Don't wanna be here? Send us removal request.

Text

Why would people look for a bank when you have IGS Digital Center for all your banking needs? Aadhaar Enabled Payment Service (AEPS), uses Aadhaar data and biometric authentication instead of customers' signature or debit card information and allows them to withdraw, deposit and transfer cash quickly. Hence, instead of looking for an ATM or bank branch, customers can visit their nearest IGS Digital Center and do all these transactions using their Aadhaar data and biometric authentication.

1 note

·

View note

Text

IGS Digital Center Limited - A step towards Digital India

IGS Digital Center Limited is India's leading service provider business now capable of offering 300+ services to its clients. The prime objective behind working of IGS Digital Center Limited is to enable our clients to earn a good amount of commission on the services they provide. But now IGS Digital Center Limited Micro ATM, IRCTC,aepsand has come up with more sophisticated products like online recharge which are in high demand. Let's take a look at the services and highlight the key qualities that make them unique to our users. So now let's start:

IRCTC Services

In recent times IGS Digital Center Limited has launched IRCTC services on its portal. So, it helps the customers to have an authorized IRCTC agent ID and allows them to book train tickets through digital shop and earn good income on daily basis. All these services are highly secure and reliable to use and help them to grow their business digitally.

Aeps

Aadhaar Enabled Payment Service (aeps) is something that makes money transfers more accessible and more secure for every segment of customers. With the help of IGS Digital Center Limited member ID, you can do money transfer, mini statement, cash withdrawal, balance inquiry and much more. For this, you have to link your customer's Aadhaar card and bank account number together.

Online Mobile Recharge & Bill Payment

MobilerechargeAnd in the area of bill payments, IGS Digital Center Limited provides you an opportunity to pay all utility bills to your customers conveniently on a one-stop platform and earn handsome income on each and every service you provide. This includes DTH, data card, water bills,electricity bill, landline bills and many other bills that you can do for your customers and increase your income.

Other services

Apart from the services mentioned above, IGS Digital Center Limited also has PAN Card Updation or Correction, FSSAI Registration, FASTag Recharge, GST Registration for Return Filing,ITRThere are more than 300 services to offer related services and many more.

Conclusion

Undoubtedly, IGS Digital Center Limited is one such platform which provides a range of exemplary 300+ services to its clients with all security and reliability aspects in mind. Moreover, it is the fastest growing digital hub which has already won the hearts of major regions of India. so what are you waiting for? Contact us today to get the Member ID of IGS Digital Center Limited.

1 note

·

View note

Text

Copyright (or author's right) is a legal term used to describe the rights that creators have over literary and artistic works. Copyrights range from books, music, paintings, sculpture, and films to computer programs, databases, advertisements, maps, and technical drawings. Copyright is the legal right to the creativity and artistic creation of any individual. It protects your work or idea from duplication or piracy, by conferring legal rights to the particular work or idea

1 note

·

View note

Text

With this fast paced life, people often forget to pay and pay their insurance premiums on time. We have a solution for this, pay the premium on time through IGS Digital Center. We present an easy and seamless life insurance premium payment experience. Now pay insurance premium online at IGS Digital Center and get rid of delays. You can pay the insurance premium using the portal of IGS Digital Center and also get the confirmation.

1 note

·

View note

Text

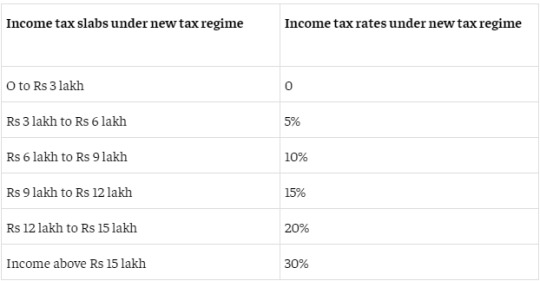

New Updates on Income Tax Slabs for FY 2023-2024

On 1st February 2023, our Finance Minister, Nirmala Sitharaman announced the new tax regime in Budget 2023. Income tax Announced some changes in the slab. The changes sparked a wave of curiosity among taxpayers. So we are here to clear all the misconceptions regarding this update with details and facts. Below are the changes announced on 1st February 2023:

1) For salaried individuals and pensioners, a standard deduction has been introduced under the new tax regime.

