#Bank API Integration Service Company in Philippines

Explore tagged Tumblr posts

Text

Digital Remittance Market Overview: Trends, Growth, and Forecast

The Digital Remittance market has emerged as a transformative force in the global financial ecosystem, streamlining cross-border money transfers through advanced digital platforms. As the demand for fast, secure, and low-cost money transfers continues to rise, digital remittance services are becoming increasingly integral to global economic activity, particularly in regions with high migration flows.

Market Overview

Digital remittance refers to the transfer of money through online platforms and mobile applications without relying on traditional financial institutions. Unlike conventional remittance methods, digital remittances offer enhanced speed, lower transaction fees, and greater convenience.

This market has witnessed remarkable growth in recent years due to increased smartphone penetration, improved internet connectivity, and the growing adoption of digital financial services. Fintech innovations and partnerships with local financial institutions have also played a crucial role in expanding the reach and efficiency of these services.

Key Market Trends

Mobile-First Solutions The surge in mobile wallet usage and app-based platforms is revolutionizing how users send and receive money. Countries with a large number of unbanked individuals, especially in Africa and Southeast Asia, are seeing rapid adoption of mobile remittance services.

Blockchain and Cryptocurrency Integration Blockchain technology is being used to improve transaction transparency and reduce transfer fees. Several companies are also experimenting with cryptocurrency as a remittance channel, though regulatory concerns remain a hurdle.

AI and Automation AI-driven fraud detection, personalized customer service, and automated compliance checks are helping digital remittance platforms become faster and more secure.

Government and Regulatory Support Many governments are promoting digital financial inclusion through favorable regulations and partnerships with fintech firms. This is boosting user trust and expanding market accessibility.

Remittance Corridors Expansion New and less common remittance routes are opening up, driven by increased globalization and labor mobility. Platforms are now focusing on underserved markets to gain competitive advantage.

Market Growth

The digital remittance market was valued at approximately USD 19 billion in 2023 and is projected to grow at a CAGR of 13–15% through 2030. The key drivers include:

Rising international migration

Growth in disposable incomes among migrant workers

Increasing reliance on digital payment ecosystems

Expanding internet and smartphone penetration in developing nations

Regional Insights

Asia-Pacific leads the digital remittance market in volume, driven by countries like India, China, and the Philippines.

North America is a key sender region, with a strong presence of migrant workers from Latin America and Asia.

Africa shows high potential for future growth, particularly with the success of mobile money solutions like M-Pesa in Kenya.

Future Forecast

Looking ahead, the digital remittance market is expected to see sustained growth driven by:

Enhanced interoperability between payment systems globally

Greater financial literacy among users in emerging markets

Integration of open banking APIs to streamline cross-border transfers

Strategic M&A activity among fintech companies aiming to scale globally

Conclusion

The Digital Remittance market is poised for exponential growth as digital transformation reshapes the financial services landscape. With ongoing innovation, evolving customer expectations, and increasing regulatory support, digital remittance platforms are not only becoming more user-friendly but also vital tools for global economic empowerment.

0 notes

Text

Artificial Neural Network Software Market is Set To Fly High in Years to Come

The Latest research study released by AMA “Worldwide Artificial Neural Network Software Market” with 100+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint and status. Understanding the segments helps in identifying the importance of different factors that aid the market growth. Some of the Major Companies covered in this Research are Google (United States), IBM (United States), Oracle (United States), Microsoft (United States), Intel (United States), Qualcomm (United States), Alyuda (United States), Ward Systems (United States), GMDH, LLC (United States), Starmind (Switzerland).

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/182533-global-artificial-neural-network-software-market Brief Summary of Artificial Neural Network Software:

An Artificial Neural Network (ANN) is defined as a bit of computing system that helps to designed and simulate the way human brain analyses and processes information. however, neural network software is mainly used to simulate, research, develop and helps to apply ANN, software concept on biological neural networks. Artificial Neural Network also called as neural networks or simulated neural networks. Market Trends:

High Adoption of 3D artificial neural network Software

Market Drivers:

Demand for machine learning

Market Challenges:

Lack of government and compliance issues

Market Opportunities:

Growing Demand from Applications in areas

The Global Artificial Neural Network Software Market segments and Market Data Break Down are illuminated below: by Application (Image Recognition, Signal Recognition, Data Mining, Others), Deployment mode (On-premises, Cloud), Industry Vertical (Banking, Financial Services, and Insurance (BFSI), Retail and e-commerce, Telecommunication and Information Technology (IT), Healthcare and Life Sciences, Manufacturing, Government and Defence, Transportation and Logistics, Others (Media and Entertainment, Travel and Hospitality, and Education), Component (Solutions, Platform/API, Services (Managed Services and Professional Services), Consulting Services, Deployment and Integration, Support and Maintenance Services) This research report represents a 360-degree overview of the competitive landscape of the Global Artificial Neural Network Software Market. Furthermore, it offers massive data relating to recent trends, technological, advancements, tools, and methodologies. The research report analyzes the Global Artificial Neural Network Software Market in a detailed and concise manner for better insights into the businesses. Regions Covered in the Global Artificial Neural Network Software Market:

The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

North America (United States, Mexico & Canada)

South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Enquire for customization in Report @ https://www.advancemarketanalytics.com/enquiry-before-buy/182533-global-artificial-neural-network-software-market The research study has taken the help of graphical presentation techniques such as infographics, charts, tables, and pictures. It provides guidelines for both established players and new entrants in the Global Artificial Neural Network Software Market. The detailed elaboration of the Global Artificial Neural Network Software Market has been provided by applying industry analysis techniques such as SWOT and Porter’s five-technique. Collectively, this research report offers a reliable evaluation of the global market to present the overall framework of businesses. Attractions of the Global Artificial Neural Network Software Market Report:

The report provides granular level information about the market size, regional market share, historic market (2018-2023) and forecast (2024-2032)

The report covers in-detail insights about the competitor’s overview, company share analysis, key market developments, and their key strategies

The report outlines drivers, restraints, unmet needs, and trends that are currently affecting the market

The report tracks recent innovations, key developments and start-up’s details that are actively working in the market

The report provides plethora of information about market entry strategies, regulatory framework and reimbursement scenario

Get Up to 10% Discount on This Premium Report: https://www.advancemarketanalytics.com/request-discount/182533-global-artificial-neural-network-software-market Strategic Points Covered in Table of Content of Global Artificial Neural Network Software Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Artificial Neural Network Software market

Chapter 2: Exclusive Summary – the basic information of the Artificial Neural Network Software Market.

Chapter 3: Displayingthe Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Artificial Neural Network Software

Chapter 4: Presenting the Artificial Neural Network Software Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2017-2022

Chapter 6: Evaluating the leading manufacturers of the Artificial Neural Network Software market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2023-2028)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source finally, Artificial Neural Network Software Market is a valuable source of guidance for individuals and companies. Get More Information @: https://www.advancemarketanalytics.com/reports/182533-global-artificial-neural-network-software-market Artificial Neural Network Software Market research provides answers to the following key questions:

What is the expected growth rate of the Artificial Neural Network Software Market?

What will be the Artificial Neural Network Software Market size for the forecast period, 2024 – 2032?

What are the main driving forces responsible for changing the Artificial Neural Network Software Market trajectory?

Who are the big suppliers that dominate the Artificial Neural Network Software Market across different regions? Which are their wins to stay ahead in the competition?

What are the Artificial Neural Network Software Market trends business owners can rely upon in the coming years?

What are the threats and challenges expected to restrict the progress of the Artificial Neural Network Software Market across different countries?

