly premium. In Idaho, the average monthly premium for a Medicare Advantage plan in 2022 is $46.39, which is slightly lower than the national average of $47.03. However, the actual premium that you will pay can vary depending on the plan that you choose, as well as other factors such as your income level.

Deductibles and Out-of-Pocket Costs

Medicare Advantage plans in Idaho may also have deductibles and other out-of-pocket costs, such as copayments and coinsurance. These costs can vary depending on the plan that you choose, but they are generally capped at a maximum amount each year. In 2022, the maximum out-of-pocket limit for Medicare Advantage plans in Idaho is $7,550, which is the same as the national limit.

Coverage and Benefits

Another factor to consider when looking at the cost of Medicare Advantage plans in Idaho is the coverage and benefits that they offer. Medicare Advantage plans must provide at least the same coverage as traditional Medicare, but they may also offer additional benefits such as dental, vision, and hearing coverage, as well as gym memberships and wellness programs. The cost of these benefits can vary depending on the plan, but they can be a significant value for beneficiaries who use them regularly.

Medicare Advantage Prescription Drug Coverage

Many Medicare Advantage plans in Idaho also include prescription drug coverage, which can be a significant cost savings for beneficiaries who take multiple medications. The cost of this coverage can vary depending on the plan, but it may be less expensive than purchasing a separate Medicare Part D prescription drug plan.

Enrollment Periods

Finally, it is important to consider the enrollment periods for Medicare Advantage plans in Idaho. You can enroll in a Medicare Advantage plan during the Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year. You can also enroll during the Initial Enrollment Period (IEP) when you turn 65 or when you become eligible for Medicare. Additionally, there are Special Enrollment Periods (SEPs) that may be available to you if you experience certain life events, such as moving or losing your existing coverage.

How To Find The Best Medicare Advantage Plan For You

Choosing the best Medicare Advantage plan for your healthcare needs can be overwhelming, especially with the variety of options available. However, with some research and careful consideration, you can find a plan that works for you. Here are some tips to help you find the best Medicare Advantage plan for your needs.

Assess your healthcare needs. The first step in finding the best Medicare Advantage plan for you is to assess your healthcare needs. Consider what types of healthcare services you need, such as prescription drug coverage, dental, vision, or hearing benefits, and whether you have any chronic conditions that require ongoing care. Also, think about the healthcare providers and hospitals that you prefer to receive care from, and whether they are in the plan's network.

Research plan options. After assessing your healthcare needs, research the available plan options in your area. Medicare.gov has a plan finder tool that can help you compare plans based on coverage, cost, and quality. Additionally, consider reaching out to a licensed insurance agent who can help you understand your options and answer any questions you may have.

Compare costs. When comparing Medicare Advantage plans, consider the costs involved. Look at the plan's premiums, deductibles, copayments, and coinsurance. Also, consider the plan's out-of-pocket maximum, which is the maximum amount you will have to pay for covered healthcare services in a given year. Keep in mind that a lower premium may mean higher out-of-pocket costs.

Check for extra benefits. Medicare Advantage plans may offer additional benefits beyond traditional Medicare coverage, such as dental, vision, and hearing coverage, gym memberships, and wellness programs. If these benefits are important to you, consider a plan that includes them.

Verify the plan's network. Make sure the plan's network includes your preferred healthcare providers and hospitals. If your provider is not in the plan's network, you may have to pay more for their services or find a new provider.

Consider prescription drug coverage. If you take prescription medications, consider a Medicare Advantage plan that includes prescription drug coverage. Review the plan's formulary, which is a list of covered drugs, to make sure your medications are covered.

Review plan ratings. Medicare Advantage plans are rated on a scale of one to five stars, with five being the highest rating. Plan ratings take into account factors such as customer satisfaction, quality of care, and management of chronic conditions. Consider choosing a plan with a high rating to ensure quality healthcare coverage.

All-in-One Coverage Options Is Right For You? Let Chris Antrim Insurance Help You

Many Medicare Advantage plans combine both Parts A & B into one package. This means fewer out-of-pocket expenses because you only pay deductibles and copayments once per year instead of twice. You can choose from an All-in-one option which includes hospitalization, skilled nursing facility, home healthcare, durable medical equipment, outpatient therapy, vision, hearing aids, and much more.