2) Under this new regime, the basic exemption limit has been increased from Rs 2.5 lakh to Rs 3 lakh.

3) The highest surcharge rate which was 37% has been reduced to 25%.

4) The income exempt under section 87A has been increased to Rs 7 lakh from Rs 5 lakh earlier. So now for FY 2023 to 2024, those having taxable income up to Rs 7 lakh and opting for the new tax regime will have to pay 0 taxes.

These new regimes will be the default option for taxpayers and you can choose to opt for the old tax regime as well.

Revised tax slabs under the new tax regime

We have to bear in mind that cess at the rate of 4%Income taxshall be added to the amount, and a surcharge shall be applicable on the taxable income which exceeds Rs.50 lakhs.

The above changes will be applicable from 1st April 2023 for FY 2023-2024, for which you will be required to submit investment declarations for the purpose of computing taxes on salary to your employer for FY 2023-2024. If you do not want to opt for the new tax regime, you must specify otherwise, your employer will assume that you have opted for the new tax regime. However, you can continue to opt for the old tax regime or go with the new regime for FY 2022-2023 (up to March 2023) or Assessment Year 2023 to 2024, depending on your choice.

Hence the main highlight of the budget announcements was the increase in the taxable income limit from Rs 5 lakh to Rs 7 lakh to avail exemption under Income Tax Slab Section 87A in India for the financial year 2023-24. To understand it in simple words, the amended income tax regime says that a person with taxable income up to Rs 7 lakh will now have to pay zero tax. And the other major attraction is the revision in tax slabs for those opting for the new regime. Our finance minister clearly said that this is a default option for every individual and one must definitely opt for the old tax regime. Those who are opting for the old tax regime will continue to get deductions under section 80C, and 80D deduction, HRA, etc. without any change in tax rates. Although the new tax regime offers you lower tax rates, it is divided into slabs as compared to the old tax regime.

1 note

·

View note

Text

All About Company Registration in India

Company registration is an important aspect for every business owner to make it reliable and accessible to every individual. It gives a unique identity to your brand and makes it more recognizable in the market with quality assurance. However if we talk about the importance of company registration, there are certain things which need to be considered on high priority.

Private Limited Company

A private limited company is a commercial entity that is owned by private investors. It has the advantage of limited liability of the members of a private limited company. Unlike a public company, which requires seven shareholders to start operations, a private limited company can start operations with only two shareholders. Since the investors, founders and management control the shares of the company, they have the freedom to transfer and sell their shares to others.

Separate Legal Identity

When you and any other person associated with your firm are legally separated from your business, it is called a separate legal identity. This basically means that if your business is sued, your personal funds are kept separate and shielded from legal proceedings. In addition, a business that is structured as a specific legal entity can: conclude contracts, own a house, initiate legal actions against third parties.

Limited liability

A limited liability is one of the hybrid entities that shields business owners from personal responsibility for their debts and liabilities. It has the advantage of taxation that is passed on to the next generation, with no limit on the number of people who can join. Members have the ability to manage the company in any way they see fit. And, unlike companies, it doesn't require as much annual paperwork or as many formalities.

Perpetual Succession

The ability of the organization to have continued enjoyment of its assets is called perpetual succession. The main advantage of perpetual existence, sometimes referred to as "perpetual succession", for a corporation is that shareholders and investors can rest assured that the organization will not disappear due to unforeseen circumstances. Another advantage, depending on your point of view, is that, when combined with the corporate board's fiduciary duty to act in the best interests of its shareholders, it requires a corporation to pursue a long-term growth strategy.

