#Aluminum Market report

Text

Global Aluminum Market: Growth Analysis & Upcoming Trends

Aluminum is one of the most widely used metals globally, finding extensive applications across transportation, construction, packaging, machinery, electrical transmission, and consumer goods sectors. Global demand for aluminum has witnessed steady growth over the past decade, driven by rapid industrialization, urbanization trends, and infrastructure development across emerging economies. According to Triton Market Research, the Global Aluminum Market is expected to experience a steady CAGR of 5.37% over the forecast period from 2024 to 2032.

Aluminum Market: Utilities Driving Global Growth

Demand Driven by Automotive and Aerospace Sectors:

The transportation industry accounts for over 27% of global aluminum consumption as of 2022. Within this, the automotive segment is the leading consumer, followed by aerospace manufacturing.

Aluminum is favored in auto-making for its light weight, strength, durability, and corrosion resistance. The metal helps enhance fuel economy and lower carbon emissions. As per estimates, an average mid-size vehicle now incorporates over 130 Kg of aluminum components. Luxury and performance vehicles use even higher quantities, nearing 230 kg. Companies like Audi, Jaguar, and Porsche aim to reduce curb weight and improve acceleration, speed, and handling.

On the other hand, the aerospace sector relies on lightweight, high-strength aluminum alloys to manufacture aircraft bodies and components. Major plane-makers forecast a need for over 1 million metric tons of new aluminum capacity by 2032 to meet production targets.

Aluminum’s Growing Efficacy in Construction and Packaging

Accounting for over 75% of global consumption, the building and construction sector is the largest end-user of aluminum today. Architectural demand is driven by the metal’s aesthetics, strength, longevity and flexibility in fabrication. Aluminum framing, cladding, windows, and curtain walls are gaining momentum in sustainable building projects.

At the same time, aluminum packaging, especially cans and foils, is witnessing high growth buoyed by rising hygiene awareness and trends such as online food delivery, packaged meals and beverages.

Rising Electricity Costs Compel Producers to Enhance Energy Efficiency

Aluminum production is an energy-intensive process. On average, electricity expenses account for around 40% of operating costs for aluminum smelting companies. Over the past few years, power tariffs have risen globally, compelling businesses to focus on enhancing energy efficiency.

Many older smelting facilities built in the 1960s-80s used outdated technologies that consumed over 15,500 kWh to produce one ton of aluminum. With electricity prices rising, producers are now retrofitting plants with modern cell designs, smart automation and advanced process controls. These upgrades can reduce energy usage by 20-30%.

For instance, Norsk Hydro’s HAL300 technology cuts power consumption down to just 13,500 kWh per ton. RUSAL’s RA-550 electrolysis technology brings further savings, using only 12,800-13,000 kWh. By enhancing energy efficiency, companies aim to curb expenses and bolster profit margins.

China Hongqiao Group, the world’s largest aluminum producer, is adopting digitization and big data analytics to optimize energy utilization across its smelting operations. This has enabled the company to cut power usage by over 15% in the past five years.

Outlook on Supply Security and New Capacity

Global aluminum production capacity must expand continuously to meet increasing demand from user industries throughout the 2020s despite facing challenges posed by tightening environmental regulations worldwide. To address this, the industry is implementing new technologies to improve energy efficiency and reduce emissions in the production process, alongside strengthening recycling initiatives to promote a transition to a circular economy and enhance sustainability.

Efforts to expand capacity include ‘brownfield’ expansions at existing sites utilizing the latest technologies, as well as the establishment of new smelting projects in regions with access to renewable power sources such as hydro, geothermal, and solar energy. Countries like Canada, Iceland, Bahrain, and the UAE are attracting investments in Greenfield facilities powered by these renewable sources. These endeavors aim to enhance supply security, achieve ecological sustainability, and meet the growing demand for aluminum products in the coming decade.

FAQs

Q1) How does recycling impact the aluminum market?

Aluminum recycling is significant, as it reduces energy consumption and environmental impact. Recycled aluminum accounts for a substantial portion of global supply.

Q2) What are the challenges faced by the aluminum market?

Overcapacity, fluctuations in energy prices, environmental concerns, and trade disputes are some of the challenges affecting the aluminum market.

#Aluminum Market forecast#Aluminum Market report#Aluminum Market#chemicals#triton market research#market research reports

0 notes

Text

Aluminum Market: Products, Applications & Beyond

Aluminum is a versatile element with several beneficial properties, such as a high strength-to-weight ratio, corrosion resistance, recyclability, electrical & thermal conductivity, longer lifecycle, and non-toxic nature. As a result, it witnesses high demand from industries like automotive & transportation, electronics, building & construction, foil & packaging, and others. The high applicability of the metal is expected to drive the global aluminum market at a CAGR of 5.24% in the forecast period from 2023 to 2030.

Aluminum – Mining Into Key Products:

Triton Market Research’s report covers bauxite, alumina, primary aluminum, and other products as part of its segment analysis.

Bauxite is anticipated to grow with a CAGR of 5.67% in the product segment over the forecast years.

Bauxite is the primary ore of aluminum. It is a sedimentary rock composed of aluminum-bearing minerals, and is usually mined by surface mining techniques. It is found in several locations across the world, including India, Brazil, Australia, Russia, and China, among others. Australia is the world’s largest bauxite-producing nation, with a production value of over 100 million metric tons in 2022.

Moreover, leading market players Rio Tinto and Alcoa Corporation operate their bauxite mines in the country. These factors are expected to propel Australia’s growth in the Asia-Pacific aluminum market, with an anticipated CAGR of 4.38% over the projected period.

Alumina is expected to grow with a CAGR of 5.42% in the product segment during 2023-2030.

Alumina or aluminum oxide is obtained by chemically processing the bauxite ore using the Bayer process. It possesses excellent dielectric properties, high stiffness & strength, thermal conductivity, wear resistance, and other such favorable characteristics, making it a preferable material for a range of applications.

Hydrolysis of aluminum oxide results in the production of high-purity alumina, a uniform fine powder characterized by a minimum purity level of 99.99%. Its chemical stability, low-temperature sensitivity, and high electrical insulation make HPA an ideal choice for manufacturing LED lights and electric vehicles. The growth of these industries is expected to contribute to the progress of the global HPA market.

EVs Spike Sustainability Trend

As per the estimates from the International Energy Agency, nearly 2 million electric vehicles were sold globally in the first quarter of 2022, with a whopping 75% increase from the preceding year. Aluminum has emerged as the preferred choice for auto manufacturers in this new era of electromobility. Automotive & transportation leads the industry vertical segment in the studied market, garnering $40792.89 million in 2022.

In May 2021, RusAl collaborated with leading rolled aluminum products manufacturer Gränges AB to develop alloys for automotive applications. Automakers are increasingly substituting stainless steel with aluminum in their products owing to the latter’s low weight, higher impact absorption capacity, and better driving range.

Also, electric vehicles have a considerably lower carbon footprint compared to their traditional counterparts. With the growing need for lowering emissions and raising awareness of energy conservation, governments worldwide are encouraging the use of EVs, which is expected to propel the demand for aluminum over the forecast period.