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact US : Craig Francis (PR & Marketing Manager) AMA Research & Media LLP Unit No. 429, Parsonage Road Edison, NJ New Jersey USA – 08837 Phone: +1 201 565 3262, +44 161 818 8166 [email protected]

#Global Artificial Neural Network Software Market#Artificial Neural Network Software Market Demand#Artificial Neural Network Software Market Trends#Artificial Neural Network Software Market Analysis#Artificial Neural Network Software Market Growth#Artificial Neural Network Software Market Share#Artificial Neural Network Software Market Forecast#Artificial Neural Network Software Market Challenges

0 notes

Link

#Payment API Integration Service Company in UK#Payment API Integration Service Company in Singapore#Bank API Integration Service Company in UK#Bank API Integration Service Company in Singapore#Bank API Integration Service Company in Philippines

0 notes

Text

Bruc Bond endeavor to lead the financial sector

Bruc Bond endeavor to lead the financial sector with sustainability, customizable product offering, and open communication. At Bruc Bond we aim to make 21st century banking straightforward, simple, and transparent.

Eyal Nachum is a fintech guru and a director at Bruc Bond. Eyal is the architect of the software that SMEs use to do cross-border payments.

Everything of payments is actually evolving. New solutions disrupt old methods for doing things, brand-new entrants gobble all the way up market share, together with a changing regulatory panorama forces adjustment along with innovation. Here everyone take a look at some of the breakthroughs in the global bills industry and the way in which they’re likely to engage in out in 2020.

The Rise with Mobile Payments Profit usage is little by little declining all over the world. Around its place, are just looking for payments ecosystem is usually shaping up to dominate. By 2023, noncash transactions will idea over the 1 trillion threshold driven as a result of increased credit card puncture, the spread involving smart mobile devices, as well as a growing global funds infrastructure.

The biggest steps in this area are utilized by Asian promotes, some of which guide the pack inside adoption of innovative digital payment answers. Major markets with China, India together with Southeast Asia usually are saturated with handheld wallets, like Alipay and Paytm. On top of that, users are effective to adopt payment and additionally transacting in social media marketing apps like WeChat and Grab.

Inside Europe and the USA the pace associated with change is much reduced. Traditional payment solutions are much better proven and entrenched, along with credit cards dominating The states and parts of European countries. Still, mobile installment payments are on the rise within tandem with the wide-spread adoption of cellular phones and their make use of for mobile hunting. Likewise, apps such as Venmo are encroaching on small amount, typical transactions between close friends and acquaintances.

Your shift to mobile phone is only set to help you accelerate in 2020 as consumers improve more comfortable with abandoning cash behind towards digital and portable payment methods. Surely, this trend aren't going to be equal across the block. For example , mobile obligations in the US will improve much faster than Philippines, which is still seriously reliant on funds for small amount deals, but the general movement will hold a fact: mobile is about being the new king.

Anybody Wants to be a Fintech In 2019 we’ve seen a long line of tech the big boys enter the bills and financial know-how space, and this fad is set to improve. Google, Apple and in many cases Facebook are all searching means of integrating funds technology into their types. Apple has became a member of forces with Goldman Sachs to offer some full-fledged credit card; Bing is planning to start out offering checking financial records as of 2020 together with US banks in addition to credit unions, going to expand to the remaining world at a later date. Such as Apple, Google is actually intending to launch debit cards in the emerging year. And Squidoo is now letting customers in some jurisdictions send out payments through the country's Messenger platform. Further more financial products from Zynga are surely heading.

While western web 2 . 0 and software the behemoths joining the flip in payments concept seems like a participate in of catch-up using eastern rivals, they can be far form the one tech giants getting into the payments house. Uber has released its very own Uber Money, to improve financial operations for their drivers. Amazon has announced bill repayment facilities to their company offerings.

We expect you'll see even more specialist giants announce their particular intentions to financialise in the coming 12 months.

Full-Suite (Payments) Offerings Until recently, installment payments companies have looked for to be as side to side as possible. The obligations infrastructure was cured as commodity, which has a high degree of agnosticism towards the industry with the client maintained through the entire payments sector. Thin air has this become more evident compared to a B2B payment space or room. B2B payments businesses have, generally, already been slow to adopt ground-breaking tech developments. Ones own offerings have stayed fundamentally unchanged massive, apart from the widespread ownership of payments APIs. This could change rapidly.

B2B customers have got, in their private lifetime, grown accustomed to this conveniences of perfectly integrated technological packages cooperating to provide a detailed purchasing and consumption solution. There is no rationale such solutions has to be inaccessible to internet business. The companies that will capitalise on this demand can certainly make it big by giving, mostly, small along with medium enterprises by using business management application that can handle bills for them as an even more service, thus locking down the SME’s ongoing loyalty to it's payment services.

When Matt Harris, an accomplice at Bain Investment capital Ventures, recently shared with Business Insider: “Imagine a florist that runs their organization on florist software programs and is managing their own inventory and ones own purchasing of carnations and their payroll and their staffing, and then that applications also offers payments. ” Pretty soon we can struggle to image the idea happening any other approach.

Machine Initiated Funds The most exciting tendencies to come might nevertheless be a little way shut off, but their vegetables have been firmly placed and deserve curiosity. As tech leaders move into the funds space, they will possess one undisputable convenience: data, troves from data. What these kind of hoards can allow these to offer customers is normally convenience beyond thinking: machine-initiated payments.

A intricacies of modern day life require maintenance, and a lot of it. Car or truck oil needs transforming, food needs choosing and delivering, residences require maintenance. Each one of routine tasks has to be remembered, scheduled, together with yes, paid for. Built is not far away any time these tasks is usually completely unloaded to smart devices and additionally forgotten about. Going low on use? If you set that as one of your nutrition essentials, your freezer or fridge could tack the application onto your next easily purchased supermarket operate. Bills need to be paid off? Let Alexa undertake it. As Byron Lichtenstein, principal at Observation Partners, recently proclaimed: “What's changed in the last two years that we identified really interesting can be that dumb installment payments don't really -obviously, they exist -but they're not really a element anymore. ”

Consequently there we have this, the trends about to take centre level in 2020: capital will continue her slow, inevitable fall from dominance, much more (giant) entrants on the crowded fintech domain, integrated software bedrooms with payments cooked in, and, probably, some consumer-grade obligations AI. Maybe one more is still far from truthfulness, but we can sole hope that 2020 will bring us nearer to it.

