#Best Billing and Accounting Software

Explore tagged Tumblr posts

Text

Affordable Billing and Accounting Software for Startups and Entrepreneurs

Starting a business is an exciting journey, but managing finances can be overwhelming. For startups and entrepreneurs, keeping track of expenses, income, and invoices is essential to ensure growth and profitability. Thankfully, affordable billing and accounting software can simplify these tasks and save both time and money. Let’s dive into how these tools can help you manage your finances effectively without breaking the bank.

Why Startups Need Billing and Accounting Software

Starting a business often means working with limited resources. Entrepreneurs need tools that are simple, effective, and, most importantly, affordable. Billing and accounting software is the perfect solution. These tools can:

Simplify Financial Management: Automate tasks like invoicing, expense tracking, and bookkeeping.

Save Time: Free up time for entrepreneurs to focus on growing their business.

Increase Accuracy: Reduce human errors in calculations and reporting.

Stay Compliant: Help businesses comply with tax laws and regulations.

Did you know? According to a study, 82% of small businesses that fail cite cash flow problems as a reason. Using budget-friendly software can help avoid this issue by keeping finances organized.

Features of Affordable Billing and Accounting Software

When choosing software, startups should look for these essential features:

Invoicing for Startups: Generate professional invoices quickly and easily. Look for tools that allow customization and automation of recurring invoices.

Expense Tracking: Monitor where your money is going and categorize expenses for better understanding.

Budget-Friendly Software: Ensure the software fits within your financial plan without compromising on quality.

Bookkeeping for Entrepreneurs: Keep accurate records of all financial transactions, which is crucial for tax filing and audits.

Cloud Accessibility: Access your financial data from anywhere, which is especially useful for remote teams.

Scalability: Choose a tool that grows with your business, so you don’t have to switch software later.

Top Affordable Billing and Accounting Software for Startups

Here are some great options that combine affordability with functionality:

1. Wave

Cost: Free for basic features

Why It’s Great: Wave is a popular choice for startups because it offers free invoicing and accounting features. You only pay for additional services like payroll.

Best For: Entrepreneurs who need simple tools to manage finances.

2. Zoho Books

Cost: Plans start at $15/month (around ₹1,200 INR)

Why It’s Great: Zoho Books offers invoicing, expense tracking, and bank reconciliation. Its user-friendly interface makes it ideal for beginners.

Best For: Small teams looking for an all-in-one solution.

3. QuickBooks Online

Cost: Plans start at $30/month (around ₹2,500 INR)

Why It’s Great: Known for its robust features, QuickBooks is perfect for scaling businesses. It offers automated invoicing, expense tracking, and detailed financial reports.

Best For: Startups planning to grow quickly.

4. FreshBooks

Cost: Plans start at $15/month (around ₹1,200 INR)

Why It’s Great: FreshBooks focuses on invoicing and is perfect for freelancers and service-based businesses.

Best For: Entrepreneurs who prioritize invoicing for startups.

5. TallyPrime

Cost: Starts at ₹600/month

Why It’s Great: TallyPrime is popular in India for its GST compliance and bookkeeping features.

Best For: Indian startups needing localized solutions.

6. Gimbook

Cost: Plans start at $10/month (around ₹800 INR)

Why It’s Great: Gimbook is designed specifically for startups and small businesses, offering simple invoicing, expense tracking, and customizable reports.

Best For: Entrepreneurs looking for an intuitive and affordable solution.

Have questions about these tools? Contact us, and we’ll help you choose the right one! Click here: https://bit.ly/4h1SnEf

Benefits of Using Budget-Friendly Software

Affordable billing and accounting tools offer numerous advantages:

Cost-Effective: These tools are designed for startups, ensuring you get essential features without spending a fortune.

Time-Saving: Automating tasks like invoicing and expense tracking can save hours each week.

Improved Cash Flow Management: Tools like Wave and QuickBooks help you monitor income and expenses, ensuring better financial decisions.

Professional Image: Sending professional invoices builds trust with clients and enhances your brand.