The Netherlands is one of the leading countries in Europe in terms of EV adoption. The Dutch government has set an ambitious goal that only zero-emission passenger cars (such as battery-operated EVs, hydrogen FCEVs, and plug-in hybrid EVs) will be sold in the nation by 2030. Further, according to the Canadian government, the country’s aluminum producers have some of the lowest CO2 footprints in the world.

Alcoa Corporation and Rio Tinto partnered to form ELYSIS, headquartered in Montréal, Canada. In 2021, it successfully produced carbon-free aluminum at its Industrial Research and Development Center in Saguenay. The company is heralding the beginning of a new era for the global aluminum market with its ELYSIS™ technology, which eliminates all direct GHG emissions from the smelting process, and is the first technology ever to emit oxygen as a byproduct.

Wrapping Up

Aluminum is among the most widely used metals in the world today, and is anticipated to underpin the global transition to a low-carbon economy. Moreover, it is 100% recyclable and can retain its properties & quality post the recycling process.

Reprocessing the metal is a more energy-efficient option compared to extracting the element from an ore, causing less environmental damage. As a result, the demand for aluminum in the sustainable energy sector has thus increased. The efforts to combat climate change are thus expected to bolster the aluminum market’s growth over the forecast period.

#Aluminum Market#aluminum#chemicals and materials#specialty chemicals#market research#market research reports#triton market research

4 notes

·

View notes

Text

Automotive Aluminum Alloy Wheels Market 2024 to 2030 Updates, News, Key Players, Cumulative Annual Growth Rate

Global Automotive Aluminum Alloy Wheels Market research report published by Exactitude Constancy reveals the current outlook of the global and key regions from the following perspectives: Key players, countries, product types, and end industries. The report studies the top companies in the global market and divides the market into several parameters. This Automotive Aluminum Alloy Wheels Market research report pinpoints the industry's competitive landscape to understand the international competition. This report study explains the expected growth of the global market for the upcoming years from 2024 to 2030. This research report is accumulated based on static and dynamic perspectives on business.

The Automotive Aluminum Alloy Wheels Market is expected to grow at 3.6% CAGR from 2023 to 2030. It is expected to reach above USD 26.43 Billion by 2030 from USD 19.21 Billion in 2023.

Browse Complete Summary and Table of Content @ https://exactitudeconsultancy.com/ja/reports/27137/automotive-aluminum-alloy-wheels-market/

#Automotive Aluminum Alloy Wheels Industry#Automotive Aluminum Alloy Wheels Market 2024#Automotive Aluminum Alloy Wheels Market Analysis#Automotive Aluminum Alloy Wheels Market Research Report#Automotive Aluminum Alloy Wheels Market Demand#Automotive Aluminum Alloy Wheels Market Growth#Automotive Aluminum Alloy Wheels Market Insights#Automotive Aluminum Alloy Wheels Market Revenue#Automotive Aluminum Alloy Wheels Market Share#Automotive Aluminum Alloy Wheels Market Size#Automotive Aluminum Alloy Wheels Market Trends

0 notes

Text

#Low-Carbon Aluminum Market#Low-Carbon Aluminum Report#Low-Carbon Aluminum Industry#Advanced Material#BISResearch

0 notes

Text

#Automotive Aluminum Alloy Wheel Market#Automotive Aluminum Alloy Wheel Market Trends#Automotive Aluminum Alloy Wheel Market Growth#Automotive Aluminum Alloy Wheel Market Industry#Automotive Aluminum Alloy Wheel Market Research#Automotive Aluminum Alloy Wheel Market Reports

0 notes

Text

Aluminum Cans Market Growth, Overview with Detailed Analysis 2022-2028

Aluminum Cans Market Growth, Overview with Detailed Analysis 2022-2028

The Aluminum Cans Market research report 2022-2030 provides an in-depth analysis of the changing trends, opportunities, and challenges influencing the growth over the next decade. The study includes a detailed summary of each market along with data related to demand, supply and distribution. The report examines Aluminum Cans market growth strategies adopted by leading manufacturers which include…

View On WordPress

#Aluminum Cans#Aluminum Cans forecast#Aluminum Cans Industry#Aluminum Cans Market#Aluminum Cans price#Aluminum Cans report#Aluminum Cans research#Aluminum Cans share#Aluminum Cans trends#Covid-19 Impact Analysis

0 notes

Photo

Aluminum Chlorohydrate Market

Aluminum chlorohydrate is an inorganic polymer and group of specific aluminum salts, which has general formula AlnCl(3n-m)(OH)m.

Read More-https://latestcmiblogs.weebly.com/article/aluminum-chlorohydrate-is-a-colorless-odorless-and-light-yellow-crystalline-solid

#Aluminum Chlorohydrate Market#Aluminum Chlorohydrate Market study#Aluminum Chlorohydrate Market report#Aluminum Chlorohydrate Market analysis#Polymer#resins

0 notes

Text

The phone or computer you’re reading this on may not be long for this world. Maybe you’ll drop it in water, or your dog will make a chew toy of it, or it’ll reach obsolescence. If you can’t repair it and have to discard it, the device will become e-waste, joining an alarmingly large mountain of defunct TVs, refrigerators, washing machines, cameras, routers, electric toothbrushes, headphones. This is “electrical and electronic equipment,” aka EEE—anything with a plug or battery. It’s increasingly out of control.

As economies develop and the consumerist lifestyle spreads around the world, e-waste has turned into a full-blown environmental crisis. People living in high-income countries own, on average, 109 EEE devices per capita, while those in low-income nations have just four. A new UN report finds that in 2022, humanity churned out 137 billion pounds of e-waste—more than 17 pounds for every person on Earth—and recycled less than a quarter of it.

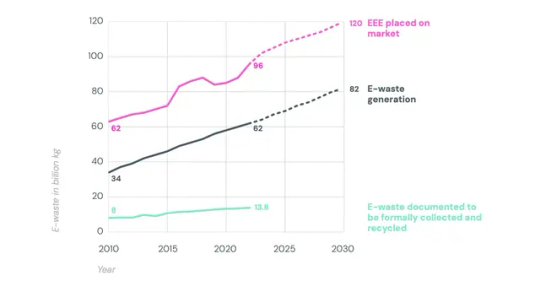

That also represents about $62 billion worth of recoverable materials, like iron, copper, and gold, hitting e-waste landfills each year. At this pace, e-waste will grow by 33 percent by 2030, while the recycling rate could decline to 20 percent. (You can see this growth in the graph below: purple is EEE on the market, black is e-waste, and green is what gets recycled.)

“What was really alarming to me is that the speed at which this is growing is much quicker than the speed that e-waste is properly collected and recycled,” says Kees Baldé, a senior scientific specialist at the United Nations Institute for Training and Research and lead author of the report. “We just consume way too much, and we dispose of things way too quickly. We buy things we may not even need, because it's just very cheap. And also these products are not designed to be repaired.”