1 note

·

View note

Text

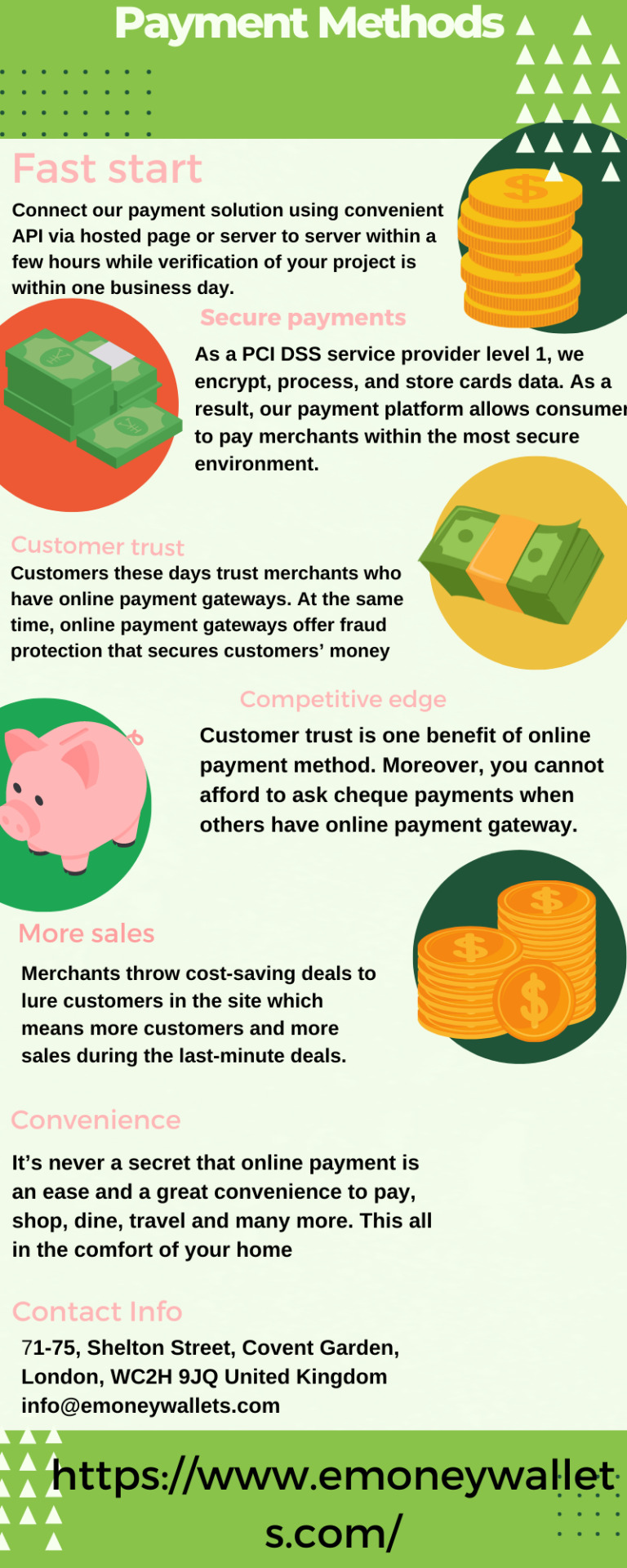

Payment and Banking Solution Company in USA

E-Money Wallets Company offers Mobile Banking & International eWallet payment solution with Debit/Prepaid integration services. A White Label virtual banking approach with hundreds of eBanking open API included Web and Mobile platform.We are best Payment and Banking Solution Provider Company in Australia, USA, UAE, Europe, Thailand and Philippines.

0 notes

Text

Containers as a Service Market – Industry Trends and Forecast to 2029.

Containers as a Service Market grows at a CAGR of 35.7% in the forecast period 2022-2029.

Market Analysis & Insights: Containers as a Service Market

The containers as a service market is expected to witness market growth at a rate of 35.7% in the forecast period of 2022 to 2029. Data Bridge Market Research report on containers as a service market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rapidly generating data globally is escalating the growth of containers as a service market.

Containers as a Service refers to the emerging cloud services that offer the container-based virtualization. These services are specifically designed to offer a complete framework to the IT departments and developers in order to manage and deploy containers application. The client can oversee, transfer, scale, and sort out the API calls or web-based interface by making the use of container as a service.

Browse Full Report: https://www.databridgemarketresearch.com/reports/global-containers-as-a-service-market

Containers as a Service Market Share Analysis

Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to containers as a service market.

Containers as a Service Market Scope and Market Size

On the basis of deployment model, the containers as a service market is segmented into public, private and hybrid cloud.

On the basis of organization size, the containers as a service market is segmented into small and medium-sized enterprises, and large enterprises.

On the basis of vertical, the containers as a service market is segmented into banking, financial services and insurance, retail and consumer goods, healthcare and life sciences, manufacturing, media, entertainment and gaming, IT and telecommunication, transportation and logistics, travel and hospitality and others.

For sample report link click here: https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-drum-liner-market

Containers as a Service Market Country Level Analysis

The countries covered in the compression therapy market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa(MEA), Brazil, Argentina and Rest of South America as part of South America.

Get some related Reports @

Global Flexible Drum Liner Market – Industry Trends and Forecast to 2027

Key Players Containers as a Service Market

IBM

Microsoft Corporation

Cisco System Inc

Google Inc

Amazon Web Services

Accenture

TOC of the report

Chapter One: Introduction

Chapter Two: Market Segmentation

Chapter Three: Market Overview

Chapter Four: Executive Summary

Chapter Five: Premium Insights

Get TOC details from here: https://www.databridgemarketresearch.com/toc/?dbmr=global-containers-as-a-service-market

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market.

Contact us:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: [email protected]

0 notes

Text

Asia-Pacific Conversational Computing Platform Market – Industry Trends and Forecast to 2027

Asia-Pacific Conversational Computing Platform Market By Type (Solution, Service), Technology (Natural Language Processing, Natura Language Understanding, Machine Learning and Deep Learning, Automated Speech Recognition), Deployment Type (Cloud, On-Premise), Application (Customer Support, Personal Assistance, Branding and Advertisement, Customer Engagement and Retention, Booking Travel Arrangements, Onboarding and Employee Engagement, Data Privacy and Compliance, Others), Vertical (Banking, Financial Services, and Insurance, Retail and Ecommerce, Healthcare and Life Sciences, Telecom, Media and Entertainment, Travel and Hospitality, Others), Country (China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia Pacific), Market Trends and Forecast to 2027.

Market Analysis and Insights: Asia-Pacific Conversational Computing Platform Market

Conversational computing platform market is expected to gain market growth in the forecast period of 2020 to 2027. Data Bridge Market Research analyses that the market is growing with a CAGR of 34.6% in the forecast period of 2020 to 2027 and expected to reach USD 11,051.60 million by 2027. People are rapidly shifting towards conversation based machines; this is expected to be the driving factor for this market.

Chatbots are user interface of conversational platforms and its related assistants, where conversational platforms enable chatbots to operate and decode the natural language. SMS, social media and other interactive platforms are integrated in these conversational platforms. APIs (application programming interfaces) are provided by conversational platform so as to integrate other interactive platforms.

Rising use of customer service support by many companies on their mobile application or website is expected to drive the market growth for this market. For instance, according to Oracle out of every 10 business entities almost 8 have implemented or planning to implement AI enabled customer service support by 2020. Advancements in artificial intelligence and machine learning are enhancing the growth rate for this market. For instance, according to Accenture by 2035 advancements in AI will lead to 40% increase in productivity through it.

This conversational computing platform market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Request-a-sample@https://www.databridgemarketresearch.com/request-a-sample/?dbmr=asia-pacific-conversational-computing-platform-market

Asia-Pacific Conversational Computing Platform Market Scope and Market Size

Asia-Pacific conversational computing platform market is segmented on the basis of type, technology, deployment type, application, and vertical. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

· On the basis of type, conversational computing platform market is segmented into solution and services. Rising demand and adaptability for chatbots to communicate with digital technologies by speaking natural languages or local languages and get the work done through artificial intelligence. Chatbots have increased work efficiency of industrial operations as well as day to day personal activities. Chatbots are accurate, precise and have helped in reducing operational time. This factor allows market to grow with highest CAGR in the forecasted period of 2027

· On the basis of technology, conversational computing platform market is segmented into natural language processing, natural language understanding, machine learning and deep learning, automated speech recognition. Natural language processing segment is dominating the market while machine learning and deep learning are expected to grow with highest CAGR for forecasted of 2027. The factor attribute growth of the market is that growing adoption of artificial intelligence in the retail sector. For instance, it has witness that about 80percent of china retailer utilize the AI tools. Thus the adoption of AI in retail has increase demand of machine learning technology.