Real-Life Example: How Software Helps Startups

Let’s consider a small digital marketing startup. They used to spend hours each week creating invoices manually and tracking expenses in spreadsheets. After switching to FreshBooks, they:

Reduced invoicing time by 50%.

Tracked all expenses in real-time.

Improved cash flow by ensuring clients paid on time with automated reminders.

This saved them around 10 hours per month, which they used to acquire new clients and grow their business.

Tips for Choosing the Right Software

Here are a few tips to ensure you pick the best tool for your business:

Start Small: Begin with free or low-cost tools and upgrade as your business grows.

Check Reviews: Look for feedback from other entrepreneurs to ensure the software meets your needs.

Try Free Trials: Most tools offer a free trial, so test them out before committing.

Look for Support: Ensure the software provides customer support to help you with any issues.

Gimbook: The Startup-Friendly Software

Gimbook is a user-friendly and cost-effective billing and accounting solution tailored for startups and small businesses. With its intuitive interface, Gimbook simplifies invoicing and expense tracking, making financial management less daunting. One standout feature is its customizable reporting, which allows entrepreneurs to analyze financial data in ways that suit their unique business needs. At just $10/month (approximately ₹800 INR), Gimbook ensures startups can access professional tools without straining their budgets. For entrepreneurs seeking an affordable yet powerful solution, Gimbook is an excellent choice.

Boost your business efficiency—try one of these affordable tools and get started now! Click here: https://bit.ly/4eMIOHF

Final Thoughts

Affordable billing and accounting software is a game-changer for startups and entrepreneurs. These tools simplify financial management, save time, and help you stay organized, all without putting a strain on your budget. Whether you choose Wave, Zoho Books, Gimbook, or TallyPrime, the right software can make all the difference in your business’s success.

So, why wait? Explore these budget-friendly options today and take the first step toward a more organized and profitable business!

#Billing and Accounting Software#Accounting Software#Billing Software#Best Billing and Accounting Software

0 notes

Text

Web Billing System

It refers to an online platform that allows businesses to manage and process billing tasks through the internet. It enables companies to create, track, send, and manage invoices electronically, all within a web browser. Unlike traditional, paper-based billing methods, a web billing system is cloud-based, meaning it's accessible from any device with an internet connection, providing convenience and flexibility. For more information Visit Us: https://aninvoice.com/

0 notes

Text

RRFINCO Common Service Centre in Bihar is a one-stop service point for bringing e-services from the Indian Government to rural and remote locations of Patna.

#loan service#recharge software#dmt software#account opening#gst services#aeps software#api integration#api solution#b2b service#b2c services#app development company#mobile app design bd#mobile recharge#mobile app development#mlm software#mutual fund#best aeps service provider#bill payment#b2b lead generation#software company#it company#credit card#commercial#distributor#e government services#entrepreneur#csc center

0 notes

Text

What is GST and Why Accurate Billing Matters?

It's a Goods and Services Tax (GST) that came out for India as an indirect tax system under one head to replace the various indirect taxes such as VAT, service tax, and excise duty with effect from July 01, 2017, to simplify the taxation process in the country. The main intention was to create a tax system to be called "one nation, one tax," making compliance easy and boosting transparency in business transactions.

GST can be classified into three categories from the point of view of nature of the transaction; they include:

CGST (Central GST): Which is levied on an intra-state sale by the central government.

SGST (State GST): Which is levied on an intra-state sale by the state government.

IGST (Integrated GST): Which is levied on inter-state transactions and falls under the head of central government for collection.

Having said that, India's GST tax system has been formulated by defining multiple tax slabs such as 5%, 12%, 18%, and 28%, depending on the type of goods or services. Generally, it has been observed that essential appeals are placed in the lower slabs, while luxury ones go as high as possible.

