#Blockchain for ESG: Blockchain Uses and reporting

Explore tagged Tumblr posts

Text

How Gen Z is Redefining Personal Finance in 2025: Trends, Tools, and Investment Habits

As we step deeper into 2025, one demographic is causing a significant shift in how the world approaches personal finance: Generation Z. Born between the mid-1990s and early 2010s, this generation is not just tech-savvy—they're financially conscious, socially aware, and driven by innovation.

Unlike Millennials who came of age during the 2008 financial crisis, Gen Z is growing up amidst decentralized finance, AI-driven banking tools, and instant-access investment platforms. They're not just participating in the financial system; they’re reshaping it.

Let’s dive into how Gen Z is redefining personal finance in 2025 and what this means for the future of money.

1. Financial Literacy Starts Earlier—and Digitally

Gen Z doesn’t wait until adulthood to learn about money. Thanks to YouTube channels, TikTok influencers, and financial podcasts, 16-year-olds today often know more about stocks, crypto, and compound interest than many adults did at 30.

Apps like Step, Greenlight, and FamPay offer financial tools tailored for teens, enabling them to manage real money while learning about savings, investments, and budgeting.

2. The Rise of Finfluencers and Social Investing

Social media is playing a powerful role in shaping Gen Z’s money mindset. “Finfluencers” like @humphreytalks and @yourrichbff offer bite-sized, relatable finance advice that’s influencing how young adults think about saving, debt, and investing.

More interestingly, social investing platforms like Public and eToro allow users to follow and mimic the portfolios of successful investors—making learning by doing more accessible than ever.

3. Investing with a Purpose: ESG and Social Impact

Unlike previous generations, Gen Z isn’t just looking for returns—they’re looking for impact. According to a 2024 Deloitte survey, nearly 75% of Gen Z investors prefer ESG-compliant portfolios that align with values like climate action, social justice, and corporate accountability.

Platforms like Zerodha’s Coin, Groww, and Sustainalytics have gained traction for offering transparency in ethical and sustainable investing.

4. Budgeting Through Automation and AI

Gone are the days of spreadsheets and envelopes. Gen Z relies heavily on budgeting tools like YNAB (You Need a Budget), Goodbudget, and AI-powered apps such as Cleo or Plum, which use conversational interfaces and automation to help users manage their spending without effort.

Some of these apps even “roast” users in a fun way for bad financial decisions, creating engagement while promoting healthy financial habits.

5. Cryptocurrency and Decentralized Finance (DeFi)

Gen Z’s openness to new technology is evident in their relationship with crypto. While Bitcoin and Ethereum still dominate portfolios, Gen Z is also exploring NFTs, DAOs (Decentralized Autonomous Organizations), and Web3 investments.

Despite volatility, over 45% of Gen Z investors in India had exposure to crypto assets in 2024, according to a report by Chainalysis. Platforms like CoinDCX, WazirX, and Binance continue to draw young investors looking for alternative wealth creation.

6. The Shift Toward Skill-Based Finance Education

As traditional education struggles to keep up with this dynamic financial landscape, many Gen Z learners are turning to skill-based courses to fast-track their financial careers. Courses in financial modeling, blockchain, and investment banking are in high demand.

For example, if you're based in India and aspiring to enter the world of finance, enrolling in an investment banking course in Mumbai can be a strategic step. Mumbai—India’s financial capital—is home to top institutes like the Boston Institute of Analytics, which offers advanced, hands-on training led by seasoned investment bankers and finance professionals. These programs equip students with real-world knowledge in M&A, equity research, financial modeling, and more—skills that are increasingly relevant in 2025.

7. Gig Economy and Multiple Income Streams

Unlike older generations who prioritized one stable job, Gen Z is entrepreneurial by nature. They juggle side hustles—freelancing, content creation, affiliate marketing—alongside traditional careers. This has changed how they view income security and has encouraged earlier investments to offset the unpredictability of gig work.

Gen Z's motto? “Don’t just save—invest and grow.”

8. Financial Wellness over Wealth Accumulation

Lastly, for Gen Z, financial freedom is not just about becoming rich—it’s about peace of mind. They prioritize mental health and lifestyle flexibility, which affects how they manage debt, save for emergencies, and approach work-life balance.

Financial wellness tools like Paytm Money, ET Money, and Navi offer robo-advisory services that personalize savings goals, insurance, and investment recommendations—all aligned with this holistic approach.

Conclusion: A New Blueprint for Financial Success

As Gen Z takes the financial reins in 2025, they're not simply following the old rulebook—they’re writing their own. With an emphasis on technology, ethical investing, and financial empowerment, this generation is redefining what it means to be financially successful.

Whether you're a budding investor, finance professional, or educator, understanding Gen Z’s approach is key to staying relevant in today’s evolving economy.

And if you're looking to build a strong career foundation in finance, enrolling in an investment banking course in Mumbai is a smart move. It offers not just theoretical knowledge, but practical tools and market exposure aligned with what this new financial generation demands.

0 notes

Text

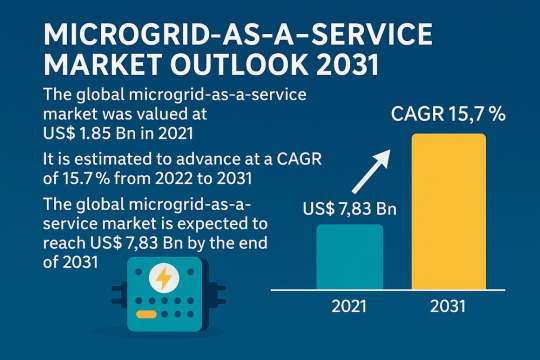

Microgrid-as-a-Service: A High-Growth $7.8B Market by 2031

The global Microgrid-as-a-Service (MaaS) market, valued at US$ 1.85 Bn in 2021, is projected to advance at a CAGR of 15.7% from 2022 to 2031 and reach a valuation of US$ 7.83 Bn by the end of 2031, according to recent market intelligence. The rapid shift toward decentralized, renewable energy and the growing need for uninterrupted power supply are major contributors to this robust growth.

Market Overview: Microgrid-as-a-Service (MaaS) is an emerging model that enables institutions, industries, and residential consumers to deploy microgrids with minimal upfront investment. MaaS provides energy security and enhances grid resilience, offering a reliable solution to frequent outages and natural disasters. It is increasingly becoming a preferred option in both developed and emerging markets for its ability to deliver cost-effective, clean, and locally sourced energy.

Market Drivers & Trends

The global MaaS market is being driven by:

Surge in renewable energy adoption: The growing installation of solar and wind energy systems is propelling the demand for intelligent microgrid solutions.

Government incentives and modernization programs: Initiatives like the U.S. Department of Energy’s Smart Grid Investment Grant Program and subsidies for clean energy projects are fostering microgrid deployments.

Growth in smart devices and grid digitization: Countries are rapidly adopting smart meters and automated transmission systems, reducing outages and improving energy efficiency.

Need for energy independence and resiliency: Particularly in disaster-prone or remote regions, microgrids provide critical backup and localized power supply.

Advancements in peer-to-peer energy trading and blockchain integration, enabling real-time, decentralized energy exchanges.

Key Players and Industry Leaders

The global MaaS market is consolidated, with a few major players commanding substantial market share. Leading companies include:

Schneider Electric – Offers Energy-as-a-Service and microgrid operation tools.

ABB – Provides turnkey solutions with digitized microgrid control platforms.

Siemens AG – Known for its intelligent energy management systems and consultancy services.

Eaton Corporation – Specializes in islanded and grid-tied microgrid operations.

Aggreko, ENGIE, Tech Mahindra, General Electric, and AIO Systems Ltd. also play significant roles in global deployments.

Emerging players such as Green Energy Corp. and Spirae, LLC are also gaining traction by focusing on software innovation and scalable energy management.

Recent Developments

In December 2021, Schneider Electric and Temasek launched GreeNext, a joint venture to deliver hybrid solar-battery microgrids to commercial and industrial clients.

