#AgriFood Tech Startups

Explore tagged Tumblr posts

Text

World Food Forum (WFF) Startup Innovation Awards ($80k Grants)

The World Food Forum (WFF) Startup Innovation Awards 2025, powered by Extreme Tech Challenge (XTC), is a global competition spotlighting youth-led startups leveraging technology to transform agrifood systems. Aligned with the United Nations Sustainable Development Goals (SDGs), this initiative seeks innovative solutions to combat global hunger and promote sustainable food systems. Features of…

0 notes

Text

ProfilePrint Secures Series B Funding: AI Shakes Up the Agrifood Landscape

AI is transforming food! ProfilePrint's latest funding round is shaking up the agrifood landscape, streamlining ingredient quality with digital fingerprints. Join the future of food! #AgriTech #AI #Investment

Singapore‘s ProfilePrint, an AI-powered ingredient quality platform, has secured a Series B funding round, injecting fresh momentum into the early-stage startup ecosystem and sending ripples of excitement through the agrifood tech space. This move signifies a growing investor appetite for innovative solutions that address inefficiencies and unlock new value chains within the global food…

View On WordPress

0 notes

Text

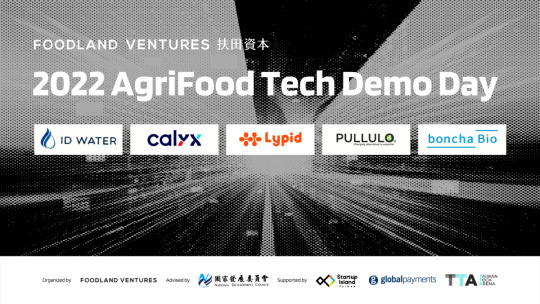

Foodland Ventures Unveils Batch 2 at AgriFood Tech Demo Day - 5 Innovative Teams Solving Challenges Across the Food Supply Chain

Foodland Ventures Unveils Batch 2 at AgriFood Tech Demo Day – 5 Innovative Teams Solving Challenges Across the Food Supply Chain

Foodland Ventures, the VC & accelerator built for AgriFood tech founders, has unveiled its latest batch of startups in its 2022 Demo Day held on November 30th. The diverse portfolio consists of 5 teams from Taiwan, Singapore and the US. Global investment in AgriFood Tech hit a record high with USD 51.7 billion in 2021; however, the need for innovative solutions grows with rising concerns for…

View On WordPress

#Agricultural Tech - Farming Tech#Agriculture#AgriFoodTech#AgTech#AgTech and FoodTech Funding#AgTech Startup#Aquaculture#Climate Change#Data-Driven#Food and Agribusiness#Food Processing#Food Security#FoodTech#Investments#Nutrition#poultry#Protein#Proteins Alternatives

4 notes

·

View notes

Photo

Illustration Photo: Workers in full personal protective equipment work at a seafood processing factory in Viet Nam. (credits: ©ILO/Nguyen Ngoc Trieu / Flickr Creative Commons Attribution-NonCommercial-NoDerivs 3.0 IGO License)

The GROW Impact Accelerator for Global Foodtech and Agtech Startups

For North America, South America, Asia, Africa, Europe, Middle East, Oceania, Worldwide

As part of the GROW Impact Accelerator you will join a prestigious network of experts and investors to take your business to the next level of growth. Participation is designed to open new markets for international startups looking to expand into Asia, and for regional startups to launch on the global stage.

Companies receive USD$200K worth of cash and in-kind investment, including a bespoke accelerator programme that refines your business model for aggressive growth and plugs you into the AgFunder agrifoodtech ecosystem for expansion internationally.

What you will get

Financial Support USD$100K investment by the AgFunder GROW Impact Fund through a SAFE, to be converted at your next financing round

An additional USD$100K worth of services & support, including AWS & Twilio credits, and packages with Klaviyo, Stripe, Zoom, and more...

Product Testing & Development Access to growth partners for product testing, development and scaling.

(e.g. test lab facilities, kitchens, on-field testing, research, tech and infrastructure, suppliers, manufacture and co-packing, marketing and customer insights)

Customer Validation Matching with some of the world’s biggest agrifood MNCs to help with customer validation and feedback, deploying pilots projects, and securing new sales contracts

Financial Support USD$100K investment by the AgFunder GROW Impact Fund through a SAFE, to be converted at your next financing round

An additional USD$100K worth of services & support, including AWS & Twilio credits, and packages with Klaviyo, Stripe, Zoom, and more...