Healthy and Accurate Billing in GST

Accurate billing plays an important part in GST compliance. A proper invoice should include:

Invoice number and date

Seller and buyer's GSTIN

HSN/SAC codes

Tax rate and amount break up

Place of delivery

The effects of errors in billing, such as wrong GSTINs, incorrect tax rates, or missing invoice elements, are that they lead to mismatching of returns and thus delay in input tax credits. By the GST Law, wrong billing can attract fines starting from ₹10,000 or 10% of the tax due-whichever is higher.

Benefits of Accurate GST Billing

Germ-free Return Filing: Correct invoices assure that you can file GSTR-1, GSTR-3B, GSTR-9 with no discrepancy.

Avoid Penalty: Avoid compliance hassle, audit, and government scrutiny.

Better Business Reputation: More professional and transparent invoices create better trust in clients and stakeholders.

Input Tax Credit Accuracy: Buyers can claim true ITC only if the invoices of their supplier are true and timely.

How Software Helps

Modern GST billing software automatically solves an equation, checks GST institutions, brings tax slabs up to date, and links the GST portal to perform direct uploads at the same time. With features like multi-user access, e-invoicing, and real-time reporting, it minimizes manual errors, optimizes tax compliance, and saves time.

Final Words

GST simplified taxation in India. But accurate billing is essential for compliance and competitiveness in business. Whether you run a small or large enterprise, entrusting reliable billing tools to use best practices is sufficient for smoother operational processes while keeping illegal risks at bay and developing long-term trust from customers and tax authorities.

This article was originally published on Tririd Biz

Contact

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

FAQ

Q1: Penalties for Wrong GST Billing

A: Penalties will start from a minimum of ₹10,000 or 10% of the tax amount and may be accompanied by an interest charge and GST registration cancellation for repeated offenders.

Q2: How frequently should GST invoicing be reconciled?

A: Monthly is an ideal practice to confirm that your GSTR-1 and GSTR-3B are in sync consistent and thereby claim rightful ITC.

Q3: For GST billing, is the use of free tools permissible for small businesses?

A: Yes! Many included applications on their scene offer free basic GST billing features perfectly suited for startups or micro-businesses.

Q4: What are necessary features of GST billing software?

A: Auto-calculation, GSTIN validation, HSN/SAC codes, integration of GSTR filing, and e-invoicing.

Q5: Will e-invoicing be a requirement for all businesses?

A: As of now, registration for e-invoicing is required for turnover more than ₹5 crores, but it might become universal in the future.

#Automated GST billing software#Best accounting software for GST#GST billing and accounting software#GST billing software for small businesses#Tririd Biz accounting software

0 notes

Text

The Ultimate Guide to Choosing the Best Jewellery Retail Software

In today’s competitive jewellery industry, success goes beyond offering exquisite designs. Managing inventory, billing, accounting, and customer relationships efficiently is essential to stay ahead. The right jewellery retail software can revolutionize operations, enhance customer experiences, and streamline business processes. But with numerous options available, how do you select the best one? This guide will help you make an informed decision.

Why Your Jewellery Business Needs Jewellery Retail Software

Running a jewellery store involves complex tasks such as billing, stock tracking, and customer management. Relying on traditional methods can result in errors and inefficiencies. Implementing jewellery retail software offers multiple benefits:

1. Streamlined Billing Processes

Jewellery transactions involve multiple pricing factors, customizations, and GST compliance. The right software automates billing calculations, generates professional invoices, and ensures accuracy.

2. Efficient Inventory Management

Manually tracking stock can be time-consuming and error-prone. Jewellery retail software provides real-time stock monitoring, prevents discrepancies, and ensures popular items are always in supply.

3. Enhanced Customer Experience

With built-in CRM features, the software stores customer purchase histories and preferences, enabling personalized services, loyalty programs, and better engagement.

4. Accurate Financial Management

Integrated accounting tools simplify revenue tracking, expense management, and tax calculations, ensuring financial accuracy and compliance.

5. Scalability for Business Growth

Whether you operate a single store or a multi-branch enterprise, scalable jewellery retail software adapts to your business expansion needs.