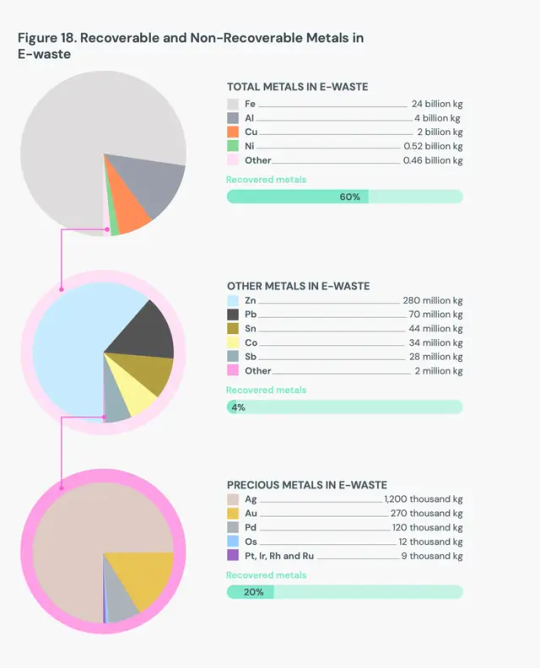

Humanity has to quickly bump up those recycling rates, the report stresses. In the first pie chart below, you can see the significant amount of metals we could be saving, mostly iron (chemical symbol Fe, in light gray), along with aluminum (Al, in dark gray), copper (Cu), and nickel (Ni). Other EEE metals include zinc, tin, and antimony. Overall, the report found that in 2022, generated e-waste contained 68 billion pounds of metal.

E-waste is a complex thing to break down: A washing machine is made of totally different components than a TV. And even for product categories, not only do different brands use different manufacturing processes, but even different models within those brands vary significantly. A new washing machine has way more sensors and other electronics than one built 30 years ago.

Complicating matters even further, e-waste can contain hazardous materials, like cobalt, flame retardants, and lead. The report found that each year, improperly processed e-waste releases more than 125,000 pounds of mercury alone, imperiling the health of humans and other animals. “Electronic waste is an extremely complex waste stream,” says Vanessa Gray, head of the Environment and Emergency Telecommunications Division at the UN’s International Telecommunication Union and an author of the report. “You have a lot of value in electronic waste, but you also have a lot of toxic materials that are dangerous to the environment.”

That makes recycling e-waste a dangerous occupation. In low- and middle-income countries, informal e-waste recyclers might go door-to-door collecting the stuff. To extract valuable metals, they melt down components without proper safety equipment, poisoning themselves and the environment. The new report notes that in total, 7.3 billion pounds of e-waste is shipped uncontrolled globally, meaning its ultimate management is unknown and likely not done in an environmentally friendly way. Of that, high-income countries shipped 1.8 billion pounds to low- and middle-income countries in 2022, swamping them with dangerous materials.

High-income countries have some of this informal recycling, but they also have formal facilities where e-waste is sorted and safely broken down. Europe, for example, has fairly high formal e-waste recycling rates, at about 43 percent. But globally, recycling is happening nowhere near enough to keep up with the year-over-year growth of the waste. Instead of properly mining EEE for metals, humanity keeps mining more ore out of the ground.

Still, the report found that even the small amount of e-waste that currently gets recycled avoided the mining of 2 trillion pounds of ore for virgin metal in 2022. (It takes a lot of ore to produce a little bit of metal.) The more metals we can recycle from e-waste, the less mining we’ll need to support the proliferation of gadgets. That would in turn avoid the greenhouse gases from such mining operations, plus losses of biodiversity.

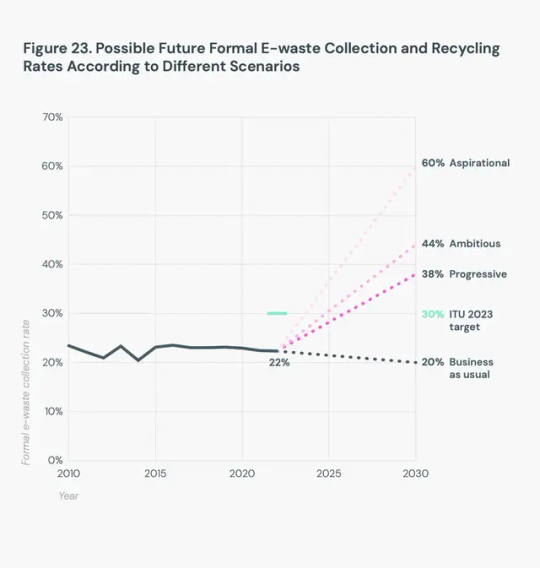

The complexity of e-waste, though, makes it expensive to process. As the chart above shows, even an ambitious scenario of a formal e-waste collection rate in 2030 is 44 percent. “There is no business case for companies to just collect e-waste and to make a profit out of this in a sustainable manner,” says Baldé. “They can only survive if there is legislation in place which is also compensating them.”

The report notes that 81 countries have e-waste policies on the books, and of those, 67 have provisions regarding extended producer responsibility, or EPR. This involves fees paid by manufacturers of EEE that would go toward e-waste management.

Of course, people could also stop throwing so many devices away in the first place, something right-to-repair advocates have spent years fighting for. Batteries, for instance, lose capacity after a certain number of charge cycles. If a phone can’t hold a charge all day anymore, customers should be able to swap in a new battery. “Manufacturers shouldn't be able to put artificial limitations on that ability,” says Elizabeth Chamberlain, director of sustainability at iFixit, which provides repair guides and tools. That includes limiting access to parts and documentation. “Repair is a harm-reduction strategy. It's not the be-all-end-all solution, but it's one of many things we need to do as a global society to slow down the rate at which we're demanding things of the planet.”

At the core of the e-waste crisis is the demand: A growing human population needs phones to communicate and fridges to keep food safe and heat pumps to stay comfortable indoors. So first and foremost we need high-quality products that don’t immediately break down, but also the right to repair when they do. And what absolutely can’t be fixed needs to move through a safe, robust e-waste recycling system. “We are consuming so much,” says Baldé, “we cannot really recycle our way out of the problem.”

26 notes

·

View notes

Text

2023 Cost vs. Value Report: 5 Best and 5 Worst Home Renovations ROI in the Los Angeles area

When it comes to home renovations, it's important to consider not only the immediate benefits of the project but also its potential resale value. The annual Cost vs. Value Report by Remodeling magazine analyzes the average cost of various renovation projects and estimates their potential return on investment (ROI) in the current housing market. In the Pacific region of the US, Los Angeles is a particularly popular area for home renovations. Let's take a look at the top 5 home renovation projects with the highest recuperation rate and the bottom 5 with the lowest recoup rate in the Los Angeles, CA area according to the 2023 Report. Some of these projects may be confirmation of what you know and some may shock you. If you have questions about a Huntington Beach home renovation call me.

Top 5 renovation projects with the highest recoup rate:

Manufactured stone veneer: The project involves replacing the existing vinyl siding on the bottom third of the street-facing facade of the house with manufactured stone veneer. The average cost of the project is $12,989, and it has an estimated ROI of 109.8%.

garage door replacement: This project involves replacing an existing garage door with a new four-section garage door with heavy-duty galvanized steel tracks. The average cost of the project is $3,776, and it has an estimated ROI of 107.3%.