Raising the Foreign Investment

Foreign investment involves the transfer of wealth from one country to another, in which foreign investors acquire significant ownership in domestic businesses and assets. Foreign investment means that foreigners have an active involvement in management as a result of their investment or have a sufficient equity position in the company to influence business strategy. Globalization is a current trend, with international corporations investing in many countries.

How To Register A Company?

Step 1: Get Digital Signature Certificate (DSC)

Step 2: Obtain Director Identification Number (DIN)

Step 3: Create an account on MCA Portal- New User Registration @ mca.gov.in

Step 4: Incorporate the company or apply to be registered.

It is all about how a company registers in India. So, learn these steps and register your company to make a mark among the masses. However, if you face any problem, you can come to IGS Digital Center and get your company registered easily.

1 note

·

View note

Text

Some important facts related to BBPS and how it works?

Most people have to stand in long queues to pay essential bills like electricity, gas or water bills. To deal with this problem and make bill payments reliable and easy for customers, on the recommendation of RBI in the year 2017, Bharat Bill Payment System (BPS) was launched by National Payments Corporation of India (NPCI).BBPS) was started. In short, BBPS is a system where one can easily pay all types of bills securely.

What is Bharat Bill Payment System, and when did its service start?

Bharat Bill Payment System is a multi-purpose utility bill payment system which makes bill payment more reliable, secure and faster. RBI controls this system with the help of various agents and online mode with instant confirmation. BBPS The main objective behind is to make the society cashless as it shifts bill payments from cash to electronic channels.

In early 2014, the RBI (Reserve Bank of India) issued guidelines for a unified payment system to make utility bill payments more reliable . NPCI (National Payments Corporation of India) developed BBPS for better payments and it was launched in mid-2016.

Work Process for BBPS Service

The working of Bharat Bill Payment System is divided into two major sections (BBPCU and BBPOU) which work in coordination to make payments secure . The first is the BBPCU (the central unit of the BBPS) which works to establish procedures and rules for all participants. In addition, it also undertakes dispute resolution, settlement and clearing between the agent and the BBPOU. The second entity is BBPOU which operates offline and online bill payments for BBPS more securely and conveniently.

Billing Services Available in Bharat Bill Payment System

As discussed in the above section, BBPS is a one-stop platform that allows you to pay all types of bills under one roof such as:

dth

fastag

electricity bill

water bill

housing tax

mobile bill

broadband bill

gas bill payment

Features of BBPS Services

There are many features that make BBPS a better platform which are mentioned below:

It's easy to access it from anywhere, anytime.

One advantage of using BBPS is that it can be accessed through online as well as offline mode. Be it cash, credit card, debit card or UPI, everything is acceptable while paying with BBPS.

standard procedures

Integrated One Point Access

complaint management

Benefits of using BBPS services

With the help of BBPS services, paying all kinds of bills becomes more secure and reliable, and it relieves people from the tedious process of standing in queues and paying bills. When it comes to the benefits of BBPS, it is divided into two segments: subscriber segment and partner segment.

To understand this more closely, let's BBPS Let's take a deeper look at some of the key points:

customer segment

Customers can avail the benefit of paying their bills conveniently from anywhere, anytime through online or offline mode. Customers can pay through BBPS through card or through UPI.

participant clause

All types of billers can be a part of BBPS system. This system has better facilities for collection and accounting of transactions and reduces the rate of fraud. Each transaction is processed through an advanced monitoring system.

Access to BBPS service with IGS Digital Center Ltd.

IGS Digital Center Limited is India's leading service provider agency providing 300+ digital services in rural and urban areas with the intention to develop India digitally. With the help of IGS Digital Center Limited, you can open your shop by taking an authorized member ID. In addition to BBPS services, you AEPSonline bill payment, dmr And many other services can be availed under one roof.