Product Testing & Development Access to growth partners for product testing, development and scaling. (e.g. test lab facilities, kitchens, on-field testing, research, tech and infrastructure, suppliers, manufacture and co-packing, marketing and customer insights)

Customer Validation Matching with some of the world’s biggest agrifood MNCs to help with customer validation and feedback, deploying pilots projects, and securing new sales contracts

Investment Network Curated introductions to AgFunder’s investment network of private and institutional investors from across the globe to help you raise your next funding round

Coaching & Mentorship Our experienced team of coaches & mentors offer startups a unique opportunity to learn from industry experts.

Co-Working Space Physical workspace in Singapore (or virtual office address, if overseas) through the duration of the programme.

Areas of interest

Advancing Smallholder Farmers

Novel Foods and Ingredients

Supply Chain Rationalisation

Climate-Smart Food Production

Circular Economy

Food Waste Valorisation

Personalised Nutrition & Health

Application Deadline: 10 January 2022

Check more https://adalidda.com/posts/6uDgo5imPkGy5rhh9/the-grow-impact-accelerator-for-global-foodtech-and-agtech

0 notes

Link

Australian goat farmers - got an innovative food idea from goats. Apply for this #goat #goats #goatmeat #goatmilk

0 notes

Text

Programa AgriFood Tech Latam 2021 recebe inscrições de 70 startups brasileiras

Programa AgriFood Tech Latam 2021 recebe inscrições de 70 startups brasileiras

O Programa AgriFood Tech Latam 2021, que conta com o apoio da Indigo, startup que desenvolve inovações digitais para o agro e uma das primeiras unicórnios (valor acima de US$ 1 bilhão) do setor no mundo, recebeu inscrições de 70 startups brasileiras. Ao todo, foram mais de 400 inscrições de startups de diversos países no Programa promovido pela Glocal, a primeira aceleradora na América Latina…

View On WordPress

0 notes

Text

Ninjacart Launches Agri-Tech Startup Program to Empower Early-Stage Innovators

Key Highlights: Program Launch: Ninjacart Startup Program is designed to support early-stage FoodTech and AgTech startups. Focus Areas: Offers technology access, venture capital opportunities, financial backing, and expert business advisory. Eligibility: Startups founded after 2020, with up to $1M in funding, operating outside India, and focused on food supply chain innovation. Applications…

0 notes

Text

Pink Farms, maior fazenda urbana vertical da América Latina, avança no varejo paulistano

Com pouco mais de quatro meses de início das vendas para o varejo, a empresa já está em pontos importantes da capital paulista

Quantos avanços podem acontecer em uma empresa dentro de quatro meses? Para a Pink Farms, maior fazenda urbana vertical da América Latina - que foi considerada a empresa mais inovadora do agronegócio brasileiro – e vencedora do Prêmio Inovação, powered by Vivo Empresas, esse período foi suficiente para que as dezenas de tipos de alfaces e microgreens, vegetais que se diferenciam por terem alto valor nutritivo, visual e sabor extremamente atraentes, ganhassem destaque nas prateleiras de alguns dos principais varejistas paulistanos, como os supermercados Mambo, os Hortifrutis Oba (onde os produtos ganharam exposição em um espaço que simula os LEDs rosa característicos da sua produção), Natural da Terra, Quitanda, Hortisabor, o charmoso centro gastronômico Eataly, entre outros.

Além disso, os produtos Pink Farms estão ganhando cada vez mais espaço nos cardápios saudáveis e saborosos de importantes endereços de food services da cidade, como Otávio Café, Suplicy Café, Tea Connection, Plant Made, entre outros. Eles ainda deram nome a pratos especialmente criados para usar os produtos da empresa, como é o caso da Urban Kitchen (a chef Jacqueline criou a Pink Farms Toast, que leva pão de fermentação natural, homus de beterraba, avocado e microgreens Pink Farms) e do Kith Restaurante (a chef Ju criou a entrada Pink Beterraba, um tartar de beterraba tostado na brasa, raspas de limão siciliano, azeite e microgreens de rúcula Pink Farms). A rápida expansão tem motivo. Com os consumidores cada vez mais preocupados e engajados em uma alimentação prática e saudável, o conceito de trabalho da empresa focado no farm to table - em português, da fazenda pra mesa, se encaixou perfeitamente, pois seu diferencial está no cultivo feito no coração das grandes cidades, bem próximo dos consumidores (a fazenda está instalada em um galpão ao lado da agitadíssima Marginal Tietê). Além disso, a qualidade dos produtos Pink Farms não fica apenas no frescor com que chegam à mesa das pessoas, mas também porque são cultivados sem a utilização de qualquer tipo de agrotóxico e por serem sustentáveis: sua produção é feita com uma redução de 95% do consumo de água e a capacidade de plantio é 100 vezes maior se comparada ao cultivo tradicional, no campo.