Entry door replacement (steel): this project involves replacing an existing entry door with a new 20-gauge steel entry door with clear dual-pane half-glass panel, jambs, and an aluminum threshold with composite stop. The average cost of the project is $1,981, and it has an estimated ROI of 94.5%.

Minor kitchen remodel: This project involves replacing cabinet fronts with shaker-style wood panels and drawer fronts, installing new hardware, replacing laminate countertops with new ones, and installing a new stainless steel sink and faucet. The average cost of the project is $27,772, and it has an estimated ROI of 88.4%.

Siding replacement (vinyl): this project involves replacing the existing siding with new foam-backed insulated vinyl siding, including all trim. The average cost of the project is $18,929, and it has an estimated ROI of 84.9%.

Bottom 5 renovation projects with the lowest recoup rate:

Backup Power Generator: This project involves installing a new standby generator to provide backup power during outages. The average cost of the project is $17,500, and it has an estimated ROI of 41.6%.

Home office remodel: This project involves converting a spare bedroom into a home office with custom cabinets, a laminate desktop, and recessed overhead lighting. The average cost of the project is $38,582, and it has an estimated ROI of 43.5%.

Sunroom Addition: This project involves adding a 200-square-foot sunroom with a new foundation and footings, vinyl windows with insulated glass, and a sliding door. The average cost of the project is $113,238, and it has an estimated ROI of 47.4%.

Major kitchen remodel: This project involves gutting the kitchen and replacing everything, including cabinets, countertops, appliances, flooring, and lighting. The average cost of the project is $81,700, and it has an estimated ROI of 47.5%.

Bathroom Addition: This project involves adding a new 6-by-8-foot bathroom to an existing space, including a fiberglass shower with a glass enclosure, a toilet, and a vanity with a solid-surface countertop. The average cost of the project is $49,782, and it has an estimated ROI of 52.4%.

When planning a home renovation project in the Los Angeles, CA area, it's important to consider not only your personal preferences and needs but also the potential resale value of the project. As seen in the 2023 Cost vs. Value Report, certain projects tend to recoup a higher percentage of their cost than others. This doesn't mean that you should always choose the highest recoup rate projects, as personal preference, location, and other factors may also come into play.

However, it's always a good idea to weigh the potential return on investment against the upfront cost when deciding on a renovation project. It's also important to keep in mind that the cost and ROI estimates provided in the report are just averages, and your actual cost and ROI may vary depending on factors such as the size of your home, the quality of materials used, and the contractor you hire.

Therefore, it's always a good idea to get multiple quotes from licensed and experienced contractors and to do your research before making a decision. With careful planning and execution, a home renovation project can not only improve your living space but also add value to your home.

Also don't forget to call me for what your Huntington Beach home value is to see if it makes sense to sell now with these upgrades and remodels.

Mr. Huntington Beach Real Estate

315 7th St D Huntington Beach, CA 92648

949-310-4110

10 notes

·

View notes

Text

Consumer Trends in the Aramid Fibre Reinforcement Materials Market

Stay ahead of the game in the aramid fiber reinforcement materials market with insights into consumer trends and key player strategies. Read on to learn more.

The Aramid Fibre Reinforcement Materials Market is a rapidly growing industry, with a wide range of applications in various sectors. To stay ahead of the competition, it's important to understand consumer trends and key player strategies. In this article, we'll explore some of the latest insights and developments in the aramid fibre reinforcement materials market.

Overview of the Aramid Fibre Reinforcement Materials Market

The aramid fibre reinforcement materials market is a highly competitive industry that is expected to experience significant growth in the coming years. Aramid fibres are known for their high strength, durability, and resistance to heat and chemicals, making them ideal for use in a variety of applications, including aerospace, automotive, and construction.

The market is driven by increasing demand for lightweight and high-performance materials, as well as growing awareness of the benefits of aramid fibers over traditional materials like steel and aluminum.

Consumer Trends Driving Market Growth

One of the key consumer trends driving growth in the aramid fibre reinforcement materials market is the increasing demand for sustainable and eco-friendly materials. Aramid fibres are known for their durability and longevity, which makes them a more sustainable option compared to traditional materials that need to be replaced more frequently.

Additionally, consumers are becoming more aware of the environmental impact of their purchasing decisions and are seeking out products that are produced using sustainable and ethical practices. As a result, manufacturers in the aramid fibre reinforcement materials market, are investing in sustainable production methods and marketing their products as eco-friendly alternatives.

Key Players and Their Strategies

In the aramid fibre reinforcement materials market, key players are implementing various strategies to stay ahead of the competition. Some are focusing on expanding their product portfolio to cater to a wider range of applications, while others are investing in research and development to improve the performance of their products.

Request a free sample copy of the report, here, https://www.nextmsc.com/aramid-fiber-reinforcement-materials-market/request-sample

The aramid fibre reinforcement materials market, which is highly competitive, consists of various market players, including;

E. I. du Pont de Nemours and Company, Teijin Ltd., Kolon Industries, Inc., Honeywell International Inc., SRO Aramid (Jiangsu) Co., Ltd., Hyosung Corporation, Toray Industries, Inc., Yantai Tayho Advanced materials Co., Ltd., Ibiden Co., Ltd., and Huvis Corporation, among others.

Additionally, many players are adopting sustainable production methods and marketing their products as eco-friendly alternatives to traditional materials. Collaborations and partnerships with other companies in the industry are also becoming more common, as players seek to leverage each other's strengths and resources to drive growth.

Emerging Technologies and Innovations

The aramid fibre reinforcement materials market is constantly evolving, with new technologies and innovations emerging to meet the changing needs of consumers. One such innovation is the development of aramid fibres with improved strength and durability, which are being used in a variety of applications, from aerospace and defense to automotive and construction.

Other emerging technologies include the use of nanotechnology to enhance the properties of aramid fibres, and the development of new manufacturing processes that allow for greater efficiency and cost-effectiveness. As these technologies continue to evolve, they are likely to have a significant impact on the aramid fibre reinforcement materials market, shaping consumer trends and driving growth for key players in the industry.

Future Outlook and Opportunities for Growth

The future outlook for the aramid fibre reinforcement materials market is promising, with continued growth expected in the coming years. As consumer demand for high-performance materials increases, key players in the industry are investing in research and development to create new and innovative products that meet these needs.

Moreover, the growing trend towards sustainability and eco-friendliness is driving the development of aramid fibers that are more environmentally friendly and sustainable. Overall, the aramid fibers reinforcement materials market presents numerous opportunities for growth and innovation, and companies that stay ahead of consumer trends and invest in new technologies are likely to succeed in this dynamic and rapidly evolving industry.

#aramid fiber#adhesives#sealants#advanced materials#materials#chemicals#globalopportunity#industry insights

7 notes

·

View notes

Text

“The war in Ukraine is also a battle for raw materials. The country has large deposits of iron, titanium and lithium, some of which are now controlled by Russia.” That’s what the federally owned German foreign trade agency Germany Trade and Invest (GTAI) reported on its website on January 16 under the title “Ukraine’s raw materials wealth at risk.”