1 note

·

View note

Text

Domestic Money Remittance Services by IGS Digital Center Limited |

In Indiadomestic money remittanceThe business has seen significant growth in recent years, with the rise of digital platforms and mobile technology making it easier for individuals and businesses to send and receive money within the country. One of the major players in the domestic funds transfer market in India is the Reserve Bank of India (RBI)-regulated National Electronic Funds Transfer (NEFT) system, which allows electronic transfer of funds between banks. Also popular is the Immediate Payment Service (IMPS), which allows the transfer of funds in real time through mobile phones.

Why choose DMR?

Apart from these traditional options, there are also several digital platforms and mobile apps that have entered the market, such as Paytm, Google Pay, PhonePe and others. These platforms use the Unified Payments Interface (UPI) system, which allows real-time transfer of funds between bank accounts using a virtual payment address.

The growth of domestic money remittance business in India is also driven by the increasing number of migrant workers in the country as well as the growing number of small businesses and e-commerce platforms. The ease and convenience of digital platforms and mobile technology have made it easier for these groups to send and receive money, giving a boost to the domestic money remittance market.

However, the domestic money remittance business in India also faces certain challenges, such as competition from other players and regulatory compliance. The government has also introduced tighter regulations in recent years to curb money laundering and terrorist financing, which has increased compliance costs for businesses operating in this sector.

Overall, the domestic money remittance business in India is expected to grow in the coming years, driven by the increasing use of digital platforms and mobile technology, as well as the growing number of small businesses and e-commerce platforms.

Advantages of Domestic Money Remittance

Traditional methods like sending checks through post were full of hassle, and DMR has increased the flexibility by providing money remittance services online. Domestic money remittance services provide you with convenient and flexible options.

You can easily record all the data of transfer/remittance and control it anytime from your mobile phone.

DMR has removed the long queues waiting outside the bank and has upgraded it to 24x7 access with just a few clicks.

Every transaction requires your digital signature, digital PIN or thumbprint, making everything more secure than ever. This has reduced the risk of fraudulent activities.

Step Towards IGS Digital Center Limited

It is possible to provide unmatched banking experience to our customers through IGS Digital Centre. You can send money up to Rs.5000/- from any part of India without any hassle using the simple money remittance services of IGS Digital Centre.

Then what are you thinking? Get your Member ID from IGS Digital Center Limited today, and start providing DMR services to your customers. Not only this, now you can access many services like DMR Services,AEPS ServicesEarn extra income regularly by outsourcing recharge services and many other services.

1 note

·

View note

Text

Pancard Creation Service with IGS Digital Center

One stop solution for all types of Digital Services in India. IGS Digital Center provides access to over 300 government and non-government services through its mobile app or web portal.

1 note

·

View note

Text

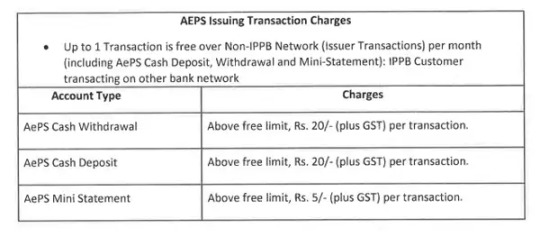

IPPB revises service charges for these Aadhaar-enabled payment system transactions

IPPB (India Post Payments Bank) has revised the Aadhaar Enabled Payment System service charges, effective from December 1, 2022. According to the National Payments Corporation of India (NPCI), "Allows online interoperable financial inclusion transactions at PoS (MicroATMs), through a business correspondent of any bank using Aadhaar authentication.aepsThere are six different ways through which transactions can be completed.

Service Charges on AEPS by IPPB

As per IPPB (India Post Payments Bank) notification, cash withdrawal, cash deposit and mini statement are free for non-IPPB customers only up to one transaction per month. On exceeding the free transaction limit,aepsIssuers will be charged Rs 20 plus GST on each cash withdrawal and cash deposit while each mini statement transaction will be charged Rs 5 plus GST.