In February 2021, ABB partnered with DEIF, combining control technologies to accelerate renewable energy integration in marine and land-based microgrid applications.

Numerous R&D initiatives are exploring virtual microgrids and blockchain-based energy trading, marking the next phase of energy decentralization.

Access key findings and insights from our Report in this sample -

Latest Market Trends

Growing preference for grid-connected microgrids due to their ability to trade unused energy and operate in hybrid or islanded modes.

Rising demand for monitoring and optimization services, ensuring efficient grid operation, reduced peak loads, and real-time energy analytics.

Surge in corporate ESG commitments, with companies seeking low-carbon and self-reliant energy systems.

Market Opportunities

The market is ripe with opportunities, particularly in:

Remote and underserved areas, where microgrids can deliver energy access.

Urban applications, as falling costs of solar panels and batteries make microgrids viable even in densely populated settings.

Commercial and industrial sectors, which demand reliable power for continuous operations.

Training and software services, as the need for skilled microgrid operators grows.

Future Outlook

Analysts predict a bright future for the MaaS industry:

Strong growth expected post-2030, driven by increased electrification, climate targets, and global energy transition goals.

The convergence of AI, IoT, and cloud computing with microgrid infrastructure will create new revenue streams in predictive maintenance and real-time grid management.

Hybrid energy systems (combining renewables, storage, and diesel) are anticipated to dominate deployments, offering cost, reliability, and environmental benefits.

Market Segmentation

The global microgrid-as-a-service market can be segmented as follows:

By Type:

Islanded Microgrid

Grid Connected Microgrid (Dominant segment with 78% share in 2021)

By Service:

Monitoring & Optimization

System Maintenance & Operations

Infrastructure Upgradation (Software & Others)

Training

Others

By End-user:

Government & Utility

Commercial

Industrial

Residential

Regional Insights

North America leads the global MaaS market, holding around 38% share, supported by:

Early adoption of renewable technologies

Government funding and incentives

Strong presence of key players

Asia Pacific is emerging as a high-growth region, driven by:

Rapid urbanization and industrialization

Government regulations promoting grid modernization

Growing demand from countries like India, China, Japan, and ASEAN nations

Europe continues to support the market with strong environmental regulations and sustainability goals.

South America and the Middle East & Africa are exhibiting steady progress, with South America showing the fastest CAGR owing to increasing renewable energy penetration and microgrid adoption in rural areas.

Why Buy This Report?

This comprehensive report offers:

In-depth analysis of current and future market dynamics

Insights into technological innovations and deployment strategies

Detailed profiling of key market players, including product portfolios and strategies

Regional and segment-wise breakdown of market share and growth rates

Strategic recommendations for stakeholders, investors, policymakers, and industry participants

0 notes

Text

Driving Change: The Rise of Sustainability Consultancy in Saudi Arabia

As global attention changes to climate responsibility and ESG performance, the demand for Sustainability Consultancy in Saudi Arabia is increasing at an unprecedented pace. Companies across industries are seeking expert advice on how to align their operations with sustainable principles, and prominent firms such as Agile Advisors are at the forefront of this shift.

Sustainability Report Consultation is an important aspect of this movement. Corporations must now offer transparent disclosures about environmental, social, and governance indicators. A reputable Sustainability Report Consultancy ensures that firms not only meet local and international regulations but also foster stakeholder trust and improve brand recognition.

Agile Advisors, a well-known sustainability consultancy in Saudi Arabia, has assisted customers in transitioning to more ecologically responsible operations. Their expertise includes carbon footprint assessments, sustainability strategy formulation, and entire Sustainability Report Consultancy, all suited to Saudi Arabia's unique regulatory environment and Vision 2030 targets.

To be competitive in this growing profession, sustainability consultancies are increasingly embracing digital tools and technologies. In Saudi Arabia, companies are using AI-powered analytics solutions to monitor and forecast ESG performance. Blockchain is being investigated for transparent supply chain traceability, and IoT sensors are now utilised to track energy consumption and emissions in real-time. These technologies improve the accuracy and efficiency of Sustainability Report Consultancy, allowing organisations to make data-driven decisions while reducing operational risks.

Furthermore, cloud-based systems are transforming collaboration between stakeholders and consultants. They improve data collecting, automate reporting, and facilitate scenario modelling. Tools like Microsoft Sustainability Manager, Enablon, and SAP's sustainability solutions are becoming commonplace in Saudi Arabia's sustainability consulting industry, providing seamless interaction with corporate systems.

Looking ahead, numerous trends are affecting the future of sustainability report consulting in the corporate world:

Mandatory ESG Reporting: As Saudi regulators push for standardised ESG disclosure requirements, firms will demand advanced Sustainability Consultancy in Saudi Arabia to stay compliant and competitive.

Integration with Corporate Strategy: Sustainability is no longer a separate activity, but is more integrated into core corporate strategy, necessitating a more comprehensive Sustainability Report Consultation.

Climate Risk and Financial Disclosure: The growing importance of climate-related financial disclosures (such as TCFD) is prompting consultancies to improve their financial and climate modelling capabilities.

Stakeholder-Driven Transparency: Investors, customers, and employees are demanding clearer sustainability narratives, necessitating more advanced Sustainability Report Consultancy services.

Agile Advisors' aim is clear: to help firms lead with purpose, innovate sustainably, and report with integrity. Agile Advisors, a leading Sustainability Consultancy in Saudi Arabia, blends strategic insight and technical innovation to provide meaningful Sustainability Report Consultancy that meets global standards and local goals.

Whether you want to fulfil compliance, increase investor confidence, or make a meaningful contribution to Vision 2030, engaging with a reputable Sustainability Consultancy in Saudi Arabia, such as Agile Advisors, is the first step toward long-term resilience and impact.

0 notes

Text

Accounting Dissertation Help with Research-Ready Topics for 2025

Writing a dissertation can be a daunting task, especially in a specialized field like accounting. The need to select the right topic, follow academic standards, conduct credible research, and maintain clarity throughout the document makes the entire process quite demanding. For students aiming to craft a strong dissertation in 2025, seeking proper Dissertation Help becomes a strategic step toward academic success.

This article offers comprehensive insight into how students can approach their accounting dissertations effectively. It also includes a curated list of research-ready topics that are relevant and impactful for the upcoming academic year.

Why Is Dissertation Help Important in Accounting?

Accounting is more than just numbers. It’s a combination of finance, analytics, law, strategy, and ethics. This complexity often makes it challenging to choose the right research focus and develop a coherent, evidence-based dissertation. Here’s why dissertation help is particularly valuable in this field:

Expert guidance ensures proper structure, methodology, and academic tone.

Topic validation helps in identifying areas with available data and future research potential.

Literature review support provides access to scholarly sources and peer-reviewed material.

Formatting and referencing help maintain compliance with APA, MLA, or other academic styles.

By taking advantage of professional support, students can focus on analysis and creativity rather than formatting and structure.

How to Choose the Right Accounting Dissertation Topic

Choosing a dissertation topic is the foundation of the entire project. A good topic should be:

Relevant to current trends

Feasible with available resources

Aligned with your academic goals

Interesting enough to sustain motivation

Students are encouraged to explore real-world issues and emerging areas in the accounting field. Avoid overly broad or excessively niche topics unless you have deep knowledge and access to resources.

Top Accounting Dissertation Topics for 2025

To help you get started, here’s a list of research-ready topics that align with current industry developments and academic interests:

1. The Impact of ESG (Environmental, Social, Governance) Reporting on Corporate Financial Performance

Explore how non-financial reporting is influencing investment decisions and overall company performance.

2. Blockchain Technology in Accounting: Disruption or Enhancement?

Examine the integration of blockchain into accounting systems and its implications on auditing, transparency, and fraud detection.

3. Forensic Accounting and Financial Fraud Detection in the Digital Age

Focus on how forensic accountants are evolving their methods to keep up with cybercrimes and digital manipulation.