There are trillions at stake. According to the GTAI, “raw material deposits worth $12.4 trillion” remain beyond the control of the Ukrainian army, “including 41 coal mines, 27 gas deposits, 9 oil fields and 6 iron ore deposits.” Ukraine has not only coal, gas, oil and wheat but also rare earths and metals—especially lithium, which has been called the “white gold” of the transition to new energy and transportation technologies. The country accounts for around one-third of Europe’s explored lithium deposits.

Only the ignorant could believe that this is irrelevant to NATO’s war aims. It would be the first major war in over 100 years that is not about mineral resources, markets and geostrategic interests. The World Socialist Web Site has pointed out in previous articles that deposits of critical raw materials in Russia and China, which are essential to the transition to electric mobility and renewable energy, are an important factor in the war calculus of NATO states.

Yet they go unmentioned in the media’s round-the-clock war propaganda. The media wish the public to believe that NATO is waging this war to defend “freedom” and “democracy”—and that after bombing Afghanistan, Iraq, Libya and Syria back into the Middle Ages under similar pretexts.

Relevant trade journals, industry magazines and think tanks, on the other hand, rave about Ukraine’s mineral wealth and discuss how best to capture it. It was to this end that German Economics Minister Robert Habeck (Green Party) even traveled to Ukraine at the beginning of April with a high-ranking business delegation.

According to the industry magazine Mining World, Ukraine has a total of around 20,000 raw material deposits, of which only 7,800 have been explored. Numerous other articles and strategy papers openly state that this is what the war is about.

On February 24, 2022, the day of the Russian invasion of Ukraine, the largest German business magazine, Capital, published an article stating that “Europe’s supply of raw materials” was “threatened” by the Russian occupation of eastern Ukraine. Ukraine was not only “the leading grain exporter” but also the largest EU supplier of iron ore pellets and “a linchpin for Europe’s energy security.” Among investors, the magazine said, there is “concern that the war will cut off exports of key raw materials.”

The GTAI article cited earlier reports that European steel mills were sourcing nearly one-fifth of their iron ore pellets from Ukraine in 2021. GTAI goes on to write that Ukraine is among the top ten producers of iron ore, manganese, zirconium, and graphite, and is “among the world leaders in titanium and kaolin.” In addition to “untapped oil and gas fields,” Ukraine’s lithium and titanium deposits, in particular, hold “enormous potential” for the European economy. In 2020, production volumes amounted to 1,681,000 tons of kaolin, 537,000 tons of titanium, 699,000 tons of manganese and 49,274,000 tons of iron ore.

Lithium for electromobility and energy storage

The price of lithium has increased more than eightfold in the last decade and is the subject of intense speculation. The metal is of strategic importance to the major imperialist powers because it is used in lithium-ion batteries installed in electric vehicles and off-grid renewable energy sources, and is also needed for lightweight aluminum alloys in the aerospace industry.

The largest lithium deposit in Europe is located in the Donetsk Oblast in the middle of the embattled Donbas region, only kilometers from the front lines. An article in the Tagesspiegel, published two months after the Russian invasion, points to untapped lithium reserves of 500,000 tons in Shevchenko near Potrovsk and at least two other Ukrainian deposits.

Western companies and Ukrainian oligarchs were already fighting bitterly for control of this “white gold” before the war. As the Tagesspiegel reports, “Ukrainian businessmen” (who stood close to the Ukrainian government of the time under the oligarch Petro Poroshenko) with connections to Western mining companies obtained mining licenses, without a tender process, for the lithium deposit in Shevchenko as early as 2018.

The company in question, Petro Consulting—which was renamed “European Lithium Ukraine” shortly before the war began—is expected to be bought out by the Australian-European mining company European Lithium once its access to Ukraine’s lithium reserves is secured.

In 2018, when the Ukrainian Geological Survey refused to issue a “special permit” for Ukraine’s second largest lithium deposit at Dobra, likewise bypassing the tender process, Petro Consulting went so far as to sue the agency. After the Ukrainian Procurator General’s Office eventually launched an investigation into the allegedly illegal special permits, Petro-Consulting had its Shevchenko mining license revoked by the courts in April 2020 until further notice.

However, a spokesman for European Lithium told Der Tagesspiegel that the company bears “no risk in connection with the Ukrainian deposits.” He expressed confidence that the projects would be “made production-ready” after the end of the war.

Titanium for the Western arms industry

In a September 2022 article titled “Ukraine’s Titanium Can Armor the West,” the transatlantic think tank Center for European Policy Analysis (CEPA) wrote: “Support for Ukraine has been driven by strategic concerns and moral-political values. But long-term Western help should also be based on solid material interests.”

“Ukraine’s substantial titanium deposits” are “a key resource critical to the West” because the metal is “integral to many defense systems,” such as aircraft components and missiles. Currently, the raw material for Airbus, Boeing and Co. is extracted “in an expensive and time-consuming six-step process” from titanium ore, which until then had been sourced to a considerable extent from Russia. This “dependence” on “strategic competitors and adversaries” is unacceptable from the West’s point of view and can be ended with the help of Ukrainian resources:

For example, Dnipro-based Velta, the largest private exporter of raw titanium in Europe, has developed a new production system that bypasses the intensive process of producing titanium sponge and could supply the US and European defense and aerospace industries with finished metal. Given there are only five countries in the world actively producing titanium sponge —China, Russia, Kazakhstan, Japan and Ukraine — Velta’s technology could be a game changer for the supply chain by cutting reliance on Russia and China.

CEPA is funded by US and European defense contractors and lists as members of its “scientific advisory board” Donald Trump’s National Security Advisor General H. R. McMaster, former German Defense Minister Annegret Kramp-Karrenbauer, former Swedish Prime Minister Carl Bildt and publicists Anne Applebaum, Francis Fukuyama, and Timothy Garton Ash among others.

The CEPA article continues, “Reorienting titanium contracts to Ukraine would stimulate the country’s economy, even during wartime, not to mention during postwar reconstruction, and simultaneously strike another blow at Russia’s war machine.” The goal, it states, should be “cementing Ukraine’s integration into Europe.”

A January 28, 2023 report in Newsweek reports, “there is a nascent effort underway in the U.S. and allied nations to identify, develop, and utilize Ukraine’s vast resources of a key metal crucial for the development of the West’s most advanced military technology which will form the backbone of future deterrence against Russia and China.” The report adds, “If Ukraine wins, the U.S. and its allies will be in sole position to cultivate a new conduit of titanium.”

“Strategic raw materials partnership” between EU and Ukraine

The US and EU efforts to plunder Ukraine’s lithium and titanium deposits are part of the broader goal of tying Ukraine to the West as a strategic raw materials supplier. In particular, the EU is seeking to free itself from dependence on China—currently its most important raw materials supplier—against which the imperialist powers, especially the United States, are preparing to wage war.

On July 13, 2021, Ukrainian Prime Minister Denys Shmyhal and Maroš Šefčovič, Vice President of the European Commission, signed a “Strategic Partnership on Raw Materials and Batteries” in Kiev to “integrate critical raw materials and battery value chains.” Ukraine’s inclusion in the European Raw Materials Alliance (ERMA) and the European Battery Alliance (EBA) serves to “bolster Europe’s resilience and open strategic autonomy in key technologies,” the EU Commission said.