Guide for AEPS Transactions

Under this scenario, the following are the required inputs to be followed by the customer:

Banks' name

Aadhaar number

Fingerprint captured during enrollment

Benefits of AEPS

The Aadhaar-enabled payment system allows users to make payments using their Aadhaar number and biometrics in a safe and secure manner.

By using biometric/iris information and demographic data from Aadhaar, the payment system eliminates the possibility of fraud and non-genuine activity.

The Aadhaar-enabled payment system will facilitate delivery of government entitlements such as NREGA, social security pension, disabled old age pension, etc. of any central or state government body using Aadhaar authentication.

Aadhaar-enabled payments facilitate interoperability between banks, in a safe and secure manner

With most BC beneficiaries being unbanked and underbanked, the model allows banks to offer financial services beyond their branch networks.

Services provided by AEPS

Cash deposit

cash withdrawal

balance inquiry

mini statement

Aadhaar to Aadhaar Fund Transfer

Authentication

BHIM AADHAAR

Become an authorized member

IGS Digital Center Limited is a service provider that enables you to offer 300+ services to your customers while maintaining the highest level of quality. Additionally, each service you provide will earn you a respectable commission. It is quite simple to get IGS Digital Center Limited Member ID and sign up to work as an AEPS Agent. To help you understand the whole process, we have included some steps in this post.

You must first apply for a member ID.

Any photo ID proof like Driving License, Passport, PAN Card, Voter ID or Aadhaar Card is required.

After that, you will go to the verification stage, when our team will check your information and supporting documents. At this point, your application may be accepted or rejected.

After approval of your application, we move on to the payment and settlement process. After paid registration, we present your Member ID and give you a contract, which you need to print on stamp paper and send back to us.

As a result, you are now a certified member of IGS Digital Center Limited.

After document verification, KYC staff will generate your member ID, activate your services, and train you before approving your documents.

1 note

·

View note

Text

electricity bill paymentMost of us have faced difficulties at one time or the other while getting our bills deposited. There was a time when there used to be long queues for depositing bills. But now time has changed. Now you can pay your all types of bills like electricity, water, telephone, gas and mobile etc online. Paying bills online is a very simple and quick process. Pay all your bills like Electricity, Water, Telephone, Mobile, Broadband and Gas etc. with the help of IGS Digital Center Limited's Online Bill Payment Service (BBPS). Using the Bill Payment service of IGS Digital Centre, you can not only view the total amount of your electricity, water and gas bills, but also pay them online in a convenient way.

insurance premium paymentInsurance is very important in today's time, but in this fast paced life, people often forget to pay their insurance premium. You can also pay your insurance premium conveniently through the online bill payment service of IGS Digital Center Limited. With the help of our portal, you can easily pay your premium anytime and avoid late-fee hassles.

mobile bill paymentWith the help of IGS Digital Centre's postpaid mobile bill service, you can conveniently pay postpaid mobile bill of all major companies including Airtel, Idea, Reliance and Vodafone. Not only this, you also get a good commission on every payment, with the help of which you can earn a steady income. Paying bills through our portal is extremely secure as it uses multiple layers of security. Additionally, as long as you don't share your password with anyone, you are completely safe. So increase your earning by becoming an authorized retailer of IGS Digital Center today itself.

1 note

·

View note

Text

Last date for filing belated and amended income tax returns (age 2022-2023)

As the new year is coming we all are planning for the celebration. Before that, one thing that needs to be done is to do your tax work. The last date to file your revised income tax return is 31 December 2022.

As per the income tax laws, if a person has forgotten to file the original income tax return on or before 31st July 2022, then the financial year 2021-22 (AY 2022-23) has been given a chance to file the dues on or before 31st December. If anyone has made any mistake while filling original ITR then you have a chance to make corrections by filing revised income tax return till 31st December 2022.