4. The Influence of Artificial Intelligence on Financial Auditing

Analyze the pros and cons of using AI tools for internal audits and risk management.

5. The Role of Behavioral Accounting in Budgeting and Forecasting

Investigate how cognitive biases and human behavior influence financial planning in organizations.

6. Comparative Study: IFRS vs. GAAP in Cross-Border Accounting Practices

Assess the difficulties and advantages companies face when transitioning between these two accounting standards.

7. Sustainability Accounting and Its Role in Corporate Strategy

Evaluate how sustainability reporting is becoming a core element of business strategy and performance evaluation.

8. The Effectiveness of Tax Avoidance Strategies in Multinational Corporations

Discuss the ethical, legal, and financial dimensions of tax planning techniques.

9. Audit Quality and Auditor Independence in Listed Companies

Study the balance between maintaining long-term client relationships and ensuring audit quality.

10. The Future of Cloud-Based Accounting: Security Risks and Advantages

Explore how cloud technology is transforming accounting processes and the risks it poses for data security.

What Makes an Accounting Dissertation Successful?

Beyond topic selection, your dissertation needs to meet certain academic expectations to stand out:

1. Clear Research Objectives

Start with well-defined goals. What are you trying to discover, prove, or analyze? Having precise research questions helps streamline your investigation.

2. Strong Literature Review

This section demonstrates your understanding of the existing body of knowledge. Focus on scholarly journals, government reports, and recent publications to give your work a solid foundation.

3. Appropriate Methodology

Choose a methodology that suits your topic — whether qualitative, quantitative, or mixed methods. Explain your data collection process, sample size, and analysis techniques clearly.

4. Data Analysis and Interpretation

Use tools like SPSS, Excel, or R to process your data. More importantly, interpret the results in light of your research questions and objectives.

5. Critical Thinking

Show your ability to analyze problems from multiple perspectives. Do not merely describe findings; evaluate their implications and limitations.

Common Challenges Students Face

While help is available, many students still face difficulties such as:

Time constraints

Poor topic alignment

Limited access to scholarly sources

Unclear academic guidelines

These issues can delay progress or compromise the quality of the final dissertation. Seeking dissertation help early can prevent such setbacks and keep your academic journey on track.

Conclusion

Writing a dissertation in accounting is a significant academic milestone. With proper planning, topic selection, and the right dissertation help, students can navigate this challenge successfully. As 2025 brings new trends and technological advancements in finance and auditing, students have exciting opportunities to explore fresh perspectives and contribute meaningful research to the field.

Choosing a relevant, research-ready topic and following academic standards is the key to a well-crafted dissertation. Whether you’re a final-year undergraduate or a postgraduate student, now is the perfect time to start preparing your accounting dissertation with confidence and clarity.

FAQs about Dissertation Help in Accounting

Q1. What is the ideal length of an accounting dissertation? Most dissertations are between 10,000 to 15,000 words. However, the requirement may vary by institution.

Q2. Can I change my topic after submitting my proposal? Yes, but you may need approval from your supervisor, especially if the new topic significantly changes your research direction.

Q3. Do I need to use primary data for my dissertation? Not necessarily. Secondary data analysis is also acceptable, depending on your topic and methodology.

Q4. How important is referencing in a dissertation? Very important. Accurate referencing demonstrates academic integrity and helps avoid plagiarism.

Q5. When should I start writing my dissertation? Start early — ideally right after your proposal is approved. Allocate time for research, writing, revisions, and proofreading.

1 note

·

View note

Text

Germany Auto Loan Market Size, Future Outlook, Drivers & Key Players

Germany Auto Loan Market Overview The Germany auto loan market is currently experiencing moderate but stable growth, driven by increased vehicle ownership, the digitalization of financial services, and the rising demand for electric vehicles (EVs). As of 2024, the market size is valued at approximately USD 40 billion, and it is projected to grow at a CAGR of 4.8% from 2025 to 2030. The surge in both new and used car purchases, especially in urban regions, continues to fuel the need for flexible automotive financing options. Key financial institutions, including banks, non-banking financial companies (NBFCs), and fintech startups, are aggressively expanding their auto loan portfolios by leveraging online platforms and tailored loan products to meet evolving consumer expectations. The adoption of digital lending solutions, artificial intelligence (AI) in credit scoring, and the development of paperless documentation are reshaping the traditional auto finance landscape. Furthermore, the demand for green mobility, encouraged by Germany’s environmental regulations and incentives for EVs, is pushing financial providers to develop new financing models specifically for electric cars, including leasing and subscription-based solutions. Germany Auto Loan Market Dynamics Drivers: The primary growth drivers include increasing disposable incomes, low interest rate environments, government subsidies on electric vehicle purchases, and rising urbanization. The ease of online loan approvals and the availability of pre-approved loan options have enhanced consumer convenience, boosting the auto loan penetration rate in Germany. Restraints: Key restraints include strict regulatory frameworks, such as the European Union’s GDPR compliance obligations, which may slow digital transformations. Additionally, high inflation rates and interest rate fluctuations pose a challenge to loan affordability, especially for middle and low-income segments. Opportunities: Fintech innovations, open banking integration, and blockchain-based smart contracts offer new avenues for market players. Green financing and electric vehicle-specific loan products represent high-growth segments, particularly with increasing consumer awareness about sustainable transportation options. Technology & Regulations: The German financial sector is rapidly adopting AI-driven risk assessment models and predictive analytics for customer profiling. Regulatory compliance, especially under the European Central Bank’s supervision, continues to shape product offerings and ensure market transparency. Sustainability goals are prompting lenders to align their offerings with ESG frameworks, further shaping product strategies and marketing approaches. Download Full PDF Sample Copy of Germany Auto Loan Market Report @ https://www.verifiedmarketresearch.com/download-sample?rid=513362&utm_source=PR-News&utm_medium=380 Germany Auto Loan Market Trends and Innovations Innovations such as digital onboarding, biometric authentication, and AI-powered chatbots are enhancing customer experience. Fintech firms are increasingly partnering with automotive OEMs and dealers to embed financing directly into the car-buying journey. Embedded finance and BNPL (Buy Now, Pay Later) models are gaining traction in the automotive sector, offering flexible repayment options. Additionally, platforms are utilizing real-time credit risk engines to assess borrower eligibility, reducing approval times to minutes. Another notable trend is the rise of usage-based financing, where vehicle telematics data is used to customize loan repayment terms based on driving behavior and mileage. These innovations not only increase customer satisfaction but also reduce default risks. Germany Auto Loan Market Challenges and Solutions Challenges: Key challenges include rising vehicle prices, semiconductor shortages affecting vehicle inventory, and fluctuating interest rates. These factors can slow down both vehicle purchases and loan disbursals.