Início -- A Pink Farms surgiu a partir de uma necessidade dos próprios empreendedores de encontrar legumes e verduras de qualidade e, também, com a missão de revolucionar a produção de hortaliças com a utilização de tecnologia. "Ao olharmos o mercado e a cadeia produtiva de hortaliças no Brasil, tivemos surpresas bastante negativas, principalmente por sua baixa eficiência, com perdas pós-colheita que chegam a 40%. Ou seja, de cada 100kg de folhas comestíveis, apenas 60kg são consumidos", comenta Geraldo Maia, cofundador da Pink Farms. Além de reduzir o desperdício de alimentos, cada espécie é extensamente estudada para que possa contar com as condições perfeitas para o seu crescimento, eliminando 100% do uso de agrotóxicos.

Ao adentrar o galpão de 750m2, em São Paulo, a visão é surpreendente: grandes salas hermeticamente fechadas, com estruturas que abrigam diversos tipos de folhagens, como os microgreens, alfaces (mimosa, mimosa roxa, lisa, lisa roxa, friseé, friseé roxa e crespa) , rúcula, manjericão, espinafre, espinafre roxo e acelga. O Pink não está apenas no nome, mas na utilização de luz de LED que, na sua composição, se torna rosa, e que faz o papel da iluminação solar. Os vegetais não conhecem a palavra sazonalidade, já que um sistema de automação controla todas as variáveis de cultivo, independe de clima e época do ano. Com um ambiente totalmente limpo e controlado, aplicam-se técnicas de hidroponia, um tipo de cultura sem solo. Sua metodologia de produção é altamente sustentável e promove uma redução de 95% no consumo de água, em comparação às lavouras a céu aberto, sem falar do sistema vertical que diminui em 90% a utilização de espaço e garante uma capacidade produtiva 100 vezes maior. Com menos manejo e intervenções, contabiliza-se uma redução de 30% de perda, resultando em produtos chamados de pós-orgânicos, aqueles cujo processo de produção é mais sustentável, produtivo, menos danoso ao meio ambiente. "Com a utilização do conceito farm to table, reduzimos a quantidade de intermediários, tempo, perdas e impacto gerado pela cadeia, sempre trazendo um produto muito mais fresco para o consumidor. É possível que ele seja consumido no dia em que foi colhido, eliminando descartes pós-colheita e aumentando o tempo de prateleira em mais de 100%", explica Maia. De acordo com o 2º Censo AgTech Startups Brasil, neste momento, mais de 300 equipes de todo o país concentram esforços para desenvolver ideias inovadoras para o agronegócio brasileiro. Mais da metade delas foi fundada nos últimos três anos, como a Pink Farms. São startups do agro, também chamadas de agtechs, que estão se tornando cada vez mais numerosas no Brasil. Em escala mundial, o AgriFood Tech Investing Report de 2018 mostra que as agtechs captaram pouco mais e US$ 17 bilhões no ano, um crescimento de 43% nos investimentos em relação a 2017. Expansão -- Tanta inovação fez com que a startup, em tão pouco tempo de existência, recebesse o aporte de R$ 2 milhões da SP Ventures, gestora de fundos de investimento de Venture Capital especializada no agronegócio, e da Capital Lab, plataforma de investimento proprietário de capital seed e de risco. O investimento está sendo utilizado na expansão da fazenda para uma escala comercial cada vez maior, com foco em atender a demanda da cidade de São Paulo, além do desenvolvimento de sua marca de consumo. Em paralelo, por meio de sua área de P&D, a Pink Farms busca aumentar seu portfólio com produtos como morango, tomate, entre outros, além de continuar aprimorando a tecnologia atual e abastecer, constantemente, o mercado com novos tipos de microgreens e alfaces.

"Nosso plano é, nos próximos anos, consolidar a Pink Farms como a maior produtora de folhosas da América Latina, quadruplicando nossa capacidade atual de produção de 30 toneladas/ano, e levá-la outras cidades como Rio de Janeiro, Brasília e Belo Horizonte", disse Geraldo Maia. "Em São Paulo, já marcamos presença em diversos endereços de varejo e food services, além da loja online, que está em fase de implantação", completou Geraldo Maia.

alimento seguro, dez/19. com Agência Guanabara – [email protected]

0 notes

Text

RootCamp, Hannover's Innovation Hub, launches its third program with seven international AgriTech startups focused on livestock and carbon farming

RootCamp, Hannover’s Innovation Hub, launches its third program with seven international AgriTech startups focused on livestock and carbon farming