Late ITR filing process

The procedure for late ITR filing is the same as for filing ITR before the due date. This process of late income tax filing comes under section 139(4) of the Income Tax Act, 1961. Being a late taxpayer a person should take care of these two things. First one has to select section 139(4) in the tax return form and second pay the applicable penalty amount, penalty interest and tax due. A penalty of INR 5000 is applicable on a person not filing due ITR and is under section 234F of the Income Tax Act. However, those paying small taxes with an income of less than Rs 5 lakh have to pay Rs 1000 as penalty. This applicable late fee needs to be paid before starting the process of late ITR filing

Procedure to File Revised ITR

The process is the same as that of filing original ITR, the only difference is that revised ITR is under section 139(5) of the Income Tax Act. Things to remember while filing Revised ITR Section 139(5) of the Income Tax Act, to ensure that the applicable Income Tax Return Form and the original ITR number are to be preserved as applicable while filing Revised ITR form It will be needed.

File belated ITR for FY 2021-22 (AY 2022-23) by 31st December 2022!

If a taxpayer misses the last date for late ITR filing, then a person has the option of filing an updated ITR. This new option has been announced by the government in the budget 2022. A person can file an updated ITR (ITR-U) even if he has filed the original, belated or revised ITR or has missed the ITR form for a particular income.

But there are some restrictions while filing updated ITR under certain circumstances. A person can file ITR-U in these cases - if they have missed the deadline or revise their ITR if they have neglected to disclose income earlier. ITR-U cannot be used to declare any loss, get income tax refund or do any other such work.

If a person has filed ITR-U for FY 2021-22 (age 2022-23) within the first assessment year i.e. 1st April 2023 to 31st March 2024 then the person will have to pay an additional tax of 25% on the outstanding tax . But if ITR-U is filed between 1 April 2024 to 31 March 2025, then 50% of the outstanding tax will have to be paid as additional tax.

After filing the income tax return, it has to be verified within 30 days. If it is not up for verification then the Income Tax Department will not process further.

Be a responsible citizen of India by paying your taxes on time. IGS Digital Center Limited Contact us and keep yourself stress free from the hassle of filing your ITR on time. Our services will help your clients to file ITR on time.

1 note

·

View note

Text

Everything You Need To Know About BBPS Service

Everyone must have experienced standing in long queues to pay their phone, water and electricity bills. Before 2017, billing was time consuming and required a lot of effort. National Payments Corporation of India (NPCI) on the advice of RBI bill payment service (BBPS) started. An integrated payment system known as BBPS provides users access to different types of bills, charges etc. at one place.

History of BBPS

It has long been necessary for the nation to have a single, easily accessible method of paying bills. The Reserve Bank of India published the rules for the Unified Payment System on 28 November 2014. National Payments Corporation of India created BBPS, which launched in August 2016.

How does it work?

The working of Bharat Bill Payment Service is divided into two components which cooperate with each other. The first and second are known as BBPCU and BBPOU respectively.

The central organization of Bharat Bill Payment Services, BBPCU aims to set guidelines and policies for all members. Additionally, it handles the clarification and settlement of disputes between the Agent and the BBPOU. The online and offline bill payment services of Bharat Bill Payment Service are run by another organization BBPOU.

Services by BBPS

bbps Through the service, the following services will be available in a particular area:

Electricity bill

Water bill

Broadband bill

Gas bill payment

Dth

FASTag

Housing tax

Features of BBPS

This service is easily accessible everywhere.

Payment through BBPS can be done offline as well as online.

Cash, Debit Card, Credit Card or UPI can be used to make the payment.

It is an integrated system for payment of bills that connects banks, billers and customers.

Benefits of BBPS

It has become easier for the citizens of the country to use the BBPS service. People no longer need to wait in long queues for hours to pay their bills as it can now be done instantly.

bbps The service, which is accessed by thousands of departments across the country, enables instant payment of DTH, broadband and water bills. These services make it possible to deliver accounts quickly from any place at any time.

You can deposit multiple bills faster in one place; No need to visit different websites of businesses or departments to submit different bills.

Bill payment through BBPS helps in cashless economy, thereby saving time and money. Customers can pay their BBPS service bills through Debit Card, Credit Card, Net Banking, UPI or by cash in person.