Regulatory barriers such as enhanced KYC norms and cross-border lending rules under EU law add compliance burdens on lenders. Solutions: Digital automation, AI-powered underwriting, and alternative credit scoring using social and behavioral data can enhance lending efficiency. Partnerships with digital marketplaces and automotive platforms can also mitigate supply chain disruptions by improving loan accessibility at the point of sale. Dynamic pricing models and flexible tenure options can help address consumer affordability issues. Germany Auto Loan Market Future Outlook The future of the Germany auto loan market looks promising, driven by a convergence of digital finance, green mobility, and customer-centric loan models. By 2030, the market is expected to surpass USD 52 billion, supported by technological advancements and shifting consumer preferences toward electric and hybrid vehicles. The integration of AI, IoT, and blockchain in lending ecosystems will likely redefine risk assessment and loan disbursement processes. As sustainability becomes a core purchasing driver, lenders who align with green financing and flexible digital offerings will lead the market evolution. Germany Auto Loan Market Competitive Landscape The Germany Auto Loan Market competitive landscape is characterized by intense rivalry among key players striving to gain market share through innovation, strategic partnerships, and expansion initiatives. Companies in this market vary from established global leaders to emerging regional firms, all competing on parameters such as product quality, pricing, technology, and customer service. Continuous investments in research and development, along with a focus on sustainability and digital transformation, are common strategies. Mergers and acquisitions further intensify the competition, allowing companies to broaden their portfolios and geographic presence. Market dynamics are influenced by evolving consumer preferences, regulatory frameworks, and technological advancements. Overall, the competitive environment fosters innovation and drives continuous improvement across the Germany Auto Loan Market ecosystem. Get Discount On The Purchase Of This Report @ https://www.verifiedmarketresearch.com/ask-for-discount?rid=513362&utm_source=PR-News&utm_medium=380 Germany Auto Loan Market Segmentation Analysis The Germany Auto Loan Market segmentation analysis categorizes the market based on key parameters such as product type, application, end-user, and region. This approach helps identify specific consumer needs, preferences, and purchasing behavior across different segments. By analyzing each segment, companies can tailor their strategies to target high-growth areas, optimize resource allocation, and improve customer engagement. Product-based segmentation highlights variations in offerings, while application and end-user segmentation reveal usage patterns across industries or demographics. Regional segmentation uncovers geographical trends and market potential in emerging and developed areas. This comprehensive analysis enables stakeholders to make informed decisions, enhance competitive positioning, and capture new opportunities. Ultimately, segmentation serves as a critical tool for driving focused marketing, innovation, and strategic growth within the Germany Auto Loan Market. Germany Auto Loan Market, By Type Germany Auto Loan Market, By Application Germany Auto Loan Market, By End User Germany Auto Loan Market, By Geography • North America• Europe• Asia Pacific• Latin America• Middle East and Africa For More Information or Query, Visit @ https://www.verifiedmarketresearch.com/product/germany-auto-loan-market/ About Us: Verified Market Research Verified Market Research is a leading Global Research and Consulting firm servicing over 5000+ global clients. We provide advanced analytical research solutions while offering information-enriched research studies. We also offer insights into strategic and growth analyses and data necessary to achieve corporate goals and critical revenue decisions.

Our 250 Analysts and SMEs offer a high level of expertise in data collection and governance using industrial techniques to collect and analyze data on more than 25,000 high-impact and niche markets. Our analysts are trained to combine modern data collection techniques, superior research methodology, expertise, and years of collective experience to produce informative and accurate research. Contact us: Mr. Edwyne Fernandes US: +1 (650)-781-4080 US Toll-Free: +1 (800)-782-1768 Website: https://www.verifiedmarketresearch.com/ Top Trending Reports https://www.verifiedmarketresearch.com/ko/product/crm-software-market/ https://www.verifiedmarketresearch.com/ko/product/devsecops-market/ https://www.verifiedmarketresearch.com/ko/product/disposable-medical-devices-sensors-market/ https://www.verifiedmarketresearch.com/ko/product/automotive-gears-market/ https://www.verifiedmarketresearch.com/ko/product/corporate-m-learning-market/

0 notes

Text

Blockchain in Manufacturing Market Creating Safer, Transparent Production Networks

The Blockchain in the Manufacturing Market was valued at USD 3.9 billion in 2023 and is expected to reach USD 116.9 billion by 2032, growing at a CAGR of 45.93% from 2024-2032.

Blockchain in Manufacturing Market is experiencing transformative growth as industries adopt decentralized technologies to improve transparency, traceability, and operational efficiency. From raw material sourcing to supply chain logistics, blockchain is reshaping how manufacturers manage data integrity and security across global networks.

U.S. manufacturers are rapidly deploying blockchain to enhance product traceability and drive smart factory initiatives

Blockchain in Manufacturing Market continues to expand as companies recognize its potential to eliminate fraud, reduce costs, and ensure compliance in real-time. With its capability to create immutable records, blockchain is gaining traction in critical manufacturing domains such as aerospace, automotive, and electronics.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6681

Market Keyplayers:

IBM Corporation – IBM Blockchain

Microsoft Corporation – Azure Blockchain Service

Amazon Web Services (AWS) – Amazon Managed Blockchain

Oracle Corporation – Oracle Blockchain Platform

SAP SE – SAP Blockchain

Huawei Technologies Co., Ltd. – Huawei Blockchain Service

Infosys Limited – Infosys Blockchain Suite

Intel Corporation – Intel Sawtooth

Siemens AG – Siemens Blockchain Lab

Wipro Limited – Blockchain as a Service (BaaS)

Deloitte Touche Tohmatsu Limited – Deloitte Blockchain Solutions

Accenture Plc – Accenture Blockchain Services

Capgemini SE – Capgemini Blockchain Applications

TIBCO Software Inc. – TIBCO Blockchain Solution

Chainstack – Chainstack Blockchain Platform

Market Analysis

The integration of blockchain in manufacturing is no longer a concept—it's becoming a core operational strategy. Manufacturers are leveraging blockchain for end-to-end supply chain visibility, smart contract automation, and counterfeit mitigation. These benefits are especially valuable in high-risk and highly regulated sectors. In the U.S., early adoption is driven by Industry 4.0 initiatives, while Europe is seeing strong traction through sustainability compliance and digital transformation mandates.

Market Trends

Growing use of blockchain for real-time supply chain transparency

Increased deployment of smart contracts to automate procurement and payments

Adoption of decentralized identity systems for equipment and personnel verification

Integration with IoT and AI for advanced process validation and data logging

Rising focus on carbon tracking and ESG reporting through blockchain ledgers

Use in quality control to ensure product authenticity and batch traceability

Formation of blockchain consortia among leading manufacturers and suppliers

Market Scope

The Blockchain in Manufacturing Market offers vast potential as manufacturers seek greater control, security, and interoperability in increasingly complex production ecosystems.

Immutable data for compliance audits and quality assurance

Enhanced supplier coordination through shared digital ledgers

Fraud and counterfeit reduction via product serialization

Real-time visibility into multi-tier supply chains

Integration with legacy ERP and MES systems

Streamlined documentation and record-keeping

Greater trust among global stakeholders and partners

Forecast Outlook

The outlook for blockchain in manufacturing is highly promising. With increasing regulatory pressure, demand for transparency, and the push toward smarter factories, blockchain adoption is set to accelerate. The U.S. remains a leader in pilot projects and implementation, while European countries are integrating blockchain into sustainability and circular economy frameworks. As manufacturing networks become more digital and global, blockchain’s role in enabling trust, efficiency, and innovation will be central to future growth.

Access Complete Report: https://www.snsinsider.com/reports/blockchain-in-manufacturing-market-6681

Conclusion

Blockchain in manufacturing is no longer an emerging trend—it's a competitive advantage. As industries pivot to digital-first strategies, blockchain offers the trust infrastructure needed for secure, transparent, and agile manufacturing. Businesses in the U.S. and Europe that invest in blockchain today are not just optimizing workflows—they are shaping the foundation of next-generation manufacturing.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A witnesses rapid transformation in the Next-Generation ICT Market driven by digital innovation

U.S.A drives innovation as Smart Port Market reshapes maritime infrastructure

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Link

0 notes

Text

China Core Banking Software Market Growth Potential for the Period 2023 to 2030 | At a CAGR of 21.7%

China is positioned as one of the most dynamic and fastest-growing markets for core banking software globally. The China Core Banking Software Market Size is projected to grow at a CAGR of 21.7% during the forecast period, fueled by sweeping digital banking reforms, rapid adoption of financial technology, and rising demand for real-time, cloud-native banking infrastructure.

China's banking landscape featuring state-owned banks, commercial banks, and a surge of digital-first institutions continues to modernize to meet the needs of an increasingly tech-savvy population and regulatory standards. The push for inclusive finance, mobile-first banking, and cross-border capabilities is accelerating core banking transformation.

Key Market Highlights:

China CAGR (2023–2030): 21.7%

Market Outlook: Fast-tracked digital transformation led by state policy and tech integration

Core Focus Areas: AI-driven risk analytics, mobile-centric banking platforms, cloud-based deployments

Regulatory Influence: People's Bank of China (PBoC) support for fintech innovation and security compliance

Key Players in the China Market:

Huawei Cloud Core Banking Solutions

Tencent Cloud FinTech Services

Ant Group (Alipay Technology)

Yonyou Network Technology Co., Ltd.