#jewellery software#best jewellery software#chit scheme#erp software#accounting software#digigold#jewellery inventory software#jewellery billing software

0 notes

Text

Best Billing Software in India: Top Picks for 2024

In the competitive landscape of 2024, selecting the right billing software is crucial for optimizing financial operations and enhancing business efficiency. Businesses in India have access to a diverse range of best billing software in India solutions, each offering unique features and benefits. This guide explores some of the top billing software options available in India, including MargBooks, and highlights their capabilities to help you make an informed choice.

Key Features to Consider

When evaluating billing software, look for the following key features that can significantly impact your business operations:

User-Friendly Interface: Software should be easy to navigate and operate, minimizing the learning curve for users.

Customizable Invoicing: The ability to personalize invoices with your branding, such as logos and specific fields, enhances professionalism and accuracy.

Automated Billing: Automated invoicing and payment reminders streamline billing processes and reduce manual effort.

Integration Capabilities: Choose software that integrates seamlessly with other business tools like accounting systems, CRM platforms, and e-commerce solutions.

Reporting and Analytics: Detailed reporting and analytics help track financial performance, identify trends, and make data-driven decisions.

Security Features: Ensure the software has robust security measures, including data encryption, user authentication, and regular backups.

Top Picks for 2024

Here are some of the top billing software solutions in India for 2024, including MargBooks:

MargBooks Overview: MargBooks is a leading billing and accounting software solution that caters to the diverse needs of Indian businesses. It offers a range of features designed to simplify billing, invoicing, and financial management. Features:

Easy Invoicing: Create and customize invoices with ease, including adding your business logo and adjusting invoice fields.

Automated Features: Automate recurring billing and payment reminders to streamline your processes.

Integrated Accounting: MargBooks integrates billing with accounting functions, providing a comprehensive financial management solution.

GST Compliance: Includes features to ensure compliance with GST regulations, including automated tax calculations and reporting.

Inventory Management: Manage inventory levels and track stock movements directly within the software. Benefits:

Comprehensive Solution: Combines billing, accounting, and inventory management in one platform.

Customization: Offers extensive customization options to tailor the software to your specific business needs.

Local Support: Provides support tailored to Indian businesses and regulatory requirements.

Marg ERP 9+ Overview: Marg ERP 9+ is a comprehensive billing and accounting solution known for its user-friendly interface and extensive features. It caters to businesses of all sizes and offers a range of functionalities to streamline billing and financial management. Features:

Customizable Invoices: Create and modify invoices with your business branding.

Automated Billing: Set up recurring invoices and automated reminders.

Integration: Seamlessly integrates with accounting software and POS systems.

Reporting: Access detailed financial reports and analytics. Benefits:

User-Friendly Interface: Designed for ease of use, reducing the need for extensive training.

Comprehensive Solutions: Suitable for businesses of all sizes, providing robust billing and accounting features.

Zoho Books Overview: Zoho Books is a cloud-based billing software offering a range of features designed to simplify invoicing and financial management. Features:

Automated Invoicing: Generate and send invoices automatically, including recurring invoices.

Expense Tracking: Track and categorize expenses efficiently.

Payment Integration: Accept online payments through various gateways.

Multi-Currency Support: Manage billing in different currencies for international transactions. Benefits:

Cloud-Based: Accessible from anywhere with an internet connection.

Integration: Connects with other Zoho products and third-party applications.

TallyPrime Overview: TallyPrime is a well-established billing and accounting software known for its detailed reporting and inventory management features. Features:

Detailed Reporting: Comprehensive financial reports and analytics.

Inventory Management: Track stock levels and movements.

Multi-Currency and Multi-Language Support: Supports diverse business needs.

Tax Compliance: Automated GST calculations and compliance features. Benefits:

Established Track Record: Trusted for its reliability and robust features.

Scalability: Suitable for growing businesses with evolving needs.

QuickBooks India Overview: QuickBooks is known for its ease of use and extensive billing features, making it a popular choice among small to medium-sized businesses. Features:

Customizable Invoices: Create personalized invoices for your business.

Automated Payment Reminders: Set up reminders to ensure timely payments.