Choosing Chris Antrim Insurance for your Medicare Advantage plan can provide you with comprehensive coverage, affordability, access to a network of healthcare providers, prescription drug coverage, personalized care, innovative technology, and high quality ratings. We believe in offering our members the best possible healthcare coverage and are committed to helping them live healthy, fulfilling lives.

Hope You Learn More About Medicare Insurance.

Originally published here: https://www.goidahoinsurance.com/is-advantage-plan-right-for-you

0 notes

Text

Which is the best zero-balance account in India? — PAN Card apply

The best zero-balance account in India depends on individual needs and preferences, as different banks offer different features and services with their zero-balance accounts. Some popular options for zero-balance accounts in India include:

Jan Dhan Yojana Account: This is a government-sponsored account that offers free zero-balance savings accounts with benefits such as insurance and overdraft facilities.

AADHAAR Enabled Payment System (AePS) Account: This is another government-sponsored zero-balance savings account that offers basic banking services through the Aadhaar platform.

BHIM UPI-based Bank Account: This is a zero-balance account linked to the BHIM UPI platform that allows for instant money transfers and bill payments.

Digital Bank Accounts: Many digital banks in India offer zero-balance accounts with added benefits such as high-interest rates, cashback, and discounts on digital transactions.

Basic Savings Bank Deposit Account: Many traditional banks in India offer basic savings account with zero balance requirements, although they may charge fees for certain services.

Ultimately, the best zero balance account will depend on the individual’s specific financial needs and preferences. It’s a good idea to compare the features and fees of different accounts and choose the one that best meets your needs.

Documents to open a bank account

The following documents are typically required to open a bank account in India:

Proof of Identity (POI) — this could be a PAN Card passport, voter ID card, Aadhaar card, driving license, or any other government-issued photo ID.

Proof of Address (POA) — this could be a utility bill, bank statement, voter ID card, Aadhaar card, driving license, or any other government-issued photo ID.

Proof of Date of Birth (DOB) — this could be a birth certificate, 10th standard certificate, passport, or Aadhaar card.

Two recent passport-sized photographs

PAN Card: A PAN card is required to open most types of bank accounts in India.

It is important to note that the required documents may vary depending on the type of account being opened and the specific requirements of the bank. Additionally, all documents must be original or certified copies and should be submitted along with a filled-out bank account opening form.

It is always advisable to check with the bank directly for the latest and complete list of required documents.

Originally published at https://www.pancardapplyonline.com on February 3, 2023.

0 notes

Text

Shop These Low Priced Electricity Plans for Columbus

New Post has been published on https://www.ohenergyratings.com/blog/shop-these-low-priced-electricity-plans-for-columbus/

Shop These Low Priced Electricity Plans for Columbus

Get Great Electricity Deals In Columbus Now

Shop and compare these low priced Columbus electricity prices and save! These recommended plans all beat the AEP Ohio price to compare rate! Use your power to choose the best energy deals for you home now!

Struggling paying your AEP Ohio bills this year? Thankfully, their price to compare has come down in the last few months. However, there are still better deals out there. We’re going to be covering our four most recommended plans. Not only do we recommend them, but they also beat out AEP Columbus Southern’s price to compare across the board. So let’s see how low priced these plans in Columbus are.

Low Priced Plans From Public Power

Our first deal is the Electric 12 Month Fixed Rate With MRC from Public Power. This plan starts out at just 6.09 cents per kWh. This is the lowest of our recommended plans, over 20% lower than the price to compare. There’s also no early termination fee. However, this plan does come with a monthly recurring charge of $9.95. This means that in addition to your electricity costs, you will be paying an additional charge every month. What would that actually look like? Well if you use the average amount of electricity for a home in Ohio, you’re looking at around $45 in electricity costs before transmission fees and charges. That makes it around $55 after the monthly charge. And that’s still cheaper than the price to compare, which comes out to around $58 every month!

Low Price With No Monthly Charge

Another great plan we recommend is the Fixed Rate Electricity 12 from Santanna Energy Services. This plan has no additional charges, and is just 6.40 cents per kWh. That means your bill would only be about $48 before riders and transmission fees. And the best part is, it’s so easy to switch your plan. However, be aware that there is a $100 early termination fee if you decide this plan isn’t right for you down the line.