Referring to the list of critical raw materials in the EU’s associated “action plan,” Šefčovič told the press, “21 of these critical raw materials are in Ukraine, which is also extracting 117 out of 120 globally used minerals.” He added: “We’re talking about lithium, cobalt, manganese, rare earths—all of them are in Ukraine.”

Following the signing, EU Internal Market Commissioner Thierry Breton, who is also responsible for the defense and space industries of EU countries, praised the “high potential of the critical raw material reserves in Ukraine” that could help in “addressing some of the strategic dependencies [of the EU].”

Speaking at Raw Materials Week in Brussels in November 2022, Prime Minister Shmyhal stressed that Ukraine is “among the top ten producers of titanium, iron ore, kaolin, manganese, zirconium and graphite” and renewed his pledge to make the country an “integral part of industrial supply chains in the EU.”

The EU’s “strategic dependencies” are by no means limited to Russia or China and certainly not to Ukraine. A global race for strategic sources of raw materials has long since begun, in the course of which the US and the leading EU powers are attempting to divide among themselves the mineral resources and other resources of the “weaker” states. Although they are jointly waging war against Russia in Ukraine, this inevitably exacerbates conflicts between themselves as well.

The escalation of the war in Ukraine shows that the ruling elites are willing to go to extremes to enforce their profit interests. Only the working class can put an end to permanent war and the prospect of devastating nuclear war by bringing the resources of the entire planet under its democratic control on the basis of a socialist program and holding war profiteers to account.

3 notes

·

View notes

Text

Cell Therapy Bioprocessing Market: Analyzing the Cell Therapy Pipeline

The global cell therapy bioprocessing market is projected to grow at a CAGR of 13.01% between 2024 to 2032, as per Inkwood Research. Cell therapy involves utilizing human cells to treat diseases and repair damaged tissues. As cell therapies continue to show promise for treating cancer, neurological conditions, and musculoskeletal disorders, optimizing bioprocessing techniques is crucial forscale-up and affordability.

Rapid progress in cell biology, gene editing tools like CRISPR, and single-cell analysis are opening new possibilities. Furthermore, automation, Artificial Intelligence (AI), and advanced analytical methods are also transforming cell therapy manufacturing.

Cell therapy bioprocessing is complex, with living cells highly sensitive to environmental fluctuations. Maintaining aseptic conditions and consistent quality at scale is challenging. In this regard, companies are implementing innovative techniques to enhance process outputs.

Cell Therapy Bioprocessing Market | Driving Efficiencies Through Optimized Processes

Cell therapy bioprocessing is complex, with living cells highly sensitive to environmental fluctuations. Maintaining aseptic conditions and consistent quality at scale is challenging. Companies are implementing innovative techniques to enhance process outputs.

As per a senior executive at Miltenyi Biotec, adopting the MACS GMP Prodigy for automated cell separation reduced processing time from 12 hours to just 90 minutes, allowing us to manufacture up to 12 patient doses per day. Closed, automated systems like this enhance standardization, minimize contamination risks, reduce labor needs, and enable reliable scale-up.

Companies are also implementing single-use technologies, which improve flexibility and reduce validation and cleaning requirements, versus stainless steel equipment. According to BioPlan Associates, over 90% of cell therapy developers use single-use equipment, especially for upstream processes like cell culture. Improving cell stability and optimizing media, buffer and reagent formulations enhances cell viability and process yields.

Cell Therapy Manufacturing: Advanced Analytical Tools for Quality Control

Rigorous quality control testing is mandatory during cell therapy manufacturing to ensure safety, identity, purity and potency. Developers are implementing advanced analytical methods like spectroscopy, chromatography, PCR, and flow cytometry for in-process monitoring and release testing.

UniLine Automated Solution from Sartorius enables automated at-line sampling of bioreactors with biocontainer-sensor assemblies for Real-Time Cell Culture Monitoring (RT-CCM) and process optimization. As per Sartorius, with UniLine’s Vi-CELL BLU Cell density and viability data is automatically gathered every 20 minutes, enabling tight process control.

Companies like Berkeley Lights (United States) are also leveraging optofluidic technology and machine learning for cell line development and antibody discovery – analyzing thousands of single cells and selecting high-performing clones with optimized workflows.

End-to-End Quality in Cell Therapy Logistics: Navigating Supply Chain Hurdles

As cell therapies approach commercialization, developers encounter challenges in establishing scaled-up supply chains that span from raw material sourcing to final dose delivery. The limited shelf lives of living cell products, stringent cold chain requirements, logistics, traceability, and specialized handling/transport are key considerations in this process. In this regard, supply chain digitization and predictive analytics can help mitigate risks of temperature excursions or delays.

Two key examples are stated below–

Cryoport, through its C3 platform, provides optimized end-to-end cold chain logistics solutions for cell therapy delivery using cloud-based monitoring and tracking.

Savsu offers innovative EVO smart passive shipping containers enabling remote temperature monitoring.

As cell therapies move from promise to reality, innovations in bioprocessing are critical to overcoming the distinct manufacturing challenges these products pose. By investing in scalable and flexible solutions, automating & standardizing processes, and strengthening supply chains, the potential of engineered cell therapies can progress from lab to clinic and, subsequently, to patients in need. Though hurdles remain, continued progress and collaboration across this sphere can further accelerate the expansion of the global cell therapy bioprocessing market.

FAQ

What are the key growth drivers of the global cell therapy bioprocessing market?

The global cell therapy bioprocessing market’s growth is accredited to increased research and development in cell-based therapies, advancements in biotechnology, the rising prevalence of chronic diseases, and supportive regulatory environments.

What are the challenges and opportunities in the cell therapy bioprocessing market?

Challenges in the cell therapy bioprocessing market include complexities in manufacturing consistent cell therapies, high research costs, stringent regulations, and logistical hurdles. On the other hand, market opportunities include developing better manufacturing techniques, exploring new therapeutic applications, and expanding into emerging sectors, leading to innovation and industry growth.

#Aluminum Market forecast#Aluminum Market report#Aluminum Market#chemicals#triton market research#market research reports

0 notes

Text

Sirens Market Research by Key players, Type and Application, Future Growth Forecast 2022 to 2032

In 2022, the global sirens market is expected to be worth US$ 170.1 million. The siren market is expected to reach US$ 244.0 million by 2032, growing at a 3.7% CAGR.

The use of sirens is expected to increase, whether for announcements or on emergency vehicles such as ambulances, police cars, and fire trucks. A siren is a loud warning system that alerts people to potentially dangerous situations as they happen.

Rapidly increasing threats and accidents have resulted in more casualties and missed business opportunities in developing economies. Demand for sirens is expected to rise during the forecast period as more people use security solutions.

As a result of rising threats and accidents in developing economies, the number of victims and lost business opportunities has rapidly increased. Adopting security solutions, such as sirens, is an effective way to deal with these challenges. Long-range sirens are used in mining and industrial applications, whereas motorised sirens are used in home security. Hand-operated sirens are used when there is no power or when a backup is required.