Expense Tracking: Efficiently manage expenses and financial records.

Integration: Connects with various financial tools and platforms. Benefits:

Ease of Use: Simplifies billing and accounting tasks with an intuitive interface.

Comprehensive Support: Provides extensive support and resources.

Busy Accounting Software Overview: Busy Accounting Software offers a range of billing and financial management features designed for various business sizes and industries. Features:

Customizable Invoices: Personalize invoice templates to reflect your brand.

Automated Billing: Manage recurring invoices and automate processes.

Detailed Financial Reporting: Generate comprehensive reports for financial analysis.

Integration: Integrates with other business tools for a seamless experience. Benefits:

Flexibility: Suitable for diverse business needs.

User-Friendly: Designed to be easy to use and navigate.

How to Choose the Right Billing Software

Choosing the best billing software in India involves several key considerations:

Define Your Needs: Identify the specific features and functionalities required for your business, such as invoicing options, automation, and integration capabilities.

Compare Options: Evaluate different billing software solutions based on their features, pricing, and user reviews. Look for software that offers the best value and aligns with your business needs.

Test the Software: Utilize free trials or demos to assess the software's functionality and ease of use before making a commitment.

Consider Scalability: Choose software that can grow with your business and accommodate future needs.

Evaluate Support: Ensure that the software provider offers adequate support and training resources to help you maximize the benefits of the software.

Benefits of Top Billing Software

Investing in the best billing software in India provides several advantages:

Increased Efficiency: Automation and streamlined billing processes reduce manual effort and improve overall efficiency.

Enhanced Accuracy: Accurate invoicing and financial reporting help maintain precise records and minimize errors.

Better Financial Management: Advanced reporting and analytics features provide insights into your financial performance, aiding in strategic decision-making.

Improved Cash Flow: Timely invoicing and automated reminders help ensure prompt payments, enhancing cash flow.

Compliance and Security: Reliable billing software ensures compliance with tax regulations and offers robust security features to protect sensitive data.

Simple Guide to the Best Billing Software in India

Selecting the best billing software for your business can be straightforward if you follow a structured approach. This simple guide provides an overview of key factors to consider and how to make an informed decision.

Key Considerations

Ease of Use: Choose software with an intuitive interface that is easy for your team to use without extensive training.

Customization: Look for software that allows you to personalize invoices and reports to match your business requirements.

Automation: Features like automated invoicing and payment reminders save time and reduce manual tasks.

Integration: Ensure the software integrates with other tools such as accounting systems and CRM platforms.

Security: Opt for software with strong security measures to protect your financial data.

Recommended Billing Software

Here are some of the best billing software options in India:

MargBooks: Offers easy invoicing, automated billing, GST compliance, and integrated accounting features. Suitable for businesses of all sizes.

Zoho Books: Cloud-based solution with automated invoicing, expense tracking, and multi-currency support.

TallyPrime: Provides detailed reporting, inventory management, and tax compliance features.

QuickBooks India: Known for its user-friendly interface, customizable invoices, and extensive support.

Busy Accounting Software: Features customizable invoicing, automated billing, and detailed financial reporting.

Making the Right Choice

To choose the best billing software for your business:

Identify Requirements: Determine the features you need, such as automation and integration.

Compare Software: Assess different options based on features, pricing, and reviews.

Test Software: Use free trials or demos to evaluate functionality and ease of use.

Consider Support: Ensure the provider offers support and training to help you maximize the software's benefits.

#Margbooks#best billing software in India#billing software in India#billing#software#accounting#BEST

0 notes

Text

TT Infotechs in Bhubaneswar offers cutting-edge software development and website design services. Enhance your business with customized solutions tailored to your needs. Contact TT Infotechs today!