Low Priced Short Term

Looking for less of a commitment? The Electric 10 Month Standard Fixed Rate from Public Power might be the right choice for you. With no additional charges or early termination fees, this plan can be a great option to hold you over when a full year isn’t necessary. This plan is the most expensive of our recommended options at 6.89 cents per kWh. That equals a bill around $52 before transmission fees and other riders. This is still a deal below the price to compare and a great option for flexibility.

Snag A Great Deal From APG&E

We have one last great price for you. The TrueSimple 12 from APG&E is a fantastic year long option. With no monthly charge or early termination fee, this plan is priced at just 6.88 cents per kWh. That means your bill before fees and charges could average around $51 per month. Again, you’re still saving over the price to compare. Snag this deal fast for a great year of savings.

Grab A Better Deal Today

While these are four of our best plans, there’s still a ton to discover. You can find plans across all of Ohio. You can easily compare companies and read reviews to find your perfect electricity plan. Check out these great plans and more at http://www.ohenergyratings.com.

0 notes

Text

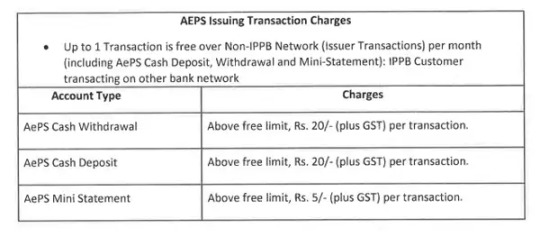

IPPB revises service charges for these Aadhaar-enabled payment system transactions

IPPB (India Post Payments Bank) has revised the Aadhaar Enabled Payment System service charges, effective from December 1, 2022. According to the National Payments Corporation of India (NPCI), "Allows online interoperable financial inclusion transactions at PoS (MicroATMs), through a business correspondent of any bank using Aadhaar authentication.aepsThere are six different ways through which transactions can be completed.

Service Charges on AEPS by IPPB

As per IPPB (India Post Payments Bank) notification, cash withdrawal, cash deposit and mini statement are free for non-IPPB customers only up to one transaction per month. On exceeding the free transaction limit,aepsIssuers will be charged Rs 20 plus GST on each cash withdrawal and cash deposit while each mini statement transaction will be charged Rs 5 plus GST.

Guide for AEPS Transactions

Under this scenario, the following are the required inputs to be followed by the customer:

Banks' name

Aadhaar number

Fingerprint captured during enrollment

Benefits of AEPS

The Aadhaar-enabled payment system allows users to make payments using their Aadhaar number and biometrics in a safe and secure manner.

By using biometric/iris information and demographic data from Aadhaar, the payment system eliminates the possibility of fraud and non-genuine activity.

The Aadhaar-enabled payment system will facilitate delivery of government entitlements such as NREGA, social security pension, disabled old age pension, etc. of any central or state government body using Aadhaar authentication.

Aadhaar-enabled payments facilitate interoperability between banks, in a safe and secure manner

With most BC beneficiaries being unbanked and underbanked, the model allows banks to offer financial services beyond their branch networks.

Services provided by AEPS

Cash deposit

cash withdrawal

balance inquiry

mini statement

Aadhaar to Aadhaar Fund Transfer

Authentication

BHIM AADHAAR

Become an authorized member

IGS Digital Center Limited is a service provider that enables you to offer 300+ services to your customers while maintaining the highest level of quality. Additionally, each service you provide will earn you a respectable commission. It is quite simple to get IGS Digital Center Limited Member ID and sign up to work as an AEPS Agent. To help you understand the whole process, we have included some steps in this post.

You must first apply for a member ID.

Any photo ID proof like Driving License, Passport, PAN Card, Voter ID or Aadhaar Card is required.

After that, you will go to the verification stage, when our team will check your information and supporting documents. At this point, your application may be accepted or rejected.

After approval of your application, we move on to the payment and settlement process. After paid registration, we present your Member ID and give you a contract, which you need to print on stamp paper and send back to us.

As a result, you are now a certified member of IGS Digital Center Limited.

After document verification, KYC staff will generate your member ID, activate your services, and train you before approving your documents.