Some additional features of sirens include a solar panel upgrade system to keep the batteries charged and a number of digital communication methods, including Ethernet, satellite, IP, fiber optic and others. Sirens have conformal coatings on their electronics, which help protect them against harsh environments. Some of the systems are made in such a way that they can be expanded or scaled depending on future capabilities.

Omni-directional sirens can be used in areas of high noise levels and those with large population densities as they provide a greater area of coverage. Sirens have external controls with triggers, which can be customized according to needs. The lightening types of sirens include bulb revolving, LED flashing and xenon lamp strobe. The loud speakers in sirens are adopted from latest piezoelectric ceramic technology.

Get a Sample Copy of this Report @

https://www.futuremarketinsights.com/reports/sample/rep-gb-4274

Other sirens are hydraulic or air driven and mostly find applications in plants and factories. Lithium batteries have replaced alkaline batteries in sirens now, since lithium batteries need not be replaced for several years. Modern sirens use latest technologies and find applications in civil defense, emergency vehicles, security systems and others. Typically, sirens are made of stainless steel, aluminum or UV stabilized polycarbonate to avoid corrosion and are equipped with protection cages. An LED flashing siren has a light source with a semi-permanent lifespan and it is used in places where bulb replacement is a problem.

Region-wise Outlook

In the global sirens market, the dominant share is held by the U.S., India, China, Japan, Australia, Germany, Singapore and the UAE. This can be attributed to the demand for security solutions in developed as well as developing economies.

The regional analysis includes:

North America (U.S., Canada)

Latin America (Mexico. Brazil)

Western Europe (Germany, Italy, France, U.K, Spain)

Eastern Europe (Poland, Russia)

Asia-Pacific (China, India, ASEAN, Australia & New Zealand)

Japan

The Middle East and Africa (GCC Countries, S. Africa, Northern Africa)

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Market Participants

Some of the key market participants identified in the global siren market are Acoustic Technology Inc., Sentry Siren Inc., MA Safety Signal Co. Ltd, Whelen Engineering Co. Inc., Federal Signal Corporation, B & M Siren Manufacturing Co., Projects Unlimited Inc., Phoenix Contact, Mallory Sonalert Products and Qlight USA Inc.

Rising population and rapid urbanization have led to an increase in demand for security solutions. The need for implementation of security has paved way for the use of electronic equipment on a large scale globally, which in turn has created opportunities for the global sirens market. As these products are durable with a high voltage capacity and easy to install, they find high selling propositions. Characteristics and properties of electronic and pneumatic equipment play a vital role in security solutions, thereby driving the global sirens market with a rise in diverse end-user applications, such as industrial warning systems, community warning systems, campus alert systems and military mass warning systems.

Report Highlights:

Detailed overview of parent market

Changing market dynamics in the industry

In-depth Polishing / Lapping Film market segmentation

Historical, current and projected market size in terms of volume and value

Recent industry trends and developments

Competitive landscape

Strategies of key players and products offered

Potential and niche segments, geographical regions exhibiting promising growth

A neutral perspective on market performance

Must-have information for market players to sustain and enhance their market footprint.

Browse Detailed Summary of Research Report with TOC @

https://www.futuremarketinsights.com/reports/sirens-market

Key Segments

Product Type:

Electronic

Electro-mechanical

Rotating

Single/dual toned

Omnidirectional

By Application:

Civil defense

Industrial signaling

Emergency vehicles

Home/vehicle safety

Security/warning systems

Military use

Others

By Installation Type:

Wall mounting

Self-standing

Water proof connector

By Regions:

North America

Europe

Asia Pacific

Latin America

MEA

2 notes

·

View notes

Text

Kick Scooters Market Growing Popularity and Emerging Trends in the Industry

Global Kick Scooters Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player’s market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improved profitability. In addition, the study helps venture or private players in understanding the companies in more detail to make better informed decisions.

Major Players in This Report Include Razor (United States)

Fuzion Scooter (United States)

Xootr LLC (United States)

Decathlon Group (France)

Globber Scooters (Singapore)

HUDORA GmbH (Germany)

Exooter Scooter (United States)

AGDA NSW (Australia)

Ancheer (United States)

Schwinn Bicycle Company (United States)

Kick scooter is a vehicle for transportation that involves standing on a skateboard-like deck, gripping the handlebars and swinging leg in a kicking motion in order to propel yourself forward. The most common kick scooters have two hard small wheels, which made from aluminum and can be folded. Some kick scooters are made for children having 3 to 4 wheels and made from plastic which, cannot be folded.

Market Drivers Easy To Handle

Rising Health Consciousness among the People

Market Trend Demand for Electric Kick Scooters worldwide

Opportunities Rising Demand from Developed and Developing Countries

Challenges Challenge to Tackle Different Road Surfaces

The Kick Scooters market study is being classified by Type (Two-Wheel Kick Scooter, Three and More Wheels Kick Scooter, Electric Kick Scooter), Application (Adults, Kids), Distribution Chanel (Online, Offline)

Presented By

AMA Research & Media LLP

2 notes

·

View notes

Text

Aluminum Composite Panels Market Growth, Overview with Detailed Analysis 2022-2028

Aluminum Composite Panels Market Growth, Overview with Detailed Analysis 2022-2028

The Aluminum Composite Panels Market research report 2022-2030 provides an in-depth analysis of the changing trends, opportunities, and challenges influencing the growth over the next decade. The study includes a detailed summary of each market along with data related to demand, supply and distribution. The report examines Aluminum Composite Panels market growth strategies adopted by leading…

View On WordPress

#Aluminum Composite Panels#Aluminum Composite Panels forecast#Aluminum Composite Panels Industry#Aluminum Composite Panels Market#Aluminum Composite Panels price#Aluminum Composite Panels report#Aluminum Composite Panels research#Aluminum Composite Panels share#Aluminum Composite Panels trends#Covid-19 Impact Analysis

0 notes

Text

Aluminum Extrusion Market Report: Opportunities and Challenges (2023-2032)

The Aluminum Extrusion Market is projected to grow from USD 81,423.94 million in 2023 to an estimated USD 162,766.83 million by 2032, with a compound annual growth rate (CAGR) of 8.00% from 2024 to 2032.

The Aluminum Extrusion Market is witnessing significant growth due to its increasing applications across various industries such as construction, automotive, aerospace, and electronics. Aluminum extrusion involves shaping aluminum alloy into desired profiles using a hydraulic press, offering benefits like lightweight, corrosion resistance, and high strength-to-weight ratio. The construction industry remains the largest end-user, driven by the demand for energy-efficient and sustainable building materials. Additionally, the automotive sector is increasingly adopting aluminum extrusions to enhance vehicle performance and fuel efficiency. Key market players, including Norsk Hydro ASA, Arconic Inc., and Constellium N.V., are focusing on innovation and expanding their production capabilities to meet the growing demand. The Asia-Pacific region dominates the market, with China being the largest producer and consumer of aluminum extrusions, followed by North America and Europe. Technological advancements, along with the rising emphasis on recycling and eco-friendly manufacturing processes, are expected to further propel market growth.