More than 250 applications from over 58 countries were received by the AgriFood Tech Accelerator for the call for Batch #3. In cooperation with the renowned partners K+S, KWS, SKW Piesteritz, hannoverimpuls and the Leipzig SpinLab Accelerator, seven startups were selected. In addition, the program is supported by IP specialist Eisenführ & Speiser and EUROTIER. The following startups will be part…

View On WordPress

#Agricultural Innovation#Agricultural Tech - Farming Tech#Agriculture#AgTech#AgTech and FoodTech Funding#AgTech Startup#Animal Feed#Biologicals in Farming#Carbon#Food and Agribusiness#Food Processing#FoodTech#Imagery#Soil Health#Sustainable Agriculture#Veterinary#Waste Management

0 notes

Photo

Illustration Photo: Research on microalgae to develop new plant-based products. Microalgae are nutritious ingredients and an important research focus for Nestlé. (credits: Nestlé / Flickr Creative Commons Attribution-NonCommercial-NoDerivs 2.0 Generic (CC BY-NC-ND 2.0))

RootCamp Incubation Program - Disruptive solutions with Positive Impact in the AgriFood Tech sector

North America, South America, Asia, Africa, Europe, Middle East, Oceania, Worldwide

RootCamp supports startups who want to accelerate their paths to market and have a positive impact in the AgriFood Tech sector with disruptive solutions.

We provide an acceleration curriculum for early stage startups but also fuel later stage startups. We also assist international companies to implement their solution within the European market. We provide access to our support network to help you with whatever you need to start scaling.

100% Free program + Incubation grant up to 50,000 Euro

We want you to focus on your solution. For every phase of our program we will grant financial support, so you focus just on disruption. No matter if it runs 3 or 12 months.

No equity, no shares, no fees. The incubation grant can reach up to 50,000 Euro.

Fields of interest

RootCamp is interested in finding solutions for the so-called upstream area of the Agri-Food Tech value chain.

We are specifically interested in the following 9 verticals but feel free to apply if your startup operates in a related field.

Ag-Biotechnology

It includes inputs for crops (including seed, fertilizer, pesticides), genetics, microbiome, breeding, input for animals and animal health.

Agribusiness Marketplaces

It includes commodities trading platforms, online input procurement, and equipment leasing platforms.

Bioenergy & Biomaterials

It includes non-food extraction and processing, feedstock technology, agriculture-related pharmaceuticals (like cannabis) and industrial biotechnology.

Farm-management, Software, Sensing & IoT

It includes agricultural data capturing devices, decision support software solutions, and big data analytics.

Farm-Robotics, mechanization & Equipment

It includes on-farm machinery, sensors, automation, drone manufacturers, grow equipment, and smart irrigation.

Innovative Food

It includes cultured meat, novel ingredients, and plant-based proteins.

Supply Chain & Packaging solutions

It includes food safety tech, food traceability tech, logistics & transport, food processing tech, waste recycles tech, packaging solutions, and sustainability tech.

Novel Farming Systems

It includes new methods of farming living ingredients.

Miscellaneous

It includes the rest.

Application Deadline: February 15, 2022

Check more https://adalidda.com/posts/zQb87L4cvKdC4AMtk/rootcamp-incubation-program-disruptive-solutions-with

0 notes

Photo

SEEDS Capital, the investment arm of Enterprise Singapore, has appointed seven co-investment partners under Startup SG Equity. This will catalyse more than S$90 million worth of investments to develop Singapore-based startups in the Agrifood tech sector. This was announced by Senior Minister of State for Trade and Industry, Dr Koh Poh Koon, at the opening of Indoor Ag-Con Asia 2019. The appointed partners are AgFunder, Hatch, ID Capital, Openspace, The Yield Lab, Trendlines and VisVires New Protein. They were selected based on their investment track record, strong commercialisation resources, networks and expertise, and familiarity with the local startup ecosystem in the Agrifood tech space. Mr Ted Tan, Chairman of SEEDS Capital and Deputy Chief Executive of Enterprise Singapore said, “Agri-tech is an important sector as we work towards the vision of developing Singapore into a leading food and nutrition hub in Asia. By leveraging on the expertise from the private sector, we will catalyse deep tech innovation through high-potential startups to develop disruptive food and agri-tech solutions, and reduce our reliance on food imports.” Besides co-investing, SEEDS Capital and the seven partners will provide hands-on assistance, such as introductions to new business partners and providing support to enter new markets, that help early-stage startups in the agrifood tech space fast-track their commercialisation process. SEEDS Capital will provide a co-matching of 7:3 for the first S$500,000 of co-investment, and up to S$4 million per deep tech startup under Startup SG Equity. Startup SG Equity focuses on developing tech startups with intellectual property and global market potential.Follow @insta_robot0 #artificialintelligence #machinelearning #bigdata#industry#agriculture #future #newtechnology Follow @insta_robot0 #datascience #deeplearning #marketing #instaart #computer #aviation Follow @insta_robot0 #sciencefairproject #science& technologies Follow @insta_robot0 (at London, United Kingdom) https://www.instagram.com/p/BuK2xvzgBch/?utm_source=ig_tumblr_share&igshid=1bsnn25y95zr3