1 note

·

View note

Text

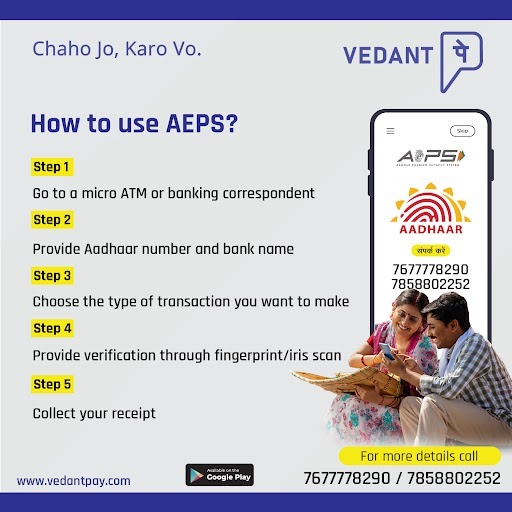

Vedant Pay | What it is and what it does?

Vedant Pay is a payment-based business vertical of Vedant Asset Ltd. Founded in 2022, it provides services similar to a bank through its mobile app, which is available on the Android platform and is coming soon for iOS. For this purpose, it has entered into agreements with Yes Bank, Bank of India, Jharkhand Rajya Gramin Bank, and Madhya Pradesh Gramin Bank. Its purpose is to provide banking services to the unbanked areas of India. With the slogan of ’Chaho Jo, Karo Wo’, it is operating in villages and semi-urban areas of Jharkhand and Madhya Pradesh. As a customer, all you have to do is to go to a Business Correspondent (B.C.) of Vedant Pay and a wide range of services will be provided to you.

SERVICES PROVIDED BY VEDANT PAY MOBILE APP

Aadhar Enabled Payment System (AEPS): Any person with a bank account and an Aadhar Card number can perform various banking functions, such as cash withdrawal up to Rupees 50,000, balance inquiry, cash deposits, fund transfers, cash withdrawals, balance inquiry, eKYC-based bank account opening, etc. For doing these activities, the bank’s ATM card is not required to be carried by the customer, as everything can be done with the help of the Aadhar Card itself.

Bharat Bill Payment System (BBPS): This facility enables a customer to make utility bill payments, such as electricity bills, gas cylinder refilling, water bills, landline bills, postpaid connections, data cards, mobile data packs, etc. All these payments can either be done directly by the customer through the Vedant Pay app or with the help of our network of agents. Multiple payment modes, such as online banking, UPI, account transfer, etc. are provided in the app and instant confirmation for the success of the transaction is provided in the app. The interface of Axis Bank’s website is used for providing services of AEPS and BBPS to the customers on PC.

Domestic Money Transfer (DMT): With Vedant Pay, you need not have to worry if you want to transfer money to anyone. You can transfer money to another person with a bank account and an Aadhar Number in a safe and secure manner via Vedant Pay mobile app. The maximum amount transferable at once is Rupees 5000. Also, a maximum of Rupees 50,000 can be transferred through the app to one person in one day. This facility is available to customers 24 hours a day and 365 days a year, meaning that customers can make fund transfer even on Sundays and bank holidays. There is instant confirmation of transactions through SMS sent to customers. Moreover, these facilities can be availed by the customers at the doorstep of their homes, by going to any Business partner of Vedant Pay, or by visiting any branch of Fino Payments Bank or selected merchant establishments. The customer’s account can be in any scheduled commercial bank in India. A bank charge of 1% of the value is payable by the customer on each transaction.

Mobile and DTH Recharge: Now, prepaid mobile connections and Direct-to-Home can be recharged with the Vedant Pay app itself. An attractive commission can be earned by customers for doing these recharges. The latest and upcoming offers can also be availed on our app as a result of doing the recharge. All the mobile operators and DTH companies of India are supported by our app for doing recharge.