#Software with website provide company in bhubaneswar#website development#web developers#digital marketing service in bhubaneswar#ecommerce website development#low cost ecommerce website in bhubaneswar#software development#best digital marketing service in bhubaneswar#software development company in bhubaneswar#low cost ecommerce website#accounting & billing software in bhubaneswar#accounting software in bhubaneswar#website design solution company#best billing software comapny

0 notes

Text

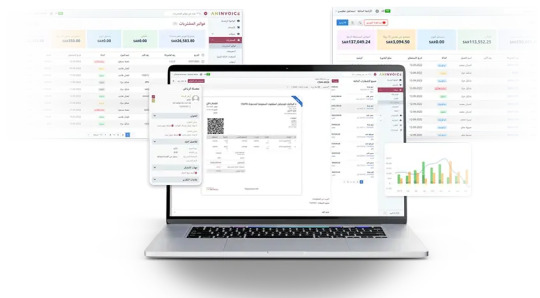

Explore the best accounting software in Saudi Arabia with advanced billing software and comprehensive ERP software in Saudi Arabia. Our best e-invoicing software integrates seamlessly with accounting e-invoicing in Saudi Arabia to ensure full compliance with Zatca e invoicing software requirements, streamlining your financial processes effectively.

1 note

·

View note

Text

Find top accounting software in Saudi and the best ERP software in Saudi Arabia to elevate your business. Our ERP providers in Saudi Arabia offer comprehensive solutions, including advanced billing software. Streamline your operations and enhance financial management with the best tools available.

#accounting software in Saudi#best ERP software in Saudi Arabia#ERP providers in Saudi Arabia#billing software

1 note

·

View note

Text

Fuel retail automation for your petrol pump

Fuel Retail Automation is transforming the way fuel retail businesses operate, bringing efficiency and accuracy to every aspect of the process. At the forefront of this transformation is Petrosoft, a leading name in the industry. Fuel retail automation involves using advanced technologies to manage and streamline various tasks in fuel stations, such as fuel dispensing, inventory management, and customer transactions.

Petrosoft offers innovative solutions that automate these processes, making fuel retailing more efficient and profitable. Their systems ensure that fuel is dispensed accurately, reducing wastage and ensuring customers get the exact amount they pay for. This level of precision not only builds customer trust but also helps in maintaining accurate inventory records.

One of the significant advantages of fuel retail automation is improved inventory management. Petrosoft’s solutions provide real-time data on fuel levels, helping retailers avoid stockouts or overstocking. This data-driven approach allows for better planning and can significantly reduce operational costs.

Customer transactions are also made smoother with Petrosoft’s automation systems. They integrate with payment terminals, allowing for quick and secure payments. This not only speeds up the checkout process but also enhances the overall customer experience. Furthermore, these systems can handle various payment methods, including credit cards, mobile payments, and loyalty programs.

In addition to these benefits, Petrosoft’s fuel retail automation solutions offer robust reporting and analytics features. Retailers can access detailed reports on sales, inventory levels, and other critical metrics, enabling them to make informed business decisions. This analytical capability helps identify trends and opportunities for growth.

In summary, Petrosoft’s Fuel Retail Automation solutions bring efficiency, accuracy, and enhanced customer satisfaction to fuel retail businesses. By leveraging advanced technologies, Petrosoft helps retailers streamline operations, reduce costs, and improve overall performance, making them a valuable partner in the fuel retail industry.

#Best Accounting Software for Petrol Pump#Billing Software for Petrol Pump#Petrol Bunk Accounting Software#Petrol Bunk Management System#Petrol Pump Management Software in India#Petrol Pump Software in India

0 notes

Text

Optimize Your Business with Pointretailsolutions' Accounting & Inventory Software Solutions in Dubai

Streamline your operations with Pointretailsolutions' cutting-edge accounting and inventory software solutions in Dubai! Our comprehensive tools help manage your finances and track inventory seamlessly, boosting efficiency and accuracy. Elevate your business performance with Pointretailsolutions' reliable software.