#artificialintelligence#machinelearning#bigdata#industry#agriculture#future#newtechnology#datascience#deeplearning#marketing#instaart#computer#aviation#sciencefairproject#science

0 notes

Text

Future Fields is tackling cultured meat’s biggest problem

One possible solution to cellular agriculture’s biggest problem — how to develop a cheap, humane, growth material for cultured meat — may have come from a conversation in line at a Tim Hortons in Alberta.

The husband and wife duo of Matt and Jalene Anderson-Baron were waiting for Timbits and coffee and talking about the technology behind their startup, Future Fields, when Jalene suggested a possible new growth medium.

Matt Anderson-Baron had hit a wall in his research, and the pair, which represented two-thirds of the founding triumvirate of Future Fields, were out for a snack. Along with co-founder Lejjy Gafour, the three friends had set out to launch a startup from Canada that could do something about the world’s reliance on animals for protein.

They recognized that the attendant problems associated with animal farming were unsustainable at a scale needed to meet global demand for meat. So the three turned their attention to cell-based alternatives to the meat market.

“It was all just our interesting crazy side project that we never thought would turn into a business,” said Jalene Anderson-Baron. “That has evolved into a successful business idea over the last year.”

Future Fields co-founders. Image credit: Future Fields

Initially, the trio had hoped to launch their own cultured meat brand to sell lab grown chicken to the world, but after four months spent experimenting in the lab, Matt Anderson-Baron and the rest of the team, decided to pivot and begin work on a new growth serum. All thanks to Tim Hortons.

“Our MVP was a chicken nugget. It worked out to be about $3,000 per pound… Which is obviously not a lucrative business model. Given that the aims was to produce something price comparable to meat,” said Anderon-Brown. “We shifted to focus on a new medium that would be economically viable. Originally we intended it for something that just we used. We didn’t realize at first the novelty of our product and how beneficial it would be to the industry. About eight months ago we decided to pivot and make that growth medium our product.”

Now, as it gets ready to leave the Y Combinator accelerator program, the company has some paid contracts in place and will be rolling out the first couple of pilot product lines of its cell growth material for shipment within the next month.

The potential demand for the company’s product is huge. Alpha Meats, Shiok Meat, Finless Foods, Memphis Meats, Meatable, Mosa Meat, Aleph Farms, Future Meat Technologies, Lab Farm Foods, and Eaat, are all companies developing lab grown alternatives to meat and fish. All told, these companies have raised well over $200 million. Some of the biggest names in traditional meat production like Tyson Foods are investing in meat alternatives.

Image Credit: Getty Images/VectorMine

“It’s about getting the price at scale. The companies that are using smaller volumes are bringing it down 10 to 100 times cheaper. We can do that. But our superpower is producing the growth medium at scale and doing it 1,000 times cheaper,” said Matt Anderson-Brown. “We’re talking about $2 to $3 per liter at scale.”

Future Fields’ founders didn’t say much about the technology that they’re using, except to say that they’re genetically modifying a specific organism by inserting the genetic code for specific protein production into their unidentified cell line to produce different growth factors.

The University of Alberta isn’t unique in its development of a Health Accelerator Program, but its equity-free approach allows startups and would-be bio-engineering entrepreneurs an opportunity to develop their businesses without fear of dilution.

Future Fields has already raised a small, pre-seed round of $480,000 from a group of undisclosed angel investors and the Grow Agrifood Tech Accelerator out of Singapore.

And company has the capacity to produce a few hundred liters of its growth factor, according to Gafour, and is working on plans to scale up production to hit tens of thousands of liters per month over the next year.

For Gafour and his compatriots, the cellular agriculture industry has already reached an inflection point, and the next steps are less about scientific discovery and radical innovation and more about iteration and commercialization.

“With the inclusion of a growth media solution, the core pieces are in place, and now it’s a matter of understanding the efficiencies in being able to scale it up,” said Gafour.

Still, there are other components that need to be developed for the industry to truly bring down costs to a point where it can compete with traditional meat. Companies still need to develop a scaffolding to support the growth of protein cells into the muscle and fatty tissues that give meat its flavor. Bioreactor design needs to improve as well, according to Matt Anderson-Baron. “It’s the wild west. There’s so many things still to be done.”