· On the basis of deployment type, conversational computing platform market is segmented into cloud and on-premise. Cloud is dominating the market, there is limitless storage capacity and no need of physical storage device for storing the recorded data. Based on previous records, on massive cloud storage capacity chatbots can detect pattern of decision making of a person. Cloud is dominating the segment and leading companies are focussing on cloud based conversational computing platforms. For instance, IBM Watson Assistant is awarded leader in cloud based conversational computing platforms.

· On the basis of application, conversational computing platform market is segmented into personal assistance, branding and advertisement, data privacy and compliance, customer engagement and retention, customer support, onboarding and employee engagement, booking travel arrangements, others). Personal assistance is dominating the market while branding and advertisement is expected to grow at a highest CAGR for forecasted period. Increasing digital marketing trend is co-relating with the application of conversational computing platforms. Digital marketers would prefer digitally managed solutions for their campaigns rather than hand managed campaigns in order to save time and cost as well as getting more accurate campaigns. Asia-Pacific being the highest growing region for conversational computing platforms, companies are focusing on providing are focussing on providing solutions according to regional languages.

· On the basis of vertical, conversational computing platform market is segmented into banking, financial ser vices, and insurance, retail and ecommerce, healthcare and life sciences, telecom, media and entertainment, travel and hospitality, others. Retail & Ecommerce segment is dominating the market while banking, financial services, and insurance is expected to grow at highest CAGR as smartphone industry and chatbots have enabled people to use banking applications and operations seamlessly in quick span of time. In addition, chatbots for banking services have helped people save time and efforts for carrying out small scale day to day financial activities.

Speak-to-analyst@https://www.databridgemarketresearch.com/speak-to-analyst/?dbmr=asia-pacific-conversational-computing-platform-market

Conversational Computing Platform Market Country Level Analysis

The conversational computing platform market is analysed and market size information is provided by country by type, technology, deployment type, application, and vertical as referenced above.

The countries covered in Asia-Pacific conversational computing platform market report are Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific.

Asia-Pacific dominates the conversational computing platform market as due to the high labour cost of China has increase the adoption of automation tool in the business. As the automation tool allow the business to improve their customer experience, time saving and many more. For instance it has been witness that in China the per labour cost in 2017 was 5.51 USD which has raise to 5.78 USD in 2018.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growing Familiarity and Dependence of People on Conversational Computing Platform Can Enhance Research and Development

Conversational computing platform market also provides you with detailed market analysis for every country growth in cloud based industry with conversational computing platform sales, services, impact of technological development in software and changes in regulatory scenarios with their support for the conversational computing platform market. The data is available for historic period 2010 to 2018.

Competitive Landscape and Conversational computing platform Market Share Analysis

Conversational computing platform market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Asia-Pacific conversational computing platform market.

The major players covered in the report are Alphabet Inc., IBM Corporation, Microsoft, Nuance Communications, Inc., Tresm Labs, Apexchat, Artificial Solutions, Conversica, Inc., Haptik, Inc., Rulai, Cognizant, PolyAI Ltd., Avaamo, SAP SE, Cognigy GmbH, Botpress, Inc., 42Chat, Accenture, Amazon.com, Inc., Oracle, Omilia Natural Language Solutions Ltd, among other players domestic and Asia-Pacific Conversational computing platform market share data is available for China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia Pacific separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many joint ventures and developments are also initiated by the companies worldwide which are also accelerating the Asia-Pacific conversational computing platform market.

For instance,

In October 2019, Artificial Solutions has signed a partnership agreement with Mobinology, which is a leading service provider of AI in Macau and Hong Kong region. Through this partnership, Mobinology will get high level of expertise in development and deployment of conversational AI applications. This will help the company to establish its presence in China’s special administrative regions (SAR).

· Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for conversational computing platforms through expanded model range.

Request for Toc@https://www.databridgemarketresearch.com/speak-to-analyst/?dbmr=asia-pacific-conversational-computing-platform-market

Asia-Pacific Conversational Computing Platform Market Size, Status and Forecast 2018 – 2025

1 Market Overview

2 Manufacturers Profiles

3 Asia-Pacific Conversational Computing Platform Sales, Revenue, Market Share and Competition by Manufacturer

4 Asia-Pacific Conversational Computing Platform Market Analysis by Regions

5 North America Asia-Pacific Conversational Computing Platform by Countries

6 Europe Asia-Pacific Conversational Computing Platform by Countries

7 Asia-Pacific Asia-Pacific Conversational Computing Platform by Countries

8 South America Asia-Pacific Conversational Computing Platform by Countries

9 Middle East and Africa Asia-Pacific Conversational Computing Platform by Countries

10 Asia-Pacific Conversational Computing Platform Market Segment by Type

11 Asia-Pacific Conversational Computing Platform Market Segment by Application

12 Asia-Pacific Conversational Computing Platform Market Forecast

13 Sales Channel, Distributors, Traders and Dealers

14 Research Findings and Conclusion

15 Appendixes

Buynow@https://www.databridgemarketresearch.com/checkout/buy/enterprise/asia-pacific-conversational-computing-platform-market

Customization Available : Asia-Pacific Conversational Computing Platform Market

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customised to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analysed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Factbook) or can assist you in creating presentations from the data sets available in the report.

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market.

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: [email protected]

RELATED REPORTS

· Conversational Computing Platform Market – Industry Trends and Forecast to 2027

· Europe Conversational Computing Platform Market – Industry Trends and Forecast to 2027

· Middle East and Africa Conversational Computing Platform Market – Industry Trends and Forecast to 2027

· North America Conversational Computing Platform Market – Industry Trends and Forecast to 2027

#Asia-Pacific Conversational Computing Platform Market#Asia-Pacific Conversational Computing Platform Marketsize#Asia-Pacific Conversational Computing Platform Markettrends#Asia-Pacific Conversational Computing Platform Marketforcast

0 notes

Text

Global API Management Market Products, Services and Solutions By Top Key Players Axway, Palo Alto Research Center Incorporated, Microsoft, Rogue Wave Software

While producing such most excellent market research report, an array of objectives is required to be kept in mind. This API Management market research report is comprehensive and object-oriented which is structured with the grouping of an admirable industry experience, talent solutions, industry insight and most modern tools and technology. Market segmentation is performed in terms of markets covered, geographic scope, years considered for the study, currency and pricing, research methodology, primary interviews with key opinion leaders, DBMR market position grid, DBMR market challenge matrix, secondary sources, and assumptions. Market Characterization-:

The overall API Management market is characterized on the basis of different analysis-:

Global API management market is expected to reach million by 2025 and is projected to register a healthy CAGR of 19.3% in the forecast period of 2018 to 2025.

API Management market Definition-:

The application programming interfaces (APIs) are a set of protocols, tools and subroutines that are used to develop software applications. These APIs are the intermediate of communication code and software programs, thereby assuring the smooth flow of operations. Further, it helps in monitoring the data of the application, which has become one of the most important parts of the organization. It can be developed by an organization either for internal use or can be purchased from third-party providers. It also offers enhanced customer experience and ensures ease of data management. API management helps in building and publishing web APIs, controlling access of application and also enforces usage policies. Also, it helps in collecting and analyzing the usage statistics as well as provides a report of the performance. The API management includes components such as gateway, publishing tools, reporting and analytics and monetization.