Conclusion

You can apply online through the IGS Digital Center portal to start BBPS service, and you can open a retail location by calling the number provided by the company. IGS Digital Center will help you to start retail business for an affordable amount. BBPS service makes it easy for the customers to pay their bills. Also IGS Digital Center provides 300+ government and non-government services. Services provided by IGS Digital Center Limited include AEPS service, DMR service, recharge service, Travel booking services, CA services, Legal services and IT services etc. are the main ones.

1 note

·

View note

Text

bus tickets online

Online bus ticket booking keeps you away from long queues at offline ticket counters. You can view lots of buses and select the suitable bus for your journey, which are available for features, reviews, ratings and bus images. You can choose the preferred bus type (Volvo Bus, AC or Non AC) and also pick up and dropping points and timings. Your ticket can be booked at reasonable prices with ongoing bank and e-wallet discounts.

Tickets for almost all State Road Transport Corporation buses can be booked at the IGS Digital Centre. There will be no refund if you fail to catch the bus. Please note that we will not be liable for refund as this may be allowed only by bus operators.

1 note

·

View note

Text

How can you access AEPS service through IGS Digital Center Limited?

What is AEPS?

aepsis a unique identification number based payment platform that enables customers to conveniently send, receive, withdraw cash, deposit cash and check balance using Aadhaar-verification.

The objective of AEPS system is to enable all sections of the society by providing basic banking services in remote areas. The National Payments Corporation of India (National Payments Corporation Limited) started the AEPS service to promote digital payments in India. AEPS makes payments fast, easy and secure, along with facilitating online services like cash withdrawal and deposits.

The biggest advantage of AEPS transaction is that it does not require any file or signature to complete the transaction. Through AEPS all customers can use their Aadhaar number to do financial transactions at Point of Sale (PoS) or Micro ATM through Aadhaar authentication.

While using AEPS, customers first need to provide the bank representative with the Aadhaar number linked to the bank account and have the thumb or finger impression scanned on a biometric machine. Any kind of transaction can be completed only after this process is completed. So AEPS is more secure and better online system than normal transaction system.

All payments through AEPS can be completed through a Business Correspondent (Bank BC) or a Bank Correspondent using a Micro ATM. But the most important condition for using AEPS service is that for this your bank account should be linked with Aadhaar.

What are the benefits of using AEPS?

Below are some of the benefits of using the AEPS system that you will get when you use this transaction system:

The system is very simple and user friendly and it takes only a few minutes to do any type of transaction or avail banking service using Aadhaar authentication.

AEPS is a very secure mode of payment which works on the basis of Aadhaar authentication only, thus protecting the customers from fraud and risky transactions.

This system helps the underprivileged section of India to ensure financial inclusion.

The AEPS system is used to provide benefits of various government schemes to remote areas and villages.

What are the documents required to use AEPS service?

Normally no specific documents are required to use the AEPS service. You must have a valid bank account number, Aadhaar number and bank name to use the AEPS service.

How can you complete AEPS transaction through IGS Digital Center Limited?

By becoming an authorized member of IGS Digital Center Limited center you can provide facility of Cash Withdrawal, Cash Deposit, Balance Check and Money Transfer etc. to your customers through AEPS.

To do AEPS through IGS Digital Center Limited follow the following steps-

Visit your nearest authorized IGS Digital Center Limited member.

After that the IGS representative will enter your 12 digit Aadhaar card number in a point on sale machine.

Next, you need to choose the type of transaction you want, such as deposit cash, withdraw cash, transfer funds within or outside the bank, balance enquiry, or get mini balance statement, etc.

Select the bank where you have your account and fill the complete details of the transaction amount.

Confirm the transaction details by placing your thumb impression on the biometric scanner.

Your transaction will be completed.

When the transaction is complete, obtain a receipt from the IGS representative.