Micro ATM: The purpose of this device is to take banking to the unbanked regions of India. A small, portable, micro-ATM machine is given to the business correspondent (BC) of Vedant Pay, from which he or she can provide ATM services to the customers. Any person wanting to withdraw money goes to our BC with his ATM card. BC connects the ATM card to the mATM machine and gives it to the customer for filling in a secret 4-digit PIN and the amount to be withdrawn. After that, the retailer gives that money to the customer. Cards of Rupay, Visa, and Master, related to any scheduled commercial bank of India are acceptable on these machines. Bluetooth-based connectivity is provided on these devices. A minimal amount is chargeable as fees for the setup of the device. After that, no amount is charged to the user or customer for using this device. In this way, a robust and efficient payment solution is provided through the micro-ATM.

mPOS: Mobile Point-of-Sale (POS) works on the micro-ATM machine, whose details are mentioned above. mPOS machines are available with retailers, to whom customers not carrying cash with them come, swipe their Debit or Credit card, and make the payment of bill amount for the purchase of goods. In return for making this transaction, the retailer is charged a small amount as fees based on a fixed percentage of the amount. Debit and credit cards of all scheduled commercial banks of India are accepted in this machine.

Tour and Tickets: Vedant Pay has a tie-up with I.R.C.T.C. for providing travel booking services. We also make travel plans for our customers, based on their demands

PAN-related Services: Services related to P.A.N. cards are also provided by Vedant Pay. These include linking PAN with Aadhar Card, making applications for new PAN cards, services of ePAN, etc. For the services of insurance, travel and ticketing, and PAN card, a separate ID and password are provided to the customers, to distinguish them from other services of Vedant Pay.

BENEFITS OF VEDANT PAY

To Retailers:

They can provide quasi-banking services to their customers.

2. They can operate from a small shop or even their homes.

3. Much elaborate setup or a lot of money is not required for starting this business.

4. They can arrange a stable source of income for themselves.

5. They can connect themselves to Vedant Pay, and through that to Vedant Asset Ltd, and can avail of various incentives provided by our company from time to time.

To Customers:

They don’t need to stand in long queues outside ATM machines for receiving money, and just have to go to a Vedant Pay BC for withdrawing their money from their bank account.

2. They can avail of many services similar to a bank from our Vedant Pay app, such as opening a bank account through e-KYC, withdrawal, and deposit of money, fund transfer to their near and dear ones, balance enquiry, mini statement, etc.

3. They only need to have a bank account linked with Aadhar, a Credit card or Debit-cum-ATM card, and/or Aadhar Card to fulfill their cash-related needs through Vedant Pay.

#vedantpay#digitalpayment#adharenabledpayment#empoweringdigitalindia#mATM#digitalindia#cashkahinvhi#aeps#bbps#mPOS#minibänk#minibankindia#chahojokarovo#microatmbusiness#microatmmachine#digitalpaymentsystem#digitalpaymentsolutions#digitalpaymentindia

1 note

·

View note

Text

Battle on the High Seas

After this & this I got to collab with the lovely @beelsbreakfast-aep to generate HCs for the Pirates v Navy fight that would result from practice of 「Captain Sky Pirates」!!!! ☆*: .。. o(≧▽≦)o .。.:*☆ It was really fun collaborating and Alice has some of the best commentary ever owo

Hope you enjoy! :D

Summer Troupe would be rehearsing a scene or two and Kaz would jokingly complain about being the only navy member, then sees Juza and calls him over for backup

It starts out following play, but then just devolves into chaos

Autumn Troupe all starts as navy because they need more physical stuffs and it’s good exercise for them

Besides they’re all freakishly good at this almost like they’ve ran after people before...

Taichi and Banri hear the commotion and join in. Banri would’ve been a pirate, but Kazu pulled him to the navy side

Omi gets hit as soon as he walks in the door, but joins in immediately because it looks fun

Sees the lack of people on the navy side once he understands what's going on and decides to join them

Sakyo gets hit and sees red so is just automatically on the chasing side

What’s scarier than an angry Sakyo ? Omi chasing you right behind

WE'VE ANGERED THE PARENTS

I WOULD RUN FOR MY LIFE

Banri’s not the one who hit Sakyo, but he saw it and laughed his ass off

Was Sakyo's first target so is now a pirate

Kazunari has no fear

It was Kaz’s shot that hit Sakyo

Kazunari now has one fear but only if Sakyo learns it was his shot

Misumi…well Misumi wanted to be navy as well, but they refused cuz they all thought they wouldn’t stand a chance if Misumi was running after them