Download API Management Research Report in PDF Brochure (Note: Kindly use your business/corporate email id to get priority): https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-api-management-market&sc

Key API Management market players Analysis-:

The study given in this section offers details of key market players. It likewise clarifies the marketing strategies adopted by these players as well as portrays their shareholdings in the API MANAGEMENT market.

Details of few key market players are given here- Axway, Palo Alto Research Center Incorporated, Microsoft, Rogue Wave Software, Inc., SAP SE, Oracle, Red Hat, Inc., CA Technologies, Inc., Fiorano Software and Affiliates, Software AG, Boomi, Inc., International Business Machines Corp., Nexright, SnapLogic, TYK Technologies, digitalML, Mashape Inc., Mulesoft, Inc., Sensedia, Tibco Software, Inc., WSO2, Inc., Amazon Web Services Inc., and others.

Segmentation Analysis-:

The total API Management market is further divided by company, by country, by manufacturer and by application/type for the competitive landscape examination.

Product Segmentation-

Global API Management Market, By Type (Carbon Identity Management, Maps & Location, Speech/Voice), Solution (Security, API Gateway, API Portal, API Lifecycle Management, API Analytics, Monetization, Administration), Service (Integration, Support Maintenance, Training Consulting), Deployment Type (On-premises, Cloud), Organization Size (Large Enterprises, Small and Medium Enterprises), Industry Vertical (IT & Telecommunication, Government & Defence, Banking, Financial, Services and Insurance (BFSI), Media & Entertainment, Healthcare, Retail & Consumer Goods, Transportation, Manufacturing)

Geographical Analysis-:

Under this section, Regional and country-level analysis of the API Management market has been performed-

Regional Segments Analysis:

The Middle East and Africa (GCC Countries and Egypt.)

North America (the United States, Mexico, and Canada.)

South America (Brazil etc.)

Europe (Turkey, Germany, Russia UK, Italy, France, etc.)

Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia.)

Set of Chapter covered in this report-:

Part 01: API Management Market Overview Part 02: Manufacturers Profiles Part 03: Global API Management Market Competition, by Players Part 04: Global API Management Market Size by Regions Part 05: North America API Management Revenue by Countries Part 06: Europe API Management Revenue by Countries Part 07: Asia-Pacific API Management Revenue by Countries Part 08: South America API Management Revenue by Countries Part 09: Middle East and Africa Revenue API Management by Countries

…….so on

New Business Strategies, Challenges & Policies are mentioned in Table of Content, Request Detailed TOC Click here https://www.databridgemarketresearch.com/toc/?dbmr=global-api-management-market&sc

0 notes

Text

Turnkey Lender & Peppermint Innovation Partnership Will Power Lending Technology Aimed to Deliver Financial Inclusion to Millions of Unbanked and Underbanked Filipinos

Perth, Western Australia – (BUSINESS WIRE) – TurnKey Lender is proud to welcome Peppermint Innovation to its fast growing family of customers in Asia.

Peppermint Innovation is an ASX-listed fintech company (ASX: PIL) focused on commercializing the Peppermint platform, a proprietary technology platform that targets four key business areas – mobile payments, eCommerce, delivery and logistics, and mobile financial services .

The Peppermint platform is an innovative financial technology solution that aims to enable financial inclusion for people with and without bank details, facilitate mobile micro-businesses and build consumer confidence.

Peppermint Innovation powers the proprietary, bank-independent mobile micro-business platform bizmoto in the Philippines.

This new partnership with TurnKey Lender will help Peppermint Innovation provide all of the “back-end” support services and features required to deliver its micro-business loan product, bizmoPay, through its bizmoto app.

Chris Kain, Managing Director and CEO of Peppermint Innovation, said, “The agreement will enable each of bizmoto’s 55,000+ qualified agents, bizmoGo drivers and registered network members to seamlessly apply for micro business loans to grow their businesses. Our corporate goal has always been to bring an innovative technology solution to the people of the Philippines to facilitate financial inclusion, micro business and consumer convenience. We look forward to working with TurnKey Lender to support us in realizing our corporate goal. ”

Peppermint is awaiting final approval from the Philippine Securities Exchange Commission (SEC) for its financial credit license, which marks a significant milestone in the company’s strategy to provide an alternative non-bank micro-business lending platform delivered through bizmoto’s mobile app.

Once approved, micro business loans will be made available to qualified bizmoto agents, bizmoGo drivers and registered network members.

For its part, TurnKey Lender is “excited to help the bizmoto user base scale their business through the smartest, smoothest lending experience,” said Dmitry Voronenko, CEO of TurnKey Lender. “We know how important this service is for millions of Filipinos with and without bank accounts and are honored to help Peppermint Innovation fulfill an important mandate.”

About TurnKey Lenders:

TurnKey Lender offers companies a smart, easy-to-use, integrated SaaS platform that is easy to adapt to business needs and includes all of the features required to make the lending process completely digital. The solution uses AI, proprietary banking-grade technology, and advanced API integrations to automate every step of the lending process through a single cloud-based solution. Different versions of the software are tailored in installments to the needs of traditional lenders (banks and credit unions), alternative lenders (fintech startups, P2P lenders, micro-lenders, etc.), and embedded lenders (any type of company looking to sell products or services) ) online or in a store.

About Peppermint Innovation Ltd (www.pepltd.com.au):

Peppermint Innovation is a FinTech company focused on the commercialization and advancement of the Peppermint platform, a mobile banking, payment and remittance, delivery and logistics, e-commerce and financial services technology for developing countries. Peppermint technology currently powers a white label app banking platform and micro-enterprise platform bizmoto in the Philippines.

source https://www.cassh24sg.com/2021/07/01/turnkey-lender-peppermint-innovation-partnership-will-power-lending-technology-aimed-to-deliver-financial-inclusion-to-millions-of-unbanked-and-underbanked-filipinos/

0 notes

Text

Trade Finance Survey 2019: Asia finds a block in blockchain

Trade Finance Survey 2019: Asia finds a block in blockchain

Trade finance is supposed to be the low-hanging fruit, where blockchain finds its easiest opportunity to prove itself as a transformative technology.

A global, arcane system beset by paper and stamps and faxes, it is riper for disruption than any other area of banking. It is made to be shaken up by the possibilities of distributed-ledger systems.

But until very recently, there’s been a lot of talk and not much action.

There has been no shortage of visible effort, from consortia such as Marco Polo and Voltron to regulators such as the Hong Kong Monetary Authority and the Monetary Authority of Singapore; there have been demonstration projects from Cargill and others; but nothing that has looked ready to be truly scale-able and, therefore, viable.

In the last few months, however, there have been signs of progress, both in terms of blockchain-based solutions and other forms of innovation that have nothing to do with distributed ledger.

Much of the action is happening in Asia-Pacific – and the possibilities are exciting.

For example, one of the most important events at the annual Sibos conference in Sydney in October was the formal launch of the Voltron blockchain platform to digitize trade finance documents, which will operate on R3’s blockchain-based Corda network from 2019.

The initiative brings together an esoteric cast of characters: multinationals BNP Paribas, HSBC, ING and Standard Chartered; Asian banks Bangkok Bank from Thailand and CTBC Holding from Taiwan; Scandinavia’s SEB and the UK’s Natwest. They want more partners alongside them – the Sibos launch was, in some sense, a pitch for them – and collectively they want to bring efficiencies to transacting letters of credit.

“Today’s trade finance solutions were built in silos, adding significant risk, operational inefficiencies and costs into the process,” says David Rutter, chief executive of R3. Voltron, he says, helps to fix that.