IGS Digital Center Limited is India's best online service provider company, by becoming a member of which you can earn handsomely by providing more than 300 government and non-government services to your customers. Services provided by IGS Digital Center Limited include AEPS service,dmr service, Bill Payment Service(BBPS), Recharge Service,travel booking services, CA Services, Legal Services and IT Services etc. are the major ones.

1 note

·

View note

Text

What is Patent and how to get it with IGS Digital Center Limited?

What is patent?

Patent is the exclusive legal right given to any person or organization on any product, innovation, intellectual property or invention.All patents granted in India are granted under Acts enacted in the years 1970 and 2003.

What are the benefits of getting patent registration done?

In the present times, it is very common to copy and steal any new discovery or invention.A patent serves to protect you from all such troubles by giving you a legal right.Following are the other benefits of getting a patent-

Patents give your product a distinct identity because your competitors cannot legally make a product similar to yours without your permission.

By getting any product or item patented, the credibility of your product in the market also increases.

If you want, you can also earn money by selling the patent of your product or by giving the right to use it to any other person or firm.

What are the documents required to get a patent?

The following documents are necessary for obtaining any patent in India-

Declaration of ownership of the invention by the applicant

Proof of having the right to register the patent

Application made for patent in Form-1

An undertaking given by the applicant

If an agent has been appointed to make the application, a letter of authorization should also be submitted.

What is the complete procedure to get patent registration done through IGS Digital Center Limited?

In earlier times, most people used to register their patent through offline medium, which took a lot of time and effort, but now you can get your patent registered online in an easy and convenient way.

If you are looking for a good portal for patent registration then you can take advantage of the portal of IGS Digital Center Limited.The complete procedure for getting patent registration done through IGS Digital Center Limited is given below-

Search Patent Online

Before obtaining a patent for your invention, you must examine it thoroughly to find out whether any other product or invention of this type already exists, and if such a product exists, whether its patent has been taken or not. .

You can easily complete the task of checking the patent online.

Through this process, it is ensured that this invention is your original discovery, which confirms the novelty and authenticity of any invention.

To search for a patent, you have to thoroughly research all aspects of your invention through online means.After this, if your invention is found to be unique or unique, then you can apply for its patent.

To get a patent, fill your provisional application by visiting the portal of IGS Digital Center Limited-

When a product is completely different or different from other products present in the market but it has not been fully developed till now, then in such a situation its provisional application has to be completed before obtaining its patent.This provisional certificate is valid only for 12 months, during which time the invention of that product has to be completed and finalized.It is mandatory to submit all these requirements within this stipulated time period and failure to do so may result in rejection of the patent.

Submit your full or complete application on the portal of IGS Digital Center Limited-

When a product is fully developed and complete, then a complete application has to be made to obtain its patent.You will be able to get legal rights on that product only after the process of this application is completed.

Pay your patent application fee through online mode-

After this you can pay your application fee through any online medium.After paying the online fee, your application will be accepted and it will be approved for patent examination.

Broadcasting in Patent Journal-

After 18 months of completing the patent application, an advertisement regarding this patent is published in the Patent Journal of the Department.In this, the title of the patent, the request number of the patent, and its complete information are given.

Pass the Patent Examination after submission of application-

After publishing the request, the next step is patent examination.Patent examination is a very important step in the patent registration process, without completing which no one can get a patent.This is not an automatic process, therefore the applicant has to himself seek inspection or patent examination within 48 months from the date of application or priority date of patent registration.

Grant of Patents by the Department

If you successfully pass the patent exam, then you are issued a patent certificate by the department, this certificate is generally valid for 20 years.

IGS Digital Center Limited is India's best online service provider company which enables its customers to earn well by providing digital services. AEPS Services, Bill Payment Services (BBPS), Recharge Services, CA Services, Travel Booking Services, etc. are some of the various services provided by IGS Digital Center Limited.

1 note

·

View note

Text

Recharge Unlimited Mobiles Online using our platform

1 note

·

View note