#pos software#pos system#retail pos software#pos billing software#best accounting software#dubai#UAE#retail pos system#billing software#restaurant pos#pos software in dubai

0 notes

Text

The importance of the best billing software in India free for small businesses

A billing system is a process used by businesses and companies to simplify the process of sending invoices to clients. Online billing software free is a software that computerizes the procedure of receiving payments and sending out regular invoices. As well, tracking expenses and tracking invoices are frequently included in free accounting software India. This blog is all about the importance of the best billing software in India free for small businesses. The best billing software in India free ensures that your clients can easily pay for the products and services they render. For small businesses, free accounting software India is important as it offers a range of benefits to businesses in achieving their goals.

Apart from that, free accounting software India for small businesses helps enhance the cost-efficiency and productivity of employees by automating repetitive tasks. In today’s time, mostly businesses are using online billing software free to manage their whole business, including accounts, financial statements, inventory management, and others.

The importance of the best billing software in India free

If you are a small business owner and looking to expand your business, then opting for online billing software free, will be the best solution for all your business requirements. Some of the benefits of

free accounting software India are as follows:

Easy creation of invoices: Since all the debit and credit information is filled out in the billing software, it automatically calculates the amount and combines all the data to create new invoices in a professional way.

Customer history and data: The information of every customer is saved in a particular database. Since all of the customer information is available in a single place, retrieving customer data and tracking becomes extremely simple. You don’t need to struggle through multiple files and papers.

Information Organization: The organization of information is a very tough and time-consuming task. For that, you need a free invoice software download that can save, organize, and fetch the data in real-time. It makes the transaction of data more accessible and smooth.

Design your invoice: Billing software for small businesses comes with predefined invoice templates that can be made according to your requirements. Customization of your own invoice template with your brand identity makes your invoices look more professional and separate from others.

Multiple modes of payment: modern-day billing software in India is coherent with payment gateways that permit you to accept payments from your customers through various modes of payment. Free invoice software download authorizes you with special features like auto-bank reconciliation, saving time and effort for integrating the transactions.

Strategies to select the best billing software in India

The selection of efficient billing processes is important for maintaining a healthy cash flow that ensures the smooth working of the business. Below are the strategies to follow before finalizing the accounting software:

Business Requirements: Understand your business needs and identify the features and functionalities that you want in a billing software.

User-friendly: Select the accounting software that is easy to use and operate and that doesn’t require any extra training.

Automation: In today’s world, time is money. So choosing billing software that has automation can help you save both time and money.

Safety: The safety of the customer's information is paramount. So, selecting accounting software that has top-notch security is a must.

After reading this blog, it is clear that billing software in India is an important factor in the expansion of business. So if you are searching for reliable and trustworthy billing software, then go for Eazybills, as it has robust security and all the features required for the proper functioning of billing.

#best billing software in india free#free accounting software india#online billing software free#free invoice software download#billing software#invoice software#easy billing software#free invoicing software#gst billing software#best gst billing software

0 notes

Text

Best Accounting Software

0 notes

Text

https://rrfinco.com/ RRFINCO is one of the Best mobile game development Service Providers, crafting incredible mobile games for IOS and Android. From concept to launch, we manage every step, ensuring top-notch quality.

#rrfinco#rrfinpay#fintech#fintechservice#FintechSolutions#gamedevelopment#gamedeveloper#gamedevelopmentservices#gamedevelopmentcompany#Mobilegameplay#MobileGameDevelopment

#dmt software#loan service#gst services#recharge software#aeps software#api integration#b2b service#api solution#b2c services#account opening#mobile app design bd#mobile app development#accounting#best aeps service provider#bill payment#fintech app development company#app development company#distributor#e government services#education#ecommerce#entrepreneur#fintech service#fintech company#fintech industry#fintech software#mutual fund#gamming software#payment getway#payment getaway

0 notes

Text

#accounting software#inventory management#best acoounting software#gst billing software#accounting software for small business

1 note

·

View note

Text

#pos software#erp for retail stores#gst accounting software for retail#garment software#footwear billing software#bookstore software#grocery billing software#supermarket billing software#gift shop software#pos system#mpos#types of pos software#importance of pos software#features in pos software for retail#gst-compliant pos system#best pos software for garment shop#mera bill mera adhikar#e-invoicing rules 2023#retail analytics

0 notes