And there are many companies working on these technologies as well. Glycosan, Lyopor and Prellis are all working on building tissue scaffolding that can be used for animal organ development.

“The vision oif our company was to accelerate this industry and move the industry along,” said Jalene Anderson-Baron. “At first we didn’t realize the potential of our technology. We thought that everyone would overcome that roadblock around the same time. As we were speaking with other companies and speaking with investors who had been in touch with other companies, we realized this was the key piece to move the industry forward.”

0 notes

Link

The Gastrotope accelerator program has helped these start-ups to optimise their business model, achieve product-market fit, and execute a scalable growth strategy.

0 notes

Text

AgriFood Tech Startup Spotlight: FruitSpec - AgFunderNews

Much of us take for approved that we can take pleasure in fresh fruit year-round and most likely have no idea just how much of a logistical feat this is for orchardists and fruit packaging houses. Naturally, understanding what sort of yield to anticipate early in the season can be a gamechanger for growers, loading homes, retailers, and even consumers.

High-value crops like orchards and vineyards have actually gotten a reasonable amount of attention from agtech start-ups and endeavor capitalists. Growers are using everything to improve various elements of their operations. There's also a big chance for start-ups to fix fruit growers' most significant discomfort: hungry pests that feast on valuable crops in the blink of an eye.

VCs are also making fruit-based plays. In Asia, Blue Sky Funds produced a "https://agfundernews.com/chinas-jd-leads-70m-round-in-online-fresh-produce-retailer-fruitday.html/"> a $ 70 million funding for a Chinese-based seller offering fresh vegetables and fruits.

Israel-based startup Fruitspec is wishing to take the secret out of yield prediction with its hyperspectral device vision innovation. Present yield estimates are based on extrapolation from manual counts of a couple of tested trees. As these quotes might differ widely in their precision, the results are destructive service decisions that cause a loss of income to all players, from growers to merchants.

"No-one really understands how much fruit they have in their orchard up until choosing. As all crucial service choices along the fruit worth chain are based upon yield quotes, not being able to accurately estimate your yield may lead to bad business efficiency," Raviv Kula, Fruitspec CEO, informed AgFunderNews. "Utilizing patented hyperspectral and computer system vision innovation, FruitSpec supplies clients with an accurate prediction of the amount of fruit they have in the orchard six-to-seven months before selecting when important decisions are made."

Did you know that AgFunder is one of the most active agrifood tech financiers? We are equalizing access to equity capital. Discover how you can invest with us.

FruitSpec's innovation consists of specifically designed sensor pods installed on any automobile that scans the trees in the orchard. Applied computer vision and a hyperspectral algorithm instantly count and quote fruit number and size, focused at the green fruit phase. Precise yield quotes use fruit packing houses and growers a service that enables them to make noise choices, which affect revenues and financial stability, without including to the workload.

Recently, the company announced that it completed effective field research studies with its option for fruit yields estimates/projections. The trials, which utilized FruitSpec's hyperspectral machine vision innovation, supposedly led to quotes that were more than 90% accurate.

We consulted with Kula to learn more about the startup's journey.

When did you launch and what development phase are you at presently as a company?

We have performed numerous international pilots (South Africa, Israel, Spain, Florida, California and Chile) with big clients. Up until now, the results show that our precision is greater than 90%. We prepare to release commercially in 2019.

Who is your target consumer?

FruitSpec targets loading homes and juice production customers. As the present organisation trend is to own the whole fruit chain or a part of the chain (i.e. a grower, loading home and juice maker) these customers will benefit the most from our service.

What are some of the obstacles that you've faced and how did you overcome them?

Next to innovation advancement, the orchard hyperspectral ground scanning is the greatest difficulty we had. Changing the right equipment to the ideal vehicle was a substantial obstacle, but we got rid of that throughout our field trials. What's been the

most surprising aspect of your start-up journey so far? The most unexpected element is

the willingness of consumers and clients'employees to help us in what we do."Yes, come and examine it, I'll help "was frequently the deal we received. My work experience is in other sectors, not farming, and this helpful mindset continues to surprise me. What's your fundraising experience been like? Who are your investors?

Fundraising is hard, despite the enthusiasm in the sector for

our innovation. We are lucky to have Trendlines as our primary seed financier. With the help of other private investors, we were able to progress and accomplish what we have today. What do you search for in an investor? To be part of the team!