Temenos (China Operations)

Avaloq (China presence)

FIS Global

Oracle Financial Services Software

Neusoft Corporation

Kingdee International Software Group

OneConnect (Ping An Group)

Inspur Group

Get Free Request Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/china-core-banking-software-market-107482

Growth Drivers:

Government-backed digital finance strategies like the Digital RMB initiative

Rise of mobile-only banks and digital wallets, boosting demand for agile back-end systems

Massive consumer base using mobile banking and fintech apps

Pressure on traditional banks to modernize legacy IT systems to compete with tech-native players

Regulatory momentum toward more transparent, auditable, and integrated banking platforms

Key Opportunities:

Deployment of AI-powered decisioning engines within the core banking stack

Expansion of digital rural banking initiatives through cloud-native platforms

Growth of green finance and ESG-aligned banking requiring adaptable core systems

Integration of blockchain for secure, cross-border transactions and digital ID management

Modernization of core systems at regional rural banks and cooperatives

Market Trends:

Proliferation of Banking-as-a-Service (BaaS) offerings for fintech partners

Wider use of biometric authentication and AI in core workflows

Localization of global core banking platforms for Chinese regulatory alignment

Collaborations between state-owned banks and tech giants for digital transformation

Real-time core systems for mobile-first generation banking customers

Technology & Application Scope:

Core Modules: Customer data management, deposits, lending, treasury, and risk analytics

Deployment Models: Cloud-native (public/private), hybrid, and on-premises for Tier 1 banks

Industries Served: Commercial banks, state-owned banks, rural banks, fintechs, and digital-only banks

Use Cases: Seamless digital onboarding, real-time payments, regulatory reporting, customer profiling

Speak To Analyst: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/china-core-banking-software-market-107482

Recent Developments:

April 2024 – A leading state-owned bank migrated its core system to Huawei Cloud, enabling faster transaction processing and real-time analytics across its mobile banking platform.

October 2023 – Tencent announced new AI-integrated core modules supporting smart loan origination and digital credit scoring for small business banking.

June 2023 – Neusoft launched a next-gen cloud-native core banking suite targeted at rural banks, focusing on scalability and compliance with China’s digital finance standards.

Conclusion:

China’s core banking software market is undergoing a digital revolution supported by policy, propelled by technology, and demanded by consumers. With the world's largest mobile-first user base and increasingly complex regulatory mandates, banks in China are rapidly replacing outdated systems with cloud-native, AI-ready, and API-first core banking platforms.

Vendors who localize solutions to meet China's data protection laws, cross-border trade requirements, and real-time transaction standards will be best positioned to capitalize on this transformative growth market.

Frequently Asked Questions:

At what CAGR is the China Core Banking Software market projected to grow in the forecast period of 2023-2030?

What are the key factors driving the China Core Banking Software market?

Who are the major players in this market?

#China Core Banking Software Market Share#China Core Banking Software Market Size#China Core Banking Software Market Industry#China Core Banking Software Market Analysis#China Core Banking Software Market Driver#China Core Banking Software Market Research#China Core Banking Software Market Growth

0 notes

Text

Driving ESG Transformation in Southeast Asia: Business Solutions for a Sustainable Future

In the evolving landscape of global business, Environmental, Social, and Governance (ESG) factors have become critical elements for long-term success and resilience. In Southeast Asia, where rapid development intersects with rising environmental and social concerns, ESG business solutions are no longer optional—they are essential. At Nordex Global, we specialize in ESG Sustainability Consulting in South East Asia, helping businesses align with sustainability standards while unlocking competitive advantages.

ESG in Asia: A Strategic Imperative

Asia, and particularly Southeast Asia, is at the forefront of climate vulnerability and socio-economic transformation. With increasing investor focus, regulatory frameworks, and stakeholder expectations, integrating ESG in business strategy is a vital priority. Governments across the region are tightening ESG compliance measures, and multinational corporations are demanding greater accountability from their local partners. This creates both urgency and opportunity for businesses operating in Asia.

ESG Business Solutions Southeast Asia: What We Offer

Nordex Global provides end-to-end ESG business solutions in Southeast Asia tailored to specific industry needs and regional dynamics. Our services include:

Materiality Assessment: Identifying ESG factors that matter most to your stakeholders and operations.

Sustainability Reporting: Aligning disclosures with international standards such as GRI, SASB, and TCFD.

ESG Risk & Opportunity Analysis: Understanding and mitigating risks while capitalizing on sustainable innovations.

ESG Integration & Roadmaps: Building long-term strategies that align ESG with business growth objectives.

With an in-depth understanding of ESG in Asia, we ensure that your company’s ESG journey is not only compliant but also strategically valuable.

ESG and Digital Transformation South East Asia: A Synergistic Approach

In today’s data-driven world, digital transformation and ESG goals are deeply interconnected. At Nordex Global, we bridge the gap between sustainability and technology with our unique offering of ESG and Digital Transformation in South East Asia. From AI-powered carbon tracking to blockchain-enabled supply chain transparency, we enable businesses to embed sustainability into their digital infrastructure.

Our consultants guide companies through digital roadmaps that improve ESG data management, enhance real-time monitoring, and support predictive analytics—transforming ESG reporting into a value-generating asset.

ESG Transformation South East Asia: From Compliance to Leadership

Southeast Asia’s business environment is undergoing a significant ESG transformation. Organizations that take a proactive stance today will lead tomorrow’s sustainable economy. Whether you are an SME looking to start your ESG journey or a multinational scaling sustainability practices, Nordex Global supports clients at every maturity level.

We help companies evolve from basic compliance to ESG excellence through:

Executive ESG training and workshops

ESG performance benchmarking

Stakeholder engagement and communication

Climate risk scenario planning

By integrating ESG in business strategy, companies can mitigate risks, build brand equity, and attract global investors.

Why Nordex Global?

Our firm combines international ESG expertise with a strong local presence in Southeast Asia. This blend allows us to deliver solutions that are both globally credible and regionally relevant. Our consultants possess deep sectoral knowledge, enabling us to offer actionable insights and sustainable pathways for transformation.

Embrace ESG in Southeast Asia with Confidence

The future of business in Southeast Asia lies at the intersection of sustainability and innovation. Nordex Global’s ESG sustainability consulting in South East Asia empowers businesses to embrace that future confidently. Let us help you unlock sustainable growth, drive digital innovation, and lead the ESG transformation across Asia.

0 notes

Text

Top Presale Crypto Projects to Watch in 2025

The crypto presale market continues to attract investors looking for early access to innovative blockchain projects. As tokens are offered before being listed on exchanges, presales present an opportunity to buy in at a discount and support a project from its early development stage.

With hundreds of new tokens emerging each month, it’s important to distinguish high-potential opportunities from hype-driven campaigns. In 2025, identifying the top presale crypto projects requires a solid understanding of token utility, team credibility, and real-world demand.

This guide explores what makes a crypto presale valuable, how to assess presale tokens, and a look at some of the most promising projects currently gaining traction.

What Is a Crypto Presale?

A crypto presale is the early fundraising phase of a blockchain project, where its native tokens are offered before they are listed on public exchanges. These sales are often structured in stages—such as seed rounds, private sales, and public whitelists.

Presales help fund development, generate early community interest, and reward initial backers with discounted token prices. The goal is to build long-term support for the project while ensuring there is sufficient liquidity and functionality at launch.

Why Crypto Presales Are Growing in Popularity

Participating in a crypto presale allows investors to:

Access tokens before they trade on exchanges

Invest at lower prices than the public sale

Gain early staking or governance rights

Support the growth of early-stage blockchain innovation

As more sophisticated projects enter the space—particularly in AI, DeFi, and real-world asset tokenization—the presale model has become a legitimate channel for early venture-style crypto investing.