Guinea pig

The guinea pig for Voltron was Cargill, which used the system to execute a blockchain-based letter of credit in May between HSBC and ING. Cargill made a shipment of soybeans from Argentina to Malaysia through its Geneva and Singapore subsidiaries, using a letter of credit completed digitally on the R3 Corda blockchain platform.

John Laurens, DBS

At the time, the trade was billed as being “set to revolutionize trade”: the first end-to-end trade finance transaction on a scale-able blockchain platform.

It demonstrated, its backers say, that blockchain was commercially and operationally viable as a solution for trade digitization, reducing the paper-based exchange times to 24 hours when in the past, they used to take as long as 10 days.

But it was important to note that this was a trade between Cargill and Cargill, so, while a signifier, it was a long way from being a true demonstration of something that was ready to revolutionize trade.

In that respect, a second Voltron/Corda transaction that took place about a week after Sibos is more important. In this transaction, a polymers shipment was made between two different companies: from Reliance Industries in India to Tricon Energy in Peru, with HSBC India serving as the advising and negotiating bank for Reliance Industries, and ING issuing the letter of credit for Tricon.

The transaction was even more important because it also enabled the digital transfer of title of the goods on the blockchain, which it did by integrating with Bolero’s electronic bill of lading platform. With this incorporated, one can say that the underlying trade was fully digitized – a first.

And the corporate customer was happy with the result, which also cut the time involved.

“The use of blockchain offers significant potential to reduce the timelines involved in exchange of export documentation from the extant seven to 10 days to less than a day,” says Srikanth Venkatachari, joint chief financial officer at Reliance Industries.

“When adopted at scale, it helps in significant optimization of working capital.”

He says it also helps with transparency and security.

The exchange of documents took place in a day, with a further two days to close the transaction including payment.

A couple of days later, HSBC was involved in another Voltron/Corda/Bolero trade, again for Cargill, but this time with Rio Tinto on the other end.

Rio Tinto sold a bulk shipment of iron ore from Australia to China for Cargill, with BNP Paribas issuing a letter of credit on Cargill’s behalf, over the blockchain, to HSBC Singapore. This time the LC issuance took less than two hours. As in the Reliance trade, the transaction included digital transfer of title with an electronic bill of lading.

Speed

The importance of steps such as these is that they increase the number of counterparties involved, demonstrate the savings in time and efficiency and, eventually, they become commonplace, which is the whole idea.

And speed has knock-on effects of its own.

“If Cargill was selling to a third-party buyer, they would normally have a credit limit on that buyer,” explains Ajay Sharma, Asia-Pacific head of trade and receivables finance at HSBC. “Until that buyer agrees to pay, Cargill is effectively unable to sell more, and if that takes five to 10 days, their turnover is impaired.

“If it concludes in 24 hours, they can put more goods on the ship and keep selling. This is why commodity guys are so keenly driving this space: it’s not just about a paperless operation, it’s the ability to accelerate trade.”

The next step involves further testing of Voltron by all the member banks, while hopefully getting more banks to commit to the platform. But bringing the whole solution into production will probably take another year. And getting it to scale will take longer still.

“This is not going to be a six-month journey to scale up,” says Sharma. “It will take three to five years.”

And what does scaling up constitute?

“We think that when it covers 15% to 20% of letters of credit, that’s a tipping point,” he says.

For that to happen, it is incumbent upon bigger players to assist smaller ones to be part of the enterprise.

“A small local or regional bank may not have the ability to spend millions of dollars to enjoy these platforms,” says Sharma. “They need a toolkit. What R3 is doing is developing toolkits to help banks join the platform, and customers.”

Luckily there is no need to reinvent the wheel.

“One important learning has been that there are already frameworks and rule books out there: UCP [Uniform Customs and Practice for Documentary Credits] exists to cover rules around trade, there is a registry rulebook about bill of lading,” he says.

“The strong feedback was: do not change these things. Leverage what already exists.”

Consortia

If there is a problem, it’s that there are so many consortia out there attempting to do largely the same thing: digitize trade finance.

ING, instrumental in Voltron, is also a member of the komgo consortium announced in September, whose other founder members include Citi, Crédit Agricole, BNP Paribas, ABN Amro, Macquarie, MUFG, SocGen, Rabobank, Natixis and non-banks such as Shell. This one aims to digitalize commodities trade in particular.

ING is also a member of Marco Polo, launched by TradeIX and R3 with a dozen financial institutions, including BNP Paribas, Commerzbank, Natwest, BBVA, Standard Chartered, SMBC and RBS. This, like Voltron, runs on the Corda distributed-ledger technology (DLT).

ING is not in we.trade, another consortium, but plenty of others are, among them HSBC, Deutsche Bank, UBS and UniCredit. And it’s not in Batavia either, but UBS and Commerzbank are, among others. R3 underpins both Voltron and Marco Polo; IBM is the tech partner of Batavia and we.trade.

In August, Standard Chartered announced a project to create an end-to-end smart guarantees service for trade finance, digitized using blockchain technology, billed as the first blockchain client pilot that fully digitizes the process of a trade finance guarantee. This project, with Siemens Financial Services and the digital trade provider TradeIX, originates from the United Arab Emirates and the Dubai Smart City initiative, but if successful will be rolled out in Asia too.

Then there is JPMorgan’s Interbank Information Network, which has now expanded to more than 100 banks, 21 of them in Asia, including ANZ, China Citic Bank, ICICI, Kasikornbank, KEB Hana, Mizuho, Bank Central Asia, Shinhan, SMBC, Union Bank of the Philippines and Woori.

But some developments have nothing to do with the bank consortia.

For example, DBS – which is, in most respects, a tech leader – does not appear in these big assemblies. The DBS approach has not been characterized by joining consortia of other banks, but by producing integrated solutions for individual clients, by harnessing DBS’s technological capabilities to address their particular needs.

The potential is very big for Asia to drive technological innovation

– Olivier Guillaumond, ING

CRaof Latiff, group head of digital and GTS product management at DBS, says the best way for the bank to be relevant in the supply chain and add value is “to build APIs [application programming interfaces] which know how to study the nodes in the blockchain, and extract the information you need in order to be able to do what you need to do. You pull data related to invoices, dates, transactions, counterparties, and digitize the supply chain process.”

Latiff continues: “There are lots of instances where the bank is in the consortium but the end-customer only gets limited incremental value. That’s not what we wanted to do.”

He argues that the better way to be differentiated is to use internal tech infrastructure to develop solutions for specific client needs, “to help our clients’ businesses achieve their objectives not just for today, but for a long time to come.”

For example, DBS announced on December 1 that it had enabled an end-to-end cross-border blockchain trade platform for a commodity supply chain network, made up of farmers, exporters, traders and end customers, but not any other banks.

DBS put this together with Agrocorp International, the global agri-commodity trading company, and with Distributed Ledger Technologies, a blockchain provider.

Among other things, it offers participants in the supply chain real-time updates on commodity prices and delivery information, as well as trade financing approval for orders coming in.

DBS says it cuts Agrocorp’s average working capital cycle by about 20 days.

At the start, the solution focuses on Australia, where about 4,500 farmers in the Agrocorp network will be connected to end-customers such as supermarkets and restaurants.

Using it, customers can get access to real-time pricing and supply information, and can carry out live transactions, tracking delivery of orders.

On the payment side, once a trigger event is reached – such as confirmation that goods have been shipped – the blockchain platform triggers instructions to DBS to request financing for Agrocorp, or to release payment to the farmer. There is little manual intervention, making it faster.

What problems does this solve for Agrocorp?

“There’s a few challenges,” says Vishal Vijay, head of business development at Agrocorp.