It is truly terrific when an investor can likewise bring

organisation experience and another perspective to the table, in addition to the cash. Have you took part in incubators or accelerators? If so was it useful? FruitSpec is presently in Trendlines Agtech's incubator. The incubator is extremely advised. As a young company, you require all the help, good recommendations, support and

connections readily available. If you are in the best program you are blessed. Any guidance for other startups out there? My experience of start-up life is that you require to be an optimistic-pessimistic individual. On the one hand, you need to be optimistic that you will dominate the world with 3 individualsin your business and on the other hand, cynical, in order to predict all the things that can fail which you will require to fret about. In other words, my suggestions is to delight in the trip ... Do you have any rivals or quasi-competitors dealing with somewhat comparable developments? Our primary competitors is manual work. Some start-ups provide yield evaluation, however toward the end of the season when the worth of that data is low.

0 notes

Text

AGRIFOOD TECH ACCELERATOR GASTROTOPE ANNOUNCES FIVE STARTUPS FOR ITS FIRST COHORT

AGRIFOOD TECH ACCELERATOR GASTROTOPE ANNOUNCES FIVE STARTUPS FOR ITS FIRST COHORT

New Delhi, January 22nd, 2019: Gastrotope, the agrifood tech accelerator founded by Taizo Son’s Mistletoe, GSF, and Infobridge, today announced the names of five startups in the first cohort of its program.

Over 150 applications were received for the program, and the following five startups have been shortlisted :

Brown Foods by Lifenectar Health Care Pvt. Ltd.

Founded in 2017 by Stanford,…

View On WordPress

0 notes

Text

Agrifood the $8 trillion industry thats worth your salt

Esther Delignat-Lavaud Rodriguez Contributor

Esther Delignat-Lavaud Rodriguez is an investor at Oxford Capital, a seed and Series A investor in the U.K.

Cannabis-infused drinks. Burgers grown in laboratories. Entire meals in bottles. Consumers, retailers and farmers alike are hungry for the next generation of food, and investors are beginning to acquire the taste, too. Early-stage investment in agrifood tech startups reached $10.1 billion in 2017, a 29 percent increase on the previous year.

Agrifood can be split into two parts. “Agritech” refers to technologies that target farmers. “Foodtech,” by contrast, targets manufacturers, retailers, restaurants and consumers. Jointly, the two have enough reach to impact every part of the production line, from farm to fork.

Recently, foodtech investments have led the charge, with Delivery Hero’s IPO and multi-million rounds in ele.me and Instacart. However, agritech deals are catching up: Indigo Agriculture and Ginkgo Bioworks raised $203 million and $275 million, respectively.

There’s also more acquisitions activity in the sector. Some recently baked news suggests that both Uber and Amazon could be in talks with Deliveroo for a potential acquisition. Meanwhile, John Deere put $305 million on the table for the robotics company Blue River Technology, and DuPont acquired farm management software Granular for $300 million.

So why the growing interest in agrifood?

Food is a huge market, and it’s changing fast

Back in 1958, there were 3 billion of us on the planet. Today, population size has reached 7.6 billion, and is due to hit a whooping 11.2 billion in 2100. That is a lot of mouths to feed.

But the appeal of the food market doesn’t stop at volume. Indeed, following Bennett’s Law, as people’s income increases their diet becomes more diverse. This economic compulsion to seek variety is being complemented by a rise in ethical consumers voting with their forks. Many have grown aware of the link between food and ecology, health and animal welfare. The number of vegans in the U.S. has increased six-fold in the last three years, and more than tripled in the U.K. over the past decade.

This is not simply a case of having our cake and eating it.

These dual trends have led to supermarket shelves and restaurant menus evolving at pace. Consumers are keen as mustard to find new and healthy “superfoods” such as insects — Eat Grub and Cricke — and new consumption-forms, from meal replacement options like Huel to vegan meal boxes such as allplants.

When it comes to agritech, alternative production models have also arisen to cater to consumers’ preferences. Vertical farms such as GrowUp and LettUs Grow, for example, could dramatically reduce the environmental impact of farming.

Combining the above two ingredients — a growing population and a diversification in diet — cooks up quite the appetizing dish for investors: The global food and agriculture industry is estimated to be worth at least $8 trillion.

New technologies are creating big opportunities

The food and agriculture value-chain is full of bottlenecks and inefficiencies. Some of them could be solved with the intelligent application of well-known technologies.

The humble online marketplace, for example. Marketplaces, including Yagro, Hectare Agritech and Farm-r, let farmers transact machinery and goods, while peer-to-peer platforms like WeFarm enable knowledge sharing. Food procurement marketplaces have cropped up too, such as COLLECTIVfood, Pesky Fish and COGZ — as have direct-to-consumer services, such as Farmdrop and Oddbox.

Some tech solutions are far more complex.