The Aluminum Extrusion Market is influenced by various dynamic factors that drive its growth and shape its future. Understanding these dynamics is crucial for stakeholders to navigate the market effectively. Key market dynamics include:

Drivers:

Growing Demand in Construction: The construction industry is a major driver of the aluminum extrusion market. The need for lightweight, durable, and energy-efficient materials in building and infrastructure projects is fueling the demand for aluminum extrusions. Aluminum's ability to be easily shaped and its strength-to-weight ratio make it ideal for windows, doors, curtain walls, and structural components.

Automotive Industry Adoption: The automotive industry is increasingly adopting aluminum extrusions to reduce vehicle weight and enhance fuel efficiency. The shift towards electric vehicles (EVs) further boosts this demand, as lightweight materials are essential for improving battery life and performance. Aluminum extrusions are used in various automotive parts, including chassis, frames, and body panels.

Technological Advancements: Innovations in extrusion technology, such as advanced die design and automation, are enhancing the efficiency and quality of aluminum extrusion processes. These advancements enable the production of complex and precise profiles, meeting the specific needs of various industries.

Sustainability and Recycling: Aluminum is highly recyclable, and the emphasis on sustainability is driving the adoption of recycled aluminum in extrusion processes. The ability to recycle aluminum without losing its properties makes it an attractive material for environmentally conscious manufacturers and consumers.

Restraints:

Volatility in Raw Material Prices: Fluctuations in the prices of raw materials, particularly aluminum ingots, can impact the profitability of aluminum extrusion manufacturers. Price volatility is influenced by factors such as changes in supply and demand, geopolitical issues, and trade policies.

High Initial Costs: The setup and operational costs associated with aluminum extrusion facilities can be high. Investments in advanced machinery, dies, and skilled labor are substantial, which can be a barrier for new entrants and small-scale manufacturers.

Competition from Alternative Materials: While aluminum offers many advantages, it faces competition from other materials such as steel, composites, and plastics. These materials may be preferred in certain applications due to their specific properties or lower costs.

Opportunities:

Expansion in Emerging Markets: Emerging economies, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the aluminum extrusion market. Rapid urbanization, industrialization, and infrastructure development in these regions drive the demand for aluminum extrusions.

Development of New Applications: Continuous research and development efforts are leading to the discovery of new applications for aluminum extrusions. Innovations in product design and material science are expanding the use of aluminum extrusions in industries such as aerospace, electronics, and renewable energy.

Integration with Advanced Manufacturing Techniques: The integration of aluminum extrusion with advanced manufacturing techniques such as 3D printing and additive manufacturing offers new possibilities for creating complex and customized profiles. This integration enhances the versatility and application range of aluminum extrusions.

Challenges:

Environmental Regulations: Compliance with stringent environmental regulations related to emissions and waste management can pose challenges for aluminum extrusion manufacturers. Adapting production processes to meet these regulations requires significant investment and continuous monitoring.

Skilled Labor Shortage: The aluminum extrusion industry requires skilled labor for the design, operation, and maintenance of extrusion machinery. A shortage of skilled workers can impact production efficiency and quality, posing a challenge for manufacturers.

Key players

Arconic Corp.

Bahrain Aluminum Extrusion Company

Constellium N.V.

Gulf Extrusions Co. LLC

Hindalco Industries Ltd.

Kaiser Aluminum

Norsk Hydro ASA

QALEX

More About Report- https://www.credenceresearch.com/report/aluminum-extrusion-market

The Aluminum Extrusion Market is evolving rapidly, driven by advancements in technology, shifting consumer preferences, and increasing demand across various industries. Key trends shaping the market include:

1. Lightweighting in Automotive and Aerospace Industries:

Automotive: The push for fuel efficiency and reduced emissions is driving the use of aluminum extrusions in vehicle manufacturing. Aluminum is increasingly used for body frames, engine components, and chassis, contributing to lighter vehicles and improved performance. The rise of electric vehicles (EVs) further accelerates this trend, as lighter materials enhance battery efficiency and range.

Aerospace: Similarly, the aerospace industry is adopting aluminum extrusions to reduce aircraft weight, thereby improving fuel efficiency and payload capacity. The demand for high-strength, lightweight materials is driving innovation in extrusion technologies for aerospace applications.

2. Sustainability and Recycling:

The aluminum extrusion market is benefiting from the growing emphasis on sustainability and the circular economy. Aluminum is highly recyclable, and using recycled aluminum reduces energy consumption and environmental impact. Companies are investing in technologies and processes that enhance recycling efficiency and promote the use of recycled materials in extrusion products.

3. Advancements in Extrusion Technology:

Technological advancements in extrusion processes are enabling the production of complex and precise profiles. Innovations such as multi-hole dies, improved cooling systems, and automation are enhancing productivity and product quality. These advancements allow for greater design flexibility and the ability to meet specific application requirements in various industries.

4. Expansion in Emerging Markets:

Emerging economies, particularly in Asia-Pacific and Latin America, are witnessing rapid industrialization and urbanization, driving the demand for aluminum extrusions. Infrastructure development, construction projects, and the growth of manufacturing sectors in countries like China, India, and Brazil are creating significant market opportunities. Increased foreign investments and government initiatives to boost infrastructure further support this trend.

5. Growth in the Construction Sector:

The construction industry remains a major consumer of aluminum extrusions. The demand for energy-efficient and sustainable building materials is driving the use of aluminum in windows, doors, curtain walls, and structural components. Aluminum's durability, corrosion resistance, and aesthetic appeal make it an ideal choice for modern construction projects. The trend towards green buildings and sustainable architecture is further boosting the adoption of aluminum extrusions.

6. Customization and Tailored Solutions:

There is a growing demand for customized aluminum extrusion solutions that meet specific design and performance criteria. Manufacturers are offering tailored extrusions to cater to unique requirements in industries such as electronics, medical devices, and consumer goods. The ability to provide bespoke solutions enhances customer satisfaction and opens new market opportunities.

7. Integration with Advanced Manufacturing Techniques:

The integration of aluminum extrusion with advanced manufacturing techniques such as additive manufacturing (3D printing) is creating new possibilities for complex and intricate designs. This integration allows for the production of components with enhanced functionality and reduced material wastage. It also facilitates rapid prototyping and small-batch production, meeting the needs of innovative and specialized applications.

8. Digitalization and Industry 4.0:

The adoption of digital technologies and Industry 4.0 principles is transforming the aluminum extrusion industry. Smart manufacturing, IoT-enabled equipment, and data analytics are improving process control, efficiency, and product quality. Digitalization enables real-time monitoring, predictive maintenance, and optimization of extrusion operations, enhancing overall productivity and competitiveness.

Segments

Based on Product

Shapes

Rods and Bars

Pipes and Tubes

Based on Application

Building & Construction

Automotive & Transportation

Consumer Goods

Electrical & Energy

Other Applications

Browse the full report – https://www.credenceresearch.com/report/aluminum-extrusion-market

Browse Our Blog: https://www.linkedin.com/pulse/aluminum-extrusion-market-analysis-bm14f

Contact Us:

Phone: +91 6232 49 3207

Email: [email protected]

Website: https://www.credenceresearch.com

0 notes