“Firstly, we’re relying on an antiquated system that was developed a few hundred years ago by the Dutch trading houses: a system of bills of lading and letters of credit, all paper documents.”

Digitizing that process brings not only convenience but “security to all the given participants in a supply chain, from the farmers to the processors to the shippers to the end-customers, that the goods are being transacted and the payments are being made.”

Second, Vijay says, is traceability.

“More and more in this environment, our customers want to know exactly where their product is coming from,” he says. “They want to be able to trace it all the way back to the farm. That’s something we are solving with this.”

So it enables sustainable practices, and the monitoring of that sustainability.

And the third is time – which begets business.

“Paper documents take time to be generated, as well as to be sent across from one part of the world to another, and time is money,” Vijay says.

Generating documents in real time and enacting payments faster mean a reduction in the working capital cycle of five to 10 days. That translates into more business, as well as interest savings.

The plan is for Agrocorp to broaden its blockchain platform from Australia to other key origination markets including Canada, Myanmar, Ivory Coast and Ukraine.

The range of commodities traded on it will grow too, from pulses such as mung beans and chickpeas, to cereals, cotton, edible nuts and oilseeds.

Regulators

Alongside all of these private-sector initiatives, regulators have been busy too, most notably the HKMA in Hong Kong and the MAS in Singapore.

“Government-sponsored activity is essential, as government initiatives typically drive effective collaboration from market participants,” says John Laurens, group head of global transaction services at DBS. “That impetus is clearly valuable in getting broad-based engagement and traction.”

There is a sense that Asia, thanks to these regulators and their proactive attitude to fintech development, can be a driver of trade finance technological innovation. ING has just set up a lab in Singapore focused on trade.

“The potential is very big for Asia to drive this,” says Olivier Guillaumond, global head of fintech at ING.

In July, the HKMA announced the launch of a project it had been instrumental in developing: a new trade finance blockchain platform in Hong Kong.

Olivier Guillaumond, ING

The project, led by the Hong Kong Trade Finance Platform Company, includes as launch partners ANZ, Bank of China (Hong Kong), the Bank of East Asia, DBS, Hang Seng Bank, HSBC and Standard Chartered.

The platform seeks to digitize trade documents and automate trade finance processes using the blockchain. Ping An OneConnect Financial Technology is the technological provider, with Deloitte as consultant.

On October 31, Ping An announced delivery of the platform, by now called eTradeConnect, initially connecting 12 joining banks (the original seven, plus BNP Paribas and the Hong Kong arms of Agricultural Bank of China, Bank of Communications, ICBC and Shanghai Commercial Bank) and some trade finance pilot clients to share trade information using blockchain technology.

First in line in any link-up with Hong Kong will probably be Singapore, which has been setting about its own trade finance innovations using the blockchain.

The main drive here has been something called Project Ubin, which started out in November 2016 as an industry collaboration to use distributed ledger technologies for the clearing and settlement of payments and securities. Phase one focused on producing a digital representation of the Singapore dollar for interbank settlement, and making the MAS’s electronic payment system interoperable with distributed ledger methods; phase two focused on inter-bank payments.

The most important step in terms of trade finance came in October, when Singapore’s minister of finance, Heng Swee Keat, formally launched the Networked Trade Platform, designed to be a one-stop digital trade ecosystem.

Heng calls it a “transformational platform which will take us from a traditional national single window which gives traders a one-stop interface for all trade related regulatory transactions, to a one-stop interface that will enable them to interact with all business partners, stakeholders and regulators on trade related transactions.”

More has followed. In November, MAS announced with the SGX that it had developed delivery-versus-payment capabilities for the settlement of tokenized assets across different blockchain platforms, which will help to simplify post-trade processes and shorten settlement cycles. That’s perhaps more of a markets initiative than a trade finance one, but it all helps.

You are seeing new functionality coming with new protocols. What do you place your investment into? It could become redundant very quickly

– John Laurens, DBS

Connectivity between the HKMA and the MAS was formalized in a memorandum of understanding signed in Singapore in November 2017, called the Global Trade Connectivity Network. The goal is to build cross-border infrastructure between the two to digitalize trade and trade finance, and from there, to expand into the region. A working committee features the two regulators plus the National Trade Platform Office (Singapore) and Hong Kong Interbank Clearing.

It is intended that a joint trade platform will go live in 2019, with existing domestic platforms feeding into it; if that works, the hope is that Japan, South China (through Shenzhen) and perhaps Thailand will follow. All of this, though, requires common ground among regulators; while it is easy to see Hong Kong and Singapore agreeing on principles, any further expansion naturally becomes more complicated.

“It’s no surprise that Singapore and Hong Kong are the first cabs off the rank,” says Laurens. “It’s not so much about trade to or from those markets, it’s the trade conducted through them. It’s therefore very important for both to ensure that their role as global trade hubs is maintained.”

China has its own initiatives, both at the state and the private-sector level. One is a blockchain-based trade finance platform in Shenzhen, backed by the People’s Bank of China and planned to include the Greater Bay Area that embraces Hong Kong, Guangdong and Macau. The architecture underpinning it is believed to have been built by Ping An.

Then at the corporate level, the automotive parts group Wanxiang has set up a range of blockchain initiatives, including not only services for its own industry but a consultancy, accelerator and conference business around blockchain.

“You have huge national distribution activity going on, with vehicles being shipped right across the country with long physical domestic supply chains through to small outlets,” says Laurens.

Blockchain technology allows the tracking of components, and availability of financing.

“The value here is transportation traditionally has struggled to find sources of financing, in large part due to a lack of information,” Laurens says. “The provision of contracts and information through blockchain makes sense, because you are de-fragmenting what’s happening nationally.”

Direction

The range of what’s happening can be bewildering, and would benefit from some unity of direction and purpose.

“The classic blockchain use is for the dematerialization of trade,” says Laurens. “Everyone sees the potential of that, but I personally think it’ll be a slow burn. Some of the mystique of the early days is behind us now, but the problem is, there is now a plethora of protocols and options. Is there going to be some orientation around a single blockchain protocol, around which the market congregates and creates a network effect? A lot of that is going to have to wash out over time.

“You are seeing new functionality coming with new protocols. What do you place your investment into? It could become redundant very quickly.”

There is widespread agreement that blockchain, in and of itself, is not a magic bullet that fixes everything.

“The way we think about distributed ledger and blockchain is: the technology is already there,” says Geoffrey Brady, head of global trade and supply chain finance at Bank of America Merrill Lynch, speaking to Asiamoney at Sibos. “The question is implementation, not tech.

“And that’s not a BAML question, it’s an industry question. The industry needs to decide what the standards will be so that we are all operating within the same ecosystem.”

But DLT and trade finance are still the best possible match out there.

“No one debates that DLT is really the answer in trade finance,” says Guillaumond. “It unites everything that DLT is for in one place: lack of transparency, lack of trust, too much paper, the number of parties, geographical reach, too long a cycle – all in one place.

“I’m not a big believer in DLT as a solution for all the problems of the world” he adds, “but trade finance? This is the place. And we believe that things will scale up even more in 2019.”

After all, there is plenty to do.

One trade finance banker recalls being in a meeting on a high floor of a Singapore tower, looking out at one of the city-state’s signature sights: hundreds of ships moored off the island’s south coast, waiting for their turn to get into the port.

“The reason they are all here is the duration of the process,” he says. “And this is a problem we need to solve. The most visible result of Marco Polo working would be if most of those ships have disappeared in two years.”