What Makes a Top Presale Crypto Project?

Not all presales are equal. The best projects typically share a few core characteristics:

Strong Use Case

The token should power a product or service that solves a real problem. Look for projects in sectors such as AI, data privacy, Web3 infrastructure, or decentralized finance.

Credible Founding Team

A transparent, experienced team is one of the clearest indicators of project reliability. Review their track record, open-source activity, and past startups or protocols.

Tokenomics with Long-Term Viability

Well-designed token distribution ensures sustainability and discourages short-term dumping. Check for balanced allocations, fair vesting schedules, and strong incentives for ecosystem growth.

Smart Contract Security

Presale projects should publish third-party audit reports before raising funds. This reduces the risk of vulnerabilities or malicious code.

Community and Ecosystem Growth

The best presales generate momentum through engaged Discord groups, Twitter activity, and consistent project updates. Community transparency is essential.

Top Presale Crypto Projects in 2025

Here are some standout projects currently considered among the top presale crypto tokens this year:

NexAI

An AI-native oracle network providing real-time, adaptive data feeds to DeFi apps and NFTs. Its token is used to reward data validators and pay for query services.

ArcBridge

A cross-chain infrastructure protocol enabling seamless data and asset transfers across L1 and L2 networks. Early token buyers get fee discounts and staking rewards.

CarbonMint

Focused on tokenizing carbon offsets and ESG compliance, CarbonMint’s platform uses blockchain to track, verify, and trade environmental assets. Its presale targets sustainability-focused funds.

These projects combine innovative use cases with practical token utility—making them strong contenders for long-term adoption.

How to Participate in a Crypto Presale

To join a crypto presale, follow these steps:

Research projects using platforms like CoinGecko, CryptoRank, or launchpads such as Seedify or DAO Maker.

Join the whitelist if required—usually through a form or KYC process.

Verify the token contract address from official sources.

Use a secure wallet like MetaMask or Trust Wallet to send contributions.

Track token allocation, vesting schedule, and project milestones after the sale.

Always double-check the source of presale links and avoid offers sent via social media DMs or unofficial channels.

Risks and Best Practices

Presale participation carries risks, including:

Token price volatility after listing

Potential delays in development

Smart contract vulnerabilities

Unproven teams or incomplete roadmaps

Changing regulatory conditions in your jurisdiction

To mitigate risks:

Never invest more than you’re willing to lose

Cross-check project audits and team details

Use a hardware wallet for storage after claim

Diversify across multiple sectors or presales

Conclusion

A well-researched crypto presale can be a valuable way to gain early exposure to promising blockchain innovations. With thoughtful evaluation and risk management, investors can identify top presale crypto projects that offer not just short-term price action, but long-term impact in the evolving Web3 landscape.

As the space matures, success will depend on substance—not hype. Focus on use case, utility, and execution, and you’ll be better positioned to make smart early-stage crypto investments.

0 notes

Text

PR Agency Experience Matters: How to Evaluate Industry-Specific Expertise

PR Agency Experience Matters: How to Evaluate Industry-Specific Expertise

The Risk of Going Generic with PR

Imagine you’re a tech startup. You’re pumped about growth and hire a PR agency to spread the word. But six months later, your $150,000 campaign lands in obscure trade publications your customers don’t read. Media tours fizzle. Your budget’s gone, and you’re left wondering if PR even works. Sound familiar? That’s what happened to a SaaS company that chose a generalist agency over a tech-savvy one.

Why did it flop? Generalist agencies often miss the mark because they don’t know your industry. They pitch broad stories, lack reporter contacts, and misunderstand your audience.

Here’s what goes wrong when you skip industry expertise:

Weak audience insight: Generic agencies don’t grasp your customers’ pain points or jargon, leading to off-target pitches. For example, a healthcare startup’s agency pitched “innovative tech” to general outlets instead of medical journals, missing key decision-makers.

Misaligned story angles: Without industry context, pitches feel forced. A fintech founder shared how their agency pitched “blockchain buzz” to retail media, ignoring trade publications like American Banker where their B2B clients lived.

Poor media connections: Specialist agencies have relationships with reporters in your niche. Generalists scramble, often pitching cold to editors who ignore them.

PR Agency Review helps you avoid these pitfalls. Its database lets you filter agencies by industry experience, showing you firms with proven track records in your vertical. For instance, a biotech client used PR Agency Review to find an agency with MedTech contacts, landing coverage in Fierce Biotech within three months.

2: Measure PR Success with Real Metrics

You wouldn’t invest in marketing without tracking ROI, so why settle for vague PR results? One in five marketers report their agencies fail to show clear ROI, according to a Relevance Digital survey. If your agency leans on fluffy metrics like impressions or ad value equivalency (AVE), you’re not getting the full picture.

The Barcelona Principles, a global PR standard, demand outcome-based metrics over vanity numbers. Impressions don’t tell you if your campaign moved the needle. Instead, focus on data that ties PR to your business goals.

Here’s what to demand from your agency:

Share of voice: How much media coverage do you get compared to competitors? A B2B software client tracked share of voice and saw their agency boost their mentions by 30% over rivals in six months.

Readership numbers: Impressions count eyeballs, but readership shows who actually saw your story. Tools like Sprout Social or Prowly help agencies report precise audience data.

Website traffic and leads: Ask how coverage drives visitors or conversions. A consumer brand tied a Forbes feature to a 15% spike in site traffic and 200 new leads, proving PR’s impact.

Lucia Marlow, a PR veteran, puts it bluntly: “If your agency can’t measure outcomes, they’re guessing.” PR Agency Review compares how top firms track success, letting you see who delivers hard data. For example, W2O Group specializes in life sciences and provides detailed KPI scorecards, showing clients exactly how campaigns drive brand authority.

Action step: Ask agencies for case studies with specific metrics. If they dodge, move on.

Question to ask: How will your agency prove their work grows your business?

3: Why Industry Verticals Matter for PR Wins

Your industry isn’t just a category — it’s a language. What lands in fintech won’t work in consumer goods. Specialist agencies speak that language fluently, building trust with reporters and crafting pitches that stick.

Take BCW Pr Agency. They dominate in fintech, using deep market knowledge to secure placements in outlets like The Financial Times. Their pitches cite trends like open banking or ESG investing, resonating with editors. Compare that to a consumer goods campaign, where lifestyle angles and influencer tie-ins matter more. A generalist agency might pitch the same story to both, missing the mark entirely.

Here’s why vertical expertise boosts PR success:

Tailored pitches: Specialists know your industry’s hot topics. A healthcare agency might pitch AI diagnostics to STAT News, while a CPG firm targets Food & Wine with sustainability trends

Trusted relationships: Beat reporters trust agencies with a track record. Edelman PR, with eight verticals like tech and healthcare, has long-standing ties to editors at Wired or Modern Healthcare.

Higher success rates: Industry data shows specialist PR campaigns succeed 50–70% more often than generic ones, thanks to precise targeting.

PR Agency Review lets you filter for agencies with vertical expertise. A retail client used it to find a CPG-focused firm, boosting their pitch-to-placement ratio by 40% compared to their previous generalist agency.

Real-world example: A medtech startup hired a specialist agency through PR Agency Review. Within two months, they landed a feature in BioPharma Dive, driving investor interest. Their old generalist agency? Zero healthcare placements in a year.

4: Demand Pricing Transparency to Protect Your Budget

Nothing stings like a surprise invoice. PR pricing varies widely — $5,000 to $50,000 monthly, per Clicta Digital. Hidden fees or vague retainers can spiral, eating your budget without clear results.

Transparent pricing builds trust and keeps your spend in check. Here’s what to look for:

Clear fee breakdowns: Know what’s retainer, project, or media spend. A tech client avoided a $10,000 overrun by demanding upfront cost clarity.

Industry benchmarks: Compare pricing to similar firms. PR Agency Review shows typical retainers by vertical, like $8,000–$15,000 for mid-size fintech campaigns.