Still ends up switching at some point

Only then is Hisoka found because Misumi spoke with the cats to track him down

Tasuku’s so glad someone else was in charge of finding him for once

Kaz + Misumi + Autumn Troupe are the ones running after the others at first, but then Kaz gets into the pirate side after being bribed by a pleading Muku with puppy eyes

Tsumugi, Azuma and Homare are most likely the least athletic of ALL Mankai and they’re reluctant to play, but finally give up when the youngsters plead with puppy eyes as well (Taichi, Sakuya, and Muku) yes, u cannot tell them no. Navy members leave them alone for a long while and they just end up hiding in Azuma’s room drinking SAKE

Newly dubbed "prisoners"

All prisoners are held in the court, watched by Kamekichi

Itaru already bribes him with snacks, so he’s corrupted by more

Takes the opportunity to up the stakes and ask for more premium items

Alcohol. he asks for alcohol. FKCKING BIRD

Sakyo almost threatening to pluck every one of his feathers when he realized the prisoners are escaping

Kamekichi claims he was sleeping

Itaru gets caught in the first minute and just hang out in the court playing on his phone (obviously)

Masumi didn’t want to play but Izumi seemed excited about it so he just joined.

Also Izumi is run after last cuz.... just cuz Everyone knows Izumi could kick their asses if she were to get serious

They let Sakyo get her though just cause, you know, drama

Juza runs after Kumon without pity and Kumon feels SO BETRAYED

“Sorry i was promised a bunch of sweets”

Tasuku's used as a distraction against Omi

Taichi ends up becoming a pirate someplace along the way and uses Tasuku as a shield

Runs towards him yelling "TASUKU HELP!!!" and Tasuku just sees him run past before he slams a door, locking him out with Omi. Tasuku doesn’t have any idea about what's going on, but he's an actor and gets really in to his role

Tasuku actually puts up a good fight and it takes several of them to just catch him

Tsuzuru as well

He opts to be a pirate since he would usually do the chasing when playing with his brothers

Sakuya keeps up a while too, his training with Tasuku pays off

Navy bribes Sakuya to be on their side and nobody realizes until it’s too late cuz HOW WOULD SAKUYA DO SUCH THING??

Catching someone and immediately apologizing KSKFKF he looks very polite

Yuki tries, but gets caught and his pride is hurt

Option of switching sides

So like if someone's caught, instead of immediately going to prison, they can offer their services to rat out the others instead, and some people use the opportunity to act as a double agent of sorts, striking deals on both sides

Citron cons everyone. Nobody’s sure what team he’s on, but he’s surprisingly good at getting away walls have citron

The water guns make another appearance

Sakoda's the secret weapons dealer smuggling in more water guns

Omi runs after Tenma and Tenma screams his lungs out

“BIG SCARY MAN”

Homare gets some fantastic expletives to add to his repertoire

Azami probably would get into it if it means taking down Sakyo

Guy gets dragged into it but has no clue what’s going on

Ends up chilling in prison with the others

Muku's one of the last one's standing. He's good at hiding and he out-ran Misumi once short-distance so is very fast

Even though Tsumugi, Azuma, and Homare aren't actively running around, they're still involved by creating little challenges for people. Win, and they'll help with bribing/distracting Kamekichi, but lose and they'll help him as guardsbird instead

They also start generating backstories and character profiles and when someone stops by, they're assigned a new persona that they now have to act out

Perhaps the reason Sakyo allows the game to go on because it's "good training of both mind and body" or some bs reasoning they manage to persuade him with

Ceasefire for dinner and the fight doesn’t resume after

But then it’s lights-out and Kazunari gets Banri as he’s coming back from the bathroom

All hell breaks loose

There are no teams and it’s a free-for-all

Not even Sakyo’s wrath dampens things for long with everyone remembering how he joined in and had fun earlier

He ends up bribing Hisoka, Misumi, and Chikage to round up everyone and get them out

Lectures about noise and neighborhood etiquette

There might be a round of summer colds that sweep the company a day or so later

#a3!#act! addict! actors!#ilualice (´▽`ʃ♡ƪ)#yes most of the strikeouts are comments from our conversations#alice is funny af

23 notes

·

View notes