Banks look beyond the blockchain

While blockchain continues to dominate discussion of innovation in trade finance, it’s not the whole story. At October’s Sibos event in Sydney, it was striking that one of the most important press conferences of the whole event had absolutely nothing to do with blockchain. In it, seven banks – ANZ, Banco Santander, BNP Paribas, Citi, Deutsche Bank, HSBC and Standard Chartered – pledged to build a digital platform called the Trade Information Network by the end of 2018.

This is the latest iteration of something that used to be called Project Wilson, and it is billed as being the first inclusive global multi-corporate network in trade finance. It focuses very specifically on the pre-financing need in the supply chain, by making it easy for corporates to communicate trade information directly with banks through a new platform, in the process developing a new widely adopted industry standard. The intention is for it to grow beyond its already formidable suite of backers – at launch more than 20 additional banks were involved in developing the network, and many corporates had committed to take part in pilots. Specifically, corporates will be able to submit and verify purchase orders and invoices to request trade financing from the banks of their choice.

The network, in providing this access, avoids the risk of double financing, makes it harder for fraudulent trade information to be passed, and so improves risk assessment, hopefully leading to an earlier provision of trade financing in the supply chain. That, in turn, makes life easier for corporates, particularly small and medium-sized enterprises. It is an open architecture system using a governance model similar to Swift, and corporates will always own their own data – which makes the whole thing easier to get off the ground, since very little of what it does is under the purview of regulators (since no money actually changes hands on the platform, nor any transfer in ownership of data). But where is blockchain here?

“We didn’t not do distributed-ledge technology (DLT) to cut a..

http://bit.ly/2Surhec

0 notes

Text

Trade Finance Survey 2019: Asia finds a block in blockchain

Trade Finance Survey 2019: Asia finds a block in blockchain

Trade finance is supposed to be the low-hanging fruit, where blockchain finds its easiest opportunity to prove itself as a transformative technology.

A global, arcane system beset by paper and stamps and faxes, it is riper for disruption than any other area of banking. It is made to be shaken up by the possibilities of distributed-ledger systems.

But until very recently, there’s been a lot of talk and not much action.

There has been no shortage of visible effort, from consortia such as Marco Polo and Voltron to regulators such as the Hong Kong Monetary Authority and the Monetary Authority of Singapore; there have been demonstration projects from Cargill and others; but nothing that has looked ready to be truly scale-able and, therefore, viable.

In the last few months, however, there have been signs of progress, both in terms of blockchain-based solutions and other forms of innovation that have nothing to do with distributed ledger.

Much of the action is happening in Asia-Pacific – and the possibilities are exciting.

For example, one of the most important events at the annual Sibos conference in Sydney in October was the formal launch of the Voltron blockchain platform to digitize trade finance documents, which will operate on R3’s blockchain-based Corda network from 2019.

The initiative brings together an esoteric cast of characters: multinationals BNP Paribas, HSBC, ING and Standard Chartered; Asian banks Bangkok Bank from Thailand and CTBC Holding from Taiwan; Scandinavia’s SEB and the UK’s Natwest. They want more partners alongside them – the Sibos launch was, in some sense, a pitch for them – and collectively they want to bring efficiencies to transacting letters of credit.

“Today’s trade finance solutions were built in silos, adding significant risk, operational inefficiencies and costs into the process,” says David Rutter, chief executive of R3. Voltron, he says, helps to fix that.

Guinea pig

The guinea pig for Voltron was Cargill, which used the system to execute a blockchain-based letter of credit in May between HSBC and ING. Cargill made a shipment of soybeans from Argentina to Malaysia through its Geneva and Singapore subsidiaries, using a letter of credit completed digitally on the R3 Corda blockchain platform.

John Laurens, DBS

At the time, the trade was billed as being “set to revolutionize trade”: the first end-to-end trade finance transaction on a scale-able blockchain platform.

It demonstrated, its backers say, that blockchain was commercially and operationally viable as a solution for trade digitization, reducing the paper-based exchange times to 24 hours when in the past, they used to take as long as 10 days.

But it was important to note that this was a trade between Cargill and Cargill, so, while a signifier, it was a long way from being a true demonstration of something that was ready to revolutionize trade.

In that respect, a second Voltron/Corda transaction that took place about a week after Sibos is more important. In this transaction, a polymers shipment was made between two different companies: from Reliance Industries in India to Tricon Energy in Peru, with HSBC India serving as the advising and negotiating bank for Reliance Industries, and ING issuing the letter of credit for Tricon.

The transaction was even more important because it also enabled the digital transfer of title of the goods on the blockchain, which it did by integrating with Bolero’s electronic bill of lading platform. With this incorporated, one can say that the underlying trade was fully digitized – a first.

And the corporate customer was happy with the result, which also cut the time involved.

“The use of blockchain offers significant potential to reduce the timelines involved in exchange of export documentation from the extant seven to 10 days to less than a day,” says Srikanth Venkatachari, joint chief financial officer at Reliance Industries.

“When adopted at scale, it helps in significant optimization of working capital.”

He says it also helps with transparency and security.

The exchange of documents took place in a day, with a further two days to close the transaction including payment.

A couple of days later, HSBC was involved in another Voltron/Corda/Bolero trade, again for Cargill, but this time with Rio Tinto on the other end.

Rio Tinto sold a bulk shipment of iron ore from Australia to China for Cargill, with BNP Paribas issuing a letter of credit on Cargill’s behalf, over the blockchain, to HSBC Singapore. This time the LC issuance took less than two hours. As in the Reliance trade, the transaction included digital transfer of title with an electronic bill of lading.

Speed

The importance of steps such as these is that they increase the number of counterparties involved, demonstrate the savings in time and efficiency and, eventually, they become commonplace, which is the whole idea.

And speed has knock-on effects of its own.

“If Cargill was selling to a third-party buyer, they would normally have a credit limit on that buyer,” explains Ajay Sharma, Asia-Pacific head of trade and receivables finance at HSBC. “Until that buyer agrees to pay, Cargill is effectively unable to sell more, and if that takes five to 10 days, their turnover is impaired.

“If it concludes in 24 hours, they can put more goods on the ship and keep selling. This is why commodity guys are so keenly driving this space: it’s not just about a paperless operation, it’s the ability to accelerate trade.”

The next step involves further testing of Voltron by all the member banks, while hopefully getting more banks to commit to the platform. But bringing the whole solution into production will probably take another year. And getting it to scale will take longer still.

“This is not going to be a six-month journey to scale up,” says Sharma. “It will take three to five years.”

And what does scaling up constitute?

“We think that when it covers 15% to 20% of letters of credit, that’s a tipping point,” he says.

For that to happen, it is incumbent upon bigger players to assist smaller ones to be part of the enterprise.

“A small local or regional bank may not have the ability to spend millions of dollars to enjoy these platforms,” says Sharma. “They need a toolkit. What R3 is doing is developing toolkits to help banks join the platform, and customers.”

Luckily there is no need to reinvent the wheel.

“One important learning has been that there are already frameworks and rule books out there: UCP [Uniform Customs and Practice for Documentary Credits] exists to cover rules around trade, there is a registry rulebook about bill of lading,” he says.

“The strong feedback was: do not change these things. Leverage what already exists.”

Consortia

If there is a problem, it’s that there are so many consortia out there attempting to do largely the same thing: digitize trade finance.

ING, instrumental in Voltron, is also a member of the komgo consortium announced in September, whose other founder members include Citi, Crédit Agricole, BNP Paribas, ABN Amro, Macquarie, MUFG, SocGen, Rabobank, Natixis and non-banks such as Shell. This one aims to digitalize commodities trade in particular.