Earned media value: Ask for APRs (advertising-to-PR ratios) to see how much coverage you get per dollar. A healthcare campaign might deliver $5 in media value for every $1 spent.

Tools like Prowly offer transparent pricing, starting at $258 monthly for basic plans. PR Agency Review goes further, listing real cost benchmarks and flagging red flags like unexplained fees or missing ROI clauses.

Sponsor benefit: Transparent agencies align with PR Agency Review’s mission, appealing to sponsors who value integrity and data-driven partnerships.

Action step: Request a detailed pricing proposal before committing. If it’s vague, walk away.

Question to ask: Can your agency justify every dollar you spend?

5: Use PR Agency Review to Win at PR

Remember that tech startup from earlier? After their $150,000 flop, they turned to PR Agency Review. They found a fintech-focused agency with strong Silicon Valley ties and clear KPIs. Now, they land monthly coverage in Forbes and TechCrunch, cementing their thought-leader status.

Here’s how you can do the same:

Define your goals: Want leads, awareness, or crisis prep? A B2B client used PR Agency Review to find an agency that tied PR to lead gen, boosting conversions by 25%.

Filter for expertise: Use PR Agency Review’s tools to shortlist firms with your vertical’s track record. A healthcare client found an agency with FDA approval expertise, avoiding regulatory PR pitfalls.

Demand proof: Ask for third-party case studies and KPI scorecards. A retail brand vetted agencies through PR Agency Review, picking one with a 90% pitch success rate.

Track results monthly: Monitor share of voice, readership, traffic, and leads. Adjust if numbers lag.

PR Agency Review’s strength lies in its unbiased, data-driven insights. It cuts through agency hype, giving you practical guidance to pick a firm that delivers. Sponsors benefit by aligning with a platform that empowers entrepreneurs with clear, actionable tools.

Real-world win: A SaaS founder used PR Agency Review to hire an agency with cybersecurity expertise. Their campaign landed a Wall Street Journal feature, driving a 20% stock bump.

Action step: Run PR Agency Review’s filters today. Shortlist three agencies and request proposals with KPIs.

Question to ask: Are you ready to transform your PR into a strategic asset?

FAQ

Do big agencies like Edelman cover niche verticals well? Yes, if they have dedicated teams. Edelman’s eight verticals, like tech and healthcare, ensure specialized pitches and reporter ties.

Can a generalist agency ever beat a specialist? Only for broad consumer brands. For niche markets, specialists’ relationships and expertise win every time.

Next Steps for Smarter PR

That startup’s PR flop could’ve been avoided with the right tools. PR Agency Review helps you find agencies that match your industry, budget, and goals.

Here’s your plan:

Audit your PR brief. What industry-specific angles matter to your audience?

Use PR Agency Review to filter for expertise and transparent pricing.

Track KPIs monthly — share of voice, readership, traffic, leads — and tweak your strategy.

With the right agency, your PR spend becomes a growth engine. Start with PR Agency Review and make your next campaign count.

0 notes

Text

Top Trends In Portfolio Management Software Market 2025: Driving Digital Transformation in Asset Management

The Portfolio Management Software Market is experiencing rapid growth as financial institutions, investment firms, wealth managers, and even individual investors embrace technology to optimize performance, minimize risk, and enhance client experience. The convergence of AI, machine learning, automation, and cloud computing is reshaping portfolio management, making it smarter, faster, and more client-centric.

Market Overview

The Global Portfolio Management Software Market Size is Expected to Grow from USD 6.79 Billion in 2023 to USD 22.55 Billion by 2033, at a CAGR of 12.75% during the forecast period 2023-2033.

Portfolio management software now serves not only large institutional investors but also small advisory firms, family offices, and even retail investors, thanks to SaaS models and modular platforms.

Get More Information: Click Here

Market Drivers

Rising demand for automated investment solutions and robo-advisors.

Integration of AI and machine learning for predictive analytics and risk management.

Stringent regulatory requirements driving adoption of compliance-ready solutions.

Need for real-time portfolio tracking across multiple asset classes and geographies.

Growth of ESG investing, requiring tools for impact measurement and reporting.

Key Demand Drivers

Expansion of wealth management services in emerging markets.

Surge in DIY investors seeking easy-to-use digital platforms.

Growing multi-asset investment strategies requiring integrated platforms.

Corporate demand for treasury and asset-liability management solutions.

Market Segmentation Insights

By Deployment

Cloud-based: Dominates due to scalability, cost efficiency, and ease of updates.

On-premise: Still preferred by large institutions for data security and customization.

By End-User

Banks & Financial Institutions: Largest adopters for enterprise-level portfolio operations.

Investment Firms & Wealth Managers: Major growth segment due to client-centric needs.

Retail & Individual Investors: Growing user base thanks to democratized investing.

Corporates: Use for treasury and pension fund management.

By Application

Risk & Compliance Management

Performance Tracking & Reporting

Trading & Order Management

Client Communication & Reporting

ESG & Impact Analytics

Competitive Analysis

Vendors in this market are focused on:

Enhancing UX/UI design for better advisor and investor experiences.

Building modular, API-driven architectures for easy integration.

Expanding AI/ML capabilities for smarter recommendations.

Providing white-labeled robo-advisory solutions for financial institutions.

Purchase This Report Today: Purchase Here

6. Key Players

SS&C Technologies Holdings Inc.

Envestnet, Inc.

Morningstar, Inc.

Broadridge Financial Solutions, Inc.

Eze Software (part of SS&C)

SimCorp A/S

Advent Software

Orion Advisor Technology

FactSet Research Systems Inc.

Charles River Development (a State Street Company)

Fiserv, Inc.

Recent Developments

Introduction of AI-powered rebalancing tools for advisors.

Growth of low-code/no-code platforms enabling customization without extensive IT support.

Launch of ESG reporting modules in mainstream portfolio management suites.

Partnerships between software vendors and fintech startups to drive innovation.

Emerging Trends

Personalized investing tools integrating life planning and financial goals.

Blockchain-based solutions for secure transaction recording and asset tokenization.

Integration with crypto-assets in multi-asset portfolio platforms.

Mobile-first platforms designed for both advisors and end investors.

Key Restraining Factors

High initial integration costs for large institutions.

Data privacy and cybersecurity concerns with cloud-based platforms.

Complexity of migrating legacy systems to modern portfolio management software.

Geographical Insights

North America: Largest market, driven by advanced financial services infrastructure.

Europe: Strong growth due to regulatory frameworks (MiFID II, SFDR) and ESG demand.

Asia-Pacific: Fastest-growing region due to wealth expansion and fintech innovation.

Middle East & Africa / Latin America: Emerging markets focused on modernizing wealth management services.

Conclusion

The Portfolio Management Software Market is at the forefront of digital innovation in finance. As clients demand transparency, personalization, and performance, the market will continue to evolve — powered by technology, shaped by regulation, and driven by the need for smarter asset management solutions. The winners will be those who combine technological agility with deep financial expertise.

About Spherical Insights & Consulting

Spherical Insights & Consulting is a leading market research and consulting firm providing actionable insights, quantitative forecasting, and trend analysis to support business decision-making. The firm serves industries such as finance, government, industrial sectors, and corporations, helping them achieve strategic growth.

Contact Us:

📞 US: +1 303 800 4326

📞 APAC: +91 90289 24100

📧 Email: [email protected] | [email protected]

🌐 Website: Contact Us

📌 Follow Us: LinkedIn | Facebook | Twitter

0 notes

Text

How Automation and Integration Are Shaping the Future of ESG

Artificial intelligence, machine learning, IoT sensors, blockchain ledgers, and cloud-scale analytics are rapidly reshaping the way organisations collect, verify, and communicate environmental, social, and governance information. When these tools are woven into a single, automated fabric, a task that once relied on spreadsheets and manual checks turns into a real-time risk-management engine—cutting costs, easing compliance pressure, and surfacing growth opportunities that used to stay hidden.