Genetic engineering, for one, is providing plenty of food for thought. Indeed, the UN suggests that food production must increase by 70 percent by 2050 to feed the world’s population growth. Genetic engineering could increase crop yields by 22 percent globally, as well as help pre-empt pre-harvest losses.

To this end, CRISPR is revolutionizing how food is grown. CRISPR technology helps producers optimize photosynthesis and the vitamin content of crops. Since it was first tested on tobacco production in 2013, CRISPR has been used on a range of crops, from wheat and rice to oranges and tomatoes; and for a whole spectrum of applications — from boosting crop resistance to pests, to improving nutritional contents. CRISPR is also being applied to livestock. At the Roslin Institute in Scotland, researchers have successfully used CRISPR to develop virus-resistant pigs.

In the same vein, there have been major advances in cellular agriculture. Cellular agriculture combines biotechnology with food and tissue engineering to produce agricultural products like meat or leather from cells cultured in a lab.

It is easy to see how cellular agriculture and the companies applying it, such as Meatable and Higher Steaks, could dramatically change farming and food production.

Therefore, investors have thus been tempted to take a bite at the “clean meat” industry. In Europe, Mosa Meat just raised $8.8 million, while U.S.-based Memphis Meats raised $17 million in 2017.

Even though products are yet to hit the shelves, the appeal is clear: The meat market will be worth $7.3 trillion by 2025, with a 73 percent increase in demand by 2050. And clean meat technology could allow for the production of meat at virtually infinite scale: In just two months, 50,000 tons of pork cells could be grown per bioreactor by using starter cells from 10 pigs. This could dramatically reduce the production cost of meat, and also its environmental cost: 6x less water is needed and 4x less greenhouse gas is emitted per pound of clean meat compared to “traditional” meat.

Artificial intelligence and machine learning is also impacting agriculture. One of the main opportunities, amongst many, is in precision agriculture.

Farmers now receive better information on crop status due to advances in image recognition, sensors, robotics and, of course, machine learning. Startups such as Hummingbird Technologies and Kisan Hub have developed solutions that outperform human “crop walks.” Similarly, Observe Technologies provides fish farmers with AI-powered insights to optimize feeding.

Consumer acceptance is also likely to be shaped by the economic, environmental and ethical implications of agrifood technologies.

Moving indoors, Xihelm (full disclosure, Oxford Capital is an investor) is developing a machine vision algorithm that enables roboticized indoor harvesting. Such technologies could help solve the labor crisis in agriculture: The 2017 labor shortage saw labor costs rise by between 9-12 percent in the U.K.

When the food moves from farm to retailers, supply chains can become unwieldy and difficult to manage. As a result, there is a $40 billion fraud problem in food. Blockchain technologies are being applied to solve this problem, powered by companies such as Provenance. Walmart recently announced that their leafy-green vegetable suppliers must upload their data to the blockchain, allowing them to trace food back to the source in 2.2 seconds instead of a week.

Agrifood tech is still an acquired taste

Although the agrifood market is huge and presents many opportunities for investment, it still isn’t quite the tech investor’s favorite dish. Yes, investment increased to $10.1 billion in 2017; however, fintech hit $39.4 billion in the same year.

There are several reasons. Digitization is growing, but it is slow. Farmers are understandably risk-averse. Their aversion is strengthened by the seasonality and fallibility of their activity. Most crops deliver produce once a year, so any missed harvest can have dramatic and long-lasting consequences. Implementing any large-scale technological solution represents a risk; therefore veering away from the status quo is a decision that cannot be taken lightly.

Regulation is a huge consideration for the sector. The Court of Justice of the European Union recently ruled that plants created with CRISPR must go through the same lengthy approval process as GMOs. In France in 2018, a law banned the use of terms like “meat” and “dairy” for vegetarian and vegan products — although it is not clear how this law will apply to cultured meat products in the future, nomenclature is a fight clean meat startups will want to win for the sake of consumer acceptance.

Consumer acceptance is also likely to be shaped by the economic, environmental and ethical implications of agrifood technologies. It is chastening to remember that agriculture employs one in four people in the global workforce, a large proportion of which are women.

The future of food could see unemployment issues in farming; large changes in livestock and feedstock production; and significant alterations in land management. Furthermore, gene editing is likely to benefit large corporations more than independent farmers — who could be put at risk.

This is not simply a case of having our cake and eating it. Instead, the ingredients need to be chosen with great care, or the “future of food” risks leaving a very bitter taste.

Original Article : HERE ; This post was curated & posted using : RealSpecific

=> *********************************************** See More Here: Agrifood the $8 trillion industry thats worth your salt ************************************ =>

Agrifood the $8 trillion industry thats worth your salt was originally posted by 16 MP Just news

0 notes