Why the classic ESG playbook is falling short

Most companies still anchor their reports on fundamentals such as Scope 1 emissions, electricity consumption, or workforce-diversity ratios. Essential as those metrics are, they paint only part of the picture. Disclosures arrive late, calculation methods differ by industry, and boiler-plate wording makes peer comparison difficult. The result is unreliable insight, frustrated investors, and growing regulatory exposure.

Enter alternative data and AI-powered insight

Bridging that gap demands sources far beyond the annual report. Alternative data spans satellite imagery estimating methane plumes, credit-card exhaust hinting at supply-chain resilience, geolocation traces mapping factory activity, mobile-app usage reflecting customer sentiment, and social-media feeds tracking reputation shifts hour by hour. When these streams flow into AI models, they generate granular, near-real-time signals that sharpen risk scoring, flag misconduct early, and highlight positive impacts that traditional metrics overlook.

Automation then amplifies the payoff. APIs pipe third-party feeds into an internal ESG lake, cleansing rules standardise formats, taxonomy tags map fields to evolving regulations, and templates generate regulator-ready disclosures with a click. What was reactive becomes predictive; what was a cost centre becomes a value generator.

A live example: Neoimpact’s ESG Intelligence Dashboard

Neoimpact demonstrates how an integrated approach works in practice. Its cloud platform fuses core metrics with dozens of alternative feeds, then layers AI analytics on top. Users can benchmark companies across sectors and regions, track score movements over time, and drill into individual risk drivers—whether that is an uptick in deforestation alerts or a spike in workforce-sentiment negativity. Asset managers gain a clearer view of portfolio exposure, while compliance teams secure auditable trails that stand up to tighter regulatory scrutiny.

Three priorities for the road ahead

Invest in unified ESG technology. Point solutions trap data in silos. Platforms that combine ingestion, validation, analytics, and disclosure collapse cost and accelerate insight.

Broaden the data lens. Fundamental metrics remain foundational, but firms overlaying them with curated alternative datasets will out-perform peers on transparency and foresight.

Automate end-to-end. From sensor deployment and API ingestion to AI scoring and one-click disclosure, automation converts episodic reporting into continuous oversight—reducing risk, protecting brand equity, and freeing talent for strategic work.

The payoff

As stakeholder expectations rise and rulebooks such as the CSRD and the SEC’s climate-disclosure mandate tighten, companies that treat ESG as an after-thought will find the cost of capital climbing. Those that embrace next-generation tech, richer data, and fully automated workflows will not only comply with less effort; they will embed sustainability into everyday decision-making and unlock durable, long-term value.

The verdict is clear: integrated, AI-driven ESG technology is shifting from nice-to-have to business essential. Acting now lets forward-looking firms turn complexity into competitive advantage—lowering cost, mitigating risk, and positioning themselves for a future where responsible performance is inseparable from financial success.

0 notes

Text

Top Trends Fuel Suppliers Are Watching in 2025

As the global energy landscape continues to shift, fuel suppliers are keeping a close eye on emerging trends that promise to reshape the industry. From the adoption of renewable diesel to enhanced carbon tracking, digital innovation, and stricter ESG reporting requirements, 2025 is shaping up to be a transformative year.

In this blog, we’ll explore the most significant trends that every fuel supplier and diesel supplier should be aware of—and how these developments can impact operational strategies, compliance, and customer relationships.

The Rise of Renewable Diesel

One of the most prominent trends in 2025 is the continued rise of renewable diesel. Unlike biodiesel, renewable diesel is chemically identical to petroleum-based diesel but made from renewable sources such as animal fats, vegetable oils, and greases. It burns cleaner and has better cold-weather performance, making it a preferred choice for fleets and municipalities aiming to meet sustainability goals.

Fuel suppliers are now offering renewable diesel as part of their standard product mix. Diesel suppliers in California and the Pacific Northwest, for instance, are witnessing high demand due to state-level mandates and incentives. The scalability and compatibility of renewable diesel with existing diesel engines give it a unique edge over other alternatives.

Carbon Tracking and Reporting Becomes Essential

With governments and corporations pledging to achieve net-zero emissions, carbon tracking is no longer optional. Fuel suppliers must now provide detailed emissions data and transparent reporting mechanisms to their clients, particularly in sectors like transportation, logistics, and manufacturing.

Advanced carbon tracking tools are enabling real-time monitoring of fuel usage and emissions, helping businesses understand their carbon footprint. In turn, fuel suppliers are investing in platforms and partnerships to offer clients these capabilities as a value-added service.

For example, several diesel suppliers are incorporating blockchain-backed carbon ledgers to ensure accuracy and trust in the data. This transparency not only meets regulatory compliance but also enhances trust and long-term relationships with eco-conscious customers.

Digital Ordering Platforms Transform the Buying Experience

The shift toward digital transformation in the fuel industry has accelerated post-pandemic, and in 2025, it’s no longer a luxury but a competitive necessity. Customers now expect the same ease of ordering fuel as they do with online retail.

Fuel suppliers are adopting modern, user-friendly digital ordering platforms that allow customers to schedule deliveries, view transaction histories, monitor tank levels, and get real-time updates—all from their smartphones or desktops.

The move toward digital platforms creates value for both fuel suppliers and their customers by:

Reduces manual errors and delays

Improves transparency and accountability

Streamlines logistics and inventory planning

Moreover, some diesel suppliers are integrating AI-powered tools that predict fuel needs based on usage patterns, further optimizing delivery schedules and inventory management.

ESG Reporting Drives Strategic Shifts

Once considered a niche concern, Environmental, Social, and Governance (ESG) reporting is now a core expectation for responsible businesses. Investors, regulators, and consumers demand transparency around how companies source, use, and impact energy.

For fuel suppliers, aligning with ESG standards involves:

Offering cleaner fuel alternatives like renewable diesel

Reducing the carbon footprint of delivery fleets

Maintaining ethical compliance and supporting our workforce in supply logistics

Fuel distributors that actively participate in ESG reporting are better positioned to attract corporate clients who need to meet their own sustainability benchmarks. This creates a cascading effect: as more businesses demand cleaner fuel and better practices, fuel suppliers must evolve or risk falling behind.

Cybersecurity in Fuel Supply Chains

As fuel distribution systems become increasingly digitized, cybersecurity has emerged as a top concern. High-profile ransomware attacks in recent years have shown just how vulnerable supply chains can be.

FFuel suppliers are now investing heavily in cybersecurity to protect sensitive customer data and ensure operational continuity. Fuel suppliers offering digital fuel delivery services must ensure their platforms are built with robust security protocols. Digital ordering platforms, while convenient, must be designed to defend against breaches that could disrupt deliveries and erode customer trust.

Predictive Analytics and AI Integration

In 2025, data-driven decision-making is becoming standard practice. Through predictive analytics, fuel suppliers can better anticipate demand spikes, optimize pricing models, and reduce waste.

AI tools are helping diesel suppliers determine the best delivery routes, manage fleet maintenance schedules, and even automate customer service through chatbots and virtual assistants. By improving internal processes, these innovations also create a smoother, more reliable customer interaction.

FAQs

What makes renewable diesel different from biodiesel in fuel performance?

While both are derived from renewable sources, renewable diesel is chemically similar to petroleum diesel and can be used directly in existing diesel engines without modifications. Biodiesel, on the other hand, may require blending and has different combustion properties.

Why is carbon tracking important for fuel suppliers?

Carbon tracking allows fuel suppliers and their customers to measure greenhouse gas emissions, comply with regulations, and make data-driven decisions to reduce environmental impact.

Are digital ordering platforms secure?

Yes, modern digital platforms used by reputable fuel supplier include robust security measures such as encryption, two-factor authentication, and regular system audits to ensure data protection.

How do ESG practices benefit a diesel supplier?

Implementing ESG standards can improve a diesel supplier’s reputation, attract environmentally conscious clients, and ensure compliance with emerging regulations.It’s a key driver of long-term value and operational cost savings.

Final Thoughts